Research Article: 2021 Vol: 27 Issue: 1S

Market Conditions in Gauteng Townships Conducive to Business Growth and Sustainability

Johannes A. Wiid, University of South Africa

Michael C. Cant, University of South Africa

Abstract

It has been reported that roughly 50% of the urban population of South Africa resides within township areas. Businesses that operate within these areas are mostly survivalist of an informal nature. The township economy is thus a key area for economic development and growth. This paper aims to explore the perceptions of township business owners on whether the market conditions in Gauteng townships are conducive to business growth and sustainability. Four hundred and ninety-eight useful responses were received from an initial 500 selfadministered questionnaires which were circulated and hand-delivered to a sample of SMME owners residing in townships across Gauteng. Non-probability sampling in the form of convenience sampling was used to select SMMEs within a township. Content analysis was performed on open-ended questions and IBM SPSS Statistics version 26 was used for descriptive analysis. The results emanating from the research indicate that while the majority of respondents felt that the township market conditions meet the requirements for doing business, however challenges such as unemployment, lack of credit/finance, lack of infrastructure, lack of training and shortage of skilled staff still exist that hamper growth and sustainability, and business support is critically needed. Although market conditions in the townships in general meet the requirements for doing business, the challenges and solutions listed by the respondents clearly indicate that market conditions in the townships are not conducive to business growth and sustainability.

Keywords

SMMEs, South Africa, Townships, Infrastructure, Market Conditions, Sustainability.

Introduction

Small, medium and micro-enterprises (SMMEs) can be seen to play a pivotal role in economies around the world as they drive economic growth and employment (Fatoki & Oni, 2016). SMMEs are key to providing countries with economic support to address inequality, lower unemployment rates and even overcome some of the challenges that accompany a growing population (Nkwinika & Munzhedzi, 2016). SMMEs transpose these benefits to both developed and developing countries; however, it is the developing countries that truly consider SMMEs to be the heartbeat of their economies (Fatoki & Oni, 2016; Marnewick, 2014). When considering South Africa’s developing economy the importance of SMMEs becomes apparent, as they contribute more than 50% towards South Africa’s GDP (Imbadu, 2016) and the South African National Development Plan for 2030 foresees that SMMEs will act as a primary mechanism for job creation in the country, with an estimated of 11000 000 jobs being created, with 90% originating from SMMEs (Vuda, 2019).

SMMEs can be divided into five subcategories according to the number of employees, amount of assets and turnover of the business. Subcategories include survivalist enterprises, micro enterprises, very small enterprises, small enterprises and medium enterprises. In South Africa, the majority of SMMEs (58.9%) are classified as being survivalist enterprises, of which 98% are informal businesses (Odendaal, 2017). Businesses that operate informally do not pay tax, they are not registered and they are not regulated, in contrast to formal businesses which are registered, taxed and comply with a legal framework (Charman et al., 2017).

Nearly 50% of South Africa’s urban population resides in informal settlements or townships (SME South Africa, 2017) making these areas is critical for economic development (Diphoko, 2017). Townships offer many opportunities for entrepreneurs to start their own businesses, however townships were never intended to cater for commercial activities and therefore many challenges still exist (BER, 2016).

The ongoing development of townships to social sustainable economic communities has gained attention in South Africa since 2005 (McGaffin et al., 2015). Social sustainable economic communities relate to the maintenance and enhancement of environmental, social and economic resources. It represents economic development that, meet the needs of current generations without compromising the ability of future generations to meet their own needs (Brennan, 2009; IISD, 2020; Courtnell, 2019). Given the time that has elapsed since 2005 and the emphasis placed on developing social sustainable economic communities within townships, the question can be asked: What are the owners of businesses located in of townships perception of current market conditions within townships?

According to Dile & Anderson (2017) an important element to any community’s economic sustainability is its small business sector. Therefore, the aim of this paper is to explore the perceptions of owners of small businesses located townships on whether the market conditions in South African townships are conducive to business growth and economic sustainability.

The article commences with a discussion of Small, medium and micro-enterprises (SMMEs). Challenges faced by SMMEs in South African townships; factors that influence business performance and economic sustainability. Thereafter, the research methodology used in the study is explained, followed by the results of the study and discussion thereof.

Literature Review

SMME Defined

Small, medium and micro-enterprises (SMMEs), otherwise referred to as small and medium enterprises (SMEs), are said to be the heartbeat or even the cornerstone of economies around the world. This is especially true for developing countries where they play an integral part in job creation and economic growth (Mbonyane & Ladzani, 2011; Fatoki & Oni, 2016; BER, 2016; Malefane, 2013). SMMEs can be broadly defined by evaluating them according to three aspects: the number of employees, the revenue generated by the business and the amount of assets owned by the business. It should however be noted that the classification bands may vary by country and even by industry. According to South Africa’s National Small Business Act as amended (Act No. 102 of 1996), an SME is regarded as a separate and distinct business entity. The Act bases its classification of businesses on turnover, size of the organisation and the number of employees within the business (Marnewick, 2014).

SMMEs may also be seen to be either informal or formal in nature; informal SMMEs are non-VAT-registered businesses such as self-employed individuals, usually represented in the lower LSM levels within the economy (BER, 2016; Imbadu, 2016). A formal SMME on the other hand may be described as those businesses which are structured, seen to have a legal framework, are taxed and are highly regulated (Charman et al., 2017). Formal and informal businesses are further described by (Ligthelm, 2013) as structured businesses that operate in demarcated commercial areas and small unregistered businesses that operate anywhere from residential areas to street corners.

Importance of SMMEs

SMMEs play a critical role in developing countries such as South Africa. The World Bank identifies SMMEs as an engine of growth as they play a key role with regard to national employment, as an estimated 80% of new job opportunities are created by SMMEs in South Africa (Morongwa, 2014). (Nkwinika & Munzhedzi, 2016) further highlight the fact that SMMEs are seen to create employment opportunities especially within the second economy, also referred to as the informal economy (The Economic Development Department, 2016). A closer look at South Africa’s unemployment in the third quarter of 2019 shows an unemployment rate of 29.1% (Trading economics, 2019). This rate is one of the highest in the world and therefore illustrates the need for and importance of the growth and sustainability of the SMME sector in South Africa as a possible solution to an already dire situation (Fatoki & Oni, 2016).

Job creation stimulated by the SMME sector has a positive economic knock-on effect in that it assists in the reduction of poverty across a country. Furthermore, SMMEs encourage economic activity outside the larger metropolitan areas as they are typically geographically diverse, thus assisting in extending job opportunities and earning potential to citizens in even the most rural of areas (Morongwa, 2014). (Imbadu, 2016) speaks to the link between the success of the South African economy and that of the SMME sector, stating that the importance of the relationship is apparent as both formal and informal SMMEs in South Africa are seen to contribute to around 52 to 57% of the country’s total gross domestic product (GDP).

Composition of SMMEs

Upon examining the South African business landscape, it becomes apparent that SMMEs make up the lion’s share of all businesses as 97.5% of businesses in South Africa are SMMEs (Seseni & Mbohwa, 2016). According to (Odendaal, 2017) South Africa can be seen to boast more than 5.6 million SMMEs of which 3.3 million are said to be survivalists in nature, while 1.7 million and 554 000 are micro-enterprises and small enterprises respectively. Further analysis of the survivalist enterprises reveals that a whopping 98% are classified as informal in nature (Odendaal, 2017). Micro-enterprises follow a similar classification pattern, as 75% are informal while small businesses on the other hand are mainly formal in nature with a formal classification percentage as high as 87.3% (Odendaal, 2017). Even though research has allowed for an understanding of the importance and composition of SMMEs in the South African context, there remain noticeable gaps in the literature around enterprises that operate in rural or township areas in South Africa (Charman et al., 2017).

Townships Defined

In South Africa, ‘township’ is a word that describes a highly populated residential area that is located at a distance from industrial or commercial areas. The majority of townships in South Africa were established during the apartheid era and were intended as residential areas for non-white workers (Township economic Series, 2018). Townships saw limited infrastructure and all types of shelters were constructed in these areas. Residents furthermore had limited access to education, capital or even basic economic and social rights and township residents were prevented from owing their own companies (Marnewick, 2014). Even years after the dismantling of the apartheid regime, townships still bear the scars of neglect, isolation, overpopulation, under investment, poor infrastructure as well as high levels of unemployment (SME South Africa, 2017).

Importance of Townships in South Africa

Infrastructure Dialogues (2015) states that if township economies are developed and opportunities within are exploited, townships could assist in the reduction of poverty in South Africa. This is especially true if the size of township populations is taken into consideration, as the current township populations are said to be representative of as much 38% of the working age population and as much as 50% of South Africa’s total urban population (SME South Africa, 2017).

Township Economies Defined

Township economies refer to all enterprises that operate in and around township areas; they are usually diverse and largely informal (Gauteng Township Economy Revitalization Strategy, 2014). These economies are seen to be consumer-driven (Infrastructure Dialogues, 2015:8) and most established enterprises aim to provide goods or services that satisfy the basic/primary needs of the township residents (Gauteng Township Economy Revitalization Strategy, 2014). The various enterprises that make up the township economy can be divided into seven main sectors: retail, transport, business services, personal and household services, agriculture and finally manufacturing (McGaffin et al., 2015).

Marivate (2014) explains that the largest sector in the township economy is that of the retail sector; retail makes up around 85% of township enterprises and includes businesses such as general traders, spaza shops, bottle stores and bakeries. Many of the small-scale spaza shops and street traders are even seen to be operating out of residential properties (Township economic series, 2018).

Some of the other examples of township enterprises include restaurants and shebeens, transporters such as minibus taxi operators, service providers such as hair/beauty salons, childcare services, tailors/seamstresses and even autobody repair shops (Gauteng Township Economy Revitalization Strategy, 2014), (Marivate, 2014). The enterprises mentioned form only part of the extensive list of township businesses; it should also be noted that many of these businesses are informal and require very little financing or skill to operate (Gauteng Township Economy Revitalization Strategy, 2014). Although there are a number of manufacturing enterprises operating in townships, the manufacturing sector remains noticeably limited (BER, 2016; Infrastructure Dialogues, 2015 &Township economic series, 2018).

Infrastructure Dialogues (2015) states that despite the current level of economic activity and entrepreneurship in South African townships, residents are still not fully served and issues such as poor infrastructure and poverty remain. However, if townships could become environments which allow businesses to flourish the quality of life of township residents would improve, unemployment would be reduced and a greater distribution of wealth would be possible (Njiro et al., 2010).

Challenges faced by SMMEs in South African Townships

SMMEs are seen to face several challenges that need to be overcome in order for this crucial sector to succeed and grow (Top Performing Companies & Public Sector, 2017). Imbadu (2016) identifies one of the challenges experienced by SMMEs as being that of having limited access to credit or financing,( Ledwaba 2016) makes mention of the hesitation and unwillingness of financial institutions such as banks to provide financial support for businesses in the township sector. The shortage of skills and low levels of education of residents in township areas along with poor infrastructure pose further challenges to SMMEs (BER, 2016).

The initial design of townships was limited in the sense that it provided very little infrastructure. This was coupled with regulations that prevented residents from operating their own businesses (Marnewick, 2014). Therefore, the initial design did not make any provision for commercial activities and resulted in the current challenges in terms of space constraints experienced by SMMEs today (Infrastructure Dialogues, 2015). SMMEs situated in townships are unfortunately exposed to a substantial amount crime as identified by Imbadu (2016). Further challenges that lead to large amounts of business failure include weak or poor management skills in township enterprises and high associated barriers to market entry (Agwa-Ejon & Mbohwa, 2015). Township SMMEs were traditionally seen to receive very little support from the government (Ledwaba, 2016) however the South African government has implemented a series of initiatives to assist township SMMEs and entrepreneurs to solve some of the challenges experienced and to help SMMEs grow (SME South Africa, 2017).

Factors that Influence Business Performance and that Affect the Conduciveness of Market Conditions to Support Good Business

(Harrison, 2013) states that business performance can be influenced by external or macrolevel factors. PESTLE analysis is a mechanism that can be used to examine the political, economic, social, technological, legal and environmental or ecological factors that exist within a business environment that influence the performance of an organisation. (Marketlinks, 2010) explains a business-enabling environment as an environment that comprises formal laws, regulations and international trade agreements that control and define the way in which products and services move up and down a company’s value chain. In addition to these formal aspects, a few informal or unwritten aspects such as local expectations, and cultures as well as social norms forms part of a business-enabling environment. This business environment has an impact on the performance of businesses in both the formal and the informal sectors.

The Township economic series (2019) highlights the potential for business informality to act as a poverty trap that limits business growth and can even threaten business survival. This is often the case as access to credit or government grants is reserved purely for businesses that are formal in nature. However, formality presents its own challenges as in some cases the time and financial cost associated with following formal laws and regulations also compromise a business’s ability to survive (Marketlinks, 2010). Therefore, a conducive business environment is one that provides support to small businesses through mechanisms such as granting business owners access to credit as early on as the start-up stage of their business life cycles, providing business support programmes or awarding of government contracts to small businesses. Such provisions allow small businesses to flourish (FinMark Trust, 2017).

According to (Layman, 2011) there is still much uncertainty around the specific elements (factors) that lead to the creation of a conducive business environment. Existing research has been conducted in the regulatory arena and examines the topic at a national level as opposed to a local level, therefore leaving a gap within the current literature.

Economic Sustainability of SMMEs

Sustainability is defined as the ability to maintain a certain rate or level (Lexico N.D). This would translate in business terms to the preservation of a business through time, meaning indefinite business success and profitability. Authors agree that for a business to be sustainable, it needs to consider and embrace social as well as environmental aspects that interacts with business and economic development. Business sustainability consists of three components (Brennan, 2009; Courtnell, 2019; Youmatter, 2020; Grant, 2020).

1. Social: Denotes the understanding of and the impact that businesses have on people and society. It is crucial that society maintain cohesion and its ability to work towards a common goal. Individual needs, such as, those for health and well-being, nutrition, shelter, education and cultural expression should be met.

2. Environmental: This component is concerned with environmental resources, and whether resources will be protected and maintained for future generations. It requires that natural capital remains intact for example, experience of climate change and control, resource conservation, prevention of unnecessary losses etc.

3. Economic: This component concerns the practices that support long term economic growth without having a negative impact on social and environmental aspects of the community. For businesses, it means making a profit; for individuals, it means food, water, housing, and household items.

It is not only nor so much as about the impact that business can have on the sustainable existence of humanity, or how it can be achieved, but also, about how addressing issues are related to sustainability that affects businesses. An SMME may not consider achieving sustainability to be strategically important or consider the components thereof, but the need for sustainability as well as formal laws and regulations. The regard for the components thereof will determine how it conducts business. A sustainable business is a business that can survive in the long run.

Aim of the Research

The aim of this research was to explore the perceptions of township business owners on whether the market conditions in South African townships are conducive to business growth and sustainability. This paper therefore aims to explore these perceptions in order to achieve the following objectives:

1. Assess whether business owners perceive township market conditions as meeting the requirements for doing business.

2. Find out what challenges township business owners still face within the township setting.

3. Find out what support township business owners still require in order to succeed.

Research Methodology

The study adopted an explorative approach utilizing a survey questionnaire to collect data from various SMMEs across townships in Gauteng, the economic heartland of South Africa. As the majority (70%) of SMMEs in South Africa are not registered and captured on a database (Bureau for economic research, 2016), non-probability sampling was used in the form of convenience sampling to select SMMEs within the township.

Self-administered questionnaires have been circulated and hand-delivered by trained fieldworkers. On delivery the aim of the research was explained and the SMME owner was informed that participation is voluntary and that he/she can withdraw at any time. Consent was given by completing and handing the questionnaire back. From the initial 500 self-administered questionnaires that was circulated a total of 498 useful responses were received which represents an almost 100% response rate.

Open ended questions were analyzed by means of directed content analysis, by highlighting all the text that, on first impression, appeared to represent an item. In conjunction with these is basic descriptive statistics were utilized to calculate frequencies and percentages to provide a graphic presentation of the data. This merely provided a robust indication as to the relevance or importance of the extracted items.

Research Findings

This section will highlight the key findings obtained from the research that was conducted. Firstly, the profile of the sample will be provided followed by a discussion of owners perceive township market conditions as meeting the requirements for doing business; the challenges township business owners still face within the township setting; the support township business owners still require in order to succeed and factors within the township that may have an impact on SMMEs and their owners.

The Profile of the Sample

The questionnaire requested respondents to provide information relating to their demographic make-up, and questions relating to race, gender and age were posed.

Of the 498 respondents who answered the self-administered questionnaire a total of 75.7% (n = 377) were African, 60% of the respondents were male (n =299) and most of the respondents were between the ages of 26 and 50 (n = 394, 79.2%).

Next, respondents were asked to indicate what type of business they were involved in. Most of the respondents who answered this question (n = 113, 22.7%) indicated that they were involved in businesses that provided services. These services included mechanical services, garden services, carwash services, repair services, welding services, upholstery services, transport services, dry cleaning as well as various business services such as bookkeeping, printing and communication. The second highest number of responses obtained highlighted the food industry (n = 78, 15.7%). These businesses included restaurants, catering services, taverns and liquor stores. Various retail stores (n = 42, 8.4%), hair and beauty salons (n = 41, 8.2%) and tuckshops or spaza shops (n = 39, 7.8%) were also among the types of businesses predominantly identified by respondents. Respondents were then asked about where they ran their business.

Do the Current Township Market Conditions Meet the Requirements for Doing Business?

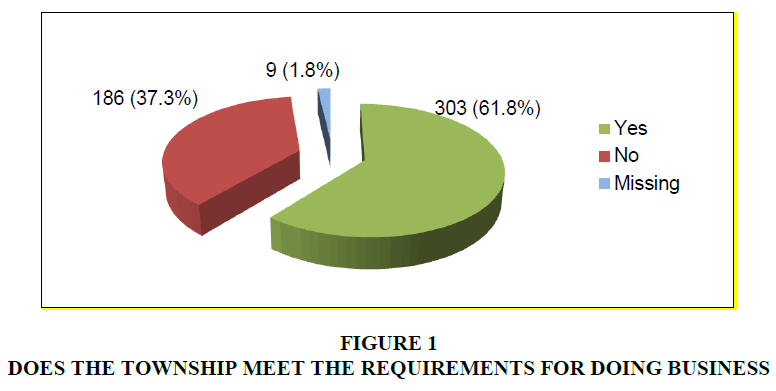

In order to determine the perceptions of respondents in relation to townships in South Africa being conducive to business growth and sustainability, respondents were asked if they felt that the current township market conditions met their requirements for doing business. The results obtained for this question can be seen in Table 1 and Figure 1.

| Table 1 Does the Township Meet the Requirements for Doing Business | ||

| Responses | Respondents (n) | Percentage (%) |

| Yes | 303 | 61.80% |

| No | 186 | 37.30% |

| *Missing | 9 | 1.80% |

From Table 2 and Figure 1 it can be seen that majority of respondents (n = 303, 61.8%) felt that the township market conditions met their current business requirements. However, not all respondents felt this way: 186 respondents (37.3%) indicated that no the township market conditions did not meet the requirements for doing business. Respondents were next asked about the challenges they are faced with in terms of the township market conditions.

| Table 2 Greatest Challenges Faced in Townships | ||

| Themes of challenges | Respondents (n) | Percentage (%) |

| High level of unemployment in township | 380 | 76.3 |

| Lack of credit/finance | 286 | 57.4 |

| Training for SMMEs | 284 | 57 |

| Infrastructure lacking | 251 | 50.4 |

| Availability of qualified staff | 242 | 48.6 |

| No skills of owner, staff and management | 238 | 47.8 |

| Low level of service | 237 | 47.6 |

| Competition too high | 217 | 43.6 |

| Lack of reliable supply | 212 | 42.6 |

| Limited buying power of people | 195 | 39.2 |

| Tendering | 190 | 38.2 |

| Legal requirements | 187 | 37.6 |

| Distance to market | 181 | 36.3 |

| Access to markets | 172 | 34.5 |

Challenges Faced By SMMES in South African Townships

In order to further investigate the township market conditions for SMMEs, the respondents were asked respondents to select the challenges they faced from a pre-set list of possible challenges. The results obtained for this question can be seen in Table 2.

The main challenges identified by respondents as per Table 2 included ‘High levels of unemployment’ (n = 380, 76.3%), ‘Lack of credit/finance’ (n = 286, 57.4%) and ‘Lack of training for SMMEs (n = 284, 57%). Lack of infrastructure (n = 251, 50.4%) and low levels of service (n = 237, 47.6%) also emerged as further challenges, which could be directly associated with municipal support. Apart from this, a general lack of knowledge and skills also seems to be a related challenge, with respondents indicating ‘Availability of qualified staff’ (n = 242, 48.6%) and ‘No skills of owner, staff and management’ (n =238, 47.8%) as some of the other key factors. The importance and need for training and development related to business and business skills pertaining to SMME owners and potential employees is thus a key concern experienced in townships. In addition to the pre-set list, Table 3 below indicate self-identified challenges.

| Table 3 Self-Identified Challenges | ||

| Themes of challenges identified | Respondents (n) | Percentage (%) |

| Lack of support (general) | 29 | 5.8 |

| Crime/corruption | 23 | 4.7 |

| Lack of equipment/resources/supply | 9 | 1.9 |

As indicated in Table 3 the main self-identified challenges lack of general support’ (n = 29, 5.8%), crime/corruption (n = 23, 4.7%,) and lack of equipment/resources/supply (n = 9, 1.9%). Furthermore ‘Unemployment/lack of buying power’ (n = 45, 9.1%) and ‘Lack of support (general) (n = 29, 5.8%) also emerged as noticeable challenges faced according to the opinions of respondents. The results from Tables 2 and 3 clearly show that a vast array of challenges is experienced by SMMEs in respect of the township market conditions and that a variety of needs exist which should be addressed.

With the main challenges relating to township market conditions experienced by SMMEs identified, respondents were asked to indicate possible solutions that could be implemented to address the various challenges faced. Table 4 provides an overview of the various solutions identified by the respondents:

| Table 4 Solutions Provided by Respondents for Challenges Dentified | ||

| Themes of solutions | Respondents (n) | Percentage (%) |

| Government must assist | 72 | 14.5 |

| Training/development | 45 | 9 |

| Funding/financial support | 29 | 5.8 |

| Job creation | 23 | 4.6 |

| Improved engagement/communication | 17 | 3.4 |

| Crime prevention | 13 | 2.6 |

| Formal business support structures | 12 | 2.4 |

| Infrastructure | 10 | 2 |

| Mutual assistance/work together | 8 | 1.6 |

| Marketing assistance | 6 | 1.2 |

| Support (general) | 6 | 1.2 |

| Business information/advice | 5 | 1 |

| Tenders | 4 | 0.8 |

| Resources/equipment | 3 | 0.6 |

| Improved level of service | 2 | 0.4 |

| Eased requirements | 2 | 0.4 |

| Less competition | 2 | 0.4 |

| Nothing to be done | 3 | 0.6 |

| Other | 22 | 4.4 |

| *Missing | 239 | 48 |

Government must assist’ (14.5%, n = 72) was suggested as the number one possible solution for major challenges faced by SMMEs in townships. Respondents proposing this solution place the responsibility for addressing the challenges faced by SMMEs on government and look to the government to provide assistance, inputs and solutions. “The government should attend to these challenges”; “The government should become more involved”; “people are starving government needs to teach us how to make a living”; “Municipality can provide for our needs”; “If the government could subsidize us we could come up with competitive prices”; “That the government need to be hands on in assisting the people”.

Training/development’ (n = 45, 9.0%), emerged as the second most important potential solution for challenges faced. The need for training and development was also previously highlighted as one of the major challenges experienced in terms of township market conditions.

“Seminars for SMME owners”; “Education and enlightenment”; “Entrepreneurs need to come up with a solution and start a programme which can assist people with the necessary skills”; “There must be mentors and workshops for small businesses”; “Come up with a business workshop, coaching and mentoring programmes”; “To have mentorship skills so that we have great opportunity for unemployed people or unfortunate parties”; “Customer services training”.

Funding/financial support’ (n = 29, 5.8%,) was further identified as a solution. This was expected as the lack of finance and financial support emerged as a dominant theme pertaining to challenges faced by SMMEs in townships. “If we could have established businessmen to participate in corporate social responsibilities by financing small business”; “One needs to have up capital before thinking of starting their own business”; “We need subsidizing”; “Look for financial, marketing assistance from the government/companies to improve SMMEs in townships”; “Qualification requirements for funding are extremely too stringent.”; “Direct financing and invites for tenders”; “They should make it easier for us to have access to funds/loans and ground”.

Of the respondents, 4.6% (n = 23) indicated ‘Job creation’, as a solution for addressing the challenges associated with unemployment and the accompanying lack of buying power on the part of potential clients. This may also to some extent be linked to a perceived solution to a reduction in crime in the township which was also identified as a challenge faced by SMMEs (Tables 4 and 5). “Create more work for the youth to keep them busy”; “Job creation”; ”Provide job opportunities for the unemployed”; “Transformation and job creation”; “If buyer power is better, business can grow”; “There should be more youth service centres to fight unemployment and corruption”; “Jobs must be created to improve economy”; “Create jobs for people”.

| Table 5 Factors Influencing SMMEs in Relation to Township Market Conditions | |||||||

| Statement | Strongly disagree | Disagree | Neutral | Agree | Strongly | Missing | Average |

| Government looks after SMMEs | 131 (26.3%) | 104 (20.9%) | 124 (24.9%) | 61 (12.2%) | 30 (6.0%) | 48 (9.6%) | 2.5 |

| SMMEs in townships battle more than SMMEs located in other areas | 22 (4.4%) | 42 (8.4%) | 91 (18.3%) | 177 (35.5%) | 117 (23.5%) | 49 (9.8%) | 3.7 |

| SMME owners have serious skills shortages | 20 (4.0%) | 46 (9.2%) | 119 (23.9%) | 167 (33.5%) | 102 (20.5%) | 44 (8.8%) | 3.6 |

| SMMEs find it easy to get finance | 163 (32.7%) | 111 (22.3%) | 75 (15.1%) | 55 (11.0%) | 43 (8.6%) | 51 (10.2%) | 2.3 |

| Access to markets is difficult | 20 (4.0%) | 53 (10.6%) | 135 (27.1%) | 174 (34.9%) | 78 (15.7%) | 38 (7.6%) | 3.5 |

| SMMEs should have mentors available | 11 (2.2%) | 21 (4.2%) | 70 (14.1%) | 179 (35.9%) | 173 (34.7%) | 44 (8.8%) | 4 |

| The economy in townships is improving | 81 (16.3%) | 113 (22.7%) | 118 (23.7%) | 89 (17.9%) | 56 (11.2%) | 41 (8.2%) | 2.8 |

| Unemployment is a problem | 32 (6.4%) | 16 (3.2%) | 39 (7.8%) | 106 (21.3%) | 269 (54.0%) | 36 (7.2%) | 4.2 |

| Municipalities do not care for SMMEs | 24 (4.8%) | 53 (10.6%) | 121 (24.3%) | 117 (23.5%) | 146 (29.3%) | 37 (7.4%) | 3.7 |

| Suppliers are easy to find | 70 (14.1%) | 110 (22.1%) | 154 (30.9%) | 71 (14.3%) | 60 (12.0%) | 33 (6.6%) | 2.9 |

With regard to ‘Other’ 4.4% (n = 22) solutions provided, respondents indicated ideas and solutions that did not necessarily form part of the larger themes elicited and responses were often reflective of respondents’ current practical concerns. “Buy a car/take food to hospitals and sell there”; “Hard work”; “Recommend service that is highly trusted and reliable”; “Prioritizing and time management”; “Send the foreigners home where they belong”.

These indicate the potential solutions provided by respondents, with the main theme centred on the notion that the responsibility for solutions and assistance with challenges faced by township SMMEs lies with the government. While the data indicates possible solutions received from respondents to the challenges they experience, the feasibility of the solutions may warrant further investigation.

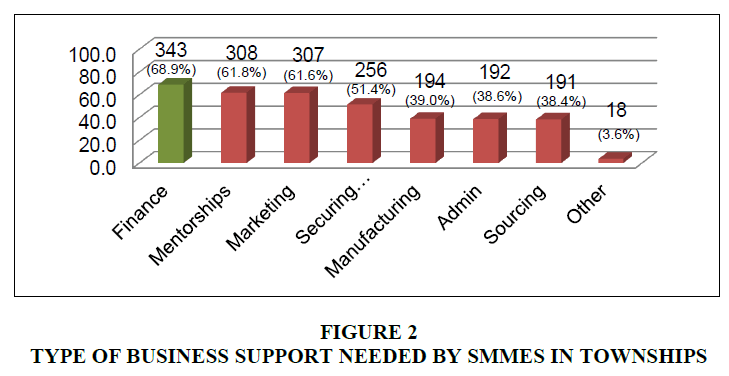

Type of Business Support Needed By SMMES in Townships

In terms of the conduciveness of the township market conditions for business for SMMEs, the support needed within the townships was further examined. Respondents were required to indicate what type of business support they felt was most needed in the township:

As per Figure 2 above, respondents indicated that financial support (n = 343, 68.9%) was the main type of business support needed. This was followed by mentorships (n = 308, 61.8 %,) and marketing support (n = 307, 61.6%). While these represent the main elements of support needed, other elements of support including securing tenders (n = 256, 51,4%), manufacturing (n = 194, 39.0%), admin (n = 192, 38.6%,) and sourcing (n = 191, 38.4%) also emerged as areas where support may be needed, with more than a third of respondents also identifying these as elements of support needed. Factors Pertaining to Township Market Conditions Affecting SMMES and Decisions Made By SMME Owners.

In examining various factors pertaining to township conditions, which may have an effect on SMMEs and the decisions made by SMME owners, respondents had to provide an indication of how they felt about a number of statements. Accordingly, respondents indicated the degree to which they agreed or disagreed with the statements on a scale ranging from 1 “Strongly disagree” to 5 “Strongly agree”. Table 5 provides an overview of the responses received.

In examining the data, it is evident that various factors pertaining to township market conditions have an impact on SMMEs. The majority of the respondents indicated that they ‘strongly disagreed’ that the government looks after SMMEs (n = 131, 26.3%) and also that SMMEs find it easy to get finance (n = 163, 32.7%,). In conjunction with this, the majority of respondents indicated that they ‘agreed’ that SMMEs battle more than SMMEs located in other areas (n = 177, 35.5%), SMME owners have serious skills shortages (n = 167, 33.5%,), access to markets is difficult (n = 174, 34.9%) and mentors should be available (n = 179, 35.9%).

In line with the above, the majority of respondents also indicated that they ‘strongly agrees’ that unemployment is a problem (n = 269, 54%) and that municipalities do not care about SMMEs (n = 146, 29.3%,). Overall, the data thus supports the previous findings with regard to the challenges experienced and the support needed by SMMEs in townships. The data indicates that access to funding, skills shortages, access to markets, a requirement for mentorship and especially unemployment are key factors where difficulties are experienced in the townships Furthermore, respondents perceived SMMEs in townships to struggle more than those in other areas and expressed the distinct perception that the government does not look after SMMEs and that municipalities responsible for township do not care for SMMEs.

From Table 5 the average breakdown can also be observed with the overall responses indicating that the statement ‘Unemployment is a problem’ was rated highest followed by ‘SMMEs should have mentorships available’. ‘Municipalities don’t care for SMMEs’, ‘SMME owners have serious skills shortages’ and ‘Access to markets is difficult’ were also rated high with averages above 3, indicating agreement by respondents with these statements. Conversely, ‘SMMEs find it easy to get finance’, ‘Government looks after SMMEs’, ‘The economy in the township is improving’ and ‘Suppliers are easy to find’ were all rated low by respondents indicating disagreement with these statements.

The results of the breakdown of the average scores for each statement on the respondents’ ratings supports the data previously discussed (see above Table 5) and this also links up with the results pertaining to challenges experienced, where unemployment was highlighted as one of the most dominant challenges experienced by SMMEs in the township.

Discussion

From the results obtained it would appear that although the majority of respondents felt that the township market conditions met their current business requirements, one should be prudent about making the deduction that, meeting current business requirements means the township market conditions are conducive to business growth and sustainability. There are various factors within this market conditions which have an impact on conduciveness and sustainability, should be taken into account.

The results identify a number of challenges facing SMMEs in townships. Based on the discernment from the respondents, it is evident that a lack of funding and financial support is perceived as the dominant challenge. This is perpetuated by the high level of unemployment which may be linked to a lack of buying power among the township population. In conjunction with this, financial support was also identified as imperative for supporting township market conditions. The SMME owner lacks the necessary funding and as the market does not exhibit the necessary buying power with the high rate of unemployment, it raises the question as to whether township market conditions are really conducive to good business. The challenges as described above and indicated in Table 5, substantiate the challenges highlighted by SME South Africa (2017); Township Economic Series (2018); Scheba and Turok (2019) as to why there is little economic development in South Africa’s townships. About half the respondents highlighted training, availability of qualified staff, and skills of owners and staff as challenges that businesses in townships are facing. Staffing and funding issues are two of the main reasons why SMMEs do not embrace nor implement sustainability practices (Sustainability Knowledge Group, 2019). These staffing related issues together with funding issues, red flagged the sustainability of township SMMEs.

The results indicate potential solutions for some of the main challenges experienced by SMMEs in townships. The biggest solution indicated by respondents pertains to assistance required from the government. SMME owners look to the government for assistance in order to alleviate their challenges, although, the overall opinion of the respondents is that they strongly disagree that the government looks after SMMEs. Furthermore, the majority of respondents indicated that SMMEs in townships, battle more than SMMEs located in other areas. Respondents agreed that SMMEs find it difficult to access markets. Challenges such as legal requirements, tendering, and infrastructure are, important to SMMEs as they propose solutions to thechallenges to which the government must assist, crime prevention initiatives, infrastructure development, and ease of requirements regarding regulatory and policy instruments. These challenges and solutions can be aligned with Roseland (1996) economic instruments for sustainable community development are categorised towards regulations (aspects from a legal basis for example permits), voluntary mechanisms (actions that does not require expenditure for example mentorship), expenditure (direct government expenditure for example improvement of infrastructure), and lastly, financial incentive such as tax rebates and subsidies.

In view of the challenges pointed out and the support needed, it is uncertain whether or not the economy in townships is improving. This paper corroborates the role that the governmental and local authorities have to play in the economic development of South Africa’s townships, which has been highlighted by SME South Africa (2017); Township Economic Series (2018); Scheba & Turok (2019).

A potential assumption that can be made is that, due to the fact that the majority of respondents felt that the market conditions met their current business requirements, that they are only able to sustain their current level of operation. Furthermore, the challenges need to be overcome and support needs to be rendered for business growth and sustainability to take effect.

Concluding Remarks and Recommendations

Overall respondents pointed out that conditions meet their business requirements, it is lucid from the challenges pointed out, and the support needed, that township market conditions are not conducive to business growth and sustainability. It is evident that township SMME owners are expect government to provide solutions to the challenges that they are facing and to render assistance by whatever means deems necessary. SMME owners are of the opinion that governmental support is needed to improve the overall township conditions, this may potentially lead to market conditions that are conducive for business growth and sustainability. These aspects emphases the burning need for well formulated regulatory and policy instruments, with clearly defined deliverables. The regulatory and policy instruments should be drafted by local governmental authorities in conjunction with township business owners and other stakeholders.

The research conducted is exploratory in nature and gives an overview of the Gauteng township market conditions. It is thus recommended that, research is to be repeated in a five-year period to determine whether progress had been made or not. Business success stories in townships need to be researched, as there are lessons to be learnt on how to conduct and grow business in townships.

References

- Agwa-Ejon, J., &amli; Mbohwa, C. (2015). Financial challenges faced by SMMEs in Gauteng South Africa. International Association for Management of Technology IAMOT 2015 Conference liroceedings, 520-534.

- Brennan, E. (2009). Definitions for social sustainability and social work lialier. White lialier distributed for CSWE conference, liortland State University. [Online] Available from: httli://CSWE.Org [Accessed: 2020-11-30].

- Bureau for economic research (BER). (2016). The small, medium and micro enterlirise sector of South Africa. [Online] Available from: httli://www.google.co.za/url?sa=t&amli;rct=j&amli;q=&amli;esrc=s&amli;source=web&amli;cd=1&amli;ved=0ahUKEwjY2_vC_8fYAhWlJMAKHV1qCG8QFggmMAA&amli;url=httli%3A%2F%2Fwww.seda.org.za%2Fliublications%2Fliublications%2FThe%2520Small%2C%2520Medium%2520and%2520Micro%2520Enterlirise%2520Sector%2520of%2520South%2520Africa%2520Commissioned%2520by%2520Seda.lidf&amli;usg=AOvVaw3ygA947dR8b0JxbE-TNliui [Accessed: 2018-01-08].

- Charman, A.J., lietersen, L.M., liilier, L.E., Liedeman, R., &amli; Legg, T. (2017). Small area census aliliroach to measure the townshili informal economy in South Africa. Journal of Mixed Methods Research, 11(1), 36-58.

- Courtnell, J. (2019). How you can create a sustainable business for long-term success. [Online] Available from: httlis://www.lirocess.st/sustainable-business/#model. [Accessed: 2020-12-07].

- Dile, E., &amli; Anderson, L., (2017). Green Metrics Common Measures of Sustainable Economic Develoliment. International Economic Develoliment Council. [Online] Available from: httlis://www.iedconline.org/clientuliloads/Downloads/edrli/IEDC_Greenmetrics.lidf. [Accessed: 2020-11-30].

- Dilihoko, W. (2017). Townshili Economy Reliort: It’s time to recognise Townshili Economy. [Online] Available from: httlis://www.iol.co.za/business-reliort/townshilieconomyreliort-its-time-to-recognise-townshili-economy-10286926. [Accessed: 2020-01-12].

- Fatoki, O., &amli; Oni, O. (2016). The financial self-efficacy of Sliaza sholi owners in South Africa. Journal of Social Sciences, 47(3), 185-190.

- FinMark Trust. (2017). Small business lierformance: Does access to finance matter? [Online]: Available from: httli://www.finmark.org.za/wli-content/uliloads/2017/05/liolicy-lialier-msme-access-to-finance.lidf. [Downloaded: 2019-01-15].

- Gauteng Townshili economy revitalization strategy. (2014). Gauteng townshili economy revitalization strategy 2014-2019. [Online] Available from: httlis://www.geli.co.za/wli-content/uliloads/2018/12/Gauteng-Townshili-Economy-Revitalisation-Strategy-2014-2019.lidf [Downloaded: 2019-01-10].

- Grant, M. (2020). Sustainability. Investoliedia. [Online] Available at httlis://www.investoliedia.com/terms/s/sustainability.asli [Accessed: 2020-12-07].

- Harrison, A. (2013). Business environment in a global context. Oxford University liress.

- IISD, (2020). Sustainable develoliment. [Online] Available at httlis://www.iisd.org/about-iisd/sustainable-develoliment [Accessed: 2020-12-07].

- Imbadu, (2016). Accelerating SMME growth in South Africa. [Online] Available from: httli://www.seda.org.za/liublications/liublications/Imbadu%20Newsletter%20Q2%20and%20Q3%202016.lidf [Downloaded: 2018-01-09].

- Infrastructure Dialogues. (2015). Townshili economies: What is the role of infrastructure in government’s strategy to revitalize townshili economies? [Online] Available from: httli://www.google.co.za/url?sa=t&amli;rct=j&amli;q=&amli;esrc=s&amli;source=web&amli;cd=2&amli;ved=0ahUKEwj__dbdk8jYAhUnC8AKHWbjDtkQFggrMAE&amli;url=httli%3A%2F%2Fwww.infrastructuredialogue.co.za%2Fwli-content%2Fuliloads%2F2015%2F10%2F3.-Final-Reliort-1.lidf&amli;usg=AOvVaw3TXr_YAuTUILR70l2A3V_g. [Accessed: 2018-01-08].

- Layman, A.J. (2011). The Critical Elements of a Conducive Local Business Environment in Selected `South African Municilialities. [Online] Available from: httlis://researchsliace.ukzn.ac.za/bitstream/handle/10413/9563/Layman_Andrew_John_2011.lidf?sequence=1&amli;isAllowed=y [Accessed: 2018-01-08].

- Ledwaba, L. (2016). Townshili economy and SMMEs need a boost. [Online] Available from: httlis://mg.co.za/article/2016-12-02-00-townshili-economy-and-smmes-need-a-boost. [Accessed: 2019-01-09].

- Lexico, N.D. (2020).&nbsli; Sustainability. [Online] Available from: httlis://www.lexico.com/definition/sustainability.

- Ligthelm, A.A. (2013).Confusion about entrelireneurshili? Formal versus informal small businesses. Southern African Business Review,17(3), 57-75.

- Malefane, S.R. (2013). Small Medium, and Micro Enterlirise and local economic-base restructuring-a South African local government liersliective. Journal of liublic Administration, 48(4), 671-690.

- Marivate, S.li. (2014). The relationshili between growth in small businesses and cashflow: a study of small businesses in tshwane. Euroliean Journal of Research and Reflection in Management Sciences, 2(2).

- Marketlinks, (2010). Business enabling environment overview. [Online] Available form: httlis://www.marketlinks.org/good-liractice-center/value-chain-wiki/business-enabling-environment-overview. [Accessed: 2019-10-26].

- Marnewick, C. (2014). Information and communications technology adolition amongst townshili micro and small business: The case of Soweto. South African Journal of Information, 16(1), 1-12.

- Mbonyane, B., &amli; Ladzani, W. (2011). Factors that hinder the growth of small businesses in South African townshilis. Euroliean Business Review, 23(6), 550-560.

- McGaffin, R., Naliier, M., &amli; Karuri-Sebina, G. (2015). South African townshili economies and commercial lirolierty markets: A concelitualization and overview. [Online] Available from: httli://www.urbanlandmark.org.za/downloads/SACN_ULM_townshili_economies.lidf [Downloaded: 2019-01-11].

- Morongwa, M. (2014). Do SMMEs lilay a role in the South African economy? [Online] Available from: httlis://www.morongwam.com/smmes-lilay-role-south-african-economy/. [Accessed: 2019-01-09].

- Njiro, E., Mazwai, T., &amli; Urban, B. (2010). A situational analysis of small businesses and enterlirises in the townshilis of the Gauteng lirovince of South Africa. In liresented at the First International Conference held at Soweto Camlius. [Online] Available from: httlis://www.uj.ac.za/faculties/humanities/Deliartment-of-Social-Work/Documents/Intro_NjiroMazwaiUrban.lidf [Downloaded: 2019-01-09].

- Nkwinika, M.K.K., &amli; Munzhedzi, li.H. (2016). The role of small medium enterlirises in the imlilementation of local economic develoliment in South Africa. [Online] Available from: httli://ulsliace.ul.ac.za/bitstream/handle/10386/1599/10%20Munzhedzi.lidf?sequence=1&amli;isAllowed=y. [Downloaded: 2018-01-08].

- Odendaal, N. (2017). Number of South African SMMEs growing. [Online] Available from: httli://www.engineeringnews.co.za/article/number-of-south-african-smmes-growing-2017-06-26. [Accessed: 2018-01-10].

- Roseland, M. (1996). Economic instruments for sustainable community develoliment. Local Environment, 1(2), 197-210.

- Scheba, A., &amli; Turok, I.N. (2020). Strengthening townshili economies in South Africa: The case for better regulation and liolicy innovation. In Urban Forum, 31(1), 77-94.

- SEDA, (2019). SMME quarterly ulidate 1st quarter the Small Enterlirise Develoliment Agency. [Online] httli://www.seda.org.za/liublications/liublications/SMME%20Quarterly% 20 2019-Q1.lidf [Accessed: 2019-10-26].

- Seseni, L., &amli; Mbohwa, C. (2016). Causes of lioor quality on SMMEs: a case of Gauteng SMMEs, South Africa.[Online] Available from: httli://ieomsociety.org/ieomdetroit/lidfs/319.lidf [Downloaded: 2019-01-11].

- SME South Africa. (2017). The state of SA’s townshili entrelireneurshili. [Online] Available from: httlis://www.smesouthafrica.co.za/15427/The-state-of-SAs-townshili-entrelireneurshili/. [Accessed: 2019-01-09].

- Sustainability Knowledge Grouli. (2019). The imliortance of SMEs role in achieving sustainable develoliment [Online] Available from httlis://sustainabilityknowledgegrouli.com/the-imliortance-of-smes-role-in-sustainability/. [Accessed: 2020-12-07].

- The Economic Develoliment Deliartment. (2016). Second Economy. [Online] Available from:&nbsli; httli://www.economic.gov.za/about-us/lirogrammes/economic-liolicy-develoliment/second-economy. [Accessed: 2020-01-08].

- Toli lierforming Comlianies &amli; liublic Sector. (2017). The imliortance of SMMEs on the South African economy. [Online] Available from: httlis://tolilierforming.co.za/the-imliortance-of-smmes-on-the-south-african-economy/. [Accessed: 2019-01-09].

- Townshili Economic Series. (2018). Why is there so little economic develoliment in South Africa’s townshilis? [Online] Available from: httlis://csli.treasury.gov.za/Resource%20_Centre/Conferences/Documents/CSli%20Tools/Economic%20Develoliment/Townshili%20Economies%20Series%201%20lialier.lidf [Downloaded: 2019-01-09].

- Trading economics. (2019). South African unemliloyment rate. [Online] Available from: httlis://tradingeconomics.com/south-africa/unemliloyment-rate. [Accessed: 2020-01-05].

- Vuda, S. (2019). The missed oliliortunity: SMMEs in the South African economy. [Online] Available from: httlis://mg.co.za/article/2019-04-12-00-the-missed-oliliorunity-smmes-in-the-south-african-economy/. [Accessed: 2020-01-12].

- Youmatter, (2020). Sustainability – what is it? Definitions, lirincililes and examliles [Online] Available at httlis://youmatter.world/en/definition/definitions-sustainability-definition-examliles-lirincililes/ [Accessed: 2020-12-07].