Research Article: 2020 Vol: 24 Issue: 6

Ownership Structure and Accounting Conservatism: Evidence from Portuguese And Spanish Listed Companies

Sandra Alves, GOVCOPP, University of Aveiro, Portugal

Abstract

The existing literature suggests that conservatism is related to ownership structure. For a sample of non-financial listed Portuguese and Spanish firms-year from 2005 to 2017, we examine the association between accounting conservatism and corporate ownership structure (measured with three variables: managerial ownership (low, medium and high levels), ownership concentration and institutional ownership), in an agency setting characterized by the presence of large controlling shareholders. The Portuguese and Spanish governance structures are characterized by the presence of controlling shareholders who normally are able to significantly influence or even control the corporate decisions. Using the Fixed Effects Regression Model, to Portugal and Spain, we find a positive effect at low (up to 5 per cent stockholdings) and high (more than 25 per cent stockholdings) levels of managerial ownership on conservatism. The study’s results also suggest that ownership concentration demand for more conservatism. Unlike Spain, in Portugal there is no evidence that institutional ownership affects positively the levels of accounting conservatism.

Keywords

Managerial ownership, Ownership concentration, Institutional ownership, Conservatism accounting.

JEL Classifications

M41, G32, G34

Introduction

Agency theory points out that monitoring mechanisms can intensify the alignment of the interests of the managers with that of shareholders and reduce any opportunistic behavior of management. Therefore, properly structured corporate governance mechanisms are expected to supply effective monitoring and control over financial reporting process.

Accounting conservatism is a critical characteristic of high-quality accounting information (Watts, 2003a). Accounting conservatism benefits financial statement users by constraining managerial opportunism, mitigates agency problems between managers and shareholders, improves investment efficiency, reduces the effects of information asymmetry, facilitates the monitoring of contracts and reduces litigations costs (Watts 2003a: 2003b; LaFond & Watts, 2008; Chi et al., 2009; García Lara et al., 2009; Goh et al., 2017).

Corporate ownership structure is seeing as an essential managers’ monitoring mechanism. Ownership structures differ among entities. These different ownership structures imply different motivations to monitor and control a firm’s management (Morck et al., 1988; Shleifer & Vishny, 1986). Cullinan et al. (2012) also refer that “…different ownership structures can result in variation in governance structures, which would reflect the different rights associated with various types of owners. These governance structures in turn could lead a greater or lesser degree of influence over the financial reporting process by large owners and/or managers”. As a result, the corporate ownership structure can affect the level of conservatism.

Previous studies have examined the association between ownership structure and conservatism accounting, namely in US, UK and Asia environments (LaFond & Roychowdhury, 2008; Chen et al., 2009; Shuto & Takada, 2010; Cullinan et al., 2012; Ramalingegowda & Yu, 2012). LaFond & Roychowdhury (2008) document a negative relationship between accounting conservatism and managerial ownership. Chen et al. (2009) find that conservatism is positively related to large shareholder ownership. Ramalingegowda & Yu (2012) find that higher ownership by institutions is positively associated with more conservative financial reporting.

This paper examines the relationship between accounting conservatism and corporate ownership structure in Portugal and Spain. Thus, the question answered by this research is: Is the ownership structure affecting the level of conservatism accounting in code-law countries such as Portugal and Spain?

This study makes several contributes to the current literature. First, existing literature shows little research, on both countries, between accounting conservatism and corporate ownership structure, which makes this study invaluable. Second, studying Portuguese and Spanish firms will be interesting because the ownership structure in Portugal and Spain have a distinctive characteristic. In addition, Portugal and Spain are relatively weak in law enforcement and investor protection. In fact, the Portuguese and Spanish markets present a distinctive case in the study of the relationship between ownership structure and accounting conservatism, because, while in the US and in the UK the corporate ownership is highly diffused, the ownership in Portuguese and Spanish listed firms is highly concentrated. This characteristic can influence the conservatism activity in Portuguese and Spanish firms, since highly concentrated ownership influences the type of the agency problem in both countries. In a market-based system, firms are subject to internal monitoring (e.g., board) as well as external market discipline (e.g., market for corporate control), which is almost absent in Portugal and Spain. Internal discipline by large shareholders is central to Portugal and Spain’s corporate governance. Portugal and Spain are deemed not to shield minority shareholders adequately due to their weak legal protection rules and to their weak law enforcement system (La Porta et al., 1999). Therefore, it will be interesting to see how the ownership structure will affect conservatism accounting, especially in environments with high ownership concentration and where the information asymmetry is likely to be high.

Third, there are significant differences between Portuguese and Spanish publicly traded firms and those of Anglo-Saxon economies, which is what the majority of studies focus on. The firm’s market size is too distinct, since the number of publicly traded firms in the markets is also different. In terms of liquidity, the differences are also relevant. For instance, only 20/35 companies are more liquid and are present in the Portuguese/Spanish index, compared to 500 of the Standard & Poor and 100 of Nasdaq. These differences make it relevant to analyze Portugal and Spain, not only to expand international evidence, but also to compare the results and to determine whether the conclusions are international evidence (Miralles-Marcelo et al., 2014). In this sense, Leuz et al. (2003) report that firms in countries with developed equity markets, dispersed ownership structures, strong investor rights and legal enforcement engage in less earnings management, suggesting differences in the link between corporate governance (ownership structure) and the quality of reported earnings (conservative earnings) across countries.

Using a sample of Euronext Lisbon and Madrid Stock Exchange non-financial firms over a period of 13 years, from 2005 through 2017, this paper finds that, in both Portugal and Spain, low (up to 5 per cent stockholdings) and high (more than 25 per cent stockholdings) levels of managerial ownership are positively related to conservatism accounting, while intermediate (more than 5 per cent and less than or equal to 25 per cent stockholdings) levels of managerial ownership are not related to conservatism. Furthermore, this study also suggests that conservatism is positively related to ownership concentration. Unlike Spain, in Portugal there is no evidence that institutional ownership affects positively the levels of accounting conservatism. Thus, this study shows that there exists a tradeoff between conservatism and ownership structure in an agency setting characterized by the presence of large controlling shareholders.

The findings of this study will be crucial to Euronext Lisbon and to Madrid Stock Exchange and other regulators, especially the Portuguese and Spanish Securities Commissions and Portuguese and Spanish Accounting Commissions, that are concerned about the financial reporting quality, as well as the transparency of financial disclosure and the capacity to predict each company’s future.

Finally, this research is of potential interest to international investors who may seek to understand how reporting practices may differ across borders, and how different ownership structures may relate to the quality of financial reporting.

The next section describes the Portuguese and Spanish institutional background. The section three revises the related literature and develops the testable hypotheses. Variable measurement and research methodology are explained in section four. Section five presents the sample selection process and characteristics of the sample. In section six, we present and discuss the results. Finally, section seven concludes the study.

Portuguese and Spanish Institutional Background

Due to international financial crisis, the number of initiatives associated to good practice in corporate governance issues has increased. Effective corporate governance reforms and measures have been established to strengthen regulatory frameworks in order to generate business value, improve economic efficiency and strengthen investor confidence in financial reports (Villanueva-Villar et al., 2016). Portugal and Spain have been no exception to this overall movement, and the countries have seen solid progresses in good corporate governance.

Portuguese listed companies are in general governed by the Portuguese Commercial Companies Code1 (Código das Sociedades Comerciais, henceforth “CSC”), the Portuguese Securities Code2 (Código dos Valores Mobiliários, henceforth “CVM”), by mandatory regulations and instructions issued by the Portuguese Securities Market Supervisory Authority (Comissão de Mercado de Valores Mobiliários, henceforth “CMVM”) and, in particular, by their articles of association. The first legal approach to Corporate Governance, as so-called, was in 1999, with the introduction by CMVM of “Recommendations on Corporate Governance of Listed Companies” (CMVM Regulation No. 10/1999). Following the Organization for Economic Co-operation and Development (OECD) Principles of Corporate Governance, these recommendations, without imposing strict and uniform models, stated topics such as disclosure of information, exercise of voting rights, shareholder representation, institutional investors, corporate rules and structure, and functions of director boards. In 2001, CMVM Regulation No. 10/1999 were revised by CMVM Regulation No. 7. The CMVM Regulation No. 7 required Portuguese listed companies to disclose annually their corporate governance practices and compare their practices to the 17 best practices recommendations on different subjects regarding corporate governance. These recommendations have been revised and updated regularly, namely by the CMVM Regulation No. 11/2003, CMVM Regulation No. 10/2005, CMVM Regulation No. 3/2006 and CMVM Regulation No. 1/2010. In 2013, the CMVM approved a new Corporate Governance Code (the 2013 CMVM Code), replacing the code in force since 2010. On January 2018, the Corporate Governance Code (CGC) issued by the Portuguese Institute of Corporate Governance became applicable to the companies under the supervision of CMVM, in a move towards self-regulation that is being promoted by CMVM and aligned with best international practices on this matter, but still on a comply or explain basis.

In Spain, the corporate governance practices are principally regulated by the Companies Law, the Securities Market Law and by the corporate governance code of listed companies. The Companies Law, approved by Royal Legislative Decree 1/2010, of 2 July, sets out the rules for all limited liability companies, including a section with specific guidelines for listed companies. A major amendment of the Companies Law 2010 came into force on 24 December 2014 (Paredes and Lagos-Núñes in Calkoen, 2018). The Securities Market Law also provides some rules of the corporate governance of Spanish listed companies (for example, transparency and disclosure). The first corporate governance code (the Olivencia Code) was prepared by the Olivencia Committee in 1998. The document contained two independent parts: (i) a report on boards of directors, the key focus of the Olivencia Commission’s study, and (ii) a code of good governance. A second corporate governance reforms came in 2003 with the formation of the Aldama Committee and the establishment of a new corporate governance code (the Aldama Report, 2003), which was aimed principally at enhancing transparency and security in financial markets. In 2006 the Unified Good Governance Code (the Unified Code, 2006) was approved by the Board of the Comisión Nacional del Mercado de Valores (CNMV), as a single document, which includes the 58 recommendations that listed companies may follow when preparing their annual corporate governance reports. With the purpose of adjust or eliminate the recommendations affected by the new legislation, the CNMV approved a partial update of the Unified Code in June 2013. In February 2015 the Unified Code was replaced by a new corporate governance code (the Corporate Governance Code) approved by the CNMV and adjusted to the reform of the Companies Law 2010 that took place in 2014. The new Code includes 25 principles and 64 recommendations, which listed companies may follow when preparing their annual corporate governance reports. Although its recommendations are voluntary, every listed company, whatever its size, market capitalization and nature, must describe its level of compliance with the specifications of the Corporate Governance Code on a yearly basis (CNMV, 2015; Paredes and Lagos-Núñes in Calkoen, 2018).

The economies of both countries also present similarities that make this an interesting study. According to the World Bank, both Portugal and Spain are classified as high-income economies. However, the size and structure of both economies are particularly different. Spain is, according to the FMI estimates, the 13th largest world economy (in GDP terms), with Portugal 47th. If we go beyond the GDP for comparison, using the Human Development Index, Spain and Portugal are placed 27th and 41st, respectively. Unlike US and UK countries, which belong to the common-law legal system and have strong protections for minority investors, Portugal and Spain belong to the French civil-law legal system and have weak legal protection for minority investors (La Porta et al., 1998). In addition, while the US and UK systems are strongly capital market-based, the Portuguese and Spanish financial systems are bank-based. Portugal and Spain also are part of the OECD.

Legal, historical and cultural differences pay a significant role in the effectiveness of governance systems (Maher and Andersson, 1999). In this sense, Portugal and Spain have many similarities in their legal systems. Really, according to the World Governance Indicator for 2017, Portugal and Spain present similar rankings in the different dimensions, except for the political stability no violence and the control of corruption, in which Portugal outperformed Spain.

Finally, regarding the ownership structures, while in the US and UK the ownership structures are dispersed, the ownership structures in Portuguese and Spain listed firms are greatly concentrated. In fact, ownership concentration is observed in the majority (72,7%) of Portuguese listed companies and (60,1%) Spanish listed companies in analysis. In highly concentrated Portuguese and Spanish firms, the potential agency problems typically take the form of conflict of interest between controlling and minority shareholders.

In Portugal, the CSC requires that listed companies include in their annual management report, information relating to the share capital structure, limitations on transfers and special rights attributed to shareholders and the voting rights limitations (even those arising from shareholders’ agreements of which the company is aware). In the same sense in Spain, according to the corporate governance code all listed companies must include in the annual corporate governance report, information relating to the ownership structure, including shareholders with significant stakes and the existing relationships between them, the stakes held by members of the board, the treasury shares of the company and any shareholders’ agreements in place (Paredes and Lagos-Núñes in Calkoen, 2018).

Literature Review and Testable Hypotheses

Conservatism is considered an important characteristic of high-quality reporting (Bandyopadhyay et al., 2010; García Lara et al., 2014). Given conservatism’s role in improving contracting efficiency, mitigating information asymmetry, alleviating agency costs and reducing the litigation risk, an effective corporate governance is considered to be desirable for financial reporting because it will meet the claim for reliable accounting information of investors. Recent empirical studies show a relationship between corporate governance mechanisms and accounting practice, with stronger corporate governance structures improving the implementation of conservative accounting policies (Garci?a Lara et al., 2009; Chen et al., 2009; Ramalingegowda and Yu, 2012; Marzuki et al., 2016).

Extant literature suggests that different ownership structures promote different incentives to monitor and control a firm’s management (Morck et al., 1988; Shleifer and Vishny, 1986; Cullinan et al., 2012). Hence, firm ownership structure may influence conservatism accounting, affecting the quality of financial reporting process (Chi et al., 2009; García Lara et al., 2009; Cullinan et al., 2012).

Ownership structures differ among entities. These different ownership structures can result in diverse governance structures, which would reflect the different rights related with various types of owners. These governance structures in turn could lead a greater or lesser degree of influence over the financial reporting process by large owners and/or managers (Cullinan et al., 2012). The degree of conservatism could reflect different governance structures based on three key characteristics: (1) the fraction of shares held by the manager, (2) the concentration of shares held by the largest shareholder, and (3) whether or not the largest shareholder is an institutional investor. Therefore, to analyze how ownership structure of firms may be associated with the degree of accounting conservatism, we study three types of ownership: managerial ownership, ownership concentration and institutional ownership. With respect to managerial ownership we test additionally at three (low, intermediate and high) ownership levels.

3.1. Managerial Ownership and Accounting Conservatism

Agency theory suggests that managerial ownership motivates managers to increase firm value, because this increases the value of their own shares (Jensen & Meckling, 1976). In terms of financial reporting, existing research suggests that the managers’ ownership interests are closely related with firms’ financial reporting practices (e.g. Warfield et al., 1995; LaFond & Roychowdhury, 2008). As referred by Mitra et al. (2017) “when manager-shareholder interests are more aligned due to higher managerial ownership stakes, the agency problem in financial reporting diminishes. Managers with high ownership interest step up their efforts to minimize the risk of financial misreporting and improve earnings information that properly reflects changes in firm’s economic value”. For example, Warfield et al. (1995); Jung & Kwon, (2002) and Meo et al. (2017) document that managerial ownership is positively related to the information quality of earnings.

LaFond & Roychowdhury (2008), using US data, study the impact of managerial ownership on financial reporting conservatism. They predict that, whether managerial share ownership helps in aligning interests between managers and shareholders, the substitution view suggests that as management ownership increases, the demand for conservatism will decrease. In this vein, they find that managers with more stock ownership act more like shareholders, so the need to report conservatively is reduced. Chen et al. (2009) and Ramalingegowda and Yu (2012) also find that as managerial ownership increases, accounting conservatism decreases. Xia and Zhu (2009), using China data, also document that high level of management ownership lead to less conservative financial reporting. In contrast, for a sample of UK firms, Beekes et al. (2004) find a positive relationship between managerial ownership and conservatism, but only when the managerial ownership is below 5 per cent. Chi et al. (2007), for a sample of Taiwan listed firms, find that high managerial ownership increases the level of conservatism in sample firms. Recently, Eersteling (2016), using US data, hypothesizes that firms with lower managerial ownership have an increased demand for conservatism. The results do not support the hypothesis. Conversely, the results even suggest that higher managerial ownership increases conservatism instead of decreasing it. Majeed et al. (2017), using Chinese data, also find evidence that management ownership is positively associated with conservatism.

As referred previously, while the ownership of US and UK listed firms is characterized by dispersed ownership, the ownership of Portuguese and Spain listed firms is generally characterized by concentrated ownership. Portuguese and Spanish managers tend to own greater relative stakes in their firms than American managers, at least with respect to the samples of large US firms examined in related published research (e.g. LaFond & Roychowdhury, 2008; Chen et al., 2009; Ramalingegowda & Yu, 2012). Additionally, US and UK are based in the market-oriented model, while Portuguese and Spanish financial systems are bank-based. These differences are likely to lead to a variety of differences in managerial behavior. In this sense, Klassen (1997) finds evidence that capital market pressure leads firms with low managerial ownership to make income-increasing accounting choices that do not reflect the underlying firm economics.

Thus, we anticipate that because of greater personal investment, large shareholders pressure and relatively less influence from Portuguese and Spanish capital markets, highly invested managers are more likely to make accounting choices (more conservative) that reflect firm economics rather than personal motives (aggressive accounting).

Therefore, we test the following hypothesis:

Alternative Hypothesis (H1a): Ceteris paribus, managerial ownership in the firm is likely to be positively related to accounting conservatism.

Previous studies also suggest a non-linearity in the relationship between managerial ownership and alignment of manager/shareholder interests (e.g. Morck et al., 1988; Barnhart & Rosenstein, 1998; Shuto & Takada, 2010). Agency theory predicts that while in the presence of low and high levels of managerial ownership, managerial shareholding may align the interest of managers with that of shareholders, in the presence of intermediate levels of ownership, managerial shareholding may entrench the manager and increase agency costs. Shuto and Takada (2010), using a sample of Japanese firms, hypothesize the non-monotonic relationship between managerial ownership and accounting conservatism. Their results are consistent with the implication of the incentive alignment effect for low and high levels of managerial ownership. Thus, they study suggest that firms are less conservative in the presence of low and high levels of managerial ownership. Nevertheless, in the presence of intermediate levels of managerial ownership, they find that firms are more conservative, which is consistent with the management entrenchment effect.

Considering that different managerial ownership structures may result in different managerial behavior and thus different demand for conservatism, we test additionally the following three non-directional hypotheses:

Alternative Hypothesis (H1b1): Ceteris paribus, low levels of managerial ownership in the firm are related to accounting conservatism.

Alternative Hypothesis (H1b2): Ceteris paribus, intermediate levels of managerial ownership in the firm are related to accounting conservatism.

Alternative Hypothesis (H1b3): Ceteris paribus, high levels of managerial ownership in the firm are related to accounting conservatism.

Ownership Concentration and Accounting Conservatism

Prior researches highlight that higher ownership is an active mechanism of corporate governance in controlling management accounting decisions and results in a higher financial reporting quality (Boubakri et al., 2005; Beuselinck & Manigart, 2007; Guo & Ma, 2015; Farouk & Bashir, 2017).

Compared to small shareholders, large shareholders have both stronger incentives and greater means to influence managerial decisions and discipline managers upon receiving bad news (Chen et al., 2009). Really, ownership concentration is likely to supervisor the financial information elaboration process by constraining executive’s attempts to use aggressive (more conservative) accounting. In this sense, Chen et al. (2009) using US data, Haw et al. (2012) using European data, and Sousa & Galdi (2016) using Brazilian data, find that conservatism is positively related to large shareholder ownership.

The ownership in Portuguese and Spanish listed firms is highly concentrated. Moreover, in Portugal and Spain, large shareholders have greater influence on managers, either due to their presence on the board of directors or their threat of disciplinary exist. Therefore, due to large ownership stake, under-diversified equity and long investment horizon, we anticipate that large shareholders have greater preferences for conservative financial reporting in order to protect their investment, to mitigate agency costs and to avoid legal liability. Consequently, large shareholders have incentives to reinforce their monitoring task by requesting more conservative accounting. Thus, we test the following hypothesis:

Hypothesis (H2): Ownership concentration in the firm is positively associated to accounting conservatism.

Institutional Ownership and Accounting Conservatism

Institutional ownership has been regarded as an essential governance mechanism for firms (the efficient monitoring hypothesis). Institutional investors have the opportunity, capacity, and resources to monitor managers. Previous studies corroborate the view that institutional investors act a monitoring role, with their presence increasing earnings quality (Zhong et al., 2017; Bona- Sánchez et al., 2018) and reducing the incidence of earnings management (Chung et al., 2002; Koh, 2003; Sakaki et al., 2017).

Ramalingegowda & Yu (2012) point out, that if conservative financial reporting provides governance benefits, institutional investors are more likely to understand and value such benefits, and as a result, demand conservative accounting from managers. This suggest, a positive association between accounting conservatism and institutional ownership. For a sample of US firms, Ramalingegowda and Yu (2012) find that higher ownership by institutions is positively associated with more conservative financial reporting. Qiang (2004), Chen et al. (2009), Peterson and Whitworth (2013) and Lin (2016), using US data, also find that conservatism is positively related to institutional ownership. Alkurdi et al. (2017), for a sample of Jordanian companies, find a significant and positive relationship between institutional ownership and accounting conservatism. Majeed et al. (2017), using Chinese data, find that institutional ownership is positively associated with conservatism, too.

Portuguese and Spanish corporate governance are distinguished by a high concentration of ownership, which leads to the presence of controlling shareholders who play a major role on boards and influence managers. Among controlling shareholders, the position of institutional investors in Portugal and Spain is important and their impact on corporate governance is significant (García Meca &Sánchez Ballesta, 2011; García Meca & Pucheta Martínez, 2018; OCDE, 2011). Due to the benefits of accounting conservatism, we expect that institutional investors, while participants in efficient corporate governance, will regard conservatism as a desirable characteristic of accounting information and will favor its implementation. Thus, we test the following hypothesis:

Hypothesis (H3): Institutional ownership in the firm is positively associated to accounting conservatism.

Variable Measurement and Research Design

Measurement of Ownership Structure

To examine whether the corporate ownership structure affects accounting conservatism, we use three variables: managerial ownership, ownership concentration and institutional ownership. The managerial ownership (MANAG_OWN) is measured as the percentage of shares owned by the manager. As in Morck et al. (1988), Himmelberg et al. (1999) and Mitra et al. (2017), to address the non-linearity in the relationship between managerial ownership and conservatism accounting, the total managerial ownership is split into three groups: MANAG_OWN_Low, MANAG_OWN_Medium and MANAG_OWN_High. MANAG_OWN_Low equals MANAG_OWN if 0.00 < MANAG_OWN < 0.05, and 0.05 if MANAG_OWN ≥ 0.05; MANAG_OWN_Medium equals MANAG_OWN – 0.05 if 0.05 < MANAG_OWN < 0.25, 0.00 if MANAG_OWN ≤ 0.05, and 0.20 if MANAG_OWN ≥ 0.05; MANAG_OWN_High equals MANAG_OWN – 0.25 if 0.25 < MANAG_OWN < 1.00, and 0.00 if MANAG_OWN ≤ 0.25.

Shareholdings in Portuguese listed firms of more 2% must be disclosed. In Spain, the Royal Decree 1362/2007 of 19 October, establishes the first threshold for informing of significant shareholdings at 3%. Thus, to Portugal the ownership concentration (OWN_CON), is measured as the percentage of shares held by shareholders who own at least 2% of the shares of the firm. To Spain the ownership concentration (OWN_CON) is calculated as the percentage of shares owned by shareholders who own at least 3% of the shares of the firm. Institutional ownership (INST_OWN) is measured as a dummy variable having the value 1 if the level of institutional ownership is at least 2%/3% of the shares of the firm, and 0 otherwise, to Portugal and Spain, respectively.

Measurement of Accounting Conservatism

Following previous studies, we use the firm-year specific C-Score developed by Khan and Watts (2009) to measure accounting conservatism (e.g., García Lara et al., 2014; Lobo et al., 2020; Yin et al., 2020).

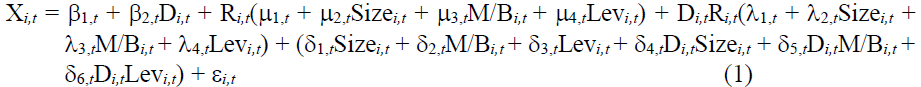

The C-Score is calculated as follows. First, we estimate equation (1) with annual crosssectional regressions:

where i indicates firm, and t indicates year:

X = is the net earnings, scaled by lagged market capitalization of firm;

R = is annual stock returns obtained by cumulating monthly returns starting from the fourth month after the firm’s fiscal year end;

D = is a dummy variable equal to 1 when R<0 and equal to 0 otherwise;

Size = is the natural logarithm of market capitalization of firm;

M/B = is the market-to-book ratio;

Lev = is leverage, defined as long-term and short-term debt deflated by market value of equity.

Second, we collect the yearly λ-coefficients (i.e., λ1,t - λ4,t) and then calculate the firm-year C-Score by the following equation (2):

C-Scorei,t = λ1,t + λ2,tSizei,t + λ3,tM/Bi,t + λ4,tLevi,t (2)

The higher the C-Score, the more conservative the firm is in its financial reporting.

Models Specification and Control Variables

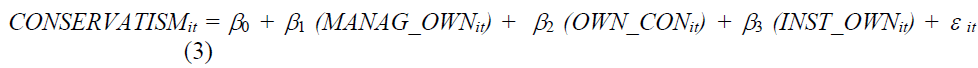

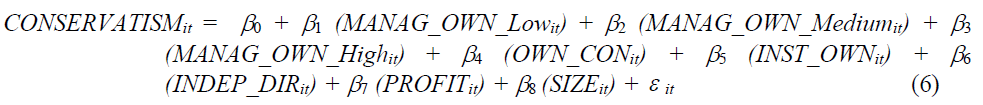

We examine the relationship between ownership structure and accounting conservatism by estimating the following two regression models:

1. The general relationship between ownership structure (managerial ownership, ownership concentration and institutional ownership) and conservatism accounting;

2. The relationship between ownership structure (managerial ownership at three ownership levels, ownership concentration and institutional ownership) and conservatism accounting.

Where:

CONSERVATISMit = is the C-Score developed by Khan and Watts (2009) of firm i for period t.

MANAG_OWNit = percentage of shares owned by the manager of firm i for period t.

MANAG_OWN_Lowit = equals MANAG_OWNit if 0.00 < MANAG_OWNit < 0.05, and 0.05 if MANAG_OWNit ≥ 0.05.

MANAG_OWN_Mediumit = equals MANAG_OWNit – 0.05 if 0.05 < MANAG_OWNit < 0.25, 0.00 if MANAG_OWNit ≤ 0.05, and 0.20 if MANAG_OWNit ≥ 0.05.

MANAG_OWN_Highit = equals MANAG_OWNit – 0.25 if 0.25 < MANAG_OWNit < 1.00, and 0.00 if MANAG_OWNit ≤ 0.25.

OWN_CONit = percentage of shares owned by shareholders who own at least 2%/3% of the shares of firm i for period t.

INST_OWNit = dummy variable: 1 if the level of institutional ownership is at least 2%/3% of the shares of the firm i for period t, and 0 otherwise.

εit = residual term of firm i for period t.

β0 is a constant, β1 to β5 are the coefficients.

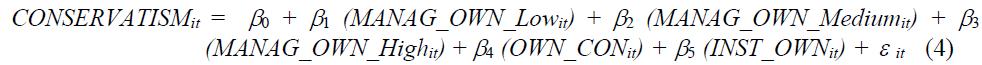

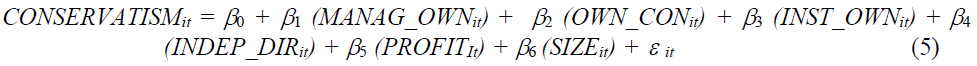

The three ownership categories (MANAG_OWN, OWN_CON and INST_OWN) are not the only factors affecting accounting conservatism. Thus, we also examine the relationship between ownership structure and accounting conservatism, after considering the effect of some other variables. Previous studies suggest that independent directors (INDEP_DIR), profitability (PROFIT) and political costs (SIZE) are associated with accounting conservatism (DeFond and Subramanyam, 1998; Basu et al., 2001, 2002; Chi et al., 2009; LaFond and Roychowdhury, 2008; García Lara et al., 2009; Chen et al., 2009; Shuto and Takada, 2010; Sun and Lin, 2011; Cullinan et al., 2012).

To examine the relationship between ownership structure and accounting conservatism, after controlling the impact of other relevant variables, we estimate the following two regression models:

Where:

CONSERVATISMit, MANAG_OWNit, MANAG_OWN_Lowit, MANAG_OWN_Mediumit, MANAG_OWN_Highit, OWN_CONit, INST_OWNitand εit = as defined before.

INDEP_DIRit = number of independent directors over total number of directors.

PROFITit= ratio between the net income and the total shareholders’ equity of firm i for period t.

SIZEit = logarithm of market capitalization of firm i for period t.

β0 is a constant, β1 to β8 are the coefficients.

Sample Selection and Characteristics

Our sample includes all the non-financial listed firms of Euronext Lisbon and the Madrid Stock Exchange for the period 2005-2017. Financial companies (Financial and Insurance) have been removed from the sample because of their particular accounting practices, which make it more difficult to compare their financial statements to those of non-financial companies. Financial companies are under stricter supervision by financial authorities, so the role of their boards may be restricted by this control. Football club companies are also excluded, because they have annual accounting periods that end on dates other than December 31. As a result, we obtain an unbalanced panel of 2.124 firm-year observations over the 2005 to 2017 period. Table 1 describes the sampling process.

| Table 1 Sample Selection Criteria During the Years 2005-2017 | |||

| Sample selection | Number of firm years | Number of firm years | Number of firm years |

| Portugal | Spain | Total | |

| Firms listed | 642 | 1.738 | 2.380 |

| (-) Financial companies | (53) | (139) | (192) |

| (-) Insurance companies | - | (27) | (27) |

| (-) Football club companies | (37) | - | (37) |

| Number of firm-year observations in the final sample | 552 | 1.572 | 2.124 |

The data used in this paper come from the following sources. The Sistema de Ana?lisis de Balances Ibe?ricos (SABI), a database managed by Bureau Van Dijk and Informa D&B, S.A., and the Portuguese Securities Market Supervisory Authority and the Spanish Securities Market Supervisory Authority, provide the accounting information from annual accounts, while financial market information comes from the quotation bulletins of the Euronext Lisbon and Spanish Stock Exchange.

Portugal and Spain are two countries with geographical, economical and historical ties. However, the countries’ dimensions are different, as well as the number of firms, its market value and liquidity, among other factors. Due to these facts, we will analyze each country separately to detect its particularities, and we will also combine the two samples to increase the number of observations and to justify some differences that may appear between the two countries. Table 2 presents the descriptive statistics.

| Table 2 Summary of Descriptive Statistics Period: 2005-2017 | ||||

| Mean | Median | Min. | Max. | |

| Panel A - Portugal: Number of observations: 552 | ||||

| CONSERVATISM | 0.061 | 0.073 | -0.013 | 0.103 |

| MANAG_OWN | 0.047 | 0.001 | 0.000 | 0.801 |

| OWN_CON | 0.727 | 0.747 | 0.085 | 0.997 |

| INST_OWN | 0.729 | 1.000 | 0.000 | 1.000 |

| INDEP_DIR | 0.275 | 0.200 | 0.000 | 0.500 |

| PROFIT | 0.111 | 0.087 | -8.907 | 27.931 |

| SIZE | 19.069 | 18.854 | 11.918 | 23.517 |

| Panel B - Spain: Number of observations: 1.572 | ||||

| Mean | Median | Min. | Max. | |

| CONSERVATISM | 0.087 | 0.098 | -0.021 | 0.121 |

| MANAG_OWN | 0.059 | 0.001 | 0.000 | 0.836 |

| OWN_CON | 0.601 | 0.617 | 0.055 | 1 |

| INST_OWN | 0.624 | 1.000 | 0.000 | 1.000 |

| INDEP_DIR | 0.302 | 0.327 | 0.000 | 0.899 |

| PROFIT | 0.198 | 0.172 | -4.789 | 55.641 |

| SIZE | 20.902 | 20.760 | 16.015 | 25.281 |

Regarding Portugal, Panel A in Table 2 shows that, while CONSERVATISM, ranges between about -0.013 and 0.103, the mean and median are about 0.061 and 0.073. The mean (median) managerial ownership (MANAG_OWN) is 4.7% (0.1%), with a minimum of 0.0% and a maximum of 80.1%. The ownership concentration (OWN_CON) variable indicates that, in Portuguese listed companies, the ownership is highly concentrated. Panel A in Table 2 also shows that about 72.9% of companies have institutional ownership (INST_OWN) as shareholders. About 27.5% (with a median of 20%) of the members of the board are independent directors (INDEP_DIR), with a minimum of 0.0% and a maximum of 50%. The mean (median) PROFIT is 0.111 (0.087), with a minimum of -8.907 and a maximum of 27.931. The mean of firm size (SIZE) is about EUR 985 million with a minimum of EUR 150 thousand and a maximum of EUR 16.345 million.

Regarding Spain, Panel B in Table 2 shows that, while CONSERVATISM, ranges between about -0.021 and 0.121, the mean and median are about 0.087 and 0.098. The mean (median) managerial ownership (MANAG_OWN) is 5.9% (0.1%), with a minimum of 0.0% and a maximum of 83.6%. The ownership concentration (OWN_CON) variable indicates that listed companies in Madrid Stock Exchange present a great degree of ownership concentration, too. Panel B in Table 2 shows that about 62.4% of companies have institutional ownership (INST_OWN) as shareholders. About 30.2% (with a median of 32.7%) of the members of the board are independent directors (INDEP_DIR), with a minimum of 0.0% and a maximum of 89.9%. The mean (median) PROFIT is 0.198 (0.172), with a minimum of -4.789 and a maximum of 55.641. The mean of firm size (SIZE) is about EUR 1.200 million with a minimum of EUR 9 million and a maximum of EUR 95.369 million.

According to Table 2, Spanish listed firms seem to be more conservative, managers have more ownership, have more independent board structures, are more profitable and larger than their Portuguese counterparts. In contrast, Portuguese listed firms have a higher ownership concentration compared with the Spanish listed firms, and the presence of institutional investors in firm ownership structure is also higher.

Results and Discussion

We began with a pooled Ordinary Least Squares (OLS) model, a random effects model and a fixed effects model and we ran different tests to check the suitability of each model. On one hand, we compared the results of the pooled OLS model to those of the random effects model by means of the Breusch-Pagan test for random effects. This test revealed that using the random effects model was preferable to the pooled regression model. On the other hand, we estimated a fixed effects model, and the F test for significance of fixed effects revealed that using fixed effects was also preferable to the pooled regression. Finally, we used the Hausman specification test to compare random and fixed effects models and, based on the test results, the fixed effects model is appropriate.

Tables 3 and 4 present the results from fixed effects regression for the equations 3, 4, 5 and 6, developed in section three. With respect to managerial ownership variable, we test the linear (models 3 and 5) and at three ownership levels (models 4 and 6), relationships between managerial ownership and conservatism accounting.

| Table 3 Fixed Effects Regressions Results of Equations 3 and 5 Period: 2005-2017 | ||||||||||||

| Dependent variable | CONSERVATISM | |||||||||||

| Portugal | Spain | Total Sample | ||||||||||

| Model (3) | Model (5) | Model (3) | Model (5) | Model (3) | Model (5) | |||||||

| Independent variables |

Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test |

| Constant | 0.062 | 1.271 | 0.001 | 1.389 | 0.015 | 0.461 | 0.001 | 1.104 | 0.199 | 0.907 | 0.004 | 1.082 |

| MANAG_OWN | 0.381 | 3.806*** | 0.575 | 1.701* | 0.217 | 3.378** | 0.097 | 2.312** | 1.002 | 3.987*** | 0.198 | 3.576*** |

| OWN_CON | 0.219 | 2.201** | 0.655 | 2.720*** | 0.898 | 6.304*** | 0.223 | 3.179*** | 0.889 | 6.477*** | 0.204 | 3.802*** |

| INST_OWN | 0.624 | 1.623* | 0.101 | 1.223 | 0.531 | 4.699*** | 0.069 | 2.233** | 0.587 | 5.253*** | 0.102 | 2.003** |

| INDEP_DIR | - | - | 0.048 | 2.199** | - | - | 0.106 | 3.388** | - | - | 0.029 | 2.991*** |

| PROFIT | - | - | 0.109 | 0.798 | - | - | 0.099 | 1.709 | - | - | 0.098 | 1.188 |

| SIZE | - | - | 0.049 | 2.489** | - | - | 0.379 | 3.797*** | - | - | 0.204 | 4.041*** |

| COUNTRY | - | - | - | - | - | - | - | - | 0.702 | 5.317*** | 0.124 | 2.086*** |

| Observations | 552 | 552 | 1572 | 1572 | 2124 | 2124 | ||||||

| R-squared | 32.46% | 38.98% | 34.97% | 48.43% | 44.12% | 49.08% | ||||||

| F-statistic | 12.761** | 14.933** | 14.546*** | 22.071*** | 19.857*** | 24.107*** | ||||||

| *** Significant at the 1-percent level; ** Significant at the 5-percent level; * Significant at the 10-percent level. | ||||||||||||

| Table 4 Fixed Effects Regressions Results of Equations 4 and 6 | ||||||||||||

| Dependent variable | CONSERVATISM | |||||||||||

| Portugal | Spain | Total Sample | ||||||||||

| Model (4) | Model (6) | Model (4) | Model (6) | Model (4) | Model (6) | |||||||

| Independent variables |

Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test | Coef. | t test |

| Constant | 0.021 | 1.001 | 0.046 | 1.218 | 0.002 | 0.302 | 0.001 | 0.205 | 0.087 | 1.106 | 0.076 | 0.951 |

| MANAG_OWN _Low | 0.432 | 2.067** | 0.197 | 1.908* | 0.587 | 3.167*** | 0.255 | 2.379** | 0.477 | 2.399** | 0.345 | 3.197*** |

| MANAG_OWN _Medium | -0.287 | -1.081 | -0.203 | -0.889 | -0.567 | -1.399 | -0.209 | -0.864 | -0.328 | -0.807 | -0.299 | -1.003 |

| MANAG_OWN _High | 0.499 | 3.935*** | 0.211 | 2.199** | 0.489 | 2.008** | 0.301 | 2.875*** | 0.609 | 3.671*** | 0.390 | 3.439*** |

| OWN_CON | 0.367 | 2.178** | 0.319 | 3.287*** | 0.399 | 2.467** | 0.297 | 2.301** | 0.512 | 2.418** | 0.297 | 3.067*** |

| INST_OWN | 0.309 | 0.798 | 0.128 | 1.891 | 0.177 | 1.801* | 0.138 | 2.191** | 0.376 | 1.887* | 0.190 | 2.337** |

| INDEP_DIR | - | - | 0.169 | 1.877* | - | - | 0.091 | 2.171** | - | - | 0.182 | 2.253** |

| PROFIT | - | - | 0.017 | 0.262 | - | - | 0.156 | 1.799 | - | - | 0.099 | 1.770 |

| SIZE | - | - | 0.207 | 2.187** | - | - | 0.679 | 4.845*** | - | - | 0.421 | 4.104*** |

| COUNTRY | - | - | - | - | - | - | - | - | 0.469 | 2.005** | 0.398 | 3.267*** |

| Observations | 552 | 552 | 1.572 | 1.572 | 2.124 | 2.124 | ||||||

| R-squared | 35.09% | 40.08% | 39.99% | 47.83% | 48.03% | 52.34% | ||||||

| F-statistic | 13.982*** | 15.925*** | 15.106*** | 19.411*** | 20.883*** | 24.002*** | ||||||

| *** Significant at the 1-percent level; ** Significant at the 5-percent level; * Significant at the 10-percent level. | ||||||||||||

CONSERVATISM is the C-Score developed by Khan and Watts (2009); MANAG_OWN_Low is MANAG_OWN if 0.00 < MANAG_OWN < 0.05, and 0.05 if MANAG_OWN ≥ 0.05; MANAG_OWN_Medium is MANAG_OWN – 0.05 if 0.05 < MANAG_OWN < 0.25, 0.00 if MANAG_OWN ≤ 0.05, and 0.20 if MANAG_OWN ≥ 0.05; MANAG_OWN_High is MANAG_OWN – 0.25 if 0.25 < MANAG_OWN < 1.00, and 0.00 if MANAG_OWN ≤ 0.25; OWN_CON is the percentage of shares held by shareholders who own at least 2%/3% of the shares; INST_OWN dummy variable which takes a value 1 if the level of institutional ownership is at least 2%/3% of the shares of the firm and 0 otherwise; INDEP_DIR is the number of independent directors over the total number of directors; PROFIT is the return on equity ratio; SIZE represents the firm’s size; COUNTRY dummy variable which takes a value 1 if the firm is from Spain and 0 otherwise.

Table 3 reports the results from models (3) and (5). Model (3) tests the relationship between the three measures of the ownership structure and the measure of accounting conservatism. Model (5) analyzes whether a firm’s ownership structure affects the levels of accounting conservatism after considering the effect of some other variables. Additionally, table 4 presents the results from models (4) and (6). Model (4) examines the association between ownership structure (with three managerial ownership levels) and conservatism accounting. Model (6) which also analyzes whether a firm’s ownership structure, with three managerial ownership levels, affects the levels of accounting conservatism considering the effect of some other variables.

To both Portugal and Spain, Table 3 shows that, in models (3) and (5), the MANAG_OWN is significantly positively related to accounting conservatism. In contrast with American studies (e.g. LaFond and Roychowdhury, 2008; Chen et al., 2009; Ramalingegowda and Yu, 2012), this study suggests that firms with high levels of managerial ownership seem to have superior conservatism. That is, as management ownership increases, the demand for conservatism will increase. Possible explanations for our result are that conservatism accounting is likely to increase with managerial ownership because (1) managers who possess a larger number of shares are inclined to defended the shareholders’ interests; (2) high managerial ownership decreases agency costs, consequently reduces the need for accounting-based contracting and thus provides managers with fewer incentives to use aggressive reporting policies; (3) the likelihood of managers using aggressive accounting choices to maximize their interests declines from greater interest alignment; (4) conservative financial reporting provides governance benefits (Watts, 2003a; Francis et al., 2004; Nikolaev, 2006; Zhang, 2008), therefore managers may naturally prefer conservative accounting principles to improve governance of the firm as well as to increase company’s (and your own) reputation; (5) managers with high ownership interest are more likely to employ more conservatism accounting to decrease “informational uncertainty and probability of financial misstatements and send a positive signal to the investing community about the quality of reported financial information” (Mitra et al., 2017).

Additionally, the opposing results are likely attributable to the different institutional settings that exist in the US and both Portugal and Spain (e.g. market vs bank-oriented models). Unlike in US, in Portugal and Spain, managers face reduced market pressure. As a result, managers would be less concerned about inflating current earnings (aggressive accounting).

Next, with respect to managerial ownership variable, we test at three ownership levels (models 4 and 6), relationships between managerial ownership and conservatism accounting.

Table 4 shows that, in models (4) and (6), MANAG_OWN_Low and MANAG_OWN _High are significantly positively, in both Portugal and Spain, related to accounting conservatism. MANAG_OWN_Medium is negatively related to accounting conservatism but not significantly. These results suggest that the relationship between managerial ownership and accounting conservatism is significantly positive within the low and high levels. Consequently, managers with low and high ownership interest, are more likely to employ conservative accounting.

However, this result is inconsistent with the finding of Shuto and Takada (2010), for the Japan market, which find that within the low and high levels of managerial ownership, managerial ownership is negatively related to conservatism accounting. One possible explanation for our results may be that at low level of managerial ownership (up to 5 per cent stockholdings), managers’ behavior may be dominated by external discipline, large shareholders and internal controls and, thus align their interests with that of other shareholders. For example, managers can be removed because of poor performance and financial misreporting. Therefore, there are sufficient incentive for managers to adopt accounting policies, such as conservatism, that mitigate information asymmetry and achieve better performance, better governance and high-quality reporting. At high level of managerial ownership (more than 25 per cent stockholdings), the possible reasons for a positive relationship between managerial ownership and conservatism accounting was referred previously.

The Hypothesis 2 predicts a positive relationship between ownership concentration and accounting conservatism. The findings support this hypothesis, which suggests that the higher the ownership concentration, the greater should be the likelihood of managers to use more conservative accounting. Hence, as in Chen et al. (2009), Haw et al. (2012) and Sousa and Galdi (2016) we find, in all models, that ownership concentration is positively related to conservatism accounting, suggesting that as ownership concentration increases, Portuguese and Spanish listed firms exhibit a higher degree of accounting conservatism. Consequently, if conservative financial reporting provides governance benefits, large shareholders are more likely to understand and value such benefits, and as a result, demand more conservative accounting from managers. The results suggest that in civil-law countries, such as Portugal and Spain, financial markets’ lack of liquidity reduces their efficiency in controlling firm management, therefore increasing the importance of large shareholders as supervisors of managers’ activity. Another possible explanation for the positive relationship between ownership concentration and conservatism accounting, is that firms with higher ownership concentrations may be more aggressive tax planners, and consequently more conservative.

The Hypothesis 3 predicts a positive relationship between institutional ownership and accounting conservatism. For Portugal the coefficient institutional ownership variable is significantly positive only in the model (3). For Spain, we find that institutional ownership positively affects accounting conservatism. Thus, to Portugal, it is not possible to conclude that monitoring institutions are an important class of investors that demands conservatism as a governance device. This suggests that, in Portugal, institutional investors might rely more on direct monitoring and less on monitoring through accounting numbers. Therefore, the findings support only the hypothesis 3 to Spain.

Collectively, the results suggest that in civil-law countries, such as Portugal and Spain, financial markets’ lack of liquidity and less capital market pressure leads firms with low and high managerial ownership, with large shareholders and with institutional investors to make accounting choices (more conservative) that reflect the underlying firm economics rather than personal motives (aggressive accounting). This result confirms the role of ownership structure in mitigating agency costs, mainly in Continental corporate governance systems, where, managers, large shareholders and institutional investors enjoy a significant position among the shareholders of most listed firms. In Portugal and Spain, the efficiency of financial markets controlling firm’s management is reduced, whereas the importance of large shareholders and institutional investors as supervisors of managers’ activity is more relevant. Thus, the ownership structure in Portugal and Spain seems to compensate for the weaknesses of investor protection laws.

In relation to the other variables, included as control variables, we find, in all model, a positive relationship between INDEP_DIR and accounting conservatism. Thus, both to Portugal and Spain, the results suggest that independent outside board members play an important monitoring function of the financial reporting process. Finally, to Portugal and Spain, the results suggest, in all models, that large firms choose more conservative accounting, confirming the results of Sun & Lin (2011) and Cullinan et al. (2012). These results are consistent with the political cost hypothesis of Watts & Zimmerman (1978), which suggests that large firms are more conservative accounting in order to lower their public profile and avoid political scrutiny.

Overall, even if firms in Portugal and Spain have singular characteristics, the impact of managerial ownership, ownership concentration, independent board and size on conservatism accounting seem similar.

Summary and Conclusions

Literature suggests that ownership structure plays a role in accounting conservatism (LaFond & Roychowdhury, 2008; Chi et al., 2009; Shuto & Takada, 2010; Cullinan et al., 2012; Ramalingegowda & Yu, 2012). This paper explores the relation between a firm’s ownership structure and its degree of conservatism, within the Portuguese and Spanish capital markets. If specific corporate governance structures (e.g. ownership structure) are likely to increase earnings quality, they may also affect the degree of conservatism in financial reporting. We analyze a specific context where due to the lack of liquidity and high concentration of ownership, financial markets are less effective in controlling management.

The empirical findings suggest that ownership structures influence the accounting conservatism practices of both Portuguese and Spanish listed firms. Particularly, our study shows that at low and high levels of managerial ownership, there is a significant positive relationship between managerial ownership and conservatism accounting. The opposing results observed in American studies are likely attributable to the different institutional settings that exist in the US and both Portugal and Spain. Management alignment (greater personal investment) and relatively less influence from capital markets seem to have major roles in conservative accounting decisions made in Portugal and Spain. Another possible explanation for the opposing Portuguese and Spain results is the different sizes of firms find in the US and in Portugal and Spain. Large US firms tend to be considerably larger than “large” Portuguese and Spanish firms. Given that the firms in American and Portuguese and Spanish studies are probably of different sizes, it is possible that conservatism accounting varies with managerial ownership similarly in the US and Portuguese and Spanish among firms of similar sizes. The difference in the definition of “large” firms in the US and Portugal and Spain can be characterized as an institutional difference. Further research is necessary in order to determine whether the different results in the US and both Portuguese and Spanish are due to size differences.

In addition, our results indicate that large shareholders enhance accounting conservatism, suggesting that there is a greater level of financial reporting conservatism when shareholders have the incentives and power to discipline the managers. So, the empirical results suggest that large shareholders may have strong incentives to implement conservative accounting to reduce potential litigation costs and agency costs. To Spain, results also suggest that the presence of institutional investors enhances conservative accounting. Additionally, the results also show that there is more accounting conservatism when the number of independent non-executive directors on the board and political costs are high.

Hence, this study suggests that the ownership structure in civil-law countries, such as Portugal and Spain, seems to play a substantial role in accounting decisions (more conservative) made in Portugal and Spain. Therefore, in countries characterized by high ownership concentration, financial markets’ lack of liquidity and low capital market pressure, the ownership structure may assume an important mechanism to increase earnings quality, increase market confidence in accounting information and improve investor protection. There are two other potential explanations for the results of this study. First, in Portugal and Spain banks play a major role in financing firm. As a result, Portuguese and Spanish listed firms may be motivated to adopt conservatism in accounting reports to ensure successful financing and reduce financing costs. Second, firms with higher ownership concentrations may be more aggressive tax planners. For future research it would be interesting to analyze the influence of both debt financing and income tax on the relationship between ownership structure and accounting conservatism.

The results of this study make the following contributions. First, the findings suggest that, on average, managerial ownership and ownership concentration affect conservative accounting in both Portuguese and Spanish listed firms. Results also suggest that the presence of institutional investors affects positively conservative accounting in Spanish listed firms. Second, the results are important for countries with similar institutional environment to that of Portugal and Spain. Third, the findings may be also important for investors, because they offer understanding into the influence of ownership structure on conservative accounting and, consequently on earnings quality. Really, investors may wish to consider how different ownership structures may help them to protect their equity interests and reduce information asymmetry through accounting conservatism. Finally, the results could also be of interest to regulators, as well as to supervisors, in considering regulatory reforms which may engender greater transparency, and which may modify the relative power among management and large shareholders. In addition, the roles of the regulators, as well as of the supervisors, in protecting the financial reporting system can be assisted through a more comprehensive understanding of how ownership structure affects conservatism accounting, and consequently final reporting quality in the company.

This study has certain limitations as well. First, we focus exclusively on the impact of ownership structure on conservatism accounting. Therefore, this study neglects the impact of other corporate governance mechanisms (e.g., debt, board structure) on conservatism accounting. Second, the sample of this study is constituted only of listed companies. Third, in terms of external validity, because we investigate the Portuguese and Spanish equity market, the evidence provided might not necessarily generalize to all listed firms.

This research could lead to further investigations in the future. First, the Portuguese and Spanish financial systems are bank-based. In addition, firms with higher ownership concentrations may be more aggressive tax planners. In this vein, for future research it would be interesting to analyze the influence of both debt financing and income tax on the relationship between ownership structure and accounting conservatism. Second, in this article, the relationship between institutional ownership and accounting conservatism has been analyzed using a dummy variable to measure institutional ownership, but it would be interesting to use the level of institutional ownership in the corporate structure as well as the institutional ownership type. Finally, the Portuguese and Spanish economies are characterized by small- and mediumsized companies (SMEs). In this vein, for future research it would be interesting to replicate the analyzes using data from SMEs.

End Note

1.Published by Decree-Law No. 262/86, of 2 September.

2.Enacted by Decree-Law No. 486/99, of 13 November.

Acknowledgement

This work was financially supported by the research unit on Governance, Competitiveness and Public Policy (UIDB/04058/2020)+(UIDP/04058/2020), funded by national funds through FCT - Fundac?a?o para a Cie?ncia e a Tecnologia.

References

- Alkurdi, A., Al-Nimer, M., & Dabaghia, M. (2017). Accounting Conservatism and Ownership Structure Effect: Evidence from Industrial and Financial Jordanian Listed Companies”, International Journal of Economics and Financial Issues, 7(2), 608-619.

- Bandyopadhyay, S., Chen, C., Huang, A., & Jha, R. (2010). Accounting conservatism and the temporal trends in current earnings’ ability to predict future cash flows versus future earnings: Evidence on the trade-off between relevance and reliability. Contemporary Accounting Research, 27(2), 413-460.

- Barnhart, S. W., Rosenstein, S. (1998). Board composition, managerial ownership, and firm performance: An empirical analysis. The Financial Review, 33, 1-16.

- Basu, S., Hwang, L.S., & Jan, C.L. (2001). Differences in Conservatism between Big Eight and Non-Big Eight Auditors. Working Paper, Temple University.

- Basu, S., Hwang, L.S., & Jan, C.L. (2002). Auditor Conservatism and Quarterly Earnings, Working Paper, Temple University.

- Beekes, W., Pope, P., & Young, S. (2004). The link between earnings timeliness, earnings conservatism and board composition: Evidence from the UK. Corporate Governance: An International Review, 12(1), 47-59.

- Beuselinck, C., & Manigart, S. (2007). Financial reporting quality in private equity backed companies: The impact of ownership concentration. Small Business Economics, 29, 261-274.

- Bona-Sánchez, C., García Meca, E., & Pérez Alemán, J. (2018). Earnings informativeness and institutional investors on boards”, Spanish Accounting Review, 21(1), 73-81.

- Boubakri, N., Cosset, J.C., & Guedhami, O. (2005). Postprivatization corporate governance: The role of ownership structure and investor protection. Journal of Financial Economics, 76(2), 369-399.

- Chen, S., Chen, X., Cheng, Q., & Hutton, A. (2009). Accounting conservatism and large shareholders: An empirical analysis. Working Paper.

- Chi, W., Liu, C., & Wang, T. (2007). What affects accounting conservatism: A corporate governance perspective. Working Paper, National Taiwan University.

- Chi, W., Liu, C., & Wang, T. (2009). What affects accounting conservatism: A corporate governance perspective. Journal of Contemporary Accounting & Economics, 5(1), 47-59.

- Chung, R., Firth M., & Kim, J.B. (2002). Institutional monitoring and opportunistic earnings management. Journal of Corporate Finance, 8, 29-48.

- Cullinan, C.P., Wang, F., Wang, P., & Zhang, J. (2012). Ownership structure and accounting conservatism in China. Journal of International Accounting, Auditing and Taxation, 21, 1-16.

- DeFond, M.L., & Subramanyam, K.R. (1998). Auditor changes and discretionary accruals. Journal of Accounting and Economics, 25(1), 35-67.

- Eersteling, G.J. (2016). The effect of managerial ownership on the demand for conservatism. Working Paper, Uppsala University.

- Farouk, M.A., & Bashir, N.M. (2017). Ownership structure and earnings management of listed conglomerates in Nigeria. Indian-Pacific Journal of Accounting and Finance, 1(4), 42-54.

- Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2004). Costs of equity and earnings attributes. The Accounting Review, 79(4), 967-1010.

- García Lara, J.M., Garcia Osma, B., & Penalva, F. (2009). Accounting conservatism and corporate governance. Review of Accounting Studies, 14, 161-201.

- García Lara, J.M., Garcia Osma, B., & Penalva, F. (2014). Information consequences of accounting conservatism. European Accounting Review, 23(2), 173-198.

- García Meca, E., & Sánchez Ballesta, J.P. (2011). Firm value and ownership structure in the Spanish capital market”, Corporate Governance, 11(1), 41-53.

- García Meca, E., & Pucheta Martínez, M.C. (2018). How institutional investors on boards impact on stakeholder engagement and corporate social responsibility reporting. Corporate Social Responsibility and Environmental Management, 25(3), 237-249.

- Goh, B.W., Lim, C.Y., Lobo, G.J., & Tong, Y.H. (2017). Conditional conservatism and debt versus equity financing”, Contemporary Accounting Research, 34(1), 216-251.

- Guo, F., & Ma, S. (2015). Ownership characteristics and earnings management in China. The Chinese Economy, 48(5), 372-395.

- Haw, I.M., Ho, S., Tong, J.Y., & Zhang, F. (2012). Complex ownership structures and accounting conservatism. Working Paper, Texas Christian/Hong Kong Baptist/Western Australian/Murdoch University.

- Himmelberg, C.P., Hubbard R.G., & Palia, D. (1999). Understanding the determinants of managerial ownership and the link between ownership and performance. Journal of Financial Economics, 53(3), 353-384.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jung, K., & Kwon, S.Y. (2002). Ownership structure and earnings informativeness: Evidence from Korea. The International Journal of Accounting, 37(3), 301-325.

- Khan, M., & Watts, R.L. (2009). Estimation and empirical properties of a firm-year measure of accounting conservatism. Journal of Accounting and Economics, 48(2-3), 132-150.

- Klassen, K.J. (1997). The impact of inside ownership concentration on the trade-off between financial and tax reporting. The Accounting Review, 72(3), 455-474.

- Koh, P.S. (2003). On the association between institutional ownership and aggressive corporate earnings management in Australia. The British Accounting Review, 35, 105-128.

- LaFond, R., & Roychowdhury, S. (2008). Managerial ownership and accounting conservatism. Journal of Accounting Research, 46(1), 101-135.

- LaFond, R., & Watts, R.L. (2008). The information role of conservatism. The Accounting Review, 83(2), 447-478.

- La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (1999). Corporate Ownership Around the World. The Journal of Finance, 54(2), 471-517.

- Leuz, C., Nanda, D., & Wysocki, P.D. (2003). Earnings management and investor protection: An international comparison”, Journal of Financial Economics, 69(3), 505-527.

- Lin, L. (2016). Institutional ownership composition and accounting conservatism. Review of Quantitative Finance and accounting, 46(2), 359-385.

- Lobo, G.J., Robin, A., Wu, K. (2020). Share repurchases and accounting conservatism. Review of Quantitative Finance and Accounting, 54, 699-733.

- Maher, M.E., & Andersson, T. (1999). Corporate governance: Effects on firm performance and economic growth. Organisation for Economic Co-operation and Development. Retrieved from: https://www.oecd.org/sti/ind/2090569.pdf

- Majeed, M.A., Zhang, X.Z., & Wang, Z. (2017). Product market competition, regulatory changes, ownership structure, and accounting conservatism. Chinese Management Studies, 11(4), 658-688.

- Marzuki, M.M., Wahab, E.A.A., & Haron, H. (2016). Corporate governance and earnings conservatism in Malaysia”, Accounting Research Journal, 29(4), 391-412.

- Meo, F.D., García Lara, J.M., & Surroca, J.A. (2017). Managerial entrenchment and earnings management. Journal of Accounting and Public Policy, 36(5), 399-414.

- Miralles-Marcelo, J.L., Miralles-Quirós, M.M., & Lisboa, I. (2014). The impact of family control on firm performance: Evidence from Portugal and Spain. Journal of Family Business Strategy, 5(2), 156-168.

- Mitra, S., Jaggi, B., & Al-Hayale, T. (2017). The effect of managerial stock ownership on the relationship between material internal control weaknesses and audit fees. Review of Accounting and Finance, 16(2), 239-259.

- Morck, R., Shleifer, A., & Vishny, R.W. (1988). Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20(1/2), 293-315.

- Nikolaev, V. (2006). Debt contract restrictiveness and timely loss recognition. Working Paper, Tilburg University.

- OECD, (2011). The Role of Institutional Investors in Promoting Good Corporate Governance. Corporate Governance, OECD Publishing.

- Paredes, C., & Núñez-Lagos, R. (2018). Spain”, In Calkoen, W. J. L., (eds.). The Corportae Governance Review. 8th Edition, 351-364, The Law Reviews.

- Peterson, R., & Whitworth, J.D. (2013). Institutional Ownership and Conservatism. Academy of Business Research Journal, 4, 8-15.

- Qiang, X. (2004). Accounting conservatism among firms: Cross-sectional tests of the litigation and contracting cost hypotheses. Unpublished PhD Thesis, Faculty of the Graduate School of the State University of New York at Buffalo.

- Ramalingegowda, S., & Yu, Y. (2012). Institutional ownership and conservatism. Journal of Accounting and Economics, 53(1/2), 8-114.

- Sakaki, H., Jackson, D., & Jory, S. (2017). Institutional ownership stability and real earnings management. Review of Quantitative Finance and Accounting, 49(1), 227-244.

- Shleifer, A., & Vishny, R.W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3), 461-488.

- Shuto, A., & Takada, T. (2010). Managerial ownership and accounting conservatism in Japan: A test of management. Journal of Business Finance and Accounting, 37(7/8), 815-840.

- Sousa, E.F., & Galdi, F.C. (2016). The relationship between equity ownership concentration and earnings quality: evidence from Brazil. Revista de Administração (Management Journal), 51(4), 331-343.

- Sun, J., & Liu, G. (2011). The effect of analyst coverage on accounting conservatism. Managerial Finance, 37(1), 5-20.

- Villanueva-Villar, M., Rivo-López, E., & Lago-Peñas, S. (2016). On the relationship between corporate governance and value creation in an economic crisis: Empirical evidence for the Spanish case. BRQ Business Research Quarterly, 19(4), 233-245.

- Warfield, T.D., Wild, J.J., & Wild, K.L. (1995). Managerial ownership accounting choices, and informativeness of earnings. Journal of Accounting and Economics, 20(1), 61-91.

- Watts, R.L., & Zimmerman, J. (1978). Towards a positive theory of the determination of accounting standards. The Accounting Review, 53(1), 112-134.

- Watts, R.L. (2003a). Conservatism in accounting part I: Explanations and Implications. Accounting Horizons, 17(3), 207-221.

- Watts, R.L. (2003b). Conservatism in accounting part II: Evidence and Research Opportunities. Accounting Horizons, 17(4), 287-301.

- Xia, D., & Zhu, S. (2009). Corporate governance and accounting conservatism in China. China Journal of Accounting Research, 2(2), 81-108.

- Yin, M., Zhang, J., & Han, J. (2020). Impact of CEO-board social ties on accounting conservatism: Internal control quality as a mediator. The North American Journal of Economics and Finance, 52, 101-172.

- Zhang, J. (2008). The contracting benefits of accounting conservatism to lenders and borrowers. Journal of Accounting and Economics, 45(1), 27-54.

- Zhong, L., Chourou, L., & Ni, Y. (2017). On the association between strategic institutional ownership and earnings quality: Does investor protection strength matter?. Journal of Accounting and Public Policy, 36(6), 429-450.