Research Article: 2018 Vol: 22 Issue: 5

Internal and External Audit and the Banks Commitment to Detect and Combating of Money Laundering in Jordan

Qasim, A. Alawaqleh, Philadelphia University, Amman, Jordan

Rana Airout, Philadelphia University, Amman, Jordan

Mahmoud M. Aleqab, Yarmouk University, Irbid, Jordan

Abstract

The aim of the study is to find the relationship between accounting factors (internal and external audit) and the 23 Jordanian banks (15 Jordanian banks & 8 foreign banks work in Jordan) commitment to detect and combating the money laundering in Jordan. The study has designed a questionnaire for collecting data. The total population was 115 questionnaires. To analyse data, the study used SPSS program. The result of the study showed that there is a direct and positive reflecting relationship between internal and external audit to detect and combating the money laundering in Jordanian banks. The main recommendations for this study is that bankers and policy makers should take all of the accounting factors (internal and external audit) into account to help them in detecting and combating of money laundering in Jordan; in the meantime the independent variables (internal and external audit) are necessitate and operative contribution towards current combating of money laundering, and conducting specific courses for users to detect the nature and importance of the independent variables essential for creation high-quality.

Keywords

Internal Audit, External Audit, Jordanian Banks, Money Laundering.

Introduction

The phenomena of money laundering adversely affects on economies of countries by reflecting on Gross Domestic Products (GDP),Gross National Products (GNP), Debt, financial and monetary policies, also on income of individuals, consumption and across all sectors.

The Jordanian economy depends mainly on remittances from Jordanian workers abroad and donations and foreign aid, where illegal remittances have become inadequate for the Jordanian economy because of money laundering.

The Jordanian economy suffers from difficulties relating to the economic situation and the situation of the neighbouring countries of Jordan, which adversely affected all the situation in Jordan, and was the inevitable result of this situation to the deficit in the governmental budget which reached to 30 billion dollars by the end of 2016 (Financial Stability Report, 2016). Therefore, the Jordanian government called on all public and private sectors and researchers to find solutions to combat money laundering. In relation, the Jordanian government established the Money Laundering Unit of the Central Bank for combating money laundering.

In this study, we will clarify the relationship of the accounting factors in Jordanian banks, based on anti-money laundering instructions in order to reduce and combat the problem which certainly driving the weak economy and social stability in Jordan. Jordan is still facing economic challenges despite its economic growth since 2014, Therefore, in 2017, the Central Bank of Jordan (CBJ) sought to maintain financial and monetary stability in order to enhance the ability of banks and other financial institutions to take risks and reduce any structural imbalances. Jordan's financial stability continued to improve despite economic and political conditions in neighboring countries which had a negative impact on Jordan's financial and economic situation (Financial Stability Report in Jordan, 2017)

Problem Statement

The problem of the study is to find the relationship of internal and external audit with money laundering in order to demonstrate the effectiveness and quality of money laundering combating by Jordanian Banks.

In general, the percentage of money laundering in the Arab world has widely increased as a result of the wars against terrorism that have been inflicted on neighboring countries of Jordan (Abu Olaim & Rahman, 2016), which negatively affected the economy of Jordan, especially the technological progress which is considered as one of the variables that have helped the existence of money laundering cases in Jordan, because those who carry out money laundering have experience in financial transactions such as economists, traders, lawyers, companies and banks. Despite the numerous international attempts and Jordanian efforts at all levels of the country's financial and security to combat the use of these suspicious accounts, there is still a big gap that still prevents the full control of the users of these accounts in a manner that ensures their discovery and achieves financial stability. Therefore, this study is designed to introduce new variables such as internal and external auditing, and its relationship with banks' commitment in Jordan to detect suspicious accounts In order to assist all sectors of the state financial and security to stop and arrest the perpetrators of these crimes and camouflage uses for their implementation.

The problem focused on determining the outcomes of the accounting factors use in banks and to find out the main problem in Jordanian banks. Until this moment, according to our limited knowledge; there are no previous researches have investigated the relationship between the accounting factors combined and the banks' commitment to detect money laundering in Jordan. Consequently, the following question helps to solve this problem:

1. What is the relationship between internal audit and banks' commitment to detect money laundering in Jordan?

2. What is the relationship between external audit and banks' commitment to detect money laundering in Jordan?

Study Objectives

This study measures the following objectives:

1. The relationship between internal audit and banks' commitment to detect money laundering in Jordan.

2. The relationship between external audit and banks' commitment to detect money laundering in Jordan.

Study Significance

The importance of the study lies in its practical and theoretical sides besides detecting money laundering. The practical side importance lies in the identification of the internal auditing and external audit and the importance of the detect money laundering in Jordan. The theoretical aspect took into account the new variable within the awareness of the researchers, such as the internal audit used in detect money laundering and its importance and effectiveness in the decision-making process.

The study is also of great importance for Jordanian economy, foreign investors and decision-makers in Jordan, such as banks, auditors and Jordanian government.

The role and relationship of the accounting factors (internal audit and external audit) in Jordan towards detect of the money laundering becomes more important than in the normal conditions.

In reality, this study will be constructive through increasing the importance of the banks knowledge about the laws that comply with the government regulations and laws regarding detect money laundering. Furthermore, there are several reasons for which this study is considered important. First, it is the first study that tackles the relationship between the accounting factors and the banks' commitment to detect money laundering in Jordan. Second, it identifies the banks' compliance with the laws and regulations related to combating money laundering and terrorism, third, this study motivates researchers in Jordan to investigate studies that increase and improve the banks' performance in anti-money laundering and anti-funding Terrorism.

Prior Research And Hypotheses Development

The importance of accounting factors (internal audit and external audit) appears through providing fit data for decision makers to make the right decision relating to money laundering in Jordan. The goal is thus to carry out the Jordanian Banks functions and detect money laundering according to law of detect of money laundering and anti-terrorism in Jordan. In relation to that, Nihad et al. (2011) Showed importance periodically audit to decision making process.

Banking Sector in Jordan

The banking sector is the most important constituent of the economy and Jordanian financial sector so that licensed banks play a key role in driving economic growth rates by mobilizing national savings to finance sectors, also the banks in Jordan is essential in the finance of productive economic sectors. In this respect, the number of licensed banks in Jordan is 23, which is divided into 15 Jordanian banks including Islamic banks and eight foreign banks (Five Arab Banks).

The use of contemporary technologies in Jordanian banks

According to Annual Report issued by the Bank for 2006, we saw new banking services provided to customers who are based on using new information and communication technology. The new services have impressed customers such as credit card, Electronic Funds Transfer Cards (EFT), prepaid cards, cards and online shopping and smart chip system

Anti-money laundering procedures by auditors

Jordan Association of Certified Public Accountants is the oversight body that is responsible to monitor the external audit profession in Jordan, Auditors verify from internal systems and policies within the companies they audit and then ensure that the company is committed to implementing these policies and testing their effectiveness, the number of external auditors are 450, auditors for 250 offices, the CBJ issued instruction related to AML No.14/2018 in June 2018 states that external auditors only perform audit and are not allowed to perform any other business , the external auditors consider that the banks' compliance with antimoney laundering combating is a duty imposed by the bank on auditors and not by the authority of central banks to obligate them to do so.

To ensure the soundness of the financial conditions of the bank, Central bank of Jordan issued article no 17 and 18 in 1 September 2016 related to Revised Instructions for Institutional Governance of Banks and in relation to that, article no 17 states that ensure that the Bank's Internal Audit Department is able to verify the availability of adequate internal control and control systems for the Bank's activities, compliance with the Bank's internal policies, international standards and legislation, auditing financial and administrative matters, commitment to the Corporate Governance Guide, ensure and support the independence of internal auditors, correct of audit notes, provide qualified human resources for internal audit management, not to entrust the internal auditors with any executive tasks, ensure that all activities of the Bank are under of the audit, including those assigned to third parties, and ensure that the Internal Audit Department is under the direct supervision of the Audit Committee.

To ensure the soundness of the financial conditions of the bank, Central bank of Jordan issued article no 17 and 18 in 1 September 2016 related to Revised Instructions for Institutional Governance of Banks and in relation to that, article no 17 states that ensure that the Bank's Internal Audit Department is able to verify the availability of adequate internal control and control systems for the Bank's activities, compliance with the Bank's internal policies, international standards and legislation, auditing financial and administrative matters, commitment to the Corporate Governance Guide, ensure and support the independence of internal auditors, correct of audit notes, provide qualified human resources for internal audit management, not to entrust the internal auditors with any executive tasks, ensure that all activities of the Bank are under of the audit, including those assigned to third parties, and ensure that the Internal Audit Department is under the direct supervision of the Audit Committee.

Furthermore, article no 17 about external audit states that change auditors every seven years, the Audit Committee shall verify the independence of the External Auditor annually and take appropriate measures to address weaknesses in the internal control and control systems or any other points made by the external auditor (Governance Code No. 63/2016).

In this respect, there are many instructions issued by Central bank of Jordan No. 14/2018 in June 2018 related to AML and in line with that, these instructions confirm that the Bank will identify and evaluate the risks of money laundering and terrorist financing and take appropriate measures to manage and reduce those risks and inform the Central Bank of Jordan of the results, these instructions have confirmed the certainty of the customer's and the sources of the funds and the confirmation of any electronic transfers made by an exhibitor regardless of their value. Also the Bank is prohibited from maintaining or dealing with anonymous accounts or fake names or makes banking relationships with anonymous people or with fictitious names or fictitious companies or banks. In closing, the bank should prepare files for suspected financial transactions related to money laundering and to submit periodic statistical reports to the Board of Directors on transactions suspected of being linked to money laundering, then provide the Central Bank with all reports issued by internal and external regulators in case of irregularities related to money laundering.

Because of concerns of the Jordanian government's about money laundering and its impact on the Jordanian economy, the money laundering unit was established according to Law No. (46) of 2007 about the Money Laundering and Financing of Terrorism. The unit enjoys financial and administrative independence and is linked to the Governor of the Central Bank of Jordan; this Unit is responsible for receiving notifications about suspected that related to transactions of money laundering and Financing Terrorism and request of the information investigate and analyze them. Consequently, this unit provides this information to the competent authorities for the purpose of combating money laundering and the financing of terrorism. In the event that information is available concerning the existence of a suspected money laundering or terrorist financing operation, the Unit shall prepare a report with information, data, and documents.

Money Laundering: Definition and Threats

The researchers use the definition of money laundering contained in the Anti-Money Laundering and Terrorist Financing Law No. 46 of 2007 in Jordan. According to this law, Money laundering is any act involving the exchange, transfer, disguise of its source, acquisition, possession, use, management, preservation, investment, deposit, concealment or disguise of its true nature, source, location, movement, disposition or ownership. The researchers believe that the definition contained in the Jordanian law includes all of the elements that are important for this study.

Regarding this, Fabian (2017) stressed that the instructions and laws imposed on the monetary sector to enforce strict anti-money laundering laws are not feasible because money laundering can occur in other industries that do not have strict anti-money laundering laws.

Jasper & Arabinda, (2011) said money laundering is a crime and ruins the connection between money and illegal actions. For that, Mohammed (2015) said, in the last years assessment of risks in the banks become focuses on money laundering because money laundering become the biggest major problem.

In relation to that, FATF (2013) confirm, that this crime (money laundering) occur by two methods, whether depositing cash money immediately into banks or money transfers relying on electronic fund transfer. Also, Description of money laundering through three stages: “placing” moneys into the financial sector; the “layering” is hiding the connection between money and its source; the last one is “integration” is convert of the money to assets and commodities (McDowell and Novis, 2001).

In fact, banks are facing main challenge related to money laundering, for example, client has many activities outside of the authority of the main bank, the complex money laundering will also make banks in more need to find a way to prevent and combat money laundering. In addition to that, the researcher considers Checklists useful in that, but there is no clear picture about what is actually happening about money laundering (Mohammed, 2015). On the contrary, Musonda & Guohua, (2011) found that commercial banks in Zambia are committed in laws and regulations related to money laundering.

Güne?, (2009) confirmed that the money laundering is a global phenomenon and increased attention about it at the national and international levels. For detect and prevent money laundering in Jordan, article (13) include that the banks working in Jordan shall comply with the procedures stipulated in the Anti-Money Laundering and Financing of Terrorism Law. In addition to that, the Jordanian law obligates financial institutions to inform the Anti-Money Laundering Unit at the Central Bank when suspected of money laundering, even if there is doubt in the bank's management that the operation to be carried out is a suspicious operation. In line with that, the notification manager must notify the unit immediately of suspicious operations whether or not this operation is carried out. Also, the external auditor in Jordan shall ensure that banks are commitment to measures of anti-money laundering.

Additionally, the instructions of the internal control and control systems (35/2007) in the third article stipulate the commitment of the executive management of the bank to provide the controlling authorities, internal audit, external auditing and any other relevant parties with the required information and statements necessary for carrying out its tasks in the optimal manner.

On other hand, The provisions of the internal control and control systems (No. 35/2007) in Jordan stipulate that the Bank shall be obliged to establish an independent internal audit department, which shall be directly related to the Audit Committee (formed in accordance with the provisions of Article 32 of the Banking Law), its functions include the development of audit procedures in line with international practice and standards, Prepare an audit plan derived from the Bank's strategic plan, prepare an annual report to check whether the internal surveillance is enough or not and control systems to reduce the risks to the Bank such as cases of terrorism funding and money laundering, and provide the internal audit department with staff that have scientific qualifications and adequate practical experience to audit all activities and processes.

In related to this study, Abu Olaim & Rahman (2016) confirmed that the Jordan is facing problem because Jordan location in the middle of conflict of economic and military region in Arab aria, the result of that, Money laundering activities have become flourishing in Jordan.

In reality, internal auditor and external auditor are facing suffering in detect money laundering because a good financial relation between banks and agents, this fact assured by (Ping, 2004) who showed that the banking secrecy is helping criminals to protect their activities in money laundering. Therefore, this study came to overcome money laundering problems in Jordan.

The General Concept of the Study Variables

Internal audit

Most of the companies in developed countries have an interest in internal audit through establishing detached internal audit departments conducted by proficient human resources to achieve the objectives in effective ways such as fraud investigations, commitment of audits procedures, audit policies, audit legal and acts, etc.) Audits and review of accounting and financial information (Staciokas and Rupsys, 2005; Shahrory, 1998).

Internal audit in Jordan is very important in organizations. Therefore, the responsibility of the organization’s top mangers is to create and preserve influential internal surveillance, which assists the organizations to face the risks and achieve goals and objectives (Al Matarneh, 2011). According to standards of the Institute of Internal Auditors, audit quality includes three factors: Proficiency, independence, objectivity and showed that the quality of internal control will assess by management and external auditor (IIA, 2003b). In relation to that, (Al Matarneh, 2011) found a positive and significant connection between competence of internal auditors and the quality of the internal audit, there is a positive and significant connection between objectivity of internal auditor and the quality of the internal audit. Moreover, he indicated that there is a positive and significant connection between internal auditing outcomes and the quality of internal audit in Jordanian Banks.

In prior research, (Mat Zain et al., 2006) found a positive relationship between internal auditors’ assessment of their contribution to financial audits and audit committee characteristics The importance of internal audit in Jordanian banks came through the main role to banks in growth Jordanian economy. Therefor the researchers take this variable (internal audit in Jordanian banks) to know its relationship with detect of money laundering for saving growth of Jordanian economy and fighting terrorism.

Also, important of internal audit function came from the results of previous studies that showed, the internal audit function, internal audit budget, staff capacity, and size of the internal audit function are related with company size (Sarens and Abdolmohammadi, 2011; Gronewold and Heerlein, 2009). These results are vital for this study because banks size is different from one to other in Jordan and also size of Money transfers to these banks from abroad are different.

Al-Twaijry et al. (2003), confirmed that the internal audit conformance with the International Standards for the Professional Practice of Internal Auditing (ISPPIA) is higher in the bank sector. Also, Alzeban (2015) appeared that the size of internal audit department are positively associated with internal audit conformance with both standards indicating that Chief Internal Auditors (CIA) tenure has an impact on conformance with the (ISPPIA); the larger the IAF, the greater the internal audit conformance with the ISPPIA. Moreover, BANK is significantly associated with internal audit conformance with ISPPIA.

Hence, Andrew and Odar, (2015) asserted that the issue is the current standards are suitable for making improvements or whether. According to that, the researchers aske is the current standard to internal audit are fit to helping internal auditors in banks to detect money laundering, the answer will be during hypotheses test.

Thus, the exploratory of internal audit role is expected to be more important in current times through knowing the relationship between it and detect of money laundering. Our question is the internal audit will success or not in contribution in detects money laundering; in relation to that Internal audit opinions about money laundering should rely on adequate work basis and adequate evidence.

On other hand, Chevers et al. (2016) showed the important of the banks in economy such as hold the savings of the public, finance, and give payment for goods and services. At the same time, the researchers examined the factors that influence on internal audit function in Jamaican commercial banks. They found that the audit quality examination, independence of organizational, professional proficiencies and management support have a significant impact on internal audit effectiveness. Depending on these results, the study confirmed the importance of the internal audit in playing mean role in the financial viability and financial health of any financial institution. In old studies, (Latibeaudiere, 2002) showed importance, effectiveness, and efficiency of internal audit department in the financial sector and in the same year (Siddiqui & Podder, 2002) said the role of internal auditors in banks is very critical.

In modern study, Fiolleau et al. (2013) showed the importance of given to internal auditors high level from independence when they wrote their reports and findings. From earlier studies until now, the researchers have noted that support of management to internal audit, appropriate between management goals and internal auditing work, and internal auditor's qualification are critical to efficiency of internal audit. Depending on previous results related to internal audit , we reached to importance of this variable to examine its relationship with commitment of banks in detect the money laundering in Jordan for helping in protect Jordanian economy. Finally, John, (1993) showed that hiring internal auditors' in financial institutions is becoming mandatory to testing of records and recordkeeping requirements of regulations on money laundering. Therefore, depending on the existence of previous positive relationships, the related hypotheses are proposed:

H1: There is a positive relationship between the internal audit and banks commitment in detect money laundering in Jordan.

External audit

John (1993) showed that the external auditors are visiting the financial institutions less than internal auditors, therefore report of external auditor has less value than internal auditor report in dealing with detect money laundering. However, external auditor has independence and outside experience in detecting and preventing of money laundering more than internal auditor. In addition to that external auditor has a good position to give observations objectively to senior management about money laundering because his reputation and keeping it in higher level. Also, auditors have a direct responsibility to provide reporting to banks in England related to deposittaking and money laundering.

Xianjie et al. (2017) showed that the audit committee has a major role in supervising on the processing of the financial reporting. And as we know, audit committee is a liaison between the management of companies and its external auditor. Indeed social relations between audit committee and auditors could effect on audit quality.

In another literature, a study was conducted by Laura, Patrizia and Fabio in Italy indicates that there is a statistically significant difference between activities of external auditors in auditing from where audit quality and Legislative committees, in this respect, the study found that there is appositive significant related to contribution in a greater auditing quality by external auditors compared with legal committees. On the contrary, they found a negative result refers to there is no statistically significant differences between the external auditors in auditing from where quality and of legal committees less complex organizations. In point of fact, Suwaidan & Qasim (2010) pointed out there is a positive relationship between external auditors fees and the total assets of audited companies , in contrast, some other researchers found there is no any relationship between the dependence of external auditors on internal auditors and external auditors fees. Furthermore, Faten & Omri (2010) investigated the association between irregularity of information and the external auditors in audit quality in the Tunisian capital market, consequently, this study arrived to many results such as: there is a negative relationship between the bid-ask, a market-based investigate of information irregularity and the employment of an industry specialist and big auditors, also there is appositive relationship between the bidask, a market-based examine of information irregularity and the audit firm tenure. In relation to external audit also, AlThuneibat, Khamees, & AlFayoumi, (2007) found that there is no statistically significant relationship between qualified auditors opinion and share prices and returns in Jordan. Not too long ago, Alzoubi (2016) found a significantly negative effect to quality of the audit on earning management in Jordanian companies from 2007 to 2010. But in the previous study, Alves (2013) revealed to a positive relationship in financial companies in Portuguese between both presence committee of audit and external audit and management of Earnings from year 2003 to 2009

In this respect, Kamal & Yousef (2016) showed a statistically significant positive association between audit fees and audit committee independency and size of corporation also the study arrived to statistically significant negative correlation between fees of external auditors and complication of business, on the other hand, audit fees insignificantly associated with profitability of companies, risk and nature of industry, audit firms position and delay of auditors reports in Emirati firms listed on Dubai Financial Market.

In particular, Alawaqleh (2017) found a statistically and appositive association between external audit and detection of cases of money laundering in Jordanian commercial banks. In line with that, the text of the Jordanian Banking Law No. (28) Of 2000 in Article (70)/c (1) specifies that "the Central Bank and the auditors selected by it during its inspection of the Bank and any subsidiary thereof shall have the right to do the following: Examine financial records and documents excluding notes of gatherings and decisions of the Directors Board and the Committee of Audit obtain copies thereof, also the executive management of the Bank in Jordan shall providing to external and internal control bodies, such as regulatory authorities, internal audit, external auditing and any bodies related, and at the time specified by those agencies with the financial statements and accounting information required to carry out their duties in the best manner.” Furthermore, The External Auditors in Jordanian Banks shall ensure that the Bank implements the money laundering and Financing Terrorism Regulations and contain the outcomes thereof in its report sent to the management. The Central Bank shall be notified immediately of any violation of these instructions.

Consequently, the researcher’s hypothesis is as follows:

H2: There is a relationship between the external audit and banks commitment in detect money laundering in Jordan.

Dependent variable

The dependent variable in this study is the banks' commitment to detect and combating of money laundering in Jordan. Previous studies showed a variety results about the detection and combating of money laundering in many countries. Aspalella (2014) showed that there is a difference between anti-money laundering law and the common law or other statutes. In line with that, this paper will show the effect of disclosure by banks about detects and combating of money laundering through the commitment of Jordanian law and legislations related to money laundering to keep Jordanian economy.

In point of fact, this disclosure conflicts with the relationship between banker and customer because the commercial success of the banking business depends on keeping on costumer's information secrecy (Jawahitha, 2002).

In this respect, Vandana et al. (2012) said: "Money laundering spoils the financial markets and corrodes the public’s confidence in global financial system". Therefore, they aimed to found a new framework for preventing money laundering in banks by mapping (Control for Information and Related Technology to Committee of Sponsoring Organization) components. To detect money laundering activities and monitor money transactions the result indicates that the banks should rely on intelligence systems.

In reality, one of the most important observations that can be highlighted in the Jordanian anti-money laundering system is the lack of all the necessary legal tools to complete the legislative structure and the basis for this system. Nevertheless, government and policy makers in Jordan need to increase and develop the technical and human capitals of many related authorities with a key role in the system Anti-money laundering where the weak of such capitals negatively affect the efficiency of money laundering system. On the organizational and supervisory side issued a number of instructions addressed to the numerous financial sectors that deal with a reasonable part of requirements and international standards related to combating of money laundering. Therefore, Banks should use a system of risk management to explain whether a prospect client, contemporary customer or real beneficiary is a political person representing risks, on the ground, most banks have internal systems and policies for anti-money laundering measures, with varying levels of sophistication and efficiency between small banks and large developed banks, in line with that, the Anti-Money Laundering Law also stipulates that persons with unknown or fictitious names or with fictitious banks should not be dealt with. The Anti- Money Laundering Regulations also provide that the Bank may not go into a banking association with a fictional bank; it further provides that the Bank shall ensure that the external bank is focus on effective control supervision by the regulatory authority in Homeland, it is also necessary to verify the availability of adequate systems to combat money laundering and terrorist funding operations at the external bank.

Consequently, Article (4)/of the Jordanian Law on the category of "foreign banks" states that the bank must "apply due diligence requirements on customers when establishing a banking relationship with an external bank and determine the nature of the Bank's external activity and reputation in the field of combating operations Money laundering and terrorist funding.”

Research Frame Work And Methodology

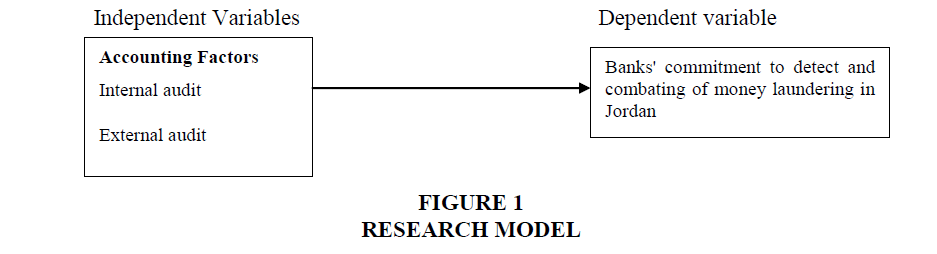

Research Model

The IVs are internal audit and external audit. The dependent variable is banks' commitment to detect and combating of money laundering in Jordan. Figure 1 indication to the model of this research.

Research Design

The basic research design utilized for this study is a survey design. There is one set of data used for collection purposes, namely primary data. The collection of primary data is accomplished using a personal survey instrument. Data is collected from the personal survey instrument (questionnaire) in order to measure the relationship between accounting factors (internal audit and external audit) and Banks' commitment to detect and combating of money laundering in Jordan. This study is strictly designed for correlation rather than causal analyses.

Society and Sample of study

The study population consisted of 23 banks in Jordan distributed by (15) Jordanian banks (including two Islamic banks), and eight foreign banks (five of which are Arab banks). Consequently, comprehensive containing method for the study population consists of the Jordanian banks of the sum of (23) Bank, the total number of questionnaires distributed was (115) questionnaire. Table 1 shows the ratio of the questionnaires sent to respondents and the percentage of those that returned them back.

Table 1 explain the response rate on study instrument(questionnaires) that sent to banks in Jordan, in addition to that this table showed the rate of return questionnaire.115 questionnaires distributed, 113 subjects received the questionnaire and only 101 out of 113 making a response rate of 89.4%.

| Table 1 Response Rate | |

| Questionnaires distributed | 115 |

| Undelivered | 2 |

| Subjects Contacted | 113 |

| Total of Responses | 101 |

| Rates of Response (101/113) | 89.4% |

Data Analysis

The multiple regression method is used in the hypothesis testing because there are more two IVS and one DV. Moreover, all variables have used the interval scale.

Instrument Reliability

The researchers relied on previous studies and questionnaires in the instrument development (5 Likert scale used). The instrument experienced several tests, such as instrument reliability and validity. The results of reliability were statistically acceptable as follows.

The Cronbach’s Alpha values range from 79% to 84%. Therefore all factors fulfilled the minimum requirement level of reliability Table 2.

| Table 2 Cronbach's Alpha Test | |

| Variables | Cronbach's alpha |

| Internal audit | 79% |

| External audit | 84% |

| Banks' commitment to detect and combating of money laundering in Jordan | 80.2% |

Linearity, Normality and Homoscedasticity Status

The outcomes of this study assured that the division of the sample answers was normal and a linear connection exists between the IVs (internal and external audit) and the DV (Banks' commitment to detect and combating of money laundering in Jordan), the DV was assured by the following investigations: (Q-Q plot and scatter plot diagrams). This assures that the sample of this research was in harmony with the population. To test the normal distribution, Histograms was used by the researchers resulting in a homogeneous form; this suggests that the normal division of data can be made possible to use the multiple regression method.

Criterion Validity

This type of test examines the relationship between all variables with each other. Hair et al. (2007) confirmed that the high correlation of 90% and above is considered an indicator of a strong internal correlation between the independent variables with each other. A high correlation among the independent variables indicates that the measurement of one variable leads to the deletion of one of them.

Table 3 indicates that the statistical results (Pearson correlation) of this study confirm that there is no high correlation among IVs. This test is necessary before the multiple regression procedure (Hair et al., 2007).

| Table 3 The Relationship Between Variables (Pearson Correlation) | |||

| Internal audit | External audit | Banks commitment | |

| Internal audit | 1 | -0.590 | 0.350 |

| External audit | -0.590 | 1 | 0.016 |

| Banks commitment | 0.350 | 0.016 | 1 |

RESULTS

Analysis of the Relationship between the Study Variables

The study used the bivariate analysis in order to test the relationship between two variables; in light of that, the researchers used the Pearson correlation coefficient to measure the linear relationship between the variables; the “0” value indicates the absence of a relationship between the variables but the “1” value indicates a strong positive correlation; and the “-1” value indicates a strong negative correlation between the variables. Therefore, Cohen (1988) confirmed that the interpretation of the strength of the relationship between two variables shown Table 4.

| Table 4 Strength Of The Relationship Between Variables | |

| Correlation | Strength of the correlation |

| R=10.0 to 29.0 or r=-01.0 to -29.0 | Low |

| R=30.0 to 49.0 or r=-30.0 to -49.0 | Medium |

| R=50 to 1 or r=-50.0 to -1 | High |

The results of the correlation analysis showed the level of the relationship between the independent variables and the dependent variable as they appear in Table 5. We note that there are one independent variable (internal audit), which has a medium correlation with the dependent variable (Banks commitment) but the external audit has a low correlation with deviation.

| Table 5 The Level Of Relationship Between The Independent Variables And The Dependent Variable | |

| Variables | Strength of the relationship |

| Internal audit | Medium |

| External audit | Low |

Multiple Regression Coefficients

The findings of the regression analysis have revealed that internal audit (p=0.000) influenced the banks' commitment to detect and combating of money laundering in Jordan. Furthermore, there is a statistically significant (p=0.003) impact of external audit on the dependent variable. MRA techniques have shown the results clearly by presenting the impact of multiple independent variables as shown in the following results Table 6.

| Table 6 Coefficients Of Independent Variables | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients | |||

| B | Std.Error | Beta | T | Sig | |

| Constant | -0.508 | 0.989 | - | -0.514 | 0.608 |

| Internal audit | 0.789 | 0.161 | 0.551 | 4.914 | 0.000 |

| External audit | 0.344 | 0.113 | 0.340 | 3.039 | 0.003 |

The regression coefficient (β) indicates the effect of the independent variables on the dependent variable. Specifically, for each unit change of the independent variable X, there is an expected change equal to the size of β in the dependent variable, Y. Hence, the regression model is as follows:

Y=?+β1X1+β2X2+ε

Where,

Y=the banks' commitment to detect and combating of money laundering in Jordan.

a=constant.

X1=internal audit.

X2=external audit.

ε=random disturbance term (error).

The value of the (internal audit) coefficient in the Table 7 was (0.789). This is a positive sign indicating the existence of a positive relationship between the banks' commitment to detect and combating of money laundering in Jordan, as an increase in the internal audit leads to the increase of the banks' commitment to detect and combating of money laundering in Jordan and vice versa. Moreover, the value of possible significance reached (0.000) in Table (7) and it is lower than the level of significance (0.05). Thus, it is accepted that there is a statistically significant relation between the dependent variable pertaining to the banks' commitment to detect and combating of money laundering in Jordan and the independent variable concerning internal audit.

| Table 7 Relationship Between The Banks' Commitment To Detect And Combating Of Money Laundering In Jordan And Internal Audit | |||||

| Model | B | Std. Error | Beta | t | sig |

| Internal audit | 0.789 | 0.161 | 0.551 | 4.914 | 0.000 |

The value of the coefficient of the (external audit) reached (0.344) and the positive sign is indicative of the existence of a direct relation between the banks' commitment to detect and combating of money laundering in Jordan and external audit factor, as an increase in external audit leads to the increase of the banks' commitment to detect and combating of money laundering in Jordan and vice versa. Moreover, the value of the possible significance reached (0.003) in Table (8) and it is lower than the level of significance (0.05). Thus, it is accepted that there is a statistically significant relation between the dependent variable pertaining to the banks' commitment to detect and combating of money laundering in Jordan and the independent variable external audit.

| Table 8 Relationship Between The Banks' Commitment To Detect And Combating Of Money Laundering In Jordan And External Audit | |||||

| Model | B | Std. Error | Beta | t | sig |

| External audit | 0.344 | 0.113 | 0.340 | 3.039 | 0.003 |

It is clear that the value of the overall correlation coefficient is R=0.445. The correlation coefficient is revealed for the independent variables (accounting factors: internal audit and external audit) and the dependent variable (the banks' commitment to detect and combating of money laundering in Jordan). It is indicated that the existence of a direct and medium correlation between the dependent and independent variables is closer to one (0.445). It is noted that the value of the determination coefficient R square is equal to 0.198; and the value of the adjusted determination coefficient is 0.182. The coefficient of determination is referred to as the amount of the explained variance by the regression model (Table 9), which makes it beneficial as a measure of predicting success (Nagelkerke, 1991).

| Table 9 Model Summaryb | ||||

| Model | R | R Square | Adjusted R Squar | Std. Error of the Estimate |

| 1 | 0.445a | 0.198 | 0.182 | 0.48390 |

| a. Predictors: (constant), internal audit and external audit | ||||

| b. Dependent Variable: the banks' commitment to detect and combating of money laundering in Jordan. | ||||

The value of the possible significance reached (0.000) and it is lower than the value of significance (0.05). Thus, the relation is significant, which explains a significant percentage in the dependent variable (the banks' commitment to detect and combating of money laundering in Jordan) Table 10.

| Table 10 Analysis Of Variance (Anova)b | |||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. |

| Regression | 5.661 | 2 | 2.831 | 12.089 | 0.000a |

| Residual | 22.947 | 98 | 0.234 | ||

| Total | 28.609 | 100 | |||

| a. Predictors: (constant), internal and external audit. b. Dependent variable: the banks' commitment to detect and combating of money laundering in Jordan. | |||||

Discussion

The association between accounting factors (internal and external audit) and the commitment to detect and combat money laundering in Jordan as applied in the banks' over the year 2017 are revealed by means of the multiple regression. The accounting factors (internal and external audit) play an important role in the Jordanian economy. For this reason, these factors have been proved reliable in achieving a number of economic goals, and they will also come up with solutions to detect and combat money laundering protecting the Jordan economy from being vulnerable to risk. The CBJ established an anti-money laundering unit to detect money laundering and counter terrorism operations to encourage foreign and local investments in Jordan, to support the economy, and prevent the financing of terrorism. The data regarding this study were attained from managers, risks managers and audit committee in Jordanian banks. The variety of regression data provides appropriate outcomes corresponding to the hypothesis.

All study outcomes were vital due to the existence of a medium direct correlation between the dependent variable (the banks' commitment to detect and combating of money laundering in Jordan) and the independent variables accounting factors (internal audit and external audit). Consequently, the correlation coefficient value R and the determination coefficient value R Square showed that the IVs are about 19.8% explained the DV, and results from this study shows a direct association between the independent variables and dependent variable.

Over the last decades, the Jordan Government has exerted big efforts to provide a road map that encourages the initiation of local and foreign investments and combating terrorism that pave the way for the Jordanian government to increase economy growth rates. To start up successfully in detecting and combating money laundering, the knowledge of the accounting factors (internal and external audit) will help Jordan attract good investments and combat money laundering to support its economy. Moreover, reconsideration of the laws related to money laundering combating and detection should be taken by the Jordanian government (Abu Olaim & Rahman, 2016).

Recommendations

1. The need to take all the accounting factors (internal and external audit) into account by banks and policy makers is necessary to help them detect and combat money laundering in Jordan because these factors ensure an effective contribution to money laundering combating. In fact, the above mentioned factors (IVs) contributed about 19.8% to the detection and combating money laundering in Jordan.

2. Holding sessions for banks strategies makers to specify the most important accounting factors that make high-quality techniques to detect and combat money laundering.

3. The CBJ should urge the Jordanian banks to use accounting factors, flexible methods and commitment to laws and legislations for helping them detect and combat money laundering.

4. This study also recommends future studies take in consideration other factors that might affect on the dependent variable (detect and combat money laundering) because the variables from this study contributed only about 19.8% to the explanation of the DV.

5. This study recommends the Jordanian government activate its role by spreading awareness among all banks employees about the importance of accounting factors (internal and external audit) in detecting the money laundry.

Limitations

The questionnaire only distributed to 23 major banks excluding their branches estimated 527 in Jordan from the distribution domain. Consequently, the limited number of observations collected may affect some results; however, this limitation is common from the perspective of researchers because of the difficulty of access of researchers to all Jordanian cities due to time constraints and high cost. Also, Bank size can affect the respondents' perception because the Jordanians banks vary in size. As well as, some banks do not face problems related to money laundering like other banks.

References

- Abu Olaim, A.M.A., & Rahman, A.A. (2016). The impact of Jordanian anti-money laundering laws on banks. Journal of Money Laundering Control, 19(1), 70-78.

- Al Matarneh, G.F. (2011). Factors determining the internal audit quality in banks: Empirical evidence from Jordan. International Research Journal of Finance and Economics, 73, 110-119.

- Alawaqlem, Q.S. (2017). The role of the external audit in detecting money laundering cases in the Jordanian commercial banks. Master Thesis, Al Bayt University/Mafraq, Jordan.

- AlThuneibat, A.A., & Khamees, B.A., & Al?Fayoumi, N.A. (2007). The effect of qualified auditors' opinions on share prices: evidence from Jordan. Managerial Auditing Journal, 23(1), 84-101.

- Al-Twaijry, A., Brierley, J., & Gwilliam, D. (2003). The development of internal audit in Saudi Arabia: An institutional theory perspective, Critical Perspectives on Accounting, 14(5), 507-531.

- Alves, S. (2013). The impact of audit committee existence and external audit on earnings management: Evidence from Portugal. Journal of Financial Reporting & Accounting, 11(2), 143-165.

- Alzeban, A. (2015). Influence of audit committees on internal audit conformance with internal audit standards. Managerial Auditing Journal, 30(6/7), 539-559.

- Alzoubi, E.S.S. (2016). Audit quality and earnings management: Evidence from Jordan. Journal of Applied Accounting Research, 17(2), 170-189.

- Aspalella, A.R. (2014). Combating money laundering and the future of banking secrecy laws in Malaysia. Journal of Money Laundering Control, 17(2), 219-229.

- Chambers, A.D., & Odar, M. (2015). A new vision for internal audit, Managerial Auditing Journal, 30(1), 34-55.

- Chevers, D., Lawrence, D., Laidlaw, A., & Nicholson, D. (2016). The effectiveness of internal audit in Jamaican commercial banks. Accounting and management Information Systems, 15(3), 522-541.

- Faten, H., & Omri, M.A. (2010). Quality of the external auditor, information asymmetry, and bid?ask spread: Case of the listed Tunisian firms. International Journal of Accounting & Information Management, 18(1), 5-18.

- FATF Guidance (2013). National Money Laundering and Terrorist Financing Risk Assessment. Financial Action Task Force, Paris.

- Financial Stability Report, Jordan, (2016). Retrieved from: http://www.cbj.gov.jo/EchoBusV3.0/SystemAssets/ PDFs/EN/FINANCIAL%20STABILITY%20REPORT%202016.pdf

- Fiolleau, K., Hoang, K., Jamal, K., & Sunder, S. (2013). How do regulatory reforms to enhance auditor independence work in practice? Contemporary Accounting Research, 30, 864-890

- Gronewold, U., & Heerlein, A. (2009). The staff capacity of the internal audit function of German corporations. Midyear meeting of the Auditing Section of the American, 2, 179-206.

- Güne?, O. (2009). Antimoney laundering under Turkish law. Journal of Money Laundering Control, 12(1), 88-92.

- Hair, J.E., Anderson, R.E., Tatham, R.L., & Black, W.C., Babin, B.J. (2007). Multivariate Data Analysis. Washington: Pearson Prentice Hall International Inc.

- Institute of Internal Auditors (IIA). (2003b). International Standards for the Professional Practice of Internal Auditing', Altamonte Springs, FL. http://www.theiia.org/ecm/guideframe. cfm?doc_id=1499.

- Jasper, L., & Arabinda, A., (2011). Transshipment and trade?based money laundering. Journal of Money Laundering Control, 14(1), 79-92.

- Jawahitha, S. (2002). Banking confidentiality-a comparative analysis of Malaysian banking statutes. Arab Law Quarterly, 17(3), 255-264.

- John, T., (1993). Providing assurance that all is well on money laundering: What role for the internal and external auditor? Journal of Financial Crime, 1(2), 107-110.

- Kamal, N., & Yousef, M.H. (2016). Factors influencing external audit fees of companies listed on Dubai Financial Market. International Journal of Islamic and Middle Eastern Finance and Management, 9(3), 346-363.

- Latibeaudiere, D. (2002). Internal audit for banks, Bank of Jamaica, 1-3. Retrieved from http://www.boj.org.jm /uploads/pdf/boj_annual/boj_annual_2003.pdf

- Mat Zain, M., Subramaniam, N., & Stewart, J. (2006). Internal auditors’ assessment of their contribution to financial statement audits: the relationship with audit committee and internal audit function characteristics. International Journal of Auditing, 10(1), 1-18

- McDowell, J., & Novis, G. (2001). The consequences of money laundering and financial crime. Economic Perspectives. An Electronic Journal of the US Department of State, 6(2), 6-8.

- Mohammed, A.N. (2015). Money laundering using investment companies. Journal of Money Laundering Control, 18(4), 438-446.

- Musonda, S., & Guohua, W. (2011). The role of money laundering reporting officers in combating money laundering in Zambia. Journal of Investment Compliance, 12(3), 49-55.

- Nagelkerke, J. (1991). A note on a general definition of the coefficient of determination. Biometrika, 78(3),691-692.

- Nihad, N., Maher, A., & Hussein, J. (2011). Study of financial indicators and their role in management decisions. Tishreen University Journal for Studies and Scientific Research, 33(8).

- Ping, H. (2004). Banking secrecy and money laundering. Journal of Money Laundering Control, 7(4), 376-382.

- Pramod, V., Li, J., & Gao, P. (2012). A framework for preventing money laundering in banks. Information Management and Computer Security, 20(3), 170-183.

- Sarens, G., & Abdolmohammadi, M. (2011b). Monitoring effects of the internal audit function: Agency theory versus other explanatory variables. International Journal of Auditing, 15(1), 1-20.

- Shahrory, M.A (1998). The application of internal auditing standards generally accepted in the Jordanian commercial banks (survey). unpublished Master Thesis, University of Jordan.

- Siddiqui, J., & Podder, J. (2002). Effectiveness of bank audit in Bangladesh. Managerial Auditing Journal, 17, 502-510

- Staciokas, R., & Rupsys, R. (2005). Internal Audit and its Role in Organizational Government. The Accounting Review, 92(5), 61-87.

- Suwaidan, M.S., & Qasim, A. (2010). External auditors' reliance on internal auditors and its impact on audit fees: An empirical investigation. Managerial Auditing Journal, 25(6), 509-525.

- Teichmann, F.M.J. (2017). Twelve methods of money laundering. Journal of Money Laundering Control, 20(2), 130-137.

- Xianjie, H., Jeffrey, A.P., Oliver, M.R., Donghui, W. (2017). Do social ties between external auditors and audit committee members affect audit quality? The Accounting Review, 92(5), 61-87.