Research Article: 2023 Vol: 27 Issue: 1S

Management Fraud Signals: Case of Saudi Arabia: Fraud Triangle Model

Abdulrahman A Al-Twaijry, Department of Accounting, College of Business & Economics, Qassim University, Saudi Arabia

Jamelah N. Alharbi, Department of Accounting, College of Business & Economics, Qassim University, Saudi Arabia

Citation Information: Al-Twaijry, A.A., & Alharbi, J.N. (2023). Management fraud signals: case of saudi arabia: fraud triangle model. Academy of Accounting and Financial Studies Journal, 27(S1), 1-19.

Abstract

Fraud is a complex phenomenon afflicting all business related parties. Fraudulent reports undermine the trust of information published in the financial market, causing massive operating investments and losses, and they could lead to corporate failure. It also hinders economic development, business growth and foreign investment. Preventing and detecting management fraud is an exceptionally important concern of corporate governance. In this study, we endeavor to develop and examine management fraud risk indicators in the light of Fraud Triangle Model. 28 fraud risk indicators were classified in equal numbers in four categories, which are pressure/motivation, opportunity, rationalization/justification, and societal-level. Subsequent to theoretical development, these indicators went through empirical examination. A questionnaire was designed to get feedback from auditors working for firms operating in Saudi Arabia. The total valid returned questionnaires were 179 (response rate = 51%). The respondents' mean analysis confirmed the importance of the 28 indicators as appropriate signals of management fraud risk (aggregate mean = 4.08 or 82%). The means of individual indicators ranged between 3.77 (75%) and 4.38 (88%). Pearson correlation analysis revealed significant correlation between each pairs of the four categories. Similarly, the great majority of individual indicators were significantly correlated with the other indicators in the same group. These results may confirm the appropriateness of these groups of management fraud risk indicators to the Saudi environment.

Keywords

Management Fraud, Fraud Triangle Model, Risk Indicators, Fraudulent Reports, Saudi Arabia.

Introduction

One of the major concerns of the latest Saudi Government has been how to clean the state of fraud and corruption. Part of the new Saudi strategy (2030 vision) has been to eliminate financial and managerial fraud and corruption. Consequently, the King of Saudi Arabia released a decree for establishing an anti-corruption authority (Nazaha) concerned with both individual and managerial fraud.

Previous research has suggested that management fraud, which is a deliberate act to obtain illegal gain (IFAC, 2009), is one of the most widespread economic crimes in the world. Anxiety of management fraud in reports has attacked shareholders and other stakeholders. This type of management fraud is related to releasing false information regarding the resources of the company (ACFE, 2018), something hard to be detected. Often, collusion exists between managers and other employees. Such complicity creates a capability to evade any internal controls (Moyes et al., 2013), and this sort of management fraud needs particular skills in order to conceal it (Yücel, 2013).

Both regulatory and professional bodies worldwide have been working seriously on promulgating a series of regulations and standards in relation to management fraud. For example, the International Standard on Auditing [ISA] 240, and the Statement on Auditing Standard [SAS] 99 focused specifically on management financial fraud. In 2017, the Saudi Organization of Certified Public Accountants (SOCPA) adopted the International Standard on Auditing 240 in an attempt to prevent management fraud and/or to detect it. This adoption was a consequence of the increase in the number of management fraud cases recently detected within Saudi Arabia. According to ISA240, both management and persons in charge of corporate governance are the principal officials responsible for the prevention and detection of management fraud. ISA240 also emphasizes the auditor's responsibility. It requires a reasonable assurance that the financial reports are free of significant misstatements due to error and/or fraud.

The purpose of this study is twofold: first, develop Fraud Triangle Model (FTM) to include culture as a fourth dimension, and second, rely on the developed FTM to work on the signals that could lead to management fraud discovery. Such signals are based on the management fraud model: pressure/motivation, opportunity, rationalization/justification, in addition to the fourth dimension related to culture. Auditors are more likely to detect management fraud if they have an adequate understanding about the motivations, opportunities, rationalizations, and cultural factors that could lead into management fraud.

Subsequent to the theoretical development of management fraud signals, an empirical examination was undertaken for the sake of an evaluation of fraud risk indicators. For this purpose, a questionnaire was designed to obtain feedback from corporate auditors working for firms operating in Saudi Arabia. The analysis was then extended to include Pearson correlations between each pairs of the four categories, and between individual indicators within each category.

Literature Review

In the eighties of the last century and after the prevalence of financial failures and the collapse of businesses, research turned towards management fraud. Some of these studies concentrated on identifying the common characteristics of fraudulent behavior in the management reports. Albrecht et al. (1984, 1986) is considerd to be one of the first significant studies on management fraud. Albrecht et al. (1986) aimed to clarify the utility of red flags in predicting fraud. Eighty-seven red marks were evaluated. The results indicated that one third of these red flags were related to management characteristics. Shortly afterwards, Pincus (1989) investigated the effectiveness of using fraud indicators to expose financial reports misleading from the auditors' viewpoint. This study concluded that only half of the respondents consider fraud red flags as an essential tool in the audit.

Some of the previous studies focused on investigating the importance and effectiveness of fraud indicators in detecting and preventing management fraud. For example, Apostolou et al. (2001) and Smith et al. (2005) endeavored to assess the importance of fraud risk indicators in the financial statements. Apostolou et al. (2001), in their exploratory study, found that fraud risk indicators associated with management characteristics were more important than red flags related to operational and financial stability characteristics, and industry conditions. Smith et al. (2005) found that Malaysian auditors recognized the importance of individual fraud indicators. They believed that the most important indicators were the financial, operational stability, and the impact of management characteristics on the control environment. Yücel (2013) also examined the level of effectiveness of the red flags on the eye of Turkish accountants. He recommended increasing attention to fraud indicators related to the corporate fraud opportunities. In the same context, Hijazi & Mahboub (2019) found that the red flags included in ISA 240 helped auditors in detecting management fraud in financial statements. Their results provided a positive relationship between pressure and fraudulent financial reporting. Based on the Lawshe approach, Huang et al. (2017) tested the validity of the content of each fraud indicator. They found pressure to be the greatest motivation for committing fraud. Magro & Cunha (2017) relied on the red flags to determine the risk of management fraud in credit unions. The study's results confirmed the prominence of fraud red flags used by internal auditors in operational activities and procedures related to internal control.

A number of studies relied on the analysis of the corporate financial reports to test the effectiveness of fraud risk indicators in predicting fraudulent reports. For example, in the United States, Elsayed (2017) examined the effectiveness of 18 fraud risk indicators related to financial performance, financial health, corporate governance, management efficiency and accounting practices. The results indicated that fraud risk indicators related to the size and independence of the board of directors, the ratio of sales to accounts receivable, days of inventory outstanding, total liabilities to total assets and the cycle of cash transfer were significant indicators of the existence of fraud in the financial reports. In china, Omidi et al. (2019) attempted to assess the efficiency of a proposed model consisting of 18 fraud risk indicators. The model was tested on the financial statements of 2,659 listed companies on the China Stock Exchange in 2015. Test results revealed that using the proposed model with the Synthetic Neural Networks (ANNs) approach classified fraudulent financial reports more accurately and effectively. In Germany, Baader and Krcmar (2018) developed an approach that combined the red flag approach with the mining process to detect fraud. By analyzing organizations' data, the researchers concluded that the financial model was used to reduce the number of positive errors incorrectly classified as a fraud act. In Malaysia, Ghafoor et al. (2018) identified factors that influenced corporate financial fraud issuance based on the Fraud Triangle Framework and ISA 240. The sample of the study was 76 fraudulent companies and 76 non-fraudulent companies, listed in the Securities Commission of Malaysia from 1996 to 2016. The results indicated that fraud in the financial reports increased with financial pressures and aggressive tax reporting. Rationalization results indicated that repeated irregularities and frequent changes by the external auditor increased the likelihood of fraud in financial reporting. In Taiwan, Lin et al. (2015) studied 576 Taiwan-listed companies from 1998 to 2010, and found that pressure/motivation and opportunity factors emerged as the most important factors in detecting fraud.

Another set of previous studies incorporated financial and non-financial risk indicators to predict erroneous reports. One of the recent researches in this field is Jan (2018). Jan aims to create a model consisting of a set of indicators of financial and non-financial fraud risk, to predict management fraud. The experimental results established that the proposed model was effective and supported the task of the auditors in discovering fraudulent financial reports and in raising the efficiency of financial markets. Song et al. (2014) proposed an improved framework for examining the risk of management fraud by integrating financial and non-financial factors using automated learning methods and the rule-based system. Their results confirmed that non-financial risk factors helped reducing errors.

Several other studies focused on examining the relationship between single indicators of fraud risk and fraudulent financial reports. Incentives and pressures were determined to be significant sources of fraudulent financial reporting. Examples of these incentives and pressures were the need for additional debt (Kassem, 2018), equity incentives for managers ( Li & Kuo, 2017; Hass et al., 2016 ), and tournament incentives for senior management (Haßa et al., 2015). Li et al. (2017) found that equity compensation for managers in low-growth companies increased management fraud. Haßa et al. (2015) evidenced that significant tournament incentives encouraged senior management to commit fraudulent operations.

Likewise, various studies have investigated the relationship between opportunity and management fraud. Previous ones have provided scientific evidence that opportunity inspired the management fraud. Examples of opportunities included weak internal controls, non-independence or ineffective board of directors and/or audit committee. Wilbanks et al. (2017) studied the impact of the independence of audit committee on the integrity of management and the effectiveness of fraud assessment on financial reports. They examined the social and professional relationships of the members of the audit committee with the executive director and CFO of the organization. The results of the survey, conducted on American public companies, suggested that the members of audit committee would reduce the measures and procedures for assessing fraud in financial reports to maintain social relations with managers. Weak internal controls are considered a great opportunity indicator of deceptive financial reporting. Donelson et al. (2016) found that weak internal controls at the entity level grant an opportunity for management fraud. Suh et al. (2019) investigated the impact of reducing opportunities on the occupational fraud in financial institutions. They found a significant relationship between a reduction of perceived opportunities and a decrease in the appearance of occupational fraud.

Rationalization factors have also been considered in previous management fraud research. A recent study by Shibley (2018) examined the rationalization factors used by unethical management attitudes to recruiting other employees to carry out fraud. Pacheco et al. (2017) used a regression model to classify the consequences of timing the change of the external auditor. They found evidence that the change of the external auditor at the end of the year indicated pressures of poor financial performance and reports of financial losses increase the risk of management fraud. Mayhew & Murphy (2014) conducted a survey on rationalization factors and found that most employees justify their fraud behavior by dumping the responsibility on the administration and doing what they are ordered to do.

Factors at the Societal-level are considered one of the most important dynamic factors affecting individuals. The prevailing culture about collectivity and individualism has a profound impact on the behaviors. Many studies have examined the impact of the collective dimension and religion on organizations. Kanagaretnam et al. (2014) studied the conservatism and risk avoidance using 70 international banks. The results indicated that the areas with a high degree of collectivity avoided risks and produced conservative financial reports. Xu et al. (2017) empirically examined the impact of religion on the corruption cases at the provincial level in China from 1998 to 2009. They reported that religious culture was negatively correlated to fraud and corruption. Elghuweel et al. (2017) reached the same conclusion after examining the impact of Islamic governance on profit management. However, no studies were found on the societal fraud indicators, and thus our research could be considered the first study to include societal-level factors as indicators of management fraud risk in the business sector.

Conceptual Framework

One of the major dominant frameworks relating to fraud is the “Fraud Triangle Model (FTM)”. The term “fraud triangle” was first existed in the mid of the 20th century (Cressey, 1953). During the last two decades, the FT model was very well recognized in both professional and academic publications. For example, FTM is embedded in professional auditing standards around the world (i.e. PCAOB, 2005; IAASB, 2009, SAS99, ISA240, ASA240). On the other hand, FTM has been widely discussed in academic accounting textbooks (Ozkul & Pamukcu, 2012) and academic research. Simbolon et al. (2019); Abbas & Fatika, (2020); Ramdany et al. (2021) are examples of recent studies focusing on FTM. Fraud Triangle is, as well, the most commonly taught framework in both forensic accounting and fraud examination courses in many countries, including USA, UK, and Australia (Smith & Crumbley, 2009).

FTM comprises three circumstances, which are argued to present when a management fraud occurs. These three conditions are (1) the pressure or incentive, (2) the opportunity, and (3) the attitude. The pressure shall provide a motive to commit fraud when there is an opportunity. Opportunity occurs whenever there are weaknesses in internal controls or there are abilities to override it. The attitude is necessary to enable the individual to rationalize the fraud commitment.

Even though the widespread dissemination of FTM, this model has been the subject of substantial debates and criticisms (Free, 2015). These criticisms encouraged researchers either to develop FTM to include further dimensions or adopt different models. For example, Wolfe & Hermanson (2004) proposed a fourth dimension of capability, Marks (2009) made additional two dimensions of arrogance and competence, Goldman (2010) added personal greed and employee disenfranchisement to the model, Cieslewicz (2010) discussed the importance of the notion of societal influences, Said et al. (2017) integrated ethical values into FTM. Ramamoorti (2008) connected the fraud triangle with routine activity theory, whilst Dorminey et al. (2010) suggested a number of acronyms (MICE), which are money, ideology, coercion and ego/entitlement, as factors of an alternative model.

Pressure/Motivation

The pressure indicators draw auditors' attention to fraudulent processes in the risk assessment process (Desai, 2008). Due to their association with fraud (Al Amin, 2017), the pressure factors and incentives are highly effective in detecting fraud in financial reporting (Lin et al., 2015). Management may resort to fraud when faced with financial pressures (Ghafoor et al., 2018; Huang et al., 2017), poor financial performance or intense competition combined with low profitability (Huang et al., 2017; Lin et al., 2015). Equity-related bonuses and remuneration may also be a trigger for fraud (Hass et al., 2016; Li et al., 2017). Managers take fraudulent behavior to raise the share price and then increase the value of their shares.

The pressure can be divided into three sections: pressures associated with financial and competitive conditions, performance pressures and pressures related to the financial position of the administration. The following list contains 7 indicators of pressure and incentives for management fraud:

1. P1 - The intensity of competition between companies with deteriorating levels of profitability.

2. P2 - Management under-reporting the company's revenue to avoid taxes and Zakat (the wealth tax).

3. P3 - Management's use of inappropriate policies to increase share prices in the Saudi market.

4. P4 - Poor financial performance that affects the company’s transactions and contracts with others.

5. P5 - Significant financial benefits for management in the company.

6. P6 - Management compensation linked to company profits.

7. P7 - Significant pressure on management and employees to meet specific financial targets.

Opportunity

Signals of management fraud risk related to opportunities mean all conditions that facilitate fraud, such as weak internal control. Opportunities exist when there are no proper monitoring and control mechanisms in place (Donelson et al. 2016; Loebbecke et al., 1989; Othman et al., 2015; Ghafoor et al., 2018). The absence of opportunity prevents managers from committing fraud, even if they are under pressure. Restricting opportunities comes under corporate control. However, in many cases management can override even authentic internal control. The opportunity to commit fraud is often associated with the ability to override controls and conceal fraud.

According to the Theory of Planned Behavior, an individual commits fraudulent behavior when he or she has a sufficient capacity to do so. Opportunity indicators are definately important in the disclosure of false financial reports (Moyes et al. 2006; Dellaportas, 2013). Opportunity factors are essential signals of management fraud (Yücel, 2013), since the fraudster is often looking for company weaknesses to exploit in order to commit fraud.

In this study, the following were the 7 indicators of opportunity related to the operational conditions, the company's control environment and its governance mechanism:

1. O1 - Control by a single person or a small group over the primary functions of an enterprise.

2. O2 - Unclear lines of authority and responsibility (complex organizational structure).

3. O3 - Ineffective internal controls.

4. O4 - Poor supervision by the board of directors and audit committees.

5. O5 - No separation of duties of the CEO and chair of the board of directors.

6. O6 - Having huge transactions with related parties.

7. O7 – Accounting estimates that have a material impact on the company, according to the professional judgment of the accountant.

Rationalization/Justification

Indications of management fraud risk related to justification/rationalization are associated to the personal or moral attitudes or values of the individual that allow him or her to commit fraud, which arises from weak ethical principles. Fraud perpetrators often resort to justifying their actions to get rid of all negative emotions and their conviction that they are honest and their actions are moral. The rationalization process takes place in an individual’s thinking, which precludes controls or observations (Huang et al., 2017), and accordingly, the decisive factor in the process of justifying unethical behaviors is the level of integrity and ethics possessed by the individual as the Planned Behavior Theory has visualized. Whenever rationalization/attitude indicators emerge, the likelihood of fraud is higher (Said et al., 2017; Yusof, 2016).

The most important signals of management fraud are attitudes and behaviors associated with aggressive and dishonest management (Shibley, 2018). A recent change of the auditor could indicate a strained relationship between the auditor and the firm’s manager(s), indicating the potential for fraudulent reporting (Ghafoor et al., 2018; Roden et al., 2016).

In our study, we have determined the signals of justification or rationalization in the management fraud by looking at both management attitudes and behavior and the relationship between the corporate management and auditors. The following list consists of 7 signals in this category:

1. R1 - Lack of management support for ethical behavior.

2. R2 - Increased management justifications for accounting policies options and estimates that have significant effects on accounts.

3. R3 - History of penalties or lawsuits against senior management or the directors for fraud or other violations,

4. R4 - Management imposes unrealistic restrictions and demands on the auditor, such as requiring the auditor report in record time.

5. R5 - Significant errors in previous audits.

6. R6 - Selection of accounting policies and estimates by non-financial managers excessively.

7. R7 - A constant change of auditors by management and the presence of disputes related to the application of inappropriate accounting and auditing principles.

Societal-level

As in the differences between individuals and organizations, each society has its own features that include values, customs, norms, beliefs and standards that contribute to defining perceptions of behaviors (Cieslewicz, 2012), and the way individuals think about their social phenomena and problems (Al Muhtami, 2015). The culture of societies determines the nature and type of appropriate or inappropriate values and behaviors. It is obvious that individuals’ behaviors and decisions are affected by their culture and values.

Religion is the driving mechanism for the cultures of societies in some countries. It has a powerful influence on the identity of individuals and their decisions (Weaver & Agle, 2002). Religious people are characterized at a high level of values and ethics (Conroy & Emerson, 2004), and the moral values of an individual are related to religion (Arli, 2017; Kara et al., 2016). Recent studies found an impact of religion on organizations. For example, (Li et al., 2019). Bjornsen & Omer (2018); Chircop et al. (2017); Du et al., (2015), argued that religion had significant influence on personnel, reports and practices. They found that companies located in strong religious areas provide high-quality and more conservative financial reports. They concluded that religious principles were negatively related to risk or fraud behavior.

Traditions and customs of societies differ from one nation to another. In some cases, they are distinguished by group, tribal affiliations, and/or clans, and in some others, they are distinguished by individualism. In tribal societies, reference groups affect individuals, which result in intercession, bias, and nepotism to be common among the followers. This may lead to bypassing to regulations meet the interests of the group. It is possible that some individuals resort to giving priority to the interests of relatives over the interests of others, or even to the interests of the company itself. Such practices are not expected to exist in the individualized societies. In some societies, secrecy and opacity are integral parts of their traditions. These negatively affect the disclosure and transparency and prevent the success of many legislations and laws.

Societal aspects are vital indicators to be included when studying management fraud. Saudi Arabia is considered, on one hand, to be tribal and clannish, and a religious country, on the other hand. Islam, which is the country’s religion, prohibits fraud, corruption, falsehood, and orders its followers to be honest, fair, and truthful. In our study, we will take into consideration indicators related to both the Islamic Sharia and social ties. The following list contains 7 risk fraud flags related to society:

1. S1 – Lack of administrative support of Islamic values, religious activities, and good morals among employees, such as rewarding honesty and refusing gifts and bribes.

2. S2 - Lack of commitment of the administration to pay zakat and contribute alms/donations (Sadakat).

3. S3 - Lack of the honesty and integrity of the administration and evading the disclosure of information required by the auditor.

4. S4 - Friendship or kinship between the management and members of the audit committee, the board of directors or the employees.

5. S5 - Personal links with clients who have many dealings with the company.

6. S6 - Management's choice of leaders and unqualified employees based on nepotism.

7. S7 – Granting of promotions and privileges based on kinship and friendship with the same family, region or sect rather than merit.

A total of 28 management fraud risk indicators were developed in the above discussion. These signals are expected to help management fraud investigation and be a strong tool for corporate governance. Even though these indicators were theoretically found to be significant for management fraud risk assessment, examining their importance in fraud detection is vital. Auditors are the best group of the corporate governance to justify the degree of importance of each of these 28 indicators. Therefore, a questionnaire was designed to acquire the feedback of corporate auditors working for firms operating in Saudi Arabia.

Questionnaire Design and Distribution

A questionnaire was designed for the purpose of examining the indicators' competence for management fraud detection. In addition to the 28 indicators, which were presented using the Five Likert Scale (5 = strongly agree, 1 = strongly disagree), there were questions about demographic data of the study sample. Mainly the questions were closed ended. However, the respondents were given the opportunity (open ended questions) to add comments if they so wished.

After the initial design, the questionnaire was edited by 7 experts. The Alpha Cronbach coefficient was calculated to measure the reliability of the questionnaire. The values ranged between 0.79 and 0.93, which suggested that the questionnaire had a high reliability degree. We also calculated Pearson's Correlation Coefficient to test the internal consistency of the questionnaire. The values for all the 28 questions were above 0.60 (average about 0.75), and all the correlations were significant at 0.01.

A sample of 350 individuals was randomly selected from auditors working for firms operating in Saudi Arabia. The valid returned questionnaires were 179 (response rate 51%), which were suitable for statistical analysis.

Demographic Data

The number of Saudi nationals in the responding sample was 129 (72%), whilst 50 (28%) were from other different nationalities. The distribution of the study sample according to the auditor's job showed that 89 were auditors while 52 were audit managers or in higher positions. The remaining 38 were assistant auditors or in lower positions. More than 40% of the responding auditors worked for large firms, while about one third were working for mid-size firms. The remaining 25% were working for international firms. The great majority of the sample (72%) had bachelor's degrees, whereas 44 (27%) respondents had degrees higher than a bachelor's. 58% of the study sample had one or more professional certification(s). That of Certified Fraud Examiner (CFE) was held by 30 auditors (17%). Other mentioned professional certifications were CIA, CPA, ACCA and SOCPA.

Nearly 50% of the study sample respondents had experience in the discovery of material misstatements in the financial reports with the intent to defraud. The answers to the question about whether the respondent had received training courses about management fraud, 150 said yes, of which 55 had received intensive training courses.

Managerial Fraud Risk Indicators Evaluation

The experimental evaluation of the extent of the importance of the 28 fraud indicator will be discussed in the following sections. Indicators in each category (pressure/incentive, opportunity, rationalization/justification and society-level) are ranked based on the mean starting with the highest indicated indicators by the study sample. We first look at the aggregate means in the categories, as presented in Table 1.

| Table 1 The Mean and S.D. of Indicators in each Category and Overall | ||

| Fraud Risk Category | Mean | Std. Deviation |

| Pressure/incentive | 4.07 | 0.53 |

| Opportunity | 4.18 | 0.56 |

| Rationalization/justification | 4.03 | 0.60 |

| Society-level | 4.03 | 0.57 |

| Overall | 4.08 | 0.46 |

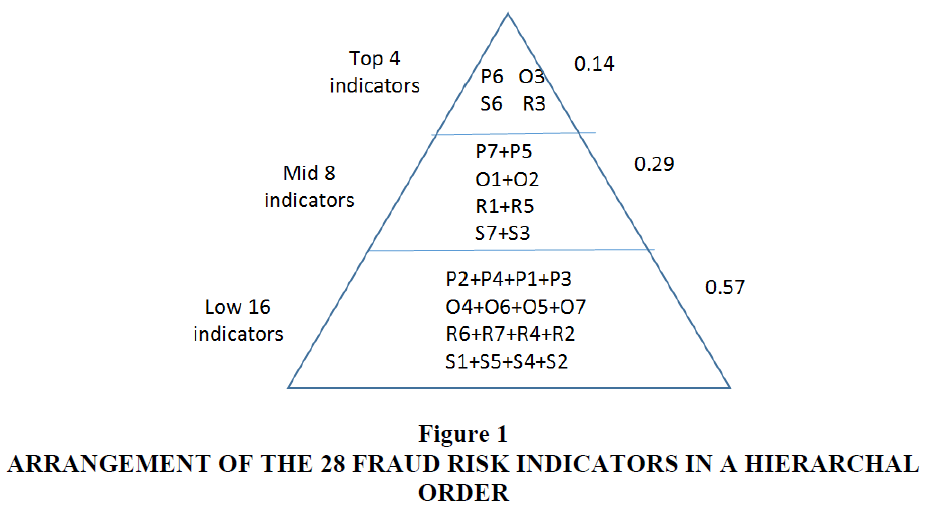

The above means can give us an idea about the expected level of perceived values of the 7 indicators in each category, collectively. In general, as presented in Table 1, the means of the indicators in an aggregate number exceeded 4.00, which was considered high (80%). Opportunity indicators received the highest score (4.18). This probably suggests that the most obvious root of management fraud was the availability of opportunity. The small values of the standard deviation (<0.60) might indicate that there was a high consensus among the respondents regarding the values of the evaluated fraud indicators. Figure 1 depicts the 28 fraud indicators in a hierarchal order.

At the top of the hierarchy (14%), the first ranked indicator of each category. These four signals are:

1. P6 - Management compensation linked to company profits.

2. O3 - Ineffective internal controls.

3. R3 - History of penalties or lawsuits against senior management or the directors for fraud or other violations.

4. S6 – Management's choice of leaders and unqualified employees based on nepotism.

A greater consideration and higher weight should be given to these indicators, since the risk of management fraud with these factors is high. Principles of corporate governance should include regulation in relations to the subjects of these signals’ arena. The second and third ranked indicators of each category are placed in the middle of the hierarchy (29%). These eight signals are:

1. P7 - Significant pressure on management and employees to meet specific financial targets.

2. P5 - Significant financial benefits for management in the company.

3. O1 - Control by a single person or a small group over the primary functions of an enterprise.

4. O2 - Unclear lines of authority and responsibility (complex organizational structure).

5. R1 - Lack of management support for ethical behavior.

6. R5 - Significant errors in previous audits.

7. S7 - Granting of promotions and privileges based on kinship and friendship of the same family, region or sect rather than merit.

8. S3 – A lack of honesty and integrity of the administration and evasion of the disclosure of information required by the auditor.

The mean for each of these 8 indicators exceeded 4.00 ( > 80%). There was an agreement among the respondents about the importance of these signals. The risk of management fraud with these factors was still high. The remaining 16 fraud risk indicators are located at the bottom of the hierarchy (57%). Although, these signals were not as strong as the other 12 indicators, they still were considered important (mean > 3.77 or 75%).

Pressure/Motivation

Table 2 presents the management fraud risk pressure and/or motivation indicators. These 7 indicators are ranked based on the value of the means.

| Table 2 The Mean and S.D. Of Indicators in Pressure and Motivation Category | |||

| Rank No. | Pressure/Motivation Indicators | Mean | S.D. |

| 1 | P6 - Management compensation linked to company profits | 4.27 | 0.708 |

| 2 | P7 - Significant pressure on management and employees to meet Specific financial targets | 4.26 | 0.759 |

| 3 | P5 - Significant financial benefits for management in the company | 4.26 | 0.743 |

| 4 | P2 - Management under-reporting the company's revenue to avoid taxes and Zakat | 4.02 | 1.086 |

| 5 | P4 - Poor financial performance that affects the company’s transactions and contracts with others | 3.94 | 0.928 |

| 6 | P1 - The intensity of competition between companies with deteriorating levels of profitability | 3.91 | 0.839 |

| 7 | P3 - Management's use of inappropriate policies to increase share prices in the Saudi market | 3.91 | 0.833 |

The most significant indicators (mean>4.25) were "management compensation linked to company profits", "significant pressure on management and employees to meet specific financial targets", and "significant financial benefits for management in the company." The remaining four indicators were also important (mean>3.90). Therefore, we can recommend these 7 indicators be adopted by individuals, such as auditors, and groups, such as corporate governance teams, as signals when assessing the management fraud risk. The values of the standard deviation suggested that the variations of the answers were small. The indicator "management under-reporting the company's revenue to avoid taxes and Zakat" received the highest standard deviation (1.09). This probably means that this indicator (P2) was more controversial than the other 6 signals.

This finding about the importance of the motivation and pressure fraud risk indicators is in line with the findings of Hijazi & Mahboub (2019), Huang et al. (2017), and Hass et al. (2016), who reached similar conclusions about the significance of motivation and/or pressure factors for committing management fraud.

Opportunity

The 7 indicators of the risk of management fraud related to opportunity are ranked in Table 3.

| Table 3 The Mean and S.D. of Indicators in Opportunity Category | |||

| Rank No. | Opportunity Indicators | Mean | S.D. |

| 1 | O3 - Ineffective internal controls | 4.38 | 0.801 |

| 2 | O1 - Control by a single person or a small group over the primary functions of an enterprise | 4.27 | 0.840 |

| 3 | O2 - Unclear lines of authority and responsibility (complex organizational structure) | 4.25 | 0.840 |

| 4 | O4 - Poor supervision by the board of directors and audit committees | 4.19 | 0.820 |

| 5 | O6 - Having huge transactions with related parties. | 4.07 | 0.940 |

| 6 | O5 - No separation of duties of the CEO and chairman of the board of directors | 4.06 | 0.916 |

| 7 | O7 - Accounting estimates that have a material impact on the company, according to the professional judgment of the accountant | 4.02 | 0.909 |

Ineffective internal control is considered to be the first open opportunity for fraud. Internal control must receive sufficient consideration by the corporate governance, as it is the big challenge of the governance. Control by a single person or a small group over the primary functions of an enterprise is also a significant indicator since fraud can exist if the power is in the hand of one person or a small group. The complex organizational structure can create a fraud opportunity. The remaining four indicators were also considered important (mean > 4.00). The standard deviations for the 7 indicators, which were close to each other (0.80 – 0.94), may perhaps confirm that the standardization of these signals was high.

The finding about the strong influence of opportunity for management fraud pursuing was consistent with the results of (Yucel, 2013; Moyes et al., 2013; Suh et al., 2019).

Rationalization/Justification

Table 4 presents the management fraud risk rationalization and justification indicators. These 7 indicators are ranked based on the value of the means.

| Table 4 The Mean and S.D. of Indicators in Rationalization and Justification Category | |||

| Rank No. | Rationalization/Justifications Indicators | Mean | S.D. |

| 1 | R3 - History of penalties or lawsuits against senior management or the directors for fraud or other violations | 4.20 | 0.849 |

| 2 | R1 - Lack of management support for ethical behavior | 4.13 | 0.793 |

| 3 | R5 - Significant errors in previous audits | 4.02 | 0.884 |

| 4 | R6 - Selection of accounting policies and estimates by non-financial managers excessively | 4.02 | 0.880 |

| 5 | R7 - Constant change of auditors by management and the presence of disputes related to the application of inappropriate accounting and auditing principles | 4.01 | 0.948 |

| 6 | R4 - Management imposes unrealistic restrictions and demands on the auditor, such as requiring the auditor report in record time | 3.97 | 0.991 |

| 7 | R2 - Increased management justifications for accounting policies options and estimates that have significant effects on accounts | 3.88 | 0.882 |

The indicator of "history of penalties or lawsuits against senior management or the directors for fraud or other violation" was ranked the highest factor to indicate rationalization of the possibility of management fraudulent practice. "Lack of management support for ethical behavior" was judged to be the second important signal, followed by "significant errors in previous audits". The remaining indicators were also considered important with a mean of 3.88 or higher. The standard deviations for the 7 indicators ranged between 0.79 and 0.99, which could mean that the consensus among the respondents regarding the level of the importance of these signals was high,

Al Amin (2017) and Yusef (2016) discussed the rationalization and justification factors' influences, and concluded that such factors should be taken into consideration when assessing management fraud risk. Our findings have supported this conclusion.

Society-level

Indicators of fraud risk related to the cultural variables were divided into two main dimensions: Islamic law and social relations. Table 5 displays management fraud risk societal indicators. These 7 indicators were ranked based on the value of the means.

| Table 5 The Mean and S.D. of Indicators in Societal-Level Category | |||

| Rank No. |

Societal-level Indicators | Mean | S.D. |

| 1 | S6 - Management's choice of leaders and unqualified employees based on nepotism | 4.21 | 0.771 |

| 2 | S7 - Granting of promotions and privileges based on kinship and friendship of the same family, region or sect rather than merit | 4.18 | 0.768 |

| 3 | S3 - Lack of The honesty and integrity of the administration and evading the disclosure of information required by the auditor | 4.09 | 0.823 |

| 4 | S1 - The administration does not support Islamic values, religious activities, and good morals among employees, such as rewarding honesty, refusing gifts, and bribes | 3.99 | 0.957 |

| 5 | S5 - Having personal links with clients who have many dealings with the company | 3.98 | 0.858 |

| 6 | S4 - There is a friendship or kinship between the management and members of the audit committee, the board of directors, or the employees. | 3.94 | 0.875 |

| 7 | S2 - Lack of commitment of the administration to pay zakat and contribute alms/donations | 3.77 | 0.982 |

"Management's choice of leaders and unqualified employees based on nepotism" was the first significant societal factor to raise the risk of fraudulent practice. It was followed by "granting of promotions and privileges based on kinship and friendship of the same family, region or sect rather than merit". "Lack of the honesty and integrity of the administration and evading the disclosure of information required by the auditor" came as the third factor. All other remaining factors (4 indicators) were also considered important (mean = 3.77 or higher). The values of the standard deviation (<1.00) suggested that the variations in the answers were small.

The literature in fraud auditing confirmed the importance of indicators at the cultural level. Since the measurement of society-level indicators vary from one nation to another, it is perhaps difficult to generalize the results. This means that these societal-level fraud risk indicators are suitable for Saudi environment and probably other countries with similar cultures. However, the countries with different cultural environments may require different societal factors.

Correlation Matrix

Correlation reflects the power of the association between two variables or two sets of variables. If the correlation is significant, it means that the variables are actually correlated to each other in the study population. Testing the significance of the correlation coefficient requires that data to be a random sample of observed points taken from a larger population, and thus the significance of the correlation provides strong enough evidence that there is a linear relationship between the variables (groups of individual indicators) in the population.

Table 6, which was produced by SPSS, reveals Pearson Correlations and their significances between each pairs of the four categories.

| Table 6 Pearson Correlation between the Four Categories | ||||

| Opportunity | Rationalization /Justification |

Societal-level | ||

| Pressure /Motivation |

Pearson Correlation | 0.538** | 0.577** | 0.494** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | |

| N | 179 | 179 | 179 | |

| Opportunity | Pearson Correlation | 1 | 0.638** | 0.540** |

| Sig. (2-tailed) | 0.000 | 0.000 | ||

| N | 179 | 179 | ||

| Rationalization /Justification |

Pearson Correlation | 1 | 0.558** | |

| Sig. (2-tailed) | 0.000 | |||

| N | 179 | |||

| ** Correlation is significant at the 0.01 level (2-tailed). | ||||

As seen above, the correlations between each two sets of groups (pressure/motivation, opportunity, rationalization/justification and societal-level) were significant at the 0.01 level. These significances may suggest that the four categories are homogenous in their importance to be together when evaluating management fraud risk assessment. The level of correlations among these categories was moderate (0.49-0.64). The Pearson Correlation between opportunity and rationalization or justification, was comparatively high (0.64). As seen before, opportunity was perceived to encourage management fraud more than the other three-group aspects. The manager, when he found the opportunity, would immediately think about the justification.

To examine the correlation between each pairs of individual indicators within each category, we looked at the Pearson Correlation matrix. Table 7 shows the values and significant of Pearson correlation between variables of pressure/motivation (Li et al., 2017).

| Table 7 Pearson Correlation between Variables of Pressure/Motivation | |||||||

| Indicator | P2 | P3 | P4 | P5 | P6 | P7 | |

| P1 | Pearson Correlation | 0.267** | 0.156* | 0.274** | 0.120 | 0.175* | 0.176* |

| Sig. (2-tailed) | 0.000 | 0.037 | 0.000 | 0.109 | 0.019 | 0.019 | |

| N | 179 | 179 | 179 | 179 | 179 | 179 | |

| P2 | Pearson Correlation | 1 | 0.406** | 0.436** | 0.253** | 0.285** | 0.226** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.001 | 0.000 | 0.002 | ||

| N | 179 | 179 | 179 | 179 | 179 | ||

| P3 | Pearson Correlation | 1 | 0.364** | 0.432** | 0.131 | 0.139 | |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.082 | 0.064 | |||

| N | 179 | 179 | 179 | 179 | |||

| P4 | Pearson Correlation | 1 | 0.302** | 0.298** | 0.314** | ||

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | ||||

| N | 179 | 179 | 179 | ||||

| P5 | Pearson Correlation | 1 | 0.327** | 0.270** | |||

| Sig. (2-tailed) | 0.000 | .000 | |||||

| N | 179 | 179 | |||||

| P6 | Pearson Correlation | 1 | 0.638** | ||||

| Sig. (2-tailed) | 0.000 | ||||||

| N | 179 | ||||||

| ** Correlation is significant at the 0.01 level (2-tailed). * Correlation is significant at the 0.05 level (2-tailed). |

|||||||

The indicator "management under-reporting the company's revenue to avoid taxes and Zakat" (P2) and indicator "poor financial performance that affects the company’s transactions and contracts with others" (P4) was significantly (sig<0.01) correlated to each of all other variables. Variable P5 "significant financial benefits for management in the company" was significantly (sig<0.01) associated with other indicators except P1 "the intensity of competition between companies with deteriorating levels of profitability" (sig>0.10). The correlation between P3 & P6 and P3 & P7 was weak (0.10>sig>0.05). The correlation significance was at the .05 level between variable P1 & P6 and P1 & P7. The level of correlations between each pairs of variables was less than 0.5, except between P6 & P7 (Pearson correlation=0.64, sig=0.000).

The high significant association between P6 and P7 suggested that their importance in risk measurement of management fraud was similar. In general, the correlation significance among these 7 indicators may confirm that this group of variables was collectively suitable for pressure and motivation fraud risk assessment. Table 8 illustrates the values and significant of Pearson correlation between variables of opportunity.

| Table 8 Pearson Correlation between Variables of Opportunity | |||||||

| Indicator | O2 | O3 | O4 | O5 | O6 | O7 | |

| O1 | Pearson Correlation | 0.459** | 0.421** | 0.365** | 0.345** | 0.169* | 0.281** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.024 | 0.000 | |

| N | 179 | 179 | 179 | 179 | 179 | 179 | |

| O2 | Pearson Correlation | 1 | 0.417** | 0.452** | 0.398** | 0.242** | 0.245** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.001 | 0.001 | ||

| N | 179 | 179 | 179 | 179 | 179 | ||

| O3 | Pearson Correlation | 1 | 0.420** | 0.338** | 0.168* | 0.277** | |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.025 | 0.000 | |||

| N | 179 | 179 | 179 | 179 | |||

| O4 | Pearson Correlation | 1 | 0.367** | 0.202** | 0.237** | ||

| Sig. (2-tailed) | 0.000 | 0.007 | 0.001 | ||||

| N | 179 | 179 | 179 | ||||

| O5 | Pearson Correlation | 1 | 0.237** | 0.397** | |||

| Sig. (2-tailed) | 0.001 | 0.000 | |||||

| N | 179 | 179 | |||||

| O6 | Pearson Correlation | 1 | 0.387** | ||||

| Sig. (2-tailed) | 0.000 | ||||||

| N | 179 | ||||||

| ** Correlation is significant at the 0.01 level (2-tailed). * Correlation is significant at the 0.05 level (2-tailed). |

|||||||

As shown in the Pearson Correlation Table 9, the associations between each pair of variables of opportunity indicators were significant at the 0.01 level (sig<0.01), except between O1 & O6 and O3 & O6, where the correlation was significant at the .05 level (sig=0.024 and 0.025). The Pearson value ranged between 0.17 and 0.46.

| Table 9 Pearson Correlation between Variables of Rationalization/Justification | |||||||

| Indicator | R2 | R3 | R4 | R5 | R6 | R7 | |

| R1 | Pearson Correlation | 0.423** | 0.305** | 0.283** | 0.181* | 0.398** | 0.245** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.015 | 0.000 | 0.001 | |

| N | 179 | 179 | 179 | 179 | 179 | 179 | |

| R2 | Pearson Correlation | 1 | 0.481** | 0.369** | 0.197** | 0.423** | 0.358** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.008 | 0.000 | 0.000 | ||

| N | 179 | 179 | 179 | 179 | 179 | ||

| R3 | Pearson Correlation | 1 | 0.274** | 0.145 | 0.370** | 0.458** | |

| Sig. (2-tailed) | 0.000 | 0.052 | 0.000 | 0.000 | |||

| N | 179 | 179 | 179 | 179 | |||

| R4 | Pearson Correlation | 1 | 0.482** | 0.374** | 0.485** | ||

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | ||||

| N | 179 | 179 | 179 | ||||

| R5 | Pearson Correlation | 1 | 0.288** | 0.463** | |||

| Sig. (2-tailed) | 0.000 | 0.000 | |||||

| N | 179 | 179 | |||||

| R6 | Pearson Correlation | 1 | 0.451** | ||||

| Sig. (2-tailed) | 0.000 | ||||||

| N | 179 | ||||||

| ** Correlation is significant at the 0.01 level (2-tailed). * Correlation is significant at the 0.05 level (2-tailed). |

|||||||

The correlation analysis provided evidence of the appropriateness of using this set of indicators as a group for opportunity fraud risk assessment. The values and significant of Pearson correlation between each pairs of variables of rationalization/justification were represented in Table 9.

The Pearson Correlation between each pair of the rationalization/justifications variables was significant at the 0.01 level, except between R1 & R5, where the correlation was significant at the 0.05 level, and between R3 & R5, where it was significant at the 0.10 level. The correlation levels range between 0.15 and 0.49. These correlation results affirmed that these 7 indicators were collectively good interpreter of the rationalization and justification fraud risk assessment (Kassem, 2018).

The values and significant of Pearson correlation between each pairs of variables of societal-level are explained in Table 10.

| Table 10 Pearson Correlation between Variables of Societal-Level | |||||||

| Indicator | S2 | S3 | S4 | S5 | S6 | S7 | |

| S1 | Pearson Correlation | 0.375** | 0.564** | 0.234** | 0.185* | 0.405** | 0.185* |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.002 | 0.013 | 0.000 | 0.013 | |

| N | 179 | 179 | 179 | 179 | 179 | 179 | |

| S2 | Pearson Correlation | 1 | 0.429** | 0.310** | 0.162* | 0.294** | 0.198** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.030 | 0.000 | 0.008 | ||

| N | 179 | 179 | 179 | 179 | 179 | ||

| S3 | Pearson Correlation | 1 | 0.281** | 0.305** | 0.430** | 0.303** | |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | |||

| N | 179 | 179 | 179 | 179 | |||

| S4 | Pearson Correlation | 1 | 0.380** | 0.319** | 0.435** | ||

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | ||||

| N | 179 | 179 | 179 | ||||

| S5 | Pearson Correlation | 1 | 0.489** | 0.457** | |||

| Sig. (2-tailed) | 0.000 | 0.000 | |||||

| N | 179 | 179 | |||||

| S6 | Pearson Correlation | 1 | 0.465** | ||||

| Sig. (2-tailed) | 0.000 | ||||||

| N | 179 | ||||||

| ** Correlation is significant at the 0.01 level (2-tailed). * Correlation is significant at the 0.05 level (2-tailed). |

|||||||

The figures in the above table tell us that Pearson Correlations between each pair of the societal factors ranged between 0.16 and 0.56. These correlations were significant at the .01 level in 15 instances, and at 0.05 level in 3 instances. These significant relations and correlations supported that the 7 indicators of societal-level collectively could help predicting management fraud (Patelli & Pedrini, 2015).

Conclusion

Financial fraud is a major type of professional fraud, which appears in the form of fraudulent reports. Intentional breaches and misstatements of financial reports are examples of practices that management execute to mislead the interrelated parties. Misleading reports are often linked to senior management. The pressure on management to fulfill its responsibilities and achieve their personal goals, along with the motivation of distorting financial statements, increases when the administration seeks to achieve its targets, to hide bad financial results or to obtain strong incentives for tournaments.

In this study, we endeavored to develop management fraud risk indicator framework in the light of a developed FTM. We managed to identify 28 indicators categorized, in equal number, into 4 classifications, which are pressure/motivation, opportunity, rationalization/justification, and societal-level. Following the theoretical development, these indicators went through a practical appraisal. A questionnaire was designed to get feedback from auditors working for firms operating in Saudi Arabia. The total valid returned questionnaires were 179 (response rate = 51%).

The respondents' mean analysis confirmed the importance of the 28 indicators as appropriate signals of management fraud risk (aggregate mean=4.08, S.D.=0.46). The means of individual indicators ranged between 3.77 (75%) and 4.38 (88%). The most important perceived indicator in pressure/motivation was "P6", management compensation linked to company profits. For opportunity, it was "O3", ineffective internal controls. İn rationalization/justification, it was "R3", history of penalties or lawsuits against senior management or the directors for fraud or other violations. In societal-level, it was "S6", management's choice of leaders and unqualified employees based on nepotism. 8 of the remaining indicators were considered of secondary importance. These were P5+P7, O1+O2, R1+R5 and S3+S7. Although the remaining indicators (16 indicators) were comparatively the lowest ranked indicators, they were still perceived as important.

Pearson correlation analysis revealed significant correlation between each pair of the four categories. Also, the great majority of individual indicators were significantly related to the other indicators in the same group. These results may add further confidence to the appropriateness of these groups of management fraud risk indicators to the Saudi environment.

Since the management fraud risk indicators might be affected by economic and business environment, law and regulation, personality, and culture, future research could examine the appropriateness of fraud signals in other countries, in particular with different environmental characteristics. Despite its importance, societal fraud indicators did not receive adequate research in the literature. Accordingly, future research related to fraud is recommended to consider such signals.

References

Al Amin, M.A. (2017). The Impact of the Indicators of Fraud Triangle Factors on the (Fraud Resulting from Deviating) Fraudulent Financial Reporting Estimating (An Experimental Study in Syrian Audit Environment). Irbid Research and Studies - Administrative and Financial Sciences, 19(2), 173-215.

Al Muhtami, S.B. (2015). Social culture and its relationship to integrity and transparency( field study on the officers working in the Riyadh region traffic). Riyadh: Master Thesis. Naif Arab University for Security Sciences.

Albrecht, W.S., Howe, K.R., & Romey, M.B. (1984). Deterring Fraud: The Internal Auditor’s Perspective. Altamonte Springs, Florida, USA: The Institute of Internal Auditors Research Foundation.

Albrecht, W.S., Romney, M.B., & Cherrington, D.J. (1986). Red-flagging management fraud: A validation. Advances in Accounting, 323-333.

Apostolou, B.A., Hassell, J.M., Webber, S.A., & Sumners, G.E. (2001). The relative importance of management fraud risk factors. Behavioral Research in Accounting, 13(1), 1-24.

Indexed at, Google Scholar, Cross Ref

Arli, D. (2017). Does ethics need religion? Evaluating the importance of religiosity in consumer ethics. Marketing Intelligence & Planning, 35(2), 205-221.

Indexed at, Google Scholar, Cross Ref

Association of Certified Fraud Examiners(ACFE). (2018). Report to The Nations 2020 Global Study On Occupational Fraud and Abuse. Austin, TX: ACFE.

Baader, G., & Krcmar, H. (2018). Reducing false positives in fraud detection: Combining the red flag approach with process mining. International Journal of Accounting Information Systems, 1-16.

Indexed at, Google Scholar, Cross Ref

Bjornsen, M., Do, C., & Omer, T.C. (2018). The Influence of Country-Level Religiosity on Accounting Conservatism. Journal of International Accounting Research, 18(1), 1-26.

Indexed at, Google Scholar, Cross Ref

Chircop, J., Fabrizi, M., Ipino, E., & Parbonetti, A. (2017). Does Branch Religiosity Influence Bank Risk‐Taking? Journal of Business Finance & Accounting, 44(1-2), 271-294.

Indexed at, Google Scholar, Cross Ref

Cohen, J., Ding, Y., Lesage, C., & Stolowy, H. (2010). Corporate Fraud and Managers' Behavior: Evidence from the Press. Journal of Business Ethics, 95(2), 271-315.

Indexed at, Google Scholar, Cross Ref

Conroy, S.J., & Emerson, T.L. (2004). Business ethics and religion: Religiosity as a predictor of ethical awareness among students. Journal of Business Ethics, 50(4), 383-396.

Indexed at, Google Scholar, Cross Ref

Dellaportas, S. (2013). Conversations with inmate accountants: Motivation, opportunity and the fraud triangle. Accounting Forum, 37(1), 29-39.

Indexed at, Google Scholar, Cross Ref

Desai, N. (2008). Brainstorming and auditors' fraud risk assessments in the presence of pressures and opportunities. Unpublished doctoral dissertation, Florida State University.

Donelson, D.C., Ege, M.S., & McInnis, J.M. (2016). Internal control weaknesses and financial reporting fraud. Auditing: A Journal of Practice & Theory, 36(3), 45-69.

Indexed at, Google Scholar, Cross Ref

Du, X., Jian, W., Lai, S., Du, Y., & Pei, H. (2015). Does religion mitigate earnings management? Evidence from China. Journal of Business Ethics, 131(3), 699-749.

Indexed at, Google Scholar, Cross Ref

Elghuweel, M.I., Ntim, C.G., Opong, K.K., & Avison, L. (2017). Corporate governance, Islamic governance and earnings management in Oman: A new empirical insights from a behavioural theoretical framework. Journal of Accounting in Emerging Economies, 7(2), 190-224.

Indexed at, Google Scholar, Cross Ref

Elsayed, A.A. (2017). Predictability of financial statements fraud-risk (Doctoral dissertation, Northcentral University).

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Reading: Addison-Wesley.

Indexed at, Google Scholar, Cross Ref

Ghafoor, A., Zainudin, R., & Mahdzan, N.S. (2018). Factors Eliciting Corporate Fraud in Emerging Markets: Case of Firms Subject to Enforcement Actions in Malaysia. Journal of Business Ethics, 1-22.

Indexed at, Google Scholar, Cross Ref

Hass, L.H., Tarsalewska, M., & Zhan, F. (2016). Equity incentives and corporate fraud in China. Journal of Business Ethics, 138(4), 723-742.

Indexed at, Google Scholar, Cross Ref

Haßa, L.H., Müller, M.A., & Vergauwe, S. (2015). Tournament incentives and corporate fraud. Journal of Corporate Finance, 34, 251-267.

Indexed at, Google Scholar, Cross Ref

Hijazi, W., & Mahboub, R. (2019). Auditors perceptions towards the effectiveness of the international standard on auditing 240 Red Flags: evidence from Lebanon. International Journal of Economics & Business Administration (IJEBA), 7(1), 162-173.

Indexed at, Google Scholar, Cross Ref

Huang, C.C., & Lu, L.C. (2017). Examining the roles of collectivism, attitude toward business, and religious beliefs on consumer ethics in China. Journal of Business Ethics, 146(3), 505-514.

Indexed at, Google Scholar, Cross Ref

Huang, S.Y., Lin, C.C., Chiu, A.A., & Yen, D.C. (2017). Fraud detection using fraud triangle risk factors. Information Systems Frontiers journal, 19(6), 1343-1356.

Indexed at, Google Scholar, Cross Ref

International Federation of Accountants [IFAC]. (2009). International Standard on Auditing No. 240: The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements. New York, NY: IFAC.

Jan, C.L. (2018). An effective financial statements fraud detection model for the sustainable development of financial markets: Evidence from Taiwan. Sustainability, 513.

Indexed at, Google Scholar, Cross Ref

Kanagaretnam, K., Lim, C.Y., & Lobo, G.J. (2014). Influence of national culture on accounting conservatism and risk-taking in the banking industry. The Accounting Review, 89(3), 1115-1149.

Indexed at, Google Scholar, Cross Ref

Kara, A., Rojas-Méndez, J.I., & Turan, M. (2016). Ethical evaluations of business students in an emerging market: Effects of ethical sensitivity, cultural values, personality, and religiosity. Journal of Academic Ethics, 14(4), 297-325.

Indexed at, Google Scholar, Cross Ref

Kassem, R. (2018). Exploring external auditors’ perceptions of the motivations behind management fraud in Egypt–a mixed methods approach. Managerial Auditing Journal, 16-34.

Indexed at, Google Scholar, Cross Ref

Li, C., Xu, Y., Gill, A., Haider, Z.A., & Wang, Y. (2019). Religious beliefs, socially responsible investment, and cost of debt: Evidence from entrepreneurial firms in India. Emerging Markets Review, 38.

Indexed at, Google Scholar, Cross Ref

Li, L., & Kuo, C. S. (2017). CEO equity compensation and earnings management: The role of growth opportunities. Finance Research Letters, 289-295.

Indexed at, Google Scholar, Cross Ref

Li, L., Qi, B., Tian, G., & Zhang, G. (2017). The contagion effect of low-quality audits at the level of individual auditors. The Accounting Review, 92(1), 137-163.

Indexed at, Google Scholar, Cross Ref

Lin, C.C., Chiu, A.A., Huang, S.Y., & Yen, D.C. (2015). Detecting the financial statement fraud: The analysis of the differences between data mining techniques and experts’ judgments. Knowledge-Based Systems, 89(1), 459-470.

Indexed at, Google Scholar, Cross Ref

Loebbecke, J.K., Eining, M.M., & Willingham, J. (1989). Auditors experience with material irregularities-frequency, nature, and detectability. Auditing-A Journal of Practice & Theory, 9(1), 1-28.

Magro, C.B., & Cunha, P.R. (2017). Red flags in detecting credit cooperative fraud: the perceptions of internal auditors. Revista Brasileira de Gestão de Negócios, 469-491.

Indexed at, Google Scholar, Cross Ref

Mayhew , B.W., & Murphy, P.R. (2014). The impact of authority on reporting behavior, rationalization and affect . Contemporary Accounting Research, 31(2), 420-443.

Indexed at, Google Scholar, Cross Ref

Moyes, G.D., Lin, P., Landry, R.M., & Vicdan, H. (2006). Internal Auditors' Perceptions of the Effectiveness of Red Flags to Detect Fraudulent Financial Reporting. Retrieved from Available at SSRN: https://ssrn.com/abstract=961457

Indexed at, Google Scholar, Cross Ref

Moyes, G.D., Young, R., & Mohamed Din, H.F. (2013). Malaysian internal and external auditor perceptions of the effectiveness of red flags for detecting fraud. International Journal of Auditing Technology, 1(1), 91-106.

Indexed at, Google Scholar, Cross Ref

Omidi, M., Min, Q., Moradinaftchali, V., & Piri, M. (2019). The Efficacy of Predictive Methods in Financial Statement Fraud. Discrete Dynamics in Nature and Society.

Indexed at, Google Scholar, Cross Ref

Othman, R., Aris, N.A., Mardziyah, A., & Zainan, N. (2015). Fraud detection and prevention methods in the Malaysian public sector: Accountants’ and internal auditors’ perceptions. Procedia Economics and Finance, 28(1), 59-67.

Indexed at, Google Scholar, Cross Ref

Pacheco-Paredes, A.A., Rama, D.V., & Wheatley, C. (2017). The timing of auditor hiring: determinants and consequences . Accounting Horizons, 31(3), 85-103.

Indexed at, Google Scholar, Cross Ref

Patelli, L., & Pedrini, M. (2015). Is Tone at the Top Associated with Financial Reporting Aggressiveness? Journal of Business Ethics, 126(1), 3-19.

Indexed at, Google Scholar, Cross Ref

Pincus, K.V. (1989). The efficacy of a red flags questionnaire for assessing the possibility of fraud. Accounting, Organizations and Society, 153-163.

Indexed at, Google Scholar, Cross Ref

Roden, D.M., Cox, S.R., & Kim, J.Y. (2016). The fraud triangle as a predictor of corporate fraud. Academy of Accounting and Financial Studies Journal, 20(1), 80-92.

Said, J., Alam, M.M., Ramli, M., & Rafidi, M. (2017). Integrating ethical values into fraud triangle theory in assessing employee fraud: Evidence from the Malaysian banking industry. Journal of International Studies, 10(2), 170-184.

Indexed at, Google Scholar, Cross Ref

Shibley, L.D. (2018). Collusion and Unethical Management Behavior in Financial Statement Reporting (Doctoral dissertation). Northcentral University.

Smith, M., Haji Omar, N., Iskandar , S.Z., & Baharuddin, I. (2005). Auditors' perception of fraud risk indicators: Malaysian evidence. Managerial Auditing Journal, 20(1), 73-85.

Indexed at, Google Scholar, Cross Ref

Song, X.P., Hu, Z.H., Du, J.G., & Sheng, Z.H. (2014). Application of machine learning methods to risk assessment of financial statement fraud: evidence from China. Journal of Forecasting, 611-626.

Indexed at, Google Scholar, Cross Ref

Suh, J.B., Nicolaides, R., & Trafford, R. (2019). The effects of reducing opportunity and fraud risk factors on the occurrence of occupational fraud in financial institutions. International Journal of Law, Crime and Justice, 79-88.

Indexed at, Google Scholar, Cross Ref

Weaver, G.R., & Agle, B.R. (2002). Religiosity and ethical behavior in organizations: A symbolic interactionist perspective. Academy of Management Review, 27(1), 77-97.

Indexed at, Google Scholar, Cross Ref

Wilbanks, R.M., Hermanson, D.R., & Sharma, V.D. (2017). Audit committee oversight of fraud risk: The role of social ties, professional ties, and governance characteristics. Accounting Horizons, 31(1), 21-38.

Indexed at, Google Scholar, Cross Ref

Xu, X., Li, Y., Liu, X., & Gan, W. (2017). Does religion matter to corruption? Evidence from China. China Economic Review, 42, 34-49.

Indexed at, Google Scholar, Cross Ref

Yücel, E. (2013). Effectiveness Of Red Flags in Detecting Fraudulent Financial Reporting: An Application In Turkey. Journal of Accounting & Finance, 60(1), 139-158.

Yusof, K.M. (2016). Fraudulent financial reporting: An application of fraud models to malaysian public listed companies (Doctoral dissertation). University of Hull.

Yusof, N.M., & Lai, M.L. (2014). An integrative model in predicting corporate tax fraud. Journal of Financial Crime, 4, 424-432.

Indexed at, Google Scholar, Cross Ref

Received: 09-Dec-2021, Manuscript No. AAFSJ-21-10367; Editor assigned: 13-Dec-2021, PreQC No. AAFSJ-21-10367(PQ); Reviewed: 27-Dec-2021, QC No. AAFSJ-21-10367; Revised: 11-Nov-2022, Manuscript No. AAFSJ-21-10367(R); Published: 18-Nov-2022