Research Article: 2022 Vol: 25 Issue: 2

Preparing and designing an accounting system according to international standards in international schools (A case study in British International Schools in Duhok)

Idris S. Mohamad, University of Zakho

Sizar Salih Abdullah, University of Duhok

Citation Information: Mohamad, I. S., & Abdullah, S. S. (2022). Preparing and designing an accounting system according to international standards in international schools (A case study in British International Schools in Duhok). Journal of Management Information and Decision Sciences, 25(2),1-15

Abstract

International schools are the institutions that aim at providing opportunities for qualitative and quantitative developments in the area of education. These international schools are seen as complementary to government education, although these schools are important to society; they do not yet have their own accounting system, where it relied on a unified accounting system for organizing accounting operations, although its requirements were not met. This research derives its importance in finding treatment solutions for problems that arise for finance auditors when they do their works in the international schools in Iraq. The problem of the research lies in the lack of a proper accounting system of its own, which made it suffer from the use of the unified accounting system, Due to non-compliance with measuring and reporting requirements for economic events. Because of the importance of the problem, the researcher chose this topic in an attempt to find solutions, as he sees that the solution to the problem is made by the supposition that (preparing and designing an accounting system in accordance with international standards for international schools in the Dohuk governorate It would support its role in achieving its own goals).

The research aims to define the accounting standards that are applied in international schools in the Dohuk governorate in general, Designing an accounting system for international schools, In order to ensure proper accounting for the activities of these schools and to improve the quality of financial disclosure by them for the purpose of benefiting from them by the relevant authorities, such as (The Financial Supervision Bureau and the Ministry of Education). The researcher reached a set of conclusions, the most prominent of which is the lack of an accounting system in international schools in Iraq in general and Dohuk governorate in particular, and that the unified accounting system does not meet the needs of its users of measurement and disclosure. Accordingly, the researcher recommends a set of recommendations, the most important of which is the adoption of the accounting system proposed by the researcher and its application in international schools in Iraq, which helps them to meet most of the needs of users of financial information.

Keywords

International schools; Accounting system; International accounting standards.

Introduction

International schools are the institutions that aim at providing opportunities for qualitative and quantitative developments in the area of education. These international schools are seen as complementary to government education, although these schools are important to society; they do not yet have their own accounting system, where it relied on a unified accounting system for organizing accounting operations, although its requirements were not met. Therefore, this research came to solve this problem by designing an appropriate system for its activity by international practices and standards.

The nature of the work and objectives of international schools in Iraq differ from other units, as the main objective is to provide educational opportunities, and because of the lack of its own accounting system, which made it suffer from the unified accounting system, and the most important things that are not available in the system used are the following:

1. Lack of a means for distributing the surplus and registering it according to its own law.

2. Lack of the accounting system used to meet its requirements in terms of the type of lists, the names of accounts, the recorded treatments, the extent to which the appropriate presentation of the financial statements is achieved.

The research derives its importance by finding effective solutions to the problems that accountants face when performing their tasks in international schools. In addition to this, the widespread of international schools, which is reflected positively on the organization and management of their work, achieving the set goals set for it under its founding laws, it can achieve confidence between the financial statements and contribute to the development of accounting work for- profit establishments. The research also highlight on the logistical support for international schools that are most beneficial to the community with the possibility of using and adapting international standards and making them suitable for application in the Iraqi environment. Because it’s main goal is to provide the chances of study.

Research Aims

The aim of the research is to include the following points:

1. Introducing the nature of the work of international schools, their objectives, and the laws governing them.

2. Introducing the accounting standards that are applied in international schools in general and that contribute to a qualitative leap in educational institutions by evaluating the outputs of the accounting systems that represent the financial statements and studying their compatibility with international accounting standards that are applied in educational institutions in particular.

3. Preparing and designing an accounting system for international schools in the Dohuk governorate to ensure proper accounting for the activities of those schools and to improve the quality of financial disclosure by them for the purpose of benefiting from them in the relevant institutions such as (The Financial Supervision Bureau and the Ministry of Education).

Literature Review

Previous Studies

Joseph (1994) evaluated the governmental accounting system applied in public hospitals in Mosul by studying its outputs and the effectiveness of these outputs, pointing out the system’s shortcomings, and suggesting subsidiary accounting systems through which the financial activities developed in these hospitals are measured.

Al-Ani (2001) aimed to design an accounting system for hospitals that are subject to Resolution 124 of 1997 to assist their management in taking useful decisions efficiently for the success of the experiment and its financial and administrative development.

Baji (2016) created a framework for a specialized electronic accounting system suitable for religious institutions, as well as an attempt to use (information technology) and highlighting their role in the work of these institutions, which leads to helping them achieve their goals.

YI Hua (2004) studied the difference between the accounting system in colleges in the United States of America and the same in China, Where the study concluded that the use of the cash basis in Chinese colleges results in inaccurate accounts, and the most important recommendations of the study were the need to follow the accrual basis of accounting, which helps to meet the accepted accounting principles.

By reviewing previous research and studies, the researcher noted that they dealt with general frameworks for designing an accounting system that contributes to raising the efficiency and effectiveness of the accounting information system in terms of speed, objectivity, detail, and appropriateness (Belkaoui, 1981; Ruppel, 2002; INTOSAI, 2004; Oguri, 2005; Al-Hayali, 2007; Wolk et al., 2007; Zietlow & Seidner, 2007; Abdel-Aal, 2008; Al-Husseini, 2008; McLaughlin, 2009; Wilson & Kattelus, 2010; Yagoubi, 2014; Donald et al., 2016; Kieso et al., 2019).

Research Hypothesis

The research starts from the following hypotheses:

Preparing and designing an accounting system appropriate to the nature of international schools in Iraq would support its role in achieving its set goals.

The international standards and practices of international schools are applicable and meet the requirements of work in the Iraqi environment.

Research Methodology

Research Methods

For the purpose of reaching the objectives of the research and proving its hypotheses, the researcher used the inductive method in studying the problem and reaching the results, Existing problems were diagnosed, solutions were found, and an accounting system for international schools in Dohuk was designed, focusing on securing their needs.

As for the tools used by the researcher, it is mainly to refer to the financial reports, official documents, the practices currently adopted in international schools in the Dohuk governorate. As well as referring to the relevant Iraqi laws, legislation, and instructions seeking to find out the nature of the needs of the administrations of these schools and the important beneficiaries through interviews and directing questions and inquiries.

Search Limits

Spatial limits

The research community was represented by the international schools located in the Kurdistan region of Iraq, Dohuk Governorate, which is the British School.

Time limits

The duration of the search was determined from (2020).

Problems Of The Accredited Accounting System In International Schools

This topic has been devoted to identifying the most important problems in using the current accounting system and the extent to which these schools are interested in the generally accepted accounting principles. Most of these schools are concerned with the aspects of exchange and receipt and neglect the aspect of accounting disclosure, where the accounting disclosure is one of the main foundations that should be based on, and the problems will be addressed as follows;

• The range

• Accounts guide

• Financial Statements

• Accounting treatments

Current Accounting Problems in International Schools in Duhok

The scope of work of the standard accounting system (IUAS) currently used

A. The unified accounting system(IUAS) is applied to economic units in the public sector that deal on economic bases and self-finance departments that target the cost of covering their production or more regardless of their connection, taking into account the following;

1. The unified accounting system (IUAS) is applied to productive economic units for the reason that their expenditures are distributed among their formations.

2. (IUAS) is applied to all training centers that serve the productivity centers, given that the expenses of these services are distributed to the productivity centers benefiting from them.

3. (IUAS) is applied to the establishments of publishing, printing, and distribution houses as they are production facilities to which the above concept applies.

4. All government facilities that engage in construction work and consultancy and laboratory services centers are among the facilities covered by the application of the (IUAS) system because it deals with economic bases.

B. (IUAS) application includes all cooperative societies.

C. (IUAS) Includes common sector companies.

1. The standardized accounting system is excluded by the following institutions;

2. Ministries and departments whose budget is financed as part of the state budget.

3. Banks

4. Insurance companies

From the foregoing, international schools or colleges were not included within the scope of this system and the lack of a special system for these institutions led to the use of the unified accounting system (IUAS).

Accounts used in the current system (IUAS)

Most of the accounts used in the unified accounting system (IUAS) do not meet the needs of international schools in Dohuk and do not provide disclosure of the different types of revenues and expenses related to the work of schools, as shown below;

Revenues

The standard accounting system (IUAS) Uses one account for the revenues that are collected from students, which is the Social Services Revenue Account 435 This account, includes the revenue received from educational, health, and social services provided to others by the economic unit whose main activity is this service. Due to the complexity of the revenue that schools get from students, this has led to confusion in the accounting work. The revenue obtained is not taken into account as shown in the Table 1.

| Table 1 Revenue Schedule For The Proposed Educational Activity |

|

|---|---|

| The account used in the current system | Accounts that are needed in schools |

| Social Services Revenue (435) | School installments |

| School ID | |

| Acceptance form | |

| Objections | |

| School document | |

| Endorsement letter | |

| Student Guide | |

| Transfer student | |

| Registration fees for new students | |

| Training course fees | |

The researcher noted that other names were mentioned in the accounts of international schools in neighboring countries such as Jordan, which are consistent with the recognized names that can be applied in Iraq, as shown in the Table 2.

| Table 2 Other Income Table |

|---|

| The text named according to international practices |

| Health insurance revenue |

| Student cafeteria revenue |

| Library revenue |

| Student Services |

The researcher believes that it is necessary to create special accounts for revenues that meet the needs of these schools in order to facilitate their classification, as well as to achieve control and control over those revenues.

Expenses

The inconsistency in the current system, which did not take into account the specificity of the education sector with regard to the main expense accounts, which will be added in the proposed system for international schools in Dohuk, as shown in the following Table 3.

| Table 3 Educational Activity Expense Schedule |

|---|

| Account names |

| Fees for lectures |

| Expenses of scientific seminars |

| Conference expenses |

| scientific research |

| Training courses |

| Scientific Scholarship |

| moving expenses |

| End of service indemnity |

Preparing And Designing The Proposed Accounting System And Applying It To The Research Sample

After the current accounting problems were identified as a result of using the unified accounting system (IUAS), The researcher will present the proposed accounting system and then apply the data of one of the international schools to it and then compare the outputs of the proposed accounting system with the outputs of the unified accounting system used in international schools and colleges, therefore, the objective of this chapter is to design and implement the proposed accounting system through the following:

The Proposed Accounting System Design

In this topic, the proposed accounting system for international schools in the Dohuk governorate will be addressed, and the proposed system is like any other accounting system. It is the availability of appropriate and reliable data and information about the activities of international schools, colleges, and universities and submitting them to the relevant authorities, and that all institutions are bound by the laws and legislation in force that are enacted to organize their work and solve all the problems we discussed in the previous chapter.

Objectives of the accounting system

The accounting system is the best means of communication in economic units, and it seeks to achieve a set of goals that are:

Providing data and information for disclosure: The main objective of the accounting system is to disclose the financial and economic results and activities implemented by international schools in Dohuk in terms of commitment to expenditures.

Availability of information that helps management in making decisions: The accounting system should provide appropriate and understandable information by classifying and organizing it in a way that helps in planning, making decisions, and following up on the performance of international schools.

Availability of controlled information: The accounting system should provide information to achieve effective administrative control over the revenues and expenses of international schools.

Availability of information to measure activity and financial position: Financial transactions related to the activities of international schools should be identified and measured, and the results reported

Scope of Work of the Accounting System

The accounting system is applied to international schools, colleges, and universities in Iraq.

Designing the components of the accounting system for international schools in Duhok

The components of any system represent from a group of foundations on which the system’s work is based in an interconnected and complementary manner to each other so that these components are provided that cannot be dispensed with for the purpose of achieving the goals for which the system was established and include the following:

Chart of accounts

The chart of accounts represents the general structure of accounts and is an important tool in directing the accounting work of the economic unit by determining the accounts that can be affected by operations. It is also an auxiliary tool that can contribute to facilitating the accounting work by giving each of the charts of accounts its own number that distinguishes it from the rest of the accounts. The method of decimal notation was followed in the design of the chart of accounts, and the Table 4 shows the proposed chart model.

| Table 4 Proposed Chart Of Accounts Template |

|

| 1 | Assets |

| 11 | Current assets |

| 111 | Money |

| 1111 | Cash at banks |

| 11111 | Unrestricted bank cash |

| 11112 | Cash at banks temporarily restricted |

| 11113 | Cash at banks restricted |

| 11112 | Cash in hand |

| 11121 | Unrestricted cash in hand |

| 11122 | Temporarily unrestricted cash in hand |

| 11123 | Restricted cash in Box |

| 11351 | Accrued interest |

| 11381 | Accrued revenue |

| 11382 | Insurances |

| 1137 | Loans |

| 11383 | Compensation claims |

| 11384 | Cash and stock differences |

| 114 | Inventories |

| 1141 | Stationery stock |

| 1142 | Inventory of supplies and errands |

| 1143 | Stock of educational books |

| 1144 | School chairs stock |

| 1147 | Furniture stock |

| 11511 | Prepaid expenses |

| 11512 | Prepaid interest expenses |

| 11513 | Prepaid rent expenses |

| 12253 | Computers |

| 12254 | Typewriters, printers and copiers |

| 12255 | Office tools and equipment |

| 12256 | Curtains and upholstery |

| 12257 | Educational books |

| 12258 | Study chairs and blackboards |

| 21113 | Founder's share of abundance |

| 2114 | Accounts payable |

| 21141 | Salaries and wages |

| 21142 | Employee Pension Fund |

| 2115 | Deserved payments |

| 21151 | Payable salaries and wages |

| 2116 | Revenue received in advance |

| 21161 | Student installments received in advance |

| 311 | Educational expenses |

| 31111 | Nominal salaries |

| 31112 | Certificate Allocations |

| 31113 | Allocations for the position |

| 31117 | Fees for lectures |

| 31118 | Incentive Rewards |

| 31351 | Legal services |

Documents

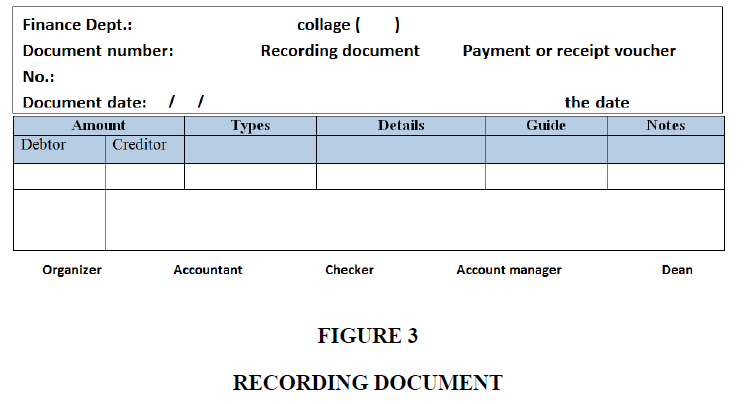

The documents represent the first components of the accounting system and are the point of the flow of accounting information. The documentary collection needed by international schools in Dohuk, depending on the nature of financial operations which is divided into Key Accounting Documents and Auxiliary accounting documents.

Key accounting documents are the main accounting documents those include

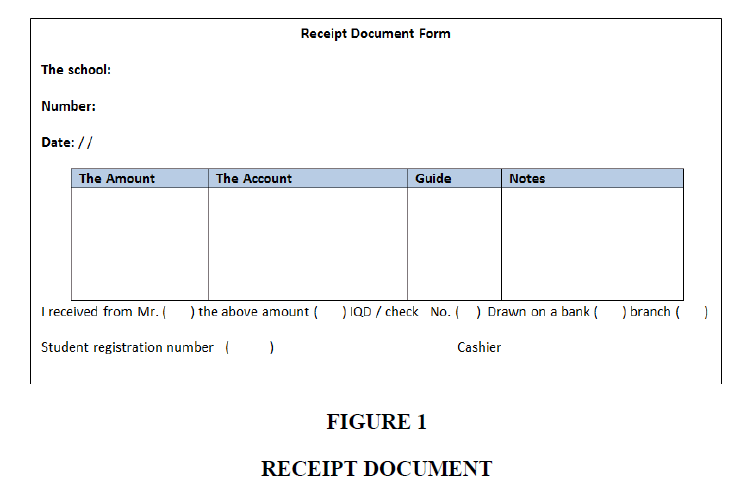

1. Receipt document: This receipt is organized by the cashier to record the receipt of cash or checks according to the established rules and it should be in several copies and according to the need for it. A copy for the cash deliverer, a copy for the school registration division, a copy for the records of receipts and deportations, and a copy for preservation. The Figure 1 shows a form and receipt document.

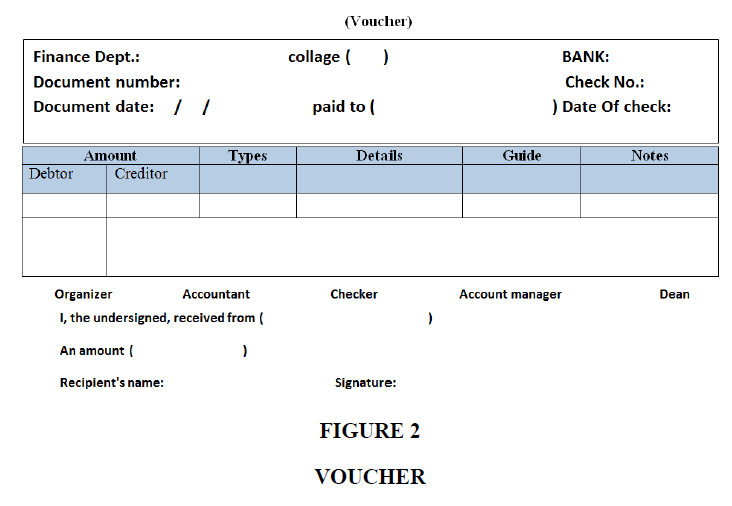

2. Voucher: Schools prepare it when they do the exchange operations, whether the exchange is cash or check, and the recipient gets a copy of it after he signs the receipt of the amount and it is in several copies as needed. The Figure 2 represents a sample voucher document.

Auxiliary accounting documents are all documents that are attached or reinforced with the main documents are represented as a means of proof of the financial transaction. It includes two main documents, which are as follows:

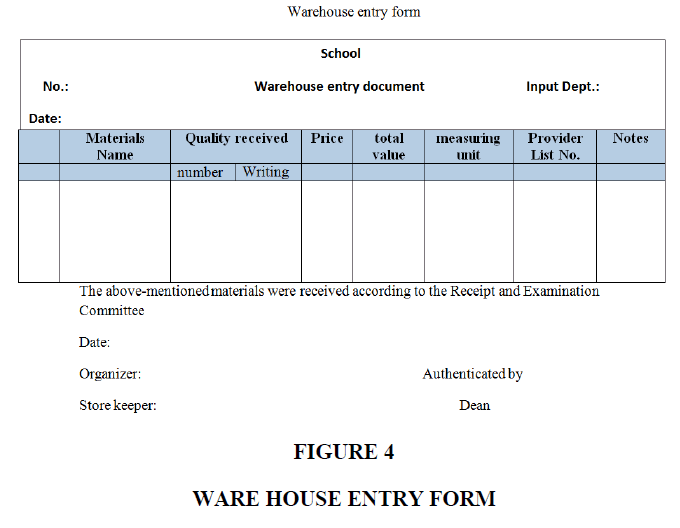

Firstly: warehouse entry document: It is attached with the main document to prove the status of receiving the materials and entering them into the school stores. The Figure 4 shows the inventory entry form.

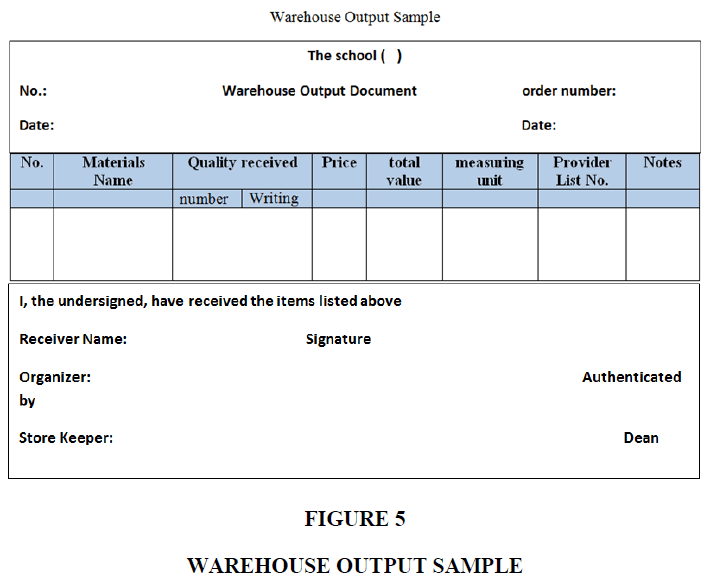

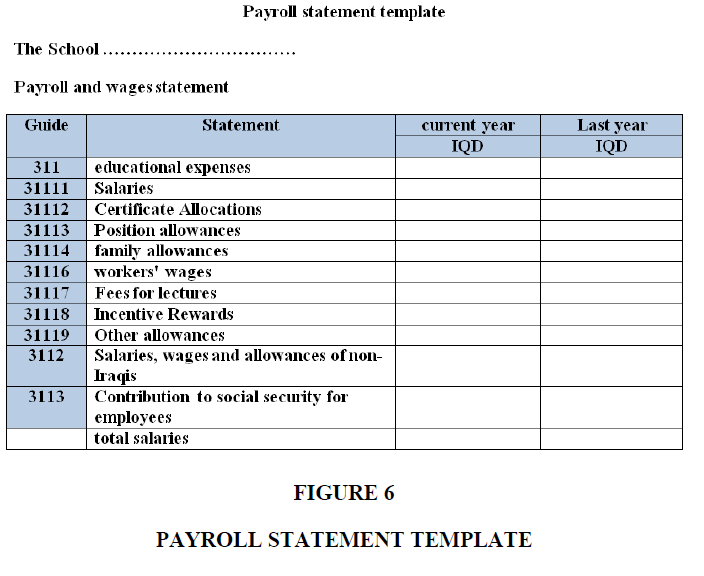

Secondly: warehouse output document: It is to be attached with the main documents to prove the state of receipt of the materials by the beneficiary party and the reduction of the inventory liability to the storekeeper. The Figure 5 and 6 shows a sample warehouse output.

Record Treatment

Record treatments are considered one of the important matters, and the most important of them have been identified by the researcher, based on accounting principles and assumptions

• When the school is established

From quota/Assets

To quota/Net restricted assets 223

Quota/Founder's share 2231

• Upon receiving the tuition installments from the student, the following entry shall be regulatedFrom quota/Cash in box are not recorded 11121

To those mentioned

Quota/revenue for educational services 41

Quota/Revenue from tuition fees 411

Quota/Study revenue 412

Quota/Student ID 413

Quota/Internal department revenue 415

Quota/Registration fees for new students 416

Quota/Revenue received in advance 2116

Conclusion

Accounting is characterized by vitality, renewal, and the ability to adapt to changes, Thus, its importance increases with the increasing complexity and diversity of economic life, with the development of management and organization methods, and in particular, with the development of information systems as a social service function, its importance increases in the present and the future with the increasing size of the impact of financial information.

The accounting information system as a support activity adds value to the international schools in the governorate of Dohuk by providing accurate information in a timely manner that helps to implement the performance of the accounting information system.

The accounts used in the unified accounting system do not meet the needs of international schools in the governorate of Dohuk, and there is no sufficient disclosure of the different types of revenues and expenses related to the work of these schools.

Not setting a time limit for the disbursement of cash allocated in accordance with the law, which led to making international schools in Dohuk governorate invest these amounts in other than what was allocated for it.

Following the decimal notation method in designing the proposed chart of accounts provides adequate disclosure for the process of classifying accounts.

Preparing the financial statements based on international standards and practices within the proposed accounting guide helps to accurately determine the result of the activity of the main activities of the international schools in the governorate of Dohuk. It also helps the financial analyst in measuring the financial ratios according to each activity.

The proposed system leads to the availability of appropriate and reliable data and information that helps the administration of international schools in Dohuk in making decisions and achieves effective control over revenues and expenses.

Recommendation

The need to develop accounting procedures to suit the current changes and the development of management and organization methods.

The need for the accounting information system to provide accurate information in a timely manner to help implement the financial activities in a very effective manner.

The necessity of clearly defining the accounting system to be applied in international schools and colleges.

Adoption of the proposed accounting system, which leads to the provision of appropriate and reliable data and information about the activities of international schools in Dohuk.

Preparing the financial statements based on international standards and practices within the proposed accounting guide helps to accurately determine the result of the activity of the main activities of the international schools in the governorate of Dohuk. It also helps the financial analyst in measuring the financial ratios according to each activity.

It is necessary to provide the possibility of knowing the cost of the student according to the science classes and departments.

It is necessary to use the proposed system because it leads to the availability of appropriate and reliable data and information that helps the administration of international schools in Dohuk in making decisions and achieves effective control over revenues and expenses.

Research Limitations

The researcher relied on a selection of international school standards, while all standards should have been taken to display and uses them in designing the proposed accounting system to show the extent of compatibility between them, however, the increase in the number of search pages prevented all of them from being taken into account.

The reluctance of international schools in Iraq to provide us with their financial statements( documentary) for one year For several reasons, including, the accounts are not certified by the Board of Financial Supervision in the region or the Federal, The need for numerous approvals for the purpose of providing information and other unconvincing excuses.

The lack of instructions for the availability of explanations for the texts of the previous International or Civil Education Law No. 13 of 1996 and the current Law No. 25 of 2017 by the Ministry of Higher Education, which opened the way for interpretation.

References

Abdel-Aal, H. T. (2008). Encyclopedia of Accounting Standards. Dar Al-Jamaa Publishing, Alexandria.

Al-Ani (2001). Designing an accounting system for government hospitals. Doctoral thesis.

Al-Hayali, W. N. (2007). Accounting Theory. Arab Open Academy Publications.

Al-Husseini, B. J. (2008). Human investment and its impact on development. Doctoral Thesis University of Baghdad.

Baji (2016). Electronic Accounting System for Religious Institutions. Master's thesis.

Belkaoui, A. R. (1981). Accounting Theory. Harcourt Brace Jovanovich, Inc. NY.

INTOSAI (2004). Executive Guidelines for Financial Control of Performance.

Joseph (1994). Evaluation and development of the accounting system in government hospitals. Master's thesis.

McLaughlin, T. A. (2016).Streetsmart financial basics for nonprofit managers. John Wiley & Sons.

Ruppel, W. (2007).Not-for-profit accounting made easy. John Wiley & Sons.

Wilson, E. R., & Kattelus, S. C. (2004).Accounting for governmental and nonprofit entities. McGraw-Hill College.

Wolk, H. I., Dodd, J. L., & Rozycki, J. J. (2016).Accounting theory: conceptual issues in a political and economic environment. Sage Publications.

Appendix

1 Asset: This account includes all the tangible and intangible assets owned by international schools in Dohuk Governorate.

111 Money: This account includes the cash in the fund and the balance of current accounts in banks.

1111 cash at banks: This account includes the balance of the total current accounts with banks, whether local or foreign.

11112Temporary cash register with banks: This account includes the balance of the total current accounts with banks that are temporarily allocated for a specific purpose.

1113 cash in the box: This account includes the cash in the school fund and its branches.

11122 Temporarily unrestricted cash in hand: This account includes the cash in the school fund that is temporarily allocated for a specific purpose

11123 restricted cash in Box: This account includes the cash in the school fund that is earmarked for a specific purpose

11351 accrued interest: This account includes the amounts that schools pay in exchange for borrowing the money of others as interest on bonds

11381 accrued revenue: This account includes the total amounts due for subsidies and income

11382 insurances: his account includes amounts paid as insurance for service contracts

1137 Loans: This account includes the movement of all amounts granted by the school to its employees, whether it is to perform work for it or personal advances

11383 compensation claims: This account includes the value of damages to the imported goods for the benefit of the school, which are borne by those who are responsible for compensation, such as insurance and transportation companies.

11384 Cash and stock differences: This account includes the amounts of the debit differences shown as a result of the inventory in the assets

114 Inventories: This account includes the cost of the physical funds in circulation acquired by the school

1141 stationery stock: this account includes the cost of stationery in the school stores

1142 Inventory of supplies and errands: This account includes the cost of materials in stock

1143 stock of educational books: This calculation includes the cost of stock of textbooks

1144 school chairs stock: This account includes the cost of the school chair inventory

1147 furniture stock: This account includes the cost of furniture inventory

11511 Prepaid expenses and interest: This account includes expenses paid in advance by the school for a full financial year.

11512 Prepaid interest expenses: this account includes prepaid expenses for insurance expenses

11513 Prepaid rent expenses: This account includes prepaid expenses as rent for a full fiscal year

12253 computers: his account includes the cost of purchasing the computers and the expenses of installing them.

12254 Typewriters, printers, and copiers: This account includes the cost of purchasing printing, and duplicating machines and the costs of installing.

12255 Office tools and equipment: This account includes the cost of purchasing office equipment, audio, and video equipment

12256 Curtains and upholstery: This account includes the cost of purchasing curtains and upholstery

12257 educational books: This account includes the cost of purchasing scientific books

12258 Study chairs and blackboards: This account includes the cost of purchasing the boards and chairs

21113 Founder's share of abundance: This account includes the obligations owed by the school

2114 accounts payable: This account includes the school's obligations towards others

21141 Salaries and wages: This account includes net salaries and wages payable

21142 Employee Pension Fund: This account includes the amounts deducted from the employees for the retirement authority account, as well as the school’s contribution to the employees’ retirement

2115 deserved payments: This account includes expenses related to the year of activity

2116 Revenue received in advance: This account includes the amount of revenue received in the year

21161 Student installments received in advance: This account includes the student's premium amounts received in a year

311educational expenses: This account includes the cost of what the school pays in cash to its employees in terms of salaries and wages

31111nominal salaries: This account includes the salaries of employees and the salaries of regular vacations that are paid upon their retirement

31112Certificate Allocations: this account includes the allowances paid to employees for the legally established academic achievement

31113Allocations for the position: This account includes the allowances paid to employees who occupy professional and supervisory positions

31117Fees for lectures: This account includes the fees paid for the lectures

31118 Incentive Rewards: This account includes the rewards that the school pays to the employees to motivate and reward them for their exceptional quality at work