Research Article: 2022 Vol: 25 Issue: 1S

Optimal decision making: influence of tax rates on the efficiency of tax systems

Andrey Nikolaevich Zharov, Peoples' Friendship University of Russia (RUDN University)

Meri Amiranovna Valishvili, Plekhanov Russian University of Economics

Alexey Alexeevich Shestemirov, Financial University under the Government of the Russian Federation

Yekaterina Sergeevna Budkina, The Russian Presidential Academy of National Economy and Public Administration

Evgeniia Alexandrovna Kashina, Lomonosov Moscow State University

Yakha Akhmudovna Khadueva, Chechen State University named after Akhmat Abdulkhamidovich Kadyrov

Citation Information: Zharov, A. N., Valishvili, M. A., Shestemirov, A. A., Budkina, Y. S., Kashina, E. A., & Khadueva, Y. A. (2022). Optimal decision making: influence of tax rates on the efficiency of tax systems. Journal of Management Information and Decision Sciences, 25(S1), 1-11.

Abstract

This research aims to address the problems of social differentiation and social equity of the tax system of the Russian Federation taking into account socioeconomic indicators in comparison with the countries using a progressive taxation scale. The authors analyse the impact of tax rates on income inequality and the effectiveness of tax systems in Russia and four countries of Latin America (Argentina, Uruguay, Colombia and Ecuador) in mitigating social differentiation. The analysis relies on mathematical models of correlation and historical and comparative research methods. The authors conclude that taxes create a significant impact on the degree of income inequality and progressive personal income taxation can be an effective tool for mitigating social differentiation in Russia. This study belongs to a narrow body of research comparing the performance of tax systems in mitigating the problems of income inequality. The authors believe that the study will help state bodies make effective decisions aimed at reducing social pressures.

Keywords

Personal income tax; Fixed taxation; Progressive taxation; Inequality; Poverty.

Introduction

The unstable economic context in many countries due to the COVID-19 pandemic lends relevance to the analysis of the social role of personal income tax, i. e., the leveling of people's economic conditions amid their significant differentiation. Given that, the principle of equitable taxation as a lever of social justice is one of the main challenges for the tax systems of most countries currently passing through acute economic and fiscal crises (Cimini et al., 2020; González-Bustamante, 2021). Keen et al. (2008) identify two groups of countries with a flat tax scale: the first one including the Baltics (Estonia, Latvia and Lithuania), characterized by tax rates set at moderately high levels - at or close to the highest marginal tax prior to the reform, and the second group (Russia, Romania, Hungary) marked by tax rates that are instead closer to the lowest of the pre-reform rates. Filer et al. (2019), describing a rather wide segment of economies in transition, observed there was no discernible effect on the measured size of unreported income following a flat tax.

Most economies in transition accompanied the introduction of a flat personal income tax rate with increased tax exemptions. Meanwhile, research into the effects of tax reforms in transition economies with a flat tax scale indicates that they produced only a moderate improvement of efficiencies but it came with stronger inequality. However, the impact of this transition to a flat taxation system from a progressive system for income inequality remains unclear. E.g., Duncan and Sabirianova (2016) found that progressivity reduced inequality in observed incomes, but had a significantly smaller impact on actual inequality, approximated by consumption-based Ginis. Meanwhile, the literature review indicates that there is only a very limited number of comparative studies on the effectiveness of the redistributive function of fiscal policy and its influence on income inequality. In this paper, we focus on the analysis of the degree of impact of personal income tax rates on the degree of personal income differentiation and the findings of comparative analysis of the redistributive impact of the tax systems in Russia and Latin America.

Given the increasing income gap in Russia over the years, the question of introducing progressivity in the tax system has gained relevance in both political and academic circles. Research hypothesis. Presumably, the tax burden in personal income taxes is closely tied to income differentiation, and the introduction of a progressive personal income tax scale would help to mitigate income gaps.

Methods

To prove the proposed hypothesis, we used the methods of multi-factor correlation and regression analysis to test the relations of social differentiation. Correlation analysis is used to calculate the strength of relations between indicators. The following scale applies for interpretation: 0-0.3 - no correlation; 0.3-0.5 - weak correlation; 0.5-0.7 - moderate correlation; 0.7-0.9 - strong correlation; 0.9-1 - very strong correlation. The dependent variable Y reflecting the degree of social differentiation is the rich/poor income ratio (income differentiation ratio).

The indicator measures the degree of economic inequality by income levels and represents the ratio of monetary income levels of the richest 10% and the poorest 10% of the population. The minimum value for this indicator is 1, indicating complete equality of income. The independent variables are selected socioeconomic indicators laid out in Table 1.

|

Table 1 |

||

|

Variable |

Interpretation |

Information base |

|---|---|---|

|

Y |

Income differentiation ratio (rich/poor income ratio) |

Federal State Statistics Service of the Russian Federation (n.d.) |

|

X1 |

Effective rate of personal income tax |

Calculated rate based on data from the Service of the Russian Federation Reports on personal income tax (Federal Tax Service of the Russian Federation, n.d.) |

|

X2 |

Inflation |

Federal State Statistics Service of the Russian Federation (n.d.) |

|

X3 |

Working-age employment rate, % |

|

|

X4 |

Education index |

|

|

X5 |

Share of skilled labour (% of workforce) |

|

The effective tax rate of personal income tax measures the ratio of the total calculated personal income tax to the total amount of income earned by the taxpayers of personal income tax.

(1)

(1)

Where  is the effective tax rate of personal income tax for the year,%

is the effective tax rate of personal income tax for the year,%

is the total calculated personal income tax, million rubles.

is the total calculated personal income tax, million rubles.

R is the total amount of income earned by the taxpayers of personal income tax, million rubles.

Historical and comparative research methods were used in the analysis of international practice in setting up a progressive taxation system. The selective study covered four Latin American countries, including Argentina, Uruguay, Ecuador and Colombia.

Comparative analysis was conducted based on indicators of income inequality and poverty rate (Table 2).

|

Table 2 |

||

|---|---|---|

|

|

|

Source |

|

Gini index |

shows income distribution, with 0 representing perfect equality and 1 representing perfect inequality |

|

|

Atkinson index |

represents a welfare-based measure of inequality. It presents the percentage of total income that a given society would have to forego to have more equal shares of income between its citizens. |

|

|

Poverty headcount ratio |

Percentage of the population living on less than $5.50 a day at 2011 international prices |

|

|

Poverty gap |

Mean shortfall in income or consumption from the poverty line $5.50 a day, expressed as a percentage of the poverty line. This measure reflects the depth of poverty as well as its incidence. |

|

The final stage of the study constitutes an analysis of the redistributive impact of taxes and social security contributions as one of the main measures of personal income taxation performance in the country.

The redistributive impact of taxes and social security contributions is largely measured by the difference between the Gini coefficient of disposable personal income and the Gini coefficient of the total personal (market) income. These indicators can be found in statistical databases gathered by the OECD (n.d.) and WIID (UNU-WIDER, n.d.). Where no country data were available in the above databases, the respective coefficients were calculated based on the official data of the respective national statistical agencies.

The Gini coefficient for market income is calculated on income before taxes and transfers, where individuals are ranked according to their market income per household member, including cases with zero income.

The Gini disposable income is calculated on incomes less direct taxes on income and wealth, social security contributions paid by households.

Where x is the share of the population

Y(cum)i is the cumulative share of income of the i-th group of the population

Calculations for this paper were performed in MS “Excel” 365.

Results

Results of Analysis of the Impact of Personal Income Tax on Income Differentiation

The input for building a multi-factor correlation model is shown in Table 3.

|

Table 3 |

||||||

|---|---|---|---|---|---|---|

|

Years |

Y |

X1 |

X2 |

X3 |

X4 |

X5 |

|

2012 |

16.4 |

0.091 |

1.066 |

0.750 |

0.793 |

0.960 |

|

2013 |

16.1 |

0.097 |

1.065 |

0.750 |

0.794 |

0.962 |

|

2014 |

15.8 |

0.104 |

1.114 |

0.760 |

0.801 |

0.963 |

|

2015 |

15.5 |

0.105 |

1.129 |

0.759 |

0.804 |

0.964 |

|

2016 |

15.5 |

0.106 |

1.054 |

0.766 |

0.815 |

0.966 |

|

2017 |

15.4 |

0.103 |

1.025 |

0.775 |

0.823 |

0.964 |

|

2018 |

15.6 |

0.103 |

1.043 |

0.782 |

0.823 |

0.964 |

|

2019 |

15.4 |

0.101 |

1.030 |

0.783 |

0.823 |

0.961 |

The results of correlation analysis indicate that the personal income differentiation coefficient shows strong correlation with the level of the effective personal income tax rate (Table 4).

|

Table 4 |

||||||

|---|---|---|---|---|---|---|

|

|

Y |

X1 |

X2 |

X3 |

X4 |

X5 |

|

Y |

1 |

|

|

|

|

|

|

X1 |

-0.902 |

1 |

|

|

|

|

|

X2 |

0.204 |

-0.130 |

1 |

|

|

|

|

X3 |

-0.777 |

0.672 |

-0.592 |

1 |

|

|

|

X4 |

-0.843 |

0.775 |

-0.627 |

0.968 |

1 |

|

|

X5 |

-0.631 |

0.784 |

0.071 |

0.269 |

0.432 |

1 |

The above results indicate a strong negative correlation between the degree of income differentiation and the personal income tax rate. It means that an increase in the effective personal income tax rate causes a decline in income inequality.

Data in Figure 1 indicates that even with the increase of the total taxable labour income, the tax rate remains unchanged at 13%. I. e., personal income tax is withheld at the rate of 13% from each individual's income irrespective of the amount.

With increasing levels of social security contributions, even stronger pressure is created on Russians' labour incomes, while earners of income on property, investment incomes and incomes hidden from oversight, are exempt from such burdens. Overall between 2012 and 2019, the personal income tax burden in Russia increased to 10.1% from 9.1%. That said, the figure had been growing until 2016 when it peaked at 10.6%. After 2016, the personal income tax burden has decreased and stood at 10.1% in 2019.

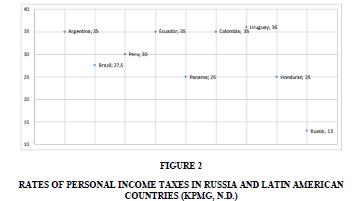

Note that the rate of tax on labour income in Russia is still one of the lowest in the world. E. g., the rate ranges between 25-36% in Latin American countries (Figure 2).

Figure 2:Rates Of Personal Income Taxes In Russia And Latin American Countries (Kpmg, N.D.)

The share of personal income tax in the budget revenues in Russia remains rather modest within 3.5% of GDP (Ministry of Finance of the Russian Federation, 2020).

Analysis of the Impact of Progressive Taxation on Mitigating Inequality and Poverty

Thus, the reality is the tax system is not very effective in addressing its social function, which justifies observations of practices of other countries showing positive trends in this field. To many researchers (Tsagan-Mandzhieva, 2018; Toledo, 2019), such countries include the countries of Latin America, where a shift toward progressive taxation of individual incomes was adopted in the late 2000s after unsuccessful neoliberal tax efforts in the 1990s that had generated a skewed structure of taxation sloping toward indirect taxes and resulted in growing social inequality.

Today, Latin America is one of the global regions with the biggest inequality problem, and the fiscal system shows moderate results in bringing down this income inequality (Bucheli et al., 2018). Table 5 outlines our comparison of the indicators of inequality and poverty in the analysed six countries.

|

Table 5 |

|||||

|---|---|---|---|---|---|

|

|

Argentina |

Uruguay |

Ecuador |

Colombia |

Russia |

|

Inequality |

|||||

|

Gini index |

38.78 |

39.4 |

44.25 |

50.11 |

34.7 |

|

Atkinson index (0.5) |

12.12 |

12.45 |

15.89 |

20.86 |

9.69 |

|

Atkinson index (1) |

22.51 |

22.92 |

28.77 |

37.08 |

18.55 |

|

Atkinson index (2) |

39.41 |

39.15 |

48.29 |

62.33 |

34.21 |

|

Poverty |

|||||

|

Poverty headcount ratio at $5.50 a day (2011 PPP), % of population |

9.9 |

2.9 |

23.3 |

28.1 |

3.8 |

|

Poverty gap at $5.50 a day (2011 PPP), % |

3.2 |

0.7 |

8.2 |

10.4 |

0.8 |

As can be seen from Table 1, the highest inequality levels are observed in Colombia and Ecuador, with Gini coefficients at 50.11 and 44.25 respectively. Compared to these Latin American countries, Russia shows the lowest figure for Gini at 34.7.

The table also shows the results for three weight parameters of the Atkinson index, indicating the level of "inequality aversion" (ε= 0,5, 1 ? 2). We focused on what happens with the lower income brackets in our distribution and thus primarily analysed the figure characterising strong inequality aversion (ε= 2). As can be seen from the findings outlined in Table 1 for ε= highest value for the Atkinson index is observed in Colombia, where the loss of welfare to inequality is 62.33% of the potential welfare level that could be achieved given equal distribution of total income. Meanwhile, Russia and Uruguay show the lowest percentage of welfare loss due to income inequality. The second part of Table 1 outlines a comparison of poverty figures by country according to the international poverty line at $5.50 a day PPP. The findings point at a strong imbalance in terms of populations living below the poverty line. While in Uruguay, 2.9% of people are poor, the respective figures rise to 28.1% in Colombia and 23.3% in Ecuador.

These differences are also seen in terms of the poverty gap. The poverty gap indicates poverty is deeper in Colombia and Ecuador (10.4% and 8.2% respectively) compared to, for instance, Uruguay and Russia, where it is less severe, given that the gap figure is much lower at 0.7% and 0.8% respectively.

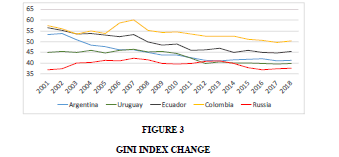

However, if we focus on change, we would see a steady downside trend in the countries of Latin America since the early 2000s, i. e., the level of income inequality is significantly down. The trend is the opposite in Russia: while in 2001 the Gini index for disposable income stood at 36.9, it equaled 37.5 in 2018 (Figure 3).

Moreover, a worrisome sign is that the figure has followed a growing trend since 2016. This indicates strengthening income inequality in Russia causing intensifying social pressures. The problem is further exacerbated by falling incomes due to the COVID-19 pandemic.

In the past decade, tax reforms were conducted in the region, primarily concerned with income tax and the structure of rates, specifically their increase, and an expansion of the tax base with the inclusion of incomes earned on capital gains and dividends (capital gains had not been previously subject to taxation). Some consequential personal tax reforms were inspired by the Scandinavian model of the so-called double system, combining a progressive scale on labour income and a relatively low flat tax scale applying to capital gains (Tsagan-Mandzhieva, 2018).

There are some common features in the personal income tax systems in the analysed Latin American countries:

a) it is evaluated at the individual level;

b) the base of personal income tax largely comprises labour income: salary, income earned through independent work, retirement benefits (in some countries) and to a lesser extent capital gains. In Argentina and Uruguay, retirement income is also subject to tax with a similar structure as labour income tax;

c) exemptions and special tax regimes include: financial investments; interest on public securities, exemptions on investment funds, capital gains in property and equities. In all countries, various deductions may apply. In Argentina, deductions are provided only on dependents (e.g., spouse, children or parents). In Ecuador and Colombia, deductions on personal expenditure apply, such as personal spending on education, healthcare and housing, and, in the case of Ecuador, there are also deductions on personal spending on food and clothing.

The degree of progressivity of the tax schedule is different by country. Tax schedules are relatively close, with various tax brackets and the maximum tax rate at 33-35%.

Every working individual in the analysed countries is obliged to make social insurance contributions (SICs) depending on their gross labour income.

We analysed the profile of the tax systems and figures of inequality and poverty in the discussed countries and focused on the impact of each instrument of tax exemption. It is key to understanding the role of taxes and exemptions in mitigating poverty and inequality and to refining the development of new policy instruments.

Figure 4 graphically maps out the findings of the comparative analysis of the impact of tax exemptions on income inequality.

Figure 4:Impact Of Tax Exemptions On Income Inequality In Russia And Some Countries Of Latin America

As can be seen from Figure 4, the system of tax exemptions providing the strongest reduction of income inequality is that of Uruguay. Indeed, the Uruguayan system tops others with more than 12.1 pp of reduction of inequality, followed by Russia (10.6 pp) and Argentina (9.14 pp). Meanwhile, the weakest redistributive impact, i. e., the smallest reduction in income inequality, is observed in Ecuador and Colombia at 0.31 pp and 3.73 pp respectively.

Discussion

Based on the study findings, only Uruguay's experience, of all analysed countries of Latin America, could be useful for Russia. The idea of exporting some of the elements of the Uruguayan system of personal income tax is supported by the findings of Bargain et al. (2017); Roca (2010); Bucheli et al. (2012), as well as the results of Uruguay's policies of equitable taxation (Oficina de Planeamiento y Presupuesto, 2016).

Earned income stemming from work (i.e. wages, salaries, etc.) is subject to progressive rates ranging from 10% to 36%. As only a few expenses are allowed as deductions (such as social security contributions and a notional amount corresponding to education, feeding, health, and housing of dependent underage children), almost the whole gross income is subject to this tax. Thus, the progressive scale of personal income tax rates applicable for residents is as shown below (Table 6).

|

Table 6 |

||

|---|---|---|

|

Gross taxable personal income, USD |

Personal income tax, % |

|

|

Lower limit |

Upper limit |

|

|

0 |

8,900 |

0% |

|

8,900 |

12,714 |

10% |

|

12,714 |

19,072 |

15% |

|

19,072 |

38,143 |

24% |

|

38,143 |

63,572 |

25% |

|

63,572 |

95,358 |

27% |

|

95,358 |

146,215 |

31% |

|

146,215 |

.. |

36% |

*Calculated by the author based on figures from PWC (n.d.) applying the exchange rate of 1 USD = 42,651 Uruguayan peso as of 31.12.2020.

A specific feature of the Uruguayan tax system is that this tax can also be paid as a family unit (PWC, n.d.). The scale of rates to be applied depends on the income of each of the family group's members. If each of the members earns more than 12 minimal salaries (one minimal salary is UYU 16,300, or 382 USD), taxable income before deductions must be added together and then the following scale of rates is applied according to the different income brackets (Table 7).

|

Table 7 |

||

|---|---|---|

|

Gross taxable personal income, USD |

Personal income tax, % |

|

|

Lower limit |

Upper limit |

|

|

0 |

17,800 |

0% |

|

17,800 |

19,071 |

15% |

|

19,071 |

38,143 |

24% |

|

38,143 |

63,572 |

25% |

|

63,572 |

95,358 |

27% |

|

95,358 |

146,215 |

31% |

|

146,215 |

- |

36% |

Thus, Uruguay has maintained a flexible progressive personal income tax scale that helps to bring down disposable income differentiation quite rapidly (Antía, 2019).

Conclusion

The findings of the study support the proposed hypothesis and invite the following conclusions.

A strong negative correlation exists between the effective personal income tax rate and the degree of income differentiation. It means that an increase in the effective personal income tax rate causes a decline in income inequality.

Compared to the analysed countries of Latin America, Russia and Uruguay have the lowest rates of inequality and poverty. However, a steady downward trend is observed in these figures in the countries of Latin America since the 2000s compared to an opposite trend in Russia.

Progressive taxation of personal incomes can be an effective instrument to ease social pressures and promote income equality. More profound research is proposed to understand the experience of the Uruguayan taxation system as it demonstrates one of the strongest redistributive effects in mitigating personal income inequality.

References

Bargain, O., Jara, H. X., & Rodriguez, D. (2017). Learning from your neighbour: swapping taxbenefit systems in Latin America. Journal of Economic Inequality, 15(4), 369-92.

Federal Tax Service of the Russian Federation (n.d.). Data on forms of statistical tax reporting.

International Labour Organization (n.d.). Statistical database MOT ILOSTAT.

KPMG (n.d.). Individual tax rates for 2011-2021.

OECD (n.d.). Statistical database of the OECD.

Oficina de Planeamiento y Presupuesto (OPP), Presidencia de la República Oriental del Uruguay (2016). Impuestos y gasto público: un ejercicio de equidad fiscal para el Uruguay. Serie: Macroeconomía del Desarrollo. Santiago: CEPAL - Naciones Unidas.

PWC (n.d.). Uruguay Tax Summary.

Roca, J. (2010). Equidad Fiscal en Uruguay. Cuánto y cómo modifica el Estado el bienestar de los uruguayos. El impacto conjunto de los impuestos y el Gasto Público Social en la Distribución del Ingreso. In Equidad Fiscal en Brasil, Chile, Paraguay y Uruguay, Serie de Equidad Fiscal en América Latina. Washington DC: BID.

The World Bank (n.d.). Retrieved from https://data.worldbank.org/indicator

Toledo, A. (2019). Sotsialno splochennoe obshchestvo. Globalnye perspektivy Latinskoi Ameriki [The shared society. A vision for the global future of Latin America]. Transl. from English by A. Guskov, science editor: A. Ryabov; foreword: Yar. Kuzminov. Moscow: Publishing house of the Higher School of Economics, 360.

Tsagan-Mandzhieva, K. N. (2018). Perekhod k progressivnomu podokhodnomu nalogooblozheniyu v stranakh Latinskoi Ameriki [Transition to progressive taxation in the countries of Latin America]. Nalogi i nalogooblozhenie [Taxes and taxation], 7, 49-58.

United Nations Development Programme (n.d.). Human development reports.

UNU-WIDER (n.d.). Statistical database on income inequality WIID.