Research Article: 2018 Vol: 22 Issue: 1

Kiss Firms Which Embrace Accounting For Human Capital Have Emerged In Kenya

Sammy Lio, United States International University-Africa

Keywords

Accounting, Human Capital, Tools, Tenability, KISS Firms.

Introduction

Knowledge-Information-Service-Sector (KISS) firms of the contemporary global economics have emerged in Kenya. These firms rely not on machines, raw materials, buildings or land for their productive capacities. The firms employ Human Capital (HC) as the foremost factor of competitive advantage, the first and most important component of Intellectual Capital (Rompho & Siengthai, 2012; Masingham, Nguyen & Massinham, 2011; Theeke & Mitchell, 2008; Carrel, 2007; Johansson, 2007; Catasus & Grjer, 2006; Youndt & Snell, 2004); the second and third have been identified as relational and structural capital (Rompho & Siengthai, 2012; Masingham et al., 2011). But is intellectual capital the most fundamental? This question will probably remain an unfolding discourse for next centuries. This is because any wisdom that touches on people is hard to define. This may be explained by the fact that people are the epitome of life and truth.

However, HC is not only the machines and raw materials in KISS firms; it is the minders of the machines (Sveiby, 1997). But it is too, the ultimate consumption of the worlds’ wealth. It is the markets. For example, all educational blueprints, formal and informal are designed for HC. Hence there is order on earth and (other planets). In the 1970s, the Human Resource Accounting (HRA) discipline experienced impediments because pundits feared it would treat people as financial objects (Grojer & Johnson, 1998). This could be attributed to the original definition of HRA as the process of developing financial assessment for people within organizations and society (Kaur, Raman and Singhania, 2014). However, White (2007) resolved this believe by affirming that the emergency of the concept of HC in the 1960s focused on demonstrating the significant contribution of people’s increasing knowledge and competence value to the economic work they do and not by any means demeaning the human value.

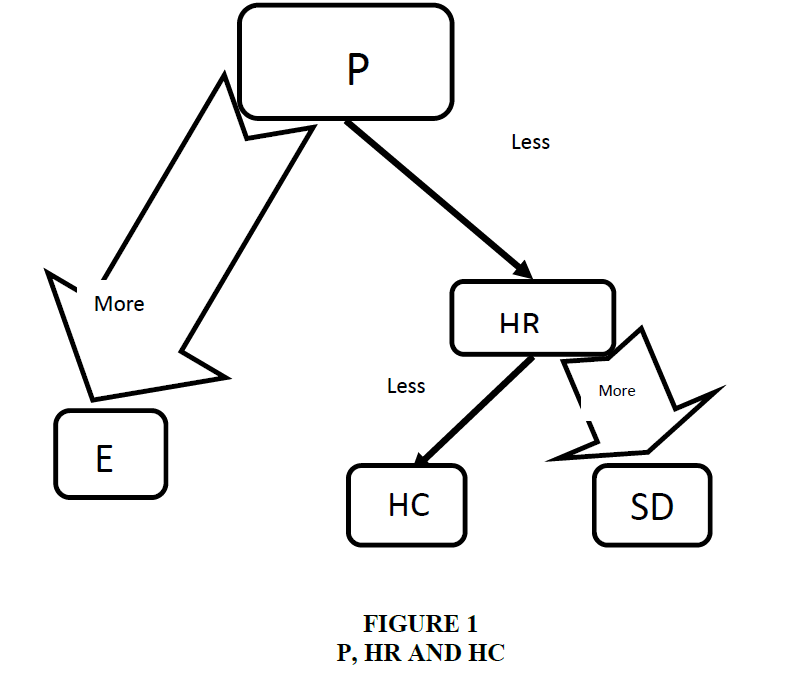

In this study amongst the Kenyan CFOs in medium and large organizations, a re-definition of HRA is suggested to distinguish between People (P) as the Epitome (E) of life itself which cannot be quantified in monetary terms; Human Resource (HR) with unique non quantifiable-non financial measurement Social Dynamics (SD) such as improved health status, enhanced well-being and greater social cohesion (Liu, 2011; United Nations Economic Commission for Europe (UNECE) Task Force on Measuring HC, 2016) as well as Human Capital (HC) (Goldin, 2014); and a focus on accounting for HC to be adopted in these organizations, as shown in Figure 1 is pursued.

This redefinition is aimed at resolving the challenges identified in HRA application. For example terminologies such as Intellectual Capital (IC), a concept which originated in the 1990s and regarded as superseding physical capital as the traditional basis for wealth creation as well as financial capital whose importance has remained valid in contemporary business and defined in the sense of human capital- customer relationships (Rompho & Siengthai, 2012; Masingham, Nguyen, & Massinham, 2011; Theeke & Mitchell, 2008; Carrel, 2007; Johansson, 2007; Catasus & Grjer, 2006; Youndt & Snell, 2004; Cascio, 1998); and identified to comprise the three dimensions of: HC, which is the focus of this study and defined as total employee job knowledge, skills, innovative competencies and team attitudes in organizations which lead to optimum firm market value; Structural Capital (SC), defined as the internal structure which includes patents, concepts, models, computers, culture and administrative systems as well as the external structure which fosters relationships with customers and suppliers, brand names, trademarks, reputation and image; and Relational Capital (RC), defined as workers knowledge on the relationships with firm external stakeholders such as customers, suppliers and local communities (Rompho & Siengthai, 2012; Masingham, Nguyen & Massinham, 2011; Gates & Langevin, 2010; Sveiby, 1997) have been considered to be synonymous with HRA.

Other terminologies considered similar to the HRA discipline include Human Competence Accounting (HCoA), a unique competencies focused approach applied to study how managers in Australian financial firms managed the work health of employees by adopting work-life balance tactics, owing to the ageing populations with increasing rates of sick leave and absenteeism from work in most western regimes (Guthrie & Murthy, 2009); Accounting for People (AFP), signifying the quantification of people who are the epitome of life itself in monetary terms (Roslender, 2009a); Social Capital (Soc.C), distinguished as the sum total of employees’ relational dynamics which have an effect on a firm’s reputation and are manifested beyond work environments (Dominguez, 2011; Catasus, Martensson, & Skoog, 2009); and Individual Capital (Ind.C), defined as the accounting of a single worker in an organization (Flamholtz, 1999; Levi & Schwartz, 1971 ).

Cascio and Boudreau (2011) have concluded that it is impossible to measure everything about talent or HR program effects. Thus as shown in Figure 1: HR=HC+SD; and P=HR+E; and therefore P>HR>HC. According to Goldin (2014) HC has been defined as the total stock of skills of the entire workforce in an organization. Hence firms can focus on accounting for THCC rather than Ind.C to enhance efficiency and cost-effectiveness. To deal with the synergetic question which has been advanced as the reason for Ind.C accounting, HR managers can apply the 360-degree peer review method to ‘validate the measurement of individuals’ HC’ (Masingham, Nguyen and Massinham, 2011. P 68) and identify individual’s synergetic strengths in self-managed teams.

Essentially, HC is a great deal, as has been amongst the academics and practitioners since the 1960s of the last century. And yet, its benefits can be actualized by its accounting in organizations hence the desire to study the existing tools’ tenability in Kenya.

Accounting For Hc Tools’ Tenability

Tenability is taken to mean justifiable. The key theme is whether or not the existing accounting for HC tools are justifiable for use in accounting for HC in the Kenyan medium and large organizations for improved decisions. For the purpose of this study, tenability is divided into various sub-themes as follows:

Understandability

A key concern is whether the existing accounting for HC tools are understandable or understood by Kenyan CFOs in medium and large firms. While addressing the issue of qualitative characteristics of useful financial information in its conceptual framework, the IFRS Foundation (2015) identified understandability as one of the enhancing components of the said information. The foundation identified the quality of understandability to mean concise classification and presentation of information however complex. For an accounting tool to execute this function, it has to be understandable itself. Numerous and disparate accounting for HC tools have been promoted. For example, Sveiby (1997) identified 21, Andriessen (2004), 30 and Massingham, Nguyen and Massingham (2011) 46, authenticating the apparent interest in HC accounting and the need of concrete tools but casting doubts on the understandability of the tools. It is the author’s proposition that a pragmatic discipline should not yield more than five frameworks.

Formula

As a measurement communication system (AAA, 1973) the accounting discipline is applied in authentic formulas. HRA has been promoted as an accounting discipline whose solitary goal is accounting for HC as material investments in firms for improved decisions by their key constituents (Chaudhry & Roomi, 2010; Flamholtz, 2005; Flamholtz, Bullen & Hua, 2002; Cascio, 1998; Dobija, 1998; Sveiby, 1997; Mercer, 1989). A key concern is whether or not; the tools have the correct formulas, in accounting for HC in Kenya. In this study, I condense the tools to 6 main ones based on the proposed metrics and formulas: To include the Stochastic Rewards Valuation Model (SRVM) (Flamholtz, 1999), the Intangible monitor (IM)(Sveiby, 1997), the Behavioural Model (BM)(Cascio, 1998), the Capitalization Model (CM) (Dobija, 1998), the Return On Investment Metric Model (ROIMM)(Mercer, 1989) and the Adjusted Present Value Technique (APVT) (Hermanson, 1964; Levi & Schwartz, 1971). I find that the formulas are as disparate as the authors. For example both the IM and BM inculcate HR non-financial measures and hence have only been applied to determining standalone indicative HC decision ratios (Cascio and Boudreau, 2011; Sveiby, 1997) rather than computing THCC in organizations. The IM is multi-faceted as it included non-HC measurement metrics such as the social dynamics (Flamholtz, Narasimhan and Bullen, 2004). And yet the THCC value is paramount in tandem with the matching postulate; to match THCC and Human Capital Earnings Potential (HCEP) in organizations. However, these ratios are meaningless unless they are based on a relative number which would authenticate them; and that number is THCC in organizations. Furthermore, it is not clear how the CM formula can be applied on HC investments; which would be best treated as an ordinary annuity, rather than an annuity due. The SRVM is fairly objective as it includes the probabilities of HC changing positions within the organization. However, although the author is associated with the Acquisition Cost (AC) as well as Learning Cost (LC) methods of accounting for HC, these are not explicitly linked to SRVM. The APVT employs salaries as the surrogate metric, although salaries should be treated as expenses and matched with HCEP. Chen and Lin (2004) distanced themselves from salaries a HC accounting metric. These incoherent frameworks have tended to discredit the HRA discipline as a unique branch of accounting whose solitary goal is accounting for HC as the foremost factor in organizations, especially the KISS firms of today. In addition, the ROIMM was ranked the best for use in Kenya. However, the ranking may have been motivating by the popularity of the notion of Return on Investment with most CFOs and not necessarily its effectiveness in accounting for HC. Essentially, the tool calculates the cost of problems solved by HC rather than THCC versus HCEP in organizations. Furthermore, organizations thrive in forecast strategies and it is the value addition on these by HC which should the focus of accounting rather than problems, which are often a subset of the strategies.

THCC versus Ind.C

Current tools have focused on computing individual employee value in reorganizations. This practice doesn’t seem practical especially for KISS firms and countries (World Bank, 2011; 2006) has proposed the accounting of HC in nations) with many workers. According to Goldin (2014), HC is the total stock of skills of the entire workforce in an organization and is separated from Ind.C in Flamholtz (1999) and Levi and Schwartz (1971). The World Bank (2006) has defined HC as the economic productive capacity embodied in individual groups in organizations. According to Massingham et al (2011), HC symbolizes the human factor in the organization and equals the combined intelligence, skills and the expertise that gives a firm its unique image. HC refers to the investments made by organizations to develop the core competencies of employees to achieve a competitive edge (Chaudhry & Roomi, 2010; Subedi, 2006); and in Gates and Langevin, (2010) it comprises all competencies and knowledge of an entity’s employees. There is a need to shift focus from accounting for individuals in organizations, to accounting for THCC in organizations, in order to match this with HCEP for better HC strategies. After all, HR managers evaluate each individual employee every year and would be very helpful in identifying individual synergetic merits in HC teams; especially using the 360-degree peer review rating method (Massingham et al, 2011).

Cost-Effectiveness

It is imperative that any business effort does not outweigh its benefits; otherwise it is rendered ineffective on a cost-benefit analysis basis. Kaur, Raman and Singhania (2014) found that R.G. Barry Corporation, the HC accounting pioneer company which employed the AC tool dropped it because it was largely not cost-effective. Other authors for example Johanson and Mabon (1998), Jensen (2001) have cited the barrier of costs as a major reason why accounting for HC tools are unimplemented.

Legal Stipulations or the IFRS(s)

The global economy has taken tremendous ‘natural’ steps to confederacy owing to HC inter-market linkages as HC learning and growth intensifies. This has led to the need for unified accounting. In the past few years, many developed and developing countries have adopted International Financial Reporting Standards (IFRSs) as their basis for financial reporting. The European Union (EU) took the lead when it mandated all listed companies in the European Union to start the adoption and implementation of the IFRSs in their financial reporting since 2005. The World Bank, the International Monetary Fund (IMF), the G8, the G7 Finance Ministers and Central Bank Governors, International Organization of Securities Commissions (IOSCO), Basel Committee on Banking Supervision, the United Nations (UN) and the Organization for Economic Co-operation and Development (OECD) have publicly recommended the adoption of a single set of global accounting standards or the IFRSs. In Kenya, besides the government’s readiness, the Kenya Accounting Standards Board (KASB) now the Financial Reporting Council (FRC), the Nairobi Securities exchange, (NSE) and the Central Bank of Kenya (CBK) were among the major agents for IFRS adoption since 1998.

Today, the IFRS(s) have become a global agenda (Pacter, 2015; Naghshbandi & Ombati, 2014; Bullen & Eyler, 2010; SEC, 2010; McCreevy, 2006) as more and more firms adopt them in the preparation and presentation of their financial statements. In the USA where local GAAPs are in use, listed entities have been mandated to apply the IFRSs in order to compare their HC performance favourably with trading partners abroad. In the developing world, for instance Kenya, the IFRSs have influenced local economic laws for consistency. Accordingly, the IFRSs writers have the power to influence the tenability of accounting for HC tools in accounting for HC in the Kenyan medium and large organizations. The absence of HC accounting IFRS (s) means that the IFRSs accounting is irrelevant to especially KISS firms which drive current economic paradigms in Kenya.

Key Accounting for HC Metrics

Metrics display Accounting for HC financial measures and hence inextricably linked with accounting for HC in organizations. Puett and Roman (1974) have so far presented results of the most comprehensive study on HC metrics identified by top managers in organizations to be included in accounting for HC in organizations; being the outcome of a study carried out in the USA’s industrial, military and government organizations contacted in Washington DC. A total of 117 interviews were contacted in 47 entities in the three sectors and targeted practicing managers as follows: 9 in engineering, 13 in science, 42 in finance, 30 in personnel and 23 in marketing. Their findings are presented in Table 1 below and includes metric in existing empirical works.

| Table 1: Accounting For Hc Metrics |

||

| Key Metrics | ||

|---|---|---|

| In Existing Literature & mostly Used in Existing Tools | Identified by Top Managers in Puett and Roman (1974) | Frequently Identified by Top Managers in Puett and Roman (1974) |

| Recruitment costs | Recruitment costs | Recruitment costs |

| Training costs | Training costs | Training costs |

| Orientation costs | Orientation costs | Orientation costs |

| Learning capacity | Leadership ability | Salary expenses |

| Knowledge accessibility | Attitude | Potential earnings |

| Managerial behavior | Motivation | |

| Peer group behavior | Potential | |

| Workforce optimism | Productivity | |

| Organizational structure | Absenteeism | |

| Leadership style | Loyalty | |

| Attitude | Salary | |

| Motivation | Replacement costs | |

| Job security | Formal education | |

| Potential | Specialty | |

| Job recognition | Mobility | |

| Job satisfaction | Age | |

| Productivity | Obsolescence | |

| Product quality | Formal courses | |

| Absenteeism | ||

| Retention and Turnover | ||

| Loyalty | ||

| Salary | ||

| Employee engagement | ||

| Replacement costs | ||

| Economic contribution | ||

| Scarce resource | ||

| Earnings | ||

Source: Puett and Roman (1974)

Thus, recruitment costs, training costs, orientation costs, salaries, as well as HC potential earnings are identified as the key metrics in accounting for HC in organizations. One hypothesis was developed.

The Study Hypothesis

H0 There is a significant relationship between accounting for HC tools’ tenability and accounting for HC adoption in Kenyan medium and large organizations.

Conceptual Framework

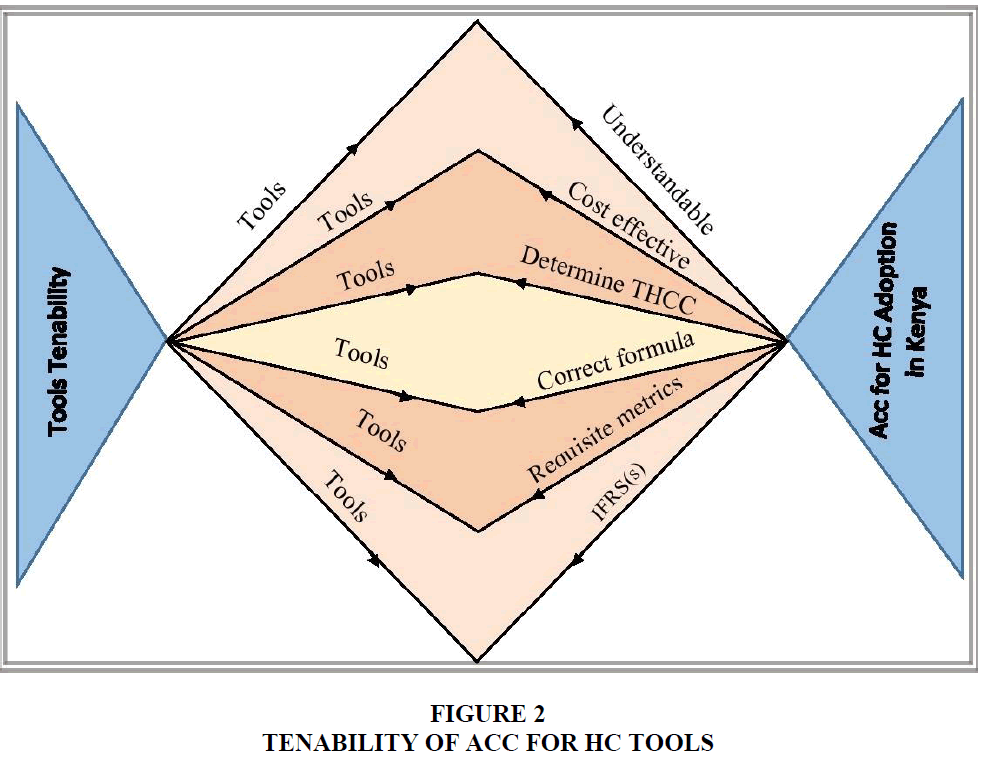

As shown in Figure 2, if the sub-hypothesis is supported and especially understandability, correct formula, calculation of THCC, as well as cost-effectiveness, this would corroborate ACC for HC tools’ tenability and the consequent adoption of ACC for HC in the Kenyan medium and large organizations. Conversely, ACC for HC adoption should render ACC for HC tools tenable as depicted. By supporting lack of IFRS as well as deficiency of key metrics, CFOs would agree with the status quo as depicted in existing empirical evidence and the reason accounting for HC has not been adopted in their organizations; which would imply that IFRS(s) and metrics are predictors of accounting for HC adoption.

Methodology

Sample and Data Collection

The study takes the realism philosophical view, focused on the explanatory-mixed methods research design and is grounded on the cross-sectional sampling plan. The key assumptions in tandem with the realism philosophical underpinnings are that: First, HC is the foremost factor in organizations’ success and especially KISS firms of the current era; second, Organizations have ‘pain’ because they are unable to account for their utmost investments; and finally, P>HR>HC and only HC may be rationally accounted for in quantitative terms. The target respondents were 165 CFOs, each from the 100 Kenyan best medium firms in the year 2016 (as ranked by renown KPMG on the basis of financial prowess) and the 65 Kenyan large organizations listed at the NSE in the same period; from which primary data was collected through the survey strategy. The criteria for medium firms in Kenya are turnover in Kenyan shillings between 5-800 million ($50,000-$8,000,000) and employees between 50 and 99. These were part of first portion of the data collection instrument. The data were collected using both hard copies as well as web-based questionnaires.

Measurement of Constructs

The Hypothesis

The tenability hypothesis was assessed on the basis of understandability (TBL1), correct formula (TBL2), calculating THCC (TBL3), cost-effectiveness (TBL4) and lack of legal stipulation such as IFRS(s) (TBL5) and deficiency of key accounting for HC metrics (TBL6); as the study variables. The study variables were measured using both the ordinal scale and Likert-type scale (1=Very strongly disagree; 2=strongly Disagree; 3=Disagree 4=Not sure; 5=Agree; 6=strongly agree; 7=Very Strongly Agree) because these scales have more informational value and are respondent centred studies (Kothari, 2011).

Control Variable

Accounting for HC practice is the control variable and is termed accounting for HC adoption. Respondents were required to state whether accounting for HC has been adopted ‘in my organization’. They were also required to state whether accounting for HC adoption is complete when THCC is placed in the statement of financial position (balance sheet) or in both general purpose and other management financial reports. All the questions were asked using the seven-point Likert scale.

Results

This portion of the research work presents the findings from the empirical evidence of the study. Firstly, the profile of the respondents is described, followed by the results of the hypothesis testing using SPSS version 24.

Profile of the Respondents

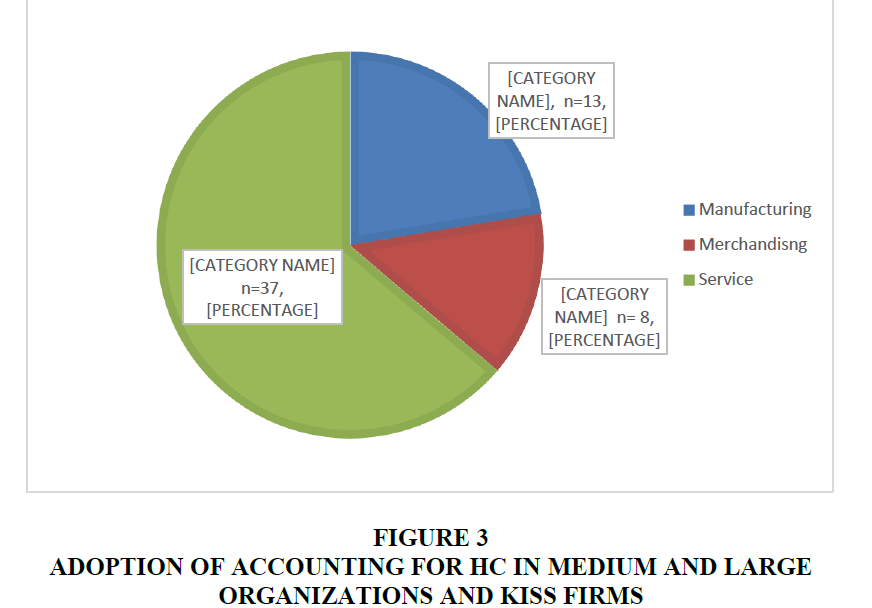

A total number of 116 questionnaires were administered to different respondents and a total of 59 questionnaires were returned for analysis. All the 59 returned questionnaires were complete and met the study requirements. This represented a 51% response rate. A t-test was employed to analyse any disparities among the hard copy (34) and web-based (25) respondents and it was found that there was no significant difference in the average scores of the variables between the two survey methods with a (p>0.05). Majority of the respondents (73%) are male while 27% are female. Sixty six percent are members of the Institute of Certified Public Accountants of Kenyan (ICPAK) while 34% belong to other professional bodies. Sixty four percent (64%) work in the service sector organizations, 22% in the manufacturing sector, while the minority (14%) are in the merchandising sector; leading to the conclusion that KISS firms have emerged in Kenya. Sixty two percent (62%) are in organizations which are not listed in NSE, while 38% are in listed organizations. Fifty three percent (53%) are in organizations with more than 99 full time employees while 47% are in organizations with between 50-99 full time employees. Fifty eight percent (58%) are in organizations with annual turnover of more than KSH 800 Million while 42% are in those with annual turnover of KSH between 5-800 Million. Sixty four percent (64%) have spent more than 5 years in their current position, 31% 1-5 years and 5% less than 1 year. Thirty three percent (33%) have expertise in costing; and 67% have expertise in other areas of accounting. Finally, 53% have worked in HRA related assignments before, Implying that 47% had not.

Description of Results

This section provides descriptive statistics of the hypotheses and the control variable (Accounting for HC adoption in Kenyan medium and large organizations) (Table 2).

| TABLE 2: Recommended Tools To Be Used In Kenyan Medium And Large Organizations | ||

| Accounting tool for HC | Frequency | Percentage |

|---|---|---|

| ROI metric model | 30 | 51.7 |

| Behavioural model | 29 | 50.0 |

| Capitalization | 23 | 39.0 |

| Adjusted present value technique and/or un-purchased goodwill approach | 16 | 27.1 |

| The intangible monitor | 15 | 25.9 |

| The stochastic rewards valuation model (SRVM) | 12 | 20.7 |

Recommended Tools

Most CFOs favoured the ROIMM and the least favoured is the SRVM. However, the ranking may have been motivating by the popularity of the notion of Return on Investment with most CFOs and not necessarily its effectiveness in accounting for HC.

Accounting for HC Metrics

The 5 key metrics in Puet JR. and Roman (1974) are ranked in the order of importance for use in accounting for HC in Kenya. The CFOs were asked to propose other metrics, but none were suggested. This implies that these metrics are sufficient for use in the accounting for HC tools in Kenya (Table 3).

| Table 3: Ranking Accounting For Hc Metrics According To Importance In Tools | ||

| Metrics | frequency | Percentage |

|---|---|---|

| Orientation costs | 15 | 25.5 |

| Recruitment costs | 14 | 23.7 |

| Training costs | 12 | 20.3 |

| Salary costs | 10 | 16.9 |

| HC earning potential | 8 | 13.6 |

Correlation Test

The findings reveals that all the sub-hypotheses measuring accounting for HC tools’ tenability have a significant linear relationship with accounting for HC adoption as indicated by significant p-values at 5% level of confidence (p<0.05) (Table 4).

| Table 4: Pearson’s Correlation Coefficient Between The Control Variable And The Sub-Hypotheses Measuring Acc For Hc Tools’ Tenability | ||||||||

| Sqr_Adoption of HC | sqr_TB L1 | sqr_TB L2 | sqr_TB L3 | sqr_TBL4 | sqr_TB L5 | sqr_TBL6 | ||

|---|---|---|---|---|---|---|---|---|

| Sqr_Adoption of HC | Pearson Correlation | 1 | ||||||

| Sig. (2-tailed) | ||||||||

| N | 56 | |||||||

| TBL1 | Pearson Correlation | 0.231* | 1 | |||||

| Sig. (2-tailed) | 0.045 | |||||||

| N | 56 | 59 | ||||||

| TBL2 | Pearson Correlation | 0.308* | 0.352** | 1 | ||||

| Sig. (2-tailed) | 0.042 | 0.006 | ||||||

| N | 56 | 59 | 59 | |||||

| TBL3 | Pearson Correlation | 0.335* | 0.414** | 0.055 | 1 | |||

| Sig. (2-tailed) | 0.046 | 0.001 | 0.679 | |||||

| N | 56 | 59 | 59 | 59 | ||||

| TBL4 | Pearson Correlation | 0.264* | 0.349** | 0.234 | 0.238 | 1 | ||

| Sig. (2-tailed) | 0.049 | 0.007 | 0.074 | 0.070 | ||||

| N | 56 | 59 | 59 | 59 | 59 | |||

| TBL5 | Pearson Correlation | 0.332* | 0.174 | 0.092 | 0.303* | 0.363** | 1 | |

| Sig. (2-tailed) | 0.035 | 0.187 | 0.486 | 0.020 | 0.005 | |||

| N | 56 | 59 | 59 | 59 | 59 | 59 | ||

| TBL6 | Pearson Correlation | 0.382* | 0.223 | -0.002 | 0.537** | 0.302* | 0.549** | 1 |

| Sig. (2-tailed) | 0.041 | 0.093 | 0.987 | 0.000 | 0.021 | 0.000 | ||

| N | 55 | 58 | 58 | 58 | 58 | 58 | 58 | |

* & ** means Pearson correlation value is significant at 5% and 1% level of significance respectively

Inferential Findings

The findings reveals a positive statistically significant linear relationship between accounting for HC Adoption (control variable-Y) and accounting for HC tools’ tenability with r=0.275and p=0.042<0.05. Further, a unit change in ACC for HC tools’ tenability increases accounting for HC Adoption by 0.289 units.

A simple linear regression was conducted with accounting for HC Adoption as the control variable and accounting for HC tools’ tenability as the explanatory variable. According to the research findings in Table 5, it is found that the explanatory variable explains 5.8% of the variation in the control variable. The model is found to significantly predict accounting for HC Adoption as indicated by an F-value of 4.325 and a significant p-value of 0.042.

| Table 5: Simple Linear Regression Models With Accounting For Hc And Accounting For Hc Tools’ Tenability | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | ||||||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | t | Sig. | R2 | F-value (p-value) |

||

| (Constant) | 14.000 | 2.842 | 4.926 | 0.000 | 0.058 | 4.325 | ||

| Square-tenability | 0.289 | 0.139 | 0.275 | 2.080 | 0.042 | (0.042) | ||

Control Variable

Accounting for HC is not adopted in Kenya. While remaining neutral on adoption being the placement of THCC in the statement of financial position, the CFOs supported the placement of THCC on both the general purpose as well as other management financial reports as follows: 3.4% very strongly disagreed, none strongly disagreed, 6.9% disagreed, 27.6% were not sure, 37.9% agreed, 12.1% strongly agreed while 12.1% very strongly agreed. On average the respondents supported the proposition with a mean score of 4.81 and standard deviation of 1.304.

Discussion and Conclusion

The study found that accounting for HC tools’ tenability would enable the adoption of accounting for HC in medium and large organizations and especially KISS firms which have emerged in Kenya. Sixty four percept (64%) of the random CFOs are in the KISS firms.

More specifically, female CFOs favoured tenability more than their male counterparts with a mean score of 4.5444 and a standard deviation of 0.80294. Kenyan ICPAK CFOs considered tenability essential in the adoption of accounting for HC in the medium and large organizations with a mean score of 4.4402, compared to CFOs of other professional affiliations whose mean score was 4.0526. CFOs in the manufacturing sector promoted that tenability would enable adoption and were closely supported by CFOs in the KISS firms. CFOs in the medium organizations which are not listed at the Nairobi Securities Exchange (NSE) were more inclined to tenability to enable adoption, than their colleagues in the large companies listed at the NSE. CFOs who had worked in their current position for more than five years considered tenability more favourably in enabling adoption than those whose experience was less than this period. Finally, those CFOs with expertise in accounting disciplines other than costing favoured tenability as a predictor of adoption more than those with expertise in costing; while those who had worked in HRA preferred tenability more than those who had not. This is an interesting finding as costing experts are more involved in HRA work (Figure 3).

Lack of tangible accounting for HC frameworks has inhibited accounting for HC adoption in the Kenyan medium and large organizations. However, from the research findings, this problem can be abetted because CFOs promote that; if the existing accounting for HC tools are understandable and have the correct formulae, accounting for HC can be adopted in their organizations since the tools are cost effective measurement and communication systems. Furthermore, they have prioritized the tools and requisite metrics and promote that accounting for HC is complete when THCC is placed in either the statement of financial position or management financial reports. For instance Dumay and Guthrie (2017) have observed the explosion in corporate reporting on the face of social media platforms which have led to the invention of more and rapid information and significantly influenced how HC data is produced, audited, disseminated, reported and consumed. The Kenyan CFOs however opine that for accounting for HC adoption to succeed in their organizations, accounting for HC tools should compute THCC, be supported by IFRS(s) and have key HC metrics which they ranked. Consequently, the null hypothesis is supported and the alternative hypothesis rejected. Thus the HRA theory is validated in Kenyan as an accounting for HC discipline. Accordingly, the IFRS(s) writers the International Accounting Standards Board (IASB) have to focus attention on accounting for HC and the HRA theory if they hope to remain relevant to KISS firms in Kenya.

References

- American Accounting Association. (1973). Statement of basic accounting theory: Evanston, IL AAA, Revised Edition.

- Andriessen, D. (2004). Making sense of intellectual capital. Elsevier Butterworth-Heinemann, Burlington, MA.

- Bullen, M.L. & Eyler, K. (2010). Human resource accounting and international developments: Implications for Measurement of Human Capital. Journal of International Business and Cultural Studies, 1-16.

- Carrell, J. (2007). Intellectual capital: An inquiry into its acceptance. Business Renaissance Quarterly, 2(1), 67-95.

- Cascio, W.F. (1998). The future world of work: Implications for human resources costing and accounting. Journal of Human Resource Costing and Accounting, 3(2), 9-19.

- Casio, W.F. & Boudreau, J. (2011). Investing in people (Second Edition): Financial impact of human resource initiatives. Pearson Education Inc, New Jersey.

- Catasus, B. & Grojer, J. (2006). Indicators : On visualizing, classifying and dramatizing. Journal of Intellectual Capital, 7(2), 187-203.

- Catasus B., Martensson M. & Skoog, M. (2009). The communication of human accounts: Examining models of sense giving. Journal of Human Resource Costing and Accounting, 13(2), 163-179.

- Chaudhry, N.I. & Roomi, M.A. (2010). Accounting for the development of human capital in manufacturing organizations: A Study of the Pakistani textile sector. Journal of Human Resource Costing and Accounting, 14(3), 178-195.

- Chen, H.M. & Lin, K.J. (2004). The role of human capital cost in accounting. Journal of Intellectual Capital, 5(1), 116-130.

- Dobija, M. (1998). How to place human resources into the balance sheet. Journal of Human Resource Costing and Accounting, 3(1), 83-92.

- Dominquez, A.A. (2011). The impact of human resource disclosure on corporate image. Journal of Human resource Costing and Accounting, 15(4), 279-298.

- Dumay, J. & Guthrie, J. (2017). Involuntary disclosure of intellectual capital: Is it relevant? Journal of Intellectual Capital, 18(1), 29-44.

- Flamholtz, E.G. (1999). Human resource accounting: Advances, concepts, methods and applications, Boston MA: Kluwer academic publishers.

- Flamholtz, E.G. (2005). Conceptualizing and measuring the economic value of human capital of the third kind. Journal of Human resource Costing and Accounting, 9(2), 78-93.

- Flamholtz, E.G., Bullen, M.L. & Hua, W. (2002). Human resource accounting: A historical perspective and future implications. Management Decision, 40(10), 947-954.

- Flamholtz, E.G., Narasimhan, R.K. & Bullen, M.L. (2004). Human resource accounting today: Contributions, controversies and conclusions. Journal of Human Resource Costing and Accounting, 8(2), 23-37.

- Gates, S. & Langevin, P. (2010). Human capital measures, strategy and performance: HR Managers’ Perceptions. Accounting, Auditing and Accountability Journal, 23(1), 111-132.

- Goldin, C. (2014). Human capital. Handbook of Cliometrics. Springer-Verlag.

- Guthrie, J. & Murthy, V. (2009). Past, present and possible future developments in human capital accounting: A tribute to Jan-Erik Grojer. Journal of Human Resource Costing and Accounting, 13(2), 125-142.

- Grojer, J.E. & Johanson, U. (1998). Current development in human resource costing and accounting: Reality, present researchers absent? Accounting, Auditing and Accountability Journal, 11(4), 495-506.

- Hermanson, R.H. (1964). Accounting for human assets. Occasional Paper No. 14, Bureau of Business and Economic Research, Michigan State University, East Lansing, MI.

- IFRS Foundation. (2015). Conceptual framework for financial reporting: Basis for conclusions exposure draft. IFRS Foundation Publications department, London, United Kingdom.

- Jensen, H. (2001). Policy and company perspectives for IC reporting. Journal of Human Resource Costing and Accounting, 6(1), 11-28.

- Johanson, U. & Mabon, H. (1998). The personnel economics institute after ten years: What has been achieved and where we are going. Journal of Human Resource Costing and Accounting, 3(2), 65-76.

- Johansson, J. (2007). Sell-side analysts’ creation of value: Key roles and relational capital. Journal of Human Resource Costing and Accounting, 11(1), 30-52.

- Kaur, S., Raman, A.V. & Singhania. (2014). Human resource accounting disclosure practices in Indian companies. Vision, 18(3), 217-235.

- KPMG. (2016). Kenya’s top 100 mid-sized companies survey. http://Kenyatop100.com/the-survey/overview.

- Liu, G. (2011). Measuring the stock of human capital for comparative analysis: An application of the lifetime income approach to selected countries. OECD Statistics Directorate, Working Paper No. 41.

- Lev, B. & Schwartz, A. (1971). On the use of the economic concepts of human capital in financial statements. Accounting Review, 103-112.

- Massingham, P., Nguyen, T.N. & Massingham, R. (2011). Using 360 degree peer review to validate self-reporting in human capital measurement. Journal of Intellectual Capital, 12(1), 43-74.

- McCreevy, C. (2006). Global convergence of accounting standards: The EU perspective. www.eujapan.com/roundtable/wp2 2006.pdf, accessed August 17, 2016.

- Mercer, M. (1989). Turning your human resources department into a profit centre. AMACOM: NY.

- Naghshbandi, N. & Ombati, R. (2014). Issues, challenges and lessons for IFRS adoption in Kenya and other adopters. International Research Journal of Management and Commerce, 1(8), 97-113.

- Pacter, P. (2015). Financial Reporting Standards for the World Economy. http://www.ifrs.org/use-around-the-world/documents/financial-reporting-standards-world-economy-june-2015.pdf, accessed March 30, 2016.

- Puett, J.F. & Roman, D.D. (1974). Human resource valuation. Academy of Management, 19(4), 656-662.

- Rompho, B. & Siengthai, S. (2012). Integrated performance measurement system for firm’s human capital building. Journal of Intellectual Capital, 13(4), 482-514.

- Roslender, R. (2009a). So tell me again just why would you want to account for people? Journal of Human Resource Costing and Accounting, 13(2), 311-329.

- SEC. (2010). Work plan for the consideration of incorporating international financial reporting standards into financial reporting system for US. Issuers New York, US SEC.

- Subedi, B.S. (2006). Cultural factors and benefits influencing transfer of training. International Journal of Training & Development, 10(2), 88-96.

- Sveiby, K.E. (1997). The new organizational wealth: Managing and measuring knowledge-based assets. Berrett-Korhler. San Francisco, CA.

- Theeke, H.A. & Mitchell, J.B. (2008). Financial implications of accounting for human resources using liability model. Journal of Human Resource Costing and Accounting, 12(2), 124-137.

- UNECE Task Force on Measuring Human Capital. (2016). Guide on Measuring Human Capital. UNECE, Conference of European Statisticians, ECE/CES/2/Add.2.

- White, L.N. (2007). A kaleidoscope of possibilities: Strategies for assessing HC in libraries. Bottom Line, 20(3), 109-115.

- World Bank. (2006). Where is the wealth of nations? The World Bank, Washington DC.

- World Bank. (2011). The Changing Wealth of Nations: Measuring Sustainable Development in the New Millennium. The World Bank, Washington DC.

- Youndt, M.A. & Snell, S. (2004). Human resource configuration, intellectual capital and organizational performance. Journal of Management Issues, 16(3), 337-360.