Research Article: 2022 Vol: 25 Issue: 6S

Interactivity and open innovation: A study of the mediating effects

Dorra Sahnoun, Sfax University

Citation Information: Sahnoun, D. (2022). Interactivity and open innovation: A study of the mediating effects. Journal of Management Information and Decision Sciences, 25(S6), 1-18.

Keywords

Interactivity, Innovation, Internet Banking

Abstract

With the development of the Internet Banking, banks can go through original channels giving them quick access to ideas or innovations. Assuming that the customer is in an open and interactive environment he/she is no longer a simple passive receiver of the banking service, but an active participant in its improvement in terms of its expectations and needs. The main objective of this article is to promote a better understanding of the role of interactivity in the success of the open innovation process in the banking sector. The conceptual model was tested in an empirical study of 96 Internet Banking users in Tunisia. The research results show that the Interactivity of Internet Banking positively and significantly influence the user customer satisfaction and commitment to his bank. Regarding the mediation effects, the results show that only the perceived security and the perceived ease of use of Internet Banking strengthen the link between interactivity and customer satisfaction.

Introduction

The existence of a healthy banking sector is essential for any economy (Tornjask & al., 2015). Competition in this sector generates the same potential benefits as in any other sector. It leads companies to find new ways to innovate more, faster and in a more flexible way. In this perspective, the ability to innovate clearly appears as a central competence in order to maintain, strengthen or create a competitive advantage (Das & al., 2018; Torjanski & al., 2014). In addition, the innovation, crucial for the long-term survival and growth of businesses, changes shape (Gandia & al., 2014). Thus, many firms are abandoning their closed internal innovation model to open up to the outside in order to seize new opportunities (Angelshaug & Sacbi, 2017; Chesbrough, 2003).

In recent years, banks have increasingly resorted to open innovation, an innovation model, based on the idea that companies can call on to other actors (research team, customers, suppliers or between companies) in their innovation process (outside in), but can also outsource their ideas by contributing to the innovation of external partners (inside in) (Naseer et al., 2021). As for (Chesbourgh, 2006), the open innovation is defined as “the exploitation of, strategically, technological developments and sources of ideas, both internal and external, have through the company's partners (competitors, suppliers, users, experts, etc”. This innovation model is thus based on the close combination of internal and external knowledge, through the various channels (partnerships, licensing agreements, networking ...), initially tested by non- financial firms (Chesbrough, 2003).

In addition, it emerges from the different banking experiences that open innovation essentially involves cooperation with customers via the relationship marketing (Enkel, Gassmann & Chesbrough, 2009; Teece, 2010; Tornjanski et al., 2014), by using technological developments, particularly in terms of telecommunications and data processing (Das et al., 2018). With the development of the Internet Banking, banks can go through original channels giving them quick access to ideas or innovations (Bacinello, 2017). This phenomenon can take several forms. On the one hand, the client innovates jointly with the bank, by providing new ideas and expressing certain needs that the company has not yet perceived. On the other hand, this platform can connect banks and customers and make them participatory zones, open and in real time (Yee & Faziharudean, 2010). We are therefore witnessing a new vision of the customer, who has become an employee of his bank on the Internet. Assuming that the customer is in an open and interactive environment he/she is no longer a simple passive receiver of the banking service, but an active participant in its improvement in terms of its expectations and needs. We suggest the hypothesis according to which a greater interactivity should logically generate higher efficiency of Internet banking service which in turn leads to better satisfaction and commitment to the bank. However, there are many difficulties in meeting the challenge of this new corporate culture through continuous collaboration with clients. In particular, the recent proliferation of open innovation in the banking sector leads us to wonder about the potential consequences of this approach, given the high risk of losing control of the customer relationship in an open model as well as the specificities of banking innovations (ko et al., 2013; O'loughlin et al., 2004; Lang & Colagate, 2003).

This research thus meets two complementary objectives. The first aims to highlight the difficulty of banks to carry out and initiate innovations within the framework of an open model while at the same time having to respect the principles of confidentiality, safety, ethics and regulation. The second is to show that the Tunisian banks could, in collaboration with their customers, succeed in a process of generation and deployment of innovations in Internet banking services. However, empirical studies on open innovation remain limited (Liotard, 2012). Our study aims to contribute to the development of an open innovation model in the banking sector through cooperation with the customer. Although the number of Tunisian Internet users is growing exponentially (5,472 million in 2016), we notice the considerable responsiveness on the part of the banks to exploit this opportunity. Our research seeks to make its contribution to try to fill this gap and asks the delicate question about the relationship between interactivity and the success of open innovation in the Banking sector.

The first title of this article presents the appeal of open innovation in the banking sector. It explains, first of all, the role played by the Internet Banking in the development of open innovation, and secondly, it exposes the risks associated with this new mode innovation. The second is devoted to the presentation of the conceptual research model, to the justification for the choice and the definition of its variables, as well as the formulation of hypotheses relating to work objectives. The third briefly presents the methodology, the field of research, the construction of variables and the sequence of data analysis methods. The results are finally presented and discussed.

The Attractiveness Of Open Innovation In The Banking Sector

After explaining how the establishment of collaborative platforms is a key to the success of open innovation, we present the risks associated with the implementation of this new innovation.

Internet banking on the way to "Open Innovation"

The switch to open innovation in the banking sector has inaugurated in a new vision of the customer. The latter then went from the status of «passive public», to that of «active player», obliging banks to adapt accordingly.

The use of the Internet offers banks the possibility of interacting directly with customers (Ltifi and Najjar, 2015). It is about sharing knowledge and know-how with them to promote in return, the capture of ideas from the outside (positive externalities) and reinject them in the company within their innovation process.

In addition, the client becomes a producer of the banking service (Knechel et al., 2020) he can even be likened to a bank employee, because agencies outsource many day-to-day transactions over the Internet. Thus, the consultation of accounts, transfer orders, checkbook requests, etc. is often managed by a net surfer without any interpersonal relationship being established with his bank.

In this context, the customer must learn to be served alone, to access to necessary information during the decision-making. This innovative and unique approach aims above all to the active participation of two parties, the bank and the customer, with a willingness to share information between them and this in real time (Hasan, 2018). It includes, among others, a reciprocal communication, information available on request, contingent answers, a personalized offer and a feedback in real-time (Perez & Martin, 2018).

The secret to success is essentially based on knowing the customer and understanding of their behavior (Hasan, 2018). In other terms, the bank must consider in detail the specific needs of each client in order to offer products and services adapted to their profile and consequently strengthen the relationship with him (Angelshaug & Saebi, 2017). For its part, WeBank, an Italian online bank, launched in 2011 a new experimentation in the matter, the goal being to imagine a banking application on iPad through the use of Internet users, in order to develop new services with its customers. The customer can therefore be qualified as a “peak user” or «advanced user». The open innovation approach can have more serious consequences than the loss of opportunities, given the high risk of losing control of the customer relationship as well as the specificities of banking innovations.

Open Innovation: Risks for the Banking Sector?

While showing a growing interest in open innovation, banks recognize the risks intrinsically linked to this new way of generating competitiveness. The reasons for this may be related to the indeterminate effects of the technology, and especially the Internet, on social interactions ($ 2.1) and features of the banking sector ($2.2).

The Undetermined Effects on Social Interactions

Today the banks are forced to design new maneuvers of communication and to position themselves on new means of audience different from the classical media. Some innovation experiences are not always successful. With the presence of Internet Banking, the physical contact may disappear in favor of dematerialized contact. So it seems that the prolonged absence of contact with staff and service suppliers can erode the relationship between the customer and the company by reducing the degree of loyalty and increasing the probability of dropping out (Quach et al., 2020). In addition, some customers hesitate to carry out banking transactions on the web, due to the perception risk of the misuse of personal data (Ko & al., 2013), the complexity of navigation and lack of confidence (Arora & Kaur, 2018).

In addition, some clients are reluctant to abandon the traditional relationship based on face-to-face interaction in favor of online banking services (Orçu & Tartar, 2017). They therefore appreciate human contact and prefer to come to the agency even they can perform some remote operations (Ko & al., 2013). In the same vein, (Roman, 2003) recognizes that the ethical behavior of account managers in the bank promote greater satisfaction and confidence among customers. Some authors believe that some clients cannot limit themselves to communication via web tools to reduce their information asymmetries; they do not even perceive the investment made by the bank in these IT as sufficient to improve the relationship (Anderson & Weitz, 1992).

It is clear that even if the internet banking develops more and its functionalities get richer, certain customers dislike implementing the open innovation in the banking industry.

Banking Specificities

In a market increasingly competitive, the banks, having opened their innovation processes like industrial firms, face several difficulties. They are often devoid of any necessary innovation practices to move forward efficiently (Das & al., 2018).

In this context, the bank collaboration with telecommunication operators and mobile phone constructors can raise questions regarding the risk of potential competition of these actors and likely to enter the payment market through mobile phone or internet (Perez and Martin, 2018). In addition, new market entrants could identify and exploit the niches which get away in the new value channels and, with the good business model, they can benefit from them rapidly as witnessed by the innovations of rupture. We can refer at this level to the case of Zopa, the English historic leader.

This destitution comes from the fact that the bank does not have a huge academic support and professional experience of Research and Development and innovation developed for centuries in other industries. Certainly, the banks have to join forces in order to improve the efficiency of the innovation process and implement it because of the specificities of the banking activity. On the other hand, the banking products and services are by nature intangible; they do not reflect an intellectual protection. This is judicially difficult to implement in terms of banking (Similar products, quite homogeneous pricing and availability of technologies in the same way on the market) (Strauss, 2013). In this context, a bank that innovates will not therefore be able to take advantage of its progress on the market for a long time because of the learning phenomenon among competitors (Acharaya & al, 2006). The rapid imitation of an innovation, by one or more competitors really harms the profitability of the investments made by the innovator.

It is undoubtedly also necessary to underline the difficulty of banks in initiating and carrying out to many innovations within the framework of an open model. The main challenge of this new culture is to enable banks, in collaboration with their customers, to succeed in the process of generating and deploying innovations on the Internet in order to achieve an open innovation model specific to this sector. This article proposes the conceptual research model and its various hypotheses, in what follows.

Conceptual Frameowork and Research Hypotheses

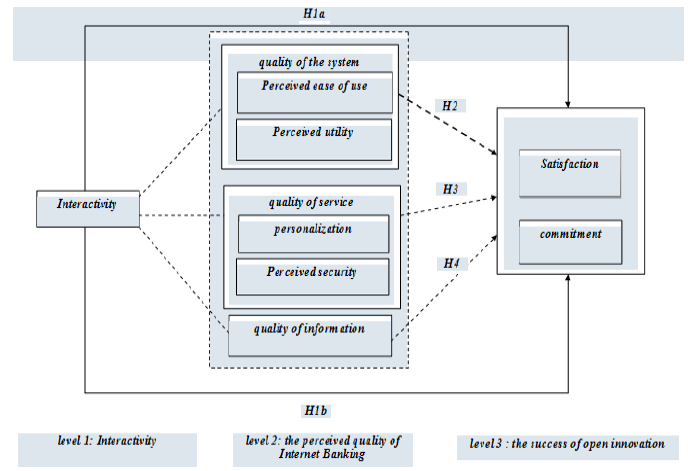

The conceptual model responds to the object of this research aiming to formulate a model of success of open innovation specific to the banking sector. The issue of the evaluation takes place in a context allowing advocating a strong integration of the ideas of customer’s ideas, in the innovation process on the Internet, in order to better respond to their needs. We propose the hypothesis according to which a greater interactivity should logically generate a greater efficiency of the banking service on the Internet which results in turn to better satisfaction and commitment to the bank. The proposed approach, in this research, is based on the structure of Delone's updated IS success model and Mclean (2003) who formalizes the direct and indirect relationships postulated between (1) interactivity, (2) the perceived quality of Internet Banking, and the success of open innovation (3), measured by satisfaction and commitment. The variables of the conceptual model and the working hypotheses are presented below. as shows in Figure 1.

The Variables of the Conceptual Model

The conceptual model (figure 1) postulates a general influence of interactivity on variables evaluating the success of open innovation in the banking sector via the customer satisfaction and his commitment to their bank. On the other hand, five main variables are supposed to have a mediating role in the interactivity-success relationship of open innovation. These variables measuring the perceived quality of Internet Banking are the quality of the system (perceived ease of use and perceived usefulness), the quality of service (Personalization of the offer and perceived security) and the quality of the information. This structure of the model leads to analyze the following three levels:

• Level I with an explanatory variable measuring interactivity.

• Level (II) with mediating variables measuring the perceived quality of the Internet Banking via the quality of the system (perceived ease of use and perceived usefulness), quality of service of the tool (perceived security and personalization of the offer) and the quality of the information.

• The third level (III) with variables to explain the success of open innovation in the banking sector, measured by customer satisfaction and commitment to their bank

Interactivity (Level I)

In the particular context of a digital environment, interactivity refers to the importance with which users can participate in the modification of the form and the content of this environment in real time (Steuer, 1992). It is in this logic that the work of (Yu et al., 2017; Ma & Zhao, 2012) is, for example dealt with to explain the importance of interactivity on the Internet Banking. The latter represents the only means which allows for the first time a dialogue which is synchronized, reciprocal and controlled between the bank and its customers (Yu et al., 2017). It is clear that the most advanced banks use websites to improve efficiency contacts and implement value-added processes for clients.

They wish to make the relationship with their customers more interactive, although they are freed from human and physical constraints. Thus, customers have the opportunity to exchange information with their banks and to perform transactions in real time (Khanboubi et al., 2019). In addition, interactivity gives the possibility of capturing the behavior of Internet user browsing, which can be interesting information for the company that innovates by adapting its offers according to the expectations of its customers. It should be noted at this level that interactivity allows the customer to participate in the creation of their own service, to model himself the most suitable offer that meets his needs (Deighton, 1996), to have a privileged relationship with the company and to make changes in content and form on the virtual environment (Steuer,1992).

The Perceived Quality of Internet Banking (level 2)

This conceptual level will give rise to the measurement of the variables relating to the perception of quality of Internet Banking. These are the intermediate variables specifying, on the one hand, the perceived quality of the system and secondly, the quality of service.

The Quality of the System: Recent literature considers the website, and in particular the Internet Banking, as a particular type of Information System (Yee & Faziharudean, 2010). The perceptions held by customers facing the “client-Internet Banking” interaction are important elements to assess the quality of the bank's website interface. There are two variables used in this research to express the customer's perception of the quality of the system. It’s about the perceived ease of use and utility perceived.

Perceived Ease of Use

(Davis, 1989) defines the perceived ease of use as "the intensity with which an individual believes that the use of a system will be without difficulty or additional efforts ".

The perception of ease of use refers to the degree in which a person believes that the use of a system does not require a lot of efforts (Venkatesh et al., 2012). The perceived ease of use of a banking website is therefore understood as the degree in which the client believes that the use of Internet Banking is effortless (Rahi, 2018), includes terms that are relevant and easy to understand, contains links that provide detailed information, displays easy-to-read pages and allows the customer to find desired information without doing too much unnecessary research (Roy et al., 2017; Ma & Zhao, 2012; Pikkarainen et al., 2006).

Perceived Utility

Utility It is defined as "the intensity with which an individual believes that the use of a system improves their performance at work "(Davis, 1989). This construct constitutes a theoretical substitute for the concept of relative advantage, developed by the Diffusion Theory of Innovation (Venkatesh et al, 2003), which reflects the degree to which an innovation is perceived as offering a greater advantage than the practice that it supplants (Kolodinsky et al., 2004). The perceived utility can express economic benefit, social prestige or other benefits (Rogers, 1995).

The rise of Internet Banking, the undeniable advantages it provides in terms of accessibility, time saving and speed compared to traditional banking, urge some researchers (Kolodinsky et al., 2004) to explain the attitude of clients towards this service. For almost all customers, Internet Banking is useful (Kolodinsky et al., 2004; Rahi et al., 2018), although they can perform banking transactions at their firms from their PCs, online and in real time, all over the world (Bitner et al., 2000; Durink, 2004), improve the management of their accounts, check their accounts day by day (Ko et al., 2013).

The Quality of Internet Banking Service: It is based on the customer’s perception rather than functional and technical dimensions of the site (Bauer et al., 2005). The objective is to understand the interface that is "a merchant website" in a rational perspective and not just functional. Thus, three variables are retained in this research, in order to measure the quality of Internet Banking service: perceived security and the personalization of the offer.

Perceived Security

Safety is presented in the literature as a fundamental issue in all remote banking activities (Lee et al., 2003; Crabbe et al., 2009; Luam & Lin, 2005). The customers show imminent concern over their financial information (Afchan et al., 2018). Indeed, the Internet banking site is one of the environments where most sensitive personal and financial information can be manipulated or subsequently used for undesirable purposes (Suh & Han, 2002; Bacinello, 2017). To reduce the feeling of insecurity on the Internet, banks should strive to adopt a culture of confidentiality, security and ethics in order to promote the establishment of a climate of trust so ease to build lasting relationships between the bank and customer (Dinev & Hart, 2006). It is also necessary to communicate the reinsurance factors and publicly announce efforts to promote the reduction in the perception of uncertainty with regard to Internet Banking (Grippa et al., 2019).

In this sense, (Rahi et al., 2018) add that the perceived security of Internet Banking constitutes a fundamental determinant in the acceptance of the tool by the customer user.

The Personalization of the Offer

The personalization of the offer assesses the bank's ability to adapt its services on the Internet to the needs and desires of its customers. This perspective is that during the customer identification, the bank could offer products and services which are appropriate and meeting his criteria (Hasan, 2018). Thus, the more a banking site is personalized and the more it adapts to the needs of its users, the more likely it is to find buyers from customers (Bauer et al., 2005).

The Internet Banking must precisely provide limited choices for each customer, according to his profile and his needs. Therefore, the customer can save time and effort to look for offers that are suitable for him (Hoffman & Novak, 1996). This allows increasing the possibility of visiting the site again, improving the reputation of the bank which will be able to cut its costs and increase its profits.

Often mentioned as a major feature of an effective relationship, personalization, allows a certain form of intimacy with the client, it also reinforces the notion of customer value (Hasan, 2018).

The Quality of the Information: In the context of a digital environment, the quality of information corresponds to the ability of the bank's website to present textual and visual information relating to their offers, in a sufficiently clear and precise manner, so that customers can understand them easily and make comparisons (Donthue Garcia, 1999). So a site is effective if it delivers relevant, well-organized and luring information. Wishing to extend this perspective to the case of Internet Banking, (Sugihartou, 2017) recognizes that customers value quality of information. Otherwise, (Hamadi, 2012) proposes to retain three attributes of the quality of information: quality of content (credible character, completeness, possibility of consulting two accounts in parallel ...), contextual quality (news, richness ...), and quality of interaction (access is ergonomic enough for a novice who does not easily understand the system of banks; the sections are well done ...). Finally, banks should present the textual and visual information, relating to their innovations on the Internet in a sufficiently clear way, complete, easy to understand and updated (Sugihartou, 2017); in order to improve the efficiency of their clients' decision-making processes (Durkin, 2004).

The Success of Open Innovation (Level III)

After having defined the first and second levels of the conceptual model, specifying the variables which are retained there, it is advisable to present, in the following development, the variables measuring the success of open innovation in the banking sector. This success is measured in this research by customer satisfaction and commitment to his bank.

Satisfaction

Applied to the context of SI, (Delone & McLean, 1992) consider satisfaction as the most often used method when it comes to measuring the success of an IT. So the user satisfaction is probably the most widespread concept of efficiency and success of IS in the Management literature in Information System (MIS) (Baroudi & Orlikowski, 1988; Ives & al, 1983). Moreover, (Bailey & Pearson, 1983) define satisfaction as being: the sum of sensations and attitudes that IT users have when facing a variety of factors affecting a specific situation”.

On the other hand, the study of (Pikkarainen et al., 2006) finds that the determinants of satisfaction depend on the contexts in which the IS / IT solutions are anchored. With the development of electronic commerce and demand for support from customers, the recent work has broadened and enriched the restrictive conception of satisfaction (Ma & Zhao, 2012) towards a dual approach (both cognitive and affective) (Mano & Olivier, 1993), dynamic and relational, rather than static cognitive and transactional (Mano & Olivier, 1993). Relationship satisfaction depends on all previous transactional satisfactions (Parasurman et al., 1994) which leads to the overall performance of a company (Lovelock & al., 2008).

In the context of Internet Banking, satisfaction is also measured in terms of all past experiences of using technology and not just based on an instant transaction. Thus, some researchers (Sugihartou, 2017; Yee & Faziharudean, 2010) show that customer satisfaction with Internet Banking depends on perceived quality, confidence, habit and reputation of the bank. On the other hand, (Ma & Zhao, 2012) show that the interactivity and efficiency of Internet Banking are the major determinants of customer satisfaction. This perspective has been adopted by several researchers in a traditional and virtual context (Arift et al., 2013; Sahin & al., 2011; Amin, 2016).

Commitment

Commitment is an important psychological force that binds the client with the organization (Morgan & Hunt, 1994; Bansal & al., 2004) and which differentiates clients “who stay from those leaving (Oliver, 1999; Yee & Faziharudean, 2010). This concept is essential at the heart of conceptual framework of relationship marketing and is a fundamental condition for the success of the customer-supplier relationship and a measure of its quality (Dwyer et al., 1987). The work of (Yuan, Lai & Chu, 2018; Sugihartou, 2017) put forward that the customer's commitment to Internet Banking is a determinant of the intention to use technology. It is also considered to be a determining factor in successful long-term Internet banking client’s relationships (Yee & Faziharudcan, 2010; Agaga & Nor, 2012).

In addition, the bank's success in implementing factors of reinsurance and Internet privacy, good reputation and satisfactory services, increase the customer commitment to internet banking (Sathiyavany & Shivany, 2018). These factors of success create a stable environment in which the two parts of the exchange can rely the advantages of each and increase net benefits for both parties. The Internet banking creates more opportunities to establish collaborative relationships with customers, which is favorable for the development of a long-term relationship (Acharaya et al., 2006).

The Research Hypotheses

The model postulates that there are direct and / or indirect dependency relationships between interactivity and the success of open innovation in the banking sector. The indirect relationships are mediated by second-level variables (||), measuring the perceived quality of the Internet banking.

First, the direct hypothesis of the model, noted Hi, assumes direct relationships between the interactivity (level 1) and the variables measuring the success of open innovation (level ||). This hypothesis breaks down into two adjacent hypotheses, noted Hla and H|b.

H1 the Interactivity positively influences the success of open innovation. Hla Interactivity positively influences customer satisfaction.

H1b Interactivity positively influences customer commitment.

Secondly, the model assumes mediation effects exerted by the variables of the conceptual level II,

Measuring the perceived quality of Internet Banking, between interactivity (level I) and the success of open innovation (level II). These effects give rise respectively to hypotheses H2, H3 and H4.

H2- Interactivity positively influences the success of innovation initiated by mediating the quality of the system.

H2a- The interactivity positively influences customer satisfaction through the mediation of ease to use perceived.

H2b- Interactivity positively influences customer satisfaction by mediating utility perceived.

H2c- Interactivity positively influences the commitment through the mediation of ease of use permue your interactivity positively influences engagement through the mediation of perceived utility.

H1- This is my first hypothesis. Maybe it will be found to be true. If it is, then all of us will really be extremely pleased!

H3- The interactivity positively influences the success of open innovation through the mediation of the quality of service.

H3a- Interactivity positively influences customer satisfaction through the mediation of personalization of the offer.

H3b- Interactivity positively influences customer satisfaction through the mediation of security perceived.

H3c- The interactivity positively influences the commitment through the mediation of personalization of the offer.

H3d- Interactivity positively influences the commitment through security perceived

H4- The Interactivity positively influences the success of open innovation through the mediation of the quality of information.

H4a- The interactivity positively influences customer satisfaction through the mediation of information quality.

H4b- The interactivity positively influences the commitment through the mediation of the quality of information.

Research Methodology

The choice of the Tunisian banking sector as a field of research is justified by two reasons On the one hand, Tunisia, and with the promulgation, in 1996, of the first scientific and technological orientation law, has become one of the few countries on the southern shore of the Mediterranean which makes innovation a national objective beside employment. Moreover, different legislative programs and actions have been implemented to encourage innovation both in the public and private sectors. On the other hand, we notice the considerable responsiveness on the part of certain Tunisian banks to exploit the opportunity for open innovation. In this sense, the Attijariwafa bank group launched in May 2017 an initiative focused on innovation, part of the open innovation program « Smart up Hackathon». This program is based on a collaborative approach bringing together the strengths of the group and the talents of the entrepreneurial and university ecosystem nationally and internationally. The goal is to bring more value to Attijariwafa customers bank, promote and encourage the spirit of creativity internally while drawing on contributions from the outside (Realities Online, 2017). Our study therefore aims to contribute to the development of a better understanding of determinants of the success of open innovation in the banking sector so that the Tunisian banks can meet the challenge of this new corporate culture through collaboration with their clients.

Data collection is based on a questionnaire administered to customer users of Internet Banking. The mode of administration of the questionnaire was performed according to the technique of face to face and administration technique via the Internet. The majority of people contacted took an interest in the research issue and were concerned with the results to come. They also expressed their intention to respond to the questionnaire.

However, they mentioned their fear that they would not be able to find the time required to do so or return it within an uncertain time. Data collection took place over four months from January to April 2016. Out of 200 questionnaires distributed, 130 were retained. Only 92 have been exploited, representing only respondents who use Internet Banking more than 5 years, i.e. a response rate of 46%. At this level, it should be noted that given the customer service representatives of certain banks refuse to give the contact details of customers familiar with Internet Banking, it was difficult to Administer of the questionnaire with the financial directors of some companies.

The results of the cross-sectional analysis of the criteria for defining and representing the sample show that the majority of respondents are men (52%), married (72%) and adults between 20 and 35 (42%). Most respondents are senior managers (46%) having a higher level of education (76%).

Research Results

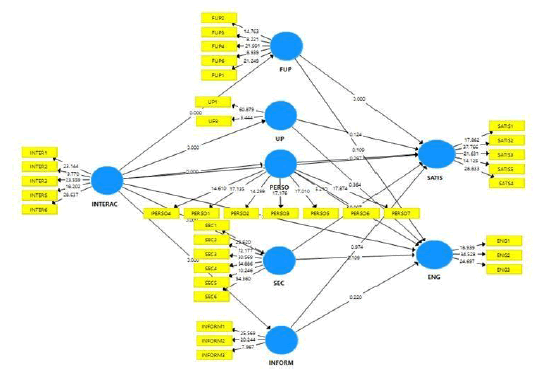

The limited sample, the non-normality of the data or the use also of different scales of measurement are the main reasons for the application of the PLS-SEM method (Henseler et al., 2009; Haier et al., 2012). Several studies have confirmed the performance of this method especially when samples are limited (Chin & Newsted, 1999). In this study, the researchers use the PLS-SEM method for the main reason which is limiting the number of respondents. The first step is to study the variables on the exploratory side. The second step, for its part, allows you to test the structural links of the research model.

Exploratory Analysis

This step consists in retaining the items of the variables of our model which representsignificantly their constructs. A limited number of items that have been removed from our analysis. Preferably, the values of the "outerloadings" must be greater than 0.7. In some cases we can retain loadings values lower than 0.7 provided that this does not influence the validity and reliability of the model variables (Haier et al., 2012) (See appendix 1, table 1).

The next step in the exploratory analysis is to assess the reliability and validity of the model variables. Cronbach's alpha above 0.6 remains acceptable. A value of 0.5 can be accepted but is considered low. Satisfactory reliability results must have Cronbach's Alpha or Composite Reliability values greater than or equal to 0.7 (Haier et al., 2012).

| Table 1 Measures Of The Realibility And Validity Of The Model Variables |

||||

|---|---|---|---|---|

| Variables | reliability | validity | ||

| Internal consistency reliability | convergent validity | Discriminate validity | ||

| Alpha de Cronbach | Composite Reliability | Variance moyenne extradite (AVE) | Fornell-Larcker Criterion | |

| Perceived ease of use (FUP) | 0.797 | 0.859 | 0.550 | 0.742 |

| Perceived utility (UP) | 0.519 | 0.750 | 0.621 | 0.788 |

| personalization of the offer (PERSO) |

0.873 | 0.901 | 0.566 | 0.753 |

| Perceived security (SEC) | 0.944 | 0.955 | 0.780 | 0.883 |

| quality of information (INFORM) | 0.688 | 0.833 | 0.632 | 0.795 |

| Satisfaction (SATIS) | 0.884 | 0.916 | 0.686 | 0.828 |

| Commitment | 0.872 | 0.921 | 0.796 | 0.892 |

| Interactivity (INTER) | 0.848 | 0.891 | 0.622 | 0.789 |

Two types of validity are used in order to see if the items of each construct are correlated together and not correlated with the other items of the other constructs (Haier et al., 2012). The values obtained must be greater than or equal to 0.5.

Analysis of the Structural Model

In order to meet our research objectives, we have proceeded in a step to perform structural link tests using the Bootstrapping technique (Haier et al., 2012). This involves testing the indirect and direct links and then analyzing the mediations. As we presented it in the modeling, the model tests the link between interactivity and the success of open innovation. Three main variables are assumed to have a role mediator in the interactivity-success relationship of open innovation. These variables are the quality of the system (perceived ease of use and perceived usefulness), the quality of service (Customization of the offer and perceived safety) and information quality. as shows in Figure 2.

| Table 2 Results of Structural |

|||||

|---|---|---|---|---|---|

| Original Sample (O) | SampleMean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | |

| FUP -> ENG | 0.239 | 0.249 | 0.149 | 1.605 | 0.109 |

| FUP -> SATIS | 0.683 | 0.680 | 0.074 | 9.280 | 0.000 |

| INFORM -> ENG | 0.144 | 0.145 | 0.117 | 1.226 | 0.220 |

| INFORM -> SATIS | 0.003 | 0.017 | 0.091 | 0.033 | 0.974 |

| INTERAC -> ENG | 0.466 | 0.468 | 0.082 | 5.689 | 0.000 |

| INTERAC -> FUP | 0.501 | 0.512 | 0.074 | 6.812 | 0.000 |

| INTERAC -> INFORM | 0.606 | 0.615 | 0.080 | 7.584 | 0.000 |

| INTERAC -> PERSO | 0.655 | 0.662 | 0.064 | 10.285 | 0.000 |

| INTERAC -> SATIS | 0.577 | 0.579 | 0.066 | 8.716 | 0.000 |

| INTERAC -> SEC | 0.458 | 0.464 | 0.100 | 4.585 | 0.000 |

| INTERAC -> UP | 0.513 | 0.519 | 0.066 | 7.818 | 0.000 |

| PERSO -> ENG | 0.132 | 0.136 | 0.138 | 0.958 | 0.338 |

| PERSO -> SATIS | -0.061 | -0.059 | 0.058 | 1.043 | 0.297 |

| SEC -> ENG | -0.204 | -0.201 | 0.127 | 1.605 | 0.109 |

| SEC -> SATIS | 0.145 | 0.147 | 0.054 | 2.679 | 0.007 |

| UP -> ENG | 0.111 | 0.104 | 0.122 | 0.907 | 0.364 |

| UP -> SATIS | 0.120 | 0.120 | 0.078 | 1.539 | 0.124 |

First, we tested the direct relationship between interactivity and the success of open innovation. Two links are presented, interactivity and user satisfaction and, user interactivity and commitment. The structural links test table confirms the significance of these links, this validates the existence of significant relationships between user interactivity and satisfaction and, user interactivity and commitment. The results prove the positive impact of interactivity on the success of open innovation. Second, we proceed to introduce the mediating variables and see if the effects change. (Zhao et al., 2010), confirm that there are three types of mediation:

• The first when the links between the independent variable and the mediator variable, and the mediator variable and the dependent variable are significant whereas the direct link between the independent variable and the dependent variable is not significant. In this case, we speak about a full mediation.

• The second case is when all the direct and indirect links are significantly positive; we speak about, in this case, an additional partial mediation.

• The third and last case is where all the links are significant but not positive; we speak about a competitive partial mediation.

Based on these findings and the results of the tests, we noticed that there are two relationships of mediations apart from the direct links validation between interactivity and the success of open innovation. The direct and indirect links between interactivity, ease of use perceived and satisfaction are all validated positively. This confirms the competitive partial mediating role advantage of the Ease of Use perceived in the Interactivity-Satisfaction relationship.

In addition, we discovered the significance of the direct and indirect links between interactivity, Safety and satisfaction. This also confirms the competitive partial mediator role of security in the Interactivity-Satisfaction relationship.

Furthermore, no mediating effect was discovered in the interactivity-commitment relationship. That being said, the results lead us to extrapolate some important observations:

• The Interactivity has a strong and positive direct effect on the success of open innovation.

• The latter has two dimensions namely satisfaction and commitment and they are significantly explained by interactivity.

• Two out of five variables in our model confirmed their mediating roles in the relationship

Interactivity Success of open innovation but this is detailed as follows:

• Significant mediation only took place at the level of Interactivity satisfaction relationship.

• The perceived ease of use dimension played the mediating role in the Interactivity Satisfaction relationship.

• The Perceived Security dimension played the mediating role in the Interactivity- Satisfaction relationship

• The Significant mediation noticed is a complementary partial mediation, that is to say, with direct and indirect positive effects.

• The quality of the information, the personalization of the offer and the perceived usefulness have no direct effects on the success of open innovation.

Discussion of the Results

The results partially confirm the assumptions made and validate the major role interactivity of Internet Banking in the success of the open innovation process in the banking sector.

First, we found that the main relation of our model which presents the effect of interactivity on the two dimensions of innovation success is validated. This is obvious since the client's participation in modifying the form or content of the site and the performance of secure transactions improves reciprocity and synchronization of dialogue (Yu et al., 2017)

Interactivity significantly and positively influences the customer satisfaction. This result confirms the results already achieved (Liu & Shrum, 2002; Ma &Zhao, 2012; Sugihartou, 2017; Yu et al., 2017). In addition, this interactivity increases the positive attitude in the customer towards the service and reassures him of the existence of a psychological force linking him with his supplier (Morgan & Hunt, 1994; Bansal & al., 2004). Moreover, a high level of interactivity should logically generate greater cognitive involvement of the customer, which in turn leads to better learning. This active role, which is assigned to him, has the tendency to develop a sense of effectiveness because of the contributions that he can make and which will eventually result in greater satisfaction.

The two dimensions of the perceived quality of Internet Banking which have a role of intermediation between interactivity and satisfaction are the perceived ease of use and the perceived security. This result is consistent with the results achieved by (Ma & Zhao, 2012), who found that the perceived ease of use and perceived security of Internet Banking are the major determinants of satisfaction. This also confirms the results of (Bacinello, 2017) that have shown that the user customer satisfaction is largely dependent on the perceived security of Internet Banking.

In addition, a banking site that includes relevant and easy to understand terms contains links that provide detailed information, displays easy-to-read pages, and allows the client to find the information requested without doing too much unnecessary research and in full security, which strengthens the collaborative dynamic between the bank and the customer. In this sense, a high level of interactivity makes it possible to advocate a strong integration of customer ideas, in the innovation process on Internet. This should logically generate a greater efficiency of the Internet banking service which in turn leads to better customer satisfaction customer. Thus, the perception is a predictor of satisfaction but only at the level of ease of use and security. This confirms the results of (Parasurman et al., 1994), which prove that perception is an important predictor of satisfaction. Interactivity is directly linked to commitment. This result is in agreement with that of (Lawson-Body & Limayem, 2004) who support the idea that Internet Banking allows the customer to participate in the creation of his own service to define and model himself the offer that best suits his needs. To make changes and innovations of the substance and form on the virtual environment in real time. This improves, as a result, the effectiveness of contacts and implements value-added processes for customers who commit to a lasting and privileged relationship with their bank.

In addition, the results reveal that the variables measuring the perceived quality of Internet Banking have no mediating effect on the relationship between interactivity and commitment. We notice a conformity of our results with those of (Yee & Faziharudean, 2010), which prove that the perceived quality of Internet Banking is not a fundamental factor in retaining customers in the long run. However, interactivity generates customer commitment but cannot be explained by perception. In this case, we should look for other variables other than perception that can explain and clarify the nature of the relationship between interactivity and commitment.

Finally, through this research, we have succeeded in showing the role of the interactivity of Internet Banking in opening up the innovation process in banks. The confirmation of this hypothesis reinforces the conclusions of previous researches which support the idea that interactivity is the most prominent feature of the Internet in general and Internet Banking in particular (Lawson-Body & Limayem, 2004; Ma &Zhao, 2012; Yee & Faziharudean, 2010; Yu et al., 2017).

Conclusion

The main objective of this article is to promote a better understanding of the role of interactivity in the success of the open innovation process in the banking sector. On a theoretical level, this work allows to enrich the literature on open innovation due to insufficient research on this subject. As an extension of the work of Delone & Mclean (2003), we identified that collaboration between banks and their Internet customers plays a key role in the process of open innovation.

In addition, the research results show that the Interactivity of Internet Banking positively and significantly influence the user customer satisfaction and commitment to his bank. Regarding the mediation effects, the results show that only the perceived security and the perceived ease of use of Internet Banking strengthen the link between interactivity and customer satisfaction. Furthermore, our research provides interesting insight into the possibility for banks to profit from a strategy of open innovation. On a practical level, this study allows banks to take advantage of Internet Banking to connect banks and customers and make participatory areas, open and in real time. Thus, banks could share knowledge and know-how with their customers to promote in return the capture of ideas from outside and re-inject them into the company in its innovation process. To better succeed in open innovation, some banks focus their strategy on more partnership and collaboration with FinTechs (Financial Technology) (Ashta et al., 2018), whose development responds to change in the behavior of consumers who use the Internet, associated with their mobile phone, a privileged means of contact with the bank. Thanks to the technological tools, the Fintech offer, through digital platforms, an innovative banking service (Lee & al., 2021). Indeed, significant degrees of interactivity, in terms of reciprocity of communications and a great involvement of the customer in the innovation process, generate a greater efficiency of the Internet banking service which in turn leads to better customer satisfaction. Under these conditions, it appears that FinTechs are not only competitors but rather complementary. They can provide banks with offers or complementary technologies that allow each customer to engage in a privileged and lasting relationship with their bank (Navaretti et al., 2017).

Finally, it is important to underline the limits of this work. First, the sample is small compared to the number of customers who manage their accounts, via the Internet, on the Tunisian territory. It might be interesting to carry out the study with a more important sample size. A second limitation is linked to the use of the measures used in different contexts from that of Tunisia. We could have gone through a qualitative study to develop measures adapted to the Tunisian context. It would be useful to complete our study through broader empirical studies and in other banking contexts globally to check the solidity of our results.

The third limit is at the level of the choice of mediation variables, measuring the quality perceived of Internet Banking, as the quality of the system and the quality of service. It would be interesting to introduce other variables such as trust and perceived value.

References

Acharaya, R., Kagan, A., Sobel, M., & Kodepaka, V. (2006). Competition and adoption of internet technologies by texas community bank. E-Service Journal, 4(3), 61-76.

Semantic scholar, Google Scholar

Afchan, S., Sharif, A., Wassem, N., & Frooghi, R. (2018). Internet banking in Pakistan: An extended technology acceptance perspective. International Journal of Business Information Systems, 27(3), 383-410.

Semantic scholar ,Google Scholar

Agaga, A.M., & Nor, K.M. (2012). Factors that influence e-loyalty of Internet users,International Journal of Electronic Commerce Studies, 3(2), 297-304.

Semantic scholar ,Crossref , Google Scholar

Amin, M. (2016), Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty. International Journal of Bank Marketing, 34(3), 280-306.

Semantic scholar , Crossref , Google Scholar

Anderson, E., & Weitz, B. (1992). The use of pledges to build and sustain commitment in distribution Channels.

Journal of Marketing Research, 29, 18-34.

Semantic scholar , Crossref , Google Scholar

Angelshaug, M., & Saebi, T. (2017). The burning platform of retail banking. The European Business Review, 30- 34.

Semantic scholar, Google Scholar

Ariff, M.S., Yun, L.O., Zakuan, N., & Ismail, K. (2013). The impacts of service quality and customer satisfaction on customer loyalty in internet banking. Procedia - Social and Behavioral Sciences, 81, 469- 473.

Semantic scholar, Google Scholar

Arora, S., & Kaur, S. (2018), Perceived risk dimensions and ITS impact on intention to use e-banking services: Aconceptual study.Journal of Commerce & Accounting Research, 7(2), 18-2.

Ashta, A., & Biot-Paquerot, G. (2018). FinTech evolution: Strategic value management issues in a fast changing industry. Strategic Change, 27(4), 301-311.

Semantic scholar ,Crossref, Google Scholar

Bacinello, E. (2017). Nonlinear antecedents of consumer satisfaction on e-banking portals. Journal of Internet Banking and Commerce, 22(8), 1- 20.

Semantic scholar ,Google Scholar

Bailey, S.E., & Pearson, S.W. (1983). Development of a tool for measuring and analyzing computer user satisfaction. Management Science, 530-545.

Semantic scholar ,Google Scholar

Bansal, H., Irving, G., & Taylor, S. (2004). A three-component model of customer commitment to service providers.Journal of the Academy of Marketing Science, 234-250.

Semantic scholar ,Crossref, Google Scholar

Baroudi, J.J., & Orlikowski, W.J. (1988). A short from measure of user information satisfaction: A psychometric evaluation and notes on uses. Journal of Management Information Systems, 44-59.

Semantic scholar, Crossref ,Google Scholar

Bauer, H., Hammerschmidt, M., & Falk, T. (2005). Measuring the quality of e-banking. The International Journal of Bank Marketing, 153- 175.

Semantic scholar, Crossref, Google Scholar

Bitner, M., Brown, S.W., & Meuter, M.L. (2000). Technology infusion in service encounters, Journal of the Academy of Marketing Science, 28(1), 49-138.

Semantic scholar ,Google Scholar

Chesbourgh, H. (2006). Open innovation: A new paradigm for understanding industrial innovation. In H.Chesbourgh, W.Vanhaverbeke & J. West (Eds.), Open innovation: Researching a new paradigm, Oxford, University Press.

Semantic scholar, Google Scholar

Chesbrough, H. (2003). Open Innovation: The New Imperative for Creating and Profiting from Technology.

Harvard Business Press.

Semantic scholar, Google Scholar

Chin, W.W., & Newsted, P.R. (1999). Structural equation modeling analysis with small samples using partial least squares, In R.H.Hoyle (Eds.), Statistical strategies for small sample research. Thousand Oaks: CA: Sage Publications. 307-341.

Semantic scholar ,Google Scholar

Crabbe, M., Standing, C., Standing, S., & Karjaluoto, H. (2009). An adoption model for mobile banking in ghana. International Journal of Mobile Communications, 515–543.

Semantic scholar ,Crossref, Google Scholar

Das, P., Verburg, R., Verbaraek, A., Bonebakker, L. (2018). Barriers to innovation within large financial services firms An in-depth study into disruptive and radical innovation projects at a bank. European Journal of Innovation Management, 96-112.

Semantic scholar, Crossref ,Google Scholar

Davis, F. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 319-340.

Semantic scholar ,Crossref ,Google Scholar

Delone, W.H., & Mclean, E.R. (1992). Information systems success: The quest for the dependent variable. Information Systems Research, 60–95.

Semantic scholar ,Google Scholar

Delone, W.H., & Mclean, E.R. (2003). the delone and mclean model of information systems success: a ten- year update. Journal of Management Information Systems, 9-30.

Semantic scholar ,Crossref, Google Scholar

Dinev, T., & Hart, P. (2006). Internet privacy concerns and social awareness as determinants of intention to transact. International Journal of Electronic Commerce, 7-31.

Semantic scholar ,Crossref ,Google Scholar

Durkin, M. (2004). In search of the Internet-banking customer: Exploring the use of decision styles. The International Journal of Bank Marketing, 484-503.

Dwyer, F.R., Schurr, P.H., & Oh, S. (1987). Developing buyer-seller relationships. The Journal of Marketing, 11- 27.

Semantic scholar ,Google Scholar

Haier, J., Sarstedt, M., & Pieper, T.M. (2012). The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long range planning, 320-340.

Semantic scholar ,Crossref ,Google Scholar

Hasan, A.A. (2018). Customer relationship management in business: A Study on Bangladesh. Journal of Business and Management, 16-20.

Henseler, J., Ringle, C.M., & Sinkovics, R.R. (2009). The use of Partiel Least Squares path modeling in international marketing,Advances in International Marketing, 77–319.

Semantic scholar ,Crossref ,Google Scholar

Hoffman, D.L., & Novak, T.P. (1996), Marketing in hypermedia computer-mediated environments. Journal of Marketing, 50-68.

Semantic scholar, Crossref, Google Scholar

Ives, B., Olson, M.H., & Baroudi, J.J. (1983). The measurement of user information satisfaction. Communications of the ACM, 785-793.

Semantic scholar, Crossref ,Google Scholar

Johnson, M.W., Christensen, C.M., & Kagermann, H. (2008). Reinventing your business model.Harvard Business Review, 86.

Semantic scholar, Crossref ,Google Scholar

Khanboubi, F., Boulmakoula, A., & Tabaa, M. (2019). Impact of digital trends using IoT on banking processes, The 10th International Conference on Ambient Systems, Networks and Technologies (ANT) April 29 – May 2, Leuven, Belgium.

Semantic scholar ,Crossref ,Google Scholar

Ko, M., Mancha, R., Beebe, N., & Yoon, H. (2013). Customers personality, their perceptions and green concern on internet banking use. Journal of Information Technology Management, 23(4).

Semantic scholar, Google Scholar

Kolodinsky, J., Hogarth, J., & Hilgert, M.A. (2004). The adoption of electronic banking technologies by US consumers. International Journal of Bank Marketing, 238-259.

Semantic scholar, Crossref ,Google Scholar

L’Innovation au cœur du Hackathon Smart Up d’Attijari Bank, Retrieved August 8, 2021, from https://www.realites.com.tn/2017/05/linnovation-au-coeur-du-hackathon-smart-up-dattijari-bank/ .

Lang, B., & Colgate, M. (2003). Relationship quality, online banking and the information technology gap. International Journal of Bank Marketing, 29-37.

SemanticScholar, Crossref ,Google Scholar

Lawson-body, A., & Limayem, M. (2004). The impact of customer relationship management on customer loyalty: The moderating role of web site characteristics. Journal of Computer-Mediated Communication, 9(4).

Semantic scholar ,Crossref, Google Scholar

Lee, M.S., Mcgoldrick, P.F., Keeling, K.A., & Doherty, J. (2003), Using ZMET to explore barriers to the adoption of 3g mobile banking services. International Journal of Retail & Distribution Management, 340-348.

Semantic scholar ,Crossref, Google Scholar

Liu, Y., & Shrum, L.J. (2002). What is interactivity and is it always a good thing? Implications of definition, person, and situation for the influence of interactivity on advertising effectiveness. Journal of Advertising, 53- 64.

Semantic scholar ,Crossref ,Google Scholar

Luarn, P., & Lin, H.H. (2005). Toward an understanding of the behavioral intention to use mobile banking.

Computers in Human Behavior, 873–891.

Semantic scholar ,Crossref, Google Scholar

Ma, Z., & Zhao, J. (2012). Evidence on E-Banking customer satisfaction in the China commercial bank sector.

Journal of software, 927-933.

Semantic scholar, Crossref ,Google Scholar

Mano, H., & Oliver, R.L. (1993), Assessing the dimensionality and structure of the consumption experience: Evaluation, feeling and satisfaction. Journal of Consumer Research, 451-466.

Semantic scholar ,Crossref ,Google Scholar

Morgan, R.M., & Hunt, S.D. (1994). The Commitment-trust theory of relationship marketing. Journal of Marketing, 20-39.

Semantic scholar ,Crossref ,Google Scholar

Naseer, S., Khawaja, K.F., Qasi. S., Sayed, F., & Shamim, F. (2021). How and when information proactiveness leads to operational firm performance in the banking sector of Pakistan? The roles of open innovation, creative cognitive style, and climate for innovation. International Journal of Information Management.

Semantic scholar, Crossref ,Google Scholar

Navaretti, G.B., Calzolari, G., & Pozzolo, A.F. (2017). FinTech and Banks: Friends or Foes?European economy : Banks, regulation and the real sector, 9- 30.

Nkel, E., Gassmann, O., Chesbrough, H. (2009). Open R&D and open innovation: Exploring the phenomenon.

R&D Management, 311-316.

Semantic scholar ,Crossref ,Google Scholar

O’loughlin, D., Szmigin, I., & Turnbul, P. (2004). From relationship to experience in retail financial services.

International Journal of Bank Marketing, 522-539.

Semantic scholar, Crossref ,Google Scholar

Oliver, R.L. (1999). Whence customer loyalty? Journal of Marketing, 33-44.

Orçu, O.E., & Tartar, Ç. (2017). An investigation of factors that affect internet banking usage based on structural equation modeling. Computers in Human Behavior, 232-235.

Semantic scholar, Crossref, Google Scholar

Parasurman, A., Zeithaml, V.A., & Berry, L.L. (1994). Reassessment of expectation as a comparison standard in measuring service quality implications for further research. Journal of Marketing, 111-124.

Semantic scholar ,Crossref ,Google Scholar

Pikkarainen, T., Karjaluoto, H. & Pahnila, S. (2006). The measurement of end-user computing satisfaction of online banking services: Empirical evidence from Finland. International Journal of Bank Marketing, 158-172.

Semantic scholar, Crossref, Google Scholar

Prahalad, C.K., & Ramaswamy, V. (2000). Co-opting customer competence. Harvard Business Review.

Semantic scholar, Google Scholar

Quach, S., Thaichon, P., Roberts, R., & Weaven, S. (2020). Loyalty layers, expectations and the role of knoweldge. Marketing intelligence and planning.

Rahi, S., Ghanib, M.A., & Ngahc, A.H. (2018). A structural equation model for evaluating user’s intention to adopt internet banking andintention to recommend technology. Accounting, 139-152.

Semantic scholar ,Crossref ,Google Scholar

Rogers, E.M. (1995). Diffusion of innovations, New York, 4th ed The Free Press.

Semantic scholar, Crossref, Google Scholar

Roman, S. (2003). The impact of ethical sales behavior on customer satisfaction, trust and loyalty to the company: An empirical study in the financial services industry. Journal of Marketing Management, 915-939.

Semantic scholar ,Crossref ,Google Scholar

Roy, S.K., Balaji, M.S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: A perceived risk perspective, Jornal of Strategic Marketing, 418-438.

Semantic scholar ,Crossref, Google Scholar

Sahin, A., Zehir, C., & Kitapçi, H. (2011). The effects of brand experiences, trust and satisfaction on building brand loyalty: An empirical research on global brands. 7th International Strategic Management Conference, 24, 1288–1301.

Semantic scholar ,Crossref ,Google Scholar

Sathyavana, S., & Shivany, S. (2018). E-Banking Service Qualities, E-Customer Satisfaction, and e-Loyalty: A conceptual Model.The International Journal of Social Sciences and Humanities Invention, 4808-4819.

Semantic scholar ,Crossref ,Google Scholar

Srinivasan, S.S., Anderson, R., & Ponnavolu, K. (2002). Customer loyalty in e-commerce: An exploration of its antecedents and consequences. Journal of Retailing, 41-50.

Semantic scholar, Crossref, Google Scholar

Steuer, J. (1992). Defining virtual reality: Dimensions determining telepresence. Journal of communication, 73-93.

Semantic scholar, Crossref ,Google Scholar

Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of Internet banking. Electronic Commerce Research and Applications, 247-263.

Semantic scholar ,Crossref, Google Scholar

Teece, D.J. (2010). Business models, business strategy and innovation, Long range planning, 172-194.

Semantic scholar ,Crossref ,Google Scholar

Tornjanski, V., Marinkovic , S., & Lalic, N. (2014). Application of ANP method based on a BOCR model for decision-making in banking. XIV international symposium SYMORG New business models and sustainable competitiveness.

Tornjanski, V., Marinkovic, S., Jaksi, M., & Arsic, V. (2015). The prioritization of open innovation determinants in banking. Industrija, 81-105.

Semantic scholar ,Crossref ,Google Scholar

Venkatesh, V., Thong, J., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS quarterly, 157-178.

Semantic scholar, Crossref ,Google Scholar

Venkatesh, V., Morris, M.G., Davis, G.B., & Davis, F.D. (2003). User acceptance of information technology: Toward a unified view,MIS quarterly, 425-478.

Semantic scholar, Crossref ,Google Scholar

Yee, B.Y., & Faziharudean, T.M. (2010). Factors affecting customer loyalty of using internet banking in Malaysia. Journal of Electronic Banking Systems.

Semantic scholar, Crossref ,Google Scholar

Yu, X., Roy, S.K., Quazi, A., Nguyen, B., & Han, Y. (2017). Internet entrepreneurship and "the sharing of information in an Internet-of-Things context The role of interactivity.stickiness,e-satisfaction and word-of- mouth in online SMEs’ websites. Internet Research, 74-96.

Semantic scholar ,Crossref, Google Scholar

Yuan, A., Lai, F., & Chu, Z. (2018). Continuous usage intention of Internet banking: A commitment-trust model. Information Systems and e-Business Management, 1-25.

Semantic scholar, Crossref ,Google Scholar

Zhao, X., Lynchjr, J.G., & Chen, Q. (2010). Reconsidering baron and Kenny: Myths and truths about mediation analysis. Journal of Consumer Research, 197–206.

Semantic scholar, Crossref, Google Scholar

Received: 08-Mar-2022, Manuscript No. JMIDS-21-10292; Editor assigned: 10-Mar-2022, PreQC No. JMIDS-21-10292(PQ); Reviewed: 22-Mar-2022, QC No. JMIDS-21-10292; Revised: 30-Mar-2022, Manuscript No. JMIDS-21-10292(R); Published: 08-Apr-2022