Research Article: 2019 Vol: 23 Issue: 5

Mandatory Social and Environmental Disclosure of Listed Companies in Vietnam

Pham Duc Hieu, Thuongmai University

Lai Thi Thu Thuy, Thuongmai University

Hoang Thi Bich Ngoc, Thuongmai University

Nguyen Thi Hong Lam, Thuongmai University

Abstract

This study investigated the level of compliance with mandatory social and environmental disclosure in Vietnam Stock Exchange for the year of 2016. A mandatory socio-environmental disclosure index was developed according to the Circular No. 155/2015/TT-BTC, which companies listed in the stock market were obliged to adopt since 2016, and was utilized for the quantification of the extent of mandatory disclosure. The connection between mandatory disclosure and some specific company characteristics was also investigated. The findings showed that the extent of mandatory socio-environmental disclosure was significant correlated with company size, leverage, profitability, and listing age. However, the correlation between mandatory socio-environmental disclosure and audit firm, industrial sectors is not statistically significant.

Keywords

Social and Environmental Disclosure, Mandatory, Listed Company, Vietnam.

JEL Classification

M41; M48.

Introduction

Information disclosed by listed companies on the stock market comprises mandatory disclosure and voluntary disclosure. While the former is the minimum information which promulgated regulation requires from a reporting entity (Owusu-Ansah, 1998; Wallace & Naser, 1995), the latter refers to the decisions of revealing more information than required, and the motivation includes managing corporate image, maintaining public relation and reducing litigation risk (Pham & Do, 2015; Li & Peng, 2011).

Since the first study on the information disclosure began in 1961 (Cert, 1961), most of the research so far has focused on exploring the voluntary rather than the mandatory disclosure (Einhorn, 2005), despite the fact that both mandatory and voluntary disclosure are potentially important (Omar & Simon, 2011).

Traditionally, socio-environmental disclosure has been voluntary and entitled as sustainability reports or Corporate Social Responsibility disclosure (CSRD). However, governments and stock exchanges around the world are increasingly imposing mandatory disclosure requirements. In comparison with voluntary socio-environmental disclosure, mandatory socio-environmental disclosure policy is claimed as a better communication platform which would provide the much needed push for businesses to go beyond social and environmental practices (Mobus, 2005). This is due to the fact that mandatory disclosure directly exposes business organizations toward public scrutiny thus engendering them to seriously consider the social and environmental consequences of their activities.

Unlike the empirical research regarding voluntary disclosure, which has several decades’ years of history, the literature concerning the compliance with mandatory social and environmental disclosure requirements is much more recent. The increase in the number of mandatory socio-environmental disclosure requirements at international and national level in recent years has resulted in considerable growth in the number of studies on the mandatory socio-environmental disclosure.

According to KPMG (2015), in 2015 eight countries with a corporate responsibility reporting rate of 90% or above have mandatory reporting requirements: India, Indonesia, Malaysia, South Africa, UK, France, Demark and Norway. In some countries, reporting legislation has been introduced by governments (France, Indonesia, and South Africa) and in others by stock exchanges (Brazil, Malaysia, and Singapore). Requirements may cover a board range of socio-environmental issues or have a specific target such as Greenhouse gas (GHG) emissions (the UK), conflict minerals (the US), or social responsibility (India).

At international level, several frameworks of social and environmental information disclosure have been also proposed worldwide to satisfy stakeholders’ information needs such as the Global Reporting Initiative (GRI) published by Sustainability Reporting Guidelines or the Global Compact issued by the United Nations in 2000.

In this paper we analysis the mandatory socio-environmental disclosure in the Vietnam’s stock exchange as a relevant example of regulation. Social and environmental disclosure requirements brought by the Circular No. 155/2015/TT-BTC affect all listed companies in Vietnam. It involves the material extension of disclosure obligations; all listed companies are required to issue a yearly social and environmental disclosure, since 31st December 2016. There are 16 information that companies must disclose spanning social (employment, health and safety), environmental (materials uses, waste management, energy and water consumption), and societal categories (relations with local community).

This paper attempts to examine whether listed companies in Vietnam comply with mandatory socio-environmental disclosure and what determinants affect such compliance. As several authors like Galani et al. (2011); Kaya (2016); and Sani (2018) state that Positivist Accounting Theory helps explain compliance with promulgated regulations based on corporate characteristics and it should take into account the following theories: Agency theory, Signaling theory, and Political theory. In this paper, we analyze these three organizational theories in a summarized manner and examine how they can be connected to the level of compliance with mandatory socio-environmental disclosure requirements in the context of Vietnam stock market.

This study contributes to the existing literature by analyzing the studies on the determinants of compliance with social and environmental disclosure requirements. This study also allows us to verify the level and determinants of compliance that are emerging in recent literature in the new context as Vietnam’s securities market.

The remaining parts of the paper are organized as follows. Section 2 provides institutional background. Section 3 discusses the theoretical framework as basis for the hypotheses development. Section 4 presents the sample selection and methodology. Section 5 presents the findings and analysis. Finally, Section 6 concludes the paper with concluding remarks and directions for future research.

Institutional Background

According to the Global Reporting Initiative (GRI), socio-environmental disclosure is part of the sustainability report, published by a company or organization about the economic, environmental and social impacts caused by its everyday activities. A social and environmental disclosure also presents the organization’s value and governance model and demonstrates the link between its strategy and its commitment to a sustainable development.

Socio-environmental disclosure has only emerged for nearly two decades. However, several reporting recommendations and guidelines, with direct and indirect reference to socio-environmental information have been introduced. They include the Conceptual Framework for Financial Reporting (IASB, 2018) and a series of related international financial reporting standards that deal with recognition, presentation and disclosure of socio-environmental items, e.g. IAS 41, IFRS 6, IAS 37, IAS 8, or IFRIC 5 (Negash, 2009). In addition, the International Federation of Accountants (IFAC), the United Nations Division of Sustainable Development (UNDSD) and a number of government or non-governmental organizations in collaboration with the Big Four auditing firms have published a number of guidelines, suggestions and even working experiences related to social and environmental reporting practices (EPA, 1995; IFAC, 2005; IMA-ACCA, 2005).

In Vietnam, regulations on corporate information disclosure are specified in legal documents such as the Law on Accounting (2003, 2015), the Law on Securities (2006), the Circular No. 52/2012/TT-BTC. In addition, in 2013, the State Securities Commission of Vietnam (SSC) in collaboration with IFC, a member of the World Bank Group, published the Handbook "The guidelines for Sustainability Reporting" with the aim of promoting socio-environmental information disclosure among listed firms in Vietnam securities market. This Handbook contains a number of contents, including information on environmental resource use, environmental impacts of products and services provided by enterprises, mitigation measures in protecting or/and correcting environmental problems, and guidelines for companies in reporting socio-environmental responsibility in their annual reports. More recently the Circular No. 55/2015/TT-BTC dated on October 6th, 2015 replaced the Circular No. 52/2012/TT-BTC and is valid for the annual report from 2016. However, only since 2016 disclosure of social and environmental information among listed enterprises in Vietnam has become mandatory.

The Circular No. 155/2015/TT-BTC requires that listed companies have to provide details in their annual reports on how they take into account social and environmental consequences of their activities and their social commitments in the favour of sustainable development.

All listed companies in Vietnam are required to issue a yearly “Report related impact of the company on the environment and society” within their annual report, since 31st December 2016. There are 16 topics that companies must report (Table 1). The topics are the measures of sustainability disclosure which are performance indicators in the area of social, environmental and societal matters. The examples of social indicators are employment, health and occupation safety, training and education, and career development. The environmental indicators are about the raw materials, energy, water consumption, and waste management. The category of societal indicators focuses on the relations with local community.

| Table 1: Mandatory Socio-Environmental Disclosure By Vietnamese Listed Companies | ||

| Category | Topic | Mandatory disclosed information |

|---|---|---|

| Environmental information disclosure | Management of raw materials | 1.The total amount of raw materials used for the operation during the year |

| 2.The percentage of materials recycled/reused to produce products and services | ||

| Energy consumption | 3.Energy consumption ? directly and indirectly | |

| 4.Energy savings during the year | ||

| 5.The number of solutions/measures for energy saving and environmental protection | ||

| Water consumption | 6.Water supply for the operation | |

| 7.Amount of water used during the year | ||

| 8.Percentage and total volume of water recycled and reused | ||

| Compliance with law on environmental protection | 9.The number of fines the company is undergone for failing to comply with laws and regulations on environment | |

| 10.The total amount to be fined for failing to comply with laws and regulations on environment | ||

| Social information disclosure | Policies related to employees | 11.Number of employees |

| 12.Employees’ average wages | ||

| 13.Labour policies to ensure employees’ health, safety and welfare | ||

| 14.The average training hours per year | ||

| 15.The skills development and continuous learning programs for employees | ||

| Societal information disclosure | Responsibility for local community | 16.The community investments and other community development activities, including financial assistance to community service |

(Source: Self-built authors)

Theoretical Framework And Hypotheses Development

As mentioned earlier, our study relies on three organizational theories that can be interconnected with the level of compliance with social and environmental disclosure requirements.

Agency theory states that the shareholders and managers tend to act in their own interests and it is this separation of interests that causes conflicts (Jensen & Meckling, 1976), hence the need for good governance mechanisms. In this theory, the disclosure is used to reduce the agency costs and information asymmetry found between shareholders and managers. The following determinants of compliance with mandatory disclosure requirements are usually related to this theory: size, leverage, type of auditor, listing age, and profitability (Demir & Bahadir, 2014; Pham & Do, 2015; Galani, Alexandridis, & Stavropoulos, 2011; Sani, 2018).

Under Signaling theory asymmetry is reduced with information sharing and compliance with standards or regulations (Galani, Alexandridis, & Stavropoulos, 2011). The determinants usually associated with this theory are liquidity, profitability, leverage, type of auditor, size, and industry (Demir & Bahadir, 2014; Pham & Do, 2015; Galani, Alexandridis, & Stavropoulos, 2011).

In the Political theory, it is hypothesized that accounting data is used to fix price in regulated industries, to fix tax policy, or to decide policy on subsidies for companies. Under this theory, correct compliance with mandatory disclosure is vital to ensure that the prices, taxes, and policies are fair. This theory is tied to the size and profitability determinants (Pham & Do, 2015; Galani, Alexandridis, & Stavropoulos, 2011; Sani, 2018).

Founded on the theoretical framework presented above, the following hypotheses were developed:

H1 Company size is positively associated with the level of mandatory social and environmental disclosure.

H2 Profitability is positively associated with the level of mandatory social and environmental disclosure.

H3 Leverage is positively associated with the level of mandatory social and environmental disclosure.

H4 Big-Four audit is positively associated with the level of mandatory social and environmental disclosure.

H5 Listing age is positively associated with the level of mandatory social and environmental disclosure.

H6 Industrial sector is associated with the level of mandatory social and environmental disclosure.

Methodology

The population for this study comprises all companies listed on Ho Chi Minh Stock Exchange (HSX), which publish their annual reports by the end of 2016. Financial firms include banks, financial, insurance and securities companies were excluded as they report under different or specific regulations. Besides, 110 companies were excluded because their annual reports were not available or insufficient database (newly listed or missing independent variable). The final sample consists of 160 companies, accounting for 87.91% of the population.

The data is extracted using the content analysis method from the annual reports of these companies for the year 2016. There is one dependent variable, six independent variables in this study. The dependent variable is the level of compliance with mandatory social and environmental disclosure requirements and is measured by mandatory disclosure index. The independent variables are company size, listing age, leverage, audit firm, profitability, and industrial sectors.

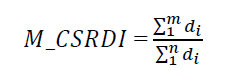

In this study, the un-weighted disclosure approach will be used to measure Mandatory Social and Environmental Disclosure Index (M_CSRDI), because it is documented less subjective and judgmental (Wallace & Naser, 1995; Pham & Do, 2015; Omar & Simon, 2011). A company is given one (1) for a disclosed item and zero (0) for otherwise. M_CSRDI calculated for each company is as follows:

Where:

M_CSRDI: Mandatory social and environmental index

d: Disclosure item i with score of one or zero

m: Actual number of relevant disclosure items (m ≤ n)

n: Number of items expected to be disclosed (n = 16)

Results And Discussions

Descriptive Statistics

Mandatory Socio-Environmental Disclosure Index and its Sub-Categories

Table 2 below presents the descriptive statistic results of M_CSRDI and its three sub-categories. As shown, the overall M_CSRDI is at 51.45%, and the standard deviation is 25.42%. There is a wide range of variation within the sample indicated by the minimum and maximum values. Specifically, environmental disclosure index (M_EnDI) has considerable dispersion in the scores, as represented by the minimum, maximum and the standard deviation.

| Table 2: Descriptive Statistics Results Of M_Csri And Its Sub-Categories | |||||

| Categories | N | Minimum | Maximum | Mean (%) | Std. Deviation |

|---|---|---|---|---|---|

| M_EnDI (Environmental disclosure index) | 160 | 0.00 | 1.00 | 40.75 | 0.30603 |

| M_SoDI (Social disclosure index) | 160 | 0.00 | 1.00 | 67.50 | 0.26632 |

| M_ScDI (Societal disclosure index) | 160 | 0.00 | 1.00 | 78.13 | 0.41470 |

| M_CSRDI (Socio-Environmental disclosure index) | 160 | 0.00 | 1.00 | 51.45 | 0.25421 |

(Source: Analysis results from SPSS 20)

Among three sub-categories, the sub-category of Mandatory Societal disclosure (M_ScDI) has the highest level of compliance (a mean of 78.13%) while Mandatory Environmental disclosure (M_EnDI) has the lowest compliance level at 40.75%. Mandatory Social disclosure (M_SoDI) is in the middle with 67.5%.

Descriptive Results for Independent Variables

Table 3 presents the rest of descriptive data about companies being analyzed, including the size of the company, the profitability, the leverage degree, the listing age, the industry type, and the type of audit firms. There is a board range of variation in size, profitability and leverage. Size ranges from 11.77 to 18.11 with a mean of 14.37 and standard deviation of 1.298; profitability ranges from -9.38% to 34.44% with a mean 7.19% and standard deviation 6.121; and leverage ranges from 0.03 to 0.97 with mean of 0.47 and standard deviation 0.214. The size distribution is skewed; and the alternative is to use natural log of total assets to measure the company’s size.

| Table 3: Descriptive Statistics Results Of Independent Variables | |||||

| Categories | N | Minimum | Maximum | Mean (%) | Std. Deviation |

|---|---|---|---|---|---|

| SIZE (Logarithm of Total Assets) | 160 | 11.77 | 18.11 | 14.37 | 1.298 |

| ROA (Profitability) | 160 | -9.38 | 34.44 | 7.19 | 6.121 |

| LEV (Leverage) | 160 | 0.03 | 0.97 | 0.47 | 0.214 |

| AGE (Listing years) | 160 | 2 | 16 | 8.25 | 2.88 |

| SECTOR (Industrial sectors) | 160 | 1 | 4 | 1.99 | 1.218 |

| AUDIT (Type of audit firms) | 160 | 0 | 1 | 0.46 | 0.499 |

Correlation Analysis and Collinearity Statistics

The Pearson correlation values in Table 4 above indicate that multicollinearity problems between dependent variable and independent variables are not likely to happen. As indicated in Table 5, tolerance scores are all greater than 0.2 and the VIF for each predictor variable is below the 10.0 benchmark. Accordingly, it can be seen that multicollinearity does not seem to be a problem in explaining the regression results of Mandatory Social Environmental Disclosure Index model.

| Table 4: Spearman And Pearson Correlation Matrix | ||||||||

| M_CSRDI | ROA | SIZE | LEV | AGE | SECTOR | AUDIT | ||

|---|---|---|---|---|---|---|---|---|

| M_CSRDI | Pearson Correlation | 1 | -0.99** | 0.107* | 0.124 | 0.070 | -0.195** | 0.016 |

| Sig. (1-tailed) | 0.012 | 0.054 | 0.126 | 0.382 | 0.014 | 0.142 | ||

| ROA | Pearson Correlation | -0.99** | 1 | 0.052 | -0.391*** | -0.27 | -0.190** | 0.095 |

| Sig. (1-tailed) | 0.012 | 0.561 | 0.000 | 0.735 | 0.016 | 0.230 | ||

| SIZE | Pearson Correlation | 0.107* | 0.052 | 1 | 0.300*** | 0.113 | 0.050 | 0.467*** |

| Sig. (1-tailed) | 0.054 | 0.516 | 0.000 | 0.156 | .526 | 0.000 | ||

| LEV | Pearson Correlation | 0.124 | -0.391*** | 0.300*** | 1 | -0.063 | .265*** | -0.076 |

| Sig. (1-tailed) | 0.126 | 0.000 | 0.000 | 0.431 | 0.001 | 0.342 | ||

| AGE | Pearson Correlation | 0.070 | -0.027 | 0.113 | -0.063 | 1 | -0.148* | 0.073 |

| Sig. (1-tailed) | 0.382 | 0.735 | 0.156 | 0.431 | 0.062 | 0.358 | ||

| SECTOR | Pearson Correlation | -0.195** | -0.190** | 0.050 | 0.265*** | -0.148* | 1 | -0.063 |

| Sig. (1-tailed) | 0.014 | 0.016 | .526 | 0.001 | 0.062 | 0.429 | ||

| AUDIT | Pearson Correlation | 0.016 | 0.095 | 0.467*** | -0.076 | 0.073 | -0.063 | 1 |

| Sig. (1-tailed) | 0.142 | 0.230 | 0.000 | 0.342 | 0.358 | 0.429 | ||

Note: * significant at p<0.10; ** significant at p<0.05; *** significant at p<0.01

(Source: Analysis results from SPSS 20).

| Table 5: Collinearity Statistics | ||

| Variables | Tolerance | VIF |

|---|---|---|

| SIZE (Logarithm of Total Assets) | 0.634 | 1.576 |

| ROA (Profitability) | 0.800 | 1.250 |

| LEV (Leverage) | 0.668 | 1.496 |

| AGE (Listing years) | 0.950 | 1.052 |

| SECTOR (Industrial sectors) | 0.901 | 1.110 |

| AUDIT (Type of audit firms) | 0.729 | 1.373 |

Multiple Regression Results

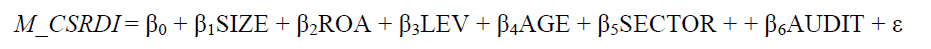

The regression model of this study is as follows:

Where:

M_CSRDI = Mandatory Social Environmental Disclosure index reported by the company in the 2016 annual report; SIZE = Logarithm total assets of the company as reported; ROA = Ratio of net profit to total asset of the company as reported; LEV = Ratio of total debt to total asset of the company as reported; AGE = listing years of the company as reported; SECTOR = Value of 1 is given if the company belongs manufacturing industry; 2 construction, 3 trading and services, and 4 for others; AUDIT = Value of 1 is given if the company is audited by Big Four auditing company and 0 for otherwise;

β0 = regression constant; β1,2…n = Coefficient to independent variables; ε = Error of prediction.

The regression results are presented in Table 6 below.

| Table 6: Multiple Regression Results | |||

| Model summary | |||

|---|---|---|---|

| R | 0.522 | ||

| R Square | 0.273 | ||

| Adjusted R Square | 0.241 | ||

| Std. Error of the Estimate | 0.35147 | ||

| Sig. | 0.017 | ||

| F. | 12.580 | ||

| Variables | Unstandardized Coefficients | t-statistics | Sig. |

| (Constant) | 0.886 | 3.452 | 0.001 |

| SIZE (Logarithm of Total Assets) | 0.026 | 1.366 | 0.034** |

| ROA (Profitability) | 0.470 | 4.795 | 0.052* |

| LEV (Leverage) | 0.036 | 1.967 | 0.071* |

| AGE (Listing years) | 0.305 | 3.732 | 0.027** |

| SECTOR (Industrial sectors) | -0.034 | -1.950 | 0.352 |

| AUDIT (Type of audit firms) | 0.029 | 1.623 | 0.534 |

Note: * significant at p<0.10; ** significant at p<0.05

(Source: Analysis results from SPSS 20)

As shown in Table 6 above, the model is significant (F=12.580, p-values = 0.017) with the adjusted coefficient of determination (adjusted R-Square) is 0.241 indicating that the predictor variables of the model explain 24.1% of the variation in the Mandatory Social and Environmental Disclosure Index (M_CSRDI). The regression coefficient for SIZE (β = 0.026) is positive and statistically significant (p-value = 0.034), suggesting that bigger companies are associated with higher level of compliance disclosure of socio-environmental information. This provides a support for Hypothesis 1 that there is a positive association between the size of a company and the extent of mandatory disclosure of listed companies in Vietnam. This finding is consistent with the studies of other researchers such as Galani et al. (2011); Hasan & Hosain (2015); Wallace & Naser (1995); Welbeck et al. (2017), and Sani (2018).

The coefficients of profitability, leverage, and age are positive and statistically significant, between 5% and 10% levels, which support the relevant hypotheses H2, H3 and H5. These results are inconsistent with findings by Pham & Do (2015); Sami (2018), and Galani et al. (2011), but consistent with Hasan & Hosain (2015) that found profitability, leverage and age significant in explaining social and environmental disclosure. On the other hand, other independent variables such as sectors and type of audit firms are not statistically significant in explaining the extent of mandatory disclosure practice made by Vietnamese listed companies. Therefore, hypotheses 4 and 6 are not supported. This finding is consistent with Pham & Do (2015); Sami (2018); Galani et al. (2011) but inconsistent with Welbeck et al. (2017) that found a positive association between firms environmental disclosures and both industrial sectors and the type of audit firms.

Conclusion and Direction For Future Research

The mandatory social and environmental disclosure scores reveal that the level of compliance disclosure released by Vietnamese listed companies is quite modest. The study finds that four factors (company’s size, profitability, leverage and listing age) have a statistically significant and positive impact on the level of compliance disclosure. A big company engages more in mandatory disclosure practice, and profitability, leverage and listing age also play an active role in improving the compliance level of mandatory socio-environmental disclosure of Vietnamese listed companies in the sample.

From the findings, several implications to accounting practice and regulation in the context of Vietnam Stock Exchange can be generated. First, improvements in compliance with mandatory social and environmental disclosure can be achieved by introducing educational programs to raise the awareness of companies about their disclosure responsibilities. Second, it also suggests that the State Securities Commission of Vietnam (SSC), who monitors the quality of disclosure, should improve their review of the disclosure content of annual reports to ensure higher levels of compliance with mandatory disclosure requirements.

One limitation of this study is that the results are based on listed companies in HSX, which represent just about 50% of the total population of listed companies in Vietnam Stock Exchange at the end of 2016. Furthermore, the study is limited to a period of one year that may raise further uncertainty about the generalization of the results.

In order to overcome those limitations, the dimension of the sample could be increased by analyzing more non-financial Vietnamese listed companies in both Stock Trading Centers in Vietnam (HNX and HSX) for a longer of time which may help to validate this study. The other independent variables such as corporate governance and board composition can be considered in further studies.

Endnotes

1. Corresponding author: Pham Duc Hieu, Thuongmai University, Hanoi, Vietnam. Email: hieu.pd@tmu.edu.vn

References

- Cert, A.R. (1961). Corporate Reporting and Investment Decisions. Berkeley: The University of California Press.

- Demir, V., & Bahadir, O. (2014). An investigation of compliance with international financial reporting standards by listed companies in Turkey. Accounting and Management Information System, 13(1), 4-34.

- Einhorn, E. (2005). The nature of the interaction between mandatory and voluntary disclosures. Journal of Accounting Research, 43(4), 593-621.

- EPA. (1995). An Introduction to Environmental Accounting As A Business Management Tool: Key Concepts and Terms. United States Environmental Protection Agency. Washington, D.C.

- Galani, D., Alexandridis, A., & Stavropoulos, A. (2011). The association between the firm characteristics and corporate mandatory disclosure the case of Greece. World Academy of Science, Enginerring and Technology, 5(5), 1048-1054.

- Hasan, M.T., & Hosain, M.Z. (2015). Corporate mandatory and voluntary disclosure practices in Bangladesh: Evidence from listed companies of dhka stock exchange. Research Journal of Finance and Accounting, 6(12), 14-32.

- Pham, D.H., & Do, T.H.L. (2015). Factors influencing the voluntary disclosure of vietnamese listed companies. Journal of Modern Accounting and Auditing, 11(12), 656-676.

- IASB. (2018). The Conceptual Framework for Financial Reporting 2018. IFRS Foundation. UK.

- IFAC. (2005). The International Guidance Document on Environmental Management Accounting. New York, USA: International Federation of Accountants.

- IMA-ACCA. (2005). From Share Value to Shared Value: Exploring the Role of Accountants in Developing Integrated Reporting in Practice.

- Jensen, M., & Meckling, W. (1976). Theory of the company: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kaya, I. (2016). The mandatory social and environmental reporting: Evidence from France. Procedia-Social and Behavioral Sciences, 229, 206-213.

- KPMG. (2015). Currents of Change the KPMG Survey of Corporate Responsibility Reporting 2015.

- Li, H., & Peng, Z. (2011). A study of factors influencing voluntary disclosure of Chinese listed companies. M&D Forum, 245-257.

- Mobus, J.L. (2005). Mandatory environmental disclosures in a legitimacy theory context. Accounting, Auditing & Accountability Journal, 18(4), 492-517.

- Negash, M. (2009). IFRS and Environmental Accounting. Retrieved from http://papers.ssrn.com/ sol3/papers.cfm?abstract_id=1516837

- Omar, B., & Simon, J. (2011). Corporate aggregate disclosure practice in Jordan. Advances in International Accounting, 27, 166-186.

- Owusu-Ansah, S. (1998). The impact of corporate attributes on the extent of mandatory disclosure and reporting by the listing companies in Zimbabwe. International Journal of Accounting, 33(5), 605-631.

- Sani, M.D. (2018). Mandatory social and environmental disclosure: A performance evaluation of listed nigerian oil & gas companies pre- and post-mandatory disclosure requirements. Journal of Finance and Accounting, 6(2), 56-68.

- Wallace, R.O., & Naser, K. (1995). Firm-specific determinants of comprehensiveness of mandatory disclosure in the corporate annual reports of firms on the stock exchange of Hong Kong. Journal of Accounting and Public Policy, 14, 311-368.

- Welbeck, E.E., Owusu, G.Y., Bekoe, R.A., & Kusi, J.A. (2017). Determinants of environmental disclosures of listed firms in Ghana. International Journal of Corporate Social Responsibility, 2(11).