Research Article: 2021 Vol: 25 Issue: 4S

Inflation Volatility Quality of Institutions and Openness

Imam Uddin, Institute of Business Managment

Hira Mujahid, Institute of Business Managment

Mosab I. Tabash, Institute of Business Managment

Shariq Ayubi, Institute of Business Managment

Muhammad AsadUllah, Institute of Business Managment

Citation Information: Uddin, I., Mujahid, H., Tabash, M.I., Ayubi, S., & Ullah, M.A. (2021). Inflation volatility quality of institutions and openness. Academy of Accounting and Financial Studies Journal, 25(S4), 1-12.

Abstract

The inflation instability creates destruction on the economy not only concerning change in prices but also over rising in the level of prices instability. The purpose of this paper is to investigate the relationship between inflation volatility, openness, and quality of institutions for the panel of 182 economies, OECD, and Non-OECD economies for the period of 1998 to 2018. The paper found that institutional quality has a significant impact on inflation volatility. It also suggests political stability and the absence of violence, regulatory quality, and rule of law dampen the inflation volatility of OECD. However, government effectiveness increases the inflation volatility in non- OECD economies. Trade openness reduces the inflation volatility of OECD conversely increases inflation volatility of non-OECD economies. The volatility of inflation of OECD and non-OECD can be improved by a low exchange rate. The policy implications are central banks do use measures internally and emphasize the stability of headline inflation rates over the medium term. It has to be taken into consideration that institutional quality influences average inflation rates.

Keywords

Inflation Volatility, Institutions Quality, Voice Accountability, Control of Corruption.

JEL Classifications

H30, H80, P30, E60.

Introduction

The inflation instability creates destruction on the economy not only concerning change in prices but also over rising in the level of prices instability. Therefore, over time the level of price instability is raised due to the high inflation volatility. About nominal contract, this stimulates risk premia in long run in economies, increases overheads for hedging against inflation uncertainty, and directs to unanticipated redistribution of income. As a consequence, inflation instability can slow down the economic growth despite if the inflation on average remains controlled.

Lately, due to financial crises researchers are more concerned about inflation volatility. The main reason for inflation volatility during financial crises is the malfunction of public institutions as it has failed to come back to financial imbalances and created greater instability. Due to achieving inflation targets, the government may overlook the condition of financial markets (Blackburn & Powell, 2011). Besides, the financial imbalances become harder due to steady and low inflation with plausible anti-inflationary policy. In fact, during financial crises, the quality of institutions has gained significant importance for economic stability (Klomp & Haan, 2014). Those economies comprise of good quality institutions are more competent to prepare policies that combat the adverse shocks than those economies that bear bad institutions.

Another most alarming event of the past few decades is the low inflation around the World (Jafari et. al., 2012). Inflation remains one of the most important factors for economic development. After globalization, inflation of the economy has been badly influenced by the openness of the economy. The relationship between openness and inflation has been identified by many researchers. Thus, the Mundell- Fleming model which is the extension of Barro & Gordon, (1981) suggests that openness has a negative association with inflation. In fact Romer (1991) suggests that more open economies have steeper Phillips curves. This is due to the expansion of monetary terms in open economies will go together with exchange rate depreciation and increasing costs for domestic people. He also reported that inflation increases with the share of goods imported.

Considering all the above discussion, the objective of the paper is to find the impact of quality of institutions and openness on inflation volatility. This is one of the primary studies which addresses the relationship of quality of institutions, openness, and inflation volatility. Furthermore, the paper identifies the desired relationship between inflation volatility and the quality of institutions of OECD countries. In the early 1980s, the inflation of OECD has been a decline to 2% from 10% over the decade 1995-2005. This progress has coincided with an increase in globalization, with more goods and services produced and traded between non-OECD and OECD countries increasing the share of GDP of OECD (Pain et al. 2008). But after the financial crisis, the targeted inflation is overestimated and needs to be investigated.

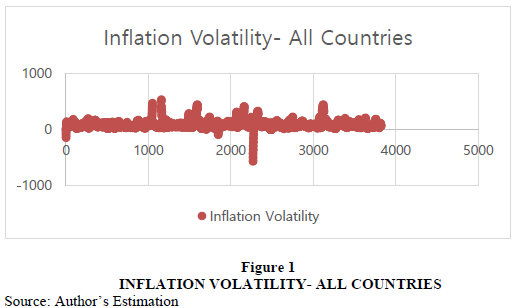

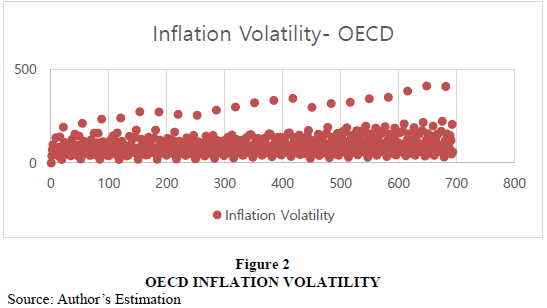

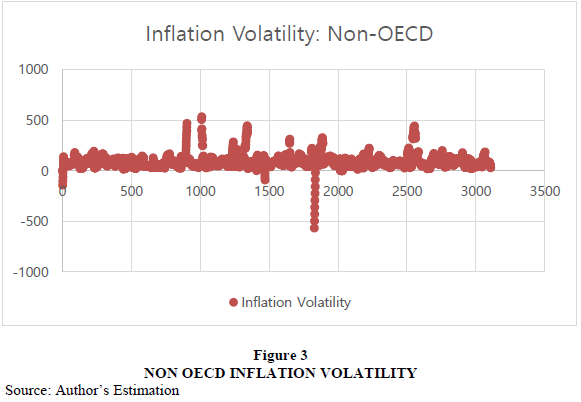

Figure 1 shows the inflation volatility of all countries where the fluctuation of inflation with respect to trade openness of all countries. Furthermore, Figure 2 depicts the inflation volatility of the Organisation for Economic Co-operation and Development (OECD) with trade openness. The trend in the figure is increasing with the increase in trade openness. In addition, Figure 3 shows Non-OECD inflation volatility with trade openness and it reflects ups and downs inflation with the high level of trade openness. By looking up these trends the paper aims to find out the effect of trade openness and quality of institutions on inflation volatility of all countries, OECD and Non-OECD. This paper identifies the effect volatility of inflation and openness of OECD. The paper consists of the following sections: Section 2 presents the review of literature, section 3 represents theoretical framework, section 4 reports results, section 5 includes the conclusion.

Review of Literature

Inflation volatility has major importance due to the relationship between inflation and growth as it is one of the important determinant for financial institutions policies and profitability (AsadUllah, 2017). Very little researches have been conducted on this issue of inflation volatility. Judson & Orphanides (1996) found some empirical evidence for panel data, that inflation volatility which is measured by the standard deviation has a negative sign on economic growth. The damaging effect of inflation on economic growth is driven by inflation volatility (Friedman, 1977). Inflation prompts high inflation volatility and uncertainty in the USA, Germany, Canada, and UK (Froyen & Waud, 1987). Also, Al- Marhubi (1998) with a panel of 78 countries found that conditional and unconditional inflation volatility harms economic growth. Blanchard & Simon (2001) documented a strong positive relationship between inflation volatility and output volatility.

López-Villavicencio & Mignon (2011) explained that in developing economies, a high-inflation history, lack of central bank independence, weak fiscal systems are the main reason for higher optimal inflation rates. Recently, has been investigated by Ibarra & Turpkin (2016) the optimal inflation rate decrease with a better quality of institutions in developing countries. Moreover, only institutions are not the main reason to disturb the inflation rate there could be some other determinant (Alonso & Garcimartin, 2013). This is pertinent to implement policies to check the quality of the institution. There are major two empirical approaches to know inflation targeting. The first approach is presented by Aizenman et al. (2011), which focuses on how Central Banks operate under inflation targeting. The second approach associates the macroeconomic results of IT versus non-IT countries.

The relationship of government deficits with inflation performance is strong with the restricted country sample. Like, Fischer, Sahay, & Vegh, (2002) reported that there is a strong link between fiscal deficit and inflation. Cottarelli, (1998) documented that a significant impact of fiscal deficits on inflation, for financing need limited access to central bank financial markets drives the government to resort, this result is supported by (Terrones & Catão, 2001). The relationship between deficit and inflation is channeled by the central bank (Arratibel et al., 2002).

The weak institution is the reason for macroeconomic volatility and instability (Acemoglu et al., 2002). They use the instrument of institution mortality settler and constraints on the Executive branch is measured as institutions. (Sah, 1991) documented that political and economic decision-making with a small number of individuals is more volatile. As opposed to centralized economies the risk caused by human unreliability is diversified. In this situation, managers are selected to appliance public policy. Rodrik, (2000) conjectured in the political field democracy is generated by cooperation and compromise and got greater economic stability. This could happen in three means, first individual preferences are altered by democracy; second, the power is reduced by the democratic to expropriate the minority. Third, the cooperative policy is developed by interaction among political group forces. Almeida & Ferreira (2003) documented the significant and negative effect of the democracy index on volatility.

Friedman (1977) documented that inflation volatility has likely to lower growth. The price mechanism is distorted by future inflation uncertainty, low economic growth and efficiency are due to the misallocation of resources, therefore inflation volatility has an adverse effect on growth. The inflation volatility disgorges in a real interest rate and exchange rates and by mean of this impact output and growth. Interest rate and exchange rates adjusted to change inflation in developing countries. Inflation volatility creates uncertainty which affects the private sector investment political and economic environments is unstable due to policymakers find it tough to design and implement long-term, growth policies.

Dotsey & Sarte (2000) applied the cash in advance model to argue that inflation volatility raises economic growth. Moreover, they recommend that inflation volatility has a positive impact on growth. Furthermore, inflation volatility affects economic growth by improving the saving rate and investment. The return on money holding uncertain when inflation volatility rise which lower money demand increases saving rate and investments. The high inflation volatility raised by capital intensity increases economic growth.

A study conducted by OECD exhibits that imports from China over the past decades have pressured inflation in the US and European region (OECD, 2006). The report further elaborates that lower-cost producers’ trade put downward pressure on OECD economies' domestic prices. Therefore, there is no allowance to correct the effect of the higher commodity price of the world that may get from progress in comparative countries like China. In addition, Pehnelt (2007) found the effect of globalization and inflation for OECD countries. The study summarises the various channels through which globalization may affect inflation. The study further explains that the output gap of the foremost trading partners is more imperative in defining inflation rates. Moreover, the study reported that freedom of economic and the extent of globalization are positively linked to the process of disinflation.

The effect of globalization on relative producer prices of Austria medium-sized and large manufacturing firm found by (Glatzer et al., 2006). The results suggest that though globalization improves labor productivity which dampens inflation. Duca & VanHoose (2000) illustrate that improved goods market competition dropped inflation, to some extent lowered the non-accelerating inflation rate on unemployment. Cavelaars (2003) also exhibits that a greater degree of product market competition causes dampening the inflation rate. In addition, OECD countries’ institutions and market competitive performance by businesses are significant in explaining inflation. Pain, Koske &Sollie (2006) suggest that in OECD countries competition from lower-priced imports has placed a burden on local producers.

Data and Methodology

A panel dataset of 182 open economies with yearly observations of the period 1998- 2018 is collected from the World Bank data bank. Inflation should be identified through monetary policy, although various other factors influence inflation. One of the important factors to determine inflation volatility is the Quality of institutions which has been collected from Governance Indicators of the World bank. The specific model for the current research is as follows.

INVOLi,t = π1 + π2 GRi,t + π3 IQi,t+ α4 Open + π5 CVi,t+ µi,t ................(1)

Where INVOL represents inflation volatility, GD stands for GDP per capita (Braun & Di tella, 2004), Indicators used for Institutional quality (IQ) are control of corruption (CC), voice accountability (VA), political stability, and absence of violence (PS), government effectiveness (GE) and regulatory quality (RQ). Military in politics and democratic accountability are explained under the head of voice accountability. In contrast, stability of government, internal and external conflicts, and ethnic tensions all are measured through the political stability and absence of violence index. However, the quality of bureaucracy is known by the government effectiveness index. The investment profile of the economy is recognized by the regulatory quality. Law and order of economy are identified by the rule of law and control of corruption index renowned for corruption of economy. Trade openness (TO) be used for openness, FD stands for financial development, Pop stands for population growth. ER is for exchange rate and government consumption is represented GC. Inflation volatility is measured by calculating the rolling standard deviation of three years. The paper applied Pooled OLS, Fixed and Random effect methods to estimate the relationship of inflation volatility, Openness, and quality of institutions.

Results

This section provides the empirical results of the relationship inflation volatility, openness, and quality of institutions of all countries, Organisation for Economic Co-operation and Development (OECD) and non-OECD. Model 1 shows the association of only openness and inflation volatility whereas Model 2 depicts the link of quality of institutions indicators and inflation volatility however combine results of openness, quality of institutions and other control variables are presented in Model 3. Table 1 represents the Pooled OLS results of all countries for the association of inflation volatility, openness, and quality of the institution. The link of Trade openness, financial development, and inflation volatility have a significant effect on inflation volatility in model 1 whereas the combined results in model 3 depict only financial development increases the inflation volatility. Model 2 shows that the quality of institutions indicators GE, RQ, and RL has a significant effect on inflation volatility while the combined results of the model demonstrate that better RQ and RL reduces the inflation volatility. However, in the case of all selected countries Exchange rates, government consumption, and GDP per capita raise the inflation volatility. Moreover, the fixed effect and random effect results are presented in 2 and 3 respectively. The results of those are not much contradicted from Tables 1 to 5.

| Table 1 Pooled OLS Results of Openness, Quality Of Institutions And Inflation Volatility – All Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| TO | -0.15263 (4.58)* |

-0.0164 (0.45) |

|

| FD | 0.4391 (20.99)* |

0.3327 (13.58)* |

|

| ER | 0.0301 (3.53)* |

||

| GC | 0.0095 (0.16) |

||

| GD | 0.0800 (3.32)* |

||

| CC | -0.0449 (0.68) |

0.0280 (0.35) |

|

| GE | 0.2471 (3.19)* |

0.1128 (1.24) |

|

| PS | -0.0568 (1.85) |

-0.0446 (1.24) |

|

| RQ | -0.4811 (7.94)* |

-0.2763 (3.72)* |

|

| RL | -0.2093 (2.43)* |

-0.2242 (2.16)* |

|

| VA | 0.0194 (0.55) |

0.0557 (1.29) |

|

| _cons | 0.3992 (2.53)* |

0.7542 (38.95)* |

-0.2492 (1.12) |

| No. of Observation | 2766 | 3420 | 2121 |

| R square | 0.41 | 0.71 | 0.62 |

| Table 2 Fixed Effect Results of Openness, Quality of Institutions and Inflation Volatility – All Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| TO | -0.2628 (4.25)* |

-0.16422 (2.37)** |

|

| FD | 0.1036 (5..03)* |

0.0786 (3.31)* |

|

| ER | 0.0606 (2.65)* |

||

| GC | -0.4067 (4.53) |

||

| GD | -0.002 (0.12) |

||

| CC | 0.05308 (0.53) |

-0.045 (0.35) |

|

| GE | -0.01657 (0.16) |

0.0881 (0.66) |

|

| PS | -0.04852 (1.01) |

-0.1226 (1.96)** |

|

| RQ | -0.5544 (6.17)* |

-0.2928 (2.52)* |

|

| RL | -0.2316 (2.00)** |

-0.4342 (2.83)* |

|

| VA | -0.1674 (2.00)** |

-0.0733 (0.66) |

|

| _cons | 1.7321 (6.4)* |

0.7367 (42.2)* |

2.0021 (5.6) |

| No. of Observation | 2766 | 3420 | 2121 |

| R square | 0.77 | 0.61 | 0.51 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics.

| Table 3 Random Effect Results of Openness, Quality of Institutions and Inflation Volatility – All Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| TO | -0.2183 (4.42)* |

-0.0760 (1.46) |

|

| FD | 0.1769 (8.69)* |

0.1472 (6.24)* |

|

| ER | 0.0419 (3.08)* |

||

| GC | -0.2286 (2.98)* |

||

| GD | 0.0231 (0.313) |

||

| CC | 0.0830 (0.95) |

0.0415 (0.4) |

|

| GE | 0.08131 (0.86) |

0.2233 (1.97)* |

|

| PS | -0.0691 (1.59) |

-0.0852 (1.72)*** |

|

| RQ | -0.5065 (6.21)* |

-0.3260 (3.42)* |

|

| RL | -0.1759 (1.66)*** |

-0.2765 (2.13)** |

|

| VA | -0.0430 (0.67) |

-0.0189 (0.28) |

|

| _cons | 1.3596 (6.07)* |

0.7535 (13.67)* |

1.1238 (3.84)* |

| No. of Observation | 2766 | 3420 | 2121 |

| R square | 0.21 | 0.71 | 0.81 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics.

| Table 4 Fixed Effect Results of Openness, Quality of Institutions and Inflation Volatility – OECD Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| GD | -0.0104 (0.36) |

||

| TO | -0.3420 (1.28) |

-0.0147 (2.79)* |

|

| FD | -0.1820 (3.49)* |

0.0042 (1.98)** |

|

| ER | -0.0102 (1.68)*** |

||

| CC | 0.1389 (0.57) |

0.5289 (0.96) |

|

| GE | -0.0291 (0.13) |

0.9527 (1.69)** |

|

| PS | 0.2283 (1.61) |

-0.3641 (1.06) |

|

| RQ | -0.6608 (2.77)* |

-2.3008 (4.27)* |

|

| RL | 0.4800 (1.45) |

1.3540 (1.63) |

|

| VA | 0.117 (0.33) |

0.3055 (0.41) |

|

| _cons | 2.7334 (2.4)** |

0.08467 (0.21) |

2.4757 (2.2)** |

| No. of Observation | 400 | 660 | 320 |

| R square | 0.86 | 0.92 | 0.77 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics.

| Table 5 Random Effect Results of Openness, Quality of Institutions and Inflation Volatility– OECD Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| GD | 0.0042 (0.15) |

||

| TO | 0.11943 (0.58) |

-0.0298 (0.82) |

|

| FD | -0.2657 (5.19)* |

0.3866 (1.88)** |

|

| ER | -0.0105 (1.98)** |

||

| CC | 0.0767 (0.33) |

0.2607 (0.6) |

|

| GE | -0.0122 (0.06) |

0.0417 (0.09) |

|

| PS | 0.1754 (1.31) |

-0.1554 (0.67) |

|

| RQ | -0.5822 (2.5)** |

-1.5665 (3.48)* |

|

| RL | 0.2322 (0.75) |

-0.5238 (0.93) |

|

| VA | -0.0242 (0.07) |

0.8274 (1.19) |

|

| _cons | 1.1054 (1.2) |

0.5593 (1.59) |

3.9893 (5.37)* |

| No. of Observation | 400 | 660 | 320 |

| R square | 0.72 | 0.91 | 0.86 |

Table 6 shows the results of Pooled OLS for OECD inflation volatility, openness, and quality of institution which suggest that trade openness and financial development reduces the inflation volatility of OECD countries as far as quality of institutions concerned PS, RQ, and RL lessen the inflation volatility whereas VA boosts the inflation volatility of OECD countries. It means that perceptions regarding some probabilities, the competency of the government to develop and implement good working policies and regulations, and e free participation of the citizens of a country in political elections without being exposed to any oppression as well as freedom of expression is much needed to stabilize OECD inflation which is similar to (Baris, 2019). Tables 4 and 7 represent the Fixed and random effect results of OECD countries which illustrate that trade openness, financial development, RQ, and exchange rate have significant effects on inflation volatility whereas the GDP per capita does not affect inflation volatility in the case of OECD. The association of openness, quality of institutions, and inflation volatility for non-OECD are presented in Table 8. The results imply that trade openness, financial development, exchange rate, CC, GE, PS, RQ, and VA are the reason for inflation volatility. the perceptions regarding the use of public power for deriving private benefits and the use of public resources for the elites, public service delivery, quality of bureaucracy, civil service quality, independency of these services from political oppressions, perceptions regarding some probabilities such as destabilization of the ruling government through some methods against the constitution, the competency of the government to develop and implement good working policies and regulations that permit and the free participation of the citizens of a country in political elections without being exposed to any oppression are important sources to reduce inflation volatility which is (Yerdelen Tatoglu, 2013) Though, trade openness, financial development, and GE increase the volatility of inflation. Whereas exchange rate, CC, PS, RQ, and VA reduces the volatility of inflation The results of fixed and random effects of non-OECD are presented in Table 7. According to fixed and random effects, results suggest financial development reduces the inflation volatility unlike the results of Pooled OLS.

| Table 6 Pooled OLS Results of Openness, Quality of Institutions and Inflation Volatility – OECD Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| GD | 0.01371 (0.695) |

||

| To | -0.3570 (2.79)* |

-0.025 (1.9)** |

|

| FD | -0.5563 (10.82)* |

0.0043 (0.18) |

|

| ER | -0.0096 (1.8)** |

||

| CC | 0.2335 (1.09) |

0.7342 (0.46) |

|

| GE | 0.1412 (0.56) |

-0.2298 (0.75) |

|

| PS | -0.0823 (0.74) |

-0.1508 (4.27)* |

|

| RQ | 0.2346 (1.03) |

-1.8580 (2.25)** |

|

| RL | -0.7281 (2.52)* |

-1.1042 (2.99)* |

|

| VA | -0.1371 (0.47) |

2.2119 (3.25)* |

|

| _cons | 1.298 (2.03)* |

0.6573 (3.14)* |

2.4405 (3.25)* |

| No. of Observation | 400 | 660 | 320 |

| R square | 0.72 | 0.73 | 0.96 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics.

| Table 7 Fixed Effect Results of Openness, Quality of Institutions and Inflation Volatility – Non-OECD Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| GD | -0.0088 (0.41) |

||

| TO | -0.0837 (1.42) |

0.1350 (1.88)*** |

|

| FD | -0.7031 (12.87)* |

-0.5467 (7.99)* |

|

| ER | -0.2694 (5.26)* |

||

| CC | 0.2207 (2.16)** |

0.1177 (0.97) |

|

| GE | 0.2202 (2.01)** |

0.3479 (2.67)* |

|

| PS | -0.0372 (0.74) |

-0.0927 (1.57) |

|

| RQ | -0.3266 (3.54)* |

-0.2670 (2.43)* |

|

| RL | -0.4296 (3.65)* |

-0.7798 (5.54)* |

|

| VA | -0.2519 (3.00)* |

-0.1824 (1.79)** |

|

| _cons | 4.2773 (15.14)* |

1.0256 (25.1)* |

3.29125 (9.73)* |

| No. of Observation | 2596 | 2900 | 1980 |

| R square | 0.72 | 0.86 | 0.73 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics

| Table 8 Pooled OLS Results of Openness, Quality of Institutions and Inflation Volatility – Non OECD Countries | |||

| Variable | Model 1 | Model 2 | Model 3 |

| GD | 0.0202 (0.86) |

||

| TO | 0.1679 (4.88)* |

0.2515 (6.85)* |

|

| FD | -0.6434 (20.45)* |

-0.7054 (17.3)* |

|

| ER | -0.0255 (2.64)* |

||

| CC | -0.3891 (5.41)* |

-0.1417 (1.72)*** |

|

| GE | 0.0777 (0.91) |

0.5043 (5.24)* |

|

| PS | 0.1030 (2.94)* |

-0.0916 (2.34)* |

|

| RQ | -0.1345 (2.09)** |

-0.3801 (5.15)* |

|

| RL | 0.2033 (2.18)** |

0.1687 (1.63) |

|

| VA | -0.3853 (10.26)* |

-0.2838 (6.56)* |

|

| cons | 2.9716 (18.01)* |

1.06083 (4.62)* |

2.7530 (13.02)* |

| No. of Observation | 2596 | 2900 | 1980 |

| R square | 0.89 | 0.87 | 0.73 |

Note:*, ** and *** represents 1%, 5% and 10% level of significance, and () represents t-statistics

Conclusion

Using panel data of 182 countries over the period 1996-2016 indicates that institutional quality is an important factor in the determination of inflation volatility in open economies. In other words, good quality institutions can experience low inflation volatility especially by focusing on regulatory quality and rule of law. The inflation instability creates destruction on the economy not only concerning change in prices but also over rising in the level of prices instability. Therefore, over time the level of price instability is raised due to the high inflation volatility. About nominal contract, this stimulates risk premia in long run in economies, increases overheads for hedging against inflation uncertainty, and directs to unanticipated redistribution of income. As a consequence, inflation instability can slow down the economic growth despite if the inflation on average remains controlled. The paper also focused on the OECD economy's quality of institutions and inflation volatility and suggests political stability and absence of violence, regulatory quality, and rule of law dampen the inflation volatility of OECD. However, government effectiveness increases the inflation volatility in non- OECD economies. Trade openness reduces the inflation volatility of OECD conversely increases inflation volatility of non-OECD economies. The volatility of inflation of OECD and non-OECD can be improved by a low exchange rate. The policy implications are central banks do use measures internally and emphasize the stability of headline inflation rates over the medium term. It has to be taken into consideration that institutional quality influences average inflation rates, since inflation rates of OECD were low in the 1950s and early 1960s, while the quality of institutions is much needed today. However, further research is necessary to draw a more detailed picture of the institutions-inflation-nexus.

References

- Acemoglu, D., Johnson, S., Robinson, J., & Thaicharoen, Y. (2003). Institutional causes, macroeconomic symptoms: volatility, crises and growth. Journal of Monetary Economics, 50(1), 49-123.

- Al-Marhubi, F. (1998). Cross-country evidence on the link between inflation volatility and growth. Applied Economics, 30(10), 1317-1326.

- Almeida, H., & Ferreira, D. (2002). Democracy and the variability of economic performance. Economics & Politics, 14(3), 225-257.

- Arratibel, O., Rodriguez-Palenzuela, D., & Thimann, C. (2002). Inflation dynamics and dual inflation in accession countries: A'New Keynesian'perspective (No. 132). ECB working paper.

- Asadullah, M. (2017). Determinants of profitability of Islamic Banks of Pakistan–A case study on Pakistan’s Islamic banking Sector. In International Conference on Advances in Business and Law (ICABL), 1(1), 61-73.

- Barro, R. J., & Gordon, D.B. (1983). A positive theory of monetary policy in a natural rate model. Journal of political economy, 91(4), 589-610.

- Blackburn, K., & Powell, J. (2011). Corruption, inflation and growth. Economics Letters, 113(3), 225-227.

- Blanchard, O., & Simon, J. (2001). The long and large decline in US output volatility. Brookings papers on economic activity, 2001(1), 135-174.

- Braun, M., & Di Tella, R. (2004). Inflation, inflation variability, and corruption. Economics & Politics, 16(1), 77-100.

- Catão, L., & Terrones, M.E. (2001). Fiscal Deficits and Inflation A New Look at the Emerging Market Evidence.

- Cavelaars, P. (2002). Does competition enhancement have permanent inflation effects? (No. 2002-5). Netherlands Central Bank, Monetary and Economic Policy Department.

- Cottarelli, M.C. (1998). The nonmonetary determinants of inflation: A panel data study. International Monetary Fund.

- Dotsey, M., & Sarte, P.D. (2000). Inflation uncertainty and growth in a cash-in-advance economy. Journal of Monetary Economics, 45(3), 631-655.

- Fischer, S., Sahay, R., & Végh, C. A. (2002). Modern hyper-and high inflations. Journal of Economic literature, 40(3), 837-880.

- Friedman, M. (1977). Nobel lecture: inflation and unemployment. Journal of political economy, 85(3), 451-472.

- Froyen, R.T., & Waud, R.N. (1984). An Examination of Aggregate Price Uncertainty in Four Countries and SomeImplications for Real Output (No. w1460). National Bureau of Economic Research.

- Glatzer, E., Gnan, E., & Valderrama, M.T. (2006). Globalization, import prices and producer prices in Austria. Monetary Policy & the Economy Q, 3, 24-43.

- Judson, R., & Orphanides, A. (1996). Inflation, Volatility, and Growth, Finance and Economics. Board of Governors, Federal Reserve of United States, Washington, DC, Discussion Paper, (96-19).

- Klomp, J., & De Haan, J. (2014). Bank regulation, the quality of institutions, and banking risk in emerging and developing countries: an empirical analysis. Emerging Markets Finance and Trade, 50(6), 19-40.

- Pain, N., Koske, I., & Sollie, M. (2006). Globalisation and Inflation in the OECD Economies.

- Pain, N., Koske, I., & Sollie, M. (2008). Globalisation and OECD consumer price inflation. OECD Journal: Economic Studies, 2008(1), 1-32.

- Pehnelt, G. (2007). Globalisation and inflation in OECD countries. Jena Economic Research Paper, (2007-055).

- Rodrik, D. (2000). Participatory politics, social cooperation, and economic stability. American Economic Review, 90(2), 140-144.

- Romer, D. (1993). Openness and inflation: theory and evidence. The quarterly journal of economics, 108(4), 869-903.

- Sah, R.K. (1991). Fallibility in human organizations and political systems. Journal of Economic Perspectives, 5(2), 67-88.

- Samimi, A.J., Ghaderi, S., Hosseinzadeh, R., & Nademi, Y. (2012). Openness and inflation: New empirical panel data evidence. Economics Letters, 117(3), 573-577.