Research Article: 2019 Vol: 23 Issue: 2

Off-Balance Accounting In the Modern Information System of an Enterprise

Nataliia Klymenko, National University of Life and Environmental Sciences of Ukraine

Oleksandra Nosovets, Odessa National Polytechnic University

Liudmyla Sokolenko, Sumy National Agrarian University

Olena Hryshchenko, National University of Shipbuilding

Tetiana Pisochenko, Mykolaiv National Agrarian University

Abstract

Taking into account the actual requirements of business activities to ensure the needs of analytical accounting and internal control of the facts and operations on off-balance sheet accounts, a system was proposed for documenting them, in the context necessary for making management decisions. It was proposed to use the method of their reflection using the digraphic system of records, a list of analytical off-balance accounting and for ensuring uniform methodological approaches to off-balance accounting. An accounting policy of the enterprise was developed in the context of off-balance sheet accounting, as a set of principles, methods and procedures used by the enterprise to reflect business facts and operations on off-balance sheet accounts and compile and report.

Keywords

Off-Balance Accounting, Digraphic Records System, Management Decisions, Information Needs Of Users, Balanced Scorecard.

JEL Classifications

M21, O16

Introduction

An important element of the information system of an enterprise is off-balance accounting, which is designed to monitor, measure and record the facts of economic activity that do not affect the property status, but which need special supervision in order to have complete information about past, current and possible future events, as well as to control the property, which does not belong to the given enterprise, but is used by it in economic activities with the right of use or disposal. Proceeding from this, the approach that focuses science on the study of theoretical, organizational and methodological directions of improving accounting in off-balance accounts is relevant.

Enterprise management is an activity that forms a complex and interconnected system that depends both on the external environment surrounding the enterprise and on the internal factors of its operation. Effective leadership requires timely, complete and reliable information. Issues of development of off-balance sheet accounting should be considered systemically from the standpoint of improving the process of information support, creating the basis for improving the efficiency of management decision making.

Special attention should be paid to the study of the potential of off-balance sheet accounting for the formation of information support for the enterprise management process and the development of an integrated off-balance sheet accounting methodology. The lack of compliance of the concept of off-balance sheet accounting with the current information needs of users and the lack of its precise regulation determine the relevance of this study.

Review of Previous Studies

Objective processes of development of market relations require fundamental changes in the enterprise management system and the application of new approaches to its high-quality information support, which is formed in the accounting system.

The main task of accounting is to collect process and provide reliable, complete, relevant and timely information about the activities of the enterprise to external and internal users for decision-making. As you can see, accounting is focused on the needs of consumers of its information and it is they who determine the direction for the further development of accounting (Drobyazko, 2018; Garbowski et al., 2019).

Most modern authors of educational and scientific publications consider off-balance sheet accounts as NOT accounting, but operational, technical, statistical, intended to reflect only the legal structure of an enterprise’s assets (Blatt & Gulbin, 2018). Some authors emphasize the controlling nature of off-balance sheet accounts (Drobyazko et al., 2019).

Giron & Rodríguez-Vives (2017) indicated the use of unilateral recordings on off-balance accounts, in which every fact that is observed at the same time reflects the right and duty always in equal amounts and cannot change separately, the authors consider off-balance accounts NOT as accounting, but as statistical, operational and technical, which is associated with the absence of double entries on them.

Zelmanovich & Hansen (2017) supported this position, stating that off-balance accounts are, in fact, forms of statistical observation, which is based on the relevant documents. However, the authors emphasized their controlling nature, as evidence of the enterprise’s responsibility for the funds indicated.

Having studied the views of twentieth and early 21st century scholars on the use of off-balance sheet accounts, we can say: many authors did not pay enough attention to them or ignored or denied the possibility and need of using them.

Currently, off-balance accounts are used in many countries, they have different names (off-balance, special, memorial, etc.), but are united by the fact that they are outside the billing system of accounting records designed to reflect elements of financial statements (assets, liabilities, equity, income, expenses and financial results) (Huang, 2017). However, there is still no sustainable list of information that should be reflected on off-balance sheet accounts. Each country has its own requirements for the mapping of off-balance sheet objects, corresponding to the general economic situation in the country, legislative regulation of accounting issues, openness of financial information and other legal, economic and social factors. The results of the study indicate that many countries use off-balance accounts, each country has its own criteria and approaches to the fact records and transactions on them.

In publications of domestic and foreign economists, there are polar opinions on the feasibility of using a simple and double record of off-balance sheet operations of enterprises. Most argue that off-balance accounts are not included in the aggregate system accounts, and they can be recorded in a simple (unigraphic) way. Some scientists are of the opinion that the use of a simple (unigraphic) record in the off-balance sheet accounting system has turned it into a non-system, non-mandatory, which is more like operational technical accounting than accounting (Hilorme et al., 2019; Hilorme et al., 2019).

It is advisable to study the nature and information capabilities of the unigraphic and digraphic systems of off-balance sheet accounting, namely: historical aspects of development and the main features of simple and double bookkeeping, the procedure for recording business transactions on off-balance sheet accounts of enterprises, budget organizations and banking institutions, and to single out the advantages and disadvantages of unigraphic and digraphic accounting systems and the impact of using each of the systems on the quality and completeness of information about the objects and facts of the company's off-balance sheet activities.

Methodology

In order to achieve the stated goal and solve the tasks set in the scientific work, such tools of scientific study methods was used: induction, deduction, historical, comparison, theoretical generalization, systematic and complex analysis, observation, abstract logical, causal relationships, descriptions, concretization, formalization, dialectical, systematization, modeling and generalization.

Results and Discussion

In modern conditions, accounting approaches that rely on standard procedures give way to more flexible accounting systems that focus on analyzing enterprise capabilities. Therefore, the task of the modern accounting system is to generate information about the total potential of the enterprise. The objective components of the enterprise's potential include: industrial, innovative, financial, informational, infrastructural and reproduction potential. The subjective components of the potential of the enterprise include: scientific, technical, marketing, personnel, the potential of management capacity and the potential of the organizational structure of the enterprise.

According to the Balanced Scorecard (BSC) theory, developed by Kaplan & Norton (2017), successful business management is possible under the condition of an integrated (balanced) approach to the assessment of tangible and intangible assets using indicators of a financial and non-financial nature. Non-financial aspects of the enterprise's activities potentially affect its financial performance, which makes them an important source of strategic planning and performance forecasting.

The need to take into account non-financial indicators in developing strategies and establishing causal relationships between individual indicators confirm such complex models for measuring and assessing economic performance, such as The Performance Prism, the control panel Tableau de Bord, the European Foundation for Quality Management (EFQM), EP2M model and others. Non-financial indicators are indicators that are not expressed in cash. The introduction and application of non-financial indicators mapping system at enterprises is quite a costly process involving the selection of their quantity and composition.

The management of the company independently determines what attention should be paid, and what can be ignored in the specific conditions of the place and time. Selected non-financial indicators should meet the following requirements: the ability to be calculated, the relationship with the strategy of economic activity of the enterprise, clarity, accessibility, relevance, interconnection with other indicators (balance).

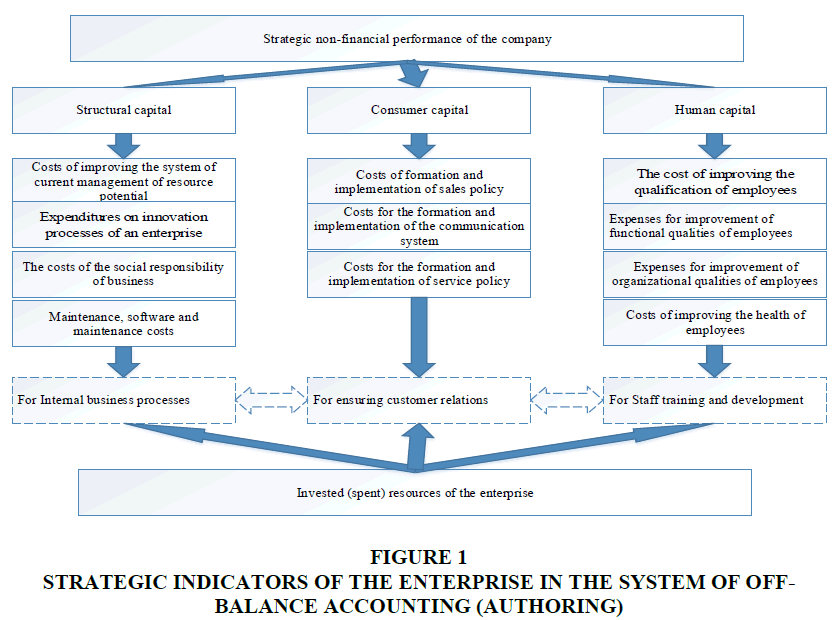

Considering the above, we propose to accumulate and summarize information on the expenses of the enterprise for the formation of consumer, structural and human capital on the off-balance sheet accounts, which is already reflected in the composition of activity expenses and requires systematization for the needs of strategic management. The components proposed for off-balance accounting of strategic indicators of the enterprise are presented in Figure 1.

The considered groups of non-financial indicators and components of intellectual capital are inherently identical and make it possible to generalize that the expenses of the enterprise for the formation of relationships with customers provide for the accumulation of consumer capital, the expenses for internal business processes - form the structural capital of the enterprise, the expenses for training and development of personnel - form human capital, and are strategic expenses, as they ensure the development of the enterprise in the long term.

According to the balanced scorecard, developed by Kaplan & Norton (2017), there are three groups of strategically important non-financial indicators: relationships with customers, internal business processes, and opportunities for staff training and development.

Off-balance accounting should expand the information capabilities of the accounting system. Correctly formulate the definition of the subject of off-balance sheet accounting means to indicate its place and role in the accounting system and determine the scope of its application.

Analysis of the regulatory framework for the regulation of elements of the accounting policy of the company allows to conclude that there is a lack of proper attention to off-balance objects and their insufficient regulatedness and the need for comprehensive study and development of specific recommendations on documentation, organization of management accounting and internal control in the off-balance sheet system in order to provide managers with the necessary high-quality information to manage the existing and proposed off-balance sheet objects.

A continuous accounting process built on a unified basis within the enterprise is designed to provide managers at various levels with the information necessary for effective management. One of the functions of accounting is the control, which is to ensure the implementation of control over the activities of the enterprise for the rapid elimination of identified deviations and errors and the subsequent selection of the correct direction of its conduct. This function provides for monitoring the safety, availability and movement of the property of enterprises, the correctness and timeliness of settlements with the state and other business entities.

In the system of off-balance accounting, the control function is to exercise supervision over the presence and movement of valuables that are not owned by the enterprise, but are temporarily in its use, disposal, storage; the formation of information about contingent assets and liabilities of the company; the status and changes in the composition of the objects of operational and strategic control. The control function of off-balance sheet accounting is implemented using elements of the accounting method: documentation, inventory, valuation, accounts, double-entry and balance synthesis.

The depth and extent of internal control is the need to obtain confidence in the accuracy of the information, which is formed by the subsystem of managerial off-balance sheet accounting and is provided to the management of the enterprise and its owners to make management decisions. Thus, internal control in the system of managerial off-balance sheet accounting is a set of procedures that ensure the accuracy and completeness of information given to the management of the enterprise; compliance with internal and external regulations in the implementation of off-balance sheet operations; preservation of off-balance accounting objects, their optimal use; ensuring accurate implementation of orders of the management bodies of the enterprise. The subject of internal control of the system of managerial off-balance sheet accounting is the facts of economic life that are reflected in off-balance sheet accounts; interrelations between them and balance objects of the accounting and their influence on decision-making and results of activity of the enterprise. Considering the role and place of internal control in the system of managerial off-balance accounting, it should be remembered that internal control in the enterprise is an integral system that obeys uniform requirements and principles of construction and operation, and only a systematic approach to the organization and methodology of internal control is the key to its quality and effectiveness in the conditions of a dynamic market environment, competition and risk.

Recommendations

As for the off-balance accounting, we recommend the following stages of the formation of a primary monitoring system: evaluation and selection of data on the facts of economic activities in accordance with the goals and objectives of accounting that is, the choice of objects; specification of objects selected for accounting, determination of their accounting parameters from the standpoint of user needs, legal requirements of legality and evidence of facts and expediency of reflection; appointment of persons responsible for the conduct and fixation of certain facts of economic life, which are to be reflected in off-balance sheet accounting; formation of a scheme for transferring the received data for further processing, which should ensure its timeliness as one of the most important information requirements in a competitive environment.

Conclusion

So, accounting and methodological support for the off-balance sheet accounting in a modern information system of the enterprise requires complex improvement in order to form an integrated accounting and control subsystem for generating accounting information on the off-balance accounts.

In order to improve internal control in the system of managerial off-balance sheet accounting, proposals were made to outline the functions of organizational control and the off-balance sheet accounting methods control, to identify basic principles, tasks, objects, methodological techniques, control procedures, to systematize information sources and to distribute functional responsibilities between individual services, departments and specialists in the process of internal control in the system of managerial off-balance accounting, which will significantly improve its quality and efficiency and ensures the targeting of control measures, their effectiveness and compliance with modern management requirements.

Compliance with the above requirements for the organization of internal control for the off-balance accounting objects will provide a clear structure of the control process, a logical sequence of control operations, an interdependence of actions of employees performing control functions within the framework of official instructions, their responsibility for their actions and will further improve the forms and methods of control.

References

- Blatt, J., & Gulbin, J. (2018). Achieving IFRS off-balance-sheet treatment in trade receivables securitizations. The Journal of Structured Finance, 23(4), 30-35.

- Garbowski M., Drobyazko S., Matveeva V., Kyiashko O., & Dmytrovska V. (2019). Financial accounting of e-business enterprises. Academy of Accounting and Financial Studies Journal, 23(2).

- Giron, C., & Rodríguez-Vives, M. (2017). Leverage interactions: A national accounts approach (No. 19). ECB Statistics Paper.

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance, 10, 4-11.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship Innovation Model for Telecommunications Enterprises. Journal of Entrepreneurship Education. 22(2).

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(1S).

- Hilorme, T., Zamazii, O., Judina, O., Korolenko, R., & Melnikova, Y. (2019). Formation of risk mitigating strategies for the implementation of projects of energy saving technologies. Academy of Strategic Management Journal, 18(3).

- Huang, J. (2017). A tale of two items sent off balance sheet: securitization and loan commitment. Working Paper. National University of Singapore.

- Kaplan, R.S., & Norton, D.P. (2017). The balanced scorecard measures that drive performance. Havard Bus Rev.

- Zelmanovich, B., & Hansen, C.M. (2017). The Basics of EBITDA. American Bankruptcy Institute Journal, 36(2), 36.