Research Article: 2021 Vol: 25 Issue: 4S

Implementation of IFRSs 9, 15, and 16 towards Accounting Information Quality: An Indonesian Case Study

Venesa Hafid El Haq, Universitas Padjadjaran

Arie Pratama, Universitas Padjadjaran

Citation Information: El Haq, H.V., & Pratama, A. (2021). Implementation of ifrss 9, 15, and 16 towards accounting information quality: an indonesian case study. Academy of Accounting and Financial Studies Journal, 25(S4), 1-8.

Abstract

The purpose of this research is to determine whether there is a difference in the quality of accounting information before and after the implementation of IFRSs 9, 15, and 16. This study divided the sample into two categories: (1) for IFRS 9, 75 public listed financial sector companies were selected; and (2) for IFRSs 15 and 16, 52 public listed non-financial sector companies were selected. It used the years 2019 and 2020 as a year before and a year after implementation, respectively. To analyse the data, this research used the Wilcoxon paired-sample test. The results indicate that the quality of accounting information improved after the implementation of IFRSs 9 and 16; however, there is no difference in the quality of accounting information before and after the application of IFRS 15. This study implies that the accounting standards need to be developed carefully to improve the relevance and representation of the financial statement itself.

Keywords

Accounting information quality, IFRS 9, IFRS 5, IFRS 16, Indonesia

Introduction

The quality of accounting information may be influenced by the standards that businesses use in preparing their financial statements. However, businesses and their environment change and develop over time. The International Accounting Standards Board (IASB) has changed several international accounting standards in response to changes in the business environment (Khalil & Ibrahim, 2017). Accordingly, the IASB has issued several new standards, such as IFRS 9: Financial Instruments, IFRS 15: Revenues from Contract with Customers, and IFRS 16: Leases, to adjust certain accounting regulations to today’s business circumstances. Each of the standards has impacts due to its implementation. Deloitte’s (2019a) analysis, conducted among banks in the United Kingdom, concluded that IFRS 9 increases the total impairment provisions. These increases are caused by the expected credit loss (ECL), particularly the 12-month ECL on stage 1 exposures and the lifetime ECL on stage 2 and stage 3 exposures. KPMG (2016a) concluded that the ECL, as the new model for loan loss provisions in IFRS 9, requires banks to create robust ECL estimations and determine when significant changes happen in the credit risk, which needs new systems, processes, and internal controls. The second standard studied is IFRS 15. The issuance of IFRS 15 was claimed to be a great milestone in financial reporting. This standard was expected to provide a ‘one-stop shop’ for accounting treatment related to revenues, regardless of the sectors or capital markets in which a business operates. Therefore, the alignment between the revenue and the performance of the company would be improved under IFRS 15. Furthermore, it would assist investors in the analysis and comparison of companies. The third standard, IFRS 16, based on Deloitte (2019b), would raise the lessee’s assets and liabilities on the balance sheet as well as the EBITDA (earnings before interest, tax, depreciation, and amortization) on the income statement. Moreover, the net debt or EBITDA is significantly the most affected by IFRS 16, especially for companies that have a large number of operating leases.

Literature Review

In Indonesia, these accounting standards were issued in 2017 and became effective in 2020, regulating the new accounting treatments related to financial instruments, revenues, and leases ithin a broader scope, these IFRSs have impacts on the accounting information uality generated, which has already been proved by several studies here are several significant issues in each of the standards Radstro?m et al. (2019) revealed that IFRS 9 gives relevant and useful information. IFRS 9 regulates the changes concerning financial instruments. Altaji & Alokdeh (2019) found that the IFRS 15 implementation generated statistical significance for the relevance and faithful representation of accounting information, which have increased. Liviu-Alexandru (2018) stated that IFRS 16 provides some advantages, such as an increase in the quality and an improvement in the comparability of financial statements. According to PWC (2016), lease transactions, which could previously be an off-balance-sheet item, now have to be on the balance sheet. Financial performance was also affected by the implementation of IFRS 16.

Hence, there is lack of studies explaining the effect of the implementation of these new accounting standards on accounting information quality. Therefore, this research aims to explain the implementation of the new standards in relation to the accounting information quality in Indonesia. This research consists of three different event studies because each IFRS has affected companies differently. For instance, IFRS 9 affected the financial sector while IFRSs 15 and 16 affected the non-financial sector. Since the study was conducted during the Covid-19 pandemic, it did not use outlier samples; hence, the samples selected were companies that were not significantly affected by the Covid-19 pandemic.

This study is expected to contribute theoretically and practically. Theoretically, it is expected to explain phenomena regarding accounting information quality and the implementation of IFRS 9, IFRS 15, and IFRS 16. For companies, this can suggest greater concern about the quality of accounting information and the standards that have just been implemented. The rest of the paper is divided as follows: section 2 presents a brief literature review and the research hypotheses, section 3 describes the research method, section 4 provides the research results, implications, and a discussion, and section 5 concludes the article.

Literature Review and Hyphothesis Development

Several previous studies have concluded that IFRS adoption increases the quality of accounting information. Key & Kim (2020) summarized the results of their research as showing less earnings management and more timely recognition of losses in South Korea after the adoption of the IFRSs, indicating that the accounting quality had increased. This is in accordance with the research by Barth, Landsman & Lang (2008), who found that IAS application increased accounting quality, shown by lower earnings management, more timely loss recognition, and increased accounting income value relevance. Chua et al. (2012) explored the mandatory IFRS adoption in Australia in 2005 and showed increasing accounting quality obtained through diminished income smoothing and more timely loss recognition after IFRS adoption. Another study, by Chen et al. (2010), pointed out that the accounting information quality increased in the EU after the IFRS adoption and is reflected in the decreased earnings management target, the smaller magnitude of absolute discretionary accruals, and the greater accrual quality.

However, several studies have concluded that IFRS adoption did not increase the accounting quality; for instance, the study by Liu & Sun (2015) examined the IFRS adoption in Canada in 2011 and concluded that no significant accounting quality changes had occurred after the IFRS adoption, specifically regarding timely loss recognition and discretionary accruals. Bryce et al. (2015) also found that IFRS adoption did not significantly enhance the accounting quality in Australia. In addition, Jeanjean & Stolowy (2008) concluded that adopting the IFRSs for the first time in Australia and the UK led to steady earnings management, indicating unchanged accounting quality. Another study, by Goodwin et al. (2008), reported that the accounting quality in Australia remained stable after the adoption of the IFRSs because the IFRS earnings and equity are not more relevant than the AGAAP earnings and equity.

Some studies have observed that IFRS 9 has affected the accounting information quality. The study by Radstro?m et al. (2019) among European banks proved that IFRS 9 gives relevant and useful information. The IFRS 9 implementation in private banks in Iraq will optimize and enhance the accounting and financial information quality in the financial statements (Alaraji et al., 2018). Another study, by Magdalena & Martani (2019), which used banks in European countries as samples, revealed that IFRS 9 adoption decreases the value of discretionary loan loss provisions and can boost the amount of credit loss recognition and ensure its timeliness. However, the principle base that was introduced by IFRS 9 leads to high flexibility. The flexibility given to banks results in different sensitivities related to the impairment model, and this shows the faithful representation as the accounting uality is low (R dstro?m et al., 2019). In addition, the study by Huian (2012) concluded that, under IFRS 9, loan loss provisions require more professional judgement, implying that managers are more likely to make discretionary loan loss provisions. Hence, the first hypothesis is.

H1: There is a difference in accounting information quality before and after the implementation of IFRS 9 9.

Several previous studies have proved that IFRS 15 has had an impact on accounting information quality. The study by Altaji & Alokdeh (2019) revealed that the IFRS 15 implementation has statistically significantly increased the relevance of accounting information and its faithful representation according to 100 external auditors working at Jordan’s Big Four audit companies. In addition, Maroun (2016) found that IFRS 15 application generates better transparency of financial performance descriptions. In contrast, the study by Tutino et al. (2019), which used Italian listed companies as samples, revealed that the IFRS 15 implementation has affected earnings management, especially in the telecommunication industry. The higher the earnings management, the lower the accounting quality. Accordingly, the second hypothesis is:

H2: There is a difference in accounting information quality before and after the implementation of IFRS 15 15.

It has been already proved by Liviu-Alexandru (2018) that IFRS 16 provides several advantages. First, the financial statement quality has improved for companies that have off-balance sheet records for leases because assets and liabilities are recognized better than in the previous standard, providing a more transparent image. Second, there has been an improvement in the financial statement comparability since IFRS 16 assesses the recognition of lease assets and liabilities in a similar manner and recognizes only the rights and obligations regarding the lease. These two advantages indicate that the quality of the accounting information generated is enhanced. According to this explanation, the third hypothesis is:

H3: There is a difference in accounting information quality before and after the implementation of IFRS 16

Methods

This research can be described as an exploratory study following the quantitative approach. In this study, the populations are different since each of the independent variables (IFRS 9, 15, and 16) might affect a different sector. For IFRS 9, the population is the financial sector, with a total of 89 companies. Then, for IFRSs 15 and 16, the population consists of a total of 126 companies appearing in the KOMPAS 100 index in 2019 and 2020. Purposive sampling was used by the author to select the samples. The sample selections for IFRS 9 and for IFRSs 15 and 16 are presented in Tables 1 and 2, respectively:

| Table 1 IFRS 9 Sample Criteria |

|

| Criteria | Total Companies |

|---|---|

| Companies categorized in the financial sector | 89 |

| Companies for which a financial statement is not available for 2019 or 2020 | (2) |

| Companies that had not implemented IFRS 9 in 2020 | (12) |

| Total | 75 |

| Table 2 IFRSs 15 and 16 Sample Criteria |

|

| Criteria | Total Companies |

|---|---|

| Companies that were included in the KOMPAS 100 index in 2019 and 2020 | 126 |

| Companies that did not stay in the KOMPAS 100 index in 2019 and 2020, respectively | (31) |

| Companies that stayed in the KOMPAS 100 index in 2019 and 2020, respectively | 95 |

| Companies that are categorized in the financial sector | (15) |

| Companies that are included in the sub-sectors that are the most affected by the Covid-19 pandemic | (16) |

| Companies for which a financial statement is not available for 2019 or 2020 | (1) |

| Companies that do not use the rupiah as their financial statement currency | (11) |

| Total | 52 |

The proxy for accounting information quality in each of the IFRSs is described below:

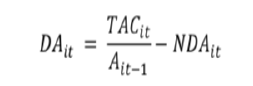

1. The IFRS 9 accounting information qualities was measured using discretionary accruals (DA) and the modified Jones model, which was developed by Dechow et al. (1995).

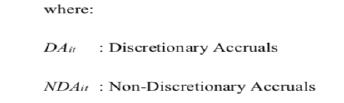

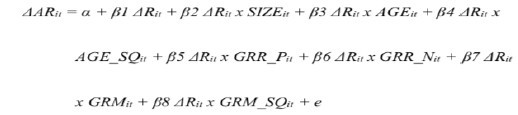

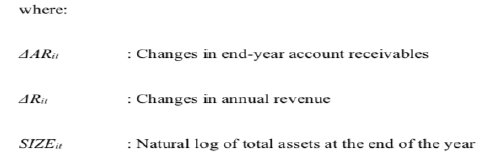

2. The IFRS 15 accounting information quality was measured using the discretionary revenue model by Stubben (2010). The discretionary revenue formula used in this study was the conditional revenue model. According to Roychowdhury (2004), residual values are used to measure the earnings management indication. The residual value is the error value with an interval of less than –0 075; exceeding 0 075 (ε < –0 075 or ε > 0 075) indicates the occurrence of earnings management practices, and, if ε is between –0.075 and 0.075, then it indicates no earnings management practices. The formula is as follows:

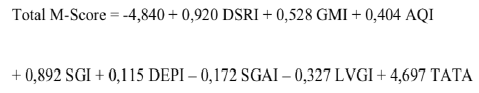

3. The IFRS 16 accounting information uality was measured using Beneish’s (1999) M-score model. The variables were measured using data from the specified year (t) and the previous year (t-1). This model contains eight variables that can be used to predict the existence of earnings management. The formula of this model is as follows:

In the application of the Beneish M-score, if the calculation result is greater than -2.22, it indicates that the company is likely to undertake earnings management and vice versa.

The data were analysed using the Wilcoxon paired-sample test, which can be classified as a non-parametric test.

Results and Discussion

The description of the data can be summarized as below in Table 3.

| Table 3 Description |

||||||

| Description | IFRS 9 | IFRS 15 | IFRS 16 | |||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | |

| Mean | 0.027 | -0.035 | 0.000 | 0.000 | -2.060 | -2.760 |

| Standard Deviation | 0.159 | 0.137 | 0.045 | 0.031 | 1.382 | 0.787 |

The Table 3 above can be interpreted as follows:

- For IFRS 9, the mean decreases from 0.027 to -0.035, which shows that the level of earnings management level decreases, reflecting a tendency towards increased accounting information quality. The standard deviation is higher than the mean, which indicates that the data are spread quite out, but it decreases from 0.159 to 0.137, which shows that the data are less spread out after the implementation of IFRS 9.

- For IFRS 15, the mean difference before and after the implementation of IFRS 15 is extremely small or absolute zero, that is, the figures remain almost unchanged, which shows that the earnings management is steady. The standard deviation is higher than the mean, which indicates that the data are quite widely spread out, but it decreases from 0.045 to 0.031, which reflects that the data become less widely spread out after the implementation of IFRS 15 and the quality of the data distribution improves.

- For IFRS 16, the mean decreases from -2.060 to -2.760, which shows that earnings management is decreasing, reflecting a tendency for the accounting information quality to increase. The standard deviation is higher than the mean, which indicates that the data are quite widely spread out, but it decreases from 1.382 to 0.787, which reflects the data becoming less spread out after the implementation of IFRS 16.

The hypothesis testing using the Wilcoxon paired sample test showed that there is a difference in accounting information quality after the implementation of IFRSs 9 and 16 but no difference in accounting information quality after the implementation of IFRS 15. The Table 4 below summarizes the results.

| Table 4 Wilcoxon Signed Rank Test |

|||

| Description | IFRS 9 | IFRS 15 | IFRS 16 |

|---|---|---|---|

| Z-score | -2.770 | -0.182 | -3.169 |

| Sig. | 0.006* | 0.855 | 0.002* |

Notes: *: significant at α = 5%

Based on the result of the statistical test, it can be proved that there is a difference in the quality of accounting information before and after the implementation of IFRS 9. Thus, the result of this research is in accordance with those of several previous studies related to IFRS adoption and accounting information quality, such as the studies by Barth et al. (2008); Chen et al. (2010); Chua et al. (2012); Key & Kim (2020). These studies concluded that IFRS adoption increased the accounting information quality, which is evident from the reduction in earnings management practices after the adoption of the IFRSs. In particular, the result is in accordance with the study by Ra?dstro?m et al. (2019), which stated that IFRS 9 provides more relevant and useful information, better reflecting the accounting information quality. It is also in line with the study by Alaraji et al. (2018), which proved that IFRS 9 optimizes and enhances the quality of accounting and financial information. The difference in accounting information quality, with a tendency to increase, may be caused by the new impairment model under IFRS 9, called expected credit loss (ECL). This new impairment model is a forward-looking impairment model, which differs significantly from IFRS 55 with the incurred loss approach. Using the new impairment recognition approach, credit losses may be discovered sooner than is possible with the previous standard (Frykström & Li, 2018). This is because, under the previous standard, impairment was carried out only if objective evidence existed. In addition, IFRS 9 requires a re-evaluation of financial assets at the end of each reporting period, resulting in tighter controls and greater transparency in financial statements (Ra?dstro?m et al., 2019). These reflect better accounting information quality.

According to the result of the statistical test, it can be concluded that there is no difference in the accounting information quality before and after the implementation of IFRS 15. IFRS 15 concerns the regulation of revenue recognition. The lack of a difference in accounting information quality after the implementation of IFRS 15 may be caused by the main concept of revenue recognition between IFRS 15 and the previous standard being not particularly different. Under IFRS 15, revenue is recognized when there is a transfer of control to the customer by transferring the promised goods or services. Meanwhile, under the previous standard, revenue was recognized when the risks and rewards were transferred. The transfer of risks and rewards is related to the legal title or ownership transfer from seller to buyer. It can be concluded that, in both the new and the previous standard, revenue is recognized when the control of an asset moves to the customer. Thus, revenue recognition’s main concept in the new standard is only slightly different from that in the previous one.

From the statistical test result, it can be proved that there is a difference in the quality of accounting information before and after the implementation of IFRS 16. Therefore, the result of this research is in accordance with several previous studies about IFRS adoption and accounting information quality, such as the studies by Barth et al. (2008); Chen et al. (2010), Chua et al. (2012); Key & Kim (2020), which stated that earnings management decreased after the adoption of the IFRSs, indicating that the quality of accounting information increased. To be more specific, the result is also in accordance with the study by Liviu-Alexandru (2018), which concluded that the quality of accounting information is enhanced under IFRS 16 due to a more transparent image because assets and liabilities that arise from leases are recognized better than in the previous standard. Therefore, financial statement comparability also improved because lease assets and liabilities are recognized in a similar manner. The difference in accounting information quality, with a tendency to increase, may be caused by the primary change in IFRS 16, in which almost all leases are recognized as financial leases. This means that off-balance-sheet leases no longer exist. Off-balance-sheet leases omit material liabilities and assets arising from operating leases (McGregor, 1996), which means that the completeness component, part of a faithful representation of accounting information quality, is not fulfilled. Therefore, the accounting information quality is improved, especially the faithful representation component, which is completeness.

Conclusion

It can be concluded that there is a difference in accounting information quality before and after the implementation of IFRSs 9 and 16 but no difference in accounting information quality before and after the implementation of IFRS 15. However, this research is not without limitations. The research period observed is quite short, only 1 year before and 1 year after the implementation of the standard. This is because IFRSs 9, 15, and 16 had just begun to be implemented when the research was conducted. The samples in this research are limited to companies in the financial sector for IFRS 9 and companies included in the KOMPAS 100 index, in which the company distribution is not spread evenly across each sector, for IFRSs 15 and 16. IFRSs 9, 15, and 16, as independent variables in this research, were implemented in 2020, which was accidentally during the Covid-19 pandemic. Further studies are recommended to extend the period and enlarge the sample observed so that the research result can represent a greater population. It would also be advisable to conduct interviews or questionnaires with some parties that are directly involved in implementing IFRSs 9, 15, and 16 to gain a better understanding of the implementation of the new standards technically and enhance the research analysis.

References

- Altaji, F., & Alokdeh, S. (2019). The impact of the implementation of international financial reporting standards no. 15 on improving the quality of accounting information. Management Science Letters, 9(13), 2369-2382.

- Barth, M.E., Landsman, W.R., & Lang, M.H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467-498.

- Beneish, M.D. (1999). The detection of earnings manipulation. Financial Analysts Journal, 55(5), 24-36.

- Bryce, M., Ali, M.J., & Mather, P.R. (2015). Accounting quality in the pre-/post-IFRS adoption periods and the impact on audit committee effectiveness—Evidence from Australia. Pacific-Basin Finance Journal, 35, 163-181.

- Chen, H., Tang, Q., Jiang, Y., & Lin, Z. (2010). The role of international financial reporting standards in accounting quality: Evidence from the European Union. Journal of international financial management & accounting, 21(3), 220-278.

- Chua, Y. L., Cheong, C.S., & Gould, G. (2012). The impact of mandatory IFRS adoption on accounting quality: Evidence from Australia. Journal of International Accounting Research, 11(1), 119-146.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review, 193-225.

- Deloitte. (2019a). After the first year of IFRS 9: Analysis of the initial impact on the large UK banks. Retrieved from www2.deloitte.com

- Deloitte. (2019b). IFRS 16 valuation impact: What you need to know now. Retrieved from www2.deloitte.com.

- Frykström, N., & Li, J. (2018). IFRS 9–the new accounting standard for credit loss recognition. Economic Commentaries, 3, 1-13.

- Goodwin, J., Ahmed, K., & Heaney, R. (2008). The effects of International Financial Reporting Standards on the accounts and accounting quality of Australian firms: A retrospective study. Journal of Contemporary Accounting & Economics, 4(2), 89-119.

- Huian, M. C. (2012). Accounting for financial assets and financial liabilities according to IFRS 9. Analele ?tiin?ifice ale Universit??ii» Alexandru Ioan Cuza «din Ia?i. ?tiin?e Economice, 59(1), 27-47.

- Jeanjean, T., & Stolowy, H. (2008). Do accounting standards matter? An exploratory analysis of earnings management before and after IFRS adoption. Journal of accounting and public policy, 27(6), 480-494.

- Key, K.G., & Kim, J.Y. (2020). IFRS and accounting quality: Additional evidence from Korea. Journal of International Accounting, Auditing and Taxation, 39, 100306.

- Khalil, A.M., & Ibrahim, M. (2017). Measurement of the effect of applying the IFRS 15, revenue from contracts with customers, on the sustainability of accounting profits – A guide from the accounting environment. Journal of Accounting and Auditing, 1(1), 1–60.

- KPMG. (2016). Revenue issues in-depth. Retrieved from assets.kpmg.

- KPMG. (2016). IFRS 9 for banks: What’s the impact on your business? Retrieved from assets.kpmg.

- Liu, G., & Sun, J. (2015). Did the mandatory adoption of IFRS affect the earnings quality of Canadian firms?. Accounting Perspectives, 14(3), 250-275.

- Liviu-Alexandru, T. (2018). The Advantages that IFRS 16 Brings to the economic environment. Ovidius University Annals, Economic Sciences Series, 18(1), 510-513.

- Magdalena, F.C.S., & Martani, D. (2021). The Effect of Ifrs 9 Adoption On Loan Loss Provisions. ICORE, 5(1).

- Maroun, W. (2017). Accounting for revenue using an accountability and business model framework: The case of the South African Institute of Chartered Accountants’ professional examinations. South African Journal of Accounting Research, 31(3), 240-254.

- McGregor, W. (1996). Accounting for leases: A new approach. Stamford, CT: Financial Accounting Standards Board.

- PWC. (2016). IFRS 16: The leases standard is changing, are you ready? Retrieved from www.pwc.com.

- Rådström, N., & Eriksson, N. (2019). The implications of IFRS 9–for Equity Analysts (Doctoral dissertation, Masters Thesis, Uppsala University). Hentet fra http://uu. divaportal. org/smash/get/diva2: 1336723/FULLTEXT01. pdf).

- Roychowdhury, S. (2004). Management of earnings through the manipulation of real activities that affect cash flow from operations. University of Rochester.

- Stubben, S.R. (2010). Discretionary revenues as a measure of earnings management. The accounting review, 85(2), 695-717.

- Tutino, M., Regoliosi, C., Mattei, G., Paoloni, N., & Pompili, M. (2019). Does the IFRS 15 impact earnings management? Initial evidence from Italian listed companies. African Journal of Business Management, 13(7), 226-238.