Research Article: 2022 Vol: 25 Issue: 3S

Model of risk classification in the electricity distribution sector of the UAE

Ahmed Husain AlMarzooqi, Universiti Teknikal Malaysia Melaka

Hyreil Anuar Kasdirin, Universiti Teknikal Malaysia Melaka

Nusaibah Mansor, Universiti Teknikal Malaysia Melaka

Citation Information: AlMarzooqi, A.H., Kasdirin, H.A., & Mansor, N. (2022). Model of risk classification in the electricity distribution sector of the UAE. Journal of Management Information and Decision Sciences, 25(S3), 1-8.

Abstract

The effective classification of risk types can form the basis for a strong response of an organization to the specific sources of risk and prevent serious losses for the company. To deliver the effective risk management model, management should be provided with a realistic and relevant risk classification model applicable to the conditions of the specific organization. This study assessed the risk classification model implemented in the energy distribution system of the UAE, specifically, the Abu Dhabi Distribution Company (ADDC). The risk classification model of the organization was critically assessed and compared to the findings of the academic literature review, including the best practices in the field of risk classification. The findings of the research formed specific recommendations for the improvement of the risk classification practices in the selected organization. The methodology of the research relied on a qualitative research design and the semi-systematic literature review.

Keywords

Risk classification; Energy distribution system; Risk; Risk types; Stakeholders.

Introduction

This article addressed one of the key elements of the performed study on the means of optimization of the risk management procedures applied in the electricity distribution system of the UAE. The target company for the study was the Abu Dhabi Distribution Company (ADDC). As one of the strongest players in the utility market in Abu Dhabi Emirate, the organization performs the distribution of water and electricity utilities among households and businesses in the region. The search of solutions for the optimization of the risk management processes at ADDC required analysis of the procedures applied in the organization to classify the categories of risks determined by the management and followed by the employees. It was sensible to determine the main categories of risks perceived by the internal stakeholders of ADDC and compare the findings with the outcomes of previous academic studies to determine the accuracy and reliability of risk identification policies applied at ADDC. This article discussed the following aspects of the previously performed study: the key problem, methodology, and the main findings of the study.

Methodology

The objective of this study was to analyze the methods of risk classification applied at ADDC and compare them with the approaches to organizational risk classification applied in the reliable academic literature. It was sensible to analyze whether the management of ADDC included all the relevant categories of risks in its regulatory documents, or the organization currently fails to pay attention to specific important sources of risks. To address this objective, the research oriented on a qualitative research design. The decision to reject the quantitative study format was explained by the absence of a clear vision of parameters that should be measured quantitatively and the absence of a sufficient volume of quantitative data that would contribute to the resolution of the research question.

To develop a detailed vision of the risk classification approach applied at ADDC, the researcher utilized qualitative data collected from the official regulatory documents of the organization. To collect the data, the researcher contacted the management of the organization, asking for approved access to the internal documentation of the company. The management of the organization provided the researcher with the following documents summarizing information about the risk classification approach applied in the company: Risk Management Guidelines (ADWEA, 2003); Risk Management Strategy (ADDC, 2014a); Procedure for HSE Risk Management (ADDC, 2014b). The procedure of data collection was based on the application of the literature review and note-taking methods.

The collection of qualitative data about the approaches to risk classification from academic literature supposed the development of a reliable and relevant sample of academic publications. The author used a semi-systematic literature review approach. The advantage of this research method compared to the systematic literature review is that it allows the researcher to analyze a research question when there is no structured information about its nature in the list of literature sources (Snyder, 2019). The researcher can summarize the positions of different researchers in a single literature review, covering the existing knowledge gaps and synthesizing new knowledge.

To develop the sample of academic literature sources, the researcher developed a set of inclusion criteria. The target sources had to be published within the last 10 years in journals with a high reputation and directly address the main question of the study. The researcher selected the literature sources in two steps. In the first step, the search engines and reliable academic literature databases were applied to identify reliable publications that met the required criteria. In the second stage of analysis, the researcher reviewed the title and abstract of the selected publications, choosing papers with the optimal characteristics from the point of study objectives.

Based on the semi-systematic literature review method, the researcher formed the knowledge base describing the existing approaches to the classification of risks in modern organizations. The comparison of the literature review findings with the classification approaches applied at ADDC provided the researcher with an insight into possible ways of improvement of the risk classification procedures in the target company.

Results and Discussion

The discussion of the study results included the presentation of literature review findings and comparison of this result with the outcomes of the ADDC documents’ analysis. The first section of the results chapter summarized available knowledge about the risk classification in academic literature. The following aspect of results was related to the assessment of common categories of risks relevant for the UAE electricity sector in general.

Key Categories of Risk in an Organization

The main issue associated with the classification of risks in an organization is that it is impossible to develop the principles of classification applicable for any type of organization depending on the sphere of its operations. The most common approach utilized for the classification of risks is associated with the assessment of the internal and external environments of the organization (Curtis & Carey, 2012). It leads to the conclusion about the subjective nature of risk as an organizational phenomenon. Hence, it is impossible to determine the objective nature of risk applicable for any type of organization.

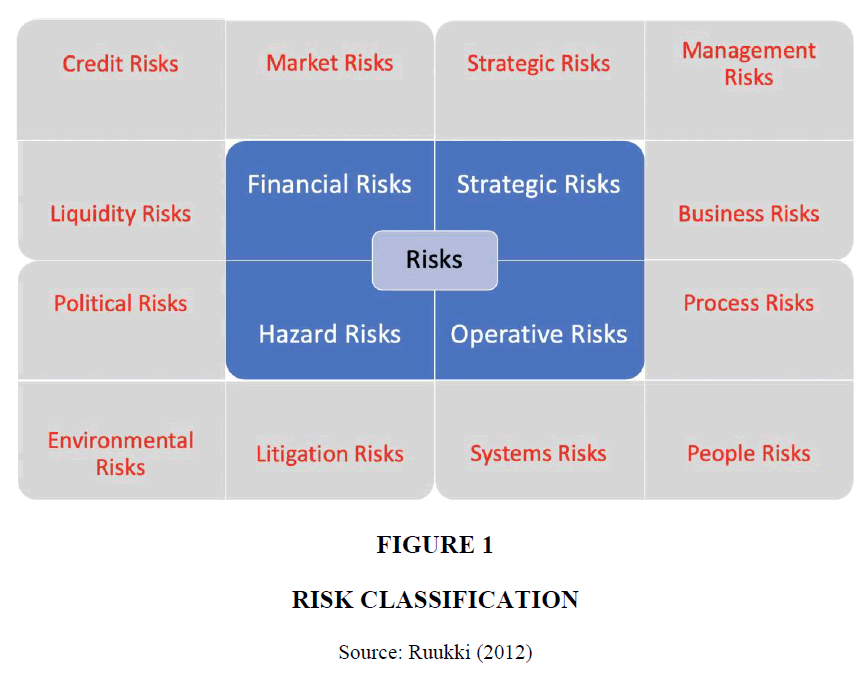

Despite the subjective nature of risks experienced by each organization, previous studies aimed to develop a general scheme of risk classification, including risks that are usually faced in different types of companies. The study by K?zakov et al. (2021) analyzed the role of modern global risks in development of organizations. This approach was not applied in the study due to global scale of the risk classification approach. The research by Ennouri (2013) developed the following risk classification model: strategic risk, operations risk, supply risk, customer risk, asset impairment risk, competitive risk, reputation risk, financial risk, fiscal risk, regulatory risk, and legal risk. Another model of common organizational risk classification, which is summarized in Figure 1, was proposed by Ruukki (2012). This model of risk classification wins in the aspect of the definition of the four main groups of risks, which are further encoded into a larger sample of risk characteristics. The orientation on the model developed by Ruukki (2012) can be a more effective approach for modern organizations.

Figure 1 Risk Classification

Source: Ruukki (2012)

Another alternative approach to the definition of risk categories in modern organizations was proposed by Dandage et al. (2018). This study developed the following risk categories that should be targeted by the management of modern organizations: financial and economical, contractual and legal, subcontractor, operational, safety and social, design, physical, delay, political, internally generated, cultural, technical, level of competition, fraudulent practices, managerial, health-related and force majeure risks (Dandage et al., 2018). This model of risk classification addressed the following aspects of risk management in the organization: analysis of the stakeholders’ perspective in the assessment of the organizational risks and assessment of the probability of unethical behavior in the context of organizational risks. Such an approach can be productive to determine whether the organization effectively integrates stakeholders’ interests and ethical behavior risks into its risk management strategy.

The final model of risk classification considered in this study was the model proposed by Al-Haj (2014). This model of risk classification determined the following categories of risk: economic and non-economic risks, dynamic and static risks, pure and speculative risks (Al-Haj, 2014). The difference between economic and non-economic risks was associated with the problems caused by a specific type of risk for the economic well-being of the company. Dynamic and static risks differed in the way environmental changes influenced the character of the risk. Static risks remained unchangeable despite the influence of the environment, while dynamic risks could change their character under influence of environmental factors. Finally, pure risks include factors that produced specific effects on the organization despite any changes in the environment, while speculative risks could produce either positive or negative implications depending on the general context (Al-Haj, 2014). Such format of risk classification provides space for creative management and assessment of a range of implications of risks for an organization.

The analysis of the available approaches to the classification of risks determined a variety of solutions available for the complex and effective organization of risk management processes in the company. This knowledge base was applied to critically assess the quality of risk classification at ADDC and recommend improvements to its future practice.

Classification of Risks in the UAE Energy Sector

An important question for discussion within the scope of the study was the assessment of risk classification specifics of the energy sector. An important specific of the energy sector is a higher level of risk in comparison to the majority of other industries (Eurelectric, 2007). The analysis of the risk classification approach in the global energy sector led to the definition of the following key categories of risks that are permanently monitored: market risk, credit risk, operational risk, and business risk (Eurelectric, 2007). Therefore, apart from the control of current operations and resilience of the energy system, the utility companies should be able to monitor market volatility factors and financial sustainability conditions.

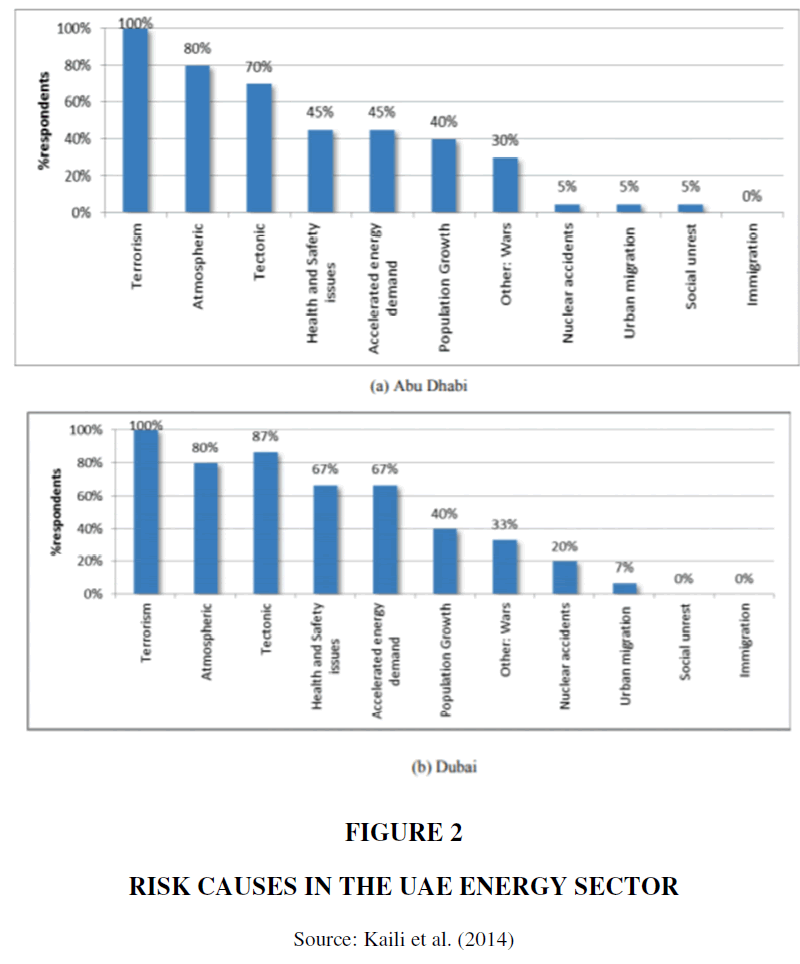

Another approach to the classification of risks in the energy sector of the UAE was demonstrated in the study by Kaili et al. (2014). The summary of the study results is presented in Figure 2. The analysis of the energy sector environment in the UAE demonstrated the existence of specific risk categories that are rarely considered by energy and utility companies in other countries and regions of the world. The following categories of risks are unique for the Middle East region: terrorism, atmospheric conditions, population growth, and war conflicts. The UAE faces specific political, demographic, and military challenges that could impact the development and resilient performance of the state’s energy sector.

The analysis of the risk management specifics in the energy sector allowed to define specific requirements for effective risk classification in this industry. The specific conditions of the UAE should also be considered during the review of the current risk management and classification approach at ADDC.

Classification of Risks at ADDC

The analysis of ADDC regulation documents led to the definition of the key categories of risks inside the organization. The Risk Management Guideline document pointed to the following types of risks depending on the impacted stakeholder: individual risk, public risk, and social risk (ADWEA, 2003). This classification divided risk into categories by the scale of impact on stakeholders. Nevertheless, the limitation of the current approach is the absence of division between the impacts of specific risks for different categories of stakeholders. It was not demonstrated whether the organization aims to distinguish the impact of the perceived risks for different types of stakeholders.

The Risk Management Strategy document of the organization highlighted the key types of risks applied for the analysis of the current operations in the organization. The following types of risks were determined: assets risks, operations and maintenance risks, project risks, HSEQ risks, and corporate functional risks (ADDC, 2014b). In this way, the organization follows an operations-oriented approach to the risk classification process. The earlier mentioned categories of risks applicable for the discussion of processes in the energy sector were integrated into the risk management processes at ADDC in the format of estimation of operational implications.

The final approach to the organization of risk classification at ADDC is the definition of different types of hazards that could impact the performance of the company. This vision of the risk classification model correlates with the vision presented by Ruukki (2012), who determined a large group of risk factors for modern organizations. The following types of hazardous events were established from ADDC documents: physical hazards, engineering hazards, chemical hazards, ergonomics hazards, biological hazards, and environmental hazards (ADDC, 2014a). Altogether, the organization applied a diversified approach to the definition of the main types of hazards that could impact its performance.

Implications of the Study

The findings of the study included the definition of the risk classification approach applied at ADDC and comparison of this approach with the best practices demonstrated in the recent academic publications. The approach currently utilized at the organization was found quite effective from the point of definition and classification of the main categories of risks that could be faced by its management and employees. However, some specific solutions for the improvement of the risk classification approach were determined.

First, the management of ADDC should pay more attention to the consideration of the stakeholder-based approach in the definition of risk types. To reach the highest level of risk management, it is sensible to estimate the impacts of the faced risks for different types of the organization’s stakeholders. This approach could be productive for the prioritization of risk management tasks and minimization of the potential costs caused by the risks occurrence.

Second, the organization needs to take into consideration unethical behavior risks. The current scheme of risk classification provided no opportunities for the definition of unethical behavior risks and their impact on the company. It is sensible to determine different types of unethical behavior challenges that could be faced by the company. The resolution of this question can help the organization to develop effective risk management practices and recommendations.

The final recommendation for the future practice of risk classification at ADDC is related to expanding the list of risks that should be included in the current risk classification model. The operational model of risk classification at ADDC includes the following categories of risks: assets risks, operations and maintenance risks, project risks, HSEQ risks, and corporate functional risks. Assets risks can include credit and market risks, which were earlier highlighted as important contributions to risk resilience of the energy sector organization. It is sensible to bring improvements to the current risk management documents of the company to address the existing regulatory gaps and provide management with reliable recommendations for monitoring and resolution of the full list of risks that were determined in the academic literature.

Opportunities for Further Study

The opportunities for further study in the context of risk classification methods analysis are related to the assessment of the prevalence of different risk types at ADDC and other UAE organizations operating in the energy sector. A comparison of the statistics describing the prevalence and impact of different risk types could contribute to the improvement of the risk management practices in the UAE energy sector. It is sensible to provide the management with insights from reliable academic literature about the compared probability of occurrence of different risk types.

To address this question, it will be important to collect primary quantitative information about the statistics of risk occurrence in the target organizations of the UAE energy sector. The complexity factor in the study of this question could be related to the risk of absence of centralized risk monitoring procedures in the target companies. If the companies do not obtain relevant and reliable statistics about the prevalence of different types of risks in their performance, it will be important to perform qualitative studies involving risk management units of the companies. Although such an approach could lead to lower reliability and validity of the results, it would provide a useful knowledge base for further development of the risk management process.

Conclusion

The results of the performed study contributed to the critical analysis of the current risk classification practices at ADDC. The comparison of the risk classification model of the company with the best solutions available in the relevant academic literature demonstrated a high level of efficiency of the company’s management in this aspect. The risk management procedures of the organization are based on the productive approach to the definition and classification of risk types, which is relevant to the current operations of the organization. Additionally, the findings of the literature review led to the definition of the opportunities for the optimization of the risk classification model at ADDC in the future. The following recommendations are the most important for the company: to integrate a stakeholder-oriented approach in the classification of risks, to expand the current list of risks, and to integrate the risk of unethical behavior into the current scheme of risk classification. The proposed improvements should improve the efficiency of risk management in the organization and guarantee a stronger response to specific risk types in the future.

References

ADDC (2014a). Procedure for HSE Risk Management. Abu Dhabi Distribution Co.

ADDC (2014b). Risk Management Strategy. Abu Dhabi Distribution Co.

ADWEA (2003). Risk Management Guidelines. Abu Dhabi Water and Electricity Authority.

Al-Haj, A.M., 2014. The Development of Risk Management Model for Palestinian Mobile Communication Companies, (Jawwal & Wataniya Case Study). Master’s Thesis submitted to An-Najah National University, Nablus-Palestine.

Curtis, P., & Carey, M. (2012). Risk Assessment in Practice. Deloitte & Touche LLP.

Dandage, R., Mantha, S., Rane, S., & Bhoola, V. (2018). Analysis of Interactions among Barriers in Project Risk Management. Journal of Industrial Engineering International, 14, 153-169.

Indexed at, Google Scholar, Cross Ref

Ennouri, W. (2013). Risks Management: New Literature Review. Polish Journal of Management Studies, 8, 288-297.

Eurelectric (2007). Risk Management in the Electricity Industry – White paper I – Overall Perspective. Union of the Electricity Industry - Eurelectric aisbl.

Kaili, K., Pathirage, C., & Amaratunga, D. (2014). Vulnerability of the Emirati Energy Sector for Disaster: A Critical Review. Procedia Economics and Finance, 18, 701- 709.

Indexed at, Google Scholar, Cross Ref

K?zakov, V., Kovalenko, N., Golub, V., Kozyrieva, N., Shchur, N. and Shoiko, V. 2021. Adaptation of the public administration system to global risks. Journal of Management Information and Decision Sciences, 24(2), 1-8.

Ruukki (2012). Annual Report of Risk Management. Rautaruukki financial reports.

Snyder, H. (2019). Literature Review as a Research Methodology: An Overview and Guidelines. Journal of Business Research, 104, 333-339.

Indexed at, Google Scholar, Cross Ref

Received: 11-Jan-2022, Manuscript No. jmids-22-10833; Editor assigned: 12-Jan-2022, PreQC No. jmids-22-10833(PQ); Reviewed: 18-Jan-2022, QC No. jmids-22-10833; Revised: 21-Jan-2022, Manuscript No. jmids-22-10833(R); Published: 25-Jan-2022