Research Article: 2021 Vol: 25 Issue: 2

Managing Market Pressure Using Sustainability Disclosure in the Banking Industry

Alwan Sri Kustono, University of Jember

Abstract

Firm value is a concern for the market, so it is crucial for the public bank. The research aims to test whether sustainability disclosure can reduce market pressure due to changes in company size, profitability, growth, and leverage in the banking industry. This research was conducted on Indonesia's public banks in 2015-2019. The total sample is 190 firm-years. Hypothesis testing technique uses variance-based structural equation modeling using SmartPLS ver. 3.3.2. The research results prove that sustainability disclosure is a mediating variable to reduce firm value pressure due to changes in profitability, operating income growth, and leverage. The bank's size has no impact on sustainability disclosure and also firm value. It is because the principal does not consider it a direct reflection of management's operational performance. It is because the principal does not consider it a direct reflection of management's operating performance. Expanding sustainability disclosures can reduce management concerns that decreased profitability and growth and increased leverage. The novelty of this research is to reveal a new point of view, namely the function of social responsibility activities to maintain firm value due to shocks in company conditions. This disclosure function is new and needs to be investigated further. The study's results have theoretical implications for the impact arising from sustainability disclosures. The practical implication is the importance of broader disclosure to give confidence about companies' sustainability prospects to the principal and society.

Keywords

Agency Theory, Principal, Sustainability Disclosure, Firm Value.

Introduction

In the perspective of agency theory, the firm value becomes one of the agent's responsibilities to the principal. The principal is the owner of the fund entrusted to the agent to be managed. Principals can be owners, investors, or creditors. In a broad context, it can mean stakeholder. Firm value is a reflection of shareholder satisfaction with the firm. The market can give penalties to management if their performance does not match expectations. The decline in the market value of the firm leads to the possibility of a lower yield. The existence of a market penalty mechanism causes management to be careful in managing the firm. Firm performance can be a determinant of firm value because firm performance can be a positive signal for principals. The financial statements' information describes information related to its economic development condition (Lee & Lee, 2019). Companies that provide adequate performance information are considered to have an excellent ability to maximize principal prosperity in the future. Therefore, the firm's shares will be increasingly in demand, and the selling price will increase, causing the firm's value to increase (Nguyen et al., 2020).

Good performance is pleasant management information for principals, both investors and bondholders. Financial performance is one factor that becomes the reference for principals in trading shares. Good economic performance will also increase market response, impacting the price of shares traded on the capital market (Herman, 2018; Kustono et al., 2021). Improving financial performance is an obligation, so that firm shares still attract principals' attention. Financial performance can be seen from the firm's published financial statements. The financial statements are the result of a firm's accounting process. Investors or creditors can use the accounting information contained in the financial statements for making investment decisions. Principals can find out the good or bad financial performance of the firm by using financial performance. Several variables that are considered influencing firm value are firm size, leverage, profitability, and growth. Previous research has shown inconsistency in results. Some studies suggest that firm size has a positive effect, while others find it negative, likewise with leverage, profitability, and growth.

The information presented in these variables can be pleasant or unexpected. These variables' inconsistency is thought to be mediated by other variables (?in?alová & Hedija, 2020; Lee & Lee, 2019; Mahrani & Soewarno, 2018; Ramadhani & Agustina, 2019; Sheikh, 2019). The mediating variables reduce the impact of changes on these variables (Galdeano et al., 2019). Management seeks to protect the firm's value from negative market views (Kustono & Effendi, 2016). One of the instruments used is the delivery of information about profit, growth, and firm liability. The firm must increase its influence if conditions are favorable and reduce if the impact is negative. One of the ways to reduce negative visibility is the delivery of positive information owned by the firm. One of them is by disclosing sustainability activities (sustainability disclosure).

Sustainability disclosure is a concept that reveals a firm has various forms of responsibility towards all stakeholders and the environment. The disclosure also presents the values and models of corporate governance and shows the relationship between its strategy and its commitment to a sustainable global economy (Chapagain, 2012; Szegedi et al., 2020). The effect of sustainability disclosure on firm value can be explained using a theoretical basis, namely agency theory. The principal surrenders his funds to be managed by the agent. Principals use market information to provide management performance appraisals because they do not have sufficient internal information. Market value is a proxy for management performance by involving market valuations. The firm's social responsibilities program can contribute to the development of the social environment in which the firm operates (Hamidu et al., 2015).

Social activities can contribute to sustainable economic growth, thereby improving the quality of life. Sustainability disclosure can be a means for companies to gain legitimacy for their business operating activities. It is a good signal to the market (Anh & Bokelmann, 2019; Jermsittiparsert et al., 2019). Individual investors are more interested in social information reported by companies in annual reports. The firm's cost of corporate social responsibility activities is also used as information to show the firm's prospects. The firm manager tries to provide a clue to investors regarding the prospect value of the firm. Principals can use it to consider whether they want to invest in a firm or not (Mahmood et al., 2019). Information signals related to the disclosure's implementation from firm managers that are well responded to by the market will have consequences on the firm's value. If principals trust the signal regarding positive information, such as the possibility of future income, it can increase the stock price and trading volume. Thus, the better the firm's information, the better the firm's stock performance will be.

Banks are an industry that is considered to extract little from nature, so they are considered to have little impact on the environment, and there is little research on the sustainability of banks. This is a contradiction because banks are consumers of processed products from nature, such as paper and energy. Banks are also tech-intensive and peopleintensive. The sustainability of a bank has a broad impact on the stability of the country's economy. There are few studies in Indonesia related to sustainability reporting in banking. In line with other global studies, these studies' results have not shown consistency (Amidjaya & Widagdo, 2019; Muslichah, 2020; Rizki et al., 2019). It is probably because the reporting rules were newly established. The Indonesia Financial Service Authority stipulates that Indonesian banks' initial stage to present banking sustainability reports from 2015-2019 and become mandatory reports for Indonesian banks from 2016. The industry's unique characteristics and reporting, the lack of research on the disclosure aspects of sustainability in banking, and the inconsistency of previous research results motivate this research. The sustainability report is the delivery of bank information in an integrated manner regarding the organization's environmental and social performance.

Literature Review

The business competition requires companies to show their performance in improving and maintaining the values that exist within the bank. Managers face concerns that there will be an impact on firm value due to changes in size (Dang et al., 2020; Szegedi et al., 2020), profitability (Ifada et al., 2019; Vicente et al., 2011), growth (Fambudi & Fitriani, 2020; Oh & Kim, 2016), and leverage (Dao & Ta, 2020; Saona & Martín, 2018). Principals can address this pressure by giving higher penalties or agency costs. The way out that can be taken is by providing good news by increasing the banks' social activities. Sustainable reporting is an important step that can be achieved in corporate sustainability. Principals, regulators, and other stakeholders are increasingly expanding in developing sustainable reporting practices. Interest in greater transparency and corporate reporting accountability of corporate strategy can promote trust and help markets function more efficiently in driving organizational progress, social and economic growth. The development and improvement that are increasing and quite significant have led to global competition in the corporate environment so that regulators and stakeholders increasingly demand companies to show their performance in improving and maintaining firm value.

Long-term corporate sustainability is more important than just profitability. This phenomenon encourages corporate social activity as a form of responsibility for the social and environmental aspects, which are determinants of sustainability. Investors and creditors can use Corporate Social Responsibility to understand the relationship between sustainability performance and sustainability disclosure. Even though the initial exposure is a voluntary disclosure, indicating that it is information or disclosure that exceeds what is required, which is seen as disclosure of performance information. Companies to increase the market value of the bank. Companies use sustainability disclosure to help users of financial statements know more about their sustainability performance. Social responsibility is the responsibility of companies that are oriented towards society and business. In establishing relationships with the community, the bank makes efforts to build a positive image towards society to create a sense of trust. The bank has a policy regarding its strategy in obtaining profits and efforts to win the competition. The limitation of bank policies must involve all stakeholders who should be limited. Focus on policies that can build positive interactions between the bank and its activities with the local community.

The bank is no longer only a selfish entity and the exclusivity of the community but as a legal entity obliged to make socio-cultural adaptations to the environment in which it is located and can be held accountable like traditional subjects in general. Corporate social responsibility activities are an ongoing joint commitment of all companies to be jointly responsible for existing social problems. Sustainability disclosure is an integration method to solve environmental and social issues integrate with their operations. Some of the benefits can be obtained by companies that carry out sustainability disclosure. According to (Kustono et al., 2020), the firm grows sustainably and gets the community's right image. Second, broader access to get a loan and additional equity. Third, companies will have loyal employees. Fourth, management can make decisions comprehensively, and there is minimal litigation risk. Various reasons for companies to voluntarily disclose social responsibilities information have been investigated in previous research. Some research includes complying with firm size, profitability, growth, leverage, and attracting principals. Firm size reflects the firm size, as seen from its total asset value (Kustono, 2021). Principals generally pay attention to larger firms because of possible political costs, monopolies, or other consequences. On the other hand, large companies also have income stability. With a lot of asset ownership, the possibility of a bank going bankrupt is relatively low. Consequences and stability make owning large companies safer and their yields guaranteed. This factor encourages principals to provide higher value.

The value of the bank's shares is increasing. They are considered to have great attractiveness to potential investors. Larger companies may have shareholders who pay attention to the social programs companies create in their annual reports, which are the means for disseminating information about corporate social and financial responsibility. More shareholders mean more disclosure. It was due to demands from shareholders and stock market analysts. The political costs faced by the bank will be manipulated by management so that they are reduced. Principals and market participants prefer to receive good news. This reason encourages the notion that large companies tend to announce more good news than small companies. The dissemination of this information is expected to reduce pressure on companies, both from regulators and market mechanisms. The sustainability report is one of the bank's instruments to avoid higher social and political costs. Sustainability disclosure can be a beneficial corporate strategy, improve decision making, and maintain good relationships with society (Goshu et al., 2017; Lourenço et al., 2012). Principals give positive respond through increasing stock prices. Vice versa, if the firm has a bad environmental performance, principals will doubt the firm and result in a negative response, namely fluctuation in the price of the firm's shares in the market, which is decreasing from year to year. Sustainability disclosure can be used to divert issues related to firm size. The report encourages principals to pay attention to the activities associated with environmental responsibility. Previous research shows a significant positive effect of firm size on disclosure.

H1: The larger the bank's size drives greater the sustainability disclosure scope to divert the principal from the impact of changes in company size and paying more attention to corporate sustainability disclosure

Profitability is the bank's ability to generate profits over a certain period. The firm cannot attract outside capital sources to invest in the firm without profit. According to (Fiscal & Steviany, 2015), investors can expect high dividends with high profits. If a stock produces a high yield, it will impact increasing firm value. They conclude that interest margin affects firm value. Assessment of a banking firm's profitability determines how much the net interest margin ratio can measure the bank's ability to generate profits. This ratio shows the bank's ability to generate net interest income to process total productive assets (Witek-Crabb, 2019). Stakeholder theory states that companies need to provide information about their stakeholders' firm performance to know its activities. The increased profitability encourages the greater level of sustainability disclosure to describe the firm's performance so that the community can accept the firm (Mahmood et al., 2019). Meanwhile, according to agency theory, the greater the firm's profit, the more extensive it discloses the social information. It is done to reduce agency costs that arise. A profit-making firm has an incentive to differentiate itself from other, less profitable companies. One way to differentiate yourself is by providing sustainability disclosure. So that the higher the firm's ability to generate profits, it is expected that the firm can provide more disclosure. Companies with bad news tend not to disclose bad news to the market, aiming that firm value does not decrease. Companies with good news will convey information to the market by completing sustainability disclosure to annual reports.

It is hoped that complete annual report information will have a positive impact on the firm. If the disclosure of good news is not carried out, the market will interpret it as bad news to impact its low rating. Swandari & Sadikin (2016) explains that profitability is a factor that gives freedom and flexibility to management to implement and disclose to shareholders the broader social responsibility program. The relationship between bank profitability and sustainability disclosure is the argument that leadership style and social reactions are integrated—the increased profitability in line with a more comprehensive disclosure of social information. Companies with high profitability will tend to provide more detailed information because they want to convince investors of their profitability (Emilsson et al., 2012; Sunghee & Heungjun, 2016; Vu et al., 2020). Besides, companies that have high profitability have more opportunities to carry out CSR activities. Therefore, the firm will provide a more detailed disclosure of social responsibility so that the public, investors, creditors, and other interested parties know for sure the social responsibility that the firm carries. It can be concluded that low profitability encourages managers to disclose firm information more broadly to convince all existing stakeholders.

H2: When the level of profitability decreases, the scope of sustainability disclosure increases to divert the principal's attention from the negative impact of changes in profitability to the bank's sustainability disclosure.

Effect of Firm Growth on the Sustainability Disclosure

The financing decision is essential for companies. In an operating income fast-growing bank, it can shift the source of financing to debt so that that management can avoid agency conflicts with the principal. The bank has to pay interest costs regularly. Conversely, if a bank is experiencing slow growth, it is better to use financing sources from the principal to reduce pressure due to the debt covenant threshold. Funding for growth can be made using retained earnings. Changes in operating income growth (growth) certainly have an impact on firm value. Management can use sustainability disclosures to make the impact of changes in growth insignificant for shareholders. (Nyame-Asiamah & Ghulam, 2019) showed that companies with high growth would disclose more information about sustainability disclosure than companies with low growth. Banks that have profitable growth in terms of economic concepts can guarantee the sustainability of their economic activities. This sustainability can reflect its ability to carry out its social responsibility maximally more than banks with low growth (Nyame-Asiamah & Ghulam, 2019; Sunghee & Heungjun, 2016; Xanthi et al., 2020). Therefore, banks will tend to make disclosures related to social responsibility implemented to show the advantages of banks that can grow to face competition in the business world to get a positive response from stakeholders. Also, firm growth indicates an increase in the firm's ability to finance activities and sustainability disclosure so that stakeholder needs for complete information can be appropriately fulfilled. Stakeholder theory states that companies with high growth will get a lot of attention from stakeholders. Banks with high growth tend to make more disclosures, especially those considered good news, including disclosures of social responsibility.

H3: When the bank's operating income growth has decreased, the sustainability disclosure scope increases to divert principals' attention from the negative impact of growth changes to the bank's sustainability disclosure.

Effect of the Leverage on the Sustainability Disclosure

Leverage is a tool to measure how much a firm depends on creditors in financing its assets. According to (Amal et al., 2019), high-interest rates on debt also encourage creditors to take an active role in monitoring the firm (management), where debt provides a signal about the firm's financial condition to find out its obligations. Therefore, banks need to provide other information to divert their supervision, such as disclosing social responsibility activities. The policy of financing use debt will benefit income tax savings. The nature of the interest expense that must be paid periodically is a deductible expense. However, if debt exceeds the optimal limit, the use of debt will reduce the firm's value because of greater risk in the form of bankruptcy. With share ownership by managers, it is expected that debt is formed in its optimal structure to achieve the firm's goal of increasing firm value. Signaling theory explains that leverage influences firm value. Leverage is a determining indicator of firm value.

It is because companies with less leverage will have the ability to provide more positive signals. Information published by managers will immediately respond from the market if the published information contains a positive value. Thus, companies with less leverage will be more attractive to principals. Leverage prevents principals from the possibility of bankruptcy. Information influences individuals' decision-making process. Therefore, companies with greater leverage will increasingly strive to create corporate firm value. Companies with less leverage will have a higher ability to make better corporate value (Febriyanto, 2018). Large companies would get greater profits from their operating activities to increase their profitability. Thus, the greater the firm's leverage, the greater the ability to create better corporate value. Several previous studies have also proven the presumption regarding the influence of leverage on firm value. Leverage positively affects firm value. It demonstrates that the greater the leverage, the greater the firm value. Stakeholder theory states that banks need to provide information to all parties interested in the firm transparently. It means that banks do according to their interests, but they also need to think about and give benefits to those interested in the firm. In perspective agency theory, high leverage ratio companies will disclose more increased social disclosures because the leverage ratio is used to see its capital structure. It can be seen the risk of uncollectible debt. Bondholders need additional good information to make sure about the future firm performance. Banks with a high debt ratio have significant financial risks.

It can lead to a decrease in other parties' confidence in the firm's ability to return its funds. When it is related to the theory of legitimacy, banks with high debt need to disclose sustainability disclosure so that the firm continues to gain the trust and positive reactions from other parties (Amal et al., 2019; Nguyen et al., 2020). Nguyen et al. (2020) states that companies with high leverage need to provide more disclosure. They have to explain to investors, creditors, or other interested parties their ability to pay debts and the impact of these loans on CSR activities, employees, society, and the environment. Companies with higher leverage ratios try to convey more good news as an instrument to reduce monitoring costs for principals so that companies with high leverage will disclose more social responsibility information than companies with a low leverage ratio.

H4: When the leverage increases, the scope of sustainability disclosure becomes wider to divert the principal's attention from the negative impact of changes in leverage on bank sustainability disclosures.

Methodology

The research aims to test hypotheses with a quantitative approach. The variables tested were financial leverage, firm growth, firm size and profitability as independent variables, sustainability disclosure as an intermediate variable, and firm value as an endogenous variable. This study's data type is secondary data from the bank's financial statements published on the Indonesia Capital Market.

Population and Sample

The population is the generalizability of the findings where the conclusions can be applied. This population is the banking listed on the Indonesia Stock Exchange for 2015-2019. Sampling using specific criteria. The criteria used in sample selection are:

1. A public bank.

2. Bank presents a complete annual report for 2015-2019 and generated consecutive profits. Banks that have experienced a loss of at least one year are not included in the analysis. It aims to equalize the financial condition of each bank. Financial distress firms generally carry out abnormal strategies, so there is concern that it will interfere with the conclusion drawing process.

3. Bank's financial statements are stated in rupiah.

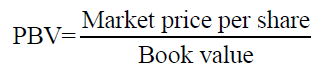

Firm value is measured using the Price Book Value Ratio (PBV). The formula for this PBV ratio is:

(1)

(1)

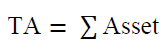

Firm size is measured using the total asset.

(2)

(2)

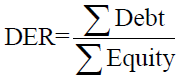

Financial leverage is a ratio that describes the extent to which the bank's debt is used in the capital. Financial leverage is calculated using the formula:

(3)

(3)

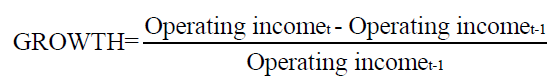

Firm growth is the banks' ability to increase their income. The growth uses the ratio of operating income growth. The bigger the income, it is expected that the greater the operational results generated by the banks.

(4)

(4)

Profitability shows banks can generate profits in a certain period. Profitability is a ratio that measures the bank's ability to obtain a positive profit increasing. It calculated using:

(5)

(5)

The CSR variable is measured using the banks' CSR information disclosure index based on GRI 4. This indexing is done by giving a value of 0 if it does not disclose the item and a value of 1 if it discloses it. The formula is as follows:

(6)

(6)

With:

CSRDj = corporate social responsibility disclosure

∑Xij = 1 if the item i is disclosed, 0 if not disclosed

Nj = number of items for bank j

Hypothesis testing uses the Partial Least Square method with SmartPLS version 3.3.2 software with basic bootstrapping, 300 iterations and 500 subsamples were used for hypothesis testing. PLS does not require normality distribution assumptions to be used for both small and large samples.

Results and Discussion

This study aims to prove the role of sustainability disclosure on the direct impact of antecedent variables and firm value. Research data were obtained from annual reports and financial statements from the Indonesia Stock Exchange and data published by each bank on its official website. The sample selection uses certain predetermined criteria to ensure the validity of the research results and the procedure can be seen in Table 1. Prudent observations were done for the period defined as the study period. Table 1 shows, for 2015, the banks that have been listed are 43 issuers. There were 5 (five) banks that changed business entities during the study period so that only 38 banks were sampled, or for the 2015-2019 period, there were 190 firm-years data.

| Table 1 Sample Selection | ||

| No | Sample Criteria | Amount |

| 1 | It was registered as public banking on the IDX during the research period. | 43 |

| 2 | Banks that have changed their business entities | (5) |

| Total samples | 38 | |

| Total research observations for five years | 190 | |

Descriptive Statistics

Descriptive statistics determine the variables' data in the average, minimum, and maximum values. The independent variables consist of firm size, financial leverage, firm growth, and profitability. Based on the results of the analysis in Table 2, it can be seen that the firm value variable ranges from 9.017 to 14.56. the mean is close to 12.4, meaning that it is close to the median value. It can be said that the mean coincides with the median so that the data is well distributed. The bank's growth variable shows a mean of 0.13. The lowest value of growth is -0.10, and the highest value is 1.15. Standard Deviation is 0.15. The sustainability disclosure variable shows a mean of 47.46, the minimum is 12, and the highest value is 92. The standard deviation is 23,912. This means that it is closer to the minimum value. The firm size variable obtained a minimum value of 27.4, a maximum value of 34.6 with a mean of 31.02, and a standard deviation of 2.05. The financial leverage variable has a minimum value of 1.59, a maximum value of 14.75, a mean value of 5.6519, and a standard deviation of 2.49. The profitability variable has a minimum value of 0.00, and a maximum value of 0.03, a mean value of 0.0121, and a standard deviation of 0.00829. The mean value is close to the midpoint value, and the data distribution is relatively good.

| Table 2 Descriptive Statistics | ||||

| Variables | Min. | Max. | Mean | Std. Dev. |

| Firm Size | 27.4 | 34.6 | 31.02 | 2.05 |

| Financial Leverage | 1.59 | 14.75 | 5.6519 | 2.49 |

| Profitability | 0.00 | 0.03 | 0.0121 | 0.008 |

| Firm Growth | -0.10 | 1.15 | 0.1326 | 0.152 |

| Sustainability Disclosure | 0.12 | 0.92 | 0.4746 | 0.2391 |

| Firm Value | 9.017 | 14.56 | 12.40 | 1.68 |

Table 3 shows that the disclosure affects firm value. The disclosure variable's path analysis test influences the firm value to obtain a significance value of 0.004 and the original sample value of 0.344. These results indicate that the sustainability disclosure variable has a positive effect on firm value. The growth variable's path analysis test shows a significance value of 0.009 and the original sample value of 0.269. These results indicate that the growth variable has a positive effect on sustainability disclosure. The leverage variable's path analysis test shows the significance is 0.009 and the original sample value is -0.320. These results indicate that the leverage variable has a negative effect on sustainability disclosure. The profitability variable's path analysis test shows the significance is 0.001, and the original sample value is -0.310. These results indicate that the profitability variable has a negative effect on sustainability disclosure. Other path analyses show the relationship between other variables is not significant. The predictor variable is unable to explain changes in the criterion variable.

| Table 3 Path Analysis Test Results | ||||

| Path relationship | Original Sample | Std. Dev. | T-Statistic | P values |

| Sustainability Disclosure à Firm Value | 0.344 | 0.120 | 2.864 | 0.004** |

| Firm Size à Sustainability Disclosure | 0.041 | 0.115 | 0.352 | 0.725 |

| Firm Size àFirm Value | 0.003 | 0.118 | 0,021 | 0.983 |

| Growth à Sustainability Disclosure | 0.269 | 0.103 | 2.621 | 0.009** |

| Growth à Firm Value | -0.085 | 0.136 | 0.624 | 0.533 |

| Leverage àSustainability Disclosure | -0.320 | 0.122 | 2.626 | 0.009** |

| Leverage àFirm Value | 0.038 | 0.114 | 0.332 | 0.740 |

| Profitability àSustainability Disclosure | -0.310 | 0.096 | 3.211 | 0.001** |

| Profitability àFirm Value | 0.004 | 0.098 | 0.036 | 0.971 |

Discussion

The path analysis results with Smart PLS show that some of the previous theories and prepositions cannot be proven in the research sample. Firm size, leverage, growth, and profitability do not directly affect firm value. The disclosure variable resolves the gaps in facts and theories. Agency theory states that where large banks have higher agency costs, they will disclose broader information to reduce agency costs. Large banks have many principles. More shareholders, which means that it requires a lot of disclosure, is due to demands from shareholders and capital market analysts. Currently, many investors and other stakeholders pay attention to information on social responsibility as firm performance. Stakeholders are considered necessary by the firm and are very influential in the firm's activities. In running its business, the firm will certainly deal with many stakeholders following its operational scope. For business activities to run according to firm expectations, it is necessary to have good relationships and communication. Social disclosure or sustainability disclosure are considered as part of the dialogue between the firm and its stakeholders.

Path analysis testing finds surprising results. Previous theories predict a relationship, either directly or indirectly, between firm value and firm size. Principals assess the firm based on the number of assets owned by the firm. The test results show that firm size does not affect firm value. This inconsistency is resolved so that the disclosure is a mask to cover firm size changes' negative impact. Hypothesis one states that when the firm's size increases, the extent of the disclosure increases to divert principals' attention from the effects of firm size changes to direct attention to the firm's sustainability disclosure. The table shows that the hypothesis is rejected. Sustainability disclosure is not a medium for an indirect relationship between firm size and firm value. Firm assets are not explanatory for changes in firm value and the disclosure of continuing reports. The market considers that assets are a follow-up effect of management policies but not an objective strategic management decision. Asset change is a management requirement to achieve management's short-term goals. The decision is not considered directly affecting the market.

The firm's market value will not change automatically because of the aspects of the firm's assets. It is consistent with the findings that (Baumann-Pauly et al., 2013; D'Amato & Falivena, 2020). Large banks are no different in disclosing information than small banks. It is because large banks are more likely to face political risk than small banks. A bank is not a firm that is under political pressure because of changes in firm assets. Banks are also not an industry whose social responsibility is of public concern because of their business characteristics. Social disclosure has no impact on the political costs of banks. An asset is not a predictor for broader sustainability disclosure. External parties use sustainability disclosure to assess business organizations' accountability for their environmental and social impacts for a set of external stakeholders. Accounting information must demonstrate that information is relevant to evaluate its social and environmental effects. Communities need information that displays the impact of an organization's operations transparently to contribute to the sustainability goals. Accounting information for internal users focuses on providing relevant information for managerial decisions. This information is based on the social activities carried out by the firm. Sustainability disclosure data helps the organization's internal management towards multidimensional sustainability goals. Assets do not have a role in continuing information disclosure.

The strategic decisions taken by management about sustainability are based on providing information on actions to safeguard the social environment. These results indicate that assets do not affect the number of social activities that the firm performs. An autoregressive test is performed to ensure that changes in other variables do not cause asset changes. Current year asset data (t) is regressed with data from the previous year (t-1). The autoregressive test data for the sample in Table 4. Whereas asset year (t+1) is a positive consequence of year t asset. An adjusted R2 shows 98.1%. It shows that the change in the existing assets depends on the previous assets. These changes tend to be positive so that they are not in line with sustainability disclosure and fluctuating firm values. The asset is an indirect operational performance of management in managing the bank. Unlike assets, leverage, profitability, and bank growth are strategic management decisions that directly determine its sustainability. Change in total assets are the effects of derivatives and carry over from year to year. It is what causes the principal to pay less attention to bank size compared to other operational variables. Changes in asset size have no impact on sustainability disclosure. Another reason is because of the different focus of social activities in large and small companies. The activities are grouped into environmental, social-human rights, labor practices, product responsibility, society, and public agencies that make the extent of disclosure different. Leverage is a ratio to measure how much a firm depends on creditors in financing its assets. Leverage relates to the firm's ability to pay obligations.

| Table 4 Autoregressive Test Result | ||||

| Test Summary | Sum of Squares | Mean Square | F | Sig. |

| Regression | 154.990 | 154.990 | 6599.767 | 0.000 |

| Adjusted R2 | 0.981 | |||

The high-interest rates on debt also encourage creditors and bondholders to take an active role in overseeing the firm. Banks need to disclose other information to reduce surveillance pressure. One way that can be done is to expand the disclosure of sustainability disclosure. Agency theory states that banks need to provide information to the principal to reduce the emergence of asymmetric information (Kustono & Effendi, 2016). Banks need to think about and transparently offer information to those who have an interest in the firm. The perspective of this theory also explains that banks with a high leverage ratio will disclose more increased social disclosures because the leverage ratio is used to see the firm's capital structure so that it can be seen the risk of uncollectible debt. Additional information is needed to eliminate the principal's doubts about the fulfillment of their rights as creditors. Banks with high debt potential have large financial risks. It can lead to a decrease in other parties' confidence in the firm's ability to return its funds. When it is related to the legitimacy theory, banks with high debt need to disclose a sustainability disclosure so that the firm continues to get the trust and positive reactions from other parties. The test results show that leverage affects firm value through sustainability disclosure. The disclosure is a mediating relationship between leverage and firm value. Based on the research, it is concluded that leverage has no direct effect on firm value.

It shows that the firm's debt is one of the drivers of changes in sustainability disclosure. The disclosure is proven to be an intervening between leverage and firm value variables. The relationship between the leverage variable and the disclosure is positive. When experiencing an increase in the level of leverage, banks will increase the disclosure of sustainability disclosure. Disclosure of sustainability disclosure has a positive impact on firm value. On the contrary, when the leverage decreases, the firm reduces the level of sustainability disclosure. Hypothesis 2 states that when the level of leverage increases, the scope of sustainability disclosure reports also increases. Expanding the disclosure of sustainability disclosure shifts the issue of growing leverage to disclosure. The firm avoids the decline in firm value. Banks with high leverage need to provide more disclosure because they have to explain to investors, creditors, or other interested parties about the firm's social responsibility, employees, and the community and environment. Banks with high leverage ratios try to convey more information as an instrument to reduce monitoring costs for principals. They disclose more social responsibility information than banks with lower leverage ratios. Banks that increase in debt tend to be closer to a debt covenant breach or risk of bankruptcy. An increase in debt means an increased risk of uncollectible debt. The more outstanding a firm's debt than its assets, the greater the firm's risk to pay its obligations. The greater the leverage ratio, the greater the level of dependence on creditors and the greater the burden of debt costs paid by the firm.

Banks with high leverage ratios should make more expansive social disclosures as good news to shareholders. The excellent communication calmed principals so that they did not put pressure on the market mechanism on shareholders. The test results show that profitability affects firm value through sustainability disclosure. The disclosure is an intervening variable that connects profitability and firm value. Profitability has no direct effect on firm value. Profitability affects the disclosure, and the disclosure affects the firm's value. Profitability correlates with the extent of disclosure. If profitability decreases, the disclosure becomes more comprehensive, and vice versa. The result is consistent with previous researches (Emilsson et al., 2012; Sunghee & Heungjun, 2016) and contrasts with the others (?in?alová & Hedija, 2020; Salehi et al., 2019). Profitability is generally defined as the firm's ability to generate profits to increase shareholder value. Agency theory shows the possibility of adverse selection due to information asymmetry. To lower this view, banks need to provide information about the firm's performance to principals and bondholders to know what the firm's activities are doing. The decrease in profitability is interpreted as incredible performance. For principals, it is bad news, so that it may put pressure on management. In these conditions, management hopes to divert the principal's attention from it. Expanding the disclosure is one way to be taken. The firm's attention to social and community is strengthening the legitimacy that the firm can survive. The smaller the firm's profit, the more extensive the social information the firm discloses. It is done to reduce agency costs that may arise due to these conditions. It is proven that firm growth does not directly affect firm value. The influence of firm growth must be through disclosure. The correlation between the two variables is negative. The test results show that growth affects firm value through sustainability disclosure. Sustainability disclosure is a solution to the inconsistency theory, which states that growth affects firm value. This variable mediates the relationship between growth and firm value.

The correlation between growth and sustainability disclosure is negative. The lower the firm's growth, the management needs to provide good news to reduce pressure from the principal. Sustainability disclosure is good news that reduces pessimistic principals' assessment to value the firm value. The negative operating income growth is anticipated by management by publishing a broader disclosure of sustainability disclosure. A decrease in growth is an indication of a reduction in productivity. If a decline occurs, it is bad news for the principal. The productivity of the firm encourages higher firm profits so that profits for shareholders will also increase. Principals will respond well to this increase to attract principals to invest their funds in the firm. Low growth is exposed to the risk of fluctuations in earnings in the future. Principals will give low value to the firm. Banks have an incentive to differentiate themselves from other banks by expanding their sustainability disclosure information. So the lower the level of profitability and growth, the firm needs performance levers. Banks with bad news tend to display other information as good news to aim that their value does not decrease. It is hoped that complete annual report information will have a positive impact on the firm. If the disclosure of good news is not carried out, the market will interpret it as bad news to impact its low rating. This study's results align with banks with low profitability and growth that tend to provide more detailed information because they want to convey to principals about the firm's prospects. Banks will provide more detailed disclosures regarding their social responsibility so that the public, investors, creditors, and other interested parties know with certainty the firm's social responsibility. Expanding sustainability disclosures can reduce management concerns that decreased profitability and growth and increased leverage concluded by some researchers (Peter & Ayoib, 2016; Sunghee & Heungjun, 2016; Szegedi et al., 2020).

Conclusion

Change in total assets are the effects of derivatives and carry over from year to year. It is what causes the principal to pay less attention to bank size compared to other operational variables. Changes in asset size have no impact on sustainability disclosure. The stated hypothesis 1 that the greater the firm size, the greater the scope for disclosure of sustainability disclosure to divert principals from the impact of changes in firm size and pay more attention to corporate sustainability disclosure is rejected Sustainability disclosure is good news related to bank performance to principals, reducing the negative impact of other bad news. If sustainability disclosure is low, it will result in a decrease in bank value. Stability and profitability can be achieved if the bank carries out social activities. Hypothesis 2 states that when the level of leverage increases, the scope of sustainability disclosure also increases to divert principals' attention from the impact of profitability changes to regional attention on firm's sustainability disclosure is accepted. Sustainability disclosure can be used by management to divert to a slow growth situation. Hypothesis 3 states that when the firm's growth has decreased, the sustainability disclosure scope increases to divert principals' attention from the impact of profitability changes to the firm's sustainability disclosure is accepted. Sustainability disclosure can cover the adverse effects of increasing corporate debt.

Principals provide a positive assessment of broader disclosures. They see that the bank is doing many social activities so that the possibility of litigation and demands from social and environmental aspects is lower. Hypothesis 4 states that when the level of leverage increases, the scope of sustainability disclosure also increases to divert principals' attention from the impact of profitability changes to regional attention on firm's sustainability disclosure is accepted. This study is limited in several ways. GRI data is data that requires accuracy in conducting the content analysis. Misidentification will lead to mistaken placement of the sustainability disclosure score. Research findings can use software that can perform content analysis. In 2018, a new GRI standard was issued so that banks prepare sustainability reports for 2019 using these standards. This study still uses the GRI 4 standard and thus requires some modifications.

References

- Amal, H., Rim, B., & Nadia, B.F.T. (2019). Corporate social responsibility disclosure and debt financing. Journal of Applied Accounting Research, 20(4), 394-415. https://doi.org/10.1108/JAAR-01-2018-0020

- Anh, N.H., & Bokelmann, W. (2019). Determinants of smallholders’ market preferences: The case of sustainable certified coffee farmers in Vietnam. Sustainability (Switzerland), 11(10). https://doi.org/10.3390/su11102897

- Baumann-Pauly, D., Wickert, C., Spence, L.J., & Scherer, A.G. (2013). Organizing corporate social responsibility in small and large firms: Size matters. Journal of Business Ethics, 115(4), 693-705. https://doi.org/10.1007/s10551-013-1827-7

- Chapagain, B.R. (2012). Corporate social responsibility: evidence from Nepalese financial service and manufacturing sectors. Economic Journal of Development Issues, 11(1), 9-20. https://doi.org/10.3126/ejdi.v11i0.6103

- ?in?alová, S., & Hedija, V. (2020). Firm characteristics and corporate social responsibility: The case of Czech transportation and storage industry. Sustainability (Switzerland), 12(5). https://doi.org/10.3390/su12051992

- D’Amato, A., & Falivena, C. (2020). Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corporate Social Responsibility and Environmental Management, 7(2), 909-902.

- Dang, H.N., Nguyen, T.T.C., & Tran, D.M. (2020). The impact of earnings quality on firm value: The case of Vietnam. Journal of Asian Finance, Economics and Business, 7(3), 63–72. https://doi.org/10.13106/jafeb.2020.vol7.no3.63

- Dao, B.T.T., & Ta, T.D.N. (2020). A meta-analysis: capital structure and firm performance. Journal of Economics and Development, 22(1), 111-129. https://doi.org/10.1108/jed-12-2019-0072

- Emilsson, L.M., Classon, M., & Bredmar, K. (2012). CSR and the quest for profitability – using Economic Value Added to trace profitability. International Journal of Economics and Management Sciences, 2(3), 43-54. https://www.omicsonline.com/open-access/csr-and-the-quest-for-profitability-using-economic-valueadded-to-trace-profitability-2162-6359-2-128.pdf

- Fambudi, I.N., & Fitriani, D. (2020). Analysis Effect of Accrual Quality, Growth Opportunity and Gender Diversity on Firm Performance (Empirical Evidence from Listed Company in Indonesia Stock Exchange). International Journal of Contemporary Accounting, 1(2), 117. https://doi.org/10.25105/ijca.v1i2.6128

- Febriyanto, F.C. (2018). the Effect of Leverage, Sales Growth and Liquidity To the Firm Value of Real Estate and Property Sector in Indonesia Stock Exchange. Eaj (Economics and Accounting Journal), 1(3), 198. https://doi.org/10.32493/eaj.v1i3.y2018.p198-205

- Fiscal, Y., & Steviany, A. (2015). The effect of size company, profitability, financial leverage and dividend payout ratio on income smoothing in the manufacturing companies listed in Indonesia Stock Exchange period 2010-2013. Jurnal Akuntansi & Keuangan, 6(2), 11-24.

- Galdeano, D.M., Fati, M., Ahmed, U., Rehan, R., & Ahmed, A. (2019). Financial performance and corporate social responsibility in the banking sector of Bahrain: Can engagement moderate? Management Science Letters, 9(10), 1529-1542. https://doi.org/10.5267/j.msl.2019.5.032

- Goshu, Y.Y., Matebu, A., & Kitaw, D. (2017). Development of Productivity Measurement and Analysis Framework for Manufacturing Companies. Journal of Optimization in Industrial Engineering, 10(22), 1-13. https://doi.org/10.22094/joie.2017.274

- Hamidu, A.A., Haron, H.M., & Amran, A. (2015). Corporate social responsibility: A review on definitions, core characteristics and theoretical perspectives. Mediterranean Journal of Social Sciences, 6(4), 83-95. https://doi.org/10.5901/mjss.2015.v6n4p83

- Herman. (2018). Benefits of Corporate Social Responsibility by Primary and Secondary Stakeholders (Case Study at PT. Asia Sawit Makmur Jaya Riau Province). Jurnal Ilmiah Manajemen Publik Dan Kebijakan Sosial, 2(2), 264-277.

- Ifada, L.M., Faisal, F., Ghozali, I., & Udin, U. (2019). Company attributes and firm value: Evidence from companies listed on Jakarta islamic index. Espacios, 40(37), 1-14.

- Jermsittiparsert, K., Siam, M.R.A., Issa, M.R., Ahmed, U., & Pahi, M.H. (2019). Do consumers expect companies to be socially responsible? The impact of corporate social responsibility on buying behavior. Uncertain Supply Chain Management, 7(4), 741-752. https://doi.org/10.5267/j.uscm.2019.1.005

- Kustono, A.S. (2021). Corporate governance mechanism as income smoothing suppressor. Accounting, 7, 1–10. https://doi.org/10.5267/j.ac.2021.1.010

- Kustono, A.S., & Effendi, R. (2016). Earnings Management and Corporate Governance Case in Indonesia. Advanced Science Letters, 22(12), 4345-4347. https://doi.org/https://doi.org/10.1166/asl.2016.8147

- Kustono, A.S., Mas’ud, I., & Agustina, W. (2020). Elimination non value-added chain: Case in cassava fermented industry Bondowoso-Indonesia. International Journal of Scientific and Technology Research, 9(2), 2215- 2218.

- Kustono, A.S., Roziq, A., & Nanggala, A.Y.A. (2021). Earnings Quality and Income Smoothing Motives: Evidence from Indonesia. Journal of Asian Finance, Economics and Business, 8(2), 821-832. https://doi.org/10.13106/jafeb.2021.vol8.no2.0821

- Lee, H., & Lee, S.H. (2019). The impact of corporate social responsibility on long-term relationships in the business-to-business market. Sustainability (Switzerland), 11(19). https://doi.org/10.3390/su11195377

- Lourenço, I.C., Branco, M.C., Curto, J.D., & Eugénio, T. (2012). How Does the Market Value Corporate Sustainability Performance? Journal of Business Ethics, 108(4), 417-428. https://doi.org/10.1007/s10551- 011-1102-8

- Mahmood, Z., Kouser, R., & Masud, M.A.K. (2019). An emerging economy perspective on corporate sustainability reporting – main actors’ views on the current state of affairs in Pakistan. Asian Journal of Sustainability and Social Responsibility, 4(1). https://doi.org/10.1186/s41180-019-0027-5

- Mahrani, M., & Soewarno, N. (2018). The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as a mediating variable. Asian Journal of Accounting Research, 3(1), 41-60. https://doi.org/10.1108/ajar-06-2018-0008

- Nguyen, T.M.P., Tran, Q.B., Do, D.T., & Tran, D.L. (2020). Impact of corporate social responsibility toward employees on business performance: The case of Vietnam. Uncertain Supply Chain Management, 8(3), 589-598. https://doi.org/10.5267/j.uscm.2020.2.004

- Nguyen, V.H., Choi, B., & Agbola, F.W. (2020). Corporate social responsibility and debt maturity: Australian evidence. Pacific-Basin Finance Journal, 62, 101374. https://doi.org/https://doi.org/10.1016/j.pacfin.2020.101374

- Nyame-Asiamah, F., & Ghulam, S. (2019). The relationship between CSR activity and sales growth in the UK retailing sector. Social Responsibility Journal, 1747-1117. https://doi.org/https://doi.org/10.1108/SRJ-09- 2018-0245.

- Oh, S., & Kim, W.S. (2016). Effect of ownership change and growth on firm value at the issuance of bonds with detachable warrants. Journal of Business Economics and Management, 17(6), 901-915. https://doi.org/10.3846/16111699.2015.1072109

- Peter, O.N., & Ayoib, C.A. (2016). The moderating effect of profitability and leverage on the relationship between eco-efficiency and firm value in publicly traded Malaysian firms. Social Responsibility Journal, 12(2), 295- 306. https://doi.org/10.1108/SRJ-03-2015-0034

- Ramadhani, C.F., & Agustina, L. (2019). Influence of Company Characteristics on Corporate Social Responsibility Disclosures in the Annual Reports of the Manufacturing Companies. Accounting Analysis Journal, 8(1), 24-30. https://doi.org/10.15294/aaj.v8i1.28614

- Salehi, M., Tarighi, H., & Rezanezhad, M. (2019). Empirical study on the effective factors of social responsibility disclosure of Iranian companies. Journal of Asian Business and Economic Studies, 26(1), 34-55. https://doi.org/10.1108/jabes-06-2018-0028

- Saona, P., & Martín, P.S. (2018). Determinants of firm value in Latin America: an analysis of firm attributes and institutional factors. Review of Managerial Science, 12(1), 65-112.

- Sheikh, S. (2019). Corporate social responsibility and firm leverage: The impact of market competition. Research in International Business and Finance, 48, 496-510. https://doi.org/https://doi.org/10.1016/j.ribaf.2018.11.002

- Sunghee, L., & Heungjun, J. (2016). The effects of corporate social responsibility on profitability: The moderating roles of differentiation and outside investment. Management Decision, 54(6), 1383-1406.

- Swandari, F., & Sadikin, A. (2016). The Effect of Ownership Structure, Profitability, Leverage, and Firm Size on Corporate Social Responsibility (CSR). Binus Business Review, 7(3), 315.

- Szegedi, K., Khan, Y., & Lentner, C. (2020). Corporate social responsibility and financial performance: Evidence from Pakistani listed banks. Sustainability (Switzerland), 12(10), 1-19. https://doi.org/10.3390/SU12104080

- Vicente, L.C., Fátima, de S.F., & Felipe, C. de V. (2011). Corporate social responsibility, firm value and financial performance in Brazil. Social Responsibility Journal, 7(2), 295-309. https://doi.org/10.1108/17471111111141549

- Vu, T.H., Tran, H.L., Le, T.T., & Nguyen, H.A. (2020). The effect of corporate social responsibility on performance in Nam Dinh seafood enterprises. Management Science Letters, 10(1), 175-182.

- Witek-Crabb, A. (2019). CSR maturity in polish listed companies: A qualitative diagnosis based on a progression model. Sustainability (Switzerland), 11(6). https://doi.org/10.3390/su11061736

- Xanthi, P., Eleni, Z., Grigoris, G., & Nikolaos, S. (2020). The effect of corporate social responsibility performance on financial performance: the case of food industry. Benchmarking: An International Journal, 27(10), 2701-2720. https://doi.org/10.1108/BIJ-11-2019-0501