Research Article: 2019 Vol: 23 Issue: 1

Intellectual Capital and Financial Performance: Empirical Evidence from Iraq Stock Exchange (ISE)

Hasan Subhi Hasan Hussein Alabass, Al Hadbaa University College, Iraq

Abstract

The purpose of this study is to investigate whether intellectual capital plays a significant role in financial performance of banking sector in Iraq. We use value-added intellectual coefficient approach to measure the intellectual capital by aggregating the capital-employed efficiency, Human capital efficiency and structural capital efficiency. For financial performance, we use two proxies, return on assets and return on equity. Initially we regress two models, return on assets and return on equity, on value-added intellectual coefficient approach separately and then regress financial performance with each component of intellectual capital. Overall findings explain significant role of intellectual capital on the financial performance of banking sector in Iraq. Furthermore, intellectual capital components like capital-employed efficiency, Human capital efficiency and structural capital efficiency have a positive and significant relation with return on assets and return on equity, except structural capital efficiency which has no significant effect on return on equity. We also find impact of human capital efficiency much stronger on financial performance than the others components in the banking sector in Iraq.

Keywords

Intellectual Capital, Financial Performance, Human Capital, Structural Capital, Relational Capital, Iraq Stock Exchange.

Introduction

Traditional approach of competitive advantage considers tangibles assets as a source of firm value (Liu, 2017; Pablos, 2002). Whereas, the researchers of recent era find the Intellectual Capital (IC) as the key factor of the competitive advantage and firm’s value (Bontis et al., 2015; Maditinos et al., 2011; Shih et al., 2010). The efficiency of IC is more critical for achieving high success and competitive advantage in banking sector than the other sectors. Banking sector needs to achieve high quality of services which cannot be reached without consider subcomponent of IC such as human resources, brand building, systems and processes (Ahuja & Ahuja, 2012). IC with its components need to attention to develop a new method of measure IC (Berzkalne & Zelgalve, 2014).

The researchers realize that IC has a positive impact on firms’ value and increase the financial performance. Existing literature also explain several methods for the development IC index (Edvinsson, 1997; Kaplan & Norton, 1996; Roos et al., 1997). In last two decade, several studies investigate the association between IC performance and financial performance of organizations, using value-added intellectual coefficient model (Chen et al., 2005; Joshi et al., 2010; Meles et al., 2016; Mondal & Ghosh, 2012; Pulic, 2004; Yalama, 2013). Previous studies, use VAIC model for effectiveness and applicability to measure the IC and to figures the impact on of each firm’s performance (Firer & Williams, 2003).

Several studies suggest three components of IC performance: Human Capital Efficiency (HCE), Structural Capital Efficiency (SCE), and Capital Employed Efficiency (CEE) (Firer & Stainbank, 2003; Makki et al., 2009; Tan et al., 2007). Study of (Meles et al., 2016; Vaisanen et al., 2007) state that only Human Capital Efficiency (HCE) of VAIC explains financial performance. (Tseng & Goo, 2005; Wang, 2008) argue that there is no relationship between VAIC components and firms’ value. Moreover, several other studies examine the relationship between IC and financial performance and found positive relationship (Chu et al., 2011; Kamath, 2008), negative (Chan, 2009a; Chan, 2009b; Ghosh & Mondal, 2009) insignificant impact. There is not a single study, who can address the relation of IC, overall and component wise, on the firm financial performance particularly in the banking sectors of Iraq. So, this study will address this gap in the literature.

On the basis above literature and study gap, the objective of this study is to answer the follow questions:

1. What is the impact of IC on financial performance especially in Iraq’s banking sector?

2. Is the Value Added Intellectual Coefficient (VAIC) model fit for this study?

3. Is there any relationship between the components of VAIC and financial performance?

4. What is the degree of significance of each component in this relationship? Based on the above mentioned objective, this study will address phenomena by using VAIC model as aggregate IC and (HCE), (SCE), and (CEE) proxies for individual component to test the impact of IC on the banking financial performance of all listed bank in Iraqi Stock Exchange(ISE) for the period of (2011-2016).

Empirical analysis explains a positive and significant relationship between Intellectual capital and financial performance in the banking sector in Iraq. Additionally, VAIC model improved the relationship between IC performance and financial performance. The components of IC also have a positive and significant with ROA. Capital Employed Efficiency (CEE), Human Capital Efficiency (HCE) and structural capital efficiency (SCE) have a positive relationship with ROE, while, Capital Employed Efficiency (CEE), Human Capital Efficiency (HCE) significantly impacts on ROE but Structural Capital Efficiency (SCE) has no significant effect. Finally, Human Capital Efficiency (HCE) has a higher significant impact on financial performance than the others components in the banking sector in Iraq.

This research contributes in several ways: first, this research provides another evidence of the impact of IC on financial performance from the banking sector in Iraq. The controversial results in the literature about the effect of IC and its components in financial performance over the world, the evidence of this study support the positive effect results. This study provides a new method for Iraqi’s banks to evaluate their performance and to enhance their IC management. Final, it provides good evidence to the bank's managers that human capital plays a more significant effect of performance compared to other components of IC to give more attention to human capital management.

The rest of this paper is organized as follow. The second section discusses the relevant Section 2 discusses the relevant literature and develops the hypothesis. The third section presents the study sample, variables, and methodology. The fourth section discusses the empirical results. Finally, section 5 concludes this paper.

Literature Review And Hypotheses Development

Intellectual Capital

Intellectual capital tends to be an important resource and a key contributor to the economic success and value creation in a business. Intellectual capital is an intangible value driver in a firm that carries about future benefits. In the current markets, competition is high and the buyers have become more informed. Also, the modern business environment is quite dynamic and the firms are facing many changes. The survival of many businesses depends on their willingness and ability to adapt to such changes (Chrisman et al., 2015). According to Obeidat et al. (2017) the firms are able to quickly adapt to the changes and remain competitive in the markets through intellectual capital. Due to innovation, the source of competitive advantage is commonly become intellectual capital.

There are several definitions of intellectual capital. However, there is very few explanation of the concept of IC. IC is based on intangible assets, which are not well addressed by companies’ balance sheet or income statement. (Yalama, 2013) find the intangible assets impact significantly on the firms’ performance and successfulness. Kayacan & Alkan, 2005; Mondal & Ghosh, 2012 also emphasize intellectual capital may be understood as the intangible assets which are not listed clearly on a firm's balance sheets but positively impact the performance.

From a resource-based perspective, the sustainability of competitive advantage based on valuable and rare tangible and intangible resources (Barney, 1991). In resource-based theory, firms consider all kinds of capitals as strategic resources such IC, physical and financial capitals because they represent a competitive advantage and superior performance through efficient use of these resources (Zeghal & Maaloul, 2010). Reed et al. (2006) develop the theory of intellectual capital based as one aspect of the theory of resource-based. The main source of competitive advantage and value added to firms is IC because physical capital is simply imitable and substitutable, and can be easily obtained from the open market (Reed et al., 2006). This consideration is also presented by (Youndt et al., 2004). These researchers consider IC as a core strategic asset through creating and maintaining the competitive advantage of the firms.

Several studies examine the relationship between IC and financial performance. Some of them find a positive relationship (Chu et al., 2011; Kamath, 2008), negative or not significant relationship (Chan, 2009a; Chan, 2009b; Ghosh & Mondal, 2009). Based on the theory of resource-based, we thus hypothesize that:

H1: intellectual capital performance is significantly and positively associated with the bank’s financial performance

In the literature, there are three components: Human Capital; Structural capital and Relational Capital. Human capital is one component of IC and the most innovative feature for firms to act according to the environmental changes that contribute the organizational performance through their knowledge, experience, and capabilities applied to improve the organizational efficiency (Tarus & Sitienei, 2015). The authors emphasize that in recent studies, human capital is the most powerful part of increasing firms’ performance sufficiently. In addition, structural capital is an important part of a firm performance because the procedures, core culture, and scientific awareness and other features add towards the progress of the enhanced firm performance (Herzog, 2011). Finally, Relational capital is based on the relationships of firms with the external and internal individuals of the firm. Therefore; it is necessary to have a good relation with employees, customers, suppliers, investors, and others because they provide their best information and valuable feedback based upon firm’s performance (Asiaei & Jusoh, 2015). So, it is necessary to examine the relationships between these components and firm’s performance especially in banking sector by using accepted measurement methods.

Recently, there is a debate about accepted measurement of IC (Chan, 2009a; Zeghal & Maaloul, 2010). There are 34 methods to measure IC reviewed by Sveiby (2010). The current and. The author finds that, the VAIC methodology is commonly used method and suggested by many researchers as the most appropriate method to measure IC performance. In developed and emerging economies, there are several studies use VAIC methodology to examine the relationship between IC performance and firms performance, in banking and non-banking sectors producing mixed results see e.g. Komnenic and Pokrajcic (2012) in Serbia, Chu et al. (2011) in Hong Kong, Wang (2011) in Taiwan, Zeghal and Maaloul ( 2010) in UK, Chan (2009a) in Hong Kong, Ting and Lean (2009) in Malaysia.

the three critical characteristics of IC including human; structural and employed capitals have been employed in recent studies (Subramaniam & Youndt, 2005). According to Pulic (2004), the banks with high investment in IC and its characteristics have improved their performance and success (Joshi et al., 2010; Mondal & Ghosh, 2012; Ting & Lean, 2009). In addition, some studies argue that the relationship between the value added of IC and firms’ performance is positive but there is a debate about which of the IC characteristics enhance financial performance. Some researchers argue that the most significant characteristic of IC has a positive relationship with financial performance is human capital efficiency (Goh, 2005; Meles et al., 2016; Mondal & Ghosh, 2012). On the other hand, others find that capital employed efficiency is the most component of IC has positively and significantly associated with the performance. Therefore, we propose our hypotheses below:

H2: Human capital efficiency is significantly and positively associated with the bank’s financial performance.

H3: Structural capital efficiency is significantly and positively associated with the bank’s financial performance.

H4: Capital employed efficiency is significantly and positively associated with the bank’s financial performance.

Research Methodology

Sample

Our sample of this study including all banks, which are divided into two main types: (Islamic and Commercial banks), listed in Iraqi Stock Exchange (ISE). Study sample based on the 30 listed banks among 39 banks due to unavailability of data. Data are manually punched form financial statement of banks, annually published in ISE. The observations of our sample for six years (2011-2016) (we use only this period because of the availability of data) are 180.

Dependent Variable

Following the literature, we use Return on Assets (ROA) which is a proxy to measure the financial performance and profitability of the banks (Dietrich & Wanzenried, 2011; Pasiouras & Kosmidou, 2007). Another method is a Return on Equity (ROE) represents the best financial indicator for stakeholders (Joshi et al., 2010; Ting & Lean, 2009; Yalama, 2013).

Experimental Variables

Value-added Intellectual Coefficient method (VAIC) was used to measure the IC performance following the literature (Ghosh & Mondal, 2009; Meles et al., 2016; Yalama, 2013). We use the three components of IC for VAIC mathematically as equation 1 below:

represents to value added intellectual coefficient of bank i with year t.

represents to value added intellectual coefficient of bank i with year t.  represents capital employed ccoefficient of bank i, in year t;

represents capital employed ccoefficient of bank i, in year t;  represents the human capital efficiency of bank i, in year t;

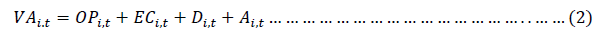

represents the human capital efficiency of bank i, in year t;  represents the structural capital efficiency coefficient of bank i, in year t. To compute these variables as shown in Table 1, the total value added (VAi,t) need to be computed as equation 2 bellow (Chu et al., 2011; Meles et al., 2016; Pulic, 2004):

represents the structural capital efficiency coefficient of bank i, in year t. To compute these variables as shown in Table 1, the total value added (VAi,t) need to be computed as equation 2 bellow (Chu et al., 2011; Meles et al., 2016; Pulic, 2004):

| Table 1 The Definitions And Measurement Of The Study’s Variables |

|

| Variables | Definitions and Measurements |

| Dependent variables | |

| ROAi,t | Return on Assets= net profits/total assets at year t. |

| ROEi,t | Return on equity=the annual net profit of individual bank before tax/average shareholders` equity. |

| Experimental Variables | |

| VAICi,t | Value added intellectual coefficient measured by mathematical equation 1. |

| CEEi,t | Capital employed efficiency coefficient= the total value added created by the bank I/the capital employed (book value of assets). |

| HCEi,t | Human capital efficiency=total value added created by the bank i;/ personnel expenses of the bank i. |

| SCEi,t | Structural capital efficiency= total value added created by the bank i/ the difference between VAi and HCi. |

| Control Variables | |

| Sizei,t | Bank size=Natural Log of Total Assets. |

| Leveragei,t | Leverage=sum of total short-term and long-term debt/total assets. |

| Timei,t | Using Dummy fix-effect variable for bank-year with value 1, otherwise 0. |

Where,  represents the Operating Profits of bank i, in year t;

represents the Operating Profits of bank i, in year t;  refers to Total employee expenses of bank i, in year t;

refers to Total employee expenses of bank i, in year t;  refers to the depreciation of bank i, in year t; and

refers to the depreciation of bank i, in year t; and  refers to amortization of bank i, in year t.

refers to amortization of bank i, in year t.

Control Variables

Following the literature to control our dependent variable, we use Size of bank (Natural Log of total assets) and leverage (sum of total short-term and long-term debt divided by total assets) (Meles et al., 2016; Mondal & Ghosh, 2012; Yalama, 2013). We use also dummy variable for years (Fix-Effect) to Control for Unobserved Heterogeneity (e.g. macroeconomic shocks).

Research Model

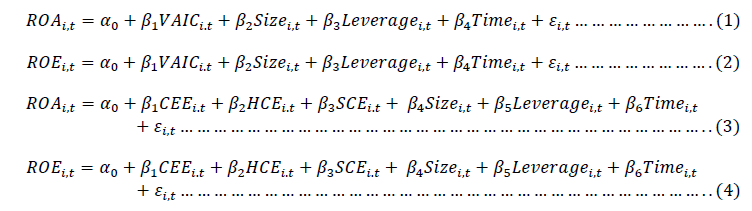

We build our regression models to test our hypotheses as bellow:

In bellow, Table 1 including variables’ definitions

Results And Discussion

Descriptive Statistics Analysis

Table 2 reports the descriptive statistics of all corresponding variables. The results show mean, standard deviation and median of Return on Assets (ROA), Return on Equity (ROE), Value-Added Intellectual Coefficient (VAIC), Capital Employed Efficiency (CEE), Human Capital Efficiency (HCE), Structural Capital Efficiency (SCE), Size, leverage. Because of binary in nature, the descriptive of a dummy variable, i.e., time has no meaning.

| Table 2 Descriptive Statistics Analysis |

|||

| Mean | Std. Dev. | Median | |

| ROA | 0.956 | 0.196 | 0.771 |

| ROE | 0.4900 | 0.186 | 0.336 |

| VAIC | 0.308 | 0.143 | 0.250 |

| CEE | 0.268 | 0.168 | 0.253 |

| HCE | 0.763 | 0.466 | 0.647 |

| SCE | 0.030 | 0.083 | 0.036 |

| Size | 1.238 | 1.064 | 1.079 |

| Leverage | 0.794 | 0.955 | 0.061 |

| Time | 0 | 0 | 0 |

| Note: ASee Table 1 for variables definitions. | |||

Pairwise Correlation Matrix

Table 3 reports pairwise correlation and significant matrix corresponding to all of the study’s variables. In this table, the correlations and their significant of all the research period during the study period are reported. Additionally, the matrix has shown correlation and its significant results for each pair respectively. ROA has positive and significant correlation with all the research variables, only with leverage has negative and high significant. Furthermore, ROE has positive and significant correlation with ROA, VAIC, CEE, HCE, SCE and Size however, it has negative and significant correlations with leverage and Time. Value added intellectual coefficient has highly significant and positive correlation with ROA and ROE. For VAIC’s dimensions, HCE has highly significant correlation than CEE and SCE. From this results, it is recognized that the correlation between dependent and independent variables are highly correlated.

| Table 3 Pairwise Correlation And Significant Matrix |

|||||||||

| ROA | ROE | VAIC | CEE | HCE | SCE | Size | Leverage | Time | |

| ROA | 1.0000 | ||||||||

| ROE | 0.0569*** | 1.0000 | |||||||

| VAIC | 0.0681*** | 0.0361*** | 1.0000 | ||||||

| CEE | 0.0021* | 0.0032* | 0.1307*** | 1.0000 | |||||

| HCE | 0.0641*** | 0.0864*** | 0.0382*** | 0.0500*** | 1.0000 | ||||

| SCE | 0.0167** | 0.0147** | 0.3169*** | 0.2100*** | 0.0432*** | 1.0000 | |||

| Size | 0.0404*** | 0.0207** | 0.0810*** | 0.1651*** | 0.0063 | 0.0945*** | 1.0000 | ||

| Leverage | -0.4530*** | -0.0347*** | -0.1069*** | 0.1247*** | 0.0388*** | 0.0223** | 0.0371*** | 1.0000 | |

| Time | 0.6164*** | -0.1090*** | 0.0515*** | 0.0905*** | -0.0165** | -0.0291*** | 0.0431*** | -0.0111 | 1.0000 |

| ASee Table 1 for variables’ definitions. * Significance at 0.10. ** Significance at 0.05. *** Significance at 0.01. |

|||||||||

Discussion

Table 3 reports OLS regression results of the four models of this study to test the hypotheses of this study. Firstly, the result of the first model suggested that the relationship between VAIC and ROA is positive and significant. The coefficient of VAIC is positive and high significant with ROA (1.631, t=3.55, p<0.01). In model 2, the coefficient of VAIC is positive and significant with ROE (1.034, t=2.32, p<0.05). Thus, these two results supporting our first hypothesis.

These Results of the Models 1 and 2 presented in Table 3 shows there is a positive and statistically significant relationship between VAIC and the financial performance indicators (ROA) and (ROE) for the period 2011-2016. This finding implies that VAIC has impact on the profitability of banks while, in Turkey, Ozkan et al. (2017) find that VAIC has no impact on the profitability of banks. Joshi et al. (2010) also find similar findings for the financial institutions operating in Australia. Moreover, the authors indicate that most of the recent studies (Maditinos et al., 2011; Mehralian et al., 2012) present various findings showing that ROA is not affected by VAIC. However, Al-Musali and Ismail (2014) coincide with results of this study, find that there is a significant positive association between VAIC and both financial performance indicators (ROE and ROA) of commercial banks. So, the aggregated results from models 1 and 2 tend to focus on VAIC as a predictor of banks’ intellectual efficiency in Iraq and as such provide support to our expectation which implies that banks with greater IC performance tend to have higher financial performance. Additionally, the results of Models 1 and 2 in Table 3 show that the control variables i.e. Size has positive and significant coefficient with ROA and ROE while, Leverage has negative coefficient with both ROA and ROE.

Furthermore, the results of Models 3 and 4 in Table 3 report the regression results of VAIC’s dimensions with ROA and ROE respectively. The coefficient of CEE has positive and high significant with ROA (4.847, t=3.02, p<0.01), as well as the coefficient of CEE in Model 4 is positive and significant with ROA (1.034, t=2.32, p<0.05) thus, this result support our second hypothesis. The coefficient of HCE is also positive and significant in both results of Models 3 and 4 (0.868, t=6.17, p<0.001; 1.935, t=6.168, p<0.001, respectively). This results support our third hypothesis. To test the fourth hypothesis, the results of Models 3 and 4 of Table 3 report the SCE has positive and significant coefficient with ROA while, the coefficient with ROE has positive but not significant. This results consistent with findings of Ting and Lean (2009) and Joshi et al. (2013) suggest that SCE does not have a statistically significant effect on the profitability of financial institutions in Malaysia and Australia. However, both results supporting the fourth hypothesis.

Finally, the results in Table 4 report that VAIC, CEE, HCE, SCE and Size positively impact on ROA and ROE. This evidence provides that the intellectual capital and its dimensions have positive impact on the financial performance.

| Table 4 OLS Regressions Results Of The Four Models Of This Study |

|||||||||

| Model 1 | Model 3 | Model 2 | Model 4 | ||||||

| ROA | Coefficient | T-Value | Coefficient | T-Value | ROE | Coefficient | T-Value | Coefficient | T-Value |

| VAIC | 1.631 | 3.55*** | 1.034 | 2.32** | |||||

| CEE | 4.847 | 3.02*** | 2.853 | 5.67** | |||||

| HCE | 0.868 | 6.17*** | 1.935 | 6.168*** | |||||

| SCE | 0.509 | 3.04*** | 0.387 | 0.798 | |||||

| Size | 0.012 | 3.87*** | 1.236 | 2.49** | 1.254 | 9.83*** | 1.116 | 9.435*** | |

| Leverage | -0.103 | 2.56** | -0.846 | 6.13*** | -0.454 | -0.902 | -1.109 | -0.93 | |

| Time | 0.365 | 2.67*** | 0.498 | 2.76*** | -0.293 | -2.16*** | -0.411 | -2.54*** | |

| Firm-year observations | 180 | 180 | 180 | 180 | |||||

| Adj. R2 | 0.118 | 0.136 | 0.183 | 0.192 | |||||

| ASee Table 1 for variables definitions. ** Significance at 0.05. *** Significance at 0.01. |

|||||||||

Conclusion

The main objective of this study is to investigate the relationship between intellectual capital and financial performance of the listed banks in Iraqi stock exchange. In different countries, the researchers find different results of the influence of IC and its components in financial performance as mentioned in the literature section above.

The findings of this study reported as bellow:

1. In the literature, there is no single study has been investigated the relationship between IC and financial performance especially, in banking sector of Iraq.

2. There is a positive and significant relationship between intellectual capital and financial performance of the Iraqi banking sector as shown in pairwise correlations matrix in Table 2

3. The IC performance impact on financial performance positively and significantly especially in banking sector in Iraq reporting in Table 3, models 1 and 3

4. VAIC model is useful to measure the IC performance for each bank separately.

5. The relationship between the components of IC performance such: Capital Employed Efficiency (CEE), Human Capital Efficiency (HCE), Structural Capital Efficiency (SCE) and financial performance is positive and significant that shown in Tables 2 and 3

6. Human Capital Efficiency (HCE) has highly significant impact on financial performance compared to other components as shown the results of Models 2 and 4 in Table 3, thus, it only the component has significant impact on ROA and ROE respectively.

7. The controversial results in the literature about the effect of IC and its components in financial performance over the world, the evidence of this study support the positive effect results.

8. This study provides a new method for Iraqi’s banks to evaluate their performance and to enhance their IC management

9. This study provides good evidence to the bank's managers that human capital plays a more significant effect of performance compared to other components of IC to give more attention to human capital management.

Recommendations

It is recommended to the future researchers to conduct the study using the variable of environment uncertainty as interaction effect on the relation between IC and firm’s performance that will bring new findings for the study. Sharing knowledge is a good dimension for human capital can be conducted might be providing new findings. In addition, the regulatory change also plays another limitation for firms especially in banking sector. Finally, business ties also play a good role for relational capital so the researchers could conduct it in the future studies. The bank's managers should give more attention to IC especially human capital management according to the results of this study

References

- Ahuja, B.R., & Ahuja, N.L. (2012). Intellectual capital approach to performance evaluation: A case study of the banking sector in India. International Research Journal of Finance & Economics, 93(1), 110-122.

- Al-Musali, M.A.K., & Ismail, K.N.I.K. (2014). Intellectual Capital and its Effect on Financial Performance of Banks: Evidence from Saudi Arabia. Procedia-Social and Behavioral Sciences, 164, 201-207.

- Asiaei, K., & Jusoh, R. (2015). A multidimensional view of intellectual capital: The impact on organizational performance. Management Decision, 53(3), 668-697.

- Barney, J. B. (1991). Firm resources and sustainable competitive advantage. Journal of Management, 17(1), 99-120.

- Berzkalne, I., & Zelgalve, E. (2014). Intellectual capital and company value. Procedia-Social and Behavioral Sciences, 110(1), 887-896.

- Bontis, N., Janosevic, S., & Dzenopoljac, V. (2015). Intellectual capital in Serbia's hotel industry. International Journal of Contemporary Hospitality Management, 27(6), 1365-1384.

- Chan, K.H. (2009a). Impact of intellectual capital on organisational performance: an empirical study of companies in the Hang Seng Index The Learning Organization, 16(1), 4-21.

- Chan, K.H. (2009b). Impact of intellectual capital on organisational performance: an empirical study of companies in the Hang Seng Index (part 2). The Learning Organization, 16(1), 22-39.

- Chen, M.C., Cheng, S.J., & Hwang, Y. (2005). An empirical investigation of the relationship between intellectual capital and firms' market value and financial performance. Journal of Intellectual Capital, 6(2), 159-176.

- Chrisman, J.J., Chua, J.H., De Massis, A., Frattini, F., & Wright, M. (2015). The ability and willingness paradox in family firm innovation. Journal of Product Innovation Management, 32(3), 310-318.

- Chu, K.W.S., Chan, H.K., & Wu, W.W.Y. (2011). Charting intellectual capital performance of the gateway to China. Journal of Intellectual Capital, 12(2), 249-276.

- Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: evidence from Switzerland. Journal of International Financial Markets, Institutions and Money, 21(3), 307-327.

- Edvinsson, L. (1997). Developing intellectual capital at Skandia. Long Range Planning, 30(3), 320-373.

- Firer, S., & Stainbank, L. (2003). Testing the relationship between intellectual capital and a company's performance: evidence from South Africa. Meditari Accountancy Research, 11(1), 25-44.

- Firer, S., & Williams, S.M. (2003). Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital, 4(3), 348-360.

- Ghosh, S., & Mondal, A. (2009). Indian software and pharmaceutical sector ic and financial performance. Journal of Intellectual Capital, 10(3), 369-388.

- Goh, P.C. (2005). Intellectual capital performance of commercial banks in Malaysia. Journal of Intellectual Capital, 6(3), 385-396.

- Herzog, P. (2011). Open and closed innovation. Different cultures for different strategies. Gemany: Gabler.

- Joshi, M., Cahill, D., & Sidhu, J. (2010). Intellectual capital performance in the banking sector: an assessment of Australian owned banks. Journal of Human Resource Costing & Accounting, 14(2), 151-170.

- Joshi, M., Cahill, D., Sidhu, J., & Kansal, M. (2013). Intellectual capital and financial performance: an evaluation of the Australian financial sector. Journal of Intellectual Capital, 14(2), 264-285.

- Kamath, G.B. (2008). Intellectual capital and corporate performance in Indian pharmaceutical industry. Journal of Intellectual Capital, 9(4), 684-704.

- Kaplan, R.S., & Norton, D.P. (1996). The balanced scorecard: Translating strategy into action. Boston: Harvard Business School Press.

- Komnenic, B., & Pokrajcic, D. (2012). Intellectual capital and corporate performance of MNCs in Serbia. Journal of Intellectual Capital, 13(1), 106-118.

- Liu, C.H. (2017). Creating competitive advantage: linking perspectives of organization learning, innovation behavior and intellectual capital. International Journal of Hospitality Management, 66(1), 13-23.

- Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G. (2011). The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital, 12(1), 132-151.

- Makki, M.A.M., Lodhi, S.A., & Rohra, C.L. (2009). Impact of intellectual capital on shareholders earning. Australian Journal of Basic and Applied Sciences, 3(4), 33-86.

- Mehralian, G., Rajabzadeh, A., Sadeh, M.R., & Rasekh, H.R. (2012). Intellectual capital and corporate performance in Iranian pharmaceutical industry. Journal of Intellectual Capital, 13(1), 138-158.

- Meles, A., Porzio, C., Sampagnaro, G., & Verdoliva, V. (2016). The impact of the intellectual capital efficiency on commercial banks performance: evidence from the US. Journal of Multinational Financial Management, 36, 64-74.

- Mondal, A., & Ghosh, S. K. (2012). Intellectual capital and financial performance of Indian banks. Journal of Intellectual Capital, 13(4), 515-530.

- Obeidat, B.Y., Tarhini, A., Masa'deh, R.E., & Aqqad, N.O. (2017). The impact of intellectual capital on innovation via the mediating role of knowledge management: A structural equation modeling approach. International Journal of Knowledge Management Studies, 8(3-4), 273-298.

- Ozkan, N., Cakan, S., & Kayacan, M. (2017). Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanbul Review, 17(3), 190-198.

- Pablos, P.O. (2002). Evidence of intellectual capital measurement from Asia, Europe and Middle East. Journal of Intellectual Capital, 3(3), 287-302.

- Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance, 21(2), 222-237.

- Pulic, A. (2004). Intellectual capital e does it create or destroy value? Measuring Business Excellence, 8(1), 62-68.

- Reed, K.K., Lubatkin, M., & Srinivasan, N. (2006). Proposing and testing an intellectual capital-based view of the firm. Journal of Management Studies, 48(4), 867-893.

- Roos, J., Roos, G., Dragonetti, N.C., & Edvinsson, L. (1997). Intellectual capital: Navigating in the new business landscape. London: MacMillan Press.

- Shih, K., Chang, C., & Lin, B. (2010). Assessing knowledge creation and intellectual capital in banking industry. Journal of Intellectual Capital, 11(1), 74-89.

- Subramaniam, M., & Youndt, M.A. (2005). The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450-463.

- Sveiby, K.E. (2010). Models for measuring intangible assets. Sveiby Knowledge Association Article (Online). Retrieved from http://www.sveiby.com/articles/IntangibleMethods.htm.

- Tan, H.P., Plowman, D., & Hancock, P. (2007). Intellectual capital and financial returns of companies. Journal of Intellectual Capital, 8(1), 76-95.

- Tarus, D., & Sitienei, E. (2015). Intellectual capital and innovativeness in software development firms: The moderating role of firm size. Journal of African Business, 16, 48-65.

- Ting, I.W.K., & Lean, H.H. (2009). Intellectual capital performance of financial institutions in Malaysia. Journal of Intellectual Capital, 10(4), 588-599.

- Tseng, C.Y., & Goo, Y.J.J. (2005). Intellectual capital and corporate value in an emerging economy: empirical study of Taiwanese Manufacturers. R&D Management, 35(2), 187-201.

- Vaisanen, J., Kujansivu, P., & L€onnqvist, A. (2007). Effects of intellectual capital investments on productivity and profitability. International Journal of Learning and Intellectual Capital, 4(4), 377-391.

- Wang. (2011). Measuring intellectual capital and its effect on financial performance: Evidence from the capital market in Taiwan. Frontiers of Business Research in China, 5(2), 243-265.

- Wang, J.C. (2008). Investigating market value and intellectual capital for S&P 500. Journal of Intellectual Capital, 9(1), 546-563.

- Yalama, A. (2013). The relationship between intellectual capital and banking performance in Turkey: Evidence from panel data. International Journal of Learning and Intellectual Capital, 10(1), 71-87.

- Youndt, M.A., Subramaniam, M., & Snell, S.A. (2004). Intellectual capital profiles: An examination of investments and returns. Journal of Management Studies, 41(2), 335-361.

- Zeghal, D., & Maaloul, A. ( 2010). Analyzing value added as an indicator of intellectual capital and its consequences on company performance. Journal of Intellectual Capital, 11(1), 39-60.