Research Article: 2021 Vol: 25 Issue: 3S

Instrument Design of Small Industry Performance Measurement in Semarang City With Balanced Scorecard Concept

Agus Wahyudin, Universitas Negeri Semarang

Maylia Pramono Sari, Universitas Negeri Semarang

Anindya Ardiansari, Universitas Negeri Semarang

Surya Raharja, Universitas Diponegoro

Nawang Kalbuana, Politeknik Penerbangan Indonesia Curug

Abstract

This study aims to identify strategic targets that will be used to design a performance measurement system. The first step is to design instruments and applications for measuring company performance to conduct internal and external analysis with SWOT analysis to find out the position of the business in the industry and what strategy should be used by using the Balanced Scorecard method. Balanced scorecard designs strategies with four perspectives, namely financial perspective, customer perspective, business internal process perspective, and learning and growth perspective. The data were retrieved from owners, employees, and consumers of KnK Koffee Resources in 2020. The results of the study indicated that internally, the strengths they have, exceed the lack of KnK Koffee Resources. However, externally, the challenges they face are bigger than the opportunities. Thus, the right business strategy is product diversification (quadrant IV).

Keywords:

Performance Measurement, SWOT Analysis, Balanced Scorecard (BSC), KnK Koffee Resources

Introduction

The Regional Medium-Term Development Plan (RPJMD) of Semarang City for 2016-2021 aims to strengthen people's economy based on local excellence and build a conducive business climate. The number of Micro, Small, and Medium Enterprises (MSMEs) in Semarang City, which is 17,456 or 95% of the total business actors, makes MSMEs as creative industries have the potential to become one of the backbones of the national economy in the future. However, during the Covid-19 pandemic, there were 1,538 MSMEs affected by the pandemic. Of this number, there are 700 MSMEs (50%) related to food processing, the rest is approximately 800 mixed MSMEs. This number is relatively small because there are still approximately 50 thousand MSMEs that are not licensed so they cannot be monitored.

Almost all sectors have experienced a decline in performance (Kalbuana, et al., 2021; Sari, 2020b, 2020a, 2020c; Asrori, 2017; Hajawiyah, 2020; Kiswanto, 2020; Nurkhin, 2019; Solikhah, 2019, 2020b, 2020a; Wahyudin, 2017; Jannah et al., 2020; Kalbuana, et al., 2021; Luwihono et al., 2021; Prasetyo, et al., 2021b; Prasetyo, et al., 2021; Prasetyo, et al., 2021; Susanto et al., 2021; Aliyyah et al., 2021; Hastomo, Karno, Kalbuana, Meiriki & Sutarno, 2021; Kalbuana, et al., 2021; Kustiningsih et al., 2020; Prasetyo, et al., 2021a; Prasetyo et al., 2021; Ardiansari, 2021) including the plantation sub-sector. The absorption of most export destination countries for Indonesian plantation commodities decreased drastically. However, coffee commodities in Indonesia are getting classier. Based on the BPS Plantation data, it is known that until February 2020, Indonesia's coffee exports were recorded at 55,989 tons, with an export value of USD 136.75 million. This includes Semarang coffee has a large market in Europe and the Middle East. Thus, the role of Semarang City cannot be ruled out regarding the development of the coffee industry in Indonesia. An MSME of KnK Koffee Resources owned by a young person in Semarang City also contributes. This home-based coffee processing industry is a stockist cafe of 60 coffee shops (75% supplier ) in Semarang, with an average turnover of 100 million per month. starting from a hobby of drinking coffee, the owner of Knk koffee Resources has opened a coffee shop business on Jalan Dewi Sartika No. 5, Gunungpati District, Semarang City. Currently, KnK Koffee Semarang has 10 employees and fosters coffee farmers in Bonjor, Tretep, Temanggung and Wonokasihan, Gunung Kelir, Ambawara areas. Besides Coffee Shop (KnK Koffee Resources), Agung also has a Café (Lost in Café), which is located in the same location.

Currently, KnK Koffee Resources has never measured the company's performance in order to provide an overview and useful information, especially in determining their future business policies and strategies. This situation is caused by the absence of adequate resources such as competent employees and relevant applications or technology. Another problem still needs to be fixed in the MSME business process of KnK Koffee Resources because there is an imbalance in the financial and non-financial (customer) aspects. On the financial side, the owner of MSME KnK koffee Resource does not make specified books containing all the income and expenditure processes such as to pay employee salaries, electricity costs, pay for raw materials, sales that have been produced, purchase costs, and others, When the initial study was conducted, the income earned by KnK Koffe Resources was Rp. 131,553,660 in May 2019. The non-financial portion as indicated by the number of customers is 75% of coffee shops in Semarang. Thus, this needs to be researched to balance the financial and non-financial aspects.

One of the methods that can help improve the performance of KnK Koffee Resources MSMEs to balance financial and non-financial aspects is the balanced scorecard (BSC) method. The Balanced Scorecard (BSC) is a management, measurement and control system that allows managers to understand business performance quickly, accurately and comprehensively. The performance measurement sees the business unit from two aspects, namely financial aspects (finance, internal business processes) and non-financial aspects (customers, learning processes and growth). Based on the problems above, it is necessary to make improvements and development of KnK Koffee Resources MSMEs in order to improve the performance of this MSME so that it can complete in the middle of global bussiness competition , know change in the performance level of MSMEs from financial non-financial aspects.

One of the methods that can help improve the performance of KnK Koffee Resources MSMEs to balance financial and non-financial aspects is the balanced scorecard (BSC) method. The Balanced Scorecard (BSC) is a management, measurement and control system that allows managers to understand business performance quickly, accurately and comprehensively. The performance measurement sees the business unit from two aspects, namely financial aspects (finance, internal business processes) and non-financial aspects (customers, learning processes and growth). Based on the problems above, it is necessary to make improvements and development of KnK Koffee Resources MSMEs in order to improve the performance of this MSME so that it can compete in the middle of global business competition, know changes in the performance level of MSMEs from financial and non-financial aspects, and design strategies of performance improvement and implement the proposed improvement.

Similar research is (Darmawan, 2019) about the increase in the income of SMEs after the implementation of the Balanced Scorecard. Research of (Cahyono, 2019) regarding the creative industry in Jember City, the financial perspective is not good, the customer perspective tends to increase slowly, the internal business process perspective fluctuates, and the growth and learning perspective tends to increase. In addition, research of Kopecka (2015); Peter & Zakariya (2014); Widi Oetomo & Ardini, (2012); Ayoup, et al., (2016); Suprapto, et al., (2009) regarding the implementation of SWOT analysis, application of BSC, and Key Performance Indicator.

This study aims to identify strategic targets that will be used to design the performance measurement system of KnK Koffee Resources, identify what performance indicators/KPIs (Key Performance Indicators) will be used to design the performance measurement system of KnK Koffee Resources, and design instruments and applications for measuring the performance of this company.

Literature Review

The efficiency and effectiveness quantification process of past actions can be defined as performance measurement. The efficiency and/or effects of past actions can be measured by defining a performance measurement as a parameter. Performance metrics are definitions of a broad-based performance measure's scope, content and component parts.

Strategy is a pattern of mobilizing and directing all company resources to realize the vision through the company's mission. Strategy forms a pattern of decision-making in realizing the company's vision. Strategy is formulated to mobilize various company resources and direct them to achieve the company's vision. In a competitive business environment, strategy plays an important and decisive role in maintaining the survival and growth of the company (Mulyadi, 2007).

The initial stage in the design of performance measurement instruments is to conduct internal and external analysis in order to identify the business units analyzed in the industry. From the internal and external analysis, the appropriate strategy can be formulated. Internal and external analysis used is a SWOT analysis. The internal analysis covers the analysis of strengths and weaknesses while environmental analysis includes opportunities and threats.

Furthermore, measurements are conducted using the Balanced Scorecard and Key Performance Indicators (KPI). According to Kaplan (2001), measurement in the BSC is divided into four perspectives, namely financial aspects (financial and internal business processes) and non-financial aspects (customers and learning and growth). Meanwhile, according to Iveta (2012), key performance indicator is a measurement of various perspectives that are quantitative based on concrete data and becoming the starting point for setting goals and executing the strategic vision of the organization. The strategic vision intended refers to how the organizational strategy is interactively integrated into the overall organizational strategies. In each performance measurement process, a measure is needed to determine the level of success or achievement of the company's performance. One of the measures used in the performance measurement process is the Key Performance Indicator (KPI). Key Performance Indicators (KPIs) also have some other criteria, including Specific, Achievable, Realistic, and Timely, which when combined with the Measurable criteria can be summarized in the acronym SMART.

Methodology

Data Collection

The research object was KnK Koffee Resources SMEs located on Jalan Dewi Sartika Raya No. 5 Undip Housing, Sukorejo Village, Gunungpati District, Semarang City. The research took place in 2020 .

The research variable was the Key Performance Indicator (KPI), which was validated directly by the MSMEs. These KPIs are strategic goals that are described from the company's objectives, which were grouped into 4 perspectives from the Balanced Scorecard (BSC) method, that is financial, internal business processes, learning and growth and customer .

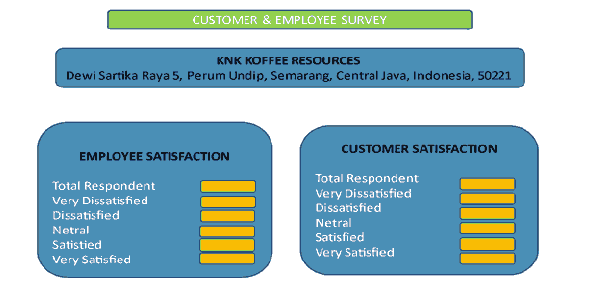

The selection of respondents for the BSC assessment was the owner who is the management, all employees who amounted to 10, and consumers who have used the products of KnK Koffee Resources. The sampling method for consumers in this study was conducted by non-probability sampling with the convenience sampling method with consideration of the ease, availability, and convenience of obtaining information from consumers who became the selected sample. The number of consumer respondents of KnK Koffe Resources selected was 100 respondents to meet the general statistical rules, namely n ≥ 30 because it has been normally distributed and can describe the population studied. The selection of respondents were owners, employees, and consumers of KnK Koffe Resources because they can influence the existing strategies of the company. The data collection was carried out for three months, namely May – July 2020. The methods used during the data collection included observations in the field, interviews, questionnaires, and internet searches.

The primary data obtained from interviews with management and filling out questionnaires with the relevant informants were collected and processed first to simplify the data. The data analysis was carried out using four balanced scorecard perspectives, the customer satisfaction index method to measure the level of customer satisfaction, the importance-performance analysis method to assess performance and attribute expectations, and the paired comparison weighting method. The results of this processing would then be analyzed and presented in the form of descriptions and tables.

Results and Discussions

Based on the results of internal and external analysis, it is found that the internal analysis has 15 strengths (plus) and 11 weaknesses (minus) so that it can be said that the strengths are greater than the weaknesses. Meanwhile, the external analysis finds 3 opportunities and 7 challenges so that the challenges are greater than the opportunities . The strengths include a comfortable location, blending with nature, friendliness of the shop staff, unique coffee taste, complete coffee variants, affordable prices, strategic location, available Wifi, adequate supply of raw materials, adequate alternative sources, own building land, heterogeneous consumers, adequate number of employees, existing financial reports and tax reports, has a website, promotional media, and registered in the marketplace, and 75% stockist of coffee shops in Semarang City. Then, the weaknesses include the quality of the coffee beans are not optimal, the equipment is not complete, not all employees have gotten training, bookkeeping employees do not have an accounting background, the owners do not have business strategy management, the owners have not been able to analyze financial statements, have not carried out the audit process, do not have cash flow reports, there is no customer and employee satisfaction survey, do not have Standard Operating Working Procedures (SOP), and there are several customer complaints.

Furthermore, the opportunities they have can increase the number of customers due to wifi facilities, as a coffee supplier for a wider segment, and making new product innovations. Meanwhile, the threats faced are many competitors, maintaining and improving quality, changing consumer preferences, unfulfilled equipment needs will affect production , website and marketplace maintenance, inappropriate decision making due to the absence of performance assessment, cash reports flow, and Financial Statements audit, and not up to date employee competencies and skills .

From the results of internal conditions plus 15 and external conditions minus 11, it can be seen that KnK Koffee Resources is in quadrant IV position. In this position, the strategy that should be applied is a diversification strategy. This strategy requires KnK Koffee Resources to differentiate with similar businesses to create a greater opportunity for business continuity . The strategies that can be applied by KnK Koffee Resources are, first, developing products sold at KnK Koffee Resources, such as creating new coffee innovations for consumers along with providing complementary products (snacks) that attract consumers attention. Second, market development, which is developing the KnK Koffee Resources market by providing promotions and enlarging the production area if Kalem Coffee has developed its business well. Third, Diversification, in this case, KnK Koffee Resources can create new products or develop old products so that they are even bigger. If KnK Koffee Resources make new products, it can have the opportunity to get a different market share according to the products that have been made .

Furthermore, the preparation of strategic maps illustrates a clear relationship between the four perspectives on KnK Coffee Resources, starting from the financial, customers, internal business processes, and learning and growth perspectives based on a diversification strategy. From the customer perspective, strategic goals to increase customer loyalty are very important for KnK Koffee Resources . With high loyalty, customers will have an attachment to products from KnK Koffee Resources and be able to market products owned by KnK Koffee Resources to other customers from mouth to mouth. Improving relationships with new customers, which is KnK Koffee Resources providing services or being able to make good relationships with new customers through products and services provided .

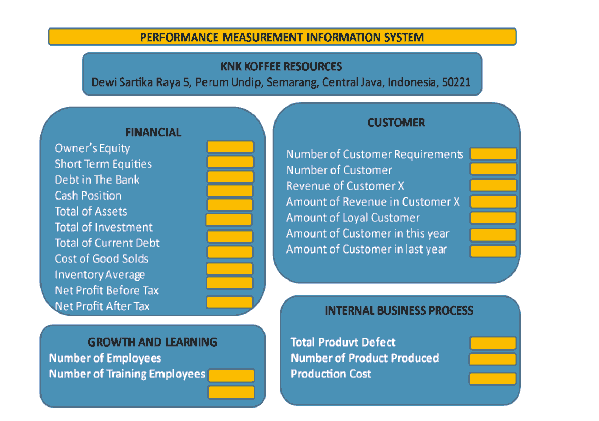

In the perspective of internal business processes, the strategic target is in accordance with the diversification strategy, which is the development of KnK Koffee Resources qualified products by innovating in order to increase sales and the market share of KnK Koffee Resources. The development of good and qualified services from the perspective of internal business processes is also very necessary because good and qualified service has a big impact on customer satisfaction. For the perspective of learning and growth at KnK Koffee Resources, this is focused on employees at KnK Koffee Resources, namely with strategic goals which include increasing job satisfaction of KnK Koffee Resources employees, improving the skills possessed by employees, and developing the knowledge that has been owned by KnK Koffee Resources employees. After drawing a strategic map, then the strategies are described in the BSC table along with the achievement targets. The KPI points are arranged in a table as shown in Table 4. below .

Hereafter, determining the key measurement indicators (Key Performance /Indicator/KPI) for each of these strategic targets. The KPIs for each strategic goal are described in Table 1. The KPIs presented are the results and studies of the KPI literature which are generally often used in companies that use the Balanced Scorecard method as a measure of the company's success in achieving the targets which are then confirmed to the owner of KnK Koffee Resources, along with the planned targets for each KPI .

| Table 1 Key Performance Indicator (Kpi) Knk Koffee Resources |

||

|---|---|---|

| Strategic targets | KPI | Target |

| Financial Perspective | ||

| Increasing Profit | F1. Sales Percentage Increase | 10% |

| F2. Profit Percentage Increase | 20% | |

| Customer Perspective | ||

| Increasing customer loyalty | C1. Customer Satisfaction Level | 100% |

| C2. Customer Complaint Handling Level | 100% | |

| C3. Customer Retention Level | 100% | |

| C4. Customer Acquisition Level | 100% | |

| Improving relationship with new customers (Market Share)? | C3. Number of activities (events, exhibitions) attended | 3 event |

| C4. Percentage of new customer purchases | 20% | |

| Internal Business Process Perspective | ||

| Development of innovative qualified product | B1. Percentage of Defective Products | 5% |

| B2. Number of new products innovated | 3% | |

| B3. Percentage of less desirable products | Decrease by 5% | |

| B4. Percentage of resolved complaint responses | 100% | |

| Learning & Growth Perspective | ||

| Increase employee satisfaction | P1. Employee satisfaction level | 100% |

| P2. Employee turnover percentage | 0% | |

| Improving employee ability | P3. Number of Employee Training | 2x |

| P4. Percentage of training employee participation | 100% | |

| Developing knowledge possessed by employees | P5. Level of employee understanding of their duties | 100% |

Furthermore, the following is the instrument for measuring the performance of KnK Koffee Resources which has been modified in such a way with KnK Koffee Resources, as shown in Figures 1 and 2 below.

Conclusions

Based on the analysis that has been done by the authors, the analysis of the business internal and external conditions, KnK Koffee Resources is in a position where the company can develop but must implement a diversification strategy as a differentiator from other similar businesses. KnK Koffee Resources can apply BSC-based performance measurement as a medium in helping business development .

Some limitations in this study are that this study has not been able to analyze performance in detail in the form of numbers since KnK Koffee Resources have not had a clear Vision and Mission yet. This study is only limited to instrument design from the analysis of the existing situation on the Client. Thus, it has not been able to assess the performance of KnK Koffee Resources since the instrument has not been implemented. Future research needs to do a comparison between the targets that have been set and the reality on the field.

The suggestion that the authors recommend for KnK Koffee Resources is that the results of the design obtained by the authors can be a baseline for KnK Koffee Resources to apply performance measurement with the Balanced Scorecard approach. With the existence of a strategy map and performance design, all parties related to KnK Koffee Resources, need to make short-term and long-term targets to develop KnK Koffee Resources as a shop that has good quality with innovations provided to consumers and used to improve the performance of KnK Koffee Resources .

References

- Aliyyah, N., Prasetyo, I., Rusdiyanto, Endarti, E.W., Mardiana, F., Winarko, R., … & Tjaraka, H. (2021). What affects employee performance through work motivation? Journal of Management Information and Decision Sciences, 24(Special Issue 1), 1–14. Retrieved from https://www.abacademies.org/abstract/what-affects-employee-performance-through-work-motivation-11529.html

- Ardiansari, A. (2021). The influence of intellectual capital on the company’s financial performance and market value. Universal Journal of Accounting and Finance, 9(2), 217–225.

- https://doi.org/10.13189/UJAF.2021.090211

- Asrori. (2017). Conservation and environmental performance of islamic enterprises in Indonesia. Pertanika Journal of Social Sciences and Humanities, 25, 187–193. Retrieved from https://www.scopus.com/inward/record.uri?partnerID=HzOxMe3b%5C&scp=85047495365%5C&origin=inward

- Ayoup, H., Omar, N., & Rahman, I.K.A. (2016). Balanced scorecard and strategic alignment: A Malaysian case. International Journal of Economics and Financial Issues, 6(4), 85–95.

- Cahyono, D. (2019). Entrepreneurship Revitalization Against Creative Industry Actors Based on Balanced Scorecard Performance, 5(1), 121–134.

- Darmawan, H. (2019). Improved performance of kecik chili printing smes using the Balanced Scorecard (BSC) Method. SAINTEK. Scientific Journal of Industrial Science and Technology, 3(2), 100.

- https://doi.org/10.32524/saintek.v3i2.602

- Hajawiyah, A. (2020). The effect of good corporate governance mechanisms on accounting conservatism with leverage as a moderating variable. Cogent Business and Management, 7(1).

- https://doi.org/10.1080/23311975.2020.1779479

- Hastomo, W., Karno, A.S.B., Kalbuana, N., Meiriki, A., & Sutarno. (2021). Characteristic parameters of epoch deep learning to predict covid-19 data in Indonesia. Journal of Physics: Conference Series, 1933(1), 12050. https://doi.org/10.1088/1742-6596/1933/1/012050

- Iveta, G. (2012). Human resources key performance indicators.

- Jannah, M., Fahlevi, M., Paulina, J., Nugroho, B.S., Purwanto, A., Subarkah, M.A., … & Cahyono, Y. (2020). Effect of ISO 9001, ISO 45001 and ISO 14000 toward financial performance of Indonesian manufacturing. Systematic Reviews in Pharmacy, 11(10), 894–902. https://doi.org/10.31838/srp.2020.10.134

- Kalbuana, N., Prasetyo, B., Asih, P., Arnas, Y., Simbolon, S.L., Abdusshomad, A., … & Mahdi, F.M. (2021). Earnings management is affected by firm size, leverage and roa: Evidence from Indonesia. Academy of Strategic Management Journal, 20(SpecialIssue2), 1–12. Retrieved from https://www.scopus.com/inward/record.uri?eid=2-s2.0-85107756548&partnerID=40&md5=f648ed22972be531e4986f7c43a47ad4

- Kalbuana, N., Suryati, A., Rusdiyanto, Azwar, Rudy, Yohana, … & Hidayat, W. (2021). Interpretation of sharia accounting practices in Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(Special Issue 1), 1–12. Retrieved from https://www.abacademies.org/abstract/interpretation-of-sharia-accounting-practices-in-indonesia-11179.html

- Kaplan, N. (2001). Translating strategy into action: The balanced scorecard translating strategy into action.

- Kiswanto. (2020). Effect of financial performance on sustainable report disclosure with the board of commissioners as the moderating variable. International Journal of Innovation, Creativity and Change, 13(4), 39–52.

- Retrieved from:

- https://www.scopus.com/inward/record.uri?partnerID=HzOxMe3b%5C&scp=85087071458%5C&origin=inward

- Kopecka, N. (2015). The balanced scorecard implementation, integrated approach and the quality of its measurement. Procedia Economics and Finance, 25(15), 59–69.

- https://doi.org/10.1016/s2212-5671(15)00713-3

- Kustiningsih, N., Kalbuana, N., Rochman, A.S., Farid, M.M., Bharmawan, A.S., Farida, I., … & Pramitasari, D.A. (2020). Study ratio financial of bank performance: Evidence from Indonesia. PalArch’s Journal of Archaeology of Egypt/ Egyptology, 17(11), 6571–6605.

- Retrieved from https://archives.palarch.nl/index.php/jae/article/view/5216

- Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., … & Rusdiyanto. (2021). Macroeconomic effect on stock price: Evidence from Indonesia. Accounting, 7(5), 1189–1202. https://doi.org/10.5267/j.ac.2021.2.019

- Mulyadi. (2007). Integrated System of Personnel Performance Management Based on Balanced Scorecard. Yogyakarta.

- Nurkhin, A. (2019). The determinants of Islamic governance disclosure: The case of Indonesian Islamic banks. Banks and Bank Systems, 14(4), 143–152. https://doi.org/10.21511/bbs.14(4).2019.14

- Peter, K.A., & Zakariya, B.H. (2014). Appraising effectiveness of key performance indicators used by Nigerian construction firms. International Journal of Education and Research, 2(12), 451–460.

- Prasetyo, I., Aliyyah, N., Rusdiyanto, Nartasari, D.R., Nugroho, S., Rahmawati, Y., … & Rochman, A.S. (2021a). Impact financial performance to stock prices: Evidence from Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(Spesial Issue 1), 1–11. Retrieved from https://www.abacademies.org/articles/impact-financial-performance-to-stock-prices-evidence-from-indonesia.pdf

- Prasetyo, I., Aliyyah, N., Rusdiyanto, R., Nartasari, D.R., Nugroho, S., Rahmawati, Y., … & Rochman, A.S. (2021b). What affects audit delay in Indonesia? Academy of Entrepreneurship Journal, 27, 1–15.

- Retrieved from: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85106558790&partnerID=40&md5=7c8a35d6ac0c782c2a679d9d916103c7

- Prasetyo, I., Aliyyah, N., Rusdiyanto, Suprapti, S., Kartika, C., Winarko, R., … & Al-asqolaini, M.Z. (2021). Performance is affected by leadership and work culture: A case study from Indonesia. Academy of Strategic Management Journal, 20(SpecialIssue2), 1–15. Retrieved from : https://www.scopus.com/inward/record.uri?eid=2-s2.0-85107749489&partnerID=40&md5=5578365b48c8267934f48d9d9b4ff27e

- Prasetyo, I., Aliyyah, N., Rusdiyanto, Tjaraka, H., Kalbuana, N., & Rochman, A.S. (2021). Vocational training has an influence on employee career development: A case study Indonesia. Academy of Strategic Management Journal, 20(2), 1–14. Retrieved from https://www.scopus.com/inward/record.uri?eid=2-s2.0-85104263411&partnerID=40&md5=45d5afb967dbe1c4405200772d9b2128

- Prasetyo, I., Endarti, E.W., Endarto, B., Aliyyah, N., Rusdiyanto, Tjaraka, H., … & Rochman, A.S. (2021). Effect of compensation and discipline on employee performance: A case study Indonesia. Journal of Hunan University Natural Sciences, 48(6), 277–298. Retrieved from http://jonuns.com/index.php/journal/article/view/617

- Sari, M.P. (2020a). Analysis of fraudulent financial reporting with the role of KAP big four as a moderation variable: Crowe’s fraud’s pentagon theory. International Journal of Financial Research, 11(5), 180–190. https://doi.org/10.5430/IJFR.V11N5P180

- Sari, M.P. (2020b). Compliance analysis of asia sustainability reporting awards (Asra) 2018 companies. International Journal of Scientific and Technology Research, 9(3), 3891–3896.

- Retrieved from: https://www.scopus.com/inward/record.uri?partnerID=HzOxMe3b%5C&scp=85082621509%5C&origin=inward

- Sari, M.P. (2020c). The report of university sustainability in Indonesia. International Journal of Innovation, Creativity and Change, 11(8), 110–124.

- Retrieved from: https://www.scopus.com/inward/record.uri?partnerID=HzOxMe3b%5C&scp=85081927305%5C&origin=inward

- Solikhah, B. (2019). The role of earning quality, audit quality and independent commissioner in suppressing tax avoidance practice. Journal of Advanced Research in Law and Economics, 10(8), 2523–2532. https://doi.org/10.14505/jarle.v10.8(46).30

- Solikhah, B. (2020a). Carbon emissions of manufacturing companies in Indonesia stock exchange: A sustainable business perspective. Journal of Physics: Conference Series, 1567(4). https://doi.org/10.1088/1742-6596/1567/4/042086

- Solikhah, B. (2020b). The extent of intellectual capital disclosure and corporate governance mechanism to increase market value. Journal of Asian Finance, Economics and Business, 7(10), 119–128.

- https://doi.org/10.13106/jafeb.2020.

- Suprapto, B., Wahab, H.A., & Wibowo, A.J. (2009). The implementation of balance score card for performance measurement in small and medium enterprises: Evidence from Malaysian health care services. The Asian Journal of Technology Management, 2(2), 76–87.

- Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, Tjaraka, H., … & Zainurrafiqi. (2021). The impacts of earnings volatility, net income and comprehensive income on share price: evidence from Indonesia stock exchange. Accounting, 7(5), 1009–1016. https://doi.org/10.5267/j.ac.2021.3.008

- Wahyudin, A. (2017). Corporate governance implementation rating in Indonesia and its effects on financial performance. Corporate Governance (Bingley), 17(2), 250–265. https://doi.org/10.1108/CG-02-2016-0034

- Widi Oetomo, H., & Ardini, L. (2012). Swot analysis in strategic management: A case study at purabaya bus station. Journal of Economics, Business, and Accountancy | Ventura, 15(2), 171.

- https://doi.org/10.14414/jebav.v15i2.73