Research Article: 2018 Vol: 22 Issue: 1

Optimal General Islamic Insurance Rating Model: A Focus Group Validation

Lukman A Olorogun, Higher Colleges of Technology, Abu Dhabi Men’s College

Keywords

Contribution, Rating, Model, Focus Group, Islamic Insurance.

JEL: G22, G23

Introduction

Underlying arguments of this study are based on Olorogun’s (2015) article entitled “A proposed contribution model for general Islamic insurance industry” published in the International Journal of Islamic and Middle Eastern Finance and Management. Olorogun’s proposed contribution model is participant-oriented focusing on the maximum utilization of the participants’ own contributions. His idea for such a new model was based on the frequent claim made by the proponents of Islamic insurance who allege that all conventional insurance models, such as rating models, business models, are essentially non-Shari’ah compliant (Hussain & Pasha, 2011; Salman, 2014; Dikko, 2014; and Fauzi et al., 2016). However, Islamic insurance evolved from the established insurance system where underwriting and rating had to be performed. While there may not be a problem with the accustomed underwriting procedures, the rating (pricing) process of Islamic insurance products has never been thoroughly studied. Furthermore, the only specific model which establishes the rate of contributions of the participants is the one introduced by Olorogun. Viewed from a broad perspective, the process of charging an accurate price on commercial transactions, regardless of the religious or ethnic background of the insurance clients, is fundamental to justice. Hence, such a rating model constitutes a matter of equity (Abidin, Haseeb, Azam & Islam, 2015; Abidin, Haseeb & Islam, 2016; Abidina, Haseeb & Jantan, 2016; and Tarman, 2010).

In respect to commercial contracts, Islamic law prescribes equity in both quotations (pricing) and quality of the good or service in question. In addition, the quantification of the transaction should reflect justice, fairness and equity without prejudice to the right to making a profit of both parties as indicates in previous literature such as Salman (2014), Fauzi et al. (2016) etc. In the present study, it means that a participant must optimise every marginal financial input to the Islamic insurance contribution as shown in previous excellent work of Arrow (1963, 1971, 1973 and 1974). Furthermore, conventional experts have asserted efforts to achieve optimal pricing model for conventional insurance such as Cummins & Mahul (2002 & 2004). This expectation of “giving full measure” constitutes the foundation of any legitimate transaction and no deliberate loss or deprivation must be caused to others in the process. The exact amount must be established beforehand and in a transparent manner to the satisfaction of all parties. In the Glorious Qur’an such action is specifically demanded as follows:

1. Give full measure and cause no loss (to others). And weigh with the true and straight balance. And defraud not people by reducing their wares, nor do evil or spread corruption and mischief in the land (Qur’an 26: 181-183).

From the above verses, it is clear that “giving full measure” constitutes the foundation of the transaction meaning that no deliberate loss should be caused to others in the process of any transaction. The exact amount should be established in the course of any given transaction so that all parties are content and do not feel cheated or taken advantage of by others. Thus, any transaction which stands in opposition to this principle is deemed illegitimate as it results in deceit, misappropriation and corruption.

In the context of the Islamic insurance business, participants deliberately join an insurance pool and thereby fulfil the condition of willfulness. On the other end, the Islamic insurance operator is bound to abide by the dictates of transparency and honesty which are upheld by accurately measuring the risk exposure and quoting an equitable and fair price (contribution) that the participant has to pay before being admitted to the pool. This equitability and fairness should be based on the magnitude of the risk the participant possesses. These procedures are further corroborated in Razimi, Romle & Ahmad (2017).

The process of arriving at the quoted contribution should be explicitly stated and made known to the participants beforehand. This practice establishes wilfulness on the part of the operator. Only if a business contract is based on the wilfulness of both parties, the contract is considered valid and Shari’ah compliant. This includes acceptance of the amount of the contract, conditions that the parties must abide by, etc. The amount quoted on a transaction is considered essential because wealth is transferred from the hand of one individual to another.

It is pertinent to state here that the level of equity required by Islamic law is different from the conventional equity. Ever since the creation of conventional insurance, the term ‘equitable premium’ has played a major role in the rating of policies or covers. However, the equitability of the premium quotation has come under scrutiny and become questionable. Equitability has been recognized as an essential part of insurance but has also frequently clashed with other considerations, such as profit maximization. As an alternative to the premium quotation such as distinguish Arrow’s (1963, 1971, 1973 and 1974) premium models, financial experts have come up with the Option Pricing Model, Capital Assets Pricing Model (CAPM) and others (Briys & De Varenne, 2001) and Olorogun (2014). However, these alternative models are not without flaws and thus, conventional insurance has failed to establish a successful premium quotation procedure which is both universally applicable and equitable.

Olorogun’s (2015) model of rating (pricing) for general Islamic insurance claims to contain a set of distinct rating quotations which has been developed by extending the conventional premium quotation (for a full view of the new model, kindly refer to Appendix A). However, a lack of data on previous losses in the general Islamic insurance industry has prohibited the empirical evaluation of the model. Thus, an alternative method of model evaluation, namely in the form of a “focus group discussion” has been adopted. It is believed that expert opinions, i.e., opinions of those familiar with the industry would be sufficient to establish the feasibility of the new contribution model. The study is arranged as follows: Discussion of the method, questions, analysis of results and conclusion.

Methods

Material and Environment

A lack of Islamic insurance industry-wise reliable data prompted the choice of focus group method of data collection. In addition, it would not be proper or accurate using conventional insurance data to measure Islamic insurance oriented pricing model considering the philosophical underlying gaps between the two industries. The focus group discussion presentation was scheduled at an Islamic finance research institute in Kuala Lumpur, Malaysia. It was held in one of its meeting rooms, equipped with a PowerPoint projector, executive chairs and tables, stationary and the surrounding walls covered with writeable glass which made it easy to illustrate important discussion points by hand. The discussion began as scheduled after the break at 2.30 PM local time. The issue or subject matter of discussion was introduced to the attendees in the form of a PowerPoint presentation designed by the researcher. In short, the environment at which the discussions took place was highly conducive to producing the required results from the discussion which was videotaped.

Participants

The attendees met the criteria set by previous studies which required that the number of focus group participants should fall between six and 12 (Bernard 1995; Baumgartner et al., 2002; and Onwuegbuzie et al., 2004), without any precondition regarding the knowledge of the participants. Other studies such as those by Krueger (1994) and Morgan (1997) stated that standard focus group discussions should include three to four attendees provided they possessed background knowledge, i.e., were specialised in the subject matter of discussion. The researcher invited up to 12 professionals including academics in the field of Islamic finance and specifically Islamic insurance and both genders. Among the actual attendees were three professionals with comprehensive knowledge in the area of discussion, one of them being a PhD candidate from IIUM, Institute of Islamic Banking and Finance (IIiBF). All final participants were of male gender and PhD holders in Islamic finance related areas and attached to the Islamic finance research institute where the discussion was held.

Furthermore, two participants were Shari’ah advisors attached to Islamic insurance companies in Kuala Lumpur, Malaysia. Thus, they participated as academics and practitioners with over 10 years of work experience. Their ancillary role consisted of being private consumers of Islamic insurance services themselves. These multiple roles buttressed the efficiency and justified the reliability of the outcome of this focus group discussion as the total population of Islamic insurance professionals was adequately represented. Initially, the discussion had been proposed to take one to two hours but was in fact completed after only 30 minutes as the participants were time-pressed following their own tight schedules, but also due to the clarity and brevity in which all the core issues were addressed and discussed.

Focus Group Question

The discussion goal was to evaluate the acceptance and practicability of the new contribution model developed for the general Islamic insurance industry. The model had already been validated earlier and examined in theory according to the existing Shari’ah commercial transaction criteria in order to determine its compliance with Islamic business ethics. Thus, the expert group discussion served as a further validation of its usability and as a confirmation of its earlier theoretical validation.

The question to be answered was whether the proposed new model was a sensible and a feasible model in view of the charging price rules for service and trade according to Islamic law or not.

Analysis of Results

The results presented are the contributions made during the focus group discussion transcribed from the videotape. The researcher presented a critique of the traditional actuarial model to the discussion group members and explained the intent and components of each of its variables. The discussion group members agreed that this model was non-complaint with the Shari’ah in respect to permissible charging prices, particularly in case of the risk premium variable. The members agreed that such a model could not be adopted by the Islamic insurance industry. In other words, the actuarial traditional model was declared impermissible according to the tenets of Islamic commercial law.

One of the participants wished more clarification on the non-compliance of the risk premium variable, which is technically the combination of additional payment if the insurer’s risk exposure is found to fall above the expected loss and the anticipation of profits. He argued that in the mudharabah contract, Islamic bank profit ratios are determined upfront and wondered why this was deemed impermissible in Islamic insurance.

His concern was resolved on the ground that the risk premium variable was not equal to the profit in a mudharabah (investment) contract. It was explained that the risk premium simply constituted the act of loading the premium, i.e., the additional rate charged by the insurer to be paid on the insurance policy by the client in anticipation of the increase in risk above the expected loss and at the same time a margin of profit collected before the contract was finalised. Profit on a mudharabah contract, however, was to be paid when the investment yielded a profit. In addition, in mudharabah the parties were aware of the components of the capital and profit sharing ratios, while to the contrary, the risk premium amount was solely known and determined by the insurer. Finally, the mudharabha contract was not conditioned upon the occurrence of misfortune. It was initiated for the purpose of making a profit. Participants in mudharabah contracts were considered equal partners, the capital provider being named rabb al-mal (owner of the capital) and the entrepreneur being named the mudharib (…) On the other hand, the business relationship between the insurer and the client (policyholder) was that of a seller and a buyer respectively. Insurance contracts, specifically general insurance contracts, were essentially renewable contracts that could in the long run be turned into long-term contracts. In the essence, the insurers loaded all expenses on their clients without any reasonable justification in terms of equity and fairness.

Upon conclusion, the discussion group members agreed that the inclusion and return of underwriting returns to the participants as detailed in the new model would be reasonable and be fair to the Islamic insurance participants. This would relieve the operators of being accused of generating undue profits through unfair means as part of the rating process which went against the fundamentals of Islamic commercial laws as laid down in the Qur’an and Sunnah. It would also increase the chances of Islamic insurance operators to capture larger markets and win ground against their conventional insurance counterparts.

Another discussion member raised his concern about the reaction of the actuary to the usage of the underwriting return. He wondered whether there was the possibility of future natural disasters such as earthquakes, subterranean fires, etc., that could wipe out all existing Islamic insurance funds at a time. His question received the reply that conventional insurers and actuaries often claimed that there existed potential threats of natural disasters on a large scale that could wipe out insurance funds. However, such eventualities had to be considered rare cases with a very low chance of ever occurring. The Tsunami which had destroyed most of the island of Ache in Indonesia in 2004 had indeed been such a rare event which, however, would not reoccur in the next centuries to come. The other group discussion members signalled at this point their approval and consent by nodding. The researcher further added that the Islamic insurance operators needed to be more honest with their participants and stop making up excuses in order to avoid the return of underwriting returns to their rightful owners.

The participants also highlighted that before the distribution of underwriting returns to the participants, managerial principles of transfer to the operators’ reserves had to be provided and that Islamic insurance provisions were being met. Thus, the obligation to distribute the underwriting returns rested on returning a reasonable percentage of the underwriting returns to the participants. Throughout the session, the discussion group members nodded to signal their approval in respect to most of the points raised.

When the underlying models of Islamic insurance contract, i.e., wakalah and mudharabah models were criticised, the assembled professionals had no objections to the obvious point made that they were inappropriate models. In other words, they agreed that there were many issues surrounding these Islamic insurance models that needed further clarification.

Conclusion

The invited discussion group members were unanimous in their agreement on the relevance of this new contribution model. They affirmed this model would be the first of its kind. The current practice in Islamic insurance is a theoretical division of returns and an uneven and unstandardized distribution between participants and investors. The proposed model, on the other hand, creates a justified and even distribution of returns of funds. Further research and modifications may be needed in the future to optimize the efficiency of this proposed model. The Islamic insurance industry needs to invest in human capital. Therefore, the need to train and establish departments of insurance and actuarial sciences across the Muslim universities could help mitigate its future challenges.

Appendix

The premium quotation is only concerned with the expected liabilities of the insurer without consideration of the returns on the funds which the insurer accumulated through investment or unclaimed premiums. Based on this premise and other reasons, the conventional insurance industry was criticized by scholars of Islamic finance and conventional financial experts such as Briys & De Varenne (2001).

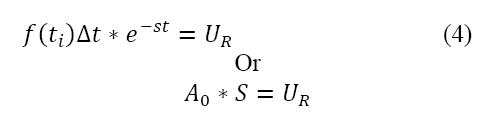

The Islamic insurance operator accumulates funds from participant contributions which usually exceed the expected claims E(S). The Islamic insurance operator, on the other hand, is expected to return this excess to the participants by incorporating it into the underwriting returns (UR). This, it is assumed, renders the Islamic insurance policy premium to be equitable and justified. This excess fund is technically known as underwriting returns.

For this research, the underwriting returns are denoted as UR

Where: U = Underwriting

R = Return

This model does not consider the method or process of generating the funds whether through investment or otherwise2. However, it is hypothesized that the Islamic insurance operator does not exhaust the fund within a stipulated period, for example, one calendar year.

The total of the accumulated fund is assumed as fixed, i.e., the insurer does not accept further contributions at a particular time except that which is generated at a rate at the stipulated time:

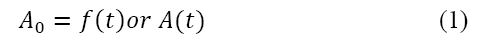

A0 is the total amount accumulated A(0) by the Islamic insurance operator at a certain period. In other words, there occurs no further influx into the fund. The reason for holding the fund fixed after a certain period of accumulation is to avoid the inaccurate derivation of underwriting return.

f(t) / A(t) is the function of time of the accumulated fund

Where t = time, in the current discussion the period of Islamic insurance which can be monthly, quarterly or yearly.

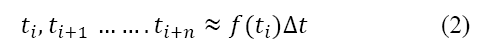

Therefore, the rate of accumulation between.

Δ is delta which means the rate of change in the accumulation of fund over time. This means there is a change in the amount accumulated from the beginning of the period of accumulation to the end of the stipulated period when the fund is fixed.

It is further assumed that there will be claims presented to the Islamic insurance operator and successfully honoured which are denoted as (S). These successful claims paid out by the Islamic insurance operator from the point of time t = 0 to the point of time tn are as shown in equation (3)3 below:

Where S is the claims presented to the Islamic insurance operators.

s = Variable of claims paid out which depends on the rate of presentation of claim at a time during the policy term.

t = Point of time at which claims are presented.

The problem between the initial point of time i.e., t = 0 when the fund is at A0 to the point of time tn., what is the amount left in the Islamic insurance operator’s fund?

The amount remaining in the fund can be derived through the convolution of the accumulated fund and the claims paid out at a point in time during the period of the policy formulated as:

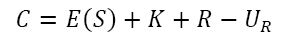

The New Proposed Optimal Islamic Insurance pricing Model is

Where:C = Contribution

E(S) = Expected claim

K = Running cost

R = Risk premium

UR= Underwriting return

Endnote

1. Olorogun, L.A. (2015). A proposed contribution model for general Islamic insurance industry. International Journal of Islamic and Middle Eastern Finance and Management, 8(1), 114-131.

2. Property and pecuniary insurance policies are usually based on yearly contracts. Similarly, Islamic insurance for property covers are annually renewable contracts. The operators require cash or liquidity throughout the year in order to meet-up with payment of claims as it falls due. Thus, most of the funds for these classes of insurance are expected to be available in cash. However, in practice managers of funds tends to re-invest these funds in equity (risky asset) or bonds (risk-free asset) or both which can easily be converted back into cash when required. This practice is described in the Black-Scholes model where a risk-free asset is denoted by (βt) and risky asset(St). For more details: P. Azcue and N. Muler, “Optimal investment policy and dividend payment policy in an insurance company”, in Annuals of Applied Probability 20/4 (2010), 1253-1302.

3 On the right-hand side of this equation appears the exponential decay function. Mathematicians and engineers employ exponential functions to determine the amount of toxic content in an environment, the growth of bacterial cultures, etc. Exponential functions are functions of t (time) measured from the starting point. Exponential growth functions are used in measuring monetary growth aspects of credit cards, bank accounts, car and home loans, etc. An exponential decay function is employed to determine the consistent rate at which an original amount will be reduced over a period of time, such as reduction of toxins. The base of an exponential function b is a positive real number other than 1 i.e., b>1 and b≠1. Thus, the domain of exponential function contains all real numbers. However, if the base is greater than 1 (b>1) the function is that of exponential growth. If, on the other hand, the base is less than 1 (b<1) the function is that of exponential decay.

References

- Abidin, I.S.Z., Haseeb, M. & Islam, R. (2016). Regional integration of the association of southeast asian nations economic community: An analysis of malaysia-association of southeast asian nations exports. International Journal of Economics and Financial Issues, 6(2).

- Abidin, I.S.Z., Haseeb, M., Azam, M. & Islam, R. (2015). Foreign direct investment, financial Development, international trade and energy consumption: Panel data evidence from selected ASEAN Countries. International Journal of Energy Economics and Policy, 5(3).

- Abidina, I.S.Z., Haseeb, M. & Jantan, M.D. (2016). Trans-Pacific Partnership (TPP) agreement: Comparative trade and economic analysis for malaysia. The Social Sciences, 11(13), 3375-3380.

- Arrow, K.J. (1963). Uncertainty and the welfare economics of medical care. America Economic Review, 53(5), 941-973.

- Arrow, K.J. (1971). Essays in the theory of risk bearing. Chicago: Markham.

- Arrow, K.J. (1973). Optimal insurance and general deductibles. A report prepared for office of economic opportunity. Santa Monica: Rand.

- Arrow, K.J. (1974). Optimal insurance design and general deductible. Scandinavian Insurance Journal, 1, 1-42.

- Briys, E. & De Varenne, F. (2001). Insurance from underwriting to derivates: Asset liability management in insurance companies. New York: John Wiley & Sons, Ltd.

- Cummins, J.D. & Mahul, O. (2002). Optimal insurance with divergent beliefs about insurer total default risk. Retrieved from www.huebnergeneva.org/documents/CumminsMahul

- Cummins, J.D. & Mahul, O. (2004). The demand for insurance with an upper limit on coverage. Journal of Risk and Insurance, 71, 253-264.

- Dikko, M. (2014). An analysis of issues in takaful (Islamic insurance). European Journal of Business and Management, 6(15), 1-5.

- Fauzi, P.N.F.N.M., Abd Rashid, K., Sharkawi, A.A., Hasan, S.F., Aripin, S. & Arifin, M.A. (2016). Takaful: A review on performance, issues and challenges in Malaysia. Journal of Scientific Research and Development, 3(4), 71-76.

- Hussain, M.M. & Pasha, A.T. (2011). Conceptual and operational differences between general Takaful and conventional insurance. Australian Journal of Business and Management Research, 1(8), 23-28.

- Olorogun, L.A. (2014). Charting a course on the Islamic finance ocean: A survey of Islamic insurance literatures. China-USA Business Review, 13(12), 755-766.

- Olorogun, L.A. (2015). A proposed contribution model for general Islamic insurance industry. International Journal of Islamic and Middle Eastern Finance and Management, 8(1), 114-131.

- Razimi, M.S.A., Romle, A.R. & Ahmad, A. (2017). Business operation model with sharia concerns and proposed resolution for Takaful. Humanity & Social Sciences Journal, 12(1), 1-6.

- Salman, S.A. (2014). Contemporary issues in Takaful (Islamic insurance). Asian Social Science, 10(22), 210-216.

- Tarman, B. (2010). Social studies education and a new social studies movement. Journal of Social Studies Education Research, 1(1), 1-16.