Research Article: 2018 Vol: 22 Issue: 1

Macroeconomic Factors Affecting Performance of Insurance Companies in Malaysia

Noraini Ismail, College of Business Management and Accounting

Izzaamirah Ishak, College of Business Management and Accounting

Normaisarah Abdul Manaf, College of Business Management and Accounting

Maizaitlaidawati Md Husin, Azman Hasim International Business School,Universiti Teknologi Malaysia

Keywords

Gross Domestic Product, Consumer Price Index, Interest Rate, Return on Asset.

Introduction

Malaysia's economy grew stronger in the third quarter 2017 with Gross Domestic Product (GDP) surged to 6.2 percent, higher than 5.8 percent in 2016 (Department of Statistics Malaysia, 2017). In Malaysia, the strong GDP is influenced by many competitive and robust industry including finance and insurance.

General Insurance Association of Malaysia (PIAM), the Malaysian national trade association of all licensed direct and reinsurance companies for general insurance, which currently has 27 member companies mentioned that the general insurance has achieved a remarkable profit of RM1.530 billion in 2016, compared to RM1.464 billion in 2015 and RM1.488 billion in 2014. However, the profitability is reported declining in the first half of 2017. Several factors have been reported to associate with the reduction of insurance company’s profitability including the moderation in insurance subsectors. There are many factors associated with company’s profitability. These factors can be divided into two, which are internal and macroeconomic factors. Most of the previous studies have investigated the effects internal factors (Chen & Wong, 2004; Lai & Limpaphayom, 2003; Haiss & Sümegi, 2008). Thus, this study takes an initiative to examine macroeconomics factors that may strongly contribute to the company’s profitability. By understanding the factors, policymakers and associates in the industry may implement strategic actions for achieving and sustaining growth.

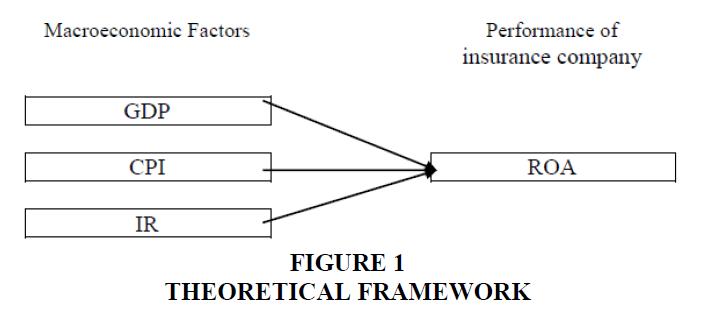

In this study used Gross Domestic Product (GDP), Consumer Price Index (CPI) and Interest Rate (IR) as macroeconomic indicators and the performance of the insurance company computed by Return on Asset (ROA). This paper would answer does macroeconomics factors give significant impact on the performance of the insurance company? The data were collected annually for 15 years from year 1996 until 2015 among 6-listed insurance companies in Bursa Malaysia.

Literature Review

The insurance industry is an integral component of the financial sector and plays an important role in the development of a nation (Cristae et al., 2014). The performance of an insurance industry has found to significantly relate to indicators of economic performance (Beck & Webb, 2003) and macroeconomics factors (Cristae et al., 2013).

Profitability, which is refers to the degree to which a business or activity yields profit or financial gain is an indicator of company’s success. Economic growth is one of the factors that significantly affect the company’s profitability (Ali et al., 2011). There are many indicators of profitability, including gross profit margin, operating profit margin, return on assets, return on equity and return on invested capital. Many factors have been associated with company’s profitability. Among the factors are gross domestic product (GDP), consumer price index (CPI) and interest rate (IR). The study on the effect of GDP, CPI and IR on profitability is prolific. For example, Kanwal & Nadeem (2013) empirically examined the impact of macroeconomic variables on the profitability of financial institutions from 2001 until 2011 and found that GDP has a significant positive effect on ROA, while IR has a negative relationship with ROA. In another study, Anbar & Alper (2011) found that GDP and CPI have a positive and significant effect on bank profitability, which were measured by ROA and ROE. Furthermore, Hailegebreal (2016) found that GDP has statically positive and significant relationship with the profitability of insurance industry.

Research Methodology

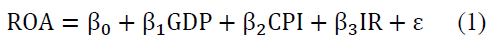

In this study, macroeconomic variables were represented by Gross Domestic Product (GDP), Consumer Price Index (CPI) and Interest Rate (IR). On the other hand, company performance was presented by Return on Asset (ROA). Data were collected from company’s annual report of six insurance companies listed in Bursa Malaysia from year 1996-2015. Pearson correlation coefficient and regression analysis were conducted to measure the relationship between variables. The findings were generated using IBM SPSS Statistics 24. Figure 1 shows the theoretical framework and equation 1 shows the multiple regression models.

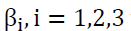

Where  the coefficient of the independent variables is,

the coefficient of the independent variables is,  is y-intercept and

is y-intercept and  is error terms occurs in the model. The hypotheses that being conducted in this research are:

is error terms occurs in the model. The hypotheses that being conducted in this research are:

H1a: There is a relationship between macroeconomic factors and performance of insurance company.

H2a: There is an impact of macroeconomic factors towards performance of insurance company.

Based on Table 1, at 10% significant level, there is a weak negative relationship between GDP, CPI and ROA with -31.6% and -29.0% respectively. Meanwhile, there is an insignificant negative relationship between IR and ROA because the p-value is a higher percentage than significant level. Thus, there is insufficient evidence to conclude that IR and ROA is associated.

| Table 1: Indicates The Result Of Pearson Correlation Of Coefficient For Roa | ||

| Variables | Pearson correlation coefficient | p-value |

|---|---|---|

| GDP | -0.316 | 0.001 |

| CPI | -0.290 | 0.002 |

| IR | -0.076 | 0.424 |

Table 2 shows R-squared is 0.155 or 15.5%. It indicates there is only 15.5% variance in ROA can be explained by macroeconomic factors. As overall, the regression model demonstrates all the macroeconomics factors significantly influence ROA at 90% confidence interval.

| Table 2: Statistics Value | |

| Measurement | Value |

|---|---|

| R2 | 0.155 |

| F-statistics | 6.742 |

| p-value | 0.000 |

By examining the regression analysis in Table 3, GDP and IR are a significant influence on ROA at 10% significant level except for CPI. It means CPI gives less impact on the performance of insurance company. Unexpectedly, GDP is negatively correlated to company performance. Therefore, the regression model is.

| Table 3: Coefficient Analysis |

||||

| Variables | B | Std. Error | t-Statistics | p-value |

|---|---|---|---|---|

| Constant | 192.037 | 82.764 | 2.320 | 0.022 |

| GDP | -38.550 | 19.830 | -1.944 | 0.054 |

| CPI | 0.423 | 0.348 | 1.215 | 0.227 |

| IR | -1.116 | 0.509 | -2.193 | 0.030 |

In conjunction with the hypothesis before, the discussion could be summarizing in below table (Table 4):

| Table 4: Summary Of Hypothetical Analysis | |

| Hypothesis | Findings |

|---|---|

| There is a relationship between GDP and ROA | Supported with negative relationship |

| There is a relationship between CPI and ROA | Supported with negative relationship |

| There is a relationship between IR and ROA | Fail to support with insignificant negative relationship |

| There is an effect of macroeconomics factors towards performance of insurance company | Supported with significant regression model |

Conclusion

This study found that GDP and CPI have negatively correlated to ROA. This relationship means that the higher the GDP of a country, the weaker the profitability of a company. Although this result is surprising, it is consistent with the findings from Haiss & Sümegi (2009) and Chen-Ying (2014). This study also found that the higher the inflation, which is measured using CPI, the smaller the profitability of a company. This finding implies that consumer prefers to save than spending money during inflation. On the other hand, IR is found to have an insignificant negative relationship with ROA. This finding implies that the performance of the insurance company is slightly associated with IR. In conclusion, this study found that insurance company’s performance is influenced by GDP and IR but not CPI as its give less impact to the company’s performance. This study suggests that further study should be taken to examine the relationship of financial ratio with the economic factor.

Acknowledgements

This project is financially supported by Bold Grant (10289176/B/9/2017/60) from Universiti Tenaga Nasional (UNITEN).

References

- Ali, K., Akhtar, M.F. & Ahmed, H.Z. (2011). Factors influencing the profitability of conventional banks of Pakistan. International Research Journal of Finance and Economics, 2(6), 235-242.

- Anbar, A. & Alper, D. (2011). Bank specific and macroeconomic determinants of commercial bank profitability: Empirical evidence from Turkey. Business and Economics Research Journal, 2(2), 139-152.

- Beck, T. & Webb, I. (2003). Economic, demographic and institutional determinants of life insurance consumption across countries. The World Bank Economic Review, 17(1), 51-88.

- Bourke, P. (1989).Concentration and other determinants of bank. Journal of Banking and Finance, 13(1), 65-79.

- Chen, R. & Wong, K.A. (2004). The determinants of bank insurance: Empirical validation in the Tunisian context. Journal of Risk and Insurance, 71(3), 469-499.

- Chen-Ying, L. (2014). The effects of firm specific factors and macroeconomics on profitability of property-liability insurance industry in Taiwan. Asian Economic and Financial Review, 4(5), 681-691.

- Cristea, M., Marcu, N. & Cârstina, S. (2014). The relationship between insurance and economic growth in Romania compared to the main results in Europe-A theoretical and empirical analysis. Procedia Economics and Finance, 8, 226-235.

- Felício, J.A. & Rodrigues, R. (2015). Organizational factors and customers' motivation effect on insurance companies' performance. Journal of Business Research, 68(7), 1622-1629.

- Hailegebreal, D. (2016). Macroeconomic and firm specific determinants of profitability of insurance industry in ethiopia. Global Journal of Management and Business Research, 16(7).

- Haiss, P. & Sümegi, K. (2008). The relationship between insurance and economic growth in Europe: A theoretical and empirical analysis. Empirica, 35(4), 405-431.

- Kanwal, S. & Nadeem, M. (2013). The impact of macroeconomic variables on the profitability of listed commercial banks in Pakistan. European Journal of Business and Social Sciences, 2(9), 186-201.

- Lai, G.C. & Limpaphayom, P. (2003). Product diversification, business structure and firm performance in Taiwanese property and liability insurance sector. Journal of Risk and Insurance, 70(4), 735-757.

- Nyamu, F. (2016). Doctoral dissertation, school of business. University of Nairobi.

- Oscar, A.J., Sackey, F.G., Amoah, L. & Frimpong, M.R. (2013).The financial performance of life insurance companies in Ghana. The Journal of Risk Finance, 14(3), 286-302.