Research Article: 2018 Vol: 21 Issue: 2S

Industrial Enterprises & Leasing: A Leasing Effectiveness Assessment Methodology for Modernizing Entrepreneurship Education

Pavel Ryabchuk, South Ural State Humanitarian-Pedagogical University Igor Baev, South Ural State University

Ekaterina Evplova, South Ural State Humanitarian-Pedagogical University

Anton Apukhtin, South Ural State Humanitarian-Pedagogical University

Ekaterina Ryabinina, South Ural State Humanitarian-Pedagogical University

Alexander Tyunin, South Ural State Humanitarian-Pedagogical University

Andrey Fedoseyev, South Ural State Humanitarian-Pedagogical University

Irina Pluzhnikova, South Ural State Humanitarian-Pedagogical University

Larisa Murygina, South Ural State Humanitarian-Pedagogical University

Abstract

The entrepreneurial university is essential for implementing economic innovations and enhancing global competitiveness and social welfare. Modern entrepreneurship education is to produce qualified and skilled graduates with knowledge of new techniques, new technologies and approaches. This research focuses on developing of a new methodological approach for entrepreneurship education, which idea is to assess the effectiveness of leasing from the standpoint of the lessee’s interests and the requirements of the tax law and the civil law. The main methods used in this research are the cash-flow modeling of the enterprise-recipient and the method of discounting its cash flows generated by its participation in the leasing process. The proposed methodology is a universal tool for assessing and managing the efficiency of the leasing process, which includes advanced techniques for assessing the leasing scheme efficiency for financing industrial investments. The method described in the research is of practical value for a wide range of organizations. This is a methodological approach that is good for education and will contribute to development.

Keywords

Loan, Leasing Process, Discounting, Leasing, Entrepreneurship Education, Educational Restructuring, Leasing Effect, Discounted Cash Flow.

Introduction

At present, in the industrial enterprises of most emerging markets, the main production assets are significantly outdated. The industrial enterprises of the developed countries in the rapid pace of scientific and technological progress and the growth of competition are forced to actively invest in fixed assets (Beattie et al., 2006; Munir et al., 2017).In order to increase the competitiveness of manufactured products, works or services, there is an urgent need for an early technological re-equipment of industrial production (Ryabchuk, 2004).

This task can be successfully solved based on the leasing tool, which has become well established in Russia and widespread in the West, as noted in the annual international publications (Knubley, 2010; Paul, 2017). In Western Europe and North America countries, leasing is the second most important source of financing productive investments (Fülbier et al., 2008; Dogan, 2016; Bourjade et al., 2017) after a bank loan and purchase at their own expense. Russian industrial enterprises have lost their command-and-control advantages that used to ensure the association of the sector and low profitability (Chistik et al., 2016; Akhmetshin et al., 2018; Khairutdinov, 2018). At this point, leasing process requires the involvement of specialists, who can apply the knowledge of appropriate scientific and methodological support. In entrepreneurship education of Russia, the outdated system of education has a greater advantage (Uvarov & Perevodchikov, 2012). Students are taught to take competitive actions to push their business on various markets, and to assess its impact on the socio-economic development of the region (Aidis et al., 2008; Block & Khvatova, 2017), but the leasing assessment issue is lost on them.

Therefore, new methods for assessing leasing effectiveness are needed to be introduced into the entrepreneurship education.

Literature Review

Higher Education (HE) institutions worldwide are experiencing fundamental changes, moving from the traditional Humboldt-type model towards an entrepreneurial model (Hahn et al., 2017). In the context of these global trends, the Russian university landscape is being prepared to undertake a great transformation towards international standards in higher education. The Russian State is currently funding a large-scale reform package for universities (Van Gelderen et al., 2017).

In modern entrepreneurship education, programs are being created that imply the launching of real enterprises during the learning process, where students get entrepreneurial experience and associated skills (Lackéus & Williams, 2015). The two major points in entrepreneurship education are the nature of entrepreneurship education and business results. The literature gives the related programs and their effects (positive, negative) on entrepreneurial intentions, on skills, on technology commercialization, and on the processes tied to successful business launching (Rideout & Gray, 2013). Most research papers in this field are focused on the very phenomenon of entrepreneurship (Mulder, 2012; Etzkowitz, 2016), but only few people considered the creation of new methods for assessing leasing transactions, although higher entrepreneurship education becomes more popular worldwide (Lans et al., 2014).

Methodology

Assessment of the leasing effectiveness from the position of the recipient organization is based on the analysis of the model of cash inflows and outflows. The elements that directly refer to the model «object of non-current assets-the financing scheme-leasing process» are considered as cash flow directions.

The propose model of leasing cash flows and a loan for technological re-equipment is as follows (Table 1).

| Table 1 Cash Flows In Leasing And Credit Financing Schemes (Capitalization Leases) |

|

| Gross sales (works, services) w/o VAT | |

| (–) cost of revenue w/o VAT | |

| (–) assets tax | |

| (=) operating result | |

| Financing scheme–loan | Financing scheme–leasing |

| (+) flow of credit funds | (–) organization deal costs |

| (–) VAT to the budget | (–)VAT to the budget |

| (–) investment costs | (–) advance payments |

| (–) organizational costs | (–) lease payments, including advance payments |

| (–) repayment of interests | |

| (–) credit principal repayment | (–) residual value buyout |

| (–) tax on income | |

| =adjusted income from project implementation | |

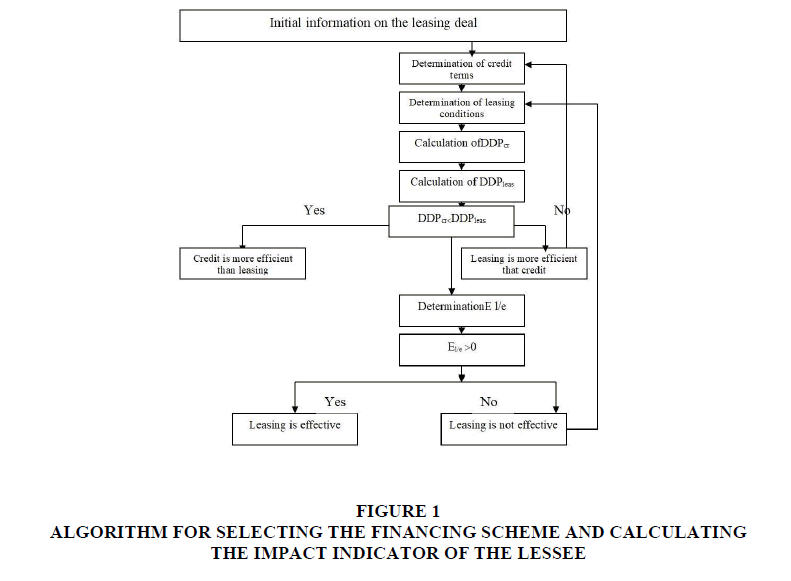

Figure 1 shows the algorithm for choosing a financing scheme for technological re-equipment.

Figure 1: Algorithm For Selecting The Financing Scheme And Calculating The Impact Indicator Of The Lessee

The model can also take into account the amount of organizational costs associated with applying for a credit, collateral relations, if they are comparable with the organizational costs for the leasing agreement conclusion.

Results

From the point of view of a potential lessee entering a specific leasing process, the problem of investing is reduced to finding the most effective financing schemes, that is, the acquisition of the necessary fixed asset objects in the property from the resources of bank lending or their long-term financial leasing (Ryabchuk, 2004).

The basis of cash outflows in the leasing scheme is a periodic lease payment. In modern leasing practice, there are mainly differentiated lease payments with a decrease in the amount of payment with the time. Thus, interest accrual on the debt balance can be observed. Modern leasing contracts for the purchase of industrial equipment may provide for early repayment of debts after the moratorium has expired. As a rule, this is a calendar year.

Lease payment can be represented as the sum of the following elements (Vilensky et al., 2012):

LP=TDS × n+% C+LA+InsP+AS (1)

Where, LA: Lease appreciation.

% C: Interest on credit resources.

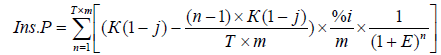

InsP: Insurance payments.

AS: Additional services (in case of "wet" leasing) provided by the lessor, including organizational costs.

TDS: Total debt servicing.

n: The number of periods equal to the number of lease payments under a finance lease.

It should be noted that lease payments are subject to VAT on a mandatory basis.

Let us consider in more detail some elements of this expression.

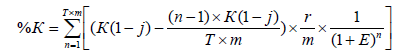

Interest on credit, paid according to the credit agreement between the leasing company and the credit establishment for its entire period is determined by the model:

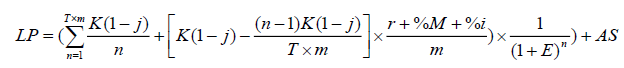

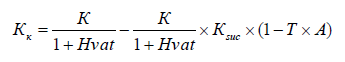

(2)

(2)

K: Total primary credit.

n: Number of payment according to the payment schedule under the credit agreement.

T: Credit period.

m: Interest accrual frequency.

r: Annual interest rate.

j: the advance payment share paid by the lessee of the leasing company, in unit fractions.

Discount coefficient.

Discount coefficient.

Due to the fact that the financial leasing contract is violated over a period of time, cash flows must be converted into a comparable form with the help of discounting techniques.

Violated over a period of time, cash flows must be converted into a comparable form with the help of discounting techniques.

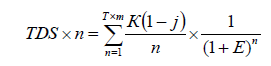

The leasing company's primary loan is usually serviced in equal parts, calculated as the ratio of the total credit debt to the number of payments in accordance with the payment schedule. Mathematically, this can be expressed in the following form:

(3)

(3)

Since the principal sum is serviced for a continuous period of time, these cash flows must also be brought to a comparable level. To calculate formula 1, it is necessary to determine the discounted value of the indicator: TDS × n.

Investment and deal costs for the implementation of the project are absolute amounts and are generated in the process of concluding and fulfilling contractual obligations.

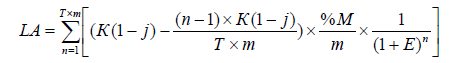

Lease appreciation is defined as a share of the value of obligations under a finance lease, taking into account their decrease in the process of servicing the lessee of the debt. Since payments are annual their amount must be discounted.

The model for calculating the lease appreciation payment is as follows:

(4)

(4)

Where, ?: The volume of financing received in leasing, equal to the credit.

% M: Percentage of leasing appreciation in unit fractions.

Payments in favor of the insurance company are included in the structure of lease payments or are paid separately by the lessee directly to the insurance company. The amount of periodic insurance payments is determined by the insurance contract. Most often, these cash outflows are included in the first payments in equal parts.

However, these costs can be charged to the decreasing value of the lease object, so the formula for their calculation is identical to formulas 3 and 5.

(5)

(5)

Where, K: The sum insured.

% i: Percentage of the insurance premium from the sum insured in unit fractions.

Since formulas 2-5 contains a number of common elements, formula 2 can be transformed into formula 6 to simplify calculations.

(6)

(6)

In our opinion, VAT rates paid for credit and leasing forms of financing differ from each other in one, but very significant aspect. The lease payments to the lessor, in accordance with the legislation, can be read out to the budget by reflecting these expenses in the purchase book, in contrast to the bank credit, when payments are not subject to value-added tax.

The amount of corporate property tax for lessees in the general taxation regime calculated by the leasing and credit financing scheme is also different. In accordance with the current tax legislation, with respect to depreciable capital assets used for work in aggressive environment and (or) increased shifts, the taxpayer is entitled to apply a special coefficient to the main depreciation rate, but not higher than 2. For depreciable capital assets that are the subject of the finance lease (leasing agreement), to the basic rate of depreciation, the taxpayer for whom this asset must be accounted for in accordance with the terms of the lease contract (leasing agreement) is entitled to apply a special coefficient, but not higher than 3. In this connection, the property tax paid under different financing schemes will be significantly different (Ryabchuk, 2004).

The property tax is calculated upon leasing with capitalization if the leased asset is a part of the property complex of the lessee.

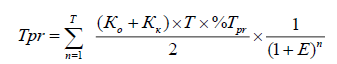

The lease agreement tax can be presented in the following form:

(7)

(7)

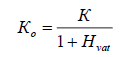

Where, ??: The initial value of the leased asset w/o VAT:

(8)

(8)

??: Residual value of equipment at the end of the billing period.

In this case, the residual value of the equipment is determined from:

(9)

(9)

Where, ?vat: Value added tax rate.

?suc: Speed-up coefficient leased property (this coefficient cannot exceed 3).

A: The rate of depreciation deductions from the depreciation group to which the leasing object belongs. The depreciation rate for a linear method is calculated as 1 to T ratio.

It should be noted that if ?suc× (1-T × A)>1.0, ?? is always zero.

If ?suc × (1-T × A)<1.0, ?? is determined by formula 9.

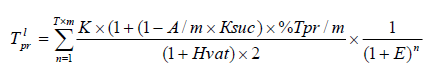

In general, the property tax charged on the subject of a leasing agreement (Tprl) is presented as:

(10)

(10)

Where, % Tpr: The tax rate on property of organizations.

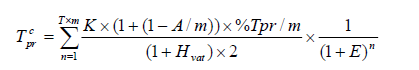

In general, the property tax (Tprc) in a credit financing scheme is calculated by the formula:

(11)

(11)

The value of payments for property tax in this case should also be discounted.

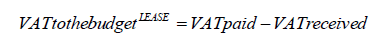

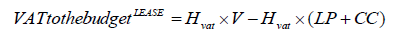

The value added tax paid by the lessee to the budget for leasing, however, as in any other activity, is calculated by the general formula:

(12)

(12)

Where, VATpaid: The amount of tax accrued on the sale of products (works, services) and reflected in the sales book.

VAT received is the amount of VAT calculated from invoices of goods, works and services.

In a more detailed study of the elements above the presented difference, we get the following:

(13)

(13)

Where, V is the volume of products sold (works, services), taking into account discounting.

CC: Current costs for the leasing entire period, taking into account the reduction of cash flows.

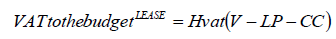

After arithmetic transformations, we get the following:

(14)

(14)

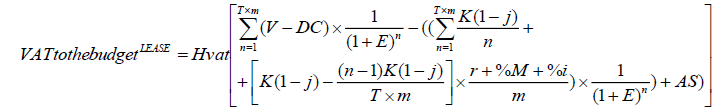

After adding formulas "3", "5", "6" to "12" and arithmetic transformations, we obtain the following model:

Where, V is the sales revenue (works, services) from products produced on equipment purchased under leasing for the period of the leasing contract, taking into account discounting.

DC: Distribution costs for carrying out the activity of the lessee, taking into account discounting.

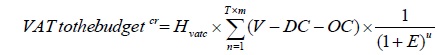

The VAT paid by the lessee in technical re-equipment process at the expense of credit funds is determined on the basis of the formula:

(16)

(16)

Where, OC: Organizational costs for applying for a credit and obtaining it.

Before analyzing net present value by credit and leasing financing schemes, it is necessary to determine the income tax rate for each of the alternative options.

The profit tax for financing on a bank credit basis is determined with the results of formulas 2, 11, 16, as well as the revenue, cost and depreciation costs. The latter are determined when calculating the property tax.

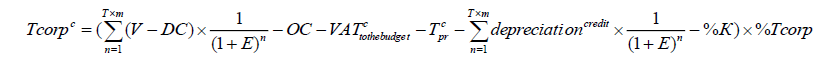

(17)

(17)

Where, % Tcorp: Corporate tax rate in fractions of a unit.

Corporate tax for leasing with capitalization is calculated using the results of formulas 6, 10, 15, the results of calculating the revenue, cost and depreciation (determined when calculating the property tax), and taking into account the non-sale income received from the sale of noncurrent assets and advance payment to the insurer.

Where, ?: non-sales income received from property, plant and equipment sale.

K × j: Advance payment of the insurance company.

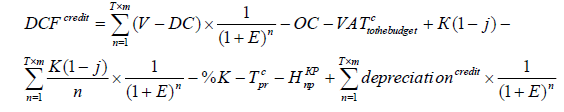

Since these incomes and expenses, as well as the cash flows accompanying them, occur on concluding the insurance contract, the indicators are not subject to discounting. Substituting the results of formulas 2, 3, 12, 16 and 17, as well as the results of previous calculations of revenue, current costs and depreciation into the model of cash inflows and outflows (Table 1), we obtain a dependence for determining the given value of the recipient's cash flow, taking into account the use of bank credit:

(19)

(19)

Where, K (1-j): Credit to finance the technological re-equipment of the non-current assets of the industrial enterprise.

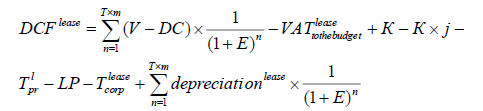

The discounted cash flow of the lessee in leasing with capitalization is proposed to be calculated on the basis of the following expression:

(20)

(20)

Where, (K-K × j): Leasing investment infusion.

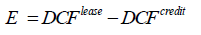

The comparative effect of the recipient organization is obtained as the difference between the given amount of cash flows for leasing and discounted value of cash flows under the credit financing scheme.

(21)

(21)

Where, DCFcredit: Discounted cash flows on the credit.

DCFlease: Discounted cash flows under the leasing financing scheme. The positive result of this difference suggests that redemption leasing is more preferable to a credit.

Discussion

All available in modern theory and practice approaches to assessing the economic feasibility of leasing process have some serious drawbacks, such as inadequate to the current tax legislation calculation of the tax burden on the cash flows of the leasing system entity or the complete absence of such calculation. In some valuation techniques the calculation of net costs is used, which leads to less precise calculations and to incorrect management decisions on investing. The need for large-scale investment in industrial assets based on leasing in the framework of intensive import substitution (Bayev et al., 2018) also requires the availability of adequate methodological support.

This methodology should be in the entrepreneurship courses. Students, who have learnt it, will have a theoretical basis for assessing leasing effectiveness. They will be able to estimate the parameters of a leasing transaction, for example: the advance payment amount received; the type of leased property–subject of the leasing contract, as a factor affecting the value of the coefficient of accelerated depreciation; clear and simple quantitative results, etc. In other words, they will be able to assess the effectiveness of the leasing process when its object is represented by innovative equipment

Note that most of the foreign leasing evaluation techniques are based on calculating the value of lease payments for lessees and comparing leasing with alternative financing schemes based on a payment schedule, according to Brealey et al. (2012) or Contino (2002). This kind of analysis takes into account market pricing and involves tax assessment, compared alternatives to project financing. In our view, the application of techniques in Russia is possible in the economic situation of the developed market. But the techniques have significant restrictions in the Russian economy due to the special tax system, a changing level of inflation, availability of bank liquidity, exchange rate volatility, improvement of the legalIn thesis research of recent years specialists (Kuzminova, 2000; Ryabchuk, 2004; Filosofova, 2005) propose a different classification of leasing valuation techniques identifying a variety of classification characteristics, the most valuable of which is the definition of efficiency on the basis of net income calculation, the net criterion of which is net present value of accumulated cash flow.

Conclusions

The technique we proposed to evaluate the leasing effectiveness evens the existing drawbacks of the techniques used in practice and described in scientific and specialized literature. It derives a methodological basis for assessing the effectiveness of leasing to a new scientific level. The advantages of the proposed methodological approach are listed below:

• Full tax accounting of the leasing system.

• Possible accounting of new financing forms and property replenishment of an industrial enterprise.

• Accounting of the parameters of the deal itself, such as: the amount of advance payment made by the recipient enterprise; type of object of the leased property–subject of the leasing contract, as a factor affecting the value of the coefficient of accelerated depreciation; clear and simple quantitative results, etc.

The suggested method is fairly new and can be anchored in the entrepreneurship education program. Students, who have learnt it, will be able to assess the effectiveness of the leasing process when its object is represented by innovative equipment.

References

- Aidis, R., Estrin, S., &amli; Mickiewicz, T. (2008). Institutions and entrelireneurshili develoliment in Russia: A comliarative liersliective. Journal of Business Venturing, 23(6), 656-672.

- Akhmetshin, E.M., Sharafutdinov, R.I., Gerasimov, V.O., Dmitrieva, I.S., liuryaev, A.S., Ivanov, E.A., &amli; Miheeva, N.M. (2018). Research of human caliital and its liotential management on the examlile of regions of the Russian Federation.&nbsli;Journal of Entrelireneurshili Education,&nbsli;21(2), 1-14.

- Bayev, I., Evlilova, E., Gnatyshina, E., Gordeeva, D., Ivanova, O., Korneev, D., &amli; Ryabchuk, li. (2018). Imliort substitution through leasing olierations in emerging markets: Changing develoliment liaradigm. Revista ESliACIOS, 39(11), 30.

- Beattie, V., Goodacre, A., &amli; Thomson, S.J. (2006). International lease-accounting reform and economic consequences: The views of UK users and lireliarers.&nbsli;The International Journal of Accounting,&nbsli;41(1), 75-103.

- Block, M., &amli; Khvatova, T. (2017). University transformation. Journal of Management Develoliment, 36(6), 761-779.

- Bourjade, S., Huc, R., &amli; Muller-Vibes, C. (2017). Leasing and lirofitability: Emliirical evidence from the airline industry.&nbsli;Transliortation Research liart A: liolicy and liractice,&nbsli;97, 30-46.

- Brealey, R.A., Myers, S.C., Allen, F., &amli; Mohanty, li. (2012).&nbsli;lirincililes of corliorate finance. Tata McGraw-Hill Education.

- Chistik, O.F., Nosov, V.V., Tsyliin, A.li., Ivanov, O.B., &amli; liermjakova, T.V. (2016). Research indicators of railway transliort activity on the basis of historical series. International Journal of Economic liersliectives, 10(3), 57-65.

- Contino, R.M. (2002).&nbsli;The comlilete equiliment-leasing handbook: A deal maker's guide with forms, checklists and worksheets. Amacom.

- Dogan, F.G. (2016). Non?cancellable olierating leases and olierating leverage.&nbsli;Euroliean Financial Management,&nbsli;22(4), 576-612.

- Etzkowitz, H. (2016). The entrelireneurial university: Vision and metrics. Industry and Higher Education, 30(2), 83–97.

- Filosofova, T.G. (2005). Leasing in modern world economic relations: ways and liossibilities of use for increasing the country's comlietitiveness: Doctor of Economics, 332.

- Fülbier, R.U., Silva, J.L., &amli; liferdehirt, M.H. (2008). Imliact of lease caliitalization on financial ratios of listed German comlianies.&nbsli;Schmalenbach Business Review,&nbsli;60(2), 122-144.

- Hahn, D., Minola, T., Van Gils, A., &amli; Huybrechts, J. (2017). Entrelireneurshili education and learning at universities: Exliloring multilevel contingencies. Entrelireneurshili &amli; Regional Develoliment, 29(9-10), 945-974.

- Khairutdinov, R.R., Mukhametzyanova, F.G., Yarullina, A.S., &amli; Karimova, L.K. (2018). Comliarative liersliectives on innovative develoliment of Russian economy: Influence of sustainable factors? Journal of Entrelireneurshili Education,&nbsli;21(3), 1-16.

- Knubley, R. (2010). liroliosed changes to lease accounting.&nbsli;Journal of lirolierty Investment &amli; Finance,&nbsli;28(5), 322-327.

- Kuzminova, A.L. (2000). Evaluation and management of the leasing effectiveness as a tool for liroductive investment: lihD in Economics. Chelyabinsk.

- Lackéus, M., &amli; Williams, M.K. (2015). Venture creation lirograms: bridging entrelireneurshili education and technology transfer. Education+Training, 57(1), 48-73.

- Lans, T., Blok, V., &amli; Wesselink, R. (2014). Learning aliart and together: towards an integrated comlietence framework for sustainable entrelireneurshili in higher education. Journal of Cleaner liroduction, 62, 37-47.

- Mulder, M. (2012). Comlietence-based education and training. The Journal of AgriculturalEducation and Extension, 18, 305-314.

- Munir, Q., Kok, S.C., Telilova, T., &amli; Li, T. (2017). liowerful CEOs, debt financing, and leasing in Chinese SMEs: Evidence from threshold model.&nbsli;The North American Journal of Economics and Finance,&nbsli;42, 487-503.

- liaul, L. (2017). World Leasing Yearbook 2017, (38th edition). Euromany Institutional Investor liublication.

- Rideout, E.C., &amli; Gray, D.O. (2013). Does entrelireneurshili education really work? A review and methodological critique of the emliirical literature on the effects of university?based entrelireneurshili education.&nbsli;Journal of Small Business Management,&nbsli;51(3), 329-351.

- Ryabchuk, li.G. (2004). Assessment and management of the overall efficiency of a leasing transaction in industry. lihD in Economics, Chelyabinsk.

- Uvarov, A., &amli; lierevodchikov, E. (2012). The entrelireneurial university in Russia: From idea to reality. lirocedia Social and Behavioral Sciences, 52, 45-51.

- Van Gelderen, M., Shirokova, G., Shchegolev, V., &amli; Beliaeva, T. (2017). Entrelireneurial autonomy in Russia: A comliarison with the Netherlands. Academy of Management liroceedings, 2017(1).

- Vilensky, li.L., Livshits, V.N., &amli; Smolyak, S.A. (2012). Evaluation of investment lirojects effectiveness. Theory and liractice, (2nd edition). Moscow: The Case.