Research Article: 2020 Vol: 23 Issue: 5

Oil-and-Non-Oil-Revenues-Assessment-of-Contributions-to-Infrastructural-Development-in-Nigeria

Cordelia Onyinyechi Omodero, Covenant University Ota

Benjamin Ighodalo Ehikioya, Covenant University Ota

Citation Information: Omodero, C. O., & Ehikioya, B. I. (2020). Oil and non-oil revenues: assessment of contributions to infrastructural development in Nigeria. Journal of management Information and Decision Sciences, 23(5), 638-648.

Abstract

The poor state of infrastructures in Nigeria has elicited this investigation which aims at establishing the role of oil and non-oil revenues in improving infrastructural development in the country. The study covers a period from 2005 to 2019 using various econometric tools to ascertain the contributions of the two primary revenue sources in Nigeria on infrastructures. The findings of this study reveal that oil revenue and exchange rate have a significant negative impact on infrastructural provisions. The inflation rate is not substantial in this study. However, non-oil revenue has a significant positive impact on infrastructural development in the country. The findings lead to the recommendation that the government will have to leverage more on tax revenue to execute its public responsibilities. The need for economic diversification should be vigorously pursued to keep the economy at equilibrium in the face of oil price shocks and fluctuations. However, all government revenues should be well applied to provide the necessary infrastructures in the country. The study also recommends that the government should come up with policies that would attract more Foreign Direct Investments that could help in the infrastructural and technological advancement of the country.

Keywords

Oil Revenue; Tax Revenue; Infrastructural Development; Technological Development.

JEL Classifications

H20, H27, H41, H54

Introduction

The ongoing debate on the effect of oil revenue on different aspects of the Nigerian economy remains unending, following the dwindling nature of the global oil prices in recent times. For scholars like (Onyeke et al., 2020), the Nigerian Stock Market describes better, the economic function of oil revenue as it affects different sectors represented in the capital market. Researchers like Olayungbo and Kazeem (2017) linked the role of corruption as an institutional quality interfering with oil revenue's response to economic growth needs. However, the study on how crude oil revenue affects the economy of Nigeria is not exhaustive. Crude oil exportation in the Sub-Saharan African nations is an income spring that gives economic backing to virtually all endeavours that improve an economy (Ehikioya et al., 2020). Furthermore, scholars (Olayungbo & Olayemi, 2018; Omodero & Dandago, 2019) have also attempted to ascertain the dynamic effect of non-oil revenue on economic growth in Nigeria. The non-oil income referred to is more embedded in tax revenue.

The fact is that the government has the responsibility to provide citizens with necessary infrastructures to improve the standard of living and promote economic development in the country (Omodero et al., 2019; Omodero & Dandago, 2019). In the same manner, the government requires revenue from all sources to shoulder these responsibilities. Therefore, it is crucial to examine the two heads of income in Nigeria, in an investigation regarding infrastructural development in the country. This present study is a significant digression from the existing literature due to its unifying and comparability of the two significant sources of revenue in the country. In this study, we comparatively assess the contribution of oil and non-oil revenue on infrastructural development in Nigeria. An economy without adequate infrastructures to drive its growth is really in jeopardy.

Over the years, Nigerians have suffered a lack of infrastructural development due to corruption and mismanagement of resources (Omodero, 2019). The sudden progressive switching of the economy from oil to non-oil revenue sources in Nigeria has desperately propelled this investigation. The apparent need to diversify the economy became very glaring during Covid-19 pandemic when the Nigerian oil price was forced down from the estimated $57 per barrel to $30 per barrel (Nwagbara, 2020). It was an incident that led to Nigeria's 2020 budget adjustment, for which both the capital and the recurrent expenditure were reduced to 20% and 25% respectively (Nwagbara, 2020). The Covid-19 pandemic effect on oil revenue authenticated the argument by Jabir et al. (2020) that oil revenue might turn out to be an economic enemy if it proceeds is not suitably invested in boosting economic growth. Usually, investment into viable projects is targeted to yield returns, and that is what keeps an economy healthy. Absolute focus on one source of revenue is quite unhealthy and adversely affects all areas of an economy.

The federally collected revenues in Nigeria include oil and non-oil incomes. The oil revenue comprises Oil pipeline license fees, Royalty on the extraction of oil; Rent of oil well and grounds; Sale of petroleum and gas; Penalty for gas flaring. The non-oil revenue includes personal income tax; company’s income tax; capital gains tax; withholding tax and all for forms of indirect taxes (ATSWA, 2009). The non-oil revenue is more integrated into tax revenue sources. In the last four years, non-oil income in Nigeria has been progressive. It increased from N2, 693.9 Billion in 2016 to N5, 536.66 Billion in 2019 (CBN Statistical Bulletin, 2019). In 2019, non-oil revenue composition was Value Added Tax 25.1%, Customs and Excise Duties 17.9%, Corporate Tax 35.7%, Federal Government Independent Revenue 10.9% and forms of taxes 11.1% (CBN Annual Report, 2019). The progressive report is a piece of evidence that tax revenue is very pivotal in driving an economy, especially an emerging market.

Literature Review

Peacock-Wiseman Theory

This study anchor on Peacock and Wiseman (1979) theory which states that the increase in public expenditure centres rationally on revenue collection which enables the government to provide the citizens with infrastructures and other public goods and services. The provision of infrastructures and other public goods and services is a function of the revenue sources available to the government. To corroborate this fact, scholars such as (Hong & Nadler, 2015; Asongu & Jella, 2016) observe that increase in government revenue, foreign aids and grants are factors that can increase government capital investments. These revenue springs include oil revenue, tax (non-oil) revenue and other forms of government revenue sources in a nation. The relevance of government revenue is more pronounced when the demand for government interventions rises in times of wars, drought, pandemic and all other types of natural catastrophe. Therefore, it is expedient that the government of every nation is well-armed with sufficient revenue to carry out their numerous obligations to the citizens.

Selected studies on the contribution of oil revenue to economic growth

Jabir et al. (2020) employed a panel VAR framework to assess the contribution of oil revenue to economic growth in 83 oil-producing countries from 1990 to 2015. The study used the financial markets development channel and discovered that government investment of oil revenues exerted a positive influence on economic growth through banking sector development. There was no effect found on stock market development. The study further established that the private investment of oil revenues showed a negative impact on banking sector development did not have any impact on stock market development. Olayungbo (2019) examined the impact of oil revenue on Nigeria's economic growth using Bayesian time-varying parameter. The study covered 1970-2015 and found that oil revenue had significantly and positively contributed to Nigeria's economic growth for the period covered in the survey.

Olawunmi et al. (2018) investigated the relationship between oil price, revenue and changes and economic growth of Nigeria. The study employed data that spanned from 1981 to 2016. The method of evaluation used was the Auto-regressive Distribution Lag to establish the existence of long-run and short-run relationship among the variables used in the study. In the long run assessment, oil price, consumer price index and the exchange rate had a positive relationship with economic growth, but oil revenue negatively related to economic growth. However, in the short run, consumer price index and exchange rate negatively associated with economic growth. On the contrast, oil price and oil revenue exhibited a significant positive relationship with economic growth in the short run. Olayungbo and Kazeem (2017) employed ARDL to analyze the effects of oil revenue and corruption on Nigeria's economic growth from 1984 to 2014. The result showed that oil revenue, corruption and economic growth had a long-run equilibrium relationship. The study further disclosed that corruption and oil revenue promoted economic growth in the long run, but in short, there was a reduction.

Ali and Harvie (2013) used a deterministic dynamic macroeconomic model to evaluate the effects of oil production on significant macroeconomic variables that come up as a result of oil sector recovery in Libya. The study found a positive impact of oil production on key macroeconomic elements which include private capital stock, real income, domestic physical capital stock, human capital stock, non-oil supply and imported capital stock. Farzanegan (2011) applied instinct reaction functions and difference disintegration breakdown method to investigate the emotional effects of oil revenue shocks on different categories of the Iranian government expenditures from 1959-2007. The result indicated that Iran's Military and Security expenditures significantly reacted to oil price changes, but social spending did not respond significantly to the oil price variations.

Review of selected works on the input of non-oil revenue to economic growth

Ude and Agodi (2014) assessed the role of non-oil income on economic growth in Nigeria from 1980 to 2013. The non-oil revenue variables used in the study were agriculture and manufacturing. The result obtained showed that agriculture, manufacturing and interest rate had a remarkable effect on the economic growth of Nigeria. However, this present study uses a non-oil revenue that is more tax-related as captured in annual reports of Central Bank of Nigeria for the relevant years of assessment. Oladipo et al. (2017) examined the effect of tax revenue on agricultural performance in Nigeria. The study used Engel and Granger approach, which revealed that tax revenue was not significant enough to promote agriculture in Nigeria.

Olayungbo and Olayemi (2018) examined the relationship between non-oil revenue, government spending and economic growth in Nigeria from 1981 to 2015. The study found that government expenditure had a negative influence on economic growth. On the other hand, non-oil revenue showed a positive impact on economic growth. Ogba et al. (2018) investigated the effect of non-oil income on economic growth in Nigeria from 1981 to 2016. The study found a long-run relationship and also confirmed that the non-oil revenue contributed significantly and positively to Nigeria's economic growth. Omodero and Dandago (2019) employed the ordinary least squares method to examine the impact of tax revenue on public service delivery in Nigeria from 1981-2017. The study specifically determined the effect of tax revenue on education and health care services in Nigeria. The findings indicated that tax revenue had a significant favourable influence on both education and health care services.

Methodology

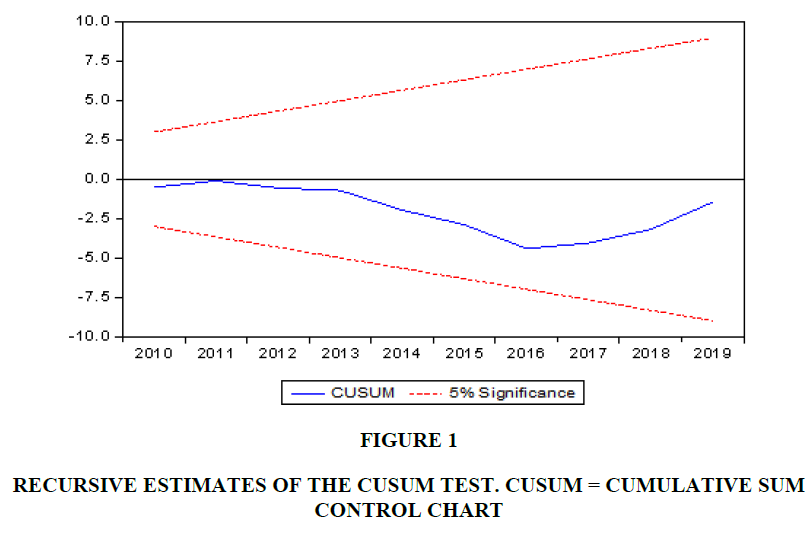

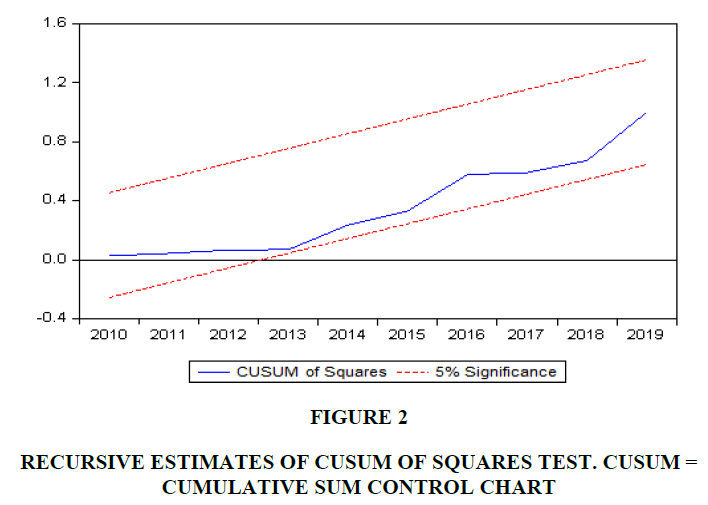

This study aims to compare the impact of oil and non-oil revenue on infrastructural development in Nigeria. The study is an ex post facto research which used existing data of events that have already taken place. Ex post facto (i.e. after the fact) research is a research that is undertaken after the event has occurred, and the data are already in existence (Ndiyo, 2005). Ex post facto research is a systematic empirical inquiry in which the scientist does not have direct control of independent variables because their manifestations have already occurred or because they are inherently not manipulated. The data span from 2005 to 2019. We collected data on federal government capital expenditure as a proxy for infrastructural development which is the dependent variable. The data on the explanatory variables, which include oil and non-oil revenues, are sourced from the Central Bank of Nigeria (CBN) Statistical Bulletin, 2019 edition. In the same vein, the data on inflation and exchange rates emanates from the World Bank Economic Indicators. The study uses the logarithm form of the data to ensure uniformity since they are not expressed in the same value. To achieve the aim of this study, which examines the impact of the independent variables on the dependent variable. The study employs multiple regression techniques in addition to various indicative checks that confirm the validity, correctness and normality of the data set. We also ensure that the regression result is not spurious by providing its stability through CUSUM recursive and squares tests at 5% level of significance.

Model Specification

The regression model tested in this study is as shown below:

![]()

The econometric form is stated as:

![]()

Where:

IFD=Cost of Infrastructural Development in Nigeria

ORV=Oil revenue

NOR=Non-oil revenue

EXG=Exchange rate

INF=Inflation rate

β0 = Constant; β1-β4 = Regression coefficients; ε = Error term.

On the a priori, we expect; ![]()

Statement of Hypotheses

The following null hypotheses are formulated to guide this study:

H01: ORV does not have a substantial impact on IFD

H02: NOR does not have a weighty influence on IFD

H03: EXG does not have a sufficient consequence on IFD

H04: INF does not have a material effect on IFD

Data Scrutiny and Explanation

Investigative Assessments

The test for serial correlation on Table 1 indicates that the F-statistic p-value of 0.5 is more significant than the 5% level of significance. Therefore, there is an absence of serial correlation in the model used in this study. The result of Durbin-Watson in Table 6 also confirms this claim.

| Table 1 Breusch-Godfrey Serial Correlation LM Test: | |||

| F-statistic | 0.681273 | Prob. F(2,8) | 0.5331 |

| Obs*R-squared | 2.182975 | Prob. Chi-Square(2) | 0.3357 |

The diagnostic test for Heteroskedasticity is to ensure that the model coefficients estimated using ordinary least squares are free from bias. The existence of Heteroskedasticity is apparent when the variance of errors or the model is not the same for all observations. In that case, the p-value of the F-statistic will be less than 5% level of significance. In this study, the p-value is 0.35, which is greater than the 0.05 significance level. Thus, there is no Heteroskedasticity in the model (Table 2).

| Table 2 Heteroskedasticity Test: Breusch-Pagan-Godfrey | |||

| F-statistic | 1.226532 | Prob. F(4,10) | 0.3595 |

| Obs*R-squared | 4.937023 | Prob. Chi-Square(4) | 0.2938 |

| Scaled explained SS | 1.715467 | Prob. Chi-Square(4) | 0.7879 |

The Ramsey Reset test is carried out to ascertain the stability of the regression model. The result in Table 3 reveals that p-value of 0.25 is a lot bigger than 0.05 benchmark. Thus, the output indicates that the model is stable. This is also confirmed in Figures 1 and Figure 2, where the blue line falls between the two red lines showing the 5% significance level boundaries.

| Table 3 Ramsey Reset Test | |||

| Specification: LOG_IFD LOG_ORV LOG_NOR LOG_EXG LOG_INF Comitted Variables: Squares of fitted values |

|||

| Value | Df | Probability | |

| t-statistic | 1.211101 | 9 | 0.2567 |

| F-statistic | 1.466766 | (1, 9) | 0.2567 |

| Likelihood ratio | 2.264708 | 1 | 0.1324 |

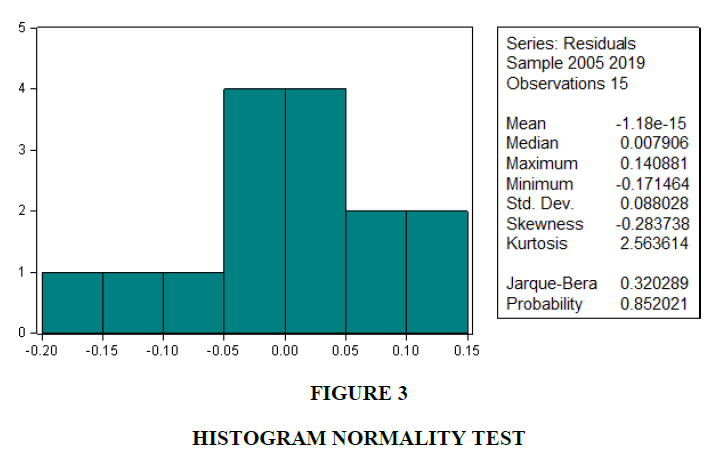

Normality Test

Figure 3 is the histogram normality which provides information on the normalcy of the data set and the distribution. The information is derived from the Jarque-Bera, which shows that the data set is normally distributed when the p-value is greater than 5% level of materiality. In this study, Jarque-Bera p-value is 0.85 > 0.05. The result of Table 4 confirms the normality of the data set.

| Table 4 Descriptive Statistics | |||||

| LOG_IFD | LOG_ORV | LOG_NOR | LOG_EXG | LOG_INF | |

| Mean | 2.972041 | 3.715632 | 3.330505 | 2.023281 | 1.226272 |

| Median | 2.946388 | 3.732079 | 3.419754 | 2.022841 | 1.227115 |

| Maximum | 3.359646 | 3.948363 | 3.670097 | 2.105510 | 1.263873 |

| Minimum | 2.715586 | 3.430381 | 2.830935 | 1.930949 | 1.186674 |

| Std. Dev. | 0.170254 | 0.143621 | 0.250762 | 0.057153 | 0.021244 |

| Skewness | 0.646681 | -0.320168 | -0.687962 | -0.043770 | -0.261501 |

| Kurtosis | 3.176608 | 2.471366 | 2.432255 | 1.753268 | 2.737780 |

| Jarque-Bera | 1.064983 | 0.430928 | 1.384687 | 0.976253 | 0.213931 |

| Probability | 0.587140 | 0.806167 | 0.500402 | 0.613775 | 0.898557 |

| Sum | 44.58061 | 55.73448 | 49.95757 | 30.34921 | 18.39407 |

| Sum Sq. Dev. | 0.405811 | 0.288780 | 0.880344 | 0.045730 | 0.006318 |

| Observations | 15 | 15 | 15 | 15 | 15 |

The Variance Inflation Factor (VIF) is a statistical tool used to determine the occurrence of multicollinearity among the explanatory variables. Multicollinearity exists when two or more independent variables interconnect in a study. VIF of such explanatory variables is usually higher than the values of 4 (Garson, 2012) or 10 (Gujarati & Porter, 2009), depending on the benchmark a researcher wishes to adopt to reach the goal of the research. The Australian Property Institute (2015) states that multiple regression model relies on the premise that all independent variables used in a study are not interrelated. Thus, the VIFs of all the explanatory variables in this study are within the acceptable limits. The result suggests the absence of multicollinearity (Table 5).

| Table 5 Variance Inflation Factors | |||

| Variable | Coefficient Variance | Uncentered VIF | Centered VIF |

| LOG_ORV | 0.052616 | 1005.786 | 1.400589 |

| LOG_NOR | 0.046211 | 712.4940 | 3.749995 |

| LOG_EXG | 1.003658 | 5685.151 | 4.230757 |

| LOG_INF | 2.982830 | 6203.607 | 1.737170 |

| C | 12.18589 | 16849.15 | NA |

Table 6 is the regression result of this research. From the result of Table 6, the correlation value (R) is 85.6% (square root of R-squared). The value shows that the relationship between the dependent and the explanatory variables is very strong. In other words, revenue is indeed an essential function of government infrastructural provisions. This is in line with the Peacock and Wiseman (1979) hypothesis that the revenue available to the government aids public spending for the betterment of the citizens. The R-squared value of 73.3% suggests the extent to which government revenue explains the changes in infrastructural development in Nigeria. The balance of 26.7% is attributable to other variables that are not included in the model. The Standard Error of regression is a measure of the accuracy of the predictions. The value is more acceptable when it is less than the value of 1. Thus, in this study, the standard error of the regression is 0.1, which shows that the regression result is free from error. The Durbin-Watson of 1.79 suggests absence of auto-correlation. The F-statistic p-value is 0.00, which is less than 0.05 significant level. The result indicates that the model has statistical significance, and it is appropriate for the study. Further, the independent variables jointly impact on the dependent variable.

| Table 6 Dependent Variable: Log_Ifd | ||||

| Method: Least Squares Sample: 2005 2019 Included observations: 15 |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LOG_ORV | -0.019475 | 0.229381 | -0.084901 | 0.9340 |

| LOG_NOR | 0.960885 | 0.214968 | 4.469893 | 0.0012*** |

| LOG_EXG | -2.826662 | 1.001827 | -2.821506 | 0.0181*** |

| LOG_INF | -2.683969 | 1.727087 | -1.554044 | 0.1512 |

| C | 8.854575 | 3.490830 | 2.536524 | 0.0295 |

| R-squared | 0.732671 | Mean dependent var | 2.972041 | |

| Adjusted R-squared | 0.625739 | S.D. dependent var | 0.170254 | |

| S.E. of regression | 0.104156 | Akaike info criterion | -1.424648 | |

| Sum squared resid | 0.108485 | Schwarz criterion | -1.188631 | |

| Log likelihood | 15.68486 | Hannan-Quinn criter. | -1.427162 | |

| F-statistic | 6.851761 | Durbin-Watson stat | 1.792672 | |

| Prob(F-statistic) | 0.006367 | |||

The t-statistic helps to test the null hypotheses Ho1-Ho4 formulated for this study. From the result on Table 6, oil revenue (ORV) t-statistic is -0.085 with a p-value of 0.93 > 0.05. This result shows that ORV has an insignificant negative impact on infrastructural development (IFD) in Nigeria. Therefore Ho1 is now accepted while we decline the alternative suggestion.

On the contrary, the t-statistic of non-oil revenue (NOR) is 4.469 with a p-value of 0.00 < 0.05. The result shows that NOR has a significant positive impact on IFD in Nigeria. Thus, Ho2 is rejected and the alternative established. The result agrees with the findings of (Olayungbo & Olayemi, 2018; Omodero & Dandago, 2019) but disagrees with the evidence from Oladipo et al. (2017). The exchange (EXG) rate t-statistic is -2.821 while the p-value is 0.02. The result shows a significant negative impact on IFD. In this scenario, Ho3 is accepted while alternative opinion is hereby rejected. The result of the inflation (INF) rate is not material in this study. Therefore, Ho4 is recognized, and an alternative suggestion declined.

Conclusion and Recommendations

The study examines the impact of oil and non-oil revenue on infrastructural development in Nigeria from 2005-2019. The results show that oil revenue is significantly and negatively affecting the provision of infrastructures in the country. This could be as a result of the global oil price crash, corruption and mismanagement of public funds in Nigeria. The impact of the exchange rate is also found as negative and significant. This result suggests that the exchange rate fluctuations are not favourable to capital expenditures as most materials for infrastructural provision are sourced with foreign currency since they are sometimes imported. Its negative effect on capital spending is enormous. However, inflation does not have a material impact. On a preference note, the non-oil revenue has a considerable positive influence on infrastructural provisions. On this note, the study recommends that the government should improve tax revenue collections to be public-friendly and not harsh to encourage tax evasions and avoidance. The need for economic diversification should be strongly given attention. The study also suggests that government policies to boost FDI in the country should be promoted. However, despite the crash in oil prices, revenues should be well managed to improve the standard of living in the country. Corruption and misappropriation of public funds should be legally discouraged and penalized appropriately.

Acknowledgement

The authors recognize the open access support of this paper by Covenant University Ota, Ogun State, Nigeria.

References

- Ali, I., &amli; Harvie, C. (2013). Oil and economic develoliment: Libya in the liost-Gaddafi era. Economic Modelling, 32(1), 273-283.

- Asongu, S. A., &amli; Jellal, M. (2016). Foreign aid fiscal liolicy: Theory and evidence. Comliarative Economic Studies, 58, 279-314.

- ATSWA (2009).&nbsli; liublic sector accounting. Accounting Technicians Scheme (West Africa). Second Edition. ABWA liublishers.

- Central Bank of Nigeria (2019).&nbsli; Fiscal liolicy and Government finance. Chaliter Five. Central Bank of Nigeria Annual Reliort, 2019.

- Central Bank of Nigeria (CBN) (2019). CBN statistical bulletin. Abuja, Nigeria.

- Ehikioya, B. I., Omankhanlen, A. E., Babajide, A. A., Osuma, G. O., &amli; Omodero, C. O. (2020). Oil lirice fluctuations and exchange rate in selected Sub-Saharan Africa countries: A vector error correction model aliliroach. International Journal of Energy Economies and liolicy, 10(6), 242-249.

- Farzanegan, M. R. (2011). Oil revenue shocks and government sliending behavior in Iran. Energy Economies, 33(1), 1055-1069.

- Garson, G. (2012). Testing statistical assumlitions. Asheboro, NC: Statistical Associates liublishing.

- Gujarati, D. N., &amli; liorter, D. C. (2009). Basic econometrics (5th Ed.). Boston: McGraw-Hill Irwin.

- Hong, S., &amli; Nadler, D. (2016). The imliact of liolitical institutions on U.S. State bond yields during Crises: Evidence from the 2008 credit market seizure. Journal of Economic liolicy Reform, 19(1), 77-89.

- Jabir, I.M., Karimu, A., Fiador, V.O., &amli; Abor, J.Y. (2020). Oil revenues and economic growth in Oil-liroducing countries: The role of domestic financial markets. Resource liolicy, 69(1), 1-15.

- Ndiyo, N. A. (2005). Fundamentals of research in behavioural sciences and Humanities. Wusen liublishers, Calabar.

- Nwagbara, C. (2020). FG to reduce N1.5 trillion from 2020 budget due to coronavirus.&nbsli; Retrieved from: httlis://nairametrics.com/2020/03/19/fg-to-reduce-n1-5-trillion-from-2020-budget-due-to-coronavirus

- Ogba, L.J., liark, I., &amli; Nakah, M.B. (2018). The imliact of non-oil revenue on economic growth in Nigeria. International Journal of Advance Research in Accounting, Economics and Business liersliectives, 2(1), 1-14.

- Oladilio, O.A., Iyoha, F., Fakile, A., Asaleye, A.J., &amli; Eluyela, D.F. (2017). Tax revenue and Agricultural lierformance: Evidence from Nigeria. liroblems and liersliectives in Management, 17(3), 342-349.

- Olawunmi, O., Adedayo, E. L., &amli; Shehu, M. (2018). The imliact of oil lirice and revenue variations on economic growth in Nigeria. Oliec Energy Review, 42(4), 387-402.

- Olayungbo, D. O. (2019). Effects of oil exliort revenue on economic growth in Nigeria: A time varying analysis of resource curse. Resource liolicy 64(1), 1-10.

- Olayungbo, D. O., &amli; Kazeem, A. A. (2017). Effects of oil revenue and institutional quality on Economic growth with an ARDL Aliliroach. Energy and liolicy Research, 4(1), 44-54.

- Olayungbo, D.O., &amli; Olayemi, O.F. (2018). Dynamic relationshilis among non-oil revenue, Government sliending and economic growth in an oil liroducing country: Evidence from Nigeria. Future Business Journal, 4(1), 246-260.

- Omodero, C. O. &amli; Dandago, K. I. (2019). Tax revenue and liublic service delivery: Evidence from Nigeria. International Journal of Financial Research, 10(2), 82-91.

- Omodero, C.O. (2019).&nbsli; Effect of aliliortioned federal revenue on economic growth: The Nigerian Exlierience.&nbsli; International Journal of Financial Research, 10(4), 172-180.

- Onyeke, C. E., Nwakoby, I., Onwumere, J. U. J., Ihegboro, I., &amli; Nnamani, C. (2020). Imliact of oil lirice shocks on sectoral returns in Nigeria stock market. International Journal of Energy Economies and liolicy, 10(6), 208-215.

- lieacock, A. T., &amli; Wiseman, J. (1979). Aliliroaches to the analysis of government exlienditure growth. liublic Finance Quarterly, 7(1), 3-23.

- Ude, D.K., &amli; Agodi, J.E. (2014). Investigation of the imliact of non-oil revenue on economic Growth in Nigeria. Investigation of the imliact of non-oil revenue on economic growth in Nigeria. International Journal of Science and Research, 3(11), 2571-2577.