Research Article: 2022 Vol: 26 Issue: 1

Loan Pricing In Vietnamese Banks in the Transition Context

Thi Thu Hien Hoang, Banking Academy, Vietnam

Thu Thuy Pham, Banking Academy

Thi Thu Ha Do, Banking Academy, Vietnam

Citation Information: Hoang, T.T., Pham, T.T., & Ha Do, T.T. (2022). Loan pricing in vietnamese banks in the transition context. Academy of Accounting and Financial Studies Journal, 26(1), 1-13.Abstract

This paper, based on the guidance a theoretical model, and previous lietrature on loan pricing, examines factors that have most important impacts on how Vietnamese commercial banks decide their lending rates on the transition phase. The Basel II capital accord, which came into effects on Vietnamese commercial banks since beginning of 2019, had have certain impacts on the way in which Vietnamese banks calculate risks, which consequently contribute to the way in which banks decide their interest rates. With the suggestion of the theoretical model about the factors influencing interest rates, we use data of a leading commercial bank to examine how lending interest rates are influenced in the transition phase context. Results show that Vietnamese commercial banks traditionally price a loan based on durations of the loans, loan amounts, and and the value of collaterals. Our paper suggests that, accomplishing the model of internal credit ratings to effectively evaluate potential risks, thus pricing loans based on risks is of the most important steps for Vietnamese banks to approach standards of Basel II.

Keywords

Lending, Interest Rate, Loan Pricing, Basel II.

Introduction

The Basel I demonstrates the decisive role of equity capital in the safety of the entire banking system. The Basel Committee in Banking Supervision (BCBS) suggested that banks’ equity should account for at least 8% of the total risk weighted assets. Basel I, however, did not categorize assets by different risk levels, which is the gap for Basel II to fill. Thanks to the improvement in risk measurement, Basel II has been introduced with the purpose of tightening regulations on banks’ capital which is sensitive to risks (BCBS, 2004, p.2; Rapullo & Suarez, 2004).

Basel II includes the concept and rationale of three pillars. The first one presents total minimum capital requirement for credit, market and operational risks. The second pillar is about supervisory review process. The third pillar gives suggestions for market disciplines. Following that, banks using the framework are required to disclose all their information to inform the market about their exposures to risks.

Basel II presents different broad methodologies for calculating minimum capital requirements. The first one is the standardized approach, which measures credit risk with the support of external credit assessments. Alternatively, the Internal Ratings-based Approach (IRB) allows banks to use their internal rating systems for risk components in determining the capital requirement for a given exposure. The risk components include measures of probability of default (PD), loss given default (LGD), exposure at default (EAD), and effective maturity (M). Although being introduced as an improvement of its previous counterparts, Basel II still raises many questions for the worldwide banking systems. One of them is the impact of its capital requirements on the overall banks’ activities and particularly on credit services. The impact of such rules was evaluated in some cases of developed countries in which the adoption of Basel II was broad. However, the potential effect of the second accord in developing countries including Vietnam is still not examined. Vietnamese banks are on their journey to apply the Basel II accord, in which the adoption is expected not only in terms of standardizing the calculation of the minimum capital, but also in enhancing risk management capabilities of Vietnamese banks. Besides, using risk-sensitive methods on loan pricing is also a matter of consideration. Particularly, in the transition phase from the adoption of Basel I to Basel II, this paper examines factors which have impacts on loans’ prices of Vietnamese banks in order to suggest some suggestions for the improvement of banks in terms of their risk-based pricing (Catarineu-Rabell et al., 2005; Jiménez & Saurina, 2004).

The paper is structured as follows. Section 1 is for an introduction. Section 2 presents the theoretical background on loan pricing. Some notions of Basel II and its impacts on loan pricing following the Basel requirements is presented in Section 3. Section 4 shows an overview of Vietnam banking system. Data, econometric models, results are analysed in Sections 5 and 6, respectively. Finally, some concluding remarks are on Section 7.

Theoretical Background in Pricing of Bank Loans

Some Important Assumptions of the Theoretical Model

The paper illustrates a theoretical model about some decisive factors that have influences on banks’ lending interests. There are some assumptions involved. Firstly, a bank which is assumed to be “risk-neutral”, which makes decisions with a purpose of maximizing its expected profits. Secondly, the model assumes that the banking industry is operating in an imperfectly competitive market, in which a few number of banks serve a large number of clients.1 This is proved by Klein (1971) and Sealey (1980), and also was expanded in a study of Ruthenberg và Landskroner (2008). In this paper, we follow the model developed by Ruthenberg và Landskroner (2008) to evaluate the decisive factors of loan interest rates.

Commercial banks, which traditionally act as one of the most important intermediaries in the credit market, raising funds from the public and use the funds to give loans to their borrowing customers. This is the main task of any commercial banks, and main source of their income. Banks earn their income from the gap between the average borrowing and average lending rate, which the later is greater than the sooner, and it need to be calculated based on certain decisive factors (Boot & Thakor, 1994).

When it comes to interbank market, banks also act as both lending parties and borrowing partners. Some banks mobilise funds and do not fully use the funds to give loans, they can give loans to other banks that are in need. Some other banks do not raise sufficient funds from public to finance their lending, which leads to the use of loans in the secondary market. The other source of secondary funds for banks is from the central bank. One certain occasions, the central bank may give loans to banks using monetary loans or the discount window loans.

Additionally, it is compulsory for a bank to hold a certain amount of funds at the central bank. This is to fulfill the central bank’s requirements on the required reserves. Besides, banks need to maintain an amount of owners’ capital which should be at least equal to the minimum amount required by the central bank. As mentioned in the first section, one of the main goal of BCBS is to urge banks to hold enough owners’ capital as a cushion again all unexpected risks. These activities come at a cost to the banks as otherwise the funds are in required reserves and surplus owners’ capital should go to loans, which generate more income for the banks.

Detangling the theoretical model of the lending interest rate decisive factors

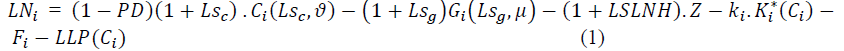

Assuming that the objective of a bank when making its decisions of mobilizing deposits from public (G) and lending (C) is to maximize its profits, then expected profit of the bank in the short term is as follows:

in which:

1.LNi is expected profit of bank i

2. PD is probability of default

3.Lsc is the average of the bank’s lending interest rate. The lending interest rate is related to risk-free interest rates (the minimum interest rate on the market) as specified:

4. where

where  is risk-free interest rate (e.g. yields to maturity of government notes) Hence,

is risk-free interest rate (e.g. yields to maturity of government notes) Hence,

1.  captures the demand function for bank loans;Ci is negatively affected by Lsc , and adjusted by a shift parameter ν, which represents some decisive factors of Ci. These are the macroeconomic factors, for example, changes in individuals’ income, and financial market situations. Changes in people’s income, which is called the income effect, may either increase or decrease demand for loans, according to whether the income effect is negative or positive. Besides, an effective an active financial market, may be an alternative of the credit market, which then reduces the number and amount of loans to be extended. This is called the substitution effect. It expected that the growth rate of loan outstanding volume is always greater than the growth rate of lending interest rates, thus we have the (a) equation. Finally, the parameter ν captures impacts of business cycles on loan demand. For example, the period of a positive economic growth often witnesses a high the demand for borrowing, which may increase banks’ lending revenue.

captures the demand function for bank loans;Ci is negatively affected by Lsc , and adjusted by a shift parameter ν, which represents some decisive factors of Ci. These are the macroeconomic factors, for example, changes in individuals’ income, and financial market situations. Changes in people’s income, which is called the income effect, may either increase or decrease demand for loans, according to whether the income effect is negative or positive. Besides, an effective an active financial market, may be an alternative of the credit market, which then reduces the number and amount of loans to be extended. This is called the substitution effect. It expected that the growth rate of loan outstanding volume is always greater than the growth rate of lending interest rates, thus we have the (a) equation. Finally, the parameter ν captures impacts of business cycles on loan demand. For example, the period of a positive economic growth often witnesses a high the demand for borrowing, which may increase banks’ lending revenue.

2. Lsg is the average interest rates of deposits

3.  is the supply function of the public’s deposits that relates (positively) to the own interest rate (Lsg) and is influenced by a shift parameter μ.

is the supply function of the public’s deposits that relates (positively) to the own interest rate (Lsg) and is influenced by a shift parameter μ.

4. LSLNH stands for the interbank lending interest rate

5. Z is the total amount of loans that a bank gives or receives in dealing with other banks the interbank market.

6. If Z is positive, which means the bank has a shortage of funds in the primary market, an therefore needs to make ends meet by borrowing from the interbank market or borrowing from the central bank using the discount-window. This activity comes at a cost for the bank, which is the interbank lending rate, and the discount interest rates charged by the central bank. In our model this is illustrated by

7. If Z is negative, which means the bank has excess sources in the primary market. This occurs when the amount of money which is mobilized from the primary market is greater than the amount which has been given to borrowing customers. In this case the bank invests the surplus funds in the secondary market by lending other commercial banks or buying some government bonds. This activity brings some income for the bank, which is captured by  in our theoretical model.

in our theoretical model.

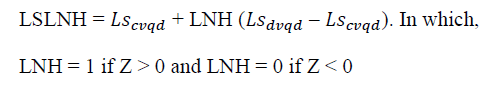

The interbank interest rate is formulated as:

Ki is the cost of the required capital in monetary terms Ki* is the cost of equity (required rate of return)

Fi is the operating cost function of the bank.

LLP(Ci) is the cost of loan loss provisions. This factor is estimated according to suggestions of Basel II. In our model it is assumed to be constant over the total loan sales in the short term.

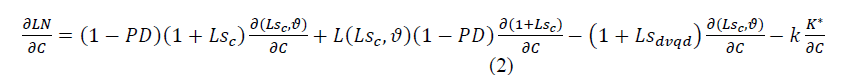

Provided that bank i with Z >0, which means the bank suffers a shortage of sources, the bank may access overnight borrowings. Taking the first derivative of LNi with respect to the amount of loans (C), yields the following.

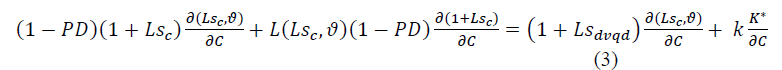

Let function (2) to be equal to 0, we found the bank’s loan volume at which the bank maximize its profit as the assumption given above, the equation (3) is yielded:

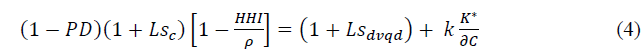

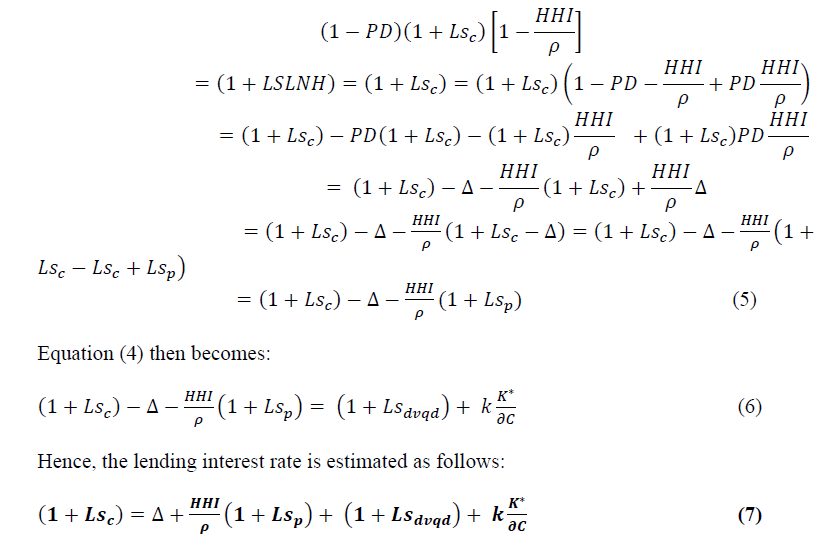

To calculate the lending interest rate at which the bank reaches its maximised profit, we rearrange (3) and sum over all banks, we have equation (4) as follows2

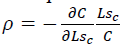

In equation (4), HHI is the Herfindahl-Hirschman index, which represents concentration in the credit market and degrees of competition among commercial banks. Accordingly, if HHI = 1, the market is monopolistic, and  is the elasticity of the demand for loans.

is the elasticity of the demand for loans.

Substituting  in (4) by Δ, which is the difference between the interest rate of a risky investment (Lsc)and the risk-free interest rate (Lsp), we have:

in (4) by Δ, which is the difference between the interest rate of a risky investment (Lsc)and the risk-free interest rate (Lsp), we have:

From (7), some factors that have influences on the lending interest rates are specified as:

1. The risk provision ( Δ) which is determined by the probability of default (of customers) and the bank’s expected profit

2. The risk-free profit (Lsp )

3. The concentration of the credit market (or the level of competition among banks) (HHI )

4. The market elasticity of demand for loans which is specific according to customers and the economic cycle ( ρ)

5. The interbank lending interest rates, the interest rate of discount-window borrowings determined by the central bank (  )

)

6. The cost of capital (equity) and the sensitivity of the required capital to changes in the amount of loans extended3

In this paper we focus on the first element, which is the risk of the customers. We try to find how banks in Vietnam decide the cost of the loan based on the risk of the customer.

Basel II and the Impact on Risk-Based Pricing in Banks

Basel II is introduced with three pillars, the following and improved of the first Basel Accord. This second accord allows banks to choose alternative approaches for calculating their required minimum capital for credit risk: i) The Standardized Approach which primarily uses external rating agencies to measure credit risk; and ii) The Internal Rating-Based approach (IRB) in which banks use their internal rating systems to assess potential credit risk.

The Standardized Approach revises and develops the risk weights built in Basel I (1988). The current range of weights of credit risk which is from 0% up to 100%, is changed from to 0% up to 150% under the new approach, and the weights are decided by an external rating agency.

The approaches offer different methods for calculating credit risks, hence the chosen approach determines the way a bank calculates its interest rates for loans. In the case of Vietnam, the Standardized Approach with the risk weights determined by the central bank is popular. Banks often quantifies risks of borrowers based on the borrower’s and loan’s characteristics. Amount of the loan, maturity, and secured status of the loan, are among the loan characteristics that have effects on the costs of the loan. Empirical evidence has confirmed this approach (Costello & Wittenberg-Moerman, 2011; Francis et al., 2012, Coleman et al., 2002). Longer duration loans entail higher risks, due to the reason that longer time means there would be more unexpected events occur, which may lead to higher probability of default. Besides, the intention of the customer may change negatively toward repaying, which is called moral hazard. Finally, banks have to incoporate the liquidity risk involved in funding long-term assets with short-term liabilities (Bhattarai, 2017).

Therefore, banks are compensated for longer maturity loans by requiring a higher interest rate. Loans with larger amount also possess more risk to the bank, as of the fact that if the custmer default, the bank makes larger losses. Basel II also suggests banks to diferentiate the risks given types of customers. Normally, business loans are considered lower risk compared to consumer loans because information asymmetries are more severe for individual customers than those of companies.

Vietnamese Banking System in the Transition Phase

From 2017 up to now Vietnamese banking system has been comprised of different ownership types. There are four government-owned banks with their owner’s equity comes 100% from the state budget. These are Agribank, GP Bank, Ocean Bank, and Construction Bank. There are 31 joint-stock banks,4 9 commercial banks which has 100% foreign capital, 2 join-venture banks, and 51 branches of foreign banks in Vietnam. Most Vietnamese commercial banks focus on retail business, so retail loans account for 90% of loan volumes of the whole system.5

The strength of Vietnamese commercial banks are traditional services such as providing deposit services, lending, and payment services. Nevertheless, some large commercial banks have expanded their activities to investment banking, mortgage banking, insurance services. The Vietnamese banking system is operated with a high level of concentration; the largest group of four over 51% state-owned commercial banks (Agribank, Vietcombank, Vietinbank, BIDV) accounts for 50% of the system’s total asset, and the HHI (Herfindahl-Hirschman) index of concentration is about 0.7.6

In terms of capital adequacy, all Vietnamese commercial banks meet the minimum capital requirement of 8%.7The average capital ratio of the whole system is about 12%, of which join venture and foreign banks are among the highest (about 24%) (see Table 1)

On the journey to fully adopt the Basel II Accord, the State Bank of Vietnam suggests an adoption procedure with two following stages:

Stage 1: Running a trial framework for a sample of 10 commercial banks including Vietcombank, VietinBank, BI V, B, Sacombank, Techcombank, CB, V Bank, VIB v Maritime Bank. The trial program is started in February 2016, and these banks are expected to basically meet all requirements of Basel II by the end of (Beck et al., 2018).

Stage 2: by 2020, all commercial banks should meet the minimum capital adequacy requirement of Basel II, and at least from 12 to 15 commercial banks successfully adopt fully Basel II requirements (The resolution of Vietnamese Government on the plan of restructuring the economy in the period of 2016 – 2020 in 8th of November, 2016).8

Data and Methodology

Data

To determine factors affecting the lending interest rates of commercial banks in recent years, data of the lending interest rates of a leading commercial bank in Vietnam were collected. We collected the data at the beginning of 2019 when Circular 13/TT–NHNN on the internal supervision of banks comes to validity. We asked the bank to provide information on credit contract details only, but not on details of the customers, therefore confidentiality of borrowers' information is ensured. We received a dataset contains 1670 observations, which are equivalent to 1670 loans. After deleting some observations due to missing information, the number of observations falls to 1489.9Information loan interest rates, loan terms, and other parameters, for which variables are constructed, are presented in Table 1.

| Table 1 Variable Descriptions |

||||

|---|---|---|---|---|

| Variable | Measurement | Name | Expected sign | |

| Dependent variable | Interest Rate | The average interest rate for individual customers (businesses) divided by loan value | INTEREST | |

| Independent variable | Loan amount | Loan amount is calculated based on the value stated in the credit agreements. The size of the loan is measured as the natural logarithm of the total loan amount. | LOANAMOUNT | - |

| Duration | Duration according to the length of time stated in the credit agreements | DURATION | + | |

| Credit guarantee | Dummy variable, valid 1 when the loan is secured, 0 if the loan is not secured | COLLATERAL | - | |

| Debt classification | Classification of loans which is based on the quality of the loan, there are 5 groups among which group 5 is non-performing loans. This categorization is according to the regulations of the State Bank | CREDIT CLASSIFICATION | + | |

| Type of customer | 1 if borrower is a business loan applied by a company, 0 if borrower is an individual asking for a consumer loan | TYPE | ||

| Purpose of the loan | Purpose of the loan, including secured loans for business, unsecured loans for business, secured loans for individual, and unsecured loans for individual | PURPOSE | ||

| Interest margin | Net interest income for the bank, which is the compensation for accepting the borower’s risk | INTEREST MARGIN | ||

We use a linear regression model to examine the factors that affect bank lending rates, the method used is least squares to estimate the parameters. Data are analysed using 14th STATA software.

Methodology

The main goal of this paper is to investigate the relationship that exists between the lending rate of commercial banks and each of explanatory variables that had been identified through literature and theories. Other than factors that are captured by the error term in the model, main explanatory variables include loan amount, loan duration, type of customers, collateral, and credit status. Hence we have the following function:

Interest rates =

Bank Lending Interest Rate: The main dependent variable used in this paper is the lending rate, which is measured by interest income from loans and advances as a fraction of total loans and advances (Asmare, 2014). Lending rates are the prices that borrowers paid when taking loans from the lenders and written in the credit contract. The lending interest rate on banks normally vary depending on the duration of the loan, value of collateral, type and risk level assessed by the bank. They can be adjusted according to the condition of the loan, for example, the bank can charge a higher interest rates if the client’s credit status worsen. In this paper, lending interest rates are collected from the bank’s database. They are the rates that the bank charge on their borrowers for using loans given by the bank. Because of confidentiality, we could only find several papers using the same kind of data (Mbao et al., 2014).

Analysis Results

Descriptive Statistics

Table 2 reports the description statistics. Loans in the sample have min value of VND 36 million (USD 1.600 equivalent) and max value of VND 14 billion (USD 640.000 equivalent). Loan amounts are quite small compared to those which provided by foreign banks due to the facts that most of customers served by Vietnam banks are individual and SMEs.

| Table 2 Variable Descriptions |

|||||

|---|---|---|---|---|---|

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| INTEREST | 1,489 | 0.1159967 | 0.0261052 | 0.039 | 0.201 |

| INTEREST MARGIN | 1,489 | 0.045755 | 0.0172045 | -0.04 | 0.09 |

| LOANAMOUNT | 1,489 | 455.9905 | 821.7053 | 0.03622 | 14140 |

| TYPE | 1,489 | 0.2323707 | 0.422486 | 0 | 1 |

| PURPOSES | 1,489 | 1.939557 | 0.7925053 | 1 | 4 |

| DURATION | 1,489 | 90.68838 | 82.22008 | 4 | 300 |

| COLLATERAL | 1,489 | 0.5775688 | 0.4941124 | 0 | 1 |

| CREDIT CLASSIFICATION | 1,489 | 1.120887 | 0.6058854 | 1 | 5 |

The borrowers have to pay interest rates as low as 3.9% and 20.1% per annum as the highest. Average interest rates of deposits for the same data period is 10%, which means the bank earns positive margin, which results in positive ROE and ROA. One interesting aspect is that the bank has rewarded customers who have low risks by giving them comparatively low or even negative margins.

Duration of the loan is about 90 months in average, with the shortest loan is 4 months and 300 months are the longest. Short term loans are normally for firms to finance their shortage in the cash flows. Almost 60 percent of individual loans have short term durations, which are used for households’ consumptions. Longer term loans are used to give customers longer time to finance their fixed assets.

In the sample, about 23 percent of borrowers are SMEs, to which loans are provided to help finance their current and fixed assets. 77 percent of clients are individual and households who borrow for their consumption needs.

Analysis of Correlation Coefficients

Table 3 reports the Pearson correlation matrix. Correlation measures the degree of linear association between variables. Table 3 shows the correlation coefficient between the dependent variables and independent variables. As can be seen from Table 3, lending interest rates have significant correlations with the rest of the variables.

| Table 3 Correlation Between Variables |

|||||||

|---|---|---|---|---|---|---|---|

| Margin Interest | Interrest Margin | Purposes | Loan Amount | Duration | Collateral | Credit Classification | |

| Margin Interest | 1 | ||||||

| Interrest Margin | 0.7853* | 1 | |||||

| Type | -0.5475* | -0.6393* | 1 | ||||

| Purposes | -0.1151* | -0.2788* | 0.8027* | 1 | |||

| Loan Amount | -0.3602* | -0.4842* | 0.4373* | 0.4373* | 1 | ||

| Duration | -0.2040* | -0.0214* | -0.5046* | -0.5046* | -0.0717* | 1 | |

| Collateral | -0.8295* | -0.8154* | 0.4448 | 0.4448 | 0.3726* | 0.3593* | 1 |

| Credit Classification | -0.0717 | 0.3108 | -0.0626* | -0.0626* | -0.0679 | 0.0819* | -0.1862* |

Except for credit status, lending interest rates are negatively correlated with type of customers, loan amount, purpose of the loan, duration of the loan, and collateral. This correlation shows that, when loan amount increases, the lending rate moves to the opposite direction. This is plausible because the costs per unit involved in marketing, screening, and processing a larger loan maybe smaller compared to that of smaller loans. Borrowers are firms have to pay lower interest rates than individuals who borrow consumer loans. This is because firms are considered as being lower risk than individuals as the latter often seen as lack of hard information for banks to assess their risks (Rose, 2017).

Collateral is highly correlated with interest rates, yet loan amount is not. This is very interesting because actually the bank considers collateral is a mean to reduce credit risks yet it does not give loans based on the value of collateral.

Interest rate and interest premium is highly correlated and move the same direction because the later is integral part of the former. If a borrower is risker, then he/she needs to pay a higher risk compensation to the bank, that leads to a higher interest premium, meaning a higher interest rate.

Multivariate Regression Analysis and Discussion of Results

We used STATA 14 software to perform multiple regression analysis, results show that 72% of the variance of lending interest rates is determined by independent variables of the model. The probability of F less than 5% indicates that R2 of the population is different from 0. Therefore, the linear model is suitable and it generate unbiased results.

The first specification shows a simpler model, and in the second specification more variables are added. Both specifications show clear results concerning the relationship between lending interest rates and their determinant factors.

The coefficients are strongly significant for all independent variables. The higher the loan amount and the longer the duration, the higher the interest rate. This means the bank considers it less risky to grant a larger loan. Besides, loans with longer durations are considered having higher default probability as the borrowers are exposed to more risks and their intention to repay may be deteriorate (moral hazard) in Table 4.

| Table 4 Regression Results |

||||

|---|---|---|---|---|

| Variable | Specification 1 | Specification 2 | Specification 3 | Specification 4 |

| LOAN AMOUNT | -0,004*** | -0,003*** | -0,003*** | -0,004*** |

| DURATION | 0.00008*** | 0,00004*** | 0,00003*** | 0,00006*** |

| COLLATERAL | -0,04*** | -0,04*** | -0,032*** | -0,04*** |

| CREDIT CLASSIFICATION | 0,003*** | 0,003*** | 0,005*** | 0,003*** |

| PURPOSES | -0,004*** | -0,002*** | ||

| Basel 1 | -0,56*** | |||

| Basel 2 | -0,042*** | |||

***Significant at the 0.01 level .

An interesting point of our results is that the loan amounts variable is statistically significant but negative in relation with interest rates. This means the higher the loan volumes, the lower the interest rates the borrowers need to pay. While the opposite is may by true due to the reason that the greater the outstanding the higher the expected loss it can be10. However, the larger a loan is, the costs involved in providing it, such as screening, monitoring, and other administration costs per VND lent should be lower, which explains a lower interest rate. Besides, greater loan volumes often go to bigger customers, where they own better and more transparent accounting information, which also reduces the costs in evaluating the customer’s creditworthiness, which also allows the client to borrow at a lower interest rate. A small beta means that loan amount may not cause much of the changes in the interest rates, however a negative sign shows that the larger the customers, the competitively lower the interest rates for them are.

As expected, loan durations are significantly positive. This means customers who ask for longer durations of loans are subject to higher interest rates. This is plausible in the sense that the longer the duration, the lower the probability for the bank to collect repayment. Projects of the customers are prone to risks and so the longer the time the likely the can be affected. Besides, the longer the time the willingness of the borrowers to repay may change and they may refuse to repay even when they have the mean. This is called the moral hazard effect (Stiglitz & Weiss, 1985).

Another documented result of the model is collateral. The results show that credit guarantee is positive and significant. According to the theory of asymmetric information (Akerloft, 1970; Stiglitz & Weiss, 1985) and the theory of the role of collateral (Besanko & Thakor, 1987). It is shown that collateral can help to reduce both negative consequences of information asymmetries, which is adverse selection and moral hazard. Therefore, collateral is considered a tool for banks to cover actual loss when the customers fail to repay. Consequently, collateral is a factor that contribute directly to reduce lending interest rates as it helps bank to cut costs by reducing loan loss provisions. However, there are studies show that, on the other hand, collateral may make the moral hazard issue more severe, as it may give the customers the incentives on paying back their loans fully, assuming that their assets would be taken away by banks anyway, and this situation worsen if the condition of the market for the assets is not good. The US subprime debts which triggered the great financial crisis of 2007 are good examples of increasing credit risks due to over-dependence on collateral. Therefore, the relationship between collateral credit risks, and lending rates is still ambiguous (Berger, 1990; Manove et al., 2001). However, it should be noted that one of the limitations of this study is that the number of observations is small, besides our measurement of the variable whether a loan is secured or not is a dichotomous one, which is rude and may not capture the characteristics of a secure loan, these may cause the insignificant results.

We found the same results for specification 2, 3, and 4. We add PURPOSE in specification 2, which shows how the purpose of the loan has some effects on the cost. The results shows a negative and significant coefficient, which means businesses are charged relatively lower interest rates compared to those on personal loans. Specification 3, with the addition of variable BASEL 1 - showing the effects of Basel II - confirms this result. BASEL 1 (TYPE * Interest margin) is a dummy variable that takes value of one if the customer is a firm and zero otherwise. The coefficient of BASEL 1 is negative, which means firms are considered lower risks compared to individuals. This result is in line with Basel 2, which suggests banks should consider risks differently between firms and individuals.This shows that commercial banks in Vietnam currently have different approaches to evaluate risks of consumer and business loans. It is expected that interest rates for business and individual consumptions should be heterogeneous, and so banks should change their traditional way of treating every loan the same under the Basel II context. The same results are found in specification 4 when we add BASEL 2 (TYPE * Interest rate).

Regarding model diagnostics, we run a Breusch-Pagan test to check the heteroskedasticity issue. This model yields a p value of 0,21 > 5%, meaning our model owns an uniform and constant variance. Therefore, we expect that our models generally generate unbiased estimates.

Conclusion

In this paper, we have analysed and examined how banks in Vietnam set prices for their loans to individual and business customers. Guided by a theoretical model, which shows the factors that contribute to loan prices, we used a set of data from a leading bank of Vietnam to test what factors have more influences on loan pricing. We found that Vietnamese banks have really set their interest rates on loans based on durations, amount of the loans, relationship with customers, and less on collateral. Our paper, hence, made contribution to theoretical background and empirical research about pricing of bank loans.

However, there are still some limitations in our study. Firstly, the empirical research is on one commercial bank which is insufficient to represent to Vietnamese banking system. Secondly, the data is imbalance in the number of retail customers and corporate customers, so it is not ideal to compare the factors on the two group of customers. Thirdly, variables of competition between banks, cost of the bank’s capital and some of macroeconomic variables are not shown in the model due to the limitation of data. We expect to include these variables into our upcoming research to improve the results.

Acknowledgement

1 See https://saylordotorg.github.io/text_introduction-to-economic-analysis/s18-01-cournot-oligopoly.html for more information about imperfect markets

2 We can see that equation 4 shows the balance between marginal costs (which is on the left of the equation) and marginal revenue (which is on the right). Firms reach their highest possible profits at this point.

3 Minimum capital is calculated based on three fundamental types of risks, which are credit risks, market risks, and operational risks, according to the Basel II Accord. If a bank extends its credit portfolio, this means its risk portfolio may be also extended, thus its owner’s equity may need to be increased accordingly.

4Including 3 joint stock banks which 51 percent is owned by the State budget

5https://www.sbv.gov.vn/webcenter/portal/vi/menu/trangchu/tk/hdchtctctd/tkmsctcb/tkmsctcb_chitiet?leftWidth=20%25&showFooter=false&showHeader=false&d

DocName=SBV373973&rightWidth=0%25¢erWidth=80%25&_afrLoop=12443697600898407#%40%3F_afrLoop%3D12443697600898407%26centerWidth%3D80%2525%26 dDocName%3DSBV373973%26leftWidth%3D20%2525%26rightWidth%3D0%2525%26showFooter%3Dfalse%26showHeader%3Dfalse%26_adf.ctrl-state%3Dzjgqpmild_268

6Roughly calculated by authors

7 Not counting banks which have negative owner’s capital

8 See https://sbf.neu.edu.vn/Resources/ ocs/Sub omain/sbf/Kỷ%20yếu%20Hội%20thảo%20khoa%20học%20“Áp%20dụng%20Basel%20II%20trong%20quản%20trị%20rủi%20ro%20của%20các%20NHT %20Việt%20Nam%20cơ%20hội,%20thách%20thức%20v %20lộ%20trình%20thực%20hiện”.pdf. Retrieved on 15 May 2019

9 Data are available upon requests.

10 The expected loss is calculated as EL = PD x LGD x EAD

References

Mbao, F.Z., Kapembwa, C., Mooka, O., Rasmussen, T., & Sichalwe, J. (2014). Determinants of bank lending rates in Zambia: A balance sheet approach. (Working Paper, WP/02)