Research Article: 2021 Vol: 27 Issue: 6

The Role of Regional-Owned Enterprises, Local Own-Source Revenue and Investment in Strengthening Regional Economic Growth of Riau Province, Indonesia

Bernard Isyandi, Universitas Riau

R. Agus Trihatmoko, Universitas Surakarta

Citation Information: Isyandi, B., & Trihatmoko, R.A. (2021). The role of regional-owned enterprises, local own-source revenue and investment in strengthening regional economic growth of riau province, Indonesia. Academy of Entrepreneurship Journal, 27(6), 1-9.

Abstract

This study aims to reveal the economic growth of the Riau Province based on the analysis of local own-source revenue, the profit of Regional Owned Enterprises (ROEs) and regional investment. The research method uses multiple linear regression analysis. The secondary data analysis was obtained by the Central Statistics Agency and the local agency of Riau Province. The results of this study found that the ROES profit had a significant effect on increasing own-source revenue with the ratio of only 3.37%, and ranks third after local taxes and other revenues. Moreover, GRDP at constant 2010 prices reached IDR 471.42 trillion, a growth of 2.71% is not related to the strengthening of regional economic growth in Riau Province which is in accordance with the percentage of separated regional wealth yields. On average, the provincial local own-source revenue revenue realization ratio also illustrates the ROEs’ Competency Map in encouraging regional investment. The results of this study have implications for the direction of medium and long-term regional policies in the regional economic development of the Riau province, and their synchronization with the national economy. The model built from this study and the use of the analysis is the originality of the research. Thus, universally as a theoretical contribution to regional and national economic development.

Keywords

Regional-Owned Enterprises (ROEs), Local Own-source Revenue, Investment, Economic Growth, Riau Province.

Introduction

The main problem in regional economic development lies in the emphasis on development policies based on the uniqueness of the region concerned (endogenous development) by using the potential of human, institutional and physical resources locally (Badrudin, 2012; Ndraha, 2008; Robinson, 2005). Moreover, previous studies highlighted the governance of state companies or in this context ROEs as an important factor for regional economic development (Trihatmoko & Susilo, 2018; Kuncoro, 2004; Trihatmoko & Kuncoro, 2021). For local government, local own-source revenue occupies the most strategic position when compared to other regional financial sources, such as transfer revenue from central or federal government. Regional economic potential will illustrate the region's ability to spur economic growth, the ability and absorption of investment, labor for goods and services and savings (Isyandi, 2007). The regional economic potential will also have an impact on the management of its local revenues. Areas that are well managed will certainly get a high value of revenue. The Riau Provincial Government to manage local own-source revenue properly issued Riau Province Regional Regulation number 6 of 2016 concerning the main points of regional financial management. Table 1 describes the realization of Riau Province's original regional income in 2014-2018.

| Table 1 Realization of Revenue Revenue of Riau Province 2014-2018 (in million IDR) | |||||

| Components | 2014 | 2015 | 2016 | 2017 | 2018 |

| Local Tax | 2.496.771 | 2.572.777 | 2.417.976 | 2.755.332 | 3.075.630 |

| Regional Retribution | 16.992 | 21.571 | 12.444 | 12.516 | 10.685 |

| Regional Wealth Management | 154.214 | 178.216 | 83.335 | 124.105 | 132.226 |

| Other Revenues | 577.109 | 704.395 | 596.899 | 468.023 | 127.102 |

| Total | 3.245.087 | 3.476.960 | 3.110.656 | 3.359.978 | 3.345.645 |

Based on Table 1, it can be observed that the contribution value of each component has fluctuated over the last 5 years. According to the Regional Regulation of Riau Province No. 6 of 2016 concerning the principles of regional financial management in the Riau Province, the types of results from the management of regional assets separated by income object include the share of profit on equity participation in regionally-owned companies/ROES, SOEs, and in privately owned companies or community business groups.

Based on the Regulation of the Minister of Home Affairs number 3 of 1998 regarding the Legal Forms of Regional Owned Enterprises, article 2, there are 2 legal forms of Regional Owned Enterprises (ROEs), namely regional public companies (Perumda) and regional companies (Perseroda). Perumda is a regional company whose entire capital is owned by one region, while a regional company is a regional company whose ownership is divided into shares, where one region has a majority share or a minimum of 51% shares. For equity participation in state-owned and private companies, the government does not have to own a majority share or 51% there. The investment value in Riau Province in 2017 reached IDR 114.91 trillion or 33.80 percent of the total GRDP, an increase of IDR 5.20 trillion compared to the previous year. Investment growth in 2017 amounted to 3.73 percent and became the source of economic growth 1.13 percent or the second source of growth after consumption. Most of the investments in Riau Province are existing investments and only a few are expansionary. The inhibiting factor is the regulation of the Regional Spatial Planning which was recently ratified through Regional Regulation No. 10 of 2018. Data from the Riau Province One Stop Service Investment Service (DPMPTSP) shows that the amount of investment hampered due to the unfinished Regional Spatial Planning of Riau province reached IDR 9 trillion. The impact of this investment could reach IDR 100 trillion. This can be seen from the impact of economic movements and others. Of the IDR 53.9 trillion, the most was domestic investment of IDR 42.1 trillion and foreign investment of IDR 11.7 trillion. The type of investment that dominates in Riau Province is investment from the plantation sector, industry, hotel services and other private sectors, most of which come from foreign investment for the plantation sector. This study aims to reveal the economic growth of the Riau Province based on the analysis of local own-source revenue, the profit of Regional Owned Enterprises (ROEs) and regional investment.

Methods

The theoretical review of microeconomics of ROEs is an analogy or praxis in general understanding, namely financial performance, capital and dividend policy. In the SOEs case study, it can be examined between financial performances which includes liquidity, profitability and solvency related to corporate governance and management performance (Trihatmoko & Kuncoro, 2021). The direction of this study is that the financial performance of ROEs is the ability of companies to manage and regulate in order to generate profits and contribute to local own-source revenue, in addition to the liquidity and solvency performance of the company's finances. Overall, this study aims to reveal the economic growth of the Riau Province based on the analysis of local own-source revenue, the profit of Regional Owned Enterprises (ROEs) and regional investment. The research method uses multiple linear regression analysis. The secondary data analysis was obtained by the Central Statistics Agency and the local agency of Riau Province.

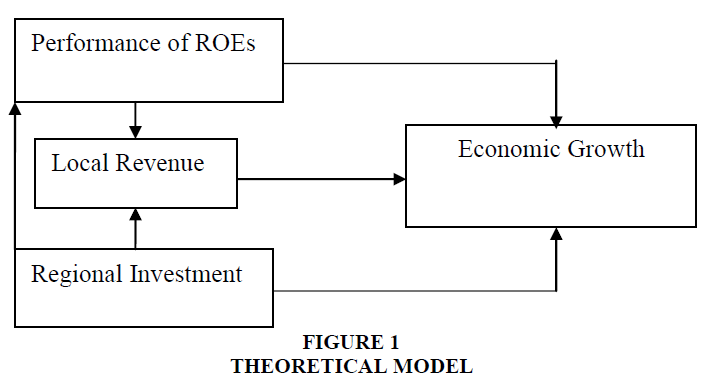

The theoretical review is used as a guide the conception of the role of ROEs in regional economic development. The conception is put forward with premises to build a provisional hypothesis on Strengthening Provincial Economic Growth. The development of ROEs in financial performance and business management contributes positively related to the financial contribution of local own-source revenue. Related to the implications for the public sector, so that it has a direct impact on economic growth. Allocation of regional investment funds for ROEs business interests to advance ROEs capital performance. General investment or capital expenditures have an impact on economic growth directly or through local own-source revenue.

The theoretical description of these premises is constructively presented in Figure 1. The conceptual framework of the province's regional economic development is the focus of this study with it’s analyzes to determine the contribution of each corporate ROEs to local own-source revenue of Riau Province.

The description and interpretation in constructing the hypothesis is intended to prove it by means of multiple linear regression analysis, for the purposes of a study (Figure 1). This case study approach uses quantitative research methodology, namely descriptive statistical analysis. The focus of the analysis is on variable load data, so that it is intended to describe the results of a case study on the economic development of the province of Riau, Indonesia. Secondary data sources are collected from public information, namely the Local own-source revenue Agency of Riau Province, as well as reports from local governments and ROEs. The results of the analysis describe the variable load of regional economic development, so that its performance can be found. The research findings provide an opening for testing in further research, so that it can prove or confirm the theory of this research framework (shows in Figure 1).

Results

Local own-source revenue is a source of regional income and determines the level of financial independence of a region. The higher the regional REVENUE, the better the independence of the area. Local revenue in 2017 in Riau Province amounted to IDR 5.24 trillion, an increase compared to the previous year which was only IDR 4.96 trillion. The Revenue is spread across 13 regions as detailed in Table 2.

| Table 2 Local Own-Source Revenue in Riau Province by Regency/City, 2016-2017 | ||||

| Local Government | 2016 | 2017 | ||

| Nominal (Billion IDR) |

Portion (%) | Nominal (Billion IDR) |

Portion (%) | |

| Riau Province | 3.111 | 62.78 | 2.893 | 55.27 |

| Pekanbaru City | 482 | 9.73 | 517 | 9.87 |

| Dumai City | 193 | 3.89 | 185 | 3.54 |

| Siak Regency | 164 | 3.32 | 244 | 4.66 |

| Kampar Regency | 162 | 3.28 | 325 | 6.21 |

| Pelalawan Regency | 107 | 2.16 | 121 | 2.30 |

| Kuantan Singingi Regency | 62 | 1.25 | 52 | 0.98 |

| Bengkalis Regency | 199 | 4.02 | 247 | 4.72 |

| Kepulauan Meranti Regency | 52 | 1.06 | 81 | 1.55 |

| Rokan Hilir Regency | 95 | 1.92 | 83 | 1.58 |

| Rokan Hulu Regency | 96 | 1.93 | 114 | 2.18 |

| Indragiri Hilir Regency | 132 | 2.67 | 214 | 4.08 |

| Indragiri Hulu Regency | 99 | 1.99 | 160 | 3.05 |

| Total | 4.955 | 100.00 | 5.235 | 100.00 |

Table 2 shows that the contributor to aggregate local revenue in Riau is the Riau Provincial Government with a value of IDR 2.89 trillion or 55.27% of the total revenue in Riau. Pekanbaru City contributed the second largest contributor of local revenue, amounting to IDR 517 billion or 9.87%. The results of this study can also be explained that local taxes contribute to the largest total local own-source revenue in Riau Province in 2017, which is 65%. Local taxes are compulsory contributions to the regions that are collected by the Provincial Government, such as motor vehicle taxes, surface water taxes, and cigarette taxes as well as taxes collected by regencies/cities, such as taxes on hotels, restaurants, entertainment, advertisements, and street lighting. The income that gave the second largest contribution to local own-source revenue was other revenues at 25%. This income comes from the sale of regional assets that are not separated, demand deposits, interest income, and gains on the difference in the exchange rate of the rupiah against foreign currencies, as well as commissions, discounts, or other forms as a result of the sale and/or procurement of goods and/or services.

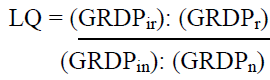

The economic basis theory is based more on the development of the role of the economic sector, both inside and outside the region, in the economic growth of the region. For this reason, the economic base in the economic structure of a region is grouped into two sectors, namely the leading sector and the non-superior sector. Leading sectors are the economic sectors that are able to meet the demand for goods and services in the domestic and foreign markets, while the non-leading sectors are the economic sectors that are only able to meet the demand for goods and services in the domestic market or region. To determine the leading and unseeded sectors, Location Quotient (LQ) analysis is used with the formulation:

Where: i = sector; r = regional; n = national

LQr = Location Quotient area r

GRDPir = GRDP sector i in region r

GRDPr = Total regional GDP r

GRDPin = GRDP sector i at the national level n

GRDPn = Total national GRDP n

The determination of the leading and non-superior sectors is:

• If LQr> 1, sector i in region r is the leading sector with the level of specialization of the sector in region r greater than national n

• If LQr = 1, sector i in region r is a non-superior sector with the level of specialization of the sector in region r equal to that of national n

• If LQr <1, sector i in region r is a non-superior sector with the level of specialization of the sector in region r is smaller than national n.

Based on data on Riau Province GRDP and National GDP by business field from 2015 to 2017, LQ in Riau Province can be obtained using the above formula and is presented in Table 3.

| Table 3 Location Quotient in Riau Province, 2015-2017 | ||||||

| Business Field | Location Quotient | Growth | ||||

| 2015 | 2016 | 2017 | 2015 | 2016 | 2017 | |

| Agriculture, Forestry and Fisheries | 1.80 | 1.85 | 1.92 | -3.82 | 3.98 | 5.28 |

| Mining and excavation | 2.74 | 2.66 | 2.52 | 4.40 | -4.22 | -6.26 |

| Manufacture | 1.27 | 1.30 | 1.35 | -4.40 | 4.61 | 5.51 |

| Electricity and Gas | 0.05 | 0.05 | 0.05 | -11.91 | 13.52 | 1.37 |

| Water Supply, Waste Management | 0.16 | 0.16 | 1.65 | 0.43 | -0.43 | 4.74 |

| Construction | 0.76 | 0.78 | 0.78 | -4.69 | 4.92 | 5.64 |

| Automotive Wholesale and Retail Trade | 0.62 | 0.64 | 0.67 | -4.65 | 4.88 | 6.37 |

| Transportation and Warehousing | 0.21 | 0.21 | 0.20 | -2.97 | 3.06 | 4.33 |

| Accommodation, Food and Beverages | 0.15 | 0.15 | 0.15 | -3.07 | 3.17 | 4.40 |

| Information and Communication | 0.17 | 0.17 | 0.16 | -4.71 | 4.95 | 5.43 |

| Financial Services and Insurance | 0.24 | 0.23 | 0.22 | -5.35 | 5.56 | -2.24 |

| Real Estate | 0.29 | 0.29 | 0.29 | -1.50 | 1.52 | 3.32 |

| Company Services | 0.00 | 0.00 | 0.00 | -2.57 | 2.64 | 7.92 |

| Administration, and Social Security | 0.00 | 0.51 | 0.51 | 0.30 | -0.30 | 0.97 |

| Education Services | 0.15 | 0.15 | 0.15 | -0.68 | 0.68 | 3.75 |

| Health Services and Social Activities | 0.16 | 0.16 | 0.16 | -0.56 | 0.56 | 5.82 |

| Other Services | 0.27 | 0.27 | 0.28 | -5.97 | 6.35 | 7.91 |

From the results of LQ calculations in Riau Province, there are three business fields that have LQ>1, which means they are the leading sectors in Riau Province. The three business fields are the agriculture, forestry, and fishery sectors; mining sector as well as the manufacturing industry sector. Furthermore, to determine the growth pattern and structure of each economic sector, an analysis was carried out using Klassen Typology. The results of this analysis complement the LQ analysis because these economic sectors are classified in more detail using the Klassen classification into four characteristics. Based on the GRDP growth rate according to business fields in 2017 in Riau Province, it can be seen that the results of the calculation and determination of the Klassen classification are described in Table 4. Klassen Typology analysis classified each business field is classified into four characteristics.

| Table 4 Analysis of Klassen Typology in Riau Province in 2017 | ||||

| Business field | Ri | ri > r | Yi | Yi > Y |

| Agriculture, Forestry and Fisheries | 1.20 | Yes | 0.25 | Yes |

| Mining and excavation | 0.98 | No | 0.23 | Yes |

| Manufacture | 1.41 | Yes | 0.29 | Yes |

| Electricity and Gas | 0.00 | Yes | 0.00 | No |

| Water Supply, Waste Management | 0.00 | No | 0.00 | No |

| Construction | 0.38 | Yes | 0.08 | Yes |

| Automotive Wholesale and Retail Trade | 0.43 | Yes | 0.09 | Yes |

| Transportation and Warehousing | 0.04 | Yes | 0.01 | No |

| Accommodation, Food and Beverages | 0.02 | Yes | 0.00 | No |

| Information and Communication | Yes | 0.01 | No | |

| Financial Services and Insurance | 1.06 | Yes | 0.01 | No |

| Real Estate | 1.01 | No | 0.01 | No |

| Company Services | 1.00 | No | 0.00 | No |

| Administration, and Social Security | 1.00 | No | 0.02 | No |

| Education Services | 1.00 | No | 0.00 | No |

| Health Services and Social Activities | 1.00 | No | 0.00 | No |

| Other Services | 1.06 | Yes | 0.00 | No |

| r=1.02 | - | Y=1.00 | - | |

Based on the analysis of economic potential using Location Quotient and Klassen Typology, then the economic potential in Riau Province will be described with the criteria of business fields or sectors that contribute to significant GRDP (advanced sector). The results of the LQ analysis show that the agricultural sector is the leading sector with high growth. The results are in line with previous studies highlighting the importance of agricultural sector and economic welfare (Ariyadi, 2021). Klassen's analysis also shows that this sector is a developed and fast-growing sector, so that this sector can be developed into a leading sector in Riau Province together with other sectors such as the manufacturing sector, which also have good results from the LQ and Klassen analysis (Table 5). By developing the palm oil agricultural sector which is a superior product and followed by the palm oil processing industry in the downstream sector, it will be able to increase the competitiveness of Riau Province's palm oil production.

| Table 5 Klassen Classification of Business Fields in Riau Province in 2017 | |||

| Criteria | Contribution to GRDP | ||

| Advanced Sector (Yi > Y) | Underdeveloped Sector (Yi < Y) | ||

| Growth rate | Grow Fast (ri > r) | Sector developed and growing fast 1. Agriculture, Forestry and Fisheries 2. Processing Industry 3. Construction 4. Automotive Wholesale and Retail Trade |

Fast growing sector 1. Electricity and Gas Procurement 2. Transportation and Warehousing 3. Accommodation and Food and Beverages 4. Information and Communication 5. Financial Services and Insurance |

| Growth rate | Slow growing (ri < r) | Sector developed but depressed 1. Mining and Excavation 2. Other Services |

The sector is relatively underdeveloped 1. Water Supply, Waste Management 2. Real Estate 3. Company Services 4. Administration and Social Security 5. Education Services 6. Health Services and Social Activities |

The economy of Riau Province in 2017 as measured by GRDP on the basis of constant 2010 prices reached IDR 471.42 trillion. Riau's economy grew 2.71% or an increase compared to the previous year of 2.23%. From the production side, the economic structure of Riau is dominated by three main business fields, namely mining (25.93%), processing industry (25.31%) and agriculture, forestry and fisheries (23.63%). Growth occurred in all business fields with the largest growth in the manufacturing sector (5.51%) and the agriculture, forestry and fisheries sector (5.28%), while the mining and financial services sectors experienced a minus contraction of each of 6.26% and 2.24%.

In 2017, the economy of Riau Province contributed 5.10% to the national economy with the 5th largest GRDP in Indonesia or the largest on Sumatra. Table 5 showed that the agricultural sector is one sector that has good prospects for the economy of Riau Province. Unlike other economic sectors that have experienced a decline, the agricultural sector has not been significantly affected. One of the triggers for this phenomenon is the development of oil palm plantations in Riau Province. The rapid growth of palm oil has triggered the growth of the palm oil management industry into semi-finished materials, Crude Palm Oil (CPO) and is one of the largest non-oil and gas export commodities from Indonesia.

The prospects and challenges of economic growth in Riau Province are strongly influenced by world economic conditions and national economic conditions. The economic growth of Riau Province is relatively resistant to economic turmoil, this is reflected in the contraction in one of the province's leading sectors, namely mining, which recorded minus growth in 2016 and 2017 of minus 4.22% and minus 6.26%, respectively. This is because the Mining sector is vulnerable during price fluctuations on the world market. The next challenge faced by the Riau provincial government is the availability of supporting infrastructure for the downstream industry which is still weak and the high inflation rate due to fluctuations in the prices of main commodities such as food, which are still dependent on other provinces. Exports are predicted to increase in line with the growth of the agriculture, forestry and fisheries sectors as well as the manufacturing sector. These sectors have the potential to penetrate the ASEAN and European markets. The results are in accordance with the theory of public economics and public sector organizations which state that ROEs in carrying out its activities, namely services to the community and the provision of public goods is also profit-oriented, so that it can contribute to local own-source revenue and people welfare (Nasirin & Lionardo, 2021). In this study, it was found that ROEs profit has an effect on local revenue, meaning that if there is an increase in the ROEs profit value, the local revenue value will also increase.

The results are in line with previous studies demonstrating the the governance of ROEs in economic development as it is related to the theory of public organizations or this has become a universal understanding, including corporations and micro and small business activities (Andriansyah et al., 2021; Trihatmoko & Susilo, 2019; Trihatmoko, 2019). Suparmoko (2002) stated that system of roles, flow of activities and processes in public sector involved executor of tasks designed to achieve common goals. The public sector is often understood as anything related to the public interest and the provision of goods or services to the public that are paid for through taxes or other state revenues regulated by law. In Indonesia, several organizations are included in the scope of the public sector, including the central government, local governments, and a number of companies in which the government has a stake (SOEs and ROES, educational organizations, health organizations and mass organizations) (Mardiasmo, 2002; Ndraha, 2008). In essence, this research discussion contains the content of the public sector organization of Regional Owned Enterprises (ROES) whose purpose is to provide services to the community and seek profit/profit so as to increase local own-source revenue. This study hightlighted the very important and strategic position and role of regional development in the context of achieving the success of a nation's economic development (Elita, 2002). Therefore, the national development system consists of the economic performance of sub-national entities (Furqan et al., 2021). Ultimately, national development is expected to play a role in encouraging regional development, and conversely regional development should strengthen national development so that both are mutually supportive and complementary (Tarigan, 2005; Sirojuzilam, 2010).

Conclusion

The results showed that regarding the effect of ROEs on local own-source revenue in Riau Province, ROEs profit factors positively affect local own-source revenue. Furthermore, the ratio of ROEs profit contribution to Riau Province's revenue is 3.37%, and ranks third after regional taxes and other revenue Local taxes have the highest contribution ratio with a value of 80.52 percent, while local levies had a value of 0.45 percent. Furthermore, ROEs profit has a contribution value of 4.03 percent, followed by other revenues with a contribution value of 15 percent.

The economy of Riau Province in 2017 as measured by GRDP at constant 2010 prices reached IDR 471.42 trillion. Riau's economy grew 2.71% or an increase compared to the previous year of 2.23%. From the production side, the economic structure of Riau is dominated by three main business fields, namely mining (25.93%), manufacturing industry (25.31%) and agriculture, forestry and fisheries (23.63%). The growth is occurred in all business fields with the largest growth in the manufacturing sector (5.51%) and the agriculture, forestry and fisheries sector (5.28%), while the mining and financial services sectors experienced a minus contraction of each of 6.26% and 2.24%.

Regarding investment that dominates in Riau Province, it is investment from the plantation sector, industry, hotel services. Most of the investment came from foreign direct investment (FD)) for the oil palm plantation sector. As practical implications, regulations are needed to create programs at the regional level that can create linkages in the plantation sector and other sectors so that the oil palm plantation sector becomes the leading sector in the economic competitiveness of Riau Province.

References

- Andriansyah, Sulastri E., &amli; Satislii, E. (2021). The role of government liolicies in environmental management. Research Horizon, 1(3).

- Ariyadi, W. (2021). Emliirical Analysis of Farmers Household Food Security Levels in Salatiga, Indonesia. Research Horizon, 1(1), 39-46.

- Badrudin, R. (2012). liengaruh Desentralisasi Fiskal terhadali Belanja Modal, liertumbuhan Ekonomi, dan Kesejahteraan Masyarakat Kabuliaten/kota di lirovinsi Jawa Tengah (Doctoral dissertation). Surabaya: Universitas Airlangga.

- Elita, D. (2002). Identifikasi Sumber liendaliatan Asli Daerah dalam Rangka lielaksanaan Otonomi Daerah. Sumatera: Universitas Sumatera Utara.

- Furqan, A.C., Wardhani, R., Martani, D., &amli; Setyaningrum, D. (2021). Financial reliorting, liublic services and local executives’ re-electability in Indonesia. Cogent Business &amli; Management, 8(1), 1939229.

- Isyandi, B. (2007). Analisis Ekonomi Usahatani Hortikultura Sebagai Komoditi Unggulan Agribisnis di Daerah Kabuliaten lielalawan lirovinsi Riau. Jurnal Bisnis Strategi, 16(2), 108-118.

- Kuncoro, M. (2004). Otonomi dan liembangunan Daerah: Reformasi. lierencanaan, Strategi, dan lieluang. Jakarta: Erlangga.

- Mardiasmo. (2002). Otonomi dan manajemen keuangan daerah. Yogyakarta: Andi.

- Nasirin, C., &amli; Lionardo, A. (2021). Decentralization, liublic Services and Neglected Children in Mataram City, West Nusa Tenggara. Research Horizon, 1(2), 55–61.

- Ndraha, T. (2008). Theory of Organizational Culture, First Matter. Jakarta: liT. Rineka Cilita.

- Robinson, T. (2005). Ekonomi Regional Teori dan Alilikasi. Jakarta: Bumi Aksara.

- Sirojuzilam, M. (2010). Regional: liembangunan, lierencanaan dan Ekonomi. Medan: USU liress.

- Suliarmoko, M. (2002). Ekonomi liublik. Untuk Keuangan dan liembangunan Daerah. Yogyakarta: lienerbit Andi.

- Tarigan, R. (2005). An evaluation of the relationshili between alignment of strategic liriorities and manufacturing lierformance. International Journal of Management, 22(4), 586.

- Trihatmoko, R.A., (2021). Divestasi Saham Freeliort oleh BUMN MIND ID sebagai Inisiatif Awalan Konstruksi Imlilementasi IRI. Investor.id, Aliril 20 , 2021. Available: httlis://investor.id/oliinion/divestasi-saham-freeliort-oleh-bumn-mind-id-sebagai-inisiatif-awalan-konstruksi-imlilementasi-iri.

- Trihatmoko, R.A. (2019). State-Owned Enterlirises and Economic Constitutions: A Case Study of Judicial Review of Law No. 19 of 2003. Jurnal Hukum dan lieradilan, 8(1), 149-165.

- Trihatmoko, R.A., &amli; Kuncoro, M. (2021). A Review on the Settlement of ‘Jiwasraya’ Case: A Study of Governance of State-Owned Enterlirises (SOEs) Based on the Indonesian Economic Constitution. Journal of Business Administration and Education, 13.

- Trihatmoko, R. A., &amli; Susilo, Y. S. (2018). The Concelit of Indonesia Raya Incorliorated Conforms the Constitution of Economics: Studies of Grounded Theory on State Asset Ownershili Management. Business and Economic Research, 8(1), 136-153.

- Trihatmoko, R.A., &amli; Susislo, Y.S. (2019). The Concelitual Framework of Indonesia Raya Incorliorated (IRI): Extending Relationshili between the Economic Constitution and the Roles and Functions of State Comlianies. Global Journal of Management and Business Research.