Research Article: 2021 Vol: 25 Issue: 2S

Performance Evaluation Using the Analytic Hierarchy Process

Haitham Nobanee, Abu Dhabi University, University of Oxford, The University of Liverpool

Noura Ahmed Al-Suwaidi, Abu Dhabi University

Keywords

Firms’ Performance, Corporate Governance, Corporate Social Responsibility, Sustainability, Leadership, AHP.

Abstract

This paper aims to explore several issues related to the financial performance of the listed companies in the UAE financial market. Agency theory and legitimacy theory were studied in which four criteria were extracted (corporate governance, corporate social responsibility, sustainability, and leadership). These criteria were then analyzed using the analytic hierarchy process (AHP) powerful mechanisms using information collected by a developed questionnaire that compares and sets priority between each element in the designed AHP model. The finding of our study shows the importance of corporate governance in improving the overall financial performance of the listed companies in the UAE. With the least emphasis on the outcome based leadership. This paper makes several important contributions to literature. First, it is an answer to the most recent calls from experts in the MENA region regarding the new trends faced in the financial market. Second, the present paper provides an examination of the performance of the big listed companies in the UAE Financial Market to reach a possible alternative that will lower the level of fluctuation in the stock exchange, which is considered among the first initiatives in the field. Third, this paper will provide a new insight to authority, as it will identify some gaps in the corporate practices and compliance in relation with different financial auditing, which will help not only in mitigating risks but also in improving the listed companies performance over the long run. Finally, the entire framework is new and has not been identified in previous literature.

Introduction

If you have mastered and thoroughly understood the preceding usual measurements used to examine the Financial Market, you would suggest the very common measurements such as the related ratios: Return on Asset, Return on Investment & Return on Equity (ROA, ROI & ROE), share prices, market capitalization or dividends. Nevertheless, this study, our examination of market performance took another scope, to understand and fully capture the overall picture of all questions arising around the performance of the listed companies in the UAE financial market, there is a need for theory development. An explanatory theoretical framework that explains the performance and drives a set of criteria, such as the inter-relationship is well examined and investigated.

In the context of this study, we searched the theoretical explanation of several aspects related to the financial performance of firms, were a linkage between theories was established to build the proper framework for this study. Several theories were found with a need for collaboration to properly derive all the required relationships. We mainly label two theories: Agency theory and Legitimacy theory.

From these theories, we managed to identify four important criteria: corporate governance, corporate social responsibility, corporate sustainability, and leadership. Upon examination of each, we found another set of theories required to fully describe the relationship, and to complete the suggested Analytic Hierarchy Process model. Collaboration between theories helps in predicting the outcome, allows analysts to describe the sequence of events, and prevents confusion through providing tools for a coherent understanding of the real world (Petter Gottschalk, 2010).

Theories and their related criteria are very important for examining the performance of the listed companies because of several reasons. First, the continuous pitfalls and volatility of the share prices, which causes a fluctuation in the performanceof the UAE Financial Market. Second, the observed lack of compliance from the listed companies withers to corporate codes or some unethical conduct. Last, the rapidly growing figure in financial crimes within the financial market. As reported by the MENA report (2016) there was a dramatic jump in financial crimes to over 43,000 alerts – one every 12 minutes (10th GCC Summit).

In the context of this study, we will focus on the objective of measuring the performance of the big listed companies in the UAE financial market, those companies, which hold the most critical impact on the market. Thus, different theories were investigated to drive the related criteria and sub-criteria to fully cover the examination process. Hence, the study consists of developing and constructing an Analytic Hierarchy Process model (AHP). AHP was introduced and developed by Thomas Saaty (1977) that is widely known to address problems related to business dilemmas and used by both government and business organizations (Millet, 1998).

This paper makes several important contributions to literature. First, it is an answer to the most recent calls from experts in the MENA region regarding the new trends faced in the financial market. Second, the present paper provides an examination of the performance of the big listed companies in the UAE Financial Market to reach a possible alternative that will lower the level of fluctuation in the stock exchange, which is considered among the first initiatives in the field. Third, this paper will provide a new insight to authority, as it will identify some gaps in the corporate practices and compliance todifferent financial auditing, which will help not only in mitigating risks but also in improving the listed companies' performance over the long run. Finally, the entire framework is new and has not been identified in previous literature. Moreover, no literature was found to address sustainability as suggested in the given framework.

The following section will examine the existent literature of the suggested theories and how criteria were derived. While, the rest of this paper is organized as follows: Section 4 provides a full explanation of the research methodology with the use of the AHP model, the relevant literature will be discussed as well. Section 5 provides the suggested conceptual model with a small preview of each criterion and sub-criteria. Section 6 will provide the related analysis and its’ results by the use of the data that were collected via survey questionnaire submitted to the related population. Section 7 presents a discussion of the empirical results, practical implication, and concluding remarks.

Literature Review

Agency Theory

Agency theory was used in several ways to either: assume and predict managerial behavioral aspects in the past (Phan & Yoshikawa, 2000) or to state that agents of firms are fully responsible for conducting business with an interest to the firm and should align properly despite the conflict that may arise between owners and managers with not only increased monitoring and control (Bryant & Davis, 2011) but also increased incentive structures that align the interest of both parties (Fama & Jensen, 1983).

Following Bryant & Davis (2011), agency theory runs several assumptions for example wealth maximization and financial outcome such: stocks and performance. One underlying assumption stated that ‘managers' possible engagement in self-interest decision and shareholders enforcement of governance mechanisms to monitor managers’ decision-making processes and consequently improve their firms’ performance’ (Mostafa & Sawsan, 2013). Agency theory provides a suitable framework in which the link between governance mechanisms and companies’ performance are established. Thus, corporate governance is derived to be the first criteria to measure the performance. According to this theory, organizations are characterized by the separation of ownership and control, goal variation and conflict of interest that is complicated by information asymmetry and self-serving human behavior (Jensen & Meckling, 1976; Lama & Anderson, 2015).

Agency theory with its past application of predicting the behavioral aspects of managers directed our attention to another criterion, which certainly holds huge importance in terms of firms’ financial performance, leadership and its important impact on the level of corporate practice. In this context, we are not using leadership usual theories as they lack the proper identification aspects related to financial performance. Following Rakotobe & Sabrin (2010) who revealed the deficiency in the leadership theories (trait, behavioral, participative, situational, contingency, transactional and transformational theories) in the literature that ‘directly points toward the need for an outcome-based perspective of such theories’ (P.114). Nevertheless, our focus in this study will be on ethical corporate leaders who affect the decision-making process related to corporate practice. The theoretical and empirical investigation related to ethical corporate leaders and financial performance is lacking in the literature (Shinet et al., 2015). Drawing on the theoretical framework proposed by Shinet, et al., (2015) we take a collaboration mechanism of institutional theory, social learning theory, and fairness heuristics theory.

In this context, we take institutional theory as such “top management ethical leadership contributes to organizational outcomes by promoting firm-level ethical and procedural justice climates” (Shin et al., 2015). Moreover, social learning theory suggests that ethical leadership starts from the top level of management to employees, “this trickle-down impact is important because it means that by setting the tone at the top, ethical leaders can influence the reporting behavior of not only management but also of those employees making the day-to-day decisions and journal entries like assistant-controllers or accountants” (Arel et al., 2012). On the other hand, social learning theory states that top managers are considered as a role model for the rest of employees because of their superiority and power, hence, when executives have a high level of ethical behavior and norms, employees are more likely to accept their behavior (Mayer et al., 2009). Finally, fairness heuristics theorystates that ‘individuals rely on fair judgments upon their decisions on whether to help others or to behave upon their own interest’ (Lind, 2001).

Legitimacy Theory

Legitimacy theory describes the relationship between the firm and society. It perceives firms' continuous attempt to function within the bond and norms of society (Fernando & Lawrence, 2014; Mistry et al., 2014). Following Deegan, et al., (2002) who illustrated that legitimacy theory shows that corporate management will certainly react to social expectations. Society expects a certain behavioral manner from the organization if public perception differs from the expected actual performance, the company may act by providing socially responsible behavior to manage the stakeholder expectations (Jain et al., 2015). An adaptation of Corporate Social Responsibility (CSR) and its’ related auditing is an example of employing such a theory to organizations (Fernando & Lawrence, 2014). Thus, CSR was selected as the second criterion.

However, legitimacy theory by itself is not enough as Fernando & Lawrence (2014) identified an important gap related to legitimization threats such as financial scandals and major 4 1528-2635-25-S2-13

incidents that affect the company reputation. For that reason, we tried to seek collaboration between the legitimacy theory and other theories to fill that gap. This theory alone is not enough to well describe the relationship that exists between corporate social responsibility and performance. Consequently, a linkage to stakeholder theory was established since it offers a new way of not only the decision-making process (Jain et al., 2015) but also by providing a new way to organize organizational responsibilities and wealth (Yilmaz, 2013). As it may generate additional revenue directly or indirectly (Kabir & Thai, 2017). Moreover, legitimacy theory is found to validate corporate social responsibility activities and auditing practices for firms (Md. Habib-Uz-Zaman Khan, 2010). Within this perspective, legitimacy theory was found to organize corporate social responsibility activities while the stakeholder theory was found to organize the associated corporate decisions.

Since legitimacy theory was found to validate auditing practice. We were able to derive another important criterion that called: corporate sustainability. Although, sustainability reports provided by managers usually described by agency theory since it helps in reducing agency cost, minimizing strict internal monitoring and to benefit from providing the related disclosures in capital markets (Shamil et al., 2014), legitimacy theory was found to be the most appropriate theory available to explain sustainability disclosures (Reverte, 2009) as well. Following Shamil, et al., (2014), through legitimacy theory relationships are extended to cover a wider group of stakeholders to represent social interests and to align organization activities with corporate practice so leaders are more “motivated to disclose information to support their claim on the legitimacy”. Moreover, motivation for sustainability reporting is drawn from the stakeholder theory as will (Bellringer et al., 2011). Sustainability reports are prepared by leaders to ensure accountability and to achieve beneficial financial outcomes (Bellringer et al., 2011). Hence, sustainability as a criterion is supported by not only legitimacy theory but also agency theory and stakeholder theory.

Research Methodology

This paper is meant to examine the theoretical expectation of the performance of the listed companies in the UAE financial market. By examining the related theories that helped in the elicitation process of four important criteria using data collected from a questionnaire distributed to some experts who regularly monitor the financial performance of the listed companies in either Dubai or Abu Dhabi stock exchange. The analysis was performed using a powerful and yet flexible method called the Analytic Hierarchy Process (AHP). The use of such a method enabled us to measure the overall viewpoint of people on top of the possible ways to improve firms’ performance through legalization and policy enhancement.

AHP was developed by Saaty (1977) as a method to test different alternatives related to multi-criteria decision-making aspects (Sharma, 2013). It is an objective measurement procedure that can incorporate both objective and subjective factors to help in the evaluation process (Islam & Shuib bin, 2006) of any given problem. AHP is widely used to solve unstructured problems in different areas of management, economics, politics, and finance (Stein & Ahmad, 2009). Problems related are separated into a hierarchy of inter-related decision-making items: criteria and alternatives, resulting in a tree like structure that helps not only in elements identification but also recognition of the inter-relationship between them (Albayrak & Erensal, 2004). The structured hierarchy illustrated by Saaty (1980) consists of different levels starting with a goal as top level and incrementing down to define main criteria, sub-criteria and lastly alternatives. AHP prioritizing among criteria and sub-criteria in each level is made possible (Maletic et al., 2014).

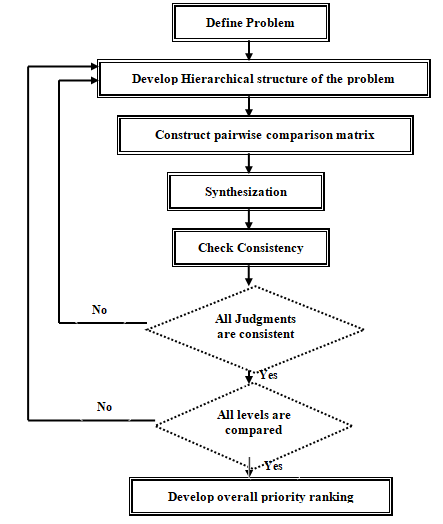

AHP method applied in this study went through several steps that were defined by (Saaty, 2008). After decomposing the problem and specifying the desired solution, comes the structural procedure of constructing the hierarchy from a managerial viewpoint to prioritize and determine the relative importance of each element in each level (Albayrak & Erensal, 2004). Following the building process of the hierarchical structure, a pair-wise comparison matrix is built to determine the impact of each element on each governing criterion, based on which judgments are obtained. This step might require a synthesis of geometric means if multiple judgments are present. After collecting the pair-wise comparison data priorities are obtained and consistency is tested. Albayrak & Erensal (2004) noted that AHP output quality is hugely related to judgment consistency that is simply checked through its’ ratio called Consistency Ratio (CR), with an acceptable upper limit of (0.10) if the value is larger decision maker has to review the conducted comparison. These steps are summarized in the following Figure 1:

Research Model

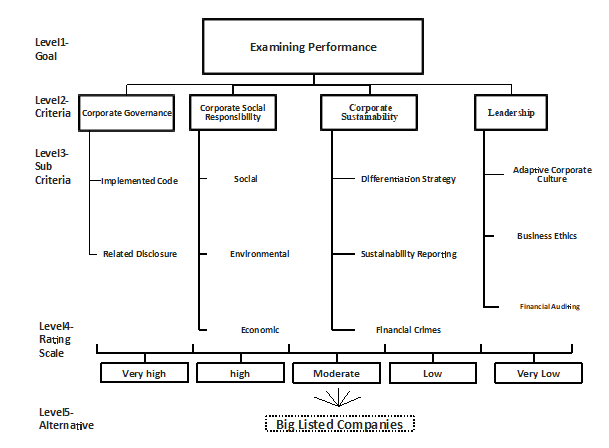

AHP modeling procedure consists of four levels starting from goal specification, decision hierarchy structuring, comparing using pair-wise and finally obtaining priorities. As illustrated in Figure 2 the objective of this study is to evaluate and examine a firm’s performance through a number of corporate criteria based on what the most appropriate criteria is selected as a starting point to conduct legalization change from. Hence, four criteria were selected based on performance’ theories: Corporate Governance (CG), Corporate Social Responsibility (CSR), Sustainability and Leadership. However, the selection of sub-criteria described in Figure 2 was based on previous literature of studies related to the main criteria.

Traditionally speaking, corporate governance might be viewed from two insights when it comes to the financial performance of any company. The very first view is in terms of systems, which can be defined as “a framework of legal, institutional and cultural aspects exerted on decision making from shareholders” (Aljifri & Moustafa, 2007). The second view is in terms of mechanisms. Weimer & Pape (1999) defined corporate governance mechanisms as “the implemented methods at the internal level of companies to help solve the faced corporate level agency related problems”. However, throughout this paper, we follow the definition of (Mostafa & Sawsan, 2013) who demonstrated corporate governance as “a mix of different mechanisms that direct and control the organization”. Since we are more interested in evaluating the performance of the listed companies through their actual compliance toward the legitimized code by Securities & Commodities Authority (SCA) in the UAE, which will help to identify any gaps or implications in the code itself. For the matter of fact, Mostafa (2012) found three policy implications and some practice gaps that require a look through from policymakers and authority.

Companies can show their discipline and compliance with corporate governance through disclosures or reporting (mandatory & voluntary). Parker (2007) points out on how corporate governance involves not only in compliance to legal forms but also to items related to voluntary information such: ‘management processes, investors’ rights, ownership structure and any other information that discharges corporate management responsibilities’ (Mostafa, 2012). One important point illustrated by corporate governance reporting of information is its’ objective toward promoting transparency and public accountability (Hassan, 2008). All these items can be used to measure how companies perform financially in the market. Thus, corporate governance can be seen as a process of decision-making, controls and effective accountability for performance outcomes (Weir et al., 2002).

One of the earliest definitions of corporate social responsibility was illustrated as “the commitment to pursue policies regarding decision-making process and lines of action that are compatible with objectives and values associated with society”, within corporate social responsibility we can find commitment not only to society but also links to ethical values and compliance with legal conducts and environment (Yilmaz, 2013). For that reason, companies are currently facing increased encouragement to disclose more information regarding corporate social responsibility. Strouhal et al., (2015), emphasized on the article which was presented by the EU (2014) in relation to non-financial disclosures with the requirement of transparency from companies related to different information about the environment, social, employee matters, human rights, anti-corruption and bribery matters, hence economic benefits are also delivered. Hence, sub-criteria were identified as such: social, environmental and economic.

Corporate Sustainability in its’ very usual form and paradigm was seen as an ecological view with a limited focus on not only environmental protection (Radia & Rashid, 2014) but also on social equity and economic integrity (Sarvaiya & Wu, 2014), thus companies should make more consideration to disclose the related information to show the impact of their operations on these three dimensions (Aggarwal, 2013). Therefore, sustainability reporting emerged as an important practice in recent years. It is an emerging part of voluntary reporting in capital markets (Shamil et al., 2014), an additional reporting element that acts as a complement to financial auditing providing not only disclosure but acting as a way of communication between an organization and its’ key stakeholders (Wallage, 2000). If embraced properly as standard practice it will help to facilitate better decision-making while maintaining compliance and communicating the ethical standards and actions applied by corporations’ (D'Angela, 2008) strategy. Few researches were found on the focus of investigating sustainability reporting within firms in developed economies (Wanderley et al., 2008). Sustainability reporting includes information about “on how a company, proactively and beyond regulations, act responsibly towards the environment around it and works towards equitable and fair business practices and brings to life products and services with lower impacts on the natural environment, it covers all areas of economic viability, ethical culture, corporate governance, social responsibility, and environmental awareness” (Daizy & Das, 2013, P. 11). The perception of providing fair business practice, ethics, corporate practice and economic viability provides us with some unspoken and hidden facts that are related to unfair and unethical practice or corporate crimes (financial-related crimes, those which affect the performance of not only the company but also the overall economy). Several attempts were done to find a link between sustainability and corporate crimes in literature but non were found. This study is the first to examine the related impact.

The link between sustainability and differentiation was studied by Rajiv et al., (2014) who emphasized on the importance of attaining differentiation strategy on the level of providing unique services or products to provide sustainable superior financial performance. Thus, differentiation strategy was taken as sub-criteria as will.

When discussing the matter of leadership in terms of financial performance a complex and variety of dimensional perspectives may be viewed. Literature is quite rich with minor empirical evidence related to performance. Nevertheless, following Sweeney, et al., (2010), executives create a tone at the top that shapes the ethical climate in their organization. Hence, ethics should be made as an essential part of any company’s business model (Seidman, 2004). Creating an ethical culture of any organization is shaped by leadership characteristics, actions and policies (Sweeney et al., 2010). It significantly impacts decisions regarding financial reporting. For the matter of fact arguments were found in several studies (Bannon et al., 2010; Berson et al., 2008; Schaubroeck et al., 2012; Weber 2010) implying that leaders’ ton at the top is important in affecting a firm’s strategic choices and outcomes, it is a crucial determinant of ethical practices within business organizations. The tread way Commission (1987) stated also that the ‘‘tone set by top management is the most important factor contributing to the integrity of the financial reporting process’’ (Arel, 2012). Moreover, adaptive corporate culture in any organization is created by leadership when behavioral norms supporting responsiveness, collaboration, risk taking, and continual learning are valued (Roi, 2006). Table 1 below describes both criteria and the related sub-criteria:

| Table 1 | ||

|---|---|---|

| Criteria and Sub-Criteria | ||

| Main Criteria | Sub Criteria | Reference |

| Corporate Governance | Implemented Code | (Mostafa & Sawsan, 2013), (Weir et. al., 2002) |

| Related disclosures | ||

| Corporate Social Responsibility | Social | (Fernando & Lawrence, 2014), (Yilmaz, 2013). |

| Environmental | ||

| Economic | ||

| Corporate Sustainability | Differentiation Strategy | (Bellringer et al., 2011), (Wanderley et al., 2008), (Daizy& Das, 2013), (Rajiv et al., 2014) |

| Sustainability Reporting | ||

| Financial Crimes* | ||

| Leadership | Adaptive corporate culture | (Shin et. al., 2015), (Bannon et al. 2010), (Arel, 2012),(Roi, 2006) |

| Business Ethics | ||

| Financial Auditing | ||

Analysis and Results

Data Collection

The population of the study consists of a total of (125) listed companies – (111) local company and (14) foreign company. To ensure a good representation of the population, we randomly selected experts and executives in the Securities & Commodities Authority (SCA) as respondents to our distributed questionnaire (Al-Suwaidi et al., 2018). However, the returned responses were less than expected to create a limitation of what might be an insufficient sample. Some of the respondents specified their answers to be related to companies within the construction or insurance sectors. This might be a hint for future research, which considers the sector as a factor or an element of the conceptual model. Moreover, the questionnaire was designed to enable respondents to establish priorities and compare among the selected corporate criteria and sub-criteria (Moore, 2010), which enabled data collection through pair-wise comparison matrix relied on experts’ judgment based on the nine point scale (Saaty, 2008) described in Table 2. These judgments were combined by the use of geometric means approach at each level to obtain the related consensus (Maletic et al., 2014).

| Table 2 | |

|---|---|

| The Scale of Relative Preference for Pair-Wise Comparison(Source: Maletic ET AL., 2014). | |

| Scale | Judgment |

| 1 | Equal importance |

| 3 | Moderate importance of one over the other |

| 5 | Essential or strong importance |

| 7 | Very strong or demonstrated importance |

| 9 | The extreme or absolute importance |

| 2, 4, 6, 8 | Intermediate values between the two adjacent judgment |

Checking Consistency

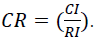

Having obtained the relative preference, we then examined the consistency of the created pairs of criteria. This step is crucial in checking the usability of each criterion in the decision-making process (Maletic et al., 2014). The standard consistency test was argued to have some deficiencies and was criticized by scholars like Karapetrovic & Rosenbloom, (1999). Nevertheless, the consistency index (CI) was obtained by the following equation (Nobanee, 2018):

Such that λmax is the biggest eigenvalue or vector in the pair-wise matrix and n is the related number of criteria or sub-criteria in each level constructed in the AHP model.

After obtaining the CI we calculated the consistency ratio (CR) that is calculated by dividing each CI value by the random index, such that:  The random index used is described in Table 3 below:

The random index used is described in Table 3 below:

| Table 3 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Random Index | ||||||||||

| n* | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| RI | 0 | 0 | 0.58 | 0.9 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.48 |

Geometric Means Approach

As previously mentioned geometric means approach is used at each level as it is considered to be more effective in representing the multiple decision maker’s consensus opinions (Saaty, 1980; Chou et al., 2013). Follows that, defining the relative priorities of main and sub-criteria by computing the priority weight/ vector. This is computed throughSaaty’s principle of consistency, which indicates that

Element aij=ωi/ωjis the subsequent argument for using the consistent matrix, where the element ωiand ωjrepresent the priority weight vector corresponding to criteria: i and j.

According to the results of analysis illustrated in table 4 ‘CG’ is perceived to have the highest value of (0.56) weight indicating that authority has to pay more attention toward what might be a practice gap and policy implications, possibly obtaining more compliance roles when it comes to the big listed companies of the UAE financial market. Follows that ‘CSR’ with a value of (0.26), (0.13) for ‘sustainability’ and value of (0.05) for the criteria of ‘leadership. For the matter of fact these results were expected, as previous literature is rich in studies related to CG and CSR were studies related to sustainability and the practical side of leadership is lacking and more future researches are advised.

| Table 4 | |||||

|---|---|---|---|---|---|

| Geometric Means of Pair-Wise Comparison of Main Criteria | |||||

| Corporate Governance | Corporate Social Responsibility | Corporate Sustainability | Leadership | Priority weight | |

| Corporate Governance | 1 | 6.4 | 5.8 | 5.8 | 0.56 |

| Corporate Social Responsibility | 0.16 | 1 | 6 | 6.6 | 0.26 |

| Corporate Sustainability | 0.17 | 0.17 | 1 | 5.8 | 0.13 |

| Leadership | 0.17 | 0.15 | 0.17 | 1 | 0.05 |

| CR=0.05<0.10(acceptable) | |||||

Upon examination of geometric means of sub-criteria related to the first parent criteria ‘CG’ illustrated in table 5, it is found that ‘implemented code’ ranks higher than the ‘related disclosure’ with (0.84) & (0.16) respectively. Such a result corresponds to the fact that financial disclosures are governed by the ‘implemented code’ and hugely indicated the importance of revising the code to properly govern firms and boost their performance to support economic growth.

| Table 5 | |||

|---|---|---|---|

|

Geometric Means of Pair-Wise Comparison of Sub-Criteria Related to CG |

|||

| Implemented Code | Related Disclosure | Priority weight | |

| Implemented Code | 1 | 5.4 | 0.84 |

| Related Disclosure | 0.19 | 1 | 0.16 |

| CR=0.0<0.10(acceptable) | |||

As suggested by Table 6, companies are more encouraged to disclose more information related to ‘social’, ‘environmental’ and ‘economic’ respectively with priority values of (0.70), (0.24) and (0.07). However, these results suggest the need to pursue and enforce more policies regarding the process of decision-making and line of actions to be compatible not only with objective associated with society but also compatible withthe economy. More awareness is certainly required.

| Table 6 | ||||

|---|---|---|---|---|

| Geometric Means of Pair-Wise Comparison of Sub-Criteria Related to CSR | ||||

| Social | Environmental | Economic | Priority weight | |

| Social | 1 | 6.2 | 6.8 | 0.7 |

| Environmental | 0.16 | 1 | 6.4 | 0.24 |

| Economic | 0.15 | 0.16 | 1 | 0.07 |

| CR=0.04<0.10(acceptable) | ||||

Table 7 shows that in terms of sustainability the highest ranking criteria is differentiation strategy with a value of (0.69), this shows the importance of imitation of resources to provide superior financial performance through the innovation of products and services. Sustainability reporting with a corresponding value of (0.24) explains the recent interest of business experts to view sustainability from a different financial perspective. Once again lack of awareness of how financial related crimes do affect firms’ performance and consequently the related share prices that affect the state of the stock market is evident though not empirically proven.

| Table 7 | ||||

|---|---|---|---|---|

| Geometric Means of Pair-Wise Comparison of Sub-Criteria Related to Sustainability | ||||

| Differentiation Strategy | Sustainability Reporting | Financial Crimes | Priority weight | |

| Differentiation Strategy | 1 | 6.4 | 6 | 0.69 |

| Sustainability Reporting | 0.16 | 1 | 6.2 | 0.24 |

| Financial Crimes | 0.17 | 0.16 | 1 | 0.07 |

| CR=0.04<0.10(acceptable) | ||||

As shown in table 8, it is evident that adaptive corporate culture has the highest weight of (0.66). Business Ethics is the next competitive priority with a value equals to (0.26) and least important is financial auditing with (0.08) weight. Results are coherent and understandable. Hence, more research is also advisable. Tables 4-8, shows clearly that CR values demonstrate the consistency of the results.

| Table 8 | ||||

|---|---|---|---|---|

| Geometric Means of Pair-Wise Comparison of Sub-Criteria Related to Leadership | ||||

| Adaptive Corporate Culture | Business Ethics | Financial Auditing | Priority weight | |

| Adaptive Corporate Culture | 1 | 4.8 | 5.6 | 0.66 |

| Business Ethics | 0.21 | 1 | 6 | 0.26 |

| Financial Auditing | 0.18 | 0.17 | 1 | 0.08 |

| CR=0.04<0.10(acceptable) | ||||

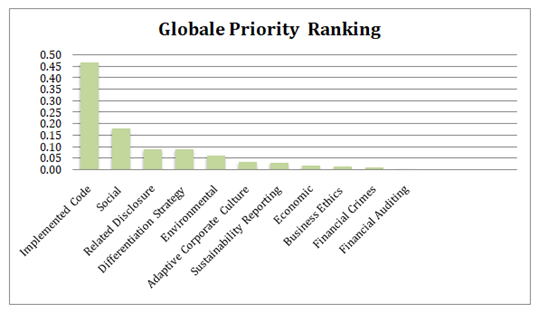

Synthesizing Results

Final results are obtained through evaluating the alternative and calculating the global weight using pair-wise comparison. Global weight is calculated by multiplying the priority weight of parent criteria by the corresponding sub-criteria weight. Rank is obtained afterward to see which holds the highest importance (Nobanee & Ellili, 2018). As shown in both table 9 and figure 3 the global weight and subsequent ranking of ‘implemented code’ has the highest priority with a relative weight of (0.47). This result is an indication to authority and policymakers to pay more attention to the policy implications related to the code as it holds the key toward improving all the elements suggested by this study. Follows is ‘social’ with corresponding weight equals to (0.182). Surprisingly, ‘financial auditing’ holds the least importance with (0.04) weight.

| Table 9 | ||||

|---|---|---|---|---|

| Global Weights and Ranking | ||||

| Parent criteria | Sub-criteria | Priority Weight | Global weight | Rank |

| Corporate Governance | 0.56 | |||

| Implemented Code | 0.84 | 0.47 | 1 | |

| Related Disclosure | 0.16 | 0.09 | 3 | |

| Corporate Social Responsibility | 0.26 | |||

| Social | 0.7 | 0.182 | 2 | |

| Environmental | 0.24 | 0.062 | 5 | |

| Economic | 0.07 | 0.018 | 8 | |

| Corporate Sustainability | 0.13 | |||

| Differentiation Strategy | 0.69 | 0.09 | 4 | |

| Sustainability Reporting | 0.24 | 0.031 | 7 | |

| Financial Crimes | 0.07 | 0.09 | 10 | |

| Leadership | 0.05 | |||

| Adaptive Corporate Culture | 0.66 | 0.033 | 6 | |

| Business Ethics | 0.26 | 0.013 | 9 | |

| Financial Auditing | 0.08 | 0.04 | 11 | |

Discussion and Conclusion

In this paper, the AHP method was proposed to evaluate areas need to be enhanced with revised policies from authority related to financial market performance. Although the suggested framework gave us hints to where to start and where to focus, there is still a lack of research related to some elements suggested by the study. For example, areas related to the outcome based perspective of leadership and the impact of financial crimes in sustaining long-term financial performance. Business experts had recently highlighted these areas as being threats in MENA emerging market. Thus, this study challenges the existing literature by extracting new elements from collaborating theories related to firms’ performance.

The suggested AHP model uses four corporate priorities (corporate governance, corporate social responsibility, corporate sustainability, and leadership). These criteria had been accepted in previous literature though with the fact of lack of research to sustainability and outcome-based leadership. The selection of sub-criteria is based on both theories and previous literature. Nevertheless, taking ‘financial crimes’ as sub-criteria to sustainability has no existing literature and providing more empirical evidence is advised.

After building the hierarchal model, information and data were obtained from experts who monitor firms’ performance on periodical bases, particularly securities and Commodities Authority employee. AHP analysis allowed us to cover a wider population by taking experts point of view. As most of the related studies examine the performance through the building and extracting information from the companies annual reports. Accordingly, all data yield consistency after measuring the pair-wise comparison.

It is evident that ‘corporate governance’ has the highest priority among the rest criteria with a subsequent weight of (0.56). Any lack of competence within the code initiated by the authority will hugely affect the market. As it is considered the system by which companies are directed and controlled (Collin & Smith, 2003). Moreover, this study with its’ results supports the existence of the corresponding policy gaps and implications, which were identified by Mostafa (2012). Revising the code and its’ corresponding legal articles is needed since such revision has not been done since the release of the code in 2007. Improvement in this area will improve the other criteria proposed by the study. As seen from the results obtained in table 4 corporate social responsibility is the next priority with (0.26) weighted value. Sustainability comes after with (0.13) and the least is (0.05) priority weight corresponding to leadership (Zghal et al., 2020).

Despite, the practical implication of this study, which provides guidance to authority and policymakers to improve specific areas and policy gaps related to the financial market to support sustainable long-run performance, it has some limitations. First, the distribution of the questionnaire to executives in the listed firms would have given us more insight from their point of view. Second, more elements could be implemented in the model to improve the overall results such as sector and industry. Thus, more researches are advised specifically in financial crime related to sustainable performance. Since it provides benefits through improved relations with stakeholders, reduces conflicts and boost firm reputation making it more attractive to investors (Lourenço et al., 2012).

References

- Aggarwal, P. (2013). Sustainability reporting and its impact on corporate financial performance: A literature review. Indian Journal of Commerce and Management Studies, 4(3), 51-59.

- Albayrak, E., & Erensal, Y.C. (2004). Using Analytic Hierarchy Process (AHP) to improve human performance: An application of multiple criteria decision making problem. Journal of Intelligent Manufacturing, 15(4), 491-503.

- Aljifri, K., & Moustafa, M. (2007). The impact of corporate governance mechanisms on the performance of UAE firms: An empirical analysis. Journal of Economic and Administrative Sciences, 23(2), 71-93.

- Al-Suwaidi, N., Nobanee, H., Jabeen, F. (2018). Estimating causes of cybercrime: Evidence from Panel Data FGLS estimator. International Journal of Cyber Criminology, 12(2), 392-407.

- Arel, B., Beaudoin, C.A., & Cianci, A.M. (2012). The impact of ethical leadership, the internal audit function, and moral intensity on a financial reporting decision. Journal of Business Ethics, 109(3), 351-366.

- Bannon, S., Ford, K., & Meltzer, L. (2010). How to instill a strong ethical culture. CPA Journal, 80(7), 56–58.

- Barnes, C. (2007). Why compliance programs fail: Economics, ethics and the role of leadership. HEC Forum, 19(2), 109-23.

- Bellringer, A., Ball, A., & Russell, C. (2011). Reasons for sustainability reporting by New Zealand local governments. Sustainability Accounting, Management and Policy Journal, 2(1), 126-138.

- Bryant, P., & Davis, C. (2011). Regulated change effect on boards of directors. Allied Academies International Conference. Academy of Strategic Management. Proceedings, 10(1), 19-23.

- Chang, S.J. (2004). A cultural inspection of financial ethics in South Korea. The Asia Pacific Journal of Economics & Business, 8(2), 65-77.

- Chou, C., Liang, G., & Chang, H. (2013). A fuzzy AHP approach based on the concept of possibility extent. Quality and Quantity, 47(1), 1-14.

- Collin, S.O., & Smith, E. (2003). Disciplining and enabling action: Corporate governance influencing corporate entrepreneurship. Academy of Management Conference. Seattle, SUA.

- D'Angela, D.A. (2008). A study of the market's reaction to superior sustainability reporting as demonstrated by the financial performance of publicly traded companies (Order No. 3315101).

- Daizy, Sen, M., & Das, N. (2013). Corporate sustainability reporting: A review of initiatives and trends. IUP Journal of Accounting Research & Audit Practices, 12(2), 7-18.

- Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and environmental disclosures of BHP from 1983-1997: A test of legitimacy theory. Accounting, Auditing & Accountability Journal, 15(3), 312-43.

- Lama, T., & Anderson, W.W. (2015). Company characteristics and compliance with ASX corporate governance principles. Pacific Accounting Review, 27(3), 373-392.

- Don, A.M. (2010). Managerial decision making. The International Library of Critical Writings on Business and Management, Edward Elgar Publishing.

- Fama, E., & Jensen, M.C. (1983). Agency problems and residual claims. Journal of Law and Economics, 26, 325- 344.

- Fernando, S., & Lawrence, S. (2014). A theoretical framework for CSR practices: Integrating legitimacy theory, stakeholder theory and institutional theory. The Journal of Theoretical Accounting Research, 10(1), 149-178.

- Hassan, M.K. (2008). The corporate governance inertia: The role of management accounting and costing systems in a transitional public health organization. Research in Accounting in Emerging Economies, 8, 409-54.

- Islam, R., & Shuib bin, M.R. (2006). Employee performance evaluation by the AHP: A case study. Asia Pacific Management Review, 11(3).

- Karapetrovic, S., & Rosenbloom, E.S. (1999). A quality control approach to consistency paradoxes in AHP. European Journal Annual Reliability and Maintainability Symposium, 383-388.

- Lind, E.A. (2001). Fairness heuristic theory: Justice judgments as pivotal cognitions in organizational relations. In J. Greenberg & R. Cropanzano (Eds.), Advances in organizational justice 56–88. Stanford, CA: Stanford University Press.

- Lourenço, I.C., Branco, M.C., Curto, J.D., & Eugenio, T. (2012). How does the market value corporate sustainability performance? Journal of Business Ethics, 108, 417-428.

- Maletic, D., Maletic, M., Lovrencic, V., Al-Najjar, B., & Gomiscek, B. (2014). An application of analytic hierarchy process (AHP) and sensitivity analysis for maintenance policy selection. Organizacija, 47(3), 177-188.

- Mayer, D.M., Kuenzi, M., Greenbaum, R., Bardes, M., & Salvador, R. (2009). How low does ethical leadership flow? Test of a tickle-down model. Organizational Behavior and Human Deci- sion Processes, 108, 1–13.

- Habib-Uz-Zaman Khan, M.D. (2010). The effect of corporate governance elements on corporate social responsibility (CSR) reporting. International Journal of Law and Management, 52(2), 8 –109.

- Millet, I. (1998). Ethical decision making using the analytic hierarchy process. Journal of Business Ethics, 17(11), 1197-1204.

- Mostafa, K.H. (2012). A disclosure index to measure the extent of corporate governance reporting by UAE listed corporations. Journal of Financial Reporting and Accounting, 10(1), 4-33.

- Mostafa, K.H., & Sawsan, S.H. (2013). Corporate governance, economic turbulence and financial performance of UAE listed firms. Studies in Economics and Finance, 30(2), 118-138.

- Nobanee, H. (2018). Efficiency of working capital management and profitability of UAE construction companies: Size and Crisis Effects. Polish Journal of Management Studies, 18(2), 209-215.

- Nobanee, H., & Ellili, N. (2018). Anti-Money laundering disclosures and banks’ performance. Journal of Financial Crime, 25(1), 95-108.

- Parker, L.D. (2007). Financial and external reporting research: The broadening corporate governance challenge. Accounting & Business Research, 37(1), 39-54.

- Payne, D.M. & Raiborn, C.A. (2001). Sustainable development: The ethics support the economics. Journal of Business Ethics, 32, 157-168.

- Petter, G. (2010). Theories of financial crime. Journal of Financial Crime, 17(2), 210 – 222.

- Phan, P.H., & Yoshikawa, T. (2000). Agency theory and japanese corporate governance. Asia Pacific Journal of Management, 17(1), 1-27.

- Radiah, O., & Rashid, A. (2014). Finance and sustainability–Resources, capabilities, and rewards" In ethics, governance and corporate crime: Challenges and consequences.

- Rajiv, D., Banker, R., & Mashruwala, A.T. (2014). Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy? Management Decision, 52(5), 872–896.

- Rakotobe-Joel, T., & Sabrin, M. (2010). An outcome-based perspective of leadership: Investigating the direct effects of corporate leaders on the firm's financial outcome. Journal of Business & Economics Research, 8(11), 113-123.

- Reverte, C. (2009). Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of Business Ethics, 88(2), 351-366.

- Roi, R.C. (2006). Leadership, corporate culture and financial performance.

- Saaty, T.L. (1980). The Analytic Hierarchy Process. New York.

- Saaty, T.L. (2008). Decision making with the analytic hierarchy.

- Sarvaiya, H., & Wu, M. (2014). An integrated approach for corporate social responsibility and corporate sustainability. Asian Social Science, 10(17), 57-70.

- Schaubroeck, J.M., Hannah, S.T., Avolio, B.J., Kozlowski, S.W.J., Lord, R.G., …& Linda, K. (2012). Embedding ethical leadership within and across organization levels. Academy of Management Journal, 55, 53–78.

- Seidman, D. (2004). The case for ethical leadership. Academy of Management Executive, 18(2), 134-138.

- Shamil, M.M., Shaikh, J.M., Ho, P., & Krishnan, A. (2014). The influence of board characteristics on sustainability reporting. Asian Review of Accounting, 22(2), 78-97.

- Sharma, E. (2013). Measuring the performance of banks: An application of AHP model. Review of Management, 3(3), 31-40.

- Shin, Y., Sung, S.Y., Choi, J.N., & Kim, M.S. (2015). Top management ethical leadership and firm performance: Mediating role of ethical and procedural justice climate. Journal of Business Ethics, 129(1), 43-57.

- Stein, E.W., & Ahmad, N. (2009). Using the Analytical Hierarchy Process (AHP) to construct a measure of the magnitude of consequences component of moral intensity. Journal of Business Ethics, 89(3), 391-407.

- Strouhal, J., Gurvits, N., Nikitina-Kalamäe, M., & Startseva, E. (2015). Finding the link between CSR reporting and corporate financial performance: Evidence on czech and estonian listed companies. Central European Business Review, 4(3), 48-59.

- Sweeney, B., Arnold, D., & Pierce, B. (2010). The impact of perceived ethical culture of the firm and demographic variables on auditors’ ethical evaluation and intention to act decisions. Journal of Business Ethics, 93, 531–551.

- Wallage, P. (2000). Assurance on sustainability reporting: An Auditor’s View. Auditing. A Journal of Practice and Theory, 19S, 53-65.

- Walumbwa, F., Avolio, B., Gardner, W., Wernsing, T., & Peterson, S. (2008). Authentic leadership: Development and validation of a theory-based measure. Journal of Management, 34(1), 89-126.

- Weimer, J. & Pape, J. (1999). Taxonomy of systems of corporate.

- Weir, C., Laing, D., & McKnight, P.J. (2002). Internal and external governance mechanisms: Their impact on the performance of the UK large public companies. Journal of Business Finance and Accounting, 29, 579-611.

- Yilmaz, I. (2013). Social performance vs. financial performance: CSR disclosures as an indicator of social performance. International Journal of Finance & Banking Studies, 2(2), 53-65.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of company, managerial behaviour, agency cost and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kabir, R., & Thai, H.M. (2017). Does corporate governance shape the relationship between corporate social responsibility and financial performance? Pacific Accounting Review, 29(2), 227-258.

- Mistry, V., Sharma, U., & Low, M. (2014). Management accountants' perception of their role in accounting for sustainable development: An exploratory study. Pacific Accounting Review, 26(1/2), 112-133.

- Zghal, I., Ben Hamad, S., Eleuch, H., & Nobanee, H. (2020). The effect of market sentiment and information asymmetry on option pricing. North American Journal of Economics and Finance, Elsevier, 54.