Review Article: 2022 Vol: 26 Issue: 4

Moderating Role of Government Intervention on the Relationship between Interest Rate and Smes Performance; Implication on Poverty Alleviation in Zamfara State

Umar Farouk Abdulkarim, Federal University Gusau

Sanni Oluwale Nurudeen, Ahmadu Bello University

Bashir Umar Faruk, Federal University Gusau

Citation Information: Abdulkarim, U.F., Nurudeen, S.O., & Faruk, B.U. (2022). Moderating role of government intervention on the relationship between interest rate and smes performance; implication on poverty alleviation in zamfara state. Academy of Accounting and Financial Studies Journal, 26(4), 1-19.

Abstract

The study examines the moderating role of government intervention on the relationship between interest rate and SME performance; implication on poverty alleviation in Zamfara state. The population of the study consists of all small-scale enterprise owners in Zamfara State. Simple random technique was used, while the sample size of 397 was arrived at using formula suggested by Israel (2013) for a finite population. The study was anchored on Gibb’s Micro and Small Enterprise Support Theory. Using regression analysis, result from the study demonstrated the importance of SMEs in reducing poverty in Zamfara State. Based on the findings, the study concludes that government intervention and interest rate are significant determinants of SMEs performance; besides government intervention significantly moderates the relationship between interest rate and SMEs performance, in addition, SMEs performance is significant determinant of poverty alleviation. The study recommends that Zamfara state government should incentivize SMEs owners by providing them with employment incentives and intervening through subvention and interest rate reductions, as well as creating an environment conducive to business growth.

Keywords

Government Intervention, Interest rate, SMEs Performance, Poverty Alleviation.

Introduction

Throughout the world, poverty has become an albatross around the necks of most nations and individual families, particularly in emerging countries. Approximately one billion people live in families with per capita earnings of less than one dollar per day throughout the world (UNN, 2022; Abdullahi, 2015). Poverty is defined as a state of being in which an individual or group is subjected to economic, social, political, cultural, and environmental deprivation. It is a condition of involuntary deprivation to which an individual, family, community, or country is subjected as a result of circumstances beyond their control (Eniola, 2014). An analysis of the average national poverty incidence suggests that the situation has not improved in the majority of Sub-Saharan African nations during the previous 20 years, with Nigeria being one of them (Ampah. 2017).

According to the World Data Lab's Poverty Clock in 2019, over 90 million people, or almost half of Nigeria's population, live in severe poverty International Center for Investigative Reporting 2019. More specifically, in June 2018, Nigeria overtook India, a nation with a population seven times than Nigeria, to become the country with the lowest GDP per capita. Every minute, around six persons in Nigeria fall prey to this trap of penury. Statistics on extreme poverty have long been a source of contention World Economic Forum.

According to a World Bank (2017), poverty in the northern parts of the nation, particularly in the North-East zone, has been growing. In 2016, the North-East accounted for over half of all poor people in the nation, and the North-East accounted for 87 percent of all poor people in the country. Furthermore, it was revealed that about 71 million Nigerians do not have access to clean water, and 130 million people do not fulfill the sanitation criteria set by the Millennium Development Goals. But things are much worse in the North-East and North-West, where only around 25% to 28% of the country's homes have access to basic utilities such as electric power, running water, and toilets (The Punch, 11th Feb, 2020).

Poor household production, as well as financial constraints and a lack of other entrepreneurship-related incentives, may all contribute to poverty (Adenutsi, 2009). Other factors that appear to be impeding poverty reduction in the country include lack of meaningful productivity growth across sectors of the economy, which is exacerbated by both domestic and global risks, making even the current GDP growth rate extremely vulnerable (World Bank, 2017). As a consequence, it was expected that effective and functioning SMEs will help to reduce the level of poverty in the country (Axelrod, 2000).

By facilitating the creation and selling of products and services that enable individuals to directly mobilize domestic savings, the development of SMEs would aid industrial dispersal, thus preventing rural-urban migration. These savings could be reinvested back into the business to ensure growth and contribute to economic development, thus lowering poverty levels in the country (Bradshaw, 2007). In the past, Small and Medium Enterprises (SMEs) have had difficulty obtaining financing due to high interest rates, the structure of the financial sector, a lack of understanding of financing alternatives, and limited access to small business support services (Daramola, 2013).

Several grassroots micro lending programs and policies have been adopted in Nigeria in order to enhance the provision of financial services to Small and Medium Enterprises (SMEs), the rural and urban poor, and other vulnerable populations (Demetriades, 2017). Among other efforts, the rural banking programme, sectoral loan distribution, concessional interest rates and the Agricultural Credit Guarantee Scheme are part of this package Despite the wide range of possible possibilities for reducing poverty, real data indicates that the depth and severity of poverty remain particularly acute in Nigeria, Sub-Saharan Africa, and South Asia (Barbier, 2000; Gibbs, 2007). Evidently, Small and Medium-Sized Enterprises (SMEs) are encountering difficulties in obtaining financing due to a lack of government regulatory assistance, and interest rate among other factors (Kadiri, 2012; Eme, 2014). Small and Medium-Sized Enterprises (SMEs) in Sub-Saharan Africa have shown that they are especially vulnerable to lack of access to funding, which has reduced investment opportunities and escalated the poverty level in the countries (Hayes, 2009).

There have been large collections of literature on SMEs performance and poverty alleviation. For instance, (Zarook et al., 2013; Boateng et al., 2015; Henseler et al., 2009). Provided evidence on SMEs performance and poverty alleviation. These studies found a statistically significant negative link; however, other investigations found a favorable relationship or found no relationship. One of the possible explanations for the mixed empirical findings is the fact that economic and legal situations change from country to country. Taking into consideration the above, the purpose of this research was to improve the psychometric power of the variables (interest rate and government intervention). Mores so, there is no known study that has empirically or theoretically examined moderating role of government intervention on the relationship between interest rate and SMEs performance; and consider its implication on poverty alleviation. Hence, the authors consider it necessary to fill this gap.

Literature Review

Gibb’s Micro and Small Enterprise Support Theory

Gibbs (2007) proposed a model that listed different rules that should be addressed when beginning Micro and Small Enterprise Development programmes. The model is dynamic in that policies, institutions, and aid packages for the growth of this business sector change as the requirements of Micro and Small Enterprises change. The component of the support service programmes is determined by the demands of MSEs (Hock, 2010).

Smallbone & Rogut (2001) also mention that despite the lack of direct government intervention, many micro and small businesses were created, sustained, and in some cases grew on their own in economies in transition as a result of individuals' creativity in resource mobilization and their ability to Adaptation to adapt to hostile external environments. As a result, the number of firms is still small and their contribution to economic development is limited under these conditions. Governments in transition economies must continue to provide the framework conditions that allow private sector development to become ingrained and sustainable in their respective environments.

As a follow-up to Gibbs (2007), argue that more intensive government interventions in the form of policy regarding affordable financing mechanisms, business infrastructure and entrepreneurship training are necessary components for developing SME culture in developing economies. According to Gibbs (2007), the GSF model for emerging economies shows that the business world of SMEs faces a variety of difficulties at different stages of development, which is important for this study. These small business owners are often required to provide guarantees from banks before borrowing money, which they do not have at their disposal, and bear the burden of exorbitant interest rates from these financial institutions, which they cannot handle Kenny. As a result, small business owners and managers would have problem meeting their loan obligations. In addition to promoting entrepreneurship through loans, investor-friendly government policies and regulations help managers of small and medium business owners enhance their entrepreneurial acumen, leading to increased company performance and poverty reduction (Manasseh, 2004). Hence, in line with the theoretical background, the study hypotheses were stated in null form as follows:

H1: Interest rate has no significant effect on SMEs performance in Zamfara state in Zamfara state

H2: Interest rate has no significant effect on poverty alleviation in Zamfara state in Zamfara state

H3: Government intervention has no significant effect on SMEs performance in Zamfara state in Zamfara state

H4: Government intervention has no significant effect on poverty alleviation in Zamfara state in Zamfara state

H5: Government intervention does not significantly moderate the relationship between interest rate and SMEs performance in Zamfara State.

H6: SMEs performance does not significantly mediate the relationship between interest rate and poverty alleviation in Zamfara state.

Small and Microenterprises (SMEs)

Small and Medium-Sized Businesses (SMEs) are critical to the economic growth of any country. They have a significant impact on both the economy and society. The total numbers of workers and/or the total amount of the company’s assets are used by the World Bank (2017) to categorise businesses as Small or Medium-Sized Enterprises (SMEs). Large and small businesses may be distinguished by the above characteristics. As a result, the definition of Small and Medium-Sized Enterprises (SMEs) may vary greatly from nation to country. Bouri et al. (2011) define medium enterprises as companies with fewer than 250 employees and a turnover of less than €50 million or a balance sheet total of less than €43 million. Companies with less than 50 workers, annual revenue of less than €10 million, or a total balance sheet of less than €10 million are considered small businesses (Morduch, 1994).

Many various definitions of small and medium-sized enterprises (SMEs) have been provided by Stork & Esselaar (2006). SMEs in Ghana are defined as businesses with six to 99 employees and fixed assets totalling no more than 2.5 billion Ghana Cedi (excluding land and buildings). The definition of a small business in South Africa includes cooperatives and non-governmental organisations, as well as any of their branches or subsidiaries, which are independently managed by a single owner or a group of owners. Cameroon defines Small and Medium-Sized Enterprises (SMEs) as companies with a turnover value of not less than 1 billion Cameroon Franc (cfa) and accrued investments of not more than 500 million CFA, its short-term credit is not more than 200 million cfa, and it has at least 5% owners of the capital and managers who are Cameroonians in charge (Nguyen et al., 2009).

Small and Medium-Sized Businesses (SMEs) in Nigeria are those with fewer than 200 workers and assets valued at less than 500 million Naira (N), excluding land and buildings (Smedan, 2012; Qureshi, 2009). Small businesses are defined as those with fewer than 49 employees and assets of less than N50 million, excluding land and buildings, that fall within the range of N5 million to N50 million. As a general rule, medium-sized businesses are those that employ 50 to 199 people and have assets totaling less than N500 million, which excludes land and buildings. Smedan (2012) defines small and medium enterprises as those with fewer than 200 employees and total assets of less than 500 million Naira (N), excluding land and building (Zarook et al., 2013).

Small and Microenterprises Performance

Performance might differ from one circumstance to the next (Ajayi, 2016). A company's progress towards its vision, aims, or objectives, such as expanding its business or hiring more people, or increasing its profitability may be measured in this way. Smith & Reece (1999) argued that an organization's performance should be measured. According to Wood (2006), the most widely used measures for gauging success are profit, return on investment, the number of clients, and sales turnover. Business success was studied by Smallbone & Rogut (2001) and Smith & Reece (1999). Who used a variety of metrics to assess the company's performance: profit; employees; sales; and asset growth? In spite of the fact that objective data is made public, it is common for managers to modify the data in order to avoid paying personal taxes. The subjective indicators, on the other hand, are concerned with the overall performance of the company.

To find out whether interest rates affect the ability of small businesses in Kampala, Uganda's capital city, to get loan financing, Ssentamu (2016) undertook an investigation. It was decided to utilise a cross-sectional/correlational design, which is based on the financial life cycle theory. From 2010 to 2014, a five-year research was carried out. Respondents were the proprietors of 130 small businesses in Kampala's Rubaga neighbourhood. When interest rates are reduced by a unit, their ability to get funding improves by 0.177 units. This was determined using ordinary least squares regression. SMEs are less likely to seek out loans from banks because of the high interest rates, according to the study's results, since they don't know how to responsibly return their debts.

A recent research by Menberu (2018) revealed that the cost of borrowing as a measure of access to financing has a considerable negative impact on the performance of small and medium enterprises. Irrelevance Theorem, Pecking Order Theory, and Trade-Off Theory are among the theories used (Stork, 2006). An interdisciplinary approach combining survey and econometric approaches was used to analyse the variables that influence Small and Medium-Sized Enterprises (SMEs) in Addis Ababa Ethiopia's access to and availability of financial resources. According to the research, 204 small business owners and managers, 50 employees of six banks and seven Microfinance Institutions (MFIs) in Addis Ababa were randomly chosen to participate in a survey. The qualitative component, on the other hand, makes use of an examination of important papers pertaining to Ethiopia's financial inclusion. To get a loan from a bank, Menberu learned that the high interest rate was one of the main difficulties.

Poverty Alleviation

Poverty is a multidimensional problem that affects people at all levels of society, including the global, national, societal, family and individual levels of society. This shows that poverty does not have a clear definition and has been well explored. As of now, poverty alleviation is one of the most pressing concerns on the national government's agenda, and is compatible with the Millennium Development Goals (MGGS), whose main objective or drivers are the eradication of poverty and hunger in the country (Sumner, 2003). In recent years, the idea of poverty has received more attention in the academic community because of its societal significance. For instance research by Demetriades et al. (2017) examines if financial development (cost to income ratio, government expenditure, inflation rate, trade openness, impaired loan and private credit) has a positive effect on poverty alleviation. It is shown that both financial deepening and better physical access are advantageous in lowering the share of persons below the poverty line, by utilising newly accessible data. Data from the respondents is analysed using descriptive and multiple regression techniques. Furthermore, the findings dispute previous findings that financial volatility may lead to an increase in poverty.

According to the findings of Mookerjee & Kalipponi (2010), there is a negative association between the number of bank branches and the Gini coefficient. Efficiency in the financial sector and financial stability are the other two aspects of financial development. The function of the banking industry in poverty reduction may not be immediately apparent since it is mainly structured to monitor the cost of inter-mediating lending. Low interest rate spreads and rapid, low-cost administrative processes are two ways that efficient banks may provide financial services to the poor at a cost-effective price.

Methodology

A survey research design was used in this study. A survey study design, according to Mugenda & Mugenda (2012), is the process of gathering information from a sample of individuals who have been chosen to reflect a stated target demographic. It entails the gathering of data that characterises and quantifies social phenomena, such as issues, circumstances, and problems that are common in society at a given moment. In the North-East of Nigeria, a survey study methodology was utilised to investigate the mediating influence of SMEs performance on the link between access to credit and poverty reduction. In Zamfara State, Nigeria, the survey research design was used to investigate the mediating impact of SMEs performance on the relationship between access to finance and poverty alleviation. The study's population consists of 57716 microenterprise owners and managers who operate their businesses in Zamfara's fourteen local governments (Anka, Bakura, Birnin-Magaji, Bukkuyum, Bungudu, Tsafe, Gummi, Gusau, Kaura-Namoda, Maradun, Maru, Shinkafi, Talata-Mafara, Zurmi). However, only 13 local was aptured by the researcher due to current attack that has lead to lost of lives and to ensure safety of the researcher in Mafara local government area. Owner/manager will be selected because of their knowledge and familiarity with the running of their own establishment. Simple random Sampling was used by the researcher to collect needed information from respondents. The sample size was determined using the formula suggested by Yamane as cited in Israel 2013 for a finite population to arrive at 397. The data was gathered via the use of a structured questionnaire that was closed ended in order to eliminate digressive replies. Adapted from the work of (Boateng et al., 2015; Nguyen et al., 2009; Yang et al., 2019; Bhattacharjee et al., 2017; Zarook et al., 2013). The performance metrics for SMEs were obtained from Boateng et al. (2015) and Apolot (2012), respectively. Items on access to finance, notably interest rates and government action, were adapted from Nguyen et al. (2009), Bhattacharjee et al. (2017), Zarook et al. (2009), amongst other sources 2013. Items on poverty alleviation were obtained from Yang et al. (2019) respectively, and were used in this section (2019). Due to the fact that it was used in a similar study and was determined to pass the reliability and validity tests with Cronbach Alpha values of 0.958, 0.921, and 0.748, it is being used in this study as well. Furthermore, responses were scored on a Likert scale of one to five points. As a consequence, the numerical values on the scale range from Strongly Agree (5 points) to Strongly Disagree (5 points), with 5 being the middle position (1 point). The questionnaire was delivered directly to the owners or managers of microenterprises functioning in the chosen Local Government Area (LGA) by the researcher. Face-to-face delivery is advocated as a realistic alternative in a nation such as Nigeria, whose research culture is still in its early stages of development (Yang et al., 2019).

Results and Discussion

Following Field's instructions, it was required to clean the data before analysing it. The data were analysed with the use of the Structural Equation Model (SEM) and the Partial least Squares (PLS) procedures in SPSS. SmartPLS3 professional version was employed in this particular instance. PLS is effective with tiny samples, according to (Hair et al., 2017). Less than 100. Due to the large number of valid replies (386), PLS SEM has been determined to be appropriate for structural equation modelling. It was determined whether or not the instrument had good reliability and validity by employing measurements, and the relationships between the study's variables were determined by applying structural models.

Normality Test

This study used multivariate normality to assess data distribution using kurtosis (peak or flatness of the distribution compared to the normal distribution) and skewness (distribution equilibrium at the center or symmetric with approximately the same shape on both sides) to check normality, which assesses the potential deviation from normality and shape Distributions (Hair et al., 2017).

According to Curran et al. (1996) Skewness values should be less than 2 and Kurtosis values should be less than 7. Additionally, states that the absolute value of Skewness greater than 3 and Kurtosis value greater than 10 may indicate a problem of normality of data distribution; and values above 20 may indicate a more serious problem of normality of data distribution. Based on the values in Table 1, it is concluded that the data is found to be normal because the absolute values of the Skewness and Kurtosis of all the items in this study are within the acceptable range of <2 and <7, respectively.

| Table 1 Below Gives The Score For Both Skewness And Kurtosis Of The Research Variables. |

|||||

|---|---|---|---|---|---|

| Construct | N | Mean | Std. Dev. | Skewness | Kurtosis |

| Government intervention | 387 | 3.37 | 1.35 | -0.47 | -1.54 |

| Interest rate | 387 | 3.21 | 0.83 | -0.48 | -0.96 |

| Poverty alleviation | 387 | 2.94 | 1.15 | 0.04 | -1.62 |

| SmeS performance | 387 | 3.32 | 0.89 | -0.62 | -1.10 |

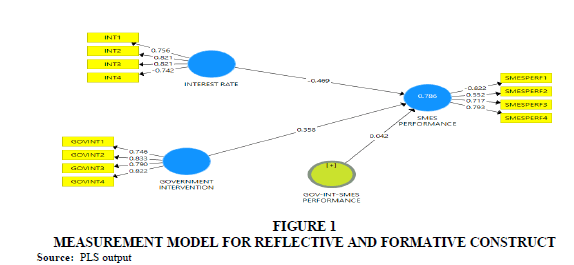

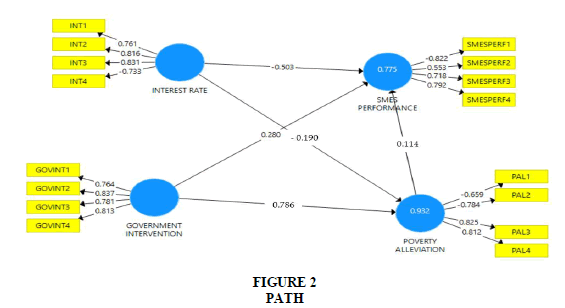

Path modeling using the PLS-SEM measurement model was used to assess the reliability and validity of the model. In Table 2, it can be seen that the reliability analysis is complete for all reflective constructs, as shown by the Composite Reliability (CR), which is above the 0.70 threshold for all variables. As a result, it is possible to obtain the mean extracted variance (AVE), which measures the convergent validity of the reflective fixtures. In Table 2, the major mean scores for each construct (i.e., mean square factor loading of items within each construct) are over a threshold of 0.50, indicating that each of these constructs explains more than 50% of the difference in the associated indices. However, in order to determine the characteristic validity of reflective constructs, it is necessary that the square root of the AVE variable for each variable be greater than the correlations of that variable with any other construct, which can be achieved using the Heterotrait-Monochromatic Ratio (HTMT). In Table 3, the diagonal bold numbers indicate the square root of AVE, which is greater than the correlation of any reflective variable with any other reflective variable, as shown. This clearly demonstrates the uniqueness of each of these constructs. Figures 1 and 2 above depicts the measuring model for the study’s reflective constructs, which shows the item reliability and constructs validity of each one Figure 1 and 2.

| Table 2 Measurement Information: Convergent Validity (N=387) For Moderating Effect (Model One) |

||

|---|---|---|

| CR | AVE | |

| GOV-INT-SMES PERFORMANCE | 1.000 | 1.000 |

| GOVERNMENT INTERVENTION | 0.825 | 0.638 |

| INTEREST RATE | 0.809 | 0.618 |

| SMES PERFORMANCE | 0.763 | 0.628 |

Source: PLS output

| Table 3 Measurement Information: Convergent Validity (N=387) For Mediating Effect (Model Two) |

||

|---|---|---|

| CR | AVE | |

| GOVERNMENT INTERVENTION | 0.818 | 0.639 |

| INTEREST RATE | 0.809 | 0.618 |

| POVERTY ALLEVIATION | 0.798 | 0.597 |

| SMES PERFORMANCE | 0.762 | 0.531 |

Source: PLS output.

Generally, scholars recommend that the AVE value of 0.50 or above indicates that the construct has a convergent validity (Hair et al., 2021). This is logical because an AVE with 0.50 signifies that the latent construct explains half of the variance of its items or factors (Hair et al., 2021). Consequently, following the threshold level of 0.50 value for the AVE, all reflective constructs in this study have convergent validity as each construct has an AVE level above 0.50. Considering the moderating effect, government intervention has CR and AVE of 0.825 and 0.638, interest rate has 0.809 and 0.618 and SMES performance has 0.763 and 0.628. Result of model two presented in Table 3 shows that, government intervention has CR and AVE of 0.818 and 0.639, interest rate has 0.809 and 0.618, poverty alleviation has 0.798 and 599 and SMES performance has 0.762 and 0.531. Thus, the values indicate that all the aforementioned reflective constructs of this study have convergent validity, and thus they all explained more than 50 percent of the variance of their respective indicators (Zulkiffli & Perera, 2011).

Discriminant Validity

This research's reflective latent variables exhibit discriminant validity since the square roots of their individual AVEs are above the correlations with the other constructs of the study, as shown in Tables 4 and 5, for this research, the reflection latent construct is unique in that it is not substantially associated with any of the other reflective latent constructs. Furthermore, according to Fornell & Larcker's (1981) criteria analysis, each of the aforementioned constructs is distinct and captures phenomena not captured by any other reflective latent constructs.

| Table 4 Fornell-Larcker Criteria Model One |

||||

|---|---|---|---|---|

| Gov-int-smes performance | Government intervention | Interest rate | Smes performance | |

| Gov-int-smes performance | 1.000 | |||

| Government intervention | 0.682 | 0.799 | ||

| Interest rate | -0.685 | -0.933 | 0.786 | |

| Smes performance | 0.666 | 0.864 | -0.872 | 0.729 |

Source: PLS output

| Table 5 Fornell-Larcker Criteria Model Two |

||||

|---|---|---|---|---|

| Government intervention | Interest rate | Poverty alleviation | Smes performance | |

| Government intervention | 0.799 | |||

| Interest rate | -0.933 | 0.786 | ||

| Poverty alleviation | -0.963 | 0.923 | 0.773 | |

| Smes performance | 0.859 | -0.869 | -0.848 | 0.729 |

Source: PLS output

Finally, the discriminant validity of the reflective constructs was evaluated using the HTMT ratio of correlation measure, which was shown to be superior to the AVE technique. Although the Fornell-Larcker criteria and the analysis of cross-loadings are the primary methodologies for assessing discriminant validity, Henseler et al. (2009) stated that they do not consistently identify the absence of discriminant validity in frequent research scenarios despite their popularity. To measure discriminant validity, they suggest an alternative technique based on the multitrait-multimethod matrix: the HTMT.

For example, in Tables 6 and 7, correlations between reflective construct components are shown as HTMT statistics. Our reflective latent constructs have a discriminant validity since the HTMT value is greater than 0.85, which is greater than what has been recommended by other researchers (Kline, 2015). Using the Fornell–Larcker criteria and the HTMT criterion, discriminant validity was confirmed. We may conclude that the reflective latent components examined in this research have high discriminant validity across all methods.

| Table 6 Htmt Model One |

|||

|---|---|---|---|

| Gov-int-smes performance | Government intervention | Interest rate | |

| Gov-int-smes performance | |||

| Government intervention | 0.755 | ||

| Interest rate | 0.768 | 1.140 | |

| Smes performance | 0.761 | 1.062 | 1.080 |

Source: PLS output

| Table 7 Htmt Model Two |

|||

|---|---|---|---|

| Government intervention | Interest rate | Poverty alleviation | |

| Government intervention | |||

| Interest rate | 1.140 | ||

| Poverty alleviation | 1.187 | 1.138 | |

| Smes performance | 1.062 | 1.080 | 1.060 |

Source: PLS output

It can be inferred that there is no multicollinearity issue based on the proof provided in Table 8. This is due to the fact that all of the variables' VIF values are less than 10 and all of the tolerance values are greater than 0.10 (Hair et al., 2021). The results of the VIF test ranges from a minimum of 1.457 to a maximum of 1.822 which are all less than 10 hence the absence of collinearity among the explanatory variables.

| Table 8 Variance Inflation Factor And Formative Indicators Significance Testing Results |

||

|---|---|---|

| poverty alleviation | SMES performance | |

| Gov-inter_smes performance | 1.604 | |

| Government intervention | 1.822 | 1.695 |

| Interest rate | 1.593 | 1.781 |

| Poverty alleviation | ||

| Smes performance | 1.457 | |

Source: PLS output

Structure Model (Internal Model)

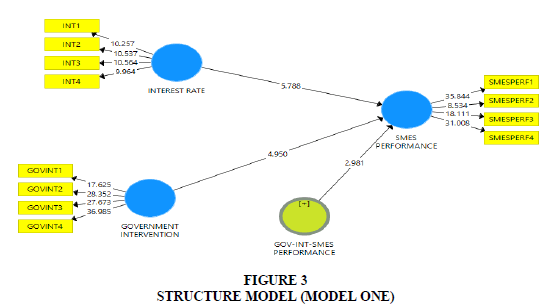

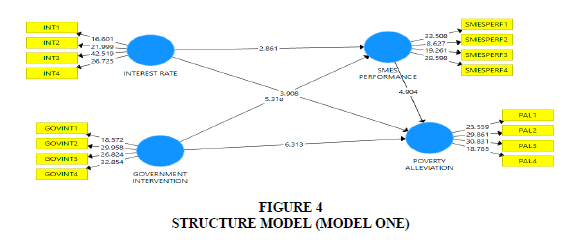

The next component, after deciding to fit the model from the measurement model, is the structural or interior model. Hair et al. (2017) established four main evaluation requirements of the PLS-SEM structural model. These involve evaluations of the importance of the trajectory coefficients, the coefficient of determination (R2), the effect size (f2) and, finally, (4) the predictive relevance (Q2). However, a start-up study is necessary to determine the direct influence of interest rate and government intervention on SMEs performance; indirect influence interest rate and government intervention on poverty alleviation and mediation effect of SMEs performance on poverty alleviation. Bootstrapping was done using 5000 subsamples. The structural model of direct effects is shown in Figures 3 and 4.

Test of Hypotheses

The study tested for the first two hypotheses. From Tables 9 and 10 the study presented the results of the path coefficients for the structural model with the beta value of the relationships, t-statistic, and p-value.

| Table 9 Path Coefficient For Direct Relationship Model One |

|||

|---|---|---|---|

| Sample Mean (M) | T Statistics (|O/STDEV|) | P Values | |

| Gov-int-smes performance -> smes performance | 0.042 | 2.981 | 0.003 |

| Government intervention -> smes performance | 0.358 | 4.950 | 0.000 |

| Interest rate -> smes performance | -0.469 | -5.788 | 0.000 |

| R-square | 0.786 | ||

Source: PLS output

| Table 10 Path Coefficient For Direct Relationship Model Two |

|||

|---|---|---|---|

| Sample Mean (M) | T Statistics (|O/STDEV|) | P Values | |

| Government intervention -> poverty alleviation | 0.786 | 6.313 | 0.000 |

| Interest rate -> poverty alleviation | -0.190 | 5.143 | 0.000 |

| Smes performance -> poverty alleviation | 0.114 | 4.905 | 0.000 |

| R-square | 0.755 | ||

| 0.932 | |||

Source: PLS output

Hypotheses and Discussion of Findings

This study has put up six hypotheses in null form as stated in the study. The hypotheses were used to test the moderating and mediating effect of government intervention and SMES performance on the relationship between interest rate and poverty alleviation. The hypotheses of the study were tested using the t- test (t-statistics) and p-value at 5% level of significance. The null hypotheses will be accepted if the t-statistics is less than 1.96 and the p-value greater than 5% otherwise rejected. The adjusted R-square signifies the systematic variation caused by the independent variables on the dependent variables. That is moderating role of government intervention and the interest rate can cause systematic change of 78.6% on SMES performance; government intervention and interest rate can cause systematic variation of75.5% on SMES performance; SMES performance on poverty alleviation with 93.2%.

The regression coefficient linking interest rate and SMES performance was significant (β=-0.469, t-statistics=2.981, p-value=0.003). It means that when interest rate increases, it would have adverse effect on SMEs performance. This is because the cost of financing is high when interest rates are high, fewer entrepreneurs would go into start-up SMEs when rates are high. For established SMEs, this would result in restricted expansion since they would be unable to acquire extra products and services for their shops or invest in new equipment and tools, so limiting their capacity to create further job opportunities in the future. Even though interest rates are significant because they regulate money flow in the economy, low interest rates help the economy grow, but they may also contribute to inflation. When interest rates are high, consumers are hesitant to take out loans because they are more difficult to repay, and the quantity of real purchases declines. Thus, the study found sufficient evidence to reject the null hypothesis which states that, interest rate does not have significant impact on SMEs performance.

The regression coefficient government intervention and SMES performance was significant (β=-0.358, t-statistics=4.950, p-value=0.000). It means that when government intervention, it may have positive impact on SMEs performance. This is due to the fact ggovernment rules and bureaucratic processes may both impede and encourage entrepreneurship, such as the formation of new businesses. The government may devise policies to encourage and assist the development of new technology, goods, and services. On this basis, the null hypothesis is rejected which states that, government intervention does not have significant impact on SMEs performance.

The regression coefficient linking moderating role of government intervention on interest rate and SMES performance was significant (β=.0.042, t-statistics=2.981, p-value=0.003). By implication higher interest rates are a result of the costs and risks associated with servicing the industry. Even though SMEs face many of these difficulties all over the world, interest rate caps, or the highest levels of interest rates at which institutions can lend, would discourage lending because they set the highest credit rate, even if risk assessments indicated that a higher rate should be paid (to maintain their margins). As a result, institutions may choose not to lend, reducing the amount of credit available to the market. Therefore, interest rate caps would be shown to be ineffective, if not completely harmful, in the fight against over-lending. With governments intervention to increase access to credit by enacting strict regulations aimed at making credit less expensive (through interest rate restrictions) or more accessible to certain groups of businesses (by directed lending). It would encourage SMEs investment and fosters better performance. Hence, the study found sufficient evidence to reject the null hypothesis which states that, government intervention does not significantly moderate the relationship between interest rate and SMEs performance.

From the regression result, it was revealed that government intervention has positive significant relationship with poverty alleviation (β=-0.786, t-statistics=6.313, p-value=0.000). It means that the more of intervention program or policies by the government, the likely less of poverty in the state. This is due to the fact that, the intervention program has a big impact on reducing poverty and promoting socio-economic development in the society, which is why it is important. Intervention programs are to make society a better place to live for everyone, and more specifically, to change people's values, attitudes and knowledge and skills, increase socioeconomic support, and in general to make a better environment for the poor people to live in. On this basis, the null hypothesis is rejected which states that, government intervention does not have significant impact on poverty alleviation.

In addition, the regression result revealed that interest rate has negative and significant relationship between interest rate and poverty alleviation (β=-0.190, t-statistics=5.143, p-value=0.000). It means that interest rate has adverse influence on poverty alleviation. That is the more of interest rate, the more less of poverty alleviation. This is because of the high rate of interest; the rising cost of borrowing, the complicated repayment schedule, and their inability to manage or use the amount of the loan are some of the main reasons why people don't pay back their loans on time, which may increase the level of penury within the society. On this basis, the null hypothesis is rejected which states that, interest rate does not have significant impact on poverty alleviation.

Finally, considering the mediating effect of SMEs performance on the relationship between government intervention and poverty alleviation, result revealed that effectiveness of SMEs through favorable intervention and interest rate have significant influence to reduce level of poverty within the society. This is statistically proven with the coefficient of 0.114 and p-value of 0.000, which is significant at 1%. It means by implication when the level of SMEs performance improves, the standard of living of may also improve. This is because it is widely acknowledged that Small and Medium-Sized Enterprises (SMEs) play a significant role in revitalizing and maintaining the nation's economy. It supports considerable employment, contributes to poverty reduction, and acts as a critical innovation engine for the economy.

The change in the value of R2 when a particular exogenous variable is deleted from the model is used to determine whether the omitted variable has any significant effect on the endogenous variable of the performance of that model for small and medium-sized enterprises (SMEs) Table 11. According to R2 value changes as a result of neglecting the latent exogenous variable, the effect size determines the relative influence of a particular latent exogenous variable on the latent endogenous variable. As a result, Cohen's formula is used to determine effect size (Cohen, 2013; Hair et al., 2017) given as:

| Table 11 Effect Size And Predictive Relevance |

||

|---|---|---|

| Construct | F2 | Effect size |

| Government Intervention- SMEs performance | 0.23 | Large |

| Interest rate - SMEs performance | 0.05 | Small |

| Government Intervention- Poverty Alleviation | 0.07 | Small |

| Interest rate - Poverty Alleviation | 0.00 | Small |

| SMEs performance - Poverty Alleviation | 0.09 | Small |

Q2 0.543; 3,353; 1,422

Source: PLS output

Where:

When an exogenous variable has a significant effect on an endogenous variable, the value of F2 is used to determine the magnitude of that effect. In this case, the R2 value of the internal variable is included before a specific external structure is deleted. After a particular exogenous variable is excluded from a model, changes in the R2 value of the endogenous variable are represented by the term “R2 excluded.”

According to the above formula, f2 values of 0.02, 0.15 and 0.35 correspond to small, medium and large effects, respectively, in the study (Cohen, 2013). Average effect size in tests of moderation, is only 0.009, which is a very small number. Thus, Kenny advises that small, medium and large effect sizes be represented as 0.005, 0.01 and 0.025 as more realistic criteria for small, medium and high effect sizes, respectively. The performance of SMEs and poverty alleviation has minor effects, according to the results presented in Tables 4 and 5. Government intervention has a significant impact on the performance of SMEs, followed by moderating relationships: government intervention and the interest rate on SME performance; interest rate on the performance of small and medium-sized enterprises; government intervention and poverty alleviation; interest rate and poverty alleviation.

Moreover, if the value of Q2 is greater than 0, then the model has a predictive significance for a particular interior construct, and if the value is less than 0, the model has no predictive relevance for that construct (Hair et al., 2017; Henseler et al., 2009). As a result, any models with Q2 greater than zero are assumed to have predictive significance and the higher the Q2, the higher the predictive significance of the models. Tables 4 and 5 shows the Q2 value gained through the use of blindfolding as a result of this procedure.

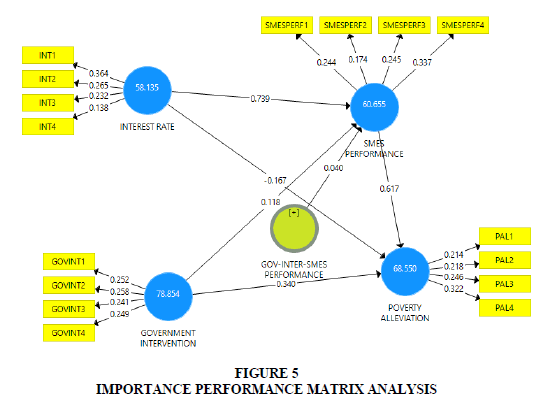

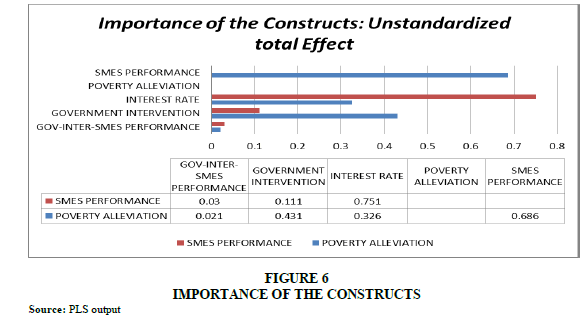

Importance-Performance Map Analysis

By taking into account average values of the latent variable scores, the Importance-Performance Map Analysis (IPMA), also known as importance-performance matrix analysis (IPA) or Impact-Performance Map Analysis (IPM), adds a new dimension to the standard PLS-SEM results reporting of path coefficient estimates. The aspects of these constructions reflect possible areas of improvement that should be given the most attention as shown in Figure 5.

The rescaling of each latent variable score such that it may take on values between 0 and 100 is shown in figure 3 (Kristensen et al., 2000). The mean values of these scores measure the construct's performance, with 0 being the lowest and 100 indicating the greatest. This performance scale is simple to comprehend since most researchers are acquainted with percentage interpretation (Hair, et al., 2017; Matthews & Thompson, 2008). According to figure 3, the interest rate has a performance of around 58.1 percent, the government intervention has a performance of around 78.8 percent, the SMES performance has a performance of around 60.6 percent, the EU has a performance of around 60 percent, and the poverty alleviation has a performance of around 68.5 percent as shown in Figure 6.

The use of unstandardized total effects in figure 4 allows us to interpret the IPMA as follows: If everything else remains constant, a one-unit increase in the predecessor's performance raises the target construct's performance by the magnitude of the predecessor's unstandardized total effect (ceteris paribus). A one-unit rise in moderating role of government intervention on interest rate, for example, results in a 3% and 2 % improvement in the performance of SMEs and poverty alleviation respectively. Furthermore, one unit increase in the government intervention results in 11.1% and 43.1% increase in the performance of SMEs and poverty alleviation respectively. In addition, unit increase in the interest rate results in 75.1% and 32.1% increase in poverty alleviation and SMES performance respectively. Finally, a one-unit rise in performance of SMEs results in a 68.9% increase in poverty alleviation.

Conclusion

By highlighting the significance of SMEs in poverty reduction, the present research adds to the literature on SMEs performance and enhances poverty alleviation. This research focuses on poverty, which is one of the most pressing challenges in the state. The residents of this area are experiencing a dearth of employment prospects as a result of economic challenges. Poverty may be alleviated through promoting the SME sector. The findings from the study revealed the importance of SMEs in reducing poverty in Nigeria, particularly in Zamfara State. The study was conducted on the moderating role of government intervention on the relationship between SMEs performance and its implication poverty alleviation. It was discovered that government intervention and interest rate have significant influence of SMEs performance and invariably has significant impact on poverty alleviation. Based on the findings, the study concludes that government intervention and interest rate are significant determinant of SMEs performance; and government intervention significantly moderate the relationship between interest rate and SMEs performance, while SMEs performance is significant determinant of poverty alleviation. As result of the findings, the study therefore recommends that Zamfara state government should incentivize SMEs owners by providing them with employment incentives and intervening through subvention and reduction of interest rates, while also creating a conducive environment for business to thrive in order to raise the standard of living for the people and alleviate poverty in the state. Only with the availability of financing can entrepreneurs manage to obtain finance for start-ups and enable current SMEs to develop and produce more wealth and jobs for the nation. Governments could help young entrepreneurs by drastically reducing the bureaucratic processes in new firms’ registration and even give tax-holidays for start-up SMEs and for those in the growth phase thereby enabling informally functioning SMEs, to register and become formal. The study recommended that, future research may be conducted in other regions such as. Similarly, future study might look at the function of the banking sector in promoting SMEs.

References

Abdullahi, M.S., Tahir, I.M., Aliyu, R.L., & Abubakar, A. (2015). Strengthening small and medium scale enterprises (SMEs) for poverty alleviation in Nigeria.IOSR Journal of Humanities and Social Science (IOSR-JHSS),20(6), 101-110.

Indexed at, Google Scholar, Cross Ref

Adenutsi, D.E. (2009). Entrepreneurship, job creation, income empowerment and poverty reduction in low-income economies. Munich Personal RePEc Archive (MPRA), 295699(1-21),

Ajayi, A. (2016). Impact of External Business Environment on Organisational Performance of Small and Medium Scale Enterprises in Osun State, Nigeria. Scholedge International Journal of Business Policy and Governance,3(10),155-166.

Indexed at, Google Scholar, Cross Ref

Ampah, S.N., Ambrose, J.O., Omagwa, J.O., & Frimpong, S. (2017). Effect of access to credit and financial services on poverty reduction in central region of Ghana.International Journal of Business and Social Science,8(8), 49-60.

Apolot, S. (2012). Organizational Learning, Innovation and Small and Medium Enterprise (SMEs) and Research Centre: In Fulfilment of the Requirements of the award of Master of Science in Entrepreneurship and Small Business Management of University of Makerere.

Axelrod, R. and Cohen, M.D. (2000), Harnessing Complexity: Organizational Implications of Scientific Frontier. Harvard Business Review, 78(2).

Barbier EB (2000). Linkages between rural poverty and land degradation. Some evidence from Africa. Agric. Ecosystem Environ,8,2337-355

Bhattacharjee, M., & Rajeev, M. (2014). Accessibility to Credit and its Determinants: A State-level Analysis of Cultivator Households in India. Margin: The Journal of Applied Economic Research, 8(3), 285–300.

Indexed at, Google Scholar, Cross Ref

Boateng, G.O., Boateng, A.A., & Bampoe, H.S. (2015). Microfinance and poverty reduction in Ghana: Evidence from policy beneficiaries.Review of Business & Finance Studies,6(1), 99-108.

Bouri, A., Breij, M., Diop, M., Kempner, R., Klinger, B., & Stevenson, K. (2011). Report on support to SMEs in developing countries through financial intermediaries. Dalberg, November, 1-48. 2011

Bradshaw, T.K. (2007). Theories of poverty and anti-poverty programs in community development. Community Development,38(1), 7-25.

Indexed at, Google Scholar, Cross Ref

Cohen, J. (2013).Statistical power analysis for the behavioral sciences. Routledge.

Indexed at, Google Scholar, Cross Ref

Curran, P.J., West, S.G., & Finch, J.F. (1996). The robustness of test statistics to nonnormality and specification error in confirmatory factor analysis. Psychological methods,1(1), 16.

Indexed at, Google Scholar, Cross Ref

Daramola, A.G. (2013). “Insecurity, Poverty and National Development: The Role of Education”: Convocation lecture on the occasion of the 21st Convocation Ceremony of the Lagos State Polytechnic, Ikorodu

Demetriades, P.O., Rousseau, P.L., & Rewilak, J. (2017). Finance, growth and fragility.

Eniola, A.A. (2014). The role of SME firm performance in Nigeria. Arabian Journal of Business and Management Review (OMAN Chapter),3(12), 33.

Indexed at, Google Scholar, Cross Ref

Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research,18(1), 39-50.

Indexed at, Google Scholar, Cross Ref

Gibbs, G.R. (2007). Thematic coding and categorizing. Analyzing qualitative data,703, 38-56.

Indexed at, Google Scholar, Cross Ref

Hair Jr, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2021).A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

Hair Jr, J.F., Matthews, L.M., Matthews, R.L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: updated guidelines on which method to use. International Journal of Multivariate Data Analysis,1(2), 107-123.

Indexed at, Google Scholar, Cross Ref

Hayes, A.F. (2009). Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Communication monographs,76(4), 408-420.

Indexed at, Google Scholar, Cross Ref

Henseler, J., Ringle, C.M., & Sinkovics, R.R. (2009). The use of partial least squares path modeling in international marketing. InNew challenges to international marketing. Emerald Group Publishing Limited.

Indexed at, Google Scholar, Cross Ref

Hock, C., Ringle, C.M., & Sarstedt, M. (2010). Management of multi-purpose stadiums: Importance and performance measurement of service interfaces.International journal of services technology and management,14(2-3), 188-207.

Indexed at, Google Scholar, Cross Ref

Kadiri, I.B. (2012). Small and medium scale enterprises and employment generation in Nigeria: the role of finance.Kuwait Chapter of the Arabian Journal of Business and Management Review,1(9), 79.

Kline, R. B. (2015).Principles and practice of structural equation modeling. Guilford publications.

Kristensen, K., Martensen, A., & Gronholdt, L. (2000). Customer satisfaction measurement at post Denmark: results of application of the European customer satisfaction index methodology. Total Quality Management,11(7), 1007-1015.

Indexed at, Google Scholar, Cross Ref

Manasseh, P. N. (2004). A text book of business finance (3rd ed.). Nairobi: McMore Accounting Books

Matthews, K. and Thompson, J.,( 2008). The economics of banking. 2nd Ed. West Sussex, United Kingdom: John Wiley and Sons Ltd

Menberu, A. (2018).Assessment of access to finance and its availability for smes in addis ababa(doctoral dissertation, addis ababa university).

Mookerjee, R., & Kalipioni, P. (2010). Availability of financial services and income inequality: The evidence from many countries.Emerging Markets Review,11(4), 404-408.

Indexed at, Google Scholar, Cross Ref

Morduch, J. (1994). Poverty and vulnerability.The American Economic Review,84(2), 221-225.

Mugenda, O., & Mugenda, A. (2012). Research Methods Dictionary: Nairobi: Applied Research & training Services Press.

Nguyen, T.H., Alam, Q., Perry, M., & Prajogo, D. (2009). The entrepreneurial role of the state and SME growth in Vietnam.Journal of Administration & Governance,4(1), 60-71.

Qureshi, I., & Compeau, D. (2009). Assessing between-group differences in information systems research: A comparison of covariance-and component-based SEM.MIS quarterly, 33(1), 197-214.

Indexed at, Google Scholar, Cross Ref

Smallbone, D. & Rogut, A. 2001. The implications of accession for SMEs. Environment & Planning, Government & Policy. 19,317–333.

SMEDAN. (2012). Survey report on Micro, Small, and Medium Enterprises (MSMEs) in Nigeria.

Smith, T.M., & Reece, J.S. (1999). The relationship of strategy, fit, productivity, and business performance in a services setting. Journal of Operations Management,17(2), 145-161.

Indexed at, Google Scholar, Cross Ref

Ssentamu, J.N. (2016).Factors influencing debt financing access by small and medium-size enterprises (smes) in rubaga, kampala

Stork, C., & Esselaar, S. (2006). Towards an African e-index: SME e-access and usage in 14 African countries.

Sumner, A. (2003, May). Economic and non-economic well-being: a review of progress on the meaning and measurement of poverty . InWIDER Conference: Inequality, Poverty and Human Well-Being(pp. 30-31).

The Punch, (2020) Nigeria’s poverty rate in North – World Bank. Retrieved from; https://punchng.com/87-nigerias-poverty-rate-in-north-world-bank/

UNN (2022). End poverty in all its forms everywhere https://www.un.org/sustainabledevelopment/poverty/

Wood, E.H. (2006), The Internal Predictors of Business Performance in Small Firms A Logistic Regression Analysis. Journal of Small Business Enterprise Development 13(3): 441-453

World Bank (2017). Doing Business 2017: Equal Opportunity for All. Washington

Yang, Y., Chen, X., Gu, J., & Fujita, H. (2019). Alleviating financing constraints of SMEs through supply chain.Sustainability,11(3),673.

Indexed at, Google Scholar, Cross Ref

Zarook, T., Rahman, M.M., & Khanam, R. (2013). Does the financial performance matter in accessing to finance for Libya's SMEs?.International Journal of Economics and Finance,5(6), 11-19.

Zulkiffli, S.N.A., & Perera, N. (2011). A literature analysis on business performance for SMEs: subjective or objective measures?. InSociety of Interdisciplinary Business Research (SIBR) Conference on Interdisciplinary Business Research 25.

Indexed at, Google Scholar, Cross Ref

Received: 11-Mar-2022, Manuscript No. AAFSJ-22-11506; Editor assigned: 14-Mar-2022, PreQC No. AAFSJ-22-11506(PQ); Reviewed: 28-Mar-2022, QC No. AAFSJ-22-11506; Revised: 11-Apr-2022, Manuscript No. AAFSJ-22-11506(R); Published: 18-Apr-2022