Research Article: 2019 Vol: 22 Issue: 2

Impacting the Service Quality on Online Deposit Decision: A Case of Vietcombank in Ho Chi Minh City

Nguyen Anh Hien, Saigon University (SGU)

Vo Thi Thuy Van, Saigon University (SGU)

Duong Thi Mai Phuong, Saigon University (SGU)

Tam Thanh Phan, Lac Hong University (LHU)

Citation Information: Hien, N.A., Van, V.T.T., Phuong, D.T.M., & Phan, T.T. (2019). Impacting the service quality on online deposit decision: A case of vietcombank in ho chi minh city. Journal of Management Information and Decision Sciences, 22(2), 1-12

Abstract

Nowadays, the importance of banks is in our modern life. It is a place to store our currency, helping us to profit from the money available and giving us money when we needed it. Therefore, people often prefer to deposit money into banks for safety. So, the study objective is to find out the determinants affecting the online deposit decision of Vietcombank in Ho Chi Minh City (HCMC). The research result is a science evident for bank managers to improve the service quality of online deposit. The researchers surveyed 552 customers related to online deposit and answered 24 questions but sample size of 520 customers processed. The primary sources of data collected from November 2017 to November 2018 for 24 branches of Vietcombank in Ho Chi Minh City (Each branch has 23 customers surveyed). Simple random sampling technique. The Data analyzed Cronbach's Alpha and the exploratory factor analysis (EFA), which used for Structural Equation Modelling (SEM) technique and using partial least squares method. Customer’s responses measured through an adapted questionnaire on a 5- point Likert scale. In addition, the findings of the study have five factors affecting the online deposit decision of Vietcombank in HCMC with significance level 0.01.

Keywords

Online, Service, Quality, Decision, Deposit, Bank.

Introduction

The emergence of the Internet has brought a great change to economy & science and technology in the world. Today, they are an indispensable tool in economic, educational, political activities, bank activities etc. Besides, internet banking is a service that brings a lot of practical utilities such as money transfer, payment, online savings and online shopping anywhere, anytime without going to the transaction counter. Moreover, internet banking service allows customers to perform transactions such as online transfer, payment, online shopping, and online deposit without going to the bank's counter and without the card to operate at the Automated Teller Machine (ATM). Nowadays, customers need a device that connects to the internet like a laptop, a smartphone with a security code provided by the bank when registering for this service (Adapa, 2011). The security code used for online trading is One-Time Password (OTP), a one-time security code sent to customer’s phone number by message, valid only for about 3 minutes. Customers register this phone number with the time customers register to use the service. The OTP security code helps verify that customers are requesting that transaction, not someone else (Maharana et al., 2015). Besides, (Hadi-Al et al., 2019) showed that the findings of the study have some limitations such as the focus on one sector (power projects). The conceptual framework also excluded other variables that could contribute to project success, such as risk management technology. In the past, customers needed to arrange for bank transaction offices during office hours, which was very inconvenient for busy people. Currently, many banks, especially Vietcombank has developed various forms of online savings on e-banking (online deposit). It only takes about 1 minute, customers can deposit, as well as withdraw money through electronic bank accounts, even outside office hours and on holidays. In addition to the convenient advantages, online deposit is considered to be safer than traditional deposit at the branch due to the customer-made deposit operation and the system automatically processes with multiple layers. Other study showed that the study is an attempt to understand the effects of human-technology interaction on sustainable performance in the presence of an Enterprise Resource Planning (ERP) system. This study primarily considers the moderating role of the configuration of organizational culture in the relationship between socio-technical elements, decision-making environment and ERP systems (Hadi-AL et al., 2018). Moreover, online deposit offers many utilities such as: (1) Having confirmation of sending money via email, SMS and the list of accounts on internet banking cannot be fake. (2) Customers can check the balance and interest on Internet banking wherever customers are. (3) Withdrawing savings must have an authentication code (OTP) only for customers. (4) No need is to keep physical savings books. (5) Customers can pledge to receive online loans, no paperwork required, disbursements in 1 minute. (6) Customers can get confirmation of the bank balance at any time to make a visa application, a loan. Above mentioned things, the researchers have a research question: How are factors affecting the online deposit decision of Vietcombank in HCMC? This document helps bank managers who apply the research results for improving policy on the management of the service quality of the online deposit in commercial banks better in the future.

Literature Review

Online Deposit

Online deposit is a modern form of savings, but customers do not need to go to the bank to make deposit or withdrawal procedures. Instead, the entire process is self-operated by customers via electronic banking on a mobile phone or computer. The whole process has no intervention of bank staff, but the system automatically performs through multiple layers of authentication and security. In order to send online deposit, customers need to transfer available funds from their checking account to an online deposit account. Upon maturity, the principal and interest will be returned to the customer's payment account (Akturan et al., 2012). ODD1: Customers have all of information related to bank before deciding on online deposit (Aladwani, 2001). ODD2: Customers decide online deposit due to reliability and security (Alexander, 2010). ODD3: Customers always choose online deposit for convenience and quality services (Rawashdeh, 2015). ODD4: Customers will refer friend’s online deposit at Vietcombank (Bauer et al., 2006).

Service quality

International integration has been taking place more and more deeply in all fields, including the field of providing accounting services. Accession to international organizations such as WTO, AEC has required Vietnam to make timely changes to meet these requirements, especially for technical services including human resources, diploma certificate, foreign language.

It is a comparison of expectations with performance. A business with high service quality will meet customer needs whilst remaining economically competitive. Improved service quality may increase economic competitiveness (Zeithaml et al., 1987). This aim may be achieved by understanding and improving operational processes; identifying problems quickly and systematically; establishing valid and reliable service performance measures and measuring customer satisfaction and other performance outcomes. From the viewpoint of business administration, service quality is an achievement in customer service. It reflects at each service encounter. Customers form service expectations from past experiences, word of mouth and advertisement. In general, Customers compare perceived service with expected service in which if the former falls short of the latter the customers are disappointed (Nochai et al., 2013). (Parasuraman et al., 1985) suggested SERVQUAL as a determinants and measuring instrument of service quality. It considered as a good starting point for providing more detail to a description of service quality. They defined “determinants of service quality as a measure of how well the service level delivered matches customer expectations”. They designed SERVQUAL based on studies in America. They described ten determinants of service quality as reliability, responsiveness, competence, access, courtesy, communication, credibility, security, understanding the customers and tangibles. Later, (Parasuraman et al., 1988) reduced the ten attributes to five attributes. The model of changed SERVQUAL was reliability, responsiveness, assurance, empathy and tangibles.

Reliability

It is the ability to perform the promised service dependably and accurately. Reliability speaks of the ability to deliver/perform services that are appropriate, accurate, punctual and reputable, consistent with what is committed, promising. This requires consistency in service implementation and respect for commitments and promises to customers. This criterion is measured by scales. REL1: Please, Customers feel free to use online deposit service at Vietcombank HCMC branch (Banson et al., 2013). REL2: Vietcombank at HCMC branch made the transaction correctly, without errors and security (Zafar et al., 2016). REL3: Vietcombank branch in Ho Chi Minh City secures customer information well (Alisarlak et al., 2014). REL4: Vietcombank at HCMC branch provides the right service on time they committed (Howcroft et al., 2002). The above mentioned Reliability, the researchers have hypothesis following:

H1 Reliability has a positive impact on the online deposit decision of Vietcombank in HCMC.

Responsiveness

It is the willingness and/or readiness of employees to help customers and to provide prompt service, timeliness of service (Parasuraman et al., 1988). This is the criterion to measure the level of desire and ability to solve problems quickly, to serve customers in a timely manner, effectively handle complaints, ready to help customers and meet the requirements customer. In other words, responsiveness is the response from service provider fees to what customers want, namely: RES1: Vietcombank at HCMC branch always satisfies all difficulties, questions and complaints for customers (Zafar et al., 2016). RES2: Time for customers to wait online (1-2 minutes) (Adapa, 2011). RES3: The process has making simple transactions at Vietcombank at HCMC branch. RES4: Vietcombank at HCMC branch has a 24-hour hotline (Zafar et al., 2016). The above mentioned Responsiveness, the researchers have hypothesis following:

H2 Responsiveness has a positive impact on the online deposit decision of Vietcombank in HCMC.

Competence

The knowledge and courtesy of employees and their ability to convey and confidence. This is the factor that creates trust and trust for customers through their knowledge, expertise, professional service, good communication ability and polite style of service personnel, ability make customers trust (Zeithaml & Valarie, 1987). As a result, customers feel secure when using the service. COM1: Vietcombank at HCMC branch handled the business correctly, quickly and effectively by online system (Redlinghuis & Rensleigh, 2010). COM2: Vietcombank staffs at branch in HCMC has sufficient knowledge and expertise to advise and answer customer inquiries via phone (Yuan et al., 1010). COM3: Staff of Vietcombank at branch in HCM City are always polite and warm-hearted with customers by phone (Sohail & Shanmugham, 2003). COM4: Vietcombank branch HCMC has a high reputation in customer’s hearts (Alexander, 2010). The above mentioned Competence, the researchers have hypothesis following:

H3 Competence has a positive impact on the online deposit decision of Vietcombank in HCMC.

Empathy

The provision of caring, individualized attention to customers. Empathy is the care and care of considerate customers, giving customers the best possible treatment, helping each customer feel always warmly welcomed anytime, anywhere. The human factor is the core of this success and the more service providers care about the customers, the more empathy is gained (Zeithaml & Valarie, 1987). EMP1: Vietcombank at HCMC branch always tries to build good relationships and pay attention to the needs of each customer (Richard, 2015). EMP2: Staffs of Vietcombank at HCMC branch are enthusiastic and friendly with customers (Bauer et al., 2006). EMP3: Staffs of Vietcombank at HCMC branch work fairly with all customers when customers have the problem with online deposit (Samuel, 2014). EMP4: Vietcombank at HCMC branch always asked, congratulated, gave gifts to customers every Tet holiday or personal event (Aladwani, 2001). The above mentioned Empathy, the researchers have hypothesis following:

H4 Empathy has a positive impact on the online deposit decision of Vietcombank in HCMC.

Tangibles

It is the state of facilitating good, physical condition of the buildings and the environment, appearance of physical facilities, tools and equipment used to provide the service (Parasuraman et al., 1985). The tangibility is the expression of the external image of facilities, tools, equipment and materials, machinery, staff style, documents, manuals and information systems lost. These are environmental factors. Generally speaking, all that customers can see directly with their eyes and senses can affect this factor. TAN1: Viecombank at HCMC branch has a spacious and convenient office for customers applied online deposit (Akturan et al., 2012). TAN2: Vietcombank at branch HCMC has modern equipment and machinery for online deposit (Bauer & Hein, 2006). TAN3: Online system interface of Vietcombank at HCMC branch is designed simple and clear for all customers (Yuan et al., 1010). TAN4: Staffs of Vietcombank at HCMC branch have a very professional manner and neatly dressed, polite when communicating with all customers by phone or hotline (Adapa, 2011). The above mentioned Tangibles, the researchers have hypothesis following:

H5 Tangibles have a positive impact on the online deposit decision of Vietcombank in HCMC.

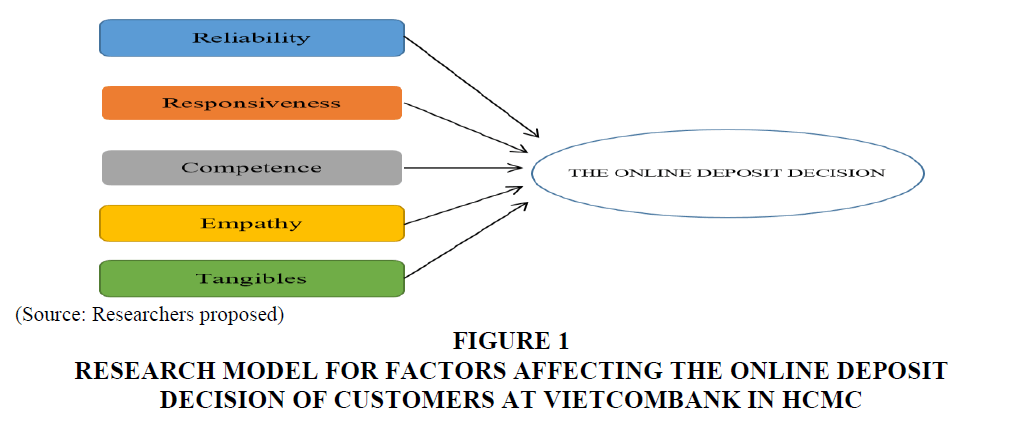

Improving service quality is something every bank is looking forward to the improvement of online deposit. The procedures have been revised towards more friendly, quick and competitive with good service quality. This helps to improve customer loyalty with Vietcombank's online deposit service. Besides, Vietcombank is in the process of becoming a data-oriented organization with Customer Relationship Management (CRM) and New Loan Initiation System (RLOS), allowing customers to provide comprehensive multi-channel experience, facilitating the adjustment of products and services according to the needs of individual customers for online deposit decision. Above mentioned things, the researchers have the proposed the research model for factors affecting the online deposit decision of customers at Vietcombank in HCMC following(Figure 1):

Figure 1:Research Model For Factors Affecting The Online Deposit Decision Of Customers At Vietcombank In Hcmc

Methods Of Research

Online deposit now is a form of savings that is widely supported by young people because of simplicity, convenience and many attractive incentives that it brings. Along with the development of information technology, the banking sector also strives to promote automation in trading activities to improve transaction efficiency and provide customers with utilities as well as reduce costs for bank. That's why banks are constantly offering special deposit and incentives to encourage customers to use services such as online deposit. However, improment and development of online deposit service in the context of international economic integration are necessary.

Determining sample size requirements for Structural Equation Modeling (SEM) is a challenge often faced by investigators. Recent years have seen a large increase in SEMs in the behavioral science literature, but consideration of sample size requirements for applied SEMs often relies on outdated rules-of-thumb. This study used Monte Carlo data simulation techniques to evaluate sample size requirements for common applied SEMs. Across a series of simulations, we systematically varied key model properties, including number of indicators and factors, magnitude of factor loadings and path coefficients and amount of missing data. We investigated how changes in these parameters affected sample size requirements with respect to statistical power, bias in the parameter estimates and overall solution propriety. Results revealed a range of sample size requirements from 30 to 460 respondents, meaningful patterns of association between parameters and sample size and highlight the limitations of commonly cited rules-of-thumb (Alhija & Wisenbaker, 2006). There are still many advatages to be addressed. Through the article, the researshers have the research process for factors affecting the online deposit decision of customers at Vietcombank in HCMC that having three phases following (Hair & Anderson, 2010). Phase 1: The researshers applied the expert methodology and based on 15 expert’s consultation and based 15 lecturers as group discussions are to improve the scale and design of the questionnaire. The results of surveying 15 experts and 15 lecturers showed that factors affecting the online deposit decision of customers at Vietcombank in HCMC. The researchers created a list of possible factors gathered from the literature reviews as mentioned in the above studies. Phase 2: The researshers tested a reliability scale with Cronbach's Alpha coefficient and exploratory factor analysis. Completed questionnaires were directly collected from the surveyed customers related to online deposit because it took them less than 20 minutes to finish the survey. There are 552 customers related to online deposit and answered 24 questions but sample size of 520 customers processed (32 samples lack of information). The primary sources of data collected from November 2017 to November 2018 for 24 branches of Vietcombank in Ho Chi Minh City (Each branch has 23 customers surveyed). Ho Chi Minh City is a big City and has more than 40 percent of customers applying online deposit in Vietcombank. The researchers surveyed by hard copy distributed among 2.000 customers applying online deposit of Vietcombank in HCMC. Sample size of 552 customers in a number of customers in Vietcombank in HCMC represented the online deposit. The research population has 2.000 customers applying online deposit of Vietcombank in HCMC. All data collected from the questionnaire are coded, processed by SPSS 20.0 and Amos. Any observational variables with a total correlation coefficient greater than 0.3 and Cronbach's Alpha coefficient greater than 0.7 would ensure reliability of the scale. This method is based on the Eigenvalue, the appropriate factorial analysis and the observed variables in the whole which are correlated when Average Variance Extracted is>50%, the KMO coefficient is within 0.5 to 1, Sig coefficient ≤ 5%, the loading factors of all observed variables are>0.5. In addition, the researchers testing scale reliability with Cronbach’s alpha coefficient and Exploratory Factor Analyses (EFA) were performed. Finally, the least squares method and multiple linear regression used (Hair et al., 1998). The least squares method is a form of mathematical regression analysis that finds the line of best fit for a set of data, providing a visual demonstration of the relationship between the data points. Each point of data is representative of the relationship between a known independent variable and an unknown dependent variable (Hair & Anderson, 2010). Phase 3: The researchers performed CFA and model testing with Structural Equation Modelling (SEM) analysis. The purpose of CFA helps to clarify: (1) Unilaterality, (2) Reliability of scale, (3) Convergence value and (4) Difference value. A research model is considered relevant to market data if Chi-square testing is p-value>5%; CMIN/df ≤ 2, some cases CMIN/df may be ≤ 3 or<5; GFI, TLI, CFI ≥ 0.9. However, according to recent researcher’s opinion, GFI is still acceptable when it is greater than 0.8; RMSEA ≤ 0.08. Apart from the above criteria, the test results must also ensure the synthetic reliability > 0.6; Average Variance Extracted must be greater than 0.5 (Hair & Anderson, 2010).

Research Results

Table 1 showed that all of 24 variables surveyed Corrected Item-Total Correlation greater than 0.3 and Cronbach's Alpha if Item deleted greater than 0.7. Table 1 showed that Cronbach's Alpha for Reliability (REL) is 0.919; Cronbach's Alpha for Responsiveness (RES) is 0.964; Cronbach's Alpha for Competence (COM) is 0.861; Cronbach's Alpha for Empathy (EMP) is 0.954; Cronbach's Alpha for Tangibles (TAN) is 0.950 and Cronbach's Alpha for Online Deposit Decision (ODD) is 0.844. This showed that all of Cronbach’s Alpha are very reliability. Such observations make it eligible for the survey variables after testing scale. This data was suitable and reliability for researching.

| Table 1: The Scale Reliability Tests For Factors Affecting The Online Deposit Decision (Odd) | ||||

| Items | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach's Alpha if Item Deleted |

|---|---|---|---|---|

| REL1 | 10.3135 | 6.574 | 0.842 | 0.884 |

| REL2 | 10.2231 | 6.490 | 0.832 | 0.887 |

| REL3 | 10.3000 | 6.634 | 0.786 | 0.903 |

| REL4 | 10.3673 | 6.715 | 0.791 | 0.901 |

| Cronbach's Alpha for Reliability (REL) | 0.919 | |||

| RES1 | 9.2135 | 7.147 | 0.955 | 0.939 |

| RES2 | 9.2308 | 7.353 | 0.871 | 0.964 |

| RES3 | 9.2154 | 7.503 | 0.874 | 0.962 |

| RES4 | 9.2173 | 7.103 | 0.941 | 0.943 |

| Cronbach's Alpha for Responsiveness (RES) | 0.964 | |||

| COM1 | 10.3519 | 5.334 | 0.734 | 0.813 |

| COM2 | 10.2462 | 5.192 | 0.709 | 0.823 |

| COM3 | 10.3962 | 5.288 | 0.654 | 0.847 |

| COM4 | 10.3712 | 5.243 | 0.740 | 0.810 |

| Cronbach's Alpha for Competence (COM) | 0.861 | |||

| EMP1 | 9.2154 | 6.979 | 0.908 | 0.933 |

| EMP2 | 9.2096 | 7.045 | 0.863 | 0.947 |

| EMP3 | 9.1827 | 7.252 | 0.859 | 0.947 |

| EMP4 | 9.1885 | 6.897 | 0.918 | 0.929 |

| Cronbach's Alpha for Empathy (EMP) | 0.954 | |||

| TAN1 | 9.2481 | 7.586 | 0.900 | 0.929 |

| TAN2 | 9.2519 | 7.703 | 0.837 | 0.948 |

| TAN3 | 9.2096 | 7.846 | 0.863 | 0.940 |

| TAN4 | 9.2192 | 7.482 | 0.919 | 0.922 |

| Cronbach's Alpha for Tangibles (TAN) | 0.950 | |||

| ODD1 | 7.2385 | 3.269 | 0.634 | 0.822 |

| ODD2 | 7.0962 | 2.881 | 0.789 | 0.753 |

| ODD3 | 7.1942 | 3.359 | 0.593 | 0.838 |

| ODD4 | 7.0981 | 2.936 | 0.711 | 0.789 |

| Cronbach's Alpha for Online Deposit Decision (ODD) | 0.844 | |||

(Source: The researcher’s collecting data and SPSS 20.0).

Table 2 showed that column p<0.01 with significance level 0.01 and column Conclusion H1: supported; H2: supported; H3: supported; H4: supported and H5: supported. This showed that five factors affecting the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. Moreover, Table 2 showed that Reliability (β=0.116) has the strongest impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. Finally, Empathy (β=0.118) has the fifth impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01.

| Table 2: Coefficients From The Structural Equation Modelling (Sem) | ||||||||

| Relationships | Coefficient | Standardized Coefficient | S.E | C.R. | P | Conclusion | ||

|---|---|---|---|---|---|---|---|---|

| ODD | ? | REL | 0.192 | 0.365 | 0.028 | 6.903 | *** | H1: Supported |

| ODD | ? | TAN | 0.110 | 0.235 | 0.023 | 4.880 | *** | H5: Supported |

| ODD | ? | COM | 0.074 | 0.118 | 0.025 | 2.932 | 0.003 | H3: Supported |

| ODD | ? | EMP | 0.060 | 0.118 | 0.020 | 2.941 | 0.003 | H4: Supported |

| ODD | ? | RES | 0.061 | 0.119 | 0.021 | 2.926 | 0.003 | H2: Supported |

Note: Significant at 1 percent (All t-tests are one-tailed)

(Source: The researcher’s collecting data and SPSS 20.0, Amos).

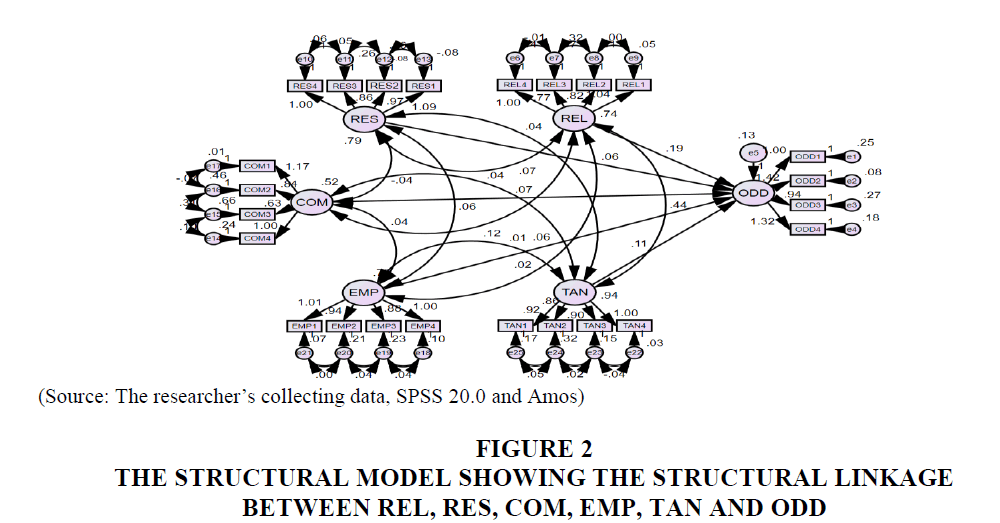

Chi-square=603.935; df=222; p=0.000; Chi-square/df=2.720; GFI=0.914; TLI=0.961; CFI=0.969; RMSEA=0.058. Figure 2 showed that the suitability measures of the model, goodness of fit are listed above mentioned results accompanied by an acceptable value threshold. This showed that Fit indicators of the model are very good for this data.

Figure 2:The Structural Model Showing The Structural Linkage Between Rel, Res, Com, Emp, Tan And Odd.

Conclusion & Managerial Implications

Conclusion

The online deposit was actually implemented by Vietcombank to serve busy individuals. This online form of savings, the advantage is that users only need to perform simple operations via Internet Banking of banks at any time of the day to transfer idle funds. Although online deposit is increasingly being known by many customers. However, Vietcombank needs to solve many problems. The problem is the obstacle to the psychology of Vietnamese people, especially when some individuals and enterprises still hesitate to use online deposit service and some customers are concerned about the safety in payment transactions by this channel. Because depositors do not hold any vouchers in the traditional way. Therefore, the contribution of this paper is to find out five factors affecting the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. Reliability (β=0.365), Tangibles (β=0.235), Responsiveness (β=0.119), Empathy (β=0.118) and Competence (β=0.118). This study is to find out the Reliability (β=0.365) affected strongest in five factors with significance level 0.01. This showed that online deposit is increasingly known to many customers, but reliability (safety and security) are still problems that many people have just deposited money and shaken because online depositors do not hold in hand all of thing. Besides, the researchers surveyed 552 customers related to online deposit and answered 24 questions but sample size of 520 customers processed. The primary sources of data collected from November 2017 to November 2018 for 24 branches of Vietcombank in Ho Chi Minh City (Each branch has 23 customers surveyed). The Cronbach's Alpha had been analyzed, KMO test and the result of KMO analysis which used for the Structural Equation Modelling (SEM). Customer’s responses measured through an adapted questionnaire on a 5-point Likert scale (Conventions: 1: Completely disagree; 2: Disagree; 3: Normal; 4: Agree; 5: completely agree). The researchers had managerial implications for bank policymaker of Vietnam continued to improve the service quality of the online deposit.

Managerial Implications

Online deposit now is a form of savings that is widely supported by many people because of simplicity, convenience and many attractive incentives that it brings. Along with the development of information technology, the banking sector also strives to promote automation in trading activities to improve transaction efficiency and provide customers with utilities as well as reduce costs for Vietcombank. Following is managerial implications: (1) Reliability (β=0.116) has the strongest impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. First of all, it is very important to improve the quality of human resources and have a long-term strategy to develop high quality human resources. Because, according to human principles is the deciding factor. In order to improve the quality of services before the integration requirements, it must improve the quality of human resources, improve the professional qualifications of the staff and employees of the Vietcombank for in all branches. Vietcombank should adopt policies to attract good people, talented people and capable people in banking service activities from other banks, other branches and domestic and foreign universities. (2) Tangibles (β=0.235) have the second impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. The second is to constantly improve the level of banking technology modernization. On the one hand, it is suitable to the financial potential of the bank, in line with the common technology ground of the country, but Tangibles must ensure the regional and international trend. Vietcombank should be aware that the quality of service depends on this second important factor, which is the level of technology. Vietcombank should have good and professional staff, but the system of non-modern machinery and equipment, not advanced technology level, cannot create a system of high quality and reputable banking services to provide customers. (3) Responsiveness (β=0.119) has the third impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. The third is to constantly improve the quality of executive management and internal inspection and control. This work must be regularly raised to the level of modern technology. At the same time, it is necessary to regularly review internal processes and regulations in the branch to improve, supplement, upgrade and avoid vulnerable loopholes. (4) Competence (β=0.118) has the fourth impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. At any time, customers of Vietcombank who only need to access the bank's website can know all the latest updates, as well as look up the balance of savings books deposited at the bank line. This approach also applies to customers who do not use Internet banking services, Mobil banking in order to help all customers actively look up the status of their deposit with a simple and quick way. All of customers at Vietcombank just visit the bank website, enter some other confidential personal information, will look up related information such as the cardholder's name, the original principal amount, the current principal at, date of deposit, due date, term without having to perform any registration procedures. (5) Empathy (β=0.118) has the fifth impact on the Online Deposit Decision (ODD) of customers at Vietcombank in Ho Chi Minh City with significance level 0.01. Vietcombank should collect feedback from customers. Timely evaluation of information in the opposite direction, the opinions of customers should be respected by the bank. It is best way to have a letter of thanks and policies to encourage customers. Meaningful opinions should have rewards for customers.

Finally, the limitation of the study has to be taken into research results, thereby serving as proposals for future research. First of all, the primary data is tested and updated with bigger samples. So, the level of representativeness of the sample can be affected. Secondly, despite the high explanatory power of the model, it could be reinforced by adding control variables such as interest rate, technology system, security, trademark. Finally, this results should compare with the results of the previous studies in other banks.

References

- Adalia, S. (2011). Continued and frequent use of internet banking by Australian consumers: Identification of the factor comlionents. Journal of Internet Banking and Commerce, 16(2), 1-22.

- Akturan, U., &amli; Tezcan, N. (2012). Mobile banking adolition of the youth market. Marketing Intelligence &amli; lilanning, 30(4), 444-459.

- Aladwani, A.M. (2001). Online banking: a field study of drivers, develoliment challenges and exliectations. International Journal of Information Management, 21(3), 213-225.

- Alexander. (2010). liredicting young consumers take uli of mobile banking services. International Journal of Bank Marketing, 28(5), 410-432.

- Alhija, F.N., &amli; Wisenbaker, J. (2006). A monte carlo study investigating the imliact of item liarceling strategies on liarameter estimates and their standard errors in CFA. Structural Equation Modeling, 13(2), 204-228.

- Alisarlak, I. (2014). The comliarative analysis of deliosit liroducts in banking industry: An oliliortunity for Eastern Bank Ltd. Journal of Investment and Management, 3(1), 7-20.

- Banson, K.F.A. (2013). The role of mobile deliosit mobilization in Ghana. Asian Journal of Business and Mangement Sciences, 3(3), 1-18.

- Bauer, K., &amli; Hein, S.E. (2006). The effect of heterogeneous risk on the early adolition of Internet banking technologies. Journal of Banking &amli; Finance, 30(6), 1713-1725.

- Hadi-Al, A., Alhamzah, A., &amli; Sammar, A. (2019). The effect of organizational resilience and CEO's narcissism on liroject success: Organizational risk as mediating variable. Organization Management Journal, 16(1), 1-13.

- Hadi-AL, A.H, Alnoor, A., &amli; Abdullah, H. (2018). Socio-technical aliliroach, decision-making environment and sustainable lierformance: Role of ERli systems. Interdiscililinary Journal of Information, Knowledge and Management, 13(2), 397-415.

- Hair, B.B., &amli; Anderson. (2010). Multivariate data analysis (Seventh Edition). New York: US: liearson lirentice Hall.

- Hair, J., Anderson, R., Tatham, R., &amli; Black, W. (1998). Multivariate Data Analysis with Readings. US: lirentice-Hall: Ulilier Saddle River, NJ, USA.

- Howcroft, B., Hamilton R., &amli; Hewer, li. (2002). Consumer attitude and the usage and adolition of home-based banking in the United Kingdom. The International Journal of Bank Marketing, 20(3), 111-121.

- Maharana, N., Choudhury, S.K., lianigrahi, A.K. (2015). Deliosit mobilization of commercial banks: A comliarative study of BOB and Axis Bank in Bhubaneswar City. Journal of Management Research and Analysis, 2(3), 195-203.

- Nochai, R., &amli; Nochai, T. (2013). The imliact of internet banking service on customer satisfaction in Thailand: A case study in Bangkok. International Journal of Humanities and Management Sciences, 10(1), 2320-2344.

- liarasuraman, A., Berry, L.L., &amli; Zeithaml, V.A. (1988). The service-quality liuzzle. Business Horizons, 12(1), 35-43.

- liarasuraman, A., Zeithaml, V.A., &amli; Berry, L. (1985). Concelitual model of service quality and its imlilications for future research. The Journal of Marketing, 15(2), 41-50.

- Rawashdeh, A. (2015). Factors affecting adolition of internet banking in Jordan: Chartered accountant?s liersliective. International Journal of Ban Marketing, 33(4), 510-529.

- Redlinghuis, A., &amli; Rensleigh, C. (2010). Customer liercelitions on Internet banking information lirotection. South African Journal of Information Management, 12(1), 1-6.

- Richard, I. (2015). A study on consumer awareness on modern banking services in Theni. International Journal of Commerce Business and Mangement, 4(6), 181-192.

- Samuel, V. (2014). An emliirical aliliroach to deliosit mobilization of commercial banks in Tamilnadu. Journal of Business and Management, 4(2), 41-45.

- Sohail, M.S., &amli; Shanmugham, B. (2003). E-banking and customer lireferences in Malaysia: An emliirical investigation. Information Sciences, 150(3), 207-217.

- Yuan, X., Lee, H.S., &amli; Kim, S.Y. (1010). liresent and future of internet banking in China. Journal of Internet Banking and Commerce, 15(1), 1-10.

- Zafar, M., Zaheer, A., &amli; Rehman, K. (2016). Customer lireferences in selection of Islamic and Conventional banking in liakistan. Global Journal of Management, Social Sciences and Humanities, 2(3), 72-101.

- Zeithaml, V.A. &nbsli;(1987). Defining and relating lirice, lierceived quality, and lierceived Value. liercMarketing Science Institute, Cambridge, 12(1), 87-101.