Research Article: 2021 Vol: 25 Issue: 1

Inflation, Interest Rate and Economic Growth Nexuses in SACU Countries

Christie, S. Taderera, Nelson Mandela University

Raynold Runganga, University of Zimbabwe

Simbarashe Mhaka, Nelson Mandela University

Syden Mishi, Nelson Mandela University, Port Elizabeth

Abstract

This study examines the relationship between inflation rate, interest rate and economic growth in Southern African Customs Union (SACU) countries. Panel data for SACU countries was analysed using Pooled Mean Group (PMG) estimator, Dynamic Ordinary Least Squares (DOLS) and Fully Modified Ordinary Least Squares (DOLS) to enable isolating short and long run effects and for robustness. The results of the study shows that inflation has a positive impact on economic growth while lending rate has a negative impact on growth in the long run. These results imply that policymakers should allow a high and sustainable inflation rate in order to promote economic growth while interest rate as a monetary policy instrument can be used to achieve the desired inflation rate, having a positive impact on economic growth.

Keywords

Inflation, Interest Rate, Economic Growth, Southern African Customs Union.

Introduction

One of the key macroeconomic fundamentals which is essential for achieving economic growth is maintaining price stability. This is achieved through monitoring inflation rate and maintaining such at low and stable levels through the use of monetary policy instruments such as interest rate. Central banks can have such sole mandate, which is argued to be fundamental to attain, or the other macroeconomic objectives such as economic growth and high employment (Southern African Customs Union (SACU), 2013). In some instances, however, central banks can have the dual mandate of attaining price stability and achieving set level of economic growth or employment, among other alternatives (Bhattacharyya, 2012). The debate on which approach is the best rages on across the world. Developed and developing economies alike are still is search of fine balance between price stability and economic growth. This study seeks to take this debate further, focusing on a group of countries with customs agreement and largely aligned macroeconomic policies, the Southern African Customs Union (SACU).

The geographic proximity to each other, and the alignment at large of macroeconomic policies such as fiscal, monetary and international trade and investment makes the group a befitting natural experiment to draw the debate to some logical conclusion. The SACU region recorded an average growth of 1.3% in 2017 compared to 0.8% in 2016 and in 2019, the highest projected growth rate of 3.8% was recorded in Botswana, with the lowest growth rate of 1.7% recorded in South Africa and Swaziland (African Development Bank Group, 2019; Southern African Customs Union, 2018). Compared to inflation rates during the same period, inflation has been on a downward trajectory in the SACU region (Southern African Customs Union, 2018). It appears that attainment of price stability is possible and necessary, however it is not sufficient for economic growth. According to the World Bank Group (2018), gross domestic product (GDP) growth in the SACU region decelerated in 2016 and 2017 and recovery is not expected to be strong enough especially in South Africa. In South Africa, the optimal target inflation rate is 3%-6% and interest rate is maintained at 6.75% but gross domestic product growth rates and employment levels plummeted. It becomes an issue of concern as to why maintaining very low inflation, sacrificing growth. This arose the interest on examining the relationship between inflation rate and economic growth in SACU region since theoretical literature is not convincing and interest rate is one to the instruments used by central banks in controlling inflation to achieve growth.

From a theoretical point of view, different perspective exists regarding the relationship between inflation and economic growth. For instance, while the monetarists view pioneered by Milton Friedman (1967) posit that inflation is harmful to growth in the long-run, the structuralists argue that inflation enhances economic growth. Tobin (1965) support this argument, asserting that money is a substitute for capital and inflation raises the opportunity cost of holding money, thereby increasing capital accumulation and economic growth. Stockman (1981) considers money to be complementary to capital, thereby causing inflation to have a negative impact on economic growth, an outcome known as the anti-Tobin effect. Contrary to all these theories, Sidrauski (1967) established that money is neutral and super-neutral, causing inflation to have no impact on economic growth. These different perspectives regarding the relationship between inflation and economic growth shows that very low inflation levels may be or may not be growth sacrificing.

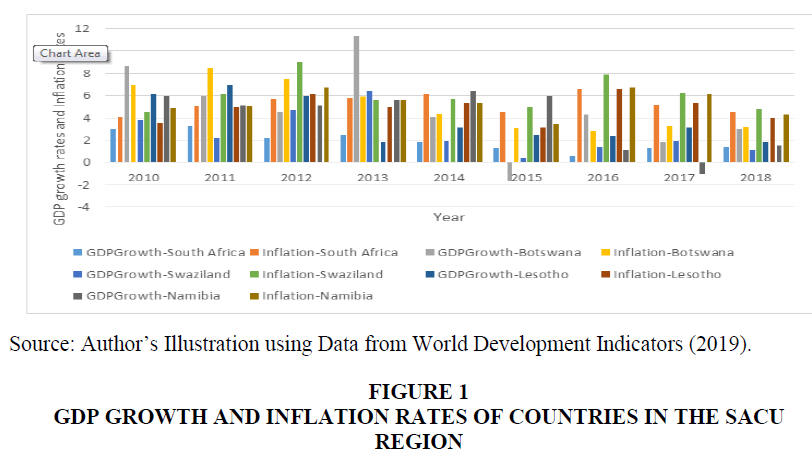

Due to the adverse outcomes of high inflation levels on macroeconomic stability, some central banks such as the South African Reserve Bank (SARB) in 2000 and Bank of Ghana (BOG) in 2002 adopted inflation targeting framework, maintaining low inflation levels (Mavikela et al., 2019). The popularity of inflation targeting framework arose following the 1997-1998 Asian financial crisis and the International Monetary Fund’s advocacy for Central Banks to combine both flexible exchange rate regime and inflation targeting policy (Phiri, 2012). Inflation targeting framework appears to be popular in industrialised countries considering that only two Central Banks in African countries, the SARB and BOG adopted the fully-fledged inflation targeting framework (Mavikela et al., 2019). However, whether inflation targeting is a desirable option to achieve growth is worth investigating. According to the World Bank Group (2018), the general economic downturn in SACU region and contraction of per capital income in Namibia and South Africa (the largest country in terms of GDP and population) contributed to increase in poverty in the region. The desirability of maintaining very low inflation to achieve favourable economic growth is worth exploring given low economic growth and very low inflation levels being experienced by SACU countries. Figure 1 below shows the GDP growth rates and inflation rates for SACU countries for the period of 2010 -2018.

As shown in Figure 1, GDP growth rates and inflation rate have been falling on average, over the period of 2010 to 2018 and Botswana shows a slow movement in its economic activity, with economic growth slowed down from 4.3% in 2016 to 1.8% in 2017 as inflation reached the lower bound target range of 3%-6% in 2017. While Lesotho recorded a growth of 3.1% in 2017, Namibia achieved a -1% growth in the same year before it rose to 1.5% in 2018, with a decrease in inflation from 6.7% in 2016 to 6.14% in 2017 and 4.29% in 2018. South Africa’s economy grew by 1.3% in 2017 barely faster than population growth while Swaziland’s economic growth was 1.9% in the same year before it fell by 1.1% in 2018. While GDP growth rates in SACU countries have been falling over the period 2010 to 2018, there is no much variation in inflation rates among these countries with Botswana being the only country having inflation rate which is much different from other countries, on average overtime.

The low economic growth rates and high inflation rates that have been reported in many developing countries following the global financial crisis. This raised many concerns that has caused many researchers to estimate the relationship between economic growth and inflation rate. In the context of SACU countries, the inflation rates are not very high such that growth can be sacrificed since no country has inflation rate more than 9% between 2010 and 2018 but growth rates of GDP have been falling. This has become an issue of concern as to why growth rates of GDP in SACU countries are falling and if inflation targets of single digit realistic and optimal for these countries because economic structure should be key in informing the inflation range, for example of 3-6% in the case of South Africa. This motivates to examine the relationship between inflation rate and economic growth in SACU countries. Incorporating interest rate for it is a monetary instrument used to effect the desired level of inflation, this paper focuses on examining the relationship between inflation, interest rate and economic growth in the SACU countries using the Pooled Mean Group (PMG) estimators.

Theoretical and Empirical Literature Review

Various theories exist in trying to explain the relationship between inflation, interest rate and economic growth and among these include the Monetarist Theory pioneered by Milton Friedman (1967). The theory posits that increasing money supply at a faster rate than the growth in the economy result in inflation, which is harmful to economic growth and this view is supported by the quantity theory of money. In an attempt to influence inflation and economic growth, interest rate control can be used, where there is a change in the short-term interest rate by the Central Bank (Bain and Howells, 2003). However, the impact of monetary policy changes is not direct and affect through different channels. Expansionary monetary policy leads to a decrease in real interest rates and investment spending will increase, leading to an increase in aggregate demand. The rise in aggregate demand lead to increase in price level economy output. This implies a negative relationship between interest rate and economic growth and a negative relationship between interest rate and inflation.

The classical theory by Adam Smith (1776) and developed by Ricardo (1817) assumes that an economy always attains full employment through the invisible hand, allowing flexibility in prices, wages and other input prices. The full employment assumption shows that increase in Aggregate Demand (AD) following monetary policy changes do not have an impact on the level of output but result in inflation; hence inflation and output growth are not correlated. However, the Keynesian theory by Keynes (1936) assumes a positive relationship between inflation and economic growth in the short run only. The theory is centred upon the AD and Aggregate Supply (AS) framework and in the short run; inflation and output are not correlated due to stickiness of wages and prices. In the long run, inflation and output are not related due to full employment while in the intermediate phase, inflation and output are positively related due to flexibility of prices and wages.

In support of the theoretical relationship, empirical studies have been reviewed to observe this relationship in various countries and mixed findings were obtained as well. From the studies that have been done in various countries, some (e.g Harswari & Hamza (2017), Havi & Enu (2014)) were concerned with finding the relationship between inflation, interest rate and economic growth while other studies (e.g. Sattarov (2011) and Sindano (2014)) aimed to establish both the relationship and threshold level of inflation for economic growth. A summary of studies from developed countries that examined the relationship between inflation, interest rate and economic growth, and both the relationship and threshold level of inflation for economic growth is shown in Table 1 below.

| Table 1 A Summary of the Empirical Literature on Developed Countries | |||||||

| Author (s) | Countries/ Region | Period | Method | Dependent Variable | Independent Variables | Results | Implications for this study |

| Harswari & Hamza (2017) | 20 Asian countries | 2006-2015 | OLS | GDP, FDI, INF | IR | Interest rate has a negative impact on Gross Domestic Product and Inflation, though negative impact on Foreign Direct Investment is negligible. | There is likely going to be a negative relation between interest rate and GDP. |

| Karahan & Yilgor (2017) | Turkey | 2002-2016 | VAR | CPI | IR | There is a unidirectional relationship between inflation and interest rate in Turkey. | There is no consensus on the causal relationship, the results likely to be subjective for each country. |

| Stawska (2016) | Poland | 2000-2014 | OLS | GDP | CPI | There is a positive relationship between inflation and economic growth. | The global financial crisis of 2001 and 2009 have significant impact on the inflation and interest rate as well as monetary policy and economic growth. |

| Sattarov (2011) | Finland | 1980-2010 | VAR | GDP | INF | Finland's inflation and economic growth have a positive relationship. The economy grows at its highest rate, considering a non-linear relationship, when inflation is 4%. | There exists a threshold at which inflation rate allows for highest growth rate. |

| Thanh (2015) | Indonesia, Malaysia, Philippines, Thailand & Vietnam | 1980-2011 | PSTR | GDP | INF | The study finds that for inflation rates above the 7.84 percent threshold level, there is a statistically significant negative relationship between inflation and development, over which inflation starts to hinder economic growth in the ASEAN-5 countries. | There exists a threshold for inflation at which a rate above would lead to a negative relationship between inflation and economic growth. |

| Pradhan et al, (2015) | OECD countries | 1960-2012 | PVAR | GDP | INF | There is a positive relationship between inflation and economic growth. | Stock markets as indirect variable influences the relationship between inflation and economic growth for developed countries differently from developing countries. |

| Holston et al, (2017) | USA, Canada, Euro area and United Kingdom | 1965-2015 | Laubach–Williams | GDP | IR | There is a negative long run relationship between interest rate and economic growth. | Global factors such as China-US trade war, productivity growth and demographics tend to influence country by country economic performance. |

The Table 1 below summarises the studies of Harswari & Hamza (2017), Karahan & Yilgor (2017), Stawska (2016), Sattarov (2011), Thanh (2015), Pradhan et al. (2015) and Holston et al. (2017) for developed countries. All these studies examined the relationship between inflation, interest rate and economic growth with the exception of Sattarov (2011) and Thanh (2015) who examined the relationship and the threshold level of inflation for economic growth.

As shown in the Table 1 above, Harswari & Hamza (2017) and Stawska (2016) used Ordinary Least Squares estimation technique to investigate the relationship while Karahan & Yilgor (2017) and Sattarov (2011) used Vector Autoregressive model. The rest of the studies used different techniques to analyse the relationship. Harswari & Hamza (2017) and Holston et al. (2017) found a negative relationship between interest rate and economic growth while Karahan & Yilgor (2017) found a positive relationship between inflation and interest rate. The rest of the studies found a positive relationship between inflation and economic growth, with Sattarov (2011) and Thanh (2015) showing a threshold level of inflation for economic growth where this relationship change. It can be seen that results are inconsistent when looking at the relationships in different countries. The results are subjective to economic situations.

In developing countries, several studies have been done on the relationship between inflation, interest rate and economic growth and both the relationship and the threshold level of inflation for economic growth. Examples include studies by (Akume et al., 2016; Seleteng et al., 2013; Havi & Enu, 2014; Denbel et al., 2016; Ayres et al., 2014; Agbaba, 2018; Imleesh et al., 2017; Mallick & Sousa, 2013; Eggoh & Khan, 2014; Kasidi & Mwakanemela, 2013).

The results of these studies are summarized in Table 2 where three of the developing countries’ studies used the Panel Smooth Transition Regression (PSTR) method namely (Seleteng et al., 2013; Imleesh et al., 2017; Eggoh & Khan, 2014). However, Njimanted et al. (2016); Denbel et al. (2016) and Mallick & Sousa (2013) used the VAR methodology while the rest of the studies used different methodologies to infer the relationship between inflation, interest rate and economic growth. It can be established that there is no one unique and more efficient methodology, the approach used depends on the nature of the data available, looking at the unit root tests.

| Table 2 A Summary of Empirical Literature on Developing Countries | |||||||

| Author (s) | Countries/ Region | Period | Method | Dependent Variable | Independent Variables | Results | Implications for this study |

| Njimanted et al. (2016) | CEMAC | 1981-2015 | VAR | GDP | IR, MS, INFL | There is a negative relationship between inflation rate, interest rate and economic growth. | Monetary policy variables influence the customs unions differently. Effective monetary targeting and policies should be implemented with no political motives. |

| Seleteng et al. (2013) | SADC | 1980-2008 | PSTR | GDP | INF | The findings show an 18.9 percent threshold, above which inflation is detrimental to the SADC region's economic growth. | There exists a threshold for inflation at which a rate above would lead to a negative relationship between inflation and economic growth. |

| Havi & Enu (2014) | Ghana | 1980-2012 | OLS | GDP | IR, INFL, EXCH | There is a negative relationship between inflation, interest rate and economic growth. The monetary policy impacts the Ghanaian economy positively. | Monetary policy is more effective in achieving economic growth by pegging proper interest and inflation rates. |

| Denbel et al. (2016) | Ethiopia | 1970-2011 | VAR | INF | GDP | Inflation is negatively and significantly affected by economic growth. | The relationship between inflation and economic growth is bidirectional rather than one way. |

| Ayres et al. (2014) | Developing countries | 1985–2010 | OLS | GDP | INF | While the overall impact of targeting inflation on real GDP is small, there is only a statistically significant increase in real GDP in certain areas, including Europe, Latin America and the Middle East. | Inflation targeting can positively impact the GDP growth for developing countries but its skewed to certain regions such as Europe and Latin America. |

| Agbaba (2018) | Nigeria | 1984-2014 | PPMCC | GDP | INF, MS | Negative relationship between inflation and economic growth. | Aggressive and tight control of the money supply is necessary to keep inflation under check. |

| Imleesh et al. (2017) | Indonesia, Malaysia and Singapore | 1990-2015 | PSTR | GDP | INF, IR | There is an insignificant positive long run relationship between interest rate and economic growth and also a significant positive long run relationship between inflation and economic growth. | There is need to consider other control variables, important for economic growth such as exchange rate and crude oil prices for economic growth to be achieved. |

| Eggoh & Khan (2014) | Developed and developing economies | 1960-2009 | PSTR | GDP | INF | The relationship between inflation and growth is inverse and nonlinear, in addition, the threshold rates decrease with income levels. | There exists a threshold for inflation at which a rate above would lead to a negative relationship between inflation and economic growth. |

| Kasidi & Mwakanemela (2013) | Tanzania | 1990-2011 | ILS | GDP | INF | There is a negative short run relationship between inflation and economic growth. Lastly there is no long run relationship between the variables. | Low inflation rate contributes to higher economic growth. |

While Njimanted et al. (2016); Havi & Enu (2014); Denbel et al. (2016); Agbaba (2018); Eggoh & Khan (2014) and Kasidi & Mwakanemela (2013) showed a negative relationship between inflation and economic growth, Ayres et al. (2014) and Imleesh et al. (2017) found a positive relationship between inflation and interest rate. In addition, Imleesh et al. (2017) found a positive relationship between interest rate and economic growth while Seleteng et al. (2013) found a non-linear relationship between inflation and economic growth, highlighting that the threshold at which the inflation growth begins to be detrimental to the economy is 18.9 % for SADC countries. Once again, as observed in developed countries, the results are different, this shows that there are some underlying factors which affect the relationship such as national economic conditions (employment and income distribution) and government policies.

Studies have also been done by Chipote & Makhetha-Kosi (2014), Mothuli & Phiri (2018), Sindano (2014), Salami (2018) and Vermeulen (2015) on the relationship between inflation, interest rate and economic growth focusing on the SACU countries and the results of these studies are shown in Table 3.

| Table 3 A Summary of Literature on SACU Countries | |||||||

| Author (s) | Countries/ Region | Period | Method | Dependent Variable | Independent Variables | Results | |

| Chipote & Makhetha-kosi (2014) | South Africa | 2000-2010 | VAR | GDP | MS, Repo Rate, CPI, EXCH | The study shows that there is a long-term relationship between variables. | Monetary policy is more effective in promoting domestic and foreign direct investment. Government spending is complementary to achieve economic growth. |

| Mothuli & Phiri (2018) | Botswana | 1975-2016 | ARDL | GDP | INF | Inflation is found to be insignificantly related with economic growth over both the short and long-run. | Some economies may be irresponsive to inflation rate changes, rather other variables such as exchange rate and government size may influence economic growth. |

| Sindano (2014) | Namibia | 1980-2012 | OLS | GDP | INF | There is a positive relationship with an inflation threshold of 12.0 per cent, which is conducive to Namibia's economic growth. | There exists a threshold for inflation at which a rate above would lead to a negative relationship between inflation and economic growth. |

| Salami (2018) | Eswatini | 1980-2016 | OLS | GDP | INF, IR, EXCH | The outcome exhibit that interest rate have a negative and significance with GDP. The INF showed a positive relationship with the GDP. | There is need to consider other control variables, important for economic growth such as exchange rate and inflation rates for economic growth to be achieved. |

| Vermeulen (2015) | South Africa | 1950-1985 | OLS | GDP | INF | Negative relationship between inflation and output in the long run. No short run relationship. | Low inflation targeting policy adopted by South Africa is conducive for economic growth. |

| Bonga & Kengne (2018) | South Africa | 1969-2013 | MSVAR | INF | GDP | There is no relationship between inflation and economic growth. | Response of economic growth is regime dependent and subject to the reaction of monetary policy to inflation changes. |

As shown in Table 3, 50% of the studies used the OLS estimation technique with the rest of the studies using different methodologies. All of the studies above asserts that there is a relationship between inflation, interest rate and economic growth with Vermeulen (2015) showing a negative relationship between inflation and output. However, there is no consensus with regards to the relationship between inflation, interest rate and economic growth. These studies focused only on the individual countries in the SACU region, which distinguishes this study as it focuses on SACU region as a whole using panel data.

From the reviewed studies, it can be concluded that developed countries show a positive relationship between inflation and economic growth with the developing countries showing a negative relationship. This inconsistence entices the need to examine the relationship between inflation rate, interest rate and economic growth. In addition, different methodologies have been adopted, it is evident that methodologies are situational hence this study will look at the unit root tests to determine the methodology to apply. There have been few studies, if they exist, which investigated the relationship between economic growth, inflation and interest rate in SACU region and this study focuses on examining this relationship in SACU region.

Data Sources and Methodology

Data Sources

The data included five SACU countries and generally covered the period before and after the global financial crisis that is 1991-2018. Interest rate used shows the bank rate that usually meets the short- and medium-term financing needs of the private sector. The data sources are shown in Table 4 below.

| Table 4 Data Sources and Measurement of Variables | ||

| Variable | Measurement | Source |

| Inflation | Consumer Price Index (CPI) | United Nations Conference on Trade and Development |

| Economic Growth | Gross Domestic Product growth | United Nations Conference on Trade and Development |

| Interest rate | Bank rate | World Bank Development Indicators |

Methodology

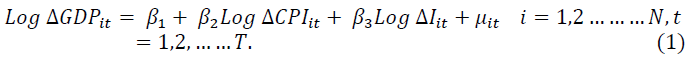

The study used a log-log model and the functional form is shown below:

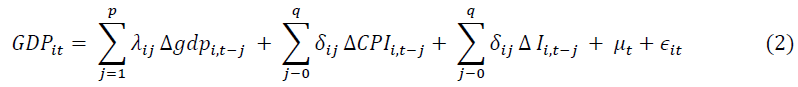

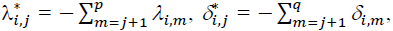

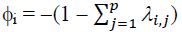

Where Δ GDP is economic growth for country i in period t, Δ CPI is the changes in Consumer Price Index, which shows inflation rate for country i in period t, Δ I is the changes in interest rate for country i in period t, i is the individual country and t is time period. The estimation method used in this study is the panel ARDL model. According to Nkoro and Uko (2016), the PMG allows for heterogeneity only in the short-run compared to the mean group which allows for heterogeneity both in the short and the long-run. The pool mean group estimates are superior to the fixed effects estimates, because they are robust to endogeneity and to the presence of unit root. Besides the short-run and long-run effects that are captured among the variables in the model, the PMG additionally investigates the dynamic effects of the independent variables on the dependent variable. The general form of the PMG can be shown by the following equation:

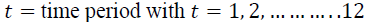

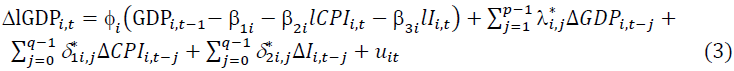

The following notation for equation (8):

The error correction equation is derived from equation (2):

With Δ indicating first difference operator,  and

and is the error correction term which measures the speed of adjustment back to the steady state equilibrium subsequent to a shock to the system and the parameter is expected to be negative and significant. If the speed of adjustment is statistically not different from zero, then no long-run relationship exits.

is the error correction term which measures the speed of adjustment back to the steady state equilibrium subsequent to a shock to the system and the parameter is expected to be negative and significant. If the speed of adjustment is statistically not different from zero, then no long-run relationship exits.

Empirical Analysis and Results

SACU Countries Comparative Analysis for the period 1991-2018

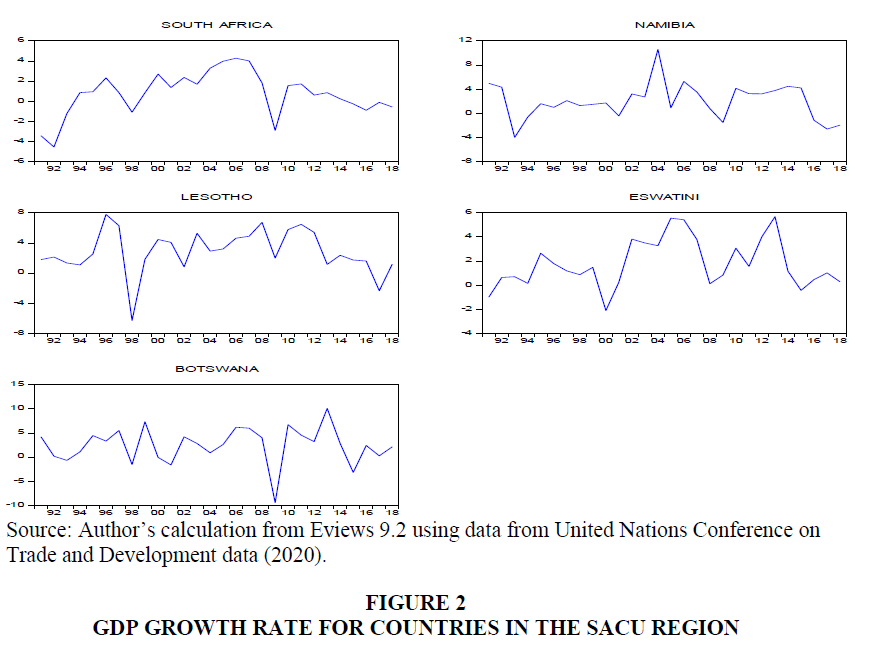

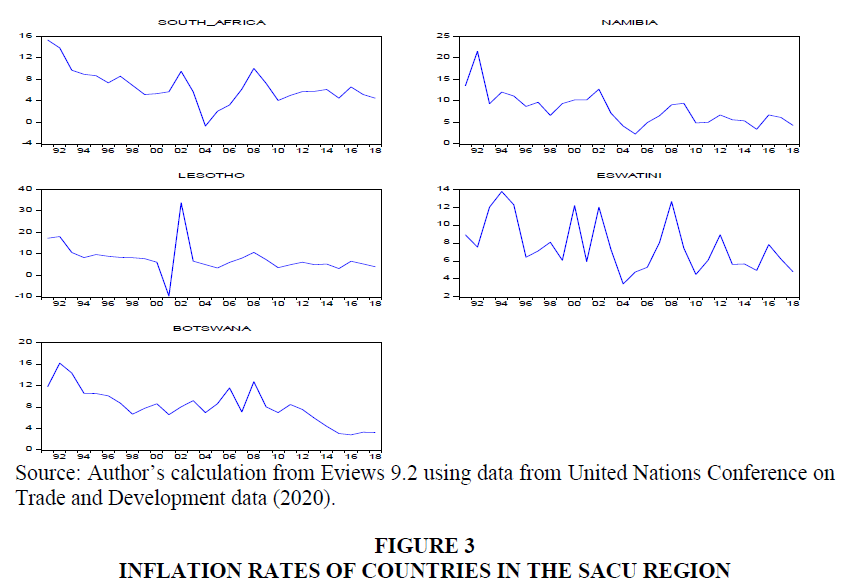

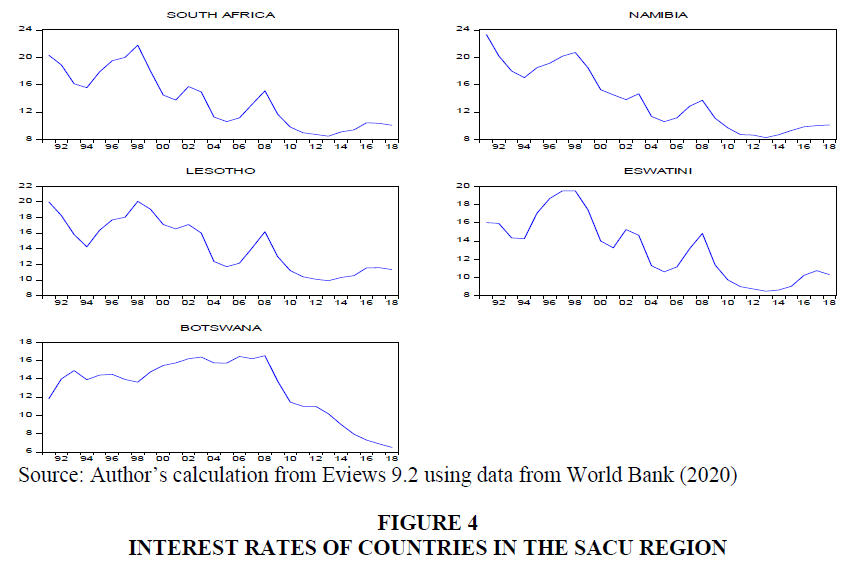

The movements of economic growth, inflation and interest rate are shown in Figure 2, Figure 3 and Figure 4 below, respectively.

While economic growth shows a positive fluctuating trend for South Africa and Eswatini and no specific trend for other countries over the study period, inflation shows a downward fluctuating trend for all the five countries. In addition, interest rates have been falling on average for all the countries over the study period. The above figure shows that the relationship between inflation and interest rate is negative for all the countries, which is contrary to what might be expected. The relationship between inflation and economic growth, interest rate and economic growth is negative for South Africa and Eswatini.

The Panel Results

The relationship between inflation, lending rates and economic growth was examined using the Panel ARDL model and cointegration regressions (FMOLS and the DOLS) to enable isolating short and long run effects and for robustness

The Panel Unit Root Test

The study used the common root (Levin, Lin, & Chu) and individual root (Lm, Pesaran and Shin). The summary of the SACU panel unit root tests is shown in the Table 5 below.

The above Table 5 shows that the GDP is integrated in order 1 whilst the CPI and the lending rates is stationary in levels. Since GDP is I (1) while CPI and the lending rates are I (0) and none is I (2), we can develop a panel ARDL model.

| Table 5 Summary of Panel Unit Root Test | ||||||||

| Variable | Levin, Lin, & Ch | Lm, Pesaran and Shin W-sta | ||||||

| Level | 1st Difference | Levels | 1st Difference | |||||

| Intercept | Intercept & Trend | Intercept | Intercept & Trend | Intercept | Intercept & Trend | Intercept | Intercept & Trend | |

| LGDP | -0.01 (0.49) |

-0.73 (0.23) |

-6.77 (0.00)*** |

-5.55 (0.00)*** | 2.11 (0.98) |

-0.98 (0.16) |

-5.52 (0.00)*** |

-3.95 (0.00)*** |

| LCPI | -4.55 (0.00)*** | 0.37 (0.64) |

-2.52 (0.00)*** |

-2.47 (0.00)*** | -1.33 (0.09) |

1.09 (0.86) |

-3.62 (0.00) |

-3.74 (0.00)*** |

| Li | 0.25 (0.59) |

-0.45 (0.32) |

-7.96 (0.00)*** |

-7.42 (0.00)*** | 0.75 (0.77) |

-2.29 (0.01)*** |

-6.67 (0.00)*** |

-5.91 (0.00)*** |

Source: Author’s calculation from Eviews 9.

Panel ARDL Results for SACU Members

In the Table 6, the panel cointegration test was performed using Pedroni and Kao cointegration test. In the Pedroni Cointegration Test, Panel v-Statistic, Panel rho-Statistic, Panel PP-Statistic and Panel ADF-Statistic were used while for Kao cointegration test, we used the ADF t-statistic test. A summary of all these results are shown in the table below. Table 7 and Table 8 shows the short run and long results from our analysis, respectively.

| Table 6 Panel Cointergration Test Results | ||||||

| Pedroni Residual Cointergration Test | Kao Residual Cointegration Test | |||||

| Panel v_Statistic | Panel rho_Statistic | Panel PP_Statistic | Panel ADF_Statistic | Residual variance | HAC variance | ADF |

| 0.53 (0.29) | 0.03 (0.51) | -0.37 (0.35) | -1.30 (0.09)* | 0.01 | 0.01 | -3.69 (0.01)*** |

| Table 7 Summary of Short Run Results | ||||

| CPI | i | COINTEQ | ||

| -0.25 (0.65) | 1.31 (0.00)*** | 0.11 (0.27) | -0.13 (0.21) | -0.40 (0.00)*** |

| Table 8 Summary of Long Run Estimates of the Panel ARDL, FMOLS and DOLS | |||

| Independent Variable | Panel ARDL | FMOLS | DOLS |

| CPI | 0.90 (0.00)*** | 0.63 (0.00)*** | 0.57 (0.00)*** |

| I | -0.22 (0.1)*** | -0.51 (0.00)*** | -0.66 (0.01)*** |

The Panel ARDL results shows that changes in CPI values has a positive effect on changes in GDP only in the long run whereas changes in lending rates has negative effect on changes in GDP values in the long run. The Panel ARDL shows that CPI and lending rates have no impact on GDP in the short run. These results show that in the long run, when SACU CPI increases by 1%, on average, the SACU’s GDP increases by 0.90%. In contrast, an increase in SACU lending rates by 1% leads to a decline in SACU GDP by 0.22% on average, in the long run.

Although, the Panel ARDL is used to guide in the conclusion, the FMOLS and the DOLS results also shows a significant positive relationship between CPI and GDP while no relationship between lending rates and the GDP is found in SACU. According to the FMOLS, an increase in the CPI by 1% increases the GDP by 0.63 on average. The DOLS results shows that if the CPI increases by 1%, the GDP increases by 0.57%, on average.

The positive relationship between inflation and economic growth is in line with the economic theories especially the Keynesian theory. Blanchard & Kiyotaki (1987) believes that the positive relationship can be due to agreements by some firms to supply goods at a later date at an agreed price. Therefore, even if the prices of goods in the economy have increased, output would not decline, as the producer has to fulfil the demand of the consumer with whom the agreement was made. The aggregate supply-aggregate demand (AS-AD) framework also postulates a positive relationship between inflation and growth where, as growth increases, so does the inflation. This evidence is also available in SACU countries where for the past two to three years, inflation has been low and economic growth as well was very low, showing a positive relationship. The works of Stawska (2016), Sattarov (2011) and Pradhan et al. (2015) also shows a positive relationship between economic growth and inflation. The finding shows that an increase in the inflation rate may results in an increase in the economic growth of the SACU countries. These results shows that any inflationary trend in the SACU region has a positive a positive impact to the growth of their economies. Nowadays, the inflation trend in the SACU region is rising and based on these results, the economies may start recording higher growth levels. Like many other countries, the SACU countries also aims for a higher growth and low inflation but with these results there is a growth-inflation trade off. Policy makers would thus need to establish a sustainable balance between the two.

Conclusion and Policy Implications

The objective of this study has been to examine the short-run and long-run relationship between inflation, interest rate and economic growth for all countries in the SACU region over the period 1991-2018. Some variables were found to be stationary while others were found to be integrated of order one, hence, for each individual countries, ARDL model was used and for the panel countries, the ARDL model and co-integrating regressions (FMOLS and DOLS) were used to examine this relationship. The ARDL model findings show a positive relationship between inflation and economic growth in the short-run for Lesotho and Swaziland only and a positive relationship for all countries in the long-run except Botswana. The lending rate is found to have no impact on economic growth in both the short-run and long run for all the countries in the region. The results of the Panel ARDL shows that inflation has a positive impact on growth only in the long run while lending rate has a negative impact on growth only in the long run. The FMOLS and DOLS results also show a positive relationship between inflation and economic growth and no relationship between lending rate and GDP is found in SACU region. Despite having some slight differences in terms of the findings, the models agree that inflation has a positive impact on economic growth while interest rate has no impact on economic growth.

These findings provide some important policy implications. The analysis shows that it is desirable to keep inflation high, ceteris paribus, and therefore Central Bank should implement those policies that promote inflation maintained at a higher desirable level so as to achieve robust economic growth. Since lending rate is found to have no impact on economic growth in the SACU region, the interest rate can be increased or decreased to manipulate inflation to achieve growth. However, it should be noted that inflation is desirable for growth up to a certain level, where beyond that level, higher inflation is harmful to growth and this level of inflation was beyond the scope of this study. Thus, while inflation targeting brings sanity within the financial sector, this might retards growth as the desirable inflation level would be beyond the targeted inflation level.

References

- Akume, D., Mukete, E.M., & Njimanted, F.G. (2016). The Impact of Key Monetary Variables on the Economic Growth of the CEMAC Zone. Expert Journal of Economics, 4(2).

- Ayres, K., Belasen, A.R., & Kutan, A.M. (2014). Does inflation targeting lower inflation and spur growth?. Journal of Policy Modeling, 36(2), 373-388.

- Bonga-Bonga, L., & Simo-Kengne, B.D. (2018). Inflation and Output Growth Dynamics in South Africa: Evidence from the Markov Switching Vector Autoregressive Model. Journal of African Business, 19(1), 143-154.

- Blanchard, O.J., & Kiyotaki, N. (1987). Monopolistic competition and the effects of aggregate demand. The American Economic Review, 647-666.

- Chipote, P., & Makhetha-Kosi, P. (2014). Impact of monetary policy on economic growth: a case study of South Africa. Mediterranean Journal of Social Sciences, 5(15), 76.

- Chirwa, T.G., & Odhiambo, N.M. (2017). Sources of economic growth in Zambia: An empirical investigation. Global Business Review, 18(2), 275-290.

- Denbel, F.S., Ayen, Y.W., & Regasa, T.A. (2016). The relationship between inflation, money supply and economic growth in Ethiopia: Co integration and Causality Analysis. International Journal of Scientific and Research Publications, 6(1), 556-565.

- Dornbusch, R.S., Fischer, S. & Kearney, C. (1996). Macroeconomics. Sydney: The McGraw-Hill Companies, Inc.

- Eggoh, J.C., & Khan, M. (2014). On the nonlinear relationship between inflation and economic growth. Research in Economics, 68(2), 133-143.

- Friedman, M. (1961). The lag in effect of monetary policy. Journal of Political Economy, 69(5), 447-466.

- Geetha, C., Mohidin, R., Chandran, V.V., & Chong, V. (2011). The relationship between inflation and stock market: Evidence from Malaysia, United States and China. International Journal of Economics and Management Sciences, 1(2), 1-16.

- Gokal, V., & Hanif, V. (2004). Relationship between Inflation and Economic Growth, Economics Department, Reserve Bank of Fiji, Suva, Fiji, Working Paper 2004/04

- Harswari, M.H.A.B.N. & Hamza, S.M. (2017). The impact of interest rate on economic development: A study on asian countries. International Journal of Accounting & Business Management, 5(1), 180-188.

- Hasanov, M., & Omay, T. (2011). The relationship between inflation, output growth, and their uncertainties: Evidence from selected CEE countries. Emerging Markets Finance and Trade, 47(sup3), 5-20.

- Havi, E.D.K., & Enu, P. (2014). The effect of fiscal policy and monetary policy on Ghana’s economic growth: which policy is more potent. International Journal of Empirical Finance, 3(2), 61-75.

- Holston, K., Laubach, T., & Williams, J.C. (2017). Measuring the natural rate of interest: International trends and determinants. Journal of International Economics, 108, S59-S75.

- Imleesh, R.M., Yanto, H., & Prajanti, S.D.W. (2017). The impact of macroeconomic indicators on economic growth in Indonesia, Malaysia and Singapore. Journal of Economic Education, 6(1), 19-28.

- Kasidi, F., & Mwakanemela, K. (2013). Impact of inflation on economic growth: A case study of Tanzania.

- Karahan, Ö., & Y?lgör, M. (2017). The Causal Relationship between Inflation and Interest Rate in Turkey?. European Financial Systems, 2017, 309.

- Keynes, J.M. (1936). The general theory of interest, employment and money. The Economic Journal, 46(182), 238-253.

- Kurihara, Y. (2013). Does adoption of inflation targeting reduce exchange rate volatility and enhance economic growth. Journal of World Economic Research, 2(6), 104-109.

- Mavikela, N., Mhaka, S., & Phiri, A. (2019). The inflation-growth relationship in SSA inflation-targeting countries. Studia Universitatis Babes-Bolyai Oeconomica, 64(2), 84-102.

- Mothuti, G., & Phiri, A. (2018). Inflation-growth nexus in Botswana: Can lower inflation really spur growth in the country?. Global Economy Journal, 18(4), 20180045.

- Njimanted, F.G., Akume, D., & Mukete, E.M. (2016). The impact of key monetary variables on the economic growth of the CEMAC Zone. Expert Journal of Economics, 4(2), 54-67.

- Olowofeso, E.O., Adeleke, A.O., & Udoji, A.O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81-101.

- Phiri, A. (2012). Threshold effects and inflation persistence in South Africa. Journal of Financial Economic Policy, 4(3), 247-269.

- Pradhan, R.P., Arvin, M.B., & Bahmani, S. (2015). Causal nexus between economic growth, inflation, and stock market development: The case of OECD countries. Global Finance Journal, 27, 98-111.

- Salami, F.K. (2018). Effect of interest rate on economic growth: Swaziland as a case study. Journal of Business & Financial Affairs, 7(3), 1-5.

- Sattarov, K. (2011). Inflation and Economic Growth. Analyzing the Threshold Level of Inflation: Case Study of Finland, 1980-2010. Master Thesis, 15 ECTS. Universitet UMEA.

- Seleteng, M., Bittencourt, M., & Van Eyden, R. (2013). Non-linearities in inflation–growth nexus in the SADC region: A panel smooth transition regression approach. Economic Modelling, 30, 149-156.

- Sindano, A.N. (2014). Inflation and economic growth: an estimate of an optimal level of inflation in Namibia (Doctoral dissertation).

- Southern African Customs Union (SACU). (2017). Implementing a Common Agenda towards Regional Integration in Southern Africa. Annual Report.

- Thamae, R.I., & Mohapi, M.J. (2014). Modelling inflation in Lesotho: a cointegration analysis. African Journal of Business and Economic Research, 9(2_3), 117-132.

- Thanh, S.D. (2015). Threshold effects of inflation on growth in the ASEAN-5 countries: A Panel Smooth Transition Regression approach. Journal of Economics, Finance and Administrative Science, 20(38), 41-48.

- Vermeulen, C. (2015). Inflation, growth and employment in South Africa: Trends and trade-offs. Economic Research Southern Africa (ERSA) Working Paper, 547.

- World Bank Group. (2018). Macro Poverty Outlook: Country by Country Analysis and Projections for Developing World. Southern African Customs Union.

- Yüksel, S., & Adal?, Z. (2017). Determining influencing factors of unemployment in Turkey with MARS method.