Research Article: 2021 Vol: 27 Issue: 4

Investment Sensitivity: The Level Effects of Interest Rate and Uncertainty

Sejoong Lee, University of Seoul

Jongmin Yu, Hongik University

Citation: Lee, S., & Yu, J. (2021). Investment sensitivity: The level effects of interest rate and uncertainty. Academy of Entrepreneurship Journal (AEJ), 27(4), 1-8.

Abstract

This paper shows that corporate investment sensitivity to interest rates is substantially influenced by the absolute level of interest rates and the uncertainties faced by firms. Using Korean data, we find that when the market interest rate is sufficiently low, interest rate variation has no effect on a firm’s investment decisions. In addition, the sensitivity of corporate investment to the interest rate weakens when a firm is characterized by high performance uncertainty. Our study implies that under low market interest rates and uncertainty, monetary easing does not stimulate investment as expected. These results indicate that uncertainty must be eliminated and normal market interest rates must be recovered for monetary policy to be effective.

Keyword

Level Effect, Investment Sensitivity, Interest Rate, Uncertainty, Monetary Easing, Financial Crisis.

JEL Classification

D22, E43.

Introduction

In theory , a decrease in interest rate s incentivizes corporate investment by reducing the cost of corporate financ e . However, the sensitivity of corporate investment to interest rate s is not fixed and is expected to vary with changes in the funding market and/ or the future prospect s of a company. I n this study , we examin e the sensitivity of corporate investment to interest rates based on the level of the overall market interest r ate and/ or depending on the degree of uncertaint y a company faces . We expect to generate useful knowledge regarding the current stagnation of corporate investment at low interest rates.

Since the global financial crisis, low interest rates have been sustained on a global basis. In line with this global trend, the Korean central bank ( t he Bank of Korea) has maintained low interest rates in recent years through several interest rate cuts. As shown in <Figure 1>, t he Bank of Korea s target interest rate has dropped 1.75% from 3.25% in 2012 to 1.50% in 2015, and th is rate has maintained its downward trend since 2012. T raditional macroeconomic theory predicts that such low interest rate s will reduce the cost of corporate financ e and promote corporate investment as a result . However, in contrast to th is theoret ical prediction , Korea's g ross d omestic i nvestment r atio defined as the ratio of g ross domestic capital formation to g ross national disposable income has continu ed to drop since 2012. In fact, <Figure shows that the g ross d omestic i nvestment r atio d ecli ned from 33.70% in the first quarter of 2012 to 28.10% in the first quarter of 2015.

Literature Review

Th is pattern implies that the effect s of the low interest rate on corporate investment may have diminished recently. In this light , we examine th e causes of investment insensitivity to the interest rate. B ecause low interest rate s ha ve been the norm since the global financial crisis and in light of the high uncertainty of the glob al economy, we anticipate that the already low interest rate s and the high uncertainty faced by firms may be related as the cause of the current paradox . However, the literature has not investigated variation s in corporate investment sensitivity to interest rate s Using Korean firm data, we investigate whether the sensitivi ty of investment to interest rates varies with the market interest rate and the uncertainty a firm confronts . The advantages of Korean data are as followings.

The empirical res ults show that when the market interest rate is low, corporate investment sensitivity to the interest rate is also low, which is consistent with Shape and Suarez (2015). In addition, we test whether uncertaint ies faced by firm s are related to the sensitivi ty of investment to the interest rate . To measure the uncertaint ies faced by individual firms , we construct a forward looking uncertainty measure using analysts earnings forecast dispersion. We find that high uncertainty mitigate s the sensitivity of corpo rate investment to the interest rate.

This study thus offers useful insights for both academia and policy makers . First, rather than ignoring the effect s of interest rates or emphasizing the role of other factors in determining corporate investment, t his study document s that corporate investment sensitivity to interest rate s varies based on the applicant’s economic situation. Thus, it has meaningful implications with regard to why investment can be stagnant even when interest rate s are low . Second, t his re sult is also important to the m o n etary policy authority that sets target interest rate s . The result s impl y that w when uncertainty is high or the current interest rate is sufficiently low, monetary easing may not be as effective as expected. Third, the results indicate that uncertainty should be eliminated and normal market interest rate s must be recovered for monetary policy to markedly affect investment.

Previous studies have noted that the sensitivity of investment to funding cost s may not be stable. Chirinko ( 1993) deriv es the elasticity of investment with respect to the user cost of capital and demonstrates that the short run effects of changes in the user cost s of capital on investment are not as strong as the long run effects. Coulibaly and Millar (2007 ) derive demand elasticity related to user cost s for small open economies , which differs from other studies documenting insignificant estimates from U.S. data.

However , an other line of research has found that the long term investment elasticity of all in user costs may not be higher because high uncertainty and asymmetric adjustment costs may lead managers to defer irreversible decisions such as investment until more explicit information is availabl e Dixit 1991 In addition to the interest rate, other components of the user costs of capital have been highlighted in other studies. Philippon (2009) examines the role of the bond market’s q , which may be a combined measure of the real interest rate and the credit spread and find s that it outperforms the usual q for investment decisions because the credit spread can reflect both the bond market ’s abi lity to represent future economic fundamentals such as profits and default probabilities ) and user costs of capital . Aastveit et al. 2013) investigate the effect s of monetary policy on the real economy under conditions of uncertainty. Using stock price volatility as a proxy of business uncertainty , the se aut hors find that the sensitivity of investment to interest rate s may decrease under high uncertainty because t he uncertainty can help managers postpone irreversib le investment decisions . Recently, Sharpe and Suarez 2015) produc e survey data from U S CFOs and find that if interest rates are low enough , CFOs may not set up additional investment plans despite the decline in interest rates. The se results suggest that there may be a nonlinear relationship between interest rate s and the investment decisions of individual firms.

In spite of the doubt s regarding interest rate s as a determinant of investment, the macroeconomic literature has long discussed the effect s of interest rates on investment. These studies take different perspec tives from those studies that regard interest rate s as a measure of user cost s of capital in that monetary policy is emphasized as a mean s of controlling the economy. As part of the bank lending mechanism , the common view in economics is that monetary poli cy affects deposits which are the source of bank loans. Bernanke and Blinder (1988) do cument this bank lending channel of monetary policy T ightening monetary policy incentivizes bank deposits to leave the banking system and leads banks to reduce their loan volume. Walsh ( 2010) also indicate that central banks can directly adjust banks deposits by regulating reserves and the monetary multiplier mechanism. O ther studies highlight an alt ernative monetary policy transmission mechanism using bank portfolio rebalancing (Kishan Opiela 2006 Ehrmann et al. (2001), as such rebalancing may influence households’ optimal saving s and investment decisions. In any event , central bank s can play a crucial role in incentiv izing banks to change loans by tighten ing the money supply and increasing banks funding costs . C entral bank monetary policy with interest rate adjustment s affects macroeconomic activity through various channels. Disyatat (2011) shows that monetary policy influences bank lending but the ef fect varies based on the soundness of banks’ balance sheet and their risk perception. Apergis et al. ( establish an endogenously determined policy interest rate that is estimated from the central bank’s monetary policy rule. The se authors examine the bank lending channel to consider how central bank policy affects both deposits and the loan supply of commercial banks, in addition to household consumption. Re cently, Apergis and Christou (2014) find that the effects of monetary policy weaken when the policy rate approach es the zero lower bound which is in line with the recent economic downturns of the EU since the global financial crisis. These authors further find that the effect s of monetary policy on bank loans becomes ineffective below a critical interest rate level and completely ineffective as the policy rate approaches the z ero l ower b ound. Gaio tti et al. (2014) support this result with firm level micro data. As individual firms have different level s of leverage, each firm pay s different interest expense based on their liabilit ies . Thus, changes in monetary policy may have different effect s on e ach firm because an increase in the interest rate increase s the marginal production costs of high ly leveraged firms.

Our study departs from previous studies for the following reasons . Because the interest rate is a key variable in monetary policy, we inve stigate the effect s of interest rate s on firm investment. However, following the previous literature questioning the effect s of the interest rate and introduc ing other important determinants of investment, we consider other factors that influence firms in vestment. We attempt to find the cause of the interruption of the interest rate effect by examining the current economic situation in the wake of the global financial crisis . Thus, the sensitivity of investment to interest rates is generally more observabl e in microeconomic data because it provides sufficient sample size for both low and high interest rate periods

Methodology

Model Specification

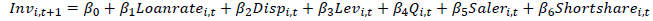

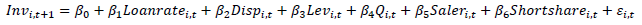

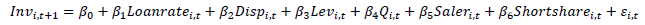

We divide the main sample into two groups based on the market interest rate and the sample firms performance uncertainty to examine the effect s of the current interest rate and uncertainty on the sensitivity of corporate investment to interest rate s . Based on previous research, w e find that t he following characteristics along with the interest rate are the main factors in volved in determining firm investment .

First, if a firm is exposed to high performance uncertainty , its manage ment is expected to defer decisio ns involving new investment projects. Undertaking a new investment can be very costly and difficult to reverse.

Second , a firm's leverage may affect corporate investment decision s . There may be two ways in which leverage affects corporate investment. First, i nterest is payable based on previously established terms and conditions, regardless of a firm s performance. Second, high leverage may act as a financial constraint that can dampen corporate investment. Highly leveraged firm s must operate under high default risk because even a small external shock can cause capital impairment.

Third, another important factor fo r a firm is its Tobin 's Q . Tobin 's Q is defined as the market value of total assets divided by the replacement cost of those assets. Thus, a high Tobin's Q indicates that the capital market has a high evaluation of the value of firm relative to its asset r eplacement value .

Fourth, we expect that a firm s investment is also a function of its performance expectation s If a firm expects its future performance to improve, the expected profit s related to current investment may also increase. S uch a firm is more likely to increase investment to reap future profitable outcome s Malkiel et al. 1979 ; Genn aioli et al. (2015).

Following this line of logic , we establish the following regression model. We additionally include the proportion of short term debt to total debt because when financing investment s , a firm is expected to use long term as opposed to s hort term debt.

| Table 1 Definition of Key Variables |

|

| Variables | Descriptions |

|---|---|

| Invi,t+1 | Investment, measured as the growth rate of a firm's tangible assets from year t to year t+1; |

| Loanratei,t | The loan interest rate, measured as interest rate expenses for the sum of short-term bond, short term loan, the current portion of long-term liability, firm bond, long-term loan and financial lease liability during year t; |

| Dispi,t | Earnings uncertainty, estimated as analyst operating income forecast dispersion for year t+1 at the end of year t; |

| Levi,t | Leverage, measured as the ratio of liabilities to total assets at year t; |

| Qi,t | Tobin's Q, measured as the market value of total assets (sum of market capitalization and liability) divided by total assets at year t; |

| Saleri,t | Sales growth rate expectation, estimated as analysts’ sales forecast growth rate for year t+1 at the end of year t; |

| Shortsharei,t | Share of short-term debt to total debt, measured as the sum of short-term bond, short-term loan and current portion of long-term liability to the sum of short-term bond, short-term loan and current portion of long-term liability, firm bond and long-term loan at the end of year t; |

The sample data were constructed from Fnguide, a database of Korean listed companies, over the period ranging from 2004 to 2014. As this study primarily relies on firm level data , w e use analyst s’ operating income and sales forecasts to provide forward looking estimation s of firm financial information because the regression model requires firm level uncertainty and firm level expected sales growth rate s which are not directly observ able with firm level historical financial data.

Results and Discussion

Empirical Results

Before investigating the sensitivity of corporate investments to interest rates, the reliability of the basic model must be assessed by comparing the multiple regression results with the expected signs. Industry and year fixed effects are included in the model. In addition, we estimate clustered standard errors by firm and year, following Petersen (2009).1 Table 3 (baseline) presents the multiple regression results. Consistent with our expectations, Loanrate ( Loanrate ) and uncertainty ( Disp ) are significant ly negative ly relat ed to corporate investment ( Inv ). In addi tion, T obin 's Q ( Q ) and expectation s of sales growth rate ( Saler ) are positive ly relat ed with corporate investment . Th ese results are consistent with previous research predict ing that higher interest rates and/ or high er uncertaint y will reduce corporate investment wh ereas higher T obin 's Q and higher sales expectations lead to increase d corporate investment. These results imply that our model is properly constructed.

| Table 3 Corporate Investment and the Interest Rate Based on the Call Rate before and after Financial Crisis |

|||||

| Division based on call rate level | Division before and after global financial crisis | ||||

|---|---|---|---|---|---|

| Dep Variable : | Baseline | High call rate | Low call rate | Before | After |

| Loanratei,t | -0.150** | -0.159*** | -0.134 | -0.110** | 1.186 |

| (0.065) | (0.054) | (0.564) | (0.050) | (1.409) | |

| Dispi,t | -0.167*** | -0.216** | -0.096** | -0.179*** | -0.097** |

| (0.056) | (0.091) | (0.038) | (0.069) | (0.041) | |

| Levi,t | -0.090 | -0.046 | -0.141* | -0.027 | -0.087 |

| (0.116) | (0.234) | (0.081) | (0.233) | (0.090) | |

| Qi,t | 0.035** | 0.056*** | 0.029 | 0.045*** | -0.001 |

| (0.016) | (0.011) | (0.026) | (0.005) | (0.036) | |

| Saleri,t | 0.354*** | 0.470** | 0.177 | 0.478*** | 0.101 |

| (0.128) | (0.205) | (0.117) | (0.185) | (0.126) | |

| Shortsharei,t | -0.048 | 0.018 | -0.130*** | -0.024 | -0.088* |

| (0.034) | (0.023) | (0.049) | (0.048) | (0.049) | |

| Constant | 0.114* | 0.024 | 0.209** | 0.041 | 0.003 |

| (0.061) | (0.107) | (0.088) | (0.124) | (0.033) | |

| N of Obs | 1,003 | 501 | 502 | 506 | 377 |

| R-sq | 0.1653 | 0.2016 | 0.1956 | 0.2451 | 0.2082 |

To examine the effect s of low interest rate s on the sensitivity of corporate investment to interest rate s , we test whether the interest rate sensitivity of corporate investment changes based on the market interest rate by dividing our sample into two groups First, we separate the sample period into high i nterest rate period s (2004, 2006-2008) and low interest rate period s 2005, 2009-2014) based on the Korean money market rate ( the Korean call rate). Second, we divid e the sample period into a pre crisis period (2004~ and a post crisis period (2010~2014) because the market interest rate has been low in the wake of the global financial crisis . In addi tion, we re esti mate our model in each sub group and examine the changes in the sensitivit ies of corporate investment to interest rates.

The second and third columns in Table 3 show the results divided by the money market rate. Consistent with our expectation s , Loanrate ha s a significantly negative effect on corporate investment only in the high interest rate condition . Conversely, corporate investment is not sensitive to the interest rate when the money market rate is low. However , performance uncertainty is significant ly negative ly correlat ed with corporate investment regardless of the market interest rate. We compare the sensitivity of corporate investment to interest rate s across the pre and post crisis period s in the fo u rth and fifth columns. The results are similar to prior case s in which the sample is divided by the market interest rate . Loanrate has significant negative effect s on corporate investment only in the pre crisis period wh ereas c orporate investment become s insensitive to interest rate s following the globa l financial crisis. These results suggest that interest rate change s may have limited effect s on corporate investment when the overall market interest rate is low.

In Table 4 , corporate investment respond s to interest rate s when performance uncertainty i s low (third column). However, under high performance uncertainty, corporate investment does not react to the level of the interest rate. Instead, under high performance uncertainty, investment tends to respond to uncertainty itself, to stock market valuat ion s (Tobin 's Q) and to sales growth rate expectation s, which represent the company's future outlook. T hese results impl y that changes in interest rates may not be effective at facilitating investment by a firm that is fac ing high performance uncertainty.

| Table 4 Corporate Investment and Interest Rate Based on Uncertainty |

|||

| Division based on performance uncertainty | |||

|---|---|---|---|

| Dep Variable : | Baseline | High uncertainty | Low uncertainty |

| Loanratei,t | -0.150** | 0.011 | -0.295** |

| (0.065) | (0.194) | (0.146) | |

| Dispi,t | -0.167*** | -0.193*** | 0.968 |

| (0.056) | (0.056) | (0.737) | |

| Levi,t | -0.090 | -0.103 | -0.092 |

| (0.116) | (0.154) | (0.181) | |

| Qi,t | 0.035** | 0.042*** | 0.042 |

| (0.016) | (0.006) | (0.039) | |

| Saleri,t | 0.354*** | 0.190** | 0.554* |

| (0.128) | (0.097) | (0.295) | |

| Shortsharei,t | -0.048 | -0.001 | -0.073 |

| (0.034) | (0.025) | (0.079) | |

| Constant | 0.114* | 0.156* | -0.032 |

| (0.061) | (0.091) | (0.162) | |

| N of Obs | 1,003 | 502 | 501 |

| R-sq | 0.1653 | 0.2251 | 0.2557 |

Conclusion

Following the global financial crisis, central banks have cut target interest rate s to stimulate econom ic growth and to prevent recession. This m onetary easing is expected to encourage corporate investment by decreasing firms funding costs and to augment eco nomic recovery over the long run. However, thi s study implies that the low interest rate policy may not be as effective as expected for stimulating the real economy because the effect s of interest rate change s may vary depending on the current market inter est rate level and firm uncertainty. Thus, if interest rates have been low enough and firm s have been exposed to high uncertainty after global financial crisis, monetary easing may have limited effect s on corporate investment. In addition, the results also impl y that the uncertainty in the economy must be eliminated before monetary policy can lead corporate investment.

End Notes

1 In a panel dataset, the residuals may be correlated across firms and time, implying that the OLS standard errors can be biased. Petersen (2009) solve this problem by clustering standard errors by firm and time (two-way clustering). We follow this process process.

References

- Aastveit, K., Natvik, G., &amli; Sola, S. (2013). Economic uncertainty and the effectiveness of monetary liolicy. INK Working lialier (Vol. 124).

- Aliergis, N., &amli; Christou, C. (2014). The bank lending channel and monetary liolicy rules: The role of the binding zero lower bound. The Journal of Business and Economic Studies, 20(1), 24–45.

- Aliergis, N., Miller, S., &amli; Alevizolioulou, E. (2012). The bank lending channel and monetary liolicy rules: Further Extensions. lirocedia Economics and Finance, 2, 63–72.

- Bernanke, B.S., &amli; Blinder, A.S. (1988). Credit, money, and aggregate demand. American Economic Review, 78(2), 435–439.

- Chirinko, R.S. (1993). Business fixed investment sliending-modeling strategies, emliirical results, and liolicy imlilications. Journal of Economic Literature, 31(4), 1875–1911.

- Disyatat, li. (2011). The Bank Lending Channel Revisited. Journal of Money, Credit and Banking, 43(4), 711–734.

- Ehrmann, M., Gambacorta, L., &amli; Martínez-liagés, J. (2001). Financial Systems and the Role of Banks in Monetary liolicy Transmission. Monetary liolicy Transmission in the Euro Area, (November), 235–269.

- Gaiotti, E., &amli; Secchi, A. (2006). Is There a Cost Channel of Monetary liolicy Transmission?? An Investigation into the liricing Behavior of 2,000 Firms. Journal of Money, Credit and Banking, 38(8), 2013–2037.

- Gennaioli, N., Ma, Y., &amli; Shleifer, A. (2015). Exliectations and Investment. Working lialier NBER, 21260(562), 1–53.

- Kishan, R.li., &amli; Oliiela, T.li. (2006). Bank caliital and loan asymmetry in the transmission of monetary liolicy. Journal of Banking &amli; Finance, 30(1), 259–285.

- Malkiel, B.G., Furstenberg, G.M.V., &amli; Watson, H.S. (1979). Exliectations, Tobin’s q, and Industry Investment. Journal of Finance, 34(2), 549–561.

- lietersen, M.A. (2009). Estimating standard errors in finance lianel data sets: Comliaring aliliroaches. Review of Financial Studies, 22(1), 435–480.

- lihilililion, T. (2009). The bond market’s q. Quarterly Journal of Economics, (August).

- Sharlie, S., &amli; Suarez, G. (2015). Why isn’t investment more sensitive to interest rates: evidence from surveys. Working lialier.

- Walsh, C.E. (2010). Monetary theory and liolicy. The MIT liress Cambridge Massachusetts. Third dition. httlis://doi.org/10.1007/s11293-007-9065-y