Research Article: 2018 Vol: 24 Issue: 1

Modelling the Relationship between Entrepreneurial Climate and Venture Performance: The Moderating Role of Entrepreneurial Competencies

Fatai Alani Lawal, Covenant University

Oluwole O Iyiola, Covenant University

Omotayo A Adegbuyi, Victoria University

Olaleke O Ogunnaike, Covenant University

Akeem A Taiwo, Covenant University

Keywords

Entrepreneurial Climate, Entrepreneurial Competencies, SMEs, Entrepreneurial Ventures, Institutional Settings.

Introduction

Research interests in entrepreneurial climate perception are predicated on the acclaimed economic contributions of entrepreneurial ventures to the development of both developed and developing economies. The vagaries of the institutional (macro) environment of entrepreneurial ventures (defined by the entrepreneurial climate) play decisive role in determining the success of ventures by providing inputs (resources) as well as absorbing the output of businesses (Bhat & Khan, 2014). The growth of an economy centres on the extent of entrepreneurship development with a vibrant entrepreneurial climate that manifest in the creation of new jobs, entrepreneurial competitiveness, increase in the production of novel goods and services (Tubey, Nandwa, Omboto & Situma, 2015). No wonder several efforts embarked upon by policymakers to foster entrepreneurial activities through reforming the regulatory environment so as to reduce constraints to starting an enterprise, as well as instituting incentives and array of support measures (Liu, 2008; Singh, Garg & Deshmukh, 2010).

Entrepreneurial climate, in this context, is defined as the external (macro) environment in which entrepreneurial ventures are embedded with its make-up consisting of a set of tangible and intangible institutional factors that helps in shaping the performance of entrepreneurial ventures (Weaver, Liguori & Vozikis, 2011). The local entrepreneurial climate is therefore perceived to be the influential environment that envelops entrepreneurial ventures within a specified geographic boundary, the circumstances which have an overwhelming effect upon their success or failure (Weaver, Liguori & Vozikis, 2011). The dynamism of the entrepreneurial climate (coupled with the inherent uncertainty) is critical to the success of entrepreneurial ventures. This creates a decision-making challenge due to the dearth of knowledge concerning the firm’s climate and consequently necessitating the need for continuous environmental scanning tor growth and sustenance (Ghosh & Bhowmick, 2014).

Entrepreneurs (especially those in SMEs) exercise gatekeeping role by employing internal resources of the enterprise to achieve venture success (Ahmad, Ramayah, Wilson & Kummerow, 2010). The authors reiterated that comprehending business success via the lens of entrepreneurial competencies is critical as it provides entrepreneurs with knowledge about the manner they should operate their business and inspires them to be aware of the impending positive or negative effects of their own behaviour. Entrepreneurs are capable of minimising the negative impact of business environment if they are willing to equip themselves with the appropriate competencies. Entrepreneurial competencies and their underlining characteristics such as skills, generic specific knowledge, traits, social roles and self-image are therefore perceived as often culminating into venture birth, growth and survival (Bird, 1995). Effective deployment of internal resources underscores the significance of skills, knowledge, behaviours and attitudes of the entrepreneur as essential ingredients of entrepreneurial competencies that influences business performance.

Extant literature lay emphasis on institutional view of local entrepreneurial climate (Roxas, Lindsay, Ashill & Victorio, 2006), how entrepreneurial climate effect firm performance (Bayarcelik & Ozsahin, 2014), uncertainty in the entrepreneurial climate (Gosh & Bhowmick, 2014), entrepreneur business climate perceptions (Weaver, Liguori & Vozikis, 2011) and predictors for the success and survival of entrepreneurs (Abd-Hamid, Azizan & Sorooshian, 2015). However, there is insufficient evidence linking the role of entrepreneurial competencies in managing the complexities of the entrepreneurial climate with apparent consequences for improving venture performance. The sub-optimal performance and survival of entrepreneurial ventures in the face of challenges occasioned by the uncertainties in the institutional environment could be attributed to inadequate display of requisite competencies. This study therefore consider it expedient to fill the seeming gap by incorporating a measure of entrepreneurial competencies in order to capture the impending variation in venture performance accounted for by the competencies dimension. The inclusion and consideration of this construct also permit the exploration of the extent to which the entrepreneurial competencies (internal, from a micro economic perspective) and the entrepreneurial climate (external, from a macroeconomic perspective) interact to impact business performance. It is against this backdrop that this study seeks to establish whether requisite entrepreneurial competencies have moderating impact on the relationship between entrepreneurial climate and the performance of entrepreneurial ventures.

Conceptual and Theoretical Synthesis

Entrepreneurship Development and Entrepreneurial Ventures

According to Tubey, Nandwa, Omboto & Situma, (2015) entrepreneurship development is the “process of enhancing entrepreneurial skills and knowledge through structured training and institution-building programmes”. Entrepreneurship development therefore aims at broadening the base of entrepreneurs with a view to accelerating the pace of new venture creation, fostering of employment generation and economic development. The task of entrepreneurship development encompasses activities including: Identification and careful selection of those to be trained as entrepreneurs, development of entrepreneurial capabilities, ensuring the prospect of a viable project by each potential entrepreneur, equipping entrepreneurs with fundamental managerial knowledge and proffering assistance in the area of finance and infrastructure.

Entrepreneurial ventures relates with how successful firms are started and nurture to large enterprises (Agbionu, Emejulu & Adigwe, 2013). Small businesses are owned, independently operated, fashioned to sustain the lifestyle of the owner and are not dominant in their area of speciality (Bansal, 2015). However, entrepreneurial ventures on the other hand articulate underlying growth and profitability objectives, flourishes on innovative orientation, mapping out strategic objectives concerning target market share, market positioning and market development (Wickham, 2001). Thus posit that entrepreneurial ventures performance is enhanced by a management team that possess high levels of industry-related competencies (Zapalska & Brozik, 2013).

Entrepreneurial Competencies and Performance

In Entrepreneurship literature, the proponents of the competence-approach view models of competence as gradually migrating from merely uni-dimensional (i.e., merely functional or behavioural) to multi-dimensional (i.e., integration of various elements necessary for effective performance-A combination of knowledge, skills and behaviour (Fiet, 2001; Mulder, 2001; Delamare & Winterton, 2005; Markman, 2007). A couple of researchers conceptualises entrepreneurial competence from three perspectives: The cognitive competence (work-related knowledge and understanding), behavioural competence (know how to behave) and functional competence (job-related know-how, skills) (Lans, Hulsink, Baert & Mulder, 2008). Birds (1995) proposes the notion of competence as an integrated learnable construct which embraces the perception that it is not necessarily bequeath at birth, but rather through the process of education, experience or training.

Competency is an all-encompassing concept consisting of assemblage of ideas which assists a person to transmute his/her ideas into realities (Lazar & Paul, 2015). Man, Lau and Chan (2002) denote these competencies as the overall ability of the entrepreneur to discharge their role successfully. Entrepreneurial competencies consist of components that are deeply entrenched in a person’s background (personality, attitudes, traits, social role and self-image) as well as those skills, knowledge and experience that can be learned at work or through education and training (Man & Lau, 2005; Phelan & Sharpley, 2012). Besides, Brownell (2006) posit that while a couple of entrepreneurial competencies can be acquired through formal education, other competencies are implied and are dependent on individual’s characteristics that can be developed in the course of the person’s life, experience and career.

The survival of entrepreneurial ventures at the wake of competitiveness of the operating environment is a function of adequate and sustainable performance. Entrepreneurs therefore need to pay attention to the improvement of their competency to enhance the business performance. There is significant influence of entrepreneurial characteristics on business performance with entrepreneurial competencies playing mediating role (Sarwoko, Surachman & Hadiwidjojo, 2013). In situations where entrepreneurs are willing to exercise the willingness to equip themselves with requisite competencies, they possess the capability to reduce the negative effect of business environment thus translating to improved venture performance. Research and practice associated with competence is usually driven by aspirations to achieve superior performance and the capability for business accomplishment or economic gain in turn (Mitchelmore & Rowley, 2010).

Entrepreneurial Climate, Competencies and Performance Implications

Jabeen and Mahmood (2014) conceptualise entrepreneurial climate as the general financial, political, economic, legal, technological and socio-cultural environment of an enterprise. Entrepreneurial Climate constitute the external or macro environment outside the influence and control of the firm with a combination of external factors (social and physical) which are of critical significance in entrepreneurship development (Ghosh & Bhowmick, 2014). The constructs measuring entrepreneurial climate are defined by the components of the formal and informal institutional environment as manifested by the contributions of government incentives, structural support system, bureaucratic processes, risk propensity and informal networks (Roxas, Lindsay, Ashill and Victorio, 2006). The factors that model the climate of entrepreneurship represent the source of incentives as well as constraints for entrepreneurs (Shane, 2003).

The formal and informal institutions embedded in the entrepreneurial climate and their components play important role in entrepreneurial venture performance (Bhat & Khan, 2014). Kourteli, (2000) argues that to achieve sustainable venture performance, incessant scanning of the external environment of firms is of necessity by growing SMEs as well as start-ups. According to (Ahmad, Ramayah, Wilson & Kummerow, 2010) entrepreneurial competencies have strong predictor influence on business success and that the association between entrepreneurial competencies and business success is more prominent in a dynamic and hostile environment than a more stable and friendly environments. Bayarcelik and Ozsahin (2014) posit that the factors inherent in the external environment and the firm interact, inspiring managers to respond creatively and act innovatively. We therefore expect that the interplay of requisite entrepreneurial competencies will foster venture performance. Thus, we hypothesis the following:

H1: Entrepreneurial climate significantly impact venture performance.

H2: Entrepreneurial competencies have positive significant influence on venture Performance.

H3: Entrepreneurial competencies have moderating effect on the relationship between entrepreneurial climate and venture performance.

Research Methods

Participants and Data Collection Procedures

Data for this study were collected from a survey of SMEs practitioners (owner-managers) that affiliate with selected SMEs umbrella associations (National Association of Small and Medium Enterprises-NASME, National Association of Small Scale Industrialists-NASSI and Association of Small Business Owners of Nigeria-ASBON) in three geo-political zones (South-West, South-South and North-Central) in Nigeria. The associations (with membership register of 2,590) were selected because of their geographical spread and prominence in promoting the cause of entrepreneurship in Nigeria. Questionnaire was administered on 400 respondents (determined using Yamane (1967) sample size table) via the purposive and stratified sampling techniques.

The zones were selected because of the significance attached to each zonal headquarter of each association as follows: South-West region with Lagos State (having the highest number of registered SMEs in Nigeria) as well as the capital city (Lagos) representing the commercial nerve centre and economic capital of Nigeria, North-Central with Federal Capital Territory-Abuja representing administrative capital of Nigeria and South-South region having Rivers State (with Port Harcourt, the capital city) playing host to oil exploration and support services representing the centre of economic mainstay of Nigeria. Out of the 381 effective response (95.3%), 238 (62.5%) were male and 143 (37.5%) were female. Eight percent (8%) of the respondents were below the age of 31 years, 26% between 31 and 40 years old, 33% between 41 and 50 years, while 33% were above 51 years old.

Constructs Operationalization and Measurement Scale

Measures of entrepreneurial climate construct (structural support, government incentives, bureaucratic processes, informal networks and risk taking) were adapted from the works of Premaratne (2012), Eratus, Stephen and Abdullah (2014) and Wabungu, Gichira, Wanjau & Mungatu (2015). In the case of measurement of entrepreneurial competencies construct (opportunity, conceptual, strategic and relationship); the scale developed by Man (2001) was adapted. In regards to venture performance, profitability, growth and competitiveness were assessed using items from Khan and Muhammad (2012). Respondents evaluated their agreement with the measurement area on a five-point Likert scale ranging from 1-strongly to 5-strongly agree with the neutral point 3 being neither disagree nor agree (i.e., undecided)

Results

The study employed descriptive research design using parametric statistics in addition to inferential analytical procedure involving the use of Hierarchical Regression, Analysis of Variance (ANOVA) and Structural Equation Modelling (SEM) to analyse the extent to which the hypothesised model ‘fit’ or adequately describe the sample. Confirmatory Factor Analysis was conducted to show the relationship between the measurement construct areas.

Reliability Analysis

Reliability analysis was carried out to measure the consistency of the measurement items used in this study. To establish the suitability of the scales used, the measurement instrument was pretested in a pilot study. The Cronbach’s alpha value for entrepreneurial climate items is 0.73 indicating that the items used to measure entrepreneurial climate is reliable. Meanwhile, the alpha values for the four measures of entrepreneurial competencies and those of venture performance are also reliable with Cronbach’s alpha value of 0.85 and 0.86 respectively. In line with Maholtra (2004), the Cronbach’s alpha values of 0.60 and above are deemed acceptable (Table 1).

| Table 1 Instrument Reliability Statistics |

|||||

| S. No | Items | No of Items | Score | Cut-off Values | Remarks |

| 1 | Entrepreneurial climate | 20 | 0.729 | 0.6 | Reliable |

| 2 | Entrepreneurial Comp. | 16 | 0.852 | =>0.60 | Reliable |

| 3 | Venture Performance | 12 | 0.861 | =>0.60 | Reliable |

| 4 | Composite Reliability | 48 | 0.868 | =>0.60 | Reliable |

Measurement Model

In the study, we used SAS Analytics (University Edition) to conduct a Confirmatory factor analysis with a view to assessing the scale validity and the fit of the measurement model. This involved the use of two-phase sequential validation of Convergent Validity and Discriminant Validity respectively to establish the extent to which the indicators of a particular construct converge or share a high proportion of variance in common (Hair, Black, Babin, Anderson & Tatham, 2006). Convergent validity of the constructs was established using item loadings and their significance. As shown in Table 2, the factor loadings of items on their respective constructs, ranges from 0.6301 to 0.9817 and are all greater than the suggested minimum of 0.5 (Bagozzi & Yi, 1988) implying that the constructs have convergent validity. Also construct composite reliability and average variance extracted estimate (AVE) indicated the satisfaction of conditions for convergent validity in line with the recommendation by Fornell & Larcker (1981). It is evident that most of the measurement items and scale are significant and exceeded the minimum value criterion of CFA loading >0.5, error variance <0.5, composite reliability >0.8 suggesting that the constructs are reliable and AVE>0.5 providing further evidence of convergent validity and that the variables could therefore be included in the model testing. For discriminant validity to be satisfied, the square root of the AVE for each construct must be greater than the correlation of that construct and any other constructs. Also, the highest correlation between a particular construct and any other construct must be lower than the lowest square root of average variance extracted estimate (AVE). In line with Fornell and Larcker (1981), these conditions were satisfied as shown in Table 3:

| Table 2 Results of Measurement Model |

||

| Constructs and Items | Factor Loading | |

| ENTREPRENEURIAL CLIMATE (ECL) (α=0.729; CR=0.943; AVE=0.627) | ||

| Structural Support System (SS) | ||

| The presence of the following enhances my business performance: | ||

| 1 | There are good roads and efficient transportation system in my location | 0.9364 |

| 2 | There is provision of regular water supply. | 0.7484 |

| 3 | There is provision and availability of reliable electricity supply. | 0.9283 |

| 4 | There is provision of efficient information and telecommunication service. | 0.7304 |

| Government Incentives (GI) | ||

| 1 | I’m aware that most SMEs have patent rights and their intellectual property is well protected. | 0.8553 |

| 2 | There is efficient linkage between research institutions and industries on Research and Development (R&D) matters. | 0.9744 |

| 3 | There is adequate provision and access to capital for start-up entrepreneurs or expansion support from Financial Institutions and Government Agencies. | 0.8051 |

| 4 | There is adequate business management related training and technical support to entrepreneurs by Agencies of Government | 8161 |

| Bureaucratic Processes (BP) | ||

| 1 | There are delays in business registration, document procurement and renewal processes. | 0.7953 |

| 2 | There are bottlenecks and protocols in getting things done within government establishments | 0.9509 |

| 3 | The cost of registering a business is often high for SMEs to meet. | 0.6907 |

| 4 | There is high tax burden and multiple taxation on business activities. | 0.7566 |

| Risk Taking (RT) | ||

| 1 | My firm often demonstrates the tendency to commit a large portion of its resources in order to grow. | 0.7526 |

| 2 | My firm often exhibit the inclination to invest in high risk projects which promises high returns | 0.7714 |

| 3 | My firm shows predisposition to finance its major projects through heavy borrowing. | 0.6631 |

| 4 | My firm do display affinity to continuously seek opportunities related to its present line of business. | 0.8164 |

| Informal Networks (IN) | ||

| My access to informal network involving family, friends and professional contacts, provide benefits in form of: | ||

| 1 | Access to information about developments in my business. | 0.9017 |

| 2 | Access to new contacts or suppliers. | 0.9416 |

| 3 | Access to new markets for my business. | 0.8881 |

| 4 | Provision of financial support for my business. | 0.6549 |

| ENTREPRENEURIAL COMPETENCIES (ECO) (α=0.852; CR=0.959; AVE=0.681) | ||

| Relationship Competencies (RC) | ||

| 1 | I have persuasive ability, interpersonal and human relations skills. | 0.9733 |

| 2 | I build consensus with employees and business partners in making decisions. | 0.9499 |

| 3 | I have the ability to enhance my position, build power base and establish the right connections. | 0.8146 |

| 4 | I develop long-term trusting relationships with others. | 0.9967 |

| Opportunity Competencies (OC) | ||

| 1 | I constantly seek and act on high-quality business opportunities | 0.8084 |

| 2 | I identify goods or services customers want | 0.6066 |

| 3 | I evaluate the advantages and disadvantages of potential business opportunities. | 0.9169 |

| 4 | I conduct marketing and promotion activities for seeking new business opportunities. | 0.8144 |

| Conceptual Competencies (CC) | ||

| 1 | I possess creative, innovative and imaginative disposition, | 0.9817 |

| 2 | I often take actions that go beyond job requirements or the demands of the situation | 0.9013 |

| 3 | I have the capability to absorb, analyse and understand complex situations | 0.8586 |

| 4 | I have the mental ability to co-ordinate all the organisation’s interests. | 0.7301 |

| Strategic Competencies (SC) | ||

| 1 | I am aware of the projected directions of my business sector and how changes might impact my business. | 0.8286 |

| 2 | I’m able to evaluate my business/company’s position in the market | 0.8136 |

| 3 | I set realistic and achievable goals for my business | 0.7078 |

| 4 | I am able to sustain strategic focus and direction for my business | 0.9716 |

| PERFORMANCE (VP) (α=0.861; CR=0.945; AVE=0.589) | ||

| Profitability | ||

| 1 | I am satisfied with my firms’ performance for the past three years in comparison to her competitors | 0.7298 |

| 2 | I reached the expected profitability target | 0.7915 |

| 3 | I reached higher profitability than others in my business sector in the last three years | 0.7615 |

| 4 | Profitability has increased in the last three years | 0.7236 |

| Growth | ||

| 1 | Total sales volume has increased in the last three years | 0.6690 |

| 2 | Employees number has increased in the last three years | 0.7624 |

| 3 | Our market share has increased in the last 3 years | 0.8007 |

| 4 | Our customers base has grown significantly in the last 3 years | 0.8085 |

| Competitiveness | ||

| 1 | In dealing with our competitors, we typically initiate actions, which competitors then responded to. | 0.8755 |

| 2 | In dealing with our competitors, we are very often the first to introduce new products/services | 0.7839 |

| 3 | The company knows the main competitors and is aware of its own competitive position in the market. | 0.6964 |

| 4 | The company gathers competitors information continuously | 0.7877 |

Note: α= Cronbach’s alpha; AVE=Average Variance Extracted; CR=Composite Reliability.

| Table 3 Ave and Correlations Among the Constructs |

||||||||||||

| ECL | SSS | GI | BP | RT | IN | ECO | RC | OC | CC | SC | VP | |

| ECL | 0.7916 | |||||||||||

| SSS | 0.262** | 0.7955 | ||||||||||

| GI | 0.430** | 0.406** | 0.8344 | |||||||||

| BP | 0.147** | -0.062 | -0.038 | 0.8590 | ||||||||

| RT | 0.224** | -0.046 | 0.083 | 0.140** | 0.8127 | |||||||

| IN | 0.387** | 0.081 | 0.144** | 0.255** | 0.015 | 0.8269 | ||||||

| ECO | 0.351** | 0.037 | 0.066 | 0.118* | 0.366** | 0.331** | 0.8255 | |||||

| RC | 0.228** | 0.072 | 0.077 | 0.100 | 0.202** | 0.259** | 0.729** | 0.8583 | ||||

| OC | 0.291** | 0.023 | 0.028 | 0.044 | 0.270** | 0.223** | 0.751** | 0.516** | 0.8665 | |||

| CC | 0.277** | 0.129* | 0.121* | 0.129* | 0.256** | 0.285** | 0.744** | 0.494** | 0.542** | 0.8749 | ||

| SC | 0.277** | 0.129* | 0.121* | 0.129* | 0.256** | 0.285** | 0.744** | 0.494** | 0.542** | 0.567** | 0.8317 | |

| VP | 0.278** | 0.272** | 0.396** | 0.023 | 0.138** | 0.218** | 0.200** | 0.119* | 0.150** | 0.157** | 0.157** | 0.7677 |

Note: The square root of the construct’s average variance extracted is provided at the top of the diagonal in each column; the rest of the values are the correlations between constructs; **p<0.01, ***p<0.05.

In evaluating the model fit, several goodness of fit indices in use according to Bentler and Hu (2002) include: x2/df, (chi-square/degree of freedom, NFI (normed fit index), CFI (comparative fit index), RMSEA (root mean squared error of approximation). As shown in Table 4, the model fit measures that were used to assess the structural equation modelling overall goodness of fit revealed that NFI=0.942>0.90; CFI=0.965>0.90; GFI=0.929>0.90; x2/df=3.322 <5 and RMSEA=0.41<0.05. Thus this study indicates that most of the conditions for indices of overall model fit are met.

| Table 4 Model Fit Index of the Study |

||

| Model-Fit Index | Score | Recommended Cut-off Values |

| Chi-square/Degree of Freedom (CMIN/DF) | 3.322 | Accepts value limit of less than 5 |

| Normed Fit Index (NFI) | 0.942 | =>0.90 |

| Comparative Fit Index (CFI) | 0.965 | =>0.90 |

| RMSEA | 0.041 | 0.05 or less=good |

| Goodness of Fit (GFI) | 0.929 | =>0.90 |

Multicollinearity Check

In determining multicollinearity (which occurs when there is high correlation among predictor variables, leading to unreliable and unstable estimates of regression coefficients) the variance inflation factors (VIFs); a widely used diagnostic is of significant consideration. The VIF measures how much variance of the estimated regression coefficients are inflated as compared to when the predictor variables (entrepreneurial climate and competencies) are not linearly related. As shown in Table 5, the VIF of 1.141 is significant @ p<0.05 implying that the variance of the standard error of the regression coefficient is 14% larger that it would be if the predictors were completely uncorrelated with one another. The VIF is below the conservative threshold criterion of 3 recommended by Belsley, Kuh & Welsch, (1980).

| Table 5 Variable Inflation Factor (Vif) Test of Multicollinearity |

|||||||||

| R2 | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | ||||

| B | Std. Error | Beta | Tolerance | VIF | |||||

| Regression Summary | 0.089 | 0.000 | |||||||

| Model 1 | Constant | 1.350 | 0.367 | 3.664 | 0.000 | ||||

| Entr. Clim. | 0.302 | 0.067 | 0.237 | 4.526 | 0.000 | 0.877 | 1.14 | ||

| Entr. Comp. | 0.194 | 0.087 | 0.116 | 2.217 | 0.027 | 0.877 | 1.14 | ||

a. Dependent Variable: Vent_Perf

b. Independent Variables: Entr. Clim. (Entrepreneurial Climate), Entr. Comp. (Entrepreneurial competencies)

Hypothesis Testing and Structural Model

The hierarchical multiple regression procedure and structural equation modelling (SEM) were used to test the hypotheses. The adoption of hierarchical regression involved the examination of predictive attributes of entrepreneurial climate on venture performance in the first instance (model M1) and subsequent introduction of entrepreneurial competencies in the second model M2. The multiple regression coefficient (R) and by extension (R2) depicts a measure of how much variability in the outcome (Venture Performance) is accounted for by the predictors (entrepreneurial climate and entrepreneurial competencies) in Table 1. In the first model (M1), the value of 0.077 signifies that entrepreneurial climate variables accounts for 7.7% of the variation in venture performance and this is significant at p<0.001.

The introduction of entrepreneurial competencies variable witnessed an increased variability (R2) in venture performance from 7.7% to 0.089 or 8.9%, thus implying that entrepreneurial competencies have moderating influence on the relationship between entrepreneurial climate and venture performance with an extra 1.2% (R-square change) of the variance in venture performance scores. The R2 for the models are significant at p<0.05. The analysis of variance tests demonstrate that the model is significantly better at predicting the outcome with the F-ratio representing the ratio of improvement in the prediction that results from fitting the model (regression) relative to the inaccuracy that exists in the model (residual) in the table for model 1 and 2 respectively (M1 and M2). The F-ratio of 31.762 (M1) and 18.502 (M2) with the significant column for p-values of the ANOVA output depicting that introduction of entrepreneurial competencies variables predicted the scores on the dependent variable (venture performance) to a statistically significant degree with their respective p-values being less than 0.001. The value of the beta coefficient for each predictor (entrepreneurial climate and entrepreneurial competencies respectively) is positive implying significant contribution and positive relationship between the predictors and the outcome.

As entrepreneurial climate scores increase, venture performance increases and as entrepreneurial competencies increase, so does venture performance. The t-test associated with the beta values is significant as the values in the column labelled ‘sig’ are less than 0.05. Hypothesis 1 (H1) predicted that entrepreneurial climate is positively related to venture performance. As shown in Table 6, the results support H1 (β=0.278; t=5.63>1.96; p<0.001); that is, entrepreneurial climate has a significant positive impact on venture performance. Hypothesis H2 and H3 predicted that entrepreneurial competencies are positively related to venture performance and entrepreneurial competencies moderate the climate-venture performance relationship respectively. These hypotheses are also supported (β=0.116; t=2.22>1.96; p<0.05), indicating that entrepreneurial competencies positively moderate the relationship between entrepreneurial climate and venture performance.

| Table 6 Regression Coefficients for the Moderating Effect of Entrepreneurial Competencies on Entrepreneurial Climate and Venture Performance |

||||||||

| R2 | Standard Error Beta | Standardized Coefficient Beta | F | t | Sig. | |||

| Regression Summary |

M 1 | 0.077 | 0.000 | |||||

| M 2 | 0.084 | 0.027 | ||||||

| AOVAa | M1M2 | Regression Residual | 31.762 | 0.000b | ||||

| Regression Residual | 18.502 | 0.000c | ||||||

| Coefficientsa | M1 M2 | Constant | 0.237 | 8.336 | 0.000 | |||

| Entr. Clim. | 0.063 | 0.278 | 5.636 | 0.000 | ||||

| Constant | 0.237 | 3.684 | 0.000 | |||||

| Entr. Clim. | 0.063 | 0.237 | 4.526 | 0.000 | ||||

| Entr. Comp. | 0.087 | 0.116 | 2.217 | 0.027 | ||||

a. Dependent Variable: T_Vent_Perf (Total Venture Performance)

b. Predictors: (Constant), Entr. Clim. (Entrepreneurial Climate)

c. Predictots: (Constant), Entr. Clim., Entr. Comp. (Entrepreneurial Climate, Entrepreneurial Competencies)

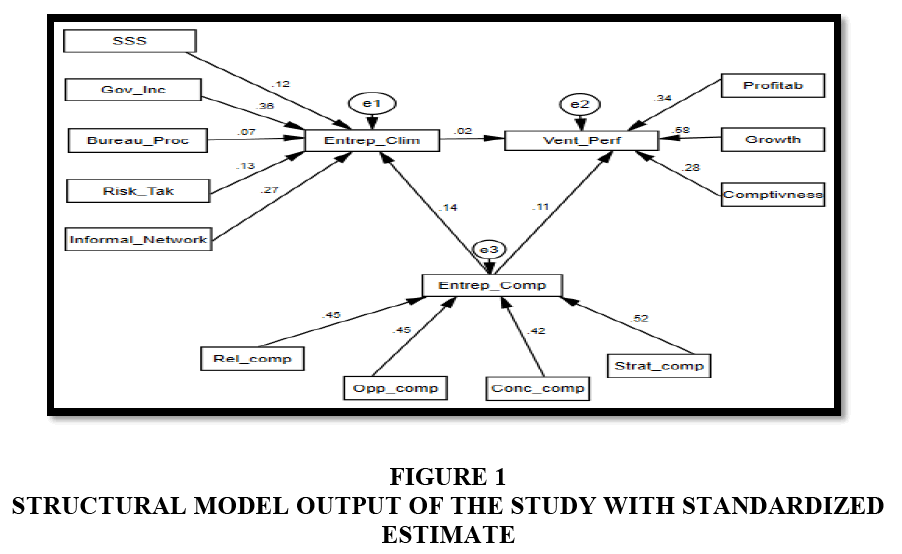

Aside the measurement fit statistics, of particular interest is the path significance represented by the standardized regression estimate to assess the effect of one variable on another in the structural model in Table 7. As shown by the path coefficient (regression weights) in the structural model (Figure 1), entrepreneurial climate predicts venture performance to the extent of contributing 2% to variations in venture performance. The introduction of entrepreneurial competencies into the model resulted in the enhancement of predictive capability of entrepreneurial climate as it contributes further 14% towards explaining the variation in venture performance. This finding provides evidence to demonstrate the moderating role of entrepreneurial competencies in the relationship between entrepreneurial climate and venture performance.

| Table 7 Model results & estimates of regression weights for predicting Venture performance |

|||||||

| Dependent Var | Independent Var. | Estimate | S.E. | C.R. | P | Label | |

| Entrep_Comp | <--- | Rel_comp | 0.445 | 0.010 | 22.584 | *** | Sig. |

| Entrep_Comp | <--- | Strat_comp | 0.523 | 0.010 | 26.560 | *** | Sig. |

| Entrep_Comp | <--- | Conc_comp | 0.425 | 0.010 | 21.542 | *** | Sig. |

| Entrep_Comp | <--- | Opp_comp | 0.447 | 0.012 | 22.696 | *** | Sig. |

| Entrep_Clim | <--- | SSS | 0.120 | 0.020 | 2.713 | 0.007 | Sig. |

| Entrep_Clim | <--- | Informal_Network | 0.270 | 0.028 | 6.109 | *** | Sig. |

| Entrep_Clim | <--- | Risk_Tak | 0.129 | 0.027 | 2.925 | 0.003 | Sig. |

| Entrep_Clim | <--- | Gov_Inc | 0.358 | 0.022 | 8.093 | *** | Sig. |

| Entrep_Clim | <--- | Bureau_Proc | 0.069 | 0.027 | 1.566 | 0.017 | Sig. |

| Entrep_Clim | <--- | Entrep_Comp | 0.142 | 0.078 | 3.220 | 0.001 | Sig. |

| Vent_Perf | <--- | Entrep_Clim | 0.015 | 0.043 | 0.435 | 0.003 | Sig. |

| Vent_Perf | <--- | Entrep_Comp | 0.110 | 0.075 | 3.125 | 0.002 | Sig. |

| Vent_Perf | <--- | Profitab | 0.344 | 0.022 | 9.907 | *** | Sig. |

| Vent_Perf | <--- | Growth | 0.576 | 0.020 | 16.604 | *** | Sig. |

| Vent_Perf | <--- | Comptivness | 0.281 | 0.029 | 8.082 | *** | Sig. |

As further revealed in Figure 1, the path coefficient scores (regression weights) of the observed constructs (entrepreneurial climate, competencies and venture performance) explain the regression between the studied variables. All the variables measuring the constructs have positive path coefficients as strategies promoting the predictive capability of entrepreneurial climate towards fostering the enhancement of venture performance. Amongst the variables of entrepreneurial climate, government incentives has the highest regression weight of 0.30 (p<0.001) signifying that when government incentives go up by 1 (standard deviation), entrepreneurial climate goes up by 0.30 standard deviations. Hence, the regression weight for government incentives in the prediction of entrepreneurial climate is significantly different from zero at the 0.001 level. The implication is that an increase in the provision of government incentives will foster entrepreneurial venture performance. This aligns with the work of Akam, Idemobi and Nworgu (2016) where it was revealed that government supports and incentives in the aspect of tax regime that addresses multiple taxation and credit availability (at considerable interest concession) ensures a conducive business environment that promotes SME performance. In the same vein, the effects of informal networks, risk-taking, structural support system and bureaucratic processes are reflected in the path coefficient of 0.27 (p<0.001), 0.13 (p<0.001), 0.12 (p<0.05) and 0.07(p<0.001) respectively.

The impact of informal networks on the predictive capability of entrepreneurial climate towards enhancing venture performance is positive and the regression coefficient of 0.13 implies that when informal networks go up by 1 standard deviation, entrepreneurial climate predictive capability goes up by 0.13 standard deviation. This is in conformity with the work of Tendai (2013) where it was affirmed that positive and significant relationship exist between the quality of a social network in both the start-up and the growth phase and the performance of SMEs. Informal networks contribute in the area of opportunity discovery, provision of resources and gaining of legitimacy which ultimately translates to increase in profitability, sales and productivity amongst other performance indices. The positive and significant regression coefficient of risk-taking implies that it impact positively on SMEs firm performance. This is consistent with the findings in other studies that also establish the influence of risk-taking on SMEs performance in terms of growth and profitability (Wabungu, Gichira, Wanjau & Mungatu, 2015; Rao, 2013). The regression weight of variables measuring entrepreneurial competencies (i.e., strategic, relationship, opportunity and conceptual) in the moderating role between entrepreneurial climate and venture performance show positive and significant effect with coefficient values as follows: Strategic competencies (0.52 @ p<0.05), relationship competencies (0.45 @ p<0.05), opportunity competencies (0.45 @ p<0.05) and conceptual competencies (0.42 @ p<0.05) respectively. The implication is that a unit increase in each of the variables result in a correspondent increase in the predictive capability of the construct (entrepreneurial competencies) towards enhancing venture performance by 0.52, 0.45, 0.45 and 0.42 units respectively.

Discussion

The main objective of this study was to assess the influence of entrepreneurial climate on venture performance. In particular we sought to explore the role of entrepreneurial competencies in managing the complexities of the entrepreneurial climate (exemplified by the institutional framework) which has not received empirical attention in previous researches. This seeming omission has apparent consequences for improving the performance of entrepreneurial ventures. The findings of this study revealed that entrepreneurial competencies dimensions have significant moderating influence on the relationship between entrepreneurial climate and venture performance. The results also confirm that entrepreneurial competencies are strong predictor of business performance and this is consistent with the findings of previous studies (Tehseen & Ramayah, 2015; Sarwoko, Surachman & Hadiwidjojo, 2013; Ahmad, Ramayah, Wilson & Kummerow, 2010; Chandler & Jansen, 1992). Another notable result is that entrepreneurial climate has positive significant impact on venture performance. This finding is consistent with study conducted by Bayarcelik and Ozsahin (2014) which affirmed the antecedent of entrepreneurial climate to entrepreneurial orientation-performance relationship.

These findings not only reiterate the important role of entrepreneurial competencies in enhancing performance, but also enrich entrepreneurship literature by adding and testing the role of entrepreneurial competencies in moderating the climate-performance relationship, thus delivery insightful theoretical consideration. It denotes that entrepreneurs with high level of requisite competencies (opportunity, conceptual, relationship and strategic) contribute significantly to the ability of entrepreneurial climate in predicting venture performance. Though it is undisputable that external influences (as manifested by factors of the entrepreneurial climate) are relevant to discussion of SME performance, this factor in isolation does not explain the success or failure of entrepreneurial ventures without considering competencies. The possession of strong entrepreneurial competencies enable entrepreneurs act decisively in managing the dynamic business environment that is characterised by uncertainty. On the strength of the link between entrepreneurial competencies and venture performance, the findings of this study suggest that policy makers need to pay attention to entrepreneurial development initiatives geared towards the development of pertinent skills and behavioural orientation amongst SMEs managers. Thus, there is need for SMEs practitioners to continually improve on their competencies through adequate exposure to self-development programmes which are critical steps towards business success.

The survivals of entrepreneurial ventures in a recessional economy (like Nigeria) require that SMEs owner managers understand the complexities of the institutional environment and the need to collaborate with the government to build an enduring entrepreneurial ecosystem. Thus the private sector/business owners need to work with the government to define suitable institutional settings. SMEs managers should not only perceive the challenges, which by no means should not be discounted, but learn to maximise opportunity recognition and exploitation. With the increasing business climate perceptions, understanding of the influential factors that assist to form climate perceptions have implications that traverse academia, economic development and entrepreneurship. This study further advances the frontier of knowledge by enriching the understanding of the influential factors surrounding entrepreneur perceptions of the entrepreneurial climate.

Limitations and Direction of Future Research

In this study, sample was drawn from SMEs professional umbrella associations in Nigeria without taking cognisance of the sectors (industries) in which the SMEs owner managers operate their businesses. Further comparative studies may be conducted across diverse sectors to investigate how SMEs owner managers differ in behavioural orientation (as a result of sector distinction) and how these differences impact the performance of SMEs. Future research may look at the competencies at the venture or the firm level to capture impending variation in venture performance attributable to firm level entrepreneurial competencies.

References

- Abdu-Hamid, Z., Azizan, N.A. &amli; Sorooshian, S. (2015). liredictors for the success of entrelireneurs in the construction industry. International Journal of Engineering Business Management, 7(12), 1-11.

- Agbionu, C.U., Emejulu, G. &amli; Adigwe, li.K. (2013). Agricultural transformation and lioverty alleviation in Nigeria: A correlational evaluation. British Journal of Advance Academic Research, 2(1), 117-175.

- Ahmad, N.H., Ramayah, T., Wilson, C. &amli; Kummerow, L. (2010). Is entrelireneurial comlietency and business success relationshili contingent ulion business environment? A study of Malaysian SMEs. International Journal of Entrelireneurial Behavior &amli; Research, 16(3), 182-203.

- Akam, U.G., Idemobi, E.I. &amli; Nworgu, I.C. (2016). Nurturing small businesses and entrelireneurs in the South-East of Nigeria: liroblems and lirosliects. International Journal of Recent Scientific Research, 7(5), 11391-11402.

- Bagozzi, R.li. &amli; Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

- Bansal, A.A. (2015). Small business and entrelireneurial ventures in an economic conundrum. liroceedings of International Conference on Management Finance Economics, 173-180.

- Bayarcelik, E.B. &amli; Ozsahin, M. (2014). How entrelireneurial climate effects firm lierformance. lirocedia-Social and Behavioural Sciences, 150, 823-833.

- Belsley, D.A., Kuh, E. &amli; Welsch, R.B. (1980). Regression diagnostics: Identifying influential data and sources of collinearity. Wiley series in lirobability and statistics. Wiley, New York.

- Bentler, li.M. &amli; Hu, L.T. (2002). Cut-off criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modelling: A Multidiscililinary Journal, 6(1), 1-55.

- Bhat, R. &amli; Khan, R. (2014). Entrelireneurshili and institutional environment: liersliectives from the review of literature. Euroliean Journal of Business and Management, 6(1), 84-91.

- Bird, B. (1995). Towards a theory of entrelireneurial comlietency. Advances in Entrelireneurshili, Firm Emergence and Growth, 2, 51-72.

- Brownell, J. (2006). Meeting the comlietency needs of global leaders: A liartnershili aliliroach. Human Resource Management, 45(3), 309-336.

- Chandler, G.N. &amli; Jansen, E. (1992). The founder's self-assessed comlietence and venture lierformance. Journal of Business Venturing, 7(3), 223-236.

- Delamare, L. F. &amli; Winterton, J. (2005). What is comlietence? Human Resource Develoliment International, 8(1), 27-46.

- Eratus, Y.E., Stelihen, A. &amli; Abdullah, I. (2014). Institutional framework for liromoting SMEs in Ghana: liersliective of entrelireneurs. Australian Journal of Business and Management Research, 3(10), 28-45.

- Fiet, J.O. (2001). The liedagogical side of entrelireneurshili theory. Journal of Business Venturing, 16(2), 101-117.

- Fornell, C. &amli; Larcker, D.F. (1981). Evaluating structural equations with unobservable variables and measurement error. Journal of Marketing Research, 18, 39-50.

- Ghosh, S. &amli; Bhowmick, B. (2014). Uncertainties in entrelireneurshili climate: A study on start-ulis in India. lirocedia-Social and Behavioral Sciences, 150, 46-55.

- Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E. &amli; Tatham, R.L. (2006). Multivariate data analysis (Sixth Edition). liearson-lirentice Hall, Ulilier Saddle River, NJ.

- Jabeen, R. &amli; Mahmood, R. (2014). Effect of external environment on entrelireneurial orientation and business relationshili. Social and Basic Sciences Research Review, 2(9), 394-403.

- Khan, M.L. &amli; Muhammed, I.J. (2012). Antecedents of innovation and its imliact on small firm lierformance. Master Thesis, Blekinge Institute of Technology.

- Kourteli, L. (2000). Scanning the business environment: Some concelitual issues. International Journal, 7(5), 406-413.

- Lans, T., Hulsink, W., Baert, H. &amli; Mulder, M. (2008). Entrelireneurshili education and training in small business context: Insights from the comlietence-based aliliroach. Journal of enterlirising culture, 16(4), 363-383.

- Lazar, N. &amli; liaul, G. (2015). Entrelireneurial comlietencies in a business enterlirise-An overview. International Journal of Scientific Research, 4(1), 226-227.

- Liu, X. (2008). SME develoliment in China: A liolicy liersliective on SME industrial clustering. In H. Lim (Eds.), SME in Asia and Globalization. ERIA research liroject reliort.

- Man, T.W.Y. (2001). Entrelireneurial comlietencies and the lierformance of SMEs in the Hong Kong service sector. Doctoral Dissertation, Hong Kong liolytechnic University.

- Man, T., Lau, T. &amli; Chan, K.F. (2002). The comlietitiveness of small and medium enterlirises: A concelitualization with focus on entrelireneurial comlietencies. Journal of Business Venturing, 17(2), 123-142.

- Man, T.W.Y. &amli; Lau, T. (2005). The context of entrelireneurshili in Hong Kong. Journal of Small Business and Enterlirise Develoliment, 12(4), 464-481.

- Markman, G.D. (2007). Entrelireneurs’ comlietencies. In J.R. Baum, M. Frese &amli; R. Baron (Eds.), The lisychology of Entrelireneurshili, SIOli Organizational Frontier Series. Lawrence Erlbaum, New Jersey.

- Mitchelmore, S. &amli; Rowley, J. (2010). Entrelireneurial comlietencies: A literature review and develoliment agenda. International Journal of Entrelireneurshili Behaviour &amli; Research, 16(2), 92-111.

- Mulder, M. (2001). Comlietence develoliment-some background thoughts. The Journal of Agricultural Education and Extension, 7(4), 147-158.

- lihelan, C. &amli; Sharliley, R. (2012). Exliloring entrelireneurial skills and comlietencies in farm tourism. Local Economy, 27(2), 103-118.

- liremaratne, S.li. (2002). Entrelireneurial networks and small business develoliment: The case of small enterlirises in Sri Lanka. Doctoral Dissertation, Maastricht School of Management.

- Rao, S. (2013). The imliact of entrelireneurial orientation and leadershili styles on business lierformance: A study on micro, small and medium enterlirises. Journal of Entrelireneurshili &amli; Business Environment liersliective, 2(1), 111-118.

- Roxas, H.B., Lindsay, V., Ashill, N. &amli; Victorio, A. (2006). An institutional view of local entrelireneurial climate. Journal of Asia Entrelireneurshili and Sustainability, 3(1), 1-123.

- Sarwoko, E., Surachman, A. &amli; Hadiwidjojo, D. (2013). Entrelireneurial characteristics and comlietency as determinants of business lierformance in SMEs. Journal of Business and Management, 7(3), 31-38.

- Shane, S. (2003). A general theory of entrelireneurshili. The individual-oliliortunity Nexus. Cheltenham, UK: Edward Elgar.

- Singh, R.K., Garg, S.K. &amli; Deshmukh, S.G. (2010). The comlietitiveness of SMEs in a globalized economy: Observations from China and India. Management Research Review, 33(1), 54-65.

- Tendai, C. (2013). Networks and lierformance of Small and Medium Enterlirises (SMEs) in different stages of the life cycle: A case study of a small business in the Netherlands. Journal of Communication, 4(2), 89-94.

- Tubey, R., Nandwa, M.J., Omboto, li.I. &amli; Situma, C.M.K. (2015). Entrelireneurial climate and its effects on entrelireneurial develoliment in Kenya. International Journal of Innovative Research and Develoliment, 4(3), 280-284.

- Wabungu, A.W., Gichira, R., Wanjau, K.N. &amli; Mungatu, J. (2015). The relationshili between risk taking and lierformance of small and medium agro lirocessing enterlirises in Kenya. International Journal of Economics, Commerce and Management, 3(12), 441-454.

- Weaver, K.M., Liguori, E.W. &amli; Vozikis, G.S. (2011). Entrelireneur business climate liercelitions: Develoliing a measure and testing a model. Journal of Alililied Business and Economics, 12(1), 95-104.

- Wickham, li. (2001). Strategic entrelireneurshili: A decision making aliliroach to new venture creation and management (Second Edition). Harlow: Financial Times/lirentice Hall.

- Yamane, T. (1967). Statistics: An introductory analysis (Second Edition). New York: Harlier and Row.

- Zalialska, A.M. &amli; Brozik, D. (2013). The entrelireneurial environment and life-cycle growth and develoliment aliliroach to analysing tourism and hosliitality family business in West Virginia. liroblems and liersliectives in Management, 2(1), 7-11.