Research Article: 2021 Vol: 25 Issue: 5

Predicting Financial Distress with the CCB Bankruptcy Model

Vitezslav Halek, University of Hradec Kralove

Abstract

The aim of this research was to present a new methodology for the assessment of financial health of a company, called the Come Clean Bankruptcy (CCB) model. The ultimate objective of the model is to detect the signs of impending bankruptcy based on a set of selected financial indicators reflecting the capital structure, liquidity and overall growth of the company. The CCB model was applied on a data sample comprising 199 entities operating in the textile/clothing industry in the Czech Republic. The outputs were compared with the actual development of those companies in 2013-2020 in order to assess whether the model can be effectively employed in practice.

Keywords

Bankruptcy Model, Predicting Risks, Financial Distress, Czech Republic.

JEL Classifications

C51, C52, C53, G17.

Introduction

Nowadays, there is a wide range of available organizational and financial measures for saving companies that found themselves in financial distress, each corresponding to the specific circumstances in the company and the causes of the financial distress. Though the efficacy of those measures is ever increasing, there is little doubt that it is much more advantageous, both in terms of time and financial costs, to prevent the bankruptcy in the first place, rather than to solve it once it occurs.

Bankruptcy is often misinterpreted. It is not the cause of the decline in value. It is the consequence of the decline. Above all, it represents a legal remedy allowing the creditors to take over a business that fails to meet its obligations due to the said decline in the value of assets. This means that with suitable tools, it is indeed possible to detect certain symptoms leading to the onset of bankruptcy. Financial analysis and corresponding models represent such tools.

The quality of existing financial analysis systems is determined directly by their complexity. Despite the fact that elementary methods of processing the data do not have the necessary explanatory power, they are used quite often. Complex systems allow for a more detailed depiction of the situation in the company, yet they tend to be confusing for the users of financial analyses. In fact, it has been shown that the users of financial analysis are able to understand less than three quarters of the analysis. One of the main objectives of the proposed model, unlike many other creditworthy/bankruptcy models, therefore is to provide a clear explanation of the obtained results.

Virtually all financial analyses require the use of data reported in financial statements. However, accounting data alone only reflects the past and not the prospects for the future. In other words, it defines the current values of strongly variable quantities (Kovanicová, 1999). These shortcomings can be eliminated by comparing the data with each other, expanding its explanatory power. That is why financial ratios are the fundamental methodological tool for financial analysis. Prediction models are often based on recommended values of indicators, which are nevertheless too broad. The CCB model, on the other hand, compares the individual ratios of a selected company with values of 198 competing entities operating in the same sector of economy, which increases the explanatory power of data and accuracy of the analysis. In addition, as a benchmark, it uses real data of entities which went bankrupt in the past in order to recognize patterns of impending bankruptcy.

Economic / financial distress arises when the internal rate of return (%) of a business falls below the level of the normal rate of return on investments with the same risk.

The range of available organizational / financial measures for saving the company is wide, the application itself should correspond to a/ specific circumstances in the company / location and b/ the causes of the financial distress. A more rational approach of the management consists of preventing the crisis. Financial analysis and its models are the main tools used for early detection of a crisis.

The first prediction models which appeared during the 1920s were rather simple in their structure. They usually included only one indicator to be analysed, such as the FitzPatrik (FitzPatrik, 1932) or Smith & Winakor (1935) models. Since then, the domain of prediction models saw tremendous development. The number of examined ratios progressively increased throughout the following decades and along with it, the number of prediction models too. Bellovary et al. (2007) indicates that from 1968 till 2007, more than 165 models have been introduced in scientific publications. Recent prediction models and analyses are increasingly complex in their structure and methodology.

López-Gutiérrez et al. (2015) conducted an extensive empirical analysis focused on possible effects of financial distress on investment activities in companies. The data was obtained for 4029 companies operating in Germany, Canada, Spain, France, Italy, UK and USA between 1996 and 2006. The study has shown that financial distress is not the only factor influencing investment. The propensity to underinvest depends also on the investment opportunities available to the company.

A similar study to the one presented herein in terms of number of analysed companies was conducted in Lithuania. Šlefondorfas (2016) has proposed a new bankruptcy prediction model and applied it on data of 145 companies (72 already bankrupt and 72 still operating). The author is of the opinion that the best way to predict future development is to create a model that is specifically designed for particular country, as the model in question was able to correctly classify 89 % of analysed companies.

Standard Logistic and Bayesian modelling was used in the Shrivastava et al. (2018) study in order to predict distressed firms in Indian corporate sector. Analysis was based on a sample of 628 companies over 10-year time span from 2006-2015. According to the results, Bayesian methodology seems to perform consistently better in terms of predictive capabilities.

Klepac & Hampel (2017) conducted a prediction of financial distress of agriculture companies operating in the European Union based on Logistic regression, the Support vector machines method with the RBF ANOVA kernel, the Decision Trees and the Adaptive Boosting based on the decision trees to acquire the best results. The goal of the authors was to find out whether it is possible to predict financial distress 1-3 years ahead with solid accuracy. According to authors, the chosen methodology performed well for 1-year ahead predictions, whereas for a longer period before bankruptcy, the models are not efficient enough to predict the bankruptcy.

Recent models are increasingly based on linear and logistic regressions, survival analysis, linear and quadratic programming, multivariate adaptive regression splines and multiple-criteria programming. Neural networks and their predictive capabilities have been studied in greater detail by (Cleofas-Sánchez et al., 2016). Their work compared several different neural models (MLP? RBF, BN and VP) with the hybrid associative memory with translation (HACT). The results of their analysis (concerning over nine real-life financial databases) have shown that the HACT neural network predicts the default cases better than the remainder of the methods analysed. Lee and Choi (2013) created a back-propagation neural network in order to carry out a multi-industry investigation of Korean companies.

Methodology

The bankruptcy model presented in this article uses relevant indicators to determine whether a company is or is not endangered by bankruptcy in the foreseeable future. It is based on the fact that every company that is at risk of bankruptcy exhibits symptoms typical of bankruptcy even before the bankruptcy occurs, for it does not follow the path of sustainable development, as defined by (Higgins, 1984).

The CCB model is built on real data of companies that went bankrupt in the past. The forecast or probability of bankruptcy can therefore be based on cash flows or optimal capital structure. It has been proved that optimal structure exists and can be approximately determined with mathematical calculations (Hl??ková, 2001). Company's liquidity represents the probability of when and under which conditions the difference between company's income and expenditure will be balanced. Probability (%) is influenced by income as well as the debt burden. This procedure allows to build a sophisticated bankruptcy scenario based on an analysis of cash flows over several years.

This scenario can be applied to any company, regardless of the current state of financial health. The signs of imminent financial distress of a company apparent from the evolution of cash flows over five years are as follows:

1. Decrease (-) in cash flow caused by decrease in profit,

2. Decrease (-) in income, slower decrease in expenditure,

3. Decrease (-) in net cash flow caused by an increase in inventories and short-term receivables

4. Decrease (-) of long-term debts,

5. Increase (+) in short-term bank loans,

6. Decrease (-) in working capital,

7. Increase (+) of interest,

8. Growth (+) of capital expenditures.

The characteristics described above are linked with the trends in the reported indicators:

1. Decrease (-) in profitability indicators,

2. Decrease (-) of debt coverage,

3. Decrease (-) of activity indicators,

4. Increase (+) in short-term debt,

5. Decrease (-) in interest coverage,

6. Increase (+) in the average interest rate.

The CCB multidimensional prediction model, which is based on the median values of the ratios of the groups comprising entities active in the selected sector, is built on a discriminant analysis. The model examines the dependence between the group p of independent variables (discriminators and one qualitative dependent variable. In addition, it allows to assign an object into one of the existing classes. The discriminator values in the input data contain objects arranged into primary classes. There are also unclassified objects which can be assigned to an appropriate class. Companies are assigned into a particular class based on the greatest degree of similarity, such as the smallest Mahalanobis distance. Below is the notation of the discriminant function:

Di = di1 Z1 + di2 Z2 ... + dip Zp (1.1)

where d1 to dp are standard classification coefficients, calculated by maximizing the ratios of intergroup / intragroup variability and Z1 to Zp are standard values of variables p. Such discriminant equation (model) is characterized in that a/ most of the companies that are having issues reach low values whereas b/ most of prosperous companies have high values (Sedlá?ek, 2007). This finding stems from the prediction of ratios based on statistical monitoring of the behavior of certain indicators in companies prior to bankruptcy and the use of signs of financial distress in order to identify companies that may become a candidate for bankruptcy in the future.

As for statistics, it is clear that the explanatory power of the numerical characteristics (averages) is closely related to the variability of the values of the monitored set. The financial development of a company cannot be predicted solely on the basis of average values of quantities. It is also necessary to examine the variability of indicator values. The more / less variable the analysed file, the worse / better financial development the company in question we can expect.

The indicators below (as illustrated by the Beaver model) clearly indicate that the average values of indicators for companies that later went bankrupt significantly deviate from stable entities. A statistically significant difference was found between the items (in ascending order):

1. Highly liquid funds,

2. Total short-term debts,

3. Net working capital,

4. Total assets,

5. Debt capital,

6. Net profit,

7. Cash flow,

8. Total assets.

The CCB model thus brings together a ratio-based prediction and the traditional bankruptcy models using the relative importance of selected ratios over time. As the scientific literature Kaplan (2001), Kone?ný (2003), Ma?íková (2001), Neumaierová (2002) indicates, analysis is in its basis an analysis of the time series or trends (trend = estimated rate of change of an indicator). That is where the discriminant analysis finds its application since it processes a wide range of ratios for two equally large groups of companies; companies faced with imminent bankruptcy and companies with no risk of bankruptcy. Apart from measuring indicators, a dynamic financial analysis aims to identify the reasons of the change in the examined data. This allows to a/ estimate future development and b/ forecast the financial situation (N?mec, 2006). The analysis is built upon the correlation between nine selected financial ratios in Table 1:

| Table 1 Correlation Analysis | ||||||||||||||

| Long-term debt to assets | Debt-to-equity ratio | Earnings multiplied by interest | Current ratio | Quick ratio | Interval rate | Return on assets | Income from assets | Inventory turnover | ||||||

| Long-term debt to assets | 1.0 | |||||||||||||

| Debt-to-equity ratio | 0.8 | 1.0 | ||||||||||||

| Earnings multiplied by interest | -0.6 | -0.6 | 1.0 | |||||||||||

| Current ratio | -0.4 | -0.6 | 0.3 | 1.0 | ||||||||||

| Quick ratio | -0.3 | -0.5 | 0.3 | 0.7 | 1.0 | |||||||||

| Interval rate | -0.1 | -0.2 | 0.1 | 0.2 | 0.5 | 1.0 | ||||||||

| Return on assets | -0.3 | -0.4 | 0.9 | 0.2 | 0.3 | 0.1 | 1.0 | |||||||

| Income from assets | -0.1 | -0.1 | 0.6 | 0.0 | 0.1 | 0.1 | 0.8 | 1.0 | ||||||

| Inventory turnover | 0.1 | 0.1 | 0.2 | -0.4 | 0.0 | -0.2 | 0.2 | 0.3 | 1.0 | |||||

The concept is based on the existence of two sets of companies. The first set contains the indicator values of prosperous companies whereas the second contains the same indicator values of companies facing difficulties. The optimal situation is when no value from the first set is lower than the highest value from the second set, or conversely no value from the first set is higher than the smallest value of the second set of entities.

This situation would mean that there is at least one value that is smaller / higher than all the values of the indicator in the group of prosperous companies. At the same time, all values of the indicator in the group of companies facing difficulties would, in comparison, have a lower / higher value. Let us use the example provided in (Sedlá?ek, 2007). The examined indicator is, for example, the ROA. Let there be a random set of ten prosperous companies with the following values Table 2:

| Table 2 ROA - Prosperous Companies | ||||||||||

| Company | 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. |

| ROA | 0.09 | 0.07 | 0.11 | 0.10 | 0.09 | 0.15 | 0.06 | 0.06 | 0.10 | 0.09 |

The average value is 0.092, i.e., 9.2%. The following values were then obtained from selection of ten companies facing difficulties Table 3:

| Table 3 ROA - Ailing Companies | ||||||||||

| Company | 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. |

| ROA | 0.01 | 0.08 | 0.02 | 0.04 | 0.02 | 0.05 | 0.03 | 0.03 | 0.08 | 0.00 |

The average value is 0.036, i.e. 3.6 %. The results indicate that that the average value of the ROA indicator is significantly higher in the set of prosperous than ailing companies.

In certain cases, the companies facing difficulties may have even better values than the worst values of the same indicator in prosperous companies. In this example, two ailing companies have a higher value of the ROA indicator (0.07 and 0.08) than two prosperous companies (0.06 and 0.06).

To solve this issue, the proposed CCB model analyses all the entities within the industry sector, not just those that were selected at random. Although this requirement puts pressure on the quality / complexity of the analytical activity, such bankruptcy prediction is far more accurate.

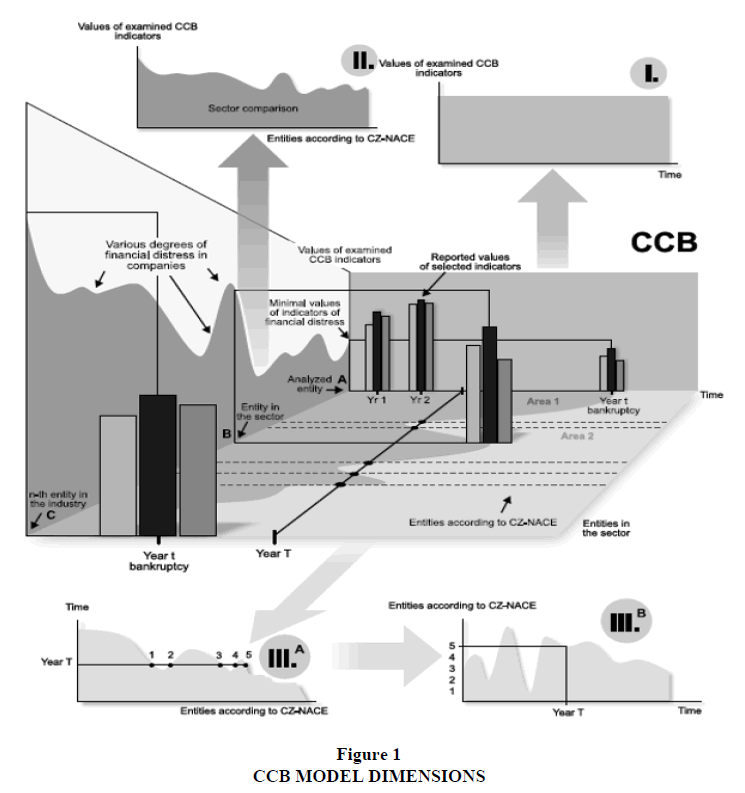

The overall process of CCB prediction can be demonstrated on a graph - see Figure 1. Since the first step of the analysis consists of finding a relationship between at least three basic variables, it is clear that a two-dimensional representation would not suffice the purpose of the prediction. The newly proposed CCB model works in three dimensions:

1. Examined CCB indicators (debt ratio, earnings multiplied by interests, working capital, etc.),

2. Examined time interval (onset of bankruptcy),

3. Companies operating in the given sector (textile industry according to CZ_NACE classification).

The proposed CCB model is primarily based on the consideration of the relationship between the evolution of selected financial indicators of the analysed company and the time horizon of the financial data. Graph I. in the Figure 1 provides data on the financial position of the company over calendar years. According to a certain key, the CCB model assembles the companies into a group of the so-called competing companies. In general, it is recommended to take into consideration the following five company characteristics:

1. Balance sheet total,

2. Amount of debt capital,

3. Mutual debt-to-equity ratio,

4. Active years in business,

5. Market share.

The horizontal area in Figure 1 has an explanatory power, as it describes the relationship between the time horizon and the time when the companies included in the group will be or were endangered by bankruptcy. The graphical representation is mathematically simplified, i.e. a continuous function between the areas marked as Area 1 and Area 2 cannot be assumed.

Before exploring the relationship between Graph III.A and III.B, we should point out the ability of Graph II. to measure the degree of CCB indicators indicating the ongoing financial distress of individual companies. Without the initial arrangement of companies into a group, there would be ambiguity in the interpretation of the results. The graph constructed in this way defines the values of the CCB indicators that are critical for individual companies in the sector.

The total area (marked as a comparison of sectors) enables an interdisciplinary comparison of the performance of various sectors. Area 1 indicates the state of financial distress of a company.

The horizontal line in Figure 1 is constructed at time (year) T and the intersections in the area and on this line represent the number of bankruptcy situations in the sector for each company. The two-dimensional representation of the relationship is provided in Graph III.A. For better clarity, it is recommended using the inverse course of the function, which is outlined in the Area III.B. Graph III.B shows how many bankruptcies occurred in the monitored time period.

Figure 1 shows three-time instants. The analysed time t for year 1, year 2 and year t. Since the vertical axis of Graph I. reflects the reported levels of indicators / data, it is possible to define the moment showing all the signs of distress followed by bankruptcy (there is a distinction between the economic / legal moment of bankruptcy). A company is deemed in bankruptcy when the minimum level of indicators reflecting financial distress (vertical axis) is not at an adequate level (horizontal axis).

The analogy with the traditional creditworthy / bankruptcy models is evident. By default, these models do not predict states in the company but merely assess the current situation and, based on trends, seek to describe the state - prosperity / immutability / bankruptcy.

Analysis

Specific data of companies operating in the textile industry (or related fields) were used in order to verify the CCB model. As mentioned in the previous chapter, current data could not be used for the test as it would require certain waiting period in order to verify the prediction provided by the model. For this reason, the model works with the year of 2013 as the starting point and a seven-year span for predicting the onset of bankruptcy.

The choice of the industry that is tested was not arbitrary. Business risk varies by industry (Bláha, 1994). The prospects of companies are determined by the very nature of the industry. The economic problems of companies operating in the textile / clothing industry are well known. We can observe specific signs of emerging bankruptcies. This fact made the set of companies figuring in the textile / clothing industry a sufficiently suitable sample on which the CCB model could be verified in Table 4.

| Table 4 Indicators of Financial Distress | |||||||||||

| Company # | Debt Ratio | Earnings to Interest | Working Capital to Total Assets | Quick Ratio Net Of Receivables | Operating Cost | Interest Tax Shields | Return On Capital | Price to Earnings | Expected Return on Debt | Q Value | Indebtedness |

| 1 | 0,63 | -7,26 | -0,76 | 0,01 | 3,89 | -0,00 | -0,06 | -7,78 | -0,20 | 0,70 | 0,03 |

| 2 | 0,52 | -45,94 | -0,11 | 0,23 | 1,01 | -0,10 | -0,17 | 18,29 | -0,21 | 10,21 | -0,16 |

| 3 | 0,06 | 9,92 | 0,44 | 1,67 | 5,43 | 0,06 | 0,01 | 88,73 | 0,02 | 0,61 | 0,01 |

| 4 | 1,94 | 0,00 | 0,26 | 0,03 | 2,42 | -0,43 | -0,43 | 1,87 | 0,87 | 2,28 | -2,90 |

| 5 | 1,19 | 0,00 | -0,20 | 0,11 | 2,15 | 0,06 | 0,03 | 1,05 | 0,20 | 1,25 | -0,11 |

| 6 | 1,02 | -4,76 | 0,22 | 0,07 | 0,72 | -0,09 | -0,11 | -0,62 | -4,15 | 1,90 | 3,87 |

| 7 | 0,72 | 28,74 | -0,40 | 0,27 | 5,83 | 0,13 | 0,11 | -15,58 | 0,34 | 1,66 | -0,06 |

| 8 | 0,41 | -81,99 | 0,46 | 1,58 | 6,92 | 0,18 | 0,04 | -1,93 | 0,40 | 2,14 | -0,23 |

| 9 | 0,52 | 0,00 | 0,50 | 1,73 | 23,62 | 0,00 | 0,00 | 7,05 | 0,10 | 2,41 | -0,09 |

| 10 | 0,23 | 23,16 | 0,54 | 0,84 | 2,01 | 0,12 | 0,07 | 12,63 | 0,10 | 2,21 | 0,07 |

| 11 | 0,27 | 36875,57 | 0,38 | 0,54 | 1,30 | 0,61 | 0,11 | 7,98 | 0,17 | 1,56 | 0,09 |

| 12 | 0,25 | 0,00 | 0,69 | 4,26 | 359,84 | 0,30 | 0,23 | -20,43 | 0,11 | 1,20 | 0,27 |

| 13 | 0,06 | 0,00 | 0,88 | 16,96 | 3,82 | 0,20 | 0,13 | 8,35 | 0,17 | 3,42 | 0,13 |

| 14 | 0,46 | -6,26 | 0,72 | 0,28 | 4,07 | -0,11 | -0,12 | 171,74 | -0,15 | 1,06 | -0,11 |

| 15 | 0,59 | -4,86 | -0,12 | 0,01 | 2,46 | -0,06 | -0,12 | -1,59 | 4,59 | 0,72 | -4,93 |

| 16 | 0,59 | 3,55 | 0,34 | 0,07 | 1,91 | 0,03 | 0,01 | 23,93 | 0,04 | 1,30 | -0,02 |

| 17 | 0,48 | 2,11 | 0,53 | -0,20 | 0,49 | 0,06 | 0,04 | -3,76 | 0,17 | 2,31 | -0,03 |

| 18 | 0,51 | 17,58 | 0,38 | 0,17 | 2,11 | 0,09 | 0,01 | 10,45 | 0,01 | 1,55 | 0,01 |

| 19 | 0,62 | 12,49 | -0,03 | 0,05 | 2,21 | 0,11 | 0,05 | 3,11 | 0,15 | 1,19 | -0,02 |

| 20 | 0,32 | -38,66 | 0,17 | 0,32 | 2,13 | -0,13 | -0,18 | 7,84 | -0,37 | 1,81 | -0,06 |

Each of the analysed companies operating in the same sector is ranked using the method of standardized variable Table 5. This step is necessary for establishing the threshold intervals indicating the probability of bankruptcy.

| Table 5 Ranking Based on Standardized Values | ||||||||||||||

| Company Serial N° | Debt Ratio | Earnings to Interest | Working Capital To Total Assets | Quick Ratio Net of Receivables | Operating Cost | Interest Tax Shields | Return on Capital | Price-to-Earnings | Expected Return On Debt | (Q) Value | Indebtedness | Sum Total | Average | Rank |

| Xpj | 1,67 | 295,51 | -0,05 | 0,92 | 19,12 | 0,16 | 0,09 | 11,72 | 0,21 | 2,27 | 3,04 | × | × | × |

| Sxj | 9,42 | 1681,02 | 3,14 | 6,15 | 224,43 | 1 | 1 | 44,98 | 1,05 | 3,85 | 46,99 | × | × | × |

| 11 | -0,15 | 21,76 | 0,14 | -0,06 | -0,08 | 0,45 | 0,02 | -0,08 | -0,04 | -0,18 | -0,06 | 21,72 | 1,97 | 1 |

| 12 | -0,15 | -0,15 | 0,24 | 0,54 | 1,52 | 0,15 | 0,14 | 4,1 | -0,1 | -0,28 | -0,06 | 5,95 | 0,54 | 2 |

| 13 | -0,17 | -0,14 | 0,3 | 2,61 | -0,07 | 0,05 | 0,04 | -0,08 | -0,04 | 0,3 | -0,06 | 2,74 | 0,25 | 3 |

| 14 | -0,13 | -0,15 | 0,25 | -0,1 | -0,07 | -0,21 | -0,21 | 3,56 | -0,12 | -0,31 | -0,01 | 2,5 | 0,23 | 4 |

| 15 | -0,11 | -0,15 | -0,24 | -0,15 | -0,07 | -0,24 | -0,24 | -0,08 | 4,18 | -0,4 | -0,02 | 2,48 | 0,23 | 5 |

| 2 | -0,12 | -0,15 | -0,1 | -0,11 | -0,08 | -0,17 | -0,17 | 0,15 | 0,23 | 2,06 | -0,01 | 1,53 | 0,14 | 6 |

| 3 | -0,17 | -0,17 | 0,16 | 0,12 | -0,06 | -0,1 | -0,08 | 1,71 | -0,19 | -0,43 | -0,06 | 0,73 | 0,07 | 7 |

| 6 | -0,07 | -0,15 | 0,09 | -0,14 | -0,08 | -0,09 | -0,13 | -0,11 | 1,16 | -0,1 | 0,02 | 0,4 | 0,04 | 8 |

| 8 | -0,13 | -0,16 | 0,17 | 0,11 | -0,05 | 0,03 | -0,05 | -0,12 | 0,18 | -0,03 | -0,01 | -0,06 | -0,01 | 9 |

| 4 | 0,03 | -0,15 | 0,1 | -0,14 | -0,07 | -0,21 | -0,21 | -0,22 | 0,63 | 0 | 0 | -0,24 | -0,02 | 10 |

| 9 | -0,12 | -0,15 | 0,18 | 0,13 | 0,02 | -0,15 | -0,09 | -0,1 | -0,1 | 0,04 | -0,03 | -0,37 | -0,03 | 11 |

| 10 | -0,15 | -0,16 | 0,19 | -0,01 | -0,08 | -0,04 | -0,02 | 0,02 | -0,1 | -0,02 | -0,06 | -0,43 | -0,04 | 12 |

| 1 | -0,11 | 0 | 0 | -0,15 | -0,07 | 0 | 0 | 0 | 0 | -0,41 | -0,06 | -0,8 | -0,07 | 13 |

| 16 | -0,11 | -0,17 | 0,13 | -0,14 | -0,08 | -0,12 | -0,09 | 0,27 | -0,16 | -0,25 | 0 | -0,72 | -0,07 | 14 |

| 17 | -0,13 | -0,17 | 0,19 | -0,42 | -0,08 | -0,09 | -0,05 | -0,13 | -0,04 | 0,01 | 0 | -0,91 | -0,08 | 15 |

| 18 | -0,12 | -0,17 | 0,14 | -0,12 | -0,08 | -0,06 | -0,08 | -0,03 | -0,19 | -0,19 | -0,06 | -0,96 | -0,09 | 16 |

| 20 | -0,14 | -0,14 | 0,07 | -0,1 | -0,08 | -0,08 | -0,13 | -0,09 | -0,17 | -0,12 | 0 | -0,98 | -0,09 | 17 |

| 19 | -0,11 | -0,17 | -0,09 | -0,14 | -0,08 | -0,04 | -0,05 | -0,19 | -0,06 | -0,28 | 0 | -1,21 | -0,11 | 18 |

| 5 | -0,05 | -0,15 | -0,16 | -0,13 | -0,08 | -0,09 | -0,06 | -0,24 | -0,01 | -0,26 | -0,07 | -1,3 | -0,12 | 19 |

| 7 | -0,1 | -0,16 | -0,95 | -0,11 | -0,06 | -0,03 | 0,01 | -0,38 | 0,12 | -0,16 | -0,07 | -1,89 | -0,17 | 20 |

The definition of the mean / standard deviation and the comparison thereof using the method of standardized variable is necessary for monitoring the values in the company rankings. The use of differentiated weights would lead to a distortion of the final ranking, as the selection of the monitored ratios was made while taking into account the goal of detecting impending bankruptcy. The calculation therefore considers unit weights that did not distort the final ranking. The mean / the standard deviation were calculated for the full set of one hundred and ninety-nine textile / clothing companies (the reference package). The individual standardized variables were then defined: for the monitored indicator and entity. The sum of standardized values, divided by the number of monitored variables gave the average of the standardized values. It was therefore possible to obtain individual average values and rank them within the analyzed reference package.

Using two threshold values (the lower 9% and 22% of the package of analyzed companies), allowed to identify forty-nine problematic textile / clothing companies. Of the 49 companies, fifteen fell within the risk interval indicating a high risk of bankruptcy. The remaining thirty-four companies from the problematic zone have approached this state.

The research and analysis of financial indicators have revealed the following patterns:

1. If a company borrows external funds, it also announces its willingness to regularly repay its debt. Debt provides the basis for financial leverage. The extent of financial leverage seems to be a necessary monitoring variable regarding the amount of debt. There are different ways to perceive the financial leverage. In the CCB model, the value of liabilities is added to the ratio of long-term debt to total capital, because long-term lease agreements oblige the company to pay a series of fixed payments.

2. The degree of indebtedness considers only long-term debt obligations. The difference between total liabilities and equity to total liabilities is not used. The coverage ratio of EBIT and depreciation to interest represents another measure of financial leverage. Regular interest payments prevent bankruptcy. The ratio provides information as to when the interest payments will no longer be covered by earnings.

3. If the volume of bank / creditor loans increases, the total coverage of the debt by assets is not that important. This issue becomes serious in case the capital was provided to the company for a shorter time horizon. The CCB model is however a prediction model with the standard seven-year time series for analysis. Once again, we need to take into account liquidity. The creditor-analyst must assess whether the company will have enough cash to repay its debt, despite the shorter time horizon. The attention is focused on liquid assets as a reliable instrument. The weight of the liquidity ratio is insignificant in the CCB model due to the volatility of the indicator.

4. Some assets have lower liquidity. A typical example would be a company selling its inventories during a crisis. Difficulties arise when the company is unable to sell its inventories of finished products for a price that is higher than the cost of production. That is why we need to focus on cash / marketable securities / outstanding receivables. The numerator of the ratio can be net of receivables. The quick ratio net of receivables seems like a more suitable option for bankruptcy purposes.

5. In our model, the quick ratio is again increased by receivables so that the numerator of the current quick ratio is not changed. The denominator contains current expenses. This ratio transforms to an interval measure that uses the average daily operating expenses in the denominator.

6. Company's performance is assessed with the return on total assets. Return is defined as earnings before interest, but after tax.

7. The payout ratio reflects the external dividend environment. The relationship between a/ dividends and b/ earnings per share provides information on how much of the earnings are paid out in the form of dividends.

8. The price to earnings ratio is a common evaluation benchmark used by investors. A high P/E ratio may mean that a/ the investors expect high dividend growth or b/ the shares are not that risky and investors therefore accept lower returns, or c/ the company expects large average growth in the future and therefore pays out a large portion of its earnings.

9. Monitoring the ratio of the book value / revalued value of a share reflects the external environment. For bankruptcy prediction purposes, the overall property structure of the company is assessed. As for the CCB model, it is using revalued assets / liabilities as it is a more suitable option. Valuing a company can often be highly problematic / impossible for analysts. It is up to the user of the CCB model to decide whether to use the net assets per one share or adjust the asset / capital structure with a selected evaluation method. The author of the model recommends making a valuation adjustment in such a way that the outputs are not distorted.

10. The analysis is also based on the market value of the company's debt / equity to the market reproduction costs of replacing the company's assets. This ratio is similar to the market / book value ratio, yet there are some several important differences. The numerator includes all debt and equity of the company, not just net equity. The denominator includes all assets and not just net capital. These assets are reported in replacement costs, not in acquisition costs. The effect of inflation could also be considered here.

11. The situations defined above describe / yet do not explain, whether / how the indebtedness, which is crucial for the prediction of financial distress, affects the company's earnings. Indebtedness increases the expected flow of earnings per share, but not the share price. This is because the expected flow of earnings is precisely offset by the change in the rate at which earnings are capitalized. The expected return on assets of the company = expected operating income divided by the total market value of securities. The decisions of a company to take a loan do not affect the operating income of the company or the overall market value of its securities. The expected return on assets of the company is therefore not affected by the decision to take a loan.

Conclusions and Discussion

Despite the fact that financial distress or bankruptcy may have a slightly different definition depending on the legislation applicable in particular country or state, it is always perceived as a situation that should be avoided. Prevention of bankruptcy is indeed always more convenient and less expensive than resolving the bankruptcy that already occurred. Due to the current pandemic and resulting uncertainty in the markets, we can expect that the interception of potential risks of financial distress will move even higher in the list of management priorities.

The presented CCB model is an analysis instrument designed specifically for this very purpose. It aims to detect the signs of impending bankruptcy based on selected indicators of financial health of a company, including sustainable development, optimal capital structure and liquidity. Ensuring the applicability of the model in practice was one of the key objectives of the research. Its explanatory power was therefore tested on the data of 199 companies operating in the textile / clothing industry in the Czech Republic. The comparison of predicted development and actual evolution of tested entities has shown that the CCB model was able to predict bankruptcy / insolvency proceedings in one third of the cases, despite the fact that the number of companies which found themselves in this situation was rather small, considering the extent of the referential package (only 9 out of 199). All the data required for the prediction were taken from standard financial statements.

It can thus be concluded that the described model represents a suitable and reliable tool for detecting financial distress in companies. Bankruptcy or insolvency is nevertheless a legal situation arising under specifically defined conditions. The CCB model should therefore be perceived as a mere support tool for the management and its outputs should prompt a further analysis or expert opinion of the circumstances in the given company.

Annexes

| Table A1 Abbreviations | |

| AS | Annual sales |

| C1,0 | Total capital |

| CFD | Financial distress cost |

| CVef | Company value at equity financing |

| dvfo | Distance from the fictitious object |

| djp | Integral indicator – Method of simple ranks |

| djsp | Integral indicator - Method of simple sum of ranks |

| WDt | Total debt |

| Eq | Equity |

| Lt | YTD loss |

| OCts | Tax shield |

| P | YTD Profit |

| r | Return on sales |

| S | Sales |

| sxj | Standard deviation |

| ui | Observed value |

| xij | Indicator value |

| Table A2 Analyzed Entities | |

| Company # | Company Name |

| 1 | Actual spinning a.s |

| 2 | ATRON, s.r.o |

| 3 | BRULEKO s.r.o |

| 4 | DIVERSO KV s.r.o. |

| 5 | Durocas Czech s. r. o. |

| 6 | KONYA - M s.r.o. |

| 7 | PRVNÍ CHRÁN?NÁ DÍLNA s.r.o |

| 8 | RESCUE s.r.o |

| 9 | SAND s.r.o |

| 10 | CZ FORUS s.r.o |

| 11 | BIKERS CROWN, s.r.o |

| 12 | Clonestar Peptide Services, s.r.o |

| 13 | Fibertex Nonwovens, a.s |

| 14 | MEDOVINKA, s.r.o |

| 15 | VEBA, textilní závody a.s. |

| 16 | VLNAP a.s |

| 17 | ASSANTE s.r.o |

| 18 | B E M A T E C H, s.r.o |

| 19 | GUMOTEX, a.s. |

| 20 | Schwinn Tschechien s.r.o |

1 Names of the companies are provided in Appendix.

2 Rank in the group of companies that are included in the table, not in terms of the whole set of 199 companies that were tested as part of the research.

References

- Bellovary, J.L., Giacomino, D.E., & Akers, M.D. (2007). A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education, 1-42.

- Bláha, Z.S., & Jind?ichovská, I. (1994). Jak posoudit finan?ní zdraví firmy. 1st ed. Prague: Management Press, 97.

- Cleofas-Sánchez, L., García, V., Marqués, A., & Salvador Sánchez, J. (2016). Financial distress prediction using the hybrid associative memory with translation. Applied Soft Computing Journal, 44, 144-52.

- FitzPatrick, P.J. (1932). A Comparison of the Ratios of Successful Industrial Enterprises with Those of Failed Companies. The Certified Public Accountant Beaver 1968. Journal of Accounting Research. (In three issues: October, 1932, 598-605; November, 1932, 656-662; December, 1932, 727-731).

- Higgins, R.C. (1984). Analysis for Financial Management. Irwin, Homewood.

- Hl??ková, M. (2001). Kapitálová p?im??enost obchodník? s cennými papíry. Prague: Univerzita Karlova Praze, Institut ekonomických studií, 41.

- Kaplan, R.S., Norton, D.S. (2001). Balanced scorecard: strategický systém m??ení výkonnosti podniku. 1st ed. Prague: Management Press.

- Klepac, V., & David, H. (2017). Predicting financial distress of agriculture companies in the EU. Agricultural Economics (Czech Republic), 63, 347-55.

- Lee, S., & Choi, W.S. (2013). A multi-industry bankruptcy prediction model using back-propagation neural network and multivariate discriminant analysis. Expert Systems with Applications, 40(8), 2941-2946.

- López-Gutiérrez, C., Sanfilippo-Azofra, S., & Torre-Olmo, B. (2015). Investment decisions of companies in financial distress. BRQ Business Research Quarterly,18, 174-187.

- Ma?íková, P., & Ma?ík, M. (2001). Moderní metody hodnocení výkonnosti a oce?ování podniku. 1st ed. Prague: Ekopress.

- N?mec, P. (2006). Hodnocení ekonomické výkonnosti podniku pomocí moderních metod finan?ní analýzy (Unpublished Master’s Thesis). Brno: Masarykova univerzita.

- Sedlá?ek, J. (2007). Finan?ní analýza podniku. Computer Press, Prague, 93.

- Shrivastava, A., Kuldeep, K., & Nitin, K. (2018). Business distress prediction using a Bayesian logistic model for Indian firms. Risks,6, 113.

- Šlefendorfas, G. (2016). Bankruptcy prediction model for private limited companies of Lithuania. Ekonomika, 95, 134.

- Smith, R., & Winakor, A. (1935). Changes in Financial Structure of Unsuccessful Industrial Corporations. Bureau of Business Research, Bulletin No. 51. Urbana: University of Illinois Press.