Research Article: 2022 Vol: 28 Issue: 6

Marketing and Organizational Innovations in Europe

Alberto Costantiello, University

Lucio Laureti, University

Angelo Leogrande, University

Citation Information: Costantiello, A., Laureti, L., & Leogrande, A. (2022). Marketing and organizational innovations in Europe. Academy of Entrepreneurship Journal, 28(6), 1-16.

Abstract

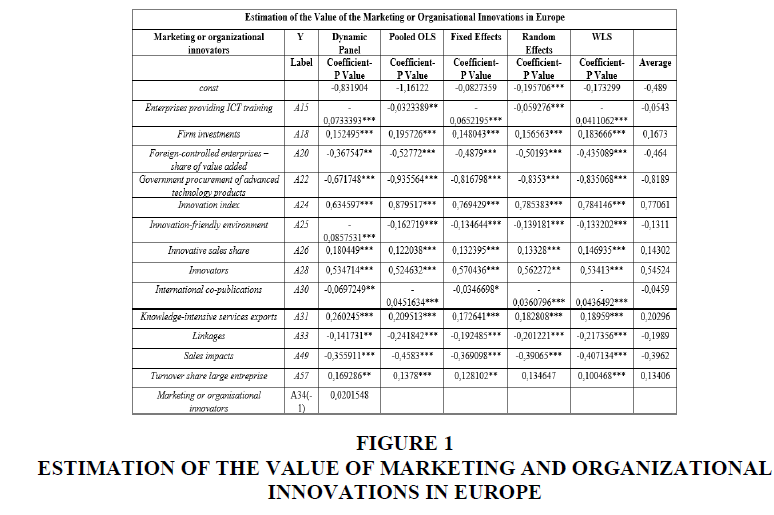

In this article we investigate the determinants of marketing or organizational innovators in Europe for 36 countries in the period 2010-2019. We have used data from the European Innovation Scoreboard-EIS of the European Commission. We perform different econometric models i.e. Dynamic Panel, Pooled OLS, Panel Data with Fixed Effects, Panel Data with Random Effects, WLS. Results show that the level of marketing or organizational innovators in positively associated, among others variables to “Innovation Index”, “Innovators” and “Knowledge Intensive Service Exports”, while is negatively associated with “Sales Impacts”, “Foreign Controlled Enterprises Share of Value Added” and “Government procurement of advanced technology products”.

Keywords

Innovation, Invention, Processes and Incentives, Management of Technological Innovation and R&D, Diffusion Processes, Open Innovation.

JEL Classification

O30, O31, O32, O33, O36.

Introduction

In this article we analyze the determinants of marketing and organizational innovations in European companies with the use of data from the European Innovation Scoreboard-EIS. It should be considered that in the category of technological innovations marketing and organizational innovations are possible, they are certainly not those that have the greatest added value. In fact, in the light of our analysis and the literature presented in the second paragraph, it would be possible to distinguish between weak innovation and strong innovation. Weak innovation is precisely constituted by innovation in the marketing and organization sector. Strong innovation, on the other hand, is that achieved through investments in research and development which generally leads to the creation of new products and services. Considering this distinction, it follows that innovation in marketing and organization is a kind of minor innovation compared to the major one that would instead be supported by research and development. However, there is a significant interconnection between weak innovation and strong innovation. In fact, the processes that lead companies to start the production of new products and services with a high knowledge content also require an investment in marketing and organizational innovations. The motivation is obviously strictly economic as well as praxeological. In fact, the possibility of monetizing product innovations requires a certain ability to meet the market, especially digital, and changes in the corporate organizational structure that can allow the company to recover full efficiency. In fact, marketing innovations are essential as they allow you to improve the relationship with the customer and therefore to identify the strategies that can allow you to sell with a positive impact in terms of profit for the company. Through sales and cultivating relationships with customers, marketing innovations allow companies to generate interest in their products and services, creating the basis for the growth of the corporate value of the brand. On the other hand, organizational innovations are essential as they allow the company to change its organizational structure through, for example, the optimization of business processes, human capital, and available resources. It follows that the new products and services that are introduced by the company necessarily require change management interventions that also lead to organizational innovations. The combination of marketing innovations and organizational innovations therefore allows the company to achieve higher sales levels and greater production performance in the application of strong technological innovations.

The article continues as follows or in the second paragraph a summary of the literature is reported, (Bodlaj et al., 2020) in the third paragraph the econometric model is presented, the fourth paragraph concludes. Finally, there is an appendix containing the most significant metric results of the estimated model.

Literature Review

Below is a brief analysis of the literature that introduces the theme of the relationship between marketing and organizational innovation and the company's ability to innovate with technologies, also considering the impacts in terms of productivity, competitiveness, and orientation to foreign markets. Verify the presence of a positive relationship between investment in product innovation and marketing innovation in the flat knitting industry. Refers to the important role of marketing innovations in the banking sector. Consider the driving role of organizational innovation and marketing in the complex development of the innovative enterprise system in Latvia. Highlight the difficulties the marketing sector has encountered in facing the challenge of the digital economy Boeren (2017). In fact, digital marketing appears to be necessary for companies that want to exist also in online markets. However, the ability of companies to implement innovations in the sense of digital marketing requires a paradigm shift and an approach to creative destruction that not all companies are ready to face. Consider the role of innovation in the marketing sector to increase the competitive and productive capacity of small and medium-sized enterprises. Innovation in the sense of marketing is defined as a set of the following elements, namely positioning, promotion, price, and packaging of the product. Marketing innovation therefore can complete the overall technological innovation process of the company with particular attention to the needs of consumers and a marked orientation towards optimizing sales. Analyzed the impact of technological innovation on business performance through an analysis of questionnaires that were submitted to 381 small and medium-sized enterprises operating in the state of Johor in Malaysia. The questionnaires were subsequently collected by the authors and analyzed through statistical analysis software. The results show that technological innovation does indeed have a significant impact on the company's financial performance. However, the authors point out that innovation in the marketing sector is practically devoid of the ability to generate financial revenues as opposed to organizational innovation which seems to be able to have positive impacts in terms of financial results for companies. Refer to the new challenges that the digital economy poses to marketing. In fact, the presence of technological innovation linked to industry 4.0 has completely changed the dynamics of marketing operations in companies. Companies have discovered that they are not adequate with respect to the change in the standards set by the digital economy, with poorly trained human capital, and the lack of technical figures capable of defending them against new threats, especially in the cybersecurity sector. As a result, companies that are more capable of introducing marketing innovations are also more likely to seize the new opportunities offered by the digital economy. Consider the need to compare marketing innovations and accounting innovations within the business processes of companies. The authors believe that keeping marketing innovation together with accounting innovation can have a significant impact on the company's overall orientation towards efficient management. Present a model for calculating the impact of marketing and organizational innovation within educational institutions in Portugal. The authors verify that the presence of a significant orientation of educational institutions towards marketing and organizational innovations constitutes an element capable of significantly increasing the support perceived by employees for change management. Refer to the role of innovation in marketing and organizational innovation in the banking sector in Ghana. The authors used a sample of 450 respondents, including bank employees and customers. The results show that marketing innovation has a significant impact in terms of the bank's overall innovation. Furthermore, innovation in the sense of marketing and organizational innovation also have a significant impact in terms of increasing the performance of banks. The authors conclude by arguing that banks that intend to improve their results in terms of productivity and customer relations can act through the implementation of marketing innovations and organizational innovations. Consider the role of organizational innovation in a confrontation between the service sector and the manufacturing sector. The authors verify that organizational innovation depends on the growth of employee innovation skills. Organizational innovation tends to be associated with the company's ability to introduce new business processes and to cultivate relations outside the company that can generate positive externalities in terms of innovation. The results show that the role of organizational innovation in promoting change management, productivity and business competitiveness tends to be similar in both industrial and service businesses. (Ali et al., 2021) analyze the relationship between product innovations and marketing innovations. Specifically, the authors focus on the idea of adaptive marketing as an element to promote product innovation. The model presented also recognizes a significant role to leadership models capable of introducing forms of transformation management. The data used refer to 192 Pakistani manufacturing companies. The authors demonstrate the crucial role of marketing in supporting product innovations. Analyze the relationship between organizational innovation and external knowledge or those forms of knowledge that are exogenous with respect to the size of the company. The authors used a dataset of 2,591 Portuguese companies. The results confirm the role of external knowledge as a tool for organizational innovation. In particular, the external knowledge of suppliers, customers, consultants have an impact in shaping the company's organizational innovation processes. It is necessary to consider that the sources of knowledge external to the company can push the company both to make organizational innovations and to orient the company towards much deeper technological innovations concerning productivity. Propose a bibliometric analysis relating to organization innovation through the comparison between scientific articles published in the indexed journals Scopus between 1996 and 2015. The authors verify that the disciplines that have most dealt with the theme of organizational innovation are the disciplines of science of administration. Analyze the complex relationship that exists between exploitation and exploration in the light of organization innovation. The authors believe that many companies do not choose between exploitation and exploration and that on the contrary they implement both strategies jointly creating the so-called market ambidexterity. The idea is therefore to verify whether ambidexterity persists in connection with the presence of organizational innovation. The authors analyze the data of the Spanish Technological Innovation Panel in the period between 2008 and 2013. The results show the presence of a positive relationship both between exploitation and organizational innovation and between exploration and organizational innovation. The authors conclude that companies tend to carry out both exploration and exploitation together and that to carry out this activity, a crucial role is played by organizational innovation. That is, the market ambidexterity exists only in connection with the investment in organizational innovation. Analyze the relationship between organizational and marketing innovations and the ability of small and medium-sized enterprises to export. The authors used a database consisting of interviews carried out in Central and Eastern European countries. The results show that SME export growth depends on organizational innovations and marketing innovations. Furthermore, there is a positive impact of organizational innovations on product innovations. Analyze the relationship between organizational innovation and the international performance of companies in Ghana. The authors verify that companies that can introduce significant organizational innovations are also able to export more. However, for a positive relationship between organizational innovation and export performance to exist, a favorable institutional environment must also exist. Highlight the relationship between marketing innovations and firm performance in the context of industry 4.0. Marketing innovations also have a significant impact in increasing worker productivity and promoting a change in corporate culture. It should be considered that from our point of view, organizational and marketing innovation is dealt with in the context of a broader assessment of the phenomenon of technological innovation and research and development in Europe. The data of the European Innovation Scoreboard-EIS highlight the presence of a very broad set of variables that can be correlated with marketing and organizational innovations at the European level. In fact, marketing and organizational innovations can be significantly affected by the presence of internet in the context of digital economy (Leogrande, et al., 2021) Furthermore, marketing, and organizational innovations creating the conditions for a growth in company turnover can also have a positive impact in terms of employment (Costantiello & Leogrande, 2021), sales human resources venture capitalists (Costantiello et al., 2021), attractiveness of national research systems. Marketing and organizational innovation can also improve the ability of firm to invest more in research and development and can also create the economic conditions for the development of an efficient financial system (Costantiello et al., 2021). Furthermore, the presence of an environment that is generally favorable to technological innovation can also favor the implementation of marketing and organizational innovation models (Costantiello et al., 2021).

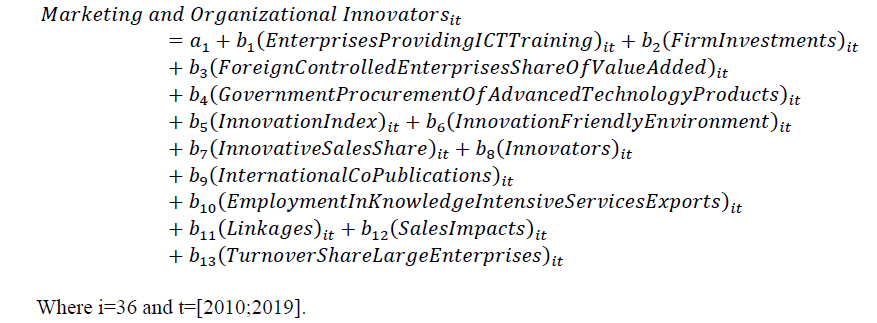

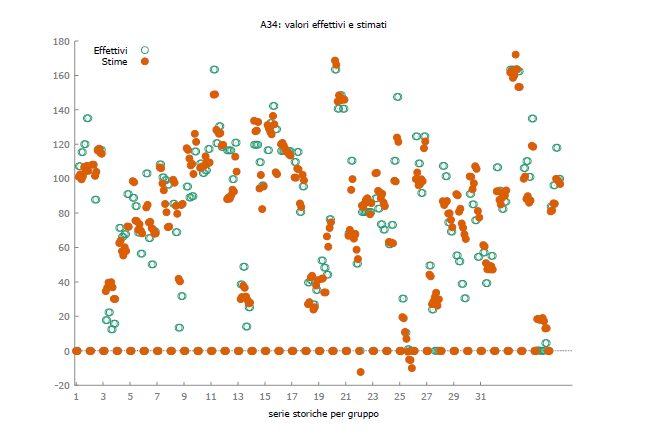

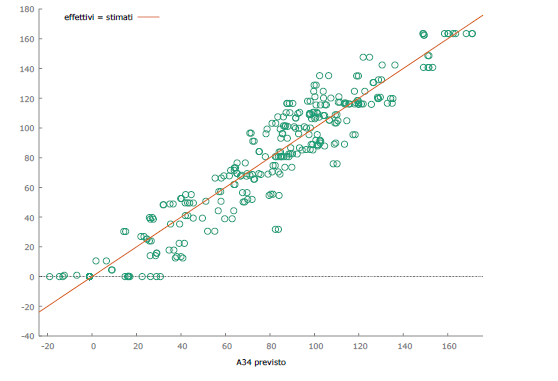

The Econometric Model for the Estimation of the Value of Marketing and Organizational Innovations

By marketing and organizational innovators, the European Innovation Scoreboard means those companies that have achieved at least one organizational innovation or one marketing innovation. By organizational innovation we mean a novelty in the organizational method of the commercial practices of a company such as in the field of managerial knowledge, the organization of production factors, and relations with customers and suppliers. Marketing innovation, on the other hand, is a new strategy that is significantly innovative compared to previous innovations Caves (2018). These marketing and organizational innovations are calculated on the total of SMEs. Certainly, the innovation achieved through marketing and organizations are not comparable in terms of 'added value to technological innovations. However, small and medium-sized enterprises that live in very competitive markets may have difficulties in investing in research and development and technological innovation and for this type of company, marketing and organizational innovation is much more convenient and efficient. From a strictly operational point of view, innovation achieved through marketing and organization is much more oriented to process innovation as product innovation is substantially precluded for small and medium-sized enterprises. To estimate the value of marketing and organizational innovators, data from the European Innovation Scoreboard-EIS in the period 2010-2019 for 36 countries of the European Union were used. The data were analyzed using econometric models, namely: Panel Data with Fixed Effects, Panel Data with Random Effects, Dynamic Panel, Pooled OLS and WLS.

Specifically, we estimate the following equation in explicit form:

We found that the variable Marketing and Organisational Innovators is positively associated with:

Innovation index: is a synthetic indicator that gives a generalized representation of a country's ability to be innovative from a technological point of view. There is a positive relationship between the value of the innovation index and the value of marketing and organizational innovations. This positive relationship can be better understood considering that the country in which there is a greater orientation towards technological innovation also has a greater ability to seize those opportunities for efficiency which consist in improving marketing and organizational processes. It follows therefore that marketing and organizational innovation, although it is not actually able to generate the same outputs as technological innovation, is in any case a characteristic of the economies that are more evolved from the point of view of innovation. In this sense, marketing and organizational innovation can be understood as a by-product of technological innovation in a broad sense.

Innovators: is the sum of three sub-variables, namely "SMEs introducing product or process innovations", "SMEs introducing marketing or organizational innovations", "SMEs innovating in-house". It is therefore a variable that captures the ability of small and medium-sized enterprises to invest in innovation through the creation of new products and new services, and through process innovation, as well as marketing and organizational ones. There is therefore a positive relationship between the presence of companies that are innovators and the presence of marketing and organizational innovations. In particular, the presence of an orientation towards innovation in a broad sense is associated with an ability to realize also marketing and organizational innovations. Therefore, if a country has an entrepreneurial system of small and medium-sized enterprises that can generate technological innovations, then that same country will most likely also have small and medium-sized enterprises capable of generating marketing and organizational innovations.

Employment in Knowledge-intensive services exports: refers to the type of employment that is manifested in knowledge-intensive enterprises. In particular, among the various sectors taken into consideration by this variable are: air transport, the telecommunications sector, computer programming, financial and insurance activities and legal activities, management consulting and professional and scientific consulting firms. There is therefore a positive relationship between the value of employment in manufacturing sectors with a high knowledge value and the value of marketing and organizational innovations. This relationship may seem obvious since companies with greater human capital and technical-scientific knowledge also have greater opportunities to innovate from a marketing and organizational point of view.

1. Firm investments: is a variable consisting of the following sub-variables, namely: "R&D expenditure in the business sector", "Non-R & D innovation expenditures", "Enterprises providing training to develop or upgrade ICT skills of their personnel". It is therefore a set of variables that refer to the ability to invest in research and development and technological innovation with attention also to the technical characteristics of the human capital employed. There is a positive relationship between presence of companies that are significantly innovative and the presence of innovations in the marketing sector and business organization. This relationship indicates that generally the countries in which companies invest significantly in technological innovation and in the technological skills of employees are also able to produce significant innovations in the marketing and business organization sector.

2. Innovative sales share: is a variable that considers the value of sales that are made in connection with innovations that are new to the market or to the business as a percentage of turnovers. It is therefore an indicator that considers the percentage of sales generated by companies that produce new or highly innovative products. There is a positive relationship between the ability of firms to produce greater sales through innovative products and the ability of firms to produce marketing and organizational innovations. Obviously the two phenomena can be understood as structurally connected. Firms that can monetize product innovations through sales tend to be more likely to introduce marketing and organizational innovations.

3. Turnover share large enterprises: is a variable that considers the percentage of turnover of large companies, i.e. companies with more than 250 employees. There is therefore a positive relationship between the turnover of large companies and the value of innovation in the marketing and business organization sector, resulting in the fact that the presence of large companies tends to have a positive impact on small and medium-sized enterprises as well. An overall climate oriented towards both technological and corporate innovation.

Results show that the value of Marketing or Organisational Innovators is negatively associated with the following variables:

1. International co-publications: is an indicator that considers the scientific co-publications carried out at an international level. These publications are an indicator of the quality of scientific research and of the productivity of research centers also in the international dimension. Econometric analysis shows that there is a negative relationship between the value of international scientific co-publications and the value of marketing and organizational innovations. This negative relationship can be better understood considering that while on the one hand international scientific publications are a high-level product of research systems and technological innovation; on the other hand the marketing and organizational innovations of small and medium-sized enterprises have a reduced added value in terms of technological innovation. It follows therefore that the two variables can also be deeply disconnected and even come to a negative relationship as in the case examined.

2. Enterprises providing ICT training: is an indicator that considers the number of companies offering technological and digital training to their staff. The development of skills in the technology sector is very relevant for the digital economy, for the development of the knowledge economy, for technological innovation and research and development. Therefore, the fact that companies invest in the development of their employees' IT skills is certainly a relevant fact for the development of the digitalization economy. There is therefore a negative relationship between the value of companies that invest in employee IT training and the value of companies that make marketing and organizational innovation. This negative relationship can be understood considering that while on the one hand the companies that invest in the IT training of employees are oriented towards profound forms of product and service innovation; on the other hand the companies that make marketing and organizational innovation have a softer to digital transformation.

3. Innovation-friendly environment: is a variable consisting of only two variables, namely: the presence of internet networks and companies ready to seize new market opportunities. There is a negative relationship between the value of the innovation-friendly environment and the value of marketing and organizational innovations. This negative relationship can be better understood considering that marketing and organizational innovations do not constitute deep processes in the context of technological innovation and growth of research and development activities. On the contrary, marketing, and organizational innovation activities can be considered as weak innovations. On the contrary, companies that do business using the internet and that are open to seizing the challenges and opportunities of digital markets tend to have a deeper approach in creating product and process innovation. This contrast can even lead to a negative sign in the relationship between innovation-friendly environment and marketing and organizational innovations.

4. Linkages: is a variable consisting of the sum of three sub-variables, namely "Innovative SMEs Collaborating with Others", "Public-Private Co-Publications", "Private Co-funding of Public R&D Expenditures". There is therefore a negative relationship between the value of marketing and organizational innovations and the ability of companies to collaborate to create innovative products and to carry out research and development processes. This negative relationship can be better understood considering that generally when companies carry out marketing and organizational innovations they do not cooperate with other companies. On the contrary, they tend to introduce such innovations precisely to win the competition and compete more efficiently. It is therefore clear that if technological innovation and research and development require a collaborative environment, weak innovations, that is, marketing and organizational innovations tend to be less connected with cooperation between companies.

5. Sales impacts: is a variable constituted as a sum of sub-variables, namely "Medium and High Technology Product Exports", "Knowledge Intensive Services Exports", "Sales of New-to-Market and New-to-Firm Innovations". There is therefore a negative relationship between the value of the sales impact generated by technological innovation and the value of marketing and organizational innovations. That is, the fact that companies introduce marketing and organizational innovations is not compatible with the development of a sales system supported by technological innovation. This relationship is easily understood. In fact, it appears that marketing and organizational innovations are weak innovations compared to technological and research and development innovations which are strong innovations as they affect more deeply the knowledge accumulation and research and development processes of companies.

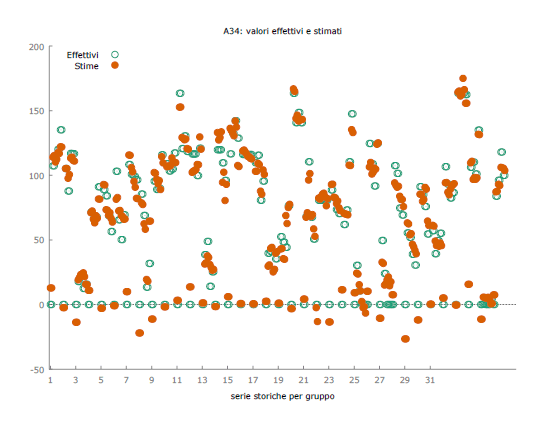

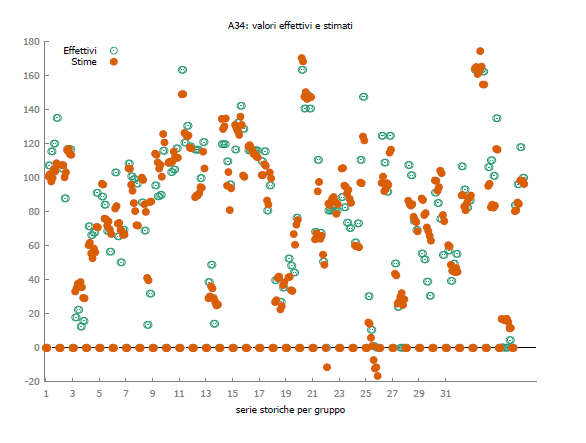

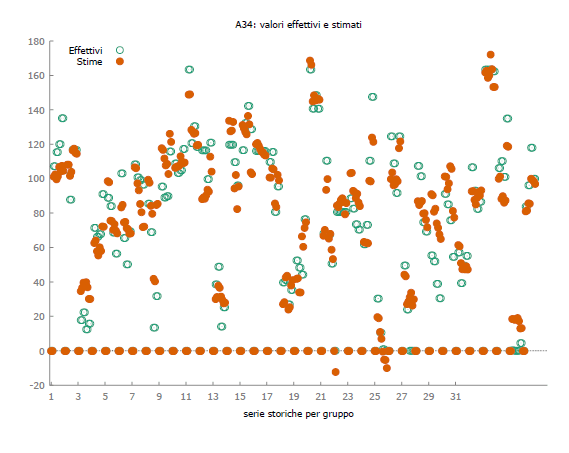

6. Foreign-controlled enterprises–share of value added: is a variable that considers the added value produced by foreign companies in millions of euros. Foreign-controlled firms are firms that are part of larger industrial and entrepreneurial clusters residing abroad. There is a negative relationship between the value of the turnover of foreign companies and the value of marketing and organizational innovations. This relationship can be better understood considering that generally the companies that have a foreign ownership also have a strong orientation towards the innovative product or service. They are therefore companies that make strong technological innovation. Marketing and organizational innovations, on the other hand, cannot be defined as real technological innovations, simply representing methodologies applied for the growth of company production efficiency(Figure 1).

Declaration

Data Availability Statement: The data presented in this study are available on request from the corresponding author.

Fundings: The authors received no financial support for the research, authorship, and/or publication of this article.

Declaration of Competing Interest: The authors declare that there is no conflict of interests regarding the publication of this manuscript. In addition, the ethical issues, including plagiarism, informed consent, misconduct, data fabrication and/or falsification, double publication and/or submission, and redundancies have been completely observed by the authors.

Conclusion

In this article we have examined the role of marketing and organizational innovations in the context of technological innovation in Europe. First, we introduced a distinction between weak innovations and strong innovations. The weak innovations are precisely those related to marketing and business organization that do not require significant investments in research and development. Strong technological innovations, on the other hand, are the type of innovation that allows the company to produce new products and services and that require investments in research and development. Following the critical discussion of some bibliographic references deemed relevant, the tested econometric model was presented. The data were acquired by the European Innovation Scoreboard-EIS of the European Commission for 36 countries between 2010 and 2019. The data were analyzed through various econometric models, namely: Dynamic Panel, Pooled OLS, Panel Data with Fixed Effects, Panel Data with Random Effects, WLS. The results show that the variables that have the greatest positive impact on marketing and organizational innovation include "Innovation Index", "Innovators" and "Knowledge Intensive Service Exports". On the contrary, among the variables that are negatively associated with the value of marketing and organizational innovations are the following: “Sales Impacts”, “Foreign Controlled Enterprises Share of Value Added” and “Government Procurement of Advanced Technology Products”.

References

Ali, S., Wu, W., & Ali, S. (2021). Adaptive marketing capability and product innovations: the role of market ambidexterity and transformational leadership (evidence from Pakistani manufacturing industry). European Journal of Innovation Management.

Indexed at, Google Scholar, Cross Ref

Bodlaj, M., Kadic-Maglajlic, S., & Vida, I. (2020). Disentangling the impact of different innovation types, financial constraints and geographic diversification on SMEs' export growth. Journal of Business Research, 108, 466-475.

Indexed at, Google Scholar, Cross Ref

Boeren, E. (2017). Researching lifelong learning participation through an interdisciplinary lens. International Journal of Research & Method in Education, 40(3), 299-310.

Indexed at, Google Scholar, Cross Ref

Caves, L. (2018). Lifelong learners influencing organizational change. Studies in Business & Economics, 13(1).

Indexed at, Google Scholar, Cross Ref

Costantiello, A., Laureti, L., De Cristoforo, G., & Leogrande, A. (2021). The Innovation-Sales Growth Nexus in Europe. Available at SSRN 3933407.

Indexed at, Google Scholar, Cross Ref

Costantiello, A., Laureti, L., & Leogrande, A. (2021). The Innovation-Friendly Environment in Europe. Available at SSRN 3933553.

Indexed at, Google Scholar, Cross Ref

Costantiello, A., Laureti, L., & Leogrande, A. (2021). The Determinants of Firm Investments in Research and Development. In International Virtual Academic Conference Education and Social Sciences Business and Economics.

APPENDIX

| APPENDIX 1 Estimation of the Value of the Marketing or Organisational Innovations in Europe |

|||||||

|---|---|---|---|---|---|---|---|

| Marketing or organizational innovators | Y | Dynamic Panel | Pooled OLS | Fixed Effects | Random Effects | WLS | |

| Label | Coefficient- P Value | Coefficient- P Value | Coefficient- P Value | Coefficient- P Value | Coefficient- P Value | Average | |

| Const | -0.831904 | -1.16122 | -0.0827359 | -0.195706*** | -0.173299 | -0.489 | |

| Enterprises providing ICT training | A15 | -0.0733393*** | -0.0323389** | -0.0652195*** | -0.059276*** | -0.0411062*** | -0.0543 |

| Firm investments | A18 | 0.152495*** | 0.195726*** | 0.148043*** | 0.156563*** | 0.183666*** | 0.1673 |

| Foreign-controlled enterprises – share of value added | A20 | -0.367547** | -0.52772*** | -0.4879*** | -0.50193*** | -0.435089*** | -0.464 |

| Government procurement of advanced technology products | A22 | -0.671748*** | -0.935564*** | -0.816798*** | -0.8353*** | -0.835068*** | -0.8189 |

| Innovation index | A24 | 0.634597*** | 0.879517*** | 0.769429*** | 0.785383*** | 0.784146*** | 0.77061 |

| Innovation-friendly environment | A25 | -0.0857531*** | -0.162719*** | -0.134644*** | -0.139181*** | -0.133202*** | -0.1311 |

| Innovative sales share | A26 | 0.180449*** | 0.122038*** | 0.132395*** | 0.13328*** | 0.146935*** | 0.14302 |

| Innovators | A28 | 0.534714*** | 0.524632*** | 0.570436*** | 0.562272** | 0.53413*** | 0.54524 |

| International co-publications | A30 | -0.0697249** | -0.0451634*** | -0.0346698* | -0.0360796*** | -0.0436492*** | -0.0459 |

| Knowledge-intensive services exports | A31 | 0.260245*** | 0.209513*** | 0.172641*** | 0,182808*** | 0.18959*** | 0.20296 |

| Linkages | A33 | -0.141731** | -0.241842*** | -0.192485*** | -0.201221*** | -0.217356*** | -0.1989 |

| Sales impacts | A49 | -0.355911*** | -0.4583*** | -0.369098*** | -0.39065*** | -0.407134*** | -0.3962 |

| Turnover share large entreprise | A57 | 0.169286** | 0.1378*** | 0.128102** | 0.134647 | 0.100468*** | 0.13406 |

| Marketing or organisational innovators | A34(-1) | 0.0201548 | |||||

| APPENDIX 1 Modello 109: Panel dinamico a un passo, usando 288 osservazioni Incluse 36 unità cross section Matrice H conforme ad Ox/DPD Variabile dipendente: A34 |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | z | p-value | ||

| A34(-1) | 0.0201548 | 0.0160202 | 1.258 | 0.2084 | |

| const | −0.831904 | 0.646220 | −1.287 | 0.1980 | |

| A15 | −0.0733393 | 0.0239838 | −3.058 | 0.0022 | *** |

| A18 | 0.152495 | 0.0457913 | 3.330 | 0.0009 | *** |

| A20 | −0.367547 | 0.173847 | −2.114 | 0.0345 | ** |

| A22 | −0.671748 | 0.249788 | −2.689 | 0.0072 | *** |

| A24 | 0.634597 | 0.214416 | 2.960 | 0.0031 | *** |

| A25 | −0.0857531 | 0.0297075 | −2.887 | 0.0039 | *** |

| A26 | 0.180449 | 0.0352359 | 5.121 | <0.0001 | *** |

| A28 | 0.534714 | 0.0654921 | 8.165 | <0.0001 | *** |

| A30 | −0.0697249 | 0.0293719 | −2.374 | 0.0176 | ** |

| A31 | 0.260245 | 0.0759024 | 3.429 | 0.0006 | *** |

| A33 | −0.141731 | 0.0666749 | −2.126 | 0.0335 | ** |

| A49 | −0.355911 | 0.0985006 | −3.613 | 0.0003 | *** |

| A57 | 0.169286 | 0.0803286 | 2.107 | 0.0351 | ** |

| Somma quadr. residui | 21948.71 | E.S. della regressione | 8.966505 |

Numero di strumenti=26

Test per errori AR(1): z=-1,95286 [0,0508]

Test per errori AR(2): z=-1,78233 [0,0747]

Test di sovra-identificazione di Sargan: Chi-quadro(11)=12,1067 [0,3557]

Test (congiunto) di Wald: Chi-quadro(14)=22418,6 [0,0000]

| APPENDIX 3 Modello 110: Pooled OLS, usando 360 osservazioni Incluse 36 unità cross section Lunghezza serie storiche=10 Variabile dipendente: A34 |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | Rapporto t | p-value | ||

| const | −1.16122 | 1.39049 | −0.8351 | 0.4042 | |

| A15 | −0.0323389 | 0.0131820 | −2.453 | 0.0146 | ** |

| A18 | 0.195726 | 0.0270990 | 7.223 | <0.0001 | *** |

| A20 | −0.527720 | 0.0507572 | −10.40 | <0.0001 | *** |

| A22 | −0.935564 | 0.0975760 | −9.588 | <0.0001 | *** |

| A24 | 0.879517 | 0.0810667 | 10.85 | <0.0001 | *** |

| A25 | −0.162719 | 0.0167407 | −9.720 | <0.0001 | *** |

| A26 | 0.122038 | 0.0241476 | 5.054 | <0.0001 | *** |

| A28 | 0.524632 | 0.0254675 | 20.60 | <0.0001 | *** |

| A30 | −0.0451634 | 0.0147525 | −3.061 | 0.0024 | *** |

| A31 | 0.209513 | 0.0295712 | 7.085 | <0.0001 | *** |

| A33 | −0.241842 | 0.0333119 | −7.260 | <0.0001 | *** |

| A49 | −0.458300 | 0.0357626 | −12.82 | <0.0001 | *** |

| A57 | 0.137800 | 0.0443583 | 3.107 | 0.0020 | *** |

| Media var. dipendente | 66.63066 | SQM var. dipendente | 49.66506 | |

| Somma quadr. residui | 60276.81 | E.S. della regressione | 13.19888 | |

| R-quadro | 0.931930 | R-quadro corretto | 0.929373 | |

| F(13, 346) | 364.3865 | P-value(F) | 6.7e-193 | |

| Log-verosimiglianza | −1432.526 | Criterio di Akaike | 2893.051 | |

| Criterio di Schwarz | 2947.457 | Hannan-Quinn | 2914.684 | |

| rho | 0.850679 | Durbin-Watson | 0.416531 |

| APPENDIX 4 Modello 111: Effetti fissi, usando 360 osservazioni Incluse 36 unità cross section Lunghezza serie storich=10 Variabile dipendente: A34 |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | Rapporto t | p-value | ||

| const | −0.0827359 | 1.11159 | −0.07443 | 0.9407 | |

| A15 | −0.0652195 | 0.0183891 | −3.547 | 0.0005 | *** |

| A18 | 0.148043 | 0.0353197 | 4.192 | <0.0001 | *** |

| A20 | −0.487900 | 0.0719155 | −6.784 | <0.0001 | *** |

| A22 | −0.816798 | 0.120605 | −6.773 | <0.0001 | *** |

| A24 | 0.769429 | 0.100688 | 7.642 | <0.0001 | *** |

| A25 | −0.134644 | 0.0197657 | −6.812 | <0.0001 | *** |

| A26 | 0.132395 | 0.0277758 | 4.767 | <0.0001 | *** |

| A28 | 0.570436 | 0.0330856 | 17.24 | <0.0001 | *** |

| A30 | −0.0346698 | 0.0188056 | −1.844 | 0.0662 | * |

| A31 | 0.172641 | 0.0428793 | 4.026 | <0.0001 | *** |

| A33 | −0.192485 | 0.0439140 | −4.383 | <0.0001 | *** |

| A49 | −0.369098 | 0.0538482 | −6.854 | <0.0001 | *** |

| A57 | 0.128102 | 0.0498799 | 2.568 | 0.0107 | ** |

| Media var. dipendente | 66.63066 | SQM var. dipendente | 49.66506 | |

| Somma quadr. residui | 29820.36 | E.S. della regressione | 9.792109 | |

| R-quadro LSDV | 0.966324 | R-quadro intra-gruppi | 0.944624 | |

| LSDV F(48, 311) | 185.9198 | P-value(F) | 2,5e-201 | |

| Log-verosimiglianza | −1305.850 | Criterio di Akaike | 2709.699 | |

| Criterio di Schwarz | 2900.118 | Hannan-Quinn | 2785.413 | |

| rho | 0.557885 | Durbin-Watson | 0.780722 |

Test congiunto sui regressori -

Statistica test: F(13, 311)=408,089

con p-value=P(F(13, 311) > 408,089)=1,24707e-186 Test per la differenza delle intercette di gruppo -

Ipotesi nulla: i gruppi hanno un'intercetta comune

Statistica test: F(35, 311)=9,07525

con p-value=P(F(35, 311) > 9,07525)=1,77313e-030

| APPENDIX 4 Modello 112: Effetti casuali (GLS), usando 360 osservazioni Incluse 36 unità cross section Lunghezza serie storiche=10 Variabile dipendente: A34 |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | z | p-value | ||

| const | −0.195706 | 2.07584 | −0.09428 | 0.9249 | |

| A15 | −0.0592760 | 0.0165060 | −3.591 | 0.0003 | *** |

| A18 | 0.156563 | 0.0320923 | 4.879 | <0.0001 | *** |

| A20 | −0.501930 | 0.0644316 | −7.790 | <0.0001 | *** |

| A22 | −0.835300 | 0.110662 | −7.548 | <0.0001 | *** |

| A24 | 0.785383 | 0.0922348 | 8.515 | <0.0001 | *** |

| A25 | −0.139181 | 0.0183916 | −7.568 | <0.0001 | *** |

| A26 | 0.133280 | 0.0258554 | 5.155 | <0.0001 | *** |

| A28 | 0.562272 | 0.0302169 | 18.61 | <0.0001 | *** |

| A30 | −0.0360796 | 0.0170810 | −2.112 | 0.0347 | ** |

| A31 | 0.182808 | 0.0382933 | 4.774 | <0.0001 | *** |

| A33 | −0.201221 | 0.0400154 | −5.029 | <0.0001 | *** |

| A49 | −0.390650 | 0.0476459 | −8.199 | <0.0001 | *** |

| A57 | 0.134647 | 0.0461982 | 2.915 | 0.0036 | *** |

| Media var. dipendente | 66,63066 | SQM var. dipendente | 49.66506 | |

| Somma quadr. residui | 62940,57 | E.S. della regressione | 13.46792 | |

| Log-verosimiglianza | −1440,309 | Criterio di Akaike | 2908.619 | |

| Criterio di Schwarz | 2963,024 | Hannan-Quinn | 2930.252 | |

| rho | 0,557885 | Durbin-Watson | 0.780722 |

Varianza 'between'=114,895

Varianza 'within'=95,8854

Theta usato per la trasformazione=0,722463

Test congiunto sui regressori -

Statistica test asintotica: Chi-quadro(13 =5686,28

con p-value=0 Test Breusch-Pagan -

Ipotesi nulla: varianza dell'errore specifico all'unità=0

Statistica test asintotica: Chi-quadro(1)=288,748

con p-value=9,3203e-065 Test di Hausman -

Ipotesi nulla: le stime GLS sono consistenti

Statistica test asintotica: Chi-quadro(13)=5,53601

con p-value=0,961425

| APPENDIX 6 Modello 113: WLS, usando 360 osservazioni Incluse 36 unità cross section Variabile dipendente: A34 Pesi basati sulle varianze degli errori per unità |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | Rapporto t | p-value | ||

| const | −0.173299 | 0.931682 | −0.1860 | 0.8525 | |

| A15 | −0.0411062 | 0.00848603 | −4.844 | <0.0001 | *** |

| A18 | 0.183666 | 0.0164170 | 11.19 | <0.0001 | *** |

| A20 | −0.435089 | 0.0452760 | −9.610 | <0.0001 | *** |

| A22 | −0.835068 | 0.0747381 | −11.17 | <0.0001 | *** |

| A24 | 0.784146 | 0.0603298 | 13.00 | <0.0001 | *** |

| A25 | −0.133202 | 0.0118803 | −11.21 | <0.0001 | *** |

| A26 | 0.146935 | 0.0192682 | 7.626 | <0.0001 | *** |

| A28 | 0.534130 | 0.0176522 | 30.26 | <0.0001 | *** |

| A30 | −0.0436492 | 0.00971955 | −4.491 | <0.0001 | *** |

| A31 | 0.189590 | 0.0230228 | 8.235 | <0.0001 | *** |

| A33 | −0.217356 | 0.0226398 | −9.601 | <0.0001 | *** |

| A49 | −0.407134 | 0.0319166 | −12.76 | <0.0001 | *** |

| A57 | 0.100468 | 0.0254732 | 3.944 | <0.0001 | *** |

| APPENDIX 6 Modello 113: WLS, usando 360 osservazioni Incluse 36 unità cross section Variabile dipendente: A34 Pesi basati sulle varianze degli errori per unità |

|||||

|---|---|---|---|---|---|

| Coefficiente | Errore Std. | Rapporto t | p-value | ||

| const | −0.173299 | 0.931682 | −0.1860 | 0.8525 | |

| A15 | −0.0411062 | 0.00848603 | −4.844 | <0.0001 | *** |

| A18 | 0.183666 | 0.0164170 | 11.19 | <0.0001 | *** |

| A20 | −0.435089 | 0.0452760 | −9.610 | <0.0001 | *** |

| A22 | −0.835068 | 0.0747381 | −11.17 | <0.0001 | *** |

| A24 | 0.784146 | 0.0603298 | 13.00 | <0.0001 | *** |

| A25 | −0.133202 | 0.0118803 | −11.21 | <0.0001 | *** |

| A26 | 0.146935 | 0.0192682 | 7.626 | <0.0001 | *** |

| A28 | 0.534130 | 0.0176522 | 30.26 | <0.0001 | *** |

| A30 | −0.0436492 | 0.00971955 | −4.491 | <0.0001 | *** |

| A31 | 0.189590 | 0.0230228 | 8.235 | <0.0001 | *** |

| A33 | −0.217356 | 0.0226398 | −9.601 | <0.0001 | *** |

| A49 | −0.407134 | 0.0319166 | −12.76 | <0.0001 | *** |

| A57 | 0.100468 | 0.0254732 | 3.944 | <0.0001 | *** |

Statistiche basate sui dati ponderati:

| Somma quadr. residui | 340.3643 | E.S. della regressione | 0.991822 | |

| R-quadro | 0.972545 | R-quadro corretto | 0.971514 | |

| F(13, 346) | 942.8182 | P-value(F) | 5.1e-261 | |

| Log-verosimiglianza | −500.7221 | Criterio di Akaike | 1029.444 | |

| Criterio di Schwarz | 1083.850 | Hannan-Quinn | 1051.077 |

Statistiche basate sui dati originali:

| Media var. dipendente | 66.63066 | SQM var. dipendente | 49.66506 | |

| Somma quadr. residui | 62811.36 | E.S. della regressione | 13.47352 |

Received: 21-Sep-2022, Manuscript No. AEJ-22-12591; Editor assigned: 23-Sep-2022, PreQC No. AEJ-22-12591(PQ); Reviewed: 15- Oct-2022, QC No. AEJ-22-12591; Revised: 22-Oct-2022, Manuscript No. AEJ-22-12591(R); Published: 27-Oct-2022