Research Article: 2021 Vol: 24 Issue: 4S

Ownership concentration, investment opportunity, operational efficiency, and firm value in Indonesian banking industry

Fatlina Zainuddin, Universitas Diponegoro and Lecturer at Univesitas Tadulako

Sugeng Wahyudi, Universitas Diponegoro

Harjum Muharam, Universitas Diponegoro

Citation Information: Zainuddin, F., Wahyudi, S., & Muharam, H. (2021). Ownership concentration, investment opportunity, operational efficiency, and firm value in Indonesian banking industry. Journal of Management Information and Decision Sciences, 24(S4), 1-10.

Abstract

The objective of the study is to find out the relationship between ownership concentration, investment opportunities, operational efficiency, and firm value. By using purposive sampling, this study employs 28 conventional banks listed on the Indonesian Stock Exchange for the period 2013-2019. By employing the WarpPLS version 6.0, this study reveals that ownership concentration and investment opportunity significantly affect firm value. In addition, operational efficiency mediates the effect of ownership concentration and investment opportunities on firm value. The higher the concentration level, the more efficient it is. This strengthens the role and function of the monitoring mechanism carried out by shareholders on management.

Keywords

Ownership concentration; Investment opportunity; Operational efficiency; Firm value.

Introduction

To optimize company value, modern organizations with publicly traded shares conduct a separation of functions between ownership and management (Berle & Means, 1932). Company owners professionally delegate company management to managers as agents who are employed and given the authority to make company operational decisions to affect the welfare of the owners (Jensen & Meckling, 1976). Separation of ownership and control aims to improve managers' skills in managing the company (Fama & Jensen, 1983). With these duties separated, the managers will be able to improve the company's value as desired by the shareholders.

The difference in interests between owners and managers results in conflict between groups within the company, and it is known as agency conflict (Ross, 1973). Agency conflicts occur because managers are more concerned with individual interests than company goals. Agency problems will affect the value of the company and hurt both parties. In order not to worsen the situation, it is necessary to take measures to minimize it. Several ways can be done to minimize agency problems, including monitoring by the company owner. Monitoring is the efforts made by the owner (principal) to reduce the deviant manager behavior (agent) in the form of measuring and observing and controlling agent behavior through budget restrictions, compensation policies, operating rules, and other policies (Jensen & Meckling, 1976).

The phenomenon shows that ownership concentration is found in many developing countries in Asia, including Indonesia (La Porta et al., 1999). Ownership concentration can be controlling the company or commonly referred to as controlling shareholder. The studies on ownership concentration have been widely conducted but still yields mixed results. Several studies have focused more on foreign ownership (Greenaway et al., 2014), family ownership (De Massis et al., 2013), government ownership (Cornett et al., 2010), and institutional ownership (Elyasiani & Jia, 2010; Hidayat et al., 2020; McConnell & Servaes, 1990). However, there are still few who focus directly on share ownership by the majority shareholder.

The research on ownership concentration itself still provides mixed conclusions. Some studies suggest that monitoring mechanisms through ownership concentration have a positive effect on firm value (Heugens et al., 2009; Hiraki et al., 2003; Lins, 2003; Nguyen et al., 2015; Vintila & Gherghina, 2014). Meanwhile, other studies state that ownership concentration does not have a significant effect on firm value (Abdallah & Ismail, 2017; Arouri et al., 2011; Bae et al., 2012; Bian & Deng, 2017; Iannotta et al., 2007; Leung & Cheng, 2013). The inconsistent research results indicate that other factors can link the effect of ownership concentration on firm value.

This study, therefore, aims to link the effect of ownership concentration and investment opportunity on firm value through operational efficiency as a mediating variable. The monitoring mechanism of ownership concentration is expected to shape the behavior of managers who prioritize efficiency strategies in their operations to produce managerial decisions to increase firm value. Operational efficiency is seen as the main key to addressing gaps in previous research on the effect of ownership concentration on firm value.

Literature Review

Ownership Concentration and Operational Efficiency

Agency theory underlies the relationship between ownership concentration and firm efficiency. Agency theory predicts that monitoring mechanisms such as ownership concentration can reduce agency problems as well as an important issue affecting performance (Eisenhardt, 1989; Jensen & Meckling, 1976). The ownership concentration mechanism as controlling shareholder can direct operational strategic decisions that are in line with their objectives (Shleifer & Vishny, 1997). With their dominance, concentrated shareholders can control the company by placing their chosen people in strategic positions, such as the position of managing director or finance director, so the dominant shareholder can easily direct the company's activities and all strategic policies taken will follow their direction (Francis et al., 2005).

Nanka-Bruce (2011) examined the effect of the performance of the internal good corporate governance mechanism on technical efficiency in manufacturing sector companies spread across 16 countries, both America and Europe, where one of the internal good corporate governance mechanism variables is ownership concentration (the largest shareholder). The result showed that the largest shareholder had a significant positive effect on technical efficiency. This result indicates that monitoring of the largest shareholder can reduce the behavior of managers who pursue personal gain which will reduce efficiency.

H1: Ownership concentration has a positive effect on operational efficiency.

Investment Opportunity and Operational Efficiency

Investment opportunities owned by the company are projected to increase the company’s value if used to make investments that generate positive net present value. One way to take advantage of investment opportunities is to make investment decisions in information technology to increase firm value (Dehning et al., 2005; Dobija, et al., 2012; Indjikian & Siegel, 2005; Melville et al., 2004). Investments in information technology make it easy for companies to recognize and provide opportunities to take advantage of certain assets to improve performance (Chari et al., 2007). The greater the investment opportunity the company has, the greater the opportunity for the use of information technology in the company's operations. High IT investment will encourage operational cost-efficiency. As is well known, information technology can provide convenience, simplify processes and improve product quality and variety through the use of IT. This is in line with the results of several studies which argue that IT investment can enable companies to achieve revenue growth and cost savings (Kauffman et al., 2015; Kauffman & Walden, 2001; Kulatilaka & Venkatraman, 2001; Sambamurthy et al., 2003).

H2: Investment opportunity has a positive effect on operational efficiency.

Ownership Concentration and Firm Value

Ownership concentration is the number or proportion of shares owned by the largest shareholder in a company. With the presence of ownership concentration, some large shareholders control large shares which are named as controlling shareholders. Share ownership is said to be concentrated if most of the shares are owned by a small number of individuals or groups so that these shareholders have a relatively dominant number of shares compared to others (Dallas, 2004). As for controlling shareholders, ownership concentration enlarges its ownership to be able to control the company and directs managers to achieve shareholder goals, either through voting power or representing themselves in management positions (La Porta et al., 1999).

Based on agency theory, ownership concentration is a key corporate governance mechanism that can solve agency problems arising from the separation of ownership and manager (Shleifer & Vishny, 1986). The monitoring mechanism is carried out by measuring and observing and controlling agent behavior through budget restrictions, compensation policies, operating rules, and other policies (Jensen and Meckling, 1976). Companies that have ownership concentration experience fewer agency problems (Al-Najjar et al., 2016; Zhuang et al., 2001). Ownership concentration can improve managerial monitoring and thus improve firm performance (Agrawal & Knoeber, 1996). Thus, ownership concentration can affect increasing firm value. Several empirical studies prove that there is a positive effect of ownership concentration on firm value include (Darko et al., 2016; Heugens et al., 2009; Hiraki et al., 2003; Kapopoulos & Lazaretou, 2007; Nguyen et al., 2015; Vintila & Gherghina, 2014; Wiwattanakantang, 2001; Xu & Wang, 1999).

H3: Ownership concentration positively affects firm value.

Investment Opportunity and Firm Value

Investment decisions are strongly influenced by investment opportunities, because the greater the profitable investment opportunity, the greater the investment to be made, in this case, the manager tries to take opportunities to maximize shareholder welfare. Concerning the achievement of company goals, there is an opportunity set that becomes a guide in investing which provides a broader view where the value of the company as the main goal depends on the company's future expenses. The Investment Opportunity Set (IOS) is a combination of assets held (assets in place) and investment options in the future with a positive net present value (Myers & Majluf, 1984). According to Gaver and Gaver (1993), IOS is a firm value whose amount depends on the expenses determined by management in the future, which at this time are investment choices that are expected to produce greater returns. Smith Jr & Watts (1992) state that management investment opportunities require decision making in an uncertain environment and consequently managerial action becomes more unobservable so that the principal feels that management has acted following their wishes or not. Firm investment opportunities are an important component of market value. This is because IOS of a company affects the way managers, owners, investors, and creditors perceive the company (Kallapur & Trombley, 2001).

H4: Investment opportunity has a positive effect on firm value.

Operational Efficiency and Firm value

The concept of operational efficiency is part of a financial study that focuses on how resources are used to facilitate company operations (Goel, 2012). Operational efficiency occurs when the right combination of people (labor), production processes, and technology to increase the productivity and value of each business operation is followed by a reduction in routine operating costs to the desired level (Choi, 2010). In the context of RBV theory, companies that have a competitive advantage are the result of valuable organizational development such as continuous innovation, integration of all stakeholders, and proactive integration of environmental objectives that are included in management strategies (Hart, 1997). In brief, the RBV theory states that it is superior competitive firms provide better corporate value valuations. The signal theory states that good information about the company will affect investors' perceptions of the company, thereby increasing the company's market value (Ross, 1977). Thus, good operational efficiency is a signal that the company has strong management and will provide high returns, this will add the equity value (share price). The empirical research of (Gill et al., 2014) supports the effect of operational efficiency on firm value.

H5: Operational efficiency has a positive effect on firm value.

The Role of Operational Efficiency as Mediator

Jensen & Meckling (1976) stated that the occurrence of agency conflict requires a monitoring mechanism that can reduce the conflict. Monitoring becomes the supervision of managers, one of which is through the ownership concentration mechanism. The ownership concentration mechanism will influence the behavior of managers in carrying out investment decisions and other efficient operations. Efficiency in investment and operational activities will align the goals of shareholders and the goals of managers so that it has an impact on increasing company value.

H6: Operational efficiency mediates the effect of ownership concentration on firm value

The Role of Operational Efficiency as Mediator

The prospect of company growth can be explained as an investment opportunity set (IOS). Myers & Majluf (1984) explain that IOS is an expense that will be made by the company in the future to affect firm value. In general, it can be said that IOS is the relationship between current and future expenditures with value/returns/prospects as a result of the decision to generate value for the company.

IOS is a combination of assets owned and investment options in the future, net present value is positive. IOS cannot be observed directly, therefore in calculating IOS a proxy will be used (Kallapur & Trombley, 2001). In a previous study, Smith Jr & Watts (1992) made three classifications of IOS proxy based on price proxy, investment proxy IOS, and IOS based on variant proxies. Adam & Goyal (2008) stated that IOS plays an important role in corporate finance to achieving company goals. This causes the company to expand opportunities to gain easy access to raise funds from investors (Scott, 2003). Investment decisions by a company are determined by the investment opportunities it has. When the company has an investment opportunity, the company can take advantage of the investment opportunity to increase company value. High investment opportunities in the future allow the company to achieve high growth rates. Thus

H7: Operational efficiency mediates the effect of investment opportunity on firm value.

Methodology

The population of this study is banking companies listed on the Indonesia Stock Exchange (IDX). The sampling technique used purposive sampling. The criteria for sampling are as follows (1) The banking companies listed on the Indonesia Stock Exchange and published financial reports for the 2013-2019 period; and (2) The banking companies that have a lot of information on the research variables. Based on the criteria, 28 banks were chosen as a sample for this study from a total population of 43.

Measures

Ownership concentration is measured using the Herfindahl Index (HI) by calculating the number of squares of share ownership in each company. If the value of HI approaches 1, it is said that share ownership is concentrated, whereas if it is close to zero it is said that share ownership is spread (Lee & O'neill, 2003; Muth & Donaldson, 1998; Setia-Atmaja et al., 2009). The investment opportunity in this study is proxied by the capital expenditure to total asset ratio. This proxy includes investment-based proxies which indicate the level of investment activity in a company (Kallapur & Trombley, 1999). Companies with high IOS will have a high investment. Furthermore, it was found that capital investment activity as measured by the ratio of capital expenditures to assets as a proxy for IOS has a positive relationship with growth realization. Operational efficiency is measured using the Cost Efficiency Ratio (Koch & MacDonald, 2014). Company value is measured using Tobin's Q. Tobin's Q is a company value measurement model based on market value where the market valuation of a firm's value measures the use of existing assets and potential future growth.

Data Analysis

Data obtained were analyzed using path analysis. It can be set up as follows:

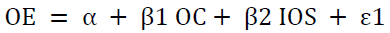

(1)

(1)

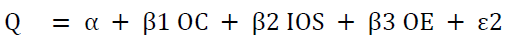

(2)

(2)

In equations 1 and 2, OC, IOS, and Q are independent and dependent variables. while OE is a mediating variable.

Results and Discussion

The descriptive statistics of the research variables are shown in Table 1.

| Table 1 Descriptive Statistics of Variables | ||||

| Variable | Min | Max | Mean | Std. Deviation |

| OC | 0.17 | 0.94 | 0.47 | 0.16266 |

| IOS | 0.00020 | 0.04049 | 0.00363 | 0.00499 |

| OE | 29 | 345.15 | 64.61 | 31.84151 |

| Q | 0.59 | 1.53 | 1.08 | 0.14052 |

| N | 196 | 196 | 196 | 196 |

Based on the results of the reliability test, it shows that the composite reliability value is >0.7 for the entire construct. Likewise, the Cronbach alpha value is >0.7 for the entire construct. So, it can be concluded that the internal consistency reliability requirements of the research instrument have been met.

The test model has predictive validity, according to Latan and Ghozali (2017) must be> zero (0). The results of the Q-square coefficient test show the value of the OE coefficient = 0.290 and the Q-square coefficient. = 0.271 which means > 0. It can be concluded that the model has predictive validity.

Test results of the Goodness of Fit (GoF) show that the Average Path Coefficient (APC) value is 0.270 with P <0.001; Mean Square (ARS) value = 0.283 with P = 0.002; and the value of Adjustable Square (AARS) is 0.274 with P = 0.002. The probability value (P) for APC, ARS, and AARS recommended as a fit model is <0.05 (Kock, 2013). In conclusion, this research model is fit. This is also supported by the AVIF value of 1.054 and the AFVIF value of 1.150, which is < 3.3, which means that no multi-co-linearity problems were found among exogenous variables. The strength of the prediction model is shown by the GoF value have a matching value > 0.36 which means that the suitability of the model is very large which is 0.532.

Table 2 shows the result of the path coefficient ownership concentration (OC) significantly affects operational efficiency (OE). It means that the higher the level of the ownership concentration, the more efficient the company will be. On the other hand, investment opportunity (IOS) also significantly affects operational efficiency. The analysis also shows that ownership concentration has a significant positive effect on firm value, which indicates that the more concentrated the owner of a firm, will gain the higher value. As one of the governance mechanisms, ownership concentration indicates that there are shareholders who have a significant level of ownership and have the authority to monitor and discipline management at a low-cost level. Based on agency theory, the separation between owner and management will create agency problems. One effective way to limit the emergence of agency problems is to have ownership concentration. Therefore, in governance mechanisms, ownership concentration plays a key role in reducing conflicts of interest between owners and managers. The existence of a majority shareholder or controlling shareholder will provide more control rights in overseeing the behavior of managers (Shleifer & Vishny, 1986). Control of ownership concentration can reduce agency problems between owners and managers (Maury, 2006; Bhaumik & Selarka, 2012). companies that have ownership concentration experience fewer agency problems (Zhuang et al., 2001; Al-Najjar et al., 2016). Ownership concentration can improve managerial monitoring and thus improve firm performance (Agrawal & Knoeber, 1996). Ownership concentration can be considered as a tool for detecting and correcting managerial errors and creating a comfortable framework for increasing firm value (Triantis & Daniels, 1995).

| Table 2 The Result of Path Analysis | ||

| Path | Coefficients | P-Value |

| OC → OE | -0.135 | 0.027 ** |

| IOS → OE | 0.545 | <0.001*** |

| OWN → Q | 0.209 | 0.001*** |

| IOS → Q | 0.058 | 0.026 ** |

| OE → Q | 0.401 | <0.001*** |

| OC → OE → Q | 0.054 | 0.039 ** |

| IOS → OE → Q | 0.218 | <0.001*** |

The estimation results also confirm that investment opportunities positively affect firm value with a path coefficient value of 0.058. This result supports hypothesis 4, and in line with the result of Kallapur & Trombley (2001) that firm investment opportunities are an important element of market value. This is because the Investment Opportunity Set (IOS) from a company affects the way the parties with an interest in the company such as owners, managers, investors, and creditors perceive the company. Generally, it can be said that IOS describes the extent of investment opportunities of a company, but it is very dependent on the future benefit of the company's expenditure. Adam & Goyal (2008) stated that IOS plays an important role in corporate finance to achieving company goals. This causes the company to expand opportunities to gain easy access to raise funds from investors (Scott, 2003). Moreover, the test result of operational efficiency positively and significantly affects firm value. This result supports hypothesis 5, which indicates that the more efficient the operational activities in the bank, the higher the value it has. The results of the indirect test on the relationship between ownership concentration and investment opportunities on firm value, the indirect effect value is 0.054 with a p-value of 0.039 and 0.218 with a p-value of 0.001. It can be concluded that ownership concentration and investment opportunities indirectly increase firm value through operational efficiency. These results also support hypotheses 6 and 7. Operating efficiency indicates that the use of financial and non-financial resources in the organization has been at an optimum and productive level by creating a synergy with the objectives of the company. It implies that the more efficient the company’s operation should be more profitable. This finding is reinforcing the previous study conducted by (Bhullar et al., 2019; Nanayakkara & Mia, 2012).

Conclusion and Recommendations

This study concludes that operational efficiency acts as a mediating variable in the relationship between ownership concentration and investment opportunity on firm value. The existence of ownership concentration is able to direct managers in maximizing operational efficiency. This is in line with agency theory in which the role of ownership is concentrated as a monitoring mechanism to minimize conflicts of interest between owners and managers. An ownership concentration mechanism as a controlling shareholder can direct operational strategic decisions following shareholder goals (Shleifer & Vishny, 1997). Furthermore, through investment opportunities, managers have several possible investment opportunities to be made in the company. Of the many options available, managers can determine the best investment option. The better an investment option, the more efficient its implementation, of course, in addition to considering the best return value obtained by the company. The two things above can give a signal that the more concentrated a company is, the better the company's value. Likewise, the greater the investment opportunities a company have, the more positive it will be for increasing company value.

This research also shows that the company can gain a competitive advantage by increasing the company's operational efficiency. This is in line with resource-based theory (RBV) which states that a firm's competitive advantage can provide better value for the company (Hart, 1997). Companies that are able to apply efficiency in their implementation will produce long-term benefits and sustainable success (McWilliams & Smart, 1993). Conversely, failure to maximize firm value is closely related to inefficiency factors (Jensen & Meckling, 1976).

Therefore, according to these findings, it can be recommended that the monitoring mechanism can be improved by increasing the concentration of ownership where shareholders can control managers in maximizing operational efficiency. Concentration ownership can still be used as a mechanism to minimize agency problems in developing countries, especially in Indonesia. However, this study also has limitations, where the research scope is still limited to the banking industry. Further research can be carried out in all other strategic industries or industries other than banks.

References

- Abdallah, A. A. N., & Ismail, A. K. (2017). Corporate governance practices, ownership structure, and corporate performance in the GCC countries. Journal of International Financial Markets, Institutions and Money, 46, 98-115.

- Adam, T., & Goyal, V. K. (2008). The investment opportunity set and its proxy variables. Journal of Financial Research, 31(1), 41-63.

- Agrawal, A., & Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of financial and quantitative analysis, 31(3), 377-397.

- Al-Najjar, B., Al Najjar, B., Kilincarslan, E., & Kilincarslan, E. (2016). The effect of ownership structure on dividend policy: Evidence from Turkey. Corporate Governance: The International Journal of Business in Society, 16(1), 135-161.

- Arouri, H., Hossain, M., & Muttakin, M. B. (2011). Ownership structure, corporate governance and bank performance: evidence from GCC countries. Corporate Ownership and Control, 8(4 D), 365-372.

- Bae, K. H., Baek, J. S., Kang, J. K., & Liu, W. L. (2012). Do controlling shareholders' expropriation incentives imply a link between corporate governance and firm value? Theory and evidence. Journal of financial Economics, 105(2), 412-435.

- Berle, A., & Means, G. (1932). The Modern Corporation and Private Property Macmillan. New York.

- Bhullar, P. S., Tandon, D. J. I. J. O. B., & Globalisation. (2019). Impact of operating efficiency on firm value-a case of Indian banking sector and information technology sector. 23(3), 452-463.

- Bian, W., & Deng, C. (2017). Ownership dispersion and bank performance: Evidence from China. Finance Research Letters, 22, 49-52.

- Chari, M. D. R., Devaraj, S., & David, P. (2007). International diversification and firm performance: Role of information technology investments. Journal of World Business, 42(2), 184-197.

- Choi, K. (2010). From operational efficiency to financial efficiency. Asian Journal on Quality, 11(2), 137-145.

- Cornett, M. M., Guo, L., Khaksari, S., & Tehranian, H. (2010). The impact of state ownership on performance differences in privately-owned versus state-owned banks: An international comparison. Journal of Financial Intermediation, 19(1), 74-94.

- Dallas, G. (2004). Governance and Risk: Analytical Hand Book for Investors, Managers, Directors, and Stakeholders, Standards and Poor, Governance Service. Mc. Graw Hill, New York.

- Darko, J., Aribi, Z. A., & Uzonwanne, G. C. (2016). Corporate governance: the impact of director and board structure, ownership structure and corporate control on the performance of listed companies on the Ghana stock exchange. Corporate Governance, 16(2), 259-277.

- De Massis, A., Kotlar, J., Campopiano, G., & Cassia, L. (2013). Dispersion of family ownership and the performance of small-to-medium size private family firms. Journal of Family Business Strategy, 4(3), 166-175.

- Dehning, B., Richardson, V. J., & Stratopoulos, T. (2005). Information technology investments and firm value. Information & Management, 42(7), 989-1008.

- Dobija, D., Klimczak, K. M., Roztocki, N., & Weistroffer, H. R. (2012). Information technology investment announcements and market value in transition economies: Evidence from Warsaw Stock Exchange. The Journal of Strategic Information Systems, 21(4), 308-319.

- Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57-74.

- Elyasiani, E., & Jia, J. (2010). Distribution of institutional ownership and corporate firm performance. Journal of Banking & Finance, 34(3), 606-620.

- Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

- Francis, J., Schipper, K., & Vincent, L. (2005). Earnings and dividend informativeness when cash flow rights are separated from voting rights. Journal of Accounting and Economics, 39(2), 329-360.

- Gaver, J. J., & Gaver, K. M. (1993). Additional evidence on the association between the investment opportunity set and corporate financing, dividend, and compensation policies. Journal of Accounting and Economics, 16(1-3), 125-160.

- Gill, A., Singh, M., Mathur, N., Mand, H. (2014). The impact of operational efficiency on the future performance of Indian manufacturing firms. International Journal of Economics and Finance Archives, 6(10), 259.

- Goel, S. (2012). Link between operational efficiency and solvency: The case of food processing industry in India.

- Greenaway, D., Guariglia, A., & Yu, Z. (2014). The more the better? Foreign ownership and corporate performance in China. The European Journal of Finance, 20(7-9), 681-702.

- Hart, S. L. J. H. B. R. (1997). Beyond greening: strategies for a sustainable world. Emerging Markets, 75(1), 66-77.

- Heugens, P. P., Van Essen, M., & van Oosterhout, J. H. (2009). Meta-analyzing ownership concentration and firm performance in Asia: Towards a more fine-grained understanding. Asia Pacific Journal of Management, 26(3), 481-512.

- Hidayat, R., Wahyudi, S., Muharam, H., & Zainudin, F. (2020). Institutional Ownership, Productivity Sustainable Investment Based on Financial Constrains and Firm Value: Implications of Agency Theory, Signaling Theory, and Asymmetry Information on Sharia Companies in Indonesia. 11(1).

- Hiraki, T., Inoue, H., Ito, A., Kuroki, F., & Masuda, H. (2003). Corporate governance and firm value in Japan: Evidence from 1985 to 1998. Pacific-Basin Finance Journal, 11(3), 239-265.

- Iannotta, G., Nocera, G., & Sironi, A. (2007). Ownership structure, risk and performance in the European banking industry. Journal of Banking & Finance, 31(7), 2127-2149.

- Indjikian, R., & Siegel, D. S. (2005). The impact of investment in IT on economic performance: Implications for developing countries. World Development, 33(5), 681-700.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kallapur, S., & Trombley, M. A. (1999). The association between investment opportunity set proxies and realized growth. Journal of Business Finance & Accounting, 26(3-4), 505-519.

- Kallapur, S., & Trombley, M. A. (2001). The investment opportunity set: determinants, consequences and measurement. Managerial finance, 27(3), 3-15.

- Kapopoulos, P., & Lazaretou, S. (2007). Corporate ownership structure and firm performance: evidence from Greek firms. Corporate Governance: An International Review, 15(2), 144-158.

- Kauffman, R. J., Liu, J., & Ma, D. (2015). Technology investment decision-making under uncertainty. Information Technology and Management, 16(2), 153-172.

- Kauffman, R. J., & Walden, E. A. (2001). Economics and electronic commerce: Survey and directions for research. International journal of electronic commerce, 5(4), 5-116.

- Koch, T. W., & MacDonald, S. S. (2014). Bank management: Nelson Education.

- Kock, N. J. T. S. S. (2013). WarpPLS 3.0 User Manual 2012 Laredo.

- Kulatilaka, N., & Venkatraman, N. (2001). Strategic options in the digital era. Business Strategy Review, 12(4), 7-15.

- La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471-517.

- Latan, H., & Ghozali, I. (2017). Partial Least Squares: Konsep, Metode dan Aplikasi menggunakan Program WarpPLS 5.0 (Third Edit).

- Lee, P. M., & O'neill, H. M. (2003). Ownership structures and R&D investments of US and Japanese firms: Agency and stewardship perspectives. Academy of Management Journal, 46(2), 212-225.

- Leung, N. W., & Cheng, M.-A. (2013). Corporate governance and firm value: Evidence from Chinese state-controlled listed firms. China Journal of Accounting Research, 6(2), 89-112.

- Lins, K. V. (2003). Equity ownership and firm value in emerging markets. Journal of financial and quantitative analysis, 38(1), 159-184.

- McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of financial Economics, 27(2), 595-612.

- Melville, N., Kraemer, K., & Gurbaxani, V. (2004). Information technology and organizational performance: An integrative model of IT business value. MIS quarterly, 28(2), 283-322.

- Muth, M., & Donaldson, L. (1998). Stewardship theory and board structure: A contingency approach. Corporate Governance: An International Review, 6(1), 5-28.

- Myers, S., & Majluf, N. (1984). Corporate financing decisions when firms have investment information that investors do not. Journal of financial Economics, 13(2), 187-221.

- Nanayakkara, G., & Mia, L. J. P. A. R. (2012). Gender, operational efficiency, population density and the performance of mirofinancing institutions. Pacific Accounting Review, 24(3), 314-333.

- Nanka-Bruce, D. (2011). Corporate governance mechanisms and firm efficiency. International Journal of Business and Management Archives, 6(5),28.

- Nguyen, T., Locke, S., & Reddy, K. (2015). Ownership concentration and corporate performance from a dynamic perspective: Does national governance quality matter? International Review of Financial Analysis, 41, 148-161.

- Ross, S. A. (1973). The economic theory of agency: The principal's problem. The American Economic Review, 63(2), 134-139.

- Ross, S. A. (1977). The determination of financial structure: the incentive-signalling approach. The bell journal of economics, 23-40.

- Sambamurthy, V., Bharadwaj, A., & Grover, V. (2003). Shaping agility through digital options: Reconceptualizing the role of information technology in contemporary firms. MIS quarterly, 237-263.

- Scott, W. R. (2003). Financial accounting theory. The International Journal of Accounting, 39(4), 431-434.

- Setia-Atmaja, L., Tanewski, G. A., & Skully, M. (2009). The role of dividends, debt and board structure in the governance of family controlled firms. Journal of Business Finance & Accounting, 36(7-8), 863-898.

- Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of political economy, 94(3, Part 1), 461-488.

- Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of finance, 52(2), 737-783.

- Smith Jr, C. W., & Watts, R. L. (1992). The investment opportunity set and corporate financing, dividend, and compensation policies. Journal of Financial Economics, 32(3), 263-292.

- Vintila, G., & Gherghina, S. C. (2014). The impact of ownership concentration on firm value. Empirical study of the Bucharest stock exchange listed companies. Procedia Economics and Finance, 15, 271-279.

- Wiwattanakantang, Y. (2001). Controlling shareholders and corporate value: Evidence from Thailand. Pacific-Basin Finance Journal, 9(4), 323-362.

- Xu, X., & Wang, Y. (1999). Ownership structure and corporate governance in Chinese stock companies. China economic review, 10(1), 75-98.

- Zhuang, J., Edwards, D., & Capulong, M. V. A. (2001). Corporate Governance & Finance in East Asia: A Study of Indonesia, Republic of Korea, Malaysia, Philippines and Thailand. Asian Development Bank.