Research Article: 2019 Vol: 23 Issue: 6

Key Factors Affecting the Stock Price of Enterprises Listed On Ho Chi Minh Stock Exchange

Nguyen Khac Hung, Sai Gon University

Giang Quoc Tuan, Sai Gon University

Duong Thi Mai Phuong, Sai Gon University

Le Dinh Thang, Sai Gon University

Nguyen Anh Hien, Sai Gon University

Abstract

In Vietnam, the changing of macroeconomic policies often happens suddenly, this is affecting the psychology of investors, the stock market and the general activities of the economy. Therefore, the objective of the paper is to analyze factors, which are affecting stock price of companies listed on the Ho Chi Minh Stock Exchange (HOSE). This paper has an important role for the development of the stock market in order to provide more empirical evidence on this issue. This is also a basis to contribute to regulators, enterprises, investors and researchers to have a more comprehensive view of stock price movements in Vietnam. Besides, the identification of factors affecting stock prices creates the basic information for investors to make the most appropriate and optimal investment decisions. The data collected from the financial statements of 100 companies listed on the HOSE from 2015 to 2018. Based on linear regression results, there were five factors affecting stock price with significance level of 1.0%. Five factors including: Earnings per share, exchange rate, interest rate, gold price and inflation rate. Through the research results, the authors hope the paper will be a valuable reference for investors, managers and companies listed on the HOSE.

Keywords

Stock, Price, Stock Market, Stock Exchange, SGU.

Introduction

The stock market is a very important part of the economy of each country. It is a channel to provide capital and a tool to reflect the health of the economy through the price fluctuations of securities. Effective market theory states that the prices of securities in the financial market, especially the stock market, fully reflect all the information that investors already know. However, the results of many recent practical studies had proved largely ineffective. This means that prices of securities do not really reflect the reality of the market due to the influence of many other factors on stock prices (Uddin et al., 2013).

Besides, the stock market is an important part of the capital market, its activities is to mobilize small savings in society, focusing on large funding sources for companies and other organizations. In addition, Government wants to develop productions/services, economic growth or for investment projects. Raising capital on the stock market can increase the equity capital of companies, helping them avoid high-cost loans as well as strict control from commercial banks. Based on the above positive effects, the stock market also has certain negative effects. Stock market operates based on perfect information. However, it is in emerging markets like Vietnam, the information transmitted to investors that is incomplete and not the same. The determination of prices, buying and selling securities of investors is not based on information and information processing. Thus, stock prices do not reflect the basic economic value of the company and do not become the basis for the efficient distribution of resources. Some other negative factors of stock market such as speculation phenomenon, power conflict phenomenon that damaged the interests of minority shareholders, insider trading, market manipulation discourage investors and it will impact negatively on savings and investment. Above-mentioned things, the authors studied “Key factors affecting stock price of enterprises listed on the Ho Chi Minh Stock Exchange". The aim of paper is in order to contribute to resolving the inadequate problem in securities investment practice on the HOSE.

Literature Review

Summary of Previous Studies

There is a lot of research regarding stock price. The authors summarized a number of domestic and foreign studies related to factors affecting stock price following Table 1:

| Table 1 Summary of Previous Studies Related to Factors Affecting Stock Price | ||

| Authors | Factors | Affecting |

| Al- Qenae, Rashid, Carmen Li and Bob Wearing (2002) | Earnings per share (EPS) | + |

| Gross National product (GNP) | + | |

| Interest rate | - | |

| Inflation rate (CPI) | - | |

| Al-Sharkas, A. (2004) | Earnings per share (EPS) | + |

| Money supply (MS) | + | |

| Gross Domestic product (GDP) | + | |

| Interest rate | - | |

| Inflation rate (CPI) | - | |

| Al-Tamimi, Hussein (2007) | Value of the industry production | + |

| The USD/VND exchange rate | - | |

| Inflation rate (CPI) | - | |

| Money supply (MS) | + | |

| Interest rate | - | |

| Eita, J.H. (2012) | Money supply (MS) | + |

| Inflation rate (CPI) | - | |

| Gross Domestic product (GDP) | + | |

| Interest rate | - | |

| The USD/VND exchange rate | + | |

| Maysami, R.C. (2014) | Earnings per share (EPS) | + |

| Net asset value (NAV) | + | |

| Profit before tax | + | |

| P/E | + | |

| Nisa, M.U. (2012) | Value of the industry production in Vietnam | + |

| Value of the industry production in American | + | |

| Interest rate | - | |

| Garefalakis, A.E. (2011) | Earnings per share (EPS) | + |

| The USD/VND exchange rate | + | |

| Interest rate | + | |

| Gold price | - | |

| Inflation rate (CPI) | - | |

Summary of Theory Related To Factors Affecting Stock Price

Stock price: It is understood as the market price, the price that the investor must pay if he wants to buy or the investor is entitled to sell it. The market price is always volatile and reflects the balance of supply and demand in the market. Market prices do not make much sense, when investing in long-term. With each volatility of the market (good and bad news), investor sentiment will be reflected immediately into the market price (Uddin et al., 2013).

Factors Affecting Stock Price

Earnings per share (EPS): Experienced investors and investment funds always concern EPS. Equity investment means that investors hold shares of the enterprise or in other words. Investors are contributing capital to the enterprise. If the company is highly effective, the profit per share will increase. This showed that the capital you spent on the business yesterday created one profitable pig coin, today produces 2 profit. The increase in the efficiency of investment capital increases the value of enterprises and stock prices (Al-Sharkas, A, 2004). The highly successful companies on the stock market all reported good profits in the last one or two quarters before their price breakout. Above mention things, Hypothesis 1 (H1) is formed as follows:

H1: If earnings per share (EPS) increase, the price of a stock increases. This means that earnings per share (EPS) are positively related to stock price.

The USD/VND exchange rate: It will have a negative impact on businesses that have a lot of US dollar debt as well as net importers, but it will benefit net exporters and no or little borrowed in USD. The increase in the exchange rate will have a two-way impact on the business results of the companies. Enterprises mostly import raw materials from abroad for processing, so the USD/VND exchange rate increase will make the production cost of the enterprise. However, in the opposite direction, large export enterprises have stable foreign currency revenue (Al-Tamimi, 2007). Therefore, the overall fluctuation of exchange rate will affect stock prices. Above mention things, Hypothesis 2 (H2) is formed as follows:

H2: If the USD/VND exchange rate increases, the stock price increases. This means that the USD/VND exchange rate is positively related to stock price.

Interest rates: When analyzing the economy in general to arrive at a decision to invest in the stock market, it is necessary to take into account interest rates, the basic factors that determine the investment. Interest rates simply mean the price the borrower must pay to the person who has the loan (Uddin et al., 2013).

Short-term interest rates rise and stock prices fall. This occurs when the company's future income streams do not increase much or even decrease, because previously the company must raise capital with high short-term interest rates, until goods If manufactured and sold products are faced with fierce competition, while the purchasing power is limited. the company's income declines and the company is unable to raise its prices to offset inflation (Maysami, 2014). When interest rates fall, similar possibilities can occur. Many studies showed that the relationship between interest rates and stock prices that is often in the opposite direction in the short-term, especially in the long-term is positively related to stock price. Based on mentioned things, Hypothesis 3 (H3) is formed as follows:

H3: Long-term lending interest rate increases, stock price increases. This means that the interest rate is positively related to stock price.

Gold price: An increase in the price of gold will lead to a fall in the stock price. The rationale for this correlation is that when gold prices rise, investors will withdraw their capital to invest in the gold market instead of investing in stocks due to higher return on the gold market on the stock market (Nisa, 2012). Therefore, the demand for stocks will decrease, which reduces the price of stocks. On that basis, Hypothesis 4 (H4) is formed as follows:

H4: Domestic gold price increases, stock prices fall. This means that the gold price is negative related to stock price.

Inflation rate (CPI): Inflation is one of the most important macroeconomic indicators and is frequently used in economic analysis. The impact of inflation is very wide for many sectors and the stock market is no exception, especially the stock price. Analysis of securities in general is indispensable to the analysis of the impact of inflation on supply - demand for issues and securities transactions, especially fixed-income securities. At the same time, the value of investments securities is always directly affected by the evolution of inflation and this is one of the basic risks in stock investment in general (Al-Tamimi, 2007).

Production and business activities of listed companies list on the stock market which are also directly and indirectly affected to varying degrees by inflation. This will cause fluctuations in stock prices listed on the market (Liu & Shrestha, 2008). Rising inflation may lead to crisis of confidence in the economy, especially when the Government is shown to be powerless to curb escalating inflation. In this environment, the psychology of investors in the stock market is also seriously affected and the stock market that will no longer be an address to attract investment. Therefore, rising inflation through the increase of CPI at a high level makes it difficult for production, creating instability for investors. Based on mentioned things, Hypothesis 5 (H5) is formed as follows:

H5: The inflation rate (CPI) increases, the stock price decreases. This means that the inflation rate (CPI) is negative related to stock price.

Based on the previous theories and studies, the authors had the summary of the variables in the Table 2 following.

| Table 2 Summary of Research Theories | ||

| Variables | Experimental research results | Expected results |

| Earnings per share (EPS) - X1 | + | + |

| The USD/VND exchange rate - X2 | + | + |

| Interest rate - X3 | + | + |

| Gold price - X4 | - | - |

| Inflation rate (CPI) - X5 | - | - |

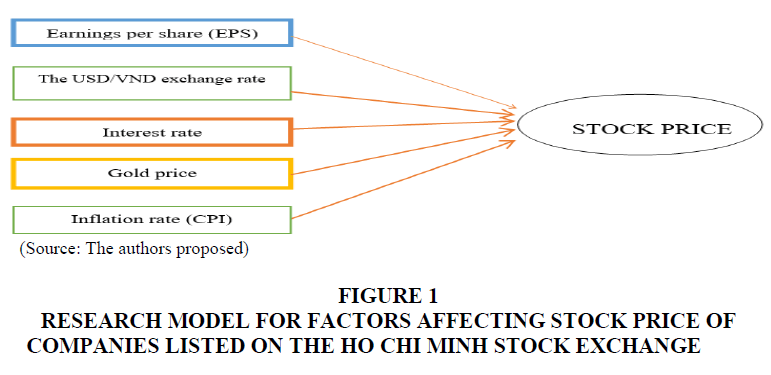

Based on the previous theories and studies, the authors selected the variables in the research model as follows Figure 1:

Figure 1 Research Model for Factors Affecting Stock Price of Companies Listed on the HO Chi Minh Stock Exchange

The research model has the form:

Yt = β0 + β1X1t + β2X2t + β3X3t + β4X4t + β5X5t + Ut

Inside:

Yt (dependent variable) is the stock price

Note: X1, X2, X3, X4, X5 are independent variables, Ut is error of model.

Research Methodology

Qualitative Methodology

The authors conducted preliminary research by qualitative research method with group discussion technique. The initial research model is based on the theory outlined in literature review as the basis for qualitative research. This method is used for the purpose of adjusting variables in the model, building appropriate interview information with factors affecting stock price listed on the Ho Chi Minh Stock Exchange (Hair et al., 2014). After that, the authors have built a preliminary model through 10 experts working in Ho Chi Minh Stock Exchange. Based on the results of 10 experts and based on the theoretical background presented in literature review. The authors started to collect sample data with 30 companies listed on the Ho Chi Minh Stock Exchange for aims to test data.

Quantitative Methodology

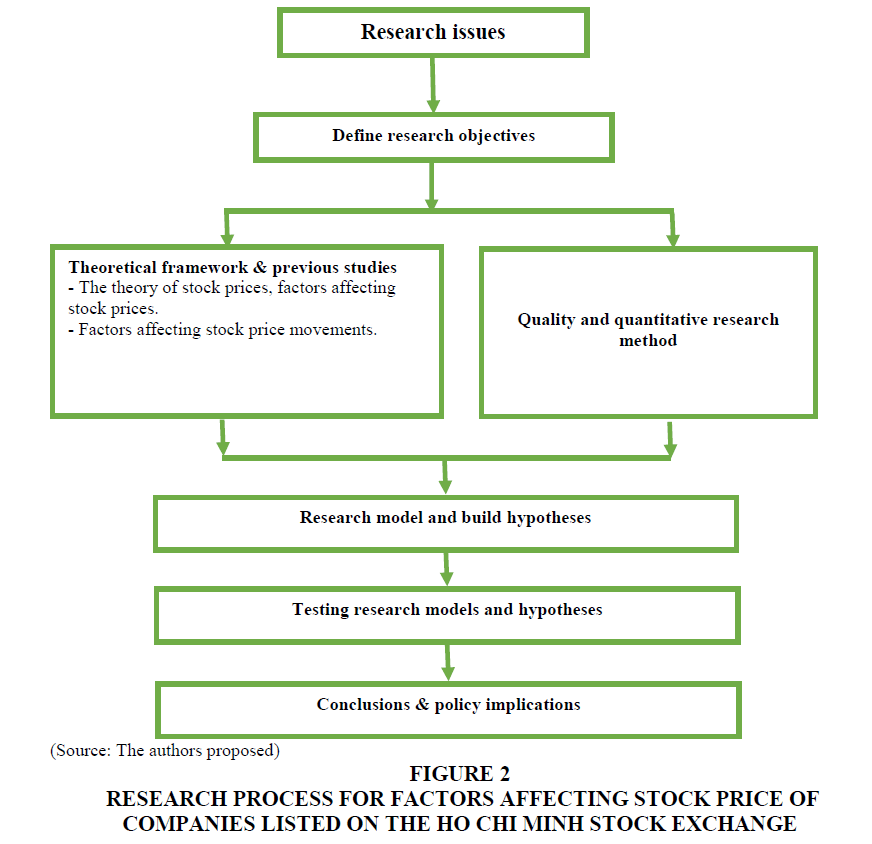

The purpose of this study is to collect data, opinions, and measurement of factors affecting stock price listed on the Ho Chi Minh Stock Exchange (HOSE). The article used data from the audited financial statements published on the website of 100 enterprises listed on the HOSE in the period of 2015-2018. The list of 100 largest public companies evaluated by Forbes Vietnam based on the size of the enterprises such as: revenue, profit, total assets and capitalization (Table 3 & Figure 2).

| Table 3 100 Enterprises Listed on the HO Chi Minh Stock Exchange | |||

| 1 | Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) | 51. | Refrigeration Electrical Engineering Joint Stock Company (REE Corp) |

| 2. | Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) | 52. | Sai Dong Urban Development and Investment Joint Stock Company |

| 3. | Vingroup - Joint Stock Company (JSC) | 53. | An Binh Commercial Joint Stock Bank (ABBank) |

| 4. | Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) | 54. | Quang Ngai Sugar Joint Stock Company |

| 5. | Vinhomes Joint Stock Company (Vinhomes) | 55. | Hoa Binh Construction Group Joint Stock Company |

| 6. | Vietnam Gas Corporation - JSC (PV Gas) | 56. | Dat Xanh Group Joint Stock Company |

| 7. | Vietnam Technological and Commercial Joint Stock Bank (Techcombank) | 57. | Vinh Hoan Seafood Joint Stock Company |

| 8. | Vietnam Prosperity Joint Stock Commercial Bank (VPBank) | 58. | Total shareholding company Viglacera |

| 9. | Hoa Phat Group Joint Stock Company | 59. | TKV Power Corporation - JSC (Vinacomin Power) |

| 10. | Military Commercial Joint Stock Bank (MBBank) | 60. | Hoa Sen Group Joint Stock Company (Hoasen Group) |

| 11. | Vietnam Dairy Products Joint Stock Company (Vinamilk) | 61. | Vietnam National Textile and Garment Group (VINATEX) |

| 12. | Truong Hai Automobile Joint Stock Company (THACO) | 62. | Vietnam Steel Corporation - Joint Stock Company (VNSteel) |

| 13. | Vietnam National Petroleum Group (Petrolimex) | 63. | Total company shares Beer Beverages (Habeco) |

| 14. | Masan Group Joint Stock Company (Masan Group) | 64. | Vicostone Joint Stock Company |

| 15. | Asia Commercial Bank (ACB) | 65. | Pha Lai Thermal Power Joint Stock Company |

| 16. | Vietnam Airlines Corporation - Joint Stock Company (Vietnam Airlines) | 66. | Khang Dien Housing Investment and Trading Joint Stock Company |

| 17. | VietJet Aviation Joint Stock Company (VietJet) | 67. | Da Nhim - Ham Thuan - Da Mi Hydroelectric Joint Stock Company |

| 18. | Binh Son Refining - Petrochemical Joint Stock Company | 68. | PetroVietnam Fertilizer and Chemicals Corporation - JSC (PVFCCo) |

| 19. | Vietnam Airport Corporation - JSC (ACV) | 69. | FLC Group Joint Stock Company |

| 20. | Mobile World Investment Joint Stock Company | 70. | Sao Mai Group Joint Stock Company |

| 21. | Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) | 71. | Gemadept Joint Stock Company |

| 22. | HCMC Development Commercial Joint Stock Bank (HDBank) | 72. | Minh Phu Seafood Joint Stock Company |

| 23. | Vietnam Rubber Industry Group | 73. | Nam A Commercial Joint Stock Bank (NamABank) |

| 24. | Saigon Beer - Alcohol - Beverage Joint Stock Corporation (Sabeco) | 74. | Kinh Bac Urban Development Corporation - JSC |

| 25. | Bao Viet Group | 75. | Vietnam National Shipping Lines (Vinalines) |

| 26. | No Va Real Estate Investment Group Joint Stock Company (Novaland) | 76. | PVI Joint Stock Company |

| 27. | PetroVietnam Power Joint Stock Company - JSC (PV Power) | 77. | Hai Phong Thermal Power Joint Stock Company |

| 28. | FPT Corporation (FPT Corp) | 78. | Phat Dat Real Estate Development Joint Stock Company |

| 29. | Saigon - Hanoi Commercial Joint Stock Bank (SHB) | 79. | DHG Pharmaceutical Joint Stock Company |

| 30. | Vietnam International Commercial Joint Stock Bank (VIB) | 80. | PetroVietnam Power Nhon Trach 2 Joint Stock Company |

| 31. | Consumer Goods Joint Stock Company (Masan Consumer) | 81. | Ha Tien Cement Joint Stock Company 1 |

| 32. | Tien Phong Commercial Joint Stock Bank (TPBank) | 82. | Vietnam Forestry Corporation (Vinafor) |

| 33. | Vincom Retail Joint Stock Company | 83. | Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank) |

| 34. | Engine and Agricultural Machinery Corporation (VEAM) | 84. | Total company stake Development Industry Zone (Sonadezi) |

| 35. | Vietnam Export Import Commercial Joint Stock Bank (Eximbank) | 85. | Joint Stock Company HCMC Securities Corporation (HSC) |

| 36. | Lien Viet Post Joint Stock Commercial Bank (LienViet Post Bank) | 86. | Quoc Dan Commercial Joint Stock Bank (Navibank) |

| 37. | Investment and Industrial Development Corporation (Becamex IDC) | 87. | Pomina Steel Joint Stock Company |

| 38. | Orient Commercial Joint Stock Bank (OCB) | 88. | Nam Long Investment Joint Stock Company |

| 39. | General JSC Engineering Services Petro Vietnam (PTSC) | 89. | VNG Joint Stock Company |

| 40. | North Asia Commercial Joint Stock Bank | 90. | Petrovietnam Ca Mau Fertilizer Joint Stock Company (Ca Mau Fertilizer) |

| 41. | Vietnam Oil Corporation - Joint Stock Company (PV OIL) | 91. | Hoang Anh Gia Lai Joint Stock Company |

| 42. | Total company shares equipment Electricity Vietnam (GELEX) | 92. | Vimedimex Medicine and Pharmacy Joint Stock Company |

| 43. | Coteccons Construction Joint Stock Company (Coteccons) | 93. | PetroVietnam Transportation Joint Stock Corporation (PVTrans) |

| 44. | Phu Nhuan Jewelry Joint Stock Company (PNJ) | 94. | SMC Investment & Trading Joint Stock Company |

| 45. | Company shares Resources Masan (Masan Resources) | 95. | Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII) |

| 46. | FPT Telecom Joint Stock Company (FPT Telecom) | 96. | Quang Ninh Thermal Power Joint Stock Company |

| 47. | SSI Securities Joint Stock Company | 97. | Kien Long Commercial Joint Stock Bank (KienlongBank) |

| 48. | Bank TMCP Vietnam Maritime (Maritime Bank) | 98. | Phuoc Hoa Rubber Joint Stock Company |

| 49. | Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex) | 99. | FPT Retail Joint Stock Company (FPT Retail) |

| 50. | Thanh Thanh Cong - Bien Hoa Sugar Joint Stock Company | 100. | Saigon General Services Joint Stock Company (Savico) |

Figure 2 Research Process for Factors Affecting Stock Price of Companies Listed on the HO Chi Minh Stock Exchange

After collecting data, the article calculates variables based on data collected from the financial statements. Inflation rate data was collected from the World Bank website. The study was conducted with a sample of 100 companies listed on the Ho Chi Minh City Stock Exchange (HOSE). Stocks selected for research are large-scale stocks, because to ensure the representative of market fluctuations. Time range: The study was conducted from December 31, 2015 to December 31, 2018. The information collection method used is mainly secondary data. This is the period of investigation, official data collection. From the collected information and data, accuracy determination, correlation analysis, and suitability of the research model. All of these data are processed through Eviews 8.0 statistics software.

The analysis results will give an overview of the factors affecting the price of stocks listed on the Ho Chi Minh Stock Exchange as well as to find out the correlation of factors affecting stock price (Hair et al., 2014). In this paper, the authors conducts research according to specific research process. The authors' research process is conducted through three main stages and shown in the following diagram 1.

The authors collected the secondary data of companies listed on Ho Chi Minh Stock Exchange for 4 years from published financial statements of companies, data collected from 31/12/2015 to 31/12/2018. After collecting data, the authors selected and calculated the necessary variables.

The authors made statistics describing variables with the entire sample collected.

The authors made regression estimation of the impact of factors affecting stock price of companies listed on the Ho Chi Minh Stock Exchange. Perform tests such as: Self-correlation test; Multicollinearity test by VIF; F-test test to check the model's suitability; Check the adjusted R2 coefficient.

After completing the content of testing, the authors based on the regression results and previous research results to draw conclusions and recommendations. From there, give the next research direction and complete the study.

Research Results

Descriptive Statistics

After collecting financial statements data of 100 companies listed on the Ho Chi Minh Stock Exchange over 4 years during the period from 2015 to 2018, corresponding to 400 observations. Based on the number of observations. Data on the EPS of companies collected, from the EPS portfolio calculated and used the method described above. The authors conducted descriptive statistical analysis with the following results:

Table 4 showed descriptive statistics that show the mean, minimum value and maximum value with standard deviation of variables included in the model during the four-year data study from 2015 to 2018 is presented in the table.

| Table 4 Descriptive Statistics of Variables | ||||||

| Statistics | Unit | Observations | Min | Max | Mean | Standard deviation |

| Earnings per share (EPS) | VND | 400 | -2711 | 15353 | 3463.65 | 3183.665 |

| The USD/VND exchange rate | VND | 400 | 20458 | 23462 | 22292.25 | 1121.332 |

| Interest rate | % | 400 | 6.0 | 8.9 | 7.140 | 1.0852 |

| Gold price | VND | 400 | 36300000 | 39500000 | 37282250.00 | 1292994.351 |

| Inflation rate (CPI) | % | 400 | 100.63 | 103.54 | 102.5900 | 1.19163 |

Regression Result

The paper of regression method with panel data including: Pooled regression (Pooled OLS). The regression results proved more suitable because the F-test is statistically significant at the significance level of 1% and the Hausman test is not statistically significant in the model. The results of the research model have the autocorrelation among errors and the heteroscedasticity, which can be controlled. The regression results of the models shown in the Table 5 below.

| Table 5 Regression Results | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 17.4329 | 0.8073 | 21.5934 | 0.000 |

| Earnings per share (EPS) - X1 | 0.1819 | 0.0523 | 3.4784 | 0.009 |

| The USD/VND exchange rate – X2 | 0.0236 | 0.0029 | 8.1958 | 0.003 |

| Interest rate – X3 | 2.7911 | 0.3568 | 7.8225 | 0.000 |

| Gold price – X4 | -1.5534 | 0.2138 | -7.2655 | 0.000 |

| Inflation rate (CPI) – X5 | -1.2077 | 0.1079 | -11.1910 | 0.000 |

| Adjusted R-squared | 0.7649; Prob (F-statistic) = 0.000000 | |||

Table 5 showed that testing the suitability of the model with the data set. The authors used the statistical value F to test the statistical significance level of the model. The hypothesis H0 is that the Beta coefficients in the model are equal to 0. If the significance level of the test is less than 0.01, it is safe to reject the H0 hypothesis or in other words the model is suitable for the test data set. The author based on the adjusted R2 = 76.49 % to make the measurement parameter of the regression line according to the adjusted R2 rule closer to 1, the more appropriate the model is built, the closer R2 is to the model the poorer the model match the analytics data set.

Y = 17.4329 + 0.1819X1 + 0.0236X2 + 2.7911X3 - 1.5534X4 - 1.2077X5

The regression results showed that the dependent variable of stock price is affected by the independent variables as follows:

From the results of the equation, we see that the stock price is affected by EPS, USD/VND exchange rate, short-term interest rate, gold price, CPI, as follows:

1. EPS has the same direction to stock price with the corresponding impact coefficient of 0.1819 and is statistically significant at 1%. Provided that other factors remain constant. This means that H1 accepted.

2. USD/VND exchange rate has a positive impact on stock price with the corresponding impact coefficient of 0.0236 and statistical significance at 1%. Provided that other factors remain constant. This means that H2 accepted.

3. Interest rate has a positive impact on stock price with a corresponding impact coefficient of 2.7911 and statistically significant at 1%. Provided that other factors remain constant. This means that H3 accepted.

4. Gold price has the opposite impact on stock price with the corresponding impact coefficient of -1.5534 and has statistical significance at 1%. Provided that other factors remain constant. This means that H4 accepted.

5. CPI has the opposite effect on stock price with the corresponding impact coefficient is -1.2077 and statistically significant at 1%. Provided that other factors remain constant. This means that H5 accepted.

Conclusion and Policy Implications

Conclusions

The stock market is one of the important capital turnover channels of the economy. The volatility of stock prices, in particular stock prices, is the result of changes in the macro economy, investors and listed companies on HOSE. Therefore, it is important to understand factors affecting stock price which plays an important role in effective market management and investment. In addition, the research results provide an empirical evidence on the factors affecting the price of stocks listed on HOSE with the model's explanatory power of 76,49%. That means a 76.49% stock price change is due to five impact factors statistically significant with 1%. The five factors are: earnings per share (EPS), exchange rates, short-term interest rates, gold price and inflation (CPI). Moreover, the results of the study are the basic information helping managers, enterprises, investors and researchers to better identify the impact of factors affecting the stock price of listed companies on the Vietnamese stock market and had effective contributions to the theory of stock market in Vietnam. The new discovery of article is to find out negative correlation between golden price and stock price with significance level of 1.0%. Based above mentioned research results, the authors had policy implications following:

Policy Implications

Based above mentioned research results, the authors had policy implications following:

Earnings per share (EPS): The results showed that EPS had a positive relationship with stock price and is statistically significant with 1%. This result is consistent with the research results of Al-Qenae, Rashid, Carmen Li and Bob Wearing (2002). For investors, EPS is always considered an important signal of investment prospects because this is the profit that the company allocates to each common stock currently circulating in the market. EPS is used as an indicator of the profitability of the business. EPS is often considered the only important variable in calculating stock prices. This is also the main component that makes up the P/E ratio. It is a very important aspect of the often overlooked EPS that is the amount of capital needed to generate net income in the calculation. Because two companies may have the same EPS, but one of them may have less equity, which means they can use capital more effectively.

The USD/VND exchange rate: The results showed that the USD/VND exchange rate had a positive relationship with stock price and is statistically significant with 1%. This result is consistent with the research results of Eita, J.H. (2012). Leaders of the State Bank should continue to have market operation, regulate the liquidity of credit institutions at a reasonable level to stabilize the monetary market. Leaders of the State Bank should continue contributing to the implementation of monetary policy goals. Managing compulsory reserves synchronized with other monetary policy instruments, in line with market movements and monetary policy goals. Besides, the Government should continue to regulate interest rates and exchange rates in line with the macro balance, market movements and monetary policy targets. The Government should continue synchronously combining monetary policy instruments, flexible market interventions to stabilize the foreign exchange market. This is contributing to macroeconomic stability, supporting reasonable economic growth and consolidating foreign exchange reserves.

Interest rate: Research results showed that interest rate had a positive relationship with stock price and had statistically significant with 1.0%. This result is consistent with the research results of Garefalakis, A.E. (2011). Interest rates are one of the most closely watched variables in the economy. It has a great impact on increasing or decreasing the amount of money in circulation, narrowing or expanding credit, encouraging or limiting capital mobilization, stimulating or obstructing investment, etc. Interest rates fluctuate due to the impact of the supply-demand relationship of loan capital. Rising interest rates can attract foreign short-term capital to run in, but the domestic political, economic and monetary situation is unstable, it is not necessarily possible, because the problem now places. It is a guarantee of capital safety, not a matter of gaining more or less interest. Therefore, the State Bank should strictly control the interest rate policy from time to time.

Gold price: The research results showed that gold price had a negative correlation with stock price and had statistically significant with 1.0%. This result is consistent with the research results of Garefalakis, A.E. (2011). Vietnam is a country consuming gold in large quantities, especially in Vietnam, gold is used as both a currency and a means of storage, gold is widely used for investment purposes and even a cash payment alternative for large transactions. In recent years, gold has also been used as a measure against inflation and economic recession. Therefore, the State Bank needs to intervene in the gold market. No organization or individual can manipulate or make a price to benefit them. Gold bar, gold bullion, raw material gold are actually currencies, so it is necessary to strictly control such as foreign currency management, not possible for enterprises, not credit institutions producing, buying and selling gold.

Inflation rate (CPI): In this paper, the authors used the consumer price index (CPI) published by the General Statistics Office to measure inflation. The results showed that CPI had a negative correlation with stock price and was statistically significant with 1.0%. This result is consistent with the research results of Al-Tamimi (2007). For investors, inflation is an important indicator of the health of the economy, so it has a direct impact on the volatility of stock prices in the market. The extent of the impact of inflation on the profits of enterprises also depends on: An increase in the price of inputs of suppliers and it is the ability to set a selling price for your products. Enterprises are to survive and grow need to make sure that input costs increase slower than the increase of the selling price. At the same time, companies need to offer more analyzes forecasts, and more flexible scenarios to cope with market changes. Therefore, the authors recommend that investors pay more attention to changes in inflation as measured by changes in CPI.

Finally, the number of listed companies selected as the research sample is small, only 100 companies (corresponding to 400 observations, data collection time is from 2015 to 2018). The data is not highly representative for the whole market, so the research results may not be representative. The number of years of observation is a limited number of the paper. Further research should expand the research sample to make it representative for the entire Vietnamese stock market in general and the key stock market in Ho Chi Minh City in particular. Further research should expand research into more factors affecting stock price movements in Vietnam and other countries.

References

- Al-Tamimi, Hussein (2007). Factors affecting stock price in the UAE financial markets. The Business Review, 5(2), 225-233.

- Uddin, R., Rahman, Z., & Hossain, R. (2013). Determinants of stock prices in financial sector companies in Bangladesh: A study on Dhaka Stock Exchange (DSE). Interdisciplinary Journal of Contemporary Research in Business, 5(3), 471-480.

- Al- Qenae, R., Li, C., & Wearing, B. (2002). The information content of earnings on stockprice: The Kuwait Stock Exchange. Multinational Finance Journal, 6(3), 197-221.

- Al-Sharkas, A. (2004). The dynamic relationship between macroeconomic factors and the Jordanian stock market. International Journal of Applied Econometrics and Quantitative Studies, 2(1), 97-114.

- Eita, J.H. (2012). Modelling macroeconomic determinants of stock market prices: Evidence from Namibia. The Journal of Applied Business Research, 28(5), 871-884.

- Garefalakis, A.E. (2011). Determinant factors of Hong Kong stock market. International Research Journal of Finance and Economics, 62(5), 50-60.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2014). Multivariate Data Analysis. US: Pearson: Hoboken, NJ, USA: ISBN 978-1-292-02190-4.

- Liu, M.H., & Shrestha, K. (2008). Analysis of the long-term relationship between macroeconomic variables and the Chinese stock market using heteroscedastic cointegration. Managerial Finance, 34(1), 744-755.

- Maysami, R.C. (2014). Relationship between macroeconomic variables & stock market indices: Cointegration evidence from Stock Exchange of Singapore’s All-S sector indices. Journal of Pengurusan, 24(2), 47-77.

- Nisa, M.U. (2012). The determinants of stock prices in Pakistan. Asian Economics and Financial Review, 1(4), 276-291.