Research Article: 2022 Vol: 25 Issue: 6S

Mutual Fund Investment and Investors Belief: A Mediation Moderation Model Analysis

Som Nath Paul, Guru Gobind Singh Indraprastha University

Citation Information: Paul, S.N. (2022). Mutual Fund Investment and Investors’ Belief: A Mediation Moderation Model Analysis. Journal of Entrepreneurship Education, 25(S6), 1-11.

Abstract

The objective of this paper is to establish the relationship between investors’ belief and investment decision. In the current research, we have developed a moderated mediation model which states that though investors’ belief in mutual fund is a very important factor for influencing investment decision, risk perception and expected return affect this relationship. Specifically, the higher degree of expected return strengthens this relationship. Structural equation modeling has been used to test the proposed hypotheses.

Keywords

Investors’ Belief, Risk Perception, Investment Decision, Expected Return, Structure Equation Model.

Introduction

The decision regarding procurement and investment of funds are two major financial functions of any entity- being it corporate, firm, or individuals who strive to maximize wealth. The decision becomes more complicated and calls for the utmost care when it is related to long term investment as it involves long term consequences, involves substantial opportunity cost and is irreversible. While the decision for investment in the long term by a firm or corporate involves the collective decision by a group of experts against some standardized criteria such as discounted cash flow technique (e.g. Net Present Value) or non-discounted cash flow technique(e.g. pay-back period), long term investment decision by a person (hereinafter referred as an investor) is largely influenced by his perception, personality and attitude Investment in a financial instrument is a gigantic task especially in the present financial scenario characterized by volatility, uncertainty, complexity and ambiguity. An investor has to process a bundle of information available in this information age for constructing an investment portfolio, which make investment decision process extremely complex (Li et al., 2017) and stressful experience An investor is not a gambler, but he is bounded by limited rationality. The search for an optimum investment vehicle had remained a holy grail since 1774 when the first mutual fund was created by the Dutch merchant, Adriaan van Ketwich. After two centuries, the first mutual fund industry in India (UTI) was started and soon becomes the hot cake for individual investors following Says’slaw (1803) that proposes “Supply creates its own demand”. A mutual fund is one of the best-known investment vehicles today among the retail investors who are willing to maximize their wealth. A mutual fund is popular among investors due to many advantages attached to it such as: lesser risky than equity, management by professionals, a standardized valuation of return (NAV) and many more. Indian Mutual Funds sector manages approximately Rs. 27 trillion (AUM) (October 2019, AMFI Report). However, total AUM is still exceptionally low at about 11% of the nation's GDPand a stunning development prospect is plausible according to AMFI's report (2019-20). While mutual fund companies understand well the need for effective marketing, they have limited understanding of how consumers make choices in this market. This hampers their marketing and public policy decisions. Purchasing for investment securities are becoming as similar as buying consumer items where each individual has different needs and goals when making investment decisions or plans. Further, there are a plethora of factors that influence their investment decisions as separate from their needs. These factors are largely influenced by their belief, expectations, personality and perceptions. The objective of this paper is to establish the relationship between investors’ belief and investment decision in the mediation of risk perception. The current study is also an effort to identify the effect of expected return among the relationship of investors belief, risk perception and investment decision. More specifically, the present study is an attempt to find the answer tithe following research questions:

• How investors’ belief towards mutual fund relates to investors’ decision towards their investment in mutual fund products.

• How investors’ risk perception influences investors’ decisions and determines the direction of the relationship between investors’ belief and investors’ decisions related to the mutual fund.

• How the expected return of investors influence the strength of the relationship between investors’ belief and investors’ decision towards the mutual fund.

Theoretical Foundation and Hypothesis Foundation

The theoretical construct of the present study was derived from the theory of planned behavior. This theory states that behavior, subjective norms, and intentions for perceived behavioral control shape one's intentions and behavior. In our study, the investment decision acts as a behavior that is observable in a particular situation vis-a-vis a given goal, behavioral intent is risk perception and it is expected to moderate the effect of intent on behavior. Investment belief that is in control of a person's behavior and risk perception is considered a normative belief, which is a perception of normative social pressure (subjective norm).

Investors’ Belief

Fodor (1985) stated in his study of human psychology that beliefs and desires, like common sense, are semantically evaluable; if satisfied their condition. Usually, the state of satisfaction with the belief is that belief is right or wrong, and the state of satisfaction of the will is something in which that desire is fulfilled or frustrated (Fodor, 1985). Pellinen et al. (2015) stated that belief towards the investment of an individual is one of the best prognostic variables of investment decision. In a nutshell, it can be stated that investors’ beliefs can predict investors’ investment behavior. Negrelli (2019), found in the study of uncertainty over market sentiment that rational investor/ analyst had seemed uncertainty and scare about the market situation as well as investment securities, i.e. the beliefs of other investors about the value of the underlying assets. (Negrelli, 2019). Linder & Sperber (2020) stated in their study that better-than-average beliefs are a general trend among investors who make investment decisions in banks and other investment venues (Linder & Sperber, 2020). Huang et al. (2019) stated that a cross occurs regarding the decision of investment. The company adopts a more aggressive cash-rich investment policy when their belief in the high and conservative policy when their belief is low. The optimistic belief also makes the firm to involve in active liquidity management. (Huang et al., 2019). Bosom’s study provides evidence of the impact of the movement of the stock price over the risk perception of investors, his belief formation as well as his investment tendency (Borsboom & Zeisberger, 2020). Irregular market movement can be caused by situation where differences of opinion are established due to belief differences, even if one is not aware of the basics. If this is the case, such devices should be carefully monitored as a market perception indicator to avoid long-term misunderstandings or mispricing (Negrelli, 2019). While investors believe (perhaps wrongly) that they can beat the stock market through individual stock research, with a gained premium in terms of confidence or optimism (Barth, 2018), (Misra et al., 2019) discussed that Indian investors’ religious belief influence their investment decision process. Bruhin et al. (2018) stated in their study that, the belief of individual on their skill directly influence their decision on investment (risky decision) (Bruhin et al., 2018).

Investors Belief and Investment Decision

The investment decision is significant for an individual to lead their life calmly and willingly. The two sides of the same coins are spending and saving. Saving emerges from protected or controlled utilization. But converting saving into investments requires solid reasons or a strong will. Savers are relied upon to procure future returns. Investment is the conversion of the present asset in long term resources that can create future returns (Gill et al., 2011). An investment procedure gives a system to accomplish two objectives, with the main significant objective being to change over investment reserve funds, and the second to pick a reasonable methodology in securing the fund. An investment decision requires a serious and systematic approach. Individuals normally lose their hard-earned cash in absence of proper management and planning. Investment decision making is impacted by numerous elements. These variables are internal or external. External variables are general to everybody, while internal factors are one of a kind among various individuals. Nowadays, financial investors are confronted with an undeniable mind-boggling investment condition in which gigantic measures of data should be accessed or analyzed (Li et al., 2017).

Detailed that people settle on buying decisions of their stock funds, as indicated by financial criteria, among others. Moreover, they express that theoretical factors, for example, ongoing stock price movement and good stock price significantly affect investors' investment decision. The investors judge primarily equity information, corporate image and neutral data such as familiarity with macroeconomic information, the recommendation from expert and their financial need for investment planning. The objectives of investors to invest in mutual fund (equity-based) are maximizing return and risk reduction (due to the diversified portfolio). Investors contend that regardless of the wealth maximization paradigm; they utilize an assortment of investment determination criteria in shares. Opined that investors relationship is impacted by the mastery of their investment knowledge as a feature of their whole portfolio selection expressed that better understanding and information in contributing empowers individual investor to settle on better investment decisions. A superior comprehension in the relationship among perceived risk, required return for investment for a mutual fund, may incite a higher affinity for mutual fund investment. Hence for the present study, the following hypothesis has been formulated.

H1: Investors belief significantly and positively relates to investment decision towards the mutual fund.

Risk Perception as a Mediator

Risk is a normal phenomenon attached to the investment decision process. The process of investment decision of individual is influenced by investor-specific behavioral factors such as risk perception, expected return and preference. Risk-taking behavior has a strong and significant influence of risk perception, as well as risk-taking behavior of individual investors, have a positive and significant influence of overconfidence. Many demographic factors such as gender, age, knowledge of financial instrument (literacy) and investment habits play important roles in constructing risk perceptions and investment decision among investors. Perceived risk negatively impacts perceived behavior control as it is stated by Xie et al. (2017) in their study. They further stated that the individuals’ confidence may increase with the lower level of risk perception in adoption to choose that product or service. Borsboom & Zeisberger (2020) stated in his study that price movement pattern has a direct and positive relationship with the investor’s risk perception. They further stated that the level of return on securities (highs, lows and absolute) worked as the most important component in the construction of the perception (risk) of the individual investor. Gill et al. (2011) suggested in their study that Indian investor is conservative investor, who consult investment advisor for reducing their perceived risk in mutual fund investment, rather than higher return. We have taken a perceived risk as mediating variable, which influences the relationship of investors’ belief and investment decision in a mutual fund, by the study of Deb & Singh (2018). Based on these past studies, the following hypothesis is formulated for the present study.

H2: Risk perception of investors significantly and negatively mediate the relationship of investors’ belief and investment decision towards the mutual fund.

Expected Return as Moderator

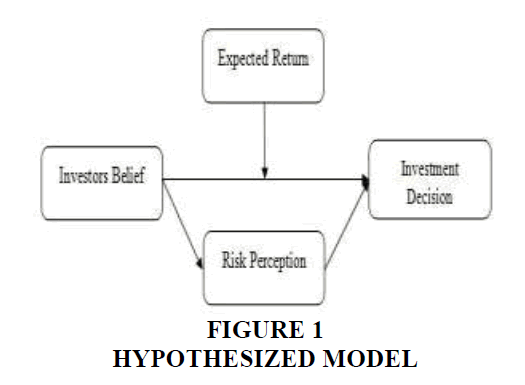

The basic capital market literature uses non-variable models, i.e. models where the movement of stock is considered separately at most, whereas the return on investment is depending on the risk exposure of the instrument (Rombouts et al., 2020). The liquidity premium also helps explain why professional investors are willing to join the contrary side of the lucrative momentum (bullish) than the retail investor. Kang et al. (2020) found that while professional investors' losses cause losses to the non-commercial component of the market movement, they recover these losses through a huge amount of intra-day trading which is symmetrical to market movement. They further expressed an exact case of how directional trading by enormous numbers of traders of security market diminishes the normal returns they have earned. Hence expected return is considered as potential moderator and the following hypothesis is formulated Figure 1.

H3: Expected return positively moderate the relationship of investors’ belief and investment decision towards the mutual fund.

Theoretical Model

The present study is an effort to identify the effect of belief, perceived risk and expected return of investment decision of an individual mutual fund investor. An evaluation model was developed to measure the relationship between the selected variables based on the proposed literature. The following estimation model was evaluated using a five-point scale (Likert) with strong disagreement (1) score from the strong agreement (5).

Questionnaire and Data Collection

The data has been collected with the assistance of a self-controlled questionnaire. Investors’ belief was evaluated utilizing five items from the investigation of Pellinen et al. (2015). Perceived risk and expected return have been measured using four items and one item taken from the investigation of Deb & Singh (2018). The investment decision was evaluated by two items received from the investigation of Gill et al. (2011).

High connections between self-administrated questionnaire and the objective measurements. The convenience sampling technique was utilized to choose responders. Google doc was coasted among responders, through email and other networking sites like: Facebook, WhatsApp and LinkedIn. Respondents were guaranteed that their reactions would be kept secret. To expedite the response rate, an email was sent after the primary mail. The total response received was 489, of which 404 were usable (84.01%) comparable reaction rates have been accounted for by a few different investigations.

Respondents Profile

The respondents of the present study are mutual funds investors. These investors have been chosen from the client database of NDI consultant Pvt. Ltd. and T. P. investment advisors. 404 qualified questionnaires were received. Gender wise there are 301 male and 103 females. There are 255 married responded 124 bachelors and 25 other (Divorced or widow). The respondents mostly represent the young group of people distributed as 21-25 years (158) 26-40 years (182), 41-55 years (49), and 56-70 years (15). The responded are mostly qualified, there are 81(Undergraduate), 149 (Postgraduate), 168 (professional) and 6 (doctors).

Analytical Approaches

The current research problem requires a model to evaluate the relation among the investors’ belief, investment decision, risk perception and the effect of expected return on these relations. Hypothesis stated that investors’ belief can predict investment decision, whereas risk perception mediates this relationship and expected return interact with all these relations. Confirmatory factor analysis have been applied to the estimation model (using AMOS 21) to ensure that all model items were constructed in a significant match with their constructs. Statistics such as root mean square error of approximation, Comparison Fit Index, Standardized Root Mean Square Residual, PClose and Chi-square (Hu et al., 1992) have been used to check model fitness. The threshold values were taken as CMIN / DF more than 1; SRMR as 0.08 and below; RMSEA to be 0.06 or below and PClose to be greater than 0.05.

Data Analysis

The table of descriptive analysis Table 1 shows the mean, standard deviation, skewness, kurtosis and inter-correlation of each scale. The skewness and kurtosis value of the entire construct are negative (except Risk perception’s skewness value) but lies within -/+ 1 fulfilling the criteria of normal distribution. The coefficient of correlation among the variable are significant (p<0.01) and below 0. Confirming that there is the absence of multicollinearity in the present data set in the data set. This is also supported by VIF (variance inflation factor) value. Durbin Watson statistics for the construct is 1.989, implying absence of auto-correlation in the data. Further, Cronbach alpha coefficient of the construct indicates excellent internal consistency of the scales of the construct as they are above 0. 85.

| Table 1 Descriptive Statistics | ||||

| Descriptive Analysis of Statistics | ||||

| Expected Return | Investment Decision | Risk Perception | Investors' Belief | |

| Mean | 2.092 | 2.715 | 1.826 | 2.426 |

| Std. Deviation | 0.856 | 0.969 | 0.849 | 0.940 |

| Variance | 0.734 | 0.938 | 0.721 | 0.883 |

| Skewness (Std. Error) | -0.177 (0.121) | -0.130 (0.121) | 0.083 (0.121) | -0.012 (0.121) |

| Kurtosis (Std. Error) | -0.616 (0.242) | -0.768 (0.242) | -0.879 (0.242) | -0.607 (0.242) |

| VIF | 2.141 | - | 2.070 | 1.483 |

| Expected Return | NA | - | - | - |

| Investment Decision | -.006 | 0.883 | - | - |

| Risk Perception | -.012 | -.571** | 0.853 | - |

| Investors’ Belief | 0.010 | 0.719** | -.730** | 0.904 |

Measurement Model

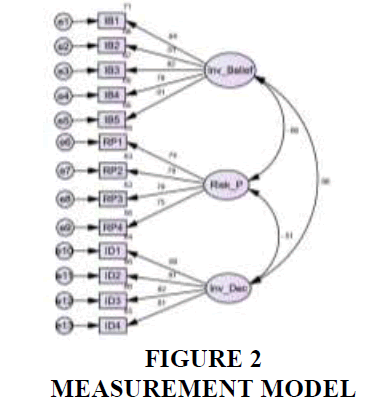

Investigative approach: The Confirmatory Factor Analysis method (using IBM.SPSS, Amos.v21) was applied for measurement of the construct item and their respective loading in the model Figure 2.

To establish the mediating and moderating effect among the investors’ belief, risk perception and investment decision, we adopted the direct effect moderation model of the process function. The model fit was measured through certain standardized statistical measures, which are χ2 statistics (chi-square), CMIN/DF, Comparative Fit Index (CFI), Standardized Root Mean Square Residual (SRMR), Root Mean Square Error of Approximation (RMSEA) and PClose (Hu & Bentler, 1999). Subsequent testing of the proposed hypothesis was performed through Path Analysis with the help of SPSS Process Macro.

Measurement Model through CFA

Confirmatory Factor Analysis provided excellent model fit as represented by CMIN=83.386, DF=62, CMIN/DF=1.345, CFI=0.993, SRMR=0.033, RMSEA=0.029, PClose=0.990 (Hu & Bentler, 1999).

Composite reliability scores for variables investment decision, risk perception and investors’ belief, were 0.883, 0.853 and 0.904 respectively. The hypothesised model also displayed convergent validity and discriminant as shown in the validity table Table 2. AVEs for Investor Belief (0.656), Risk Perception (0.594) and investment decision (0.654) are higher than 0.5 while CR values of Investor Belief (0.905), Risk Perception (0.854) and investment decision (0.883) are greater than 0.7. Further, CR values for all constructs are greater than their corresponding AVEs. Hence, it can be established that there is no concern of convergent validity problems.

| Table 2 Validity Table | |||

| Validity Measures | Variables | ||

| Investors Belief | Risk Perception | Investment Decision | |

| CR | 0.905 | 0.854 | 0.883 |

| AVE | 0.656 | 0.594 | 0.654 |

| MSV | 0.439 | 0.439 | 0.435 |

| √AVE | 0.810 | 0.770 | 0.809 |

Table 2 also shows that the Maximum Shared Variance (MSV) of Investor Belief (0.439), Risk Perception (0.439) and investment decision (0.435) are lesser than the values of Average Variance Extraction Values (AVE) for all structures and the correlation between's different structures is lower than the √AVE. So it also confirms the validity of differentiation between the structures. Finally, to test biasness in the model, we introduced a new latent variable in a way that all visible variables are associated with it, with variance of the common factor limited to 1. It was observed for all variables that the difference among standard estimates with CLF and without CLF was less than 0.200, confirming absence of common method bias.

Hypothesis Testing

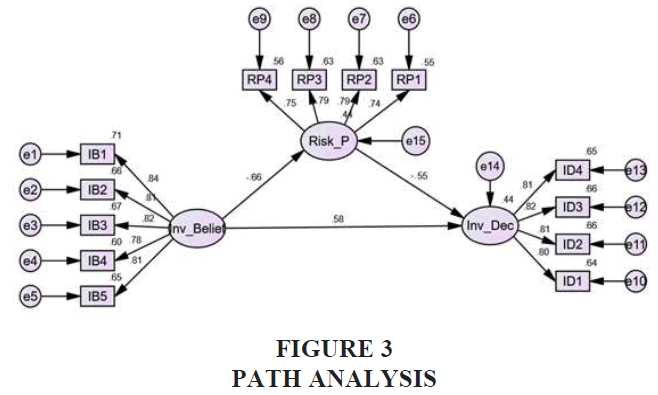

Structural model fit: The chi-square (χ2) value of the structural model is 83.386. However, as χ2 values vary depending on the size of the sample, so it is advisable to test additional general measurement metrics. χ2/df=1.345 approves acceptable compatibility of default model with sample data (Hu & Bentler, 1999). The value of CFI (0.993) and PClose (0.990) approached to 1, which is a good structural fit indicator. The model fit also being approved by values of SRMR (0.033) and RMSEA (0.029) relative to the degree of freedom. Thus we can conclude that the path model is appropriate for model fit analysis Figure 3.

The empirical values of path analysis obtained from the SPSS process for model 5 outputs can be used for testing hypothesis by interpreting their values as inferred in Table 3. Hypothesis 1 proposed that investors’ belief have a significant positive relationship with the investment decision of mutual fund investors. As shown in Table 3 the standard coefficient value of β 0.686 (t=11.5523, p<0.001), specifies the significant association between investors’ belief and investment decision in absence of any mediator thereby validating hypothesis H1.

| Table 3 Table For Analysis of Regression | ||

| Hypothesis | Direct Effect β | Result |

| Investors’ Belief àInvestment Decision | 0.686*** | Hypothesis 1 accepted |

The result of mediation analysis of process output has been shown in Table 4 (Using SPSS 21) to test the proposed hypothesis H2. The standardized regression weight between investors’ belief and risk perception was negative and statistically significant (β=-0.661, t=- 21.4166, p<0.001). Further standardized regression weight between risk perception and investment decision is also negative and statistically significant (β=-0.550, t=-13.4166, p<0.001) relates. Total indirect effect of investors’ belief on investment decision, through risk perception of investor is therefore significant (β=-0.363). Further, the direct effect of investors’ belief on investor’s decision is also significant (β=-0.586). Thus, it can beconcluded that investors risk perception negatively and partially mediate the positive relationship of investors belief and investors decision ;supporting hypothesis H2.

| Table 4 Regression Analysis for Mediation | ||||

| Hypothesis | Effect (Direct) β | Effect (Indirect) β |

Total Effect | Conclusion |

| Investors’ Belief àInvestment Decision | 0.586*** | -0.363*** | 0.223*** | Partial Mediation& Hypothesis 2 accepted |

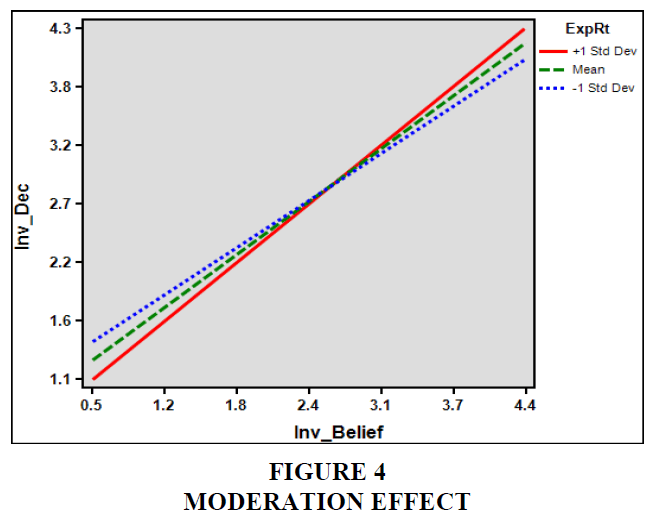

In H3, it was hypothesized that the significant and positive relation of investors’ belief and investment decision towards mutual fund investment strenthens with a greater score of expected return in comparison to a lesser score of expected return. The result received from data analysis confirms that there is a positive effect(β=0.102, t=2.414, p<0.05)of interaction (cross product of investors belief and expected return) on investment decision, supporting the hypothesis (H3). This interface is graphically presented in Figure 4. The graph displays a strong association among investors’ belief and investment decision towards mutual fund investment with the higher and lower expected return. So it can be stated that expected return strengthens the relationship (positive) between investors’ belief and investment decision towards mutual fund and it validates the hypothesis (H3).

Results

The present study is an attempt to identify the relation of investors’ belief and investment decision of mutual fund investors. The result of our study depicts that investors’ belief has positive and significant ( β=0.686) relation with investment decision in absence of any mediator (Linder & Sperber, 2020). Investors’ belief influence their decision if their belief shows a positive sense (gaining profit) for their instrument. But in the presence of risk perception (mediator) investors’ belief act differently.

There is a partial mediation in our study (direct effect β=0.586, indirect effect β=-0.363) of risk perception, i.e. risk perception of investor negatively influence the relation between investors’ belief and investment decision of mutual fund investors. The present study further illustrates that expected return strengthens the relation of investors’ belief and investment decision. The investors who expecta higher return of investment have a higher influence on their belief on investment decision.

Discussion

Practical Implication and Future Prospect for Study

In the current research, we havedeveloped a moderated mediation model which states that though investors’ belief in mutual fund is a very important factor for influencing investment decision, risk perception and expected return affect this relationship. Specifically, the higher degree of expected returnstrengthens this relationship. It is very important to understand the level of belief of investor on investment advisor for constructing a better fund/portfolio. In our study, we have shown that risk perception mediates the relation of belief and investment decision. It can be stated that theses relation exists among the rational investors. The result of our study can help mutual fund marketer for creating better promotion plan considering the belief of investors. The marketer can focus on cultivating belief among their existing as well prospective investors.

Conclusion

The current study is carried out with only mutual fund instrument, which is one of the main constraints of the study. It may be possible to explore many more different characteristics of observed variable/factor if we induce some more instrument of similar nature such as unitlinked plan, pension fund instrument etc. The researcher can further explore the relation of investor’s expertise and belief together because these are the most important factors which instigate overconfidence bias. Further, it will be interesting to study these relations with different category of investment instrument together, such as stock, bank deposit, debt instrument etc.

References

Barth, D. (2018). The Costs and Beliefs Implied by Direct Stock Ownership. Management Science, 64(11), 5263-5288.

Indexed at, Google Scholar, Cross ref

Borsboom, C., & Zeisberger, S. (2020). What makes an investment risky? An analysis of price path characteristics. Journal of Economic Behavior & Organization, 169, 92-125.

Indexed at, Google Scholar, Cross ref

Bruhin, A., Santos-Pinto, L., &Staubli, D. (2018). How do beliefs about skill affect risky decisions?. Journal of Economic Behavior & Organization, 150, 350-371.

Deb, S., & Singh, R. (2018). Dynamics of Risk Perception Towards Mutual Fund Investment Decisions. Iranian Journal of Management Studies, 11(2), 407-424.

Fodor, J.A. (1985). Fodor's guide to mental representation: The intelligent auntie's vade-mecum. Mind, 94(373), 76-100.

Gill, A., Biger, N., Mand, H. S., & Gill, S.S. (2011).Factors that affect mutual fund investment decision of Indian investors. International Journal of Behavioural Accounting and Finance, 2(3-4), 328-345.

Hu, L.T., & Bentler, P.M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural equation modeling: a multidisciplinary journal, 6(1), 1-55.

Indexed at, Google Scholar, Cross ref

Hu, L.T., Bentler, P.M., & Kano, Y. (1992). Can test statistics in covariance structure analysis be trusted?. Psychological Bulletin, 112(2), 351.

Huang, W., Liu, B., Wang, H., & Yang, J. (2019). Dynamic optimal investment policy under incomplete information. The North American Journal of Economics and Finance, 50, 100976.

Indexed at, Google Scholar, Cross ref

Kang, W., Rouwenhorst, K.G., & Tang, K. (2020). A tale of two premiums: The role of hedgers and speculators in commodity futures markets. The Journal of Finance, 75(1), 377-417.

Indexed at, Google Scholar, Cross ref

Li, C.W., Tiwari, A., & Tong, L. (2017). Investment decisions under ambiguity: Evidence from mutual fund investor behavior. Management Science, 63(8), 2509-2528.

Indexed at, Google Scholar, Cross ref

Linder, C., & Sperber, S. (2020). “Mirror, Mirror, on the Wall–Who Is the Greatest Investor of all?” Effects of Better-than-Average Beliefs on Venture Funding. European Management Review, 17(2), 407-426.

Indexed at, Google Scholar, Cross ref

Misra, R., Srivastava, S., &Banwet, D. K. (2019). Do religious and conscious investors make better economic decisions? Evidence from India. Journal of Behavioral and Experimental Finance, 22, 64-74.

Negrelli, S. (2019). Bubbles and persuasion with uncertainty over market sentiment. Games and Economic Behavior, 120, 67-85.

Indexed at, Google Scholar, Cross ref

Pellinen, A., Törmäkangas, K., Uusitalo, O., &Munnukka, J. (2015). Beliefs affecting additional investment intentions of mutual fund clients. Journal of Financial Services Marketing, 20(1), 62-73.

Rombouts, J.V., Stentoft, L., &Violante, F. (2020). Pricing individual stock options using both stock and market index information. Journal of Banking & Finance, 111, 105727.

Indexed at, Google Scholar, Cross ref

Xie, Q., Song, W., Peng, X., &Shabbir, M. (2017). Predictors for e-government adoption: integrating TAM, TPB, trust and perceived risk. The Electronic Library.

Indexed at, Google Scholar, Cross ref

Received: 06-Aug-2022, Manuscript No. AJEE-22-12437; Editor assigned: 08-Aug -2022, PreQC No. AJEE-22-12437(PQ); Reviewed: 22- Aug-2022, QC No. AJEE-22-12437; Revised: 26-Aug -2022, Manuscript No. AJEE-22-12437(R); Published: 31-Aug -2022