Research Article: 2018 Vol: 22 Issue: 4

Information Content and Determinants of Timeliness Financial Reporting: Evidence From an Emerging Market

Evi Rahmawati, Universitas Muhammadiyah Yogyakarta, Indonesia

Abstract

This paper reports the findings of a study on information content and the determinants of timeliness of corporate report of manufacturing companies listed on the Indonesian Stock Exchange. The empirical analysis reveals that the significant determinants of timeliness of annual reporting in Indonesia are company size, earnings quality and audit factors (big 4/non big 4 audit firms and audit opinion). Profitability, capital structure and accounting complexity are insignificant determinants of timeliness of financial reporting in Indonesia, though these factors have been found to be significant determinants of financial reporting in other countries. Furthermore, no evidence was found to support the association between information content of financial reports and its timeliness. This paper reports the findings of a study on information content and the determinants of timeliness of corporate report of manufacturing companies listed on the Indonesian Stock Exchange. The empirical analysis reveals that the significant determinants of timeliness of annual reporting in Indonesia are company size, earnings quality and audit factors (big 4/non big 4 audit firms and audit opinion). Profitability, capital structure and accounting complexity are insignificant determinants of timeliness of financial reporting in Indonesia, though these factors have been found to be significant determinants of financial reporting in other countries. Furthermore, no evidence was found to support the association between information content of financial reports and its timeliness.

Keywords

Evi Rahmawati, Universitas Muhammadiyah Yogyakarta, Indonesia

Introduction

Timeliness of financial reporting is an important characteristic of financial information usefulness. The Timeliness of financial reports needs to be considered in order for it to be relevant. Financial reports need to be available to decision makers before the financial information loses its capacity to influence economic decisions. This study is relevant because recent regulatory actions suggest that improving timeliness of financial reporting is a priority for regulators (Doyle and Magilke, 2013; Schmidt and Wilkins, 2013). Timeliness is considered as an enhancing characteristic of ‘the relevance’ qualitative characteristic of financial reporting as stated in the Project Update between the International Accounting Standard Board and the Financial Accounting Standards Board (FASB, 2010).

The late release of financial information reduces its relevance, meaning that the information may lose its relevance if there is undue delay in it being reported. In other words, if reporting is delayed until all facts are known, it may be too late for users to make valid decisions. Timely reporting affects the information usefulness of annual report meaning that there is high information content in more useful information (Givolvy and Palmon, 1982). Givolvy and Palmon (1982) find that there is an association between information content of earnings announcements and timeliness of financial reporting in the US public companies. Ball and Brown (1968) suggest that accounting information is reflected in security prices prior to the release of the report. Apparently, other sources of information allow the market to anticipate the earnings report so that the variability of returns (amount of information) associated with earnings reports may be related to reporting lag. More specifically, longer reporting lags provide the opportunity for more of the information in the report to be supplied by other sources, either through search activity by investors, through other voluntary disclosures by firms, or through predictions of the earnings reports supplied by earnings releases of earlier reporting firms. Chambers and Penman (1984) suggest that later reports would be associated with relatively less price variability than earlier reports.

This study aims at examining the information content and the determinants of the timeliness of financial reports released by an unbalanced panel of 434 Indonesian manufacturing companies during the period 2003-2008. The main objective of this study is to test whether there is an association between the timeliness of financial reporting and information content of the financial statements and how company characteristics, such as company’ size, company profitability, company capital structure, complexity of operations, earnings quality and audit factors affect timeliness of financial reporting in an emerging market, Indonesian Stock Exchange.

The remainder of this paper is structured as follows. Section 2 reviews prior studies and develops the research hypotheses. The next section, describes the research design. Section 4 reviews the empirical results. Section 5 provides concluding remarks.

Prior Studies and Hypotheses Development

Studies of Timeliness of Financial Reporting In Developed and Emerging Markets

The focus of prior studies on the association between information content, company characteristics and audit factors and timeliness of financial reporting or audit lag, has been mainly on the developed markets in North America (Ashton et al., 1989; Bamber et al., 1993; Givoly and Palmon, 1982; Chambers and Penman, 1984; Zeghal, 1984), Europe (Frost and Pownall, 1994; Soltani, 2002), Australia (Dyer and McHugh, 1975; Davis and Whittred, 1980) and (Carslaw and Kaplan, 1991). Recently, however, the literature has begun to focus on emerging markets, for example, China by Haw et al. (2003) and Wang et al. (2008), Bangladesh by Iman et al. (2001) and Ahmed (2003) and Bahrain by Abdulla (1996). Companies in emerging capital markets tend to reveal less information and are slower to report than companies in developed markets (Errunza and Losq, 1985; Leventis and Weetman, 2004). Indonesia, as one of the emerging markets in South East Asia, has some characteristics that make its capital market an interesting case for investigation. It is one of the largest recipients of foreign investment in the region. However, it was also one of the worst affected by the 1997 financial crisis due to massive but relatively temporary capital outflows. The Indonesian economy generally seems to be volatile with respect to its relationship with the global economy and its internal political situation.

Timely reporting in emerging markets is of particular importance since information in these markets is relatively scarce and has a longer time lag (Errunza and Losq, 1985). Timely reporting enhances decision-making and reduces information asymmetry in such markets. Hence, research on the determinants of timely reporting could help regulators in emerging capital markets to formulate better policies to enhance financial reporting practices in these markets. The number of days mandated by regulatory bodies for financial statements to be released to the public varies across countries. For example, the regulatory deadline for submitting annual reports after the fiscal year end is 90 days in Australia, 60 days in the US, 120 days in China, 180 days in India and 90 days in Indonesia (Ahmed, 2003). The Indonesian Capital Market and Financial Institution Supervisory Agency (BAPEPAM-LK) plays a very important role in business reporting supply chain as public companies are obliged to submit their financial reports to the Institution by 90 days after the fiscal year end.

Hypotheses Development

Information content (the stock market reaction) of timeliness of financial reporting

For the short term signal effects of timeliness, Givoly and Palmon (1982) and Leventis and Weetman (2004) suggest that the price reaction to the disclosure of early earnings announcements is significantly more pronounced than the reaction to late announcements suggesting a decrease in the information content as the reporting lag increases. Chambers, and Penman (1984) suggest that companies that tend to release their annual reports earlier generate higher cumulative abnormal returns and those that tend to release their annual reports later generate lower ones. Kross and Schroeder (1984) indicate that the timeliness of annual reports is relative to the abnormal returns around the report release date. Companies that release their annual reports earlier generate higher cumulative abnormal returns than companies that engage in later releases.

Information content of financial information means whether the financial report conveys useful information to the stock market. One of the factors that can affect the information content of the release of information is the capital market’s expectation as to the content and timing of the release (Foster, 1986). Theoretically, there will be uncertainty as to either the content or timing of company financial information releases. The larger the extent of uncertainty, the greater is the potential for any releases of information to cause a revision in security prices. High degree of market reaction towards earnings announcements is indicated by the high degree of cumulative abnormal returns around the announcements date meaning that there is high information content of the earnings announcements. Hence, companies that release their annual reports earlier have higher information content than those that release annual reports later (Givolvy and Palmon, 1982; Chambers and Penmann, 1984). Consequently, we formulate the following hypothesis:

H1: There is an association between information content (stock market reaction) and time lag of financial reporting in Indonesia.

Determinants of Timeliness of Financial Reporting

study analysed the following determinants of timeliness; company characteristics (company size, profitability and leverage, complexity of operations and earnings quality) and audit factors (the audit firms and the audit opinion).

Company Size

There are many reasons why company size has an association with the timeliness of financial reporting. First, the larger the company, the greater will be the involvement of outside interests in its affairs (Davies and Whittered, 1980). By reducing the time lag, large companies can eliminate uncertainty in the market with respect to company performance. Secondly, larger companies are often associated with greater resources, more advanced accounting information systems and are more technologically developed as compared to smaller companies. These attributes should aid larger companies in timely reporting. It is argued that large firms are likely to have stronger internal controls; internal auditing and greater accountability, all of which should make it easier to audit a large number of transactions in a relatively shorter time. Thirdly, there are economic reasons why large companies have incentives to opt for a shorter reporting lag. One of the main reasons is that large companies are more visible to the public (Ismail and Chandler, 2003). Based on the above findings the following hypothesis is developed:

H2: There is a negative association between company size and financial reporting time lag in Indonesia.

Profitability

Profitability is expected to influence company reporting behaviour. The performance of a company has a signalling effect on the markets for corporate securities. It is reasonable to expect the management of a successful company to report its good news to the public on a timely basis. In contrast, auditors take much more time to audit failing (high risk) companies as a defence against potential future litigation (Owusu-Ansah, 2000). Empirical evidence is however mixed. Dyer and McHugh (1975) and Davies and Whittred (1980) report no association between profitability and total reporting lag in Australia. However, a negative relationship between profitability and timely reporting behaviour has been reported in a number of studies (Abdulla, 1996; Carslaw and Kaplan, 1991; Owusu-Ansah, 2000). However, Dyer and McHugh (1975) and Garsombke (1981) reported contradictory results. Givoly and Palman (1982); Haw and Wu (2000) suggest that earnings announcements containing good news might be moved forward and that bad news tends to be delayed. The phenomenon of delayed bad news can also be explained in terms of stakeholder theory (Haw and Wu 2000). The stakeholder theory suggests that in the absence of an opportunity to hide bad news because of mandatory disclosure requirements, managers have incentives to delay its release (Watts, 1992). By delaying bad news, management is giving shareholders a “silent signal” and the opportunity to divest themselves of the firm’s shares before the information reaches the market. Similarly, announcing good news early will ensure that it is not pre-empted by other sources (Ismail and Chandler, 2003; Mahajan and Chander, 2008). Therefore, the third hypothesis to be tested is:

H3: There is a negative association between company profitability and financial reporting time lag in Indonesia.

Capital Structure

Highly leveraged firms report faster than firms with less leverage. Based on agency theory, this view contends that higher monitoring costs are incurred by firms that are highly leveraged. Because highly leveraged firms have incentives to invest sub-optimally, debt holders normally include clauses in debt contracts that constrain the activities of management (Jensen and Meckling, 1976). One such clause is to require prompt disclosure on a more frequent basis so that the debt holders can reassess long-term financial performance or the position of the company (Owusu-Ansah, 2000). Another view holds that highly leveraged firms report more slowly than less leveraged firms. Supporters of this view believe that a high debt to total assets ratio increases the probability of failure (Carslaw and Kaplan 1991; Owusu-Ansah 2000), particularly, when the general economy is poor (Carslaw and Kaplan, 1991). In their studies on timeliness of annual reporting in New Zealand, Zimbabwe and Thailand, Carslaw and Kaplan (1991) and Owusu-Ansah (2000), respectively, support the view that highly levered firms report more slowly than the lowly levered firms. This study proposes that companies with high leverage take a longer time to release their financial reports compared to companies with a lower leverage. Therefore, we develop the following hypothesis for the relationship between company leverage and financial reporting lag in Indonesia. Hence, the fourth hypothesis to be tested is:

H4: There is a positive association between company leverage and financial reporting time lag in Indonesia.

Complexity of Operations

It is expected that the degree of complexity of a company's operations influences the timeliness of company reporting. The degree of complexity of operations, which depends on the number and locations of company’s operating units and diversification of its product lines and markets, is more likely to affect the time required by an auditor to complete an audit. Thus, a positive relationship between operational complexity and timeliness is expected, Ashton et al. (1987) also find a significant positive relationship between operational complexity and reporting delay. Hence, the following hypothesis is developed:

H5: There is a positive association between complexity of company operations and financial reporting time lag in Indonesia.

Earnings Quality

Chai and Tung (2002) examines whether firms releasing earnings reports later than expected engage in earnings management. Earnings management occurs when managers use judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of the company or to influence contractual outcomes that depend on reported accounting numbers (Schipper, 1989). Extensive research has identified various motives for earnings manipulation (Dechow et al., 1995; DeFond and Park, 1997; Becker et al., 1998). Previous research has documented that early earnings announcements are associated with good news and that reporting delays are associated with market’s anticipation of bad news. Givoly and Palmon (1982) find that price reactions are more pronounced for early announcements than for late announcements. Managers may be attempting to affect planned stock sales or negotiate contracts in the best possible light prior to the disclosure of unexpected bad news. Chai and Tung (2002) analyses two other managerial motives for delaying bad news. First, extra time is required to undo the bad news through accruals manipulation. Second, management might deliberately delay bad news until other industry-wide bad news is released in order to justify the potential reputational and litigation costs. Chai and Tung (2002) find that there is an association between reporting time lag and earnings management. Late reporters employ income-decreasing accruals as a means of earnings manipulation to enhance future profits and bonuses. The longer the reporting lag, the greater is the magnitude of discretionary accruals used by late reporters to store up income-increasing accruals potential for subsequent periods. Hence, the sixth hypothesis to be tested is:

H6: There is a negative association between earnings quality and financial reporting time lag in manufacturing firms in Indonesia.

Audit Firms

Consistent with prior research (Iman et al., 2001; Tai, 1994), it can be argued that larger audit firms (henceforth, international audit firms) in emerging countries complete audits more quickly because they have greater staff resources and better experience in auditing listed companies. Further, international audit firms may enjoy economies of scale in the provision of audit services and are more efficient in verifying accounts compared with smaller domestic audit firms in Indonesia. Hence, the seventh hypothesis to be tested is as follows:

H7: There is a an association between the size of the auditor (Big-Four Audit Firms or the Non Big-Four Audit Firms) and financial reporting time lag in Indonesia.

Audit Opinion

The presence of a qualified audit opinion may be expected to be associated with a longer audit delay, since auditors are likely to be reluctant to issue a qualification and may spend some time attempting to resolve the items subject to the qualification. Support for this expectation is provided by Whittred (1980) using Australian data; Carslaw and Kaplan (1991) using New Zealand data; Ashton et al. (1987), and Bamber et al. (1993) using US data. Hence, the eighth hypothesis to be tested is:

H8: There is an association between unqualified, qualified or other audit opinions and financial reporting time lag in Indonesia.

Data and Methodology

Data

Stock market (stock price) data were obtained from the Indonesian Stock Exchange database maintained by Universitas Muhammadiyah Yogyakarta, Indonesia. The data needed to calculate the determinant variables were from the audited company annual reports which are available on the Indonesia Stock Exchange website.

This study uses a stratified sample of 434 annual reports of manufacturing companies in Indonesia during the period 2003 to 2008. The sample was selected based on the following criteria:

1. Manufacturing companies must be listed on the Indonesia Stock during the period January 2003 to December 2008.

2. The annual report filing dates must be available.

3. There should not be other major events around the dates of release of annual reports.

4. The stock price data must be available during the sample period.

Methodology

Assessing the information content

Event study methodology is used to assess information content (how the market reacts to the timeliness financial reporting) which relates to the hypotheses (1). A concern regarding event study methodology is the use of an appropriate calculation model for estimating expected returns. The literature suggests that abnormal returns around an event can be calculated using several different models (Strong, 1992) which include:

1. The market model.

2. Mean-adjusted returns.

3. Market-adjusted returns.

4. Capital Asset Pricing Model.

5. The matched/control portfolio benchmark.

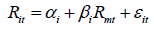

Prior studies suggest that methodology based on the market model works well in various conditions, such as clustering, small sample size, non-normality, and non-synchronous trading, both when using monthly and daily security returns (Brown and Warner, 1985). Brown and Warner (1985) also note that “the methodologies based on the ordinary least squares market model using standard parametric tests work better under a variety of conditions”. Thus, the market model depicted by equation (1) is used to calculate the abnormal returns in this study.

(1)

(1)

Where,

Rit=Natural log return1 on security i for time period t

αi=Intercept of the market model.

βi=Beta for security i

Rm=Natural log return on market portfolio (share index) for period t

εit=Independently and identically distributed error term

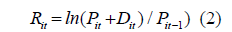

Rit=Calculated using equations (2) below:

Where,

Pit=Price of security i at time t

Dit=Dividends paid on security i during period t

Pit−1=Security price on security i for period t-1

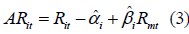

After estimating equation 1, it is used to calculate the abnormal returns (ARit) as follows:

The event date used in this study is the date on which the annual report is released to the public for the first time. In the event study methodology, the length of the event window is normally extended over more than one day. In this study the daily abnormal returns from twodays before the event day (t-2) to two days after the event day (t+2) are used. Rees (1995) states that “the five-days event window is considered short enough to reduce the potential for confounding events but wide enough to capture the effects of financial information release on prices”.

In this study betas used to compute abnormal returns are adjusted to account for the thin trading problem which normally occurs in emerging capital markets such as the Indonesian Stock Exchange. This study uses the methods suggested by Scholes and Williams (1977) and Dimson (1979) to adjust betas to account for thin trading problem.

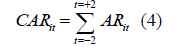

The cumulative abnormal returns for the five-day event window are then calculated from equation (4) by cumulating abnormal returns from day -2 to +2 relative to event day (day 0) (over a 5-days event window) as follows:

The CARit represents the information content of for the release of financial report by company i.

After estimating the betas according to Dimson, Scholes and William’s methods, following models are used to test the first hypothesis.

Model 1

Model 2

Where,

CARDim=Cumulative abnormal return calculated using market model with beta adjusted using Dimson (1979) method.

CARSchW=Cumulative abnormal return calculated using market model with beta adjusted using Scholes and Williams (1977) method.

Control Variables

SIZE=Company size measured by market capitalisation.

PROF=Company profitability.

CAPS=Company capital structure.

Assessing the determinants of timeliness of financial reporting

The models (3) to (6) were estimated to test the hypotheses 2, 3, 4, 5, 6, 7 & 8.

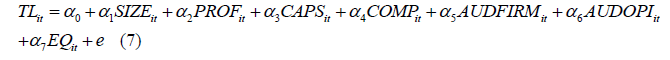

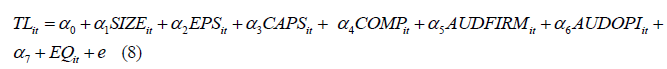

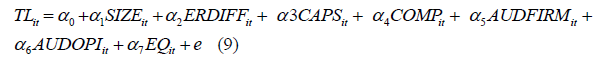

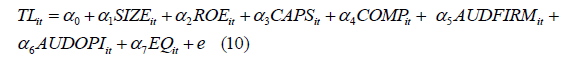

Model 3

Model 4

Model 5

Model 6

Where,

SIZE=Company size, measured by market capitalisation

PROF=Company profitability, measured by ratio of net income to total assets

EPS=Company profitability, measured by earnings per share

ERDIFF=Company profitability, measured by earnings difference

ROE=Company profitability, measured by ratio of net income to total equity

CAPS=Company capital structure, measured by ratio leverage

COMP=Complexity of business operations measured by the number of business lines or number branches

AUDFIRM=Audit firm, where big 4 audit firms equal 1 and non-big 4 audit firms equal 0

AUDOPI=Audit opinion, where unqualified audit opinion equal 1 and qualified audit opinion equal 0

EQ=Earnings quality is calculated using Dechow and Dichev (2002) accrual quality method.

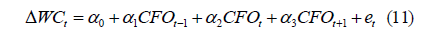

Earnings Quality (EQ) is measured using accrual quality (Dechow and Dichev,2002)2, which is calculated from the standard deviation of residuals from firm-specific regressions of changes in working capital on past, present, and future operating cash flows, equation 11 below.

Where,

ΔWCt= change in working capital accruals of firm i for period t3

CFOt-1= cash flow from operations of firm i for period t-1

CFOt= cash flow from operations of firm i for period t

CFOt+1== cash flow from operations of firm i for period t+1

The standard deviation of the residuals from equation (11) is a firm-level measure of accrual quality where higher standard deviations denote lower quality and vice versa (Dechow and Dichev, 2002).

Table 1 presents a summary of the dependent and independent variables, and the proxies used to measure them.

| Table 1 VARIABLES DEFINITIONS AND MEASURES |

|

| Variable | Proxy |

| Time lag of financial reporting (TL) | Number of days between the financial year ends to the time when annual report is published for the first time to public. |

| Information Content | |

| Cumulative abnormal return Dimson (CARDim) | Cumulative abnormal return calculated with beta adjusted for emerging market using Dimson (1979) method |

| Cumulative abnormal return Scholes & Williams (CARSchW) Company size (SIZE) | Cumulative abnormal return calculated with beta adjusted for emerging market using Scholes and Williams (1977) method Market Capitalization. |

| Profitability | |

| Company Profitability (PROF) | Return On Assets (Ratio of Net Income to Total Assets) |

| Earnings Per Share (EPS) | Company’s Earnings Per Share |

| Earnings Difference (ERDIFF) | Earnings Difference (Earningst – Earningst-1) |

| Return On Equity (ROE) | Ratio of Net Income to Total Equity |

| Capital structure (CAPS) | Company’s leverage (Total Debt to Total Assets) |

| Complexity of company operations(COMPLEX) | 1 if the number of branches/subsidiaries is more than 1; 0 otherwise |

| Earnings Quality (EQ) | Earnings Quality measured using Dechow & Dichev (2002) method |

| Audit factors | |

| Audit firm (AUDITFIRM) | 1 if the auditor is a Big Four firm; 0 otherwise |

| Audit Opinion (AUDITOPI) | 1 if audit opinion is an unqualified opinion; 0 otherwise |

Results

Descriptive Statistics and Correlation Analysis

The time lag profile of selected manufacturing companies in Indonesia during the period 2003 to 2008 is shown in Table 2. Summary statistics show that 213 companies (49%) delay their reports beyond the regulatory limit. This implies that the compliance rate in Indonesia is very low. Although 221 companies report by the due date, which is 90 days after the financial year end, a large number of companies (50%) have taken more than two months to submit their reports. Nine percent of the companies have taken more than four months to release their reports. Only 4 companies (one percent) have taken less than 2 mon to report.

| Table 2 FREQUENCY DISTRIBUTION OF REPORTING TIME LAGS FOR REPORTING PERIOD 2003 TO 2008 REPORTING TIME LAG (IN DAYS) |

||

| No. of annual reports | Percentage % | |

| 0–60 days | 4 | 1 |

| 61–90 days | 217 | 50 |

| 91–120 days | 174 | 40 |

| More than 120 days | 39 | 9 |

| Total | 434 | 100 |

Table 3 summarizes the descriptive statistics of the dependent and the independent variables (excluding dummy) used in this study. It shows that the average (mean) of the time lag was 97 days which exceeded the maximum period of three months allowed after the end of the fiscal year. It also shows that the minimum reporting time lag is 28 days and the maximum reporting time lag is 314 days.

| Table 3 DESCRIPTIVE STATISTICS FOR DEPENDENT AND INDEPENDENT VARIABLES EXCLUDING DUMMY VARIABLES |

||||||||||

| Statistic | TL | CARDim | CARSch | SIZE | PROF | EPS | ERDIFF | EREQ | CAPS | EQ |

| Mean | 97.000 | 0.156 | 0.138 | 12.419 | 0.022 | 154.890 | 7885441 | 622943.00 | 0.587 | -9.614 |

| Median | 97.400 | 0.103 | 0.098 | 12.423 | 0.024 | 15.000 | 1379000 | 103.80 | 0.500 | -4.003 |

| Maximum | 314.000 | 9.876 | 2.884 | 18.520 | 0.433 | 6958.000 | 2807184000 | 277841536.00 | 4.630 | -0.419 |

| Minimum | 28.000 | 0.000 | 0.000 | 3.229 | -1.444 | -2045.000 | -344429 | -2307421.00 | -1.040 | -39.890 |

| Std. Dev. | 24.280 | 0.432 | 0.181 | 2.527 | 0.132 | 658.660 | 344957999 | 12620922.00 | 0.587 | 12.568 |

| Observations | 434 | 434 | 434 | 434 | 434 | 434 | 434 | 434 | 434 | 434 |

The correlation coefficients between the variables (excluding dummy) are shown in Table 4. This is to ensure that the regression models used do not suffer from a serious multicollinearity problem. Tolerance and Variance Inflation Factor (VIF) statistics are also reported for each of the models estimated. The figures in Table 4 for VIF show that the models do not suffer from multicollinearity problem. The VIFs do not exceed 0.70 rule of thumb (Anderson et al., 1993).

| Table 4 CORRELATION COEFFICIENTS BETWEEN INDEPENDENT VARIABLES EXCLUDING DUMMY VARIABLES |

|||||||||||

| Variables | TL | SIZE | PROF | EPS | ERDIFF | EREQ | CAPS | EQ | |||

| TL | - | -0.2296 | -0.1392 | -0.051 | -0.0913 | -0.0693 | 0.0231 | -0.1837 | |||

| CARDim | -0.0116 | 0.0235 | -0.1069 | -0.0461 | -0.1361 | -0.0095 | 0.1289 | -0.1148 | |||

| CARSchW | -0.0029 | -0.0149 | -0.1344 | -0.0928 | -0.1237 | -0.0068 | 0.1189 | -0.1322 | |||

| SIZE | -0.2296 | - | 0.2443 | 0.1718 | 0.0374 | 0.1478 | -0.0951 | 0.0527 | |||

| PROF | -0.1392 | 0.2443 | - | 0.3152 | 0.2101 | 0.0349 | -0.2691 | 0.2842 | |||

| EPS | -0.051 | 0.1718 | 0.3152 | - | 0.0758 | -0.0119 | -0.1161 | 0.0375 | |||

| ERDIFF | -0.0913 | 0.0374 | 0.2101 | 0.0758 | - | 0.6240 | -0.1237 | 0.0291 | |||

| EREQ | -0.0693 | 0.1478 | 0.0349 | -0.0119 | 0.6240 | - | -0.0276 | 0.0011 | |||

| CAPS | 0.0231 | -0.095 | -0.2691 | -0.1161 | -0.0127 | -0.0276 | - | -0.0785 | |||

| EQ | -0.1837 | 0.0527 | 0.2842 | 0.0375 | 0.0291 | 0.0011 | -0.0785 | - | |||

Regression Results

Results of Assessing the Information Content of Timeliness of Financial Reporting

Table 5 shows the regression results (Models 1 and 2) for testing the association between the information content of financial statements and its timeliness reporting (hypothesis 1). Cumulative abnormal returns were calculated using market model with adjusted beta. The adjusted betas were calculated using Dimson (1979) and Scholes and Williams (1977) methods. This measure of market reaction was used in an emerging market condition, like Indonesian Stock Exchange. The results show that the Time Lag (TL) coefficients were negative but insignificant towards the dependent variable of cumulative abnormal return using beta adjusted Dimson. However the coefficient of TL is positive but also insignificant towards the CARSchW dependent variable. Therefore no evidence was found in relation to the association between the market reaction and the timeliness of financial reporting in Indonesia. These results are inconsistent with the findings of studies by Chamber and Penmann (1984) and Givolvy and Palmon (1982).

| Table 5 MULTIVARIATE REGRESSION RESULTS |

||||||||||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |||||||

| Variables | a | t | a | t | a | t | a | t | a | t | a | t |

| Constant | -0.05 | -0.23 | 0.07 | 1.04 | 141.99 | 15.68** | 135.82 | 15.16** | 141.28 | 15.96** | 144.8 | 13.55** |

| TL | -0.01 | -0.21 | 0.01 | 0.15 | ||||||||

| SIZE | 0.01 | 1.07 | 0.01 | 0.45 | -1.98 | -3.78** | -1.85 | -3.60** | -1.92 | 3.74** | -2.21 | -3.26** |

| PROF | -0.34 | -1.59 | -0.15 | -1.89 | -3.81 | 0.38 | ||||||

| EPS | -0.01 | -0.82 | ||||||||||

| ERDIFF | 1.45 | 0.36 | ||||||||||

| EREQTY | -0.01 | -1.05 | ||||||||||

| CAPS | 0.14 | 2.82** | 0.05 | 2.56** | -1.18 | -0.48 | -1.14 | -0.48 | -1.33 | -0.56 | 0.03 | 0.01 |

| COMP | -0.4 | -0.77 | -0.41 | -0.79 | -0.42 | -0.8 | 0.26 | 0.72 | ||||

| AUDFIRM | 4.08 | 1.60* | 4.02 | 1.57* | 4.06 | 1.60* | 3.41 | 1.25 | ||||

| AUDOPI | -24.53 | -4.04** | -19.62 | -3.23** | -24.28 | -4.07** | -25.7 | -3.65** | ||||

| EQ | -0.36 | -3.51* | -0.38 | -3.72** | -0.35 | -3.54 | -0.46 | -4.32** | ||||

| F Stat | 3.38 | F Stat | 3.33 | F Stat | 7.71 | F Stat | 6.99 | F Stat | 7.7 | F Stat | 7.49 | |

| Sig. | 0.0099 | Sig. | 0.0108 | Sig. | <.0001 | Sig. | <.0001 | Sig. | <.0001 | Sig. | <.0001 | |

| Adj. R2 | 0.0263 | Adj. R2 | 0.0257 | Adj. R2 | 0.1194 | Adj. R2 | 0.111 | Adj. R2 | 0.1191 | Adj. R2 | 0.1334 | |

** indicates significant at 1% level of significance.

* indicates significant at 5% level of significance.

Results of Assessing the Determinants of Timeliness of Financial Reporting

The regression results of the determinants of timeliness of reporting are shown in Table 5 testing the hypothesis 2-8. In the four models (Models 3-6), considered the determinants of the reporting lag period, each includes different measures of company profitability. Adjusted Rsquared values of the models range between 11.10% and 13.34%. All are significant at less than 1% significant level. The models indicate that the coefficients of company size (SIZE), audit opinion (AUDOPI) and company earnings quality (EQ) are negative and significant.

The coefficient of size is negative and significant at 1% or less, this indicates that larger companies reports more timely than smaller firms. These results are in line with findings of a large number of studies including Davis and Whittred (1980) and Ismail and Chandler (2003). Furthermore, the coefficient of the audit firm (AUDFIRM) is positive and significant at 5% or less, indicating that companies with auditor from big 4 report quicker or on time than companies with non-big 4 auditors. Such results are consistent with findings of Iman et al., (2001) and also support the empirical findings reported by Ng and Tai (1994: 2007). The model also indicates the coefficient of audit opinion (AUDOPI) is negative and significant at 1% level or less, this indicates that companies with qualified opinion will take longer time to report to public. This finding support by Ashton et al. (1987), Carslaw and Kaplan (1991) and Bamber et al. (1993) suggesting that the presence of a qualified audit opinion is associated with a longer audit delay and result in more reporting lag.

The earnings quality variable is significant at 5% or less, indicating that companies with high earnings quality report more timely than companies with low earnings quality. This result is consistent with the finding of Chai and Tung (2002). There is an association between reporting time lag and earnings management. Late reporters employ income-decreasing accruals as a means of earnings manipulation to enhance future profits and bonuses. The longer the reporting lag, the greater is the magnitude of discretionary accruals used by late reporters to store up income-increasing accruals potential for subsequent periods. Companies with more earnings management indicates low earnings quality, this leads to longer reporting time. However, the coefficients of profitability variables, company capital structure and company complexity of operations are insignificant. These indicate that there are no associations between reporting time lag and company profitability, company capital structure and company complexity of operations in manufacturing firms in Indonesia.

Summary and Conclusions

This study examined the information content and the determinants of timeliness of corporate reports of Indonesian manufacturing firms. It, particularly, attempted to study the stock market reaction of timeliness of reporting and the associations of company size, company profitability, company capital structure, complexity of operations, company earnings quality, auditor size, and audit opinion to time lag reporting period, the period between the financial year end and the date and the of first publication date. To test the study's hypotheses, this study used an unbalanced panel data of 434 firm-years observations during 2003-2008. Indonesia stock exchange is categorised as an emerging capital market, no evidence was found towards the market reaction of timeliness of reporting in Indonesia. The resources that were available to large companies and the political pressure exercised on them by different stakeholders, big firms tend to have a shorter reporting lag period, which leads to early release of annual reports to the public. Company profitability which signal good and bad news factors did not determined the reporting time lag period. As a result, this early publication of information probably did not add value to investors. Furthermore, it was found that high earnings quality associated with timelier reporting.

Audit firm, is measured in terms of Big Four and non-Big four firms, and audit opinion are found to have significant effect on this study. These results indicate that the time lag period is determined by the size of audit firm and audit opinion. Finally, this line of research can be extended to study the determinants of the timeliness of quarterly and interim corporate reports for Indonesian companies.

Endnote

1. This study used logarithm returns. Strong (1992) suggests that logarithmic returns are analytically more traceable when linking together sub-period returns to form returns over long intervals.

2. Various measures of earnings quality developed by prior studies include the predictability of future performance; earnings variability; accruals quality; the correlation between cash, accruals, and income; the abnormal accruals component; and earnings persistence (Cohen, 2003; Schipper and Vincent, 2003).

3. Following Dechow and Dichev (2002), the change in working capital accruals (ΔWCt) is ΔAR+ΔInventory+ΔOther Current Assets-ΔAP-ΔTP-ΔOther Current Liabilities, where AR is accounts receivable, AP is accounts payable, and TP is taxes payable. The change in working capital accruals can also be calculated from the equation (Richardson et al., 2005) ΔWC=WCt-WCt-1. WC=current operating assets (COA)-current operating liabilities (COL), where COA=current assets-cash and short-term investments and COL=current liabilities-debt in current liabilities.

References

- Abdulla, J.Y.A. (1996). The timeliness of Bahraini annual reports, in: T.S. Doupnik & S.B. Salter (Eds). Advances in International Accounting, 9, 73-88.

- Ahmed, K. (2003). The timeliness of corporate reporting: A comparative study of south Asia. Advances in International Accounting, 16, 17-43.

- Atiase, R.K., Bamber, L.S., & Tse, S. (1989). Timeliness of financial reporting, the firm size effect, and stock price reactions to annual earnings announcements. Contemporary Accounting Research, 5(2), 526-552.

- Anderson, D., Sweeney, D., & Williams, T. (1993). Statistics for business and economics. New York: West Publishing Company.

- Ashton, R.H., Graul, P.R., & Newton, J.D. (1989). Audit delay and the timeliness of corporate reporting. Contemporary Accounting Research, 5(2), 657-673.

- Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6(2), 159-178.

- Bamber, E.M., Bamber, L.S., & Schoderbek, M.P. (1993). Audit structure and other determinants of audit report lag: An empiri cal analysis. Auditing: A journal of practice & theory, 12(1), 1-23

- Becker, C.L., Defond, M.L., Jiambalvo, J., & Subramanyam, K.R. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15(1), 1-24.

- Bruner, R.F., Conroy, R.M., Estrada, J., Kritzman,M., & Li, W. (2002). Introduction to valuation in emerging markets. Emerging Market Review, 3(4), 310-324.

- Brown, S.J., & Warner, J.B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14(1), 3-31.

- Carslaw, C.A.P.N. & Kaplan, S.E. (1991). An examination of audit delay: further evidence from New Zealand. Accounting and Business Research, 22(85), 21-32.

- Chai, M.L., & Tung, S. (2002). The effect of earnings announcement timing on earnings management. Journal of Business Finance & Accounting, 29(9/10), 1337-1354.

- Chambers, A.E., & Penman, S.H. (1984). Timeliness of reporting and the stock price reaction to earnings announcements. Journal of Accounting Research, 22(1), 21-47.

- Cohen, D.A. (2003). Quality of financial reporting choice: Determinants and economic consequences: SSRN.

- Davies, B., & Whittred, G.P. (1980). The association between selected corporate attributes and timeliness in corporate reporting: further analysis. Abacus, 16(1), 48-60.

- Dechow, P.M., & Dichev, I.D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. Accounting Review, 77(4), 35.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1996). Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research, 13(1), 1-36.

- DeFond, M.L., & Park, C.W. (1997). Smoothing income in anticipation of future earnings. Journal of Accounting and Economics, 23(2), 115-139.

- Dimson, E. (1979). Risk measurement when shares are subject to infrequent trading. Journal of Financial Economics, 7(2), 197-226.

- Dyer, J.C., & McHugh, A.J. (1975). The timeliness of the Australian annual report. Journal of Accounting Research, 13(3), 204-219.

- Doyle, J.T., & Magilke, M.J. (2013). Decision usefulness and accelerated filing deadlines. Journal of Accounting Research, 51(3), 549-581

- Errunza, V.R., & Losq, E. (1985). The behaviour of stock prices on LDC markets. Journal of Banking and Finance, 9(4), 561-575.

- FASB (2009). Project Update IASB & FASB. Retrieved from http://www.fasb.org.

- Foster, G. (1986). Financial statement analysis (Second Edition). Prentice-Hall International.

- Frost, C.A., & Pownall, G. (1994). Accounting disclosure practices in the United States and the united kingdom. Journal of Accounting Research, 32(1), 75-102.

- Garsombke, H. P. (1981) Timeliness of corporate financial disclosure. In (Ed.) J. K. Courtis Communication via Annual Reports, AFM Exploratory Series No. 11, 204-218. Armidale, NSW: University of New England.

- Givoly, D., Hayn, C.K., & Natarajan, A. (2007). Measuring reporting conservatism. Accounting Review, 82(1), 65-106.

- Givoly, D., & Palmon, D. (1982). Timeliness of annual earnings announcements: Some empirical evidence. Accounting Review, 57(3), 486.

- Han, J.C.Y., &Wild, J.J. (1997). Timeliness of reporting and earnings information transfers. Journal of Business Finance & Accounting, 24(3/4), 527-540.

- Haw, I.M.G., Park, K., Qi, D., & Wu, W. (2003). Audit qualification and timing of earnings announcements: Evidence from China. Auditing, 22(2), 121-146.

- Iman, S., Ahmed, Z.U., & Khan, S.H. (2001) Association of audit delay and audit firms’ international links: Evidence from Bangladesh. Managerial Auditing Journal, 16(3), 129-133.

- Jaggi, B., & Tsui, J. (1999) Determinants of audit report lag: further evidence from Hong Kong. Accounting and Business Research, 30(1), 17-28.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kross, W., & Schroeder, D.A. (1984). An empirical investigation of the effect of quarterly earnings announcement timing on stock returns. Journal of Accounting Research, 22(1), 153-176.

- Ismail, K.N.I.K, & Chandler, R. (2003). The timeliness of quarterly financial reports of companies in Malaysia. SSRN eLibrary.

- La Porta, R., Lopez-de-Silanes, F., & Shleifer, A., & Vishny, R. (1998). Law and finance. Journal of Political Economy, 106(6), 1113-1155.

- Leventis, S., & Weetman, P. (2004). Timeliness of financial reporting: Applicability of disclosure theories in an emerging capital market. Accounting & Business Research, 34(1), 43-56.

- Naim, A. (1999).Value information timeliness of submission of financial statements: Empirical analysis of information regulation in Indonesia. Journal of Economics and Business Indonesia, 14(2), 85-100.

- Ng, P.P.H., & Tai, B.Y.K. (1994) An empirical examination of the determinations of audit delay in Hong Kong. British Accounting Research, 26(1), 43-59.

- Mahajan, P., & Chander, S. (2008). Determinants of timeliness of corporate disclosure of selected companies in India. The Icfai University Journal of Accounting Research, 7(4), 28-63.

- Olveira, L., Rodrigues, L., & Craig, R. (2010). Intangible assets and value relevance: Evidence from the Portugues stock exchange. The British Accounting Review, 42(4), 241-252.

- Owusu-Ansah, S. (2000) Timeliness of corporate financial reporting in emerging capital markets: Empirical evidence from the Zimbabwe Stock Exchange. Accounting and Business Research, 30(3), 241-254.

- Owusu-Ansah, S., & Leventis, S. (2006). Timeliness of corporate annual financial reporting in Greece. European Accounting Review, 15(2), 273-287.

- Rees, L.L. (1995). The information contained in reconciliations to earnings based on U.S. accounting principles by non-U.S. companies. Accounting and Business Research, 25(100), 301-310.

- Richardson, G.D. (1989). Discussion of Timeliness of financial reporting, the firm size effect, and stock price reactions to annual earnings announcements. Contemporary Accounting Research, 5(2), 553-555.

- Richardson, S.A., Sloan, R.G., Soliman, M.T., & Tuna, I. (2005). Accrual reliability, earnings persistence and stock prices. Journal of Accounting and Economics, 39(3), 437-485.

- Schmidt, J. & Wilkins, M.S. (2013). Bringing darkness to light: The influence of auditor quality and audit committee expertise on the timeliness of financial statement restatement disclosures. Auditing: A Journal of Practice and Theory, 32(1), 221-224

- Schipper, K., & Vincent, L. (2003). Earnings quality. Accounting Horizons, 17, 97-110.

- Scholes. M., & Williams. J. (1977). Estimating betas from nonsynchronous data. Journal of Financial Economics, 5(3), 309-327.

- Soltani, B. (2002). Timeliness of corporate and audit reports: Some empirical evidence in the French context. The International Journal of Accounting, 37(2), 215-246.

- Schwartz, K.B., & Soo, B.S. (1996). The association between auditor changes and reporting lags. Contemporary Accounting Research, 13(1), 353-370.

- Wang, X., Gu, J., & Chen, C. (2008). Timeliness of annual reports, management disclosure and information transparency-evidence from China. SSRN eLibrary.

- Watts, R. L. (1992). Accounting choice theory and market-based research in accounting. The British Accounting Review, 24(3), 235-267.

- Whittred, G.P. (1980). The timeliness of the Australian annual report: 1972-1977. Journal of Accounting Research, 18(2), 623-628.

- Zeghal, D. (1984). Timeliness of accounting reports and their information content on the capital market. Journal of Business Finance & Accounting, 11(3), 367-380.