Research Article: 2019 Vol: 23 Issue: 2S

Model of Calculation Management with Enterprise Contractors

Petro Garasyim, National Forestry University of Ukraine

Alexander Bradul, Kryvyi Rih National University

Nataliya Slobodyanyuk, Donetsk National University of Economy and Trade

Halyna Volyanyk, National Forestry University of Ukraine

Svitlana Shutka, National Forestry University of Ukraine

Abstract

The matrix of the classification of the probability of return of counterparties' receivables according to the categories of debt servicing quality in 9 classes of the debtor is constructed. Features of the formation of bonuses in the system of electronic commerce are considered. It is proved that for increasing the level of the informativeness of the management accounting of the state of payments with suppliers, it is necessary to introduce an analytical table, where would be shown the debt in the context of each supplier according to the contracts, terms of debt repayment on schedule and in fact. The operogramme of the movement of the consignment note with the corresponding composition of accounting works is constructed.

Keywords

Contractors, Receivables, Quality of Debt, Matrix, Operogramme Movement.

JEL Classification

M21, O16

Introduction

The global non-payment crisis forces enterprises to look for new ways to repayment of receivables for goods, work, and services. The estimation of the probability of return of receivables is an obligatory element of the management of settlements with contractors in order to choose ways of debt repayment: factoring, forfaiting, etc. Enterprises in modern economic conditions operate in conditions of uncertainty, especially in the implementation of business operations, which are related to settlements with counterparties. In modern economic conditions, the timely repayment of obligations is a priority for the development of economic relations. Violation of terms of repayment of obligations reduces solvency of economic entities, adversely affects the rhythm of the operation of enterprises, affects on the financial performance of activities, and leads to a decrease in profitability.

The reasons for choosing the approach the managing of repayment of receivables are the actual goals of its activities. If the main goal of the company is survival in a competitive environment, the establishments of low prices for goods, work, services and increasing the period of deferred payment for contractors are debt management tools. These tools are also used when the company seeks to take the maximum market share. Opposite economic instruments are used when an enterprise strives to maximize the gain level: the choice of alternative debt repayment tools (factoring, forfaiting, etc.) to increase cash flows.

Literature Review

Late payment for goods and services leads to deterioration of the financial condition of the company (Badarinza et al., 2019). Therefore, in the financial and economic activities of compamies, a lot of attention is paid to the accounting and analysis of settlements with debtors (Benos et al., 2017). The central task for all accountants is to create an effective mechanism for analyzing calculations to reduce debt, to introduce the most accurate estimate of doubtful debts, and to find the best methods for analyzing receivables that would provide all the necessary information to users of financial statements (Paddrik & Young, 2017; Koev et al., 2019).

Methodology

In the process of study, general scientific and special methods of scientific knowledge were used, namely: critical analysis, scientific abstraction and generalization of scientific experience from modern theoretical studies (in determining the conceptual apparatus, studying the theoretical foundations and scientific approaches to the management of receivables); analysis and synthesis, induction and deduction, system analysis; classification and analytical and abstract and logical (with theoretical generalizations, systematization of factors influencing the quality of receivables, classification of receivables and the development of a conceptual model of management of receivables of enterprises, formulation of conclusions and practical recommendations); statistical analysis (when summarizing tendencies, conditions and features of the formation of accounts receivable, management of accounts receivable of e-commerce trading enterprises); optimization (when modeling the structure of receivables); graphic (for visual and schematic representation of theoretical and practical study results).

Findings and Discussions

The presence of receivables is associated with the search for a compromise solution between risk and return. Its optimal amount is determined by comparing the gains that the company expects to receive at a certain level of funds invested in receivables, with the costs that it will undertake for this. Formalized procedures and models of enterprise behavior regarding existing and potential counterparties for selling products (goods) on credit are the real management of the company's receivables, which, in turn, are an integral part of the company's management. In most practical situations, a company works with limited resources and in a balance between risk and potential gains. With limited resources of a company, it becomes necessary to search for optimal sources and instruments for financing the sale with a deferred payment. Thus, the primary is the management of crediting the counterparties of the enterprise, and in the event of a shortage of working capital, there is a need to refinance the resulting receivables.

The policy regarding the buyers of goods must be so flexible that there is a possibility of its change depending on the factors of the macro- and microenvironment.

The information base of the study consists of legislative and regulatory acts of Ukraine, statistical data of the State Statistics Service of Ukraine, reporting and accounting data of wholesale e-business companies.

The reporting for 2014-2018 years of 20 companies of this sector were used, the information was provided by the regional representatives of the State Statistics Service of Ukraine.

The introduction of the critical value of the probability that an enterprise will receive economic benefits from the maintenance of receivables would have a certain practical value. Accounts receivable, as a result of a credit operation, is one of the important components of debt relations in general, a key element for calculating indicators of their performance.

An important methodological problem of assessing the state of debt relations between companies is to determine the quality of accounts receivable. Accounts receivable as an asset has the potential to directly or indirectly contribute to the flow of funds into enterprises, characterizing its economic profitability. The ‘quality’ of receivables should be considered taking into account the economic advantage of this particular receivables for this particular company.

As the main indicator of the quality of accounts receivable, it is proposed to use the share of overdue debts in its total volume, which will allow characterizing the state of debt relations between companies at different levels.

This is the only type of reserve, the creation and use of which is regulated by international and national legislation. But the existing problems of assessment, determining the amounts of bad debts, the establishment of time thresholds for the doubtfulness of return require further study to solve them. If the likelihood of repayment of receivables from contractors in terms of the quality of debt service in the ‘high’ ‘good’ range, the contractors will pay their debts in accordance with the terms of the contract; ‘satisfactory’ ‘weak’, it is necessary to form reserves for repayment of receivables, to reflect in the financial statements of an enterprise, to apply instruments that contribute to the repayment of debts factoring, forfeiting, and the like; ‘unsatisfactory’ to carry out the elimination measures.

The main point of the choice of methodology for the calculation of reserves for doubtful debts is the determination of the maturity of receivables that it is necessary to create a reserve for bad and doubtful debts. We propose to determine the doubtfulness of repayment of receivables, based on the state of debt servicing by the debtor.

The obtained probabilities of repayment of arrears by the contractor are defined as the category of receivables quality on the basis of the risk assessment of the return. The limits of the range of the risk of return on receivables can be determined using the matrix (Table 1).

| Table 1: Determination Of The Risk Of Repayment Of Receivables (Author's Development) | |

| Category of credit for a loan | The value of the loan risk indicator |

|---|---|

| 1 – the highest | 0.01 – 0.06 |

| 2 | 0.07 – 0.20 |

| 3 | 0.21 – 0.50 |

| 4 | 0.51 – 0.99 |

| 5 – the lowest | 1.0 |

Each of the financial coefficients of the multi-factor discriminant model of the probability of contactor debt repayment can be analyzed in more detail. In particular, the turnover rate of current assets, namely the turnover of accounts receivable due to the number of calendar days of delay in debt repayment. Then, for wholesale companies, determining the state of debt servicing by the debtor depends on the number of calendar days of delay (Table 2).

| Table 2: Determination Of The State Of Debt Servicing By The Debtor For Wholesale Companies (Author's Development) | |

| Number of calendar days of delay (inclusive) | Debt service condition |

|---|---|

| from 0 to 7 | «high» |

| from 8 to 30 | «good» |

| from 31 to 90 | «fair» |

| from 91 to 180 | «low» |

| over 180 | «bad» |

According to the results of the combined data in tables 1 and 2, the classification of the probability of return of receivables from contractors is conducted. This classification is carried out according to the quality categories on the basis of a certain class of the enterprise and its maintenance of debt in accordance with Table 3.

| Table 3: Classification Of The Probability Of Repayment Of Receivables By Contractors According To The Categories Of Debt Service Quality (Author's Development) |

|||||

| Debtors class | Debt service condition | ||||

|---|---|---|---|---|---|

| «high» | «good» | «fair» | «low» | «bad” | |

| 1 | 1 | 1 | 3 | 4 | 5 |

| 2 | 1 | 1 | 3 | 4 | 5 |

| 3 | 1 | 2 | 3 | 4 | 5 |

| 4 | ? | 2 | 3 | 4 | 5 |

| 5 | 2 | 2 | 3 | 4 | 5 |

| 6 | 2 | 3 | 4 | 4 | 5 |

| 7 | 2 | 3 | 4 | 4 | 5 |

| 8 | 2 | 3 | 4 | 4 | 5 |

| 9 | 2 | 3 | 4 | 5 | 5 |

After determining the debtor's class, the enterprise should monitor and control the repayment of receivables. At the same time, it is possible to restructure debt with appropriate measures. Develop a realistic and credible debt repayment program, which should identify the measures needed to maintain business solvency, a detailed timetable that reflects all the actions required for the implementation of the planned actions (Tetiana et al., 2018). Demand from contractors the economic justification of debt recovery, based on competent financial modeling of the enterprise and multifactorial analysis of the situation, model of the company's development with and without restructuring, and containing an independent and conservative confirmation of the company's future revenues. Prepare a proposal for contractors to properly structure debt working in detail restructuring technology to optimize its parameters and minimize risks.

At the present stage of social development, more and more companies of the trade sector are trading in an e-commerce system. Let’s us consider the characteristic features of the settlements with counterparties in these conditions. First, we should to consider the characteristic features of the activities of e-business trading (Schwarz, 2018; Drobyazko, 2018).

Enterprises in modern economic conditions operate in conditions of uncertainty, especially in the implementation of business operations, which are related to settlements with counterparties. The business activity of the company is accompanied by the necessity of using, besides own and borrowed capital, to use it (Wang, 2017). In modern economic conditions, the timely repayment of obligations is a priority for the development of economic relations. Violation of terms of repayment of obligations reduces solvency of economic entities, adversely affects the rhythm of the operation of enterprises, affects the financial performance of activities and leads to a decrease in profitability. In view of this, the use of reliable, qualitative and adequate information on the debt that is formed in the accounting system is essential.

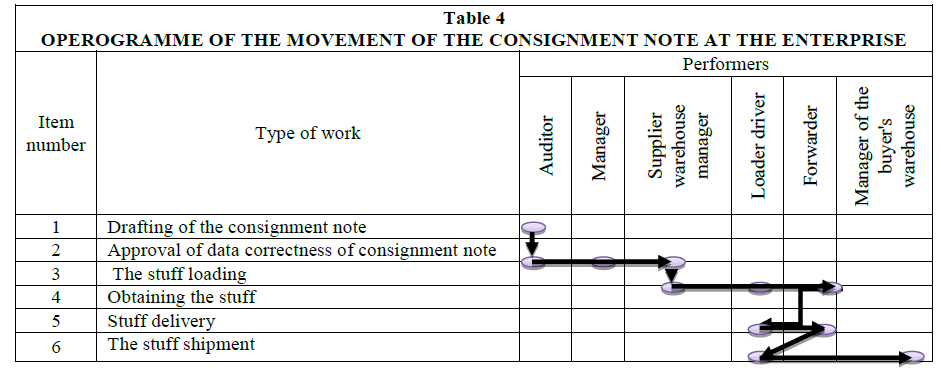

Operogramme of the movement of the consignment note at the enterprise is presented in the Table. 4.

The document flow of settlements with counterparties is a rationally organized system for the formation, verification and processing of primary accounting documents, the quality of maintenance of which is characterized by the use of an operogramme and workflow schedules by a company. Operogramme bill of lading is an organizational document that regulates the processing of incoming or outgoing documents, compiled for the designation of operations for accounting for receivables, registration, coordination, etc. and to indicate responsible executives.

The results of our study are confirmed by the following studies. The graphical method makes it possible to establish logical links between various stages of work with certain types of documents in a company, to trace the sequence of such accounting work and its content (Hilorme et al., 2019). The analytical paper on calculations with suppliers is proposed to be conducted during the year, after which it is closed and transferred to the archive, where the term of its storage is 3 years. The remainder is transferred to the newly created document of the next reporting period.

Recommendations

In order to improve the information support of the organization of accounting for receivables, we have recommendations to classify long-term receivables by non-repayment period; to disclose in the Notes to the annual financial statements information on current receivables by type of calculation. We propose to determine the doubtfulness of the repayment of receivables, based on the state of debt servicing by the debtor, 5 classes: ‘high’, ‘good’, ‘satisfactory’, ‘weak’, ‘unsatisfactory’. The approach based on grouping debts according to the timing of their occurrence provides certain advantages, which allow to reduce the highly complex procedures of analytical accounting of reserves of doubtful debts, which greatly simplifies accounting, and also eliminates the fundamental differences in recording these operations in the national accounting system and in accounting according to the international standards.

Conclusion

In modern conditions of company operation in the industry, receivables occupy a significant share in the structure of working capital, which requires special attention from managers and requires effective management with the goal of timely receipt of funds and an overall increase in the efficiency of their use, since they have a direct impact on the financial condition of the business entities.

It should be noted that the main difference between reserves-regulators of the formation of a source of reimbursement of expenses from reserves-regulators of asset and capital assessment is that deductions to secure liabilities consist of funds that are not subject to taxation later, and reserves related to the articles of equity of a company are formed from the part of the profit, which has already passed the stage of taxation.

The purpose of creating reserves for economic facts of indefinable consequences at a company is to minimize the risks in the process of creating a source of compensation for adverse effects.

Prospects for further research are the development of a working plan for accounting accounts payable to suppliers and contractors, the formation of typical correspondence for analytical accounting, the development of a technical map of the proposed sub-accounts, etc.

References

- Badarinza, C., Ramadorai, T., & Shimizu, C. (2019). Gravity, Counterparties, and Foreign Investment. Retrieved from https://dx.doi.org/10.2139/ssrn.3141255

- Benos, E., Wood, M., & Gurrola-Perez, P. (2017). Managing market liquidity risk in central counterparties. Retrieved from https://dx.doi.org/10.2139/ssrn.3003564

- Drobyazko, S.I. (2018). Actual problems of provision of financial statements for texonomy of IFRS. Economy and finance, 8, 4-10.

- Koev, S.R., Moroz, I., Mushynska, N., Kovin’ko, O., & Kovalchuk, S. (2019). Featurea of building a managerial career based on entrepreneurship education. Journal of Entrepreneurship Education, 22, (1S), 2019.

- Paddrik, M., & Young, P. (2017). How safe are central counterparties in derivatives markets? Retrieved from https://dx.doi.org/10.2139/ssrn.3067589

- Schwarz, D. (2018). The ability of listed companies to optimize their capital structure, shape their distribution policy and fight hostile takeovers by repurchasing their own shares. Entrepreneurship and Sustainability Issues, 6(2): 636-648.

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22,1-8.

- Tetiana, H., Karpenko, L., Fedoruk, O., Shevchenko, I., & Drobyazko, S. (2018). Innovative methods of performance evaluation of energy efficiency project. Academy of Strategic Management Journal, 17(2), 112-110.

- Wang, X. (2017). Differences in the prices of vulnerable options with different counterparties. Journal of Futures Markets, 37(2), 148-163.