Research Article: 2017 Vol: 21 Issue: 2

Liquidity, Profitability and Solvency of UAE Banks: A Comparative Study of Commercial and Islamic Banks

Mosab I Tabash, Al Ain University of Science and Technology

Hassan I Hassan, Al Ain University of Science and Technology

Keywords

Liquidity, Profitability, Solvency, Commercial banks, Islamic banks, UAE

JEL Classification: G21, G32

Introduction

The growth of any economy to a great extent depends largely on the performance of its banking sector. The banking sector works as intermediary linking two parties; who gave the funds and the other party who invested the funds for productive purposes and thereby contributing to economic development. In the financial world, there are two types of banks. One is called commercial banking sector and the other is called Islamic banking sector. The main difference between the two types of bank sectors is the philosophy in which the banking sector depends on. In Islamic banking sector, the interest rate is totally prohibited even it is small or large. Therefore, sometimes, it is called interest-free banking. In the other side, commercial banks are based totally on interest. So, it is called interest-based banks. Nowadays, Islamic banks and commercial banks are working together in a dual regulatory environment and there is a competition between them in attracting potential customers and fulfilling their expectations and developing new instruments and modes of financing which in turn benefits the economy in the long-term.

In the United Arab Emirates, the two types of banks are working together in a very competitive environment. Recently, Islamic banks enhance their position in the world and particularly in the UAE during the global financial crisis 2008. Islamic banks are partially affected by the crisis and outperformed than commercial banks (Athanasoglou et al., 2005; Tabash and Dhankar, 2014). Also, from another side, Islamic banks contributed positively to the growth of the economy of UAE (Tabash and Anagreh, 2017).

The United Arab Emirates (UAE) gives more attention and support for Islamic banking industry. For example, Dubai Emirate is working on to become a hub for Islamic finance industry in the world. The UAE government supports the Islamic banking industry growth through its strategic plan 2021 (Emirates Diary, 2015). Currently, there are twenty-three local banks and twenty-two international banks working in the UAE. Out of the twenty three local banks, seven are fully-fledged Islamic banks working under Islamic standards as appeared in appendix (1) and the rest banks have both system, Islamic and traditional operations (Emirates Diary, 2015).

Islamic banking sector accounts for 80% of total Islamic finance assets. Organisations like “Ernst & Young, 2015” and the Malaysia Islamic Financial Centre (MIFC) have predicted that the size of the Islamic finance market will reach U.S $3.4 trillion by end of 2018, whilst Pricewaterhouse Coopers (PwC) predicts a U.S $2.7 trillion market by 2017 (Islamic Finance Report, 2016). In the most of Middle East region countries, the assets of Islamic banking assets are growing faster than commercial banking assets. There are also a huge demand for Islamic banks products from non-Muslim countries like Malaysia, U.K, Germany and Hong Kong (World Bank report, 2015).

Liquidity, profitability and solvency are the different dimensions of the performance of any bank. Each of these dimensions is equally important as it plays a vital role in the maintenance of the bank financial viability. If the bank is financially viable it would be able to survive for a long time in the future. The 2008 global financial crisis has made a query on the persistent and increasing fragility of the financial institutions not only in U.S. but also at a global level. Banks have weak capital structure to provide liquidity to interested parties on time. Due to this capital structure, banks are often at the spot in the financial crisis (Diamond and Rajan, 2001). Therefore, the recent global financial crisis has brought to the surface the importance of bank performance and profitability both at national and international level.

The banks has an increasing significance in emerging countries because banks are the major source of finance and funding for the majority of firms and are main depository to encourage people for the saving (Athanasoglou et al., 2008). UAE banks are the major financial intermediaries as they are playing a vital role in the economic development of the country. UAE banks have performed well during the recent financial turmoil, as it is evident from its annual credit growth and profitability. In the light of using technology, new generation of both banking types have gained a reasonable position in the banking industry. In this competitive environment, it becomes essential to measure the performance of the banks especially of Islamic banks and commercial banks. So, the main focus of this study is to look into whether the performance of Islamic banks is different from the conventional banks with respect to profitability, liquidity and solvency in UAE and to determine the determinants of profitability for both Islamic and commercial banks.

The present study is divided into six sections. Section 1 gives an introduction of the study. Section 2 shows the objectives and hypothesis of the study. Section 3 describes the methodology used to analyse the data. Section 4 provides the relevant literature on the banking sector performance. Section 5 analyses the data and discusses the results. Finally, conclusion is given in section 6.

Objectives And Hypothesis Of The Study

The main objectives of the study are:

• To measure the liquidity of UAE Islamic and commercial banks over 2011-2014.

• To assess the profitability of UAE Islamic and commercial banks over 2011-2004.

• To evaluate the solvency of UAE Islamic and Commercial banks over 2011-2014.

• To compare the liquidity, profitability and solvency between Islamic and commercial banks of UAE.

• To measure the impact of liquidity and solvency on the profitability of Islamic and commercial banks of UAE.

Based on the objectives of the study, the following hypotheses are developed.

Hypothesis H1: There is no significant difference in the Liquidity between Islamic and Commercial banks of UAE

Hypothesis H2: There is no significant difference in the profitability between Islamic and Commercial banks of UAE.

Hypothesis H3: There is no significant difference in the solvency between Islamic and Commercial banks of UAE.

Data And Methodology

The present study is analytical in nature and based on secondary data. The data has been collected for Islamic and commercial banks of UAE. Data for Islamic banks is fetched from Islamic Banks and Financial Institutions database (IBIS). The data for commercial banks is fetched from Bank Scope database. The time period of the study includes 4 years ranging from 2011-2014. The sample of the study comprised of 7 fully-fledged Islamic banks and 14 commercial banks of UAE. Different financial ratios have been calculated to measure liquidity, profitability and solvency of UAE Islamic and commercial banks. Independent sample “t” test has been applied to compare the mean of liquidity, profitability and solvency of Islamic and commercial banks of UAE. Microsoft Excel, SPSS 22 and Views 7 are used to do all the tests and statistical analysis. The list of Islamic and commercial banks of UAE is on the appendix 1. Further, in this study, we will check the impact of liquidity and capital adequacy on the profitability of both Islamic and commercial banks in the context of UAE by using stepwise regression model. But before applying the regression analysis, data has been examined against outliers to be valid to the regression model. Therefore, correlation analysis has been done for all variables. As a rule of thumb, if the correlation coefficients between two regressors are less than 0.8, it means there is no multi-collinearity between variables. After correlation test, we can proceed to multiple liner regression models. The current study depends on using stepwise regression model to assess the relationship between ROA, donated as Y and two definite independent variables, denoted as LQ and CA. Researcher found one restriction during the data collection for the mentioned variables, which is unavailability of data for longer periods particularly for Islamic banks. The regression model for the three variables is written below.

Y (ROA)=α+β1 (LQ)+β2 (CA)+? (1)

Where,

ROA: Dependent variable to measure profitability of Islamic and commercial banks.

α: constant

β1-β2: Coefficients of independent variables.

?: Error term

LQ and CA: Independent variables to measure the performance of Islamic and commercial banking sector.

Ratios Used

• Profitability is a revealing indicator of the efficiency of the bank competitiveness in the market and quality of its management. Return on Assets (ROA) is a barometer of the performance of the bank that measures how efficiently the assets of the banks are being used. Higher the ratio indicates the better profitability of the bank.

• Liquidity is crucial for the banks because they are the specialized form of business that is engaged in borrowing and lending. Liquid assets to total assets represent the proportion of assets that bank has in the liquid or cash and cash equivalent. This ratio represents the cash management of the bank (Table 1).

• Solvency is related to the ability of the bank to withstand the shocks (Arena, 2005). Capital adequacy ratio is measured to ensure the capacity of the bank in meeting the losses. The higher the ratio, the more will be the protection of investors. Ratios used in this analysis are shown in Table 1.

| Table 1: Ratios Used | |||

| 1 | Ratio Category Profitability | Ratio Used Return on Assets | Ahmed et al., 2011 |

| 2 | Liquidity | Liquid Assets to Total Assets | Moore, 2010 |

| 3 | Solvency | Capital Adequacy Ratio | Büyük?alvarc? and Abdio?lu (2011) |

Literature Review

Profitability is a measure of efficiency and control of a bank. It indicates the efficiency and effectiveness with which the operations of the banks are carried out. Poor operational performance may be due to lack of control of the bank over the expenses which result into low profits. Liquidity in bank refers to ability of the bank to meet short term obligations as and when they become due for payment. Liquidity position indicates the ability of the bank to meet the current debts, efficiency of the management in utilizing working capital and the progress attained in the current financial position. Solvency of the bank refers to the ability of the bank to meet long-term obligations as and when they matured. Shareholders, debenture holders and long-term creditors like financial institutions are interested in solvency position of the bank. Solvency is also used to analyse the capital structure of the bank. This indicates the pattern of financing, whether long-term requirements have been met out through the long-term funds or not. Many studies have been conducted in the area of performance of commercial banks but in the area of Islamic banks, the studies are still limited. Some of the relevant studies are mentioned below.

Arena (2005) examined the bank fundamentals to find the reasons of bank failure. The study compared the 444 banks at Latin America and East Asia for the period of 1995-1999. The study concluded that the bank level fundamentals not only significantly affect the likelihood of bank failure but also explain the likelihood of failure for the failed banks. The study found that failed banks had fundamentals weakness in their asset quality, liquidity and capital structure prior to the onset of crisis. Further, Bordelean and Graham (2010) evaluated the relationship between liquid asset holding and profitability for a panel of Canadian and U.S. banks for the period of 1997-2009. Their study found that there is a non-linear relationship between liquid assets and profitability. The study concluded that profitability is improved for banks that hold some liquid assets but excess of holding liquid assets diminished the bank’s profitability.

A study of Kumbirai and Webb (2010) investigated the liquidity, profitability and credit quality performance of South Africa’s commercial banks for the period of 2005-2009. The study found that the global financial crisis had adverse effect on South African banks which had resulted into falling profitability, low liquidity and deteriorating credit quality of the banking sector. Moreover, European Central Bank (2010) in its report on EU banking structures concluded that Return on Equity (ROE) is not a good measure of bank performance. It is a part of performance as it reflects the level of profitability through equity capital. This approach had not proved adequate in the present volatile and competitive environment. ROE is not risk sensitive as it failed to discriminate the best performing bank from the other in terms of sustainability of their results during the recent crisis. The report concluded that the main parameter of bank performance must include earning, efficiency, risk taking and leverage.

In the year of 2011, Aremu evaluated the liquidity and asset management of Nigerian banks for the period of 1975-2009 using different liquidity ratios. Liabilities to Assets, Loans to Assets, Loans to Deposits, Cash to total liabilities and Log (total assets) are representing size of bank. The study found that out of three banks, two are more liquid than the third one. The study concluded that Central Bank of Nigeria (CBN) remains liquid at all times to avoid the liquidity crisis. In the same year, Khrawish (2011) identified the determinants of commercial banks performance in Jordan for the period of 2000-2010. The study found significant and positive relationship between ROA and bank size, total liabilities to total equity, total equity to total assets and net interest margin. The results showed negative relationship between ROA and annual growth in GDP and inflation rate of the commercial banks. The study concluded that internal factors are the major performance determinants of Jordanian banks in comparison to external factors.

Further, Olweny and Shipho (2011) assessed the effect of bank specific factors of profitability of 38 Kenyan commercial banks for the period of 2002-2008. The study found that bank specific factors like capital adequacy, asset quality, liquidity and efficiency related factors had a significant impact on profitability while none of the market factors had a significant impact on profitability on Kenyan banks. The study concluded that revenue diversification; reduction in operational cost can increase the profitability of Kenyan commercial banks. In a study of Buyuksalvarci and Abdio?lu (2011) who investigated the determinants of Turkish bank’s capital adequacy ratio and its effects on financial positions of banks. They used annual data fetched from bank’s annual reports for the years ranging from 2006-2008. They used Capital Adequacy Ratio (CAR) as dependent variable and nine independent variables like bank size, deposits, liquidity, leverage, loans, loan loss reserve, ROA, ROE and net interest margin. They concluded that loans, ROE and leverage have a negative impact on CAR while ROA has a positive impact on CAR. Further, they showed that bank size, deposits, liquidity and net interest margin have no influence on CAR of Turkish banks.

In the next year, Onaolapo and Olufemi (2012) analysed the effect of capital adequacy on Nigerian banking sector for the period of 10 years (1999-2008). Augmented Dickey Fuller (ADF) is used to test the stationary of time series data and pairwise Granger Causality is used to determine the co-integration between the variables. The study found that ROA, ROE and efficiency ratios did not significantly affect the capital adequacy of Nigerian banks. The study concluded that banks had to improve corporate governance, regulatory focus and personnel training to ensure sound financial health of commercial banks in Nigeria.

For Islamic banking studies, Adnan and Ramlan (2015) in their study titled as the profitability of Islamic and conventional bank: Case study in Malaysia showed that Islamic banks are more profitable than conventional banks in the context of Malaysian banking industry. Further, they concluded that Return on Equity (ROE) is a determinant factor for conventional banks; meanwhile ROE and ROA are determinant factors of profitability for Islamic banks in the case of Malaysia. Another study of Malaysia, Tarmizi and Wasiuzzaman (2017) in their study concluded that the capital and asset quality have an inverse relationship with bank profitability while liquidity and operational efficiency have a positive influence on Islamic banks. Further, Zahid, Hussein and Azizuddin (2016) examined the performance between Islamic and commercial banks in Malaysia. They revealed that Islamic banks are better than commercial banks in liquidity and profitability. Furthermore, Mohammed and Kamaruddin (2013) explained in their study also from Malaysia that the liquidity and capital adequacy for Islamic banks is better than conventional banks.

On the basis of above literature, it is identified that various studies have been carried out relating to the performance of commercial banks. Not many studies have been carried out to measure the performance of Islamic banks on different dimensions. Whether the commercial banks or Islamic banks are performing well on each dimension or there may be having a problem in any one or more dimensions of the performance of the banks. Thus, there is a literature gap which needs to be fulfilled. The present study is an attempt in this direction especially in the commercial and Islamic banks of UAE.

Results, Analysis and Discussions

Profitability, Liquidity and Solvency Ratios of Islamic Banks

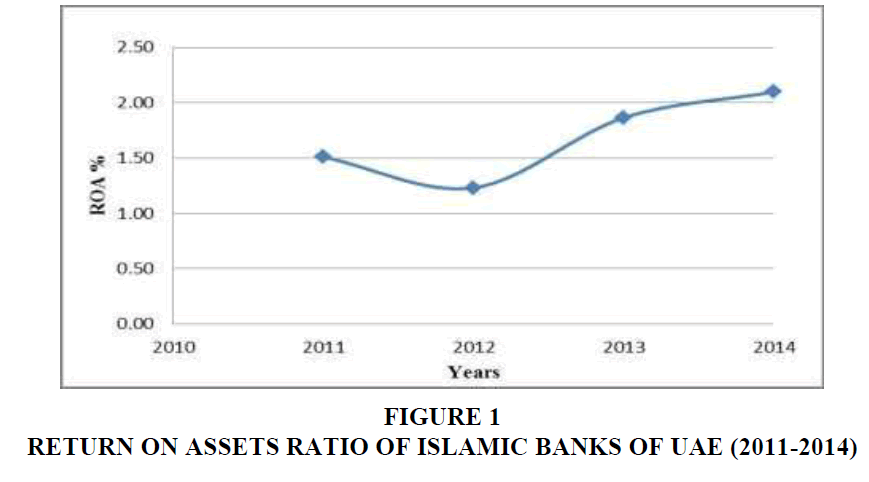

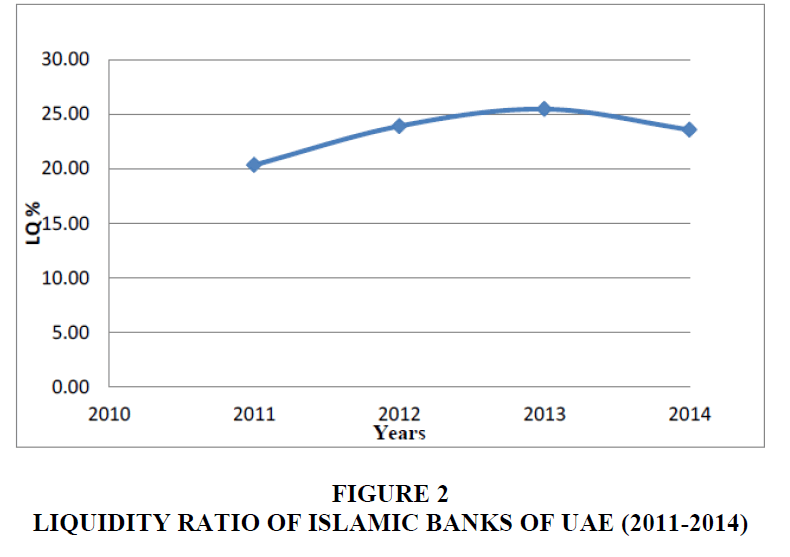

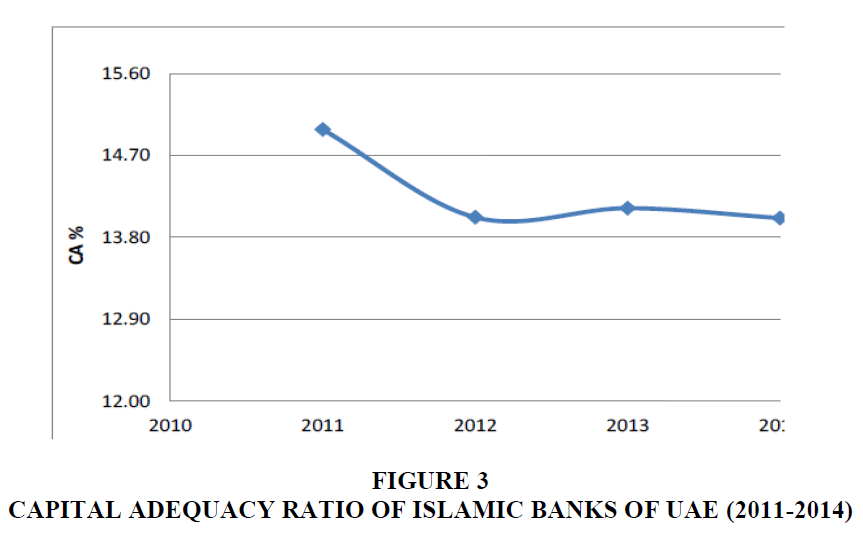

It is clear from Table 2 the average ratios for Return on Assets, Liquidity and Capital Adequacy ratios for fully-fledged Islamic banks of UAE over the period 2011-2014. Figure 1 shows the ROA ratio is increasing over time for Islamic banks in the UAE. It gives an indication that Islamic banks are performing well in generating profits of their investments. Figure 2 shows the liquidity ratio for the Islamic banks. We can notice from the figure that the liquidity of Islamic banks is stable over the study period. With respect to capital adequacy ratio, Figure 3 shows that the ratio is also stable for all fully-fledged Islamic banks in the UAE.

| Table 2: Ratios For Islamic Banks In Uae | |||

| Ratios | ROA % | LQ | CA |

|---|---|---|---|

| 2011 | 1.51 | 20.34 | 14.98 |

| 2012 | 1.23 | 23.90 | 14.02 |

| 2013 | 1.86 | 25.47 | 14.12 |

| 2014 | 2.10 | 23.58 | 14.01 |

Profitability, Liquidity and Solvency Ratios of Commercial Banks

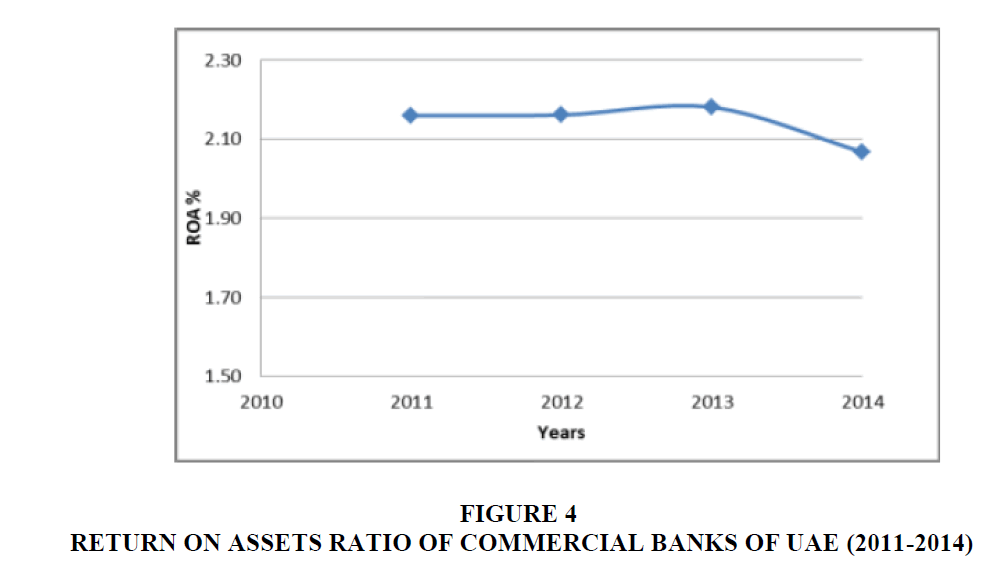

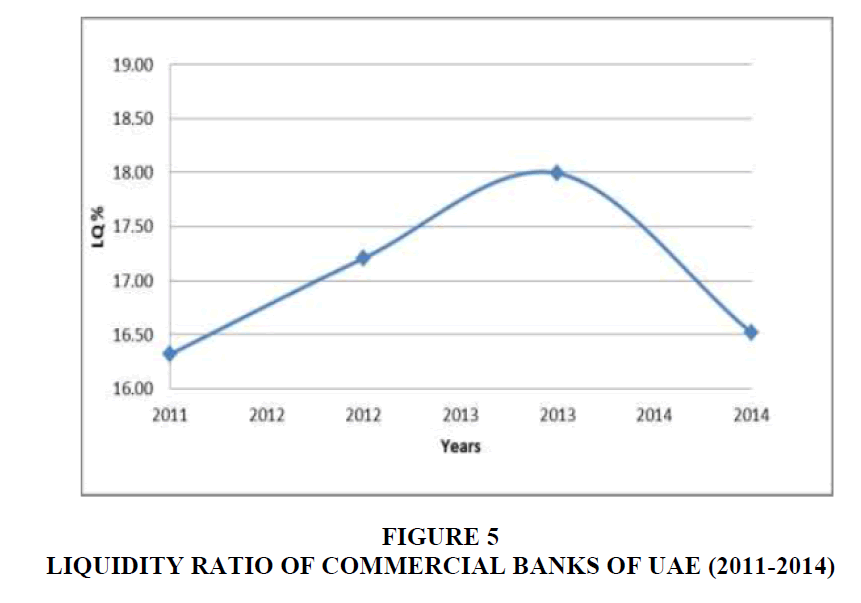

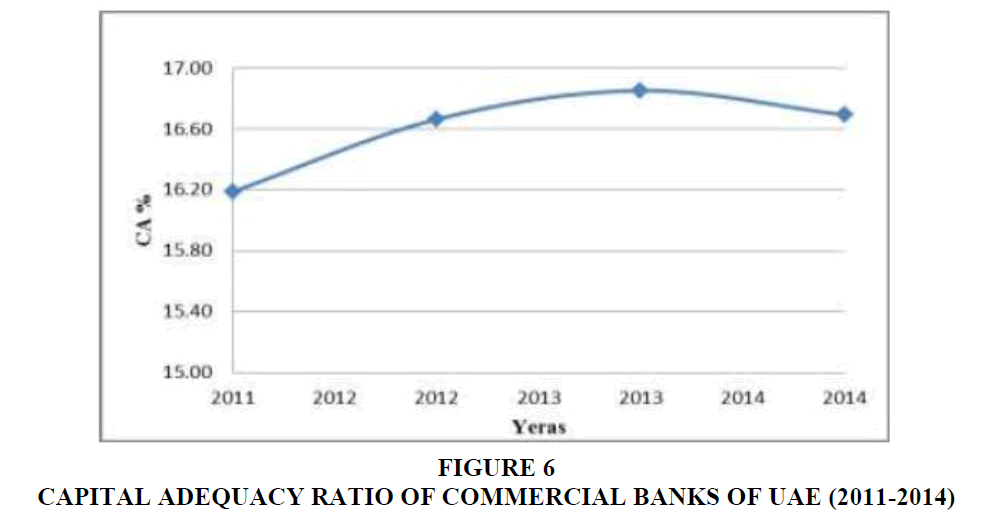

| Table 3: Ratios For Commercial Banks In Uae | |||

| Ratios | ROA% | LQ | CA |

|---|---|---|---|

| 2011 | 2.16 | 16.32 | 16.19 |

| 2012 | 2.16 | 17.21 | 16.66 |

| 2013 | 2.18 | 17.99 | 16.85 |

| 2014 | 2.07 | 16.52 | 16.69 |

Table 3 gives the average ratios for Return on Assets, Liquidity and Capital Adequacy ratios for commercial banks of UAE over the period 2011-2014. Figure 4 shows the ROA ratio is stable over time for commercial banks in the UAE. It gives an indication that commercial banks are different in their trend compared to Islamic banks. Figure 5 shows the liquidity ratio for the commercial banks of UAE. We can notice from the figure that the liquidity of commercial banks is not stable over the study period. With respect to capital adequacy ratio, Figure 6 shows that the ratio is increasing for commercial banks in the UAE.

| Table 4 : Descriptive Statistics For Both Islamic And Commercial Banks In Uae | |||

| 1. Islamic Banks | |||

|---|---|---|---|

| ROA | LQ | CA | |

| Mean | 1.68 | 25.54 | 14.28 |

| Median | 1.17 | 24.50 | 11.89 |

| Maximum | 6.76 | 38.84 | 24.95 |

| Minimum | -2.01 | 13.66 | 6.92 |

| Std. Dev. | 2.02 | 8.11 | 4.82 |

| Skewness | 1.39 | 0.05 | 1.29 |

| 2. Commercial Banks | |||

| Mean | 2.14 | 17.02 | 16.60 |

| Median | 2.06 | 14.50 | 16.22 |

| Maximum | 5.15 | 34.00 | 29.62 |

| Minimum | 0.57 | 6.00 | 9.84 |

| Std. Dev. | 0.96 | 7.32 | 4.61 |

| Skewness | 1.21 | 0.61 | 1.01 |

Descriptive Analysis and Comparison between Islamic and Commercial Banks

From the Table 4 below, it shows the comparisons between commercial and Islamic banks in the UAE. The Return on Assets (ROA) of Islamic banks is (1.68%) lower than commercial banks. The mean of liquidity ratio (LQ) for Islamic banks is 25.54% higher than the liquidity of commercial banks. This result supports the finding of Gunasegavan and Wasiuzzaman (2013) who found that Islamic banks are better than commercial banks in liquidity management. Islamic banks are doing better in liquidity due to its investment deposits in their sound financing activities as compared to commercial banks. The mean of capital adequacy ratio for Islamic banks (14.28) is lower than commercial bank’s adequacy ratios. The median is less than the mean for all variables for both Islamic and commercial banks which means the data are positively skewed.

Independent Sample t-test.

To know whether there is any significant difference in the liquidity, profitability and solvency of Islamic and commercial banks of UAE, t-test has been applied to check if there is a significant difference between the two kinds of banks. The level of significance is checked at 5 percent.

| Table 5: Independent Sample T Test | |||||

| Variables | Banks type | No. | Mean | t | Sig. |

|---|---|---|---|---|---|

| Profitability | Islamic | 7 | 1.68 | -2.421 | 0.013 |

| Commercial | 14 | 2.14 | |||

| Liquidity | Islamic | 7 | 23.22 | 5.532 | 0.225 |

| Commercial | 14 | 17.01 | |||

| Solvency | Islamic | 7 | 14.28 | -8.461 | 0.350 |

| Commercial | 14 | 16.60 | |||

The results of the Table 5 revealed that there is a significant difference in the profitability of Islamic and commercial sector banks of the UAE since p value 0.013 is less than 5% level of significance. So, the null hypothesis is rejected and we conclude that there is a significant difference in the profitability between Islamic and commercial banks in the UAE. For liquidity and capital adequacy ratios, the p values for both ratios are 0.225 and 0.35, respectively and it is more than 5% level of significance. Therefore, we can’t reject the null hypothesis and we can say that there is no significant difference between Islamic and commercial banks in the UAE.

Correlation

| Table 6: Correlation Matrix For Islamic Banks Variables | |||

| ROA | LQ | CA | |

|---|---|---|---|

| ROA | 1.00 | ||

| LQ | 0.41 | 1.00 | |

| CA | -0.24 | -0.61 | 1.00 |

| Table 7: Correlation Matrix For Commercial Banks Variables | |||

| ROA | LQ | CA | |

|---|---|---|---|

| ROA | 1.00 | ||

| LQ | -0.30 | 1.00 | |

| CA | 0.49 | 0.05 | 1.00 |

Table 6 and 7 show the correlation coefficients between explanatory variables. As a rule of thumb, multi-collinearity is to be considered as a big problem in the regression analysis if the pair-wise correlation coefficients between two regressors are in more than 0.8. It is clear from the Table 6 and 7 that the correlation coefficients between variables were less than 0.8. This indicates that there is no multi-collinearity between variables for both Islamic and commercial banks in the UAE. It is also clear from Tables 6 and 7 a positive and negative relationship between independent variables and dependent variables. For Islamic banks, it is clear that liquidity has a positive correlation with ROA, which means when ROA increases, LQ also increases. At the same time, capital adequacy has a negative correlation with ROA which indicates when ROA increases, CA decreases for Islamic banks in the UAE. The opposite picture is drawn for Commercial banks in the UAE as shown in Table 7.

Regression Analysis

| Table 8: Stepwise Regression For Islamic Banks | |||

| Stepwise Regression Output Analysis | |||

|---|---|---|---|

| Variables | Coefficients | t-Statistic | Prob. |

| Constant | -1.23 | -0.48 | 0.63 |

| lQ | 0.11 | 1.87 | 0.07*** |

| CA | 0.01 | 0.12 | 0.90 |

| R Squared | 0.17 | ||

| Adjusted R Squared | 0.11 | ||

| F-Statistic | 2.59 | ||

| Prob. | 0.09 | ||

****Significance at 5%, 10%

| Table 9: Stepwise Regression For Commercial Banks | |||

| Stepwise Regression Output Analysis | |||

|---|---|---|---|

| Variables | Coefficients | t-Statistic | Prob. |

| Constant | 1.13 | 2.46 | 0.02 |

| lQ | -0.04 | -2.93 | 0.00* |

| CA | 0.10 | 4.55 | 0.00* |

| R Squared | 0.35 | ||

| Adjusted R Squared | 0.32 | ||

| F-Statistic | 13.99 | ||

| Prob. | 0.00 | ||

****Significance at 5%, 10%.

The stepwise regression analyses for Islamic banks and commercial banks are shown in Table 8 and 9 respectively. It is clear from the results of Table 8 that liquidity is a significant determinant of the profitability of Islamic banks at 10% level of significance since p value 0.07<0.1. This result is consistent with other studies of Zahid, Hussein and Azizuddin (2013) and Mohammed and Kamaruddin (2013). For capital adequacy ratio, it is clear that the ratio is not significant since p value is higher than 0.05 level of significance. The R square is 17% which means that liquidity and capital adequacy are explaining 17% of the variations in the profitability of Islamic banks and the remaining 83% are explained by other factors not included in this study like asset quality, management quality, earning power and sensitivity to market risk.

The stepwise regression analysis for commercial banks is shown in Table 9. It is clear from the results that the liquidity is a significant determinant of the profitability of commercial banks at 5% level of significance since p value 0.0.00<0.05. Also, this result is consistent with other studies of Zahid, Hussein and Azizuddin (2013) and Mohammed and Kamaruddin (2013). For capital adequacy ratio, it is clear the ratio is also significant since p value is lower than (0.05) level of significance. This indicates that liquidity and capital adequacy are determinants of the profitability in commercial banks in UAE. The R square is 35% which means that liquidity and capital adequacy are explaining 35% of the variations in the profitability of commercial banks and the remaining 65% are explained by other factors not included in this study like asset quality, management quality, earning power and sensitivity to market risk. It is also indicated that the overall model is somehow good fit and the independent variables are jointly affecting the profitability of commercial banks in the UAE.

Conclusion

The current study gives insights into Liquidity, profitability and solvency of the Islamic and commercial banks in the UAE. Three important dimensions (Liquidity, profitability and solvency) of banks (Islamic vs. Commercial) which helped not only in evaluating the performance of these banks but also played an important role in determining the financial viability of the banks and as well economic development. The present study found that the mean for liquidity position is better of Islamic banks than commercial banks working in the UAE. Also, there is a significant difference between Islamic and commercial banks in terms of profitability. While, there is no significant difference for capital adequacy and liquidity between Islamic and commercial banks. The study concluded also that liquidity is a determinant factor for Islamic banks profitability. Furthermore, capital adequacy and liquidity are determinants of commercial banks profitability.

APPENDIX

| Appendix 1: List Of Islamic Banks Of Uae | |

| No. | Bank Name |

|---|---|

| 1 | DUBAI ISLAMIC BANK (DIB) |

| 2 | ABU DHABI ISLAMIC BANK (ADIB) |

| 3 | SHARJAH EMIRATES BANK |

| 4 | EMIRATES ISLAMIC BANK |

| 5 | HILAL BANK |

| 6 | AJMAN BANK |

| 7 | NOOR BANK |

| Appendix 2: List Of Commercial Banks Of Uae | |

| No. | Bank Name |

|---|---|

| 1 | EMIRATES NBD PJSC |

| 2 | NATIONAL BANK OF ABU DHABI |

| 3 | FIRST GULF BANK |

| 4 | ABU DHABI COMMERCIAL BANK |

| 5 | MASHREQBANK PSC |

| 6 | NATIONAL BANK OF RAS AL-KHAIMAH (P.S.C.) (THE)- RAKBANK |

| 7 | UNION NATIONAL BANK |

| 8 | COMMERCIAL BANK OF DUBAI P.S.C. |

| 9 | NATIONAL BANK OF FUJAIRAH PJSC |

| 10 | UNITED ARAB BANK PJSC |

| 11 | NATIONAL BANK OF UMM AL-QAIWAIN PSC |

| 12 | COMMERCIAL BANK INTERNATIONAL P.S.C. |

| 13 | BANK OF SHARJAH |

| 14 | INVEST BANK P.S.C. |

References

- Adnan, M. & Ramlan, H. (2001). The profitability of Islamic and conventional bank: Case study in Malaysia. Procedia Economics and Finance, 35, 359-367.

- Ahmed N., Ahmed Z. & Naqvi, I. (2011). Liquidity risk and Islamic banks: Evidence from Pakistan. Interdisciplinary Journal of Research in Business, 1(9), 99-102.

- Aremu, A.M. (2011). A perspective on liquidity and asset management of commercial banks in Nigeria: Evidence from some selected banks. Journal of Emerging Trends in Economics and Management Science, 2(6), 454-460.

- Arena, M. (2005). Bank failures and bank fundamentals: A comparative analysis of Latin America and East Asia during the nineties using bank level data. Bank of Canada Working Paper No. 2005-19, 1-57.

- Athanasoglou, P.P., Brissimis, S.N. & Delis, M.D. (2008). Bank-specific, industry specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money, 18, 121-136.

- Bordelean, E. & Graham, C. (2010). Impact of liquidity on bank profitability. Bank of Canada Working Paper No. 2010-xx, 1-24.

- Buyuksalvarci, A. & Abdioglu, H. (2011). Determinants of capital adequacy ratio in Turkish banks: A panel data analysis. African Journal of Business Management, 5(27), 11199-11209.

- Diamond, D.W. & Rajan, R. (2001). Liquidity risk, liquidity creation and financial fragility: A theory of banking. Journal of Political Economy, 10(9), 287-327.

- Earnest & Young Report. (EY, 2015). Competitiveness Report, accessed on: 04, Jan. 2016, can be reachable through the website http://www.ey.com/EM/en/Industries/Financial-Services/Banking/Capital-Markets/EY-world-islamic-banking-competitiveness-report-2014-15, accessed on 15 Oct, 2016.

- Emirates Diary. (2015). Islamic banks in UAE report. Available at http://emiratesdiary.com/uae-tips/list-of-islamic-banks-in-uae#ixzz4OOVVgTyg, accessed on 19 Sept 2016.

- European Central Bank. (2010). Beyond RoE - How to Measure Bank Performance, Appendix to the Report on EU Banking Structures, September, 1-44.

- Islamic Finance Report. (2014) Accessed through https://www.islamicfinance.com/2014/12/size-islamic-finance-market-vs-conventional-finance/ retrieved at 04 Nov, 2016.

- Kamaruddin, B.H. & Mohd, R. (2013). CAMEL analysis of Islamic banking and conventional banking in Malaysia. Business and Management Quarterly Review, 4(3), 81-89.

- Khrawish, H. (2011). Determinants of commercial bank performance: Evidence from Jordan. International Research Journal of Finance and Economics, 81,148-159.

- Kumbirai, M. & Webb, R. (2010). A financial ratio analysis of commercial bank performance in South Africa. African Review of Economics and Finance, 2(1), 30-53.

- Moore, W. (2010). How do financial crises affect commercial bank liquidity? Evidence from Latin America and the Caribbean, MPRA Paper No. 2010-21473, Munich: Munich Personal Re Pec Archive.

- Olweny, T. & Shipo T. (2011). Effects of banking sectoral factors on the profitability of commercial banks in Kenya. Economics and Finance Review, 1(15), 1-30.

- Onaolaop, A.A. & Olufemi, A.E. (2012). Effect of capital adequacy on the profitability of the Nigerian banking sector. Journal of Money, Investment and Banking, 24, 61-72.

- Tabash, M.I. & Anagreh, S.A. (2017). Do Islamic banks contribute to growth of the economy? Evidence from United Arab Emirates (UAE). Banks and Bank Systems, 12(1), 113-118.

- Tabash, M.I. & Dhankar, R.S. (2014). The impact of global financial crisis on the stability of Islamic banks: Empirical evidence. Journal of Islamic Banking and Finance, 2(1), 367-388.

- Tarmizi, H. & Wasiuzzaman, S. (2017). Profitability of Islamic banks in Malaysia: An empirical analysis. Banking and Finance, 6(4), 53-68.

- World Bank. (2015). Islamic finance report. Available at: http://www.worldbank.org/en/topic/financial sector/brief/Islamic-finance, accessed on 15 Sept, 2016.

- Zahid, Z., Hussin, S. & Azizuddin, A. (2016). Performance comparison of Islamic and commercial banks in Malaysia. AIP Conference Proceedings, 1782, doi:10.1063/1.4966070.