Research Article: 2022 Vol: 25 Issue: 1

Knowledge and application of qualitative and quantitative models in the decision-making process during the covid-19 pandemic: Peru and Chile business sector

Merino-Núñez, Mirko, Universidad Señor de Sipán S.A.C. Pimentel

Villanueva Quispe, Miyuki Tania, Universidad Señor de Sipán S.A.C. Pimentel

Torres Vilchez, Rosmery Tatiana, Universidad Señor de Sipán S.A.C. Pimentel

Coronel Bustamante, Luis Fernando, Universidad Señor de Sipán S.A.C. Pimentel

Ramon Laboriano, Celso Alexander, Universidad Señor de Sipán S.A.C. Pimentel

Peralta Cotrina, Sandra, Universidad Señor de Sipán S.A.C. Pimentel

Citation Information: Mirko, M-N., Miyuki Tania, V. Q., Rosmery Tatiana, T. V., Luis Fernando, C. B., Celso Alexander, R. L., & Sandra, P. C. (2022). Knowledge and application of qualitative and quantitative models in the decision-making process during the covid-19 pandemic: Peru and Chile business sector. Journal of Management Information and Decision Sciences, 25(1), 1-15.

Abstract

Decision-making is always a difficult process, especially when defining an investment, management, sales, production, industrial, academic or labor project. Setting the objectives to be achieved, preparing a plan, carrying out the actions and then evaluating the results is a process that anyone can carry out and that will facilitate the decision-making process. Organizations have explicit objectives, but they are also complex systems whose decisions not only obey administrative, legal, economic standards or productivity criteria, but must also adapt to the conditions of their environment, to the capacities, competencies and abilities of their workforce of professionals and technicians, and to the physical, technological, material and other resources that they have. It is this motivation that leads us to question if the level of knowledge and application of qualitative and quantitative models is being used properly in the decision-making process of the business sector during a pandemic context in 2021. The general objective is to determine the level of knowledge of these models in the decision-making process, as well as their application, in the business sector during the COVID 19 pandemic in Peru and Chile in 2021; by relying on different specific objectives like analyzing the level of each of the knowledge dimensions of the qualitative and quantitative models mentioned for the decision-making process of the business sector and evaluating in each dimension the knowledge and application of said models in the decision-making process of that sector. The type of research was descriptive and quantitative, undergoing an analysis of the importance of good decision-making in the business sector, appropriate for a non-experimental design without the manipulation of any variables. The total number of companies was 3'995,202 as the universe for both countries, the sample size of the strata by country being 260 and 124 for Peru and Chile. Regarding the discoveries: the general alternate hypothesis is accepted, which establishes that there is not a low level of knowledge and application of qualitative and quantitative models in the decision-making process of the business sector during the COVID-19 pandemic, Peru and Chile, 2021. And lastly, it was concluded that the working hypothesis is partially accepted because it shows a trend from medium to low knowledge, that is to say 51.3% and 28.6% respectively and agrees with most of the dimensions evaluated.

Keywords

Qualitative models; Quantitative models; Business decision-making.

Introduction

Nowadays, companies are increasingly faced with decision-making, choosing between different options or ways to solve different everyday situations in various circumstances: work, family, personal, sentimental or business (in the latter case using quantitative methodologies offered by Management). Thus, we can find the research of Del Pilar (2019), carried out in Colombia, whose objective was to address the debate regarding how much the North American Free Trade Agreements (NAFTA), the integration with the Southern Common Market (Mercosur), and the decision-making process before their signing have an impact on national sovereignty.

Before making any decision, it is necessary to understand its implication and consequences. Any decision made causes a chain of events in motion. Therefore, it is of the utmost importance to be sure of what is to be done and to be convinced that it is the right alternative. To systematize the generated knowledge, one must have attitude and critical thinking.

When analyzing the different forms of adaptation, distinct limits and scopes will emerge very clearly. If this is not understood, an idealized picture of organizational performance will continue to exist and a more accurate diagnosis that can contribute, in a significant way, to the improvement of performance will not be achieved (Espinosa, 2016, p.69-70). It is important to have knowledge of the existing methodologies in the decision-making process because, in this way, the best decision will be made for the company avoiding risks that could jeopardize it. There are different techniques to assess multiple criteria, such as hierarchical decision analysis. This is how Franco et al. (2021), in their article regarding the techniques for decision-making applied by older people in Ecuador when faced with improper payment of income tax, find that most adults in the Ecuadorian population suffer social abuse, loneliness, non-acceptance and insufficient income as their main problems. It is the government's obligation, then, to protect this vulnerable group who have seen various aspects of their lives affected, including rent payment procedures. Applying the hierarchy of causes, it can be seen that there is a correlation between political and legal causes, and the economic consequences, finding a directly proportional positive relationship, concluding that, by improving the political environment, the legal environment will also improve, subsequently influencing the different dimensions analyzed. As explained by Solano et al., (2019), by improving the decision-making processes, the technical team and decision makers at a higher level can concentrate on performing another task.

Likewise, in Colombia, Blanco-Mesa et al. (2021) in their article "Strategic Decision-Making in Uncertain Environments", point out that, at present, decision-making has an important impact on what is achieved by organizations, so they have developed innovative procedures that allow the evaluation of subjective and rational resources under uncontrollable conditions; therefore, its goal was to study the aggregation operator in decision making in an uncertain environment, concluding that integrating information produces changes when choosing alternatives. Having knowledge is essential in a company in order to achieve the objectives and goals set, thus obtaining greater productivity in the organization. A good business decision must be quick, effective, judicious and efficient; since, given that the success or failure of any company depends on these.

Vázquez-Ramos et al. (2017) in Spain designed and developed a software that allows the evaluation of decision-making in school age, based on aspects of space and time, called "Interactive Volleyball Game", obtaining this evaluation program at a high level of reliability and validity. Accordingly, Ladrón de Guevara et al. (2020), in their research in Colombia on the level of education and gender and their influence on financial decision-making, conclude that women have a greater qualm about risk and that, for financial decision-making, the influence of educational level is low. What is more, Hernández and Moreno (2021), Mexico, in their article on the implementation of a dashboard to support decision-making when distributing machinery and raw material for bakery products, find a transaction system that lacks personalized reports generating a burden for the user when obtaining and consolidating them. Subsequently, González and Villamizar (2018) in Colombia, fond the LEGO Serious Play methodology effective to learn decision-making. Rubio et al. (2020) researching decisions when faced with an increase in people in need of intensive care and the effective availability of means, found that allocating resources or prioritizing treatment become vital elements, with the need for an ethical frame of reference that enables the necessary clinical decision-making.

As Griffin (2017) points out, the decision-making process involves reordering and clarifying in what type of decision the organization finds itself, finding the alternatives, choosing the "best" one and applying it in practice. There are many analysis tools for good business decision-making. Thus, the combination of the PERT (Project Evaluation and Review Technique) and the critical path (CPM, Critical Path Method), are two of the best known techniques to develop a project network and define the deadline for its completion. Meanwhile, Amaya (2009), indicates that a decision tree is used in circumstances where the optimization of series or sets of decisions are needed. Castellanos et al. (2018) clarify that, by knowing the conditional values (payments) or monetary values and evaluating the probabilities of each state of nature, one could find the expected monetary value for each alternative. And if that decision comes with additional external information, as Alvarenga, Blanco & Vásquez (2009) state, then the way to obtain the value of the information provided by the market analysis (the sample) is by calculating the expected value of the sample information (VEIM), with or without information. In the same way, Begoña (2007) asks: what is the value of having that information? how much would one be willing to offer for it? It should be noted that the more information you have, the greater the expected gain becomes. It is therefore convenient to know what Carreto (2016) tells us, which is that the only way to make an appropriate decision is through using a correct procedure, or a decision-making model, which will allow the saving of time, effort and energy. According to Solano (2017) there are five factors that must be considered when deciding: future effects, reversibility, impact, quality and periodicity.

When an organization is going to make a decision, it must rigorously evaluate each alternative, analyzing the relationship between cost and benefit of each one, in order to choose the one that makes the most sense. However, Robbins (2015) explains that the conditions in which each person makes their decisions reflect the forces of context (facts and events) which are beyond the control of the individual and which will affect, over time, the outcome of their decisions. Such conditions can be classified as certainty, risk, and uncertainty. Such is the case of Menegazzo et al. (2017) in Brazil, who analyze the relationship between the demographic characteristics of the manager and the use of information to support decisions in micro and small business. The result indicates that these administrators are more likely to use financial information than non-financial information.

The main problem of the research was to know if the level of knowledge of qualitative and quantitative models and their application in the decision-making process of the business sector during the COVID-19 pandemic, Peru and Chile 2021, is used properly. Thanks to this research, it was possible to analyze how important it is to have knowledge of the methodologies in the decision-making process in both Peru and Chile.

Methodology

The type of research was quantitative and descriptive, which was chosen because the research analyzed the importance of adequate decision-making in the business sector. The design was non-experimental given that no variables were manipulated, showing the facts as they are in context and time.

According to the National Institute of Statistics and Informatics (INEI, 2020) in its technical report Business Demographics in Peru – III Quarter (2020), the number of active businesses reached 2’701,066 nationwide. On the Chilean side, according to the Internal Revenue Service – SSI. (2020), states in its web portal that the number of businesses nationwide was 1'294,136 (2019). Therefore, for this research, the total number of businesses under evaluation amounted to 3’995,202. For the research work, 384 officials, employees, owners and shareholders of public and private companies between Peru (260) and Chile (124) will be referenced. Regarding the technique and procedures for collecting information, one person per company will be interviewed. In this sense, being the nationality of the participants the main indicator of segmentation, stratified sampling was considered. At this juncture, a questionnaire conducted online was used, which consists of thirty-seven questions related to the research carried out on a Google form. This instrument of information collection was validated by experts in the subject of study, in order to detect whether or not there are weaknesses and propose alternatives for improvement. In addition, there was a pilot sample of 60 companies that answered the digital questionnaire through the Google forms, both from Peru and Chile. In order for the answers given by each interviewee to be of the Likert scale type, the instrument in question was adequate. The information was processed for this purpose using the statistical software SPSS V.25, determining the reliability through Cronbach’s Alpha coefficient, in which a 0.854 was obtained. That indicates that, among the observations, the concordance can be considered "good", according to the scale of George and Mallery; therefore, the result obtained with this code is valid and reliable.

The principles of ethics selected for the development of the research were based on the Belmont Report and the National Commission for the Protection of Human Research Subjects (1979) which clarifies the following: welfare, justice and respect for people (p. 4); which are also conjugated with those used in scientific research such as: credibility, truth value, transferability, applicability, consistency, dependence, neutrality and relevance.

Results

A virtual survey was used as a technique to obtain the information, interviewing 384 representatives of companies from the countries of Chile and Peru, with 124 from the southern country and 260 Peruvian ones.

96.6% of the representatives evaluated state that they agree that both quantitative and qualitative techniques are relevant when making a decision within the organization, while only 1% state they disagree (Table 1).

| Table 1 Total Distribution of the Dimension: Techniques or Tools | ||||||||

| Techniques or Tools | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P1 | The qualitative technique is an important factor when making a decision within the organization | 4 | 1.0 | 9 | 2.3 | 371 | 96.6 | 384 |

| P2 | It is fundamental to use quantitative techniques when making a decision within the organization | 4 | 1.0 | 9 | 2.3 | 371 | 96.6 | 384 |

| Total | 4 | 1.0 | 9 | 2.3 | 371 | 96.6 | 384 | |

According to the representatives of the companies evaluated, item P5 has the highest percentage with 93.2% indicating that they agree to address purchase orders through operational decisions, in second place is item P10 with 91.7% indicating that a semi-structured decision should be taken with criteria and after evaluation; followed by P6 with 90.6%; who think that planned decisions are useful for strategic decisions; while item P7 is the one that has the lowest percentage in this dimension with 58.3%, agreeing that unplanned decisions would be used when the company is in debt to be able to solve contingencies. On the side of those who indicated that they disagree, in item P7 with 25.3% and in P8 with 19.8%. they point out that decision-making under uncertainty occurs when the future cannot be predicted based on previous experiences (Table 2).

| Table 2 Total Distribution of the Dimension: Classification | ||||||||

| Classification | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P3 | There is, in the institution, a specific system that helps in strategic decision-making | 23 | 6.0 | 43 | 11.2 | 318 | 82.8 | 384 |

| P4 | The officials and/or employees of the dependencies or areas of the company have a clear understanding of the strategic objectives and methods for good managerial decision-making | 34 | 8.9 | 35 | 9.1 | 315 | 82.0 | 384 |

| P5 | Operational decisions can be used to address purchase orders in the organization | 7 | 1.8 | 19 | 4.9 | 358 | 93.2 | 384 |

| P6 | Planned decisions would be useful for the development of the strategic activities of the company | 9 | 2.3 | 27 | 7.0 | 348 | 90.6 | 384 |

| P7 | Unplanned decisions should be used only when the company is in debt | 97 | 25.3 | 63 | 16.4 | 224 | 58.3 | 384 |

| P8 | Decision-making under uncertainty occurs when the future cannot be predicted based on previous experiences | 25 | 6.5 | 49 | 12.8 | 310 | 80.7 | 384 |

| P9 | An unstructured decision is an advantage for the company if there is competition in the market | 76 | 19.8 | 47 | 12.2 | 261 | 68.0 | 384 |

| P10 | A semi-structured decision must be taken with criteria and a prior evaluation of the company | 8 | 2.1 | 24 | 6.3 | 352 | 91.7 | 384 |

| Total | 35 | 9.1 | 38 | 10.0 | 311 | 80.9 | 384 | |

Of the four items evaluated by the representatives of the companies, four have exceeded 80% indicating that they agree, with the highest percentage being item P12 with 85.2%. On the side of the interviewees who said they disagree, the highest percentage is located in item P13 with 6.8% (Table 3).

| Table 3 Total Distribution of the Dimension: Managerial Decision-Making in Scenarios of Certainty, Risk, Uncertainty and Turbulence | ||||||||

| Managerial decision-making in a scenario of certainty | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P11 | In the company where you work, for the most part, managerial decision-making is accurate because they are based on a comprehensive information system based on indicators and standards | 25 | 6.5 | 50 | 13.0 | 309 | 80.5 | 384 |

| P12 | In the company where you work, there are indicators and standards of business management that reduce uncertainty in decision making | 20 | 5.2 | 37 | 9.6 | 327 | 85.2 | 384 |

| P13 | You are aware of the probability of occurrence and risk impact that your company currently faces in the midst of the Covid-19 pandemic | 26 | 6.8 | 50 | 13.0 | 308 | 80.2 | 384 |

| P14 | You believe that the turbulence condition appears when your potential market is uncertain | 20 | 5.2 | 56 | 14.6 | 308 | 80.2 | 384 |

| Total | 23 | 5.9 | 48 | 12.6 | 313 | 81.5 | 384 | |

Linear Programming I dimension: simplex method, graphic method, technological and IT tools, application of qualitative and quantitative models in the decision-making process that will allow you to measure risks and uncertainty in the business sector of those observed, the highest percentage can be found in item P18 with 92.2%, with an evaluation of agreement in that it is important to apply qualitative and quantitative models to the decision-making process that will allow you to measure the risks and uncertainty in the business sector, followed by P17 with 79.9%, stating that the company where you work has technological and IT tools for decision-making. At the other extreme, those who indicated that they disagree are 9.4% and 8.9%, presented in items P15 and P16 respectively, on the use of the simplex and graphic method (Table 4).

| Table 4 Linear Programming I Dimension | ||||||||

| Linear Programming I | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P15 | Through the simplex method one can make accurate decisions in the company | 36 | 9.4 | 86 | 22.4 | 262 | 68.2 | 384 |

| P16 | The graphical method is very useful in linear programming | 34 | 8.9 | 56 | 14.6 | 294 | 76.6 | 384 |

| P17 | The company where you work has technological and IT tools for the managerial decision-making process | 27 | 7.0 | 50 | 13.0 | 307 | 79.9 | 384 |

| P18 | The application of qualitative and quantitative models is important for the decision-making process that will allow you to measure risks and uncertainty in the business sector | 3 | 0.8 | 27 | 7.0 | 354 | 92.2 | 384 |

| Total | 25 | 6.5 | 55 | 14.3 | 304 | 79.2 | 384 | |

The highest percentage is located in those who indicated that they agree, with 73.7%, about the importance of using the simplex method; while 10.4% stated that they disagree (Table 5).

| Table 5 Total Distribution of the Dimension: Linear Programming II | ||||||||

| Linear Programming II | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P19 | It is important to use the simplex method for the improvement of the managerial and operational decision-making process | 40 | 10.4 | 61 | 15.9 | 283 | 73.7 | 384 |

| Total | 40 | 10.4 | 61 | 15.9 | 283 | 73.7 | 384 | |

Regarding the evaluation of the Linear Programming III dimension, which contains two items (P20 and P21), it is observed that the highest percentage is located in those 82.6% who indicated that they agree that the use of qualitative and quantitative model software in the decision-making process is useful in a company to be more competitive, while in P20 the percentage decreases to 74.2%, who pointed out that the allocation model allows us to determine the productivity of a company. On the side of those who disagree, item P21 is where it has the highest percentage with only 5.7% on the use of software (Table 6).

| Table 6 Total Distribution of the Dimension: Linear Programming III | ||||||||

| Linear Programming III | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P20 | The allocation model allows us to determine the productivity of a company | 14 | 3.6 | 85 | 22.1 | 285 | 74.2 | 384 |

| P21 | You consider that, in the decision-making process, the use of a software for qualitative and quantitative models is useful in a company to be more competitive | 22 | 5.7 | 45 | 11.7 | 317 | 82.6 | 384 |

| Total | 18 | 4.7 | 65 | 16.9 | 301 | 78.4 | 384 | |

According to the representatives of the companies evaluated, item P22 indicates that the technique of Review and Evaluation of Projects is useful for project administration and management, presenting the highest percentage with 77.3% who indicated that they agree. Also, 75% agreed on the use of the method of the critical path or diagram CPM (Critical Path Method) indicating that it is important for project management. While for those who expressed that they disagree, the highest percentage is visualized in item P23 with 12% (Table 7).

| Table 7 Usefulness of Pert and CPM Tools in Project Management | ||||||||

| Project Management | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P22 | You believe that the PERT tool (called the Project Evaluation and Review Technique) is useful for project administration and management | 39 | 10.2 | 48 | 12.5 | 297 | 77.3 | 384 |

| P23 | You agree that the Critical Path Method (CPM) is important for project management | 46 | 12.0 | 50 | 13.0 | 288 | 75.0 | 384 |

| Total | 43 | 11.1 | 49 | 12.8 | 293 | 76.2 | 384 | |

It is observed that the highest percentage of 84.6% is among those who indicated that they agree, corresponding to items P24 and P26 respectively in the use of the table of results for decision-making in a scenario of certainty and uncertainty, while P25 is close with 79.7%. on the use of the table of losses in uncertainty scenarios. At the other extreme, that is, those who indicated that they disagree, in item P26 is where it is seen that there is a higher percentage (3.4%) and in a smaller percentage in item P25 with 1.8% (Table 8).

| Table 8 Dimension: Managerial Decision-Making in Scenarios of Certainty and Uncertainty | ||||||||

| Managerial decision-making in a scenario of uncertainty | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P24 | Table of results that indicates the scenarios of uncertainty in the decision-making process | 12 | 3.1 | 47 | 12.2 | 325 | 84.6 | 384 |

| P25 | Table of results that indicates the scenarios of certainty in the decision-making process | 7 | 1.8 | 71 | 18.5 | 306 | 79.7 | 384 |

| P26 | The use of a table of losses for the decision-making process in a scenario of uncertainty | 13 | 3.4 | 46 | 12.0 | 325 | 84.6 | 384 |

| Total | 11 | 2.8 | 55 | 14.2 | 319 | 83.0 | 384 | |

Use of decision criteria: Expected Monetary Value (EMV), Expected Opportunity Loss (EO), Expected Value of Sampled Information (EVSI); Expected Value of Perfect Information (EVPI), Decision Tree, Utility and Sensitivity Analysis.

According to the workers representing the companies of Chile and Peru evaluated, in relation to the dimension, which has nine items, the highest percentage is concentrated in item P32 with 90.4% indicating that the Expected Value of Sample Information (EVSI) is very useful; followed by 90.1% in item P27 indicating that the decision criteria are important to achieve the objectives of a company. On the side of the officials and workers that indicated they disagree, the highest percentage is visualized in item P31 with 8.3% being in doubt if the Expected Value of Perfect Information (EVPI), is the difference in absolute value between the possible profit obtained with the perfect information and the profit that is expected without the perfect information; followed by item P30 with 7.6% that denotes that the Expected Value of Sample Information (EVSI) is not very useful because it allows us to read quantitative studies (Table 9).

| Table 9 Use of Decision Criteria | ||||||||

| Managerial decision-making in a risk scenario | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| P27 | Decision criteria are important to achieve goals in a company | 4 | 1.0 | 34 | 8.9 | 346 | 90.1 | 384 |

| P28 | The Expected Monetary Value (EMV) criteria is useful for decisions in certainty scenarios | 27 | 7.0 | 80 | 20.8 | 277 | 72.1 | 384 |

| P29 | The Standard Operating Procedures (SOP) model is a procedure that can provide effective solutions in the decision-making process | 23 | 6.0 | 77 | 20.1 | 284 | 74.0 | 384 |

| P30 | The Expected Value of Sample Information (EVSI) is very useful because it allows us to read quantitative studies, whose information serves in the decision-making process | 29 | 7.6 | 71 | 18.5 | 284 | 74.0 | 384 |

| P31 | The Expected Value of Perfect Information (EVPI), is the difference in absolute value between the possible profit obtained with the perfect information and the profit that is expected without the perfect information. | 32 | 8.3 | 95 | 24.7 | 257 | 66.9 | 384 |

| P32 | The decision tree is a model that helps us analyze sequential decisions based on the use of probabilities and results and predict the economy of a company | 9 | 2.3 | 28 | 7.3 | 347 | 90.4 | 384 |

| P33 | Utility is a model that serves to obtain necessary information when making decisions in risk scenarios | 5 | 1.3 | 38 | 9.9 | 341 | 88.8 | 384 |

| P34 | The sensitivity analysis in business decision-making can determine the processes that are not allowing the achievement of objectives | 14 | 3.6 | 53 | 13.8 | 317 | 82.6 | 384 |

| P35 | The Expected Value of Sample Information (EVSI) will allow us to determine the most optimal decision strategy | 16 | 4.2 | 75 | 19.5 | 293 | 76.3 | 384 |

| Total | 18 | 4.6 | 61 | 15.9 | 305 | 79.5 | 384 | |

Taking into account the discoveries made, we accept the general alternate hypothesis that establishes that there is not a low level of knowledge and application of qualitative and quantitative models in the decision-making process of the business sector during the COVID-19 pandemic, Peru and Chile, 2021, as shown in Table 10. To determine the ranges of the levels of the present study, they been calculated through the percentile method, which is a statistical technique used for determination based on how above or below one is of the established average.

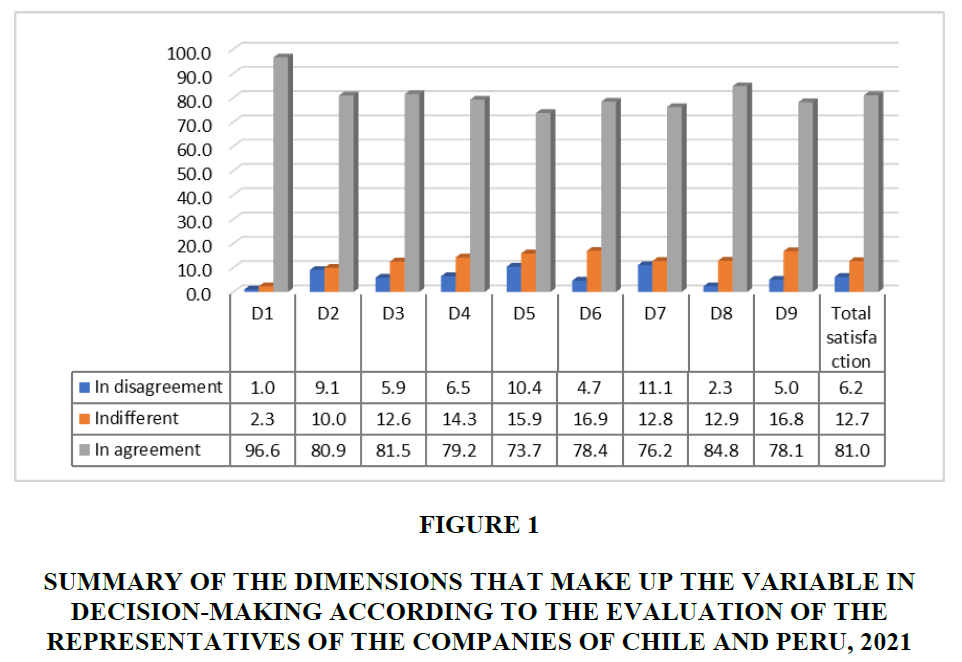

In general, all dimensions exceed the 73% in which the interviewees, meaning the workers, officials and owners of the companies of Chile and Peru, have indicated that they are "in agreement" (Table 9), highlighting the dimension D1 (techniques or tools) which reaches 96.6%, highlighting the importance of the use of quantitative and qualitative mathematical models in the business decision-making process for the two countries in question. These findings are related to those stated by Franco et al. (2021) in the use of decision-making techniques to assess the environment of older people in Ecuador in the face of tax cancellation proceedings.

The second dimension with the highest percentage is the D8, with 84.8% of the respondents mentioning they agree with managerial decision-making in scenarios of certainty and uncertainty using results and losses tables, relevant in companies (Table 9).

81.5% of respondents agreed with the third dimension D3 on managerial decision-making in scenarios of certainty, risk, uncertainty, and turbulence being fundamental and important; they agree with what Amaya (2010) indicates about the different decision-making models. The results found clarify that the company must have indicators and standards of business activities for the minimization and maximization of decision-making. In addition, they agree that they are aware of how likely risks are to occur and which ones the company is willing to face in the midst of a pandemic. They also state they are prepared for turbulence scenarios. In contradiction, we must take into account what Akyürek (2020) says, which points out the change in the style of the leaders’ decision-making according to the demographic characteristics; the author showed that the styles for making decisions change partially according to age, sex, amount of time in their work position and overall working time, however, the same does not happen regarding educational degree and position (Table 10).

| Table 10 Summary of the Dimensions that Make up the Variable in Decision-Making According to the Evaluation of the Representatives of the Companies of Chile and Peru, 2021 | ||||||||

| Dimensions | In disagreement | Indifferent | In agreement | n | ||||

| n | % | n | % | n | % | |||

| D1 | Quantitative and qualitative Techniques or Tools | 4 | 1.0 | 9 | 2.3 | 371 | 96.6 | 384 |

| D2 | Classification (by level, by methods and synthetically) | 35 | 9.1 | 38 | 10.0 | 311 | 80.9 | 384 |

| D3 | Managerial decision-making in scenarios of certainty, uncertainty, risk and turbulence | 23 | 5.9 | 48 | 12.6 | 313 | 81.5 | 384 |

| D4 | Linear Programming I (simplex method, graphic method, technological and IT tools, application of qualitative and quantitative models in the decision-making process) | 25 | 6.5 | 55 | 14.3 | 304 | 79.2 | 384 |

| D5 | Linear Programming II (on the importance of using the simplex method) | 40 | 10.4 | 61 | 15.9 | 283 | 73.7 | 384 |

| D6 | Linear Programming III (the allocation model and software use of these decision-making models) | 18 | 4.7 | 65 | 16.9 | 301 | 78.4 | 384 |

| D7 | Project Management (Usefulness of PERT and CPM tools) | 43 | 11.1 | 49 | 12.8 | 293 | 76.2 | 384 |

| D8 | Managerial decision-making in a scenario of uncertainty (table of results and losses) | 9 | 2.3 | 50 | 12.9 | 326 | 84.8 | 384 |

| D9 | Managerial decision-making in a risk scenario | 19 | 5.0 | 65 | 16.8 | 300 | 78.1 | 384 |

| Total Satisfaction | 24 | 6.2 | 49 | 12.7 | 311 | 81.0 | 384 | |

The fourth dimension with the highest percentage was D2, with 80.9% indicating that they agree with the questions about the knowledge of the classification of the qualitative and quantitative models used by the business sector in the decision-making process, stating the following in relation to their levels: the existence of a specific system, employees and staff understanding strategic objectives and methods, and operational decisions being well used in making purchase orders; in relation to the methods, indicated that the planned decisions are useful for the development of business activities, and the unplanned ones should be used when the company is not doing well economically. With regard to the synthesis, they state that decisions made under uncertainty cannot be predicted based on past experiences, so they agree with the use of mathematical models; unstructured decision-making will be used when there is strong competition in the sector, and a semi-structured decision will be made after an evaluation of quantitative and qualitative models.

In relation to the fifth dimension, D4, on the knowledge and use of linear I programming methods, it reached 79.2%, and it should be noted that the simplex method was the appropriate tool to make accurate decisions in the economic unit; and that the graphical method is vital in this type of linear programming for the better visualization of such decisions. In addition, companies have technological and IT tools for this managerial decision-making process; and they also indicated that it was necessary to apply quantitative and qualitative models in this managerial and operational process; similarly, Amaya (2009) agrees that linear programming can be applied to decision problems (Table 9).

The dimension D6 amounted to 78.4% who agreed with the knowledge and use of the allocation model that allows them to determine the productivity of the business, through the use of software for quantitative and qualitative models for the decision-making process, achieving greater business competitiveness. Similarly, Hernández and Moreno (2021) implemented a dashboard that supports decision-making in the distribution of machinery and raw material for bakery products, for the visualization of reports and to support the sales unit to make correct decisions (Table 9).

78.1% agreed on dimension D9 regarding the knowledge of models and criteria for making managerial decisions in risk scenarios, from which it can be inferred that the decision criteria are remarkable in the achievement of business objectives; that the expected monetary value (EMV) is useful in risk scenarios, just as Castellanos et al. (2018) stated, which shows that it is the long-run average value of any decision, in other words, the sum of the possible payments, each weighted by the probability of the payment occurring in the possible decisions. Likewise, the respondents pointed out that the expected loss of opportunity (ELO) are procedures with effective solutions in the managerial process; and regarding the expected value of sample information (EVSI) they indicated that it is advantageous for reading the quantitative models. Then, they agreed that the expected value of perfect information (EVPI) used is the difference between the expected gain to be obtained with information and without information for decision-making. In addition, as Begoña (2007) highlights, this modification can lead to an expense for trying to count information and how much we are willing to pay for it. Besides that, the interviewees stated that they agreed with decision trees being models to help analyze sequential decision and predict the results of the companies’ economy. Thus, Amaya (2009) argues that a decision tree is used in situations in which it is necessary to optimize a series or set of decisions. To end this dimension, it can be concluded that the interviewees pointed out that utility models and sensitivity analysis are decisive in the decision-making process during risk scenarios (Table 10).

In relation to project management knowledge, 76.2% agreed that the Project Evaluation and Review Technique (PERT) and the critical path method (CPM) are substantial for the management of project activities; similarly, Izar (2019) points out that these two techniques are tools for the elaboration of the project network and the definition of the deadline for its cancellation (Table 9).

Lastly, dimension D5 achieved 73.7% of agreement regarding the use of the simplex method to improve the managerial and operational decision-making process. With regard to the interviewees who stated that they "disagree", they amount to only 11.1%, which corresponds to dimension D7 (Project Management), followed by dimension D5 (Linear Programming II) with 10.4%.

Regarding the level of satisfaction, it can be seen in Table 10 and Figure 1.

Figure 1 Summary of the Dimensions that Make up the Variable in Decision-Making According to the Evaluation of the Representatives of the Companies of Chile and Peru, 2021

When analyzing by dimensions and the overall level of the decision-making process during the COVID-19 pandemic in the business sectors of Chile and Peru, one can find that the medium level stands out overall with 51.3% and the high level with 20.1%, amounting to a total of 71.4% of the interviewees, leaving 28.6% of these at a low level. Regarding each of the dimensions, the medium level has a higher percentage in 8 out of the 9 which contain the variable under study, being Dimension 1 the only one that presents a higher percentage at a low level that reaches 44.8%. Regarding the other dimensions, the highest percentage, as already indicated (mostly a medium level), can be found in the D5 with 56.3%, followed by the D7 with 53.4% and in the lowest percentage is in the D1 with 33.6%. For those at a high level, one can find that D6 and D2 have a high percentage at this level, reaching 34.4% and 31.5% respectively.

Discussion

After analyzing and determining the level of knowledge on how to apply qualitative and quantitative models in the decision-making processes of the business sector of the countries of Chile and Peru in the context of the COVID-19 pandemic, it can be concluded that the working hypothesis is partially accepted because it shows a trend from medium to low knowledge, that is to say 51.3% and 28.6% respectively (Figure 1); which agrees with Akyürek (2020) who points out that the change in style when managers make decisions depends on demographic characteristics, and that if you take into account age, sex, amount of time in their work position and overall working time, decision-making styles differ from each other. Similarly, Menegazzo et al. (2017) point out that the demographic characteristic of the manager and the use of information to support managerial decisions in micro and small enterprises are interrelated. It should be noted that, considering the sum of the percentages of levels, 71.4% of the surveyed businessmen, officials and employees have a medium to high level compared to 79.9% between medium to low, which marks a difference of 8.5% (Table 11), and agrees with what Espinosa (2016) states regarding the need for attitude and critical thinking for the systematization of models that help decision-making for any activity in a company.

| Table 11 Total Distribution of the Level of Satisfaction by Dimensions Which Make up the Variable in the Decision-Making Process According to the Evaluation of the Representatives of Chile and Peru | ||||||||

| Dimensions | Low | Medium | High | Total | ||||

| n | % | n | % | n | % | |||

| D1 | Techniques or tools | 172 | 44.8 | 129 | 33.6 | 83 | 21.6 | 384 |

| D2 | Classification | 106 | 27.6 | 157 | 40.9 | 121 | 31.5 | 384 |

| D3 | Managerial decision-making in a scenario of certainty | 84 | 21.9 | 195 | 50.8 | 105 | 27.3 | 384 |

| D4 | Linear Programming I | 97 | 25.3 | 200 | 52.1 | 87 | 22.7 | 384 |

| D5 | Linear Programming II | 101 | 26.3 | 216 | 56.3 | 67 | 17.4 | 384 |

| D6 | Linear Programming III | 67 | 17.4 | 185 | 48.2 | 132 | 34.4 | 384 |

| D7 | Project Management | 115 | 29.9 | 205 | 53.4 | 64 | 16.7 | 384 |

| D8 | Managerial decision-making in a scenario of uncertainty | 116 | 30.2 | 166 | 43.2 | 102 | 26.6 | 384 |

| D9 | Managerial decision-making in a risk scenario | 104 | 27.1 | 193 | 50.3 | 87 | 22.7 | 384 |

| Total Satisfaction | 110 | 28.6 | 197 | 51.3 | 77 | 20.1 | 384 | |

When evaluating the first specific objective of each of the dimensions of the decision-making variable, which according to the model are a total of nine, Figure 1 shows that all exceed the 73.7% in which businessmen, officials and collaborators have expressed that they agree with all the questions asked in this study; being the dimension Techniques or Tools the one that makes the difference with 96.6% of the total, who consider the use of qualitative and quantitative tools, but have to take into account what Blanco-Mesa et al. (2021) highlight in their article which clarifies that the incidence of the effect of decision-making is significant in the different organizations, which has led to the deployment of new procedures that access the analysis of all intrinsic and rational resources in various situations and contingencies in this process; followed by managerial decision-making in a scenario of uncertainty with 84.8%, being aware of the tables of results and losses in uncertainty scenarios used in companies. It is appropriate to point out that the representatives, officials and collaborators of these companies have indicated in a smaller percentage that they disagree, being the Techniques or Tools dimension the one that presents only 1%, followed by the managerial decision-making in a scenario of uncertainty dimension with 2.3%, as shown in Table 10.

In relation to the second secondary objective, it is observed that regarding the level of satisfaction for each dimension, eight (8) out of the nine (9) dimensions (Table 11) are in a medium level, highlighting the dimension five (D5) Linear programming II (56.3%) which indicates the importance of using the simplex method; while in those in a low level, the Techniques or Tools dimension stands out in a higher percentage (44.8%) not being satisfied with the qualitative and quantitative tools of decision-making; and in a high level the Linear Programming III dimension (34.4%) can be found, which emphasizes the use of the allocation model and software for these decisions.

From a grouping, one can have another visibility of the magnitude of the results, with six (6) dimensions having a medium to low level, those being the following in order: Project Management: PERT and CPM (83.3%); Linear programming II (82.6%); Techniques or Tools (78.4%), Linear Programming I (77.4%), Managerial Decision-Making in a Scenario of Risk (77.4%) and Managerial Decision-Making in a Scenario of Uncertainty (73.4%).

In the case of the dimensions in which the level orientation is displayed from medium to high, they are: Linear Programming III (82.6%); Managerial Decision-Making in a Scenario of Certainty (78.1%); Linear Programming I (74.8%) and lastly Classification of Model Types (72.4%). As reiterated by Solano et al. (2019), the decision-making process will improve if the operational technical part of the company adapts to the management of quantitative and qualitative models so that the higher decision makers can concentrate on performing other more relevant tasks within the company. To exemplify the models, Vázquez-Ramos et al. (2017) propose the design and creation of software for the evaluation of decision-making in school age regarding the sport of volleyball.

Conclusion

It can be concluded the decision-making process articulates with procedural, organizational, knowledge, taxonomic-moderating and environmental factors to make the different decision alternatives more effective, towards achieving the organization’s objectives, thus dynamically balancing the demands imposed by the environment and the need for the organization's system. There is an equal importance of having an ethical reference to guide the necessary and appropriate decision-making.

References

Amaya, J. (2009) Toma de decisiones gerenciales: Métodos cuantitativos para la administración. [Managerial Decision Making: Quantitative Methods for Management] 2a. Ed. Bogotá: Ecoe Ediciones.

Blanco-Mesa, F., León-Castro, E., & y Acosta-Sandoval, A. (2021) Strategic Decision-Making in Uncertain Environments [Toma de Decisiones Estratégicas en Entornos Inciertos]. Revista de Métodos Cuantitativos para la Economía y la Empresa. 30, 79-96.

Griffin, R.W. (2017). Administración [Administration] (10ª ed.). México: CENGAGE Learning.

Hernández, R.C., & y Moreno, H.B.R. (2021). “Implementación de un tablero para apoyar la toma de decisiones en el sector privado en la distribución de maquinaria y materia prima para productos de panadería” [Implementation of a dashboard to support decision making in the private sector in the distribution of machinery and raw materials for bakery products] Revista Ibérica de Sistemas e Tecnologías de Informacao. 2021(E42). 103-112.

Robbins, C. (2005). Un Empresario Competitivo Administración. México: Pearson educación. [A Competitive Entrepreneur Management Mexico: Pearson Education].

Rubio, O., Estrella, A., Cabre, L., Saralegui-Resta, I., Martin, M., Zapata, L., Esquerda, M., Ferre, R., Castellanos, A., Trenado, J., & y Ambas, J. (2020). Recomendaciones éticas para una difícil toma de decisiones en las unidades de cuidados intensivos debido a la excepcional situación de crisis por la pandemia COVID-19: Una rápida revisión y consenso de expertos. [Ethical recommendations for difficult decision making in intensive care units due to the exceptional COVID-19 pandemic crisis situation: A rapid expert review and consensus]. Medicina Intensiva, 44(7), 439-445.

Solano, E. L., Montoya-Torres, J. R., & Guerrero-Rueda, W. (2019). Un sistema de apoyo a la toma de decisiones para el enrutamiento técnico con ventanas de tiempo: un estudio de caso de una empresa de servicios públicos colombiana. [A decision support system for technical routing with time windows: a case study of a Colombian utility company] Academia Revista Latinoamericana de Administración, 32(2), 138-158.