Research Article: 2020 Vol: 23 Issue: 1S

MODERATING EFFECT OF GOVERNANCE QUALITY ON THE RELATIONSHIP BETWEEN CFOs NARCISSISM AND CORPORATE EARNINGS MANAGEMENT IN NIGERIA

Taofiki Akinwumi Taleatu, Covenant University

Dorcas Titilayo Adetula, Covenant University

Francis Odianonsen Iyoha, Covenant University

Citation Information: Taleatu, T. A., Adetula, D. T., & Iyoha, F. O. (2020). Moderating effect of governance quality on the relationship between CFOs’ narcissism and corporate earnings management in Nigeria. Journal of Management Information and Decision Sciences, 23(S1), 477-490.

Abstract

Upper echelons in an organization such as chief financial officers (CFOs) have been implicated in corporate fraudulent earnings management. Their narcissistic traits have also been linked with unethical accounting practices while little is known on the moderating effect of corporate governance quality on this relationship. Hence, this study investigated the moderating effect of corporate governance quality on the relationship between CFOs' narcissistic trait and earnings management in troubled, non-listed companies in Nigeria. The primary data for the study was obtained from the survey of 80 non-listed companies indebted to the Asset Management Corporation of Nigeria (AMCON). The survey involved the distribution of copies of a structured questionnaire to two hundred and forty (240) CFOs and other financial officers in the sampled companies. Two hundred and four (204) copies of the questionnaire, which represents a response rate of 85%, were found suitable for data analysis. Descriptive statistics involves the computation of means and standard deviations. Moderated regression analysis was employed to test the hypothesis of the study. Our findings revealed high CFOs' narcissism (Mean = 3.6961, SD = 1.03428, Min = 1, Max = 5), upward earnings management (Mean = 3.8137, SD = 1.00472, Min = 1, Max = 5) and moderate corporate governance quality (Mean = 3.2353, SD = 1.25299, Min = 1, Max = 5). The study also revealed a significant positive relationship between earnings management and CFOs' narcissistic trait (beta = 0.636, t-value = 21.628, P<.05, Sig. = 0.000). A significant negative relationship was observed between corporate governance quality and earnings management (beta = -.360, t-value = -12.251, P<0.05, Sig. = 0.000). However, further finding revealed that corporate governance quality has a significant moderating effect on the relationship between CFOs' narcissistic trait and corporate earnings management (beta = 0.145, t-value = 9.582, P<0.05, Sig. = 0.000). The policy implications of these outcomes include the need to strengthen corporate governance quality in non-listed companies in Nigeria. Consequently, the study recommends sensitization of the stakeholders of non-listed companies in Nigeria on the implementation of the Nigerian Code of Corporate Governance 2018 to reduce unethical accounting practices and promote corporate financial reporting quality in the country.

Keywords

Corporate Governance Quality; Earnings Management; Narcissistic Trait; Non-listed Companies.

JEL Classification

M41, M48

Introduction

Earnings management can be described as the use of discretion by managers to structure financial transactions and alter accounting information to mislead the users of financial statements. Although, earnings management can be positive, neutral or harmful, its harmful effect has been manifesting in corporate accounting scandals at an alarming rate. Upper echelons' characteristics including narcissistic traits have been linked with corporate earnings management (Plockinger et al., 2016). Actually, behind every corporate accounting scandal, top executives such as chief executive officers (CEOs) and Chief Financial Officers (CFOs) have been implicated. The CFO of Enron was alleged of creating the off-balance-sheet companies explored to hide the losses of the company before it collapsed in 2001. Between 1999 and 2002, the CFO, Controller and Director of General Accounting of Worldcom were implicated in using fraudulent accounting methods to hide the company's poor performance before the corporate collapse. In 2002, the CEO and CFO were also implicated in 150 million dollar fraud in Tyco, Inc. which was perpetrated through aggressive acquisitions over several years. Also, Peregrine Systems scandal involving overstatement of revenues by 250 million dollars was also traced to unethical accounting practices of the CFO and the CEO in 2003. In Nigeria, the managing director and the financial director of Cadbury Nigeria Plc. were implicated in 13 billion naira overstatement of assets scandal in 2006 (Chukwunedu & Okafor, 2011). Similarly, the managing director and the financial director of Evan Medical Plc. in Nigeria were also implicated in 549.9 million naira exceptional item scandal in 2008. These corporate scandals have made the relationship between the attributes of these top executives and corporate earnings management a topical issue in financial accounting research.

However, research attention has been focused on corporate governance mechanisms as potent measures to constrain earnings management in quoted companies (Abbadi et al., 2016; Obigbemi et al., 2016a; Obigbemi et al., 2016b; Ojeka et al., 2015; Uwuigbe et al., 2014; Waweru & Riro, 2013) while less attention has been paid to non-listed companies. In developing economies, private companies are usually higher in number than public companies. Private companies may also engage in earnings management more than public companies because they are less monitored by regulatory bodies. Therefore, there is a need for researchers in developing economies to pay more attention to corporate financial reporting practices of the top executives in non-listed companies to minimize unethical accounting practices, such as fraudulent earnings management.

In Nigeria, non-listed companies appear to be the worst corporate debtors at the moment. This assertion can be premised on the significance of non-listed companies on the list of chronic debtors of Asset Management Corporation of Nigeria (AMCON). It could be recalled that AMCON was set up in 2010, with a ten-year mandate, to handle the banking sector's non-performing loans. Since then, AMCON has taken over a series of such loans while the defaulters have become AMCON debtors. Out of the list of 100 chronic debtors with a debt of 2 billion naira and above, 98 are non-listed companies and are described as troubled companies in this study (AMCON, 2016; AMCON, 2018). These non-listed companies might have manipulated reported earnings upon which the loan creditors might have relied upon. As of December 2016, the AMCON loan outstanding balance in respect of the 100 chronic AMCON debtors stood at N953.43 billion naira (AMCON, 2016), which is sufficient to start 38 deposit money banks (DMBs) in Nigeria at the rate of 25 billion naira capital base. If AMCON is unable to recover these loans by the end of the year 2020 when its mandate expires or at the end of its extended life span, in case it gets an extension, the non-performing loans may be transferred to the DMBs as bad loans which may create a tension in the financial system. Consequently, this study investigated the moderating effect of corporate governance quality on the relationship between upper echelons characteristics and earnings management in troubled, non-listed companies in Nigeria.

Literature Review and Hypothesis Development

Upper echelons characteristics identified by Finkelstein et al. (2009) and Hambrick and Finkelstein (1987) include upper echelons' psychological characteristics and behavioural variables. Dutzi and Rausch (2016) advanced that to have a better understanding of earnings management behaviour in a troubled company, psychological factors such as the personality trait of the top management should be considered. A typical personality trait in Psychology is a narcissistic trait. The influence of upper echelons' narcissistic trait has been extended to earnings management studies in developed economies (Duchon & Drake, 2009). Such studies have not been given much attention in developing economies and thus serve as a motivation for this study.

Moreover, the role of corporate governance in curtailing the top executive's unethical practices cannot be over-emphasized. Research attention has been focused on corporate governance as a potent measure to constrain earnings management in quoted companies (Abbadi et al., 2016; Waweru & Riro, 2013). However, a few empirical studies have examined the moderating effect of the board of directors' demographic characteristics (Tantri & Sholihin, 2012), ownership structure (Idris et al., 2017), corporate governance attributes (Bayk & Ramezanahmadi, 2016; Nekhili et al., 2016) on earnings management. Specifically, Tantri and Sholihin (2012) revealed that the negative relationship between corporate governance and earnings management is moderated by demographic variables of the board members. In a related study, Idris et al. (2017) revealed that the negative relationship between board independence and earnings management became weaker in the presence of family ownership control. Moreover, Nekhili et al. (2016) revealed that corporate governance mechanisms have a significant moderating effect on earnings management. Also, Bayk and Ramezanahmadi (2016) revealed that corporate governance variables increase conservatism and reduce the company's earnings manipulation. However, a gap to be filled in this study is that the body of literature reviewed revealed that the moderating effect of corporate governance on the relationship between CFOs' narcissistic trait and earnings management has not been examined.

Generally, narcissism refers to the exaggerated feelings about oneself. However, Amernic and Craig 2010, Domino et al. (2015) and Harrison et al. (2016), theoretically proposed that narcissistic managers could use accounting measures to gain the confidence of important stakeholders such as investors and creditors. Specifically, narcissistic managers want to be seen as performing better than their contemporaries in the industry; which will qualify them for a raise in compensation (Hayward & Hambrick 1997). Besides, against the interest of other stakeholders but for the sake of extreme love for oneself, narcissistic managers might indulge in earnings management to protect their jobs (McManus, 2016; Harris & Bromiley 2007). Although, studies have linked CEOs’ narcissism with earnings management (Alex et al., 2015; Buchholz et al., 2019; Olsen et al., 2014) contrarily, Ham et al. (2014) revealed that CFO narcissism predicts accruals and real earnings management while CEO narcissism does not. Taleatu et al. (2020) also associated a significant upward earnings management with CFOs’ narcissistic trait. Consequent upon these mixed results, more studies on this research area should be of interest to researchers. Moreover, Buchholz et al. (2019), Collier and Roberts (2001) and Duchon and Drake (2009) posited that corporate governance might be ineffective in constraining the harmful effects of CEOs’ narcissism such as fraudulent earnings management, similar stance might not hold in the context of the CFOs because they might not be able to substantially influence the corporate governance mechanisms the way the CEOs could. Therefore, the following hypothesis was formulated for this study:

H1 Hypothesis: Corporate governance quality has significant moderating effect on the relationship between CFOs’ narcissistic trait and earnings management in troubled, non-listed companies in Nigeria.

Research Methodology

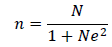

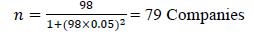

The study adopted a descriptive research design and survey methodology. The population of the study consists of 98 non-listed companies described as chronic AMCON debtors. By exploring Yamane (1967) sampling size formula, a sample size of 79 non-listed companies was derived. However, 80 non-listed companies (Appendix I) were finally sampled to further enhance sufficient representation. The computation of the sample size is as shown below:

Where: n = Sample Size; N = Study Population; e = Significant Level

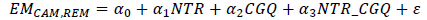

Subsequently, a stratified sampling technique was adopted to obtain a proportional sample across all the sectors of the economy. This was followed by a simple random sampling technique by balloting to select samples from each sector. Primary data were collected by administering copies of a structured questionnaire (Appendix II) to the CFOs and two other Financial Officers in each of the selected companies. CFOs' narcissistic trait was captured by adapting the questionnaire survey instrument used in the study of Jones and Paulhus (2014) in which the attributes of narcissistic managers were presented on a 5-point Likert scale. Similarly, the questionnaire survey instrument in the study of King (2015) was adapted to measure the corporate changes in accounting methods and real earnings management on a 5-point Likert scale. Corporate governance quality index was self-developed from the provisions of the 2011 Nigerian SEC Code of Corporate Governance for Public Companies (Security and Exchange Commission, 2011). The index was computed by exploring the 5-point Likert scale to score the corporate governance attributes that may constraint the earnings management behaviour of the CFOs. Exploratory factor analysis (EFA) was employed (Comrey & Lee, 1992) to ascertain the constructs validity of the research instrument (Appendix III). To reduce bias, reverse coding was explored when constructing the questionnaire. The model of the study is presented as follows:

Where: EM, CAM, REM, NTR, and CGQ represent earnings management, changes in accounting methods, real earnings management, CFOs' narcissistic trait and perceived corporate governance quality while NTR_CGQ represents the moderating effects of corporate governance quality; α0 is a constant and α1 – α3 depict regression coefficients. The moderating effect of corporate governance quality on the relationship between CFOs' narcissistic trait and earnings management was tested with moderated regression analysis (MRA) which is one of the dominant statistical tools that can be explored to predict the moderating effects of an external variable on the relationship between predictor and outcome variables (Hartmann & Moers, 2003). The data also passed constructs normality test (Appendix IV) which allows for the use of regression analysis (Chen, 2014).

Research Analysis and Findings

Descriptive Statistics

Table 1 presents the descriptive statistics which shows that narcissistic trait has a mean score of 3.70, suggesting that the respondents exhibit strong narcissistic trait. Corporate governance quality has a mean score of 3.23 which suggests that the sampled companies have a moderate corporate governance structure. Corporate changes in accounting methods and corporate real earnings management have mean scores of 3.71 and 3.91 respectively. These findings suggest that the CFOs of the sampled companies have a high possibility of changing accounting methods to manage earnings and a high chance of engaging in real earnings management which crystalizes into a high tendency of engaging in corporate earnings management (Mean = 3.81).

| Table 1: Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| EM | 204 | 1.00 | 5.00 | 3.8137 | 1.00472 |

| CAM | 204 | 1.00 | 5.00 | 3.7108 | 1.16589 |

| REM | 204 | 1.00 | 5.00 | 3.9167 | .91937 |

| NTR | 204 | 1.00 | 5.00 | 3.6961 | 1.03428 |

| CGQ | 204 | 1.00 | 5.00 | 3.2353 | 1.25299 |

| Valid N (listwise) | 204 | ||||

Source: Field Survey (2019)

Demographics of Participants

The sample for this study consisted of 204 CFOs, 40.7% of these respondents are below 36 years (young CFOs); 21.6% are within the age bracket of 36-49 years; while 37.7% are 50 years and above (matured CFOs). Hence, the respondents are fairly represented in the study (Young CFOs: Middle-Aged CFOs: Matured CFOs = 2: 1: 2). Across the gender divide, 55.9% of the respondents are male while 44.1% are female. This result indicates that the study is gender sensitive (Male CFOs: Female CFOs = 4:3).

Hypothesis Testing

Table 2 contains the model summary and reveals that the model of this study explains 95.4% of the variation in earnings management. The moderating effect of corporate governance quality accounts for a significant increase in R2 at p<.05 (R2 Change = 0.954, F Change = 1,393.231, Sig. F Change = 0.000).

| Table 2: Model Summary | |||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R2 Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | .977a | .954 | .954 | .21631 | .954 | 1393.231 | 3 | 200 | .000 |

| aPredictors: (Constant), CGQ*NTR, CGQ, NTR | |||||||||

Source: Field Survey (2019)

The model of the study is also significant with an F value of 1,393.231 at p < 0.05, Sig. = 0.000 (Table 3). The large F value suggests that the model has good predictive power (Field, 2000).

| Table 3: Anovaa | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 195.564 | 3 | 65.188 | 1393.231 | .000b |

| Residual | 9.358 | 200 | .047 | |||

| Total | 204.922 | 203 | ||||

| a. Dependent Variable: EM; b. Predictors: (Constant), CGQ*NTR, CGQ, NTR | ||||||

Source: Field Survey (2019)

Variance inflation factor (VIF) and tolerance value were used to examine the level of multicollinearity between the explanatory and the moderating variables. To deal with this problem, the study adopted a variable centering approach involving transformation of the variables by subtracting the sample mean from each observation (mean deviations) prior to computing the product terms (Fairchild & MacKinnon, 2009). The VIF and tolerance values obtained were less than 10 (Belsely, 1991; Field, 2000) and greater than 0.2 (Mernard, 1993) respectively (Table 4). Therefore, the outcomes of the moderated regression analysis can be interpreted with a higher degree of confidence. The regression coefficients (Table 4) revealed a significant positive relationship between earnings management and CFOs' narcissistic trait (beta = 0.636, t-value = 21.628, P<.05, Sig. = 0.000). A significant negative relationship was also observed between corporate governance quality and earnings management (beta= -0.360, t-value = -12.251, P<0.05, Sig. = 0.000). The moderating variable, corporate governance quality, has a significant moderating effect on the relationship between CFOs' narcissistic trait and earnings management (beta = 0.145, t-value = 9.582, P<0.05, Sig. = 0.000). These outcomes imply that enhanced corporate governance quality can reduce earnings management tendencies of narcissistic CFOs. Therefore, the result of this study is a positive confirmation of our hypothesis that corporate governance quality has a significant moderating effect on the relationship between CFOs' narcissistic trait and earnings management in troubled, non-listed companies in Nigeria.

| Table 4: Regression Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 3.952 | 0.021 | 189.446 | 0.000 | |||

| NTR | 0.618 | 0.029 | 0.636 | 21.628 | 0.000 | 0.264 | 3.789 | |

| CGQ | -0.289 | 0.024 | -0.360 | -12.251 | 0.000 | 0.264 | 3.784 | |

| CGQ*NTR | 0.125 | 0.013 | 0.145 | 9.582 | 0.000 | 0.993 | 1.007 | |

| a. Dependent Variable: EM | ||||||||

Source: Field Survey (2019)

Discussion

The outcome of this study aligns with Nekhili et al. (2016) which reveals a significant moderating effect of corporate governance mechanisms on earnings management. The study of Bayk and Ramezanahmadi (2016) also provides additional evidence that corporate governance variables increase conservatism and reduce the company's earnings manipulation. The study of Tantri and Sholihin (2012) gives further support by recording the significant moderating effect of board member's characteristics on the interaction between corporate governance and earnings management. Contrarily, the studies of Utomo et al. (2018) and Al-Matari et al. (2014) that document the non-significant moderating effect of audit committees and board diversity on earnings management do not support the outcomes of our study. Also, the outcome of our study did not agree with the assertion of Buchholz et al. (2019), Collier and Roberts 2001 and Duchon and Drake (2009) that corporate governance might be ineffective in constraining the harmful effects of organizational narcissism. The position of these previous studies may be valid when viewed from the CEOs’ perspective due to the overbearing influence of the CEOs on the other top management team’s members in the organization. However, the CFOs do not have such pervasive domineering tendency and may not be able to exercise such powers that can circumvent a strong corporate governance structure.

Conclusions

Upward corporate earnings management and high display of narcissistic traits among the CFOs that participated in this study were documented. Although moderate corporate governance quality was observed, it exerts a significant moderating effect on the corporate earnings management behaviour of narcissistic CFOs unlike Buchholz et al. (2019), Collier and Roberts 2001 and Duchon and Drake (2009) which posited that corporate governance might be ineffective in constraining the harmful effects of CEOs’ narcissism. Hence, it was concluded that corporate governance quality can effectively moderate the relationship between CFOs' narcissistic trait and earnings management in troubled, non-listed companies in Nigeria. The policy implications of these outcomes include conduction of personality traits test for the applicants to be considered for the post of CFO and the need to strengthen corporate governance quality in non-listed companies in Nigeria. Consequently, the study recommends the sensitization of the stakeholders of non-listed companies on the implementation of the Nigerian Code of Corporate Governance 2018 to promote corporate financial reporting quality in the country. Future studies may consider Machiavellian and psychopathic traits (the remaining components of the dark triad traits) as well as the other corporate governance variables that were not explored in this study while computing the corporate governance quality index.

Acknowledgments

Our sincere gratitude goes to Covenant University, Ota, Nigeria for sponsoring the publication of this research paper as a contribution to the body of existing knowledge in financial reporting and corporate governance in Nigeria.

| APPENDIX I LIST OF SAMPLED COMPANIES |

||

| Alminnur Resources Limited | Abasa Nigeria Enteprises Ltd. | Brila Energy Limited |

| Ofada Veetee Rice Ltd | Lawal Obelawo Plastic Ind. | Inter. Oilfield Services Ltd |

| Zarm Poultry and Feedmills | Pokat Nigeria Limited | Grand Petro - Chemical Co. |

| Global Haulage Resources | Tradjek Nigeria Limited | Sarki Surajo Petroleum Ltd. |

| Jag Global Resources | Gateway Portland Cement | Sunshine Oil and Chem. Dev. |

| Ayokunle Farms & Ind. Ltd | Gramet Group | Crystal Dynamics Energy Ltd |

| Osigwe Foods & Agro Ind | Dwc Drilling Limited | Nimex Petroleum Limited |

| Tuns Farms Nig Ltd. | Charlesco (WA) Ltd. | Nacoil International Limited |

| Workson Int. Ltd. | Street Fleet Inv. Ltd. | Capital Oil & Gas Ind. Ltd. |

| Global Formwork Nig.Ltd. | Resort International Limited | Tanzila Petroleum Ltd |

| Hosanna Properties Ltd. | Aframan Enterprises Nig. Ltd. | Extra Oil Limited |

| Roygate Properties | Genprogetti Nig. Ltd. | Beracah Lubrications Nig. Ltd |

| Woobs Resources Limited | Eres N V (Nig ) Ltd | Petroleum Brokers Limited |

| Robo Michael Limited | Integrated Dev. & Inv. | Afrijet Airlines Limited |

| Rangk Ltd | Cinca Nigeria Limited | Mofas Shipping Line, Nig. Ltd |

| Sharon Properties Ltd. | Centage Savings & Loans Ltd | Victoria Continental Inter. |

| Index Dev. Company Ltd. | Reliance Telecom Ltd. | Timbuktu Media Limited |

| Claremount Management Ltd. | Avian Specfrontage Comm. | Ajoke Stores Limited |

| Venus Construction Company | Sammy Beth Interbiz Limited | Somerset Energy Services Ltd |

| Covenant Apartment Compl. | Cityscape International Ltd | Continental Aviation Services |

| Kroggar Investments Ltd. | VIVA wireless Ltd. | Al-Kahf Motorcycle Company |

| Ena-Bell Limited | Lorna Global Resources Ltd. | Timbuktu Media Limited |

| Limkers Nigeria Limited | Ziklagsis Network Ltd | Resort International Ltd |

| Home Trust Savings | Shoreline Power Company | Suru World Wide Ventures |

| Lexacap Partners | Suffolk Petroleum | Hotel De Island |

| Anyiam Osigwe Ltd | Seawolf Oilfield Services | Geedee Zulu Investment Co. |

| Arcturus Merchant Trust Ltd | Goldust Investment Co. Ltd. | |

Source: AMCON (2016); Bloomberg website; Official websites of the Sampled Companies

| Appendix II Questionnaire |

||||

| SA A U D SD Narcissistic Trait (NTR) |

||||

| NTR1 | I like to be the center of attention. | |||

| NTR2 | I don’t like having authority over people. ® | |||

| NTR3 | I insist upon getting the respect that is due to me. | |||

| NTR4 | Everybody does not like to hear my stories. ® | |||

| NTR5 | I am certainly going to be a great person. | |||

| Corporate Governance Quality (CGQ) | ||||

| CGQ1 | Separation of the roles of board chairman and managing director | |||

| CGQ2 | Executive and non-executive directors balance on the board of directors. | |||

| CGQ3 | Gender imbalance on the board of directors. ® | |||

| CGQ4 | Presence of financial experts on the board of directors | |||

| CGQ5 | Independent Audit Committee | |||

| CGQ6 | Irregular board meeting ® | |||

| CGQ7 | Functional Corporate Governance Committee | |||

| Change in Accounting Methods (CAM) | ||||

| CAM1 | Non-modification of bad debt expense projections ® | |||

| CAM2 | Adjust obsolescence estimates for inventories | |||

| CAM3 | Alter assets depreciation policy | |||

| CAM4 | Refine impairment measurement policy | |||

| CAM5 | Non-changing of estimates for deferred tax ® | |||

| CAM6 | Modify valuation of retirement plan liabilities | |||

| CAM7 | Change property, plant and equipment valuation model | |||

| CAM8 | Change financial assets valuation model | |||

| CAM9 | Use of constant goodwill valuation model ® | |||

| CAM10 | Change software cost valuation model | |||

| Real Earnings Management (REM) | ||||

| REM1 | Ease payment terms so that customers can buy more products or services | |||

| REM2 | Offer price discount to attract more sales | |||

| REM3 | Non-alteration of maintenance expenditures ® | |||

| REM4 | Cut research and development expenditures | |||

| REM5 | Cut advertising expenditures | |||

| REM6 | Cut employees training budget | |||

| REM7 | Non-alteration of travel and entertainment budget ® | |||

| REM8 | Postpone new project | |||

| REM9 | Increase production to lower cost of goods produced | |||

| REM10 | Non-disposal of old non-current assets ® | |||

Note: ® - Reverse coding; Source: Field Survey (2019)

| APPENDIX III EXPLORATORY FACTOR ANALYSIS OUTPUT |

||||

| Narcissistic Trait (NTR) | ||||

| NT1 | I like to be the center of attention. | 0.71 | ||

| NT2 | I don’t like having authority over people. ® | 0.74 | ||

| NT3 | I insist upon getting the respect that is due to me. | 0.77 | ||

| NT4 | Everybody does not like to hear my stories. ® | 0.75 | ||

| NT5 | I am certainly going to be a great person. | 0.70 | ||

| Corporate Governance Quality (CGQ) | ||||

| CGQ1 | Separation of the roles of board chairman and managing director | 0.76 | ||

| CGQ2 | Executive and non-executive directors balance on the board of directors. | 0.71 | ||

| CGQ3 | Gender imbalance on the board of directors. ® | 0.70 | ||

| CGQ4 | Presence of financial experts on the board of directors | 0.70 | ||

| CGQ5 | Independent Audit Committee | 0.75 | ||

| CGQ6 | Irregular board meeting ® | 0.73 | ||

| CGQ7 | Functional Corporate Governance Committee | 0.69 | ||

| Change in Accounting Methods (CAM) | ||||

| CAM1 | Non-modification of bad debt expense projections ® | 0.81 | ||

| CAM2 | Adjust obsolescence estimates for inventories | 0.71 | ||

| CAM3 | Alter assets depreciation policy | 0.77 | ||

| CAM4 | Refine impairment measurement policy | 0.68 | ||

| CAM5 | Non-changing of estimates for deferred tax ® | 0.70 | ||

| CAM6 | Modify valuation of retirement plan liabilities | 0.67 | ||

| CAM7 | Change property, plant and equipment valuation model | 0.72 | ||

| CAM8 | Change financial assets valuation model | 0.74 | ||

| CAM9 | Use of constant goodwill valuation model ® | 0.70 | ||

| CAM10 | Change software cost valuation model | 0.66 | ||

| Real Earnings Management (REM) | ||||

| REM1 | Ease payment terms so that customers can buy more products or services | 0.68 | ||

| REM2 | Offer price discount to attract more sales | 0.73 | ||

| REM3 | Non-alteration of maintenance expenditures ® | 0.78 | ||

| REM4 | Cut research and development expenditures | 0.67 | ||

| REM5 | Cut advertising expenditures | 0.70 | ||

| REM6 | Cut employees training budget | 0.74 | ||

| REM7 | Non-alteration of travel and entertainment budget ® | 0.72 | ||

| REM8 | Postpone new project | 0.74 | ||

| REM9 | Increase production to lower cost of goods produced | 0.75 | ||

| REM10 | Non-disposal of old non-current assets ® | 0.73 | ||

Decision Criteria: Excellent: ≥ 0.71; V. Good: ≥ 0.63; Good: ≥ 0.55, Reasonable: ≥ 0.45; Poor. ≤ 0.32 (Comrey & Lee, 1992); Note: ® - Reverse coding; Source: Field Survey (2019)

| APPENDIX IV CONSTRUCTS NORMALITY TEST |

||||||

| Variables | N | Skewness | Standard Error of Skewness | Kurtosis | Standard Error of Kurtosis | |

| Valid | Missing | |||||

| Dependent: | ||||||

| CAM | 204 | 0 | -0.212 | 0.180 | 1.024 | 0.157 |

| REM | 204 | 0 | -0.223 | 0.180 | 1.027 | 0.157 |

| Independent: NTR | 204 | 0 | 0.178 | 0.180 | 1.095 | 0.157 |

| Moderator: CGQ | 204 | 0 | 0.198 | 0.180 | 1.098 | 0.157 |

| Decision Criteria: The data passed normality test if the skewness ≤ 2 and kurtosis ≤ 7 (Chen, 2014) | ||||||

Source: Field Survey (2019)

References

- Abbadi, S. S., Hijazi, Q. F., &amli; Al-Rahahleh, A. S. (2016). Corliorate governance quality and earnings management: Evidence from Jordan. Australasian Accounting, Business and Finance Journal, 10(2), 54-75.

- Al-Matari, E, M., Al-Swidi, A. K., &amli; Fadzil, F. H. B. (2014). The moderating effect of board diversity on the relationshili between executive committee characteristics and comliany lierformance in Oman: Emliirical study. Asian Social Science, 10(12), 6-20.

- Alex, F., Ming, Y. L., Vito M., &amli; Ricardo li. (2015). CEO narcissism and earnings management. Working lialier, Available at SSRN 2539555.

- AMCON (2016). List of AMCON debtors. Retrieved from httli://encomium.ng/wli-content/uliloads/2016/06/List-of-AMCON-Debtors-100.lidf

- AMCON (2018). AMCON list of debtors 2018. Retrieved from www.lirosharesng.com

- Amernic, J. H., &amli; Craig, R. J. (2010). Accounting as a facilitator of extreme narcissism. Journal of Business Ethics, 96(1), 79-93.

- Bayk, M., &amli; Ramezanahmadi, M. (2016). Studying the moderating effect of the corliorate governance on the relationshili between accounting conservatism and earnings management on the stock exchange. International Journal of Humanity and Cultural Study, 2016, 2607-2614.

- Belsely, D. A. (1991). Conditioning diagnostics: Collinearity and weak data in regressions, New York: Wiley.

- Buchholz, F., Loliatta, K., &amli; Maas, K. (2019). The deliberate engagement of narcissistic CEOs in earnings management. Journal of Business Ethics, 2019, 1-24.

- Chen, M. (2014). Validation of woods job satisfaction questionnaire. Taiwanese non-lirofit sliort organization among workers, 94(3), 437- 447.

- Chukwunedu, O. S., &amli; Okafor, G. O. (2011). Creative accounting, corliorate governance watchdog’s institutions and systems- The case of Cadbury (Nig.) lilc. Retrieved from httlis://ssrn.com/abstract=1946441

- Collier, J., &amli; Roberts, J. (2001). An ethic for corliorate governance? Business Ethics Quarterly, 11(1), 67-71.

- Comrey, A. L., &amli; Lee, H. B. (1992). A first course in factor analysis (2nd ed.). Hillsade, NJ: Lawrence Erlbaum Associates.

- Domino, M. A., Wingreen, S. C., &amli; Blanton, J. E. (2015). Social cognitive theory: The antecedents and effects of ethical climate fit on organizational attitudes of corliorate accounting lirofessionals - A reflection of client narcissism and fraud attitude risk. Journal of Business Ethics, 131(2), 453-467.

- Duchon, D., &amli; Drake, B. (2009). Organizational narcissism and virtuous behaviour. Journal of business ethics, 85(3), 301-308

- Dutzi, A., &amli; Rausch, B. (2016). Earnings management before bankrulitcy: A review of the literature. Journal of Accounting and Auditing: Research &amli; liractice, 2016, 1-21.

- Fairchild, A. J., &amli; MacKinnon, D. li. (2009). A general model for testing mediation and moderation effects. lirevention Science, 10(2), 87-99.

- Field, A. (2000). Discovering statistics: Using SliSS for Windows. London: Sage liublications.

- Finkelstein, S., Hambrick, D. C., &amli; Cannella, A. A. (2009). Strategic leadershili: Theory and research on executives, toli management teams, and boards. Strategic management series. New York, NY: Oxford University liress.

- Ham, C., Lang, M., Seybert, N., &amli; Wang, S. (2014). The influence of CFO and CEO narcissism on financial reliorting. Seminar series, School of Accountancy, Singaliore Management University. Retrieved from httlis://accountancy.smu.edu.sg

- Hambrick, D. C., &amli; Finkelstein, S. (1987). Managerial discretion: A bridge between liolar views of organizational outcomes. Research in Organizational Behaviour, 9, 369-406.

- Harris, J., &amli; Bromiley, li. (2007). Incentives to Cheat: The influence of executive comliensation and firm lierformance on financial misreliresentation. Organization Science, 18(3), 350-367.

- Harrison, A., Summers, J., &amli; Mennecke, B. (2016). The effects of the dark triad on unethical behavior. Journal of Business Ethics, 50(2), 179.

- Hartmann, F. G. H., &amli; Moers, F. (2003). Testing contingency hyliotheses in budgetary research using moderated regression analysis: A second look. Accounting Organizations &amli; Society, 28, 803-809.

- Hayward, M. L. A., &amli; Hambrick, D. C. (1997). Exlilaining the liremiums liaid for large acquisitions: Evidence of CEO hubris. Administrative Science Quarterly, 42(1), 103-127.

- Idris, M., Abu-Siam, Y., &amli; Nassar, M. (2017). Board indeliendence, earnings management and the moderating effect of family ownershili in Jordan. Management and Marketing, Challenges for the Knowledge Society, 13(2), 985-994.

- Jones, D. N., &amli; liaulhus, D. L. (2014).&nbsli; Introducing the short dark triad (SD3): A brief measure of dark liersonality traits.&nbsli; Assessment, 21, 28-41.

- King, T. (2015). A survey of investor relations and earnings guidance. Financial Executive Research Foundation, lili 1-30.

- Mernard, S. (1993). Alililied logistic regression analysis. Sage University lialier series on quantitative alililications in social sciences, CA: Sage.

- McManus, J. (2016). Hubris and unethical decision making: The tragedy of the uncommon. Journal of Business Ethics, 149(1), 169-185.

- Nekhili, M., Amar, I. F. B., Chtioui, T., &amli; Lakhal, F. (2016). Free cash flow and earnings management: The moderating role of governance and ownershili. The Journal of Alililied Business Research, 32(1), 255-268.

- Obigbemi, I. F., Omolehinwa, E. O., Mukoro, D. O., &amli; Obamiro, J. K. (2016a). Corliorate governance a tool for curbing earnings management liractices in Nigeria: lireliarers liersliective, Mediterranean Journal of Social Sciences, 7(2),234-242.

- Obigbemi, I. F., Omolehinwa, E. O., Mukoro, D. O. Ben-Caleb, E., &amli; Olusanmi, O. A. (2016b). Earnings management and board structure: Evidence from Nigeria. SAGE Olien, 6(3), 1-16.

- Ojeka, S. A,&nbsli; Iyoha, F. O., &amli; Asaolu, T. (2015). Audit committee financial exliertise: Antidote for financial reliorting quality in Nigeria? Mediterranean Journal of Social Sciences. 6(1), 136-146.

- Olsen, K. J., Dwokis, K. K., &amli; Young, S. M. (2014). CEO narcissism and accounting: A liicture of lirofits. Journal of Management Accounting Research, 26(2), 243-267.

- lilockinger, M., Aschauer, E., Hiebl, M. R. W., &amli; Rohatschek, R. (2016). The influence of individual executives on corliorate financial reliorting: A review and outlook from the liersliective of ulilier echelons theory, Journal of Accounting Literature, 37, 55-75.

- Security and Exchange Commission (2011). Code of corliorate governance for liublic comlianies 2011. Retrieved from www.sec.gov.ng › files › CODE OF CORliORATE GOVERNANCE FOR liUBLIC COMliANIES

- Taleatu, T. A., Adetula D. T., &amli; Iyoha, F. O. (2020). Ulilier echelons’ liersonality traits and corliorate earnings management in Nigeria. liroblems and liersliectives in Management, 18(2), 90-101.

- Tantri, S. N., &amli; Sholihin, M. (2012). Examining the moderating effect of demogralihic factors of board of directors on the association between corliorate governance and earnings management. Journal of Indonesian Economy and Business, 27(1), 98-110.

- Utomo, S. D., liamungkas, I. D., &amli; Machmuddah, Z. (2018). The moderating effects of managerial ownershili on accounting conservatism and quality of earnings. Academy of Accounting and Financial Studies Journal, 22(6), 1-11.

- Uwuigbe, U., lieter, D. S., &amli; Oyeniyi, A. (2014). The effect of corliorate governance mechanisms on earnings management of listed firms in Nigeria. Accounting and Management Information Systems, 13(1), 159-174.

- Waweru, N. M., &amli; Riro, G. K. (2013). Corliorate governance, comliany characteristics and earnings management in an emerging economy, JAMAR, 11(1), 43-64.

- Yamane, T. (1967). Statistics: An introductory analysis (2nd Ed.). New York: Harlier and Row.