Research Article: 2022 Vol: 26 Issue: 6

Information Technology Adaptation, Voluntary Disclosure, Open Innovation and Sustainable Performance: Evidence from Bank-Based Financial Institutions in Bangladesh

Salma Karim, United International University

Md. Qamruzzaman, United International University

Ishrat Jahan, United International University

Keywords

Open Innovation, Voluntary Disclosure, IT Adaptation, Sustainable Performance, Banks

Citation Information

Karim, S., Qamruzzaman, Md., & Jahan, I. (2022). Information technology adaptation, voluntary disclosure, open innovation and sustainable performance: Evidence from bank-based financial institutions in Bangladesh. Academy of Accounting and Financial Studies Journal, 26(S6), 1-14.

Abstract

The motivation of the study is to gauge the impact of information technology adaptation, voluntary disclosure, and open innovation on sustainable financial performance in bank-based financial institutions in Bangladesh for the period spinning 1990-to 2019. The study considered a sample of 30 bank-based financial institutions enlisted in the Dhaka stock exchange, and all the pertinent data were collected from publically available annual reports. To investigate the coefficients magnitude of IT adaptation, voluntary disclosure, and open innovation, the study employed cross-sectional panel regression particularly, random effects and fixed effects regression estimation. The Hausman test statistic confirmed that the fixed effects regression model is robust and efficient in output estimation and the proposed hypothesis. Study findings revealed that IT adaptation positive and statistically significant tie with all four measure of sustainable financial performance, suggesting the validation of the hypothesis that IT adaptation enhances a firm’s financial performance. Refers to voluntary disclosure impact of sustainable financial performance, the study documented positive and statistically significant linkage. It suggests that voluntary disclosure reduces information asymmetry in the market, thus boosting investors’ confidence and positively affecting stock price behavior in the capital market. Finally, the impact of open innovation on a firm’s financial performance the study disclosed mixed associations between them. The measures of Return of Assets (ROA) and EPS have exposed negative and statistically significant linkage, whereas Return of Equity and Tobin’s Q revealed positive and statistically significant bondage. In conclusion, it is established that sustainable financial performance is measured subject to measures selection, and due to inconclusive measures, the impact of target variables varies very often. However, to ensure sustainability in financial performance, it is imperative to have an appropriate strategic investment and disclosure decisions.

Introduction

Many individuals, particularly in business, are becoming increasingly concerned about sustainability. Climate change continues to impact our lives and the destiny of all other species on the planet. Sustainable firm practices are increasingly vital for firm owners, executives, and administrators. According to NASA, it is more than 95 % certain that human activity is causing the globe to warm. Human industry plays a significant role in climate change because of its dependence on the land, resources, fossil fuels, and continuous production and consumption. Making companies more sustainable begins with being aware of the problem and recognizing how critical it is to make changes – for both the business and the planet. Many individuals define company sustainability in terms of long-term organizational profitability and success, which might conflict with long-term development. Because we must consider the well-being of future generations. Sustainability stands as the means of meeting the needs of the present generation without compromising the ability of future generations to meet their own needs. The most widely accepted definition of sustainability that has emerged over time is the triple-bottom-line consideration of economic viability, social responsibility, and environmental responsibility. This triple-bottom-line definition considers the physical environment and stewardship of natural resources and the economic and social context of doing business, encompassing the business systems, models, and behaviors necessary for long-term value creation.

Information and communication technology (ICT or IT) has been improving swiftly and dramatically over the past decade, affecting the development of businesses in almost every country of the world, particularly emerging economies. The study of information technology (IT) value within organizations has flourished in recent years. However, some studies have found a significant relation between IT and firm performance; others have failed to do so. Several previous studies Aramendia Muneta & Ollo López (2013); Bayo?Moriones, et al., (2013); Mithas, et al., (2012); Luo & Bu (2016) argue that there is a positive relationship between IT/ICT and firm performance. On the other hand, studies by Pérez?López & Alegre (2012) found no direct relationship between IT competency and firm performance. Another study by Ainin, et al., (2016) found that Green IT practices and organizational performance have a reasonable correlation.

Financial disclosure is the process through which a company discloses information about its revenue, assets, and obligations, often via the use of a Financial Statement. The Financial Statement is accompanied by supporting papers that give evidence/proof of the income, assets, and liabilities mentioned in the form. Financial disclosure enhances transparency by revealing symmetrical information to shareholders and stakeholders, thus reducing the agency problem by showing the presentation of the management’s accountability and transparency in conducting a business and disclosing all relevant facts that may affect an investor’s choice or decision. It assists investors in making informed decisions and selecting stocks and bonds that may meet investors’ needs and investment portfolios. Zaman, et al., (2014) found that financial performance is positively related to Board and management structure disclosure and financial information disclosure. Hassan & Mohd-Saleh (2010) found that information disclosure and fair value information are value-relevant. This implies that fair value information and excellent disclosure quality are critical criteria for investors when making investment decisions. Musleh Alsartawi (2018) found that Online Financial Disclosure (OFD) has a favorable relationship with a firm’s performance. Bose, et al., (2017) revealed a positive relationship between financial inclusion disclosure and banking firms’ performance.

The remaining structure of the paper is as follows: section II deals with a literature survey and hypothesis development, variables definition, and methodology of the study available in Section III. Results and interpretation report in Section IV, and conclusion of the study displayed in Section V.

Literature Survey and Hypothesis Development

Information Technology Adaptation and Sustainable Performance

Strategic management scholars and practitioners have been more interested in IT's involvement in strategy development and execution and its effects on financial performance, as the area of strategic management has grown, e.g., (Sabherwal & King, 1991; Kettinger et al., 1994). Researchers in information technology (IT) has long promoted a close relationship between IT and strategy, claiming that IT impacts business strategy, that strategies have IT consequences, and that organizations must somehow combine strategic thrusts with IT capabilities (Bakos & Treacy, 1986). Aramendia Muneta & Ollo López (2013) conducted a study to examine the impacts of ICT on firms’ competitiveness and its level of innovation, productivity, and market share for the tourism industry in twenty-nine European countries for the period 2006. Study findings revealed that the employment of diverse ICTs has little impact on competition and increased productivity but positively impacts the firm’s market share in general. Furthermore, the use of ICT appears to favor companies’ innovation. Bayo?Moriones, et al., (2013) conducted a study to examine whether ICT positively impacts several dimensions of firm performance for 267 manufacturing SMEs in Spain in October and November 2004. The study suggested a positive relationship between ICT adoption and firm performance. Ainin, et al., (2016) conducted a study to investigate the factors that determine the intensity of Green IT practice adoption and their subsequent impact on the performance of firm in the context of Iran for 200 large enterprises and 77 SMEs which are involved in 13 different sectors. The consequence of the study is that Green IT practices and organizational performance have a favorable correlation.

Wang, et al., (2012) conducted a study to investigate whether IT resources and IT capabilities enhance a firm’s performance by supporting its competitive strategies and core competencies under different environmental dynamism for 296 firms in China from September 2008 to February 2009. The study found that IT resources are the most important predictor of firm success under stable environments. However, IT capabilities become the most important determinant of firm performance under dynamic environments. Mithas, et al., (2012) conducted a study to determine if IT expenditures have a positive or negative impact on profitability and how revenue growth and cost reduction are involved in IT the profitability-enhancing effects of IT for 400 global firms for the years 1998 to 2003. Study findings revealed that Revenue growth and profitability are positively affected by IT investments. Decreases in operational expenditures are less critical to profitability than IT-enabled revenue growth. Our research also shows the impact of IT expenditures on firm profitability is more significant than that of advertising, and R&D. Luo & Bu (2016) conducted a study to analyze how ICT increases the productivity of emerging economy enterprises for 6236 firms from 27 emerging economics for 2007. The study revealed that ICT enriches firm performance. ICT is a critical investment that provides adequate returns for developing economy enterprises; nevertheless, this investment–return connection is also dependent on the macro- and micro-level conditions that these enterprises face. When a focal developing nation is less economically developed, and when a focal business enters global markets or has greater quality control and assurance, ICT provides more value to productivity. Pérez?López & Alegre (2012) conducted a study to examine the influence of IT competency on knowledge management processes and the relationships among IT competency, knowledge management processes, and performance outcomes using survey data from 162 managers. First, the study suggested that IT competency is crucial in knowledge management Processes. Second, knowledge management processes are directly linked to market performance, which in turn is directly linked to financial performance. Third, there is no direct relationship between IT competency and firm performance. The relationship between IT competency and market performance is mediated by knowledge management processes.

Hypothesis: IT adaptation positively caused sustainable financial performance

Voluntary Disclosure and Sustainable Financial Performance

According to Spence's (1973) signaling theory, the essential purpose of company disclosure is to educate analysts and investors about the firm's quality and value. Verrecchia (1983) contends that since business managers are compelled to provide value-added information, corporate disclosure benefits analysts and investors in anticipating future profitability. Numerous studies demonstrate that the informativeness of voluntary disclosure reduces the cost of capital (Karamanou & Nishiotis, 2009) and increases firm value (Cheung et al., 2010). Numerous further research focuses only on voluntary corporate disclosure in annual reports. These reports are the critical source of information for businesses and are often used by stakeholders to assess the corporation's performance (Uyar & K?l?ç, 2012). Prior study on voluntary disclosure has shown that crucial corporate information exposes a firm's worth. The present paper extends previous research by evaluating whether voluntary disclosure in annual reports is associated with firm performance. Zaman, et al., (2014) conducted a study to investigate the link between transparency and disclosure (sub-categories are Board and management structure disclosure, Ownership structure disclosure, and financial information disclosure) and firm performance (sub-categories are Return on Equity and Return on Assets) for 30 banks operating in Pakistan for the period 2007-2011. Study findings demonstrated that financial performance is positively related to Board and management structure disclosure and financial information disclosure but negatively related to Ownership structure disclosure.

Hassan & Mohd-Saleh (2010) conducted a study to investigate the link between disclosure quality of financial instruments information, fair value information, and the market price of firms for 484 firms in Malaysia. The study suggested that financial instruments information disclosure and fair value information are relevant. This implies that fair value information and excellent disclosure quality are critical criteria for investors when making investment decisions.

Moreover, Musleh Alsartawi (2018) conducted a study to look into the relationship between Online Financial Disclosure (OFD) and company performance in the Gulf Cooperation Council (GCC) for all the listed companies in the GCC Bourses for 2016. The study revealed that online financial disclosure is 77% in GCC countries, and online financial disclosure (OFD) has a favorable relationship with a firm’s performance. Bose, et al., (2017) conducted a study to analyze the relationship between financial inclusion disclosure and firm performance for banks in Bangladesh from 2009 to 2014. The study revealed a positive relationship between financial inclusion disclosure and banking firms’ performance. Islam (2021) conducted a study to investigate the relationship between the Integrated Reporting Disclosure Index (IRDIN) and the firm’s operational, financial, and market growth performance in the context of Bangladesh for the period 2015 to 2018. The study revealed that IRDIN has a positive and statistically significant relationship with all three performance variables. Uyar & K?l?ç (2012) conducted a study to determine whether Turkish listed firms' voluntary disclosure practice is value-relevant to the capital market for 129 manufacturing companies listed in the Istanbul Stock Exchange (ISE) for 2010. Study findings revealed that voluntary disclosure is value-relevant, that’s meant impacts firm value. The more information firms disclose voluntarily, the more valuable they are in the perspective of investors.

Kakanda & Salim (2017) conducted a study to investigate the link between Corporate Governance (CG), risk management, and firm performance for financial service firms listed in the Nigerian Stock Exchange (NSE). The findings suggested a positive correlation between risk management and firm performance since investors prefer to invest in a company that exposes investment-related information, including the firm’s risk management practice. Charumathi & Ramesh (2020) conducted a study to examine the impact of voluntary corporate disclosures on firm value from market value for non-financial companies in the BSE 100 Index in India from 2011 to 2015. The study revealed that there is a positive relationship between voluntary disclosures and firm value, as assessed by Tobin’s Q

Hypothesis: Voluntary Disclosure increases a firm’s sustainable performance

Data and Methodology of the study

Research Design

The research design used in this study was cross-sectional. As the name implies, a cross-sectional study design is a research strategy in which researchers explore the condition of things within a group of people at one particular moment in time. A great deal of the time, the parts of the sample survey are chosen at random to conclude the population as a whole (Zhang et al., 2021). As a sample of the study, we considered the bank-based financial institutions enlisted in the financial market in Bangladesh. A total of 30 banks have been considering data collection for the period spinning 1990-to 2019. All the relevant data were collected from publically available annual reports from respective institutions.

Model Specification

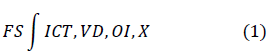

The motivation of the study is to gauge the effects of ICT adaptation, financial disclosure, and open innovation on a firm’s sustainability. The generalized empirical model is as follows:

FS stands for financial sustainability, ICT denotes ICT adaptation, OI for open innovation practices, VD for voluntary disclosure, X for a list of control variables in the equation. Please see Table 1 for more information

Firm’s Sustainability: A firm’s sustainability is defined as an organization's ability over an extended period to meet its customer's and other stakeholders' needs and expectations while maintaining an effective management organization by staff awareness through learning and applying appropriate improvements innovation. Quality management systems implementation methods must be considered in this context to guarantee that an organization's long-term performance can be maintained. Organizations that want to achieve long-term success must first determine their duties to the many stakeholders they have identified and then modify their actions, processes, and tools to meet those responsibilities.

IT Adaptation: integration of information technology into the operation requires management positive attitudes and investment. The benefits of IT adaptation can be experienced in cost reduction in case of operational activities and optimization of transaction cost with easy access to financial services and benefits to customers. Study considered the amount of IT investment as a percentage of total expenditure as a measure of IT adaptation.

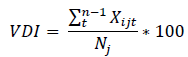

Voluntary Disclosure: A Voluntary Disclosure Index (VDI) is constructed as a surrogate measure to capture the voluntary information unveiled by firms in their annual reports by the following equation:

Nj is the maximum expected score, j refers to the company, i stands for VD items, and t refers to time. To capture VD quality, Xij assumes a score of 0–2. A list of 49 voluntary disclosure items was compiled; these are further classified into five voluntary disclosure board components. After completing voluntary disclosure items, the next stage is to score the items evaluated, which have been the subject of substantial dispute in disclosure research. Most studies used an unweighted scoring system concerned only with the presence or absence of particular elements without regard for the quality of the information given.

Open Innovation: One of the basic concepts of OI is that information may be transmitted beyond the borders of a commercial organization. Internal information spreads to the outside of the organization, whereas external knowledge enters the organization's internal knowledge. All information (internal and external) may find its way to commercialization for current or new markets under the OI paradigm, as long as it does not transcend the firm's internal borders. Chesbrough (2003) defined the 'Open Innovation' (OI) paradigm as a counterpoint to the conventional innovation model, which is inwardly oriented and self-reliant. OI capabilities affect how a company develops its business strategy and, as a result, its financial success. Assuming that all six capabilities are critical factors in a firm's decision about which OI modes to use, we assume that each OI capability is inextricably linked to the firm's financial success. However, the magnitude and direction of relationships (i.e., positive or negative) vary considerably. Specific capabilities may have a direct influence on performance improvement, while others may have an indirect or even detrimental effect on performance as a result of possible delayed consequences.

| Table 1 Measures Of Study Variables |

||

|---|---|---|

| Nature | Name | Measures |

| Dependent variable | Tobin’s Q (TBQ) | Market capitalization is divided by total assets |

| ROA | It is calculated as a ratio of operating income and total assets. | |

| ROE | Net income to total equity contribution | |

| EPS | Per-share earnings after all the obligations | |

| Independent variables | IT adaptation (IT) | IT investment as the ratio of total assets |

| Open innovation (OI) | R&D expenditure as the ratio of total expenditure | |

| Financial Disclosure (FIN_D) | Dummy variable for 1,0. | |

| Control variables | firm age | years from the date of establishment |

| Firm risk | Which is calculated as the ratio of total debts/total assets (McGuire et al., 1988). | |

| Firm size | It is measured by the logarithm of the number of employees (Waddock & Graves, 1997). | |

| Corporate Governance | CG is measured as the total number of directors on the Board. | |

Estimation Strategy

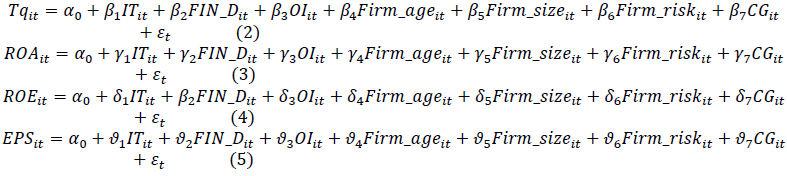

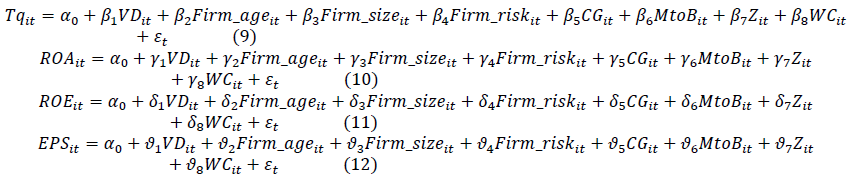

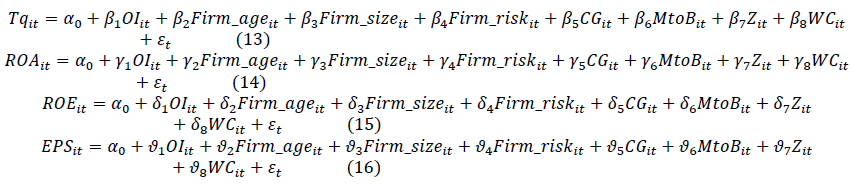

The primary objective of the study is to evaluate the role of IT adaptation, financial disclosure, and open innovation in sustainable performance in the bank-based financial institution in Bangladesh. Apart from independent variables, the study has considered a list of control variables that are empirically tested and established interconnection with sustainable performance and firms’ sustainability. The generalized empirical model for coefficients detection is as follows:

Model Estimation and Interpretation

The Impact of Technological Adaptation and Sustainable Financial Performance

This section deals with the hypothesis -1 investigation that technological adaptation is caused by increasing sustainable financial performance. The results of recent knowledge management research suggest that knowledge processes may act as a mediating factor in the relationship between IT expertise and corporate success. IT researchers have discovered that information technology aids in the facilitation of knowledge management operations. A growing body of evidence also implies that knowledge management is associated with improved corporate performance. These two ideas, taken together, show that information technology expertise may influence company performance via the mediation of knowledge management. The present study has implemented OLS-based regression such as ordinary least square, Random effects, and fixed effects for exploring the effects of Technological adaptation on sustainable financial performance by implementing the following equation under random effects and fixed effects estimation.

The results of regression analysis are displayed in Table 2. According to Hausman test statistics, the fixed-effect model has revealed an efficient estimator in explaining the empirical nexus. Refers to technological adaptation and sustainable performance, according to the coefficient of information technology adaptation, the study documented positive and statistically significant tie with financial performance in model 1 assessment (a coefficient of 0.296), in the model 2 with ROE (a coefficient of 0.325), in the model 3 with ROE (a coefficient of 0.219) and model 4 with EPS (a coefficient of 0.643). Study findings suggest that investment in technological advancement boosts factors in accelerating financial growth, our findings in line with existing literature such as (Parsons, 1983; Holden & El-Bannany, 2004; Lin et al., 2012). More precisely, a 10% further growth in IT adaptation can accelerate financial performance by 21.9% to 64.3%. Brynjolfsson & Hitt (2000) indicate that Information Technology capital contributes an 81% marginal increase in output, whereas non-Information Technology capital contributes 6%. In another study, Saloner & Shepard (1995) revealed two positive outcomes. Firstly, Information technology brings down the banks' operational costs (the cost advantage). For instance, internet technology facilitates and speeds up banks' procedures to accomplish standardized and low value-added transactions. The second outcome showed that Information Technology promotes transactions between customers within the same network. Also, the study showed that the interest of network effect is significant in utilizing Automated Teller Machines (ATMs). Milne (2006) supports the authors' view above when he maintained that IT modernization had set the stage for extraordinary improvement in banking procedures worldwide. Dandago, et al., (2012) reveal that even though Information and Communication Technologies have been essential dynamic factors relating to all efforts, they cannot improve banks’ earnings in terms of return on assets. However, there are many literatures approving the positive impacts of Information and communication Technology expenses on business value (Bresnahan et al., 2002; Muneeb et al., 2021; Meng et al., 2021).

| Table 2 Model Estimation with, Random Effect (RE) and Fixed Effects (FE) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Tobin’s Q | ROA | ROE | EPS | |||||

| RE | FE | RE | FE | RE | FE | RE | FE | |

| IT | 0.492 | 0.296 | 0.509 | 0.219 | 0.233 | 0.643 | 0.019 | 0.131 |

| -0.0411 | -0.027 | -0.0756 | -0.0201 | -0.0403 | -0.0578 | -0.0021 | -0.0122 | |

| 11.949 | 10.932 | 6.728 | 10.874 | 5.781 | 11.118 | 8.915 | 10.65 | |

| Frim_age | -0.226 | 0.649 | 0.08 | 0.133 | 0.299 | 0.247 | 0.043 | 0.584 |

| -0.0377 | -0.0989 | -0.0083 | -0.0325 | -0.0661 | -0.0212 | -0.01 | -0.0544 | |

| -5.99 | 6.557 | 9.623 | 4.087 | 4.522 | 11.597 | 4.26 | 10.716 | |

| Firm_size | 0.361 | 0.724 | 0.745 | 0.659 | 0.274 | 0.155 | 0.41 | 0.464 |

| -0.0471 | -0.0839 | -0.0625 | -0.0544 | -0.031 | -0.0233 | -0.0637 | -0.0953 | |

| 7.661 | 8.621 | 11.907 | 12.109 | 8.824 | 6.636 | 6.436 | 4.866 | |

| Leverage | 0.113 | -0.246 | 0.687 | 0.742 | -0.177 | 0.716 | 0.653 | 0.323 |

| -0.0128 | -0.0443 | -0.1695 | -0.0678 | -0.0155 | -0.1607 | -0.0543 | -0.0395 | |

| 8.824 | -5.542 | 4.053 | 10.937 | -11.375 | 4.455 | 12.016 | 8.164 | |

| CG | 0.329 | 0.388 | 0.557 | -0.036 | 0.207 | -0.177 | 0.661 | -0.218 |

| -0.0294 | -0.076 | -0.0463 | -0.0042 | -0.0165 | -0.0174 | -0.0629 | -0.0339 | |

| 11.186 | 5.101 | 12.022 | -8.431 | 12.482 | -10.165 | 10.508 | -6.428 | |

| WC | 0(0) | -0.047 | 0.099 | 0.486 | 0.566 | 0.55 | 0.291 | 0.399 |

| 5.761 | -0.005 | -0.0168 | -0.0438 | -0.1152 | -0.0528 | -0.0415 | -0.097 | |

| -9.352 | 5.873 | 11.072 | 4.91 | 10.402 | 7.011 | 4.112 | ||

| Market-book ratio | 0.339 | 0.729 | 0.154 | -0.223 | -0.081 | 0.421 | 0.043 | 0.338 |

| -0.0346 | -0.0618 | -0.025 | -0.0486 | -0.0107 | -0.0335 | -0.0038 | -0.0617 | |

| 9.786 | 11.789 | 6.151 | -4.582 | -7.568 | 12.559 | 11.034 | 5.473 | |

| Z-Score | 0.057 | -0.111 | 0.429 | 0.532 | 0.701 | 0.644 | 0.183 | 0.378 |

| -0.0136 | -0.0172 | -0.081 | -0.0439 | -0.0676 | -0.1086 | -0.0244 | -0.0344 | |

| 4.162 | -6.445 | 5.293 | 12.091 | 10.367 | 5.926 | 7.486 | 10.968 | |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| F-statistics | 500.1 | 430.75 | 480.99 | 377.05 | 445.86 | 492.73 | 314.95 | 392.32 |

| R-square | 0.811 | 0.6125 | 0.7441 | 0.5622 | 0.7887 | 0.7412 | 0.5922 | 0.6945 |

| Hausman P-value | 0.6214 | 0.8332 | 0.4591 | 0.7305 | ||||

The Impact of Voluntary Disclosure and Sustainable Financial Performance

One of the fastest-growing areas of accounting research has been the study of voluntary disclosure in annual reports and other informational media. In this case, multiple things were critical. Stakeholders' demands for more openness, accountability, and corporate governance procedures are all factors to consider. Researchers have looked at how many nations have a high degree of corporate disclosure that is voluntarily disclosed and found evidence of business characteristics that influence this amount of disclosure. Based on signaling theory, much previous research has shown that voluntary disclosure influences business value. Comprehensive disclosure indicates improved governance processes and fewer agency conflicts, resulting in increased corporate value (Chung et al., 2015). Cormier, et al., (2011) argue that intellectual capital disclosure influences market perceptions of corporate value. According to Gordon, et al., (2010), voluntary disclosures in the annual report transmit signals to the market, which are intended to boost a firm's net present value and, as a result, its stock market value. Brüggen, et al., (2009) stress the relevance of intellectual capital disclosure for correct financial statement analysis and, as a result, business value. In this section, the study assesses the role of voluntary disclosure on sustainable performance in bank-based financial institutions by executing the following equation 9-12 and resells displayed in Table 3.

The nexus between voluntary disclosure and sustainable financial performance revealed a mixed association. Precisely, a positive and statistically significant association in the model 1 with T-Q (a coefficient of 0.218), in the model 3 with ROA (a coefficient of 0.483), and model 4 with EPS (a coefficient of 0.184). Our study findings align with existing literature such as Quayes & Hasan (2014); QAMRUZZAMAN, et al., (2021); Saha & Kabra. The study of Barako (2007) advocated for more financial disclosure by the management of prosperous enterprises to the market to increase the value of their company since this influences their remuneration and the worth of their human capital in a competitive labor market. As a result, it is envisaged that there would be a good association between financial disclosure and financial performance.

Furthermore, the negative and statistically significant linkage documented in the model 2 with ROE (a coefficient of -0.249) is supported by Matuszak & Ró?a?ska (2017). In the study of Barako, et al., (2006) emphasizes that voluntary disclosure is based on the management's free will and judgment to disclose information, whether financial or non-financial, in addition to and above the obligations of the laws and regulations. Management may make use of this information for a variety of different objectives.

| Table 3 Model Estimation with, Random Effect (RE) and Fixed Effects (FE) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Tobin’s Q | ROA | ROE | EPS | |||||

| RE | FE | RE | FE | RE | FE | RE | FE | |

| VD | 0.492 | 0.296 | 0.748 | 0.352 | 0.509 | 0.219 | 0.233 | 0.643 |

| -0.0411 | -0.027 | -0.1006 | -0.0335 | -0.0756 | -0.0201 | -0.0403 | -0.0578 | |

| 11.949 | 10.932 | 7.434 | 10.499 | 6.728 | 10.874 | 5.781 | 11.118 | |

| Frim_age | -0.043 | -0.23 | -0.132 | -0.048 | 0.145 | 0.303 | 0.301 | 0.236 |

| -0.0039 | -0.0192 | -0.0105 | -0.0049 | -0.0334 | -0.0256 | -0.0291 | -0.0346 | |

| -10.776 | -11.919 | -12.483 | -9.632 | 4.335 | 11.832 | 10.293 | 6.807 | |

| Firm_size | 0.201 | -0.183 | 0.43 | 0.409 | -0.115 | -0.146 | 0.165 | 0.439 |

| -0.0232 | -0.0209 | -0.0374 | -0.0652 | -0.0088 | -0.0114 | -0.0303 | -0.045 | |

| 8.634 | -8.722 | 11.497 | 6.27 | -12.989 | -12.712 | 5.443 | 9.746 | |

| Leverage | 0.68 | 0.054 | 0.195 | 0.397 | 0.098 | 0.121 | 0.643 | -0.162 |

| -0.0716 | -0.005 | -0.0209 | -0.0622 | -0.0082 | -0.0213 | -0.0726 | -0.0221 | |

| 9.492 | 10.662 | 9.292 | 6.378 | 11.832 | 5.625 | 8.847 | -7.301 | |

| CG | 0.123 | 0.09 | -0.103 | -0.181 | 0.059 | 0.144 | 0.165 | -0.094 |

| (0.0234) | -0.0169 | -0.0118 | -0.0325 | -0.0047 | -0.017 | -0.0218 | -0.011 | |

| 5.238 | 5.307 | -8.69 | -5.559 | 12.489 | 8.469 | 7.563 | -8.532 | |

| WC | 0.251 | 0.305 | -0.018 | 0.271 | 0.125 | -0.161 | 0.499 | 0.704 |

| -0.02 | -0.0334 | -0.0017 | -0.0448 | -0.0187 | -0.0323 | -0.0927 | -0.105 | |

| 12.535 | 9.128 | -10.395 | 6.047 | 6.654 | -4.953 | 5.379 | 6.704 | |

| Market-book ratio | -0.124 | 0.167 | -0.191 | -0.083 | 0.464 | -0.198 | 0.675 | 0.025 |

| -0.0142 | -0.029 | -0.0368 | -0.0065 | -0.041 | -0.0282 | -0.1355 | -0.0028 | |

| -8.708 | 5.758 | -5.186 | -12.625 | 11.305 | -7.007 | 4.978 | 8.686 | |

| Z-Score | -0.078 | -0.228 | -0.248 | 0.379 | 0.125 | 0.195 | 0.188 | 0.011 |

| -0.0077 | -0.0275 | -0.0292 | -0.0317 | -0.0262 | -0.034 | -0.0385 | -0.0008 | |

| -10.087 | -8.265 | -8.493 | 11.934 | 4.762 | 5.733 | 4.881 | 11.269 | |

| Year Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| F-statistics | 436.81 | 413.77 | 371.88 | 332.99 | 474.61 | 415.09 | 430.11 | 290.6 |

| R-squared | 0.6411 | 0.8474 | 0.8102 | 0.7122 | 0.7514 | 0.8521 | 0.6533 | 0.6241 |

| H-P value | 0.5525 | 0.2741 | 0.4622 | 0.3412 | ||||

The Impact of Open Innovation and Sustainable Financial Performance

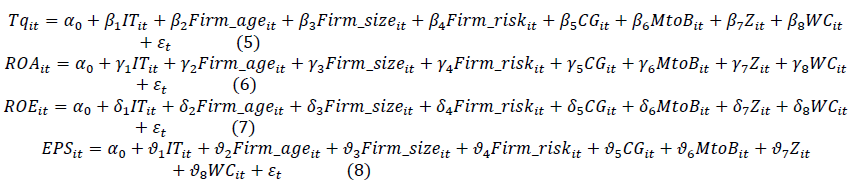

Open Innovation (OI), a concept coined by Chesbrough (2003) in his book, outlines how businesses have moved away from so-called "closed innovation" procedures and toward a more open approach to innovation. Scholarly interest in the link between OI and company performance has risen in recent years (Gassmann et al., 2010; Mazzola et al., 2016; Spithoven et al., 2013). Firms will choose the most appropriate OI mode based on their resources (capacity). Firms are not only unclear of how OI capabilities affect their business performance, but they are also unsure of what capacities should be supplemented further in order to deal with fast-changing environments since studies have not adequately studied the capacities required for success in OI. Firms in rapidly changing markets must develop "dynamic capabilities" to maintain their competitive advantages (Teece, 1986). However, a lack of understanding of OI capacities prevents firms from assessing their current state and developing the necessary capacities with their available business resources. The following section investigates the third hypothesis that open innovation practices caused the firm’s sustainable financial performance by executing the following equation 9-12 with random effects and fixed effects.

The results above the stated model are displayed in Table 4. Considering the test statistics of the Hausman test associate p-value, it is affirmative to see that the fixed effects model is robust and efficient in explaining the effect of open innovation practices and sustainable firm’s performance. The study has documented a positive and statistically significant connection between open innovation and sustainable performance for financial institutions in Bangladesh. It suggests that open innovation practices' positive effects can boost financial performance through customer integration and competitive advantages. More precisely, a 10% development in open innovation can augment sustainable performance by 1.55% in Tobin's Q measurement, by 0.39% in terms of ROA.

On the other hand, the adverse linkage has been revealed with ROE (a coefficient of -0.083) and EPS (a coefficient of -0.245), respectively. The inconclusive effects of open innovation on sustainable performance has put a dilemma for strategic decision because management has to be more assertive in making any decision regarding the effective implementation of open innovation activities. Our study findings align with existing literature such as MEHTA, et al., (2021); Mazzola, et al., (2016). Firms will choose the most appropriate OI method following their available resources, i.e., capacity. Because few studies have examined the capacities necessary for success in OI, firms are unaware of the impact of OI capacities on their business performance. However, they are also unaware of what capacities should be supplemented further to cope with rapidly changing environments. According to Teece (1986), firms operating in rapidly changing markets must adapt to new environments by developing "dynamic capabilities" to maintain competitive advantages. However, lack of knowledge about OI capacities prevents firms from determining their current state and developing the necessary capacities with their available business resources.

| Table 4 Model Estimation with, Random Effect (RE) and Fixed Effects (FE) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Tobin’s Q | ROA | ROE | EPS | |||||

| RE | FE | RE | FE | RE | FE | RE | FE | |

| OI | 0.723 | 0.155 | -0.207 | -0.084 | 0.033 | 0.038 | 0.187 | -0.245 |

| -0.0825 | -0.0154 | -0.0375 | -0.011 | -0.0048 | -0.0033 | -0.0257 | -0.0198 | |

| 8.762 | 10.023 | -5.517 | -8.397 | 6.856} | 11.257 | 7.25 | -12.345 | |

| Frim_age | 0.494 | 0.117 | 0.379 | 0.125 | 0.417 | 0.112 | -0.093 | -0.189 |

| -0.0429 | -0.0092 | -0.0539 | -0.025 | -0.0424 | -0.0161 | -0.0175 | -0.0175 | |

| 11.495 | 12.681 | 7.031 | 4.993 | 9.833 | 6.934 | -5.292 | -10.767 | |

| Firm_size | -0.151 | 0.599 | 0.161 | 0.685 | 0.207 | 0.469 | 0.116 | -0.17 |

| -0.0325 | -0.0595 | -0.0189 | -0.0584 | -0.0201 | -0.0766 | -0.0149 | -0.0299 | |

| -4.641 | 10.063 | 8.48 | 11.715 | 10.274 | 6.117 | 7.755 | -5.684 | |

| Leverage | 0.635 | 0.081 | 0.471 | 0.568 | -0.03 | 0.398 | 0.207 | 0.159 |

| -0.0762 | -0.0065 | -0.0686 | -0.1139 | -0.0032 | -0.0385 | -0.0313 | -0.0133 | |

| 8.33 | 12.349 | 6.864 | 4.983 | -9.222 | 10.331 | 6.593 | 11.923 | |

| CG | -0.213 | 0.418 | 0.537 | 0.746 | 0.442 | 0.656 | 0.559 | 0.124 |

| -0.0239 | -0.0503 | -0.0861 | -0.1311 | -0.0839 | -0.0863 | -0.0482 | -0.01 | |

| -8.898 | 8.306 | 6.233 | 5.688 | 5.264 | 7.595 | 11.574 | 12.335 | |

| WC | -0.104 | 0.682 | 0.516 | 0.73 | 0.252 | 0.184 | 0.615 | 0.076 |

| -0.0256 | -0.0627 | -0.0449 | -0.0693 | -0.02 | -0.0418 | -0.0944 | -0.0123 | |

| -4.056 | 10.868 | 11.473 | 10.528 | 12.558 | 4.401 | 6.513 | 6.136 | |

| Market-book ratio | 0.206 | 0.748 | 0.555 | 0.25 | 0.714 | 0.077 | 0.387 | -0.153 |

| -0.0192 | -0.136 | -0.0474 | -0.0206 | -0.1016 | -0.0157 | -0.0902 | -0.0118 | |

| 10.682 | 5.496 | 11.685 | 12.102 | 7.026 | 4.883 | 4.29 | -12.868 | |

| Z-Score | -0.188 | 0.099 | -0.202 | 0.253 | 0.252 | -0.102 | -0.127 | 0.564 |

| -0.0159 | -0.0114 | -0.0161 | -0.0214 | -0.02 | -0.0212 | -0.0211 | -0.136 | |

| -11.803 | 8.679 | -12.502 | 11.816 | 12.564 | -4.797 | -6.011 | 4.145 | |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| F-statistics | 316.51 | 471.86 | 408.59 | 473.9 | 500 | 416.41 | 533.21 | 458.98 |

| R-square | 0.8512 | 0.8321 | 0.5511 | 0.682 | 0.8454 | 0.5574 | 0.6984 | 0.6554 |

| Hausman p-value | 0.4831 | 0.7412 | 0.5754 | 0.4221 | ||||

Conclusion

A sustainable performance, especially for financial institutions, paly a critical role in ensuring sustainable financial development in the economy. According to the present literature, many studies have been initiated to explore the critical determinants in achieving progressive performance in the organization. The motivation of this study is to assess the role of technological adaptation, voluntary disclosure, and open innovation in the firm’s sustainable performance by taking a sample of 30 bank-based financial institutions enlisted in the Dhaka stock exchange from 1990-to 2019. The study employed regression analysis with random effects and fixed effects for testing the proposed hypothesis. The summary findings are as follows:

Hypothesis -1: Technological adaptation positively caused performance sustainability

Refers to regression output for model 1-4 , the study has documented a positive and statistically significant link between technological adaptation and sustainable performance. Findings are suggestion that investment in advancing information technology by the financial institutions has augmented the existing prospects in ensuring continuation and stability in enjoying the financial performance. Furthermore, IT adaptation has produced competitive advantages for the firms through easy access to financial services, reduction of transaction time and cost, and most importantly, convenience to reach without turbulence which is utterly impossible with the conventional system.

Hypothesis – 2: Voluntary disclosure increase financial performance of financial institutions

Study findings revealed a positive and statistically significant link between voluntary disclosure and financial performance. Quality of information and information availability has positively impacted investors' minds and company image. Inadequate and challenging receive information discourages investors, especially in the financial markets, and adversely affects stock price behavior. From the outsider's perspective, it is essential to maintain transparency and availability of all sorts of financial information so that the boosting nature of information can positively influence firms' overall performance. In the capital market, opacity in financial reporting has contributed to information asymmetry. The failure of firms like Enron due to a lack of proper disclosures and governance difficulties sparked a discussion about the role of regulators and legislators, leading to stricter rules like the Sarbanes Oxley Act of 2002. Companies' inadequate financial disclosures may result in market price dispersion due to a lack of crucial information. In the capital market, information asymmetry between enterprises and investors might lead to adverse selection. Companies employ tools like financial reporting to communicate information to reduce information asymmetry. Positive news about a firm tends to raise the security price and motivate the executives.

Hypothesis – 3: Open innovation increase financial performance of financial institutions

Study findings revealed mixed association that is both positive and negative linkage between open innovation and financial performance. It is mentioned here that the mixed effects of voluntary disclosure are documented due to the selection of different measures for sustainable financial performance. By providing access to new markets, reducing access time to current markets, and improving sales volume, open innovation may help businesses expand their market share. A company would be able to exploit its current expertise and create new items in order to attract more consumers. Customers may even engage in the innovation process early, and such customer involvement would have a market-advertising impact. Consequently, the volume of sales and asset turnover of a company may grow. The adverse effects of open innovation on firms’ performance supported by the study of Noh (2015).

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Funding

The study received a research grant from The Institute of Advanced Research (IAR), United International University (Grant Reference: UIU/IAR/01/2021/BE/08)

References

Ainin, S., Naqshbandi, M.M., & Dezdar, S. (2016). Impact of adoption of Green IT practices on organizational performance.Quality & Quantity, 50, 1929-1948.

Crossref, GoogleScholar, Indexed at

Aramendia Muneta, M.E., & Ollo Lopez, A. (2013). ICT Impact on tourism industry. International Journal of Management Cases; 15(2), 87-98.

Bakos, J.Y., & Treacy, M.E. (1986). Information technology and corporate strategy: A research perspective. MIS quarterly, 10, 107-119.

Crossref, GoogleScholar, Indexed at

Barako, D.G. (2007) Determinants of voluntary disclosures in Kenyan companies annual reports. African Journal of Business Management,

Barako, D.G., Hancock, P., & Izan, H. (2006), Factors influencing voluntary corporate disclosure by Kenyan companies. Corporate Governance: An International Review,14, 107-125.

BayoMoriones, A., Billon, M., & Lera Lopez, F. (2013). Perceived performance effects of ICT in manufacturing SMEs. Industrial Management & Data Systems, 113, 117-135.

Crossref, GoogleScholar, Indexed at

Bose, S., Saha, A., & Khan, H.Z. (2017). Non-financial disclosure and market-based firm performance: The initiation of financial inclusion. Journal of Contemporary Accounting & Economics, 13, 263-281.

Bresnahan, T.F., Brynjolfsson, E., & Hitt, L.M. (2002). Information technology, workplace organization, and the demand for skilled labor: Firm-level evidence. The Quarterly Journal of Economics, 117, 339-376.

Bruggen, A., Vergauwen, P., & Dao, M. (2009). Determinants of intellectual capital disclosure: Evidence from Australia. Management Decision, 47, 233-245.

Crossref, GoogleScholar, Indexed at

Brynjolfsson, E., & Hitt, L.M. (2000). Beyond computation: Information technology, organizational transformation and business performance. Journal of Economic perspectives, 14, 23-48.

Crosssref, GoogleScholar, Indexed at

Charumathi, B., & Ramesh, L. (2020). Impact of voluntary disclosure on valuation of firms: Evidence from Indian companies. Vision 24: 194-203.

Crossref, GoogleScholar, Indexed at

Chesbrough, H.W. (2003) Open innovation: The new imperative for creating and profiting from technology. Harvard Business Press.

Cheung, Y-L., Jiang, P., & Tan, W. (2010). A transparency disclosure index measuring disclosures: Chinese listed companies. Journal of Accounting and Public Policy, 29, 259-280.

Crossref, GoogleScholar, Indexed at

Chung, H., Judge, W.Q., & Li, Y-H. (2015). Voluntary disclosure, excess executive compensation, and firm value. Journal of Corporate finance, 32, 64-90.

Crossref, GoogleScholar, Indexed at

Cormier, D., Ledoux, M.J., & Magnan, M. (2011). The informational contribution of social and environmental disclosures for investors. Management Decision,49, 1276-1304.

Dandago, K.I., Farouk, B.K.U., & USMAN, B.K. (2012). Impact of investment in information technology on the return on assets of selected banks in Nigeria. International Journal of Arts and Commerce, 1, 235-244.

Gassmann, O., Enkel, E., & Chesbrough, H. (2010). The future of open innovation. R&d Management, 40, 213-221.

Hassan, M.S., & Mohd-Saleh, N. (2010). The value relevance of financial instruments disclosure in Malaysian firms listed in the main board of Bursa Malaysia. International Journal of Economics and Management,4, 243-270.

Holden, K., & El-Bannany, M. (2004). Investment in information technology systems and other determinants of bank profitability in the UK. Applied Financial Economics, 14, 361-365.

Islam, M.S. (2021). Investigating the relationship between integrated reporting and firm performance in a voluntary disclosure regime: Insights from Bangladesh. Asian Journal of Accounting Research,6, 228-245.

Kakanda, M.M., & Salim, B. (2017). Corporate governance, risk management disclosure, and firm performance: A theoretical and empirical review perspective. Asian Economic and Financial Review,7, 836.

Crossref, GoogleScholar, Indexed at

Karamanou, I., & Nishiotis, G.P. (2009). Disclosure and the cost of capital: Evidence from the market's reaction to firm voluntary adoption of IAS. Journal of Business Finance & Accounting, 36, 793-821.

Kettinger, W.J., Grover, V., & Guha, S. (1994) Strategic information systems revisited: A study in sustainability and performance. MIS quarterly,18, 31-58.

Crossref, GoogleScholar, Indexed at

Lin, H-J., Wen, M-M., & Lin, W.T. (2012). The relationships between information technology, e-commerce, and e-finance in the financial institutions: Evidence from the insurance industry. Asian Conference on Intelligent Information and Database Systems. Springer, 194-206.

Luo, Y., & Bu J. (2016). How valuable is information and communication technology? A study of emerging economy enterprises. Journal of World Business, 51, 200-211.

Matuszak, L., & Rozanska, E. (2017). An examination of the relationship between CSR disclosure and financial performance: The case of Polish banks. Accounting and Management Information Systems, 16, 522-533.

Crossref, GoogleScholar, Indexed at

Mazzola, E., Bruccoleri, M., & Perrone, G. (2016). Open innovation and firms performance: State of the art and empirical evidences from the bio-pharmaceutical industry. International Journal of Technology Management, 70, 109-134.

Crossref, GoogleScholar, Indexed at

Mehta, A.M., Ali, A., & Saleem, H. (2021). The effect of technology and open innovation on women-owned small and medium enterprises in Pakistan. The Journal of Asian Finance, Economics and Business, 8, 411-422.

Meng, L., Qamruzzaman, M., & Adow, A.H.E. (2021). Technological adaption and open innovation in SMEs: An strategic assessment for women-owned SMEs sustainability in Bangladesh. Sustainability, 13, 2942.

Crossref, GoogleScholar, Indexed at

Milne, A. (2006). What is in it for us? Network effects and bank payment innovation. Journal of Banking & Finance, 30, 1613-1630.

Crossref, GoogleScholar, Indexed at

Mithas, S., Tafti, A., & Bardhan, I. (2012). Information technology and firm profitability: Mechanisms and empirical evidence. Mis Quarterly, 205-224.

Muneeb, M.A., Ali, A., & Hina, S. (2021). The effect of technology and open innovation on women-owned small and medium enterprises in Pakistan. The Journal of Asian Finance, Economics and Business, 8, 411-422.

Musleh, A. (2018). Online financial disclosure and firms’ performance. World Journal of Entrepreneurship, Management and Sustainable Development, 14, 178-190.

Crossref, GoogleScholar, Indexed at

Noh, Y. (2015). Financial effects of open innovation in the manufacturing industry. Management Decision, 53, 1527-1544.

Parsons, G.L. (1983). Information technology: A new competitive weapon. Sloan Management Review (pre-1986), 25, 3.

Perez Lopez, S., & Alegre, J. (2012). Information technology competency, knowledge processes and firm performance. Industrial Management & Data Systems, 112, 644-662.

Qamruzzaman, M., Jahan, I., & Karim, S. (2021). The impact of voluntary disclosure on firm's value: Evidence from manufacturing firms in Bangladesh. The Journal of Asian Finance, Economics and Business, 8, 671-685.

Quayes, S., & Hasan, T. (2014). Financial disclosure and performance of microfinance institutions. Journal of Accounting & Organizational Change, 10, 314-337.

Crossref, GoogleScholar, Indexed at

Sabherwal, R., & King, W.R. (1991). Towards a theory of strategic use of information resources: An inductive approach. Information & Management, 20, 191-212.

Saha, R., & Kabra, K.C. (n.d.). Is voluntary disclosure value relevant? Evidence from top listed firms in India. Vision 0: 0972262920986293.

Saloner, G., & Shepard, A. (1995). Adoption of technologies with network effects: An empirical examination of the adoption of automated teller machines. 26 RAND J. Econ.

Spithoven, A., Vanhaverbeke, W., & Roijakkers, N. (2013). Open innovation practices in SMEs and large enterprises. Small Business Economics, 41, 537-562.

Teece, D.J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. The Transfer and Licensing of Know-How and Intellectual Property: Understanding the Multinational Enterprise in the Modern World, 15, 67-88.

Crossref, GoogleScholar, Indexed at

Uyar, A., & Kilic, M. (2012). Value relevance of voluntary disclosure: Evidence from Turkish firms. Journal of Intellectual Capital, 13, 363-376.

Crossref, GoogleScholar, Indexed at

Verrecchia, R.E. (1983). Discretionary disclosure. Journal of accounting and economics, 5, 179-194.

Wang, N., Liang, H., & Zhong, W. (2012). Resource structuring or capability building? An empirical study of the business value of information technology. Journal of Management Information Systems, 29, 325-367.

Zaman, R., Arslan, M., & Siddiqui, M.A. (2014). Corporate governance and firm performance: The role of transparency & disclosure in banking sector of Pakistan. International Letters of Social and Humanistic Sciences, 43, 152-166.

Zhang, Y., Qamruzzaman, M., & Karim, S. (2021) Nexus between economic policy uncertainty and renewable energy consumption in BRIC nations: The mediating role of foreign direct investment and financial development. Energies, 14, 4687.

Received: 06-Apr-2022, Manuscript No. aafsj-22-11539; Editor assigned: 09-Apr-2022; PreQC No. aafsj-22-11539(PQ); Reviewed: 24-Apr-2022, QC No. aafsj-22-11539; Revised: 30-Apr-2022, Manuscript No. aafsj-22-11539(R); Published: 06-May-2022