Research Article: 2022 Vol: 25 Issue: 5S

Motivation as a Predictor of Employee Performance: A Case Study of Ebonyi State University Micro-Finance Bank Limited

Sunday Nwambam Aja, Ebonyi state University

Fabian Udum Ulo, Ebonyi state University

Friday Ogbaga, Ebonyi state University

Silas Nwankpu Igwe, Ebonyi state University

Beatrice Osoego, Ebonyi state University

Citation Information: Aja, S.N., Ulo, F.U., Ogbaga, F., & Igwe, S.N. (2022). Motivation as a Predictor of Employee Performance: A Case Study of Ebonyi State University Micro-Finance Bank Limited. Journal of Entrepreneurship Education, 25(S5),1-14.

Abstract

The extent employees’ needs are met by their organization could influence their behaviour either positively or negatively which demands for further studies. This study investigated motivation as predictor of employees’ job performance with reference to Ebonyi State University Micro-Finance Bank Limited. The study adopted descriptive research design where the researcher used secondary data from other related studies to evaluate the behaviour EBSU MFB Ltd staff toward motivation. The data used were analyzed using Percentages and Pearson ‘r’ to describe their stand on the research topic. Regression and ANOVA were used to test the hypotheses at 0.05 level of significance. The result revealed that intrinsic and extrinsic motivation positively correlate with employees’ job performance. The result also show that there is no significant difference between intrinsic and extrinsic motivation as they correlate with employees’ work performance thus settling the controversies surrounding the supremacy of either intrinsic or extrinsic motivation as panacea for enhancing staff job performance. The findings lead credence to two factor theory of motivation because while extrinsic motivational factors result in employee job satisfaction, intrinsic motivational factors prevent job dissatisfaction and both in both in extension may lead to increase or decrease in employee job performance as the case may be. The practical implication of this is that managers need to understand the interconnectivity of the two to bring about employee job satisfaction and improved job performance for the overall banks’ increase productivity to help revamp ailing developing economy like Nigeria especially with the scourge of Covid-19 pandemic. The researcher recommended that EBSU MFB Ltd like other banks and business organization should regularly access employees’ needs to ascertain what motivates to work. Bank managers should also put in place robust financial and non-financial incentives as motivating employees for increased productivity for local, national and global competitiveness.

Keywords

Motivation, Intrinsic Motivation, Extrinsic Motivation, Employee Job Performance.

Introduction

Banks like other business organizations are established to organize efforts and activities of individuals to provide products such as goods and services for profit. As formal organization, banks have common features like governance structure, aims and objectives to achieve, policy on resource management, condition of service for worker and legal regulations controlling their business operation. Employees subscribe to bank jobs because of fat salaries that will enable them meet their needs despite the high demand of their work (Abdolshah et al., 2018; Khan et al., 2017; Lekic et al., 2020; Njuguna & Owuor, 2016). The volatile and competitive market environment in the banking sector and the unfortunate down turn of global economy especially in developing economies like Nigeria coupled with the effect of the Covid-19 pandemic which have forced banks (microfinance inclusive) to develop strategies to reduce operation costs including number of staff (Wijesundera, 2018).

This scenario has made banks to gear their efforts toward retaining only the best employees with the same pay or less while expecting them to do more work harder in order to maintain company’s productivity. It is obvious that under this condition, employees’ job satisfaction could reduce and in extension their performance especially when they see that the future is unsure. It is on this premise that Shkoler & Kimura (2020) was of the view that business organization like bank should motivate good employees in order to retain them because they are likely to look for other more attractive job opportunities elsewhere. On this note therefore, it is necessary for researchers to explore how employees attitude and behaviour toward their job could be influenced through motivation especially at the micro-finance bank sector which to the best of the researcher’s knowledge have not been addressed.

Microfinance bank is a limited liability company licensed by the central bank of Nigeria to carry on business of providing financial and non-financial services to customers especially those who lack access to traditional financial services of commercial banks. The difference between microfinance and conventional banks is in their scope of operations (FXOGOR, 2017).

Previous studies suggested that motivated employees are likely to perform their job better and have low intention to leave their organization (Eneh, 2016; Nabi et al., 2017; Octaviannand et al., 2017; Okoye & Ezejiofor, 2013; Oluwayomi, 2018; Omolo, 2015; Peretomode, 1991; Shkoler & Kimura, 2020; Wijesundera, 2018). Motivation in the context of this work is the process or action that courses workers behaviour to be energized, directed and sustained toward a goal. In other words, motivation is a state of mind which causes it to be filled with the energy and enthusiasm to drive a person to work in a certain way to achieve goals. It can be either intrinsic or extrinsic. Intrinsic motivation comes within the individual worker or work itself for instance sense of accomplishment, opportunity to use one’s ability (creativity); receiving appreciation, positive recognition and being treated with dignity (Uzonna, 2013). Extrinsic motivation on the other hand comes from outside the individual worker such as work conditions, salary, promotion, allowances and other fringe benefits (Aja, 2016). These motivational factors have severally been used to influence employees’ job performance.

In business organization, performance could be addressed from the perspective of organizational performance and employees’ performance. Organizational performance represents the aggregate member of staff in an organization working together to achieve the organizational goals and objectives. Employee performance on the other hand refers to how individual members of an organization use their skills and abilities individually in order to accomplish organizational goals and objectives. Staff or employees’ job performance in this context is how the employees fulfill their work assignments and execute their required tasks. It explains how well or poorly employees do their job duties or behave in their work place to accomplish job tasks (Donohoe, 2019). The close relationship between employees’ performance and organizational performance demand that organizations that want to be competitive should find out how motivate their staff to increase performance and also be willing to remain in the job.

Statement of the Problem

The volatile, uncertain and competitive market environment of the banking industry especially with the effect of the global Covid-19 pandemic, have increased employee turnover in their bid to look for safer job. This scenario has presented as a challenge to the extent that banks (microfinance inclusive) that wish to stay in business need to look for ways of motivating to retain their good staff. This high staff turn -over might have accounted for numerous bank collapse or mergence. Recently there is news of Access bank acquiring diamond bank. United bank for Africa acquired Nigerian standard trust bank. IBTC bank and Stanbic bank merged to form Stanbic IBTC. NBM bank, Indo Nigeria bank, Magnum trust bank, and Nal bank merged to form Sterling bank. First bank is currently in talk with Heritage bank and Fidelity bank for possible acquisition. The list is endless which attest to the fact that it is not rosy in the Nigeria banking sector. This is a wake-up call for Microfinance banks to explore ways of assess their staff’s needs with the view to identifying areas where motivation is lacking for remedy. Despite these developments in the banking industry, no research work has focused on investigating motivation (intrinsic and extrinsic) as predictor of bank staff job performance in Nigeria. Related studies done outside Nigeria were on the impact of motivation in employees’ performance in banks but not micro-finance banks. It is on this premise that this study was conceived to find out the extent motivational factors could predict employees’ job performance in micro-finance banks for the sector’s sustainability contribution to the overall national growth and development in Nigeria.

Purpose of the Study

The general aim of the study is to analyze motivation as a predictor of employees’ job performance in Ebonyi state University Micro-Finance bank (MFB) limited. This was realized by reviewing other studies on motivation and employee job performance and also by evaluating secondary data and findings for possible recommendations. Specifically, the objectives of this study sought:

1. To ascertain the extent intrinsic motivations predict employees’ job performance in Ebonyi state University Micro-Finance bank limited.

2. To determine the extent extrinsic motivations predict employees’ job performance in Ebonyi State University Micro-Finance bank limited.

3. To compare the extent intrinsic and extrinsic motivation differ as correlates of employees’ job performance in Ebonyi State University Micro-Finance bank Limited.

Rationale or Justification of the Objectives

Today most organizations strive to put in place policies that could take care of employees’ job satisfaction such as compensation, staff development and job security which could contribute to improved employees job performance and overall organizational success. This emphasize that organization that places staff motivation as top priority will have competitive advantage with reduced costs in staff turnover and experience increased productivity steadily.

Many studies have suggested the need to conduct further research on the relationship between motivation and employee job performance so as to shed more light on the effect of intrinsic and extrinsic motivational factors on employees’ behaviour by taking comprehensive look at the workforce diversity and job satisfaction/performance. This informed the objectives of the study.

Significance of the Study

The findings of the study will be of great help to staff, management and regulatory agencies of the banking industry as well as other researchers conducting research on related topic.

The findings of the study will reveal types of motivational variables that better satisfy staff needs to increase their productivity in the bank sector.

The management of the banking sectors will be equipped with the needed strategies and approaches to motivate their employees for enhanced job satisfaction/ performance.

The findings of the study will provide the bank regulatory agencies with necessary information on the various incentives required by bank staff for possible enforcement.

The findings of this study will provide intending researchers with empirical data for future research in related topics. Also when the findings of this study are published or presented in academic for will contribute to existing knowledge and influence future studies.

Scope of the Study

The study investigated the extent intrinsic and extrinsic motivate predict employees’ job performance as well as the differences between intrinsic and extrinsic motivation as correlates of employees’ job performance in Ebonyi State University Micro-Finance Bank limited, Abakaliki. The study simply analyzed the relationship or correlation between intrinsic and extrinsic motivation with employees’ job performance.

Research Questions

The following research questions will guide the study:

1. To what extent does intrinsic motivation predict employees’ job performance in Ebonyi State University Micro- Finance Bank Limited?

2. To what extent does extrinsic motivation predict employees’ job performance in Ebonyi State University Micro- Finance Bank Limited?

3. To what extent does intrinsic and extrinsic motivation differ as correlates of employees’ job performance in Ebonyi State University Micro-Finance Bank Limited?

Research Hypothesis

The following null hypotheses tested at 0.05 level of significance were formulated for the study.

H01: There is no significant relationship between intrinsic motivation and employees’ job performance in Ebonyi State University Micro-Finance Bank Limited.

H02: There is no significant relationship between extrinsic motivation and employees’ job performance in Ebonyi State University Micro-Finance Bank Limited

H03: There is no difference between intrinsic and extrinsic motivation as correlates of employees’ job performance in Ebonyi State University Micro-Finance Bank Limited

Research Methodology

This section will be discussed under the following sub-headings:

Research Philosophy

This research is based on the epistemological objectivist point of view because it utilized different types of knowledge from theories and data from existing literature to understand and interpret the present situation so as to draw conclusion to generalize on universal social reality. Here, it is assumed that every business organization has its policies on condition of service and job descriptions which prescribe employees’ duties, operating procedure to adhere, formal structure of position for reporting that are very much similar to other organisations. Also the researcher borrowed ontological stance since the study aimed to discover the motivational factors that govern employees’ behaviour toward their job performance in order to predict how employees would act in the future despite the personal beliefs and values of the researcher.

Approaches to Theory Development

Approaches to theory development are classified into deductive, inductive and abductive (Ketokivi & Mantere, 2010; Abdulkadir, 2020). Abductive approach was used in this study to generate testable conclusions by using known premises in terms of logic and information generated from empirical studies to generalize interaction between the specific and general ideas for generalizability. Available secondary data was used to analyses a phenomenon; identify themes and patterns from the theoretical review. These known premises, themes and patterns as shown in Table 1 is tested through Munyua (2017); Eneh (2016) secondary data to draw conclusions and generalizations on those stated known premises.

| Table 1 Correlation Between Intrinsic Motivation and Job Performance | ||

| Job performance | Intrinsic motivations | |

| Intrinsic motivation | 0.178 | 1.000 |

| Job performance | 1.000 | 0.178 |

| Source: Munyua (2017) | ||

It is also through the adductive approach that this study incorporate existing theory discussed in the literature review to verify and criticize the present findings where ever possible.

Research design

In recognizing the purpose of the study which sought to investigate the extent intrinsic and extrinsic motivate predict employees’ job performance as well as the differences between intrinsic and extrinsic motivation as correlates of employees’ job performance in Ebonyi State University Micro-Finance Bank limited, Abakaliki. This is a correlational study which adopted both descriptive survey and evaluative approaches. The purpose of choosing descriptive survey is that it will enable the researcher to use secondary data to describe an existing phenomenon (Kumar, 2020; Krishnaswami & Satyaprasad, 2010), aimed at findings out the extent motivation predict employees’ job performance.

Research Strategy

The study collected data from internet sources, project reports and existing theories. Abductive and descriptive/ evaluative research design combined together formed the research strategy. The stated known premises, themes and patterns used to arrive at testable conclusions through abductive approach are used to answer three major questions of the research: To what extent does intrinsic motivation predict employees job performance?, To what extent does intrinsic motivation predict employees’ job performance?, and What is the relationship between intrinsic extrinsic motivation and employees’ job performance in a descriptive and evaluative manner.

Types and Sources of Data

Based on the fact that this research is a desk based research, its methodology utilized secondary data. These secondary data were collected from internet sources and unpublished project reports. The used in the literature review section are peer reviewed articles, journal, unpublished research projects and text books. Analysis of data for this study was done through Munyua (2017); Eneh (2016); Wijesundera (2018) project reports surveys which were used to answer the research questions and hypotheses of this research. The reliability and validity of the questionnaire used by the researchers for data collection.

The limitation envisaged by the research was that the secondary data were got from researches carried in conventional banks outside the area of study. However, commercial banks and Microfinance banks perform similar functions but at different levels.

Data Analysis Methods

The data sets are analysed using quantitative and qualitative methods. Different sets of statistical data are reviewed from Munyua (2017); Eneh (2016); Wijesundera (2018) project reports. Percentages, Pearson Product Moment Correlation Coefficient and Pie chats were used to answer the research questions while regression equation and ANOVA were used to test the hypotheses at 0.05 level of significance. Using these methods, known premises were built, themes and patterns were identified and established as were presented in chapters four and five of this work.

Ethical Issues

This research topic, purposes and research questions were derived from existing theories and literature review. The secondary data used as sources of data were collected from unpublished project reports combined with internet sources because of time and cost constraints. Ethical challenges regarding to accessibility of the data was not encountered because the secondary data were research reports publically available in the internet and the University libraries. Also the data collected were reliable and sufficient to answer this research questions.

Ethical issues were considered from the point of data collection to conclusion. The general code of ethics was also applied throughout the research work. The researcher has acted openly and truthfully and the data analysis/ findings were presented appropriately. The researcher has no conflict of interest with the data presented with the source and results. The research was conducted with utmost responsibility and obligation not to harm any individual or group. No confidential data and anonymity were incorporated or disclosed in this research. The sources of data, method of data analysis and findings were adequately acknowledged. Also the analysis of data and interpretation were carefully checked to ensure the accuracy of this research and any other outcomes.

Evaluation of Secondary Data

The major evaluation of secondary data was based on the research works summarized above. First the research purpose (objectives) and questions were considered in relation to the secondary data. Munyua (2017); Mushtaque et al. (2021); Eneh (2016); Wijesundera (2018) research field surveys were used to answer the research questions and hypotheses of this study has shown below.

Analysis of Secondary Data

Research question 1: Extent intrinsic motivation predict employees’ job performance of Ebonyi State University Micro-Finance Bank Limited.

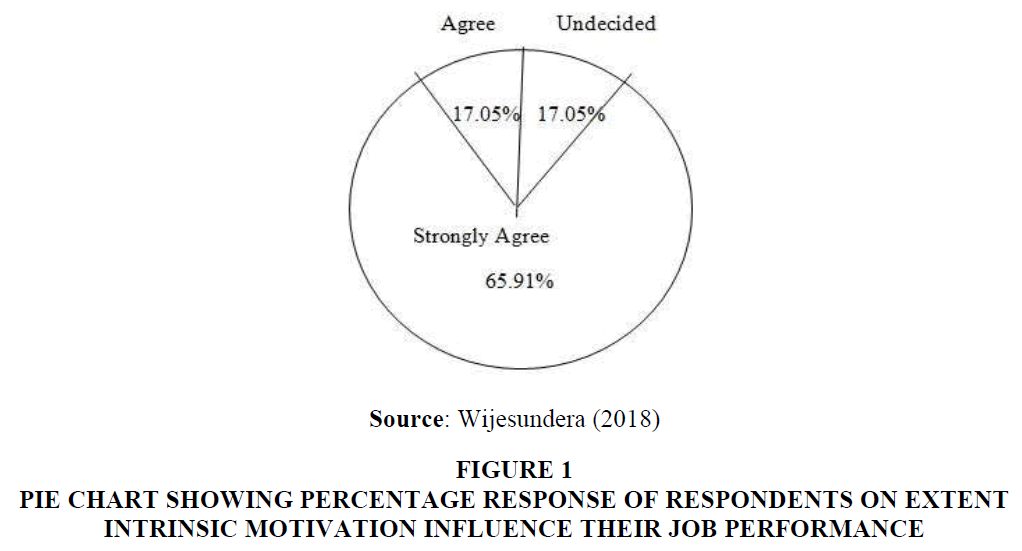

The above pie chart shows that majority of the respondents (66%) strongly\ agreed that non-financial incentives listed in the survey have positive influence on their motivation level and work performance, 17% of the respondents agreed to the same statement. However, 17% of the respondents neither agree nor disagree to the statement that non-financial incentives influence their motivation and work performance positively.

Correlation between Intrinsic Motivation and Job Performance

The results in Table 1 above illustrate that job performance and intrinsic motivation have a correlation of 17.8%. This indicates a positive significant relationship between intrinsic motivation and job performance.

Model Summary

This model as shown from the results in Table 1 aims at determining the relationship between intrinsic motivation and job performance.

The analysis of result in Table 2 showed that intrinsic motivation and job performance has an R Square value of 0.032. This implies that the model indicates 3.2% of the total variance of the independent variable (intrinsic motivation). The implication of this study is that other factors not studied account for the remaining 96.8% of the variation in the dependent variable (job performance).

| Table 2 Summary of the Model the Correlation Between Intrinsic Motivation with Job Performance. | ||

| Model | R | R square |

| 1 | 0.178 | 0.032 |

| Source: Munyua (2017) | ||

ANOVA (Analysis of variance) to Establish the Relationship between Intrinsic Motivation and Job Performance.

The above Table 3 shows the analysis of (ANOVA) result for the model with intrinsic motivation as the independent variable and job performance as the dependent variable. The result shows that the model has a P-value of 0.015 < 0.05. This implies that there is significant relationship between intrinsic motivation and job performance.

| Table 3 Relationship Between Intrinsic Motivation and Employees’ Job Performance. | |||||

| Model | Sum of squares | Degree of freedom | Mean square | F | p-value |

| Regression | 1.485 | 1 | 1.485 | 6.076 | 0.015 |

| Residual | 45.200 | 168 | .244 | - | - |

| Total | 46.684 | 169 | - | - | - |

| Source: Munyua (2017) | |||||

Research question 2: Extent extrinsic motivation correlate with employees’ job performance in Ebonyi State University Micro-Finance Bank Limited.

The result of data analysis in Table 4 above shows that 62.9% of the 97 respondents strongly agree that extrinsic motivation enhances employee job performance, 18.6% agreed that extrinsic motivation predict employee’s job performance, 9% disagreed that extrinsic motivation influences employees’ job performance, while 9% also were undecided on the issue.

| Table 4 Percentage Response of Respondents on The Extent Extrinsic Motivation Predict Employees’ Job Performance | ||||

| Response | Frequency | Percentage % | Valid % | Cumulative % |

| Strongly Agree (SA) | 61 | 62.9 | 62.9 | 90.7 |

| Agree (A) | 18 | 18.6 | 18.6 | 18.6 |

| Disagree (D) | 9 | 9.3 | 9.3 | 27.8 |

| Undecided (U) Total |

9 97 |

9.3 100.0 |

9.3 100.0 |

100.0 |

| Source: Eneh (2016) | ||||

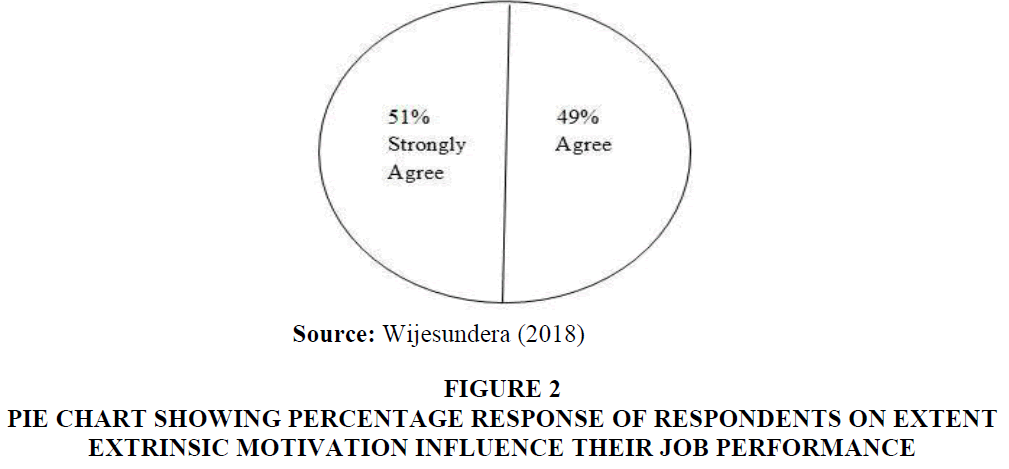

The respondents were asked to respond whether financial incentive had a positive influence on their motivation and work performance. The above pie chart revealed that 51% strongly agree and 49% agreed to eh statement. This implies that all the respondents agreed that extrinsic motivation has a direct impact on their work performance.

The below Table 5 shows the correlation coefficient used in determining the existence of a linear relationship between extrinsic motivation (independent variable) and employees’ job performance (dependent variable). Using Pearson Product Moment Correlation, the coefficient is 0.264. This indicates a positive correlation between extrinsic motivation (X) and employees’ job performance (Y) in EBSU (MFB) ltd.

| Table 5 Correlation Result on Extrinsic Motivation and Employees’ Job Performance | |||

| Intrinsic motivation | Employee job performance | ||

| Extrinsic motivation | Pearson Correlation | 1 | 0.264 |

| Sig. (2tailed) | - | 0.009 | |

| N | 97 | 97 | |

| Employee | Pearson Correlation | 0.264 | 1 |

| Job performance | Sig (2 tailed) | 0.009 | - |

| N | 97 | 97 | |

| Source: Eneh (2016) | |||

Research question 3: To what extent does intrinsic and extrinsic motivation differ as correlate of employees’ job performance in Ebonyi State University Micro-Finance Bank Limited.

The above Table 6 shows that 83% of the respondents agreed that intrinsic motivation positively correlate with their job performance while 100% of the respondents agreed that extrinsic motivation correlate with their job performance. Although p-value of 0.264 as indicated by the correlation between extrinsic motivation and employees’ job performance is higher than the p-value of 0.015 as indicated by the correlation between intrinsic motivation and employee’s job performance however, the difference is not significant. This implies that intrinsic and extrinsic motivation provided by organization positively relate with employee’s job performance.

| Table 6 Difference Between Intrinsic and Extrinsic Motivation as Correlate of Employees Job Performance | ||||

| Variable | Strongly agree | Agree | Undecided | Total |

| Intrinsic motivation | 66% | 17% | 17% | 83% |

| Extrinsic motivation | 51% | 49% | 0% | 100% |

| Source: Summary of the Figure 1 and 2 | ||||

Figure 1 Pie Chart Showing Percentage Response of Respondents on Extent Intrinsic Motivation Influence their Job Performance

Figure 2 Pie Chart Showing Percentage Response of Respondents on Extent Extrinsic Motivation Influence their Job Performance

Significance of the Independent Variable on Dependent Variable

This section aimed at finding out if there is any statistical significance between the dependent variable and independent variable

H1: Intrinsic motivation has no significant relationship with employee job performance in EBSU (MFB) ltd.

The above Table 7 shows the significance of independent variable (intrinsic motivation) on dependent variable (job performance). From the result, there is a significant relationship between intrinsic motivation (independent variable) and employees’ job performance (dependent variable) since it as a P-value of 0.015 < 0.05. The model coefficient that determines effect of intrinsic motivation on job performance is given as: 1.332 + 0.065 X1 = Y, where X1 is intrinsic motivation and Y is job performance. Therefore the null hypothesis was rejected.

| Table 7 Significance of Intrinsic Motivation on Job Performance | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients Beta | t | P-value | |

| B | Std. Error | ||||

| 1 (Constant) | 1.332 | .084 | 15.907 | .000 | |

| Intrinsic motivation | .065 | .026 | 178 | 2.465 | 0.015 |

| Source: Munyua (2017) | |||||

H2: Extrinsic motivation has no significant relationship with employee job performance in EBSU (MFB) ltd.

The test analysis result in Table 8 shows at calculated value of 2.667 while its P-value is 0.009 at 0.05 level of significance using two-tailed test, the t-table value is 1.980. The decision since the t-calculated value 2.667 is greater than the t-table value (1.980) after, the null hypothesis was rejected and it was concluded that extrinsic motivation has significant relationship with employees’ job performance in EBSU (MFB) ltd.

| Table 8 Significance of Extrinsic Motivation on Employee Job Performance | |||||

| Model | Unstandardized Coefficient | Standardized coefficient Beta |

t | Sig | |

| B | Std. Error | ||||

| Constant | 3.929 | .237 | 16.607 | .000 | |

| Extrinsic Motivation | .142 | .053 | .264 | 2.667 | .009 |

| Source: Eneh (2016) | |||||

H3: There is no difference between intrinsic and extrinsic motivation as correlates of employees’ job performance in Ebonyi State University Micro-Finance Bank Limited.

The result on Table 9 showed that intrinsic and extrinsic motivation has correlation coefficient P- values of 0.015 and 0.009 on employees’ job performance respectively indicating positive correlation. These values although different but the difference is not significant.

| Table 9 Differences Between Intrinsic and Extrinsic Motivation as Correlates of Employees’ Job Performance | |

| Variables | Correlation coefficient |

| Intrinsic motivation | P – value = 0.015 |

| Extrinsic motivation | P – value = 0.009 |

| Source: Summary of tables 7 and 8 above | |

Summary of Findings

The summary of result and findings of this study were presented in this chapter, conclusion, recommendation and suggestions for further studies were also highlighted here.

The purpose of this study was to investigate motivation as a correlate of employees’ job performance with particular reference to Ebonyi State University Micro-Finance Bank Limited. The study was guided by three research questions and three hypotheses.

Descriptive survey design was adopted for the study secondary data from published article online and unpublished academic thesis was used to state the known promises, themes and patterns in order to arrive at testable findings through adductive approach. The data were analyzed using percentage, pie chart, Pearson ‘r’ and ANOVA.

The findings showed that non-financial incentives (intrinsic motivation factors) like working conditions, job security, recognition, promotion, employee engagement and performance appraisal influence employees of EBSU ltd job performance positively which by further interpretation indicate a positive correlation between intrinsic and extrinsic motivation and employees’ job performance with correlation of 17.8% with R square of 0.32 and P-value of 0.015<0.05.

The study established that financial incentives (extrinsic motivation factors) such as salary, healthcare, commission housing and traveling allowances as well as bonus have direct impact on EBSU MB ltd employee’s job performance indicating that extrinsic motivation predict employees’ job performance with correlation of 0.264 with P- value of 0.009 < 0.05.

The study also find out that both intrinsic and extrinsic motivation positively correlate EBSU MFB Ltd employees’ job performance based on the p-values indicated above.

There are significant relationship between both intrinsic and extrinsic motivation and EBSU MFB ltd employees’ job performance.

Similarly the different between intrinsic and extrinsic motivation as correlates of EBSU MFB Ltd employees job performance was not significant.

Discussion of Findings

Research purpose 1: Extent intrinsic motivation predict employees’ job performance the findings revealed that intrinsic motivation has a positive correlation with employees’ job performance in EBSU MFB LTD. This finding was supported by Munya 2017 who established that intrinsic motivation contributed significantly to employees’ job performance in KenyaUnity Savings and Credit Cooperative Society Ltd. Also Inuwa (2016); Shrirang et al. (2021); Altekar (2021) found out that non-financial monetary incentives like job security, staff growth opportunity, employee engagement and so on increase employees’ job satisfaction and their job performance. Similarly, Khan et al. (2017) in their study established that fringe benefits, empowerment, recognition and good work environment enhance employees’ motivation to improve their work performance. This findings indicate that employees are motivated to perform their work better if there are adequate reward and vice versa.

Research Purpose 2: Extent extrinsic motivations predict employees’ job performance. The findings this study showed that extrinsic motivation has a positive correlation with employees’ job performance in EBSU MFB Ltd. The findings was corroborated by Eneh (2016); Nabi et al. (2017) who found out that salary, bonuses, commission and other allowances have positive correlation with employee’s productivity. This was supported by Wijesundera (2018) whose study indicated positive correlation between monetary incentives (extrinsic motivation) and employees’ job performance in a Dubai based semi-government Commercial bank.

Research Purpose 3: Difference between intrinsic and extrinsic motivation as correlated of employees job performance. This study found out that both monetary and non-monetary incentives positively correlate with employee’s job performance. Although the P-values of their correlation differ but not significantly. This finding was in line with Wijesundera (2018) who observed that employees ranked some non-financial and financial incentives highly as motivating indicators, which implies that both intrinsic and extrinsic motivation positively correlate with employees’ job performance. It can be inferred that employees should be motivated by these determinates in order to improve their performance.

Conclusion

Motivation as Predictor of Employees’ Job Performance

The findings of this study showed positive correlation and significant relationship between both intrinsic and extrinsic motivation with employees’ job performance. These are significant indicators that motivation predicts employees’ job performance. The study concludes that rewarding employees with appropriate intrinsic and extrinsic motivation factors will not only improve their performance but also promote their job satisfaction to remain in the organization.

Recommendations

Based on the findings, the researcher recommended that EBSU MFB Ltd should regularly access employees’ needs to ascertain what motivates them to put their best. Bank managers should also put in place robust financial and non-financial incentives for motivating employees to increased productivity for the organization’s local, national and global competitiveness.

Limitations

This study utilized secondary data from studies carried in Kenya and UAE banks where the working conditions have significant variation with the country under study that may influenced the motivation and performance of their employees. In order to gain more generalizability of the findings, further empirical studies should be conducted in banks within the area of study. However, EBSU MFB Ltd and other banks throughout the world can utilize the findings from the current research for better management of incentives motivate employees to enhance their job satisfaction and increase job performance.

References

Abdolshah, M., Khatibi, S.A.M., & Moghimi, M. (2018). Factors influencing job satisfaction of banking sector employees. Journal of Central Banking Theory and Practice, 7(1), 207-222.

Indexed at, Google Scholar, Cross Ref

Abdulkadir, H.G. (2020). Opportunities and challenges of Ethiopian oil seeds and pulses export performance. International Journal of Scientific and Engineering Research, 11 (7), 1505-1550.

Aja, S.N. (2016). Fundamentals of Educational organization and management. Lecture Monograph. Department of Educational Foundations Ebonyi state University, Abakaliki.

Altekar, S. (2021). Job Satisfaction and Motivation: Predictors of Employee Performance. International Journal of Modern Agriculture, 10(2), 27-36.

Donohoe, A. (2019). Employee performance.

Eneh, S.I. (2016). Employee performance and extrinsic reward in cement manufacturing firms in South-South, Nigeria: A study of United, Atlas and Ibeto firms. PhD Thesis Ebonyi state University, Abakaliki.

FXOGOR (2017). Difference between Microfinance bank and conventional banks.

Ketokivi, M., & Mantere, S. (2010). Two strategies for inductive reasoning in organizational research. Academy of management review, 35(2), 315-333.

Indexed at, Google Scholar, Cross Ref

Khan, A., Ahmed, S., Paul, S., & Kazmi, S.H.A. (2017). Factors affecting employee motivation towards employee performance: A study on banking industry of Pakistan. Proceedings of the 11th International Conference on Management Science and Engineering Management. 1(11), 615-625.

Krishnaswami, O.R. & Satyaprasad, B.G. (2010). Business research method. Girgoan, Mumbai: Himalaya Publishing House.

Kumar, D. (2020) Impact of workforce diversity on performance of employees in commercial banks of Mysore.

Lekic, S., Vapa-Tankosic, J., Mandic, S., Rajakovic-Mijailovic, J., Lekic, N., & Mijailovic, J. (2020). Analysis of the Quality of the Employee–Bank Relationship in Urban and Rural Areas. Sustainability, 12(13), 5448.

Indexed at, Google Scholar, Cross Ref

Munyua, K. M. (2017). Influence of intrinsic motivation on job performance and organisational commitment among the employees: case of k-Unity, Kiambu County, Kenya (Doctoral dissertation, University of Nairobi).

Mushtaque, T., Jodoon, I.A., Idress, R.N., Imram, A. & Rehman, Z. (2021). Workforce diversity and employee performance: A case of commercial banks in Pakistan. Humanities and Social Sciences Reviews, 9(3), 09-15.

Nabi, N., Islam, M., Dip, M.T. & Hassain, A. (2017). The impact of motivation on employee performances: A case study of Karmasangthan bank limited, Bangladesh. International Journal of Business Review, 5(4), 57-78.

Njuguna, S.G. Owuor, E. (2016). Factors affecting employees satisfaction in banking industries: case of consolidated banks of Kenya limited, Kenya. European Journal of Business and Strategic Management, 1(11), 51-69.

Octaviannand, R., Pandjaitan, N.K., & Kuswanto, S. (2017). Effect of Job Satisfaction and Motivation towards Employee's Performance in XYZ Shipping Company. Journal of education and practice, 8(8), 72-79.

Okoye, P.V.C. & Ezejiofor, R.A. (2013). The effect of human resources development on organizational productivity. International Journal of Academic Research in Business and Social Sciences, 3(10), 250- 268.

Oluwayomi, A.E. (2018). The impact of motivation on employee performance in selected insurance companies in Nigeria. International Journal of African Development, 5(1), 31- 42.

Omolo, P.A. (2015). Effect of motivationon employee performance of commercial banks in Kenya: Acase study of Kenya commercial bank in Migori County. International Journal of Human Resource Studies, 5(2), 87.

Peretomode, V.F. (1991). Educational administration: Applied concepts and theoretical perspectives for students and practitioners. Joja Educational Research and Publishers.

Shkoler, O. & Kimura, T. (2020). How does work motivation impact employees’ investment at work and their job engagement. Frontiers in Psychology, 11(38), 1-16.

Indexed at, Google Scholar, Cross Ref

Shrirang, A. Bharti, W. & Aakanksha, U. (2021). Job satisfaction and motivation: Predictors of employee performance. International Journal of Modern Agriculture, 10 (2), 27-36.

Uzonna, U.R. (2013). Impact of motivation on employees’ performance: A case study of Credit West Bank Cyprus. Journal of Economic and International Finance, 5(5), 199-211.

Wijesundera, L.K. (2018). The impact of motivation on employee performance: An exploratory case on Dubai based semi government commercial bank. MBA Dissertation Cardiff Metropolitan University, UK.

Received: 10-Jun-2022, Manuscript No. AJEE-22-12204; Editor assigned: 13-Jun-2022, PreQC No. AJEE-22-12204(PQ); Reviewed: 27- Jun-2022, QC No. AJEE-22-12204; Published: 30-Jun-2022