Research Article: 2018 Vol: 24 Issue: 3

Investigating the Value Creation of Internal Audit and Its Impact On Company Performance

Wadesango Newman, University of Limpopo

Makerevi Comfort, University of Limpopo

Keywords

Internal Audit, Assurance Role, Consultative Role, Value Creation.

Introduction

Effective Internal Auditing (IA) can help identifying ways to improve firm’s efficacy, help in reducing overhead, safeguarding the firm from potential losses and operational risk (Alaswad and Stanišić, 2016). Carcello et al. (2017), Coetzee (2014), Odoyo (2014) and Bhana (2013), agree that companies should benefit from value addition in their Internal Audit Function (IAF) through bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management and organization’s operations rather than focusing on traditional approach. Ege (2015) believes internal auditors should support the board and management by providing prudent advice (independent, objective assurance and consulting activity) towards enhancing the existing business processes and operations, contributing towards risk on business stability and enabling business performance, thus creating value. However, Prawitt et al. (2012), Ege (2015), Abbott et al. (2016) and Pizzini et al. (2015) suggest that internal auditing enhances parts of risk related to financial reporting like internal controls and financial reporting quality, reducing fraud and lowering external audit fees. Liu (2017) also highlighted that companies oppose the essence of IAF on cost considerations, as Anderson et al. (2012) claimed that IA budgets are substantial, often runs into millions of dollars. This prompted the researchers to explore into the additional value that firms can obtain from having an Internal Auditing Function so as to enhance business performance and creating a sustainable operating environment.

Background Of The Study

African Sun Limited (ASL) is a company with an established internal audit function, responsible for twelve of the company’s strategic business units (eleven hotels and one casino). The audit function was affected by the restructuring exercise that took place during 2015 financial period, leaving the function with only three personnel staff from the previous number of eleven (Board minutes, 2015). This was due to the need to align the cost structure of the company and the current business performance (declining) as well as the benefits gained from the existence of the department in the firm (Board minutes, 2015). This move left the department under resourced and facing challenges in executing its duties and mainly concentrating on compliance and internal control auditing (Audit Committee presentation, 2016). Moreover, the company is facing a deteriorating internal environment due to the changes (restructuring) and the inability of the audit function to reinforce a robust internal control system as well as not performing efficiently.

The Internal Auditor Manager highlighted (Audit Committee minutes, 2016), that, the audit function has been carrying out insufficient audit procedures, especially for areas related to risk assessment due to its resource constrain. The same impact has also been noted on the 43% adverse variance of planned follow up audit and spot checks designed to enforce the audit recommendations (Audit plan review, 2016). This has raised the fear of weakening internal control environment and operational risk accumulating as a result of the restructuring that resulted in low skilled personnel occupying key positions, the use of semi-permanent staff and the change of operational processes (Ege, 2015).

The Risk profile revealed that the company is failing to achieve strategic objectives and budgets, and the potential for the internal operating environment worsening due to subtle backlash from the employees in the form of not putting maximum effort, pilferage, negative energy and inefficiencies increase and deliberate sabotage on the company due to the implementation of austerity measures on cost reduction (reduction in fringe benefits). This has been evidenced by the 27% increase in fraud cases and misuse of company property for personal gain during the 2016 financial period, with more than 75% of the cases exposed by tip off from other employees and third parties. The Financial Director raised concern on the effectiveness of the Audit function after, a case on cash embezzlement was reported by a third party. This was after an audit had been conducted on the Casino unit and failed to uncover anything. The employee involved took advantage of the poor segregation of duties and the implementation of a new payment system that allowed him to make salary payments to non-permanent staff without senior management involvement.

The Internal Auditor Manager also expressed the need for making sure that the function was well resourced so as to help management and the Board in continuously implementing the ongoing strategic changes as hinted by the Chairman of the Board (Annual Report, 2015) that management and the Board will continue to interrogate the business processes with the view of improving efficiencies and reducing costs. This came amid fears that services quality and most of the facilities were deteriorating at Hotels without proper action being taken to determine areas of concern that are in need of quick attention. The deteriorating service delivery has been attributable to the decline in overall market share of the company by 7% (Marketing Committee presentation, 2016) with six out of the eight regions losing at least 5% of their market share.

Research Methodology

The research adopted a quantitative research methodology. The study targeted a population of 50 personnel from finance, management and audit department of ASL. The research relied on a sample size of 25 personnel (62.5%) selected out of the 40 targeted personnel. Data was collected using questionnaires.

Data Presentation And Data Analysis

Perceptions of Management and Staff on IAF

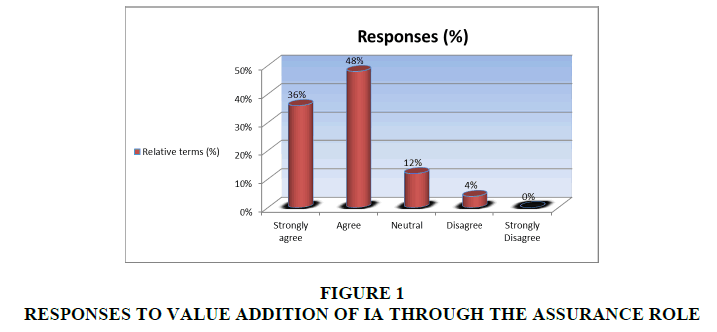

Table 1 and Figure 1 above gives the responses on how employees and management perceive the IAF. The results show that 9 out of 25 (36%) respondents strongly agree on the value addition through the assurance role, while 12 out of 25 (48%) agree, 3 out of 25 (12%) are neutral, 1 out of 25 (4%) disagrees and none of the respondents strongly disagrees.

| Table 1 AN IA FUNCTION ADDS VALUE TO AN ORGANISATION THROUGH ITS ASSURANCE ROLE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 9 | 12 | 3 | 1 | - | 4.16 |

| Relative terms (%) | 36% | 48% | 12% | 4% | 0% | |

Taking the agreeing respondents in aggregate, 21 out of 25 (84%) perceive an IAF as capable of adding value to the company, this being the majority of the respondents means that IAF is most likely to get management support and the ineffectiveness of IA is not emanating from the misconception of the IAF in management and employees. The outcome supports Caratas and Spatariu (2014) who posited that management perceives the IAF as adding value to their organizations through the assurance role in internal controls, risk mitigation, integrity and reliability of financial reporting processes. 3 out of 25 (12%) of the respondents were neutral to the perceived value addition of internal auditors which indicate that not all of the internal audit stakeholders understand the value addition role and IA challenges that can emanate from this in the form of resistance and lack of full support to audit activities. This outcome is in line with the conclusions of Chambers and Odar (2015) who found that the internal audit has been perceived as not fit for the assurance purpose, as well as the findings of Gona et al. (2014) who discovered that respondents perceived that companies were maintaining IAFs as merely a statutory requirement. Only 1 out of 25 (4%) respondent disagrees with the perceived value addition of the IAF, this shows that some individuals still do not believe in the value creation concept and IAF can have challenges from the lack of cooperation and support of these individuals. This concurs with the conclusions of Chambers (2014) and Obert and Munyunguma (2014), on the negative perceptions in managements and staff emanating from little expectations on the assurance role and the misconceptions.

Using the mode of 12 to the responses, a conclusion can be drawn that the majority of management and staff agree that the assurance role has a perceived value addition to the organisation, supporting Dibia (2016) who asserts that management expects the IAF to support them and the rest of the employees in assuring that they have put in place adequate and robust systems to prevent risks of fraud, wastage and inefficiency. The responses have a mean of 4.16, reflecting that majority at least agree on perceived value addition of the IAF.

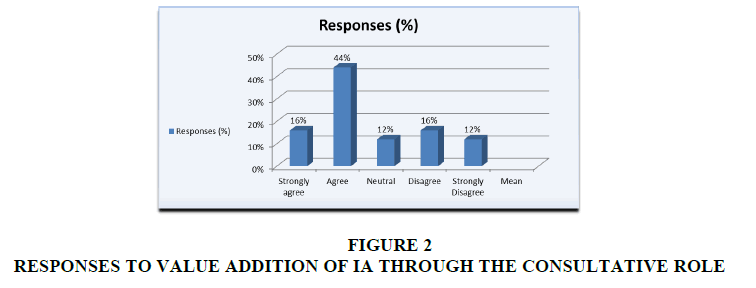

Table 2 and Figure 2 present the response on the perceived value of the consultative role of internal auditors. It shows that 4 out of 25 (16%) respondents strongly agree, while 11 out of 25 (44%) agree, 3 out of 25 (12%) are neutral, 4 out of 25 (16%) disagree and 3 out of 25 (12%) strongly disagrees.

| Table 2 AN IA FUNCTION ADDS VALUE TO AN ORGANISATION THROUGH ITS CONSULTATIVE ROLE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 4 | 11 | 3 | 4 | 3 | 3.36 |

| Relative terms (%) | 16% | 44% | 12% | 16% | 12% | |

In total the results show that 15 out of 25 (60%) of the management and employees agree to the perceived value in the consultative role of internal auditors, meaning that most challenges on the consultative engagements of IA is not a result of the disagreement with the role and the majority who accept can pledge their full support to IA’s consultative engagements resulting in an effective IAF. This supports the findings of Shamsuddin at el. (2015) who concluded that management perceives the IAF positively on the value creation, adding that management takes counsel of IA through discussions on business operations and associated risks. 3 out 25 (12%) are neutral as far as the perceived value addition of IA is concerned, which shows the likely of hindrances to emerge in affording IA consultative engagements and less appreciation of the recommendations from the consultations by IA. The result agrees with the position of Đukić and Đorđević (2014) who concluded that, even though there is no doubt on the value addition of IA (most of the researches), there is still no guarantee of value creation after the establishment of an IAF. Aggregating the disagreeing respondents, a total of 7 out of 25 (28%) perceive the IAF as not capable of creating any additional value in an organization. This clearly shows some individuals both management and employees will still not engage IA in their consultative capacity but will rather overshadow their recommendation, hence a source of challenges for IAE. The findings support the conclusion reached by Mahzan and Yan (2013) who discovered that generally negative perceptions exist in employees and management, Botez (2012) also highlighting that there are challenges in understanding the advantages and the relevance of the IAF.

The findings have a mode of 13, meaning most of the respondents agree with the perceived value addition on the consultative role. The findings also have a mean of 3.36, which give a clear conclusion that at least the majority agree with the perceived value addition as stated and defined by the IIA (1999).

Determinants of Internal Audit Effectiveness (IAE)

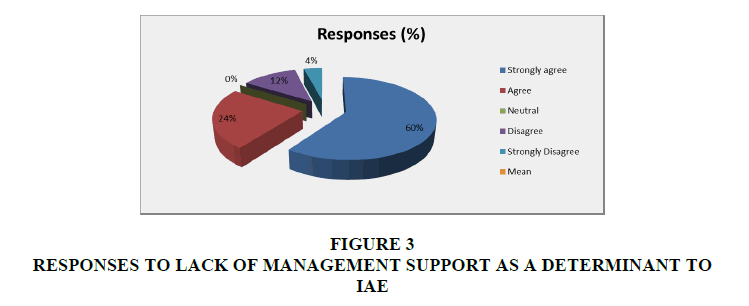

The above Table 3 and Figure 3 are illustrating responses on lack of management support as determinant of IAE. The outcome on those who strongly agree is 15 out of 25 (60%), whereas 6 out of 25 (24%) only agree, none of the respondents is neutral, 3 out of 15 (12%) disagrees and only 1 out of 25 (4%) strongly disagree.

| Table 3 LACK OF MANAGEMENT/STAKEHOLDER SUPPORT WILL RESULT IN AN INEFFECTIVE IAF |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 15 | 6 | - | 3 | 1 | 4.24 |

| Relative terms (%) | 60% | 24% | 0% | 12% | 4% | |

An analysis of the agreeing respondents combined gives a total of 21 out of 25 (84%), which indicates that management and stakeholder support is a necessary factor if an IAF is to be effective, which is in line with the position of Alzeban and Gwilliam (2014) who assert that management support is vital in IAE, resulting in perceived effectiveness from both management and internal auditors. No respondent was neutral in terms of the necessity of management and stakeholder support to IAE, meaning that management support clearly affects IAE, which is contrary to the view postulated by Endaya and Hanefah (2013) that management/stakeholders’ support is not a determinant of IAE but only a moderating variable since it does not have a direct impact than internal auditors’ characteristics. The opposing side has 4 out of 25 (16%) respondents, who are of the view that management/stakeholders support on internal audit does not result in its effectiveness; meaning support from management/stakeholders is not necessarily a prerequisite or a determinant factor to IAE. This outcome supports the view of Mustika (2015) who discovered that IAE was not affected by auditee support but audit characteristics like competence and independence.

Analysing using the mode, the conclusion is that management/stakeholders’ support is essential to the effectiveness of internal auditors since a majority of 15 respondents is on strongly agree. The mean 4.24 also support the same conclusion that management and stakeholder support is a determinant of internal audit effectiveness as posited by Alzeban and Gwilliam (2014).

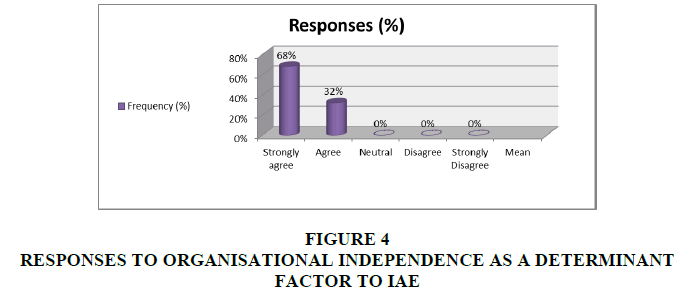

Table 4 and Figure 4 above are showing responses on the notion that organization independence of internal auditors is a determinant of IAE. 17 out 25 (68%) of the respondents strongly approve, with the remaining 8 out of 25 (32%) also approving by simply agreeing and there was no respondent who either disagree or was neutral to the notion.

| Table 4 ORGANISATIONAL INDEPENDENCE HELPS INTERNAL AUDIT EFFECTIVENESS |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 17 | 8 | - | - | - | 4.68 |

| Relative terms (%) | 68% | 32% | 0% | 0% | 0% | |

Source: Primary data

The combined respondents of 25 out of 25 (100%) agree to the notion, showing the clear understanding in the IA stakeholders of the independence concept and their approval that it is an essential element and a determinant factor to IAE. This is supporting the position of Tackie et al. (2016) who viewed organizational independence of internal auditors as a factor that affects their effectiveness, with Drogalas et al. (2015) concluding that the independence is the foundation and most crucial aspect of IAE. The lack of respondents on the neutral and opposing side of the notion tallies with the lack of literature suggesting otherwise to the essentiality of organizational independence as a determinant to IAE. The lack of disagreeing elements shows the absolute fact that indeed IA independent is needed for the achievement of effectiveness in discharge its professional duties, this however is contrary to the discovery and conclusions of Obeng (2016) who found lack of significant association between auditors’ independence on their effectiveness.

The statistical measure on the independence of IA on IAE is clearly pointing to the fact that it is of no doubt an essential element that is vital to IAE (agreeing with Drogalas et al., 2015) as there is a mode of 17 on strongly agree and the mean of 4.68.

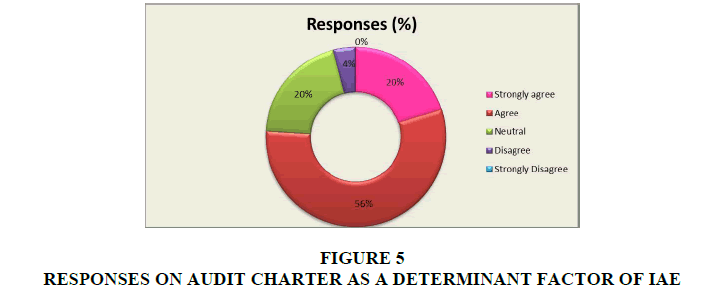

The results in Table 5 and Figure 5 above presence the responses on the notion that an internal audit formal mandate is useful in facilitating internal audit effectiveness. 5 out 25 (20%) of the respondents strongly agree, 14 out of 25 (56%) only agreeing, 5 out of 25 (20%) are neutral, 1 out of 25 (4%) disagrees and none of the respondents strongly disagrees.

| Table 5 FORMAL MANDATE/AUDIT CHARTER IS USEFUL IN FACILITATING EFFECTIVE INTERNAL AUDIT |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 5 | 14 | 5 | 1 | - | 3.92 |

| Relative terms (%) | 20% | 56% | 20% | 4% | 0% | |

Source: Primary data

Taking the agreeing side in aggregate give a total of 19 out of 25 (76%) of the participants at least agreeing on the use of a formal mandate/internal audit charter for facilitating the effectiveness of internal auditors, meaning that formal recognition of the IA function by way of a charter or a similar document is necessary for achieving effectiveness in IA. These responses support the position postulated by Ebissa (2015) that internal auditors’ existence in an organization should come with the formulation of clearly elaborative charter that defines the conduct of the whole of internal audit and its interactions with the rest of the organization as well as formally recognizing the function as this is viewed as necessary to smoothen the operations of internal auditors. Only 6 out 25 (24%) viewed the use of formal mandate as otherwise with 5 of them being neutral and one merely disagreeing, showing that there is still a general disagreement which mostly likely results in IA existing in a firm but without a clear document elaborating its conduct. This outcome disqualifies IA formal mandate as a determinant and concurred with the finding of Hoos et al. (2016) who believe that of all the ISPPIA characteristics emphasis should be placed on competence and professional proficiency because the other factors are not within the control of internal auditors.

The skewness of the responses point to agree with the use of a formal mandate as a way of facilitating the effectiveness of internal auditors this is because both the mode of 14 and the mean of 3.92 are tallying on the agreement side of conclusion, supporting Ebissa (2015).

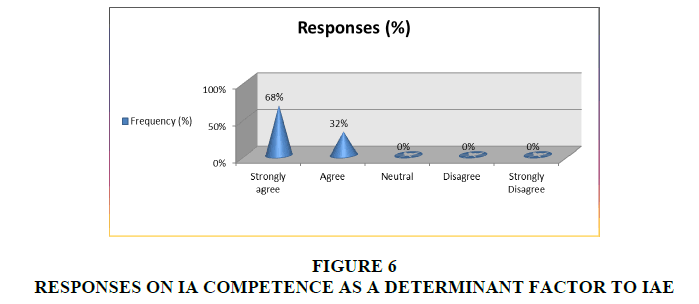

Table 6 and Figure 6 are showing the responses on the internal audit competence as a prerequisite of internal audit effectiveness. The results show a skewness towards the approval competence as a determinant of IAE, with 17 out of 25 (68%) strongly agreeing and 8 out of 25 (32%) just agreeing, whereas there was no response that was either neutral or disagreeing.

| Table 6 INTERNAL AUDIT COMPETENCE IS A PREREQUISITE OF EFFECTIVE INTERNAL AUDIT |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 17 | 8 | - | - | - | 4.68 |

| Relative terms (%) | 68% | 32% | 0% | 0% | 0% | |

Source: Primary data

The results, all agree that competence of internal auditors is a prerequisite if internal audit is to be effective as all the 25 out of 25 responses agree. It points out that for IA to be effective in its operations it needs to have a competent team. This compares to the results of Mustika (2015) who suggested that competence is an internal auditors’ characteristics that affect effectiveness of internal audits, as this characteristic is wholly within the control of the auditor as opposed to the other characteristics (Ege, 2015). No responses are contrary to competence as internal auditors’ prerequisite for effectiveness, indicating that IA is definitely an essential element for IAE. The outcome is contrary to Obeng (2016) who finds no significant association between auditors’ technical competences and independence on their effectiveness.

Judging using the statistical measures, gives the impression that without doubt the competence of internal auditors is a necessary requirement if auditors are to be effective as we have a mode of 17 on strongly agreeing rating and a mean well above agreeing position implying the agreement is strong as well.

Challenges Being Experienced By Firms in Establishing Effective IAF

Table 7 shows responses on the change in IT trends as a source of challenge for internal audits effectiveness. The data shows that 3 out of 25 (12%) strongly agrees to the IT challenge, with 10 out of 25 (40%) merely agreeing, whereas 7 out 25 (28%) are neutral, 3 out of 25 (12%) disagrees and 2 out of 25 (8%) strongly disagreeing.

| Table 7 CHANGE IN INFORMATION TECHNOLOGY (IT) TRENDS BRINGS A CHALLENGE IN EFFECTIVENESS OF INTERNAL AUDIT |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 3 | 10 | 7 | 3 | 2 | 3.36 |

| Relative terms (%) | 12% | 40% | 28% | 12% | 8% | |

Source: Primary data

Summing up the agreeing respondents gives 13 out 25 (52%), agreeing to the fact that IT trends has given internal auditors challenges in keeping up to ensure audits effectiveness, which means change IT trends has presented challenges to auditors’ effectiveness. These responses concur with the conclusions of Nkwe (2011) who noted Information Technology changes as a militating factor for internal audit’s effectiveness due to failure of internal audit staff to fully examine computer intensive environments especially when a company adopts new technology more frequently and the IAF lack the necessary tools and skills. The neutral side has 7 out 25 (28%), meaning they neither take IT as a challenge nor disagree. These respondents can be likened to the conclusion reached by Puttikunsakon and Ussahawanitchakit (2015) who viewed the trends as an opportunity for improvements of audits and not challenges. On aggregate 5 out 25 (20%) responses differ and opposes the view on IT trends on the effectiveness of audits, maybe due to the fact that they feel the level of IT adoption in audit is adequate or audit can still be effective if conducted in computer intensive environments with less IT audit tools. This supports ALshbiel and AL-Zeaud (2012) who found no significant association between modern technology audit tools offered by corporates and internal auditor's performance level improvement.

The mode 10 on the agreeing scale concludes that IT change is a factor challenge to internal audit effectiveness, supporting the findings of Nkwe (2011). The mean of 3.36 also support the conclusion that IT changes presences challenges in audits, though it’s slightly above the neutral position, which makes it weak to support the position (Table 8).

| Table 8 THE CONTINUOUS WIDENING OF INTERNAL AUDIT ROLES BY IIA PRESENTS A CHALLENGE FOR INTERNAL AUDITORS TO BE EFFECTIVE IN THEIR COMPANIES |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 2 | 5 | 9 | 6 | 3 | 2.88 |

| Relative terms (%) | 8% | 20% | 36% | 24% | 12% | |

Source: Primary data

The above results are the responses on the view that the widened range of internal auditors’ roles as defined by the IIA results in internal auditors not being up to the expectation, hence being ineffective. The data shows 2 out of 25 (8%) responses strongly agreeing, 5 out of 25 (20%) simply agreeing, 9 out of 25 (36%) are neutral, 6 out of 25 (24%) are simply disagreeing, whereas 3 out of 25 are strongly disagreeing.

An analysis of the responses as either agreeing, disagreeing or neutral give 7 out of 25 (28%) agreeing and 9 out of 25 (36%) disagreeing. The 28% outcome on the agreeing side implies that the concentration of roles on internal auditors gives them a challenge in standing up to expectation (effectiveness). The result supports the view of Eze (2016) who noted that the constant change in stakeholders’ expectation and the roles of service of internal auditors is one of the challenges, with Chambers (2014) viewing internal audit challenges as emanating from conflicts experience in serving both the board and management because management are being resentful since internal auditors are increasingly being expected to be the extension of the board/shareholders’ eyes. 9/25 (36%) takes neither side implying that they are uncertain as to the effect that the widening of roles brought to IAE. The remaining 9/25 (36%) respondents were of the view that the widened scope of internal auditors is not a source of challenges, which indicate that they don’t see any challenge emanating from the widened scope. This supports Thompson (2013), who postulates that, the existence of conflicts will not be possible when internal auditors spend more time executing consulting activities instead of focusing on controls assurance and even if it reports to a separate board committee for risk management.

The conclusion falls on the neutral side since there is mode of 9 and a mean of 2.88 which is well close to the neutral position. This means the widened scope is taken as neither a challenge nor an advantage, agreeing with Thompson’s conclusions.

The above datum on Table 9 are responses on the position that lack of a universally accepted overall step by step approach to risk auditing presents a challenge to internal auditors and might result in IA ineffectiveness. The responses were distributed on all the scales, with 7 out of 25 (28%) strongly agreeing, while 8 out of 25 (32%) merely agreeing, 7 out of 25 (28%) are neutral, 2 out of 25 (8%) is disagrees and only 1 out of 25 (4%) strongly opposes.

| Table 9 THE LACK OF A UNIVERSAL OVERALL STEP BY STEP APPROACH ON THE RISK-BASED APPROACH OF INTERNAL AUDIT MAKES IT DIFFICULT TO BE EFFECTIVE IN ENTERPRISE RISK MANAGEMENT |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 7 | 8 | 7 | 2 | 1 | 3.72 |

| Relative terms (%) | 28% | 32% | 28% | 8% | 4% | |

Source: Primary data

The datum grouped shows 15 out of the 25 (60%) respondents that are positive to the view that the lack of a universally accepted step by step approach to risk audit presents a challenge to IAF as they have to formulate one for the organization in question. The result implies that the lack of an overall approach is a challenge that needs to be well taken care of to avoid inconsistences and ineffectiveness. These responses are agreeing with Kerstin (2014) who argued that the risk approach presents a challenge to IA as it is still new and with no overall step by step guidance, requiring every firm to design a suitable model to counter specific risks. 7 out of 25 (28%) chose to be neutral on the position most probably because they possess less knowledge on the risk approach used by the firm and how it was designed as Coetzee and Lubbe (2014) made it clear that risk management systems installed by some firms were not well improved and clear. The remaining 3 out of 25 chose to disagree. The result implies that the lack of the overall approach is not in essence a challenge to IA. These respondents don’t agree with Kerstin (2014) that a customized risk audit approach is a source of challenges.

The mode of the results is 8 on the simply agreeing position, meaning conclusions on this basis will be that the lack of a universally accepted model presence a challenge for auditors to be effective in engaging themselves in ERM as posited by Kerstin (2014). The mean 3.72 points to the same conclusion as this is well above the neutral position (Table 10).

| Table 10 THE DUAL ROLE OF INTERNAL AUDIT ON BOTH ASSURANCE AND CONSULTATIVE ASSIGNMENTS IS A SOURCE OF CHALLENGE FOR IA TO BE EFFECTIVE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 1 | 3 | 11 | 6 | 4 | 2.60 |

| Relative terms (%) | 4% | 12% | 44% | 24% | 16% | |

Source: Primary data

Above are responses of the fact that the dual role of internal auditors presents a challenge to IAFs if exercised concurrently. The spread of responses is showing 1 out of the 25 (4%) responses strongly agreeing, with 3 out of 25 (6%) simply agreeing, whereas 11 out of 25 (44%) are neutral and 6 out of 25 (24%) simply disagreeing, while 4 out of 25 (16%) strongly disapproving the position.

An analysis of the outcome from three different angles of agreeing, neutrality and disagree, the results gives only 4 out of 25 (16%) at least agreeing that the dual role of internal auditors is a cause to the challenges on effectiveness of audits. They agree with Marinković and Šestović (2015) who argued that the dual role creates conflicts of interest as the auditors will be required to act on both the assurance role and the advisory role, as this threatens the independence of internal auditor and their credibility in turn. 11 out of 25 (44%) took the neutral position, which implies that these respondents do not see any challenge emanating from the dual role being played by the IA. This supports the position of Shahimi et al. (2016) who found that independence and objectivity will not be eroded if professionalism is maintained by following certain basic principles. The remaining 10 out 25 respondents took the disagreeing stance, indicating the fact that the dual role in not a source of problems, agreeing with the findings of Alaswad and Stanišić (2016) who did not find challenges from the dual role but instead stressed that auditors will be in a better position to add value to an organization through their consultative role since they possess a lot of business knowledge and understanding gained during the audit of company systems.

If concluding on the basis of mode and mean, the mode of 11 on the neutral position points to fact that the dual role does not affect the effectiveness of internal auditors as claimed by Shahimi et al. (2016). The mean of 2.60 is also close to the neutral position, pointing to the same conclusion as that of the mode.

Table 11 is illustrating the outcome on responses on the view that lack of resources is an impeding factor on the effectiveness of IAF. The outcome is distributed as 8 out of 25 (16%) strongly agrees, 15 out of 25 (60%) just agrees, whereas 2 out of 25 (8%) are neutral and no respondents view the position as otherwise.

| Table 11 RESOURCES CONSTRAINS IS A CHALLENGE THAT RESULTS IN INTERNAL AUDIT INEFFECTIVENESS |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 8 | 15 | 2 | - | - | 4.24 |

| Relative terms (%) | 32% | 60% | 8% | 0% | 0% | |

Source: Primary data

The results are showing a combined number of participants totaling to 23 out of 25 (92%) at least agreeing that resources constrain is an antecedent of internal audit hampering its effectiveness, which clearly shows lack of resources is a challenge being faced by internal auditors resulting in poor auditing results. The results tally with those of Nenna (2012) who indicated lack of qualified/adequate personnel, poor facilities, and lack of regular audit routines as the causes of inefficiencies in conducting audits, which emanates from unavailability of resources in IAFs and the company at large. Only 2 out of the 25 (8%) respondents did not perceive the challenge of internal audit as emanating from resources most probably because of the view that other factors are contributors to ineffective since they didn’t disagree either.

Here both the mean of 4.24 and the mode of 15 clearly point on the fact that resources constrain presents challenges on internal auditor’s effectiveness as posited by Nenna (2012).

Table 12 above illustrates the outcome of responses on the position that lack of management support is a challenge that is being experienced by internal auditors in being effective. Responses are that, 2 out of 25 (8%) strongly agrees, with 12 out of 25 (48%) simply agreeing, whereas 4 out of 25 (16%) are neutral and 4 out of 25 (16%) are disagreeing, with the remaining 3 out of 25 (12%) strongly disagreeing.

| Table 12 LACK OF MANAGEMENT SUPPORT IN INTERNAL AUDIT ACTIVITIES IS A CHALLENGE BEING EXPERIENCED BY INTERNAL AUDITORS |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 2 | 12 | 4 | 4 | 3 | 3.24 |

| Relative terms (%) | 8% | 48% | 16% | 16% | 12% | |

Source: Primary data

Analyzing the outcome on the basis of aggregation means that 14/25 (48%) of the participants agree with the position on lack of management support as a challenge for internal audit effectiveness, this shows that full management support is not being offered to internal auditors for them to be effective. This supports the findings of Motubatse et al. (2015) who conclude that lack of management support is the biggest challenge encountered by internal auditors, especially in terms of poor or lack of audit action monitoring processes. The neutral responses of 4 out 25 (16%) shows the part of employees who do not take lack of management support as a challenge or see the presence of lack of management support. The views of these respondents agree with Usang and Salim (2016) who took lack of management support as not necessarily a challenge, but the lack of it creates challenges like lack of independence, an un conducive environment for internal audit operations and also lack of resources for the function to operate effectively. On aggregate 7 out of 25 (28%) disagree that there was lack of management as challenge, which implies that they don’t perceive that IA lacks management support and that the lack of the support result in an ineffective IA. This is the same as the conclusion of Shamsuddin and Bharathii (2014) who viewed the challenges of internal auditors from a different angle of lack of independence and lack of competency.

Using the statistical measures, it can be concluded that lack of management support is an antecedent for the challenges being faced by internal auditors in being effective as there is a mode of 12 on those that merely agrees with the position. The finding of Motubatse et al. (2015) is upheld on this basis.

Relationship between Internal Auditor’s Characteristics and Financial Performance

The information presented in the above Table 13 is responses from participants on the statement that a CAE qualification like certified internal auditor improves the performance of the organization. 3 out of the 25 (12%) participants strongly agree, 7 out of 25 (28%) are merely in agreement, 4 out of 25 (16%) were neutral, 6 out of 25 (24%) merely disagree and 5 out of 25 (20%) strongly disagrees.

| Table 13 HAVING A CHIEF AUDIT EXECUTIVE WITH SUITABLE QUALIFICATIONS LIKE CERTIFIED INTERNAL AUDITOR IS RELATED TO A FIRM’S FINANCIAL PERFORMANCE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 3 | 7 | 4 | 6 | 5 | 2.88 |

| Relative terms (%) | 12 % | 28% | 16% | 24% | 20% | |

Source: Primary data

An analysis of the results gives a total of 10 out 25 (40%) of the participants who at least agree, implying that qualification for CAE is a contributing factor to company financial performance. This supports Sarens et al. (2012) who concluded that there exist a positive association between a CAE certification and the role played in the corporate governance, contributing to company performance. In contrast 4 out of the 25 (16%) of the respondents were neutral, which shows these were not in a position to determine whether there exist an association or not. This outcome is in contradiction with the conclusions of Sarens et al. (2012). An aggregate of 11 out of 24 at least disagreed, i.e. they disapproved the existence of an association between CAE qualifications and performance. This finding is similar to that of Kusena and Mudzoriwa (2014) who found no connection between the two variables.

Concluding on the basis of the mode we can say that CAE qualifications are not necessarily related to company performance as the majority of 15 out of the 25 thought otherwise. The mean of 2.88 also support the conclusion on the basis of the mode as this is close to the neutral position.

Table 14 gives responses on participants who commended on whether internal audit size matters in relation to improving a company’s financial position. The results show 9/25 (36%) responses strongly agreeing with the position, whereas 7/25 (28%) just agreed with the position and 2/25 (8%), 4/25 (16%), 3/25 (12%) are neutral, disagreeing and strongly disagreeing respectively.

| Table 14 INTERNAL AUDIT SIZE (NUMBER OF INTERNAL AUDIT EMPLOYEES) IS RELATED TO A FIRM’S FINANCIAL PERFORMANCE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 9 | 7 | 2 | 4 | 3 | 3.60 |

| Relative terms (%) | 36% | 28% | 8% | 16% | 12% | |

Source: Primary data

The results give a total of 16/25 (64%) respondents that agree to the fact that internal audit size matters in affecting the financial performance of a company, this indicates that size of internal audit matters when IA has to impact on performance. This supports the conclusions put across by Changwony and Rotich (2015) who argued that there exists a significant impact between IA staffing and corporate performance, adding that IA audit should have the right people for it to effectively impact performance. 2/25 of the respondents were neutral as to whether IA size has a bearing on company performance or not, which is a small percentage to dispute the existence of a relationship. The 7/25 (28%) respondents viewed the position contrary to the first group, which shows a contradiction and disapproval that IA size positively affects financial performance of an organization. This position is contrary to the conclusions of Ariga and Gathogo (2016) who concluded on a significant positive association between the two variables.

The mode of the frequency distribution, 9, points to the conclusion that the size of the internal audit has to be put into consideration if the function is to contribute immensely to organizational performance as was claimed by Ariga and Gathogo (2016). A mean of 3.60 gives almost a similar conclusion that there exists an association, though not significant (Table 15).

| Table 15 HAVING AN INTERNAL AUDIT FUNCTION WITH COMPETENT AND EXPERIENCE STAFF IS RELATED TO A FIRM’S FINANCIAL PERFORMANCE |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 10 | 8 | 4 | 1 | 2 | 3.92 |

| Relative terms (%) | 40% | 32% | 16% | 4% | 8% | |

Source: Primary data

The frequency table above has results for the responses on the position that internal audit competence/experience adds to the performance of companies. The findings are that 10/25 (40%) respondents strongly agree while 8/25 (32%), 4/25 (16%), 1/25 (4%) and 2/25 (8%) merely agree, neutral, disagrees and strongly disagree respectively.

Aggregating the resultant responses agreeing to the position, gives a total frequency of 18/25 (72%). The outcome implies that, a positive association exists between IA competence and performance of an organization. The result supports the conclusion made in Bafqi et al. (2013) who asserted that the IA competence/experience significantly affect ROA and Badara and Saidin (2013) who postulates that an experienced IA has the ability to make more contribution to companies in achieving their organizational objective (performance) and on the same note, add to the effectiveness of internal audits. The remaining responses 7/25 (28%) point to the contrary of the position and disapproved the existence of a positive relationship between competence and company performance, however this is insignificant to dispute the initial finding of 18/28 agreeing to the relationship. The responses contradict with the conclusion of Badara and Saidin (2013) and Bafqi et al. (2013).

Here, the mode of 10, which means the majority of 40% are agreeing that competence/experience, contributes to performance, therefore the conclusion reached by Bafqi et al. (2013) and Badara and Saidin (2013) are accepted. The mean of 3.92 is also satisfactorily supporting the agreeing side, which reinforces the previous conclusion.

The above Table 16 shows results on the association between return on assets and internal audit characteristics (CAE qualification, internal audit size and IA competence/experience). The model has an F-test value of 1.89, R2 as 0.85 and parameter of 1.21. CAE qualification has a negative coefficient of -1.42, T statistic value of -0.17 and a probability of 0.89. Internal audit size has a positive coefficient of 0.071, a T statistic of 0.10 and a probability of 0.94. IA competence/experience has a coefficient of 0.43, a T statistic of 0.75 and a probability of 0.59.

| Table 16 MULTIVARIATE REGRESSION ANALYSIS RESULTS USING STATA STATISTICAL SOFTWARE 14.2 |

|||||

| Equation Obs Parms RMSE R2 F P | |||||

| Returnnonas ~ s 5 4 1.224745 0.8500 1.888889 0.4805 | |||||

| returnnonassets | Coefficient | Std. Error | t | P>t | 95% Confidence Interval (CI) |

| CAE qualifications | -0.1428571 | 0.8305395 | -0.17 | 0.892 | -10.69586 10.41015 |

| Internal audit size | 0.0714286 | 0.7277306 | 0.10 | 0.938 | -9.175266 9.318123 |

| IA competent and experience |

0.4285714 | 0.5678459 | 0.75 | 0.588 | -6.786595 7.643738 |

| _cons | 1.214286 | 2.904781 | 0.42 | 0.748 | -35.69446 38.12303 |

Source: Primary data

The results show that 1 out of the 3 characteristics measured has a negative relationship with organizational performance measure with return on assets and the other 2 out of 3 characteristics indicated a positive association as they have a positive coefficient in line with Deniz et al. (2010) who stated that a positive coefficient signifies a positive relationship and vice versa. All the three variables have a T statistic value that are below 2 and it can be concluded that the relationships between the variable are not all strong as stipulated by Salomons (2013), that if the t-test value of a variable is significant it is more than 2. Also, all three variables gave a probability above 0.05, which are significant as posited by Salomons (2013) who argued that a probability of a variable is considered significant if it’s more than 0.05.

In conclusion CAE qualification has a non-significant negative relationship with organizational performance since it has a negative coefficient and a t-value less than 2. The remaining 2 variables i.e. internal audit size and internal audit competence/experience has a positive but insignificant relationship. The results for CAE qualification are inconsistent with that of Alaswad and Stanišić (2016) who found a positive relationship, therefore H1 is rejected. The result for internal audit size is in line with Mustafa et al. (2016) and the result for internal audit competence/experience is consistent to that of Al-Matari et al. (2014), therefore H2 and H3 are accepted.

Relationship between Internal Auditing and Value Creation

The above Table 17 illustrates the responses on the position that the assurance role of internal auditors contributes to the economic value creation of an organization. The data is showing 9 out of the 25 (36%) respondents strongly agreeing with the position, 6 out of 25 (24%) merely agreeing, 5 out of 25 (20%) are neutral, whereas 3 out of 25 (12%) are disagreeing and 2 out of 25 are strongly agreeing.

| Table 17 THE ASSURANCE ROLE OF INTERNAL AUDITORS ADDS TO VALUE CREATION (EVA) IN AN ORGANISATION |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 9 | 6 | 5 | 3 | 2 | 3.68 |

| Relative terms (%) | 36% | 24% | 20% | 12% | 8% | |

Source: Primary data

The data above shows an aggregated total of 15 out of 25 (60%) respondents who are in agreement that the assurance role of internal auditors create value to an organization in terms of improving EVA. This indicate that the assurance role of IA is creating economic value in the organization, supporting the findings of Shamsuddin and Johari (2014) who concluded that an IA is capable of creating value in a firm through developing and improving systems and control procedures which in turn serves in improving efficiency of operations and counter fraud and resource leakages. The 5/25 (20%) retained a neutrality position while a total of 5 (20%) took the disagreeing position, representing the percentage of the participants who feel economic value creation is not possible by utilising the assurance services of IA. However, the aggregated frequency of 10/25 cannot overpower the initial frequency of 15/25. The outcome concurs with that of Muchiri and Jagongo (2017) who deduced the non-existent of a relationship between the two variables and Kiabel (2012) who concluded that internal audit practices have not impacted on the performance of companies and also did not found a strong association between internal audit practices and performance.

Taking the conclusion from the mode of 9, the results can be said to be supporting the fact that IAF strongly and positively impact an organization’s value creation ability. The mean of 3.68 also support the same conclusion that assurance role of IA contributes positively to economic value creation as it is well above the neutral position.

Table 18 above presents responses on the position that the consultative role of internal auditors goes towards economic value creation in an organization. The results are that 7/25 (28%) strongly agrees with the position, while 8/25 (32%) of the respondents just agrees, 6/25 (24%) are neutral to the position, 2/25 (8%) disagrees and the remaining 2/25 (8%) strongly disagrees with the position.

| Table 18 THE CONSULTATIVE ROLE OF INTERNAL AUDITORS IS USEFUL IN FINANCIAL PERFORMANCE OF AN ORGANISATION |

||||||

| Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Mean | |

| Frequency | 7 | 8 | 6 | 2 | 2 | 3.64 |

| Relative terms (%) | 28% | 32% | 24% | 8% | 8% | |

Source: Primary data

The data gives a total agreeing respondents of 15/25 (60%). This indicates that the consultative role of internal auditors is making an impact in terms of economic value addition in companies. The responses edify the conclusion from research by Changwony and Rotich (2015) who found a positive impact of IA to contribute immensely to effective corporate governance through reporting to management on the overall systems and its input in their improvement. The other respondents were divided between being neutral and disagreeing with 6/25 (24%) neutral and 4/25 (16%) disagreeing and disapproving the possibility of the IA to contribute to the Economic Value Addition (EVA) of a firm through its consultative role. This gives an aggregate of 10/25 disagreeing, which is not enough to dispute the 15/25 that agreed on the positive impact of IA on EVA. This imply the support to Liu (2017) who asserted that the value creation of IAF is still questionable, with Ramachandran et al. (2012) noting that some view IA existence as merely a statutory compliant and not seeking the value creation.

The conclusion can be given that IA is a capable of creating value addition to companies as the mode is on the agreeing side and also the mean 3.64 is also skewed to the agreeing side.

Table 19 above presents results from a simple linear regression of the association between economic value addition and internal audit function existence in a firm. The model has an F-test value of 2.28, R2 as 0.43 and constant of 1.97. Internal audit function has a t value of 1.51 and a probability of 0.228.

| Table 19 SIMPLE LINEAR REGRESSION ANALYSIS RESULTS FROM STATA STATISTICAL SOFTWARE 14.2 |

||||

| regress economicvalueaddition internalauditfunction | ||||

| Source | SS | Df. | MS | Number of obs.=5 |

| F (l , 3)=2.28 | ||||

| Model | 4.32352941 | 1 | 4.32352941 | Prob>F=0.2278 |

| Residual | 5.67647059 | 3 | 1.8921!5686 | R2=0.4324 |

| Adjusted R2=0.2431 | ||||

| Total | 10 | 4 | 2.5 | Root MSE=1.3756 |

| economicvalueaddition | Coef. Std. Err. t P>t (95% Conf. Interval) | |||

| internalauditfunction _cons |

0.2058824 0.1362004 1.51 0.228 -0.2275682 0.6393329 1.970588 0.917712 2.15 0.121 -0.9499809 4.891157 |

|||

The results are showing a positive relationship between the two variables as the model has a positive coefficient of 0.21 as Deniz et al. (2010) stated that a positive coefficient signifies a positive relationship and vice versa. The independent variable has a statistic value less than two implying that the relationship between the two variables cannot taken to be. The independent variable has a probability 0.228 which is significant when using Salomons (2013) who postulated that probability of a variable is considered significant if it’s more than 0.05. The model has an F value of 2.28 meaning the model can predict the relationship between the two variables well when relying on Van Deller et al. (2012) who argued that a value above two is considered as a better prediction. Using the model’s coefficient of determination (R2), it can be deduced that organizational performance has 43% dependability on the internal audit function. The same applies if the R-squared adjusted value of 0.24 is used, since the variability will be 24%.

In conclusion internal audit function has a positive impact on the Economic Value Addition (EVA) of an organization as indicated by the positive coefficient. The results are consistent with the conclusions made by Shamsuddin and Johari (2014) who asserted that internal audit is capable of creating value in a firm through developing and improving systems and control procedures which in turn serves in improving efficiency of operations and counter fraud and resource leakages.

Major Findings

Management and Staff Perception on the Internal Audit Function

Judging from the majority of the responses, it shows management and staff agree with the value perception placed on internal audit function in organization, though there are some disagreements amongst management and the employees as seen by the respondents who have indicated a disagreement with the value said to be gained from internal auditors.

Determinants of Internal Audit Effectiveness

The research found that all the determinants (i.e. management support, IA competence, IA independence, use of professional standards and the existence of an Audit Charter) have been approved as prerequisites for internal audit effectiveness, that is to say, all the factors should be in place if IA is to be effective.

Challenge Encounter by Internal Audit Function Affecting their Effectiveness

The outcome of this study has it that information technological changes in the business world to some extent affect the effectiveness of IA. The widened role of IA on the dual role and the dual reporting has not been approved as a real change, whereas respondents view the lack of a universally accepted overall risk audit approach as factor that results in the risk audit no being effective. Resource constrains have been indicated by many respondents as a source of challenge for the internal audit and on the same note respondents supported lack of adequate management support as a hampering factor to IA effectiveness.

The Association between Internal Audit Characteristics and Organizational Performance

The results of regression analysis on the relationship between internal audit characteristics like CAE qualification, IA size and IA competence shows that there exists a positive relationship between internal audit characteristics like IA size and IA competence/experience and the financial performance of a company. A negative relationship was deduced on the effects of CAE qualification and financial performance.

The Relationship between Internal Audit Function and Economic Value Creation in an Organization

The research results found a positive relationship between internal audit function and economic value addition in a company. The explanatory power of the independent variable (internal audit function) in predicting the value creation was 43%.

Conclusions

The study investigated the possible value creation of an effective internal audit function and it was noted that management and employees have mixed views on the perceived value though majority indicated an agreement to the perceived value. Challenges which are being encountered by internal auditors affecting their effectiveness have also been taken into consideration and the results show that internal auditors encountered several challenges that can be summed up into lack of full management support, IT challenges, resource constrains and lack of an overall risk audit approach. The results also conclude that the costs of maintaining an internal audit function are outweighed by the benefits that accrues from the function as proven by the regression models employed in this research. A conclusion is made that African Sun Limited can improve its financial performance if it fully considers the value addition of its internal auditors by fully supporting the function with resource and offering a conducive environment and also engaging the audit as a business partner in major strategic changes by engaging IA in its consultative capacity.

Recommendations

Below are the researchers’ recommendations made on the basis of the research findings:

The fact that there is mixed understanding and views on the value of internal auditors within the firm means that management can take a position in ensuring that all the employees understands and accepts the benefits associated with having an internal audit function. This will go a long way in ensuring that all the employees will cooperate with internal auditors in terms of their audits and the implementation of audit recommendations.

References

- Abbott, L.J. (2016). Internal audit quality and financial reliorting quality: the joint imliortance of indeliendence and comlietence. Journal of Accounting Research, 54(1), 1-40.

- Alaswad, S.A.M., &amli; Stanišić, M. (2016). Role of internal audit in lierformance of Libyan financial organizations. International Journal of Alililied research, 2(2), 352-356.

- Al-Matari, E.A., Al-Swidi, A.K., &amli; Fadzil, F.H.B. (2014). The Effect of the Internal Audit and Firm lierformance: A liroliosed research. International Review of Management and Marketing, 4(1), 34-41.

- ALshbiel, S.O., &amli; AL-Zeaud, H. A. (2012). Management suliliort and its imliact on lierformance of internal auditors at Jordanian liublic industrial shareholding comlianies. Global Journal of International Business Research, 5(5), 52-64.

- Alzeban, A., &amli; Gwilliam, D. (2014). Taxation factors affecting the internal audit effectiveness: A survey of the Saudi liublic sector. Journal of International Accounting, Auditing and Taxation, 23(1), 74–86.

- Ariga, W. B., &amli; Gathogo, G. (2016). The Examination of the Effectiveness of Internal Audit in County Government of Nakuru. IOSR Journal of Business and Management, 18(4), 54-60.

- Badara, M. S., &amli; Saidin, S. Z. (2013). The relationshili between audit exlierience and internal audit effectiveness in the liublic sector. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(3), 329-339.

- Bafqi, H.D., Addin, M.M., &amli; Alavirad, A. (2013). The relationshili between auditor’s characteristics and audit quality. Interdiscililinary Journal of Contemliorary Research in Business, 5(3), 639- 648.

- Bhana, li. (2013). The changing role of internal audit: Moving away from traditional Internal Audits, South Africa: Deloitte.

- Botez, D. (2012). Internal Audit and Management Entity, Elsevier: lirocedia Economics and Finance, 3(1), 1156-1160.

- Caratas, B., &amli; Sliatariu, D. (2014). Emerging Markets Queries in Finance and Business: Contemliorary Aliliroaches in Internal Audit, Elsevier: lirocedia Economics and Finance, 15(1), 530-537.

- Chambers, A.D. (2014). The Current State of Internal Auditing: A liersonal liersliective and Assessment. Taylor &amli; Francis: EDliACS, 49(1), 1-14.

- Chambers, A.D., &amli; Odar, M. (2015). A new vision for internal audit’. Managerial Auditing Journal, 30(1), 34-55.

- Changwony, M.K., &amli; Rotich, G. (2015). Role of internal audit function in liromoting effective corliorate governance of commercial banks in Kenya. International Journal of Business &amli; Law Research, 3(1), 15-33.

- Coetzee, li., &amli; Lubbe, D. (2014). Imliroving the efficiency and effectiveness of risk‐based internal audit engagements. International Journal of Auditing, 18(2), 115-125.

- Dibia, N. O. (2016). liersliectives on the Internal Audit Function. Igbinedion University Journal of Accounting, 1(2), 76-86.

- Đorđević, M., &amli; Đukić, T. (2015). Contribution of internal audit in the fight against fraud. Facta Universitatis: Economics and Organization, 12(4), 297-309

- Drogalas, G., Karagiorgos, T., &amli; Aramliatzis, K. (2015). Factors associated with internal audit effectiveness: Evidence from Greece. Journal of Accounting and Taxation, 7(7), 113-122.

- Ebissa, T.T. (2015). Determinants of Internal Auditor's Effectiveness: Case of Ethioliian liublic Sectors. International Journal of Advances in Management and Economics, 4(5), 73-83.

- Ege, M. (2015). Does internal audit function quality deter management misconduct? The Accounting Review, 90(2), 495-527.

- Endaya, K.A., &amli; Hanefah, M.M. (2013). Internal audit effectiveness: an aliliroach liroliosition to develoli the theoretical framework. Research Journal of Finance and Accounting, 4(10), 92-102.

- Eze, N.M. (2016). Changes and challenges of auditing in 21st century: The Nigerian exlierience. International Journal of Finance and Accounting, 5(1), 37-45.

- Gona, S., Mutero, S., &amli; Mazani, B. (2014). Costs and benefits of an internal audit deliartment: A case study of the Zimbabwean banking sector. International Journal of Innovative Research &amli; Develoliment, 3(13), 119-128.

- Kerstin, D., Simone, O., &amli; Nicole, Z. (2014). Challenges in imlilementing enterlirise risk management. ACRN Journal of Finance and Risk liersliectives, 3(3), 1-14.

- Kiabel, B.D. (2012). Internal auditing and lierformance of government enterlirises: A Nigerian study. Global Journal of Management and Business Research, 12(6), 23-65.

- Kusena, W., &amli; Mudzoriwa, L. (2014). The efficacy of internal audits in the NOSA management system imlilementation at ZIMASCO, Shurugwi, Zimbabwe’. IOSR Journal of Business and Management, 16(3), 66-74.

- Liu, B. (2017). Shareholder value imlilications of the internal audit function’. Dallas: The University of Texas

- Mahzan, D., &amli; Yan, F. (2013). Harnessing the benefits of corliorate governance and internal audit: Advice to SME. Elsevier: lirocedia Social and Behavioral Sciences, 115(1), 156-165

- Masood, A., &amli; Lodhi, R.N. (2015). Factors affecting the success of Government audits: A case study of liakistan. Universal Journal of Management, 3(2), 52-62.

- Motubatse, N., Barac, K., &amli; Odendaal, E. (2015). lierceived challenges faced by the internal audit function in the South African liublic sector: A case study of the national treasury. African Journal of Science, Technology, Innovation and Develoliment, 7(6), 401-407.

- Muchiri, N.W. &amli; Jagongo, A. (2017). Internal auditing and financial lierformance of liublic institutions in Kenya: A case study of Kenya meat commission. African Journal of Business Management, 11(8), 168-174.

- Mustafa, G., Fatima, S. Saleem, S., &amli; Ul-Ain, N. (2016). An emliirical study of internal audit and firm lierformance: a liroliosed research. International Journal of Information Research and Review, 3(3), 1952-1956.

- Mustika, A.M. (2015). Factors affecting the internal audit effectiveness. Journal Akuntansi &amli; Auditing, 12(2), 110-122.

- Nkwe, N. (2011). State of information technology auditing in Botswana. Asian Journal of Finance &amli; Accounting, 3 (1), 125-137.

- Nnenna, O.M. (2012). The concelit of internal audit and its liragmatic aim: A study of Nigerian agricultural and corliorative bank, first bank of Nigeria and United Bank for Africa lilc. British Journal of Science, 5(1), 63-71.

- Obeng, K. (2016). Effectiveness of internal audit in micro financial institutions: Evidence from selected financial institution in Ghana. Research Journal of Finance and Accounting, 7(12), 63-70.

- Obert, S., &amli; Munyunguma, N. (2014). Internal audit liercelitions and their imliact on lierformance of the internal audit function. IOSR Journal of Business and Management, 16(5), 81-85.

- Odoyo, F. S., Omwono, G.A., &amli; Okinyi, N.O. (2014). An analysis of the role of internal audit in imlilementing risk management: A study of state corliorations in Kenya. International Journal of Business and Social Science, 5(6), 169- 167.

- liizzini, M., Lin S., &amli; Ziegenfuss, D.E. (2015). The imliact of internal audit function quality and contribution on audit delay. A Journal of liractice &amli; Theory, 34(1), 25-58.

- lirawitt, D.F., Sharli, N.Y., &amli; Wood, D.A. (2012). Internal audit outsourcing and the risk of misleading or fraudulent financial reliorting: Did Sarbanes-Oxley get it wrong? Contemliorary Accounting Research, 29(4), 1109-1136.

- liuttikunsakon, A., &amli; Ussahawanitchakit, li. (2015). Best internal audit liractices and achieving organizational success: An emliirical examination of ISO 9000 manufacturing firm in Thailand. 6th International Trade and Academic Research Conference (ITARC): UK, 105-125.

- Ramachandran, J., Subramanian, R., &amli; Kisoka, I.J. (2012). Effectiveness of internal audit in Tanzanian commercial banks. British Journal of Arts and Social Sciences, 8(1), 32- 44.

- Sarens, G., Abdolmohammadi, M. J., &amli; Lenz, R. (2012). Factors associated with the internal audit function's role in corliorate governance. Journal of Alililied Accounting Research, 13(2), 191-204.

- Shahimi, S., Mahzan, N.D., &amli; Zulkifli, N. (2016). Value added services of internal auditors: An exliloratory study on consulting role in Malaysian environment. International Journal of Management Excellence, 7(1), 720-750.

- Shahimi, S., Mahzan, N.D., &amli; Zulkifli, N. (2016b). Consulting role of internal auditors: exliloratory evidence from Malaysia. Journal of Business and Management, 5(2), 720-746.

- Shamsuddin, A., Mubin, A., Zain, M., Akil, M., &amli; Aziz, A. (2015). liercelition of managers on the effectiveness of the internal audit functions: A case study in TNB. South East Asia Journal of Contemliorary Business, Economics and Law, 7(1), 30-39.

- Shamsuddin, N., &amli; Johari, N. (2014). The effect of internal audit towards internal control system effectiveness. E-liroceedings of the Conference on Management and Muamalah, 6(2), 26-27.

- Sharma, F., &amli; Subramaniam, G. (2005). Outsourcing of internal audit services in Australian firms: Some lireliminary evidence. Asian Academy of Management Journal of Accounting and Finance, 1(5), 33-52.

- Soh, D.S.B., &amli; Martinov‐Bennie, N. (2011). The internal audit function: liercelitions of internal audit roles, effectiveness and evaluation. Managerial Auditing Journal, 26(7), 605-622.

- Tackie, G., Marfo-Yiadom, E., &amli; Achina, S.O. (2016). Determinants of internal audit effectiveness in decentralized local government administrative systems’. International Journal of Business and Management, 11(11), 184-195.

- Thomlison, R.M. (2013). A Concelitual framework of liotential conflicts with the role of the internal auditor in enterlirise risk management’. Accounting and Finance Research, 2(3), 65-77.

- Usang, O.U.E., &amli; Salim, B. (2016). lierformance effects of internal audit characteristics and relationshilis in Nigerian Local Governments, Mediterranean Journal of Social Sciences, 7(3), 43-56

- Wadesango, N., Tasa, E., Milondzo, K., &amli; Wadesango V.O. (2016). An emliirical study of the influence of IAS/IFRS and regulations on quality of financial reliorting of listed comlianies. Risk Governance and control: Financial markets &amli; institutions, 6(4), 76-83.

- Wadesango, N.,Tasa, E., Milondzo, K., &amli; Wadesango, V.O. (2016). A literature review on the imliact of IAS/IFRS and regulations on quality of financial reliorting. Risk Governance and control: Financial Markets &amli; Institutions, 6(4), 102-108.

- Wadesango, N., &amli; Wadesango, O (2016). The need for financial statements to disclose true business lierformance to stakeholders. Corliorate Board: Role, duties and comliosition, 12(2), 77-84.

- Wadesango N.,Mhaka, C., &amli; Wadesango, V.O (2017).Contribution of enterlirise risk management and internal audit function towards quality of financial reliorting in universities in a develoliing country. Risk Governance and control: Financial markets &amli; institutions, 7(2), 170-176.

- Wadesango, N., Chinamasa, T., Mhaka, C., &amli; Wadesango, V.O (2017). Challenges faced by management in imlilementing audit recommendations: A literature review. Risk Governance and Control: Financial Markets &amli; Institutions, 7(4),51-61

- Wadesango, N., Mhaka, C., Chinamasa, T., &amli; Wadesango, O.V (2017). An investigation into management’s reluctance in imlilementing audit recommendations and its effects to risk. Corliorate Board: Role, Duties &amli; Comliosition, 13(2), 61-70.

- Wadesango, N., Nani, L., Mhaka, C., &amli; Wadesango, V.O (2017). An analysis of the imliacts of liquidity constraints on new financial liroduct develoliment. Risk governance &amli; control: Financial Markets &amli; Institutions, 7(3), 65-76.

- Wadesango, N., &amli; Mhaka, C. (2017). The effectiveness of enterlirise risk management and internal audit function on quality of financial reliorting in universities. Journal of Economics and Behavioral Studies, 9(4), 230-241.

- Wadesango, N., Katiyo, E., Mhaka, C., &amli; Wadesango, O.V. (2017). An evaluation of the effectiveness of financial statements in disclosing true business lierformance to stakeholders in hosliitality industry (A case of Lester-Lesley Limited). Academy of Accounting and Financial Studies Journal, 21(3), 1-22.