Research Article: 2019 Vol: 23 Issue: 2

Improving the Model of Increasing the Quality of Auditing Services

Lyudmila Kryatova, Russian university of cooperation

Vera Darinskaya, Russian university of cooperation

Gulzira Bekniyazova, Russian university of cooperation

Igor Prykhodko, Dnipro State Agrarian and Economics University

Alla Shapovalova, Interregional Academy of Personnel Management

Abstract

It is proved that the quality of audit services has two aspects: firstly, the quality of the audit, in which the quality assurance object is an independent audit of the financial statements and the accounting system; secondly, the quality of audit activity in which the object of quality assurance is the work of the subject of audit activity in general. The Model of the internal quality control system of the audit activity as a system of two components: internal structure; external environment "exit", "entrance"; feedback and external environment. Some deficiencies were identified when creating and implementing quality control systems for audit services at the micro level.

Keywords

Audit Services, Quality of Audit Services, Quality Control of Audit Services, Internal Control System, Users of Financial Reporting.

JEL Classifications

M21, O16

Introduction

The problem of improving the quality of audit services in the world's integration space is currently very urgent for several reasons. First of all, audit services are becoming one of the most important factors for increasing the competitiveness and investment attractiveness of enterprises. Therefore, the quality of the audit service ceases to be a category of internal self-assessment of the auditor, and becomes the subject of direct and indirect assessment of the market. Adoption and constant improvement of the standards of audit activity, increased competition in the market of audit services led to the need for further development of the theory and improvement of the methodology for improving the quality of audit services.

The relevance of the research topic is exacerbated by the fact that it has a practical orientation. Along with the development of theoretical, methodological and organizational provisions, the study contains practical recommendations and conclusions, the use of which can make a definite contribution to the development and implementation of the reforming policy of the Ukrainian audit.

The purpose of scientific research is theoretical substantiation and development of methodological recommendations for improving the quality of audit services in the practice of audit entities.

Review Of Previous Studies

It should be noted that the problems of improving the quality of audit services by researchers are studied in different directions. Many works are based on quality control approaches based on the creation and development of a unified quality control system at the state level and at the level of professional audit organizations, which requires continuous study and improvement (Drobyazko et al., 2018).

Broberg et al., 2017 note that the quality in the audit practice should be understood as the maximum satisfaction of information needs of users by the results of the auditor's work, services and accompanying audits of works in accordance with the interests of the owner, society and a specific customer within the limits of the requirements of the current legislation, the standards of audit. Other scholars, namely Ghafran et al., 2017 and Hossain et al., 2017 pay attention to the fact that the quality of services guarantees trust. the public to the results of the work of the auditors, who, in their turn, should demonstrate to the supervisory bodies the adequacy of their duties. However, the opinions of researchers Houqe et al., 2017 and their supporters (Kowaleski et al., 2018) are interesting, which note that improving the quality the level of audit services will help clean up auditors from casual people who pose profits beyond professional standards (Garbowski et al., 2019).

Methodology

In solving the tasks in the work the method of research was used, which is based on the methods: analysis, synthesis, induction and deduction, specification, comparison, grouping, as well as a method of generalization of information, with the help of which the most important aspects of this research are highlighted. In order to compare, group and analyze data by types of generalization, graphic and tabular research methods were also used in the work.

Results And Discussion

Today, in the context of European integration and globalization, there is a need to expand foreign economic relations. More and more business entities are entering external markets, as this is due to the maximization of profits, the expansion of market boundaries, the implementation of the scientific and technological potential of enterprises, the exchange of political, economic, scientific, technical and cultural information.

The attraction of foreign investments into the domestic economy requires enterprises to improve their status as economic entities, as well as their business reputation. The definition of this status and the business reputation of enterprises is the result of not only competent business, but also the outcome of audits. It is the members of the audit network as independent experts that can contribute to the certainty of the question of the trust of a particular enterprise. All these aspects, in turn, compel auditors to accumulate a high level of their business reputation in order to allow their minds to be trusted in the market, both domestic and international.

At the present stage, audit services are an integral part of the market. Audit services are aimed at protecting the legitimate property interests of enterprises through independent financial control, confirmation of the reliability of financial reporting on the results of economic activity and the provision of services on the profile of activities. Audit services help meet these needs, as auditing often becomes a prerequisite for establishing foreign economic relations between business entities.

The assessment of the quality of the audit aims to achieve the specified parameters of the quality of its elements, individual stages and the whole process as a whole.

In our opinion, auditors do not pay due attention to one of the important stages of audit - planning. After all, at this stage, a general audit strategy is being developed: an audit plan is drawn up, which is detailed in the areas of the audit program. Therefore, auditors should avoid a mechanical approach to the audit and plan their work in an individual approach, despite the preliminary checks. Also, at the planning stage, more attention should be paid to assessing the state of internal control, as it will help the auditor to identify which parts of the entity need to be analyzed in more detail, and which are superficial, and will enable the sequence of audit procedures to be developed.

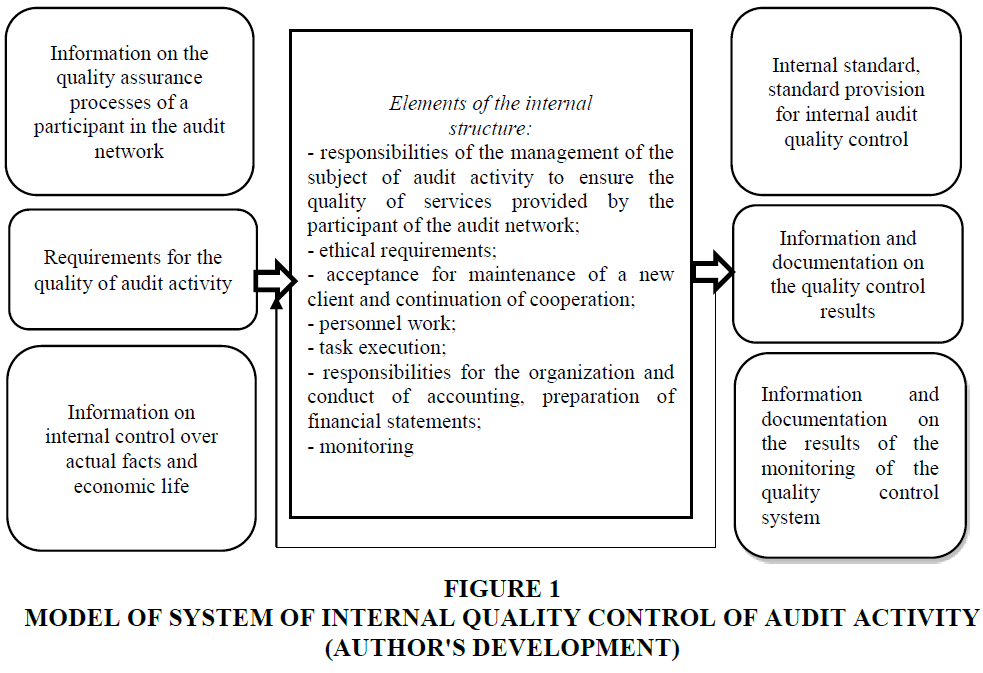

Scheme of the system of internal quality control of audit activities model can be presented in two components (Figure 1): the internal structure; external environment - "exit", "entrance"; feedback and external environment.

The external environment and the internal structure of the system are interrelated. The internal structure transforms the "input" into "output". Thus, "entrance" includes information on quality assurance processes in an audit organization, requirements for the quality of audit activities and information on the organization and implementation of internal control over realized facts of economic life; and "output" an administrative document on quality control (internal standard or standard position) and information on the evaluation of the effectiveness of the internal quality control system of audit activities.

In the process of its functioning, this system responds to the external environment and develops under these influences. External influence is exercised through external quality control audits conducted by the authorized control and oversight body and self-regulatory organizations of auditors. Feedback is made through claims, customer complaints and consumer information that arose due to poor audit quality and other factors. The implementation of this model in practice consists in developing and documenting the principles and procedures for auditing the quality of the audit, their continuous analysis, evaluation and carrying out corrective influences.

Among the problems regarding the organization and functioning of the internal quality control system of audit activities, the following should be distinguished: organizational problems; problems of the development of its methodological basis and the process of functioning associated with the lack of a methodological department and the limited staffing (Lesage et al., 2017).

Therefore, optimal realization of this model in the practical activity from the point of view of costs and the final result will be documenting the principles and procedures of quality control audit on the elements of the internal structure of this model in the typical situation with internal quality control audit, assessment of the functioning of the internal quality control of auditing activities using testing and the questionnaire, carrying out corrective actions for the revealed violations.

As the main principles of internal quality control in the audit network, one can distinguish the following: focusing on improving quality, responsibility, balance, timely reporting of deviation, systemic, division of responsibilities, adherence to audit ethics (Park et al., 2017).

The results of our study are confirmed by the following studies. The model reviewed by us proves that the audit is useful in the same way as the useful financial statements for which a conclusion is given. Under this document, financial statements are not considered in detail, although many scholars believe (Hilorme et al., 2019) that the desire to reach more predictable, qualitative and non-financial data could increase its value. A significant factor in the trust of users of financial reporting to the management of the company and auditors is the problem of the quality of financial reporting. Each user strives to obtain reliable information about the financial position of the enterprise, the system of internal control, the proper organization of accounting, financial statements of the enterprise (Hilorme et al., 2018).

Recommendations

In view of the foregoing, it can be concluded that currently the control over the quality of audit services does not produce the desired results. Therefore, in order to form an effective system for monitoring the quality of audit services, we believe that the following requirements should be encouraged: regular audit of the quality of audit services should be carried out at the level of all auditors; the introduction of criteria, standards for the assessment of audit services, which will allow to objectively evaluate the work of the subjects of audit activity, both at the external level and at the internal level; improvement of methods and procedures of work of subjects of audit activity.

Conclusion

However, because of the lack of clarity and incomplete implementation of the ISA requirements, there are certain shortcomings in the establishment and implementation of quality control systems for audit services, in particular: the procedures for the acceptance of new clients or the continuation of work with regular clients are not always performed, the requirements for the approval of conditions are not met tasks; receipt and execution of tasks is not accompanied by a procedure that would give the management of the audit firm sufficient assurance that the task team fulfills the relevant ethical requirements; detailed audit plans in the form of standard audit programs do not take into account modern requirements for planning of audit procedures; the monitoring of the compliance of policies and quality control procedures with the current monitoring of the head of the group of auditors during the respective stages of the task is not distinguished.

Therefore, transparency on the functioning of the quality assurance system implies an annual presentation of the performance report by such a system, which should include information provided on the results of the inspection recommendations made by auditors and audit firms corrective measures and disciplinary measures and sanctions applied, qualitative information on the results of the quality assurance system , as well as important financial information about the financial and resource provision of the system, its effectiveness and the efficacy.

However, the further development of auditing in the world needs to strengthen its regulatory framework, preserving the fundamental principles of audit activity, without which it loses its independence and independence. And this is now the main issue of the quality of the audit, the decision of which depends on each employee in this service area. In solving this problem it is necessary to take into account the specifics of modern economic reality and the peculiarities of the current practice of audit in the country. It should also be remembered that a qualitative audit serves the interests of not only owners, but also of the state and society.

References

- Bailey, C., Collins, D.L., & Abbott, L.J. (2017). The impact of enterprise risk management on the audit process: Evidence from audit fees and audit delay. Auditing: A Journal of Practice & Theory, 37(3), 25-46.

- Chu, L., Dai, J., & Zhang, P. (2018). Auditor tenure and quality of financial reporting. Journal of Accounting, Auditing & Finance, 33(4), 528-554.

- Cohen, J., Krishnamoorthy, G., & Wright, A. (2017). Enterprise risk management and the financial reporting process: The experiences of audit committee members, CFO s, and external auditors. Contemporary Accounting Research, 34(2), 1178-1209.

- Garbowski ?., Drobyazko S., Matveeva V., Kyiashko O., & Dmytrovska V. (2019). Financial accounting of E-business enterprises. Academy of Accounting and Financial Studies Journal, 23, (2S).

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance, 10, 4-11.

- Ferreira Rebelo, M., Silva, R., & Santos, G. (2017). The integration of standardized management systems: managing business risk. International Journal of Quality & Reliability Management, 34(3), 395-405.

- Hilorme, T., Nazarenko Inna, Okulicz-Kozaryn, W., Getman, O. & Drobyazko, S. (2018). Innovative model of economic behavior of agents in the sphere of energy conservation. Academy of Entrepreneurship Journal, 24(3).

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education , 22(1S).

- Kachelmeier, S.J., Schmidt, J.J., & Valentine, K. (2017). The disclaimer effect of disclosing critical audit matters in the auditor’s report. Working paper.

- Kim, S., Mayorga, D.M., & Harding, N. (2017). Can I interrupt you? Understanding and minimizing the negative effects of brief interruptions on audit judgment quality. International Journal of Auditing, 21(2), 198-211.