Research Article: 2021 Vol: 25 Issue: 5S

Information Technology to Encourage Voluntary Complience Taxation of MSMEs in Central Java Indonesia

Kiswanto, Universitas Negeri Semarang

Atta Putra Harjanto, Universitas Negeri Semarang

Ain Hajawiyah, Universitas Negeri Semarang

Uswatun Khasanah, Universitas Negeri Semarang

Nuke Monika Kristi, Universitas Negeri Semarang

Citation Information: Kiswanto, Harjanto, A.P., Hajawiyah, A., Khasanah, U., & Kristi, N.M. (2021). Information technology to encourage voluntary complience taxation of msmes in central java indonesia. Academy of Accounting and Financial Studies Journal, 25(S5), 1-11.

Abstract

The government continues to strive to increase state revenues sourced from taxes. One of the efforts made is by issuing PP. 23 of 2018 concerning Income Tax obtained from certain activities (MSMEs). With the issuance of this Government Regulation, it is hoped that it will voluntarily increase the awareness of Micro, Small, and Medium Enterprises (MSMEs) taxpayers to fulfill their tax obligations, including paying taxes. In addition, other efforts that can encourage voluntary compliance of taxpayers are the development of information technology. Information technology here means using an accounting system that can be developed periodically. Product of information technology has a role in facilitating MSME taxpayers in fulfilling their tax obligations. So that in the end, the advancement of information technology can encourage voluntary tax compliance of Central Java MSMEs. Based on the study results, the attitude of the tax officers became the main driver in increasing MSME taxpayer compliance through simplicity, while simplicity encourage awareness which in turn increased compliance. Second, the attitude of tax officers can directly affect compliance through awareness without having to go through simplicity. These two essential findings mean that the role of the tax authorities in providing services to SMEs taxpayers is significant and becomes the main driver in creating voluntary compliance for SMEs taxpayers.

Keywords

MSME, Information Technology, Voluntary Compliance

Background

Taxes have an essential role for the government, and the government should increase public awareness to voluntarily in their tax obligations. The government issued Law Number 6 of 1983 concerning General Provisions and Tax Procedures to change the tax collection system used in Indonesia, namely the use of a self-assessment system. The role of voluntary awareness is an essential factor in increasing tax revenue for the government. However, on the other hand, there is a miss-match compared to the contribution of MSMEs to state revenue, especially in terms of tax revenue, where the contribution of MSMEs to tax revenue is minimal, which is approximately 0.5% of total tax revenue. The imbalance in the assistance of MSMEs is an indication that the level of MSME compliance in fulfilling tax obligations is still deficient. So, the government is trying to increase the role of MSMEs in increasing state revenue from the tax sector.

Efforts are made by issuing Government Regulation Number 23 of 2018 concerning Income Tax on Income from Businesses Received or Obtained by Taxpayers with Certain Gross Circulation and the development of information technology. It is intended to increase awareness in fulfilling voluntary tax compliance and encourage state revenue contribution from MSMEs. In addition, other efforts that can promote voluntary compliance of taxpayers are the development of information technology. Information technology in question is to use an accounting system that can be developed periodically—the development of information technology that facilitates MSME taxpayers in fulfilling their tax obligations.

Since the issuance of Law Number 6 of 1983, the government has taken various ways to increase tax revenues. The government made a fundamental change with the distribution of Law Number 6 of 1983 concerning General Provisions and Tax Procedures to change the tax collection system used in Indonesia, namely the use of a self-assessment system that replaced the official assessment system. The method of collecting income tax in Indonesia uses a self-assessment system, which means starting from calculating, paying, and reporting, the taxpayer carries it out. In other words, taxpayers determine the amount of tax owed themselves (Supadmi& Hapsari, 2010).

Irianto (2005) in Vanesa & Hari (2009) describes several forms of awareness of paying taxes that encourage taxpayers to pay taxes, namely: First, understanding that taxes are a form of participation in supporting state development, by realizing this, taxpayers want to pay taxes because they feel they are not able to pay taxes. Munari (2005) states that tax awareness, taxpayers' opinions about the weight of the income tax burden, taxpayers' perceptions about the implementation of income tax penalties, and tax avoidance significantly affect income tax receipts. Suhendra (2010) shows that the level of taxpayer compliance and income tax payable has a positive effect on the increase in corporate income tax at the KPP, and tax audits have no impact on increasing corporate income tax revenues. Sari and Afriyanti (2010) obtained the results that taxpayer compliance and tax audit significantly affect income tax revenues. Enahoro & Jayeola (2012), in their research, prove that tax administration, tax policy, and tax regulations have a significant effect on tax revenue. Doramasy (2011) states that tax administration has a significant effect on income tax revenues.

But on the other hand, there is a miss-match compared to the contribution of MSMEs to state revenue, especially in tax revenue, where the contribution of MSMEs to tax revenue is minimal, which is approximately 0.5% of total tax revenue. The imbalance in the contribution of MSMEs is an indication that the level of MSME compliance in fulfilling tax obligations is still deficient. So, the government is trying to increase the role of MSMEs in increasing state revenue from the tax sector. This effort is carried out by issuing Government Regulation Number 46 of 2013 concerning Income Tax on Income from Businesses Received or Obtained by Taxpayers with Certain Gross Circulation. The issuance of PP 46 of 2013 is intended to increase awareness in fulfilling voluntary tax compliance and encourage state revenues from MSMEs.

This study focuses on aspects of Awareness, Simplicity, Ease, Tax Officers Attitudes, and Compliance. Many studies examine taxpayer compliance.

Literature Review

Theory of Planned Behavior (TPB)

The Theory of Planned Behavior (TPB) is a development of the Theory of Reasoned Action (TRA) proposed by Icek Ajzen (1991). TPB states that behavior is caused by intention. Meanwhile, the Theory of Reasoned Action (TRA) was put forward by Martin Fishbein & Icek Ajzen,(1967). Stating that the behavior displayed by individuals arises because of the intention to behave. The emergence of the will to act is determined by three determining factors, namely:

a. Behavioral beliefs, namely individual beliefs about the results of behavior and evaluation of these results (beliefs strength and outcome evaluation).

b. Normative beliefs, namely beliefs about the normative expectations of others and the motivation to fulfill those expectations (normative beliefs and motivation to comply).

c. Control beliefs, namely beliefs about the existence of things that support or hinder the behavior from being displayed (control beliefs) and perceptions about how strong the things help and hinder the behavior (perceived power). Barriers that may arise when the behavior is displayed can come from within oneself or from the environment.

Behavioral beliefs produce attitudes toward positive or harmful behavior. Normative beliefs create perceived social pressure or subjective norms, and control beliefs lead to perceived behavioral control or perceived behavioral control (Ajzen, 2006). Azjen(2006) also states that the more positive the attitude towards subjective behavior and norms, the greater the perceived control a person has, the stronger one's intention to elicit specific behaviors. Finally, according to actual behavioral control conditions, the intention will be realized if the opportunity arises. On the other hand, the behavior that appears may be contrary to the individual's choices. This happens because the conditions in the field do not allow to bring up the behavior that has been intended so that it will quickly affect the individual's perceived behavioral control. Perceived behavioral control that has changed will influence the behavior displayed so that it is no longer the same as what was intended.

Attribution Theory

Attribution theory is proposed to explain that the differences in our judgments of individuals depend on the meanings of the attributions we give to certain behaviors. Attribution theory states that when individuals observe a person's behavior, they try to determine whether it was generated internally or externally. (Robbins,2002). Behavior caused by internal factors is behavior that is believed to be under the individual's personal control. In contrast, behavior caused by external factors is behavior that is influenced from outside, namely a person's behavior is seen as a result of situational or environmental pressures.

Attribution theory is proposed to explain that the differences in our judgments of individuals depend on the meanings of the attributions we give to certain behaviors. Attribution theory states that when individuals observe a person's behavior, they try to determine whether it was generated internally or externally. (Robbins,2002). Behavior caused by internal factors is behavior that is believed to be under the individual's personal control. In contrast, behavior caused by external factors is behavior that is influenced from outside, namely a person's behavior is seen as a result of situational or environmental pressures.

- Specificity (solitude or Distinctiveness), meaning that a person will perceive other individuals differently in different situations. If someone's behavior is considered unusual, then other individuals who act as observers will give external attributions to the behavior. Conversely, it will be assessed as an internal attribution if it is regarded as a regular thing.

- Consensus, meaning if everyone has the same view in responding to someone's behavior if in the same situation. If the consensus is high, it includes external attribution. Conversely, if the agreement is low, it contains internal attribution.

- Consistency, i.e., if someone judges the behavior of others with the same response from time to time. The more consistent the behavior, the more likely people will attribute it to internal causes and vice versa.

Attribution theory groups two things that can distort the meaning of attribution. First, the fundamental attribution error tends to underestimate the influence of external factors rather than internal factors. Second, a person's prejudices tend to attribute success to internal factors, while failures are linked to external factors. Attribution theory is related to taxpayers' attitudes. Taxpayer awareness is the influence of one's internal factors while applying a self-assessment system, and examination is an external factor that makes a person decide. The attitude of taxpayers who are aware of their tax obligations and using a self-assessment system and analysis affects income tax revenue. In other words, income tax revenue is highly dependent on the behavior or decisions of the taxpayer.

Social Learning Theory

Social learning theory says that a person can learn through direct observation and experience (Bandura & Robbins, 2001). This theory extends Skinner's operant conditioning theory (in Robbins, 2001), which is a theory that presupposes behavior as a function of its consequences. According to Bandura in Robbins (2001), the process in social learning includes:

- The process of attention (attentional), the process of awareness, namely people will only learn from a person or model if they already know and pay attention to the person or model.

- The retention process, the storage process, is the process of remembering the actions of a model after the model is no longer readily available.

- The process of motor reproduction, motor reproduction, is converting observations into actions.

- The reinforcement process (reinforcement) process is a process in which individuals are provided with positive stimuli or rewards to behave according to the model.

This social learning theory is relevant to explain the behavior of taxpayers in fulfilling their tax obligations. A person will realize his obligations in taxation, pay taxes on time, if through his direct observation and experience that the tax collection has made a real contribution to the development in his area. In addition, with experience and observations, the behavior of taxpayers in responding to applicable tax collection methods and responding to tax audits will be more aggressive so that they can follow various applicable tax rules.

Theoretical Thinking Framework

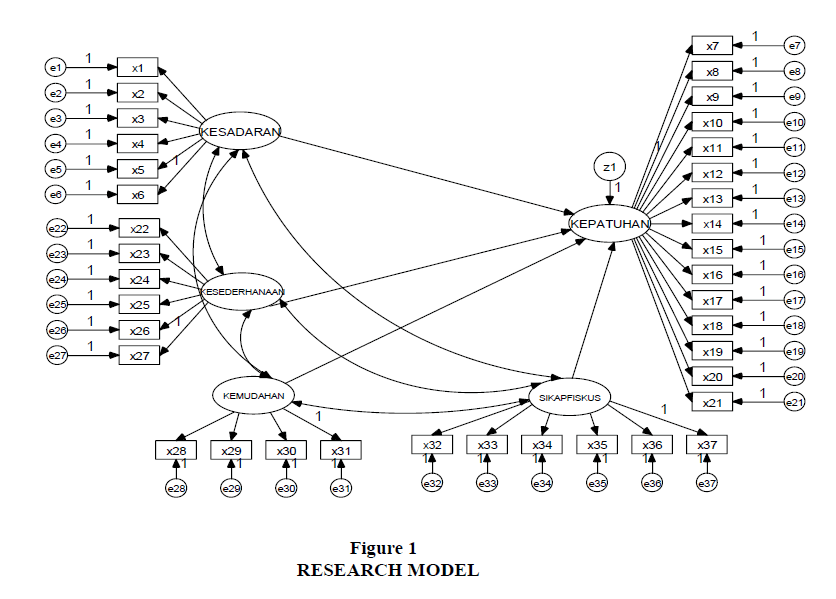

The government continues to strive to increase state revenues sourced from taxes. One of the efforts made is by issuing PP. 46 of 2013 concerning Income Tax obtained from certain activities (MSMEs), which is updated with PP N. 23 of 2018 concerning Income Tax on Income from Business Received or Obtained by Taxpayers with Certain Gross Circulation. The issuance of the Government Regulation is expected to increase awareness voluntarily of Micro, Small, and Medium Enterprises (MSMEs) taxpayers to fulfill their tax obligations, including paying taxes. This research focuses on modeling voluntary compliance of MSME taxpayers, which is formed from the perspective of Awareness, Simplicity, Ease, and Fiscal Attitude. Therefore, this study proposes several research hypotheses as follows Figure 1.

Hypothesis 1: Fiscal Attitudes Affect Consciousness

Hypothesis 2: Fiscal Attitudes Affects Simplicity

Hypothesis 3: Fiscal Attitudes Affects Ease

Hypothesis 4: Fiscal Attitudes Affect Compliance

Hypothesis 5: Simplicity affects Consciousness

Hypothesis 6: Simplicity affects Ease

Hypothesis 7: Awareness affects compliance

Hypothesis 8: Ease affects compliance

Research Methods

This study aims to identify and obtain an in-depth picture of the voluntary compliance of MSME taxpayers in Central Java. This study uses MSME taxpayers in Central Java. The sample was selected using the random sampling method. Based on the data collection conducted, 101 respondents were obtained.

This study uses a structural equation model approach. The data were tested for validity and reliability based on corrected item-total correlation and Cronbach's alpha. Furthermore, hypothesis testing was carried out using a confirmatory factor analysis approach to obtain the best model regarding voluntary compliance of Central Java SMEs.

Result

Descriptive Statistics

The following is a summary of the results of descriptive statistical tests and validity and reliability tests Table 1:

Descriptive statistics on the variables of awareness, compliance, simplicity, convenience, and fiscal attitude indicate that the average respondent's answer is at number 4. This means that, on average, the respondents' perceptions agree that the tax system from various perspectives is good. However, the variables of simplicity, convenience, and tax officers' attitude are still below 4. So that these four variables become the focus and interesting findings, this means that the respondent is still in a state of doubt. So it can be interpreted that the MSME tax system is still difficult (not simple) and not easy to be understood and implemented by taxpayers. On the other hand, the importance of the fiscal attitude is also getting more attention because it seems that respondents have not been able to receive good tax service services in fulfilling the tax obligations of MSME taxpayers.

Validity and reliability tests showed good results. The corrected item-total correlation value for all variables has a value above 0.3. This shows that all indicators in each variable are valid. The Cronbach's Alpha values are each variable of awareness (0.774), Compliance (0.809), Simplicity (0.765), Ease (0.757), Fiscal Attitude (0.828). So that the validity and reliability tests have met the requirements.

Confirmatory Factor Analysis Test

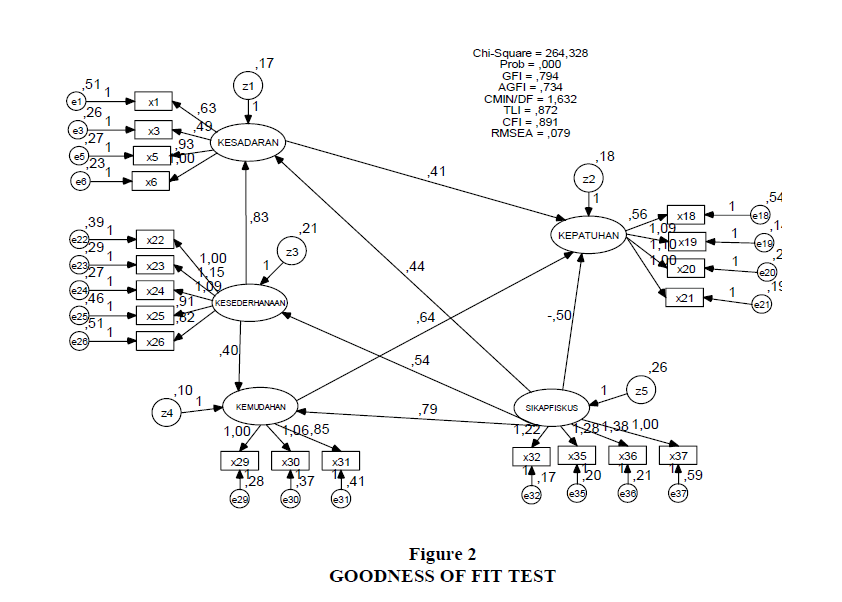

A confirmatory factor analysis test is needed to find a research model of voluntary compliance of MSME tax. The following is the feasibility test of the research model shown in Figure 2:

The picture above shows the results of the calculation of the goodness of fit index. The calculation results mean that this research model does not meet the assumption of the goodness of fit model. This is indicated by the calculation results presented in the Table 2 below.

The Table 2 above shows the results of the goodness of fit model calculation, where the model has not been able to meet the goodness of fit model assumption. Therefore, the next step is to eliminate several indicators that are not valid and reliable to be used as measurements of certain variables so that a model that fits the research data will be obtained. In the following, the results of the model are presented after eliminating several indicators for each unreliable variable.

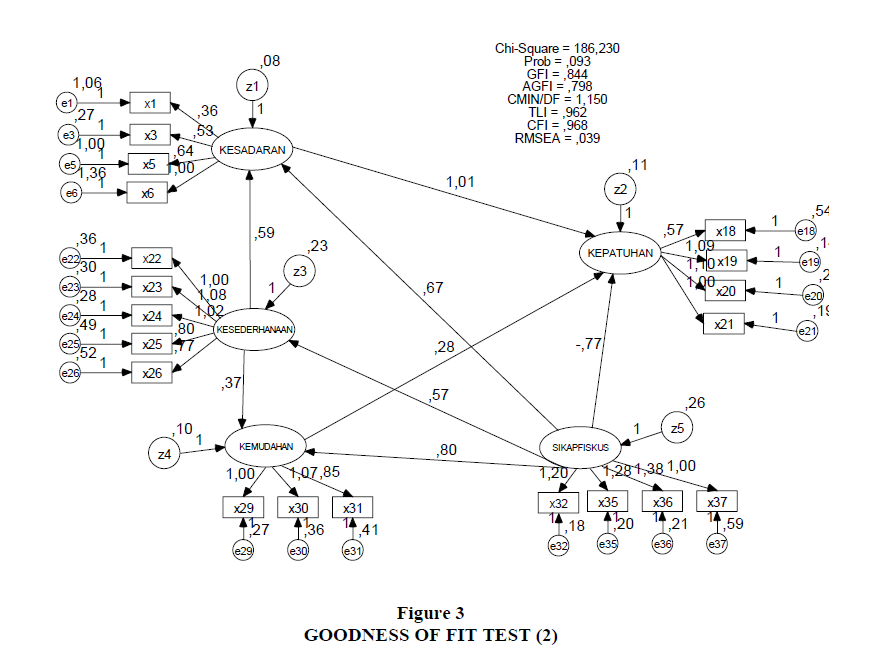

After processing the data by eliminating several indicators, the results of the goodness of fit 2 test were obtained.

Figure 3 and Table 3 show the results of the calculation of the goodness of fit model that has been met. This means that the model that fits the data is if the relationship between the responsibility variable and several research variables is omitted. Therefore, has been found a model that fits the data, then proceed to the next step of the analysis, namely testing the hypothesis. The results of hypothesis testing are presented below Table 4.

The results of the statistical test above can be seen that the attitude of the tax officer affects simplicity, convenience, and awareness. Still, the attitude of the tax officers is not able to affect compliance. Variable simplicity can affect awareness and compliance. Awareness variable affects compliance, but compliance is not influenced by convenience. These results show two significant findings: first, the tax authorities' attitudes are the main driver in increasing MSME taxpayer compliance through simplicity and simplicity, encouraging awareness which increases compliance. Second, the attitude of tax officers can directly affect obedience through awareness without having to go through simplicity. These two essential findings mean that the role of the tax authorities in providing services to SMEs taxpayers is crucial and becomes the main driver in creating voluntary compliance for SMEs taxpayers.

Discussion

Based on the results of the conceptual modeling above, it is known that first, the fiscal attitude is the primary driver in increasing MSME taxpayer compliance through simplicity and simplicity, encouraging awareness which in turn increases compliance. Second, the attitude of tax officers can directly affect obedience through awareness without having to go through simplicity. These two essential findings mean that the role of the tax authorities in providing services to SMEs taxpayers is crucial and becomes the main driver in creating voluntary compliance for SMEs taxpayers.

Fiscus attitude affects simplicity, convenience, awareness but does not affect obedience. Arum & Zulaikha (2012) show that the tax service has a positive and significant effect on taxpayer compliance. In contrast, Mir'atusholihah et al. (2012) show that the quality of tax officers' service impacts but is not significant on SME taxpayer compliance. Research conducted by Yusro & Kiswanto (2014) shows that tax rates and awareness of paying taxes do not affect SME taxpayer compliance.

Aspects of understanding the simplicity of the MSME taxation system were developed using WP's understanding indicators regarding the calculation of MSME PPh, bookkeeping, recording, simple MSME PPh calculations, gross circulation calculations, and the difficulty of calculating gross turnover.

Based on the data obtained, it is known that most MSME taxpayers have done bookkeeping, recording, and understand the procedure for calculating MSME taxpayer income under PP. 46 of 2013. This shows how complicated it is to calculate MSME income tax under PP No. 46 of 2013, which is caused by gross turnover. It is difficult for MSME taxpayers to understand because they must have a basis for bookkeeping or recording to calculate gross turnover in one tax year. Even though that did not happen for all respondents of WP MSMEs in the city of Semarang, there were still some respondents who considered PP No. 46 of 2013 can be implemented.

The inputs and suggestions given by the respondents can be concluded that the UMKM taxpayers still feel that the implementation of PP No. 46 of 2013 is perceived as burdensome for the UMKM taxpayers. This is because the understanding of tax obligations related to calculating, paying, and reporting taxes owed are not all well understood by MSME taxpayers. As one example is the heavy tax rate of 1% of the total turnover in the tax year concerned, not to mention the calculation of gross turnover, which the respondents well understand. The calculation of gross turnover as the basis for calculating the tax payable by MSME taxpayers requires them to have adequate books or records. At the same time, MSME human resources are primarily high school graduates. It is hoped that the implementation of PP No. 46 of 2013 can make it easier for taxpayers to calculate, pay, and report as obligations for MSME taxpayers in Semarang, which in turn increases taxpayer compliance in fulfilling tax obligations.

Taxpayer awareness affects taxpayer compliance. This result is in line with Arum & Zulaikha (2012), showing that taxpayer awareness has a positive and significant influence on taxpayer compliance. Atsani & Priambudi (2012) show that taxpayer awareness has a positive and significant effect on SME taxpayer compliance.

Ease does not affect compliance. This is not in line with the concepts and findings put forward by Nalendro (2014) that tax payers who do not understand the tax regulations and processes taxpayers cannot determine their behavior correctly so that taxpayer compliance is low. Research conducted by Mir'atusholihah et al. (2012) shows that tax knowledge significantly affects SME taxpayer compliance.

Conclusion

Based on the temporary findings of this research, the suggestions given are: The condition of MSMEs in Central Java is currently still in the stage of looking for forms because there are still many MSMEs that still need capital assistance to increase their productivity. From a business perspective, many MSMEs in Central Java are still categorized as new and still have a relatively small turnover, so it is challenging to maintain their survival in the future.

Based on data processing during conceptual modeling, it was found that first, tax officers' attitude became the main driver in increasing MSME taxpayer compliance through simplicity and simplicity, encouraging awareness, which increased compliance. Second, the attitude of tax officers can directly affect obedience through awareness without having to go through simplicity. These two essential findings mean that the role of the tax authorities in providing services to SMEs taxpayers is significant and becomes the main driver in creating voluntary compliance for SMEs taxpayers. Based on the conceptual model found, a tax calculation application system can be made whose output can be used for MSME tax reporting so that it is hoped that it can increase the voluntary compliance of MSME taxpayers.

Furthermore, MSME actors must manage their MSMEs well, both in terms of business and tax management, considering the great competition in terms of capital and product development desired by the market. The government should provide facilities under each type of MSMEs, especially the products produced by MSMEs. Mainly tax officers services in providing tax services, especially MSME taxpayers. This needs to be done considering that many MSME taxpayers do not understand the applicable tax regulations.

References

- Arum, H. P., & Zulaikha, Z. (2012). Pengaruh kesadaran wajib pajak, pelayanan fiskus, dan sanksi pajak terhadap kepatuhan wajib pajak orang pribadi yang melakukan kegiatan usaha dan pekerjaan bebas (Studi di wilayah KPP Pratama Cilacap) (Doctoral dissertation, Fakultas Ekonomika dan Bisnis).

- Priambudi, A. A. A., & Rusydi, M. K. (2013). Pengaruh Pemahaman Perpajakan, Tarif Pajak, Sanksi Pajak, serta Pelayanan Pembayaran Pajak terhadap Kepatuhan Wajib Pajak UMKM di Kota Surabaya. Jurnal Ilmiah Mahasiswa FEB, 2(1).

- Gunadi. (2005). Fungsi Pemeriksaan Terhadap Peningkatan Kepatuhan Wajib Pajak (Tax Compliance). Jurnal Perpajakan Indonesia,4(5), 4-9.

- Koperasi, K. N., & UKM, R. (2007). Pedoman Pemeringkatan Koperasi.

- Mir’atusholihah, M. (2013). Pengaruh Pengetahuan Perpajakan, Kualitas Pelayanan Fiskus dan Tarif Pajak terhadap Kepatuhan Wajib Pajak (Studi pada Wajib Pajak UMKM di Kantor Pelayanan Pajak Pratama Malang Utara) (Doctoral dissertation, Brawijaya University).

- Muliari, N. K., & Setiawan, P. E. (2011). Pengaruh persepsi tentang sanksi perpajakan dan Kesadaran wajib pajak pada kepatuhan Pelaporan wajib pajak orang pribadi di kantor Pelayanan pajak pratama denpasar timur. Jurnal Ilmiah Akuntansi dan Bisnis, 6(1).

- Yunasih, V., DP, E. N., & Rofika, R. (2016). Faktor-faktor Yang Mempengaruhi Kepatuhan Membayar Pajak Orang Pribadi Yang Berwirausaha Dengan Lingkungan Dan Preferensi Risiko Sebagai Variabel Moderasi (Studi Empiris Pada Wajib Pajak Orang Pribadi Yang Berwirausaha Terdaftar Di Kpp Pratama Bangkinang) (Doctoral dissertation, Riau University).

- Yusro, H. W., & Kiswanto, K. (2014). Pengaruh Tarif Pajak, Mekanisme Pembayaran Pajak dan Kesadaran Membayar Pajak terhadap Kepatuhan Wajib Pajak UMKM di Kabupen Jepara. Accounting Analysis Journal, 3(4).