Research Article: 2022 Vol: 26 Issue: 3S

Municipal Bonds: A Bibliometric Analysis

Benny Hutahayan, Faculty of Law, University of Brawijaya

Citation Information: Hutahayan, B. (2022). Municipal bonds: a bibliometric analysis. Academy of Accounting and Financial Studies Journal, 26(S3), 1-22.

Abstract

Local governments are required to be able to increase the capacity of local governments in carrying out their duties as public servants as stated in Articles 57-62 of the Law on Fiscal Balance between Central and Regional Governments. The originality of this research is to map research related to Municipal Bonds with a bibliometric approach, especially with the R-Biblioshiny tool. This study aims to determine the development and trend ofresearch Municipal Bonds published by journals in the field of economics and finance business. The export data is then analyzed using the R Biblioshiny application program to find out the bibliometric map research developments related to Municipal Bonds. The results of the study show that the number of publications on the developmental role of economic research and finance continues to increase.

Keywords

Municipal Bonds Municipal Bonds, Bibliometrics, R-Applications, Fiscal, Decentralization.

Introduction

The economic crisis raises several problems that must be faced by local governments; the main economic issue is fiscal sustainability to finance regional economic development. This problem arose as a consequence of the issuance of Law No.22 of 1999 on Regional Government and Law no. Law 25 of 1999 concerning Fiscal Balance between the Central Government and Regional Governments, accompanied by the emergence of Law no. 32 of 2004 and Law No. 33 of 2004. With the emergence of this law, it is hoped that local governments have wider authority to develop potential and resources in order to improve people's welfare. The year 2001 was the beginning of fiscal decentralization and regional autonomy in Indonesia, where the Regency and City Governments as well as the Provincial Governments in Indonesia basically had a big responsibility in providing public facilities. Most of the public facilities or government projects and activities that were previously handled and financed by the central government will now be the burden of local governments. Such as public works, health, education and culture, communication, agriculture, environment and labor.

Thus, the challenge for local governments in the era of fiscal decentralization is to be able to increase the capacity of local governments in carrying out their duties and responsibilities well as public servants. Not only the capacity of the Regional Government in managing expenditures or expenditures but also in order to increase revenues (revenue) to finance development and improve community welfare.

Fiscal decentralization in Indonesia is guided by Law No. 33 of 2004 concerning the financial balance between the central government and regional governments where in article 5 paragraph (1) it is stated that the sources of Regional Revenue in the implementation of decentralization can be obtained consisting of Regional Revenues and Financing. Regional income as referred to in paragraph (1) comes from: Realization of Regional Original Revenue (PAD), balancing funds and other legitimate regional revenues. The financing as referred to in paragraph (1) shall come from: SILPA (the remaining excess of the previous year's budget), regional loans, reserve funds and proceeds from the sale of regional assets. Article 57-62 of the Law on Fiscal Balance between the Central and Regional Governments regulates the possibility of the government issuing regional debts/bonds. This will provide an alternative solution for local governments in order to finance development by issuing these regional bonds. But not all local governments can issue these bonds; there are strict regulations that must be met by local governments to issue regional bonds. The mechanism for issuing bonds is complex, requires high costs and there is a possibility that local governments will fail (default). Only a few local governments that have good fiscal capacity can issue regional bonds. Therefore, in order to determine the choice of development projects to be financed from regional bonds, they must have a return of investment, so that they will not burden the Regional Revenue and Expenditure Budget (APBD) (Setiadi, 2016).

Regional Governments can issue Regional Bonds only to finance public sector investment activities that generate revenue and provide benefits to the community which are the affairs of the Regional Government based on applicable laws and regulations. The bonds issued can be used to finance several different activities. Regional government activities that can be financed with regional bonds include: (a) drinking water services; (b) handling of waste and waste; (c) transportation; (d) hospital; (e) traditional market; (f) shopping areas; (g) entertainment centers; (h) tourism and nature conservation areas; (i) terminals and sub-terminals; (j) housing and flats; and (k) local and regional ports.

Research on topics related to Municipal Bonds has been relatively widely carried out by researchers such as those conducted by (Cebula, 2020; Chen et al., 2011; Drukker et al., 2020; Fomin et al., 2019; Cebula, 2018). In a study conducted by Cebula (2020) which investigated the effect of the interest rate on the federal budget deficit and various other control variables and obtained the results that federal policy had a very important impact on the municipal bond market. However, there is still very little or almost no research that tries to map research related to Municipal Bonds with a bibliometric approach, especially with the R-Biblioshiny tool. This study aims to map out authors, countries, journals, topic clusters and several other bibliometric identifications related to Municipal Bonds to fill the research gap.

Literature Review

Law Number 33 of 2004 concerning Financial Balance between the Central Government and Regional Governments, opens up opportunities for regions to obtain alternative funding through the issuance of regional bonds. This statement is explicitly stated in Chapter VIII, the seventh part on regional bonds. However, these opportunities have not been matched by the readiness of the Regions to manage and organize: (1) their internal organizational instruments; (2) its relationship with external parties. According to Saparie (2008) management and arrangement not only determine the steps for issuing regional bonds, but also prepare from pre-activities to post-issue regional bonds.

Regional bonds according to the Regulation of the Minister of Finance Number 147/PMK.07/2006 concerning Procedures for Issuance, Accountability, and Publication of Information on Regional Bonds, the definition of regional bonds is Regional Loans offered to the public through public offerings in the capital market. This understanding is in accordance with the definition of regional bonds in Government Regulation number 54 of 2005 concerning regional loans. Regional Bonds are debt securities issued by regional governments that are offered to the public through public offerings on the capital market. These bonds are not guaranteed by the Central Government (Government) so that all risks that arise as a result of the issuance of Regional Bonds are the responsibility of the Regional Government. Issuance of debentures is evidence that the local government has made loans/debts to the holders of the bonds. The loan will be repaid according to the agreed terms and conditions. Local governments that issue regional bonds are obliged to pay interest periodically in accordance with a predetermined period of time. At maturity, local governments are obliged to return the principal of the loan.

Thus, the local government's plan to issue regional bonds creates a very interesting situation, as the regional autonomy taps are opened, especially with the issuance of Law No. 33 of 2004 concerning Central and Regional Financial Balance and Minister of Finance Regulation No. 147/PMK.07/2006 concerning Issuance Procedures. , Accountability, and Publication of OD Information. Financing through the issuance of bonds is indeed a relatively cheap alternative to financing and the funds that can be obtained are quite large, but all of this will be accompanied by many consequences that must be met by the regional government as anissuer.

The purpose of the issuance of Regional Bonds is to finance a public sector investment activity that generates revenue and provides benefits to the community. For this reason, it should be noted that the issuance of bonds is not intended to cover regional cash shortages. Regional Bonds will be traded on the domestic capital market in accordance with the capital market laws and regulations.

In a journal compiled by (Brune & Liu, 2011). This journal conducted a study entitled “The contagion effect of default risk insurer downgrades: The impact on insured municipal bonds”. This journal discusses regional bonds which are often insured by insurance companies that promise to pay investors if there is a default on the part of the issuer. However, just as the financial strength of an insurer can provide assurance to investors, questions about the stability of an insurer can raise investors' concerns. This paper considers three major downgrades of large municipal bond insurers and the effect of each downgrade on a large sample of municipal bonds. The results reveal a widespread effect: not only is the risk premium on bonds insured by the downgraded insurance company affected, but also the risk premium on bonds insured by other insurers.

Another journal compiled by Kalotay & Abreo in 2017. This journal conducted a study entitled “Municipal bond insurance: identifying the best payment plan”. This journal discusses the volume of municipal bond insurance decreased dramatically after the 2008 financial crisis. Insurance is now recovering gradually. Two related considerations complicate the identification of the best insurance plan. One is the current practice in municipal markets of issuing repurchasable bonds with above-market coupons; the bonds are very likely to be returned. The other is that the cost of insurance may depend on when the bonds are returned. This paper shows how contemporary fixed income analytics can be applied to identify the best payout plan. Refund time is an important determinant of which premium payment plan is the best deal. For certain bond structures, the probability of a refund favors a plan that is contingent on that event.

From the Journal of Financial Services Research, (Daniels & Vijayakumar, 2001) conducted a study entitled "The Competitive Impact of Commercial Bank Underwriting on the Market for Municipal Revenue Bonds". This journal examines the impact of the entry of commercial banks in the local revenue bond market. We show that issues borne by commercial banks have lower underwriting spreads but do not yield lower returns than issues borne by non-bank investment firms. In particular, this is more significant for non-investment grade bonds guaranteed by commercial banks. Our results are consistent with the interpretation that bank entry has resulted in increased competition in the municipal income bond market and that the lower yields observed for bank-insured commercial bonds may be due to banks holding private information. Overall, our results suggest that policy changes leading to easing of the restrictive provisions on underwriting local revenue bonds have a beneficial effect.

Table 1 presents a comprehensive synopsis of the 25 selected articles based on the topic, objective, findings, and recommendation. The data presented was critical for the eligibility assessment of each article (Ahlgren et al., 2003).

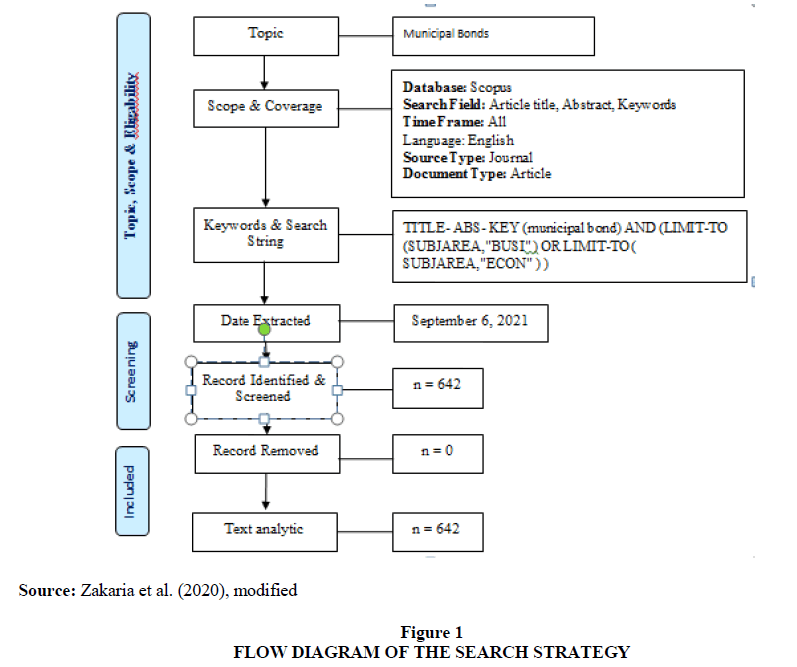

The review process was carried out on September 6, 2021. Figure 1, illustrates the three steps in identifying research documents, namely eligibility, screening, and inclusion, which are involved in the systematic review process. The keywords that will be used in this study try to answer the research questions in the introduction. Some general statistics from the data set are presented to get an overview of research related to good governance. All articles that met the search query were evaluated from the text analysis aspect.

Then the research documents were analyzed using the bibioshiny software, a free software supported by the R environment (CRAN, The Comprehensive R Archive Network, https://cran.r-project.org/ ) which provides a set of tools for quantitative research in bibliometrics and scientometrics. In the bibliometric literature, the greatest attention is on the construction of bibliometric maps. Next, a text analysis of the results of bibliometrix mapping related to keywords will be carried out.

Results and Discussion

Source

Following a table of the types of documents used in the research with the keywords Municipal Bonds The number of documents analyzed were 642 documents which were divided into 4 types of documents, including journal articles (495 documents), anthology/book chapters (106 documents), conference papers (11 documents), and reviews (30 documents) Table 1.

| Table 1 Document Type Document |

|||

|---|---|---|---|

| No | Type | Number of Articles | Percentage |

| 1 | Journal Article | 495 | 77.10% |

| 2 | Book Chapter | 106 | 16.51% |

| 3 | Conference Paper | 11 | 1.72% |

| 4 | Review | 30 | 4.67% |

| Total | 642 | ||

Based on the results of the grouping of document types above, the most widely used document types as research subjects with the keyword "Municipal Bonds" are documents in the form of journal articles with a percentage of 77.10% or as many as 495 documents, and documents with the lowest percentage are conference papers where the percentage is 1.72% or as many as 11 documents. Based on the type of document, it can be concluded that the references used are quite valid because most of them come from Scopus indexed scientific journals.

Text Analysis

Text analysis was performed using R-studio and biblioshiny software developed by Massimo Aria and Corrado Cuccurullo from the University of Naples and Luigi Vanvitelli from the University of Campania (Italy). Text analysis was carried out by analyzing more deeply the search related to words that often appear in the Municipal Bonds theme. This is intended to add references that can be made by the government in tackling economic problems based on existing studies from all over the world.

To explore the results of the meta-analysis, in this section a visual mapping chart of 642 documents related to Municipal Bonds will be presented. The results of the keyword mapping analysis become the basis for mapping together important or unique terms contained in certain documents. Mapping is a process that enables one to recognize elements of knowledge and their configuration, dynamics, interdependencies and interactions.

Sources Analysis

Most relevant sources

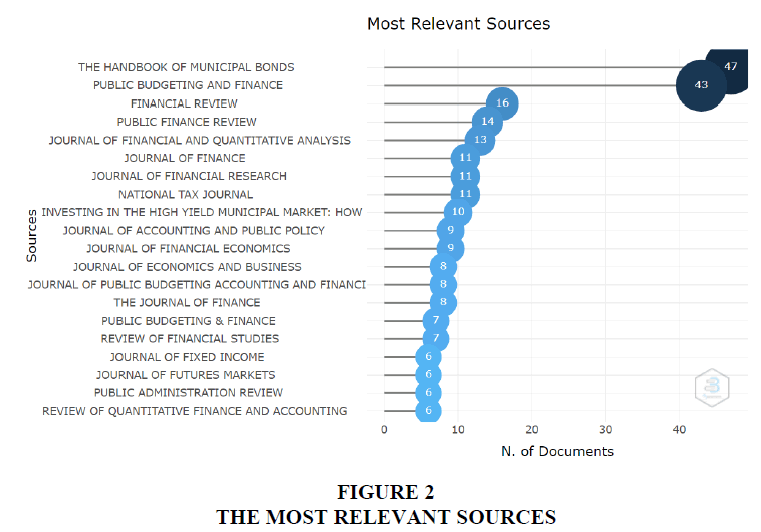

Figure 2 above shows the number of research documents published by each journal based on their level of relevance to the Municipal Bonds theme. In economics and business research. The data displays a list of the names of the top published journals and the interval of the number of documents published with a blue bar chart. The darker the blue color shows the more quantity and relevance of the research theme, the number of documents published by all journals ranges from 0 to 47 documents Figure 2.

The Handbook of Municipal Bonds is a journal that is in the top position with a total of 47 documents published in a dark blue bar graph compared to other journal bars. This is because the journal is relevant to the theme discussed. An example of a paper published by The Handbook of Municipal Bonds is a paper entitled “Managing a national municipal bond fund” written by (Grant, 2011). The paper presents the questions investors should ask in selecting the total return on national municipal bond funds and how portfolio managers make trading decisions for such funds which are particularly high investment levels in structure and relatively long duration. This chapter discusses other aspects of national funds including seeing national funds through the eyes and expectations of investors and why investors would choose national funds over state-specific funds or high-yield funds. The interests of shareholders should be the main concern of portfolio managers. This means that portfolio managers must always keep shareholders in mind when executing long-term strategies. As noted in this chapter, in managing funds, long-term strategies can be influenced by other market participants and their views of the city world on any given day.

Source impact

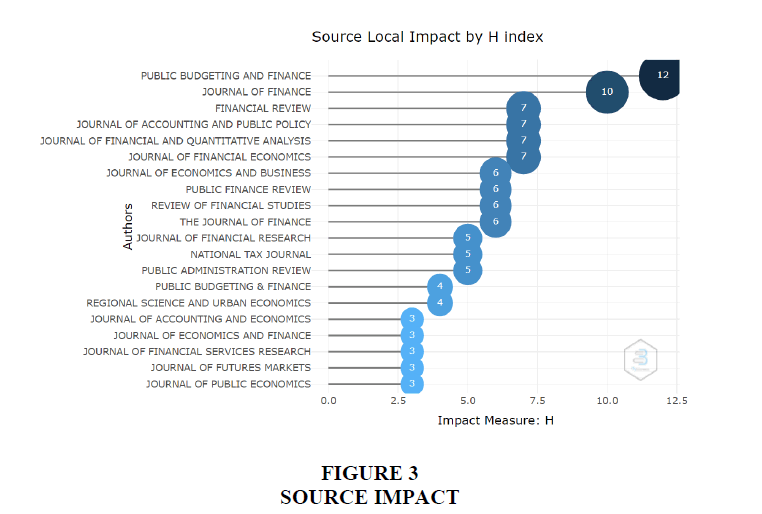

Journal calculations are not only based on the quantity produced or its relevance. However, this research was also conducted based on the impact of each journal that publishes a paper on the theme of Municipal Bonds by calculating the h index of the journal which is depicted in the blue bar graph. In addition to showing the h-Index value obtained, the diagram above also illustrates the impact generated by the journal through the blue color displayed. The darker the blue in the chart, the greater the impact of the journal. Then the journal h-index interval in this study ranged from 0.0 to 12.0 Figure 3.

From the data above, it can be seen that Public Budgeting and Finance is in the top position with an H index of 12.0 which is marked in dark blue. Furthermore, it can be seen that the Journal of Finance is in second place with an hIndex of 10.0. Meanwhile, for journals with an hIndex 3.0, there are 5 journals marked with a bright blue color on the diagram, which indicates the low impact of the journal(Ridzuan et al., 2021)..

The journal with the highest impact is Public Budgeting and Finance. Public Budgeting and Finance serves as a forum for the communication of research and experience in all aspects of government finance and provides a meaningful exchange between research from universities, private and not-for-profit research institutions, practitioners in public finance markets, government agencies, and the experience of those practicing government budgeting and finance. Applied government finance researchers, practitioners and teachers turn to Public Budgeting & Finance to find understandable, reliable and thoughtful analysis of key issues in the field. The content of the journal covers the spectrum of budget and policy processes and financial management, is never limited to one level of government or even one country, and is always evenly distributed across disciplines and approaches in applied government finance. It is this focus that fits the theme of Municipal Bonds because it is still within the scope of the discussion of public finance, so this journal achieved the highest h-index value and became the journal with the most impact on the literature reviewed in this study.

Source Growth

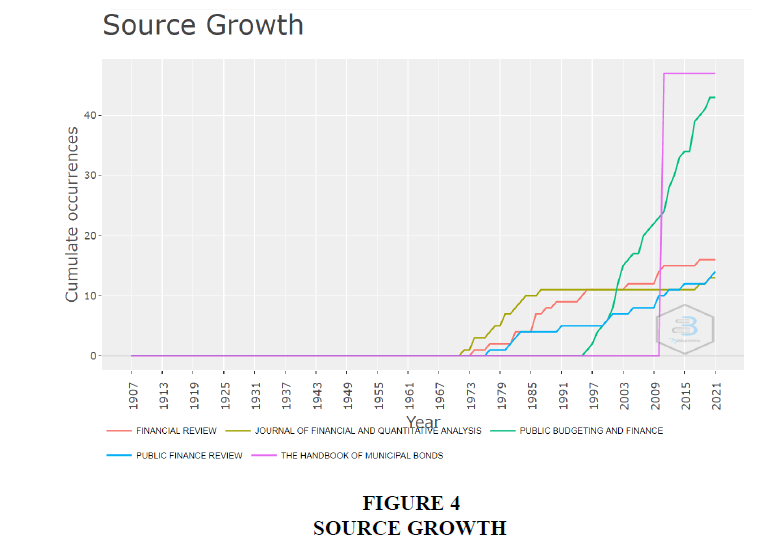

This study also discusses the development of journals that become research sources on the theme of Municipal Bonds in economics and business research. The curve above shows the development of the annual appearance of each journal from 1907 to 2021, so that an illustration is obtained of whether the journal has increased or decreased with a curve line during the research period, especially in the publication of papers with the theme of Municipal Bonds. The curve illustrates that research with the theme of Municipal Bonds in economics and business research tend to experience volatile growth in publishing Figure 4.

From the curve above, it can also be seen that there are 2 journals which in 2021 will be at their highest peak. The Handbook of Municipal Bonds appeared in 1907 but stagnated until 2009, but from 2010 it grew rapidly to reach the top of the highest issuance, but not long after, it stagnated again until 2021. Then Public Budgeting and Finance began to appear in 1996 and continues to experience significant development every year until 2021, and has the potential to experience development in the following years (Boyack et al., 2005).

Authors Analysis

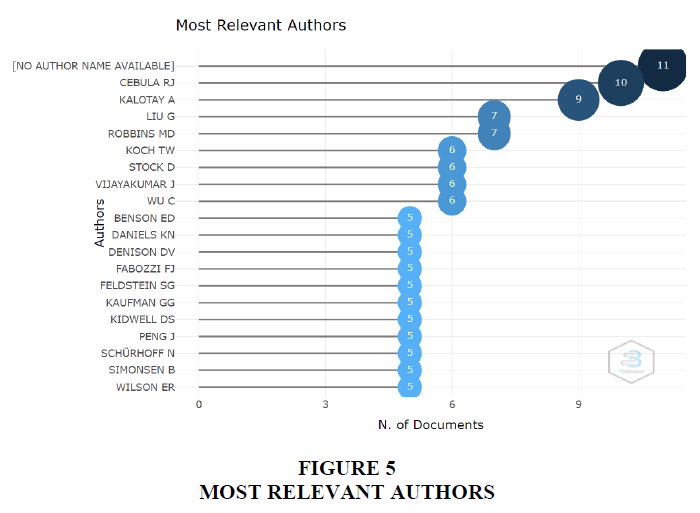

Most relevant authors

Figure 5, shows the number of research documents published by each author based on their level of relevance to the Municipal Bonds theme. in economics and business research. The data displays a list of the names of the top published authors and the interval of the number of documents published with a blue bar chart. The darker the blue color indicates the more quantity and relevance of the research theme, the number of documents published by all journals ranges from 0 to 11.0 documents, with a total of 20 authors listed in the most relevant data sources.

Author Cebula RJ is the writer who is in second place with a total of 10.0 documents published because at the top position it is not recorded who the exact author wrote regarding municipal bonds. Cebula RJ became the second largest writer because the journal was relevant to the theme discussed. Among his writings is a paper entitled "Reflections on and inquiry into unfamiliar as well as familiar factors that may influence the market for municipal bonds" which discusses the impact of various factors on ex ante real interest rate yields on high quality municipal bonds. The AR/2SLS estimate implies that this ex ante real interest rate is a function of increasing the ex-ante real interest rate yield on thirty-year Treasury bonds while a function of decreasing net capital flows. The results in question were also found to have been negatively affected by the Deregulation of Depository Institutions and the Monetary Control Act. Further, the estimate finds that this measure of the interest rate is a decreasing function of the maximum marginal federal personal income tax rate. Moreover, it is found that, given the interaction term, the ex-ante real interest rate yield in high-class municipalities is an increase function not only of the budget deficit but also of the aggregate tax gap (Wu, 1991).

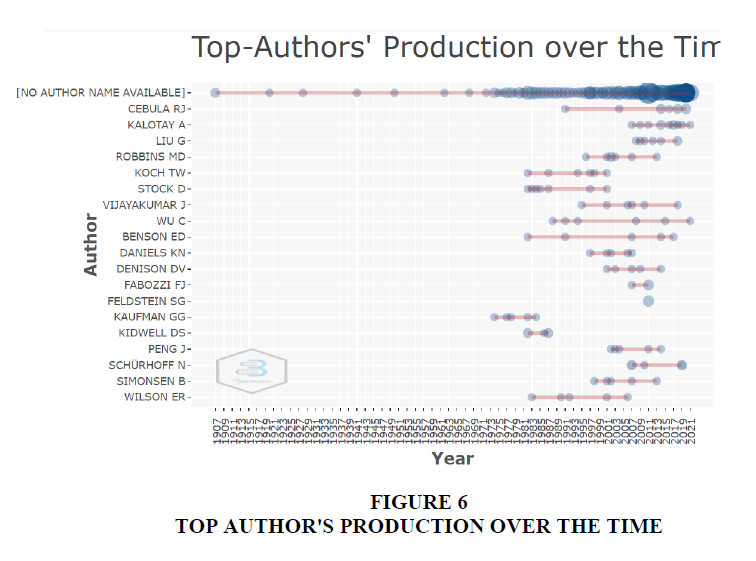

Top Author’s Production over the Time

Productivity can not only be measured in journals but specifically for writers. Where in the picture above shows the productivity of several top writers during the research period, namely from 1907 to 2021. This productivity is indicated by a red line since the author published his research until the last year the author published his research. In addition, the circle on the red line shows the number of papers published according to the applicable year Figure 6.

The image above presents an overview of the authors who have written research related to the theme of Municipal Bonds in economics and business research for the past few years. Author who has been publishing for a long time and has a long track record in research related to Municipal Bonds in economics and business research, namely Wu C from 1987 to 2021, he is still productive in writing. With a paper entitled "A Certainty Equivalent Approach to Municipal Bond Default Risk Estimation" published by the Journal of Financial Research in 1991. This paper expands the default risk neutrality model for regional bonds to consider the effect of risk aversion on the estimated probability of default. A model is proposed to separate default risk assessment from investor risk aversion. Empirical results show that the risk neutrality model consistently overestimates the default probability but the magnitude of this overestimate is generally small and not statistically significant (Surachman & Setiawan, 2016).

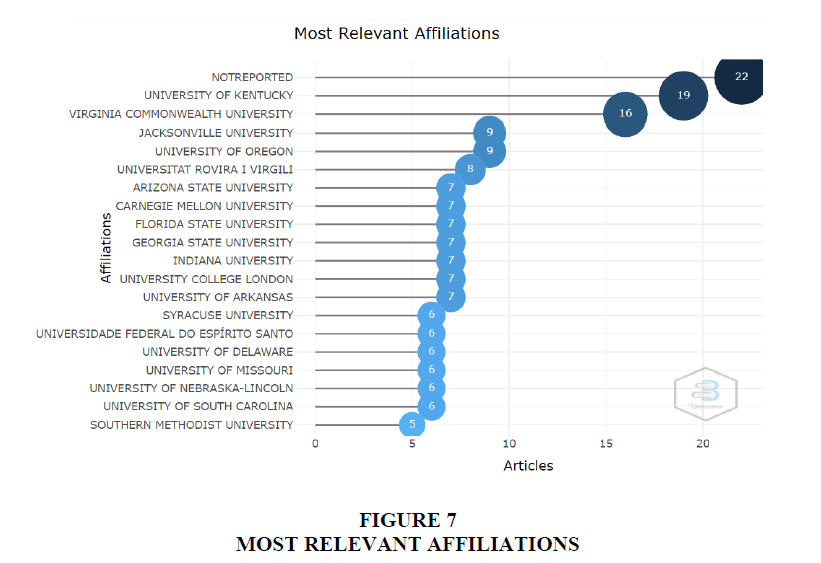

Most Relevant Affiliations

Most relevant affiliations show the number of research documents with the theme Municipal Bonds in economic and financial research based on the author's affiliation. The figure shows the top 20 affiliates and the number of published document intervals with a blue bar chart. The darker the blue color indicates the more affiliation of the researcher. The number of published documents ranged from 0 to more than 22 documents Figure 7.

Not reported is the author's affiliation in the top position with the number of publications of more than 22 documents. In second place is the University of Kentucky with 19 documents published. Journals The University of Kentucky partners with various parties in the UK community to publish an open access journal. We provide editors with a specially designed journal site and an efficient online publishing system to streamline the editorial process. Journals hosted by the British Library have high online visibility thanks to search engine optimization, and authors receive a monthly report on the number of downloads of their articles. In addition, the British Library undertakes long-term preservation of published content to ensure lasting access to them in the future.

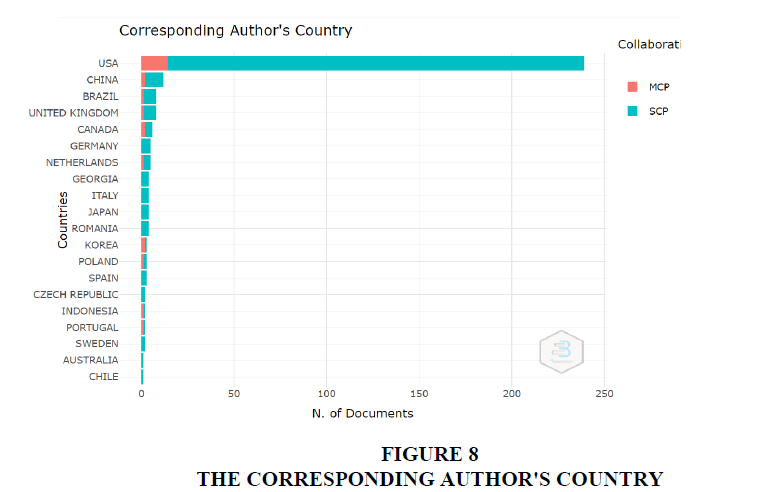

Corresponding Author’s Country

Picture above shows the author's correspondence countries contained in each article by calculating the total form of collaboration between SCP (single country collaboration) or collaboration of one country and MCP (multiple country collaboration) or collaboration between several countries. There are top 20 countries included in this data and the document quantity ranges from 0 to more than 235.0 paper documents issued with the theme of Municipal Bonds. The results obtained are that the USA is ranked first as the country with the highest number of correspondent authors with more than 235.0 published papers. Then the second place was won by China. The rest, other countries published papers under 50.0. The picture above shows that countries in the world have the same number of MCP and SCP collaboration forms, namely 10.

One of the papers with the author is from the USA, namely a paper entitled “Municipal bond insurance: identifying the best payment plan” written by (Kalotay & Abreo, 2017). The paper discusses the volume of regional bond insurance decreased dramatically after the 2008 financial crisis Figure 8. Insurance is now starting to recover gradually. Two related considerations complicate the identification of the best insurance plan. One of these is the current practice in municipal markets of issuing bonds that can be purchased with above-market coupons; the bonds are very likely to be returned. The other is that the cost of insurance may depend on when the bonds are returned. This paper shows how contemporary fixed income analysis can be applied to identify the best payout plan.

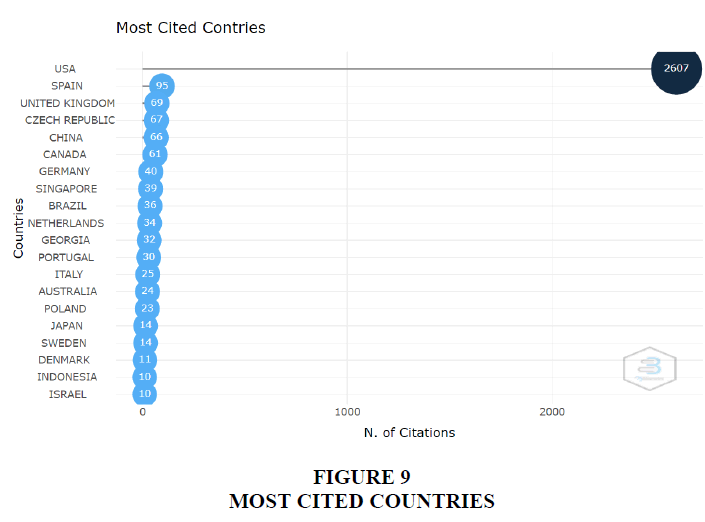

Most Cited Countries

This study also classifies research with the theme of Municipal Bonds based on the country of origin of the most cited authors. The number of published document citations is shown through a blue bar chart. The blue gradation indicates that the darker blue indicates the greater the quantity of citations in the Municipal Bonds study. There are several words with the number of occurrences between 0 and more than 2607 occurrences. The top 20 countries listed are marked with a blue diagram showing a comparison of the number of citations and their relevance to the Municipal Bonds theme in economics and business research.

Based on the graph above, the country with the most cited articles is the USA with a total of 2607 citations. Then followed by Spain and the United Kingdom in second and third place. Among the papers from the USA that are the most active countries are the paper written by Chen et al. (2011), entitled Tax calendar effects in the municipal bond market: Tax-loss selling and cherry picking by investors and market timing by fund managers. This paper discusses municipal bond returns, bond fund flows and purchasing activities by fund managers during the period 1990-2009, we find evidence of rational opportunistic trading patterns related to the tax calendar by fund investors and fund managers. In particular, mutual fund shareholders conduct tax loss sales in December and reinvest in January. In April, June, and September, fund investors rationally choose to sell their short-term bond fund shares rather than their long-term bond fund shares to raise cash to pay estimated taxes. Unlike fund shareholders, fund managers adopt a contrarian strategy of buying in December and selling in January (Zedan et al., 2020).

Documents Analysis

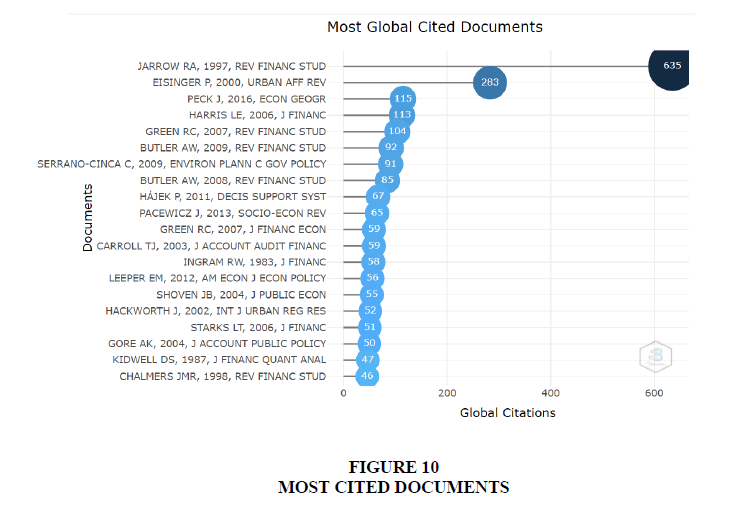

Most cited documents

Most cited documents show the order of citation data for articles in the Municipal Bonds theme which contains the name of the author, year of publication and the journal that published in the form of a blue bar chart. The darker the blue, the greater the number of citations. The number shown in the total citations is between 0 and more than 635. It was found that Jarrow et al. (1997) became the article with the top citation of more than 341 citations Figure 10. Paper entitled “A Markov model for the term structure of credit risk spreads” This article provides a Markov model for the term structure of credit risk spreads. This model is based on Jarrow et al. (1997), with the bankruptcy process following a Markov chain of discrete state spaces in credit ratings. The parameters of this process are easy to estimate using observable data. This model is useful for pricing and hedging corporate debt with embedded options, for pricing and hedging OTC derivatives with counterparty risk, for pricing and hedging government (foreign) bonds that are subject to default risk (e.g. municipal bonds), for pricing and hedging credit derivatives, and for risk management. This article presents a simple model for assessing risky debt that explicitly includes a company's credit rating as an indicator of the likelihood of default. Thus, this article presents an arbitrage-free model for the term credit risk spread structure and its evolution over time. This model will prove useful for pricing and hedging corporate debt.

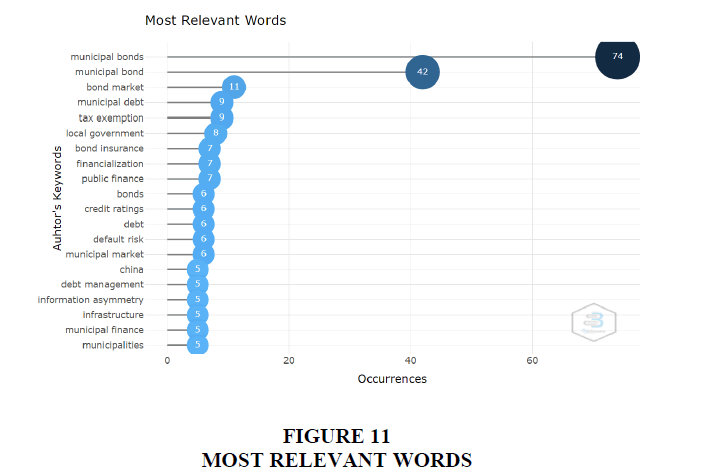

Most Relevant Words

Most relevant word analysis was carried out on keywords from each document, where there were several words with a number of occurrences between 0 to 74 times. The image above shows the 20 most relevant words used in the research collection related to the keyword “Municipal Bonds”. The top word with the most number of occurrences and most relevant to the keyword Municipal Bonds is the word municipal bonds itself, with the highest number of occurrences 74 times. The second most relevant word related to the theme of Municipal Bonds namely the bond market with 11 appearances. Furthermore, the third and fourth most relevant words relate to the theme of Municipal Bonds with the occurrence of the word 9 times, namely the word municipal debt and tax exemption Figure 11.

The study, entitled Social Capital and the Municipal Bond Market (Li et al., 2018) explains the influence of social capital on the local bond market. Defined as norms and networks that encourage cooperation, social capital is a social construct that captures a region's level of altruism, trust, and propensity to honor obligations. We expect that cities with high social capital are more trustworthy and inclined to honor their debt obligations, which will result in lower bond yields. Our findings confirm that bonds issued by municipalities located in high social capital districts show lower yields compared to municipalities located in low social capital districts. Our findings are also supported by bond prices in the secondary market, which indicates that bonds from municipalities located in high social capital areas have higher prices. Additional tests reveal that the effect of social capital is stronger for general bonds, suggesting that social capital is more important for bonds where municipal willingness to pay taxes is an important factor. Finally, we document that municipal bonds in areas of high social capital tend to be uninsured, suggesting that social capital can act as a substitute for bond insurance.

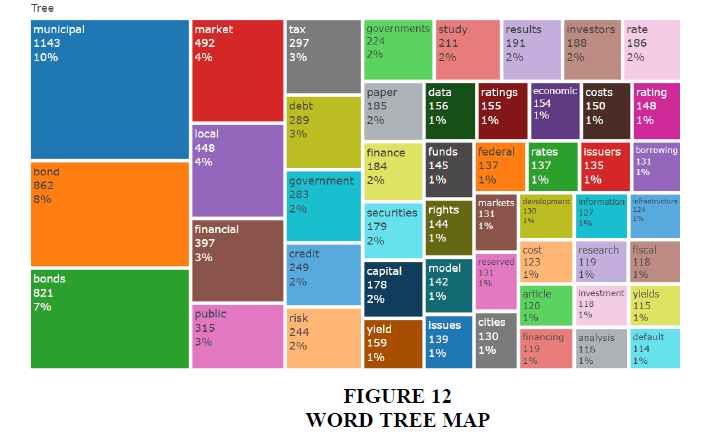

Word Tree Map

Next will be displayed the words relevant to the research related to the theme of Municipal Bonds on an abstract document in the form of a word tree map. Word Tree Map displays words that often appear in boxes similar to regions on a map, where the more words that appear, the larger the square area.

Based on the results of the analysis of the document abstract, it was found that the most dominant word for research with the theme of Municipal Bonds i.e. Municipal, Bond, Bonds, Market, Local, Financial, Public Most of the research related to the theme of Municipal Bonds currently discussing about “Municipal”. This is because the word "municipal" is relatively closely related to regional problems that occur in the world Figure 12.

Research conducted on Municipal Bonds including the title The community reinvestment act and real municipal bond interest rate yields in the united states: evidence from the municipal bond market (Cebula, 2020) which discusses the validity of the claim by the US Office of the Comptroller of the Currency (2014) that The Community Reinvestment The Act of 1977 may have acted to reduce the interest rate on high-level municipal bonds in the United States. The model also investigates the interest rate effect of the federal budget deficit (as well as a variety of other control variables). Estimates for the 1973–2016 study periods reveal that the Community Reinvestment Act of 1977 may have reduced ex post real interest rate yields in high-class municipalities. The evidence also implies that the ex post real interest rate yield in high-class municipalities has been a function of increasing the federal budget deficit (expressed as a percent of GDP).

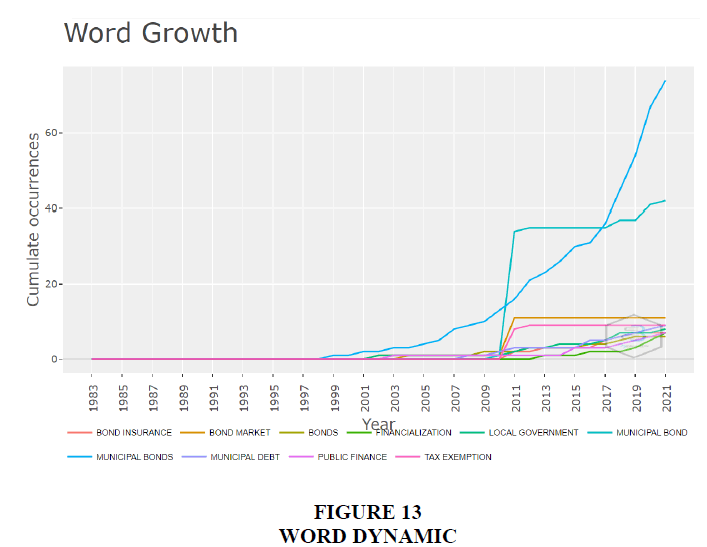

Word Dynamic

Based on the image analysis of keyword documents, in a study with the theme of Municipal Bonds, words that often appear are also described in the form of a development curve each year with an annual occurrence value. Where these results indicate the average quantity of the occurrence of these keywords in the data collection studied in research with the theme Municipal Bonds every year. Figure 13 shows that the majority of words that appear frequently and began to develop since 1983, and continue to increase until 2021. From the figure above, it can be concluded that the research with the most significant increase in occurrence is keywords related to Municipal Bonds. and has very significant potential for continued growth.

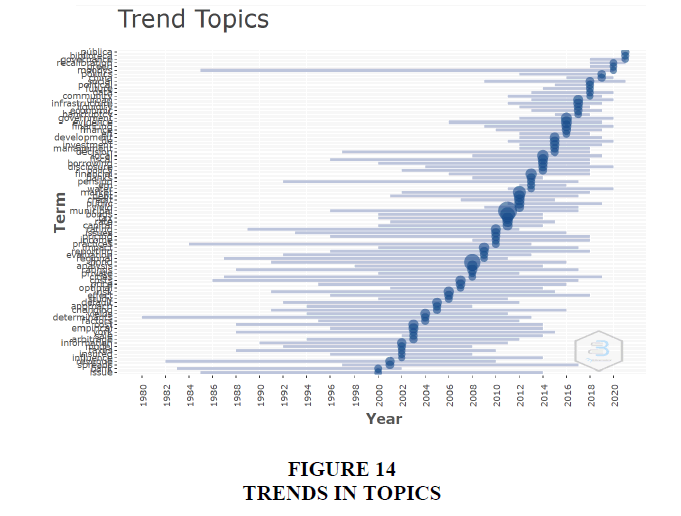

Tren Topics

Based on the analysis of the results of the analysis of document titles in research with the theme of Municipal Bonds, Trends in topics are also an important part of this research. Where the picture above shows and overview of the development of topics related to Municipal Bonds from time to time with the division per year, so it is known what topics have been used for a long time and what topics have been used recently? The trend of this topic also considers the frequency value of each word indicated by the log axis Figure 14.

So, apart from looking at annual trends, topic occurrences are also adjusted to the frequency with which words appear in research themes related to Municipal Bonds. The higher indicates the more the word is used, and the further to the right, the more recently the word was used. Municipal Bonds theme development began to experience a significant increase since 1988. Based on the description of the data above, the most recent and most widely used topics are related to the theme of Municipal Bonds namely Public, Governance. The word governance is most widely used in 2018-2021 because the theme of governance is closely related to current world government problems. The journal entitled “The effects of high-quality financial reporting on municipal bond ratings: evidence from US local governments” written by Park et al., (2020) discusses credit rating agencies mentioning that government factors are one of the criteria for assessing local government bond ratings, recent studies on credit ratings offer relatively little evidence of how government factors affect local government bond ratings, compared to socioeconomic and financial factors. By utilizing the Certificate of Achievement for Excellence in Financial Reporting Program award from the Government Finance Officers Association as an indicator of high quality financial reporting, we found that the quality of financial reporting is one of the important factors that determine the rating of local government bonds. We also show that the repeated act of providing high-quality financial reporting is invaluable to cities by increasing market credibility and thereby increasing rankings.

1. Cluster 1 consists of keywords: Financial, Issues, Investment, Capital, Financing, Government, Finance, Public, Debt, Infrastructure, Local, Urban, Fiscal, Development, Markets, City

2. Cluster 2 colored green consists of keywords: Analysis, Empirical, Performance

3. Cluster 3 purple color consists of keywords: Municipal, Bond, Bonds, Tax Exampt, Revenue, Rate, Tax, Effect, Cost, Market, Credit, Risk, Yields, Yield, Effect, Default, Insurance, Disclosure, Information, Pricing, Rating, Funds, Ratings, Evidence, Role, Price.

4. Cluster 4 blue color consists of keywords: Rates, Costs, Borrowing, Impact

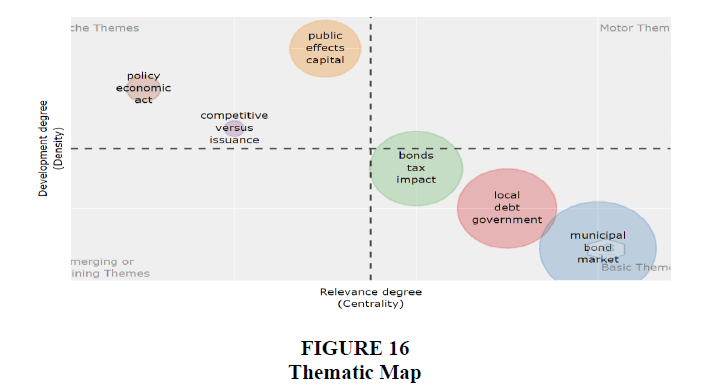

Thematic Map

This research will also a thematic map analysis that appears based on density and centrality is analyzed based on the title of the document with the research theme Municipal Bonds which is divided into 4 quadrants. This result is obtained from a semi-automatic algorithm by reviewing the titles of all references to the object of research. The upper left quadrant is a highly developed and isolated themes. Quadrants show specific themes and are rarely studied, but have high development, which is indicated by high density but low centrality. The themes in this quadrant are Public, Effects, Capial, Policy, Economic, Act, Competitive, Versus, Issue. While the lower left quadrant represents emerging or declining themes, this quadrant shows themes that have been used for a long time but experience an increasing or decreasing trend with low density and centrality. However, no themes have emerged regarding Municipal Bonds in this quadrant Figure 16.

The upper right quadrant is a motor theme or a driving theme which is characterized by high density and centrality, so it needs to be developed and is important to be studied in further research. However, no themes have emerged regarding Municipal Bonds in this quadrant. Finally, the lower right quadrant is the basic and transverse themes which are characterized by high centrality but low density. These themes are important to be included in the research because they are general topics that are commonly used. The themes that appear in this quadrant are Bonds, Tax, Impact, Local, Debt, Governance, Municipal, Bonds, Market.

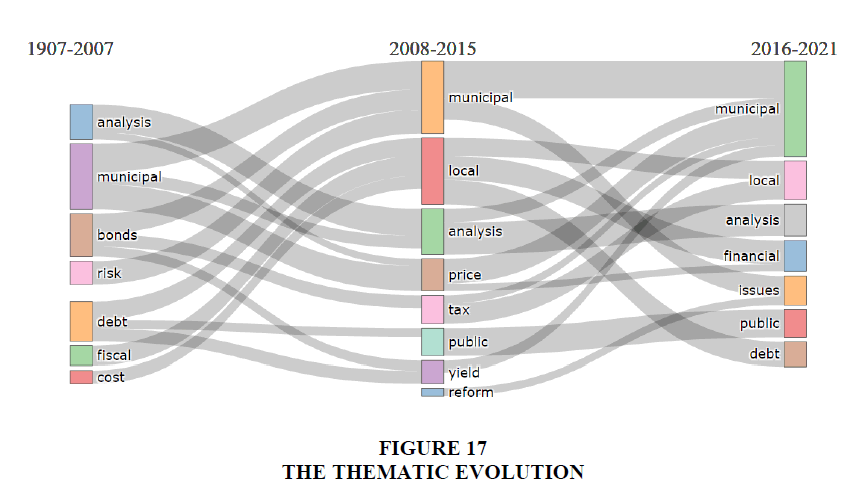

Thematic Evolution

Themes used in the research paper are constantly changing, especially from recently published papers compared to papers that have been published for a long time. The image above shows the evolution analyzed by theme with research related to Municipal Bonds which consists of themes that are depicted as rectangles with a larger size, the more widely used. Although the theme of this research is about Municipal Bonds, the data obtained show that there are several sub-themes that are widely used Figure 17.

The Thematic Evolution is divided into 3 parts. Where the left side shows several themes that were widely used from 1907 to 2007, there are 7 themes listed with different sizes depending on the quantity of use of these themes. The theme "Municipal" ranks first, followed by the theme "Bonds". The second or middle part shows the most frequently used themes in the period between 2008-2015. There are 8 themes, of which 2 are an evolution of the themes that appeared in the previous period, namely the themes of "Municipal" and "Analysis" which are extensions of several themes shown by colorful plots. The last or right section shows the themes that are widely used from 2016-2021. There are 7 themes, where almost all of them are the evolution of the previous period namely “Municipal”, “Local”, “Analysis”, “Public”, and “Debt” which is an extension of several themes indicated by colorful plots.

Conclusion

This study tries to evaluate the topic of Municipal Bonds using text analysis from 1907-2021. The conceptual structure of R 'biblioshiny' provides the network and the main research themes. We have identified two research networks in the Municipal Bonds literature using a co-occurrence network. This research network is “Municipal” and “Bonds”. Combining the two networks in this study will solve many environmental problems. Furthermore, in conceptual structure, this research has spread thematic maps to place themes and subthemes on the graph and divided them into four clusters (dropping or emerging themes, basic themes, highly developed and isolated themes, motor themes). However, there are only 2 quadrants that give rise to themes, namely highly developed and isolated themes represented by Public, Effects, Capial, Policy, Economic, Act, Competitive, Versus, Issues and Basic themes or transversal represented by Bonds, Tax, Impact, Local, Debt, Governance, Municipal, Bonds, Market.

Acknowledgement

Thank you to all parties for their support and input in the preparation of this research. All the support and input given is very useful for the perfection of this research.

References

Ahlgren, P., Jarneving, B., & Rousseau, R. (2003). Requirements for a cocitation similarity measure, with special reference to Pearson's correlation coefficient. Journal of the American Society for Information Science and Technology, 54(6), 550-560.

Indexed at, Google Scholar, Cross Ref

Boyack, K.W., Klavans, R., & Börner, K. (2005). Mapping the backbone of science. Scientometrics, 64(3), 351-374.

Indexed at, Google Scholar, Cross Ref

Brune, C., & Liu, P. (2011). The contagion effect of default risk insurer downgrades: The impact on insured municipal bonds. Journal of Economics and Business, 63(5), 492-502.

Indexed at, Google Scholar, Cross Ref

Cebula, R.J. (2018). Reflections on and Inquiry into Unfamiliar as well as Familar Factors that may Influence the Market for Municipal Bonds. Review of Regional Studies, 48(2), 145-154.

Indexed at, Google Scholar, Cross Ref

Cebula, R.J. (2020). The community reinvestment act and real municipal bond interest rate yields in the united states: evidence from the municipal bond market. Review of Regional Research, 40(1), 3-12.

Indexed at, Google Scholar, Cross Ref

Chen, H., Estes, J., & Ngo, T. (2011). Tax Calendar Effects in the Municipal Bond Market: Tax?Loss Selling and Cherry Picking by Investors and Market Timing by Fund Managers. Financial Review, 46(4), 703-721.

Indexed at, Google Scholar, Cross Ref

Daniels, K.N., & Vijayakumar, J. (2001). The competitive impact of commercial bank underwriting on the market for municipal revenue bonds. Journal of Financial Services Research, 20(1), 57-75.

Indexed at, Google Scholar, Cross Ref

Drukker, A.J., Gayer, T., & Gold, A.K. (2020). Tax-exempt municipal bonds and the financing of professional sports stadiums. National Tax Journal, 73(1), 157-196.

Indexed at, Google Scholar, Cross Ref

Fomin, M., Lakhno, Y., & Pyshnograi, A. (2019). Municipal Bonds As A Tool For Development Of Infrastructure. Public Administration Issues, 2, 185-210.

Grant, A. (2011). Managing a national municipal bond fund. The Handbook of Municipal Bonds.

Jarrow, R.A., Lando, D., & Turnbull, S.M. (1997). A Markov model for the term structure of credit risk spreads. The Review of Financial Studies, 10(2), 481-523.

Indexed at, Google Scholar, Cross Ref

Kalotay, A., & Abreo, L. (2017). Municipal bond insurance: identifying the best payment plan. Journal of Risk Finance.

Indexed at, Google Scholar, Cross Ref

Li, P., Tang, L., & Jaggi, B. (2018). Social capital and the municipal bond market. Journal of Business Ethics, 153(2), 479-501.

Indexed at, Google Scholar, Cross Ref

Park, J., Lee, H., Butler, J.S., & Denison, D. (2021). The effects of high-quality financial reporting on municipal bond ratings: evidence from US local governments. Local Government Studies, 47(5), 836-858.

Indexed at, Google Scholar, Cross Ref

Ridzuan, A.R., Zakaria, S., Bayu, A.F., Yusoff, N.Y.M., Sulaiman, N.F.C., Razak, M.I.M., ... & Lestari, A. (2021). Nexus between Financial Development and Income Inequality before Pandemic Covid-19: Does Financial Kuznets Curve Exist in Malaysia, Indonesia, Thailand and Philippines?. International Journal of Energy Economics and Policy, 11(2), 260.

Indexed at, Google Scholar, Cross Ref

Setiadi, W. (2016). Study of regional bond as an alternative source of financing for local development (case study in central java province government).Journal of RAK (Financial Accounting Research), 1(1), 61-74.

Surachman, E. N., & Setiawan, H. (2016). Municipal Bonds as the Financing Strategy For Urban Infrastructure: Case Study Of Jakarta MRT. Jurnal Keuangan dan Perbankan, 20(3), 369-381.

Indexed at, Google Scholar, Cross Ref

Wu, C. (1991). A certainty equivalent approach to municipal bond default risk estimation. Journal of Financial Research, 14(3), 241-247.

Indexed at, Google Scholar, Cross Ref

Zedan, K., Daas, G., & Awwad, Y. (2020). Municipal bonds as a tool for financing capital investment in local government units in Palestine. Investment Management & Financial Innovations, 17(1), 213.

Indexed at, Google Scholar, Cross Ref

Received: 20-Dec-2021, Manuscript No. AAFSJ-21-10568; Editor assigned: 22-Dec-2021, PreQC No. AAFSJ-21-10568(PQ); Reviewed: 05-Jan-2022, QC No. AAFSJ-21-10568; Revised: 14-Jan-2022, Manuscript No. AAFSJ-21-10568(R); Published: 21-Jan-2022