Research Article: 2021 Vol: 25 Issue: 3

Mediating Effect of Firm Size on Corporate Social Responsibility Cost and Financial Performance of Listed Non Financial Companies in Nigeria

Arzizeh Tiesieh Tapang, Michael Okpara University of Agriculture Umudike

Ashishie Peter Uklala, University of Calabar

Esor Egbe Ibi, University of Calabar

Samuel M. Takon, University of Calabar

Ekpenyong B. Obo, University of Calabar

Vivian A. Mbaze Ebock, University of Calabar

Edim Ndifon Obim, University of Calabar

Stephen E. Nkamare, University of Calabar

Abstract

This study examined the mediating effect of firm size on the relationship between corporate social responsibility cost and financial performance of listed non-financial companies in Nigeria. The content analysis approach was adopted and data collected from secondary sources. The collected data were analyzed using the ordinary least square techniques. The results revealed that companies with higher or equal to the median value expend more on corporate social responsibility while companies with the value below the median expend less on corporate social responsibility. The study also revealed that there is a positive and significant relationship between corporate social responsibility cost and return on equity. It further revealed that there is a positive and significant relationship between corporate social responsibility cost and firm size. Also, the results showed that there is a positive and significant relationship between firm size and return on equity. Finally, the results from the analysis showed that firm size partially mediates the relationship between corporate social responsibility cost and return on equity. The study concludes that large companies are investing more on corporate social responsibility than smaller companies. The study recommended that for corporate companies in Nigeria to improve their image/reputation they should engage in CSR operations in all its aspects, thereby growing their returns. Corporate companies should spend fair sums of their profits on social donation which in essence would result in a rise in their earnings.

Keywords

Corporate Social Responsibility, Financial Performance, Firm Size, Mediating Effect, Nigeria.

Introduction

The growing concern about the environment, and in particular sustainability, has promoted legislation at the national and international levels. In Nigeria the Environmental Protection Act of 1990 takes the first steps toward a piecemeal implementation of ‘the-polluter-pays’ principles through a system of integrated pollution control. The Act provides for levies on certain categories of companies to fund the regulatory and control bodies which were to enforce it (Ayeni, 1978). Controls are placed on emissions and industrial processes and there is more public disclosure on the operations of polluting companies. For the accounting function, a legal obligation is imposed to minimize waste production utilizing what is called the “Best Available Technology Not Entailing Excessive Cost” (BATNEEC) principle (Adewumi, 2005).

Accountants have begun to define some ecological issues falling within their range of skills. For example, CIMA (1997) argued that the forward thinking management accountant should be taking an active role in environmental management, as he or she has key skills to apply to the process. The basic financial accounting model may be an impediment to change as it only records and employs the data that arise from a transaction which generates a price. Prices are only generated when property rights are transferred. Majority of the matters that are of concern in ecology are things over which property rights do not exist. As a result, the basic financial accounting model ignores it (Gray, 1995). Although there is an active and essential role that accountants can play in the development of sound environmental and reporting procedures, much work must be done to develop more comprehensive reporting systems involving both quantitative and qualitative techniques.

The United Nations Environment Program (UNEP) has been active in directing attention to issues of environmental disclosure. Recommendations have been made for the disclosure of key environmental issues facing firms and plans for addressing them; progress in addressing changes required by future legal requirements; actual and projected-levels of environmental expenditure; energy use, materials use, emissions and waste disposal routes; financial estimates of savings and benefits flowing from pro-environment efforts; and an independent audit statement (Adams, 2000). In spite of this and other similar efforts, the preference has been to avoid regulated reporting. This situation encourages companies to generally give low priority to the reporting of social information. The slow response on the part of Companies towards heightened public concern over environmental issues is unfortunate in view of the fact that external reports are extremely valuable as a means of promoting public accountability, the need for which is central to the emerging green agenda. The problem is not particular to the UK, as it has been observed across several countries including Nigeria.

Today, the level of demand goes beyond the direct impact of the organizations business and also incorporates how corporations can contribute to societal and environmental causes. For corporations, these activities are manifested through the concept of corporate social responsibility (CSR). However, from a corporate perspective, it is difficult to measure if these changes can have a positive impact on a firm. Instead, these contributory practices are mainly measurable from a philanthropic perspective. “Business is not divorced from the rest of the society. Communities have expressed more mistrust of corporations because of various scandals. This has put business ethics in the spot light influencing companies to be good corporate citizens, respecting the law but also to create good social values and principles.

The main objective of the study is to examine the mediating effect of firm size on the relationship between corporate social responsibility cost and economic evaluation of listed companies in Nigeria.

Hypotheses Development

Hypothesis 1: Corporate social responsibility cost has a positive and significant relationship with return on equity.

Hypothesis 2: Firm size has a positive and significant relationship with corporate social responsibility cost.

Hypothesis 3: Firm size has a positive and significant relationship with return on equity.

Hypothesis 4: Firm size has a mediating effect on the relationship between corporate social responsibility cost and return on equity.

Literature Review

Conceptual Framework

Concept of corporate social responsibility

The concept of Corporate Social Responsibility (CSR) has attracted a lot of scholarly attention and is viewed from different perspectives and angles. These perspectives vary from individual scholarly authors to organizations and extend beyond notions embodied in current laws. Essentially, it represents an emerging debate having its source in political and social theories. The concept of social responsibility introduces new problems. First, there is yet no generally accepted definition of the concept of social responsibility of business enterprise. Almost everyone agrees that they should be socially responsible, though it may be argued that such a view is merely extension of the universally accepted doctrine that individual, either single or in groups, should weigh the impact of their actions on others (Glautier & Underdown, 2002). But, on critically viewing the various definitions given one could observed that they are centered on three themes as stated by Wissink (2012). These themes are corporate relations to economic, societal and environmental sustainability. It is on this basis that several terms like corporate conscience, good corporate citizenship, business responsibility, business citizenship, social performance, sustainable responsible business, community relations and responsible business are used to connote Corporate Social Responsibility (CSR).

The concept is therefore closely linked to the principle of sustainability, which argues that enterprises should make decisions based not only on financial factors such as profits and dividends, but also based on the immediate and long term social and environmental consequences of their activities (Tilt, 2009). According to Srivastava (2010) the basic focus of Corporate Social Responsibility (CSR) concept is to provide prime benefits to employees, environment, customers, society and shareholders which are considered as stakeholders of the firm. The stakeholders are all the interested parties that have directly or indirectly affected by the overall organizations processes.

Corporate Social Responsibility (CSR) describes

“A demonstration of certain responsible behavior on the part of public and the private (government and business) sectors toward society and the environment”.

Business for Social Responsibility (BSR), a leading Global Business partner, in a Forum held in 2006 defined Corporate Social Responsibility as achieving commercial success in ways that honors ethical values and respect people, communities, and the natural environment. For Business for Social Responsibility, Corporate Social Responsibility also means addressing the legal, ethical, commercial and other expectations society has for business, and making decisions that fairly balance the claim of all key stakeholders. In its simplest terms, it is: “what you do”, “how you do it” “and when and what you say”.

Corporate Social Responsibility is viewed as a comprehensive set of policies, practices and programmes that are integrated into businesses operations, supply chain, and decision making processes throughout the company and wherever the company does businesses that are supported and rewarded by top management. It also includes responsibility for current and past actions as well as future impacts. The issues that represent a company’s Corporate Social Responsibility focus vary by business, size, sector and even geographical region. It is seen by leadership of companies as more than a collection of discrete practices or occasional gestures or initiatives motivated by marketing, public relations or other business benefits (Auka, 2011).

Corporate social responsibility development in Nigeria

With regard to Nigeria and the development of corporate social responsibility, Nigeria has been party to several international human rights treaties. The government of Nigeria is one of the governments together with Azerbaijan and Ghana, Kyrgyzstan who have committed to the UK-led Extractive Industries Transparency Initiative, where they have committed to making public all their revenues for oil, gas and mining (Tapang et al., 2012).

Building on the United Nations declarations, conventions and efforts of constituents especially the International Labour Organization (ILO), the ISO has continued a process towards a harmonized approach under the leadership of both the Swedish Standard Institute and the Brazilian Association of Technical Standards. This process has active participation of Nigeria where the National Mirror Committee on Social Responsibility is working to contribute towards the completion of ISO 26000 by 2008. The aim is to encourage voluntary commitment to social responsibility and will lead to common guidance on concepts, definition and methods of evaluation.

The Nigerian government has also through its NEEDS strategy (Nigerian National Planning Commission 2004) set the context by defining the private sector role as by stating that

“The private sector will be expected to become more proactive in creating productive jobs, enhancing productivity, and improving the quality of life. It is also expected to be socially responsible, by investing in the corporate and social development of Nigeria…”

Corporate social responsibility and economic evaluation

The concept of sustainability is a new buzzword in CSR practice and is generally regarded as having emerged from the environmental perspective to mean how firms manage physical resources so that they are conserved for the future. Therefore, economic sustainability is about the economic performance of the organization itself. Sustainability development calls for economic growth that can relieve the great poverty of less developed countries, based on policies that sustain and expand the environmental resource base (Tapang & Bassey, 2017).

In a bid to forestall the conflictual relationship that exist between host communities and the firms having recognized their obligations to the firms shareholders and to the society since Corporate Social Responsibility (CSR) enhance their reputations (Elkington, 1998) asserted that firms should not only focus on enhancing its value through maximizing profit and outcome but concentrate on environmental and social issues equally. In line with Elkington assertion, firms over the years have spent billions of naira on projects as their contribution towards addressing the peculiarity of the social economic development challenges aimed to ameliorate the sufferings of the people who have been adversely affected by their activities and also create an enabling environment for the continuation of business. The principal beneficiaries of firms’ Corporate Social Responsibility (CSR) policies are in the areas of healthcare, education, security, housing, agriculture, arts and tourism, sports, charity organizations, religion, social clubs, government agencies, youth development, public infrastructure development and creating some level of employment opportunities. However, as Aduralere (2019) puts it “this in recent times is fast becoming an apology medium for vagrant abuse of social responsibility and protection of the environment in the scramble for maximizing profit”. Such highly publicized charitable and philanthropic venture as he calls it has not been able to placate the abused publics who have been impoverished, neglected starved, marginalized, unemployed and environmentally bastardized (Yomere, 2002)

Ejumudo (2010, 2008) contends that Corporate Social Responsibility (CSR) is in tandem with the principles of justice that seeks to achieve an accommodation or balance between access to environmental costs or burdens (pollution, unemployment, social and economic dislocation and crime) and environmental benefits (nutrients, food, clean air and water, health care, educational assistance, skills acquisition and development, community development and transportation and safe jobs).

This has not been the case in Nigeria. Rather, Corporate Social Responsibility (CSR) in Nigeria has been very divisive (Yomere, 2002), pitching ethnic groups against one another. Thus firms’ corporate social acts are usually perceived by the people including the host communities as a “pin in haystack in comparison to the huge take-home revenues of these firms” (Aderemi, 2011). Aderemi (2011) further capture their divisive act in the following words: It serves as a shield against the various cases of resources exploitation and complicity of the firms in human right violations. Thriving on the ethnic disputes, (which they have helped to create), resource control tussle like in the case of the Niger Delta region between the host communities and the federal government, the firms and other corporate bodies simply continues to get away with their abuse of the environment.

So divisive have the firms in terms of their corporate behavior, that it is they who determine who is employed in the technical firms. Yomere (2002) noted this when he said that highly qualified Nigerian youth hardly find favor in the recruitment polices of these multinational firms. He continues: The argument that these graduate Nigerian youths did not meet the so called standard of excellence as an excuse for recruiting graduates or their people from outside Nigeria is totally unacceptable (Murdiono, 2018).

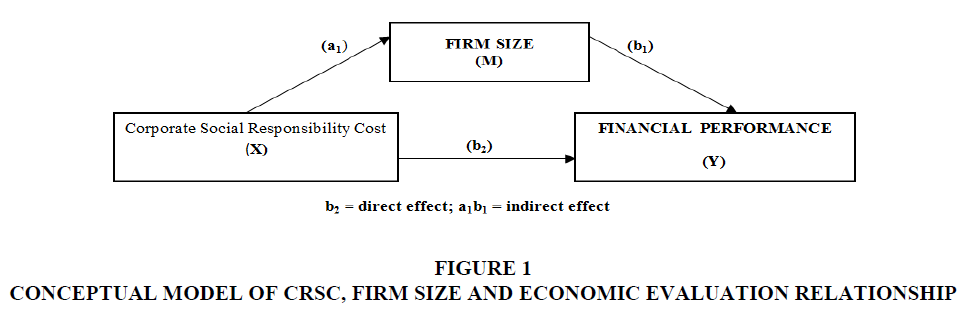

Similarly, demands for adequate monetary compensations for damages done on the environment and the request for special compensation for contractors operating in the environment or host communities is usually met with divisive strategies. The issue of compensation is a very good example in highlighting the divisive nature of companies in the categories of exploration, manufacturing, construction, and industrial companies “supposed” Corporate Social Responsibility. Aside the fact compensations are not adequately paid, if it is paid at all, they often employ the divide and rule tactics in paying compensation. What they do is to seek out those they feel can be very troublesome, educated or enlightened and pay little money to them believing that these can placate any uprising from their operating environment thus it has clearly proved that firms commitment to CSR is very vague, complacent and environmentally disoriented Figure 1.

Theoretical Framework

Empirical review

Aduralere (2019) study examined the impact of firm size on firm’s performance in Nigeria: A comparative study of selected firms in the building industry in Nigeria. The selected firms used in the building industry are Nigeria Wire and Cable plc, Lafarge WAPCO plc, Cement Company of Northern Nigeria, Nigeria Ropes and Ashaka Cement plc. The annual data from 2004 to 2017 was collected from companies’ annual reports and financial statement on key variables for firm’s size and performance which are return on asset, return on equity, output per labour, output per capital, total asset, total sales, capital, and number of employees, leverage, liquidity and age of the firm. His work revealed that firm size has a significant relationship with financial performance.

Orlitzky (2001), Studied how firm size confounds the relationship between corporate social performance and firm financial performance. This study examines the integration of three meta-analyses of more than two decades of research on (1) CSP and FFP, (2) firm size and CSP, and (3) firm size and FFP into one path-analytic model. The present study does not confirm size as a third factor which would confound the relationship between CSP and FFP.

Achmad (2018), carried out a research on the influence of corporate social responsibility disclosure towards company stock return moderated by profit. The study was carried out using secondary. Data collected were analyzed using ordinary least square regression analysis. Corporate social responsibility cost was used to measure CSRD, while ROE was used to measure stock return. The findings revealed that Corporate Social Responsibility (CSR) Disclosure positively affects the stock return. The study suggests that the value of stock return can be enhanced by improving both quality and quantity of CSR in the annual report of the company.

Amadi & Ndu (2018), conducted a study on corporate social responsibility practice and corporate performance of selected deposit money banks in Nigeria. Using data from the annual reports of five topmost DMBs in Nigeria (FBN, Zenith Bank, GT bank, UBA and Access bank). Philanthropic responsibilities was used as the sole dimension of CSR, while market share (MS) and liquidity were used as the measures of corporate performance. The regression technique for data analysis, it was found that there is positive and significant association between CSR and MS; and that there is no significant association between CSR and Liquidity. Based on this, it was concluded that banks in Nigeria can improve their market share through improved CSR practices; while liquidity cannot be improved by CSR. The study recommended that CSR practices be fully incorporated into the Nigerian banking sector, with regulatory bodies empowered to ensure conformity to extant rules and standards; Banks should view CSR as a means of achieving some corporate objectives.

Boafo & Kokuma (2018) conducted a study on the impact of corporate social responsibility on organisational performance. The research was descriptive. Primary data were captured through the use of questionnaires administered to management and staff of Vodafone Ghana ltd. Target population of the study was made up of management and staff of Vodafone Ghana ltd. (20) respondents. Ethical cost, philanthropic cost and social responsibility cost were used to measure CSR while PAT was used to measure performance. The study revealed that CSR has a substantial and positive impact on all performance. It was therefore recommended that companies should identify their stakeholders’ needs before taking CSR initiatives; also top management must understand the strategic financial benefits of CSR activities and include CSR initiates in their strategic plansates for companies that incurred social costs as a way of encouraging good corporate reportage.

Dickson & Nwosu (2018) conducted a study on effects of corporate social responsibility on organizational performance of selected firms. The study was carried out using primary data with the aid of well-structured questionnaire. Corporate social responsibility cost was used as proxy for CSR, while profit and sales was used as proxies for performance. The data were analyzed using simple regression analysis. The result showed that there is relationship between corporate social responsibility and organizational performance. It is recommended that management of MTN Nigeria and NB Plc should improve the well-being of their employees as it has a way of influencing their performances which will also affect the profit of the organization.

Dilashenyi et al. (2018), investigated the impact of corporate social responsibility on firm’s financial performance in Malaysia, with the use of primary data. The research employs a quantitative research approach whereby a sample 153 respondents were collected using a stratified random sampling technique. Philanthropic cost, ethical cost and environmental cost was used as proxy for CSR, while business risks, company’s reputation, employee engagement and stakeholder concern was used as proxies for performance. Employing SPSS software, multiple linear regression analysis was carried out. The results of multiple regression revealed that business risk, company reputation and stakeholder concern exert statistically significant influences on firm’s financial performance. However, there was no enough evidence to support the claim that employee engage can significantly influence firm’s financial performance.

Ernfjord & Voigt (2018) investigated the relationship between CSR reporting and financial reporting, with the use of primary data. The research employs secondary data. The findings revealed a negative and significant relationship between CSR disclosure and earnings management, across all our CSR variables. In the multivariate regression analysis, the findings revealed significant results for one CSR variable. Specifically, the study revealed that firms that issue a separate CSR report are less likely to engage in accruals manipulation. The study recommends for separate corporate social responsibility reporting for increase in earnings management and efficient financial reporting.

Giltahi et al. (2018) conducted a study on corporate social responsibility disclosure and the value relevance of annual reports for listed banks in Kenya. The study was carried out using both primary and secondary. Data collected were analyzed using ordinary least square regression analysis. The results revealed that corporate social responsibility disclosure had a positive and significant relationship with value relevance of annual reports which was measured by the average market price per share, (MPS). This study therefore concluded that corporate social responsibility disclosure in annual reports of listed banks in Kenya affect the value relevance of the annual reports. The study recommends an expanded role of the auditor in reviewing the corporate social responsibility disclosure and other accounting narratives.

Hang & Ngoc (2018) conducted a study on the effect of corporate social responsibility disclosure on financial performance. This study was conducted using a two-step Generalized Method of Moment (GMM) technique with instrumental variables for balanced panel data through the annual reports and sustainable development reports of 43 enterprises listed on the Vietnam stock market from 2006 to 2016 (473 observations). The results showed that the level of corporate social responsibility disclosure has a positive effect on return on assets. This study has important implications for enterprises in terms of investing activities and corporate social responsibility disclosure. The study recommends for effective disclosure of corporate social responsibility for increase in performance.

Irfan & Faizen (2018), carried out a research on the impact of corporate social responsibility on financial performance evidence from pharmaceutical sector listed companies of Pakistan. The study was carried out using secondary. Proxies used in measuring corporate social responsibility are expenditure on Education, Healthcare and Environment, Donation, and Workers Welfare Fund used, while earning per Share (EPS), Return on Assets (ROA), and Return on Equity (ROE) as measurement of financial performance. Data collected were analyzed using multiple regression analysis. The findings revealed that there is a positive significant impact of corporate social responsibility on financial performance of pharmaceutical firms in Pakistan. The study recommends that producers are proposed to ensure CSR related revelation, that won't just yield productivity yet in addition it will amplify the market estimation of offers of that unit, eventually gathering of complex social and financial advantages.

Kouzoumi (2018), investigated the relationship between corporate social responsibility and firm performance. The study was conducted using secondary data and the data were analyzed using multiple regression analysis. The findings revealed a positive and significant relationship between corporate social responsibility and firm performance. The study recommends that firms should disclosure the cost incurred on corporate social responsibility in order to enhance corporate performance.

Leonardo et al. (2018), conducted a study on corporate Social Responsibility and corporate performance: evidence from a panel of US listed companies. Corporate social responsibility cost was used as proxy for CSR, while ROE was used as proxy for corporate performance. The study was conducted using secondary data and the data were analyzed using ordinary least square regression analysis. The results find partial support to the hypothesis that corporate social responsibility is a move from the shareholders wealth to a multi-stakeholders welfare target.

Marcela et al. (2018), carried out a research on the relationship between corporate social responsibility and business success. The study was carried out using secondary data through the use of annual reports and accounts of Tobacco industry. Philanthropic and ethical cost, while business success was measured using business growth, sales growth and profit. Data collected were analyzed using regression analysis. The result of the analysis shows that there is a relationship between corporate social responsibility and business success.

Miner et al. (2018), carried out a research on the Corporate Social Responsibility Disclosure in Jordan: An Analysis of Annual Reports of listed companies. The study was carried out using secondary. Data collected were analyzed using ordinary least square regression analysis. Corporate social responsibility was measured using total spending on environmental protection and cost incurred in providing social amenities to the host community, while performance is measured using ROE and ROA. The findings revealed that Jordanian listed companies disclose, although this voluntary disclosure might be considered low as the means of disclosure were (17%) (i.e., overall) in the annual reports for the period 2010-2015. In addition, the results show that the highest corporate social responsibility disclosure was for the Activities for workers information and the lowest was for the consumer and environmental protection information for the period 2010- 2016. The study recommends that companies should disclose their corporate social responsibility cost for effective accountability.

Niresh & Silva (2018), conducted a study on the nexus between corporate social responsibility disclosure and financial performance: evidence from the listed banks, finance and insurance companies in Sri Lanka. Corporate social responsibility was measured using philanthropic and ethical cost, while performance is measured using net profit margin, ROA and ROE. Secondary data has been utilized in this study and the observed data consists of six-year period from 2010 to 2015. Information in relation to CSR was obtained from the companies’ annual reports over the years from 2010 to 2014 and the data with regard to companies’ financial performance was collected over the years from 2011 to 2015. Two multiple regression models were analyzed using Stata. Findings of the study revealed that there is a significant association between Corporate Social Responsibility Disclosure and future financial performance of the selected listed banks, finance and insurance companies in Sri Lanka. The study recommends that the regulating bodies of corporates in Sri Lanka for example Colombo Stock Exchange (CSE), Ceylon Chamber of Commerce (CCC) and Securities and Exchange Commission encourage companies to adopt sustainability principles in their core business operations.

Obafemi et al. (2018), conducted a study on the investment in corporate social responsibility, disclosure practices, and financial performance of banks in Nigeria. The data were collected using secondary source. Investment in corporate social responsibility was used to measure to CSR while ROA was used to measure financial performance of firms. The data were analyzed using descriptive statistics. Using panel data set from banks in Nigeria, a developing country, this paper examines the effects of corporate social responsibility (CSR) investment and disclosure on corporate financial performance. The results suggest that CSR investment without due disclosure would have little or no contribution to corporate financial performance. The major implication of this paper is that it supports the argument that corporate entities stand to benefit from voluntary disclosures of CSR activities than mere engaging in CSR activities without proper channels of communicating to stakeholders. Hence, banks should not only engage in CSR activities, but also make deliberate efforts to disclose such activities appropriately to accrue certain financial benefits in the long run.

Okwemba et al. (2018), conducted a study on effect of corporate social responsibility on organization performance. The data were collected using primary data with the aid of well-structured questionnaire. Environmental cost, ethical cost and philanthropic cost used to measure CSR, while customer satisfaction, competiveness, customer relation was used to measure performance. Based on the results of this study, it was concluded that philanthropic responsibility of a bank has an impact on bank performance. The positive significant correlation coefficient 0.490, P<0.05 shows that any increase in philanthropic responsibility will increase the performance of the bank. The study recommended that for banks to retain its customers they should focus on more on their ethics of how they treat their employees, customers and other stakeholder Bank management should priorities CSR activities in their institution and ensure enough resources and personnel are set aside to fund the CSR activities.

Olaoye & Oluwadare (2018), conducted a study on corporate social responsibility and stock price market of selected listed companies in Nigeria. The data for this study were gathered from secondary source. Corporate social responsibility measured using CSR disclosure index awareness in financial statements and its contributions while performance was measured using PAT. The findings of regression analysis confirm as a whole that firm social responsibility is not correlated to stock price market. It also discovered that corporate social responsibility could not be influenced by stock price market. The paper recommends that those who are saddled with responsibility should draw a line of distinction between factors that affect CSR from stock price market in order to achieve organizational goals and satisfy different stakeholders.

Onyekwelu et al. (2018), conducted a study on the analytical review of the effect of corporate social reporting disclosures on performance of firms in the financial sector in Nigeria. The sample size of this work was two banks randomly selected from the fifteen banks listed on the floor of the Nigeria Stock Exchange (NSE) for the year 2010-2014. The study used corporate social responsibility expenditure as a measurement for CSR while ROA, ROE, EPS and PAT were all used as proxy for financial performance. In testing hypotheses, multiple regression analysis was used. The study reveals that Social Responsibility Expenditure does not have significant effect on the Gross Earnings of banks in Nigeria. It was also observed that Social Responsibility Expenditure does not have any significant effect on Profit after Tax of banks in Nigeria. The result of this study equally revealed that Social Responsibility Expenditure has little or no effect on the Share Price of banks in Nigeria. The study recommends that companies should take social accounting disclosure as part of their normal reporting mandate in order to better inform stakeholders and the report must be separately disclosed and form part of the content report statements and government should provide rebates for companies that incurred social costs as a way of encouraging good corporate reportage.

Resmi et al. (2018), conducted a study on the impact of corporate social responsibility on financial performance of industries in Bangladesh. Corporate social responsibility cost was used as proxy for CSR while ROA, ROE, EPS and national income were used as proxies for performance. Data was collected from secondary sources. Regression, correlation was used for analyzing the data and results discussion. The findings presented revealed that return on equity (ROE) & net income has significant impact on financial performance favoring those firms that do Corporate Social Responsibility whereas; return on assets (ROA) & earnings per share (EPS) has no significant impact on financial performance. The study recommends that CSR phenomenon should be considered as an essential growth element and FP-boosting tool through Agribusiness industries of Bangladesh.

Taridi (2018), carried out a research on the development of corporate social responsibility in Indonesia and its impact on company. The study was carried out using secondary. Data collected were analyzed using ordinary least square regression analysis. The findings revealed that Result indicated that beside there was an improvement, the level of CSR implementation in top 200 listed companies in Indonesia during the period of 2014 and 2015 was generally still low compared to global CSR implementation standard. The study recommends that companies should disclose their corporate social responsibility cost for effective accountability.

Umar et al. (2018), investigated the relationship between corporate social responsibility disclosure (CSRD) and financial performance of listed conglomerates firms in Nigeria, with the use of secondary data. The secondary data was sourced from sampled firms’ annual account and reports between 2007-2016. Corporate social responsibility cost was used to measure CSR, while ROA, ROE and ROCE was used as proxies for performance. The data generated were analyzed using descriptive, multivariate regression, Correlation and disclosure index. The major finding from the analysis reveals that there was a positive relationship between CSRD and financial performance, in the light of the major findings it was concluded that, CSRD brings about improvement in the financial performance of the sampled conglomerates in Nigeria since they maintain a positive relationship.

Umoren et al. (2018), conducted a study on corporate social responsibility and firm performance in Nigeria. Data were collected through secondary source. The data obtained were analysed using descriptive statistics, correlation and regression. The determinants of disclosure were proxied by company size, profitability and auditor type. The findings revealed that, the level of CSR was 44%, made up of social disclosure (68%) and environmental disclosure (6%). Findings also revealed that CSR was influenced by company size and auditor type; but not by profitability. This paper recommends a mandatory CSR reporting framework in line with international best practice for all listed companies in Nigeria.

Adeniyi (2017), carried out a research on the corporate social responsibility reporting and business sustainability in Nigeria: emerging issue. The study was carried out using secondary data. The data were analyzed using regression analysis. Corporate social responsibility cost was used to measure CSR while return on capital employed and net profit margin was used to measure performance. The study discovered that there is significant relationship between corporate social responsibility and business sustainability.

Methods

The study made used of content analysis in the collection of data. The population consisted of seventy-two (72) listed non-financial companies in the Nigeria Stock Exchange (NSE, 2019). The entire 72 listed non-financial companies were sampled for the study. Data were collected from secondary sources.

Model Specification

The study made use of a mediation panel regression model in Table 1. The mediation is tested using the causal step approach as follows:

| Table 1 Operationalization of Variables | ||

| Variables | Proxy | Code |

| Independent Variables | ||

| Corporate social responsibility cost | Amount expended on donation | CSRC |

| Firm size | Log of Total Assets | FSIZE |

| Dependent Variable | ||

| Financial performance | Return on equity | ROE |

ROEit = b0 + b1LogCSRCit + ei ............................................................ 1

FSIZEit = a0 + a1LogCSRCit + ei .......................................................... 2

ROEit = b0 + b1LogFSIZEit + b2LogCSRCit + ei ................................... 3

The mediation is evaluated based on four conditions:

1. b1 ≠ 0 in the first equation;

2. a1 ≠ 0 in the second equation;

3. b1 ≠ 0 in the third equation; and

4. b2 ≠ 0 in the third equation

Where:

ROE = Return on Equity; CSRC = Corporate Social Responsibility Cost (Amount expended on donation); FSIZE = Firm Size (Log of Total Assets); a1b1 = indirect effect; b2 = direct effect; ei = error term.

Results and Interpretation

Table 2 shows the descriptive statistics of the study. From the table the mean value of financial performance proxy by return on equity is 12.95%. This implies that about 12.95% of the observation shows the level of financial performance. The median value of corporate social responsibility cost (Donation) for the sampled companies is 0.845. The maximum value for the study is 1.751 while the minimum value was 0.867. This therefore means that companies with higher or equal to the median value of 0.841 expend more on corporate social responsibility while companies with the value below 0.841 expend less on corporate social responsibility.

| Table 2 Descriptive Statistics | |||

| Statistics | ROE | FSIZE | LogCSRC |

| Mean | 12.945 | 6.915 | 0.845 |

| Median | 12.102 | 8.688 | 0.841 |

| Min | 86.266 | 4.844 | 0.867 |

| Max | 153.384 | 37 | 1.751 |

| Sum | 8929.94 | 4789.45 | 604 |

| Source: Researcher Computation (2020) | |||

Hypothesis 1 results in Table 3 and Table 4 indicated that there is a positive and significant relationship between corporate social responsibility cost and return on equity.

| Table 3 Mediating Effect Analysis (Testing of Hypotheses) | ||||||

| Hypothesis | Regression | R2 | F | Beta | t | Sig. |

| H1 | CSRC→ ROE | 0.224 | 220.573 | 0.346 | 10.502 | .030* |

| H2 | CSRC→ FSIZE | 0.124 | 79.732 | 0.245 | 6.314 | .045** |

| H3 | FSIZE→ ROE | 0.151 | 104.375 | 0.275 | 7.224 | .032** |

| H4 | FSIZECSRC→ ROE | 0.207 | 170.857 | 0.322 | 9.243 | .043** |

| Note: *significant at p < .05; ** with mediator variable. | ||||||

| Table 4 Result of Sobel Test | ||||

| Regression | Input( unstandardized coefficients) | Output (Sobel test result) | ||

| Beta | Std. Error | t | Sig | |

| CSRC→FSIZE | 0.174 | 0.011 | 10.147 | 0 |

| FSIZE→ROE | 0.12 | 0 | 10.147 | 0 |

Hypothesis 2 also showed that there is a positive and significant relationship between corporate social responsibility cost and firm size.

Hypothesis 3 further showed that there is a positive and significant relationship between firm size and return on equity.

Hypothesis 4 explored the mediating effect of firm size on the relationship between corporate social responsibility cost and return on equity, a series of steps were followed. Firstly, corporate social responsibility cost was regressed against economic evaluation (ROE). The relationship was found to be significant. Next the mediator variable (Firm size) was added to the model and the result was found to be significant. However, the beta value was less than the beta value for the direct corporate social responsibility cost to return on equity relationship. The results from the analysis show that firm size partially mediates the relationship between corporate social responsibility cost and return on equity. To assess the significance of the mediating effect, a Sobel test was performed. To perform a Sobel test, the beta values and their corresponding standard errors both for the relationship between corporate social responsibility cost and firm size; and between firm size and return on equity was used. The results indicated a partial mediation because the direct and the indirect effects were both significant. Hence, hypothesis 4 which states that firm size has a mediating effect on the relationship between corporate social responsibility cost and return on equity is accepted. The implication of this result is that firm size partially mediates the relationship between corporate social responsibility cost and return on equity.

Discussion of Findings

The empirical findings of hypothesis one showed that corporate social responsibility cost has a positive and significant relationship with return on equity. This result is consistent with the findings of (Achmad, 2018; Dickson & Nwosu, 2018; Orlitzky, 2001; Amadi & Ndu, 2018; Boafo & Kokuma, 2018; Dickson & Nwosu, 2018; Dilashenyi et al., 2018; Ernfjord & Voigt, 2018; Giltahi et al., 2018; Hang & Ngoc, 2018; Irfan & Faizen, 2018; Kouzoumi, 2018; Leonardo et al., 2018; Marcela et al., 2018; Miner et al., 2018; Niresh & Silva, 2018; Obafemi et al., 2018; Okwemba et al., 2018; Olaoye & Oluwadare, 2018; Onyekwelu et al., 2018; Resmi et al., 2018; Taridi, 2018; Umar et al., 2018; Umoren et al., 2018; Adeniyi, 2017).

The study also revealed that firm size has a positive and significant relationship with corporate social responsibility cost and return on equity. This result corroborated the findings of (Aduralere, 2019).

Conclusion and Recommendations

Based on the results, it is concluded that large companies are investing more on corporate social responsibility than smaller companies. The study further concludes that firm size has a partial mediation on the relationship between corporate social responsibility cost and return on equity.

In view of the findings in this study, it is recommended that

1. In order to improve their image/reputation, corporate companies in Nigeria should engage in CSR operations in all its aspects, thereby growing their returns.

2. Corporate companies should spend fair sums of their profits on social donation which in essence would result in a rise in their earnings.

References

- Murdiono, A. (2018). The Influence of Corporate Social Responsibility (CSR) Disclosure Towards Company Stock Return Moderated By Profit. KnE Social Sciences, 457-466.

- Adams, F.J. (2000). Particulate pollution trends in Nigeria. Journal of Regional Science and Urban Economics, 27(1), 87-107.

- Adeniyi, S. (2017). Corporate social responsibility reporting and business sustainability in Nigeria: emerging issue. International Journal of Economics, Business and Management Research, 1(1), 33-44.

- Adewumi, J.R. (2005). Environmental costs assessment. Lagos: Evans Publishers.

- Aduralere, O. (2019). The impact of firm size on firm performance in Nigeria: A comparative study of selected firms in the building industry in Nigeria. Asian Development Policy Review, 7(1), 1-9.

- Amadi, J. & Ndu, E. (2018). Corporate social responsibility practice and corporate performance of selected deposit money banks in Nigeria. International Journal of Advanced Studies in Economics and Public Sector Management, 5(10), 63-88.

- Ayeni, O. (1978). Patterns process and problems of urbanization in Nigeria. Ibadan: Heinemann Educational Books Ltd.

- Boafo, N. & Kokuma, D. (2018). Impact of corporate social responsibility on organizational performance. European Journal of Business and Management, 8(22), 46-58.

- Dickson, R. & Nwosu, N. (2018). Effects of corporate social responsibility on organizational performance of selected firms. Journal of Business and Management, 20(2), 1-8.

- Dilashenyi, D., Uma, M. & Mathavi, M. (2018). Impact of corporate social responsibility on firm’s financial performance in Malaysia. International Journal of Business and Management, 13(3), 220-232.

- Ejumudo, K. (2008). The unending Niger Delta crisis: An ecological perspective. Journal of Social Policy and Society, 3(3), 34-49.

- Ejumudo, K. (2010). Government tax policy oil industry and corporate social responsibility in Nigeria; in A.S. Akpotor et al. (eds) Sustainable environmental peace and security in the Niger Delta. Abraka: Delta State University Press

- Elkington, J. (1998). Cannibals with forks: The triple bottom line theory. Century business. Gabriela Island, BC: New Society Publishers.

- Ernfjord, K. & Voigt, M. (2018). Relationship between CSR reporting and financial reporting. Master’s Thesis work in Accounting and Finance, Gothenburg University, 2018.

- Glautier, M. & Underdown, B. (1998). Accounting Theory and Practice. Great Britain: Pitman.

- Gray, W.B., & Shadbegian, R.J. (1995). Pollution abatement costs, regulation, and plant-level productivity. NBER working paper, (w4994).

- Hang, T. & Ngoc, T. (2018). Corporate social responsibility disclosure on financial performance. Asian Journal of Finance and Accounting, 10(1), 40-50.

- Irfan, T. & Faizen, M. (2018). Impact of corporate social responsibility on financial performance evidence from pharmaceutical sector listed companies of Pakistan. European Journal on Business Management, 4(11), 1-83.

- Kouzoumi, T. (2018). The relationship between corporate social responsibility and firm performance; Exploring the moderating effect of country issues. Thesis work in accounting and Finance. Tilburg University, 2018.

- Leonardo, B., Stefania, G. & Damiano, P. (2017). Corporate social responsibility and corporate performance: Evidence from a panel of US listed companies. Paper presented ad the XIII Tor Vergata Financial Conference, 2017.

- Marcela, M., Ljerka C. & Vesna B. (2018). Relationship between corporate social responsibility and business success. IJARSS, 4(1), 56-70.

- Miner, A., Amer, M. & Bilal N. (2018). Corporate social responsibility disclosure in Jordan: An analysis of annual reports of listed companies. International Journal of Business Society, 2(3), 9-14.

- Niresh, J. & Silva, W. (2018). The nexus between corporate social responsibility disclosure and financial performance; Evidence from the listed banks, finance and insurance companies in Sri Lanka. Journal of Accounting and Finance, 7(2), 65-88.

- Obafemi, R., Oluwabunmi, A. & Collins, S. (2018). Investment in corporate social responsibility disclosure practices and financial performance of banks in Nigeria. Journal on Accounting and Finance, 1(1), 33-45.

- Okwemba, E., Chitiavi, M., Egessa, R., Douglas, M. & Musiega, M. (2018). Effect of corporate social responsibility on organization performance. International Journal of Business and Management Invention, 3(4), 37-52.

- Olaoye, O. & Oluwadare, O. (2018). Corporate social responsibility and stock price market of selected listed companies in Nigeria. International Journal of Academic Research in Business and Social Sciences, 8(7), 872-886.

- Onyekwelu, U., Eneh, G. & Okechukwu, E. (2018). Analytical review of the effect of corporate social reporting disclosures on performance of firms in the financial sector in Nigeria. Research Journal of Finance and Accounting, 9(6), 31-39.

- Orlitzky, M. (2001). Does firm size confound the relationship between corporate social performance and firm financial performance?. Journal of Business Ethics, 33(2), 167-180.

- Resmi, I., Begum, N. & Hassan, M. (2018). Impact of corporate social responsibility on financial performance of industries in Bangladesh. American Journal of Economics, Finance and Management, 4(3), 74-87.

- Srivastava, D.K. (2010). Perspectives on corporate social responsibility (CSR): A case study of the Tata group of companies. Gupta, A., Ethics, Business and Society: Managing Responsibly, 62-69.

- Tapang, A.T., Bessong, P.K., & Ujah, P.I. (2015). Management influence and auditor’s independence in Nigerian Banks. International Journal of Economics, Commerce and Management, 3(4), 1-26.

- Tapang, A.T., Bassey, B.E., & Bessong, P.K. (2012). Environmental activities and its implications on the profitability of oil companies in Nigeria. International Journal of Physical and Social Sciences, 2(3), 285-302.

- Tapang, A.T., & Bassey, B.E. (2017). Effect of corporate social responsibility performance on stakeholder’s perception of telecommunication companies in Nigeria (a study of MTN, Globalcom & Etisalat). Journal of Business and Management, 19(6), 39-55.

- Tilt, C.A. (2009). Corporate responsibility, accounting and accountants. In Professionals' perspectives of corporate social responsibility, Springer, Berlin, Heidelberg, 11-32.

- Umar, S., Saidu, S. & Jamilu, U. (2018). Relationship between corporate social responsibility disclosure (CSRD) and financial performance of listed conglomerates firms in Nigeria. Asian Journal of Economics Business and Accounting, 7(4), 1-8.

- Umoren, A., Isiavwe-Ogbani, A. & Atolagbe, T. (2016). Corporate social responsibility and firm performance in Nigeria. A paper to be presented at ICAN 2nd Annual International Academic Conference on Accounting and Finance, at Lagos Airport Hotel, Ikeja on 18th to 20th May, 2016. . 983-998.

- Wissink, R. (2012). Testing the relation between corporate social performance and corporate financial performance (Doctoral dissertation, Master thesis RBA Wissink University of twente business administration).

- Yomere, G. (2002). Corporate social responsibility of oil Companies in the Niger Delta; in C. O. Orubu et al (ed). The Petroleum Industry, the Economy and the Niger Delta Environment. Abraka; Dept. of Economics; Delta State University, Abraka.