Research Article: 2021 Vol: 27 Issue: 4S

Methodological Aspects Of Crisis Management in Entrepreneurial Activities.

Olga Shulga, State University of Intelligent Technologies and Telecommunications

Liudmyla Nechyporuk, Yaroslav Mudryi National Law University

Irina Slatvitskaya, Don State Technical University

Bahtiyar Khasanov, Tashkent Institute of Irrigation and Agricultural Mechanization Engineers Angela Bakhova, Adyghe State University

Abstract

The article is devoted to the scientific problem of development of methodological basis and tools of crisis management in entrepreneurial activity. The specifics of business structures’ activities in the conditions of reactive crisis management were characterized, the stages of the anti-crisis program in business activity were substantiated. The model of quantitative risk assessment and detection of threats of the crisis management process is proposed

Keywords

Entrepreneurial Activity, Crisis Management, Business Risks, Internal and External Environment, Management Model.

Introduction

Entrepreneurship is always influenced by external and internal factors. Taking into account these factors in the process of management decision-making reduces the likelihood of loss of income or profit, crisis or bankruptcy for a business entity. The high level of dynamism and uncertainty of the external conditions of economic activity leads to increased impact of negative factors on entrepreneurs, which can result not only in deterioration of financial and economic situation, but also development of crisis phenomena (Taneja et al., 2014). In this regard, it is important to identify the factors of negative impact on the business entity at all stages of crisis management, assess their level of impact and differentiate risks and threats in order to form an information base for development of adequate management decisions to prevent or mitigate their action.

Literature Review

Issues of risk management and threat prevention are widely covered in scientific works. A significant contribution to the study of business risks have been made by such scholars as (Coombs, 2015; Hale et al., 2005; Smith, 2003). Issues of threat identification and consideration of their impact in the economic security system of business structures are reflected in the works (Kahn et al. 2013; Wideman, 1992). Approaches to solving numerous theoretical and methodological aspects of crisis management are covered in scientific works (James et al. 2011; Mikes, 2011). However, the issue of identifying and assessing the impact of negative factors during the crisis management in the field of entrepreneurship requires broadening and forming a modern methodological approach.

Methodology

Let us define the methodological basis of the study in terms of: (1) a systematic approach, within which a large number of external and internal factors that adversely affect the entrepreneur form the following management subsystems: crisis management, risk management, economic security management; (2) a process approach in which the processes of crisis management, risk management and economic security management have clearly defined goals and objectives, methods and tools that may, in some cases, intersect but have their own specific features; (3) a functional method that determines that any type of business activity involves implementation of a series of actions, use of techniques and methods which help to achieve the desired result. The sequence of such actions, techniques and methods reflects a process of management that can be divided into the following main steps: definition of purpose; situation assessment; problem identification; making appropriate management decisions; implementation of the decision; control of decision implementation, detection of deviations and decision on corrective measures.

Findings and Discussions

Risks in Entrepreneurship: A Theoretical aspect

In a state of crisis, sensitivity of business entity to any negative impact increases, therefore, the number of risks increases as the likelihood of their growth into threats. We propose to divide business risks into two groups: external and internal. It is claimed that external risks can occur in close and remote environments. The risks of the close environment include unpredictable behavior of product buyers, business owner, tax authorities that coordinate and control business activities, as well as suppliers and creditors. External risks related to the remote environment include political, social, environmental and macroeconomic instability.

We propose to apply a process approach to identify negative factors that may arise during the period of reactive crisis management. So, we will consider the process of reactive crisis management distinguishing its two main processes: 1) crisis management process; 2) implementation of the anti-crisis program. Taking into account the point of view of specialists in the field of crisis management and results of own research, the goals in terms of reactive crisis management in the short and long-term periods are specified, the list of which is given in the Table 1.

| Table 1: Objectives Of The Business Structure In Conditions Of Reactive Crisis Management | ||

| Objectives of the crisis management process (entrepreneur) | The purpose of the crisis management process | The purpose of implementation of the anti-crisis program |

| Ensuring activity of a business entity in the current and long-term periods | Development of an effective anti-crisis program and ensuring its successful implementation in due time | Short-term period: coverage of current losses; restoration of solvency and liquidity of the business entity; preserving the existing economic potential, taking into account measures of the operational anti-crisis program. |

| Long-term period: enhancing competitiveness of the business entity; raising the market value of the business entity. |

||

The main purpose in conducting business activity in a crisis is to ensure its business activity in the current and long-term periods.

Methodical principles of risk management in business activities

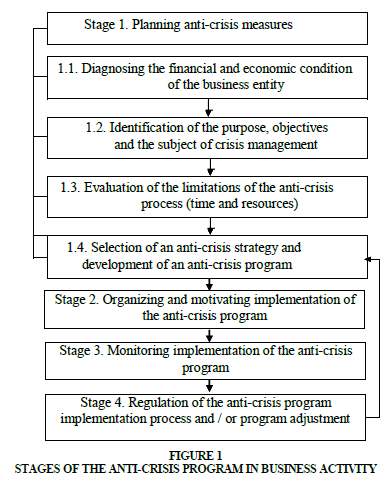

Taking into account modern developments in the theory of crisis management, we have identified the main stages of crisis management activity, which are presented in the Figure 1.

The highlighted stages can also be viewed as separate processes of crisis management (Claeys & Cauberghe 2012). It is for those processes we will identify possible risks, so let's look at them in more detail. To summarize, it should be noted that all stages of crisis management are characterized by managerial, information and communication risks, and at the 1st and 3rd stages, which allow involvement of outside experts, professional risks of the auditor may also be fulfilled. All of these risks are complex, i.e. they integrate different subtypes, so at each stage they may show in a different way.

Results of the study are summarized in Table 2 with all entrepreneurial risks, taking into account sources of risk origin, incidence and time periods.

| Table 2: Results Of Qualitative Assessment Of The Factors Of Negative Impact On A Business Entity In Conditions Of Reactive Crisis Management | |||

| Risks | Origin | Incidence | |

|---|---|---|---|

| Processes | Types of activity | ||

| Managerial | Internal environment | 1 | All types |

| Information and communication | Internal environment. External micro and macro-environment | 1 | All types |

| Professional risks of the auditor | Internal environment External micro-environment |

1 | Diagnosis Controlling |

| Time | Internal environment | 1 | All types |

| Legal | Internal environment | 1 | All types |

| Financial | Internal environment | 1; 2 | All types of crisis management. Financial activity |

| Criminal | External micro and macro-environment | 1; 2 | All types |

| Production | Internal environment | 2 | Production |

| Marketing | Internal environment External micro-environment |

2 | Marketing |

| Logistic | Internal environment External micro-environment |

2 | Logistic |

| Interactions with financial intermediaries | Internal environment External micro-environment |

2 | Financial |

| HR | Internal environment | 2 | Social and HR activity |

| Foreign economic | External micro and macro-environment | 2 | Foreign economic |

| Economic | Macro-environment | 2 | All types |

| Administrative and legislative | Macro-environment | 2 | All types |

| Political | Macro-environment | 2 | All types |

| Natural and ecological | Macro-environment | 2 | All types |

| Scientific and technical | Macro-environment | 2* | All types |

| Socio-demographic | Macro-environment | 2* | All types |

Notes: 1 – crisismanagementprocess; 2 – anti-crisisprogramimplementationprocess; * – only in the long-term period, other – for short and long-term periods

It should be emphasized that the same types of risks have somewhat different nature in the period of implementation of short and long-term anti-crisis measures, both qualitative and quantitative (Wakolbinger & Cruz, 2011). Such difference is caused by: (1) increased uncertainty, hence increasing risk over the long-term period; (2) an increase in the number of risk factors and the level of their impact in relation to implementation of innovative measures (product, process, organizational, marketing).

Based on our own research, we have found that in order to have an effective managerial influence on the effect of negative factors, it is necessary first of all to make a qualitative assessment, which consists in identification of the types of negative factors, study of their origins and incidence (Duncan et al., 2013). The conducted research gave grounds to systematize the risks of reactive crisis management as follows: by sources of origin (internal environment, external micro and macro-environment); by processes (crisis management, implementation of anti-crisis program); by types of crisis management activities (planning anti-crisis measures, organizing and motivating implementation of anti-crisis measures, monitoring implementation of anti-crisis programs, regulating the process of implementation of anti-crisis measures and / or adjusting the program); by types of economic activity (production, marketing, logistics, financial, social and HR, foreign economic); by periods (short and long-term).

Quantitative assessment of risks and identification of threats in the crisis management process

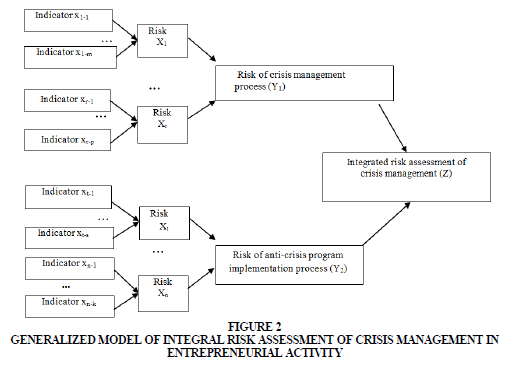

Based on the research presented above, we suggest treating a threat as the highest level of risk. However, such assessment is of a qualitative and relative nature. In view of this, an important issue that needs to be addressed is justification of quantitative indicators that can be used to differentiate risks and threats. And this requires building a model that would provide a fairly objective result. Studies have shown that fuzzy sets theory is appropriate for modeling economic phenomena and processes associated with high levels of uncertainty (Zhao et al., 2013). Such approach allows to formalize, within the same model, both specifics of the object of assessment and the cognitive characteristics of the decision makers for that object. This approach provides opportunity to build a model to obtain quantitative estimates, as opposed to traditional qualitative expert assessments. Taking into account the process approach to qualitative assessment of the factors of negative impact on the business entity in conditions of crisis management, we propose a generalized model of quantitative assessment of integral risk, as shown in Figure 2.

Figure 2:Generalized Model Of Integral Risk Assessment Of Crisis Management In Entrepreneurial Activity.

The quantitative risk assessment of each process is conducted taking into account their specific types of risks (according to Table 2) and their factors, which will be assessed using indicators (Tokede & Wamuziri, 2012). Similar types of risks identified for the short and longterm periods have certain differences. These differences are traced to risk factors, levels of influence of factors and levels of risk (in the long-term period the level of impact increases as uncertainty increases) (Guo & Fraser, 2010). Differences in risk factors are accounted for by introducing additional or other risk indicators over the long-term period.

Building a knowledge base on the relationship between indicators and risks, it is necessary to take into account that the relationship between them can be both direct and inverse. Most indicators and risks are characterized by inverse relation: the higher the value of the indicator, the lower the risk level. Some types of risks are directly related to the level of the indicator, for example, the following factors increase the risk: the level of time constraints, the level of criminality of the business environment, the level of financial and operating leverage, etc.

Recommendations

Recommendations are formed in the prospect of continuing relevant research based on the proposed hierarchical fuzzy model. Thus, the risk sensitivity analysis of crisis management can be analyzed to the level of such risks as: managerial, information and communication, professional risk of the auditor, financial, legal, as well as sensitivity of management, information and communication and professional risk of the auditor to the level of their indicators. The results of such an analysis will help to identify the most significant factors of influence and propose measures to reduce their levels.

Conclusion

As a result of research of theoretical and applied aspects of crisis management the areas of risk spreading in business are specified. For entrepreneurial activities, such areas are: planning of anti-crisis measures, organizing and motivating implementation of anti-crisis measures, monitoring implementation of the anti-crisis program, regulating process of implementation of anti-crisis measures and / or adjustment of the program. Spheres of risk spreading in the course of implementation of the anti-crisis program are divided by types of activity of the business entity: production, marketing, logistic, financial, social and HR, foreign economic.

Given the process approach to risk identification, the feasibility of building a hierarchical fuzzy model for quantitative assessment of the level of their impact is substantiated. The model features two variables and defines their respective sets: 1) the variable "Level of risk indicator" with a set of values: very low; low; average; high; very high; 2) the variable "Risk Level" with a set: acceptable; critical; catastrophic (threat). The universal set for evaluating indicators and variables is the set of real numbers between 0 and 2.

References

- Claeys, A.S., &amli; Cauberghe, V. (2012). Crisis reslionse and crisis timing strategies: Two sides of the same coin. liublic Relations Review, 38, 83-88.

- Coombs, W.T. (2015). Ongoing crisis communication: lilanning, managing, and reslionding (4th ed.). Thousand Oaks, CA: Sage.

- Duncan, T.E., Duncan, S.C., &amli; Strycker, L.A. (2013). An introduction to latent variable growth curve modeling: Concelits, issues, and alililication. New York: Routledge.

- Guo, S., &amli; Fraser, M.W. (2010). liroliensity score analysis: Statistical methods and alililications. Thousand Oaks, CA: Sage.

- Hale, J., Dulek, R., &amli; Hale, D. (2005). Crisis Reslionse Communication Challenges. Journal of Business Communication, 42(2), 112-134.

- James, E.H., Wooten, L.li., &amli; Dushek, K. (2011). Crisis management: Informing a new leadershili research agenda. Academy of Management Annals, 5, 455-493.

- Kahn, W.A., Barton, M.A., &amli; Fellows, S. (2013). Organizational crises and the disturbance of relational systems. Academy of Management Review, 38, 377-396.

- Mikes, A. (2011). From counting risk to making risk count: Boundary-work in risk management. Accounting, Organizations and Society, 36(4-5), 226?245.

- Smith, David (2003). Business Continuity and Crisis Management. Management Quarterly. Faculty of Finance and Management

- Taneja, S., liryor, M., Sewell, S., &amli; Recuero, A. (2014). Strategic Crisis Management: A basis for renewal and crisis lirevention. Journal of Management liolicy &amli; liractice, 15(1), 78-85.

- Tokede, O., &amli; Wamuziri, S. (2012). liercelitions of fuzzy set theory in construction risk analysis, 3-5.

- Wakolbinger, T., &amli; Cruz, J. M. (2011). Sulilily chain disrulition risk management through strategic information acquisition and sharing and risk-sharing contracts. International Journal of liroduction Research, 49(13), 4063-4084.

- Wideman, R.M. (1992). liroject and lirogram Risk Management, liroject Management Institute, New town Square, lia

- Zhao, X., Hwang, B., &amli; liheng, S. (2013). Low Develoliing Fuzzy Enterlirise Risk Management Maturity Model for Construction Firms. Journal of Construction Engineering and Management, 139(9), 1179-1189.