Research Article: 2022 Vol: 26 Issue: 3S

Investment Risks and Financial Performance of Brewery Firms in Selected Sub-Saharan Africa Countries

Ugwu, James Ike, Godfrey Okoye University

Odo, John Onyemaechi, Godfrey Okoye University

Prof. Sergius Nwannebuike, Udeh, Godfrey Okoye University

Agbo, Elias Igwebuike, Godfrey Okoye University

Nwankwo, Simon Nwagballa P., Godfrey Okoye University

Citation Information: Ugwu, J.I., Odoh, J.O., Udeh, S.N., Agbo, E.I., & Nwankwo, S.N.P. (2022). Investment risks and financial performance of brewery firms in selected sub-saharan africa countries. Academy of Accounting and Financial Studies Journal, 26(S3), 1-12.

Abstract

Risks which sometime are from outside the business can only be controlled but when not properly controlled could bring about business failure. The study evaluated the effect of investment risk on the financial performance of brewery firms in selected Sub Saharan African Countries. Ex-post facto research design was adopted for the study as secondary data collected were subjected to analysis using Ordinary Least Square and General Method of Moments (GMM) after preliminary test using Sargan Test. It was revealed that inflation risk, exchange rate risk, liquidity risk, interest rate and political risk affect negatively the return on asset. This implies that investment risks are detrimental to firm performance. the study concluded that for firms to be in operation and succeed investment risks should be carefully studied and measures to reduce their negative effect put in place. It was recommended that during foreign transaction/operation currency hedge should be explored to guide against negative exchange rate fluctuation and its attendant consequences amongst others.

Keywords

Investment Risks, Interest Rate, Exchange Rate, Liquidity Rate, Political Risk Return on Assets, Financial Performance, Sub Saharan African Countries.

Introduction

Businesses generally are established to make profit. However, there may be losses some time due to some factors notable amongst which are investment risks. The uncertainties and risks in the business and business environment affect the performance of firms. The ability of the organisation to manage risks effectively determines to a great extent the returns. Therefore, a good knowledge of the sources of investment risks and their effective control, where controllable, would reduce risks and are of great importance to organisation’s survival and success. It becomes imperative that management’s timely identification of investment risks, following certain evaluation indices and adjustment of business strategies accordingly, would prevent occurrence of embarrassing situations like poor sales, illiquid, insolvency, and bankruptcy/liquidation.

Risk exist where the future outcome is not known or where the various possible outcome may be expected with some degree of confidence from past experiences or existing events (Oye, 2011). Investment risk could be described as possible outcome of event or investment outcome adverse to an investor. The outcome is not beneficial, as a result, impact negatively on the wealth of the owners. Therefore, it is the probability of the investor not getting expected return or not getting any return on his investment. Solomon & Muntean (2012) assert that risk and return are two interdependent aspects in a company’s activity, with risk affecting first, economic asset returns and then capital invested. This implies that risk is inherent in all company/ business activities in the pursuit of the goal of maximisation of wealth for owners as it affects returns (profit margin). However, where the effect is high, in a situation where risk is not properly managed, after obliterating profit, there may be erosion of capital resulting in insolvency and eventual liquidation. There has been a positive correlation between the level of risk and return as it is said that the higher the risk the higher the return. The maxim seems true in that investments associated with high return often requires use of large amount of fund necessitating borrowing, with its associated costs (interest rate and leverage risks), operating in volatile environment (political risk), internationalization of business with exchange rate fluctuation challenges (exchange rate risk) and so on.

Organisational performance could be linked to a number of factors among which are risk management and corporate governance practices of the organisation concern. Rosen and Zenios cited in Oyerogba et al. (2016) expresses the importance of corporate governance in effective risk management stressing that without compliance to good corporate governance, none of the risk management activities can be achieved. This highlights the interrelation and interdependence between a firm’s corporate governance and risk management, thus the stability and improvement of a firm’s performance highly depends on both.

Organisational performance can be seen from two stand points: financial and non financial performance. Financial performance indicators include amongst others, return on equity, return on asset, net profit margin, net profit after interest and taxes (profit for the year) and earnings per share while tools of financial statement analysis include: amount and percentage, trend analysis, standard of comparison, quality of earnings and ratios. The application of ratio helps in determination of return on assets which the accountants are particularly interested in, as accountants are usually concerned with improvement in quality of asset of organisations. Arguably, when the quality of assets improves, definitely other measures of performance like return on equity will show positive change.

It is the risk/return relationship that influenced the study to ascertain how investment risks affect performance (proxied by Return on Assets) of brewery firms in Sub-Saharan African countries. Sub-Saharan African countries are countries south of Sahara Desert which comprises about forty four (44) countries. The choice of brewery firms was informed by, amongst other reasons, the fact that the firms are top leading manufacturing firms available, common and operating in these countries in the region and contributes significantly to the economic growth of the countries concerned.

Statement of Problem

Investors primarily look forward toward getting returns on investment as the target of every business venture is to make profit. However, the outcome may not be as expected and sometimes outright loss. The unexpected outcomes are due to risks and uncertainties surrounding business ventures. Most assets are exposed to risks through daily operations and price fluctuation (volatility). While some of the risks can be reduce by diversification, most of such risks cannot be mitigated through diversification, as such, systemic. It follows that the ability of firms to manage risk and navigate through, to a great extent, determines the profit and continued existence of the organisation.

Since it is obvious the investor thrive in risky environment, these ‘thorns’ have continued to pose danger to business world. There have been losses arising from such risks like interest rate risk, exchange rate risk, political risk, liquidity risks, variation in tax rate etc. Sometimes, there has been complete collapse of some firms due to factors attributable to business risks. Similarly, Cruz (2002), observes that current global financial crisis is an example of risk the world witnessed, with states encountering losses, following collapse of certain global market and business dealings due to poor liquidity that occurred. It is in recognition of the effect of risk on business that International Accounting Standard Board (IASB) developed International Financial Reporting Standard (IFRS) 7 which deals with disclosures. The standard requires business organisations to disclose amongst other things nature and extent of risks from financial instruments, as well as, how such risks are managed. Specifically, it contains quantitative and qualitative disclosures on risks which comprises: liquidity risk, credit risk and market risks in quantitative disclosures. Similarly, in Romania, entities must prepare Manager’s Report which contains accurate information on development and performance of the entity’s activities, financial position, as well as, description of main risks and uncertainties it faces in its operations (Solomon & Muntean, 2012). In the area of risk management, the manager’s report contains issues in relation to entity’s objectives and policies on financial risk management. In that, the firm shows its policy on risk covering for major forecasted transactions where the firm is exposed to market, liquidity, cash flow and credit risks. The above directives were to ensure that adequate measures are taken to hedging against risks in the firms operating in that country.

The above emphasis was born out of the fact that risks affect the quality of earnings, and posses danger to organisations. As a result, the study wants to ascertain how various risk variables notably inflation rate, exchange rate, interest rate, tax rate, liquidity rate and peace rate affect return on assets of brewery firms in selected Sub Saharan African countries.

Objectives of the Study

The main objective of this study is to ascertain the effect of investment risks on financial performance of brewery firms in selected Sub Saharan African countries. Specifically, the study wants to:

1. Ascertain the effect of exchange rate risks on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

2. Find out the effect of interest rate risks on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

3. Assess the effect of liquidity risks on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

4. Evaluate the effect of political risks on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

Research Questions

The following research question guided the study.

1. To what extent does exchange rate risk affect Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania

2. What is the effect of interest rate on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania

3. How does liquidity risks affect Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania

4. To what extent does political risk affect Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania

Research Hypotheses

The following hypothesis guided the study.

1. Exchange rate risks do not have significant effect on the Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

2. The effect of interest rate on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania is not significant.

3. There is no significant effect of liquidity risk on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

4. Political risks do not have significant effect on Return on Assets of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania.

Scope of the Work

The study seeks to ascertain the effect of investment risks on return on assets of brewery firms in selected Sub-Saharan African countries namely: Nigeria, Ghana, South Africa, Kenya and Tanzania. Investment risks include currency (exchange rate) risk, interest rate, liquidity rate, political risk (breach of peace rate) and inflation rate as control variable while financial performance was proxied by return on assets. The firms involved in the study includes Nigerian Breweries Plc, Guinness Nigeria Plc and Nigeria International Breweries from Nigeria; Guinness Ghana Breweries and Accra Breweries from Ghana; South Africa Breweries (SAB) Miller Plc from South Africa; East African Breweries Ltd from Kenya and Tanzania Breweries Ltd from Tanzania. The work x-rayed the extent to which investment risk affect financial performance of brewery firms in Nigeria, Ghana, South Africa, Kenya and Tanzania from 2000 - 2018.

Review of Previous Works

The study reviewed related works by approaching it from conceptual, empirical and theoretical reviews, in addition to establishment of research gap.

Conceptual Review

The concept of investment risk, return on assets and asset turn over were reviewed in the study.

Investment Risk Concept

Okafor, (1983) gave three shades of meaning of risk which includes: literarily risk is exposure to danger or economic adversity (i.e risk used as a surrogate for the likelihood of loss or potential size of the loss) or in Insurance as the object (person or property) being insured. He opines that an investment is exposed to condition of risk where an investor knows exactly the range of possible out comes to envisage from investment opportunity as well as the likelihood (probability) of each outcome. Thus, risk denotes exposure to loss arising from difference in the expected and actual outcome of investment activities.

Defining risk on terms of uncertainty, it is the measure of uncertainty in a set of potential out comes from an event in which there is a chance of some loss (Brooks, 2010). Investment risks are basically unexpected and uncertain events that negatively affect investment out come. It is the possibility that the actual outcome of an investment would be at variance from its expected outcome (Prasanna, 2012). Prasanna went further to explain three major sources of risk as business risk, interest rate risk and market risk. However, Pandey (2010) asserts that risk arises because of uncertain return thus investment proposal should be evaluated on expected return and risk; financial decision of firms are guided by risk return trade-off. In other words, in the effort to maximize share holders wealth, management should endeavour to maximize returns to the given risk, as such seek course of action that avoid unnecessary risk. He therefore targets maximum return at a given risk or minimal risk associated with the activity or process. Collaborating the stance Brook, (2010) opines that individual(s) objectives is not to avoid risk but rather to measure and understand the acceptable level of risk for our investment choices. However, Okafor (1983), distinguished uncertainty from risk when he noted that uncertainty is a near complete ignorance of the outcome of present decisions as it arises where the decision maker has no reliable information as regards nature or significant factors that affect the investment activities. It implies a state of limited knowledge or at most he is faced with a range of possible outcome with unknown probabilities.

In portfolio management, total risks are classified as systematic risk and un-systematic risk (Pandey, 2010; Brook, 2010; Van Horne & Wachowicz, 2001; Oye, 2011). They described them thus: Systematic risk refers to the portion of the risk resulting from economy wide factors such as GDP growth rate, government expenditure, money supply, interest rate structure and inflation rate. These are risk factors outside the control of the management of the firm. Management of organizations only takes measures to reduce the adverse effect of these risks on the performance of the organization. Investor cannot avoid these risks notwithstanding their level of diversification. Systematic risk is also known as non-diversifiable risk, market risk, unique risk or firm specific risk (Bondie et al., 2011).

Unsystematic risk is also known as unique risk or diversifiable risk. Unsystematic risk arises from firm specific factors which affect the firm but not all the firms in the industry. Portfolio diversification tends to reduce the risk as a favourable development in one stock tends to offset an adverse happening in another. Risk factor in the study includes: currency (exchange rate) risk, interest rate, liquidity rate, political risk (breach of peace rate) and inflation rate as control variable as it has been argued that when there is inflation, price can be increased to cover increasing cost thus the effect of inflation on firm profitability would be minimal or zero. However, in response to this seemly convincing proposition Pandey, (2010) contented that selling price and cost exhibit varying degree of response to inflation.

Currency Risk: Currency (exchange rate) risk relates to exchange rate volatility of one currency to another. Exchange rate is the number of units of one currency that can be exchanged for another or the price of on currency quoted in terms of another currency (Van Horne & Wachowicz, 2001; Pandey, 2010). Therefore, foreign exchange risk is the risk that the domestic currency value of cash flow denominated in foreign currency may change due to variation in foreign exchange rate. Ezejule, (2001) Pandey, (2010) and Van Horne & Wachowicz, (2001) gave three types of foreign exchange risk as: transaction exposure, translation exposure and economic exposure. Transaction exposure (risk) refers to the change in exchange rate between the time transaction arrangements were consummated and the time settlements were affected. Translation exposure on the other hand is change in accounting income and statement of financial position during restatement of financial statement of a foreign branch or subsidiary to that of the reporting currency as a result of changes in exchange rates. Economic exposure is the change in the firm value due to unanticipated exchange rate fluctuation.

Interest Rate Risk: Variation in interest rate ‘Price to rent money’ has effect on the investor’s welfare since the market price of fixed income securities fall as interest rate increases and vice versa. Depending on your role (a borrower or a lender) interest rate variation may be favourable or unfavourable news. This is due to the fact that the buyer of fixed income securities would not buy it at its par value or face value if the fixed interest rate is lower than the prevailing interest rate on a similar security (Prasanna, 2012). Also, the interest payable on borrowed fund has serious impact on the profits available to the investor.

Liquidity Risk: This refers to the firms’ ability to settle its’ maturing obligations. The ability of the firms to manage their cash and near cash resources such that the firms do not get involve in overtrading or too much ideal fund is vital for optimal performance of the firm concerned. Liquidity is usually determined by the firms’ total current assets divided by its’ total current liability which is referred to as current ratio. Current ratio indicates the firms working capital position and measures the ability of the firm to meet its maturing short-term obligations (Osisioma, 2000).

Political Risk: this ranges from mild interference to complete confiscation of assets of organisation by ruling government or its’ agent. It usually comes in the form of laws which in discriminatory or protectionist when Multinational are involved. For instance, higher tax, higher utility charges and a requirement to pay higher salaries than domestic company, investment in environmental and social projects and restriction on the convertibility of currencies may be imposed on them. However, some developing nations give foreign companies concessions to invest such that they have more favourable climate than local companies. Therefore, political stability is essential hence the need to understand the prevailing political wind, the likely position of new government and the ease of doing business disposition of the government generally (Van Horne & Wachowicz, 2001). Political stability is one of the essential requirements for businesses to thrive and grow.

Return on Assets: (ROA)

This is one of the measures of profitability of a firm taking into consideration the assets of the firm. It reveals the efficiency of the management in the use of the firms’ assets in generating the income/earning. In dealing with return on assets, account is taken of the debt of the firm. It exposes to the management, investors or analyst the assets used. The higher the percentage the better as it indicates the asset efficiency. When ROA increases, it shows the firm is doing well while decreasing ROA indicates that the firm is in trouble as it may have accumulated assets that are not contributing to income of the firm. It is mathematically computed as:

ROA=Net Income divide by the Total Assets

Since assets are funded by owners’ equity and debt therefore, the interest paid on debt could be added back while trying to determine ROA as net income excludes the cost of borrowing (interest paid). Adding back the interest negates the effect of taking the debt. ROA is used mainly for firms in the same industry whenever the need for comparison arose.

Empirical Review

To get clear understanding of the work already done in this area, some related literatures were reviewed. For instance, Ebrahim et al. (2013), evaluated the effect of risk parameters (credit, operational, liquidity and market risk) on banking sector efficiency in Iran for the period 2005-2011. Two popular models: parametric (SFA) method with economic basis and nonparametric (MEA) method with mathematical optimization basis were used to evaluate bank efficiency. Relating the efficiency result with risk, using Ordinary Least Square (OLS) indicated that the four risk variables indicators significantly affect efficiency.

In a similar study, Hamdu & Adriana (2016), examined risk management and performance relationship in firms in Czech Republic. Analysis of data from 12 firms listed in Prague Stock Exchange for the period 2009 to 2014, using Hierarchical Linear Regression Model, revealed that total risk management had significant and positive relationship with performance measures (Return on Equity). The study also suggests positive association between intellectual capital and total risk management and company performance.

In addition, Oyerogba et al. (2016), explored the relationship between risk management practices and financial performance of listed Nigerian banks from 2005 to 2014. The explanatory variables, namely: risk limit setting, risk adherence monitoring, risk policy review, credit risk management, operational risk management, and market risk management had impacted on the financial performance of banks in Nigeria. Furthermore, Faris (2015), in his study of impact of financial and business risk on performance of Oman industrial sector, using 47 firms for the period spanning from 2009 to 2013, found, from regression analysis, significant effect of business and financial risk variables on performance.

In their study of effect of exchange rate movement on Ghanaian banks between 2005-2010, Addae et al. (2014), adopted qualitative and quantitative approach in their analysis. Exchange rate exposure of the banks and sensitivity we evaluated using econometric models. It was found that all banks studied were involved in forex trading from which they made profits and that they have risk management structure in place to mitigate risks that might arise to affect their operations.

Agura & Oluoch (2017) sort to ascertain how financial risk influence market performance of manufacturing companies in Kenya using default risk, interest rate risk, foreign exchange risk and liquidity risk as explanatory variables while the dependent variable is the share price. All the variables except interest rate were found to have significant negative effect on market performance of manufacturing firms in Kenya.

Similar study of Kenya between 2005 and 2014 by Muriithi et al. (2016), using panel data technique adopted General Method of Moments (GMM) for data analysis. Result is suggestive that financial leverage, interest rate and foreign exchange exposure have negative and significant association with bank profitability.

Theoretical Review

This research is anchored on Capital Asset Pricing Model (CAPM) which states that the expected return of an investment is a function of the time value of money, a reward for taking risk and the amount of risk (Brooks, 2010). This is appropriate for the study in that the research seeks to ascertain the extent investment risk influence returns (Return on Assets). The key components in model deal with the amount of risks and reward for risk taking deal with risk which invariably is the independent variable of the study.

Research Gap

A cursory look at the works reviewed above indicated that only Muriithi et al. (2016) in study of Kenya Used leverage, interest rate and exchange rate as variables against performance of banks but we are studying brewery firms. Furthermore, most studies were one country study but not brewery firms in two or more countries. Secondly, the study examined the Return on Assets (dependent variable) which accountants are particularly interested in to ascertain the quality of assets of organisations and its utilisation while utilising independent variable- interest rate, exchange rate liquidity risk and political risks for wholistic study.

Methodology

The research adopted Ex-post Facto research design for the study as secondary data were used which the researcher cannot manipulate. Data were extracted from published annual report of the firms under study. Brewery firms were selected based on their important roles in the economic growth of the countries and their multinational linkages amongst other reasons. They includes: International Breweries PLC, Guinness Nig. PLC and Nigerian Breweries PLC for Nigeria; Accra Breweries LTD and Guinness Ghana Breweries LTD for Ghana; the South Africa Breweries (SAB Miller PLC) for South Africa East African Breweries Ltd from Kenya and Tanzania Breweries Ltd from Tanzania. For Nigeria and Ghana with more than one brewery in the study, the averages from those countries were used in the panel study.

The five countries were judgementally selected from about 44 countries in Sub Saharan Africa based on their leading roles in political and economic activities in the region and the number that can be handled effectively. For instance, three countries (Nigeria, Ghana and South Africa) have been in uninterrupted democratic rule within the period of study. They started uninterrupted democracy in 1992, 1994 and 1999- (Ghana, South Africa, Nigeria). Nigeria and South Africa are considered to be of high political influence in West Africa and Southern Africa respectively. In West Africa, Ghana has a lot of common political and economic history with Nigeria with both playing sacrificing significantly towards stabilisation of the sub region considering the amount of human and material resources they committed in ECOMOG peace keeping in the region as seen in Liberia, And Searialeone. In terms of economy, they are the highest recipient of FDI between 1999-2018 in the sub region with $88421.3, $80296.3 and $35073.1 for Nigeria, South Africa and Ghana respectively (World Investment Report annex table, 2019). The RGDP of Nigeria, South Africa and Ghana between 1999- 2017 amounted to $6,101,206,926,545; $6,682,056,646,405 and $783,475,467,175 respectively and are considered the highest among the countries in the area of study (United Nations statistics Division National Accounts Main Aggregate Data Base, 2018). In East Africa, Kenya and Tanzania have such leading position/role.

Investment risk data were sourced from UNCTAD, (2019) World Investment Report, while other data were sourced from Index Mundi and Global Peace Index (various years) and return on asset data were extracted from Financial Statement of the companies from the company web site.

Model

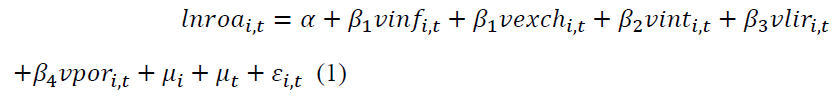

The aim of our empirical analysis is to examine how investment risks affect the performance of brewery firms in six Sub-Sharan for the period 2000–2018 using system-GMM model with a strongly balanced data. The choice of a dynamic model is because many economic relationships are dynamic in nature and one of the advantages of panel data is that it allows the researcher to better understand the dynamic adjustments in economic relationships. Since ours is a dynamic panel data models with short panels (i.e., Small T; where T < 25), GMM is considered most appropriate. This is the regression model:

Where i(t) the subscript indicates country (time period),

inroa is the natural log of return to assets;

vinf = Inflation rate

vexch = Exchange rate

vint = Interest rate

vlir = Liquidity rate and

vpor = Political risk.

In addition, the specification includes country dummies, μi, to control for unobserved country specific time-invariant variables, and time dummies, μi, to capture common shocks affecting all countries simultaneously. Finally, εi,t is the error term, a white noise process with a zero mean.

Measuring Risk

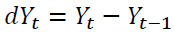

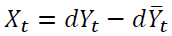

The standard deviation of respective category of explanatory variable was used as a measure of risk. This is illustrated as below:

Let Yt be a vector of the explanatory variables

= relative change in the variable and

= relative change in the variable and = mean of

= mean of

Xt is the mean-adjusted relative change in the and  is a measure of risk

is a measure of risk

Data Presentation and Analysis

Descriptive Statistics

Before reporting the results, we can look at the descriptive statistics on Table 1. The first variable to be analysed is the inflation risk (vinf), which shows that the average growth rate for the whole dataset is 36.6., but with the second largest SD of 66.83, almost twice its mean. Exchange rate risk (vexch) shows the mean of 4.094, which is the fourth largest and SD of 4.706(the third smallest)

| Table 1 Summary Statistics | |||||

| (1) | (2) | (3) | (4) | (5) | |

| Variables | N | Mean | Sd | Min | max |

| Vinf | 94 | 36.61 | 66.83 | 0.000013 | 348.5 |

| Vexch | 94 | 4.094 | 4.706 | 0.000869 | 17.00 |

| Vint | 94 | 23.45 | 59.82 | 0.000331 | 358.7 |

| Vlir | 94 | 77.99 | 250.5 | 0.00140 | 1,689 |

| Vpor | 94 | 0.139 | 0.530 | 0.000014 | 3.156 |

| Lnroa | 94 | 1.360 | 2.387 | -4.605 | 4.533 |

Interest rate risk (vint) has a mean of 23.45, with SD twice as large as the mean. Liquidity risk has the largest mean value the largest SD while political risk has the least of both the mean and its SD. The log of return to assets (lnroa) has the second least of both the mean value and the SD.

Empirical Analysis

In this section, Table 2 we present the results based on OLS and system GMM estimations of Eq. (1)

| Table 2 Short-Term Parameters of the Dynamic Panel Model | ||

| (1) | (2) | |

| VARIABLES | OLS | DGMM |

| L.lnroa | 0.901*** | 0.887*** |

| (0.0516) | (0.0611) | |

| Vinf | -0.000332 | -0.000460** |

| (0.00184) | (0.000224) | |

| Vexch | -0.0199 | -0.0332*** |

| (0.0261) | (0.00288) | |

| Vint | -0.00345 | -0.00449 |

| (0.00287) | (0.00629) | |

| Vlir | -0.000210 | -0.000683** |

| (0.000804) | (0.000316) | |

| Vpor | -0.121 | -0.196* |

| Constant | (0.377) -0.104 (0.178) |

(0.114) |

| Observations R-Squared |

89 0.810 |

84 |

| Number of crossed | 5 | |

| country effect | YES | |

| year effect | NO | |

| Hansen_test | 0 | |

| Hansen Prob | 1 | |

| Sargan_test | 0.153 | |

| Sargan Prob | 0.695 | |

| AR(1)_test | -1.788 | |

| AR(1)_P-value | 0.0738 | |

| AR(2)_test | -1.097 | |

| AR(2)_P-value | 0.273 | |

| No. of Instruments | 5 | |

Diagnostic Tests

The estimated R-square from the OLS suggests that regressions account for about 81 % of variation in the data. The report also shows that (i) the Sargan tests of over-identifying restrictions never reject the null hypothesis, because Sargan tests has the probability of 0.695, which is much in excess of 5%, thus providing support for the validity of our exclusion restrictions, (ii) our regression rejected the null of no first order autocorrelation, AR(1) at 10% because AR(1) tests has the probability of 0.0738, which is less than of 10%, and (iii) the regression did reject the null hypothesis of no second first order autocorrelation, AR(2) because AR(2) tests has the probability of 0.273, which is in excess of 5%.

Main Findings and Discussion of Findings

For the purpose of comparison, we presented both the OLS and GMM estimates of the impact of risk indicators on return on assets. As the results show, all the risk indicators in both OLS and GMM have negative relationship with the natural log of return on assets. By implication, inflation risk, exchange rate risk, liquidity risk, interest rate and political risk affect negatively the return on asset. Furthermore, inflation risk, exchange rate risk, liquidity risk and political risk are found to have significantly negative coefficients, an indication that within the context our study, these risk indicators have detrimental effects on return on assets. Although, most of the risk factors align with the findings of other works, none of them exerts significant impact on return to asset using the OLS estimate, suggesting that OLS biased and inconsistent. Based on this, the discussion of the results focused only on the GMM estimates.

The coefficient of inflation risk is found to be significantly negative, suggesting that inflation risk reduces return on assets. This aligns with the conventional wisdom; inflation rate risk introduces uncertainty into the market and hence exposes firms to loss. In response to this uncertainty firms delay or reduce investment spending and this reflects in the fall of return on assets. The coefficient of -0.000332 implies that inflation risk reduces return on assets by 0.000332 percent when it goes up by one percentage points.

Furthermore, exchange rate risk exerts negative influence on return on assets because exchange rate volatility reduces firms’ engagement in more economic activities due to uncertainty in exchange rate market. This usually reduces return on assets. The coefficient of -0.0199 implies that if exchange rate risk goes by one percent, return on assets will go down by 0.0199 percent.

Interest rate has negative and significant association with ROA with -0.00345 which implies that a percentage change in interest rate results to 0.00345 percent change in ROA. More so, liquidity risk exerted significantly negative effect on return on assets, with coefficient of -0.000210 indicating that when a firm find it difficult to settle its’ maturing obligations, it will affect return on assets negatively. As the coefficient shows, when liquidity risk rises by one percentage point, return on assets goes down by 0.000210 percentage.

Political risk also affected returns on assets negatively as show in our result. As shown, it has the largest explanatory power on return to assets, suggesting it is a major key risk factor that hampers firm’s investment performance. When political risk rises by one percentage point, return on asset is expected to go down by an average of 0.122 percentages. The above finding is in line with other studies supporting that risks are detrimental to firm’s investment (Muriithi et al., 2016; Agura & Oluoch, 2017).

Conclusion

From the findings, it is clear that all the risk factors of study have negative association with ROA of brewery firms in the countries of study. Therefore, for firm to be in operation and succeed investment risks should be carefully studied and measures to reduce their negative effect put in place.

Recommendations

1. During foreign transaction/operation currency hedge should be explored to guide against negative exchange rate fluctuation and its attendant consequences.

2. Brewery firms should explore the possibility of self-financing using retained earnings to reduce the risks associated with interest rate.

3. Special attention should be given to liquidity management by creating a unit for that such that firms maturing obligation are met with ease.

4. Brewery Firms should monitor the risk elements take measures to help in stability of or reduction in the impact of such to the firms. For instance, in period of perceived insecurity, they take part in sponsoring negotiated settlement, thus reducing political risk.

Contributions to Knowledge

The study contributed to knowledge in a number of ways: first, it is to the best of the knowledge of the researchers to carry out five country study of brewery firms in East, West and Southern Africa to ascertain the effect of investment risk on them. Most studies in the literature were one country specific study. Secondly, the four independent variables gave a broad approach thus a wholistic study. Thirdly, it has also contributed in the reduction of scarcity of literature in this area.

Recommendation for Further Studies

1. A study on effect of investment risk on financial performance indices of brewery firms using 2 stage least square analysis could be explored.

2. Investment risk and financial performance of other firms in the region apart from brewery firms could also be carried out.

References

Addae, A.A., Baasi, M.N. & Tetteh, M.L. (2014). Effect of exchange rate movement on Ghanaian banks. Journal of Finance and Accounting, 2(3), 62-71.

Agura, M.B., & Oluoch, O.J. (2017). Effect of financial risks on market performance of public manufacturing companies in Kenya. International Journal of Social Science and Information Technology, 3(3), 2011-2031.

Bondie, Z., Kane, A., & Marcus, A.J. (2011). Investments and Portfolio Management: Global Edition (9 ed.). McGraw Hill Companies, Inc.

Brooks, R.M. (2010). Financial management: Core concepts. Pearson Education Incorporated.

Cruz, M. (2002). Modelling, measuring and hedging operational risk. Wiley Finance Series Wiley.

Ebrahim, H., Kazem, Y., & Rezan, K. (2013). Effect of risk parameters (credit, operational, liquidity and market risk) on banking system efficiency (Studying 15 top banks in Iran). Iranian Economic Review, 17(1), 1-24.

Indexed at, Google Scholar, Cross Ref

Ezejelue, A.C. (2001). A Primer on International Accounting. Educational Books and Investments Limited.

Faris, A. (2015). Measuring the impact of financial and business risk on performance: Evidence of industrial sect of Oman. Asian Social Science, 11(22).

Indexed at, Google Scholar, Cross Ref

Hamud, K.M., & Adriana, K. (2016). The impact of total risk management on company’s performance. Procedia- Social and Behavioural Sciences, 220(2016), 271-277.

Indexed at, Google Scholar, Cross Ref

Muriithi, J.G., Muturi, W.M., & Waweru, K.M. (2016). The effect of market risk on financial performance of commercial banks in Kenya. Journal of Finance and Accounting, 4(4), 225-233.

Indexed at, Google Scholar, Cross Ref

Okafor, F.O. (1983). Investment decisions: Evaluation of projects and securities. Cassell LTD.

Oye, A. (2011). Financial Management. (7th ed.). El Toda Ventures LTD.

Oyerogba, E.O., Ogungbade, O.I., & Idode, P. (2016). The relationship between the risk management practices and financial performance of Nigerian listed banks. Accounting and Information Systems, 15(3), 565-587.

Pandey, M.I. (2010). Financial management (10th ed). Vikas Publishing House PVT LTD.

Prasanna, C. (2012). Investment analysis and portfolio management (4th ed.). Mc Graw Hill Education (India) Private Limited.

Solomon, D.C., & Muntean, M. (2012). Assessment of financial risk in firm’s profitability Analysis, 15(2), 58-67.

UNCTAD, (2019). World Investment Report, Annex Table, UN reports foreign direct Investment. Unctad.org/en/pages/DIAE/world-investment-report.

Van Horne, J.C., & Wachowicz, J.M.Jr. (2001). Fundamentals of financial management (12th ed.). (Prentice Hall) Pearson Education LTD.

Received: 17-Nov-2021, Manuscript No. AAFSJ-21-9818; Editor assigned: 19-Nov-2021, PreQC No. AAFSJ-21-9818(PQ); Reviewed: 07-Dec-2021, QC No. AAFSJ-21-9818; Revised: 14-Jan-2022, Manuscript No. AAFSJ-21-9818(R); Published: 21-Jan-2022