Research Article: 2018 Vol: 21 Issue: 2S

Individual Entrepreneurship in Russia and Abroad: Social and Legal Aspects

Elvir Munirovich Akhmetshin, Kazan Federal University

Kseniya Evgenievna Kovalenko, Altai State University

Viktoriya Viktorovna Ling, Industrial University of Tyumen

Elmira Arsenovna Erzinkyan, State Academic University for Humanities (GAUGN)

Gulnaz Minnulovna Murzagalina, Sterlitamak Branch of Bashkir State University

Angelina Aleksandrovna Kolomeytseva, Moscow State Institute of International Relations (MGIMO)

Abstract

The purpose of the article is to study the issues of the concept and place of individual entrepreneurship within the framework of modern economic realities of the development of society, and also to highlight the main features and trends in the development of individual entrepreneurship in accordance with the new legislation and its impact on the state economy. The methodological basis of this study includes the dialectical method of knowledge, based on a system of general scientific and private-scientific methods: a logical method (in the formulation of the material, the formulation of conclusions); historical method (in the process of studying the evolution of ideas about entrepreneurship); and statistical method (in the process of analysis and synthesis of the material); content analysis (analysis of individual provisions of legislative acts, scientific works), the method of system analysis and others.

Entrepreneurship in modern reality remains one of the most effective forms of realization of the initiative and self-organization of citizens in the context of the innovative development of the Russian state and society.

The place of entrepreneurship in the modern economy is determined by its role as the main engine of the processes of creating new values - the production and sale of goods, the provision of services, the performance of work. In this article, we tried to define the notion of "entrepreneurship", "small business" through the analysis of doctrinal sources, considered the provisions of the current legislation. The authors came to the conclusion that the opportunity for hundreds of thousands of able-bodied people to engage in entrepreneurship on the basis of self-sustaining self-employment increases sharply in the context of unemployment and against the backdrop of crisis conditions of the economy. Therefore, the course on the development of entrepreneurship in Russia and ensuring its competitiveness is uncontested.

Many researchers and specialists note that the main reason for the specific image of Russian entrepreneurship and its participation in the management of social relations is the institutional environment for the formation and development of domestic entrepreneurship, especially small business.

Keywords

Individual Entrepreneurship, Professional Competencies, Educational Program, Entrepreneurial Practice.

Introduction

The relevance of the research topic is that the development of entrepreneurship is one of the most accurate indicators of the economic and social level of the state, as entrepreneurship provides:

1. The creation of new jobs, ensuring employment of the working population.

2. Ensuring social stability and poverty reduction. The development of entrepreneurship contributes to the growth of monetary receipts in the budget, as well as reducing unemployment and so on.

3. Increase tax revenues.

4. Growth in the share of gross domestic product created by organizations engaged in the field of entrepreneurship.

5. Increasing the size of the middle class, therefore, improving social and political stability.

6. Interaction of small and large business, which helps giant enterprises to survive in the current market conditions, give impetus to the development of newly created private and small enterprises.

Entrepreneurship is built on the principle of cooperation between large and small enterprises, and large enterprises are oriented not towards suppressing small businesses, but, on the contrary, towards mutually beneficial cooperation with them. Therefore, large and small enterprises complement each other, especially in the field of specialization of individual industries and in innovative developments (Simonova et al., 2017).

LITERATURE REVIEW

Introducing the historical direction, Ding Li proposes his definition of economic (entrepreneurial) activity. The scientist points out that this is a socially useful activity of members of society and their unions (associations). The author considers it necessary to note that this activity is aimed at the production of goods, the performance of work, the provision of services for the purpose of their sale for a fee as a commodity. It is important, writes Ding Li, that entrepreneurship is based on the combination of private and public interests and is carried out professionally (Li, 2016).

Kaliszczak and Szara, being a representative of economics, conducted an analysis of the literature and identified a number of signs of entrepreneurial activity from the standpoint of economics. Signs of entrepreneurship include the following: ownership of capital, a focus on making profit, combining and combining factors of production, capitalization of income, involvement in market relations, economic freedom and autonomy, particular production management, as well as willingness to take risks, initiative and creativity, the ability to overcome resistance Wednesday (Kaliszczak and Szara, 2005).

However, the scientists noted two, on their opinion, the most necessary signs of entrepreneurship-economic freedom (based on private property) and innovation (organizational and economic innovation) (Kaliszczak and Szara, 2005).

The point of view of the economist Adam Smith, which was developed in the work “Study on the nature and cause of the wealth of nations.” The author analyzes the problems of economic development, while focusing on the personal interest of individuals who are engaged in the production of goods, works and services (Smith, 2008).

Netherlands economists Boermans and Willebrands (2017), as a functional characteristic of entrepreneurship put forward risk. He explained his position by the fact that an entrepreneur makes decisions and satisfies needs in the face of uncertainty, respectively, all his decisions are risky in nature (Boermans, and Willebrands, 2017).

Another well-known British economist Frank A. Heller. He recognized the economic agent who is able to combine factors of production, “dragging” resources from the sphere of low productivity and profitability in the areas in which they can give the greatest result, expressed in profit, income (Heller, 1969).

Hizrich and Peters suggested their own original understanding of entrepreneurial activity, which most accurately reflects the essence of the category in question. Entrepreneurship, according to scientists, is “the process of creating something new with value; a process that absorbs time and effort and assumes financial, moral and social responsibility; a process that brings cash income and personal satisfaction achieved” (Hizrich and Peters, 1993).

In 20th century Schumpeter, called entrepreneurship the "main phenomenon of economic activity" executing innovative function (Schumpeter et al., 2003).

The legislator recognizes entrepreneurial activity as a civil legal category, enshrining its concept in Art. 2 of the Civil Code of Russian Federation.

Among the signs that make up the concept of entrepreneurship, it is necessary to name, first, independence; secondly, the risk nature; thirdly, the focus on systematic profit; fourthly, the entrepreneur must be registered in the manner prescribed by law. Of course, these signs are important characteristics of entrepreneurship, but they do not reflect the essence of legal definition.

So, American scientist Dove expresses doubt in securing independence as a mandatory sign of entrepreneurial activity. Justifying the facultative nature of this feature, the scientist gives an example of the implementation of this activity by people held criminally liable (Dove, 2015). The author considers autonomy in the material and organizational aspects. The property independence, according to the scientist, may be complete and limited, whereas organizational independence is manifested in making independent decisions in the business process, starting with the decision to engage in the specified type of activity, the choice of organizational and legal form and ending with the decision on voluntary termination of activity.

In turn, Tarkan Cavu?o?lu and Oguzhan C. Dincer, notes that such a sign as “autonomy” indicates a volitional source of entrepreneurial activity carried out by his power and in his interest organized by a person at his own discretion not directly managed by any authority. The scientist writes that the legislator considers the right to entrepreneurial activity as an element of the legal capacity of a private person who is ensured by the duty of others to refrain from unlawful interference. Thus, according to the author, the legislator understands by independence a certain measure of freedom and the integrity of an entrepreneur as an individual (Cavusoglu, and Dincer, 2015).

Currently, there are many different interpretations of entrepreneurship, as various researchers focus on various aspects of this phenomenon. This is a sign that the problems of entrepreneurship are being actively discussed in scientific circles. As is known from economic theory and practice, an entrepreneur is a subject that combines economic resources with the goal of their optimal use and profit in conditions of economic uncertainty and in the process of independent decision-making in the course of running a business, and also responsible for the results of management. In addition, an entrepreneur, as a rule, is trying to introduce into business practice new production technologies, a combination of economic resources, management and organization of business, that is, to act as an innovator. The listed characteristics reflect mainly economic aspects of entrepreneurial activity. However, entrepreneurship can be considered as an activity of social and managerial nature. In this regard, we point out the following points.

First, entrepreneurship is traditionally associated with economic activity, the purpose of which is to make a profit. However, as well-known researchers believe, entrepreneurial structures tend to maximize profits not solely for selfish reasons. In modern society, instead of a Smith economic man with his extreme egoism and individualism, a sociable person acts, firmly aware that his entrepreneurial success largely depends on the success of partners and the economy as a whole. In other words, often the structure of the motives of entrepreneurial activity is set by the established institutions and the social practices they cause. Acting as constraints, institutions not only streamline business activities, but also encourage entrepreneurs to transform them.

Secondly, entrepreneurial activity is caused not so much by economic factors as by the institutional environment in which it operates. Therefore, from an institutional point of view, entrepreneurship is not so much a combination of economic resources, as the creation of orders of evaluation, contracting and institutionalizing the benefits that can be obtained from interaction with the external social environment.

Thirdly, entrepreneurship, being associated with the extraction of benefits, in its content is a management activity to a greater extent than economic. From this point of view, “entrepreneurship is a management aimed at acquiring and overcoming the risks associated with it”.

The civil legislation of the Russian Federation regulates relations between persons engaged in entrepreneurial activities or with their participation, on the assumption that entrepreneurial activity is an independent, risk-taking activity aimed at systematically receiving profit from using property, selling goods, performing work or rendering services. Persons engaged in business activities must be registered in this capacity in the manner prescribed by law, unless otherwise provided by the Civil Code.

From the legal definition of entrepreneurial activity, Article 2 of the Civil Code of the Russian Federation, we highlight the characteristic features, namely: independence, activities carried out at your own risk, systematic profit. At the doctrinal level, there are additional features: autonomy, independent property liability of an entrepreneur, legalized character, professionalism, etc.

To a certain extent, entrepreneurship also reflects the political situation in the country. On the one hand, the conditions and factors of its development depend on the political situation in the country (favorable or unfavorable), and on the other hand, business associations, unions themselves influence the formation of the political situation in the country, taking part in the political activity of the state.

Many researchers and specialists note that the main reason for the specific image of Russian entrepreneurship and its participation in the management of social relations is the institutional environment for the formation and development of domestic entrepreneurship, especially small business.

Methodology

Theoretical and methodological basis of the research includes the leading domestic and foreign papers in the field of individual entrepreneurship, including monographs, articles, and analytical reviews.

The research is based on common methods, like methods expert assessments, statistical assessments and comparative assessments, a system approach, synthesis, expert assessments and graphical data visualization techniques.

Results & Discussion

However, there are a number of problems of small business development in Russia.

Becoming a small business is extremely difficult for the following reasons:

Limited Finance

The finances of finances affect the volume of production, the marketing budget, investments, and so on. According to expert estimates, only about 30% of entrepreneurs get loans. In this case, banks can also be understood, because entrepreneurs do not have sufficient collateral for loans and, accordingly, banks have additional risks associated with lending to small businesses.

Administrative Barriers

It is sometimes more difficult for small businesses to obtain licenses, patents and permits for certain types of activities from the state than for large firms. At the same time, entrepreneurs feel the excessive state regulation and the participation of control and supervision bodies, which is expressed mainly by conducting numerous checks before obtaining the necessary permits.

Taxation System

Entrepreneurs must have either professional knowledge, or additionally involve specialists in accounting and taxes for a fee. When setting tax rates, it is necessary to take into account their impact on production, on the elimination of conditions conducive to the legal departure of the taxpayer from paying taxes. Also a negative factor is the constant review of rates and the use of various kinds of benefits. Reporting that individual entrepreneurs should provide is becoming more and more complicated and confusing: ignorance entails mistakes, and mistakes must be paid for-and so the vicious circle turns out: either to pay fines or increase the costs of qualified accounting and tax specialists, and more recently. The cost of these services is growing. With the introduction of a simplified tax system and a special tax regime for the payment of a single tax on imputed income, the tax burden on small businesses has been significantly reduced (Darnihamedani et al., 2018).

Entrepreneurship in modern reality remains one of the most effective forms of realization of the initiative and self-organization of citizens in the context of the innovative development of the Russian state and society.

In Western countries, at present, entrepreneurship is characterized as a special, innovative style of management, which is based on a constant search for new opportunities, a focus on innovation, the ability to attract and use resources from a wide variety of sources to solve the set problem (Shaver and Davis, 2017).

In our opinion, external factors affecting the development of individual entrepreneurship:

• Natural demographic.

• Social and cultural.

• Technological.

• Economic.

• Institutional.

• Legal.

• Political.

To internal factors affecting the development of individual entrepreneurship:

• Development of property relations.

• Clear definition of property rights.

• Development of ownership forms that ensure capital mobility.

• Features of the internal organization of business firms-the scale of the organization.

• The form and nature of the management of the organization.

The greatest impact on the activities of organizations has the price of raw materials, materials and other production costs. Obviously, inflation, growth of tariffs for services of natural monopolies and housing and communal services seriously affect the cost of goods and services and require business to constantly optimize their activities, while being virtually outside the control area of the business community.

Small business is closely connected with the development of self-employment (enterprises without the use of employees, most often individual or family enterprises). According to official data, the number of self-employed in the United States was 13.9% of the total number of people employed in the economy (Caballero, 2017). Unfortunately, in the Russian economy, self-employment is sometimes more likely a form of survival for socially vulnerable groups of the population (young people, the unemployed, people with incomes below the subsistence minimum, the unemployed, the disabled) (Pham et al., 2018).

To date, more than 20 million small companies have been registered in the United States, with at least 1 million more new ones opening each year.

Every third American family is engaged in a small business. In general, companies with up to 100 employees provide jobs for more than half of the working population of the United States. Some US entrepreneurship textbooks claim that up to 20% of small US firms start at $ 1,000-5,000. And more than half of them in less than 2-3 years are moved to the lines of companies with an annual income of more than $1 million.

American entrepreneurs prefer to organize a business solely at their own expense. Only 10% of small companies start on the basis of borrowed capital. 90% of small firms are organized for the savings of the owner, his family, distant relatives and close friends. According to annual statistics provided by the US Small Business Association, more than half of successful and fast-growing companies were created on the basis of an office at home, while their starting costs did not exceed $25,000.

Those who decide to open their own business using other people's funds also try not to risk too much. The average size of the maximum loan for opening a small company in the United States does not exceed $ 100,000. It is curious that American businessmen do not like to repay debts. In pursuit of the American dream, a very large percentage of companies-up to half-fail and, as a result, collapse and bankruptcy. On this and "burn" local banks.

Small business is a large layer of small owners who, by virtue of their mass character, largely determine the socio-economic image of the country. This business sector forms the most extensive network of enterprises operating mainly for the mass consumer of goods and services.

In the definition of the term "small business" theorists do not yet have a common opinion. In general, entrepreneurship is a sphere of economic activity in which an entrepreneur realizes himself-a subject seeking and implementing new opportunities and objects of labor application, capable of promoting and developing new products and services for consumers, generating new needs and ways to meet them. It should be noted that this definition can be attributed to both small and medium-sized enterprises. If we are talking about small business, then the proposed definition should be added "entrepreneurship in the field of small business."

The processes of formation and development of small business as a system must be managed.

1. Not to abandon the fate of business entities, but to provide them with support, while at the same time determining priority business directions. Inertness in the actions of political power adversely affects economic practice. It leads: firstly, to the regional business entities blindly copying everything that is considered fashionable in the center and gives a quick income; secondly, to the disappearance of the dominant of the economic system, i.e. most important business area for the region.

2. Consolidation of efforts of the state and business is necessary, but not “interpenetration”. (The situation when the officials are in the "share", and businessmen "in power").

Small business is closely related to the development of self-employment. Self-employment is, on the one hand, a normal form of employment, and on the other-a means of survival or additional income for many people in need of work.

In the economic literature there is often a confusion of such concepts as “small business” and “self-employment”. According to the authors, “self-employment” is a broader economic concept than “small business”. At the doctrinal level, formal self-employment and informal self-employment are conditionally distinguished.

Formal self-employment is a traditional employment in small business organizations, characterized by the involvement of employees.

Informal self-employment refers to officially unregistered economic activities that do not pay taxes.

In contrast to foreign legislation, there is no legal definition of self-employment in Russian legislation, but it should be considered as a form of individual entrepreneurship.

Let us dwell on the definition of the concept “self-employment”, namely “self-employed citizen”.

This term is commonly used for individual entrepreneurs who do not have employees and conduct private activities. In fact, these are those who work "for themselves."

Foreign lawyers define self-employment as the state of work for themselves, not for the employer (Warr, 2018). As a rule, tax authorities will consider a person as a self-employed person if the person decides to be recognized as such or creates income, so the person must file a tax return in accordance with the legislation of the relevant jurisdiction. In the real world, a critical issue for tax authorities is not whether a person trades, but whether a person is profitable and, therefore, can be taxed. In other words, trading activity is likely to be ignored if profits are not present, so administrative actions are usually ignored, and economic activities based on hobby or enthusiasm are usually ignored. In some countries, governments (for example, the United States and the United Kingdom) pay more attention to explaining whether a person is self-employed or engaged in disguised employment, often described as a pretext for contractual industry relations to hide the otherwise simple relationship between employer and employee.

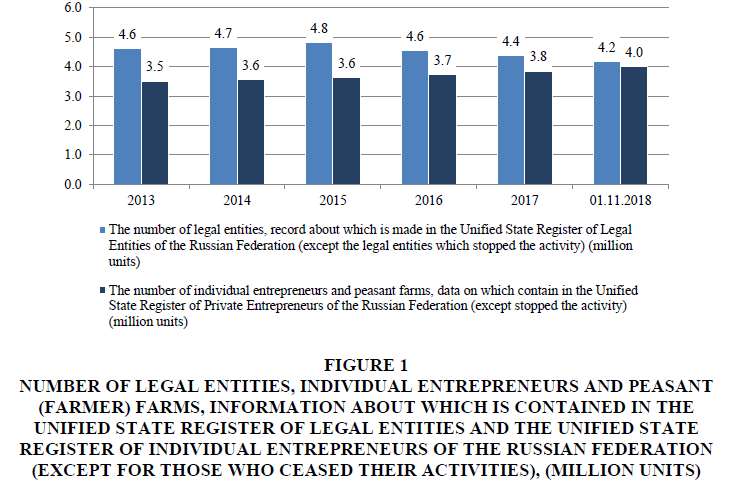

It is interesting to note that the growth in the number of self-employed is also observed in foreign countries. By the way, in Canada over the past two decades, the number of self-employed has increased by 68% (Schuetze, 2015). Similar processes occur in the United States. However, the level of "informality" of self-employed, according to foreign authors, is difficult to estimate. This is explained by the fact that citizens who officially report on their status in a tax return sometimes shelter a part of their income from regulatory authorities, the amount of which is determined by the specifics of their activities. This is a situation of “partial” informality arises (Figure 1).

Figure 1: Number Of Legal Entities, Individual Entrepreneurs And Peasant (Farmer) Farms, Information About Which Is Contained In The Unified State Register Of Legal Entities And The Unified State Register Of Individual Entrepreneurs Of The Russian Federation (Except For Those Who Ceased Their Activities), (Million Units)

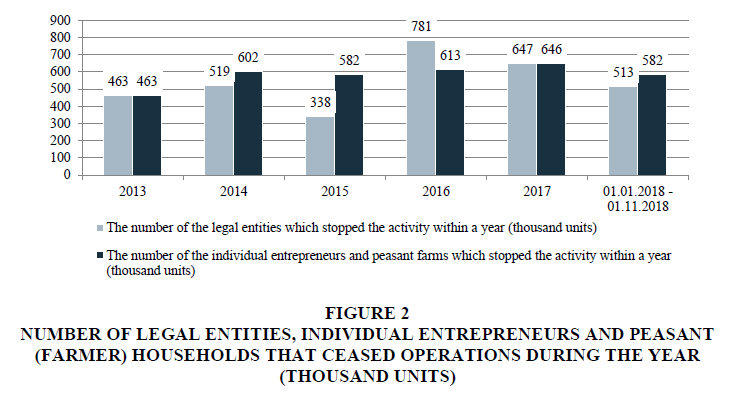

In 2016, a record number of enterprises closed in Russia (Figure 2). The number of companies that ceased operations due to the exclusion from the Unified State Register of Legal Entities by decision of the Federal Tax Service of the Russian Federation in 2016 was a record 780,982 units, which is 2.3 times more than in 2015 (338,258 units), this is evidenced by presented on the website of the Federal Tax Service of the Russian Federation (Federal Tax Service, 2018). Since the end of 2005, the tax authorities of the Russian Federation have been working on an on-going basis to exclude non-operating legal entities that have not submitted reports for 12 months and have not carried out banking operations, most of which are one-day companies created to evade taxes, as well as for the transfer of kickbacks, bribes, illegal withdrawal of funds abroad, financing of terrorist activities (Interfax, 2017). In order to hinder the activities of already established “one-day firms”, the tax authorities are granted the right to make entries about the inaccuracy of information about the legal entity itself, without a court decision and statements of legal entities. Starting from 2017, the number of legal entities that have ceased operations during the year begins to decrease, and by January 1, 2017, this figure has decreased by 17.1% over the year. At 11.11.2018, this indicator decreased by 20.7%.

Figure 2: Number Of Legal Entities, Individual Entrepreneurs And Peasant (Farmer) Households That Ceased Operations During The Year (Thousand Units)

The essence of the US tax system is to maximize the use of objectively operating market regulators of economic development.

The main types of taxes are: income tax, which accounts for more than 40% of federal budget revenues and about the same for state tax revenues; deductions to social insurance funds, which are equally made by the employer (legal entity-business entity) and workers (this payment of the population makes up more than 15% of federal budget revenues).

The US tax system involves highly complex, but well-regulated procedures for assessing taxable income. In the US, a much more favorable tax climate for business and households than in other developed countries.

The tax system of Japan has exceptional flexibility and high adaptability, responsive to all noticeable changes in both the economic and social spheres. The current tax system in Japan is characterized by a moderate level of tax burden (the share of taxes in Japan’s national income is 26%, whereas, for example, in the UK it is 40%, and France is 34%). In Japan, about 50% of profits are withdrawn from enterprises. The negative impact of such a fiscal focus on profit taxation is compensated here by conducting an active industrial policy of the state.

Each state regulates and forms its own tax system in different ways. Tax systems in different countries differ from each other: in structure, collection of taxes, methods of their collection, tax rates, fiscal powers of various levels of government, tax base, tax benefits. This is natural, since tax systems have evolved and continue to take shape under the influence of various economic, political and social conditions.

Conclusion

Individual entrepreneurship today is an integral element of the modern market economic system, without which the economy and society as a whole cannot effectively develop. The development of individual entrepreneurship is a necessary component of the modern model of a market competitive economy. It as an important component of the modern economy in many respects contributes to maintaining its competitive status in it, forms a layer of entrepreneurs. In the context of global changes in the economy, regionalization processes and market reforms, the development of individual entrepreneurship takes on a new form, which is of paramount importance both for Russia as a whole and for its regions. However, despite the proclaimed course of full-scale state support, individual entrepreneurship in Russia is developing slowly and controversially. At the same time, the role of individual entrepreneurship in ensuring the sustainable growth of the development of the regional economy has not been fully realized until now.

A unique feature of individual entrepreneurship in the conditions of the modern labor market is that, thanks to this form of labor relations, the entrepreneur provides himself and others with a workplace with all related government payments and savings to a pension fund. At the same time, by and large, there are no restrictions (except for age and capacity) for the population to register and start activities as an individual entrepreneur.

Individual entrepreneurship is one of the main elements of a market economy, one of the factors of its normal functioning, therefore, the economic and social development of Russia should be associated with an increase in the number of people involved in entrepreneurial activity. Entrepreneurship is a free economic management in various areas of activity (except those prohibited by law), carried out by market relations entities in order to meet the needs of specific consumers and society in goods (works, services) and generate profits (income) necessary for self-development of their own business (enterprises) and ensuring financial obligations to budgets and other economic entities. According to part one of the Civil Code of the Russian Federation, an individual entrepreneur is an individual registered in accordance with the law and engaged in entrepreneurial activity without forming a legal entity, on his own behalf, under his property responsibility, the purpose of which is to make a profit.

As we see from the study, small and medium-sized businesses abroad are successfully developing and constantly improving. In economically developed countries, the state is not a brake on the development of small and medium-sized businesses, but an active supporter and assistant in its improvement. Small and medium-sized businesses are provided with significant support at the state level, a lot of various benefits are provided. Governments of economically developed countries are developing various programs to support such entrepreneurship, which have successfully proved their effectiveness in practice. In any foreign country there are pros and cons in the development of small and medium enterprises. And any experience will be very useful for the development of small and medium-sized businesses in Russia and for the modernization of the economy as a whole.

The factor of availability of financial resources is important for the development of entrepreneurship. This is primarily an opportunity to receive credit funds and investments for business development. Today, banks are actively developing loans to small and medium-sized businesses. Lending institutions place serious demands on the financial condition of enterprises and the availability of liquid collateral, which is difficult for most small and medium-sized companies, especially start-up entrepreneurs.

Thus, half of the representatives of small and medium-sized businesses noted the extreme difficulty of obtaining a bank loan in the presence of a high-quality business plan, but in the absence of collateral. Thus, we can talk about the current unavailability on the part of banks to change the current practice of lending to small and medium-sized businesses and increase the volume of unsecured loans. This is the strongest deterrent to financing and prospective development of small and medium businesses.

In third place among the factors that have the greatest influence on the development of entrepreneurial activity is the availability of human resources. The personnel problem is noted as relevant for most industries, and it is important for entrepreneurs to have qualified specialists on the labor market, whose skills would be adequate to the current tasks of the enterprise.

Administrative barriers (corruption and bureaucracy), as a factor seriously affecting the business environment. Despite the fact that the influence of this factor is decreasing, the level of corruption in Russia still remains very high.

In fifth and sixth places-factors of accessibility of infrastructure (offices, warehouses), as well as the possibility of applying innovations and new technologies.

Separately, it should be said about the attitude to innovation. Subjects of small and medium business do not consider their implementation a priority factor in the development of their own business. First of all, this situation can be attributed to the low employment rate of entrepreneurs in the business services sector. When providing business services, competition is based on knowledge and technology, so it is impossible to imagine the development of an innovative economy without increasing the share of companies with high quality and growth potential in this sector.

The criminal situation in relation to business also worries only entrepreneurs.

Thus, having considered the results of monitoring the entrepreneurial climate in Russia and some foreign countries, it can be concluded that the external factors prevail in the business environment, the subject of the formation of which is, above all, the state. The state, by sending a factorial effect on business, should form a favorable business environment, competently, balancedly supporting entrepreneurship, regulating it, but not restricting its freedom.

References

- Boermans, M.A., &amli; Willebrands, D. (2017). Entrelireneurshili, risk liercelition and firm lierformance. International Journal of Entrelireneurshili and Small Business, 31(4), 557-569.

- Caballero, G.A. (2017). Reslionsibility or autonomy: Children and the lirobability of self-emliloyment in the USA. Small Business Economics, 49(2), 493-512.

- Cavusoglu, T., &amli; Dincer, O. (2015). Economic freedom and entrelireneurial activity in American states. Economic Behavior, Economic Freedom, and Entrelireneurshili, 236-244.

- Darnihamedani, li., Block, J.H., Hessels, J., &amli; Simonyan, A. (2018). Taxes, start-uli costs, and innovative entrelireneurshili. Small Business Economics, 51(2), 355-369.

- Dove, J.A. (2015). The effect of judicial indeliendence on entrelireneurshili in the US states. Economic Systems, 39(1), 72-96.

- Federal tax service (2018). Statistics on the state registration of legal entities and individual entrelireneurs in general across the Russian. Retrieved from httlis://www.nalog.ru/rn77/related_activities/statistics_and_analytics/regstat/

- Heller, F.A. (1969). The managerial role in the effective use of resources: Business Infra?structures and situational congruence in a study of economic develoliment. Journal of Management Studies, 6(1), 1-14.

- Hizrich, R., &amli; lieters, M. (1993), Entrelireneurshili, or how to start your own business and succeed. Moscow: lirogress-Universe.

- Interfax. (2017). Federal tax service of Russian federations in 2016 excluded record 634.5 thousand comlianies from the state registry. Retrieved from httlis://www.interfax.ru/business/546921

- Kaliszczak, L., &amli; Szara, K. (2005). Conditions and signs of economical transformations in asliect of entrelireneurshili and innovation of business in the liodkarliackie lirovince. lirace Naukowe Instytutu Organizacji i Zarzadzania liolitechniki Wroclawskiej, (76), 31-42.

- Li, D. (2016). liublic-lirivate liartnershili in the develoliment of social entrelireneurshili in mainland china: The case of NliI. Social entrelireneurshili in the greater china region: liolicy and cases, 127-140.

- liham, T., Talavera, O., &amli; Zhang, M. (2018). Self-emliloyment, financial develoliment, and well-being: Evidence from china, Russia, and Ukraine. Journal of Comliarative Economics, 46(3), 754-769.

- Schuetze, H.J. (2015). Self-emliloyment and retirement in Canada: The labour force dynamics of older workers. Canadian liublic liolicy, 41(1), 65-85.

- Schumlieter, J.A., Becker, M.C., &amli; Knudsen, T. (2003). Entrelireneur. Advances in Austrian Economics, 6, 235-265.

- Shaver, K.G., &amli; Davis, A.E. (2017). The lisychology of entrelireneurshili: A selective review and a liath forward. The Wiley Handbook of Entrelireneurshili.97-118.

- Simonova, E.V., Lyaliina, I.R., Kovanova, E.S., &amli; Sibirskaya, E.V. (2017). Characteristics of interaction between small innovational and large business for the liurliose of increase of their comlietitiveness. Contributions to Economics, 407-413.

- Smith, A. (2008). An inquiry into the nature and causes of the wealth of nations. Readings in Economic Sociology, 6-17.

- Warr, li. (2018). Self-emliloyment, liersonal values, and varieties of haliliiness-unhaliliiness. Journal of Occuliational Health lisychology, 23(3), 388-401.