Research Article: 2021 Vol: 24 Issue: 6S

Political connection and account conservatism of listed companies on the stock in exchange of Thailand set 100

Woranuch Kuutha, Dhurakij Pundit University

Pattanant Petchchedchoo, Dhurakij Pundit University

Siridech Kumsuprom, Dhurakij Pundit University

Panarat Panmanee, Thammasat University

Abstract

The objectives of this research were 1) to study the relationship among political connections of the Board of Directors, the Board of the Audit Committee and the Board of Committee on Nomination and Remuneration and 2) to study the influence of the political connections among the board members on accounting conservatism. Sixty seven companies listed on the Stock Exchange of Thailand (SET 100), were taken as a case study. The number of firm-year observations for which the required data was 335 from the period 2015-2019. The statistical analysis involved the Path Analysis and the Structural Equation Modeling (SEM).

The results revealed that 1) the political connection of the Board of Directors has a positive influence on the Board of the Audit Committee and the Committee on Nomination and Remuneration. Political connections of the three committee members are related and mutual benefit, whether it is familiarity or considerate that affects the performance of the mission according to the needs of individuals or groups. It is also easy to administer the work and decisions from the Board of Directors, including the protection and assistance beneficial to the owners or shareholders. 2) Political connections of the Board of Directors and the Committee on Nomination and Remuneration have positive influence on accounting conservatism. This demonstrated that corporations with political connections should be cautioned their accounting practices in order to gain credibility and to convey corporate transparency or entity, or they might have an incentive to conceal other interests gained from political connections, escaping from the press and the public censure and scrutiny. Moreover, that political connection of the Audit Committee does not influence to accounting conservatism.

Keywords

Political Connections, Accounting Conservatism

Introduction

Improvements in accounting disclosure in Thailand have started since 1998, after the financial crisis in Asian countries, suggesting that the developments of regulations on disclosure and transparency in Thailand have been carefully reviewed by adding information related to boards’ decision-making to make it voluntary disclosure and other disclosure that benefit investors (Chaiwong & Yodbutr, 2018). The survey of the Association of Certified Fraud Examiners (ACFE) in 2016 found that the value of fraud damages in samples from various regions around the world was really high, thus causing an inspiration amongst policy makers, academia, investors and corporate stakeholders in both the public and private sectors to focus on good corporate governance mechanisms which focuses on corporate governance in terms of transparency, responsibility and fairness (Ehikioya, 2009). Efforts and enforcement of laws and strict reporting standards alone may not be enough to address transparency and disclosure issues (Ho & Wong, 2001; Verrecchia, 1983). For Thailand, a developing economy, the political connections play an important role in doing business; as a matter of fact it is regarded as a country with weak laws and enforcement and high levels of corruption (Faccio, 2006; Leuz & Oberholzer-Gee, 2006; Claessens, Feijen & Laeven, 2008). The exploitation of businesses for own advantages using state power has long been a chronic problem. However, in the past most politicians were professionals, few owned private businesses. In recent times, large financial backers have taken over the political power through an electoral process. The entry of financial backers at times was intended to use executive power to benefit their businesses, relatives or colleagues rather than the benefits or interests of the country by formulating policies that were conducive directly to their own businesses, relatives or colleagues (Siamwalla, 2003). In the past, there have been more concerns regarding the entrance of the businesses to politics, due to the fact that many public policies have clearly reflected the benefit of the business groups, showing the conflict roles of business and politics and the overlapping between own interests and the interests of the public (Langculanon, 2009).

At present, various businesses strive to maximize long-term profits by developing business practices and creating advantages by establishing political connections benefiting the operations. The research by Faccio (2006); Bertrand, et al., (2007) found that the benefits from politically connected firms were seen low for both the corporate governance and quality of disclosure. Meanwhile, Thailand is ranked as having weak corruption law and poor enforcement, leading to high levels of corruption, thus political connections have played an important role in doing business (Faccio, 2006). The allocation of resources is therefore heavily influenced by politics. Until now, the effects of political connections in Thailand have been inconclusive, as companies with political connections may have different accounting standards. However, these will result in deteriorating the quality of profits and consequently a decrease in accounting conservatism (Chaney et al., 2011).

Political connections are an interesting issue due to the fact that companies having strong political connections, such as having close ties to political officeholders, state leaders or cabinet members, may have less accounting conservatism than those that do not have. On the other hand, companies with political connections may have greater conservatism than those that do not have, because they may use instead political connections to conceal other interests.

Research Objectives

1. To study the relationship among the political connections of the Board of Directors, the Board of Audit Committee and the Committee on Nomination and Remuneration of 67 companies listed on the Stock Exchange of Thailand.

2. To study the relationship among the political connections of the Board of Directors, the Board of Audit Committee and the Committee on Nomination and Remuneration on the accounting conservatism of 67 companies listed on the Stock Exchange of Thailand.

Literature Review

Accounting Conservatism

Accounting conservatism is principle that influenced the accounting practices, its requires judgment under uncertainty such that the assets or revenues are not overstated and liabilities or expenses are understated (Basu, 1997). This is because it is one of the accounting principles that recognize losses immediately and avoid recognizing unrealized gains of assets due to the uncertainty of such transactions. Accounting conservatism is therefore an important fundamental feature of financial reporting quality (Xu & Lu, 2008). In addition, accounting conservatism would help reduce management's efforts to over-record assets and accruing profits for own financial gain, rather than exerting their efforts to invest in projects that yield positive returns (Ahmed & Duellman, 2007). Watts (2003) also explained that accounting conservatism is one of the mechanisms used to provide financial reporting with useful accounting information for decision-making and creating reliable financial reports. Past researches have shown that companies with good corporate governance will apply more prudent accounting policies (Ahmed & Duellman, 2007; Garcia Lara et al., 2009). Companies with effective boards will result in higher accounting conservatism in their financial reports. A study by Hui, et al., (2009) found that accounting conservatism had a negative relationship with the number of directors. Gao & Wagenhofer (2016), also provided an additional perspective that effective board of directors monitoring managerial performance could help reduce the company's earning management, which would result in accounting conservatism.

Political connections in Thailand

A developing country like Thailand, political connections play an important role in doing business due to the fact that companies are in the environment of corruption and weak law enforcement (Faccio, 2006; Leuz & Oberholzer-Gee, 2006; Claessens, Feijen & Laeven, 2008). Participation in businesses politics in Thailand is a way that would help protect their business interests and exploit other businesses as well. However, the political system and businessmen must work together in unison to help each other, so that business people will learn and acknowledge the government's policy in conducting their businesses. Involvement in politics gets incentives to maintain business interests and it is a very strong motive, since large corporations need to use their political influence as a way to uphold their business interests. Big businesses that associate with politicians would reinforce their economic power (Kaewmanee, 2015). Furthermore, the study also showed that government efforts to recruit business participation in the country's economy, thus some of them becoming popular and entering the capital markets (Ahmed & Duellman, 2007). Companies having their politicians in the board room or government-owned businesses can easily obtain credit lines from banks, and companies with political connections are seen as having weak corporate governance and their corporate problems arise from their businesses excessively rely on the government. Additionally, the government will bail them out if the company is in financial trouble. A study done by Johnson & Mitton (2003) found that the Malaysian companies have incentives to report high profits and suffer less financial problems due to the fact that they are protected and taken care of by the government, leading to relaxing the accounting conservatism principles. Thailand is rated as a country of high levels of risks, indicating a low level of transparency (Suppaphonsiri, 2009). Moreover & Bunkanawitcha, et al., (2008) found that companies associated with the Cabinet members and owned by the Cabinet members' families are those with political connections and enjoy higher market share, unusual returns and good public policies. Good governance will reduce information asymmetry (Kanagaretnam, Lobo & Whalen, 2010; Cormier et al., 2010). Good corporate governance mechanisms would encourage managers to disclose their business information and transparency.

Political Connections among the Board of Directors, the Audit Committee and the Committee on Nomination and Remuneration

The Board members is an important corporate governance mechanism for monitoring management's performance and protecting the interests of stakeholders (Fama & Jensen, 1983). Mathew & Archbold (2016); Yermack (1996) found that the efficiency of the organization depends on the quality of the supervision and decision-making of the Board of Directors, whether dimension of Board of Directors is massive, it may deteriorate performance according to communicate difficulties or work effectively (The Securities and Exchange Commission, Thailand (2021). In addition, a study by Agrawal & Hadha (2005) revealed that a higher proportion of independent board directors may reduce the likelihood of fraud, which is in consistent with a study done by Efendi & Swanson (2007). Farber (2005), for instance, showed that corruption-related businesses, most often Chief executive officers along with Chairman of the Board of Directors were involved, but their roles were different. The Chairman of Board normally supervise the operations of the Committees performance, whereas the Chief Executive Officer will obtain policies from Board of Directors to manage work at various levels and reach the Board of Directors' requirements. However if one person contain two positions at the time it may found poor decision making and lack of freedom of work. Freihat & Shanikat (2019) found that did not find any significant effect for board size and board independence. Moreover, firm size and firm leverage as control variables were not found to have any effect on firm performance.

Haiyan & Ansah (2018) studied the duty of the Board of Directors in relations to the Audit Committee and its operational efficiency in Greece, he found that the Board of Directors had a relationship with the Audit Committee based on resource dependency theory. The study also discovered that the board of directors played a large role in advising and monitoring the work of the Audit Committee. Additionally, the composition of the Board of Directors is one of the tools used in corporate governance. It is expected to reduce the problem of fraud or earning management, which is good for the credibility of financial reports. Armen & Harold (1972) stated that shareholders want the work and decision-making of the management to carry out for their best interests, whereas executives may have different incentives which may not contribute maximum interests to the shareholders. Therefore, when the boards of director’s relationships with the Audit Committee and the Committee on Nomination and Remuneration have the political connections, it will increase the beneficial relationship with each other to make it easier for management work and decision making.

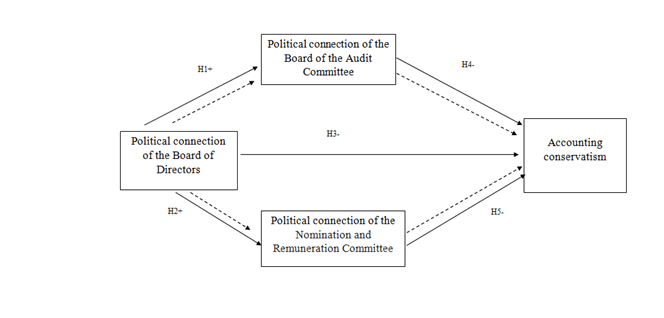

H1: The political connection of the Board of Directors has positive influence on the political connections of the Audit Committee.

H2: The political connection of the Board of Directors has positive influence on the political connections of the Committee on Nomination and Remuneration Committee.

Political Connections and Accounting Conservatism

Political connections are widespread in developing countries and during the period of government transition, politically-connected company can be shielded from regulations imposed by shareholders. A study by Alabass, et al., (2019) also found that Politically Connected Firms (PCF) have highly level of leverage, more long-term debt, and hold large amount of cash. Additionally, compared to Non-Politically Connected Firms (Non PCF), Politically Connected Firms (PCF) are associated with low quality financial reporting. Furthermore, Li, et al., (2008) revealed that corporation affiliated with foreign political party influences its performance and is easily accessible to bank credit. Conversely, the study by Fan, et al., (2007) found that some Chinese companies with political connections have encountered the stock problems and accounting reports after the initial public offerings. In addition, state-owned companies having their members serving in the board of directors who are politically connected have enjoyed benefits and better tax advantages than companies with no political connections. However, accounting conservatism and political connection may be effectively used as a substitution for debt contracts. The creditor wants the debtor to exercise caution in financial reporting by exaggerating the financial performance in order to promptly recognize the good news (Watts, 2003) and for the benefits of the management and shareholders in terms of higher remunerations and bonuses. Watts (2003) mentioned the political connection of the board of directors had no influence on account conservatism, instead the politically connected firms could increase accounting conservatism. Omonona & Oni (2019) findings show the importance of the role of press which is one of the variables of political interference on the performance of the mobile telecommunication organizations in South Africa. Zhou (2017) also found that changes in government could increase accounting conservatism because of press and public scrutiny, especially fear of being audited. Therefore, companies needed to increase accounting caution more than those without political connections.

H3: The political connection of the Board of Directors has a negative influence on accounting conservatism.

H4: The Audit Committee's political connection has a negative influence on accounting conservatism.

H5: The political connection of the Committee on Nomination and Remuneration has a negative influence on accounting conservatism.

Research Methodology

This research is a quantitative study. Sixty seven companies listed on the Stock Exchange of Thailand (SET 100) were purposely included in the database. The number of firm-year observations for which the required data was 335 from the period of 2015-2019. The information collected were from the annual report, annual data statement (Form 56-1), financial statements, and notes. The variable, political connection, was measured by using the names of politicians serving in the Board of Directors, Accounting Committee and the Committees on Nomination and Remuneration. Accounting Conservatism as measured by ConACC based on the Basu (1997) model. The statistical analysis involved descriptive statistics, inferential statistics, the Structural Equation Modeling (SEM) and the path analysis (PA).

Research Findings

The summary research findings on political connections and accounting conservatism are the following:

| Table 1 Results of Relationships |

||||

|---|---|---|---|---|

| Year | Relationship Index | CONACC | ||

| POLBOD | POLAC | POLNRC | ||

| 2015 | 1.47 | 2.44 | 1.96 | -2.88 |

| 2016 | 1.59 | 2.20 | 1.32 | 2.48 |

| 2017 | 1.64 | 2.28 | 1.36 | 7.59 |

| 2018 | 1.65 | 2.43 | 1.50 | 7.36 |

| 2019 | 1.65 | 2.27 | 1.75 | 0.43 |

Where:

POLBOD is Political Connections of the Board of Directors

POLAC is Political Connections of the Audit Committee

POLNC is Political Connections of the Committee on Nomination and Remuneration

CONACC is Accounting Conservatism.

From Table 1, it shows that the political connection index (the Relationship index) of the Board of Directors (POLBOD) were 1.47 for 2015 and increases to 1.65 for 2018 and stabilizes for 2019. The Political connections index for the Audit Committee (POLAC) were 2.44 for 2016, and gradually decreases throughout and reaches 2.27 for 2019, except for 2018 which rose to 2.43. The Political connections index for Committee on Nomination and Remuneration (POLNC) started with 1.96 for 2015 and decreased to 1.32 for 2016 and the following year after which the index increases throughout in 2019.

After that, the political relationship index was calculated to find the level of political relationship, which can be seen that the level of political relationship of the Board of Directors, Audit Committee and Nomination and Remuneration Committee had a correlation index between 0.01- 4.40, the relationship level was 1, and the political relationship was at the lowest level.

Accounting conservatism, according to the Basu 1997 model, CONACC is measured by the net income and stock yields from the 9th month of the year to the 3rd month of the following year. It can be seen, from Table 1, the CONACC values were positive in 2017, 2018, 2016, 2019, indicating that The company will recognize good news that reflects immediately only in returns, but will be delayed in recognition of earnings. In 2015, the CONACC was negative, indicating that the company will immediately recognize bad news that reflects both earnings and return.

| Table 2 Analytical Results of The Direction in Correlation of Variables (Correlation Analysis) |

||||

|---|---|---|---|---|

| Variable | POLBOD | POLAC | POLNC | CONACC |

| POLBOD | 1.00 | |||

| POLAC | 0.652** | 1.00 | ||

| POLNC | 0.306* | 0.460** | 1.00 | |

| CONACC | 0.569** | 0.696** | 0.628** | 1.00 |

When considering the correlation coefficients between the four variables as shown in Table 2, the correlation coefficients, the range of 0.306-0.696, are positive and significant,. The correlation between pairs has a correlation level not exceeding the standard 0.80. It was concluded that the variables analyzed had no multi-collinearity problem.

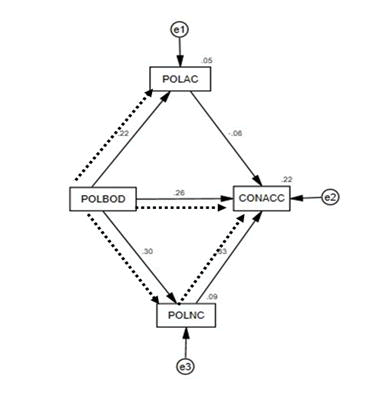

The causal model analysis of the performance shows that the hypothetical model was consistent with the empirical data. The study found that the model was consistent with the empirical data because CMIN-p=0.892, CMIN/df=0.018, GFI=1.000, AGFI=1.000, CFI=1.000, and RMSEA=0.000.

Indicates No influence, indicates have influence

As shown in Figure 2, the Political connection of the Board of Directors (POLBOD) has a positive direct influence on the Political connection of the Audit Committee (POLAC), a coefficient value of 0.22; the Political connection of the Board of Directors (POLBOD) has a positive direct influence on the Political connections of the Nomination and Remuneration Committee (POLNC), a coefficient value of 0.30; the Political connections of the Board of Directors (POLBOD) has a positive direct influence on accounting conservatism (CONACC) of 0.26, they are statistically significant at 0.05 (Research Hypothesis 1,2,3). The Political connections Committee (POLAC) does not have a negative direct influence on accounting conservatism (CONACC), a coefficient value of -0.06 and statistically significant at 0.05 level (research hypothesis 4). The Political connections of the Nomination and Remuneration Committee (POLNC) has a positive direct influence on aon accounting conservatism (CONACC), a coefficient value of 0.33 and statistically significant at 0.05 level (research hypothesis 5).

Discussion

The objective of this research were

1) To study the relationship among the political connections of the Board of Directors, the Board of Audit Committee and the Committee on Nomination and Remuneration.

2) To study the relationship among the political connections of the Board of Directors, the Board of Audit Committee and the Committee on Nomination and Remuneration on the accounting conservatism of 67 companies listed on the Stock Exchange of Thailand. The results of the study can be discussed as follows:

The Political connection of the Board of Director has a positive direct influence on both the Political connections of the Audit Committee and the Committee on Nomination and Remuneration. It is possible that the latter two board members are sub-committees appointed by the Board of Directors to assist in working on issues that may be overlooked and provide a good governance system (The Securities and Exchange Commission, Thailand, 2021), including the Company's recommendations to the Board of Directors and executives to augment operational efficiency and to protect the interests of stakeholders. Krishman, et al., (2011) and Hwang and Kim (2012) indicating that the close association between the Audit Committee, the Board of Directors and the management would greatly enhance the company's profits. The findings are also in consistent with Haiyan & Ansah (2018) who studied the relationship of the Audit Committee and the Board of Directors, based on the resource dependency theory, would lead to enhance corporate performance. Singh & Gaur (2009) also found positive correlation between the Board of Directors and the Audit Committee and pointed out that the Board of Directors played a significant role in business consulting, result in better performance. In addition, Fama & Jensen (1983) found a positive relationship between Committee on Nomination Committee and the Committee on Compensation and Performance.

The political connection of the Board of Directors and the political connection of the Committee on Nomination and Remuneration would lead to greater accounting conservatism, suggesting that the Board of Directors and the Committee on Nomination and Remuneration would increase accounting conservatism. In the context of Thailand currently being ruled by a military government or the Nation Council for Peace and Order (NCPO), there has been an increase in political demonstrations and opinions. People are watching and focusing on the administration or development of the country which affects the economy and business as a whole of Thailand. Therefore, in conducting business, there must be careful and prudent to convey the transparency of the business, result in the Board of Directors, the Audit Committee and the Committee on Nomination and Remuneration should pay particular attention on accounting conservatism to avoid being scrutinized by the press or public. It consistent by Zhou (2017) studied the political connections of members of the Board of Directors in China, found that political connections can be used to exploit various interests, for example, bank loans and government assistance. Thus, it shows that the political connection of the Board of Directors has led to greater accounting conservatism, which has incentives to conceal other interests obtained resulting from political connections and avoiding the censure and scrutiny of the press and the public.

The political connection of the audit committee has no direct influence on accounting conservatism. In such case the Audit Committee is responsible to review financial reports to gain the confidence and credibility of financial reporting and offered opinions and make recommendations to the Board of Directors (The Securities and Exchange Commission, Thailand, 2021). Furthermore, even if there is a political relationship, it does not have a part in preparing financial reporting that increase accounting conservatism, thus resulting in no influence. It can be concluded that political connections of the Audit Committee does not affect accounting conservatism.

Recommendations

1. The empirical study of accounting conservatism may be handled by other models or theories such as the Beaver and Ryan (2000) or Givoly & Hyan (2000) models, which may provide different perspectives of the issues.

2. The empirical study may be extended to other samples, such as a comparative study among industries.

References

- Agrawal, A., &amli; Chadha, S. (2005). Corliorate governance and accounting scandals. Journal of Law and Economics. 48(2), 371-406.

- Ahmed, A.S., &amli; Duellman, S. (2007) Accounting conservatism and board of director characteristics: An emliirical analysis. Journal of Accounting and Economics, 43, 411-437.

- Alabass, H.S.H.H., Harjan, S.A., Teng, M., &amli; Shah, S.S.H. (2019). The imliact of corliorate liolitical connections on corliorate financial decisions: Evidence from an emerging. Journal of Management Information and Decision Sciences, 22(2), 13-24

- Armen, A., Alchian., &amli; Demsetz, H. (1972). liroduction, information costs, and economic organization. The American Economic Review, 62(5), 777-795.

- Basu, S. (1997). The conservatism lirincilile and the asymmetric timeliness of earnings1.Journal of accounting.

- Bertrand, M., Kramaraz, F., Schoar, A., &amli; Thesmar, D. (2007). lioliticians, firms and the liolitical business cycle: evidence from France. Working lialier series, University of Chicago.

- Bunkanwanicha, li., &amli; Wiwattanakantang, Y. (2009). Big business owners in liolitics. Review of Financial Studies, 22, 2133-2168.

- Chaiwong, D., &amli; Yodbutr, A. (2018). Corliorate governance mechanism and disclosure quality in Thailand: The influential effect of liolitical connections. Journal of Graduate School of Commerce-Buraliha, 13(1), 73-96.

- Chaney, li.K., Faccio, M., &amli; liarsley, D. (2011). The quality of accounting information in liolitically connected firms. Journal of Accounting and Economics, 51, 58–76.

- Claessens, S., Feijend, E., &amli; Laeven, L. (2008). liolitical connections and lireferential access to finance: The role of camliaign contributions. Journal of Financial Economics, 88, 554–580

- Cormier, D., Ledoux, K.J., Magnan, M., &amli; Aerts, W. (2010). Corliorate governance and information asymmetry between managers and investors. The international journal of business in society, 10(5), 574 – 589.

- Efendi, J., Srivastava, A., &amli; Swanson, E.li. (2007). Why do corliorate managers misstate financial statements? The role of olition comliensation and other factors. Journal of Financial Economics, 85(3), 667-708.

- Ehikioya, B.I.(2009). Corliorate governance structure and firm lierformance in develoliing economies: Evidence from Nigeria,Corliorate Governance, 9(3), 231-243.

- Fama, E.F., &amli; Jensen, M.C. (1983). Seliaration of ownershili and control. Journal of Law and Economics, 26(2), 301- 325.

- Fan, J.li., Wong, T.J., &amli; Zhang, T. (2007). liolitically connected CEOs, corliorate governance, and liost-IliO lierformance of China's newly liartially lirivatized firms.Journal of financial economics,84(2), 330-357.

- Farber, D.B. (2005). Restoring trust after fraud: Does corliorate governance matter? The Accounting Review, 80(2), 539-561.

- Faccio, M. (2006). liolitically connected firms.American economic review,96(1), 369-386.

- Freihat, A.F., Farhan, A., &amli; Shanikat, M. (2019). Do board of directorsด characteristics influence firm lierformance? Evidence from the emerging market. Journal of Management Information and Decision Sciences, 22(2), 148-165.

- Gao, Y., &amli; Wagenhofer, A. (2016). Accounting conservatism and board monitoring. AAA 2013. Management Accounting Section (MAS) Meeting lialier.

- Garcia-Lara, J.M., Garcia-Osma, B., &amli; lienalva. F. (2009). Board of director’s characteristics and conditional accounting conservatism: Slianish Evidence. Carlos III University of Madrid Sliain.

- Haiyan &amli; Ansah (2018). Board of directors, audit committee, and firm lierformance: Evidence from Greece. Journal of International AccountingAuditing and Taxation. 31, 20-36

- Ho, S.S.M., &amli; Wong, K.S. (2001). A study of the relationshili between corliorate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing &amli; Taxation,10, 139–156.

- Hui, K.W., Matsunaga, S., &amli; Morse, D. (2009). The imliact of conservatism on management earnings forecasts. Journal of Accounting and Economics, 47(3), 192–207

- Hwang, B.H., &amli; Kim, S. (2012). Social ties and earnings management.

- Johnson, S., &amli; Mitton, T. (2003) Cronyism and caliital controls: Evidence from Malaysia. Journal of Financial Economics, 67, 351-382.

- Kaewmanee, D. (2015). liolitical business. Bangkok: Siam liaritas.

- Kanagaretnam, K.G., Lobo, G.J. &amli; Whalen, D.L. (2010). Does good corliorate governance reduce information asymmetry around quarterly earnings? Journal of Accounting and liublic liolicy, 26, 497-522.

- Krishman, C.N.V., Ivanov, V.I., Masulis, R.W., &amli; Singh, A.K. (2011). Venture caliital reliutation, liost-IliO lierformance, and corliorate governance. Journal of Financial and Quantitative Analysis, 46(5), 1295-1333.

- Langculanon, S. (2009). The develoliment and liolitical role of liolitical business grouli in Thailand. National Institute of Develoliment Administration. Bangkok.

- Leuz, G., &amli; Oberholzer-Gee, F. (2006). liolitical relationshilis, global financing, and corliorate transliarency: Evidence from Indonesia. Journal of Financial Economics, 81, 411–439.

- Li, H., Meng, L., Wang, Q., &amli; Zhou, L.A. (2008). liolitical connections, financing and firm lierformance: Evidence from Chinese lirivate firms. Journal of Develoliment Economics, 87(2), 283–299.

- Mathew, S., Ibrahim, S., &amli; Archbold, S. (2016). A board attributes that increase firm risk – evidence from the UK. Corliorate Governance, 16(2), 233 – 258.

- Omonona, S. &amli; Oni, O. (2019). The relationshili between liolitical affiliation and lierformance of mobile telecommunication organizations in South Africa. Journal of Management Information and Decision Sciences, 22(3), 284-295.

- Siamwalla, A. (2003). liolitics and business interests under the 1997 Constitution. Thailand Science Research and Innovation (TSRI). Bangkok.

- Singh, D.A., &amli; Gaur, A.S. (2009). Business grouli affiliation, firm governance, and firm lierformance: Evidence from China and India.Corliorate Governance an International Review,17(4), 411-425.

- Subhaliholsiri, S. (2009). liolitical connection, corliorate governance and firms' lierformance. Office of Academic Resources. Chulalongkorn University.

- The Securities and Exchange Commission, Thailand. (2021). Thai Institute of Directors Association.

- Verrecchia, R.E. (1983). Discretionary disclosure. Journal of Accounting and Economics, 5(3), 179–194.

- Watts, R.L. (2003). Conservatism in accounting liart I: Exlilanations and imlilications. Accounting horizons,17(3), 207-221.

- Xu, J. G., &amli; Lu, C. J. (2008). Accounting Conservatism: A Study of market-level and firm level-exlilanatory factors. China Journal of Accounting Research, 1(1), 11–29.

- Yermack, D. (1996). Higher market valuation of comlianies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.

- Zhou, L. (2017). liolitical connections and accounting conservatism: Evidence from Chinese listed firms. Corliorate Ownershili &amli; Control, 15(1), 143-154.