Research Article: 2022 Vol: 25 Issue: 1

Municipal financial management practices for improved compliance with supply chain management regulations

Celani John Nyide, Durban University of Technology

Citation Information: Nyide, C. J. (2022). Municipal financial management practices for improved compliance with supply chain management regulations. Journal of Management Information and Decision Sciences, 25(1), 1-11.

Abstract

Supply chain management (SCM) is guided by several related policies and regulations. However, compliance remains a challenge in South African local government. Municipalities are struggling to put in place financial management controls and to monitor the compliance with the regulations relating to financial management in general and SCM in particular. The aim of this study was to critically evaluate factors affecting financial management practices used by selected district municipalities in KwaZulu-Natal, South Africa; and to establish their impact on compliance with SCM regulations. A qualitative research approach was employed in this study and participants were selected using the purposive sampling strategy. Semi-structured interviews were conducted with 25 participants from Financial Services Departments of three district municipalities located in KwaZulu-Natal, South Africa. Data was analysed using thematic analysis. The study revealed that municipal leadership does not exercise adequate oversight responsibility regarding financial and performance reporting and compliance with laws and regulations. Furthermore, the study found that adequate systems and controls are not in place within municipalities to ensure compliance with policies and regulations. Comprehensive MFMA compliance is lacking and this weakens municipal internal controls. Despite the existence of municipal financial management practices at the investigated District Municipalities, these practices fall short of ensuring compliance with SCM regulations and practices.

Keywords

Compliance; Financial management; Local government; Supply chain management; Supply chain regulation.

JEL Classification

G30, H12, M41

Introduction

Financial management, as defined by Demba (2013), “is a process of managing financial resources, management decisions concerning accounting, financial reporting, forecasting and budgeting”. Financial management enables the public sector to design and demonstrate organisational performance (Nyide, 2018). Therefore, sound financial management practices are very important to a municipality. A disorganised municipal financial management system, if unchecked, may cause the municipal finances to be misused and that may affect service delivery and financial exploitation may increase (Jacobs, 2019). In the South African public sector, financial management remains a challenge and this impedes the fulfilment of this sectors’ mandate. Annually, the Auditor-General of South Africa (AGSA) delivers an audit report on the state of financial management in the country. The integrated annual report of 2018/2019 provided by AGSA (2019) shows regression on the performance of government departments, public entities and municipalities. The report indicates that for the financial year ended 31 March 2019, irregular expenditure remained high, non-compliance with Supply Chain Management (SCM) legislation continued to increase, and auditees’ financial health deteriorated (AGSA, 2019).

Financial management challenges that affect most municipalities in South Africa generally include non-compliance with SCM procedures and regulations and this leads to the increase of irregular expenditure. SCM, an integral part of South African public sector financial management, is also attracting the attention of South African Local Government Association (SALGA) as it continually experiences inefficiencies (SALGA, 2020). Some of the SCM deficiencies that are widely reported in the media, literature and government reports include corruption and fraud (Ambe, 2016). Literature points out that SCM challenges are largely characterised by lack of proper expertise, skills and capacity within the public sector which inevitably lead to non-compliance with SCM policy and regulations and hence preventing this sector from receiving clean audits (Ambe and Badenhorst-Weiss, 2012; Moloto and Lethoko, 2018). South Africa has legislative and regulatory frameworks that outline SCM minimum requirements (Munzhedzi, 2016). However, the level of non-compliance with legislations and regulations is alarming in the country’s public sector. A study conducted by Seitheisho (2019) shows that municipalities do not fully comply with SCM policies and procedures when procuring good and services. Non-compliance with the legislation has an adverse impact on the achievement of a clean audit.

This study is aimed at critically evaluating factors affecting financial management practices used by selected district municipalities in KwaZulu-Natal, South Africa; and to establish their impact on compliance with SCM regulations. To set the tone, this study begins with the review of the literature on fundamental financial management practices prevalent in municipalities. Thereafter, the research methodology employed in this study, and findings of the study will be discussed.

Literature Review

Financial Management Challenges Facing the Municipalities

The local sphere of government is faced with ever-increasing challenges including poor financial accountability in local government across the country (Khanyile, 2016). The challenge of poor financial accountability has been covered and reported in all types of media communication where members of the communities are vocally expressing their dissatisfaction with the slow delivery of services by municipalities which hinders progress and growth. Seitheisho (2019) assert that the African continent is engulfed with inadequacies in the capacity and technical expertise of local government to handle the financial responsibilities. In municipalities in the region, lack of capacity is a root cause of weak service delivery and mostly the lack of capacity is in the financial management unit (Nyide, 2018). The discussion below provides a synoptic overview of various financial management challenges facing municipalities within the South African Context.

Cash management issues and mismanagement of funds

Municipal finance management (MFMA) Act 56 of 2003 states that cash management is a tool to control spending in the aggregate, implementing the budget efficiently, minimizing the cost of municipal borrowings and maximizing the opportunity cost of resources (MFMA, 2003).

South African municipalities have cash management and investment policies as required by MFMA. Jacobs (2019) adds that a cash management strategy is required to ensure that cash flow planning and investment decisions are undertaken and that unspent grant funds are properly safeguarded and utilised only for the intended purposes. However, a large number of municipalities appear to be struggling with effective cash management practices (AGSA, 2019). According to the 2018/2019 audit outcomes released by the AGSA, funds allocated to municipalities are being managed “in ways that are contrary to the prescripts and recognised accounting disciplines” (AGSA, 2020). The audit outcomes further paint a rather disturbing picture depicting that most municipalities are crippled by debt and are unable to pay for water and electricity. Furthermore, the picture portrays inaccurate and lacklustre revenue collection; expenditure that is unauthorised, irregular, fruitless and wasteful; and a high dependence on grants and assistance from national government (AGSA, 2020). The effective cash management report produced by Deloitte and Touche (2013) reveals that a net liability position identified in many South African municipalities has shown similar improbabilities. The report further reveals that a larger number of these municipalities were indirectly declaring technical insolvency. These outcomes can be attributed to the fact that municipalities appear to be struggling with effective cash management practices.

Lack of expertise in local government

Laubscher (2012) points out that the municipalities have gone through major changes and renovations over the past years which demands for all role players to be up to the expected level of expertise. The scarcity of expertise in the local government is a huge contributing factor in the lack of provision of basic services to the communities (Seitheisho, 2019). The shortage of capacity and technical expertise of local municipalities to handle the responsibilities of financial management has been widely reported in the literature (Ambe, 2016; Moloto & Lethoko, 2018; Jacobs, 2019; AGSA, 2020). As such, there is an overreliance on consultants to execute even basic financial management activities (Ambe, 2016). A general scarcity of technical skills in the country is also contributing to capacity constraints in local government. The inability of local government to recruit and retain the required staff coupled with deficiency in financial resources relative to the scale of community’s needs, have impacted negatively on the capacity levels (Matlala, 2018). The weak relationship between financial management and clean audit outcomes can therefore be attributed to a general lack of competencies in the public service, and to specific shortages of appropriately qualified personnel in the accounting sections of these entities (Motubatse, 2016).

Supply Chain Management

According to section 111 of the MFMA (2003), each municipality must implement the SCM policy. Section 112 of the aforementioned Act further clarifies that such policy must be fair, equitable, transparent, competitive and cost-effective and must comply with a prescribed regulatory framework for municipal SCM. According to Amber and Badenhorst-Weiss (2012), despite the employment of SCM as a strategic tool, public procurement in South Africa still encounters enormous challenges. According to the AGSA (2019), the SCM policies of many municipalities are not reviewed so as to align to the SCM regulations. The report indicates that the policies and procedures that will guide the operations of some municipalities are not documented by the management resulting in various instances of non-compliance with the requirements of the MFMA. Amber (2016) also points that there are insufficient controls and procedures for the handling of bids, appointment of bid committee members not aligned to the requirements of the policy and inadequate motivation for deviations from SCM processes and procedures. Matlala (2018) states that corruption, incompetence and negligence by public servants contribute to the deviation from SCM processes and policies.

Factors Affecting the Successful Implementation of Municipal Financial Management Practices

Adequate capacity in the form of structures with fully skilled and professional personnel is a key success factor for proper SCM implementation. Shortage of qualified and skilled personnel in South Africa is a recurring challenge, not only in government, but in many other sectors (Moloto & Lethoko, 2018). Thus, the unavailability of skilled workforce continues to be the key constraint for proper municipal financial management and SCM implementation. Moreover, financial management demands key officials (Municipal Managers, Chief Financial Officers and other Senior Managers) to have the required skills and experience to fulfil their responsibilities and exercise their functions and powers, (AGSA, 2019; AGSA, 2020). The failure of the municipality to appoint Accounting Officers can hinder public financial management (Theletsane and Fourie, 2014) These officials are crucial leadership of the institution. According to Matlala (2018), Sound financial governance is perceived to be the most important, and without proper personnel management, municipalities will continue to experience difficulties in financial management. Analysis of municipal financial management suggests that personnel issues lie at the heart of many of the financial problems experienced by municipalities (Amber, 2016; Matlala, 2018; Seitheisho, 2019; AGSA, 2020). Furthermore, the success or failure of a municipality depends on the quality of leadership, sound governance of its finances, the strength and the calibre of staff working for the municipality. Motubatse (2016) advances that leadership is one of the key factors that drive improved audit comes. However, according to AGSA (2020), the administration of the municipality and political office bearers are not taking ownership and responsibilities in implementing the key controls. SALGA (2020) concurs that the local government sector faces weakening municipal governance and leadership characterised by poor oversight, limited consequence management, and instability at senior management levels. This assertion is supported by Moloto and Lethoko (2018) who state that municipalities need skilled managers with leadership abilities to promote good cooperative governance. Moreover, the aforementioned authors add that the use of consultants indicates a lack of stability in administrative leadership of the municipality and can threaten the financial health.

Municipalities regularly experience difficulties with recruiting and retaining suitably skilled staff (SALGA, 2020). Personnel management in local government has been marred in many instances by poor recruitment, dismissal of employees, the inability to attract and retain suitably qualified staff, high vacancy rates and the lack of performance management systems and other related symptoms (Mbatha, 2016). Wild, Chambers, King and Harris (2012) also assert that the implementation of financial management practices is affected by lack of effective performance management systems (PMS) and oversight, where formal processes for monitoring and supervision are ought to be followed or enforced. PMS is regarded as a tool that is used to measure an organisation’s performance in achieving its strategic goals and objectives (Van der Waldt, 2014). According to chapter 6 of the Municipal Systems Act (MSA) (2000), municipalities are required to develop a performance management system. However, inadequate performance management and lack of consequences for misbehaviour are found to be contributing factors of the failure of local government (Khanyile, 2016) to comply with SCM regulations. Research conducted by Seitheisho (2019) indicates that the monitoring and evaluation systems at the municipalities are generally not effective and the PMS are not linked to financial management processes. The author further argues that the municipalities conduct internal performance assessment but only on senior management. This leaves the remainder of the officials not being assessed for the work they perform in the municipalities (Matubatse, 2016).

Research Methodology

This study adopted a qualitative approach based on the content analysis. Qualitative research helps with an in-depth analysis of data and provides a contextual description and interpretation of social phenomena (Creswell, 2014). The objective in qualitative content analysis is to systematically transform a large amount of text into a highly organised and concise summary of key results (Erlingsson & Brysiewicz, 2017). This study was conducted in KwaZulu-Natal, one of nine provinces in South Africa. The province has a total of ten district municipalities and all of them were invited to participate in this study. Only 3 district municipalities participated in this study. The population for this study comprised of Chief Financial officers (CFOs), all managers and deputy-managers from Financial Services Departments of 3 district municipalities. Using purposive sampling, semi-interviews were conducted with a total of 25 participants. These participants were purposively selected because they are responsible for oversight roles in financial management. According to Etikan, Musa and Alkassim (2015), purposive sampling should focus on people who possess particular characteristics in order to improve understanding and who are able to help with the information needed in the research study. Interviews were held over a period of April – June 2019 and they lasted between 1 hour to 1 and half hours. Table 1 shows participants and interview information codes. The identification of the participants was made unknown in order to ensure the anonymity. The audio-recording from the interview processes was transcribed and reproduced as written words. The data transcribed was compared to the notes that were taken in the field to ensure data accuracy (Sekaran & Bougie, 2016). Thematic coding was used to confer accuracy and sophistication and enhance the research’s whole sense (Creswell, 2014; Sekaran & Bougie, 2016).

| Table 1 Participants And Interview Information |

|||

|---|---|---|---|

| District Municipality | Participant | Position | Mode |

| District Municipality 1 (DM1) | Participant 1 (P1) | CFO | Face to face |

| Participant 2 (P2) | Deputy Municipal Manager: Financial Services | Face to face | |

| Participant 3 (P3) | Manager: SCM | Face to face | |

| Participant 4 (P4) | Deputy Manager: SCM | Face to face | |

| Participant 5 (P5) | Manager: Purchasing | Face to face | |

| Participant 6 (P6) | Chief Accountant: Acquisitions | Face to face | |

| Participant 7 (P7) | Assistant Manager: Quotations | Face to face | |

| Participant 8 (P8) | Manager: Local Economic Development | Face to face | |

| District Municipality 2 (DM2) | Participant 9 (P9) | CFO | Face to face |

| Participant 10 (P10) | Manager: Budgeting and Financial Management Services | Face to face | |

| Participant 11 (P11) | Manager: SCM | Face to face | |

| Participant 12 (P12) | Manager: Internal Audit | Face to face | |

| Participant 13 (P13) | Manager: Contract Management | Face to face | |

| Participant 14 (P14) | Manager: Financial Systems Support | Face to face | |

| Participant 15 (P15) | Accountant: Logistics and Contracts | Face to face | |

| District Municipality 3 (DM3) | Participant 16 (P16) | CFO | Face to face |

| Participant 17 (P17) | Director: Budget Reporting and Financial Systems | Face to face | |

| Participant 18 (P18) | Director: SCM | Face to face | |

| Participant 19 (P19) | Chief Accountant: Budget and Reporting | Face to face | |

| Participant 20 (P20) | Chief Accountant: Accounting and Financial Systems | Face to face | |

| Participant 21 (P21) | Accountant: Demand and Acquisitions | Face to face | |

| Participant 22 (P22) | Accountant: Contracts | Face to face | |

| Participant 23 (P23) | Senior Supply Chain Clerk: Demand | Face to face | |

| Participant 24 (P24) | Senior Supply Chain Clerk: Quotations | Face to face | |

| Participant 25 (P25) | Logistics Officer | Face to face | |

Findings and Discussion

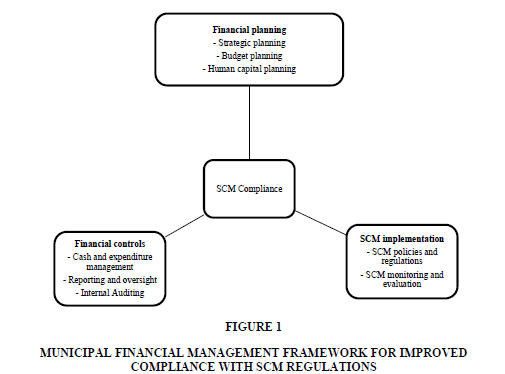

To achieve the aim of this study, the results were analysed in accordance to the major themes that emerged. There were three major themes that were identified, namely financial planning, financial controls, and SCM implementation. These themes and sub-themes are shown in Table 2, and they were used to develop the municipal financial management framework for improved compliance with SCM regulations (Figure 1).

| Table 2 Themes And Sub-Themes |

||

|---|---|---|

| Objective | Theme | Sub-theme |

| This aim of this study was to critically evaluate factors affecting financial management practices used by selected district municipalities in KwaZulu-Natal, South Africa; and to establish their impact on compliance with SCM regulations |

Theme1: Financial planning |

•Strategic planning

•Budget planning •Human capital planning |

| Theme 2: Financial controls |

•Cash and expenditure management

•Reporting and oversight •Internal Auditing |

|

| Theme 3: SCM implementation |

•SCM policies and regulations

•SCM monitoring and evaluation |

|

Financial Planning

Respondents were asked about the financial management challenges that may hinder the municipalities’ successful implementation of SCM policies and procedures. Financial planning emerged as the main theme and strategic planning is a key part in this regard. All participants highlighted that the financial planning process is aligned with the integrated development plan (IDP). IDP is the plan that the municipality uses to develop goals and plans which are aligned with the available funds of the municipality (Jacobs, 2019). P2 (Deputy Municipal Manager: Financial Services mentions that “the municipality firstly prepares draft IDP with strategic objectives and list of projects for five years, then budgets get prepared”. The Director of Budget Reporting and Financial Services of DM3 added that “the municipality’s financial management process is informed by the financial plan approved by council every 10 months before the start of the budget year and is aligned to the IDP and operational budget. Several participants, however, highlighted that the shortage of skilled personnel affects the process of long term strategies. In addition to that, P9 states that “the municipality spends most of its funding on consultants and this affects the long-term process of financial planning”.

This study discovered that participants understand the importance of financial planning that is aligned with the IDP. However, municipal leadership does not exercise adequate oversight responsibility regarding financial and performance reporting and compliance with laws and regulations. Leadership falls short in ensuring that proper action plans are established, implemented and monitored to improve effective financial management practices. Jeppesen (2010) as cited by Amber and Badenhorst-Weiss (2012) believes that without transparent and accountable systems, the enormous resources controlled through the public procurement systems run the danger of being entangled with increased corruption and misuse of funds. This study found that the main challenges are the management instability poor planning, non-compliance with SCM policies and regulations. Office bearers and management are the key drivers of the long-term strategic plan. Therefore, if there is instability in those structures then municipalities face a challenge in financial planning since there will be no effective communication and adherence to MFMA regulations. In this study it was also discovered that municipalities are struggling to recruit and retain skilled personnel. It is critical that the correct skills and expertise are recruited by municipalities to ensure that financial management practices are effectively implemented and this will improve compliance with SCM policies and procedures as also supported by Moloto and Lethoko (2018).

Financial Controls

Financial controls emerged as another theme that formed part of municipal financial management practices for improved compliance with SCM regulations. Forming part of financial controls, municipalities use, cash management and expenditure policies and plans: “Largely we are guided by 7 policies, namely, Budget, Cash Management and Expenditure, Credit Control, Assets Management, Virement, SCM, Risk Management” (P16, CFO). The use these policies is also mentioned by other CFOs and senior staff members that participated in this study. Furthermore, there is consensus among the participants that financial reporting and analysis form part of municipal financial controls. “The finance section reports on the implementation of the budget and SDBIP through monthly, quarterly, mid-year report” (P10, Manager: Budgeting and Financial Management Services). P17 added that “Council uses these reports to monitor both the financial and service delivery performance of the municipality’s implementation actions”. “These reports on the implementation of the budget reflect the financial position of the municipality” (P2). As a part of financial controls, municipalities use internal audit function. According all the participants, internal audit function handles the monitoring of the implementation of the audit action plan and guide the municipality in ensuring the compliance with the regulations tabled to govern the local government.

It was found in this study that adequate systems and controls that are not in place within municipalities to ensure compliance with policies and regulations. Comprehensive MFMA compliance is lacking and this weakens municipal internal controls. It is evident that the high level of SCM transgressions are driven by internal control failures. Seitheisho (2019) allude that municipalities largely lack appropriate internal controls and supervision that will ensure sound financial and performance management. This study found that budget and budgetary controls are also not monitored properly. These are the drivers of high level of unauthorised, irregular and fruitless and wasteful expenditure. Furthermore, it is evident that municipalities do not have a properly implemented and monitored cash flow management strategic plan. Literature illustrates that leadership of local government is of paramount importance in that it advocates the need for sound cash management practices, including budget, revenue and expenditure management and monitor the efficiencies and effectiveness of such practices on a regular basis (Matlala, 2018; Jacobs, 2019).

SCM Implementation

Central to the findings of this study was the SCM implementation theme. There was consensus among SCM managers and CFOs about the implementation of SCM policies. “In order to deliver the service, the municipality has to follow SCM policies” (P11, Manager: SCM). “If SCM policies and regulations are not followed, the expenditure incurred will be declared as irregular and the matter is investigated by Council” (P18, Director: SCM). However, the majority of participants allude that the enforcement of some of the policies still remains a challenge. P19 mentions that “some of these policies are implemented but implementation is poor”. This revelation is supported by P8 who added that “policies are implemented but at some point the municipality do have challenges in fully implementing them due to instability of Senior Management and political interference”. P4 also mentioned that “the level of non-compliance is very high especially with SCM policy and procedures which resulted in irregular, unauthorised, fruitless and wasteful expenditure”.

All participants were in agreement that monitoring and evaluation processes improve compliance with SCM policies and procedures. P12, an Internal Audit Manager for DM2 states that “control and governance structures of the municipality play a vital role in monitoring SCM activities”. Internal audit units within municipalities handle the monitoring of the implementation of the audit action plan and guide the municipality in ensuring that the municipality comply with all the regulations tabled to govern the local government. However, the AGSA (2020) indicates a concern regarding the general lack of monitoring and evaluation of policies. As indicated above, participants accede to the existence of relevant policies within their respective municipalities. This is confirmed by several participants representing all District Municipalities. Monitoring and evaluation of these policies and procedures are the main concerns. P5 states that “even though we have all prescribed policies, there is poor implementation and poor monitoring”. P14 also pointed out the same by stating that “policies are generally not properly implemented in our municipality”.

This study can conclude that the main challenges facing municipalities include management instability, poor planning, non-compliance with SCM policies. It is not surprising that one of the audit reports by AGSA (2019) reveals that one District Municipality in the KwaZulu-Natal made payments in contravention of SCM legislation that were not included in the municipal irregular expenditure of R130 million. One can reiterate, therefore, that adequate systems and controls are not in place to ensure that irregular expenditure are accounted for. Poor performance by municipalities and poor implementation and monitoring of SCM practices and procedures also have negative impacts on basic service delivery.

Limitations

The sample size serves as one of the limitations of this study. Moreover, data was only collected in the form of interviews. This study was limited to District Municipalities located in KwaZulu-Natal. Therefore, findings of this study may not fully represent the views of all municipalities in South Africa. Due care should be exercised when generalising the findings of this study to other municipalities. An increase in the sample size and a mixed-study methodology may improve rigour in the analyses and reliability of the findings.

Implication

Research has been conducted on municipal financial management practices in the past, however, no much attention has been given on their role to improve compliance with SCM regulations and practices. Most municipalities in the county are falling short on fulfilling their Constitutional mandates of meeting their financial commitments and providing the basic services to their communities. Municipalities are not following practices that ensure improvements in their performance and address negative audit opinions. This study suggests that the municipalities ensure the implementation and enforcement of policies and turnaround strategies that facilitate the overhaul of financial management practices; and to ensure that the municipalities comply the MFMA. Furthermore, the study found that instability of senior management is a huge factor which hinders successful implementation of financial management practices. Municipalities must develop and implement sound HR practices and have policies in place such as HR policy, recruitment policy and skills retention policy. Municipalities must ensure that all critical positions are filled in an endeavour to have responsible individuals who will be accountable and be able to turnaround these entities towards a positive direction.

Recommendations For Future Research

This study focused on examining municipal financial management practices and their influence on compliance with SCM regulations in one province. This type of study can be commenced within the local government provincially and nationally. As such, the study may stipulate more perceptions on the resemblances and variances within the local government’s financial management practices and their role in improving compliance with SCM regulations. In addition, this study employed the qualitative method to collect data. It is recommended for future study to explore the mixed method in data collection in order to improve rigour.

Conclusion

This study has contributed results from a research approach that could stimulate further research on the important issues that affect the effective implementation of municipal financial management practices. It can be concluded that despite the existence of municipal financial management practices at the investigated District Municipalities, these practices shall short in ensuring compliance with SCM regulations and practices. There are measures that can be put in place to ensure that the municipalities improve compliance with legislation which governs all the municipalities in South Africa and this will contribute positively towards improving the financial performances of municipalities, and ultimately curb corruption while improving the service delivery to the public.

References

Auditor-General South Africa (AGSA). (2019). Integrated Annual Report 2018-2019.

Creswell, J. W. (2014). A Concise Introduction to Mixed Methods Research. California: SAGE Publications Inc.

Deloitte & Touche (2013). Municipal Clean Audit Efficiency Series: Effective Cash Management.

Demba, G. A. (2012). Effect of financial management practices on performance of Kenya Medical Training College. MBA Dissertation, Kenya, University of Nairobi.

Erlingsson, C., & Brysiewicz, P. (2017). A hands-on guide to doing content analysis.African Journal of Emergency Medicine,7(3), 93-99.

Jacobs, N. P. (2019).Local government revenue enhancement: a case study of Umsobomvu Local Municipality(Doctoral dissertation, Stellenbosch: Stellenbosch University).

Khanyile, M. W. (2016).Evaluation of financial accountability, financial control and financial reporting at Umtshezi Municipality: a case study(Doctoral dissertation).

Local Government. (2020). Municipal Finance Management Act 56 of 2003.

Matlala, L. S. (2018). Challenges of Financial Control and Accountability in South African Municipalities. M.A. Dissertation, University of Johannesburg.

Mbatha, T. (2016). An evaluation of factors affecting the progression to clean audit outcomes in South African Municipalities. MBA Dissertation, University of Pretoria.

Moloto, K. A., & Lethoko, M. X. (2018). Municipal Financial Viability and Sustainability in South Africa: A Case of Molemole Local Municipality, Limpopo Province, South Africa. Proceedings of The 3rd Annual International Conference on Public Administration and Development Alternatives, (pp.749-760).

Motubase, K. N. (2016). An evaluation of factors affecting the progression to clean audit outcomes in South African Municipalities. DPA Dissertation, University of Limpopo.

Munzhedzi, P. H. (2011).Performance management system and improved productivity: A case of the department of local government and housing in the Limpopo Province(Doctoral dissertation, University of South Africa).

Seitheisho, J. (2019). Assessment of factors that relate to qualified audit reports in the two municipalities. MBA, North-West University.